Deck 5: Net Present Value and Other Investment Criteria

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/74

Play

Full screen (f)

Deck 5: Net Present Value and Other Investment Criteria

1

Which of the following investment rules may not use all possible cash flows in its calculations?

A)NPV

B)payback period

C)IRR

D)profitability index

A)NPV

B)payback period

C)IRR

D)profitability index

payback period

2

Internal rate of return (IRR)method is also called the:

A)discounted payback period method.

B)discounted cash-flow (DCF)rate of return method.

C)modified internal rate of return (MIRR)method.

D)book rate of return method.

A)discounted payback period method.

B)discounted cash-flow (DCF)rate of return method.

C)modified internal rate of return (MIRR)method.

D)book rate of return method.

discounted cash-flow (DCF)rate of return method.

3

Which of the following investment rules has the value additivity property?

A)the payback period method

B)the net present value method

C)the book rate of return method

D)the internal rate of return method

A)the payback period method

B)the net present value method

C)the book rate of return method

D)the internal rate of return method

the net present value method

4

If the NPV of project A is + $30 and that of project B is -$60,then the NPV of the combined projects is:

A)+$30

B)-$60

C)-$30

D)-$1,800

A)+$30

B)-$60

C)-$30

D)-$1,800

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

5

The payback period rule:

A)varies the cut-off point with the interest rate.

B)determines a cut-off point so that all projects accepted by the NPV rule will be accepted by the payback period rule.

C)requires an arbitrary choice of a cut-off point.

D)both A and C.

A)varies the cut-off point with the interest rate.

B)determines a cut-off point so that all projects accepted by the NPV rule will be accepted by the payback period rule.

C)requires an arbitrary choice of a cut-off point.

D)both A and C.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

6

The survey of CFOs indicates that the IRR method is used for evaluating investment projects by approximately:

A)12% of firms.

B)20% of firms.

C)75% of firms.

D)57% of firms.

A)12% of firms.

B)20% of firms.

C)75% of firms.

D)57% of firms.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

7

The cost of a new machine is $250,000.The machine has a five-year life and no salvage value.If the cash flow each year is equal to 25% of the cost of the machine,calculate the payback period for the project:

A)2.0 years

B)2.5 years

C)3.0 years

D)4.0 years

A)2.0 years

B)2.5 years

C)3.0 years

D)4.0 years

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

8

The main advantage of the payback rule is:

A)adjusts for uncertainty of early cash flows.

B)simple to use.

C)does not discount cash flows.

D)better accounts for salvage costs at the end of a project.

A)adjusts for uncertainty of early cash flows.

B)simple to use.

C)does not discount cash flows.

D)better accounts for salvage costs at the end of a project.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

9

If the net present value (NPV)of project A is +$100,and that of project B is +$60,then the net present value of the combined projects is:

A)+$100

B)+$60

C)+$160

D)+$6,000

A)+$100

B)+$60

C)+$160

D)+$6,000

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following statements regarding the discounted payback period rule is true?

A)The discounted payback rule uses the time value of money concept.

B)The discounted payback rule is better than the NPV rule.

C)The discounted payback rule considers all cash flows.

D)The discounted payback rule exhibits the value additivity property.

A)The discounted payback rule uses the time value of money concept.

B)The discounted payback rule is better than the NPV rule.

C)The discounted payback rule considers all cash flows.

D)The discounted payback rule exhibits the value additivity property.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

11

The following are measures used by firms when making capital budgeting decisions EXCEPT:

A)payback period.

B)internal rate of return.

C)P/E ratio.

D)net present value.

A)payback period.

B)internal rate of return.

C)P/E ratio.

D)net present value.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

12

The payback period rule accepts all projects for which the payback period is:

A)greater than the cut-off value.

B)less than the cut-off value.

C)positive.

D)an integer.

A)greater than the cut-off value.

B)less than the cut-off value.

C)positive.

D)an integer.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

13

The following are disadvantages of using the payback rule EXCEPT the rule:

A)ignores all cash flow after the cutoff date.

B)does not use the time value of money.

C)is easy to calculate and use.

D)does not have the value additivity property.

A)ignores all cash flow after the cutoff date.

B)does not use the time value of money.

C)is easy to calculate and use.

D)does not have the value additivity property.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

14

If the NPV of project A is + $120,that of project B is -$40,and that of project C is + $40,what is the NPV of the combined project?

A)+$100

B)-$40

C)+$70

D)+$120

A)+$100

B)-$40

C)+$70

D)+$120

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

15

The net present value of a project depends upon the:

A)company's choice of accounting method.

B)manager's tastes and preferences.

C)project's cash flows and opportunity cost of capital.

D)company's profitability index.

A)company's choice of accounting method.

B)manager's tastes and preferences.

C)project's cash flows and opportunity cost of capital.

D)company's profitability index.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

16

The survey of CFOs indicates that the NPV method is always,or almost always,used for evaluating investment projects by approximately:

A)12% of firms.

B)20% of firms.

C)57% of firms.

D)75% of firms.

A)12% of firms.

B)20% of firms.

C)57% of firms.

D)75% of firms.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

17

Given the following cash flows for project Z: C0 = -1,000,C1 = 600,C2 = 720,and C3 = 2,000,calculate the discounted payback period for the project at a discount rate of 20%.

A)1 year

B)2 years

C)3 years

D)>3 years

A)1 year

B)2 years

C)3 years

D)>3 years

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

18

Given the following cash flows for project A: C0 = -1,000,C1 = +600,C2 = +400,and C3 = +1,500,calculate the payback period.

A)one year

B)two years

C)three years

D)cannot be determined

A)one year

B)two years

C)three years

D)cannot be determined

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following investment rules does NOT use the time value of money concept?

A)Net present value

B)Internal rate of return

C)The payback period

D)Profitability index

A)Net present value

B)Internal rate of return

C)The payback period

D)Profitability index

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

20

Suppose a firm has $100 million in excess cash.It could:

A)invest the funds in projects with positive NPVs.

B)pay high dividends to the shareholders.

C)buy another firm.

D)all of the options

A)invest the funds in projects with positive NPVs.

B)pay high dividends to the shareholders.

C)buy another firm.

D)all of the options

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

21

Project X has the following cash flows: C0 = +2,000,C1 = -1,300,and C2 = -1,500.If the IRR of the project is 25% and if the cost of capital is 18%,you would:

A)accept the project.

B)reject the project.

A)accept the project.

B)reject the project.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

22

One can use the profitability index most usefully for which situation?

A)when capital rationing exists

B)evaluation of exceptionally long-term projects

C)evaluation of non-normal projects

D)when a project has unusually high cash-flow uncertainty

A)when capital rationing exists

B)evaluation of exceptionally long-term projects

C)evaluation of non-normal projects

D)when a project has unusually high cash-flow uncertainty

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

23

If the sign of the cash flows for a project changes two times,then the project likely has:

A)one IRR.

B)two IRRs.

C)three IRRs.

D)four IRRs.

A)one IRR.

B)two IRRs.

C)three IRRs.

D)four IRRs.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

24

Music Company is considering investing in a new project.The project will need an initial investment of $2,400,000 and will generate $1,200,000 (after-tax)cash flows for three years.Calculate the NPV for the project if the cost of capital is 15%.

A)$169,935

B)$1,200,000

C)$339,870

D)$125,846

A)$169,935

B)$1,200,000

C)$339,870

D)$125,846

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

25

The IRR is defined as:

A)the discount rate that makes a project's NPV equal to zero.

B)the difference between the cost of capital and the present value of the cash flows.

C)the discount rate used in the NPV method.

D)the discount rate

A)the discount rate that makes a project's NPV equal to zero.

B)the difference between the cost of capital and the present value of the cash flows.

C)the discount rate used in the NPV method.

D)the discount rate

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

26

The quickest way to calculate the internal rate of return (IRR)of a project is by:

A)trial and error method.

B)using the graphical method.

C)using a financial calculator.

D)doubling the opportunity cost of capital.

A)trial and error method.

B)using the graphical method.

C)using a financial calculator.

D)doubling the opportunity cost of capital.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

27

Muscle Company is investing in a giant crane.It is expected to cost $6.5 million in initial investment,and it is expected to generate an end-of-year cash flow of $3.0 million each year for three years.Calculate the IRR.

A)14.6 %

B)16.4 %

C)18.2 %

A)14.6 %

B)16.4 %

C)18.2 %

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

28

Driscoll Company is considering investing in a new project.The project will need an initial investment of $2,400,000 and will generate $1,200,000 (after-tax)cash flows for three years.Calculate the IRR for the project.

A)14.5%

B)18.6%

C)20.2%

D)23.4%

A)14.5%

B)18.6%

C)20.2%

D)23.4%

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

29

Mass Company is investing in a giant crane.It is expected to cost $6.0 million in initial investment,and it is expected to generate an end-of-year cash flow of $3.0 million each year for three years.At the end of the fourth year,there will be a $1.0 million disposal cost.Calculate the MIRR for the project if the cost of capital is 12%.

A)17.8%

B)15.3%

C)23.8%

A)17.8%

B)15.3%

C)23.8%

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

30

Story Company is investing in a giant crane.It is expected to cost $6.0 million in initial investment,and it is expected to generate an end-of-year after-tax cash flow of $3.0 million each year for three years.Calculate the NPV at 12%.

A)$2.4 million

B)$1.2 million

C)$0.80 million

D)$0.20 million

A)$2.4 million

B)$1.2 million

C)$0.80 million

D)$0.20 million

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

31

The following are some of the shortcomings of the IRR method except:

A)IRR is conceptually easy to communicate.

B)Projects can have multiple IRRs.

C)IRR cannot distinguish between a borrowing project and a lending project.

D)It is very cumbersome to evaluate mutually exclusive projects using the IRR method.

A)IRR is conceptually easy to communicate.

B)Projects can have multiple IRRs.

C)IRR cannot distinguish between a borrowing project and a lending project.

D)It is very cumbersome to evaluate mutually exclusive projects using the IRR method.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

32

Project Y has following cash flows: C0 = -800,C1 = +5,000,and C2 = -5,000.

Calculate the IRRs for the project:

A)25% and 400%.

B)125% and 500%.

C)-44% and 11.6%.

Calculate the IRRs for the project:

A)25% and 400%.

B)125% and 500%.

C)-44% and 11.6%.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

33

Project X has the following cash flows: C0 = +2,000,C1 = -1,150,and C2 = -1,150.If the IRR of the project is 9.85% and if the cost of capital is 12%,you would:

A)accept the project.

B)reject the project.

A)accept the project.

B)reject the project.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

34

Given the following cash flows for Project M: C0 = -1,000,C1 = +200,C2 = +700,C3 = +698,calculate the IRR for the project.

A)23%

B)21%

C)19%

D)17%

A)23%

B)21%

C)19%

D)17%

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

35

Given the following cash flows for project A: C0 = -3,000,C1 = +500,C2 = +1,500,and C3 = +5,000,calculate the NPV of the project using a 15% discount rate.

A)$5,000

B)$2,352

C)$3,201

D)$1,857

A)$5,000

B)$2,352

C)$3,201

D)$1,857

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

36

Dry-Sand Company is considering investing in a new project.The project will need an initial investment of $1,200,000 and will generate $600,000 (after-tax)cash flows for three years.However,at the end of the fourth year,the project will generate -$500,000 of after-tax cash flow due to dismantling costs.Calculate the MIRR (modified internal rate of return)for the project if the cost of capital is 15%.

A)8.1%

B)12.6%

C)28.2%

A)8.1%

B)12.6%

C)28.2%

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following methods of evaluating capital investment projects incorporates the time value of money concept?

i.payback period; II)discounted payback period; III)net present value (NPV); IV)internal rate of return

A)I,II,and III only

B)II,III,and IV only

C)III and IV only

D)I,II,III,and IV

i.payback period; II)discounted payback period; III)net present value (NPV); IV)internal rate of return

A)I,II,and III only

B)II,III,and IV only

C)III and IV only

D)I,II,III,and IV

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

38

A project will have only one internal rate of return if:

A)the net present value is positive

B)the net present value is negative

C)the cash flows decline over the life of the project

D)there is a one-sign change in the cash flows

A)the net present value is positive

B)the net present value is negative

C)the cash flows decline over the life of the project

D)there is a one-sign change in the cash flows

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

39

If an investment project (normal project)has an IRR equal to the cost of capital,the NPV for that project is:

A)positive.

B)negative.

C)zero.

D)unable to determine.

A)positive.

B)negative.

C)zero.

D)unable to determine.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

40

The profitability index is the ratio of the:

A)future value of cash flows to investment

B)net present value of cash flows to investment

C)net present value of cash flows to IRR

D)present value of cash flows to IRR

A)future value of cash flows to investment

B)net present value of cash flows to investment

C)net present value of cash flows to IRR

D)present value of cash flows to IRR

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

41

The benefit-cost ratio is defined as the ratio of:

A)net present value cash flows to initial investment.

B)present value of cash flows to initial investment.

C)net present value of cash flows to IRR.

D)present value of cash flows to IRR.

A)net present value cash flows to initial investment.

B)present value of cash flows to initial investment.

C)net present value of cash flows to IRR.

D)present value of cash flows to IRR.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

42

The discounted payback rule calculates the payback period and then discounts the payback period at the opportunity cost of capital.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

43

Decommissioning and clean-up costs for any project is always insignificant and should typically be ignored.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

44

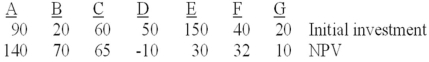

The following table gives the available projects (in $millions)for a firm.

If the firm has a limit of 210 million to invest,what is the maximum NPV the company can obtain?

A)200

B)283

C)307

D)347

If the firm has a limit of 210 million to invest,what is the maximum NPV the company can obtain?

A)200

B)283

C)307

D)347

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

45

The internal rate of return is the discount rate that makes the NPV of a project's cash flows equal to zero.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

46

The internal rate of return is the discount rate that makes the PV of a project's cash inflows equal to zero.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

47

The payback rule ignores all cash flows after the cutoff date.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

48

In the case of a loan project (borrowing),one should accept the project if the IRR is more than the cost of capital.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

49

The benefit-cost ratio is equal to the profitability index plus one.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

50

The profitability index of a positive NPV project is always positive.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

51

A project's internal rate of return depends on its level of risk.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

52

Present values have the value additivity property.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

53

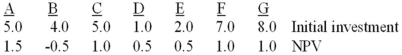

The following table gives the available projects (in $millions)for a firm.

The firm has only 20 million to invest.What is the maximum NPV that the company can obtain?

A)3.5

B)4.0

C)4.5

D)5.0

The firm has only 20 million to invest.What is the maximum NPV that the company can obtain?

A)3.5

B)4.0

C)4.5

D)5.0

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

54

What is the profitability index of an investment with cash flows in years 0 thru 4 of -340,120,130,153,and 166,respectively,and a discount rate of 16%?

A).15

B).22

C).35

D).42

A).15

B).22

C).35

D).42

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

55

Soft rationing may be used to control managerial behavior.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

56

How does modified internal rate of return (MIRR)differ from IRR?

A)MIRR does not consider cash flows occurring after the cutoff date.

B)MIRR uses NPV.IRR does not.

C)MIRR calculates the PV of cash inflows and then divides by the PV of the investment.

D)MIRR reduces the number of sign changes in a cash-flow sequence.

A)MIRR does not consider cash flows occurring after the cutoff date.

B)MIRR uses NPV.IRR does not.

C)MIRR calculates the PV of cash inflows and then divides by the PV of the investment.

D)MIRR reduces the number of sign changes in a cash-flow sequence.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

57

Which investment analysis technique is used the least by CFOs?

A)net present value

B)internal rate of return

C)payback

D)book rate of return

A)net present value

B)internal rate of return

C)payback

D)book rate of return

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

58

The profitability index is always less than 1.0.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

59

The IRR rule states that firms should accept any project offering an internal rate of return in excess of the cost of capital.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

60

There can never be more than one value of the IRR for any sequence of cash flows.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

61

A project's "book value" represents,essentially,the market valuation of the project.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

62

The discounted payback technique discounts cash flows at the opportunity cost of capital and then calculates the payback period.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

63

Briefly explain the value additivity property.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

64

The discounted payback technique will never accept a negative-NPV project.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

65

Briefly explain the term soft rationing.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

66

What are some of the disadvantages of using the IRR method?

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

67

Discuss some of the advantages of using the payback method.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

68

Briefly discuss capital rationing.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

69

Accounting earnings from a firm's income statement,prepared according to generally accepted accounting principles (GAAP),are typically the best data source for calculating a project's NPV.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

70

Briefly explain the term hard rationing.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

71

When calculating a weighted average profitability index,should you apply an index of zero to leftover money?

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

72

Discuss some of the disadvantages of the payback rule.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

73

The denominator of the profitability index is the present value of the investment.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

74

What are some of the advantages of using the IRR method?

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck