Deck 14: Interest Rate and Currency Swaps

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/25

Play

Full screen (f)

Deck 14: Interest Rate and Currency Swaps

1

A foreign operation which is financially or operationally independent of the Canadian parent company such that the exposure to exchange rate changes is limited to the Canadian company's net investment in the foreign operation is called

A)Interdependent foreign operation

B)Integrated foreign operation

C)Independent foreign operation

D)Self-sustaining foreign operation

A)Interdependent foreign operation

B)Integrated foreign operation

C)Independent foreign operation

D)Self-sustaining foreign operation

D

2

Which of the following items will be translated at historical exchange rate under temporal method:

A)Monetary assets

B)Nonmonetary assets

C)Income statement items

D)Both b and c

A)Monetary assets

B)Nonmonetary assets

C)Income statement items

D)Both b and c

B

3

Which of the following is a translation method where the gain or loss due to translation adjustment does not affect reported cash flows?

A)current/non-current method

B)current rate method

C)current/future method

D)short/long term method

A)current/non-current method

B)current rate method

C)current/future method

D)short/long term method

B

4

Under the temporal method

A)All balance sheet and all income statement items are translated at the current exchange rate

B)All balance sheet and some income statement items are translated at the current exchange rate

C)Some balance sheet and all income statement items are translated at the current exchange rate

D)Some balance sheet and some income statement items are translated at the current exchange rate

A)All balance sheet and all income statement items are translated at the current exchange rate

B)All balance sheet and some income statement items are translated at the current exchange rate

C)Some balance sheet and all income statement items are translated at the current exchange rate

D)Some balance sheet and some income statement items are translated at the current exchange rate

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

5

An "integrated foreign operation" refers to:

A)A foreign operation which is financially or operationally independent of the Canadian parent company such that the exposure to exchange rate changes is limited to the Canadian company's net investment in the foreign operation

B)A foreign operation which is financially or operationally independent of the Canadian parent company such that the exposure to exchange rate changes is similar to the exposure that would exist had the transactions of the foreign operation been undertaken directly by the Canadian parent

C)A foreign operation which is financially or operationally interdependent with the Canadian parent company such that the exposure to exchange rate changes is limited to the Canadian company's net investment in the foreign operation

D)A foreign operation which is financially or operationally interdependent with the Canadian parent company such that the exposure to exchange rate changes is similar to the exposure that would exist had the transactions of the foreign operation been undertaken directly by the Canadian parent

A)A foreign operation which is financially or operationally independent of the Canadian parent company such that the exposure to exchange rate changes is limited to the Canadian company's net investment in the foreign operation

B)A foreign operation which is financially or operationally independent of the Canadian parent company such that the exposure to exchange rate changes is similar to the exposure that would exist had the transactions of the foreign operation been undertaken directly by the Canadian parent

C)A foreign operation which is financially or operationally interdependent with the Canadian parent company such that the exposure to exchange rate changes is limited to the Canadian company's net investment in the foreign operation

D)A foreign operation which is financially or operationally interdependent with the Canadian parent company such that the exposure to exchange rate changes is similar to the exposure that would exist had the transactions of the foreign operation been undertaken directly by the Canadian parent

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

6

Consider an MNC based in Canada with manufacturing activities in Japan.The result of a change in the ¥/$ exchange rate on the assets and liabilities of the consolidated balance sheet is:  Ignoring transaction exposure in the yen,the translation exposure will indicate a possible need for a "balance sheet hedge" of:

Ignoring transaction exposure in the yen,the translation exposure will indicate a possible need for a "balance sheet hedge" of:

A)¥200,000,000 more liabilities denominated in yen

B)¥200,000,000 less assets denominated in yen

C)a or b

D)none of these

Ignoring transaction exposure in the yen,the translation exposure will indicate a possible need for a "balance sheet hedge" of:

Ignoring transaction exposure in the yen,the translation exposure will indicate a possible need for a "balance sheet hedge" of:A)¥200,000,000 more liabilities denominated in yen

B)¥200,000,000 less assets denominated in yen

C)a or b

D)none of these

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

7

The "functional currency" is:

A)the currency of the primary economic environment in which the entity operates

B)the currency in which the MNC prepares its consolidated financial statements

C)a currency that is not the parent firm's home country currency

D)b and c

A)the currency of the primary economic environment in which the entity operates

B)the currency in which the MNC prepares its consolidated financial statements

C)a currency that is not the parent firm's home country currency

D)b and c

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

8

A "self-sustaining foreign operation" refers to:

A)A foreign operation which is financially or operationally independent of the Canadian parent company such that the exposure to exchange rate changes is limited to the Canadian company's net investment in the foreign operation

B)A foreign operation which is financially or operationally independent of the Canadian parent company such that the exposure to exchange rate changes is similar to the exposure that would exist had the transactions of the foreign operation been undertaken directly by the Canadian parent

C)A foreign operation which is financially or operationally interdependent with the Canadian parent company such that the exposure to exchange rate changes is limited to the Canadian company's net investment in the foreign operation

D)A foreign operation which is financially or operationally interdependent with the Canadian parent company such that the exposure to exchange rate changes is similar to the exposure that would exist had the transactions of the foreign operation been undertaken directly by the Canadian parent

A)A foreign operation which is financially or operationally independent of the Canadian parent company such that the exposure to exchange rate changes is limited to the Canadian company's net investment in the foreign operation

B)A foreign operation which is financially or operationally independent of the Canadian parent company such that the exposure to exchange rate changes is similar to the exposure that would exist had the transactions of the foreign operation been undertaken directly by the Canadian parent

C)A foreign operation which is financially or operationally interdependent with the Canadian parent company such that the exposure to exchange rate changes is limited to the Canadian company's net investment in the foreign operation

D)A foreign operation which is financially or operationally interdependent with the Canadian parent company such that the exposure to exchange rate changes is similar to the exposure that would exist had the transactions of the foreign operation been undertaken directly by the Canadian parent

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements hold true in general:

A)Eliminating transaction exposure will also eliminate translation exposure

B)Eliminating transaction exposure will increase translation exposure

C)Eliminating transaction exposure will reduce translation exposure

D)None of these

A)Eliminating transaction exposure will also eliminate translation exposure

B)Eliminating transaction exposure will increase translation exposure

C)Eliminating transaction exposure will reduce translation exposure

D)None of these

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the above statements pertain to self-sustaining foreign operations?

A)(i)

B)(i) and (ii)

C)(iii) and (iv)

D)(i), (ii), and (iii)

A)(i)

B)(i) and (ii)

C)(iii) and (iv)

D)(i), (ii), and (iii)

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

11

A foreign operation which is financially or operationally interdependent with the Canadian parent company such that the exposure to exchange rate changes is similar to the exposure that would exist had the transactions of the foreign operation been undertaken directly by the Canadian parent is called a

A)Interdependent foreign operation

B)Integrated foreign operation

C)Self-sustaining foreign operation

D)Has no special name

A)Interdependent foreign operation

B)Integrated foreign operation

C)Self-sustaining foreign operation

D)Has no special name

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the above statements pertains to integrated foreign operations?

A)(i)

B)(i) and (ii)

C)(iii) and (iv)

D)(i), (ii), and (iii)

A)(i)

B)(i) and (ii)

C)(iii) and (iv)

D)(i), (ii), and (iii)

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

13

XYZ Corporation,a Canadian parent firm,has a wholly owned sales affiliate,ABC Ltd.,in the United Kingdom.The affiliate was established to service to the local market. Assume that:

1)the functional currency of ABC is the pound

2)the reporting currency is the dollar

3)the initial exchange rate $1.00 = £ 0.67

ABC's nonconsolidated balance sheets and the footnotes to the financial statements indicate that ABC owes the parent firm £200,000.Assume that,XYZ had made an investment of $300,000 in the affiliate.Under CICA 1650,the intercompany debt and investment will appear on the consolidated balance sheet as:

A)£200,000

B)$201,493

C)$298,507

D)none of these

1)the functional currency of ABC is the pound

2)the reporting currency is the dollar

3)the initial exchange rate $1.00 = £ 0.67

ABC's nonconsolidated balance sheets and the footnotes to the financial statements indicate that ABC owes the parent firm £200,000.Assume that,XYZ had made an investment of $300,000 in the affiliate.Under CICA 1650,the intercompany debt and investment will appear on the consolidated balance sheet as:

A)£200,000

B)$201,493

C)$298,507

D)none of these

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

14

The Canadian methods for consolidating the financial reports of an MNC are:

A)short/long term method and current/future method

B)current/non-current method and short/long term method

C)temporal method and current rate method

D)temporal method and economic/non-economic method

A)short/long term method and current/future method

B)current/non-current method and short/long term method

C)temporal method and current rate method

D)temporal method and economic/non-economic method

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

15

Under the current rate method

A)All balance sheet and all income statement items are translated at the current exchange rate

B)All balance sheet and some income statement items are translated at the current exchange rate

C)Some balance sheet and all income statement items are translated at the current exchange rate

D)Some balance sheet and some income statement items are translated at the current exchange rate

A)All balance sheet and all income statement items are translated at the current exchange rate

B)All balance sheet and some income statement items are translated at the current exchange rate

C)Some balance sheet and all income statement items are translated at the current exchange rate

D)Some balance sheet and some income statement items are translated at the current exchange rate

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

16

The "reporting currency" is:

A)the currency of the primary economic environment in which the entity operates

B)the currency in which the MNC prepares its consolidated financial statements

C)a currency that is not the parent firm's home country currency

D)a and c

A)the currency of the primary economic environment in which the entity operates

B)the currency in which the MNC prepares its consolidated financial statements

C)a currency that is not the parent firm's home country currency

D)a and c

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

17

Translation exposure refers to:

A)accounting exposure

B)the effect that an unanticipated change in exchange rates will have on the consolidated financial reports of an MNC

C)the change in the value of a foreign subsidiaries assets and liabilities denominated in a foreign currency, as a result of exchange rate change fluctuations, when viewed from the perspective of the parent firm

D)all of these

A)accounting exposure

B)the effect that an unanticipated change in exchange rates will have on the consolidated financial reports of an MNC

C)the change in the value of a foreign subsidiaries assets and liabilities denominated in a foreign currency, as a result of exchange rate change fluctuations, when viewed from the perspective of the parent firm

D)all of these

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

18

Translation exposure is defined as:

A)the sensitivity of realized domestic currency values of the firm's contractual cash flows denominated in foreign currencies to unexpected exchange rate changes

B)the extent to which the value of the firm would be affected by unanticipated changes in exchange rate

C)the potential that the firm's consolidated financial statement can be affected by changes in exchange rates

D)ex post and ex ante currency exposures

A)the sensitivity of realized domestic currency values of the firm's contractual cash flows denominated in foreign currencies to unexpected exchange rate changes

B)the extent to which the value of the firm would be affected by unanticipated changes in exchange rate

C)the potential that the firm's consolidated financial statement can be affected by changes in exchange rates

D)ex post and ex ante currency exposures

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

19

The net effect of an increase in the exchange rate on translation exposure depends on

A)The translation method used

B)Whether the value of assets exceeds the value of liabilities

C)Whether the value of liabilities exceeds the value of assets

D)All of these

A)The translation method used

B)Whether the value of assets exceeds the value of liabilities

C)Whether the value of liabilities exceeds the value of assets

D)All of these

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

20

A Canadian firm has an integrated foreign operation in the United States.Which of the following statements is false?

A)If the US dollar appreciates, the Canadian dollar value reported in the balance sheet of the assets in the United States will be larger.

B)If the US dollar depreciates, the Canadian dollar value reported in the balance sheet of the assets in the United States will be smaller.

C)a and b

D)Need more information

A)If the US dollar appreciates, the Canadian dollar value reported in the balance sheet of the assets in the United States will be larger.

B)If the US dollar depreciates, the Canadian dollar value reported in the balance sheet of the assets in the United States will be smaller.

C)a and b

D)Need more information

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

21

Explain the differences between an integrated foreign operation and a self-sustaining foreign operation.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

22

Assume that translation or transaction exposure cannot be hedged at the same time and you have to decide on the firm's hedging policy.What should you do?

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

23

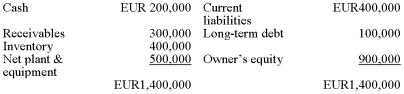

The French subsidiary of a Canadian parent has the following balance sheet (in euros):  The euro increases in value from EUR 1.6/C$ to EUR 1.3/C$.Using the current rate method,what happened to the total value of assets?

The euro increases in value from EUR 1.6/C$ to EUR 1.3/C$.Using the current rate method,what happened to the total value of assets?

The euro increases in value from EUR 1.6/C$ to EUR 1.3/C$.Using the current rate method,what happened to the total value of assets?

The euro increases in value from EUR 1.6/C$ to EUR 1.3/C$.Using the current rate method,what happened to the total value of assets?

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

24

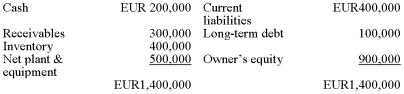

The French subsidiary of a Canadian parent has the following balance sheet (in euros):  The euro increases in value from EUR 1.6/C$ to EUR 1.3/C$.Using the temporal method,what happened to the total value of assets?

The euro increases in value from EUR 1.6/C$ to EUR 1.3/C$.Using the temporal method,what happened to the total value of assets?

The euro increases in value from EUR 1.6/C$ to EUR 1.3/C$.Using the temporal method,what happened to the total value of assets?

The euro increases in value from EUR 1.6/C$ to EUR 1.3/C$.Using the temporal method,what happened to the total value of assets?

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

25

Explain the major differences between translating financial statements for self-sustaining foreign operations and for integrated foreign operations.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck