Deck 6: International Parity Relationships and Forecasting Foreign Exchange Rates

Question

Question

Question

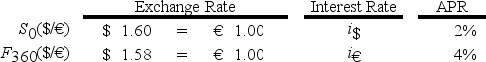

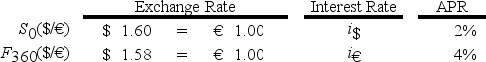

Question

Question

Question

Question

Question

Question

Question

Question

Question

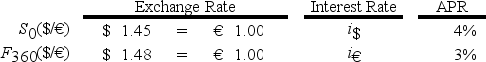

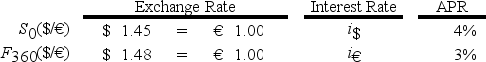

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/85

Play

Full screen (f)

Deck 6: International Parity Relationships and Forecasting Foreign Exchange Rates

1

Interest Rate Parity (IRP)is best defined as

A)occurring when a government brings its domestic interest rate in line with other major financial markets.

B)occurring when the central bank of a country brings its domestic interest rate in line with its major trading partners.

C)an arbitrage condition that must hold when international financial markets are in equilibrium.

D)none of the options

A)occurring when a government brings its domestic interest rate in line with other major financial markets.

B)occurring when the central bank of a country brings its domestic interest rate in line with its major trading partners.

C)an arbitrage condition that must hold when international financial markets are in equilibrium.

D)none of the options

C

2

Suppose you observe a spot exchange rate of $1.0500/€.If interest rates are 5% APR in the U.S.and 3% APR in the euro zone,what is the no-arbitrage 1-year forward rate?

A)€1.0704/$

B)$1.0704/€

C)€1.0300/$

D)$1.0300/€

A)€1.0704/$

B)$1.0704/€

C)€1.0300/$

D)$1.0300/€

B

3

Covered Interest Arbitrage (CIA)activities will result in

A)unstable international financial markets.

B)restoring equilibrium prices quickly.

C)a disintermediation.

D)no effect on the market.

A)unstable international financial markets.

B)restoring equilibrium prices quickly.

C)a disintermediation.

D)no effect on the market.

B

4

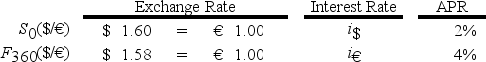

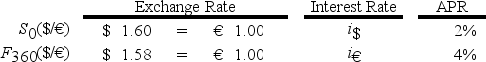

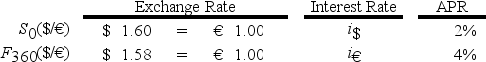

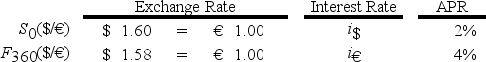

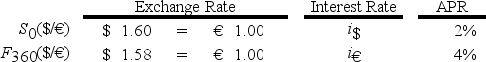

Suppose that the one-year interest rate is 4.0 percent in Italy,the spot exchange rate is $1.60/€,and the one-year forward exchange rate is $1.58/€.What must the one-year interest rate be in the United States?

A)2%

B)2.7%

C)5.32%

D)none of the options

A)2%

B)2.7%

C)5.32%

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

5

Suppose that the one-year interest rate is 3.0 percent in Italy,the spot exchange rate is $1.20/€,and the one-year forward exchange rate is $1.18/€.What must the one-year interest rate be in the United States?

A)1.2833%

B)1.0128%

C)4.75%

D)none of the options

A)1.2833%

B)1.0128%

C)4.75%

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

6

A currency dealer has good credit and can borrow either $1,000,000 or €800,000 for one year.The one-year interest rate in the U.S.is i$ = 2% and in the euro zone the one-year interest rate is i€ = 6%.The spot exchange rate is $1.25 = €1.00 and the one-year forward exchange rate is $1.20 = €1.00.Show how to realize a certain profit via covered interest arbitrage.

A)Borrow $1,000,000 at 2%.Trade $1,000,000 for €800,000; invest at i€ = 6%; translate proceeds back at forward rate of $1.20 = €1.00,gross proceeds = $1,017,600.

B)Borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €848,000 back into euro at the forward rate of $1.20 = €1.00.Net profit $2,400.

C)Borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €850,000 back into euro at the forward rate of $1.20 = €1.00.Net profit €2,000.

D)Borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €848,000 back into euro at the forward rate of $1.20 = €1.00.Net profit is $2,400.Additionally,one may borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €850,000 back into euro at the forward rate of $1.20 = €1.00.Net profit is €2,000.

A)Borrow $1,000,000 at 2%.Trade $1,000,000 for €800,000; invest at i€ = 6%; translate proceeds back at forward rate of $1.20 = €1.00,gross proceeds = $1,017,600.

B)Borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €848,000 back into euro at the forward rate of $1.20 = €1.00.Net profit $2,400.

C)Borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €850,000 back into euro at the forward rate of $1.20 = €1.00.Net profit €2,000.

D)Borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €848,000 back into euro at the forward rate of $1.20 = €1.00.Net profit is $2,400.Additionally,one may borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €850,000 back into euro at the forward rate of $1.20 = €1.00.Net profit is €2,000.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

7

Suppose that the one-year interest rate is 5.0 percent in the United States and 3.5 percent in Germany,and that the spot exchange rate is $1.12/€ and the one-year forward exchange rate,is $1.16/€.Assume that an arbitrageur can borrow up to $1,000,000.

A)This is an example where interest rate parity holds.

B)This is an example of an arbitrage opportunity; interest rate parity does not hold.

C)This is an example of a Purchasing Power Parity violation and an arbitrage opportunity.

D)none of the options

A)This is an example where interest rate parity holds.

B)This is an example of an arbitrage opportunity; interest rate parity does not hold.

C)This is an example of a Purchasing Power Parity violation and an arbitrage opportunity.

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

8

Suppose that the annual interest rate is 5.0 percent in the United States and 3.5 percent in Germany,and that the spot exchange rate is $1.12/€ and the forward exchange rate,with one-year maturity,is $1.16/€.Assume that an arbitrager can borrow up to $1,000,000.If an astute trader finds an arbitrage,what is the net cash flow in one year?

A)$10,690

B)$15,000

C)$46,207

D)$21,964.29

A)$10,690

B)$15,000

C)$46,207

D)$21,964.29

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

9

An arbitrage is best defined as

A)a legal condition imposed by the CFTC.

B)the act of simultaneously buying and selling the same or equivalent assets or commodities for the purpose of making reasonable profits.

C)the act of simultaneously buying and selling the same or equivalent assets or commodities for the purpose of making certain guaranteed profits.

D)none of the options

A)a legal condition imposed by the CFTC.

B)the act of simultaneously buying and selling the same or equivalent assets or commodities for the purpose of making reasonable profits.

C)the act of simultaneously buying and selling the same or equivalent assets or commodities for the purpose of making certain guaranteed profits.

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

10

Suppose that the one-year interest rate is 5.0 percent in the United States; the spot exchange rate is $1.20/€; and the one-year forward exchange rate is $1.16/€.What must the one-year interest rate be in the euro zone to avoid arbitrage?

A)5.0%

B)6.09%

C)8.62%

D)none of the options

A)5.0%

B)6.09%

C)8.62%

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

11

A formal statement of IRP is

A) = .

B) = .

C) = .

D)F($ / €)- S($ / €)= - .

A) = .

B) = .

C) = .

D)F($ / €)- S($ / €)= - .

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

12

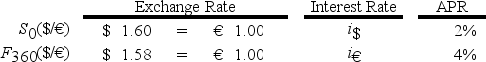

Suppose that the annual interest rate is 2.0 percent in the United States and 4 percent in Germany,and that the spot exchange rate is $1.60/€ and the forward exchange rate,with one-year maturity,is $1.58/€.Assume that an arbitrager can borrow up to $1,000,000 or €625,000.If an astute trader finds an arbitrage,what is the net cash flow in one year?

A)$238.65

B)$14,000

C)$46,207

D)$7,000

A)$238.65

B)$14,000

C)$46,207

D)$7,000

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

13

How high does the lending rate in the euro zone have to be before an arbitrageur would not consider borrowing dollars,trading for euro at the spot,investing in the euro zone and hedging with a short position in the forward contract?

A)The bid-ask spreads are too wide for any profitable arbitrage when i€ > 0

B)3.48%

C)?2.09%

D)none of the options

A)The bid-ask spreads are too wide for any profitable arbitrage when i€ > 0

B)3.48%

C)?2.09%

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

14

Suppose that you are the treasurer of IBM with an extra U.S.$1,000,000 to invest for six months.You are considering the purchase of U.S.T-bills that yield 1.810 percent (that's a six month rate,not an annual rate by the way)and have a maturity of 26 weeks.The spot exchange rate is $1.00 = ¥100,and the six month forward rate is $1.00 = ¥110.The interest rate in Japan (on an investment of comparable risk)is 13 percent.What is your strategy?

A)Take $1m,invest in U.S.T-bills.

B)Take $1m,translate into yen at the spot,invest in Japan,and repatriate your yen earnings back into dollars at the spot rate prevailing in six months.

C)Take $1m,translate into yen at the spot,invest in Japan,hedge with a short position in the forward contract.

D)Take $1m,translate into yen at the forward rate,invest in Japan,hedge with a short position in the spot contract.

A)Take $1m,invest in U.S.T-bills.

B)Take $1m,translate into yen at the spot,invest in Japan,and repatriate your yen earnings back into dollars at the spot rate prevailing in six months.

C)Take $1m,translate into yen at the spot,invest in Japan,hedge with a short position in the forward contract.

D)Take $1m,translate into yen at the forward rate,invest in Japan,hedge with a short position in the spot contract.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

15

Suppose you observe a spot exchange rate of $2.00/£.If interest rates are 5 percent APR in the U.S.and 2 percent APR in the U.K.,what is the no-arbitrage 1-year forward rate?

A)£2.0588/$

B)$2.0588/£

C)£1.9429/$

D)$1.9429/£

A)£2.0588/$

B)$2.0588/£

C)£1.9429/$

D)$1.9429/£

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

16

Suppose that you are the treasurer of IBM with an extra U.S.$1,000,000 to invest for six months.You are considering the purchase of U.S.T-bills that yield 1.810% (that's a six month rate,not an annual rate)and have a maturity of 26 weeks.The spot exchange rate is $1.00 = ¥100,and the six month forward rate is $1.00 = ¥110.What must the interest rate in Japan (on an investment of comparable risk)be before you are willing to consider investing there for six months?

A)1.991 percent

B)1.12 percent

C)7.45 percent

D)−7.45 percent

A)1.991 percent

B)1.12 percent

C)7.45 percent

D)−7.45 percent

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

17

An Italian currency dealer has good credit and can borrow €800,000 for one year.The one-year interest rate in the U.S.is i$ = 2% and in the euro zone the one-year interest rate is i€ = 6%.The spot exchange rate is $1.25 = €1.00 and the one-year forward exchange rate is $1.20 = €1.00.Show how to realize a certain euro-denominated profit via covered interest arbitrage.

A)Borrow $1,000,000 at 2%.Trade $1,000,000 for €800,000; invest at i€ = 6%; translate proceeds back at forward rate of $1.20 = €1.00,gross proceeds = $1,017,600.

B)Borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €848,000 back into euro at the forward rate of $1.20 = €1.00.Net profit is $2,400.

C)Borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €850,000 back into euro at the forward rate of $1.20 = €1.00.Net profit is €2,000.

D)Borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €850,000 back into euro at the forward rate of $1.20 = €1.00.Net profit is €2,000.Alternatively,one could borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €848,000 back into euro at the forward rate of $1.20 = €1.00.Net profit is $2,400.

A)Borrow $1,000,000 at 2%.Trade $1,000,000 for €800,000; invest at i€ = 6%; translate proceeds back at forward rate of $1.20 = €1.00,gross proceeds = $1,017,600.

B)Borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €848,000 back into euro at the forward rate of $1.20 = €1.00.Net profit is $2,400.

C)Borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €850,000 back into euro at the forward rate of $1.20 = €1.00.Net profit is €2,000.

D)Borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €850,000 back into euro at the forward rate of $1.20 = €1.00.Net profit is €2,000.Alternatively,one could borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €848,000 back into euro at the forward rate of $1.20 = €1.00.Net profit is $2,400.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

18

Suppose you observe a spot exchange rate of $1.0500/€.If interest rates are 3 percent APR in the U.S.and 5 percent APR in the euro zone,what is the no-arbitrage 1-year forward rate?

A)€1.0704/$

B)$1.0704/€

C)€1.0300/$

D)$1.0300/€

A)€1.0704/$

B)$1.0704/€

C)€1.0300/$

D)$1.0300/€

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

19

A U.S.-based currency dealer has good credit and can borrow $1,000,000 for one year.The one-year interest rate in the U.S.is i$ = 2% and in the euro zone the one-year interest rate is i€ = 6%.The spot exchange rate is $1.25 = €1.00 and the one-year forward exchange rate is $1.20 = €1.00.Show how to realize a certain dollar profit via covered interest arbitrage.

A)Borrow $1,000,000 at 2%.Trade $1,000,000 for €800,000; invest at i€ = 6%; translate proceeds back at forward rate of $1.20 = €1.00,gross proceeds = $1,017,600.

B)Borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €848,000 back into euro at the forward rate of $1.20 = €1.00.Net profit is $2,400.

C)Borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €850,000 back into euro at the forward rate of $1.20 = €1.00.Net profit is €2,000.

D)Borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €850,000 back into euro at the forward rate of $1.20 = €1.00.Net profit is €2,000.Alternatively,one could borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €848,000 back into euro at the forward rate of $1.20 = €1.00.Net profit is $2,400.

A)Borrow $1,000,000 at 2%.Trade $1,000,000 for €800,000; invest at i€ = 6%; translate proceeds back at forward rate of $1.20 = €1.00,gross proceeds = $1,017,600.

B)Borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €848,000 back into euro at the forward rate of $1.20 = €1.00.Net profit is $2,400.

C)Borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €850,000 back into euro at the forward rate of $1.20 = €1.00.Net profit is €2,000.

D)Borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €850,000 back into euro at the forward rate of $1.20 = €1.00.Net profit is €2,000.Alternatively,one could borrow €800,000 at i€ = 6%; translate to dollars at the spot,invest in the U.S.at i$ = 2% for one year; translate €848,000 back into euro at the forward rate of $1.20 = €1.00.Net profit is $2,400.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

20

When Interest Rate Parity (IRP)does not hold

A)there is usually a high degree of inflation in at least one country.

B)the financial markets are in equilibrium.

C)there are opportunities for covered interest arbitrage.

D)the financial markets are in equilibrium and there are opportunities for covered interest arbitrage.

A)there is usually a high degree of inflation in at least one country.

B)the financial markets are in equilibrium.

C)there are opportunities for covered interest arbitrage.

D)the financial markets are in equilibrium and there are opportunities for covered interest arbitrage.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

21

The price of a McDonald's Big Mac sandwich

A)is about the same in the 120 countries that McDonalds does business in.

B)varies considerably across the world in dollar terms.

C)supports PPP.

D)none of the options.

A)is about the same in the 120 countries that McDonalds does business in.

B)varies considerably across the world in dollar terms.

C)supports PPP.

D)none of the options.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

22

Purchasing Power Parity (PPP)theory states that

A)the exchange rate between currencies of two countries should be equal to the ratio of the countries' price levels.

B)as the purchasing power of a currency sharply declines (due to hyperinflation)that currency will depreciate against stable currencies.

C)the prices of standard commodity baskets in two countries are not related.

D)the exchange rate between currencies of two countries should be equal to the ratio of the countries' price levels,and as the purchasing power of a currency sharply declines (due to hyperinflation)that currency will depreciate against stable currencies.

A)the exchange rate between currencies of two countries should be equal to the ratio of the countries' price levels.

B)as the purchasing power of a currency sharply declines (due to hyperinflation)that currency will depreciate against stable currencies.

C)the prices of standard commodity baskets in two countries are not related.

D)the exchange rate between currencies of two countries should be equal to the ratio of the countries' price levels,and as the purchasing power of a currency sharply declines (due to hyperinflation)that currency will depreciate against stable currencies.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

23

Generally unfavorable evidence on PPP suggests that

A)substantial barriers to international commodity arbitrage exist.

B)tariffs and quotas imposed on international trade can explain at least some of the evidence.

C)shipping costs can make it difficult to directly compare commodity prices.

D)all of the options

A)substantial barriers to international commodity arbitrage exist.

B)tariffs and quotas imposed on international trade can explain at least some of the evidence.

C)shipping costs can make it difficult to directly compare commodity prices.

D)all of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

24

If a foreign county experiences a hyperinflation,

A)its currency will depreciate against stable currencies.

B)its currency may appreciate against stable currencies.

C)its currency may be unaffected-it's difficult to say.

D)none of the options

A)its currency will depreciate against stable currencies.

B)its currency may appreciate against stable currencies.

C)its currency may be unaffected-it's difficult to say.

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

25

If the annual inflation rate is 2.5 percent in the United States and 4 percent in the U.K.,and the dollar appreciated against the pound by 1.5 percent,then the real exchange rate,assuming that PPP initially held,is ________.

A)parity

B)0.9710

C)−0.0198

D)4.5

A)parity

B)0.9710

C)−0.0198

D)4.5

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

26

Although IRP tends to hold,it may not hold precisely all the time

A)due to transactions costs,like the bid-ask spread.

B)due to asymmetric information.

C)due to capital controls imposed by governments.

D)due to transactions costs,like the bid-ask spread,as well as capital controls imposed by governments.

A)due to transactions costs,like the bid-ask spread.

B)due to asymmetric information.

C)due to capital controls imposed by governments.

D)due to transactions costs,like the bid-ask spread,as well as capital controls imposed by governments.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

27

Will an arbitrageur facing the following prices be able to make money?

A)Yes,borrow $1,000 at 5 percent; trade for € at the ask spot rate $1.01 = €1.00; Invest €990.10 at 5.5 percent; hedge this with a forward contract on €1,044.55 at $0.99 = €1.00; receive $1.034.11.

B)Yes,borrow €1,000 at 6 percent; trade for $ at the bid spot rate $1.00 = €1.00; invest $1,000 at 4.5 percent; hedge this with a forward contract on €1,045 at $1.00 = €1.00.

C)No; the transactions costs are too high.

D)none of the options

A)Yes,borrow $1,000 at 5 percent; trade for € at the ask spot rate $1.01 = €1.00; Invest €990.10 at 5.5 percent; hedge this with a forward contract on €1,044.55 at $0.99 = €1.00; receive $1.034.11.

B)Yes,borrow €1,000 at 6 percent; trade for $ at the bid spot rate $1.00 = €1.00; invest $1,000 at 4.5 percent; hedge this with a forward contract on €1,045 at $1.00 = €1.00.

C)No; the transactions costs are too high.

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

28

Will an arbitrageur facing the following prices be able to make money?

A)Yes,borrow €1,000,000 at 3.65 percent; trade for $ at the bid spot rate $1.40 = €1.00; invest at 4.1 percent; hedge this with a long position in a forward contract.

B)Yes,borrow $1,000,000 at 4.2 percent; trade for € at the spot ask exchange rate $1.43 = €1.00; invest €699,300.70 at 3.5 percent; hedge this by going SHORT in forward (agree to sell € @ BID price of $1.44/€ in one year).Cash flow in 1 year $237.76.

C)No; the transactions costs are too high.

D)none of the options

A)Yes,borrow €1,000,000 at 3.65 percent; trade for $ at the bid spot rate $1.40 = €1.00; invest at 4.1 percent; hedge this with a long position in a forward contract.

B)Yes,borrow $1,000,000 at 4.2 percent; trade for € at the spot ask exchange rate $1.43 = €1.00; invest €699,300.70 at 3.5 percent; hedge this by going SHORT in forward (agree to sell € @ BID price of $1.44/€ in one year).Cash flow in 1 year $237.76.

C)No; the transactions costs are too high.

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

29

Some commodities never enter into international trade.Examples include

A)nontradables.

B)haircuts.

C)housing.

D)all of the options

A)nontradables.

B)haircuts.

C)housing.

D)all of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

30

Suppose that the one-year interest rate is 5.0 percent in the United States and 3.5 percent in Germany,and the one-year forward exchange rate is $1.16/€.What must the spot exchange rate be?

A)$1.1768/€

B)$1.1434/€

C)$1.12/€

D)none of the options

A)$1.1768/€

B)$1.1434/€

C)$1.12/€

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

31

A currency dealer has good credit and can borrow either $1,000,000 or €800,000 for one year.The one-year interest rate in the U.S.is i$ = 2% and in the euro zone the one-year interest rate is i€ = 6%.The one-year forward exchange rate is $1.20 = €1.00; what must the spot rate be to eliminate arbitrage opportunities?

A)$1.2471 = €1.00

B)$1.20 = €1.00

C)$1.1547 = €1.00

D)none of the options

A)$1.2471 = €1.00

B)$1.20 = €1.00

C)$1.1547 = €1.00

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

32

A higher U.S.interest rate (i$ ↑)relative to interest rates abroad,ceteris paribus,will result in

A)a stronger dollar.

B)a lower spot exchange rate (expressed as foreign currency per U.S.dollar).

C)a stronger dollar and a lower spot exchange rate (expressed as foreign currency per U.S.dollar).

D)none of the options

A)a stronger dollar.

B)a lower spot exchange rate (expressed as foreign currency per U.S.dollar).

C)a stronger dollar and a lower spot exchange rate (expressed as foreign currency per U.S.dollar).

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

33

As of today,the spot exchange rate is €1.00 = $1.25 and the rates of inflation expected to prevail for the next year in the U.S.is 2 percent and 3 percent in the euro zone.What is the one-year forward rate that should prevail?

A)€1.00 = $1.2379

B)€1.00 = $1.2623

C)€1.00 = $0.9903

D)$1.00 = €1.2623

A)€1.00 = $1.2379

B)€1.00 = $1.2623

C)€1.00 = $0.9903

D)$1.00 = €1.2623

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

34

The interest rate at which the arbitrager borrows tends to be higher than the rate at which he lends,reflecting the

A)transaction cost paradigm.

B)midpoint.

C)bid-ask spread.

D)none of the options

A)transaction cost paradigm.

B)midpoint.

C)bid-ask spread.

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

35

Governments sometimes restrict capital flows,inbound and/or outbound.They achieve this objective by means of

A)jawboning.

B)imposing taxes.

C)bans on cross-border capital movements.

D)all of the options

A)jawboning.

B)imposing taxes.

C)bans on cross-border capital movements.

D)all of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

36

In view of the fact that PPP is the manifestation of the law of one price applied to a standard commodity basket,

A)it will hold only if the prices of the constituent commodities are equalized across countries in a given currency.

B)it will hold only if the composition of the consumption basket is the same across countries.

C)it will hold only if the prices of the constituent commodities are equalized across countries in a given currency or if the composition of the consumption basket is the same across countries.

D)none of the options

A)it will hold only if the prices of the constituent commodities are equalized across countries in a given currency.

B)it will hold only if the composition of the consumption basket is the same across countries.

C)it will hold only if the prices of the constituent commodities are equalized across countries in a given currency or if the composition of the consumption basket is the same across countries.

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

37

As of today,the spot exchange rate is €1.00 = $1.60 and the rates of inflation expected to prevail for the next year in the U.S.is 2 percent and 3 percent in the euro zone.What is the one-year forward rate that should prevail?

A)€1.00 = $1.6157

B)€1.6157 = $1.00

C)€1.00 = $1.5845

D)$1.00 × 1.03 = €1.60 × 1.02

A)€1.00 = $1.6157

B)€1.6157 = $1.00

C)€1.00 = $1.5845

D)$1.00 × 1.03 = €1.60 × 1.02

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

38

If the interest rate in the U.S.is i$ = 5 percent for the next year and interest rate in the U.K.is i£ = 8 percent for the next year,uncovered IRP suggests that

A)the pound is expected to depreciate against the dollar by about 3 percent.

B)the pound is expected to appreciate against the dollar by about 3 percent.

C)the dollar is expected to appreciate against the pound by about 3 percent.

D)the pound is expected to depreciate against the dollar by about 3 percent and the dollar is expected to appreciate against the pound by about 3 percent.

A)the pound is expected to depreciate against the dollar by about 3 percent.

B)the pound is expected to appreciate against the dollar by about 3 percent.

C)the dollar is expected to appreciate against the pound by about 3 percent.

D)the pound is expected to depreciate against the dollar by about 3 percent and the dollar is expected to appreciate against the pound by about 3 percent.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

39

If IRP fails to hold,

A)pressure from arbitrageurs should bring exchange rates and interest rates back into line.

B)it may fail to hold due to transactions costs.

C)it may be due to government-imposed capital controls.

D)all of the options

A)pressure from arbitrageurs should bring exchange rates and interest rates back into line.

B)it may fail to hold due to transactions costs.

C)it may be due to government-imposed capital controls.

D)all of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

40

If the annual inflation rate is 5.5 percent in the United States and 4 percent in the U.K.,and the dollar depreciated against the pound by 3 percent,then the real exchange rate,assuming that PPP initially held,is

A)0.07.

B)0.9849.

C)−0.0198.

D)4.5.

A)0.07.

B)0.9849.

C)−0.0198.

D)4.5.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

41

The random walk hypothesis suggests that

A)the best predictor of the future exchange rate is the current exchange rate.

B)the best predictor of the future exchange rate is the current forward rate.

C)the best predictors of the future exchange rate are the current exchange rate and the current forward rate.

D)none of the options

A)the best predictor of the future exchange rate is the current exchange rate.

B)the best predictor of the future exchange rate is the current forward rate.

C)the best predictors of the future exchange rate are the current exchange rate and the current forward rate.

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

42

If the exchange rate follows a random walk

A)the future exchange rate is unpredictable.

B)the future exchange rate is expected to be the same as the current exchange rate,St = E(St + 1).

C)the best predictor of future exchange rates is the forward rate Ft = E(St + 1/It).

D)the future exchange rate is expected to be the same as the current exchange rate,St = E(St + 1),and the best predictor of future exchange rates is the forward rate Ft = E(St + 1/It).

A)the future exchange rate is unpredictable.

B)the future exchange rate is expected to be the same as the current exchange rate,St = E(St + 1).

C)the best predictor of future exchange rates is the forward rate Ft = E(St + 1/It).

D)the future exchange rate is expected to be the same as the current exchange rate,St = E(St + 1),and the best predictor of future exchange rates is the forward rate Ft = E(St + 1/It).

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

43

One implication of the random walk hypothesis is

A)given the efficiency of foreign exchange markets,it is difficult to outperform the market-based forecasts unless the forecaster has access to private information that is not yet reflected in the current exchange rate.

B)given the efficiency of foreign exchange markets,it is difficult to outperform the market-based forecasts unless the forecaster has access to private information that is already reflected in the current exchange rate.

C)given the relative inefficiency of foreign exchange markets,it is difficult to outperform the technical forecasts unless the forecaster has access to private information that is not yet reflected in the current futures exchange rate.

D)none of the options

A)given the efficiency of foreign exchange markets,it is difficult to outperform the market-based forecasts unless the forecaster has access to private information that is not yet reflected in the current exchange rate.

B)given the efficiency of foreign exchange markets,it is difficult to outperform the market-based forecasts unless the forecaster has access to private information that is already reflected in the current exchange rate.

C)given the relative inefficiency of foreign exchange markets,it is difficult to outperform the technical forecasts unless the forecaster has access to private information that is not yet reflected in the current futures exchange rate.

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

44

The Fisher effect can be written for the United States as: A.i$ = ?$ + E(?$)+ ?$ × E(?$)B.?$ = i$ + E(?$)+ i$ × E(?$)C.q = D. =

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

45

Good,inexpensive,and fairly reliable predictors of future exchange rates include

A)today's exchange rate.

B)current forward exchange rates (e.g.,the six-month forward rate is a pretty good predictor of the spot rate that will prevail six months from today).

C)esoteric fundamental models that take an econometrician to use and no one can explain.

D)today's exchange rate,as well as current forward exchange rates (e.g.the six-month forward rate is a pretty good predictor of the spot rate that will prevail six months from today).

A)today's exchange rate.

B)current forward exchange rates (e.g.,the six-month forward rate is a pretty good predictor of the spot rate that will prevail six months from today).

C)esoteric fundamental models that take an econometrician to use and no one can explain.

D)today's exchange rate,as well as current forward exchange rates (e.g.the six-month forward rate is a pretty good predictor of the spot rate that will prevail six months from today).

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

46

The International Fisher Effect suggests that

A)any forward premium or discount is equal to the expected change in the exchange rate.

B)any forward premium or discount is equal to the actual change in the exchange rate.

C)the nominal interest rate differential reflects the expected change in the exchange rate.

D)an increase (decrease)in the expected inflation rate in a country will cause a proportionate increase (decrease)in the interest rate in the country.

A)any forward premium or discount is equal to the expected change in the exchange rate.

B)any forward premium or discount is equal to the actual change in the exchange rate.

C)the nominal interest rate differential reflects the expected change in the exchange rate.

D)an increase (decrease)in the expected inflation rate in a country will cause a proportionate increase (decrease)in the interest rate in the country.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

47

Decision-making for multinational corporations formulating international sourcing,production,financing,and marketing strategies depends,primarily,on

A)risk management techniques.

B)expertise of staff attorneys.

C)luck.

D)forecasting exchange rates as accurately as possible.

A)risk management techniques.

B)expertise of staff attorneys.

C)luck.

D)forecasting exchange rates as accurately as possible.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

48

Forward parity states that

A)any forward premium or discount is equal to the expected change in the exchange rate.

B)any forward premium or discount is equal to the actual change in the exchange rate.

C)the nominal interest rate differential reflects the expected change in the exchange rate.

D)an increase (decrease)in the expected inflation rate in a country will cause a proportionate increase (decrease)in the interest rate in the country.

A)any forward premium or discount is equal to the expected change in the exchange rate.

B)any forward premium or discount is equal to the actual change in the exchange rate.

C)the nominal interest rate differential reflects the expected change in the exchange rate.

D)an increase (decrease)in the expected inflation rate in a country will cause a proportionate increase (decrease)in the interest rate in the country.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following issues are difficulties for the fundamental approach to exchange rate forecasting?

A)One has to forecast a set of independent variables to forecast the exchange rates.Forecasting the former will certainly be subject to errors and may not be necessarily easier than forecasting the latter.

B)The parameter values,that is the α's and β's,that are estimated using historical data may change over time because of changes in government policies and/or the underlying structure of the economy.Either difficulty can diminish the accuracy of forecasts even if the model is correct.

C)The model itself can be wrong.

D)none of the options

A)One has to forecast a set of independent variables to forecast the exchange rates.Forecasting the former will certainly be subject to errors and may not be necessarily easier than forecasting the latter.

B)The parameter values,that is the α's and β's,that are estimated using historical data may change over time because of changes in government policies and/or the underlying structure of the economy.Either difficulty can diminish the accuracy of forecasts even if the model is correct.

C)The model itself can be wrong.

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

50

The Fisher effect states that

A)any forward premium or discount is equal to the expected change in the exchange rate.

B)any forward premium or discount is equal to the actual change in the exchange rate.

C)the nominal interest rate differential reflects the expected change in the exchange rate.

D)an increase (decrease)in the expected inflation rate in a country will cause a proportionate increase (decrease)in the interest rate in the country.

A)any forward premium or discount is equal to the expected change in the exchange rate.

B)any forward premium or discount is equal to the actual change in the exchange rate.

C)the nominal interest rate differential reflects the expected change in the exchange rate.

D)an increase (decrease)in the expected inflation rate in a country will cause a proportionate increase (decrease)in the interest rate in the country.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

51

With regard to fundamental forecasting versus technical forecasting of exchange rates

A)the technicians tend to use "cause and effect" models.

B)the fundamentalists tend to believe that "history will repeat itself" is the best model.

C)the technicians tend to use "cause and effect" models and the fundamentalists tend to believe that "history will repeat itself" is the best model.

D)none of the options

A)the technicians tend to use "cause and effect" models.

B)the fundamentalists tend to believe that "history will repeat itself" is the best model.

C)the technicians tend to use "cause and effect" models and the fundamentalists tend to believe that "history will repeat itself" is the best model.

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

52

The Efficient Markets Hypothesis states

A)markets tend to evolve to low transactions costs and speedy execution of orders.

B)current asset prices (e.g.,exchange rates)fully reflect all the available and relevant information.

C)current exchange rates cannot be explained by such fundamental forces as money supplies,inflation rates and so forth.

D)none of the options

A)markets tend to evolve to low transactions costs and speedy execution of orders.

B)current asset prices (e.g.,exchange rates)fully reflect all the available and relevant information.

C)current exchange rates cannot be explained by such fundamental forces as money supplies,inflation rates and so forth.

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

53

Academic studies tend to discredit the validity of technical analysis.Which of the following is true?

A)This can be viewed as support technical analysis.

B)It can be rational for individual traders to use technical analysis-if enough traders use technical analysis the predictions based on it can become self-fulfilling to some extent,at least in the short-run.

C)The statement can be explained by the difficulty professors may have in differentiating between technical analysis and fundamental analysis.

D)none of the options

A)This can be viewed as support technical analysis.

B)It can be rational for individual traders to use technical analysis-if enough traders use technical analysis the predictions based on it can become self-fulfilling to some extent,at least in the short-run.

C)The statement can be explained by the difficulty professors may have in differentiating between technical analysis and fundamental analysis.

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

54

The benefit to forecasting exchange rates

A)are greatest during periods of fixed exchange rates.

B)are nonexistent now that the euro and dollar are the biggest game in town.

C)accrue to,and are a vital concern for,MNCs formulating international sourcing,production,financing,and marketing strategies.

D)all of the options

A)are greatest during periods of fixed exchange rates.

B)are nonexistent now that the euro and dollar are the biggest game in town.

C)accrue to,and are a vital concern for,MNCs formulating international sourcing,production,financing,and marketing strategies.

D)all of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

55

Researchers have found that the fundamental approach to exchange rate forecasting

A)outperforms the efficient market approach.

B)fails to more accurately forecast exchange rates than either the random walk model or the forward rate model.

C)fails to more accurately forecast exchange rates than the random walk model but is better than the forward rate model.

D)outperforms the random walk model,but fails to more accurately forecast exchange rates than the forward rate model.

A)outperforms the efficient market approach.

B)fails to more accurately forecast exchange rates than either the random walk model or the forward rate model.

C)fails to more accurately forecast exchange rates than the random walk model but is better than the forward rate model.

D)outperforms the random walk model,but fails to more accurately forecast exchange rates than the forward rate model.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following is a true statement?

A)While researchers found it difficult to reject the random walk hypothesis for exchange rates on empirical grounds,there is no theoretical reason why exchange rates should follow a pure random walk.

B)While researchers found it easy to reject the random walk hypothesis for exchange rates on empirical grounds,there are strong theoretical reasons why exchange rates should follow a pure random walk.

C)While researchers found it difficult to reject the random walk hypothesis for exchange rates on empirical grounds,there are compelling theoretical reasons why exchange rates should follow a pure random walk.

D)none of the options

A)While researchers found it difficult to reject the random walk hypothesis for exchange rates on empirical grounds,there is no theoretical reason why exchange rates should follow a pure random walk.

B)While researchers found it easy to reject the random walk hypothesis for exchange rates on empirical grounds,there are strong theoretical reasons why exchange rates should follow a pure random walk.

C)While researchers found it difficult to reject the random walk hypothesis for exchange rates on empirical grounds,there are compelling theoretical reasons why exchange rates should follow a pure random walk.

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

57

The moving average crossover rule

A)is a fundamental approach to forecasting exchange rates.

B)states that a crossover of the short-term moving average above the long-term moving average signals that the foreign currency is appreciating.

C)states that a crossover of the short-term moving average above the long-term moving average signals that the foreign currency is depreciating.

D)none of the options

A)is a fundamental approach to forecasting exchange rates.

B)states that a crossover of the short-term moving average above the long-term moving average signals that the foreign currency is appreciating.

C)states that a crossover of the short-term moving average above the long-term moving average signals that the foreign currency is depreciating.

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

58

Generating exchange rate forecasts with the fundamental approach involves

A)looking at charts of the exchange rate and extrapolating the patterns into the future.

B)estimation of a structural model.

C)substituting the estimated values of the independent variables into the estimated structural model to generate the forecast.

D)estimation of a structural model and substitution of the estimated values of the independent variables into the estimated structural model to generate the forecast.

A)looking at charts of the exchange rate and extrapolating the patterns into the future.

B)estimation of a structural model.

C)substituting the estimated values of the independent variables into the estimated structural model to generate the forecast.

D)estimation of a structural model and substitution of the estimated values of the independent variables into the estimated structural model to generate the forecast.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

59

According to the technical approach,what matters in exchange rate determination

A)is the past behavior of exchange rates.

B)is the velocity of money.

C)is the future behavior of exchange rates.

D)is the beta.

A)is the past behavior of exchange rates.

B)is the velocity of money.

C)is the future behavior of exchange rates.

D)is the beta.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

60

The main approaches to forecasting exchange rates are

A)Efficient market,Fundamental,and Technical approaches.

B)Efficient market and Technical approaches.

C)Efficient market and Fundamental approaches.

D)Fundamental and Technical approaches.

A)Efficient market,Fundamental,and Technical approaches.

B)Efficient market and Technical approaches.

C)Efficient market and Fundamental approaches.

D)Fundamental and Technical approaches.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

61

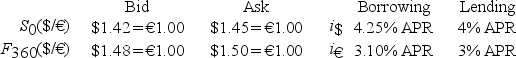

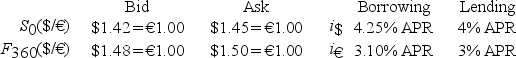

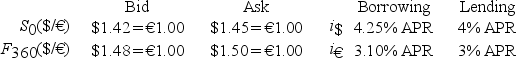

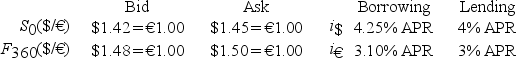

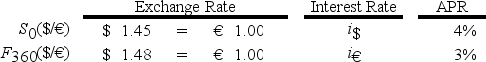

Assume that you are a retail customer (i.e.,you buy at the ask and sell at the bid).Use the information below to answer the following question.

If you had €1,000,000 and traded it for USD at the spot rate,how many USD will you get?

If you had €1,000,000 and traded it for USD at the spot rate,how many USD will you get?

If you had €1,000,000 and traded it for USD at the spot rate,how many USD will you get?

If you had €1,000,000 and traded it for USD at the spot rate,how many USD will you get?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

62

According to the monetary approach,the exchange rate can be expressed as

A)S = × ×

B) =

C)S = × ×

D)none of the options

A)S = × ×

B) =

C)S = × ×

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

63

According to the research in the accuracy of paid exchange rate forecasters,

A)you can make more money selling forecasts than you can following forecasts.

B)the average forecaster is better than average at forecasting.

C)the forecasters do a better job of predicting the future exchange rates than the market does.

D)none of the above.

A)you can make more money selling forecasts than you can following forecasts.

B)the average forecaster is better than average at forecasting.

C)the forecasters do a better job of predicting the future exchange rates than the market does.

D)none of the above.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

64

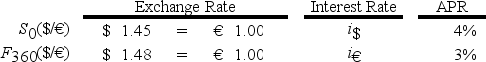

Assume that you are a retail customer (i.e.,you buy at the ask and sell at the bid).Use the information below to answer the following question.

If you had borrowed $1,000,000 and traded for euro at the spot rate,how many € do you receive?

If you had borrowed $1,000,000 and traded for euro at the spot rate,how many € do you receive?

If you had borrowed $1,000,000 and traded for euro at the spot rate,how many € do you receive?

If you had borrowed $1,000,000 and traded for euro at the spot rate,how many € do you receive?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

65

Assume that you are a retail customer.Use the information below to answer the following question.

If you had borrowed $1,000,000 and traded for euro at the spot rate,how many € do you receive?

If you had borrowed $1,000,000 and traded for euro at the spot rate,how many € do you receive?

If you had borrowed $1,000,000 and traded for euro at the spot rate,how many € do you receive?

If you had borrowed $1,000,000 and traded for euro at the spot rate,how many € do you receive?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

66

Assume that you are a retail customer.Use the information below to answer the following question.

If you borrowed $1,000,000 for one year,how much money would you owe at maturity?

If you borrowed $1,000,000 for one year,how much money would you owe at maturity?

If you borrowed $1,000,000 for one year,how much money would you owe at maturity?

If you borrowed $1,000,000 for one year,how much money would you owe at maturity?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

67

According to the research in the accuracy of paid exchange rate forecasters,

A)as a group,they do not do a better job of forecasting the exchange rate than the forward rate does.

B)the average forecaster is better than average at forecasting.

C)the forecasters do a better job of predicting the future exchange rate than the market does.

D)none of the options

A)as a group,they do not do a better job of forecasting the exchange rate than the forward rate does.

B)the average forecaster is better than average at forecasting.

C)the forecasters do a better job of predicting the future exchange rate than the market does.

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

68

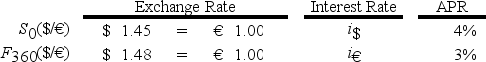

Use the information below to answer the following question.

If you had borrowed $1,000,000 and traded for euro at the spot rate,how many € do you receive?

If you had borrowed $1,000,000 and traded for euro at the spot rate,how many € do you receive?

If you had borrowed $1,000,000 and traded for euro at the spot rate,how many € do you receive?

If you had borrowed $1,000,000 and traded for euro at the spot rate,how many € do you receive?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

69

Studies of the accuracy of paid exchange rate forecasters

A)tend to support the view that "you get what you pay for".

B)tend to support the view that forecasting is easy,at least with regard to major currencies like the euro and Japanese yen.

C)tend to support the view that banks do their best forecasting with the yen.

D)none of the options

A)tend to support the view that "you get what you pay for".

B)tend to support the view that forecasting is easy,at least with regard to major currencies like the euro and Japanese yen.

C)tend to support the view that banks do their best forecasting with the yen.

D)none of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

70

Use the information below to answer the following question.

If you borrowed €1,000,000 for one year,how much money would you owe at maturity?

If you borrowed €1,000,000 for one year,how much money would you owe at maturity?

If you borrowed €1,000,000 for one year,how much money would you owe at maturity?

If you borrowed €1,000,000 for one year,how much money would you owe at maturity?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

71

Assume that you are a retail customer (i.e.,you buy at the ask and sell at the bid).Use the information below to answer the following question.

If you borrowed $1,000,000 for one year,how much money would you owe at maturity?

If you borrowed $1,000,000 for one year,how much money would you owe at maturity?

If you borrowed $1,000,000 for one year,how much money would you owe at maturity?

If you borrowed $1,000,000 for one year,how much money would you owe at maturity?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

72

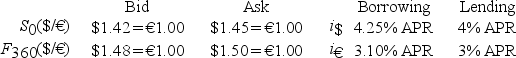

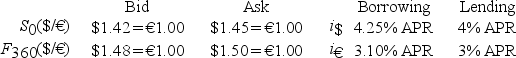

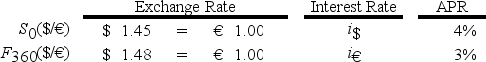

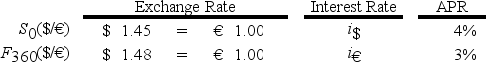

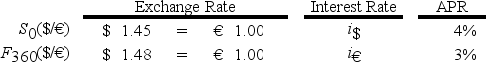

Use the information below to answer the following question.

If you had €1,000,000 and traded it for USD at the spot rate,how many USD will you get?

If you had €1,000,000 and traded it for USD at the spot rate,how many USD will you get?

If you had €1,000,000 and traded it for USD at the spot rate,how many USD will you get?

If you had €1,000,000 and traded it for USD at the spot rate,how many USD will you get?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

73

Assume that you are a retail customer (i.e.,you buy at the ask and sell at the bid).Use the information below to answer the following question.

If you borrowed €1,000,000 for one year,how much money would you owe at maturity?

If you borrowed €1,000,000 for one year,how much money would you owe at maturity?

If you borrowed €1,000,000 for one year,how much money would you owe at maturity?

If you borrowed €1,000,000 for one year,how much money would you owe at maturity?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

74

Assume that you are a retail customer.Use the information below to answer the following question.

If you borrowed €1,000,000 for one year,how much money would you owe at maturity?

If you borrowed €1,000,000 for one year,how much money would you owe at maturity?

If you borrowed €1,000,000 for one year,how much money would you owe at maturity?

If you borrowed €1,000,000 for one year,how much money would you owe at maturity?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

75

Use the information below to answer the following question.

If you had €1,000,000 and traded it for USD at the spot rate,how many USD will you get?

If you had €1,000,000 and traded it for USD at the spot rate,how many USD will you get?

If you had €1,000,000 and traded it for USD at the spot rate,how many USD will you get?

If you had €1,000,000 and traded it for USD at the spot rate,how many USD will you get?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

76

Use the information below to answer the following question.

If you borrowed $1,000,000 for one year,how much money would you owe at maturity?

If you borrowed $1,000,000 for one year,how much money would you owe at maturity?

If you borrowed $1,000,000 for one year,how much money would you owe at maturity?

If you borrowed $1,000,000 for one year,how much money would you owe at maturity?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

77

According to the monetary approach,what matters in exchange rate determination are

A)the relative money supplies.

B)the relative velocities of monies.

C)the relative national outputs.

D)all of the options

A)the relative money supplies.

B)the relative velocities of monies.

C)the relative national outputs.

D)all of the options

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

78

Use the information below to answer the following question.

If you had borrowed $1,000,000 and traded for euro at the spot rate,how many € do you receive?

If you had borrowed $1,000,000 and traded for euro at the spot rate,how many € do you receive?

If you had borrowed $1,000,000 and traded for euro at the spot rate,how many € do you receive?

If you had borrowed $1,000,000 and traded for euro at the spot rate,how many € do you receive?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

79

Use the information below to answer the following question.

If you borrowed $1,000,000 for one year,how much money would you owe at maturity?

If you borrowed $1,000,000 for one year,how much money would you owe at maturity?

If you borrowed $1,000,000 for one year,how much money would you owe at maturity?

If you borrowed $1,000,000 for one year,how much money would you owe at maturity?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

80

Use the information below to answer the following question.

If you borrowed €1,000,000 for one year,how much money would you owe at maturity?

If you borrowed €1,000,000 for one year,how much money would you owe at maturity?

If you borrowed €1,000,000 for one year,how much money would you owe at maturity?

If you borrowed €1,000,000 for one year,how much money would you owe at maturity?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck