Deck 9: Management of Economic Exposure

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/100

Play

Full screen (f)

Deck 9: Management of Economic Exposure

1

When exchange rates change,

A)this can alter the operating cash flow of a domestic firm.

B)this can alter the competitive position of a domestic firm.

C)this can alter the home currency values of a multinational firm's assets and liabilities.

D)all of the above

A)this can alter the operating cash flow of a domestic firm.

B)this can alter the competitive position of a domestic firm.

C)this can alter the home currency values of a multinational firm's assets and liabilities.

D)all of the above

D

2

The link between the home currency value of a firm's assets and liabilities and exchange rate fluctuations is

A)asset exposure.

B)operating exposure.

C)both a and b

D)none of the above

A)asset exposure.

B)operating exposure.

C)both a and b

D)none of the above

A

3

Currency risk

A)is the same as currency exposure.

B)represents random changes in exchange rates.

C)measure "what the firm has at risk."

D)both a and b

A)is the same as currency exposure.

B)represents random changes in exchange rates.

C)measure "what the firm has at risk."

D)both a and b

B

4

When the Mexican peso collapsed in 1994, declining by 37 percent,

A)U.S. firms that exported to Mexico and priced in peso were adversely affected.

B)U.S. firms that exported to Mexico and priced in dollars were adversely affected.

C)U.S. firms were unaffected by the peso collapse, since Mexico is such a small market.

D)both a and b

A)U.S. firms that exported to Mexico and priced in peso were adversely affected.

B)U.S. firms that exported to Mexico and priced in dollars were adversely affected.

C)U.S. firms were unaffected by the peso collapse, since Mexico is such a small market.

D)both a and b

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

5

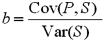

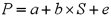

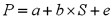

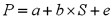

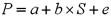

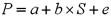

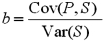

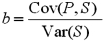

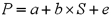

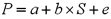

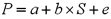

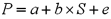

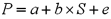

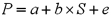

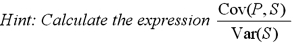

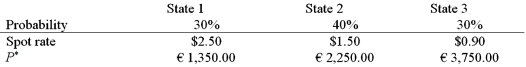

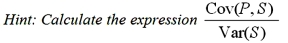

The exposure coefficient  in the regression

in the regression  is:

is:

A)A measure of how a change in the exchange rate affects the dollar value of a firm's assets.

B)Has a value of zero if the value of the firm's assets is perfectly correlated with changes in the exchange rate.

C)both a and b

D)none of the above

in the regression

in the regression  is:

is:A)A measure of how a change in the exchange rate affects the dollar value of a firm's assets.

B)Has a value of zero if the value of the firm's assets is perfectly correlated with changes in the exchange rate.

C)both a and b

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

6

Economic exposure refers to

A)the sensitivity of realized domestic currency values of the firm's contractual cash flows denominated in foreign currencies to unexpected exchange rate changes.

B)the extent to which the value of the firm would be affected by unanticipated changes in exchange rate.

C)the potential that the firm's consolidated financial statement can be affected by changes in exchange rates.

D)ex post and ex ante currency exposures.

A)the sensitivity of realized domestic currency values of the firm's contractual cash flows denominated in foreign currencies to unexpected exchange rate changes.

B)the extent to which the value of the firm would be affected by unanticipated changes in exchange rate.

C)the potential that the firm's consolidated financial statement can be affected by changes in exchange rates.

D)ex post and ex ante currency exposures.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

7

The link between a firm's future operating cash flows and exchange rate fluctuations is

A)asset exposure.

B)operating exposure.

C)both a and b

D)none of the above

A)asset exposure.

B)operating exposure.

C)both a and b

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

8

When exchange rates change,

A)U.S. firms that produce domestically and sell only to domestic customers will be unaffected.

B)U.S. firms that produce domestically and sell only to domestic customers can be affected if they compete against imports.

C)U.S. firms that produce domestically and sell only to domestic customers will be affected, but only if they borrow in foreign currency to finance their domestic operations.

D)both a and b

A)U.S. firms that produce domestically and sell only to domestic customers will be unaffected.

B)U.S. firms that produce domestically and sell only to domestic customers can be affected if they compete against imports.

C)U.S. firms that produce domestically and sell only to domestic customers will be affected, but only if they borrow in foreign currency to finance their domestic operations.

D)both a and b

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

9

Suppose a U.S.-based MNC maintains a vacation home for employees in the British countryside and the local price of this property is always moving together with the pound price of the U.S. dollar. As a result,

A)whenever the pound depreciates against the dollar, the local currency price of this property goes up by the same proportion.

B)the firm is not exposed to currency risk even if the pound-dollar exchange rate fluctuates randomly.

C)both a and b

D)none of the above

A)whenever the pound depreciates against the dollar, the local currency price of this property goes up by the same proportion.

B)the firm is not exposed to currency risk even if the pound-dollar exchange rate fluctuates randomly.

C)both a and b

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

10

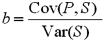

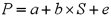

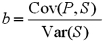

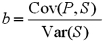

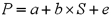

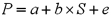

The exposure coefficient in the regression  is given by:

is given by:

A)

B)

C)

is given by:

is given by:A)

B)

C)

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

11

Exposure to currency risk can be measured by the sensitivities of

A)the future home currency values of the firm's assets and liabilities.

B)the firm's operating cash flows to random changes in exchange rates.

C)both a and b

D)none of the above

A)the future home currency values of the firm's assets and liabilities.

B)the firm's operating cash flows to random changes in exchange rates.

C)both a and b

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

12

Two studies found a link between exchange rates and the stock prices of U.S. firms,

A)this suggests that exchange rate changes can systematically affect the value of the firm by influencing its operating cash flows.

B)this suggests that exchange rate changes can systematically affect the value of the firm by influencing the domestic currency values of its assets and liabilities.

C)both a and b

D)none of the above

A)this suggests that exchange rate changes can systematically affect the value of the firm by influencing its operating cash flows.

B)this suggests that exchange rate changes can systematically affect the value of the firm by influencing the domestic currency values of its assets and liabilities.

C)both a and b

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

13

Operating exposure measures

A)the extent to which the foreign currency value of the firm's assets is affected by unanticipated changes in exchange rates.

B)the extent to which the firm's operating cash flows will be affected by unexpected changes in exchange rates.

C)the affect of changes in exchange rates will have on the consolidated financial reports of a MNC.

D)the affect of unanticipated changes in exchange rates on the dollar value of contractual obligations denominated in a foreign currency.

A)the extent to which the foreign currency value of the firm's assets is affected by unanticipated changes in exchange rates.

B)the extent to which the firm's operating cash flows will be affected by unexpected changes in exchange rates.

C)the affect of changes in exchange rates will have on the consolidated financial reports of a MNC.

D)the affect of unanticipated changes in exchange rates on the dollar value of contractual obligations denominated in a foreign currency.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

14

Suppose the U.S. dollar substantially depreciates against the Japanese yen. The change in exchange rate

A)will tend to weaken the competitive position of import-competing U.S. car makers.

B)will tend to strengthen the competitive position of import-competing U.S. car makers.

C)will tend to strengthen the competitive position of Japanese car makers at the expense of U.S. makers.

D)none of the above

A)will tend to weaken the competitive position of import-competing U.S. car makers.

B)will tend to strengthen the competitive position of import-competing U.S. car makers.

C)will tend to strengthen the competitive position of Japanese car makers at the expense of U.S. makers.

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

15

Before you can use the hedging strategies such as a forward market hedge, options market hedge, and so on, you should consider running a regression of the form  . When reviewing the output, you should initially focus on

. When reviewing the output, you should initially focus on

A)the intercept a.

B)the slope coefficient b.

C)mean square error, MSE.

D)R2.

. When reviewing the output, you should initially focus on

. When reviewing the output, you should initially focus onA)the intercept a.

B)the slope coefficient b.

C)mean square error, MSE.

D)R2.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

16

Suppose the U.S. dollar substantially depreciates against the Japanese yen. The change in exchange rate

A)can have significant economic consequences for U.S. firms.

B)can have significant economic consequences for Japanese firms.

C)can have significant economic consequences for both U.S. and Japanese firms.

D)none of the above

A)can have significant economic consequences for U.S. firms.

B)can have significant economic consequences for Japanese firms.

C)can have significant economic consequences for both U.S. and Japanese firms.

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

17

A purely domestic firm that sources and sells only domestically,

A)faces exchange rate risk to the extent that it has international competitors in the domestic market.

B)faces no exchange rate risk.

C)should never hedge since this could actually increase its currency exposure.

D)both b and c

A)faces exchange rate risk to the extent that it has international competitors in the domestic market.

B)faces no exchange rate risk.

C)should never hedge since this could actually increase its currency exposure.

D)both b and c

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

18

It is conventional to classify foreign currency exposures into the following types:

A)economic exposure, transaction exposure, and translation exposure.

B)economic exposure, noneconomic exposure, and political exposure.

C)national exposure, international exposure, and trade exposure.

D)conversion exposure, and exchange exposure.

A)economic exposure, transaction exposure, and translation exposure.

B)economic exposure, noneconomic exposure, and political exposure.

C)national exposure, international exposure, and trade exposure.

D)conversion exposure, and exchange exposure.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

19

In recent years, the U.S. dollar has depreciated substantially against most major currencies of the world, especially against the euro.

A)The stronger euro has made many European products more expensive in dollar terms, hurting sales of these products in the United States.

B)The stronger euro has made many American products less expensive in euro terms, boosting sales of U.S. products in Europe.

C)Both a and b

D)None of the above

A)The stronger euro has made many European products more expensive in dollar terms, hurting sales of these products in the United States.

B)The stronger euro has made many American products less expensive in euro terms, boosting sales of U.S. products in Europe.

C)Both a and b

D)None of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

20

The exposure coefficient  in the regression

in the regression  informs

informs

A)how much of a foreign currency to sell forward.

B)the part of the variability of the dollar value of the asset that is related to random changes in the exchange rate.

C)captures the residual part of the dollar value variability that is independent of exchange rate movements.

D)how many call options to write.

in the regression

in the regression  informs

informsA)how much of a foreign currency to sell forward.

B)the part of the variability of the dollar value of the asset that is related to random changes in the exchange rate.

C)captures the residual part of the dollar value variability that is independent of exchange rate movements.

D)how many call options to write.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

21

Consider a U.S. MNC who owns a foreign asset. If the foreign currency value of the asset is inversely related to changes in the dollar-foreign currency exchange rate,

A)the company has a built-in hedge.

B)the dollar value variability that is independent of exchange rate movements.

C)both a and b

D)none of the above

A)the company has a built-in hedge.

B)the dollar value variability that is independent of exchange rate movements.

C)both a and b

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following conclusions are correct?

A)Most of the volatility of the dollar value of the British asset can be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 236,717 ($)2 and 493,751 ($)2 respectively.

B)Most of the volatility of the dollar value of the British asset cannot be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 236,717 ($)2 and 493,751 ($)2 respectively.

C)Most of the volatility of the dollar value of the British asset cannot be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 125,000 ($)2 and -127,500 ($)2 respectively.

D)Most of the volatility of the dollar value of the British asset can be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 125,000 ($)2 and -127,500 ($)2 respectively.

A)Most of the volatility of the dollar value of the British asset can be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 236,717 ($)2 and 493,751 ($)2 respectively.

B)Most of the volatility of the dollar value of the British asset cannot be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 236,717 ($)2 and 493,751 ($)2 respectively.

C)Most of the volatility of the dollar value of the British asset cannot be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 125,000 ($)2 and -127,500 ($)2 respectively.

D)Most of the volatility of the dollar value of the British asset can be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 125,000 ($)2 and -127,500 ($)2 respectively.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

23

The variability of the dollar value of an asset (invested overseas) depends on

A)the variability of the dollar value of the asset that is related to random changes in the exchange rate.

B)the dollar value variability that is independent of exchange rate movements.

C)both a and b

D)none of the above

A)the variability of the dollar value of the asset that is related to random changes in the exchange rate.

B)the dollar value variability that is independent of exchange rate movements.

C)both a and b

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following would be an effective hedge?

A)Sell £2,500 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

B)Buy £2,500 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

C)Sell £25,000 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

D)None of the above

A)Sell £2,500 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

B)Buy £2,500 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

C)Sell £25,000 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

D)None of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

25

On the basis of regression Equation  we can decompose the variability of the dollar value of the asset, Var(P), into two separate components Var(P) = b2 × Var(S) + Var(e). The first term in the right-hand side of the equation, b2 × Var(S) represents.

we can decompose the variability of the dollar value of the asset, Var(P), into two separate components Var(P) = b2 × Var(S) + Var(e). The first term in the right-hand side of the equation, b2 × Var(S) represents.

A)the part of the variability of the dollar value of the asset that is related to random changes in the exchange rate.

B)captures the residual part of the dollar value variability that is independent of exchange rate movements.

C)none of the above

we can decompose the variability of the dollar value of the asset, Var(P), into two separate components Var(P) = b2 × Var(S) + Var(e). The first term in the right-hand side of the equation, b2 × Var(S) represents.

we can decompose the variability of the dollar value of the asset, Var(P), into two separate components Var(P) = b2 × Var(S) + Var(e). The first term in the right-hand side of the equation, b2 × Var(S) represents.A)the part of the variability of the dollar value of the asset that is related to random changes in the exchange rate.

B)captures the residual part of the dollar value variability that is independent of exchange rate movements.

C)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

26

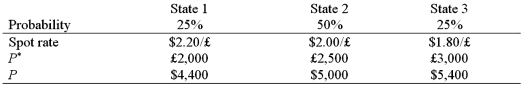

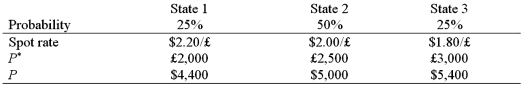

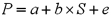

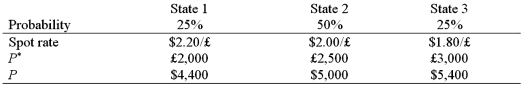

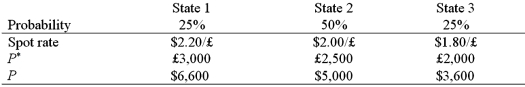

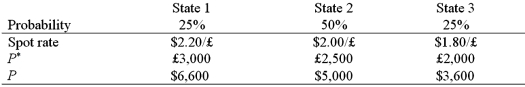

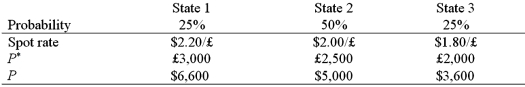

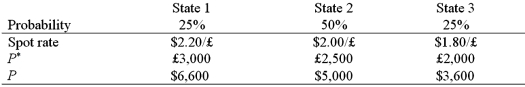

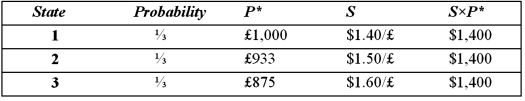

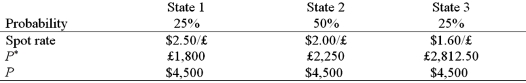

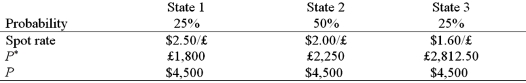

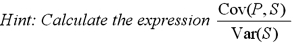

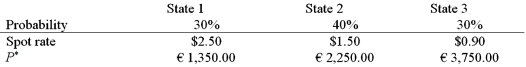

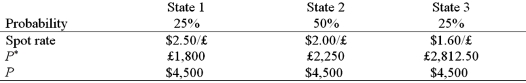

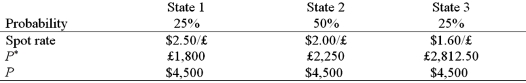

A U.S. firm holds an asset in Great Britain and faces the following scenario:  where,

where,

P* = Pound sterling price of the asset held by the U.S. firm

P = Dollar price of the same asset

The expected value of the investment in U.S. dollars is

A)$4,950.

B)$3,700.

C)$2,112.50.

D)none of the above

where,

where,P* = Pound sterling price of the asset held by the U.S. firm

P = Dollar price of the same asset

The expected value of the investment in U.S. dollars is

A)$4,950.

B)$3,700.

C)$2,112.50.

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

27

On the basis of regression Equation  we can decompose the variability of the dollar value of the asset, Var(P), into two separate components.

we can decompose the variability of the dollar value of the asset, Var(P), into two separate components.

A)Cov(P,S) = b2 × Var(P) + Var(S)

B)Var(P) = b2 × Var(S) + Var(e)

C)Cov(P,S) = b2 × Cov(S,P) + Cov(S,e)

D)Var(P) = b2 × Var(S)

E)None of the above

we can decompose the variability of the dollar value of the asset, Var(P), into two separate components.

we can decompose the variability of the dollar value of the asset, Var(P), into two separate components.A)Cov(P,S) = b2 × Var(P) + Var(S)

B)Var(P) = b2 × Var(S) + Var(e)

C)Cov(P,S) = b2 × Cov(S,P) + Cov(S,e)

D)Var(P) = b2 × Var(S)

E)None of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

28

From the perspective of the U.S. firm that owns an asset in Britain, the exposure that can be measured by the coefficient b in regressing the dollar value P of the British asset on the dollar/pound exchange rate S using the regression equation  is

is

A)asset exposure.

B)operating exposure.

C)accounting exposure.

D)none of the above

is

isA)asset exposure.

B)operating exposure.

C)accounting exposure.

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

29

With regard to operational hedging versus financial hedging,

A)operational hedging provides a more stable long-term approach than does financial hedging.

B)financial hedging, when instituted on a rollover basis, is a superior long-term approach to operational hedging.

C)since they both have the same goal, stabilizing the firm's cash flows in domestic currency, they are fungible in use.

D)none of the above

A)operational hedging provides a more stable long-term approach than does financial hedging.

B)financial hedging, when instituted on a rollover basis, is a superior long-term approach to operational hedging.

C)since they both have the same goal, stabilizing the firm's cash flows in domestic currency, they are fungible in use.

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

30

A U.S. firm holds an asset in Great Britain and faces the following scenario:  where,

where,

P* = Pound sterling price of the asset held by the U.S. firm

P = Dollar price of the same asset

The variance of the exchange rate is:

A)0.0200

B)0.10

C)0.002

D)none of the above

where,

where,P* = Pound sterling price of the asset held by the U.S. firm

P = Dollar price of the same asset

The variance of the exchange rate is:

A)0.0200

B)0.10

C)0.002

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

31

A U.S. firm holds an asset in Great Britain and faces the following scenario:  where,

where,

P* = Pound sterling price of the asset held by the U.S. firm

P = Dollar price of the same asset

The variance of the exchange rate is:

A)0.0200

B)0.10

C)0.002

D)none of the above

where,

where,P* = Pound sterling price of the asset held by the U.S. firm

P = Dollar price of the same asset

The variance of the exchange rate is:

A)0.0200

B)0.10

C)0.002

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

32

The extent to which the firm's operating cash flows would be affected by random changes in exchange rates is called

A)asset exposure.

B)operating exposure.

C)both a and b

D)none of the above

A)asset exposure.

B)operating exposure.

C)both a and b

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

33

A firm with a highly elastic demand for its products

A)will be unable to pass increased costs following unfavorable changes in the exchange rate without significantly lowering the quantity sold.

B)will be able to raise prices following unfavorable changes in the exchange rate without significantly lowering the quantity sold.

C)can easily pass increased costs on to consumers.

D)will sell about the same amount of product regardless of price.

A)will be unable to pass increased costs following unfavorable changes in the exchange rate without significantly lowering the quantity sold.

B)will be able to raise prices following unfavorable changes in the exchange rate without significantly lowering the quantity sold.

C)can easily pass increased costs on to consumers.

D)will sell about the same amount of product regardless of price.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

34

In recent years,

A)the U.S. dollar has appreciated substantially against most major currencies of the world, especially against the euro.

B)the U.S. dollar has depreciated substantially against most major currencies of the world, especially against the euro.

C)the U.S. dollar has maintained its value against most major currencies of the world, especially against the euro.

A)the U.S. dollar has appreciated substantially against most major currencies of the world, especially against the euro.

B)the U.S. dollar has depreciated substantially against most major currencies of the world, especially against the euro.

C)the U.S. dollar has maintained its value against most major currencies of the world, especially against the euro.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

35

A U.S. firm holds an asset in Great Britain and faces the following scenario:  where,

where,

P* = Pound sterling price of the asset held by the U.S. firm

P = Dollar price of the same asset

The expected value of the investment in U.S. dollars is:

A)$5,050

B)$3,700

C)$2,112.50

D)none of the above

where,

where,P* = Pound sterling price of the asset held by the U.S. firm

P = Dollar price of the same asset

The expected value of the investment in U.S. dollars is:

A)$5,050

B)$3,700

C)$2,112.50

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following are identified by your text as a strategy for managing operating exposure: 1) Selecting low-cost production sites

2) Flexible sourcing policy

3) Diversification of the market

4) Product differentiation and R&D efforts

5) Financial Hedging

A)1), 3), and 5) only

B)2) and 4) only

C)1), 4), and 5) only

D)1), 2), 3), 4), and 5)

2) Flexible sourcing policy

3) Diversification of the market

4) Product differentiation and R&D efforts

5) Financial Hedging

A)1), 3), and 5) only

B)2) and 4) only

C)1), 4), and 5) only

D)1), 2), 3), 4), and 5)

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

37

Operating exposure can be defined as

A)the link between the future home currency values of the firm's assets and liabilities and exchange rate fluctuations.

B)the extent to which the firm's operating cash flows would be affected by random changes in exchange rates.

C)the sensitivity of realized domestic currency values of the firm's contractual cash flows denominated in foreign currencies to unexpected exchange rate changes.

D)the potential that the firm's consolidated financial statement can be affected by changes in exchange rates.

A)the link between the future home currency values of the firm's assets and liabilities and exchange rate fluctuations.

B)the extent to which the firm's operating cash flows would be affected by random changes in exchange rates.

C)the sensitivity of realized domestic currency values of the firm's contractual cash flows denominated in foreign currencies to unexpected exchange rate changes.

D)the potential that the firm's consolidated financial statement can be affected by changes in exchange rates.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

38

On the basis of regression Equation  we can decompose the variability of the dollar value of the asset, Var(P), into two separate components Var(P) = b2 × Var(S) + Var(e). The second term in the right-hand side of the equation, Var(e) represents.

we can decompose the variability of the dollar value of the asset, Var(P), into two separate components Var(P) = b2 × Var(S) + Var(e). The second term in the right-hand side of the equation, Var(e) represents.

A)the part of the variability of the dollar value of the asset that is related to random changes in the exchange rate.

B)captures the residual part of the dollar value variability that is independent of exchange rate movements.

C)none of the above

we can decompose the variability of the dollar value of the asset, Var(P), into two separate components Var(P) = b2 × Var(S) + Var(e). The second term in the right-hand side of the equation, Var(e) represents.

we can decompose the variability of the dollar value of the asset, Var(P), into two separate components Var(P) = b2 × Var(S) + Var(e). The second term in the right-hand side of the equation, Var(e) represents.A)the part of the variability of the dollar value of the asset that is related to random changes in the exchange rate.

B)captures the residual part of the dollar value variability that is independent of exchange rate movements.

C)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

39

What does it mean to have redenominated an asset in terms of the dollar?

A)You have undertaken a hedging strategy that gives the asset a constant dollar value.

B)Multiply the foreign currency value of the asset by the spot exchange rate.

C)Undertaken accounting changes to eliminate translation exposure.

D)None of the above

A)You have undertaken a hedging strategy that gives the asset a constant dollar value.

B)Multiply the foreign currency value of the asset by the spot exchange rate.

C)Undertaken accounting changes to eliminate translation exposure.

D)None of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

40

The "exposure" (i.e. the regression coefficient beta) is:

A)-25,000

B)2,5000

C)-2,500

D)none of the above

A)-25,000

B)2,5000

C)-2,500

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

41

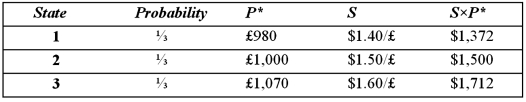

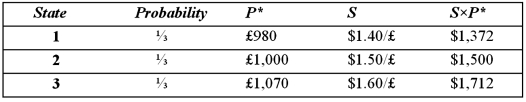

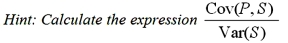

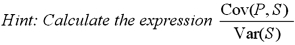

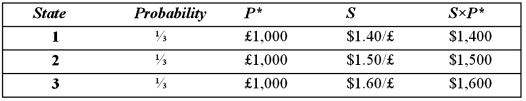

Suppose a U.S. firm has an asset in Britain whose local currency price is random. For simplicity, suppose there are only three states of the world and each state is equally likely to occur. The future local currency price of this British asset (P*) as well as the future exchange rate (S) will be determined, depending on the realized state of the world.  Which of the following statements is most correct?

Which of the following statements is most correct?

A)The firm faces no exchange rate risk since the local currency price of the asset and the exchange rate are negatively correlated.

B)The firm faces substantial exchange rate risk since the local currency price of the asset and the exchange rate are positively correlated.

C)The firm's exchange rate exposure can be completely hedged with derivatives written on the British pound.

D)Since randomness is involved, no hedging is possible.

Which of the following statements is most correct?

Which of the following statements is most correct?A)The firm faces no exchange rate risk since the local currency price of the asset and the exchange rate are negatively correlated.

B)The firm faces substantial exchange rate risk since the local currency price of the asset and the exchange rate are positively correlated.

C)The firm's exchange rate exposure can be completely hedged with derivatives written on the British pound.

D)Since randomness is involved, no hedging is possible.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

42

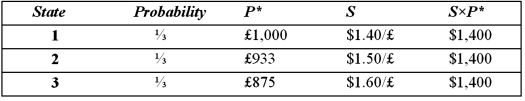

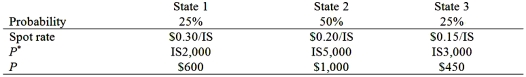

A U.S. firm holds an asset in Israel and faces the following scenario:  where,

where,

P* = Israeli shekel (IS) price of the asset held by the U.S. firm

P = Dollar price of the same asset

The expected value of the investment in U.S. dollars is:

A)$2,083.33

B)$762.50

C)$6,250.00

D)$6,562.50

where,

where,P* = Israeli shekel (IS) price of the asset held by the U.S. firm

P = Dollar price of the same asset

The expected value of the investment in U.S. dollars is:

A)$2,083.33

B)$762.50

C)$6,250.00

D)$6,562.50

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

43

A U.S. firm holds an asset in Great Britain and faces the following scenario:  where,

where,

P* = Pound sterling price of the asset held by the U.S. firm

P = Dollar price of the same asset

The expected value of the investment in U.S. dollars is:

A)$5,050

B)$4,500

C)$2,112.50

D)none of the above

where,

where,P* = Pound sterling price of the asset held by the U.S. firm

P = Dollar price of the same asset

The expected value of the investment in U.S. dollars is:

A)$5,050

B)$4,500

C)$2,112.50

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following would be an effective hedge?

A)Sell £7,500 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

B)Buy £2,500 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

C)Sell £25,000 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

D)None of the above

A)Sell £7,500 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

B)Buy £2,500 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

C)Sell £25,000 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

D)None of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

45

A U.S. firm holds an asset in Great Britain and faces the following scenario:  Where P* = Pound sterling price of the asset held by the U.S. firm

Where P* = Pound sterling price of the asset held by the U.S. firm

The CFO decides to hedge his exposure by selling forward the expected value of the pound denominated cash flow at F1($/£) = $2/£. As a result

A)The firm's exposure to the exchange rate is made worse.

B)He has a nearly perfect hedge.

C)He has a perfect hedge.

D)None of the above

Where P* = Pound sterling price of the asset held by the U.S. firm

Where P* = Pound sterling price of the asset held by the U.S. firmThe CFO decides to hedge his exposure by selling forward the expected value of the pound denominated cash flow at F1($/£) = $2/£. As a result

A)The firm's exposure to the exchange rate is made worse.

B)He has a nearly perfect hedge.

C)He has a perfect hedge.

D)None of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following would be an effective hedge?

A)Sell 53 Israeli shekels forward at the 1-year forward rate, F1($/IS), that prevails at time zero.

B)Buy 53 Israeli shekels forward at the 1-year forward rate, F1($/IS), that prevails at time zero.

C)Sell 12,898 Israeli shekels forward at the 1-year forward rate, F1($/IS), that prevails at time zero.

D)None of the above

A)Sell 53 Israeli shekels forward at the 1-year forward rate, F1($/IS), that prevails at time zero.

B)Buy 53 Israeli shekels forward at the 1-year forward rate, F1($/IS), that prevails at time zero.

C)Sell 12,898 Israeli shekels forward at the 1-year forward rate, F1($/IS), that prevails at time zero.

D)None of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

47

Suppose a U.S. firm has an asset in Britain whose local currency price is random. For simplicity, suppose there are only three states of the world and each state is equally likely to occur. The future local currency price of this British asset (P*) as well as the future exchange rate (S) will be determined, depending on the realized state of the world.  Which of the following statements is most correct?

Which of the following statements is most correct?

A)The firm faces no exchange rate risk since the local currency price of the asset and the exchange rate are negatively correlated.

B)The firm faces substantial exchange rate risk since the local currency price of the asset and the exchange rate are positively correlated.

C)The firm's exchange rate exposure can be completely hedged with derivatives written on the British pound.

D)Since randomness is involved, no hedging is possible.

Which of the following statements is most correct?

Which of the following statements is most correct?A)The firm faces no exchange rate risk since the local currency price of the asset and the exchange rate are negatively correlated.

B)The firm faces substantial exchange rate risk since the local currency price of the asset and the exchange rate are positively correlated.

C)The firm's exchange rate exposure can be completely hedged with derivatives written on the British pound.

D)Since randomness is involved, no hedging is possible.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

48

The "exposure" (i.e. the regression coefficient beta) is:

A)7,500

B)2,5000

C)-2,500

D)none of the above

A)7,500

B)2,5000

C)-2,500

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following conclusions are correct?

A)Most of the volatility of the dollar value of the Israeli asset can be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 236,717 ($)2 and 493,751 ($)2 respectively.

B)Most of the volatility of the dollar value of the Israeli asset cannot be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 236,717 ($)2 and 493,751 ($)2 respectively.

C)Most of the volatility of the dollar value of the Israeli asset cannot be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 8.22 ($)2 and 59,211 ($)2, respectively.

D)Most of the volatility of the dollar value of the Israeli asset can be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 8.22 ($)2 and 59,211 ($)2 respectively.

A)Most of the volatility of the dollar value of the Israeli asset can be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 236,717 ($)2 and 493,751 ($)2 respectively.

B)Most of the volatility of the dollar value of the Israeli asset cannot be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 236,717 ($)2 and 493,751 ($)2 respectively.

C)Most of the volatility of the dollar value of the Israeli asset cannot be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 8.22 ($)2 and 59,211 ($)2, respectively.

D)Most of the volatility of the dollar value of the Israeli asset can be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 8.22 ($)2 and 59,211 ($)2 respectively.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

50

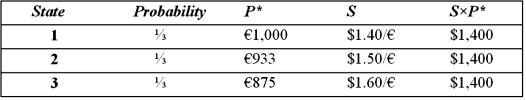

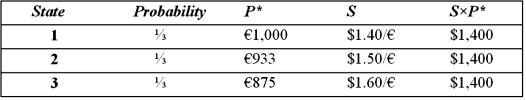

A U.S. firm holds an asset in Italy and faces the following scenario:  Where P* = Euro price of the asset held by the U.S. firm

Where P* = Euro price of the asset held by the U.S. firm

The CFO decides to hedge his exposure by selling forward the expected value of the euro denominated cash flow at F1($/£) = $1.50/€. As a result

A)the firm's exposure to the exchange rate is made worse.

B)he has a nearly perfect hedge.

C)he has a perfect hedge.

D)none of the above

Where P* = Euro price of the asset held by the U.S. firm

Where P* = Euro price of the asset held by the U.S. firmThe CFO decides to hedge his exposure by selling forward the expected value of the euro denominated cash flow at F1($/£) = $1.50/€. As a result

A)the firm's exposure to the exchange rate is made worse.

B)he has a nearly perfect hedge.

C)he has a perfect hedge.

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following would be an effective hedge?

A)Sell £2,278.13 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

B)Buy £2,500 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

C)Sell £25,000 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

D)None of the above

A)Sell £2,278.13 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

B)Buy £2,500 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

C)Sell £25,000 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

D)None of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

52

The "exposure" (i.e. the regression coefficient beta) is:

A)-52.6316

B)1,289.80

C)12,898.00

D)none of the above

A)-52.6316

B)1,289.80

C)12,898.00

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

53

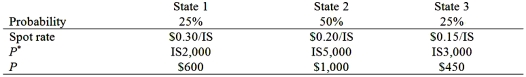

Find an effective hedge financial hedge if a U.S. firm holds an asset in Great Britain and faces the following scenario: ![<strong>Find an effective hedge financial hedge if a U.S. firm holds an asset in Great Britain and faces the following scenario: P* = Pound sterling price of the asset held by the U.S. firm P = Dollar price of the same asset The CFO runs a regression of the form The regression coefficient beta is calculated as Where The variance of the exchange rate is calculated as: E(S) = 0.25 × $2.20 + 0.50 × $2.00 + 0.25 × $1.80 = $.55 + $1 + $.45 = $2.00 VAR(S) = 0.25($2.20 - $2.00)<sup>2</sup> + 0.50($2.00 - $2.00)<sup>2</sup> + 0.25($1.80 - $2.00)<sup>2</sup> = 0.01 + 0 + 0.01 = 0)02 The expected value of the investment in U.S. dollars is: E[P] = 0.25 × $6,600 + 0.50 × $5,000 + 0.25 × $3,600 = $5,050 Which of the following is the most effective hedge financial hedge?</strong> A)Sell £7,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. B)Buy £7,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. C)Sell £2,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. D)0.25 × £3,000 + 0.50 × £2,500 + 0.25 × £2,000 = £2,500](https://d2lvgg3v3hfg70.cloudfront.net/TB2454/11ea736f_438a_1c4f_8d35_d59ae1f3be3d_TB2454_00_TB2454_00.jpg) P* = Pound sterling price of the asset held by the U.S. firm P = Dollar price of the same asset

P* = Pound sterling price of the asset held by the U.S. firm P = Dollar price of the same asset

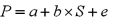

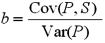

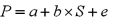

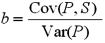

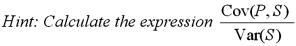

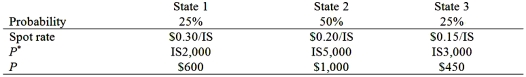

The CFO runs a regression of the form![<strong>Find an effective hedge financial hedge if a U.S. firm holds an asset in Great Britain and faces the following scenario: P* = Pound sterling price of the asset held by the U.S. firm P = Dollar price of the same asset The CFO runs a regression of the form The regression coefficient beta is calculated as Where The variance of the exchange rate is calculated as: E(S) = 0.25 × $2.20 + 0.50 × $2.00 + 0.25 × $1.80 = $.55 + $1 + $.45 = $2.00 VAR(S) = 0.25($2.20 - $2.00)<sup>2</sup> + 0.50($2.00 - $2.00)<sup>2</sup> + 0.25($1.80 - $2.00)<sup>2</sup> = 0.01 + 0 + 0.01 = 0)02 The expected value of the investment in U.S. dollars is: E[P] = 0.25 × $6,600 + 0.50 × $5,000 + 0.25 × $3,600 = $5,050 Which of the following is the most effective hedge financial hedge?</strong> A)Sell £7,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. B)Buy £7,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. C)Sell £2,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. D)0.25 × £3,000 + 0.50 × £2,500 + 0.25 × £2,000 = £2,500](https://d2lvgg3v3hfg70.cloudfront.net/TB2454/11ea736f_438a_4360_8d35_e7b6abf133fe_TB2454_11_TB2454_11.jpg) The regression coefficient beta is calculated as

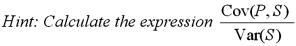

The regression coefficient beta is calculated as ![<strong>Find an effective hedge financial hedge if a U.S. firm holds an asset in Great Britain and faces the following scenario: P* = Pound sterling price of the asset held by the U.S. firm P = Dollar price of the same asset The CFO runs a regression of the form The regression coefficient beta is calculated as Where The variance of the exchange rate is calculated as: E(S) = 0.25 × $2.20 + 0.50 × $2.00 + 0.25 × $1.80 = $.55 + $1 + $.45 = $2.00 VAR(S) = 0.25($2.20 - $2.00)<sup>2</sup> + 0.50($2.00 - $2.00)<sup>2</sup> + 0.25($1.80 - $2.00)<sup>2</sup> = 0.01 + 0 + 0.01 = 0)02 The expected value of the investment in U.S. dollars is: E[P] = 0.25 × $6,600 + 0.50 × $5,000 + 0.25 × $3,600 = $5,050 Which of the following is the most effective hedge financial hedge?</strong> A)Sell £7,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. B)Buy £7,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. C)Sell £2,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. D)0.25 × £3,000 + 0.50 × £2,500 + 0.25 × £2,000 = £2,500](https://d2lvgg3v3hfg70.cloudfront.net/TB2454/11ea736f_438a_4361_8d35_993c29364ee6_TB2454_11_TB2454_11.jpg) Where

Where ![<strong>Find an effective hedge financial hedge if a U.S. firm holds an asset in Great Britain and faces the following scenario: P* = Pound sterling price of the asset held by the U.S. firm P = Dollar price of the same asset The CFO runs a regression of the form The regression coefficient beta is calculated as Where The variance of the exchange rate is calculated as: E(S) = 0.25 × $2.20 + 0.50 × $2.00 + 0.25 × $1.80 = $.55 + $1 + $.45 = $2.00 VAR(S) = 0.25($2.20 - $2.00)<sup>2</sup> + 0.50($2.00 - $2.00)<sup>2</sup> + 0.25($1.80 - $2.00)<sup>2</sup> = 0.01 + 0 + 0.01 = 0)02 The expected value of the investment in U.S. dollars is: E[P] = 0.25 × $6,600 + 0.50 × $5,000 + 0.25 × $3,600 = $5,050 Which of the following is the most effective hedge financial hedge?</strong> A)Sell £7,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. B)Buy £7,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. C)Sell £2,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. D)0.25 × £3,000 + 0.50 × £2,500 + 0.25 × £2,000 = £2,500](https://d2lvgg3v3hfg70.cloudfront.net/TB2454/11ea736f_438a_4362_8d35_4fbba354e821_TB2454_00_TB2454_00.jpg) The variance of the exchange rate is calculated as:

The variance of the exchange rate is calculated as:

E(S) = 0.25 × $2.20 + 0.50 × $2.00 + 0.25 × $1.80 = $.55 + $1 + $.45 = $2.00

VAR(S) = 0.25($2.20 - $2.00)2 + 0.50($2.00 - $2.00)2 + 0.25($1.80 - $2.00)2 = 0.01 + 0 + 0.01

= 0)02

The expected value of the investment in U.S. dollars is:

E[P] = 0.25 × $6,600 + 0.50 × $5,000 + 0.25 × $3,600 = $5,050

Which of the following is the most effective hedge financial hedge?

A)Sell £7,500 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

B)Buy £7,500 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

C)Sell £2,500 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

D)0.25 × £3,000 + 0.50 × £2,500 + 0.25 × £2,000 = £2,500

![<strong>Find an effective hedge financial hedge if a U.S. firm holds an asset in Great Britain and faces the following scenario: P* = Pound sterling price of the asset held by the U.S. firm P = Dollar price of the same asset The CFO runs a regression of the form The regression coefficient beta is calculated as Where The variance of the exchange rate is calculated as: E(S) = 0.25 × $2.20 + 0.50 × $2.00 + 0.25 × $1.80 = $.55 + $1 + $.45 = $2.00 VAR(S) = 0.25($2.20 - $2.00)<sup>2</sup> + 0.50($2.00 - $2.00)<sup>2</sup> + 0.25($1.80 - $2.00)<sup>2</sup> = 0.01 + 0 + 0.01 = 0)02 The expected value of the investment in U.S. dollars is: E[P] = 0.25 × $6,600 + 0.50 × $5,000 + 0.25 × $3,600 = $5,050 Which of the following is the most effective hedge financial hedge?</strong> A)Sell £7,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. B)Buy £7,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. C)Sell £2,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. D)0.25 × £3,000 + 0.50 × £2,500 + 0.25 × £2,000 = £2,500](https://d2lvgg3v3hfg70.cloudfront.net/TB2454/11ea736f_438a_1c4f_8d35_d59ae1f3be3d_TB2454_00_TB2454_00.jpg) P* = Pound sterling price of the asset held by the U.S. firm P = Dollar price of the same asset

P* = Pound sterling price of the asset held by the U.S. firm P = Dollar price of the same assetThe CFO runs a regression of the form

![<strong>Find an effective hedge financial hedge if a U.S. firm holds an asset in Great Britain and faces the following scenario: P* = Pound sterling price of the asset held by the U.S. firm P = Dollar price of the same asset The CFO runs a regression of the form The regression coefficient beta is calculated as Where The variance of the exchange rate is calculated as: E(S) = 0.25 × $2.20 + 0.50 × $2.00 + 0.25 × $1.80 = $.55 + $1 + $.45 = $2.00 VAR(S) = 0.25($2.20 - $2.00)<sup>2</sup> + 0.50($2.00 - $2.00)<sup>2</sup> + 0.25($1.80 - $2.00)<sup>2</sup> = 0.01 + 0 + 0.01 = 0)02 The expected value of the investment in U.S. dollars is: E[P] = 0.25 × $6,600 + 0.50 × $5,000 + 0.25 × $3,600 = $5,050 Which of the following is the most effective hedge financial hedge?</strong> A)Sell £7,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. B)Buy £7,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. C)Sell £2,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. D)0.25 × £3,000 + 0.50 × £2,500 + 0.25 × £2,000 = £2,500](https://d2lvgg3v3hfg70.cloudfront.net/TB2454/11ea736f_438a_4360_8d35_e7b6abf133fe_TB2454_11_TB2454_11.jpg) The regression coefficient beta is calculated as

The regression coefficient beta is calculated as ![<strong>Find an effective hedge financial hedge if a U.S. firm holds an asset in Great Britain and faces the following scenario: P* = Pound sterling price of the asset held by the U.S. firm P = Dollar price of the same asset The CFO runs a regression of the form The regression coefficient beta is calculated as Where The variance of the exchange rate is calculated as: E(S) = 0.25 × $2.20 + 0.50 × $2.00 + 0.25 × $1.80 = $.55 + $1 + $.45 = $2.00 VAR(S) = 0.25($2.20 - $2.00)<sup>2</sup> + 0.50($2.00 - $2.00)<sup>2</sup> + 0.25($1.80 - $2.00)<sup>2</sup> = 0.01 + 0 + 0.01 = 0)02 The expected value of the investment in U.S. dollars is: E[P] = 0.25 × $6,600 + 0.50 × $5,000 + 0.25 × $3,600 = $5,050 Which of the following is the most effective hedge financial hedge?</strong> A)Sell £7,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. B)Buy £7,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. C)Sell £2,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. D)0.25 × £3,000 + 0.50 × £2,500 + 0.25 × £2,000 = £2,500](https://d2lvgg3v3hfg70.cloudfront.net/TB2454/11ea736f_438a_4361_8d35_993c29364ee6_TB2454_11_TB2454_11.jpg) Where

Where ![<strong>Find an effective hedge financial hedge if a U.S. firm holds an asset in Great Britain and faces the following scenario: P* = Pound sterling price of the asset held by the U.S. firm P = Dollar price of the same asset The CFO runs a regression of the form The regression coefficient beta is calculated as Where The variance of the exchange rate is calculated as: E(S) = 0.25 × $2.20 + 0.50 × $2.00 + 0.25 × $1.80 = $.55 + $1 + $.45 = $2.00 VAR(S) = 0.25($2.20 - $2.00)<sup>2</sup> + 0.50($2.00 - $2.00)<sup>2</sup> + 0.25($1.80 - $2.00)<sup>2</sup> = 0.01 + 0 + 0.01 = 0)02 The expected value of the investment in U.S. dollars is: E[P] = 0.25 × $6,600 + 0.50 × $5,000 + 0.25 × $3,600 = $5,050 Which of the following is the most effective hedge financial hedge?</strong> A)Sell £7,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. B)Buy £7,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. C)Sell £2,500 forward at the 1-year forward rate, F<sub>1</sub>($/£), that prevails at time zero. D)0.25 × £3,000 + 0.50 × £2,500 + 0.25 × £2,000 = £2,500](https://d2lvgg3v3hfg70.cloudfront.net/TB2454/11ea736f_438a_4362_8d35_4fbba354e821_TB2454_00_TB2454_00.jpg) The variance of the exchange rate is calculated as:

The variance of the exchange rate is calculated as:E(S) = 0.25 × $2.20 + 0.50 × $2.00 + 0.25 × $1.80 = $.55 + $1 + $.45 = $2.00

VAR(S) = 0.25($2.20 - $2.00)2 + 0.50($2.00 - $2.00)2 + 0.25($1.80 - $2.00)2 = 0.01 + 0 + 0.01

= 0)02

The expected value of the investment in U.S. dollars is:

E[P] = 0.25 × $6,600 + 0.50 × $5,000 + 0.25 × $3,600 = $5,050

Which of the following is the most effective hedge financial hedge?

A)Sell £7,500 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

B)Buy £7,500 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

C)Sell £2,500 forward at the 1-year forward rate, F1($/£), that prevails at time zero.

D)0.25 × £3,000 + 0.50 × £2,500 + 0.25 × £2,000 = £2,500

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following conclusions are correct?

A)Most of the volatility of the dollar value of the British asset can be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 1,125,000 ($)2 and 2,500 ($)2 respectively.

B)Most of the volatility of the dollar value of the British asset cannot be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 236,717 ($)2 and 493,751 ($)2 respectively.

C)Most of the volatility of the dollar value of the British asset cannot be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 125,000 ($)2 and -127,500 ($)2 respectively.

D)Most of the volatility of the dollar value of the British asset can be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 125,000 ($)2 and -127,500 ($)2 respectively.

A)Most of the volatility of the dollar value of the British asset can be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 1,125,000 ($)2 and 2,500 ($)2 respectively.

B)Most of the volatility of the dollar value of the British asset cannot be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 236,717 ($)2 and 493,751 ($)2 respectively.

C)Most of the volatility of the dollar value of the British asset cannot be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 125,000 ($)2 and -127,500 ($)2 respectively.

D)Most of the volatility of the dollar value of the British asset can be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 125,000 ($)2 and -127,500 ($)2 respectively.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following conclusions are correct?

A)Most of the volatility of the dollar value of the British asset can be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 0 ($)2 and 0 ($)2 respectively.

B)None of the volatility of the dollar value of the British asset can be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 0 ($)2 and 0 ($)2 respectively.

C)Most of the volatility of the dollar value of the British asset cannot be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 125,000 ($)2 and -127,500 ($)2 respectively.

D)Most of the volatility of the dollar value of the British asset can be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 125,000 ($)2 and -127,500 ($)2 respectively.

A)Most of the volatility of the dollar value of the British asset can be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 0 ($)2 and 0 ($)2 respectively.

B)None of the volatility of the dollar value of the British asset can be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 0 ($)2 and 0 ($)2 respectively.

C)Most of the volatility of the dollar value of the British asset cannot be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 125,000 ($)2 and -127,500 ($)2 respectively.

D)Most of the volatility of the dollar value of the British asset can be removed by hedging exchange risk because b2[Var(S)] and Var(e) are 125,000 ($)2 and -127,500 ($)2 respectively.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

56

A U.S. firm holds an asset in Israel and faces the following scenario:  where,

where,

P* = Israeli shekel (IS) price of the asset held by the U.S. firm

P = Dollar price of the same asset

The variance of the exchange rate is:

A)0.001968

B)0.002969

C)0.003968

D)0.004968

where,

where,P* = Israeli shekel (IS) price of the asset held by the U.S. firm

P = Dollar price of the same asset

The variance of the exchange rate is:

A)0.001968

B)0.002969

C)0.003968

D)0.004968

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

57

Suppose that you implement your hedge from the last question at F1($/£) = $2/£. Your cash flows in state 1, 2, and 3 respectively will be

A)$5,100, $5,000, $5,100.

B)$5,100, $5,100, $5,100.

C)$5,000, $5,000, $5,000.

D)none of the above

A)$5,100, $5,000, $5,100.

B)$5,100, $5,100, $5,100.

C)$5,000, $5,000, $5,000.

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

58

The "exposure" (i.e. the regression coefficient beta) is:

A)7,500

B)2,5000

C)-2,500

D)none of the above

A)7,500

B)2,5000

C)-2,500

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

59

Suppose a U.S. firm has an asset in Britain whose local currency price is random. For simplicity, suppose there are only three states of the world and each state is equally likely to occur. The future local currency price of this British asset (P*) as well as the future exchange rate (S) will be determined, depending on the realized state of the world.  Which of the following statements is most correct?

Which of the following statements is most correct?

A)The firm faces no exchange rate risk since the local currency price of the asset and the exchange rate are negatively correlated.

B)The firm faces substantial exchange rate risk since the local currency price of the asset and the exchange rate are positively correlated.

C)The firm's exchange rate exposure can be completely hedged with derivatives written on the British pound.

D)Since randomness is involved, no hedging is possible.

Which of the following statements is most correct?

Which of the following statements is most correct?A)The firm faces no exchange rate risk since the local currency price of the asset and the exchange rate are negatively correlated.

B)The firm faces substantial exchange rate risk since the local currency price of the asset and the exchange rate are positively correlated.

C)The firm's exchange rate exposure can be completely hedged with derivatives written on the British pound.

D)Since randomness is involved, no hedging is possible.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

60

A U.S. firm holds an asset in Great Britain and faces the following scenario:  where,

where,

P* = Pound sterling price of the asset held by the U.S. firm

P = Dollar price of the same asset

The variance of the exchange rate is:

A)0.0200

B)0.101875

C)0.002

D)none of the above

where,

where,P* = Pound sterling price of the asset held by the U.S. firm

P = Dollar price of the same asset

The variance of the exchange rate is:

A)0.0200

B)0.101875

C)0.002

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

61

The firm may not be able to pass through changes in the exchange rate

A)in markets with mainly domestics (foreign to the firm) competitors.

B)in markets with low price elasticities.

C)both a and b

D)none of the above

A)in markets with mainly domestics (foreign to the firm) competitors.

B)in markets with low price elasticities.

C)both a and b

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

62

Generally speaking, a firm is subject to high degrees of operating exposure when

A)either its cost or its price is sensitive to exchange rate changes.

B)both the cost and the price are sensitive to exchange rate changes.

C)both the cost and the price are insensitive to exchange rate changes.

D)none of the above

A)either its cost or its price is sensitive to exchange rate changes.

B)both the cost and the price are sensitive to exchange rate changes.

C)both the cost and the price are insensitive to exchange rate changes.

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

63

The firm may not be subject to high degrees of operating exposure

A)when changes in real exchange rates are exactly offset by the inflation differential.

B)when changes in nominal exchange rates are exactly matched by the inflation differential.

C)when changes in nominal exchange rates are exactly offset by the inflation differential.

D)none of the above

A)when changes in real exchange rates are exactly offset by the inflation differential.

B)when changes in nominal exchange rates are exactly matched by the inflation differential.

C)when changes in nominal exchange rates are exactly offset by the inflation differential.

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

64

Generally speaking, when both a firm's costs and its price is sensitive to exchange rate changes

A)the firm is not subject to high degrees of operating exposure.

B)the firm is subject to high degrees of operating exposure.

C)the firm should hedge.

D)none of the above

A)the firm is not subject to high degrees of operating exposure.

B)the firm is subject to high degrees of operating exposure.

C)the firm should hedge.

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

65

Consider a U.S.-based MNC with a wholly-owned European subsidiary selling a product sourced in euro and priced in euro with inelastic demand. Following a depreciation of the dollar against the euro, which of the following is the most true?

A)Since they have inelastic demand, the U.S. firm can just pass through the impact of the exchange rate change.

B)Since they have elastic demand, the U.S. firm cannot just pass through the impact of the exchange rate change.

C)Since the exchange rate movement was favorable to the U.S. firm, there is no impact on the firm's position.

D)None of the above.

A)Since they have inelastic demand, the U.S. firm can just pass through the impact of the exchange rate change.

B)Since they have elastic demand, the U.S. firm cannot just pass through the impact of the exchange rate change.

C)Since the exchange rate movement was favorable to the U.S. firm, there is no impact on the firm's position.

D)None of the above.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following is true?

A)The competitive effect is that a currency depreciation may affect operating cash flow in the foreign currency by altering the firm's competitive position in the marketplace.

B)The conversion effect is defined as a given accounting cash value in a foreign currency will be converted into a lower dollar amount after currency depreciation.

C)The competitive effect is defined as a given operating cash flow in a foreign currency will be converted into a lower dollar amount after a currency depreciation.

D)None of the above

A)The competitive effect is that a currency depreciation may affect operating cash flow in the foreign currency by altering the firm's competitive position in the marketplace.

B)The conversion effect is defined as a given accounting cash value in a foreign currency will be converted into a lower dollar amount after currency depreciation.

C)The competitive effect is defined as a given operating cash flow in a foreign currency will be converted into a lower dollar amount after a currency depreciation.

D)None of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following can a company use to manage operating exposure?

A)Selecting low-cost production sites, diversifying the market.

B)Low cost production sites, but not financial hedging.

C)Pursuing a flexible sourcing policy, product differentiation, R&D efforts.

D)Both a and c.

A)Selecting low-cost production sites, diversifying the market.

B)Low cost production sites, but not financial hedging.

C)Pursuing a flexible sourcing policy, product differentiation, R&D efforts.

D)Both a and c.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

68

Consider a U.S.-based MNC with a wholly-owned Italian subsidiary. Following a depreciation of the dollar against the euro, which of the following conclusions are correct?

A)The cash flow in euro could be altered due an alteration in the firm's competitive position in the marketplace.

B)A given operating cash flow in euro will be converted to a higher U.S. dollar cash flow.

C)Both a and b

D)None of the above

A)The cash flow in euro could be altered due an alteration in the firm's competitive position in the marketplace.

B)A given operating cash flow in euro will be converted to a higher U.S. dollar cash flow.

C)Both a and b

D)None of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

69

A firm's operating exposure is

A)defined as the extent to which the firm's operating cash flows would be affected by the random changes in exchange rates.

B)determined by the structure of the markets in which the firm sources its inputs, such as labor and materials, and sells its products.

C)determined by the firm's ability to mitigate the effect of exchange rate changes by adjusting its markets, product mix, and sourcing.

D)all of the above

A)defined as the extent to which the firm's operating cash flows would be affected by the random changes in exchange rates.

B)determined by the structure of the markets in which the firm sources its inputs, such as labor and materials, and sells its products.

C)determined by the firm's ability to mitigate the effect of exchange rate changes by adjusting its markets, product mix, and sourcing.

D)all of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following is false?

A)The competitive effect is that a depreciation may affect operating cash flow in the foreign currency by altering the firm's competitive position in the marketplace.

B)The conversion effect is defined as a given operating cash flow in a foreign currency will be converted into a lower dollar amount after a currency depreciation.

C)The competitive effect is defined as a given operating cash flow in a foreign currency will be converted into a lower dollar amount after a currency depreciation.

D)None of the above

A)The competitive effect is that a depreciation may affect operating cash flow in the foreign currency by altering the firm's competitive position in the marketplace.

B)The conversion effect is defined as a given operating cash flow in a foreign currency will be converted into a lower dollar amount after a currency depreciation.

C)The competitive effect is defined as a given operating cash flow in a foreign currency will be converted into a lower dollar amount after a currency depreciation.

D)None of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

71

Generally speaking, a firm is subject to high degrees of operating exposure

A)when its costs are sensitive to exchange rate changes.

B)when its prices are sensitive to exchange rate changes.

C)when either its cost or its price is sensitive to exchange rate changes.

D)none of the above

A)when its costs are sensitive to exchange rate changes.

B)when its prices are sensitive to exchange rate changes.

C)when either its cost or its price is sensitive to exchange rate changes.

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

72

What is the objective of managing operating exposure?

A)Stabilize cash flows in the face of fluctuating exchange rates.

B)Selecting low cost production sites.

C)Increase the variability of cash flows in the face of fluctuating exchange rates.

D)Both a and c

A)Stabilize cash flows in the face of fluctuating exchange rates.

B)Selecting low cost production sites.

C)Increase the variability of cash flows in the face of fluctuating exchange rates.

D)Both a and c

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

73

The firm may not be able to pass through changes in the exchange rate

A)in markets with low product differentiation.

B)in markets with high price elasticities.

C)both a and b

D)none of the above

A)in markets with low product differentiation.

B)in markets with high price elasticities.

C)both a and b

D)none of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

74

Consider a U.S.-based MNC with a wholly-owned German subsidiary. Following a depreciation of the dollar against the euro, which of the following describes the conversion effect of the depreciation?

A)The cash flow in euro could be altered due a change in the firm's competitive position in the marketplace.

B)A given operating cash flow in euro will be translated to a higher U.S. dollar cash flow.

C)Both a and b

D)None of the above

A)The cash flow in euro could be altered due a change in the firm's competitive position in the marketplace.

B)A given operating cash flow in euro will be translated to a higher U.S. dollar cash flow.

C)Both a and b

D)None of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

75

What is the objective of managing operating exposure?

A)Stabilize accounting results in the face of fluctuating exchange rates.

B)Selecting low cost production sites.

C)Increase the variability of cash flows in the face of fluctuating exchange rates.

D)None of the above

A)Stabilize accounting results in the face of fluctuating exchange rates.

B)Selecting low cost production sites.

C)Increase the variability of cash flows in the face of fluctuating exchange rates.

D)None of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

76

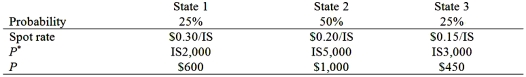

Suppose a U.S. firm has an asset in Italy whose local currency price is random. For simplicity, suppose there are only three states of the world and each state is equally likely to occur. The future local currency price of this asset (P*) as well as the future exchange rate (S) will be determined, depending on the realized state of the world.  Assume that you choose to "hedge" this asset by selling forward the expected value of the euro denominated cash flow at F1($/£) = $1.50/€. Calculate your cash flows in each of the possible states.

Assume that you choose to "hedge" this asset by selling forward the expected value of the euro denominated cash flow at F1($/£) = $1.50/€. Calculate your cash flows in each of the possible states.

A)$1,400, $1,400, $1,400

B)$1,496.6, $1,400, $1,306.40

C)$1,404, $1,404. $1,404

D)None of the above

Assume that you choose to "hedge" this asset by selling forward the expected value of the euro denominated cash flow at F1($/£) = $1.50/€. Calculate your cash flows in each of the possible states.

Assume that you choose to "hedge" this asset by selling forward the expected value of the euro denominated cash flow at F1($/£) = $1.50/€. Calculate your cash flows in each of the possible states.A)$1,400, $1,400, $1,400

B)$1,496.6, $1,400, $1,306.40

C)$1,404, $1,404. $1,404

D)None of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

77

Consider a U.S.-based MNC with a wholly-owned Italian subsidiary. Following a depreciation of the dollar against the euro, which of the following describes the competitive effect of the depreciation?

A)The cash flow in euro could be altered due an alteration in the firm's competitive position in the marketplace.

B)A given operating cash flow in euro will be translated to a higher U.S. dollar cash flow.

C)Both a and b

D)None of the above