Deck 11: Risk and Return

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/39

Play

Full screen (f)

Deck 11: Risk and Return

1

Which term best refers to the practice of investing in a variety of diverse assets as a means of reducing risk?

A)Systematic

B)Unsystematic

C)Diversification

D)Security market line

E)Capital asset pricing model

A)Systematic

B)Unsystematic

C)Diversification

D)Security market line

E)Capital asset pricing model

Diversification

2

Which statement is correct?

A)A portfolio that contains at least 30 diverse individual securities will have a beta of 1.0.

B)Any portfolio that is correctly valued will have a beta of 1.0.

C)A portfolio that has a beta of 1.12 will lie to the left of the market portfolio on a security market line graph.

D)A risk-free security plots at the origin on a security market line graph.

E)An underpriced security will plot above the security market line.

A)A portfolio that contains at least 30 diverse individual securities will have a beta of 1.0.

B)Any portfolio that is correctly valued will have a beta of 1.0.

C)A portfolio that has a beta of 1.12 will lie to the left of the market portfolio on a security market line graph.

D)A risk-free security plots at the origin on a security market line graph.

E)An underpriced security will plot above the security market line.

An underpriced security will plot above the security market line.

3

Which one of these is the best example of systematic risk?

A)Discovery of a major gas field

B)Decrease in textile imports

C)Increase in agricultural exports

D)Decrease in gross domestic product

E)Decrease in management bonuses for banking executives

A)Discovery of a major gas field

B)Decrease in textile imports

C)Increase in agricultural exports

D)Decrease in gross domestic product

E)Decrease in management bonuses for banking executives

Decrease in gross domestic product

4

The risk premium for an individual security is based on which one of the following types of risk?

A)Total

B)Surprise

C)Diversifiable

D)Systematic

E)Unsystematic

A)Total

B)Surprise

C)Diversifiable

D)Systematic

E)Unsystematic

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

5

Which statement is true?

A)The expected rate of return on any portfolio must be positive.

B)The arithmetic average of the betas for each security held in a portfolio must equal 1.0.

C)The beta of any portfolio must be 1.0.

D)The weights of the securities held in any portfolio must equal 1.0.

E)The standard deviation of any portfolio must equal 1.0.

A)The expected rate of return on any portfolio must be positive.

B)The arithmetic average of the betas for each security held in a portfolio must equal 1.0.

C)The beta of any portfolio must be 1.0.

D)The weights of the securities held in any portfolio must equal 1.0.

E)The standard deviation of any portfolio must equal 1.0.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

6

Standard deviation measures risk while beta measures risk.

A)systematic; unsystematic

B)unsystematic; systematic

C)total; unsystematic

D)total; systematic

E)asset-specific; market

A)systematic; unsystematic

B)unsystematic; systematic

C)total; unsystematic

D)total; systematic

E)asset-specific; market

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

7

A portfolio is:

A)a single risky security.

B)any security that is equally as risky as the overall market.

C)any new issue of stock.

D)a group of assets held by an investor.

E)an investment in a risk-free security.

A)a single risky security.

B)any security that is equally as risky as the overall market.

C)any new issue of stock.

D)a group of assets held by an investor.

E)an investment in a risk-free security.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

8

The expected rate of return on Delaware Shores stock is based on three possible states of the economy.These states are boom,normal,and recession which have probabilities of occurrence of 20 percent,75 percent,and 5 percent,respectively.Which one of the following statements is correct concerning the variance of the returns on this stock?

A)The variance must decrease if the probability of occurrence for a boom increases.

B)The variance will remain constant as long as the sum of the economic probabilities is 100 percent.

C)The variance can be positive, zero, or negative, depending on the expected rate of return assigned to each economic state.

D)The variance must be positive provided that each state of the economy produces a different expected rate of return.

E)The variance is independent of the economic probabilities of occurrence.

A)The variance must decrease if the probability of occurrence for a boom increases.

B)The variance will remain constant as long as the sum of the economic probabilities is 100 percent.

C)The variance can be positive, zero, or negative, depending on the expected rate of return assigned to each economic state.

D)The variance must be positive provided that each state of the economy produces a different expected rate of return.

E)The variance is independent of the economic probabilities of occurrence.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

9

Which one of the following best exemplifies unsystematic risk?

A)Unexpected economic collapse

B)Unexpected increase in interest rates

C)Unexpected increase in the variable costs for a firm

D)Sudden decrease in inflation

E)Expected increase in tax rates

A)Unexpected economic collapse

B)Unexpected increase in interest rates

C)Unexpected increase in the variable costs for a firm

D)Sudden decrease in inflation

E)Expected increase in tax rates

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

10

Which one of the following portfolios will have a beta of zero?

A)A portfolio that is equally as risky as the overall market

B)A portfolio that consists of a single stock

C)A portfolio comprised solely of U.S.Treasury bills

D)A portfolio with a zero variance of returns

E)No portfolio can have a beta of zero.

A)A portfolio that is equally as risky as the overall market

B)A portfolio that consists of a single stock

C)A portfolio comprised solely of U.S.Treasury bills

D)A portfolio with a zero variance of returns

E)No portfolio can have a beta of zero.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

11

Systematic risk is:

A)totally eliminated when a portfolio is fully diversified.

B)defined as the total risk associated with surprise events.

C)risk that affects a limited number of securities.

D)measured by beta.

E)measured by standard deviation.

A)totally eliminated when a portfolio is fully diversified.

B)defined as the total risk associated with surprise events.

C)risk that affects a limited number of securities.

D)measured by beta.

E)measured by standard deviation.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

12

Which one of the following is the best example of unsystematic risk?

A)Inflation exceeding market expectations

B)A warehouse fire

C)Decrease in corporate tax rates

D)Decrease in the value of the dollar

E)Increase in consumer spending

A)Inflation exceeding market expectations

B)A warehouse fire

C)Decrease in corporate tax rates

D)Decrease in the value of the dollar

E)Increase in consumer spending

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

13

The systematic risk principle states that the expected return on a risky asset depends only on the asset? s risk.

A)unique

B)diversifiable

C)asset-specific

D)market

E)unsystematic

A)unique

B)diversifiable

C)asset-specific

D)market

E)unsystematic

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

14

Stock A comprises 28 percent of Susan's portfolio.Which one of the following terms applies to the 28 percent?

A)Portfolio variance

B)Portfolio standard deviation

C)Portfolio weight

D)Portfolio expected return

E)Portfolio beta

A)Portfolio variance

B)Portfolio standard deviation

C)Portfolio weight

D)Portfolio expected return

E)Portfolio beta

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

15

A stock is expected to return 13 percent in an economic boom,10 percent in a normal economy,and 3 percent in a recessionary economy.Which one of the following will lower the overall expected rate of return on this stock?

A)An increase in the rate of return in a recessionary economy

B)An increase in the probability of an economic boom

C)A decrease in the probability of a recession occurring

D)A decrease in the probability of an economic boom

E)An increase in the rate of return for a normal economy

A)An increase in the rate of return in a recessionary economy

B)An increase in the probability of an economic boom

C)A decrease in the probability of a recession occurring

D)A decrease in the probability of an economic boom

E)An increase in the rate of return for a normal economy

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

16

The slope of the security market line represents the:

A)risk-free rate.

B)market risk premium.

C)beta coefficient.

D)risk premium on an individual asset.

E)market rate of return.

A)risk-free rate.

B)market risk premium.

C)beta coefficient.

D)risk premium on an individual asset.

E)market rate of return.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

17

The security market line is defined as a positively sloped straight line that displays the relationship between the:

A)beta and standard deviation of a portfolio.

B)systematic and unsystematic risks of a security.

C)nominal and real rates of return.

D)expected return and beta of either a security or a portfolio.

E)risk premium and beta of a portfolio.

A)beta and standard deviation of a portfolio.

B)systematic and unsystematic risks of a security.

C)nominal and real rates of return.

D)expected return and beta of either a security or a portfolio.

E)risk premium and beta of a portfolio.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

18

Which one of the following statements is correct?

A)The risk premium on a risk-free security is generally considered to be one percent.

B)The expected rate of return on any security, given multiple states of the economy, must be positive.

C)There is an inverse relationship between the level of risk and the risk premium given a risky security.

D)If a risky security is correctly priced, its expected risk premium will be positive.

E)If a risky security is priced correctly, it will have an expected return equal to the risk-free rate.

A)The risk premium on a risk-free security is generally considered to be one percent.

B)The expected rate of return on any security, given multiple states of the economy, must be positive.

C)There is an inverse relationship between the level of risk and the risk premium given a risky security.

D)If a risky security is correctly priced, its expected risk premium will be positive.

E)If a risky security is priced correctly, it will have an expected return equal to the risk-free rate.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

19

The amount of systematic risk present in a particular risky asset relative to that in an average risky asset is measured by the:

A)squared deviation.

B)beta coefficient.

C)standard deviation.

D)mean.

E)variance.

A)squared deviation.

B)beta coefficient.

C)standard deviation.

D)mean.

E)variance.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

20

Which one of these represents systematic risk?

A)Major layoff by a regional manufacturer of power boats

B)Increase in consumption created by a reduction in personal tax rates

C)Surprise firing of a firm's chief financial officer

D)Closure of a major retail chain of stores

E)Product recall by one manufacturer

A)Major layoff by a regional manufacturer of power boats

B)Increase in consumption created by a reduction in personal tax rates

C)Surprise firing of a firm's chief financial officer

D)Closure of a major retail chain of stores

E)Product recall by one manufacturer

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

21

The beta of a risky portfolio cannot be less than nor greater than _.

A)0; 1

B)1; the market beta

C)the lowest individual beta in the portfolio; market beta

D)the market beta; the highest individual beta in the portfolio

E)the lowest individual beta in the portfolio; the highest individual beta in the portfolio

A)0; 1

B)1; the market beta

C)the lowest individual beta in the portfolio; market beta

D)the market beta; the highest individual beta in the portfolio

E)the lowest individual beta in the portfolio; the highest individual beta in the portfolio

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

22

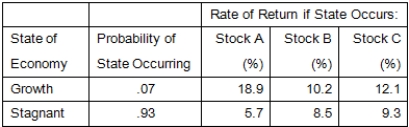

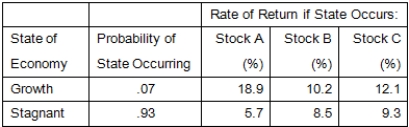

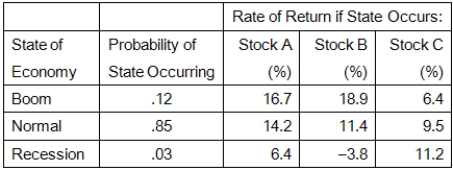

Given the following information,what is the standard deviation of the returns on a portfolio that is invested 40 percent in Stock A, 35 percent in Stock B, and the remainder in Stock C?

A)1.68 percent

B)6.72 percent

C)3.16 percent

D)2.43 percent

E)16.57 percent

A)1.68 percent

B)6.72 percent

C)3.16 percent

D)2.43 percent

E)16.57 percent

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

23

Julie wants to create a $5,000 portfolio.She also wants to invest as much as possible in a high risk stock with the hope of earning a high rate of return.However,she wants her portfolio to have no more risk than the overall market.Which one of the following portfolios is most apt to meet all of her objectives?

A)Invest the entire $5,000 in a stock with a beta of 1.0

B)Invest $2,500 in a stock with a beta of 1.98 and $2,500 in a stock with a beta of 1.0

C)Invest $2,500 in a risk-free asset and $2,500 in a stock with a beta of 2.0

D)Invest $2,500 in a stock with a beta of 1.0, $1,250 in a risk-free asset, and $1,250 in a stock with a beta of 2.0

E)Invest $2,000 in a stock with a beta of 3, $2,000 in a risk-free asset, and $1,000 in a stock with a beta of 1.0

A)Invest the entire $5,000 in a stock with a beta of 1.0

B)Invest $2,500 in a stock with a beta of 1.98 and $2,500 in a stock with a beta of 1.0

C)Invest $2,500 in a risk-free asset and $2,500 in a stock with a beta of 2.0

D)Invest $2,500 in a stock with a beta of 1.0, $1,250 in a risk-free asset, and $1,250 in a stock with a beta of 2.0

E)Invest $2,000 in a stock with a beta of 3, $2,000 in a risk-free asset, and $1,000 in a stock with a beta of 1.0

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

24

Bruno's stock should return 14 percent in a boom,11 percent in a normal economy,and 4 percent in a recession.The probabilities of a boom,normal economy,and recession are 8 percent,90 percent,and 2 percent,respectively.What is the variance of the returns on this stock?

A)011387

B).000169

C)001506

D)001538

E)011561

A)011387

B).000169

C)001506

D)001538

E)011561

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

25

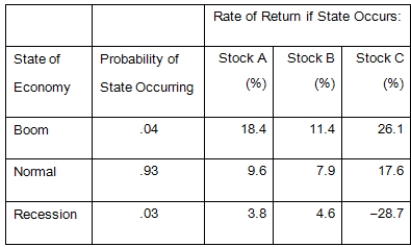

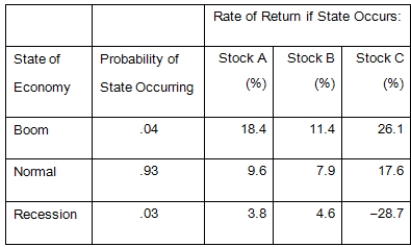

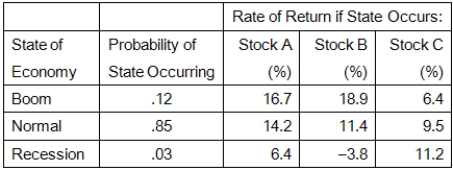

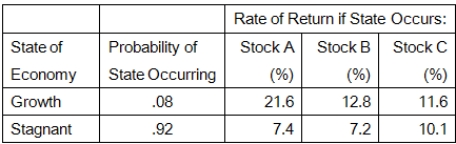

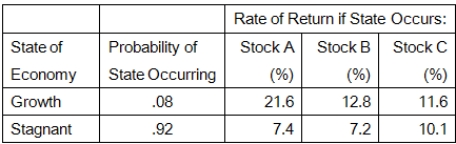

Given the following information,what is the expected return on a portfolio that is invested 30 percent in both Stocks A and C,and 40 percent in Stock B?

A)11.08 percent

B)12.94 percent

C)12.33 percent

D)10.84 percent

E)10.42 percent

A)11.08 percent

B)12.94 percent

C)12.33 percent

D)10.84 percent

E)10.42 percent

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

26

Which statement is correct?

A)An underpriced security will plot below the security market line.

B)A security with a beta of 1.54 will plot on the security market line if it is correctly priced.

C)A portfolio with a beta of .93 will plot to the right of the overall market.

D)A security with a beta of .99 will plot above the security market line if it is correctly priced.

E)A risk-free security will plot at the origin.

A)An underpriced security will plot below the security market line.

B)A security with a beta of 1.54 will plot on the security market line if it is correctly priced.

C)A portfolio with a beta of .93 will plot to the right of the overall market.

D)A security with a beta of .99 will plot above the security market line if it is correctly priced.

E)A risk-free security will plot at the origin.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

27

Given the following information,what is the expected return on a portfolio that is invested 35 percent in Stock A, 45 percent in Stock B, and the balance in Stock C?

A)12.04 percent

B)12.16 percent

C)12.91 percent

D)13.46 percent

E)11.87 percent

A)12.04 percent

B)12.16 percent

C)12.91 percent

D)13.46 percent

E)11.87 percent

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

28

Fiddler's Music Stores' stock has a risk premium of 8.3 percent while the inflation rate is 3.1 percent and the risk-free rate is 3.8 percent.What is the expected return on this stock?

A)9.0 percent

B)6.9 percent

C)12.1 percent

D)13.7 percent

E)15.2 percent

A)9.0 percent

B)6.9 percent

C)12.1 percent

D)13.7 percent

E)15.2 percent

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

29

The addition of a risky security to a fully diversified portfolio:

A)must decrease the portfolio's expected return.

B)must increase the portfolio beta.

C)may or may not affect the portfolio beta.

D)will increase the unsystematic risk of the portfolio.

E)will have no effect on the portfolio beta or its expected return.

A)must decrease the portfolio's expected return.

B)must increase the portfolio beta.

C)may or may not affect the portfolio beta.

D)will increase the unsystematic risk of the portfolio.

E)will have no effect on the portfolio beta or its expected return.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

30

Westover stock is expected to return 36 percent in a boom,14 percent in a normal economy,and lose 75 percent in a recession.The probabilities of a boom,normal economy,and a recession are 2 percent,93 percent,and 5 percent,respectively.What is the standard deviation of the returns on this stock?

A)19.90 percent

B)20.52 percent

C)20.41 percent

D)18.79 percent

E)19.74 percent

A)19.90 percent

B)20.52 percent

C)20.41 percent

D)18.79 percent

E)19.74 percent

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

31

Given the following information,what is the standard deviation of the returns on a portfolio that is invested 35 percent in both Stocks A and C,and 30 percent in Stock B?

A)1.95 percent

B)1.13 percent

C)3.67 percent

D)2.91 percent

E)2.36 percent

A)1.95 percent

B)1.13 percent

C)3.67 percent

D)2.91 percent

E)2.36 percent

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

32

Diversifying a portfolio across various sectors and industries might do more than one of the following.However,this diversification must do which one of the following?

A)Increase the expected risk premium

B)Reduce the beta of the portfolio to one

C)Increase the security's risk premium

D)Reduce the portfolio's systematic risk level

E)Reduce the portfolio's unique risks

A)Increase the expected risk premium

B)Reduce the beta of the portfolio to one

C)Increase the security's risk premium

D)Reduce the portfolio's systematic risk level

E)Reduce the portfolio's unique risks

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

33

Portfolio diversification eliminates:

A)all investment risk.

B)the portfolio risk premium.

C)market risk.

D)unsystematic risk.

E)the reward for bearing risk.

A)all investment risk.

B)the portfolio risk premium.

C)market risk.

D)unsystematic risk.

E)the reward for bearing risk.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

34

Which one of the following is the vertical intercept of the security market line?

A)Market rate of return

B)Individual security rate of return

C)Market risk premium

D)Individual security beta multiplied by the market risk premium

E)Risk-free rate

A)Market rate of return

B)Individual security rate of return

C)Market risk premium

D)Individual security beta multiplied by the market risk premium

E)Risk-free rate

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

35

Southern Wear stock has an expected return of 15.1 percent.The stock is expected to lose 8 percent in a recession and earn 18 percent in a boom.The probabilities of a recession,a normal economy,and a boom are 2 percent,87 percent,and 11 percent,respectively.What is the expected return on this stock if the economy is normal?

A)14.79 percent

B)17.04 percent

C)15.26 percent

D)16.43 percent

E)11.08 percent

A)14.79 percent

B)17.04 percent

C)15.26 percent

D)16.43 percent

E)11.08 percent

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

36

The capital asset pricing model:

A)assumes the market has a beta of zero and the risk-free rate is positive.

B)rewards investors based on total risk assumed.

C)considers the relationship between the fluctuations in a security?s returns versus the market?s returns.

D)applies to portfolios but not to individual securities.

E)assumes the market risk premium is constant over time.

A)assumes the market has a beta of zero and the risk-free rate is positive.

B)rewards investors based on total risk assumed.

C)considers the relationship between the fluctuations in a security?s returns versus the market?s returns.

D)applies to portfolios but not to individual securities.

E)assumes the market risk premium is constant over time.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

37

Blue Bell stock is expected to return 8.4 percent in a boom,8.9 percent in a normal economy,and 9.2 percent in a recession.The probabilities of a boom,normal economy,and a recession are 6 percent,92 percent,and 2 percent,respectively.What is the standard deviation of the returns on this stock?

A)38 percent

B)55 percent

C)13 percent

D)42 percent

E)06 percent

A)38 percent

B)55 percent

C)13 percent

D)42 percent

E)06 percent

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

38

Assume you own a portfolio of diverse securities which are each correctly priced.Given this,the reward-to-risk ratio:

A)for the portfolio must equal 1.0.

B)for the portfolio must be less than the market risk premium.

C)for each security must equal zero.

D)of each security is equal to the risk-free rate.

E)of each security must equal the slope of the security market line.

A)for the portfolio must equal 1.0.

B)for the portfolio must be less than the market risk premium.

C)for each security must equal zero.

D)of each security is equal to the risk-free rate.

E)of each security must equal the slope of the security market line.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

39

A portfolio is comprised of 35 securities with varying betas.The lowest beta for an individual security is .74 and the highest of the security betas of 1.51.Given this information,you know that the portfolio beta:

A)must be 1.0 because of the large number of securities in the portfolio.

B)is the geometric average of the individual security betas.

C)must be less than the market beta.

D)will be between 0 and 1.0.

E)will be greater than or equal to .74 but less than or equal to 1.51.

A)must be 1.0 because of the large number of securities in the portfolio.

B)is the geometric average of the individual security betas.

C)must be less than the market beta.

D)will be between 0 and 1.0.

E)will be greater than or equal to .74 but less than or equal to 1.51.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck