Deck 12: Money,Banking and the Financial System: Old Problems With New Twists

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/130

Play

Full screen (f)

Deck 12: Money,Banking and the Financial System: Old Problems With New Twists

1

If you keep some cash in a safe place so that you have it to use later,money is serving which function?

A)A medium of exchange

B)A measure of value

C)A store of value

D)A barter facilitator

E)All of the above

A)A medium of exchange

B)A measure of value

C)A store of value

D)A barter facilitator

E)All of the above

C

2

Commercial banks operate

A)By attracting deposits and making loans

B)Both pay and charge interest

C)By engaging in financial intermediation

D)All of the above

E)Under the control of state governments

A)By attracting deposits and making loans

B)Both pay and charge interest

C)By engaging in financial intermediation

D)All of the above

E)Under the control of state governments

D

3

In the early years of the American republic,the First Bank of the United States was established through the efforts of

A)Thomas Jefferson

B)George Washington

C)James Madison

D)Alexander Hamilton

E)Aaron Burr

A)Thomas Jefferson

B)George Washington

C)James Madison

D)Alexander Hamilton

E)Aaron Burr

D

4

A stock is

A)A financial instrument that provides ownership rights to shareholders

B)A financial instrument that provides annual payments of interest

C)A financial instrument that is traded only in primary financial markets

D)A financial instrument that is bought and sold by commercial banks

E)All of the above

A)A financial instrument that provides ownership rights to shareholders

B)A financial instrument that provides annual payments of interest

C)A financial instrument that is traded only in primary financial markets

D)A financial instrument that is bought and sold by commercial banks

E)All of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

5

Throughout the history of the U.S.,until the creation of the Federal Reserve System in 1913,the monetary system was

A)Characterized by a series of panics and periods of instability

B)Under the control of the Second Bank of the United States

C)The product of the work of President Andrew Jackson

D)Based upon the English system

E)Under the supervision of the US Mint

A)Characterized by a series of panics and periods of instability

B)Under the control of the Second Bank of the United States

C)The product of the work of President Andrew Jackson

D)Based upon the English system

E)Under the supervision of the US Mint

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

6

Money serves as

A)A unit of account

B)A store of value

C)A medium of exchange

D)All of the above

E)An emblem of personal wealth

A)A unit of account

B)A store of value

C)A medium of exchange

D)All of the above

E)An emblem of personal wealth

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

7

The Financial Crisis of 2008 affected

A)Only commercial banks

B)Only investment banks

C)Only insurance companies

D)All of the above

E)The revenues of only state governments

A)Only commercial banks

B)Only investment banks

C)Only insurance companies

D)All of the above

E)The revenues of only state governments

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

8

A financial intermediary

A)Seeks deposits

B)Makes loans

C)Matches up savers and borrowers

D)All of the above

E)Operates in between two banks

A)Seeks deposits

B)Makes loans

C)Matches up savers and borrowers

D)All of the above

E)Operates in between two banks

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

9

A dividend

A)Must be paid by a commercial banks

B)Must be paid by corporations to owners of the company's stock

C)Is a distribution of a corporation's profits to stockholders

D)Is a financial instrument that is bought and sold by commercial banks

E)None of the above

A)Must be paid by a commercial banks

B)Must be paid by corporations to owners of the company's stock

C)Is a distribution of a corporation's profits to stockholders

D)Is a financial instrument that is bought and sold by commercial banks

E)None of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

10

Banking regulation is intended to prevent

A)Bank failures

B)Excess bank profits

C)Bank losses

D)Banks from selling securities

E)Banking monopolies

A)Bank failures

B)Excess bank profits

C)Bank losses

D)Banks from selling securities

E)Banking monopolies

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

11

When you compare a dollar's worth of apples to a dollar's worth of oranges,money is serving which function?

A)A medium of exchange

B)A measure of value

C)A store of value

D)A barter facilitator

E)A measure of wealth

A)A medium of exchange

B)A measure of value

C)A store of value

D)A barter facilitator

E)A measure of wealth

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

12

When you use dollar bills to pay for a purchase at a store,money is serving which function?

A)A medium of exchange

B)A measure of value

C)A store of value

D)A barter facilitator

E)All of the above

A)A medium of exchange

B)A measure of value

C)A store of value

D)A barter facilitator

E)All of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

13

Commercial banks

A)Attract deposits by offering to pay interest

B)Sell new issues of stocks and bond

C)Operate on a non-profit basis

D)Attract deposits by offering free toasters

E)None of the above

A)Attract deposits by offering to pay interest

B)Sell new issues of stocks and bond

C)Operate on a non-profit basis

D)Attract deposits by offering free toasters

E)None of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

14

Corporations raise funds in

A)The money market

B)The primary financial market

C)The secondary financial market

D)Both the primary and secondary financial markets

E)None of the above

A)The money market

B)The primary financial market

C)The secondary financial market

D)Both the primary and secondary financial markets

E)None of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

15

Commercial banks

A)Started by offering credit to wealthy landowners

B)Began as goldsmiths that provided receipts to customers who stored their gold with the goldsmith

C)Operate in both the primary and secondary financial markets

D)Operate only in cities with major financial markets

E)Began in Germany

A)Started by offering credit to wealthy landowners

B)Began as goldsmiths that provided receipts to customers who stored their gold with the goldsmith

C)Operate in both the primary and secondary financial markets

D)Operate only in cities with major financial markets

E)Began in Germany

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

16

During most of the 1800s,the federal monetary authority was called

A)The Bank of America

B)The Bank of Washington

C)The First National Bank

D)The Third Bank of the United States

E)None of the above

A)The Bank of America

B)The Bank of Washington

C)The First National Bank

D)The Third Bank of the United States

E)None of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

17

When a person buys a stock on a stock exchange they are participating in

A)The money market

B)The primary financial market

C)The secondary financial market

D)Both the primary and secondary financial markets

E)None of the above

A)The money market

B)The primary financial market

C)The secondary financial market

D)Both the primary and secondary financial markets

E)None of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

18

Prior to the creation of the Federal Reserve System,the money supply

A)Was very stable and highly valued

B)Was comprised of currency printed by the Department of the Treasury

C)Was produced by local banks and often traded at a discount

D)Was available only to bank depositors

E)Was comprised of gold

A)Was very stable and highly valued

B)Was comprised of currency printed by the Department of the Treasury

C)Was produced by local banks and often traded at a discount

D)Was available only to bank depositors

E)Was comprised of gold

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

19

Insurance policies

A)Require an initial,one-time payment by policy holders but no further outlay

B)Make payments to policy holders on a monthly basis

C)Require a regular payment of insurance premiums by policy holders

D)Require an initial payment and regular payments of insurance premiums by policy holders

E)None of the above

A)Require an initial,one-time payment by policy holders but no further outlay

B)Make payments to policy holders on a monthly basis

C)Require a regular payment of insurance premiums by policy holders

D)Require an initial payment and regular payments of insurance premiums by policy holders

E)None of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

20

Investment banks

A)Make loans to individual households to buy houses and cars

B)Work with corporations to finance their operations through primary financial markets

C)Work with corporations to finance their operations through secondary financial markets

D)Work with investments from private individuals

E)None of the above

A)Make loans to individual households to buy houses and cars

B)Work with corporations to finance their operations through primary financial markets

C)Work with corporations to finance their operations through secondary financial markets

D)Work with investments from private individuals

E)None of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

21

Suppose the legal reserve requirement is 0.20,and a bank has excess reserves of $1,000,000.The ultimate increase in the money supply will be

A)$2,000,000

B)$200,000

C)$800,000

D)$5,000,000

E)$500,000

A)$2,000,000

B)$200,000

C)$800,000

D)$5,000,000

E)$500,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

22

Banks make loans from their

A)Required reserves

B)Excess reserves

C)Net worth

D)U.S.government securities

E)None of the above

A)Required reserves

B)Excess reserves

C)Net worth

D)U.S.government securities

E)None of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following is among the assets of a commercial bank?

A)Demand deposits

B)Net worth

C)Any liability

D)Loans and investments

E)Time deposits

A)Demand deposits

B)Net worth

C)Any liability

D)Loans and investments

E)Time deposits

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

24

Who controls the aggregate volume of demand deposits in the banking system?

A)The U.S.Treasury

B)The Federal Reserve Board of Governors

C)Congress

D)Bankers

E)The President of the United States

A)The U.S.Treasury

B)The Federal Reserve Board of Governors

C)Congress

D)Bankers

E)The President of the United States

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

25

Money does not serve as a

A)Medium of exchange

B)Store of value

C)Measure of value

D)Price index

E)It serves as all of the above

A)Medium of exchange

B)Store of value

C)Measure of value

D)Price index

E)It serves as all of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

26

If the reserve ratio is 10% and a new demand deposit of $10,000 is made,what is the maximum deposit creation possible?

A)$1,000

B)$9,000

C)$10,000

D)$90,000

E)$100,000

A)$1,000

B)$9,000

C)$10,000

D)$90,000

E)$100,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

27

The inflation rate and the growth in the money supply are

A)Usually inversely related

B)Usually directly related

C)Never directly related

D)Not related to one another

E)Negatively related

A)Usually inversely related

B)Usually directly related

C)Never directly related

D)Not related to one another

E)Negatively related

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

28

When a central bank wants to increase the money supply,it

A)Sells bonds

B)Buys bonds

C)Sells good and services

D)Buys goods and services

E)Does none of the above

A)Sells bonds

B)Buys bonds

C)Sells good and services

D)Buys goods and services

E)Does none of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

29

If the reserve ratio is 20% and a new demand deposit of $10,000 is made,what is the maximum deposit creation possible?

A)$1,500

B)$10,000

C)$15,000

D)$40,000

E)$50,000

A)$1,500

B)$10,000

C)$15,000

D)$40,000

E)$50,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

30

M2 includes

A)M1,plus savings and time deposits of small denomination,and money market mutual funds

B)M1 plus savings and time deposits of large denomination (over $100,000)

C)M1 plus banks acceptances and Treasury bills

D)M1 plus currency and demand deposits

E)None of the above

A)M1,plus savings and time deposits of small denomination,and money market mutual funds

B)M1 plus savings and time deposits of large denomination (over $100,000)

C)M1 plus banks acceptances and Treasury bills

D)M1 plus currency and demand deposits

E)None of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

31

If the reserve ratio is 10% and a new demand deposit of $5,000 is made,what is the maximum deposit creation possible?

A)$500

B)$4,500

C)$5,000

D)$45,000

E)$50,000

A)$500

B)$4,500

C)$5,000

D)$45,000

E)$50,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

32

M1 includes

A)Currency and coins in circulation,traveler's checks,demand deposits at commercial banks,and other checkable deposits

B)Currency and coins in circulation,all demand deposits,and all time deposits

C)All demand deposits and all time deposits

D)Just currency and coins in circulation

E)None of the above

A)Currency and coins in circulation,traveler's checks,demand deposits at commercial banks,and other checkable deposits

B)Currency and coins in circulation,all demand deposits,and all time deposits

C)All demand deposits and all time deposits

D)Just currency and coins in circulation

E)None of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

33

If the Open Market Committee of the Federal Reserve sells securities,this action will

A)Decrease the money supply

B)Increase the money supply

C)Reduce the reserve requirement

D)Decrease the discount rate

E)Do none of the above

A)Decrease the money supply

B)Increase the money supply

C)Reduce the reserve requirement

D)Decrease the discount rate

E)Do none of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

34

The basic money supply is

A)Composed of small denomination time deposits plus coin and currency held by the nonbank public

B)Composed of assets that are completely liquid and easily accessible

C)Our broadest measure of money

D)Simply the coins and currency held by the nonbank public

E)None of the above

A)Composed of small denomination time deposits plus coin and currency held by the nonbank public

B)Composed of assets that are completely liquid and easily accessible

C)Our broadest measure of money

D)Simply the coins and currency held by the nonbank public

E)None of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is true of a fractional reserve banking system?

A)Banks must hold all of depositors' deposits in their vaults

B)Banking is only a fraction of the services banks provide to their customers

C)Banks lend out part of their depositors' deposits

D)The reserve ratio is 100%

E)Banks may not hold excess reserves

A)Banks must hold all of depositors' deposits in their vaults

B)Banking is only a fraction of the services banks provide to their customers

C)Banks lend out part of their depositors' deposits

D)The reserve ratio is 100%

E)Banks may not hold excess reserves

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

36

Excess reserves

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

37

To reduce inflationary pressures,the Federal Reserve authorities should

A)Sell government securities,raise reserve requirements,and lower the discount rate

B)Sell government securities,lower reserve requirements,and lower the discount rate

C)Buy the government securities,raise reserve requirements,and raise the discount rate

D)Sell government securities,raise reserve requirements,and raise the discount rate

E)Buy government securities,decrease reserve requirements,decrease the discount rate

A)Sell government securities,raise reserve requirements,and lower the discount rate

B)Sell government securities,lower reserve requirements,and lower the discount rate

C)Buy the government securities,raise reserve requirements,and raise the discount rate

D)Sell government securities,raise reserve requirements,and raise the discount rate

E)Buy government securities,decrease reserve requirements,decrease the discount rate

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

38

The Gramm-Leach-Bliley Act allows banks to

A)Sell insurance

B)Underwrite insurance

C)Sell securities

D)Invest in real estate

E)Do all of the above

A)Sell insurance

B)Underwrite insurance

C)Sell securities

D)Invest in real estate

E)Do all of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

39

The money multiplier is

A)1/r

B)Er

C)R/E

D)E/r

E)1+1/Er

A)1/r

B)Er

C)R/E

D)E/r

E)1+1/Er

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

40

Money is "liquid" because

A)It loses value with inflation

B)Coins can be melted to use their metal to make goods

C)It serves as a measure of value

D)It does not have to be sold to buy goods and services

E)It is a valuable asset

A)It loses value with inflation

B)Coins can be melted to use their metal to make goods

C)It serves as a measure of value

D)It does not have to be sold to buy goods and services

E)It is a valuable asset

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

41

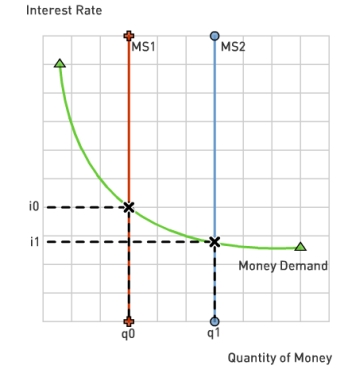

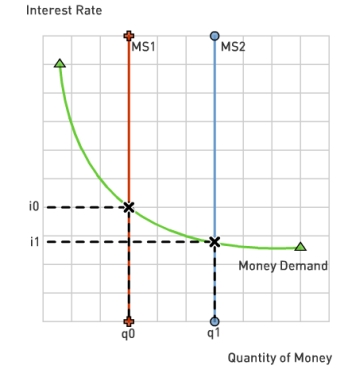

The Following Questions Refer to the graph below.

Based on the diagram,the opportunity cost of money is higher if

A)The interest rate is i0

B)The interest rate is i1

C)The money supply is curve MS1

D)The money supply is curve MS2

E)The opportunity cost of money is not shown in the diagram

Based on the diagram,the opportunity cost of money is higher if

A)The interest rate is i0

B)The interest rate is i1

C)The money supply is curve MS1

D)The money supply is curve MS2

E)The opportunity cost of money is not shown in the diagram

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

42

A key assumption in the quantity theory of money is that

A)The supply of money is increasing at a constant rate b The price level is stable over long periods of time

C)The level of output of goods and services changes frequently in response to changes in velocity

D)The velocity of money is constant

E)None of the above

A)The supply of money is increasing at a constant rate b The price level is stable over long periods of time

C)The level of output of goods and services changes frequently in response to changes in velocity

D)The velocity of money is constant

E)None of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

43

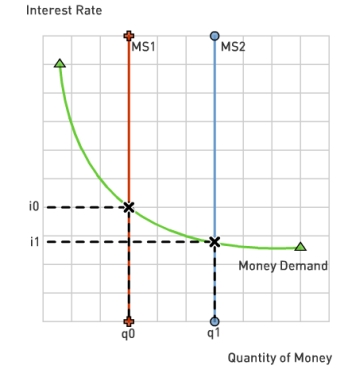

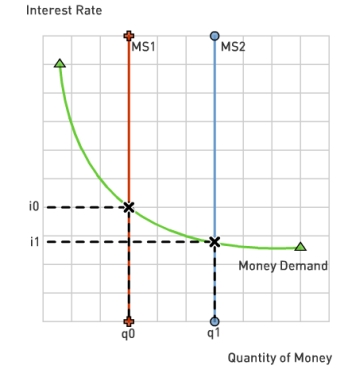

The Following Questions Refer to the graph below.

Suppose that the Fed has increased the money supply.This is shown in the diagram by

A)q1 to q0

B)q0 to q1

C)MS1

D)MS2

E)None of the above

Suppose that the Fed has increased the money supply.This is shown in the diagram by

A)q1 to q0

B)q0 to q1

C)MS1

D)MS2

E)None of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

44

A subprime mortgage

A)Made obtaining a mortgage easier for low income households

B)Is a mortgage that does not meet the requirements for a conventional mortgage

C)Is usually structured as an adjustable rate mortgage

D)All of the above

E)Is no different from a conventional mortgage

A)Made obtaining a mortgage easier for low income households

B)Is a mortgage that does not meet the requirements for a conventional mortgage

C)Is usually structured as an adjustable rate mortgage

D)All of the above

E)Is no different from a conventional mortgage

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

45

When the Open Market Committee (FOMC)purchases government securities,their actions are an attempt to

A)Raise interest rates

B)Lower interest rates

C)Reduce borrowing

D)Raise the inflation rate

E)Influence voters in the next presidential election

A)Raise interest rates

B)Lower interest rates

C)Reduce borrowing

D)Raise the inflation rate

E)Influence voters in the next presidential election

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

46

A collateralized debt obligation (or CDO)

A)Is generally riskier than a single debt of an equal value

B)Sells for a lower price than re-sales of individual mortgages that comprise them

C)Is sold in the primary financial market

D)Is a financial instrument that obscures the underlying risks of the mortgages that comprise them

E)Is always a bad financial investment

A)Is generally riskier than a single debt of an equal value

B)Sells for a lower price than re-sales of individual mortgages that comprise them

C)Is sold in the primary financial market

D)Is a financial instrument that obscures the underlying risks of the mortgages that comprise them

E)Is always a bad financial investment

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

47

The quantity theory of money emphasizes

A)Government taxation policies

B)Government spending policies

C)Labor productivity

D)Changes in the money supply

E)None of the above

A)Government taxation policies

B)Government spending policies

C)Labor productivity

D)Changes in the money supply

E)None of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

48

The Federal Reserve can decrease the supply of money by

A)Selling U.S.government securities

B)Buying U.S.government securities

C)Selling goods and services

D)Buying goods and services

E)Decreasing the reserve requirement

A)Selling U.S.government securities

B)Buying U.S.government securities

C)Selling goods and services

D)Buying goods and services

E)Decreasing the reserve requirement

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

49

The Federal Open Market Committee (FOMC)is highly concerned with

A)The national unemployment rate

B)The growth of real GDP

C)Interest rates

D)The level of the stock market

E)All of the above

A)The national unemployment rate

B)The growth of real GDP

C)Interest rates

D)The level of the stock market

E)All of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

50

When the Fed increases the money supply,it generally has the effect of

A)Making banks more profitable

B)Increasing the value of stocks

C)Lowering interest rates

D)Lowering the inflation rate

E)Increasing the size of bank deposits

A)Making banks more profitable

B)Increasing the value of stocks

C)Lowering interest rates

D)Lowering the inflation rate

E)Increasing the size of bank deposits

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

51

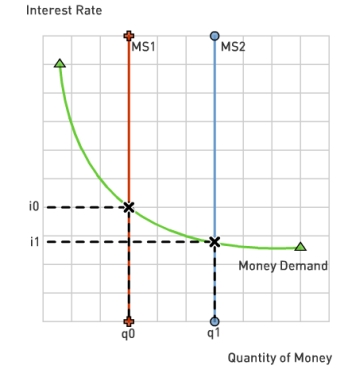

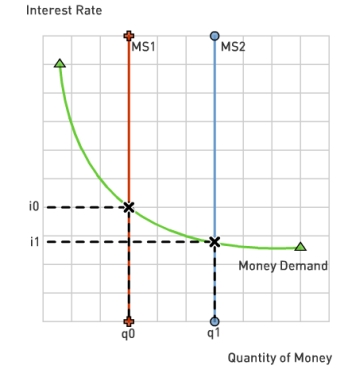

The Following Questions Refer to the graph below.

A shift from MS1 to MS2 would be the result of

A)An increase in aggregate demand

B)An increase in aggregate supply

C)A decision by the Fed to purchase government securities by the FOMC

D)A decision by the Fed to sell government securities by the FOMC

E)A change in the stock market

A shift from MS1 to MS2 would be the result of

A)An increase in aggregate demand

B)An increase in aggregate supply

C)A decision by the Fed to purchase government securities by the FOMC

D)A decision by the Fed to sell government securities by the FOMC

E)A change in the stock market

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

52

The Federal National Mortgage Association (or Fannie Mae)was created to

A)Make mortgages hard to obtain

B)Make mortgages less likely to go into foreclosure

C)Make a larger market in mortgages by establishing a secondary financial market in mortgages

D)Make mortgages available to new immigrants to the US

E)None of the above

A)Make mortgages hard to obtain

B)Make mortgages less likely to go into foreclosure

C)Make a larger market in mortgages by establishing a secondary financial market in mortgages

D)Make mortgages available to new immigrants to the US

E)None of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

53

The growth in the residential real estate market is largely a product of

A)A large increase in the demand for housing

B)An unexpected growth in US population

C)A decline in housing prices

D)A tightening of government policies that restrict homeownership

E)A decrease in mortgage availability

A)A large increase in the demand for housing

B)An unexpected growth in US population

C)A decline in housing prices

D)A tightening of government policies that restrict homeownership

E)A decrease in mortgage availability

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

54

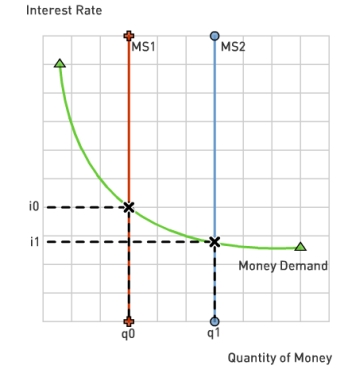

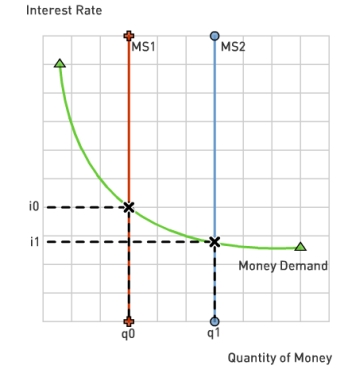

The Following Questions Refer to the graph below.

If the Fed wanted to stimulate business investment,it could do so by

A)Increasing interest rates from i1 to i0

B)Decreasing the money supply from MS2 to MS1

C)Increasing the money supply from MS1 to MS2

D)Raising the Reserve Requirement

E)Increasing the Discount Rate

If the Fed wanted to stimulate business investment,it could do so by

A)Increasing interest rates from i1 to i0

B)Decreasing the money supply from MS2 to MS1

C)Increasing the money supply from MS1 to MS2

D)Raising the Reserve Requirement

E)Increasing the Discount Rate

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

55

The residential housing market saw remarkable increases in

A)Housing prices at the end of the 1990's and through the first half of the 2000's

B)Housing prices at the end of the 1980's and beginning of the 1990's

C)Foreclosure rates at the end of the 1990's and through the first half of the 2000's

D)Foreclosure rates at the end of the 1980's and beginning of the 1990's

E)Both A and C

A)Housing prices at the end of the 1990's and through the first half of the 2000's

B)Housing prices at the end of the 1980's and beginning of the 1990's

C)Foreclosure rates at the end of the 1990's and through the first half of the 2000's

D)Foreclosure rates at the end of the 1980's and beginning of the 1990's

E)Both A and C

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

56

When the Fed wishes to increase the money supply,it can do so by

A)Purchasing government securities through open market operations

B)Lowering the Discount Rate

C)Reducing the Reserve Requirement

D)All of the above

E)Increasing the size of bank deposits

A)Purchasing government securities through open market operations

B)Lowering the Discount Rate

C)Reducing the Reserve Requirement

D)All of the above

E)Increasing the size of bank deposits

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

57

A mortgage backed security is

A)A share of common stock based upon home mortgages

B)A financial instrument that reduces risk by pooling together a large number of mortgages into one asset

C)A financial instrument developed to reduce liquidity in the housing market

D)A financial instrument that is the combination of only subprime mortgages

E)All of the above

A)A share of common stock based upon home mortgages

B)A financial instrument that reduces risk by pooling together a large number of mortgages into one asset

C)A financial instrument developed to reduce liquidity in the housing market

D)A financial instrument that is the combination of only subprime mortgages

E)All of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

58

The value of money varies

A)Directly with the interest rate

B)Directly with the price level

C)Directly with the volume of employment

D)Inversely with the price level

E)With none of the above

A)Directly with the interest rate

B)Directly with the price level

C)Directly with the volume of employment

D)Inversely with the price level

E)With none of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

59

According to the equation of exchange,

A)The right-hand side will equal the left-hand side only if velocity does not change from year to year

B)Velocity must be constant

C)An increase in the quantity of money will lead to an increase in the price level,other things constant

D)Prices cannot change

E)All of the above

A)The right-hand side will equal the left-hand side only if velocity does not change from year to year

B)Velocity must be constant

C)An increase in the quantity of money will lead to an increase in the price level,other things constant

D)Prices cannot change

E)All of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

60

The equation of exchange is

A)MP = QV

B)MV = PQ

C)M = V/PQ

D)P = Q/MV

E)PV = QM

A)MP = QV

B)MV = PQ

C)M = V/PQ

D)P = Q/MV

E)PV = QM

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

61

The US has,over its history,had only one national bank,that is,a Bank of the United States.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

62

Silversmiths became banks when they started lending out money based upon the excess silver that they held for their customers.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

63

Besides homeowners,who attempted to profit from increasing home prices during the housing bubble in the early part of the 2000s?

A)Large corporations

B)Speculators

C)Foreign investors

D)Individuals who had low incomes

E)All of the above

A)Large corporations

B)Speculators

C)Foreign investors

D)Individuals who had low incomes

E)All of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

64

In late 2008,the US Treasury Department began

A)Closing banks that were not following regulations

B)To implement the Troubled Asset Relief Program (TARP)

C)Raising interest rates to stimulate the economy

D)Engaging in open market operations

E)To implement the opening of a new Bank of the United States

A)Closing banks that were not following regulations

B)To implement the Troubled Asset Relief Program (TARP)

C)Raising interest rates to stimulate the economy

D)Engaging in open market operations

E)To implement the opening of a new Bank of the United States

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

65

The federal government stepped in during 2008 to prevent several commercial banks and investment banks from failing based upon the idea that

A)They were "too big to fail"

B)Any business failure would hurt shareholders

C)These banks made large political contributions and this was a way for politicians to pay them back

D)Government would make large profits by doing so

E)None of the above

A)They were "too big to fail"

B)Any business failure would hurt shareholders

C)These banks made large political contributions and this was a way for politicians to pay them back

D)Government would make large profits by doing so

E)None of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

66

Many large banks and Wall Street investment firms got into financial problems due to

A)Investments in subprime mortgages

B)Required payments on credit default swaps

C)Failures of collateralized debt obligations resulting from home foreclosures

D)Having to mark down a significant number of their assets due to the "mark to market" accounting requirement

E)All of the above

A)Investments in subprime mortgages

B)Required payments on credit default swaps

C)Failures of collateralized debt obligations resulting from home foreclosures

D)Having to mark down a significant number of their assets due to the "mark to market" accounting requirement

E)All of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

67

A capital gain exists

A)When one political party increases the number of its members in Congress

B)When an interest payment is made

C)When the price of an asset goes up

D)When the price of an asset exceeds the price paid for it

E)When taxes are paid on the asset

A)When one political party increases the number of its members in Congress

B)When an interest payment is made

C)When the price of an asset goes up

D)When the price of an asset exceeds the price paid for it

E)When taxes are paid on the asset

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

68

An increase in the reserve requirement can

A)Decrease interest rates

B)Increase liquidity

C)Decrease the money supply

D)Increase the money supply

E)Decrease the profits of banks

A)Decrease interest rates

B)Increase liquidity

C)Decrease the money supply

D)Increase the money supply

E)Decrease the profits of banks

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

69

Liquidity of an asset increases when

A)It is easier to convert the asset into cash

B)The asset's value is below its original price

C)The asset is purchased

D)The asset depreciates

E)The asset is put on the market

A)It is easier to convert the asset into cash

B)The asset's value is below its original price

C)The asset is purchased

D)The asset depreciates

E)The asset is put on the market

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

70

Home equity loans

A)Allow a home owner to recapture some of the increase in the value of their home without selling the home

B)A way for homeowners to issue stock,or equity,in their home

C)Only used when home prices are increasing

D)A way for the market to eliminate paper profits

E)None of the above

A)Allow a home owner to recapture some of the increase in the value of their home without selling the home

B)A way for homeowners to issue stock,or equity,in their home

C)Only used when home prices are increasing

D)A way for the market to eliminate paper profits

E)None of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

71

The interest rate on an adjustable rate mortgage (ARM)is

A)Set to equal the Fed Funds rate

B)Adjusted on a daily basis

C)Set to rise at the end of every year for the life of the mortgage

D)Adjusted periodically based upon current market conditions

E)Adjusted based upon the value of the house purchase

A)Set to equal the Fed Funds rate

B)Adjusted on a daily basis

C)Set to rise at the end of every year for the life of the mortgage

D)Adjusted periodically based upon current market conditions

E)Adjusted based upon the value of the house purchase

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

72

Historically,many commercial banks began as

A)Coffee houses and taverns where stocks were traded

B)Jewelry stores that specialized in the sale of precious stones

C)Businesses that engaged in small loans

D)Goldsmiths that held stores of gold for their customers

E)None of the above

A)Coffee houses and taverns where stocks were traded

B)Jewelry stores that specialized in the sale of precious stones

C)Businesses that engaged in small loans

D)Goldsmiths that held stores of gold for their customers

E)None of the above

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

73

Residential real estate is generally considered to be more liquid than a savings account.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

74

Assets that are "marked to market" will be priced at

A)Their original purchase price

B)Their original purchase price less the depreciation of the asset

C)A price that is equal to the original purchase price plus the rate of inflation

D)A price that is based upon the asset's current market value

E)A price determined in the stock market

A)Their original purchase price

B)Their original purchase price less the depreciation of the asset

C)A price that is equal to the original purchase price plus the rate of inflation

D)A price that is based upon the asset's current market value

E)A price determined in the stock market

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

75

A credit default swap

A)Is what happens when homeowners swap their mortgages with their neighbors

B)Is a way for investors in collateralized debt obligations (or CDO's)to make even more money

C)Is a way for investors in collateralized debt obligations (or CDO's)to reduce the risk of an increase in mortgage foreclosures

D)Is a way for investors to increase the risks to homeowners

E)Exists only in markets with subprime mortgages

A)Is what happens when homeowners swap their mortgages with their neighbors

B)Is a way for investors in collateralized debt obligations (or CDO's)to make even more money

C)Is a way for investors in collateralized debt obligations (or CDO's)to reduce the risk of an increase in mortgage foreclosures

D)Is a way for investors to increase the risks to homeowners

E)Exists only in markets with subprime mortgages

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

76

When a share of stock is sold on the New York Stock Exchange,it is traded

A)In a prime financial market

B)In a primary financial market

C)For a promise to pay a fixed return

D)To another stock exchange

E)In a secondary financial market

A)In a prime financial market

B)In a primary financial market

C)For a promise to pay a fixed return

D)To another stock exchange

E)In a secondary financial market

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

77

The financial crisis that began in 2008 is a result of all of the following except

A)The bursting of the dot.com bubble

B)Problems in the residential real estate market

C)Changes in accounting rules about asset valuation

D)Large firms taking on assets whose value was not well determined

E)Policies that allowed many unqualified homebuyers to receive mortgages that they could not pay

A)The bursting of the dot.com bubble

B)Problems in the residential real estate market

C)Changes in accounting rules about asset valuation

D)Large firms taking on assets whose value was not well determined

E)Policies that allowed many unqualified homebuyers to receive mortgages that they could not pay

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

78

Investment banks assist corporations in issuing stocks and bonds in the primary financial market.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

79

Each of the following is a financial intermediary except

A)Commercial banks

B)Investment banks

C)Insurance companies

D)Credit unions

E)All of the above are financial intermediaries

A)Commercial banks

B)Investment banks

C)Insurance companies

D)Credit unions

E)All of the above are financial intermediaries

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

80

Commercial banks are financial intermediaries but insurance companies are not.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck