Deck 6: Accounting Methods and Taxes

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/68

Play

Full screen (f)

Deck 6: Accounting Methods and Taxes

1

Most partnerships, S corporations, and personal service corporations owned by individuals choose a September 30 year-end so that they may defer 3 months of income.

False

2

Annualizing" is a method by which the taxpayer can usually decrease the amount of tax he or she pays.

False

3

Which one of the following entities cannot use the cash method for tax purposes?

A)A large almond farm with $40 million in gross receipts.

B)A continuing education provider with $20 million in gross receipts and 200 employees.

C)A law firm operating as a personal service corporation with $5.4 million in gross receipts.

D)A small sole proprietorship with $150,000 in gross receipts.

E)All of the above may use the cash method.

A)A large almond farm with $40 million in gross receipts.

B)A continuing education provider with $20 million in gross receipts and 200 employees.

C)A law firm operating as a personal service corporation with $5.4 million in gross receipts.

D)A small sole proprietorship with $150,000 in gross receipts.

E)All of the above may use the cash method.

E

4

Kate is an accrual basis, calendar-year taxpayer.On November 1, 2018, Kate leased out a building for $4,500 a month.On that day Kate received 7 months rental income on the building, a total of $31,500 ($4,500 × 7 months).How much income must Kate include on her 2018 tax return as a result of this transaction?

A)$4,500

B)$9,000

C)$31,500

D)$54,000

E)None of the above

A)$4,500

B)$9,000

C)$31,500

D)$54,000

E)None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

5

The hybrid method of accounting involves the use of both the accrual and cash methods of accounting.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

6

All S corporations must use the accrual basis of accounting.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

7

If a corporation has a short tax year, other than their first or last year of operation, explain how the corporation calculates the tax for the short period.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

8

Under the cash basis of accounting, most expenses are generally deducted in the year they are paid.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

9

In general, accrual basis taxpayers recognize income when it is earned, regardless of when it is received.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

10

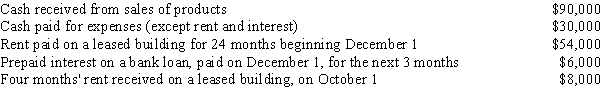

Polly is a cash basis taxpayer with the following transactions during the year:  Calculate Polly's income from her business for this calendar year.

Calculate Polly's income from her business for this calendar year.

Calculate Polly's income from her business for this calendar year.

Calculate Polly's income from her business for this calendar year.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

11

Amy is a calendar year taxpayer reporting on the cash basis.Indicate which of the following income or expense items should not be included in her 2018 tax return.

A)On April 15, 2019, she makes a deductible contribution to an IRA for 2018.

B)She prepays half a year of interest in advance on her mortgage on the last day of 2018.

C)She pays all her outstanding invoices for standard business expenses in the last week of December 2018.

D)She sends out a big bill to a customer on January 1, 2019, even though she did all of the work in December of 2018.

A)On April 15, 2019, she makes a deductible contribution to an IRA for 2018.

B)She prepays half a year of interest in advance on her mortgage on the last day of 2018.

C)She pays all her outstanding invoices for standard business expenses in the last week of December 2018.

D)She sends out a big bill to a customer on January 1, 2019, even though she did all of the work in December of 2018.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

12

In cash basis accounting, for tax purposes:

A)Income is recognized when it is actually or constructively received and expenses are recognized when they are actually or constructively incurred, regardless of when paid.

B)Income is recognized when it is earned regardless of when received and expenses are recognized when they are actually or constructively incurred.

C)Income is generally recognized when it is actually or constructively received and expenses are generally recognized when they are paid.

D)The cash basis is not allowed for businesses reported on Schedule C.

A)Income is recognized when it is actually or constructively received and expenses are recognized when they are actually or constructively incurred, regardless of when paid.

B)Income is recognized when it is earned regardless of when received and expenses are recognized when they are actually or constructively incurred.

C)Income is generally recognized when it is actually or constructively received and expenses are generally recognized when they are paid.

D)The cash basis is not allowed for businesses reported on Schedule C.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is not an acceptable method of accounting under the tax law?

A)The accrual method

B)The cash method

C)The hybrid method

D)All of the above are acceptable

E)None of the above are acceptable

A)The accrual method

B)The cash method

C)The hybrid method

D)All of the above are acceptable

E)None of the above are acceptable

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

14

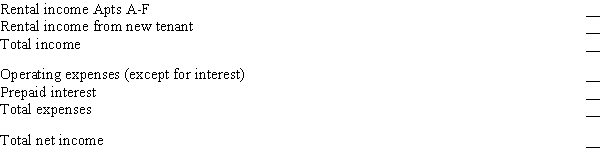

Tom, a cash basis sole proprietor, provides the following information:

What amount should Tom report as net earnings from self-employment?

A)$10,900

B)$11,300

C)$11,400

D)$14,400

E)None of the above

What amount should Tom report as net earnings from self-employment?

A)$10,900

B)$11,300

C)$11,400

D)$14,400

E)None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

15

Choose the incorrect statement.

A)Books and records may be kept on a different year-end basis than the year-end used for tax purposes.

B)The choice to file on a fiscal year-end basis must be made with an initial tax return.

C)Almost all individuals file tax returns using a calendar year accounting period.

D)An individual may request IRS approval to change to a fiscal year-end basis if certain conditions are met.

A)Books and records may be kept on a different year-end basis than the year-end used for tax purposes.

B)The choice to file on a fiscal year-end basis must be made with an initial tax return.

C)Almost all individuals file tax returns using a calendar year accounting period.

D)An individual may request IRS approval to change to a fiscal year-end basis if certain conditions are met.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

16

The Dot Corporation has changed its year-end from a calendar year-end to August 31.The income for its short period from January 1 to August 31 is $54,000.The tax for this short period is:

A)$2,040

B)$6,250

C)$8,667

D)$10,527

A)$2,040

B)$6,250

C)$8,667

D)$10,527

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

17

Vernon is a cash basis taxpayer with a calendar tax year.On October 1, 2018, Vernon entered into a lease to rent a building for use in his business at $3,000 a month.On that day Vernon paid 18 months' rent on the building, a total of $54,000 ($3,000 × 18 months).How much may Vernon deduct for rent expense on his 2018 tax return?

A)$0

B)$12,000

C)$36,000

D)$54,000

E)None of the above

A)$0

B)$12,000

C)$36,000

D)$54,000

E)None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

18

Generally, cash basis taxpayers must deduct payments of prepaid interest using the accrual method.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

19

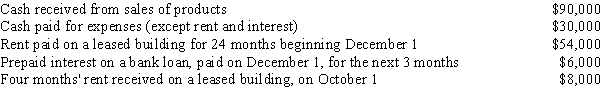

William, a cash-basis sole proprietor, had the following receipts and disbursements for the current year:

For the current year, what amount should William report as net earnings from self-employment?

A)$13,400

B)$14,000

C)$15,000

D)$20,000

E)None of the above

For the current year, what amount should William report as net earnings from self-employment?

A)$13,400

B)$14,000

C)$15,000

D)$20,000

E)None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

20

Becky is a cash basis taxpayer with the following transactions during her calendar tax year:

What is the amount of Becky's taxable income from her business for this tax year?

A)$7,000 loss

B)$11,000

C)$27,500

D)$28,000

E)None of the above

What is the amount of Becky's taxable income from her business for this tax year?

A)$7,000 loss

B)$11,000

C)$27,500

D)$28,000

E)None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

21

Mary sells to her father, Robert, her shares in AA Corp for $55,000.The shares cost Mary $80,000.How much loss may Mary claim from the sale?

A)$0

B)$25,000

C)$55,000

D)$80,000

E)None of the above is correct

A)$0

B)$25,000

C)$55,000

D)$80,000

E)None of the above is correct

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

22

Salary earned by minors may be included on the parents' tax return.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

23

Beverly is the sole owner of Bev & Associates, an accrual basis corporation.In 2018, Bev & Associates has an unprofitable year and Beverly lends the corporation $50,000 to meet expenses.The corporation accrues interest expense of $5,000 on the loan from Beverly, but does not pay the interest to her in cash.How much of the $5,000 in accrued interest expense can Bev & Associates deduct on its 2018 corporate tax return? Explain.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

24

Jerry and Julie are brother and sister.Jerry sold stock to Julie for $5,000, its fair market value.The stock cost Jerry $10,000 5 years ago.Also, Jerry sold Carol (an unrelated party)stock for $2,000 that cost $10,000 3 years ago.What is Jerry's recognized loss before the $3,000 capital loss limitation?

A)$0

B)$8,000

C)$5,000

D)$13,000

E)$14,000

A)$0

B)$8,000

C)$5,000

D)$13,000

E)$14,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

25

Assume Karen is 12 years old and her only income is $5,500 of interest income from a bank account with money her parents have given her to save for college.If Karen does not elect to include her income on her parents' return, what is her income tax liability?

A)$550

B)$445

C)$564

D)$963

A)$550

B)$445

C)$564

D)$963

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following is true with respect to the related party rules?

A)Bill sells stock to his sister for a $3,000 loss.Bill can deduct the loss on his tax return.

B)A taxpayer's uncle is a related party for purposes of Section 267.

C)A disallowed loss on a related party transaction can be used to offset any future gain when the property is sold to an unrelated party.

D)Under the constructive ownership rules of Section 267, a shareholder owns 10 percent of the stock owned by a corporation in which he or she is a shareholder.

E)None of the above are true.

A)Bill sells stock to his sister for a $3,000 loss.Bill can deduct the loss on his tax return.

B)A taxpayer's uncle is a related party for purposes of Section 267.

C)A disallowed loss on a related party transaction can be used to offset any future gain when the property is sold to an unrelated party.

D)Under the constructive ownership rules of Section 267, a shareholder owns 10 percent of the stock owned by a corporation in which he or she is a shareholder.

E)None of the above are true.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

27

Assume Alan's parents make gifts of $10,000 to him every year starting at age one, Alan's parents are in the 35 percent income tax bracket, and Alan is now 15 years old and has $11,700 of interest income for 2018.

a.Calculate the tax on Alan's interest income if his income is not included on his parents' return.

b.Explain why the "kiddie tax" rules are in the law.

a.Calculate the tax on Alan's interest income if his income is not included on his parents' return.

b.Explain why the "kiddie tax" rules are in the law.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

28

ABC Corporation is owned 30 percent by Andy, 30 percent by Barry, 20 percent by Charlie, and 20 percent by Uptown Corporation.Uptown Corporation is owned 90 percent by Charlie and 10 percent by an unrelated party.Barry and Charlie are brothers.Answer each of the following questions about ABC under the constructive ownership rules of Section 267:

a.What is Andy's constructive ownership percentage under Section 267?

b.What is Barry's constructive ownership percentage under Section 267?

c.What is Charlie's constructive ownership percentage under Section 267?

d.If Andy sells property to ABC for a $6,000 loss, what amount of that loss can be recognized for tax purposes (before any annual limitations)?

a.What is Andy's constructive ownership percentage under Section 267?

b.What is Barry's constructive ownership percentage under Section 267?

c.What is Charlie's constructive ownership percentage under Section 267?

d.If Andy sells property to ABC for a $6,000 loss, what amount of that loss can be recognized for tax purposes (before any annual limitations)?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

29

If a loss from sale or exchange of property between related parties is disallowed and the property is subsequently sold to an unrelated party,

A)An amended return may be filed to claim the loss previously disallowed.

B)The unrelated party may claim the loss previously disallowed.

C)The disallowed loss may be used to offset gain on the subsequent sale.

D)The disallowed loss may be used if there is a further loss on the subsequent sale.

E)The disallowed loss is lost forever.

A)An amended return may be filed to claim the loss previously disallowed.

B)The unrelated party may claim the loss previously disallowed.

C)The disallowed loss may be used to offset gain on the subsequent sale.

D)The disallowed loss may be used if there is a further loss on the subsequent sale.

E)The disallowed loss is lost forever.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

30

If the net unearned income of a minor child is to be taxed at trust and estate rates, the parents may elect, under certain conditions, to include the child's gross income on their tax return.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

31

Tom, age 13, is claimed as a dependent by his parents.Tom has unearned income of $3,400 and $300 of income from mowing lawns in the neighborhood.If the first $2,550 of Tom's net unearned income is taxed at 10%, what is Tom's 2018 income tax liability?

A)$0

B)$265

C)$459

D)$370

E)None of the above

A)$0

B)$265

C)$459

D)$370

E)None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

32

Net unearned income of certain minor children is taxed at their parents' tax rates.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

33

A parent may elect to include a child's income in the parent's return if:

A)No estimated tax has been paid in the name of the child and the child is not subject to backup withholding.

B)The child's income is only from interest and dividend distributions.

C)The child's gross income is more than $1,050 and less than $10,500.

D)All of the above must be met for a parent to elect to include a child's income in the parent's return.

A)No estimated tax has been paid in the name of the child and the child is not subject to backup withholding.

B)The child's income is only from interest and dividend distributions.

C)The child's gross income is more than $1,050 and less than $10,500.

D)All of the above must be met for a parent to elect to include a child's income in the parent's return.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

34

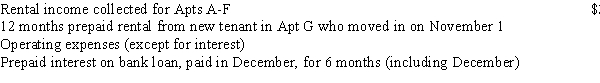

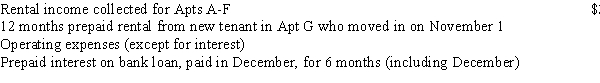

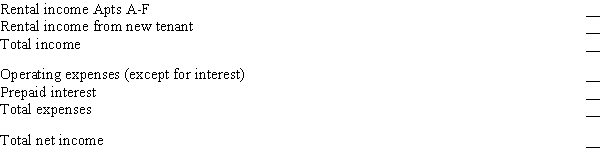

Countryside Acres Apartment Complex had the following transactions during the year:  Using the accrual method, calculate the net income:

Using the accrual method, calculate the net income:

Using the accrual method, calculate the net income:

Using the accrual method, calculate the net income:

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

35

In 2018, which of the following children would have income taxed at trust and estate rates?

A)A 13-year-old child with salary income of $12,000

B)A 12-year-old child with net unearned income of $3,200

C)A nonstudent, 19-year-old child with net unearned income of $12,000

D)A 9-year-old child with salary income of $1,000

E)All of the above

A)A 13-year-old child with salary income of $12,000

B)A 12-year-old child with net unearned income of $3,200

C)A nonstudent, 19-year-old child with net unearned income of $12,000

D)A 9-year-old child with salary income of $1,000

E)All of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

36

Unearned income of a 16-year-old child may be taxed at trust and estate rates.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

37

BOND Corporation is owned 25 percent by Brian, 30 percent by Orville, 20 percent by Nate, and 25 percent by Dart Corporation.Dart Corporation is owned 80 percent by Brian and 20 percent by Nate.Brian and Orville are brothers.Answer each of the following questions about BOND Corporation under the constructive ownership rules of Section 267:

a.What is Brian's constructive ownership percentage for Section 267 purposes?

b.If Nate sells property to BOND Corporation for a $7,500 loss, what amount of that loss can be recognized for tax purposes (before any annual limitations)?

a.What is Brian's constructive ownership percentage for Section 267 purposes?

b.If Nate sells property to BOND Corporation for a $7,500 loss, what amount of that loss can be recognized for tax purposes (before any annual limitations)?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following types of income is not subject to the "kiddie tax"?

A)Interest income

B)Dividend income

C)Salary income

D)Capital gains on stock sales

E)All of the above are subject to the "kiddie tax"

A)Interest income

B)Dividend income

C)Salary income

D)Capital gains on stock sales

E)All of the above are subject to the "kiddie tax"

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

39

If a cash basis business owner pays 18 months of rent expense in advance during the last month of the tax year, how is this treated on the tax return? What is the reason tax law requires this treatment?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

40

Sales of property at a gain may be restricted under the related party rules of the Internal Revenue Code.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

41

In 2018, household employers are not required to pay FICA taxes on cash payments of less than $2,100 paid to any household employee in a calendar year.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following itemized deductions may not be deducted in computing the individual alternative minimum tax?

A)Qualified home mortgage interest

B)State income taxes

C)Medical expenses (limited to 7.5 percent of AGI)

D)Charitable deductions

E)All of the above

A)Qualified home mortgage interest

B)State income taxes

C)Medical expenses (limited to 7.5 percent of AGI)

D)Charitable deductions

E)All of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

43

For 2018, the maximum base amount for computing the Medicare portion of the self-employment tax is $150,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

44

In determining an employee's FICA tax to be withheld, the maximum amount of wages subject to FICA must be reduced by the taxpayer's self-employment earnings.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

45

Emily is a self-employed attorney.

a.Assuming that Emily earns $20,000 from her practice, calculate the total amount of her self-employment tax liability for 2018.

b.Assuming that Emily earns $145,000 from her practice, calculate the total amount of her self-employment tax liability for 2018.

a.Assuming that Emily earns $20,000 from her practice, calculate the total amount of her self-employment tax liability for 2018.

b.Assuming that Emily earns $145,000 from her practice, calculate the total amount of her self-employment tax liability for 2018.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

46

For purposes of the additional 0.9% Medicare tax on earned income, a single taxpayer having earned income of more than $200,000 is generally subject to the tax.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following is not an adjustment or tax preference item for 2018 for purposes of the individual alternative minimum tax (AMT)?

A)State income tax refunds

B)Certain passive losses

C)Interest from private activity bonds

D)Cash charitable contributions

E)All of the above are adjustment or tax preference items for AMT

A)State income tax refunds

B)Certain passive losses

C)Interest from private activity bonds

D)Cash charitable contributions

E)All of the above are adjustment or tax preference items for AMT

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

48

In 2018, Tom had net earnings of $80,000 from the plant nursery he owns.What is his liability for self-employment taxes on his earnings?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

49

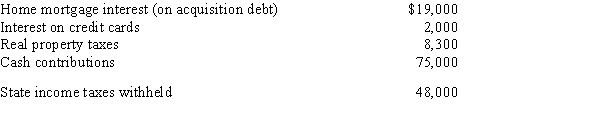

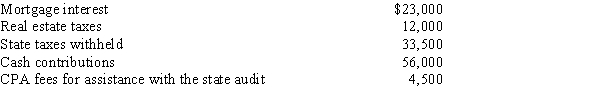

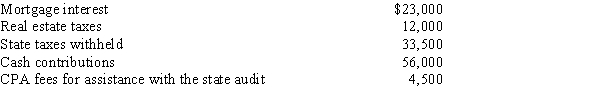

Dan and Maureen file a joint income tax return for 2018.They have two dependent children, ages 7 and 9.Together they earn wages of $830,000.They also receive taxable interest income of $8,000 and interest on City of Los Angeles bonds of $78,000.During 2018, they received a state income tax refund of $3,000 relating to their 2017 state income tax return on which they itemized deductions.Their expenses for the year consist of the following:  Calculate Dan and Maureen's tentative minimum tax liability assuming an AMT exemption amount of $109,400, before any phase-outs.Show your calculations.

Calculate Dan and Maureen's tentative minimum tax liability assuming an AMT exemption amount of $109,400, before any phase-outs.Show your calculations.

Calculate Dan and Maureen's tentative minimum tax liability assuming an AMT exemption amount of $109,400, before any phase-outs.Show your calculations.

Calculate Dan and Maureen's tentative minimum tax liability assuming an AMT exemption amount of $109,400, before any phase-outs.Show your calculations.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

50

Dividend income is not subject to the self-employment tax.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following types of income is subject to the self-employment tax?

A)Interest income

B)Gain on sale of real estate

C)Income from a sole proprietor's law practice

D)Dividends from stock

E)None of the above

A)Interest income

B)Gain on sale of real estate

C)Income from a sole proprietor's law practice

D)Dividends from stock

E)None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the common deductions below are allowed for both regular tax purposes and for AMT purposes in 2018?

A)The standard deduction

B)Personal and dependency exemptions

C)State income taxes, property taxes, and all other taxes deducted on Schedule A

D)Mortgage interest from the acquisition of a residence with a loan balance less than $750,000

E)Miscellaneous itemized deductions taken on Schedule A

A)The standard deduction

B)Personal and dependency exemptions

C)State income taxes, property taxes, and all other taxes deducted on Schedule A

D)Mortgage interest from the acquisition of a residence with a loan balance less than $750,000

E)Miscellaneous itemized deductions taken on Schedule A

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

53

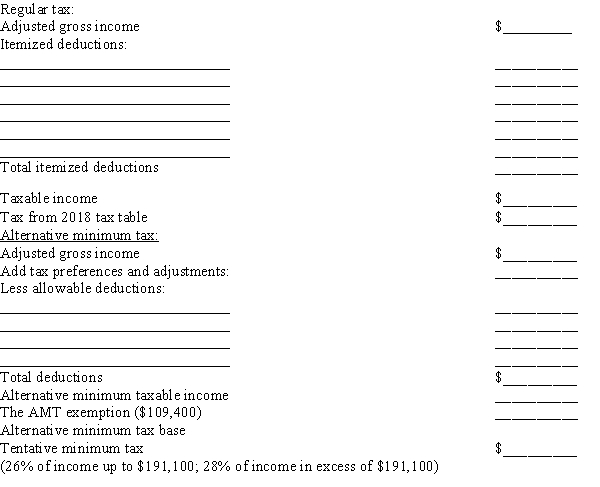

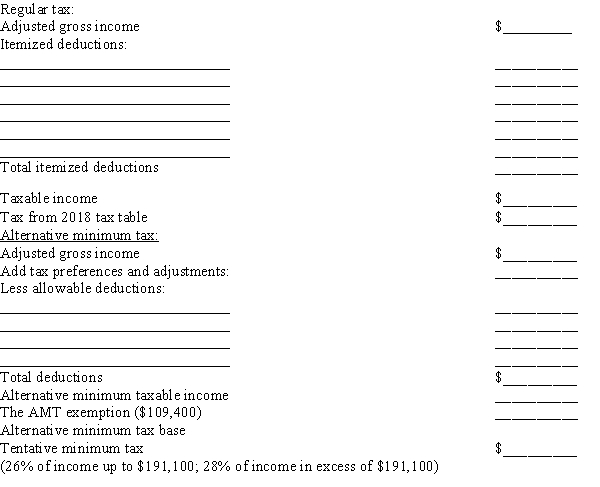

John and Susan file a joint income tax return for 2018.They have two dependent children, students, ages 19 and 20.John earns wages of $908,000 and John and Susan have interest income of $102,000.In 2018, they settle a state tax audit and pay $50,000 for back state taxes due to an overly aggressive tax-sheltered investment.Their other expenses for the year include:

a.Calculate John and Susan's 2018 regular tax and tentative minimum tax on the schedule provided.

b.How much is the total tax liability shown on John and Susan's 2018 Form 1040?

a.Calculate John and Susan's 2018 regular tax and tentative minimum tax on the schedule provided.

b.How much is the total tax liability shown on John and Susan's 2018 Form 1040?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

54

List at least two AMT preferences and/or adjustments and show the simplified formula for calculating AMT.Do not include dollar exemption amounts or the tax rate schedule.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

55

A taxpayer would be required to pay Social Security and Medicare taxes for a domestic employee in all but one of the following situations.In which situation would this not be required?

A)A nanny who earns $22,000 a year

B)A baby-sitter who earns $1,300 a year

C)A cook who is paid $35,000 a year

D)A cleaning lady who is paid $8,000 a year

E)The taxpayer would not have to pay Social Security and Medicare taxes in any of the above situations

A)A nanny who earns $22,000 a year

B)A baby-sitter who earns $1,300 a year

C)A cook who is paid $35,000 a year

D)A cleaning lady who is paid $8,000 a year

E)The taxpayer would not have to pay Social Security and Medicare taxes in any of the above situations

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following items may be subject to the self-employment tax?

A)A partner's distributive share of partnership income

B)Dividend income

C)Capital gains

D)Interest income

E)None of the above

A)A partner's distributive share of partnership income

B)Dividend income

C)Capital gains

D)Interest income

E)None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

57

Household employers are not required to pay FICA taxes on part-time household employees.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

58

Self-employment taxes:

A)Consist of Medicare tax and Social Security tax.

B)Are not affected by wages the taxpayer earns as an employee.

C)Apply to taxpayers with less than $400 in self-employment earnings.

D)Are calculated based on unearned income such as interest and dividends as well as net earnings from self-employment.

A)Consist of Medicare tax and Social Security tax.

B)Are not affected by wages the taxpayer earns as an employee.

C)Apply to taxpayers with less than $400 in self-employment earnings.

D)Are calculated based on unearned income such as interest and dividends as well as net earnings from self-employment.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

59

Lucinda is a self-employed veterinarian in 2018.Her Schedule C net earnings are $86,000 for the year.Calculate the total amount of Lucinda's self-employment tax liability for 2018.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

60

What was the original purpose of the alternative minimum tax?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

61

Karen is single and earns wages of $250,000 in 2018.She has no other income.How much is her 0.9 percent Medicare tax on earned income?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

62

Gerald is single and earns $80,000 in dividend income and $180,000 in wage income in 2018.Compute his additional 3.8 percent Medicare tax on net investment income.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

63

Ellen uses the head of household filing status and has a dependent daughter.Ellen has self-employment income of $310,000 as an architect and $10,000 of self-employment losses from a jewelry making business.

a.What is Ellen's 0.9% additional Medicare tax for 2018?

b.Is Ellen allowed to include a portion of the 0.9% additional Medicare tax in computing the deduction for self-employment taxes reported as an adjustment for AGI on the front page of her income tax return?

a.What is Ellen's 0.9% additional Medicare tax for 2018?

b.Is Ellen allowed to include a portion of the 0.9% additional Medicare tax in computing the deduction for self-employment taxes reported as an adjustment for AGI on the front page of her income tax return?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

64

The Affordable Care Act (ACA)added a Medicare tax of 3.8 percent on net investment income

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

65

The 0.9 percent Medicare tax applies to:

A)Earned income

B)Tax exempt income

C)Gain on the sale of a principal residence

D)IRA distributions

A)Earned income

B)Tax exempt income

C)Gain on the sale of a principal residence

D)IRA distributions

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

66

Peter and Joan are married and Joan has self-employment income of $240,000.Peter is retired.How much additional 0.9% Medicare tax will Peter and Joan owe with their 2018 income tax return?

A)$360

B)$2,160

C)$0

D)They will receive a $90 refund

A)$360

B)$2,160

C)$0

D)They will receive a $90 refund

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

67

The 3.8 percent ACA Medicare tax does not apply to:

A)Interest

B)Dividends

C)Capital gains

D)Wages

A)Interest

B)Dividends

C)Capital gains

D)Wages

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

68

Melody and Todd are married and have employee wages of $250,000 each in 2018.They have no other income.How much additional 0.9% Medicare tax will Melody and Todd have to pay or receive as a refund when they file their 2018 income tax return?

A)$1,350 will be due with their return in addition to amounts withheld.

B)$1,350 will be refunded with their return.

C)$900 will be refunded with their return.

D)$3,600 will be due with their return in addition to amounts withheld.

A)$1,350 will be due with their return in addition to amounts withheld.

B)$1,350 will be refunded with their return.

C)$900 will be refunded with their return.

D)$3,600 will be due with their return in addition to amounts withheld.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck