Deck 27: The Basic Tools of Finance

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/67

Play

Full screen (f)

Deck 27: The Basic Tools of Finance

1

Sometimes On Time (SOT)Airlines is considering buying a new jet.SOT would be more likely to buy a new jet if there were either

A)a decrease in the price of a new jet or a decrease in the interest rate.

B)a decrease in the price of a new jet or an increase in the interest rate.

C)an increase in the price of a new jet or a decrease in the interest rate.

D)an increase in the price of a new jet or an increase in the interest rate.

A)a decrease in the price of a new jet or a decrease in the interest rate.

B)a decrease in the price of a new jet or an increase in the interest rate.

C)an increase in the price of a new jet or a decrease in the interest rate.

D)an increase in the price of a new jet or an increase in the interest rate.

A

2

Which of the following concepts is most helpful in explaining why investment increases when the interest rate falls?

A)deadweight loss

B)present value

C)economic growth

D)financial intermediation

A)deadweight loss

B)present value

C)economic growth

D)financial intermediation

B

3

Imagine that someone offers you X dinars today or 1,500 dinars in 5 years.If the interest rate is 6 percent,then you would prefer to take the X today if and only if

A)X > 1,055.56.

B)X > 1,120.89.

C)X > 1,213.33.

D)X > 1,338.26.

A)X > 1,055.56.

B)X > 1,120.89.

C)X > 1,213.33.

D)X > 1,338.26.

B

4

Which,if any,of the present values below are computed correctly?

A)A payment of 100 dinars to be received one year from today,with a 2 percent interest rate,has a present value of 98.81.

B)A payment of 200 dinars to be received two years from today,with a 3 percent interest rate,has a present value of 188.52.

C)A payment of 300 dinars to be received three years from today,with a 4 percent interest rate,has a present value of 234.34.

D)None of the above are correct to the nearest cent.

A)A payment of 100 dinars to be received one year from today,with a 2 percent interest rate,has a present value of 98.81.

B)A payment of 200 dinars to be received two years from today,with a 3 percent interest rate,has a present value of 188.52.

C)A payment of 300 dinars to be received three years from today,with a 4 percent interest rate,has a present value of 234.34.

D)None of the above are correct to the nearest cent.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

5

Mixster Concrete Company is considering buying a new cement truck.The owners and their accountants decide that this is the profitable thing to do.Before they can buy the truck,the interest rate and price of trucks change.In which case do these changes both make them less likely to buy the truck?

A)Interest rates rise and truck prices rise.

B)Interest rates fall and truck prices rise.

C)Interest rates rise and truck prices fall.

D)Interest rates fall and truck prices fall.

A)Interest rates rise and truck prices rise.

B)Interest rates fall and truck prices rise.

C)Interest rates rise and truck prices fall.

D)Interest rates fall and truck prices fall.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

6

The future value of a deposit in a savings account will be smaller

A)the longer a person waits to withdraw the funds.

B)the lower the interest rate is.

C)the larger the initial deposit is.

D)All of the above are correct.

A)the longer a person waits to withdraw the funds.

B)the lower the interest rate is.

C)the larger the initial deposit is.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

7

You are given three options.You may have the balance in an account that has been collecting 5 percent interest for 20 years,the balance in an account that has been collecting 10 percent interest for 10 years,or the balance in an account that has been collecting 20 percent interest for five years.Each account had the same original balance.Which account now has the lowest balance?

A)the first one

B)the second one

C)the third one

D)They all have the same balance.

A)the first one

B)the second one

C)the third one

D)They all have the same balance.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following statements best describes the economist's view of finance and the financial system?

A)The financial system is very important to the functioning of the economy,and the tools of finance are often helpful to us as individuals when we find ourselves making certain decisions.

B)The financial system,while interesting,is not very important to the functioning of the economy; however,the tools of finance are often helpful to us as individuals when we find ourselves making certain decisions.

C)The financial system is very important to the functioning of the economy; however,the tools of finance are not particularly helpful to us as individuals since we seldom make decisions for which those tools are useful.

D)The field of finance is intimately concerned with the financial system and the tools of finance,and financial economists see great importance in them; however,the "mainstream" economist sees little value in studying financial markets or the tools of finance.

A)The financial system is very important to the functioning of the economy,and the tools of finance are often helpful to us as individuals when we find ourselves making certain decisions.

B)The financial system,while interesting,is not very important to the functioning of the economy; however,the tools of finance are often helpful to us as individuals when we find ourselves making certain decisions.

C)The financial system is very important to the functioning of the economy; however,the tools of finance are not particularly helpful to us as individuals since we seldom make decisions for which those tools are useful.

D)The field of finance is intimately concerned with the financial system and the tools of finance,and financial economists see great importance in them; however,the "mainstream" economist sees little value in studying financial markets or the tools of finance.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

9

According to the rule of 70,if the interest rate is 10 percent,about how long will it take for the value of a savings account to double?

A)about 6.3 years

B)about 7 years

C)about 7.7 years

D)about 10 years

A)about 6.3 years

B)about 7 years

C)about 7.7 years

D)about 10 years

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

10

What is the future value of 375 dollars at an interest rate of 3 percent one year from today?

A)371.75

B)386.25

C)393.33

D)None of the above are correct to the nearest cent.

A)371.75

B)386.25

C)393.33

D)None of the above are correct to the nearest cent.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

11

Three people go to the bank to cash in their accounts.Amy had her money in an account for 25 years at 4 percent interest.Bill had his money in an account for 20 years at 5 percent interest.Celia had her money in an account for 5 years at 20 percent interest.If each of them originally deposited 500 dollars in their accounts,which of them gets the most money when they cash in their accounts?

A)Amy

B)Bill

C)Celia

D)They each get the same amount.

A)Amy

B)Bill

C)Celia

D)They each get the same amount.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following changes would decrease the present value of a future payment?

A)a decrease in the size of the payment

B)an increase in the time until the payment is made

C)an increase in the interest rate

D)All of the above are correct.

A)a decrease in the size of the payment

B)an increase in the time until the payment is made

C)an increase in the interest rate

D)All of the above are correct.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

13

If the interest rate is r percent,then the rule of 70 says that your savings will double about every

A)70/(1 - r)years.

B)70/(1 + r)years.

C)70/r years.

D)70(1 + r)/r years.

A)70/(1 - r)years.

B)70/(1 + r)years.

C)70/r years.

D)70(1 + r)/r years.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

14

Other things the same,when the interest rate rises,the present value of future revenues from investment projects

A)rises,so investment spending rises.

B)falls,so investment spending rises.

C)rises,so investment spending falls.

D)falls,so investment spending falls.

A)rises,so investment spending rises.

B)falls,so investment spending rises.

C)rises,so investment spending falls.

D)falls,so investment spending falls.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

15

Compounding refers directly to

A)finding the present value of a future sum of money.

B)finding the future value of a present sum of money.

C)changes in the interest rate over time on a bank account or a similar savings vehicle.

D)interest being earned on previously-earned interest.

A)finding the present value of a future sum of money.

B)finding the future value of a present sum of money.

C)changes in the interest rate over time on a bank account or a similar savings vehicle.

D)interest being earned on previously-earned interest.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

16

Eloise deposits 250 dollars into an account and one year later has 272.50.What interest rate was paid on Eloise's deposit?

A)8 percent

B)9 percent

C)10 percent

D)None of the above is correct.

A)8 percent

B)9 percent

C)10 percent

D)None of the above is correct.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

17

Allen Steel Company is considering whether to build a new mill.If the interest rate rises,

A)the present value of the returns from the mill will fall,so Allen will be less likely to build the mill.

B)the present value of the returns from the mill will fall,so Allen will be more likely to build the mill.

C)the present value of the returns from the mill will rise,so Allen will be less likely to build the mill.

D)the present value of the returns from the mill will rise,so Allen will be more likely to build the mill.

A)the present value of the returns from the mill will fall,so Allen will be less likely to build the mill.

B)the present value of the returns from the mill will fall,so Allen will be more likely to build the mill.

C)the present value of the returns from the mill will rise,so Allen will be less likely to build the mill.

D)the present value of the returns from the mill will rise,so Allen will be more likely to build the mill.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

18

Discounting refers directly to

A)finding the present value of a future sum of money.

B)finding the future value of a present sum of money.

C)calculations that ignore the phenomenon of compounding for the sake of ease and simplicity.

D)decreases in interest rates over time,while compounding refers to increases in interest rates over time.

A)finding the present value of a future sum of money.

B)finding the future value of a present sum of money.

C)calculations that ignore the phenomenon of compounding for the sake of ease and simplicity.

D)decreases in interest rates over time,while compounding refers to increases in interest rates over time.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

19

Other things the same,an increase in the interest rate makes the quantity of loanable funds demanded

A)rise,and investment spending rise.

B)rise,and investment spending fall.

C)fall,and investment spending rise.

D)fall,and investment spending fall.

A)rise,and investment spending rise.

B)rise,and investment spending fall.

C)fall,and investment spending rise.

D)fall,and investment spending fall.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

20

At an annual interest rate of 10 percent,about how many years will it take 100 dinars to double in value?

A)5

B)7

C)9

D)11

A)5

B)7

C)9

D)11

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

21

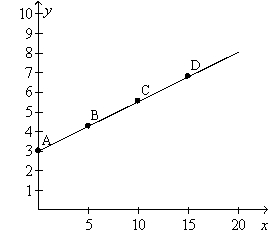

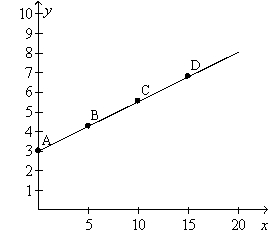

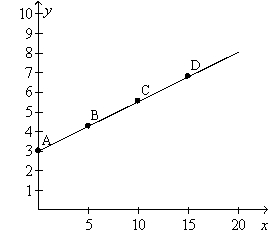

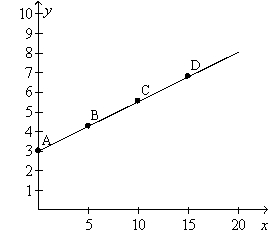

Figure 27-5.On the graph,x represents risk and y represents return.

Refer to Figure 27-5.Point A represents a situation in which

A)all of a person's savings are allocated to a class of safe assets.

B)the person knows with certainty that his or her return will be 3 percent.

C)the standard deviation of the person's portfolio is zero.

D)All of the above are correct.

Refer to Figure 27-5.Point A represents a situation in which

A)all of a person's savings are allocated to a class of safe assets.

B)the person knows with certainty that his or her return will be 3 percent.

C)the standard deviation of the person's portfolio is zero.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

22

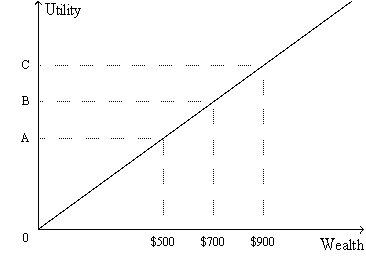

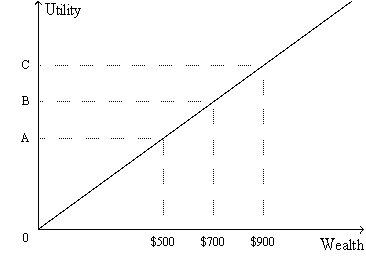

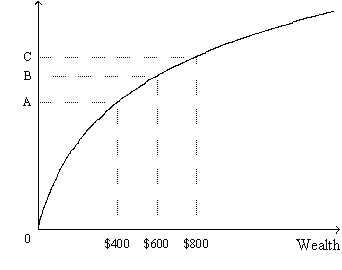

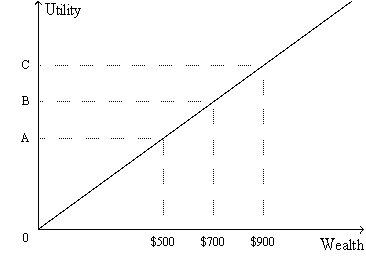

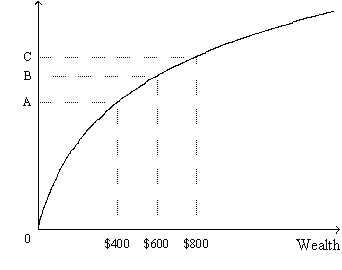

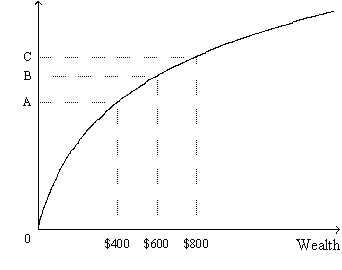

Figure 27-3.The figure shows a utility function for Rob.

Refer to Figure 27-3.From the appearance of Rob's utility function,we know that

A)if Rob owns a house,then he definitely would buy fire insurance provided the cost of the insurance were reasonable.

B)Rob would voluntarily exchange a portfolio of stocks with a high average return and a high level of risk for a portfolio with a low average return and a low level of risk.

C)Rob is risk averse.

D)Rob is not risk averse.

Refer to Figure 27-3.From the appearance of Rob's utility function,we know that

A)if Rob owns a house,then he definitely would buy fire insurance provided the cost of the insurance were reasonable.

B)Rob would voluntarily exchange a portfolio of stocks with a high average return and a high level of risk for a portfolio with a low average return and a low level of risk.

C)Rob is risk averse.

D)Rob is not risk averse.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

23

Albert Einstein once referred to compounding as

A)"an obsession among economists that defies explanation."

B)"the greatest mathematical discovery of all time."

C)his own discovery.

D)John Maynard Keynes's greatest contribution.

A)"an obsession among economists that defies explanation."

B)"the greatest mathematical discovery of all time."

C)his own discovery.

D)John Maynard Keynes's greatest contribution.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

24

Tami knows that people in her family die young,and so she buys life insurance.Preston knows he is a reckless driver and so he applies for automobile insurance.

A)These are both examples of adverse selection.

B)These are both examples of moral hazard.

C)The first example illustrates adverse selection,and the second illustrates moral hazard.

D)The first example illustrates moral hazard,and the second illustrates adverse selection.

A)These are both examples of adverse selection.

B)These are both examples of moral hazard.

C)The first example illustrates adverse selection,and the second illustrates moral hazard.

D)The first example illustrates moral hazard,and the second illustrates adverse selection.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

25

In effect,an annuity provides insurance

A)against the risk of dying and leaving one's family without a regular income.

B)against the risk of living too long.

C)to people who are not risk-averse.

D)to people whose utility functions do not display the usual properties.

A)against the risk of dying and leaving one's family without a regular income.

B)against the risk of living too long.

C)to people who are not risk-averse.

D)to people whose utility functions do not display the usual properties.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

26

The problem of moral hazard arises because

A)life is full of all sorts of risks.

B)after people buy insurance,they have less incentive to be careful about their risky behavior.

C)a high-risk person is more likely to apply for insurance than is a low-risk person.

D)insurance companies go to great effort to avoid paying claims to their policy holders.

A)life is full of all sorts of risks.

B)after people buy insurance,they have less incentive to be careful about their risky behavior.

C)a high-risk person is more likely to apply for insurance than is a low-risk person.

D)insurance companies go to great effort to avoid paying claims to their policy holders.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

27

If the efficient markets hypothesis is correct,then

A)the number of shares of stock offered for sale exceeds the number of shares of stock that people want to buy.

B)the stock market is informationally efficient.

C)stock prices never follow a random walk.

D)All of the above are correct.

A)the number of shares of stock offered for sale exceeds the number of shares of stock that people want to buy.

B)the stock market is informationally efficient.

C)stock prices never follow a random walk.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

28

A company that produces computer peripherals is considering buying some new equipment that it expects will increase future profits.If the interest rate rises,the present value of these future earnings

A)rises.The company is more likely to buy the equipment.

B)rises.The company is less likely to buy the equipment.

C)falls.The company is more likely to buy the equipment.

D)falls.The company is less likely to buy the equipment.

A)rises.The company is more likely to buy the equipment.

B)rises.The company is less likely to buy the equipment.

C)falls.The company is more likely to buy the equipment.

D)falls.The company is less likely to buy the equipment.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

29

A measure of the volatility of a variable is its

A)present value.

B)future value.

C)return.

D)standard deviation.

A)present value.

B)future value.

C)return.

D)standard deviation.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

30

Figure 27-5.On the graph,x represents risk and y represents return.

Refer to Figure 27-5.Which of the following statements is correct?

A)At point A the standard deviation of the portfolio is 3.

B)A risk averse person always will choose to be at point A.

C)At point D the portfolio consists of about 15 percent stocks and 85 percent safe assets.

D)The figure shows that the greater the risk,the greater the return.

Refer to Figure 27-5.Which of the following statements is correct?

A)At point A the standard deviation of the portfolio is 3.

B)A risk averse person always will choose to be at point A.

C)At point D the portfolio consists of about 15 percent stocks and 85 percent safe assets.

D)The figure shows that the greater the risk,the greater the return.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

31

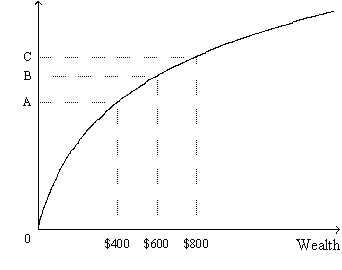

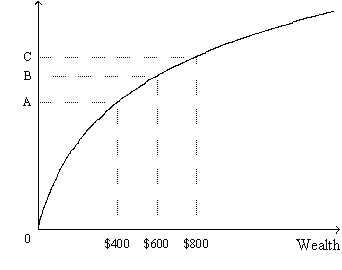

Figure 27-1.The figure shows a utility function.

-Refer to Figure 27-1.Let 0A represent the distance between the origin and point A; let AB represent the distance between point A and point B; etc.Which of the following ratios best represents the marginal utility per dollar when wealth increases from $400 to $600?

A)

B)

C)

D)

-Refer to Figure 27-1.Let 0A represent the distance between the origin and point A; let AB represent the distance between point A and point B; etc.Which of the following ratios best represents the marginal utility per dollar when wealth increases from $400 to $600?

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

32

A high-ranking corporate official of a well-known company is unexpectedly sentenced to prison for criminal activity in trading stocks.This should

A)raise the price and raise the present value of the corporation's stock.

B)raise the price and lower the present value of the corporation's stock.

C)lower the price and raise the present value of the corporation's stock.

D)lower the price and lower the present value of the corporation's stock.

A)raise the price and raise the present value of the corporation's stock.

B)raise the price and lower the present value of the corporation's stock.

C)lower the price and raise the present value of the corporation's stock.

D)lower the price and lower the present value of the corporation's stock.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

33

Risk aversion helps to explain various things we observe in the economy,including

A)adherence to the old adage,"Don't put all your eggs in one basket."

B)insurance.

C)the risk-return trade-off.

D)All of the above are correct.

A)adherence to the old adage,"Don't put all your eggs in one basket."

B)insurance.

C)the risk-return trade-off.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following best illustrates moral hazard?

A)After a person obtains life insurance,she takes up skydiving.

B)A person obtains insurance knowing he is in poor health.

C)A person holds stock only in very risky corporations.

D)A person holds stocks from only a few corporations.

A)After a person obtains life insurance,she takes up skydiving.

B)A person obtains insurance knowing he is in poor health.

C)A person holds stock only in very risky corporations.

D)A person holds stocks from only a few corporations.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

35

Figure 27-1.The figure shows a utility function.

Refer to Figure 27-1.What is measured along the vertical axis?

A)risk aversion

B)marginal utility

C)utility

D)the number of units of a good that can be purchased

Refer to Figure 27-1.What is measured along the vertical axis?

A)risk aversion

B)marginal utility

C)utility

D)the number of units of a good that can be purchased

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

36

Figure 27-3.The figure shows a utility function for Rob.

Refer to Figure 27-3.If most people's utility functions look like Rob's utility function,then it is easy to explain why

A)people buy various types of insurance.

B)we observe a trade-off between risk and return.

C)most people prefer to hold diversified portfolios of assets to undiversified portfolios of assets.

D)None of the above are correct.

Refer to Figure 27-3.If most people's utility functions look like Rob's utility function,then it is easy to explain why

A)people buy various types of insurance.

B)we observe a trade-off between risk and return.

C)most people prefer to hold diversified portfolios of assets to undiversified portfolios of assets.

D)None of the above are correct.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is correct concerning a risk-averse person?

A)She would not play games where the probability of winning and losing a dollar are the same.

B)She might not buy health insurance if she thinks her risks are low.

C)Her marginal utility of wealth decreases as her income increases.

D)All of the above are correct.

A)She would not play games where the probability of winning and losing a dollar are the same.

B)She might not buy health insurance if she thinks her risks are low.

C)Her marginal utility of wealth decreases as her income increases.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

38

An increase in the number of corporations in a portfolio from 1 to 10 reduces

A)market risk by more than an increase from 110 to 120.

B)market risk by less than an increase from 110 to 120.

C)firm-specific risk by more than an increase from 110 to 120.

D)firm-specific risk by less than an increase from 110 to 120.

A)market risk by more than an increase from 110 to 120.

B)market risk by less than an increase from 110 to 120.

C)firm-specific risk by more than an increase from 110 to 120.

D)firm-specific risk by less than an increase from 110 to 120.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

39

Fourteen years ago William put money in his account at First National Bank.William decides to cash in his account and is told that his money has quadrupled.According to the rule of 70,what rate of interest did Alfred earn?

A)5 percent

B)7 percent

C)10 percent

D)14 percent

A)5 percent

B)7 percent

C)10 percent

D)14 percent

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

40

Figure 27-1.The figure shows a utility function.

Refer to Figure 27-1.Which distance along the vertical axis represents the marginal utility of an increase in wealth from $600 to $800?

A)the distance between the origin and point B

B)the distance between the origin and point C

C)the distance between point A and point C

D)the distance between point B and point C

Refer to Figure 27-1.Which distance along the vertical axis represents the marginal utility of an increase in wealth from $600 to $800?

A)the distance between the origin and point B

B)the distance between the origin and point C

C)the distance between point A and point C

D)the distance between point B and point C

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

41

According to the efficient markets hypothesis,at any moment in time,the market price is the best estimate of the company's value based on publicly available information.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

42

If stock prices follow a random walk,it means

A)long periods of declining prices are followed by long periods of rising prices.

B)the greater the number of consecutive days of price declines,the greater the probability prices will increase the following day.

C)stock prices are unrelated to random events that shock the economy.

D)stock prices are just as likely to rise as to fall at any given time.

A)long periods of declining prices are followed by long periods of rising prices.

B)the greater the number of consecutive days of price declines,the greater the probability prices will increase the following day.

C)stock prices are unrelated to random events that shock the economy.

D)stock prices are just as likely to rise as to fall at any given time.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

43

Risk aversion simply means that people dislike bad things to happen.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

44

The present value of any future sum of money is the amount that would be needed today,at current interest rates,to produce that future sum.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

45

According to the rule of 70,if you earn an interest rate of 3.5 percent,your savings will double about every 20 years.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

46

Economists disagree as to whether

A)the stock price of a company should reflect the company's expected profitability.

B)the basic tools of finance reflect valid ideas.

C)stock prices reflect rational estimates of a company's true worth.

D)there is any relationship between stock market fluctuations and fluctuations in the economy more broadly.

A)the stock price of a company should reflect the company's expected profitability.

B)the basic tools of finance reflect valid ideas.

C)stock prices reflect rational estimates of a company's true worth.

D)there is any relationship between stock market fluctuations and fluctuations in the economy more broadly.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

47

If the efficient market hypothesis is correct,then

A)index funds should typically beat managed funds,and usually do.

B)index fund should typically beat managed funds,but usually do not.

C)mutual funds should typically beat index funds,and usually do.

D)mutual funds should typically beat index funds,but usually do not.

A)index funds should typically beat managed funds,and usually do.

B)index fund should typically beat managed funds,but usually do not.

C)mutual funds should typically beat index funds,and usually do.

D)mutual funds should typically beat index funds,but usually do not.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

48

Diversification cannot reduce market risk.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

49

Adverse selection is illustrated by people who take greater risks after they purchase insurance.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is correct concerning stock market irrationality?

A)Bubbles could arise,in part,because the price that people pay for stock depends on what they think someone else will pay for it in the future.

B)Economists almost all agree that the evidence for stock market irrationality is convincing and the departures from rational pricing are important.

C)Some evidence for the existence of market irrationality is that informed and presumably rational managers of mutual funds generally beat the market.

D)All of the above are correct.

A)Bubbles could arise,in part,because the price that people pay for stock depends on what they think someone else will pay for it in the future.

B)Economists almost all agree that the evidence for stock market irrationality is convincing and the departures from rational pricing are important.

C)Some evidence for the existence of market irrationality is that informed and presumably rational managers of mutual funds generally beat the market.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

51

If more people think a corporation's stock is overvalued than think it is undervalued then there is a

A)surplus,so its price will rise.

B)surplus,so its price will fall.

C)shortage,so its price will rise.

D)shortage,so its price will fall.

A)surplus,so its price will rise.

B)surplus,so its price will fall.

C)shortage,so its price will rise.

D)shortage,so its price will fall.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

52

The market for insurance is an example of diversification.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

53

Suppose that interest rates unexpectedly rise and that Carter Corporation announces that revenues from last quarter were down but not as much as the public had anticipated they would be down.According to the efficient markets hypothesis,which of the these things make the price of Carter Corporation Stock fall?

A)both the interest rate rising and the revenue announcement

B)neither the interest rate rising nor the revenue announcement

C)only the interest rate rising

D)only the revenue announcement

A)both the interest rate rising and the revenue announcement

B)neither the interest rate rising nor the revenue announcement

C)only the interest rate rising

D)only the revenue announcement

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

54

An asset market is said to experience a speculative bubble when

A)the price of the asset rises above what appears to be its fundamental value.

B)the price of the asset appears to follow a random walk.

C)the market cannot establish an equilibrium price for the asset.

D)the asset is a natural resource and its supply is manipulated by foreign nations and foreign firms.

A)the price of the asset rises above what appears to be its fundamental value.

B)the price of the asset appears to follow a random walk.

C)the market cannot establish an equilibrium price for the asset.

D)the asset is a natural resource and its supply is manipulated by foreign nations and foreign firms.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

55

The concept of present value helps explain why the quantity of loanable funds demanded decreases when the interest rate increases.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

56

If a savings account pays 5 percent annual interest,then the rule of 70 tells us that the account value will double in approximately 14 years.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

57

Historically the return on stocks has been higher than the return on bonds.In part this reflects the higher risk from holding stock.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

58

From the standpoint of the economy as a whole,the role of insurance is to greatly reduce or eliminate the risks inherent in life.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

59

The future value of $1 saved today is $1/(1 + r).

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

60

If a person had increasing marginal utility,then the decline in utility from losing $1,000 would be greater than the increase in utility from gaining $1,000.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

61

Draw graphs showing the following three relationships.

1.The relation between utility and wealth for a risk averse consumer.

2.The relation between standard deviation and the number of stocks in a portfolio.

3.The relation between return and risk.

1.The relation between utility and wealth for a risk averse consumer.

2.The relation between standard deviation and the number of stocks in a portfolio.

3.The relation between return and risk.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

62

List three different ways that a risk-averse person can reduce financial risk.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

63

What's the difference between firm-specific risk and market risk?

Will diversification eliminate one or both?

Explain.

Will diversification eliminate one or both?

Explain.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

64

Give an example of adverse selection and an example of moral hazard using homeowners insurance.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

65

Studies find that mutual fund managers who do well in one year are likely to do well the next year.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

66

As the interest rate increases,what happens to the present value of a future payment?

Explain why changes in the interest rate will lead to changes in the quantity of loanable funds demanded and investment spending.

Explain why changes in the interest rate will lead to changes in the quantity of loanable funds demanded and investment spending.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

67

If you believe the stock market is informationally efficient,then it is a waste of time to engage in fundamental analysis.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck