Deck 31: Accounting for Equity Investments,including Investments in Associates and Joint Arrangements

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/70

Play

Full screen (f)

Deck 31: Accounting for Equity Investments,including Investments in Associates and Joint Arrangements

1

Accounting for investments in associates are within the scope of AASB 121 Investments in Associates and Joint Ventures.

False

2

When two or more venturers combine their operations,resources and expertise to manufacture,market and distribute jointly a particular product this is likely to be categorised as a jointly controlled entity under AASB 11 Joint Arrangements.

False

3

Where an entity holds a controlling equity interest in another entity it may choose to account for that interest using the equity method of accounting.

False

4

Where a joint venturer prepares consolidated financial statements then the equity method will be used in the consolidated financial statements.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

5

Investments are commonly classified into equity investments,cash investments,property investments and bonds.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

6

An equity investment is deemed to exist where the investor has acquired an equity instrument,which can be defined as any contract that evidences a residual interest in the assets of an entity after deducting all its liabilities.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

7

One reason for holding equity investments in the form of marketable securities is that they generally earn a higher return than cash on deposit at a bank.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

8

Examples of marketable securities are debentures,shares,options or bonds that can be readily sold at reasonably short notice.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

9

As prescribed in AASB 11 Joint Arrangements,where a separate entity is formed the joint arrangement is always referred to as a joint operation.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

10

An associate is an investee over which the investor has control.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

11

A joint venture is where the parties to the joint arrangement have joint control over the rights to the net assets of the arrangement.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

12

If the investor is required to prepare consolidated financial statements,it recognises its investment in an associate by applying the equity method of accounting in its consolidated financial statements,and by applying the amortised cost method in its separate financial statements.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

13

In respect of its interests in joint operations,AASB 11 Joint Arrangements prescribes a joint operator to recognise in its financial statements,the assets that it controls and the liabilities that it incurs,and the expenses that it incurs and its share of the income that it earns from the sale of goods or services by the joint operation.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

14

The one-line method of accounting for joint ventures is not permitted under AASB 11.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

15

If a joint venture is deemed to be a reporting entity according to terms contained in the AASB Conceptual Framework,then general purpose financial reports that comply with the relevant accounting standards may need to be prepared.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

16

The method of accounting for a joint operation is commonly known as the line-by-line method.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

17

A joint arrangement where assets and liabilities for the arrangement are held in a separate vehicle can be either a joint venture or a joint operation.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

18

AASB 128 defines an 'investee' as an entity in which an investor has a controlling interest.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

19

In accordance with AASB 137 Provisions,Contingent Liabilities and Contingent Assets,the investor shall disclose the contingent liabilities of its associates.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

20

An associate is an entity over which the investor has significant influence,which is not a subsidiary,but which may be a joint arrangement entity.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

21

An equity instrument is defined as:

A) an agreement to exchange rights in an entity at an agreed price by a willing buyer and a willing seller in an arm's length transaction.

B) an arrangement in writing to transfer the risks and rights of ownership to the holder of the script in exchange for consideration in the form of payment in cash or kind.

C) any contract that evidences a residual interest in the assets of an entity after deducting all of its liabilities.

D) an arrangement to ultimately settle in cash or by transferring a right to another financial asset to the holder within a specified time and at a specified value.

A) an agreement to exchange rights in an entity at an agreed price by a willing buyer and a willing seller in an arm's length transaction.

B) an arrangement in writing to transfer the risks and rights of ownership to the holder of the script in exchange for consideration in the form of payment in cash or kind.

C) any contract that evidences a residual interest in the assets of an entity after deducting all of its liabilities.

D) an arrangement to ultimately settle in cash or by transferring a right to another financial asset to the holder within a specified time and at a specified value.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

22

AASB 128 requires that the investor's share of the post-acquisition profit or loss of its associates be adjusted for certain inter-entity transactions including:

A) the associate's transactions with its own associates.

B) any transactions between the associate and a controlled entity of the investor.

C) any transactions between the associate and any other associates of the investor.

D) any transactions between the associate and a controlled entity of the investor and any transactions between the associate and any other associates of the investor.

A) the associate's transactions with its own associates.

B) any transactions between the associate and a controlled entity of the investor.

C) any transactions between the associate and any other associates of the investor.

D) any transactions between the associate and a controlled entity of the investor and any transactions between the associate and any other associates of the investor.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

23

A factor that should be considered in determining the existence of significant influence would include:

A) the economic dependency of the investor in the investee.

B) the investor's participation in decisions about the distribution or retention of the investee's profits.

C) the ability of the investor to gain technical information from the investee.

D) the representation of the investee on the board of directors of the investor.

A) the economic dependency of the investor in the investee.

B) the investor's participation in decisions about the distribution or retention of the investee's profits.

C) the ability of the investor to gain technical information from the investee.

D) the representation of the investee on the board of directors of the investor.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

24

Jay Ltd acquired a 25 per cent interest in Low Ltd on 1 July 2013 for a cash consideration of $177 500.Low Ltd's equity at the time of purchase was as follows: Additional information:

On 1 July 2013 Low's plant and equipment had a carrying value of $120 000 but a fair value of $140 000.The remaining expected useful life of the plant and equipment at this date was 10 years.Low did not revalue the plant and equipment in its books.

For the period ending 30 June 2014 Low Ltd recorded an after-tax profit of $70 000,out of which dividends of $30 000 were proposed in the 2013/2014 period and paid in the 2014/2015 period.

For the year ended 30 June 2015 Low Ltd had an after-tax profit of $90 000 out of which it provided for a dividend of $40 000,which has not been paid.

Jay Ltd does not accrue the dividends of associates as revenue when they are proposed.The investment has been recorded in Jay's books in accordance with the cost method.What consolidation journal entries are required to apply the equity accounting method for the period ended 30 June 2015?

A)

B)

C)

D)

On 1 July 2013 Low's plant and equipment had a carrying value of $120 000 but a fair value of $140 000.The remaining expected useful life of the plant and equipment at this date was 10 years.Low did not revalue the plant and equipment in its books.

For the period ending 30 June 2014 Low Ltd recorded an after-tax profit of $70 000,out of which dividends of $30 000 were proposed in the 2013/2014 period and paid in the 2014/2015 period.

For the year ended 30 June 2015 Low Ltd had an after-tax profit of $90 000 out of which it provided for a dividend of $40 000,which has not been paid.

Jay Ltd does not accrue the dividends of associates as revenue when they are proposed.The investment has been recorded in Jay's books in accordance with the cost method.What consolidation journal entries are required to apply the equity accounting method for the period ended 30 June 2015?

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

25

Bee Ltd acquired a 40 per cent interest in Bop Ltd on 1 July 2014 for a cash consideration of $772 000.Bop Ltd's equity at the time of purchase was as follows: Additional information:

On 1 July 2014 Bop's plant and equipment had a carrying value of $600 000 but a fair value of $650 000.The carrying value of land was $560 000 while the fair value was $600 000.The remaining expected useful life of the plant and equipment at 1 July 2014 was 8 years.Bop did not revalue either asset in its books.

For the period ending 30 June 2014 Bop Ltd recorded an after-tax profit of $470 000,out of which dividends of $60 000 were proposed in the 2014/2015 period and paid in the 2015/2016 period.

For the year ended 30 June 2016 Bop Ltd had an after-tax loss of $60 000.Bop Ltd proposed a dividend of $120 000,which has not been paid this period.

Also during the year ended 30 June 2016,Bop Ltd revalued the land to $610 000.

Bee Ltd accrues dividends of associates as revenue when they are proposed.The investment has been recorded in Bee Ltd's books in accordance with the cost method.What consolidation journal entries are required to apply the equity accounting method for the period ended 30 June 2016?

A)

B)

C)

D)

On 1 July 2014 Bop's plant and equipment had a carrying value of $600 000 but a fair value of $650 000.The carrying value of land was $560 000 while the fair value was $600 000.The remaining expected useful life of the plant and equipment at 1 July 2014 was 8 years.Bop did not revalue either asset in its books.

For the period ending 30 June 2014 Bop Ltd recorded an after-tax profit of $470 000,out of which dividends of $60 000 were proposed in the 2014/2015 period and paid in the 2015/2016 period.

For the year ended 30 June 2016 Bop Ltd had an after-tax loss of $60 000.Bop Ltd proposed a dividend of $120 000,which has not been paid this period.

Also during the year ended 30 June 2016,Bop Ltd revalued the land to $610 000.

Bee Ltd accrues dividends of associates as revenue when they are proposed.The investment has been recorded in Bee Ltd's books in accordance with the cost method.What consolidation journal entries are required to apply the equity accounting method for the period ended 30 June 2016?

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

26

Significant influence is defined in AASB 128 as:

A) the demonstrated ability of an entity to affect substantially both the financial and operating policies of another entity.

B) the power of an entity to participate in the financial and operating policies of the investee, but it is not control or joint control.

C) the demonstrated ability of an entity to affect substantially or control either the financial or operating policies of another entity.

D) the capacity or demonstrated ability of an entity to impact substantially or control the operations of another entity.

A) the demonstrated ability of an entity to affect substantially both the financial and operating policies of another entity.

B) the power of an entity to participate in the financial and operating policies of the investee, but it is not control or joint control.

C) the demonstrated ability of an entity to affect substantially or control either the financial or operating policies of another entity.

D) the capacity or demonstrated ability of an entity to impact substantially or control the operations of another entity.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

27

AASB 128 requires that where an investor company does significantly influence an investee:

A) The investee company must revalue its assets to fair value and disclose all related party transactions.

B) The investor company must mark the shares to market.

C) The investee company must provide the investor company with details regarding profits made on inter-company transactions so that they may be eliminated from the group accounts.

D) The investor company must adopt the equity method of accounting for the investment.

A) The investee company must revalue its assets to fair value and disclose all related party transactions.

B) The investor company must mark the shares to market.

C) The investee company must provide the investor company with details regarding profits made on inter-company transactions so that they may be eliminated from the group accounts.

D) The investor company must adopt the equity method of accounting for the investment.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

28

Hip Hop Ltd acquired a 30 per cent interest in Rock Ltd on 1 July 2014 for a cash consideration of $984 000.Rock Ltd's assets and liabilities were recorded at fair value at the time of purchase and were represented by equity as follows: Additional information relating to the period ended 30 June 2016:

The opening balance of Rock's retained earnings was $1 100 000.Rock Ltd had paid a dividend out of pre-acquisition profits of $80 000 during the 2013/2014 period.

Rock Ltd had an after-tax profit of $260 000 for the 2014/2015 period.

Rock Ltd declared an $80 000 dividend out of post-acquisition profits.This dividend will not be paid until the following period.

Hip Hop Ltd accrues the dividends of associates as revenue when they are proposed.What is the amount of the investment in Rock Ltd and the income that will be recorded in the books of Hip Hop Ltd as at 30 June 2016 under (i)the cost method and (ii)the equity method?

A) (i) Investment $960 000; income $24 000 (ii) Investment $1 092 000; income $78 000

B) (i) Investment $960 000; income $24 000 (ii) Investment $1 068 000; income $78 000

C) (i) Investment $984 000; income $0 (ii) Investment $1 068 000; income $24 000

D) (i) Investment $936 000; income $48 000 (ii) Investment $1 014 000; income $78 000

The opening balance of Rock's retained earnings was $1 100 000.Rock Ltd had paid a dividend out of pre-acquisition profits of $80 000 during the 2013/2014 period.

Rock Ltd had an after-tax profit of $260 000 for the 2014/2015 period.

Rock Ltd declared an $80 000 dividend out of post-acquisition profits.This dividend will not be paid until the following period.

Hip Hop Ltd accrues the dividends of associates as revenue when they are proposed.What is the amount of the investment in Rock Ltd and the income that will be recorded in the books of Hip Hop Ltd as at 30 June 2016 under (i)the cost method and (ii)the equity method?

A) (i) Investment $960 000; income $24 000 (ii) Investment $1 092 000; income $78 000

B) (i) Investment $960 000; income $24 000 (ii) Investment $1 068 000; income $78 000

C) (i) Investment $984 000; income $0 (ii) Investment $1 068 000; income $24 000

D) (i) Investment $936 000; income $48 000 (ii) Investment $1 014 000; income $78 000

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

29

Equity accounting is argued to provide:

A) a more accurate measure of value of the associate than the market value of the shares.

B) an easier to understand measure of value than the lower of cost and net realisable value method.

C) a better reflection of the performance and value of the associate company than the cost method.

D) a theoretically consistent approach that is in line with the conceptual framework.

A) a more accurate measure of value of the associate than the market value of the shares.

B) an easier to understand measure of value than the lower of cost and net realisable value method.

C) a better reflection of the performance and value of the associate company than the cost method.

D) a theoretically consistent approach that is in line with the conceptual framework.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

30

Derivative instruments are instruments that:

A) derive their value from stock exchanges and futures markets.

B) derive their value from some other underlying expenditure.

C) derive their value from some other underlying derivative.

D) derive their value from some other underlying assets.

A) derive their value from stock exchanges and futures markets.

B) derive their value from some other underlying expenditure.

C) derive their value from some other underlying derivative.

D) derive their value from some other underlying assets.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

31

Examples of bonds include:

A) debentures.

B) options.

C) preference shares.

D) accounts payable.

A) debentures.

B) options.

C) preference shares.

D) accounts payable.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

32

The treatment of equity investments depends on a number of factors,including:

A) the date of purchase.

B) whether the investee entity is in the life or general insurance industry.

C) whether or not the investor has significant influence over the investee.

D) whether the investee entity is in the life or general insurance industry and whether or not the investor has significant influence over the investee.

A) the date of purchase.

B) whether the investee entity is in the life or general insurance industry.

C) whether or not the investor has significant influence over the investee.

D) whether the investee entity is in the life or general insurance industry and whether or not the investor has significant influence over the investee.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

33

Businesses invest in the marketable securities of other entities for the short-term because:

A) Using cash to purchase marketable securities improves the current ratio, loosening debt covenant restrictions.

B) It is an effective way to manage cash surpluses so that the investment may be turned into cash at short notice.

C) A diversified portfolio of marketable securities is less risky than having cash on deposit.

D) Using cash to purchase marketable securities improves the current ratio, loosening debt covenant restrictions and it is an effective way to manage cash surpluses so that the investment may be turned into cash at short notice.

A) Using cash to purchase marketable securities improves the current ratio, loosening debt covenant restrictions.

B) It is an effective way to manage cash surpluses so that the investment may be turned into cash at short notice.

C) A diversified portfolio of marketable securities is less risky than having cash on deposit.

D) Using cash to purchase marketable securities improves the current ratio, loosening debt covenant restrictions and it is an effective way to manage cash surpluses so that the investment may be turned into cash at short notice.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

34

Firms may make long-term investments in the equity instruments of other entities because:

A) It may ultimately form the basis for a takeover bid.

B) Holding a diversified portfolio of shares can reduce the level of risk of the entity.

C) The investment is expected to yield a return in the form of capital gains and dividends.

D) All of the given answers are correct.

A) It may ultimately form the basis for a takeover bid.

B) Holding a diversified portfolio of shares can reduce the level of risk of the entity.

C) The investment is expected to yield a return in the form of capital gains and dividends.

D) All of the given answers are correct.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

35

The requirements of AASB 128 relating to the equity method of accounting for investments in associates include:

A) adjustments for impairment losses recognised by the associate.

B) the notional adjustment of the carrying amounts of the identifiable assets, liabilities and contingent liabilities of the associate to fair value.

C) the calculation of a notional goodwill or excess on acquisition that is not required to be separately disclosed.

D) all of the given answers.

A) adjustments for impairment losses recognised by the associate.

B) the notional adjustment of the carrying amounts of the identifiable assets, liabilities and contingent liabilities of the associate to fair value.

C) the calculation of a notional goodwill or excess on acquisition that is not required to be separately disclosed.

D) all of the given answers.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

36

Flower Ltd acquired a 35 per cent interest in Bud Ltd on 1 July 2013 for a cash consideration of $469 000.Bud Ltd's assets and liabilities were recorded at fair value at the time of purchase and were represented by equity as follows: Additional information relating to the period ended 30 June 2015:

The opening balance of Bud's retained earnings was $500 000.Bud Ltd had paid a dividend out of pre-acquisition profits of $30 000 during the 2013/2014 period.

Bud Ltd had an after-tax profit of $190 000 for the 2014/2015 period.

Bud Ltd revalued land during the period,creating an asset revaluation reserve of $100 000.

Bud Ltd declared a $60 000 dividend out of post-acquisition profits.This dividend will not be paid until the following period.

Flower Ltd accrues the dividends of associates as revenue when they are proposed.The investment has been recorded in Flower's books in accordance with the cost method.What consolidation journal entries are required to apply the equity accounting method for the period ended 30 June 2015?

A)

B)

C)

D)

The opening balance of Bud's retained earnings was $500 000.Bud Ltd had paid a dividend out of pre-acquisition profits of $30 000 during the 2013/2014 period.

Bud Ltd had an after-tax profit of $190 000 for the 2014/2015 period.

Bud Ltd revalued land during the period,creating an asset revaluation reserve of $100 000.

Bud Ltd declared a $60 000 dividend out of post-acquisition profits.This dividend will not be paid until the following period.

Flower Ltd accrues the dividends of associates as revenue when they are proposed.The investment has been recorded in Flower's books in accordance with the cost method.What consolidation journal entries are required to apply the equity accounting method for the period ended 30 June 2015?

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

37

Eagle Ltd is the ultimate parent entity in a group of companies.On 1 July 2013 Eagle Ltd acquired 30 per cent of the issued capital of Sparrow Ltd for a cash consideration of $366 000.At the date of acquisition the net assets of Sparrow Ltd are recorded at fair value and are represented by equity as follows: Additional information:

During the financial year ending 30 June 2014 Sparrow Ltd makes a profit before tax of $140 000 and an after-tax profit of $89 000.

Sparrow Ltd proposed a dividend of $20 000 for the 2013/2014 period that will be paid early in the next period.

Eagle Ltd does not recognise dividends proposed by associates until they are paid.

During the year ended 30 June 2014 Sparrow made inter-entity sales to members of Eagle's economic group.These include:

Sparrow sold inventory to Peregrin Ltd,an 80 per cent owned subsidiary of Eagle Ltd.The inventory cost Sparrow $8000 and was sold to Peregrin for $12 000.Half of that inventory is still on hand in Peregrin at the end of the period.

Sparrow sold inventory to Seagull Ltd,a 25 per cent owned associate of Eagle's.The inventory cost Sparrow $10 000 and was sold to Seagull for $15 000.Forty per cent of this inventory is still on hand in Seagull at the end of the period.

The tax rate is 30 per cent.

What consolidated journal entry(ies)is(are)required to equity account for Eagle's interest in Sparrow Ltd for the period ended 30 June 2014?

A)

B)

C)

D)

During the financial year ending 30 June 2014 Sparrow Ltd makes a profit before tax of $140 000 and an after-tax profit of $89 000.

Sparrow Ltd proposed a dividend of $20 000 for the 2013/2014 period that will be paid early in the next period.

Eagle Ltd does not recognise dividends proposed by associates until they are paid.

During the year ended 30 June 2014 Sparrow made inter-entity sales to members of Eagle's economic group.These include:

Sparrow sold inventory to Peregrin Ltd,an 80 per cent owned subsidiary of Eagle Ltd.The inventory cost Sparrow $8000 and was sold to Peregrin for $12 000.Half of that inventory is still on hand in Peregrin at the end of the period.

Sparrow sold inventory to Seagull Ltd,a 25 per cent owned associate of Eagle's.The inventory cost Sparrow $10 000 and was sold to Seagull for $15 000.Forty per cent of this inventory is still on hand in Seagull at the end of the period.

The tax rate is 30 per cent.

What consolidated journal entry(ies)is(are)required to equity account for Eagle's interest in Sparrow Ltd for the period ended 30 June 2014?

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

38

Mop Ltd acquired a 40 per cent interest in Bucket Ltd on 1 July 2014 for a cash consideration of $824 000.Bucket Ltd's assets and liabilities were recorded at fair value at the time of purchase and were represented by equity as follows: Additional information relating to the period ended 30 June 2015:

Bucket Ltd had an after-tax profit of $665 000.

Bucket Ltd proposed a dividend out of pre-acquisition profits of $90 000.

Later in the period Bucket Ltd paid the $90 000 dividend and declared a further $100 000 dividend out of post-acquisition profits.This dividend will not be paid until the following period.

Mop Ltd accrues the dividends of associates as revenue when they are proposed.The investment has been recorded in Mop's books in accordance with the cost method.What consolidation journal entries are required to apply the equity accounting method for the period ended 30 June 2015?

A)

B)

C)

D)

Bucket Ltd had an after-tax profit of $665 000.

Bucket Ltd proposed a dividend out of pre-acquisition profits of $90 000.

Later in the period Bucket Ltd paid the $90 000 dividend and declared a further $100 000 dividend out of post-acquisition profits.This dividend will not be paid until the following period.

Mop Ltd accrues the dividends of associates as revenue when they are proposed.The investment has been recorded in Mop's books in accordance with the cost method.What consolidation journal entries are required to apply the equity accounting method for the period ended 30 June 2015?

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following are categories that are commonly used to classify investments?

A) equity investments and property investments

B) electronic investments and bonds

C) international investments and cash investments

D) electronic investments and bonds and international investments and cash investments

A) equity investments and property investments

B) electronic investments and bonds

C) international investments and cash investments

D) electronic investments and bonds and international investments and cash investments

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

40

Dixie Ltd acquired a 20 per cent interest in Jazz Ltd on 1 July 2013 for a cash consideration of $366 000.It has a sufficient balance of voting rights in Jazz Ltd to give it significant influence in its operating and financing decisions.Jazz's assets and liabilities were recorded at fair value at the time of purchase and were represented by equity as follows: During the period ended 30 June 2014 the following events occurred:

Jazz had an after-tax profit of $348 000.

Jazz proposed a dividend out of pre-acquisition profits of $25 000.

Later in the period Jazz paid the $25 000 dividend and declared a further $25 000 dividend out of post-acquisition profits.This dividend will not be paid until the following period.

Dixie Ltd accrues the dividends of associates as revenue when they are proposed.What is the amount of the investment in Jazz Ltd and income that will be recorded in the books of Dixie Ltd as at 30 June 2014 under (i)the cost method and (ii)the equity method?

A) (i) Investment in Jazz Ltd $366 000; income $5000 (ii) Investment in Jazz Ltd $385 600; income $69 600

B) (i) Investment in Jazz Ltd $366 000; income $10 000 (ii) Investment in Jazz Ltd $306 400; income $10 000

C) (i) Investment in Jazz Ltd $366 000; income $10 000 (ii) Investment in Jazz Ltd $435 600; income $79 600

D) (i) Investment in Jazz Ltd $361 000; income $5000 (ii) Investment in Jazz Ltd $425 600; income $69 600

Jazz had an after-tax profit of $348 000.

Jazz proposed a dividend out of pre-acquisition profits of $25 000.

Later in the period Jazz paid the $25 000 dividend and declared a further $25 000 dividend out of post-acquisition profits.This dividend will not be paid until the following period.

Dixie Ltd accrues the dividends of associates as revenue when they are proposed.What is the amount of the investment in Jazz Ltd and income that will be recorded in the books of Dixie Ltd as at 30 June 2014 under (i)the cost method and (ii)the equity method?

A) (i) Investment in Jazz Ltd $366 000; income $5000 (ii) Investment in Jazz Ltd $385 600; income $69 600

B) (i) Investment in Jazz Ltd $366 000; income $10 000 (ii) Investment in Jazz Ltd $306 400; income $10 000

C) (i) Investment in Jazz Ltd $366 000; income $10 000 (ii) Investment in Jazz Ltd $435 600; income $79 600

D) (i) Investment in Jazz Ltd $361 000; income $5000 (ii) Investment in Jazz Ltd $425 600; income $69 600

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

41

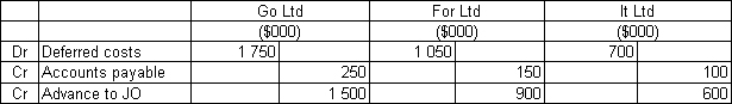

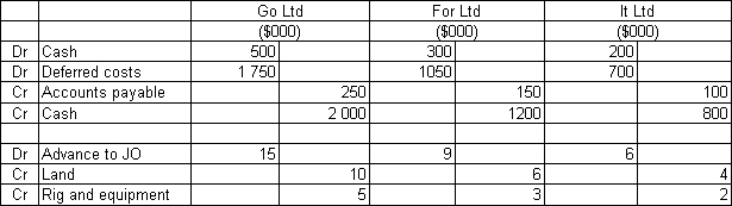

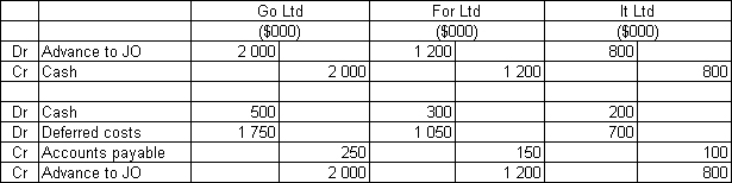

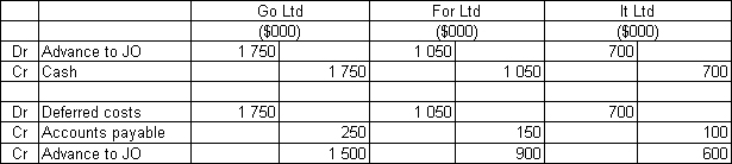

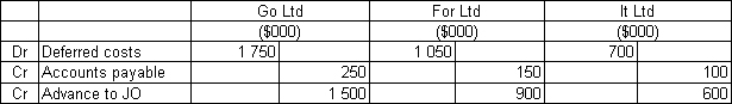

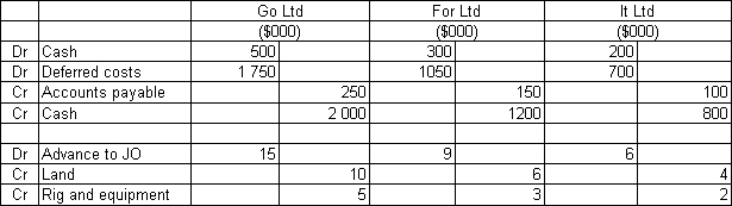

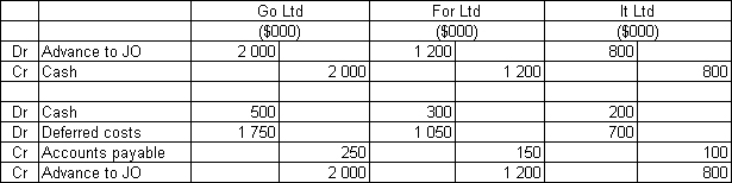

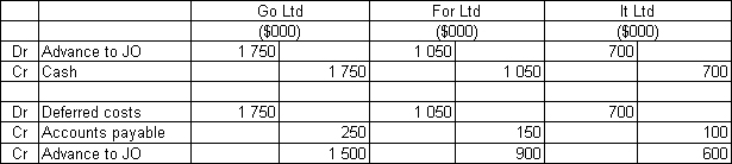

Go Ltd,For Ltd and It Ltd contractually form a joint operation on 1 July 2013 to construct an oil well to extract oil that each of the joint operators will refine.The three companies agree to contribute the following amounts of capital to the venture in the same proportion as their rights to the assets and outputs: The funds are used on 1 July 2013 to purchase the land for $20 million and a rig and other equipment for $10 million.The balance of $20 million will be called on by the joint venture manager as required.For Ltd and It Ltd borrowed $5 million and $4 million respectively to finance their contributions to the joint venture.

The following information relates to the year ending 30 June 2014:

Total cost of production of $3 500 000.These costs have been deferred in order to amortise them as the production of oil commences.

Of the total costs of production all but $500 000 have been paid in cash.

The joint venture manager called on the joint operators to contribute a further $4 000 000 in total with each joint operator contributing the appropriate portion according to their share in the joint venture (provided above).

Assume that the necessary entries have been made to record the formation of the joint venture.What entries would be required to record the transactions for the year ended 30 June 2014?

A)

B)

C)

D)

The following information relates to the year ending 30 June 2014:

Total cost of production of $3 500 000.These costs have been deferred in order to amortise them as the production of oil commences.

Of the total costs of production all but $500 000 have been paid in cash.

The joint venture manager called on the joint operators to contribute a further $4 000 000 in total with each joint operator contributing the appropriate portion according to their share in the joint venture (provided above).

Assume that the necessary entries have been made to record the formation of the joint venture.What entries would be required to record the transactions for the year ended 30 June 2014?

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

42

Where joint operators contribute assets to a joint venture,the accounting treatment is which of the following?

A) Treat the contribution as a capital investment and replace the asset with an investment account called 'advance to joint venture'.

B) Close off the accumulated depreciation account if applicable to the asset account and remove the net book value of the other joint venturers' shares of the asset against the account 'advance to joint venture'. This leaves the venturer's own share in its own accounts.

C) The value of the contribution is assessed at fair value, with the difference between fair value and the carrying amount being treated as a profit or loss on sale.

D) The asset is restated to fair value and the asset revaluation reserve treated as part of the advance to the joint venture.

A) Treat the contribution as a capital investment and replace the asset with an investment account called 'advance to joint venture'.

B) Close off the accumulated depreciation account if applicable to the asset account and remove the net book value of the other joint venturers' shares of the asset against the account 'advance to joint venture'. This leaves the venturer's own share in its own accounts.

C) The value of the contribution is assessed at fair value, with the difference between fair value and the carrying amount being treated as a profit or loss on sale.

D) The asset is restated to fair value and the asset revaluation reserve treated as part of the advance to the joint venture.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

43

On 30 June 2013,Perkins Ltd,Thorpe Ltd and Hackett Ltd entered into a joint operation to produce apparel and related products for the Australian national swimming team.The joint operators equally share in output and costs.On the same date,the recorded amounts of each joint operator's contributions are as follows: Assume that agreed values equal recoverable amount and no revaluations have occurred.

Which of the following combinations correctly indicates the effects on the statement of financial position and statement of financial performance of Hackett Ltd,respectively,after processing the journal entries to account for this joint operation arrangement?

A) no change; no change

B) asset increase; profit increase

C) asset decrease; profit decrease

D) asset increase; profit decrease

Which of the following combinations correctly indicates the effects on the statement of financial position and statement of financial performance of Hackett Ltd,respectively,after processing the journal entries to account for this joint operation arrangement?

A) no change; no change

B) asset increase; profit increase

C) asset decrease; profit decrease

D) asset increase; profit decrease

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

44

Two years after Voss Limited acquired a 30 per cent holding in its associate Warren Limited,the following journal entry appeared in the consolidated accounts of Voss Limited at the end of 2017/2018. Which of the following statements is correct?

A) Voss Limited is a parent entity.

B) Warren Limited revalued its land upwards by $90 000 in 2017-2018.

C) This entry will be passed only in this current year if there are no future revaluations made by Warren Limited.

D) Voss Limited is a parent entity and Warren Limited revalued its Land upwards by $90 000 in 2017-2018.

A) Voss Limited is a parent entity.

B) Warren Limited revalued its land upwards by $90 000 in 2017-2018.

C) This entry will be passed only in this current year if there are no future revaluations made by Warren Limited.

D) Voss Limited is a parent entity and Warren Limited revalued its Land upwards by $90 000 in 2017-2018.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

45

A joint venture is defined in AASB 11 as:

A) an arrangement whereby two or more parties carry on business with a common goal to make a profit and each can commit the joint venture to debts through decisions made unilaterally.

B) an arrangement whereby two or more venturers establish a common activity in which they jointly and severally take responsibility for liabilities and expenses and obtain the benefits of outputs generated.

C) a legal entity constituted by venturers pursuing a common goal and sharing control of assets and responsibility for expenses and liabilities.

D) a joint arrangement whereby two or more parties undertake an economic activity that is subject to joint control and have rights to the net assets of the arrangement.

A) an arrangement whereby two or more parties carry on business with a common goal to make a profit and each can commit the joint venture to debts through decisions made unilaterally.

B) an arrangement whereby two or more venturers establish a common activity in which they jointly and severally take responsibility for liabilities and expenses and obtain the benefits of outputs generated.

C) a legal entity constituted by venturers pursuing a common goal and sharing control of assets and responsibility for expenses and liabilities.

D) a joint arrangement whereby two or more parties undertake an economic activity that is subject to joint control and have rights to the net assets of the arrangement.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

46

A venturer that recognises in its financial statements the assets that it controls,the liabilities it incurs,the expenses that it incurs and its share of the income that it earns from the sale of goods or services by the joint venture is prescribed by AASB 11 for which type(s)of joint venture(s)?

A) jointly controlled entities

B) jointly controlled assets

C) joint operations

D) jointly controlled assets and jointly controlled operations

A) jointly controlled entities

B) jointly controlled assets

C) joint operations

D) jointly controlled assets and jointly controlled operations

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

47

Quartermain Limited has the following investments:

1)Christian Limited-a 100 per cent owned subsidiary

2)Hudson Limited-a 75 per cent owned subsidiary

3)Lane Limited-a 40 per cent owned associate

4)Daicos Limited- a 25 per cent owned associate

Lane Limited sells inventory,which cost Lane Limited $40 000 to acquire,to Christian Limited,at a mark up of 50 per cent.25 per cent of the inventory remains on hand at the end of the period.What is the amount to be eliminated in the consolidated accounts of Quartermain Group Limited?

A) $4000

B) $2500

C) $2000

D) $5000

1)Christian Limited-a 100 per cent owned subsidiary

2)Hudson Limited-a 75 per cent owned subsidiary

3)Lane Limited-a 40 per cent owned associate

4)Daicos Limited- a 25 per cent owned associate

Lane Limited sells inventory,which cost Lane Limited $40 000 to acquire,to Christian Limited,at a mark up of 50 per cent.25 per cent of the inventory remains on hand at the end of the period.What is the amount to be eliminated in the consolidated accounts of Quartermain Group Limited?

A) $4000

B) $2500

C) $2000

D) $5000

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

48

Creed Ltd and Nickleback Ltd enter into a contractual agreement to form a joint arrangement,which is considered to be a joint operation on 1 July 2015.Creed Ltd is to contribute land and equipment and Nickleback Ltd agrees to contribute $8 million.It is agreed that they will share output,assets and future contributions in the ratio 60: 40 (Creed/Nickleback).The contribution by Creed Ltd has an agreed fair value of $9 million for the land and $3 million for the equipment.The book value of the land is $8 million and the net book value of the machinery is $2 million.

What are the entries to record the formation of the joint operation in the books of Creed Ltd and Nickleback Ltd?

A)

B)

C)

D)

What are the entries to record the formation of the joint operation in the books of Creed Ltd and Nickleback Ltd?

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

49

A joint operation should be accounted for using the:

A) cost method in the venturer's own books and the equity method in the group accounts (if they are prepared).

B) net market method in the books of the venturer and also in the group accounts.

C) cost method in the venturer's own books and the equity method in the group accounts, if they are prepared. Where group accounts are not prepared, the equity method should be applied in the venturer's own books.

D) line-by-line method in the joint operator's statement of financial position.

A) cost method in the venturer's own books and the equity method in the group accounts (if they are prepared).

B) net market method in the books of the venturer and also in the group accounts.

C) cost method in the venturer's own books and the equity method in the group accounts, if they are prepared. Where group accounts are not prepared, the equity method should be applied in the venturer's own books.

D) line-by-line method in the joint operator's statement of financial position.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

50

A joint operation:

A) is a jointly controlled entity set up as a partnership.

B) is a joint venture that is not yet functioning at its full capacity.

C) is a joint arrangement that has rights to the assets and obligations for the liabilities relating to the arrangement.

D) is a joint arrangement that does not has rights to the assets and obligations for the liabilities relating to the arrangement.

A) is a jointly controlled entity set up as a partnership.

B) is a joint venture that is not yet functioning at its full capacity.

C) is a joint arrangement that has rights to the assets and obligations for the liabilities relating to the arrangement.

D) is a joint arrangement that does not has rights to the assets and obligations for the liabilities relating to the arrangement.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

51

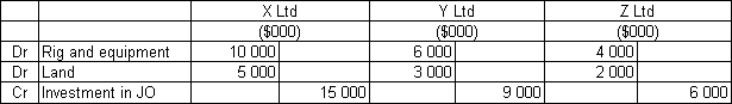

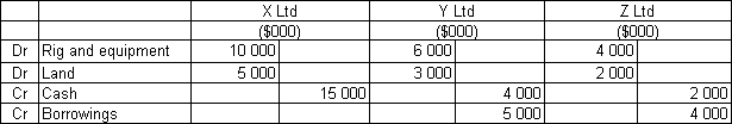

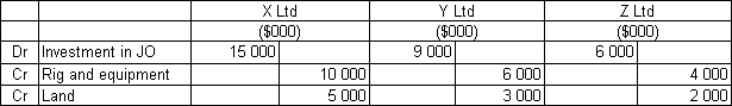

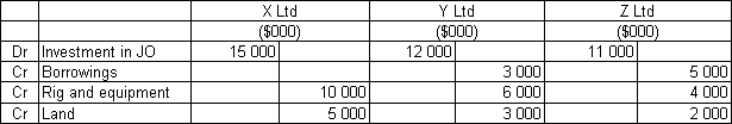

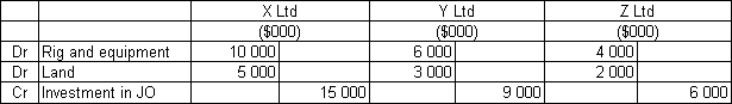

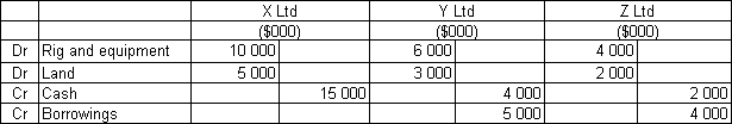

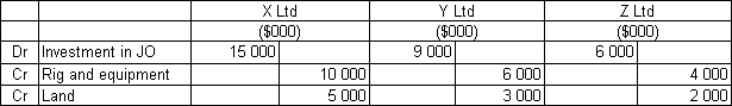

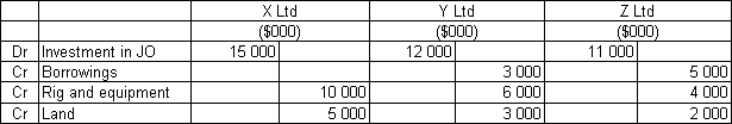

X Ltd,Y Ltd and Z Ltd contractually form a joint operation on 1 July 2013 to construct an oil well to extract oil that each of the joint operators will refine.The three companies agree to contribute the following amounts of capital to the joint operation in the same proportion as their rights to the assets and outputs: The funds are used on 1 July 2013 to purchase the land for $20 million and a rig and other equipment for $10 million.The balance of $20 million will be called on by the joint operation manager as required.Y Ltd and Z Ltd borrowed $5 million and $4 million respectively to finance their contributions to the joint operation.What entries would be required to record the establishment of the joint operation and where would these entries be made?

A)

The entries would be consolidation journal entries for each joint operator.

The entries would be consolidation journal entries for each joint operator.

B)

The entries would be made in each joint operator's own books.

The entries would be made in each joint operator's own books.

C)

The entries would be made in each joint operator's own books.

The entries would be made in each joint operator's own books.

D)

The entries would be made in each joint operator's own books.

The entries would be made in each joint operator's own books.

A)

The entries would be consolidation journal entries for each joint operator.

The entries would be consolidation journal entries for each joint operator.B)

The entries would be made in each joint operator's own books.

The entries would be made in each joint operator's own books.C)

The entries would be made in each joint operator's own books.

The entries would be made in each joint operator's own books.D)

The entries would be made in each joint operator's own books.

The entries would be made in each joint operator's own books.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

52

In determining the existence of 'significant influence',and considering voting power,consideration must be given to:

A) the voting power directly related to the voting rights attaching to the equity interests.

B) the distribution of the balance of the voting power.

C) excluding voting power that applies only in contingent circumstances.

D) the voting power directly related to the voting rights attaching to the equity interests; the distribution of the balance of the voting power; and excluding voting power that applies only in contingent circumstances.

A) the voting power directly related to the voting rights attaching to the equity interests.

B) the distribution of the balance of the voting power.

C) excluding voting power that applies only in contingent circumstances.

D) the voting power directly related to the voting rights attaching to the equity interests; the distribution of the balance of the voting power; and excluding voting power that applies only in contingent circumstances.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

53

Sting Ltd and Pink Ltd enter into a contractual agreement to form a joint arrangement which is considered to be a joint operation on 1 July 2014.Sting Ltd is to contribute land and production buildings and equipment.Pink Ltd agrees to contribute $8.1 million in cash.It is agreed that they will share output,assets and future contributions in the ratio 50: 50.The following information relates to the contribution by Sting Ltd. What are the entries to record the formation of the joint operation in the books of Sting Ltd and Pink Ltd?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

54

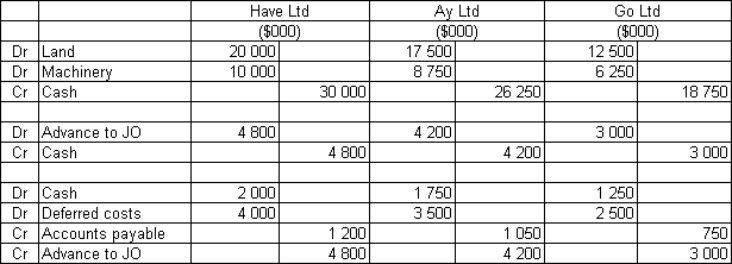

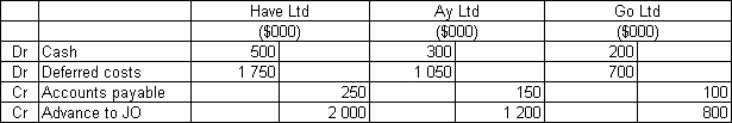

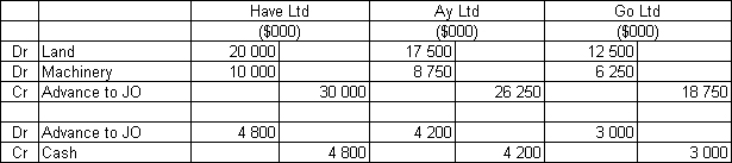

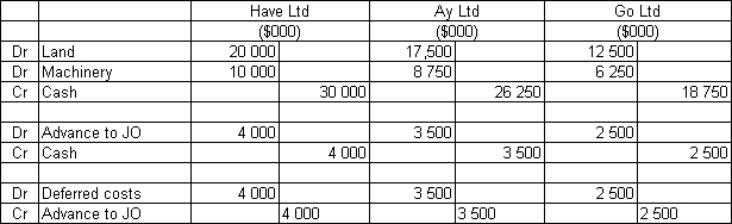

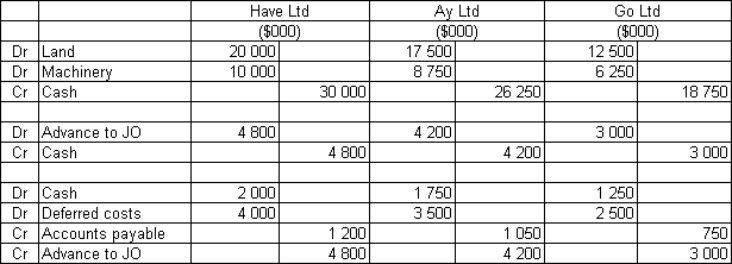

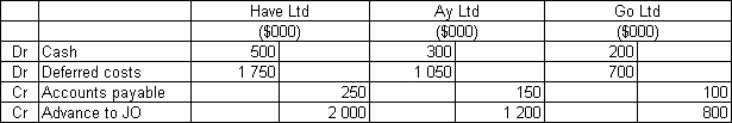

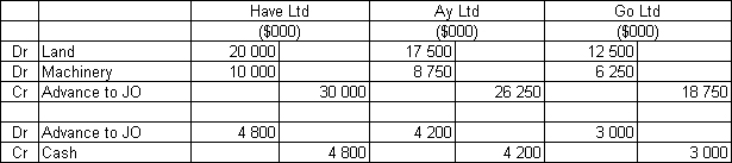

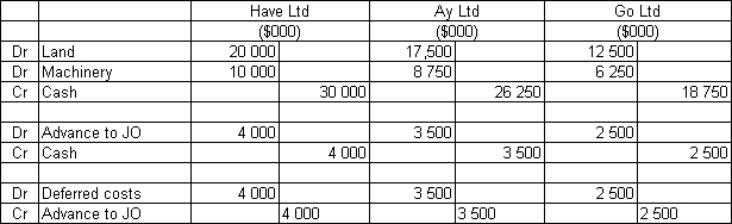

Have Ltd,Ay Ltd and Go Ltd contractually form a joint operation on 1 July 2013 to undertake a bauxite mining venture.The three companies agree to contribute the following amounts of capital to the joint operation in the same proportion as their rights to the assets and outputs: The funds are used on 1 July 2013 to purchase the mining site for $50 million and drilling and other heavy machinery for $25 million.The balance of $25 million will be called on by the joint operation manager as required.

The following information relates to the year ending 30 June 2014:

Total cost of production of $10 000 000.These costs have been deferred in order to amortise them as mining commences.

Of the total costs of production all but $3 000 000 have been paid in cash.

The joint operation manager called on the joint operators to contribute a further $12 000 000 in total with each joint operator contributing the appropriate portion according to their share in the joint operation (provided above).

What entries would be required to record the formation of the joint operation and the transactions for the year ended 30 June 2014?

A)

B)

C)

D)

The following information relates to the year ending 30 June 2014:

Total cost of production of $10 000 000.These costs have been deferred in order to amortise them as mining commences.

Of the total costs of production all but $3 000 000 have been paid in cash.

The joint operation manager called on the joint operators to contribute a further $12 000 000 in total with each joint operator contributing the appropriate portion according to their share in the joint operation (provided above).

What entries would be required to record the formation of the joint operation and the transactions for the year ended 30 June 2014?

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following statements is in accordance with AASB 11Joint Arrangements?

A) Investors in jointly controlled entities account for their investment under equity method if their ownership percentage exceeds 20 per cent.

B) The existence of a contractual arrangement distinguishes joint arrangements from investments in associates in which the investor has significant influence.

C) The contractual arrangement establishes joint control over the arrangement in such a way no single venturer is in a position to control the activity unilaterally.

D) Activities that have no contractual arrangement to establish joint control but in substance have established joint control are considered joint ventures for the purposes of AASB 11.

A) Investors in jointly controlled entities account for their investment under equity method if their ownership percentage exceeds 20 per cent.

B) The existence of a contractual arrangement distinguishes joint arrangements from investments in associates in which the investor has significant influence.

C) The contractual arrangement establishes joint control over the arrangement in such a way no single venturer is in a position to control the activity unilaterally.

D) Activities that have no contractual arrangement to establish joint control but in substance have established joint control are considered joint ventures for the purposes of AASB 11.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

56

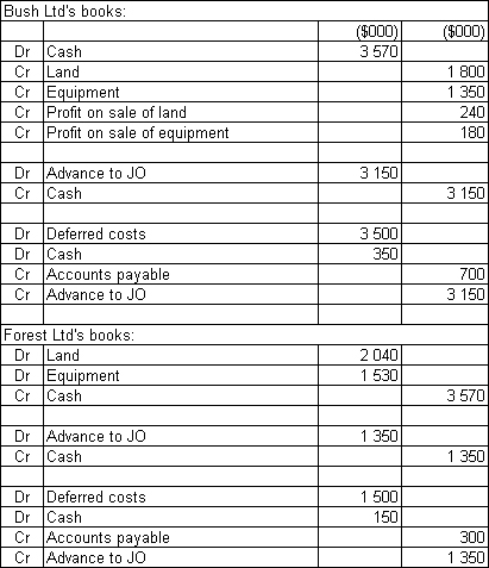

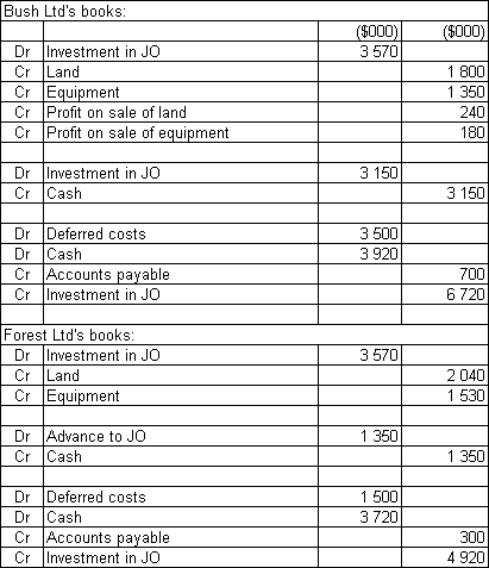

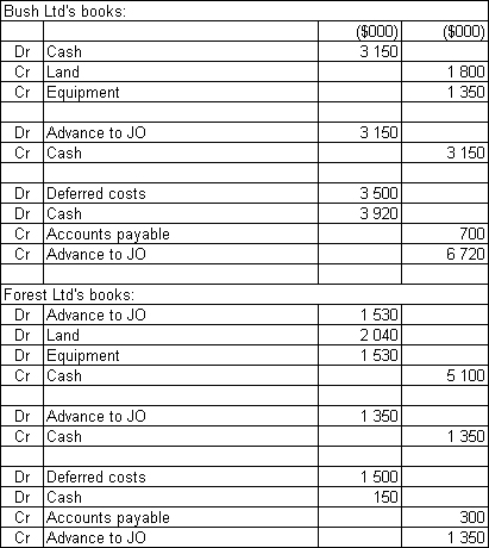

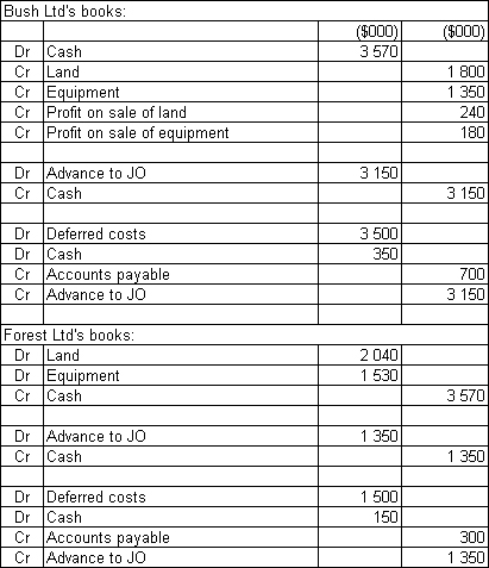

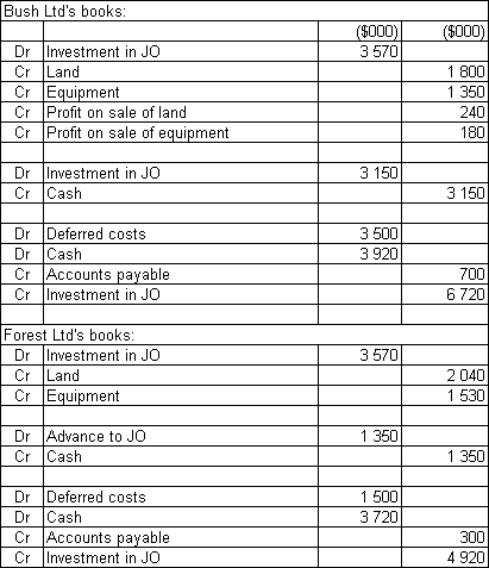

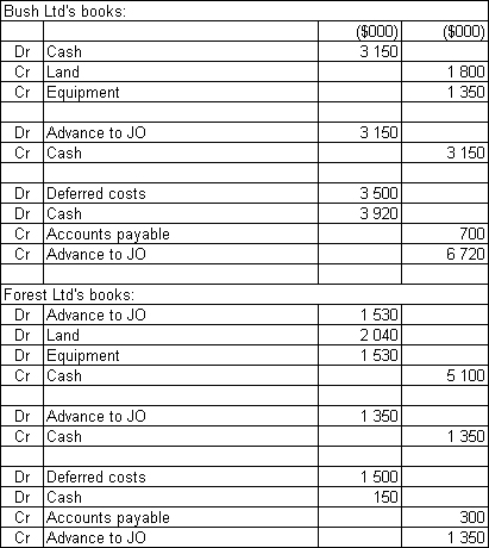

Bush Ltd and Forest Ltd enter into a contractual agreement to form a joint arrangement which is considered to be a joint operation on 1 July 2014.Bush Ltd is to contribute land and equipment.Forest Ltd agrees to contribute $5.1 million in cash.It is agreed that they will share output,assets and future contributions in the ratio 70: 30 (Bush/Forest).The following information relates to the contribution by Bush Ltd:

The following information relates to the year ending 30 June 2015:

Total cost of production of $5 000 000.These costs have been deferred in order to amortise them as production commences.

Of the total costs of production all but $1 000 000 have been paid in cash.

The joint venture manager called on the venturers to contribute a further $4 500 000 in total with each venturer contributing the appropriate portion according to their share in the joint operation.

What entries would be required to record the formation of the joint operation and the transactions for the year ended 30 June 2014?

A)

Bush Ltd's books:

B)

C)

D)

The following information relates to the year ending 30 June 2015:

Total cost of production of $5 000 000.These costs have been deferred in order to amortise them as production commences.

Of the total costs of production all but $1 000 000 have been paid in cash.

The joint venture manager called on the venturers to contribute a further $4 500 000 in total with each venturer contributing the appropriate portion according to their share in the joint operation.

What entries would be required to record the formation of the joint operation and the transactions for the year ended 30 June 2014?

A)

Bush Ltd's books:

B)

C)

D)

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

57

Where a joint venture is a partnership:

A) It should be accounted for by the venturer using the equity method.

B) It should be accounted for by the venturer using partnership accounting separately to the financial accounts of the venturers and any profit on sale of the output from the joint venture reported in the income statement of the individual venturers.

C) It should be accounted for by the venturer as a partnership and the line items added into the group's financial statements.

D) It should be accounted for using full consolidation accounting.

A) It should be accounted for by the venturer using the equity method.

B) It should be accounted for by the venturer using partnership accounting separately to the financial accounts of the venturers and any profit on sale of the output from the joint venture reported in the income statement of the individual venturers.

C) It should be accounted for by the venturer as a partnership and the line items added into the group's financial statements.

D) It should be accounted for using full consolidation accounting.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

58

A joint arrangement that is not structured through a separate vehicle is called:

A) a joint venture.

B) a joint operation.

C) an expense joint venture or a joint operation.

D) a partnership.

A) a joint venture.

B) a joint operation.

C) an expense joint venture or a joint operation.

D) a partnership.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

59

On 30 June 2013,Perkins Ltd,Thorpe Ltd and Hackett Ltd entered into a joint operation to produce apparel and related products for the Australian national swimming team.The joint operators equally share in output and costs.On the same date,the recorded amounts of each joint operator's contributions are as follows: Assume that agreed values equal recoverable amount and no revaluations have occurred.

Which of the following combinations correctly indicates the effects on the statement of financial position and statement of financial performance of Thorpe Ltd,respectively,after processing the journal entries to account for this joint operation arrangement?

A) no change; no change

B) asset increase; profit increase

C) asset decrease; profit decrease

D) asset increase; profit decrease

Which of the following combinations correctly indicates the effects on the statement of financial position and statement of financial performance of Thorpe Ltd,respectively,after processing the journal entries to account for this joint operation arrangement?

A) no change; no change

B) asset increase; profit increase

C) asset decrease; profit decrease

D) asset increase; profit decrease

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

60

Quartermain Limited has the following investments:

1)Christian Limited-a 100 per cent owned subsidiary

2)Hudson Limited-a 75 per cent owned subsidiary

3)Lane Limited-a 40 per cent owned associate

4)Daicos Limited-a 25 per cent owned associate

Lane Limited sells inventory,which cost Lane Limited $80 000 to acquire,to Hudson Limited,at a mark up of 25 per cent.A quarter of the inventory remains on hand at the end of the period.What is the amount to be eliminated in the consolidated accounts of Quartermain Group Limited?

A) $4000

B) $2500

C) $2000

D) $5000

1)Christian Limited-a 100 per cent owned subsidiary

2)Hudson Limited-a 75 per cent owned subsidiary

3)Lane Limited-a 40 per cent owned associate

4)Daicos Limited-a 25 per cent owned associate

Lane Limited sells inventory,which cost Lane Limited $80 000 to acquire,to Hudson Limited,at a mark up of 25 per cent.A quarter of the inventory remains on hand at the end of the period.What is the amount to be eliminated in the consolidated accounts of Quartermain Group Limited?

A) $4000

B) $2500

C) $2000

D) $5000

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

61

Explain the term 'significant influence',and how it is determined,including several factors that need to be considered when making such determination

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

62

Outline the arguments for and against the use of equity accounting,relative to cost method,when accounting for an investment.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

63

Explain how an investor may lose significant influence without a change in ownership levels.How should one account for such loss of significant influence?

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

64

Briefly describe,and differentiate between,the two types of joint arrangements referred to in AASB 11.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

65

Discuss the accounting treatment for a joint operation as prescribed in AASB 11 Joint Arrangements.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

66

Discuss the accounting treatment for a joint venture as prescribed in AASB 128 Investments in Associates and Joint Ventures.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

67

Briefly summarise the key disclosure requirements for joint arrangements according to AASB 11.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

68

Explain the requirements of AASB 128 in relation to accounting in the investor's books,for the effect of accounting losses and revaluation decrements made by the associate.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

69

Discuss why management is motivated to make both short-term and long-term equity investments?

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

70

Discuss how the carrying amount of an investment in an associate is determined as prescribed in with AASB 128 Investments in Associates and Joint Ventures.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck