Deck 24: Segment Reporting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/77

Play

Full screen (f)

Deck 24: Segment Reporting

1

The core principle of AASB 8 Operating Segments is for a reporting entity to disclose information to enable users of its financial statements to evaluate the nature and financial effects of the business activities in which it engages and the economic environments in which it operates.

True

2

Management may be concerned that segment reporting will put the entity at competitive disadvantage,so it has been suggested that it can avoid providing accurate segment reports through opportunistic interpretation of the definition of a business segment.

True

3

AASB 8 bans the disclosure of segments that do not pass the '10 per cent test'.

False

4

AASB 8 identifies five factors that are to be considered in determining whether or not products and services are related for the purposes of defining a business segment.It further specifies that the products and services included in a business segment must be similar with respect to all these factors.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

5

AASB 8 allows reportable segments to be combined as a single operating segment if:

(a)they exhibit similar long-term financial performance; and (b)they are similar in all of the appropriate factors identified in the standard in relation to segment revenues,expenses,assets and liabilities.

(a)they exhibit similar long-term financial performance; and (b)they are similar in all of the appropriate factors identified in the standard in relation to segment revenues,expenses,assets and liabilities.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

6

AASB 8 Operating Segments requires reconciliation of total reportable segment revenues,total profit or loss,total assets,total liabilities and other amounts disclosed for reportable segments to the corresponding amounts shown in the parent entity's separate financial statements.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

7

Segment information may be useful to investors who wish to use ethical guidelines about which industries or countries they invest in.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

8

AASB 8 Operating Segments requires an entity to report a measure of segment liabilities and particular income and expense items,if such measures are regularly provided to the chief operating officer.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

9

If a financial report contains both the consolidated financial statements of a parent and the parent's separate financial statements,segment information is required for both statements.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

10

Legal entities often combine to form an economic entity.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

11

Two or more operating segments may be aggregated into a single operating segment if aggregation is consistent with the core principle of AASB 8,or the segments have similar economic characteristics,or the segments are similar in the nature of the products and services.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

12

A geographical segment is defined in part by AASB 8 as being a distinguishable component of an entity engaged in providing products and services within a particular social and cultural environment.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

13

The consolidated statement of comprehensive income provides an indication of the aggregated financial performance of many dissimilar entities.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

14

For a segment to be reportable,AASB 8 requires that majority of revenues be earned from external parties and the segment satisfies one of the three quantitative thresholds.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

15

IFRS 8 was issued as part of the ongoing process to converge IASB standards with the US accounting standards.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

16

Identification of operating segments in AASB 8 Operating Segments adopts a 'rules-based' approach,while its predecessor AASB 114 Segment Reporting adopts a 'principles-based' approach.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

17

Research has shown that companies only provide segment information when it is required by accounting regulation.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

18

AASB 8 does not require disclosure of a reportable segment if a segment is mainly transacting with related parties.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

19

AASB 8 specifies guidelines regarding whether or not a segment is reportable.These guidelines are known as the 10 per cent rules.All three rules are required to be met in order to establish a reportable segment.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

20

AASB 8 specifies that a geographical segment cannot include more than two countries:

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

21

The guidelines to determine that a segment is reportable in accordance with AASB 8 Operating Segments includes:

A) The segment's external revenue is equal to or greater than 10 per cent of the external sales of all operating segments.

B) The expenses of the segment that relate to external sales are equal to or greater than 10 per cent of total segment expenses.

C) The segment's reported revenue, including both sales to external customers and intersegment sales or transfers, is 10 per cent or more of the combined revenue, internal and external, of all operating segments.

D) The expenses of the segment that relate to external sales are equal to or greater than 10 per cent of total segment expenses, and the segment's revenues are 10 per cent or more of the total segment revenues.

A) The segment's external revenue is equal to or greater than 10 per cent of the external sales of all operating segments.

B) The expenses of the segment that relate to external sales are equal to or greater than 10 per cent of total segment expenses.

C) The segment's reported revenue, including both sales to external customers and intersegment sales or transfers, is 10 per cent or more of the combined revenue, internal and external, of all operating segments.

D) The expenses of the segment that relate to external sales are equal to or greater than 10 per cent of total segment expenses, and the segment's revenues are 10 per cent or more of the total segment revenues.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

22

Situations in which aggregated data may be sufficient to evaluate the performance of an entity include:

A) where the entity has not existed for a long period of time.

B) where the segments of the entity have highly correlated profit prospects.

C) where the entity has a large consolidated asset base.

D) where the entity operates in different geographic areas with different risks.

A) where the entity has not existed for a long period of time.

B) where the segments of the entity have highly correlated profit prospects.

C) where the entity has a large consolidated asset base.

D) where the entity operates in different geographic areas with different risks.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

23

According to AASB 8,factors to be considered in aggregating operating segments include:

A) a similar production process.

B) exchange control regulations.

C) a common communications network.

D) a similar regulatory environment.

A) a similar production process.

B) exchange control regulations.

C) a common communications network.

D) a similar regulatory environment.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

24

AASB 8 identifies a number of purposes for segment data.These include to:

A) enhance understandability of the information.

B) achieve comparability with other entities.

C) provide relevant and reliable information to users about product/service-related risks and returns.

D) all of the given answers.

A) enhance understandability of the information.

B) achieve comparability with other entities.

C) provide relevant and reliable information to users about product/service-related risks and returns.

D) all of the given answers.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

25

Potential costs of providing segment information include:

A) management taking extra risks in order to attempt to generate increased returns in its segment.

B) allowing current or potential investors to identify that the entity is earning high profits in a segment.

C) disclosing that a segment is making a loss, which may lead to take-over bids by other organisations.

D) allowing current or potential competitors to identify that the entity is earning high profits in a segment, which may increase competition through new entrants or an attempt to replicate the factors leading to the entity's success.

A) management taking extra risks in order to attempt to generate increased returns in its segment.

B) allowing current or potential investors to identify that the entity is earning high profits in a segment.

C) disclosing that a segment is making a loss, which may lead to take-over bids by other organisations.

D) allowing current or potential competitors to identify that the entity is earning high profits in a segment, which may increase competition through new entrants or an attempt to replicate the factors leading to the entity's success.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

26

Gollum Ltd provides the following segment information: There are no inter-segment sales.Which of the segments are reportable applying only the segment result test?

A) industrial manufacturing, project consulting, retailing, agriculture; geographical segments: Australia, Pacific Islands, US.

B) business segments: industrial manufacturing, project consulting; geographical segments: Australia.

C) business segments: industrial manufacturing, project consulting, mechanical engineering, retailing, agriculture; geographical segments: Australia, Pacific Islands, US.

D) business segments: industrial manufacturing, project consulting, agriculture; geographical segments: Australia, Pacific Islands.

A) industrial manufacturing, project consulting, retailing, agriculture; geographical segments: Australia, Pacific Islands, US.

B) business segments: industrial manufacturing, project consulting; geographical segments: Australia.

C) business segments: industrial manufacturing, project consulting, mechanical engineering, retailing, agriculture; geographical segments: Australia, Pacific Islands, US.

D) business segments: industrial manufacturing, project consulting, agriculture; geographical segments: Australia, Pacific Islands.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

27

Segment revenues do not include:

A) interest earned on loans to other segments.

B) interest or dividend income, unless the segment's operations are primarily of a financial nature.

C) joint venturer's revenues from its share of joint venture operations.

D) interest earned on loans to other segments and interest or dividend income, unless the segment's operations are primarily of a financial nature.

A) interest earned on loans to other segments.

B) interest or dividend income, unless the segment's operations are primarily of a financial nature.

C) joint venturer's revenues from its share of joint venture operations.

D) interest earned on loans to other segments and interest or dividend income, unless the segment's operations are primarily of a financial nature.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following characteristics of a segment is not considered reportable in AASB 8 Operating Segments?

A) Reported revenue, both external and internal, is 10 per cent or more of the combined revenue, both external and internal of all operating segments.

B) The absolute amount of its reported profit or loss is 10 per cent or more of the greater, in absolute amount, of (i) the combined reported profit of all operating segments that did not report a loss and (ii) the combined reported loss of all operating segments that reported a loss

C) Assets are 10 per cent or more of the combined assets of all operating segments.

D) Operating segments that do not meet any of the quantitative thresholds, but management believes that information about the segment would be useful to users of the financial statements.

A) Reported revenue, both external and internal, is 10 per cent or more of the combined revenue, both external and internal of all operating segments.

B) The absolute amount of its reported profit or loss is 10 per cent or more of the greater, in absolute amount, of (i) the combined reported profit of all operating segments that did not report a loss and (ii) the combined reported loss of all operating segments that reported a loss

C) Assets are 10 per cent or more of the combined assets of all operating segments.

D) Operating segments that do not meet any of the quantitative thresholds, but management believes that information about the segment would be useful to users of the financial statements.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

29

Managers may choose to provide segment data voluntarily because:

A) They want to highlight the companies in the group that are doing well.

B) Managers generally do not believe that consolidated accounts are meaningful.

C) The segment information will demonstrate more accurately where they have done well and where they have done badly.

D) It demonstrates a greater level of accountability that may attract investment funds.

A) They want to highlight the companies in the group that are doing well.

B) Managers generally do not believe that consolidated accounts are meaningful.

C) The segment information will demonstrate more accurately where they have done well and where they have done badly.

D) It demonstrates a greater level of accountability that may attract investment funds.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

30

AASB 8 requires that:

A) Reportable segments must individually constitute less than 75 per cent of the entity's total revenues.

B) The total revenues attributable to the reportable segments must be equal to or greater than 75 per cent of the entity's total revenues.

C) The total external revenues attributable to reportable segments must equal at least 75 per cent of the entity's total revenues.

D) The sum of the individual reportable segment's profits or losses must be equal to or greater than 75 per cent of the entity's absolute amount of profit or loss.

A) Reportable segments must individually constitute less than 75 per cent of the entity's total revenues.

B) The total revenues attributable to the reportable segments must be equal to or greater than 75 per cent of the entity's total revenues.

C) The total external revenues attributable to reportable segments must equal at least 75 per cent of the entity's total revenues.

D) The sum of the individual reportable segment's profits or losses must be equal to or greater than 75 per cent of the entity's absolute amount of profit or loss.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

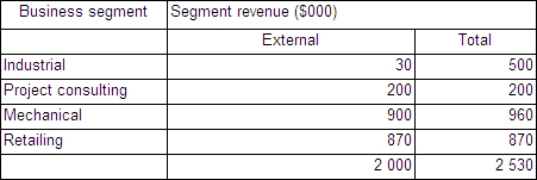

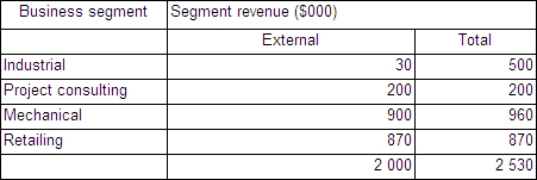

31

The following segment information relates to Tolkein Enterprises:  Applying the tests for identifying a reportable segment in accordance with AASB 8,which of the above segments qualify for reporting and do the segments satisfy the 75 per cent test?

Applying the tests for identifying a reportable segment in accordance with AASB 8,which of the above segments qualify for reporting and do the segments satisfy the 75 per cent test?

A) mechanical engineering and retailing, 75 per cent test satisfied; No

B) industrial manufacturing, mechanical engineering and retailing, 75 per cent test satisfied; Yes

C) project consulting, mechanical engineering and retailing, 75 per cent test satisfied; Yes

D) industrial manufacturing, project consulting, mechanical engineering and retailing, 75 per cent test satisfied; No

Applying the tests for identifying a reportable segment in accordance with AASB 8,which of the above segments qualify for reporting and do the segments satisfy the 75 per cent test?

Applying the tests for identifying a reportable segment in accordance with AASB 8,which of the above segments qualify for reporting and do the segments satisfy the 75 per cent test?A) mechanical engineering and retailing, 75 per cent test satisfied; No

B) industrial manufacturing, mechanical engineering and retailing, 75 per cent test satisfied; Yes

C) project consulting, mechanical engineering and retailing, 75 per cent test satisfied; Yes

D) industrial manufacturing, project consulting, mechanical engineering and retailing, 75 per cent test satisfied; No

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

32

In the situation where an entity has invested in segments that are diverse:

A) Segment information should enable the users of the financial statements to better predict the future profitability of the entity.

B) Segment information should enable the users of the financial statements to better predict the risk exposure of the entity.

C) Segment information is less useful because according to portfolio theory investments that are not correlated reduce the risk of an entity.

D) Segment information should enable the users of the financial statements to better predict the future profitability of the entity and enable the users of the financial statements to better predict the risk exposure of the entity.

A) Segment information should enable the users of the financial statements to better predict the future profitability of the entity.

B) Segment information should enable the users of the financial statements to better predict the risk exposure of the entity.

C) Segment information is less useful because according to portfolio theory investments that are not correlated reduce the risk of an entity.

D) Segment information should enable the users of the financial statements to better predict the future profitability of the entity and enable the users of the financial statements to better predict the risk exposure of the entity.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

33

The guidelines for determining that a segment is reportable in accordance with AASB 8 include:

A) Its segment result, whether a profit or loss, is 10 per cent or more of the combined result of all segments that earned a profit or the combined result of all segments that incurred a loss, whichever is the greater absolute amount.

B) Its segment result, if a profit, is 10 per cent or more of the combined result of all segments that made a profit, or if the segment made a loss, its loss is 10 per cent or more of the absolute amount of the total segment losses.

C) Its segment result, whether a profit or loss, is 10 per cent or more of the absolute value of the combined results of all segments.

D) Its segment result, whether a profit or loss, is 10 per cent or more of the combined result of all segments that earned a profit or the combined result of all segments that incurred a loss, whichever is the lesser absolute amount.

A) Its segment result, whether a profit or loss, is 10 per cent or more of the combined result of all segments that earned a profit or the combined result of all segments that incurred a loss, whichever is the greater absolute amount.

B) Its segment result, if a profit, is 10 per cent or more of the combined result of all segments that made a profit, or if the segment made a loss, its loss is 10 per cent or more of the absolute amount of the total segment losses.

C) Its segment result, whether a profit or loss, is 10 per cent or more of the absolute value of the combined results of all segments.

D) Its segment result, whether a profit or loss, is 10 per cent or more of the combined result of all segments that earned a profit or the combined result of all segments that incurred a loss, whichever is the lesser absolute amount.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

34

Gandulf Ltd provides the following segment information: Which of the segments are reportable applying only the segment asset test?

A) business segments: industrial manufacturing, project consulting, mechanical engineering; geographical segments: Australia, US.

B) business segments: industrial manufacturing, mechanical engineering; geographical segments: Australia.

C) business segments: mechanical engineering; geographical segments: Australia.

D) business segments: industrial manufacturing, project consulting, mechanical engineering, retailing, agriculture; geographical segments: Australia, US.

A) business segments: industrial manufacturing, project consulting, mechanical engineering; geographical segments: Australia, US.

B) business segments: industrial manufacturing, mechanical engineering; geographical segments: Australia.

C) business segments: mechanical engineering; geographical segments: Australia.

D) business segments: industrial manufacturing, project consulting, mechanical engineering, retailing, agriculture; geographical segments: Australia, US.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

35

In AASB 8 Operating Segments,which of the following is not a consideration in determining the operating segments of an entity?

A) business activities from which an entity may earn revenues and incur expenses

B) component of an entity whose operating results are regularly reviewed by the entity's chief operating decision maker

C) the entity's distribution and supply chain management system

D) component of an entity where discrete financial information is available

A) business activities from which an entity may earn revenues and incur expenses

B) component of an entity whose operating results are regularly reviewed by the entity's chief operating decision maker

C) the entity's distribution and supply chain management system

D) component of an entity where discrete financial information is available

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

36

The guidelines to determine that a segment is reportable in accordance with AASB 8 Operating Segments includes:

A) The segment's reported revenue, including external customers and intersegment sales or transfers, is 10 per cent or more of the combined revenue, internal and external, of all operating segments.

B) The segment's reported profit or loss is 10 per cent or more of the greater, in absolute amount, of (i) the combined reported profit of all operating segments that did not report a loss and (ii) the combined reported loss of all operating segments that reported a loss.

C) The segment's assets are 10 per cent or more of the combined assets of all operating segments.

D) All of the given answers are correct.

A) The segment's reported revenue, including external customers and intersegment sales or transfers, is 10 per cent or more of the combined revenue, internal and external, of all operating segments.

B) The segment's reported profit or loss is 10 per cent or more of the greater, in absolute amount, of (i) the combined reported profit of all operating segments that did not report a loss and (ii) the combined reported loss of all operating segments that reported a loss.

C) The segment's assets are 10 per cent or more of the combined assets of all operating segments.

D) All of the given answers are correct.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

37

An important argument for providing segmental information in the financial reports is:

A) It is simpler and easier for users to follow.

B) Consolidated information is so aggregated that it may disguise poor performance and very good performance among segments of the entity.

C) The shareholders of the individual companies in the group can use the segment information to assess the performance of their company.

D) The segments of the entity will be taxed separately on their earnings.

A) It is simpler and easier for users to follow.

B) Consolidated information is so aggregated that it may disguise poor performance and very good performance among segments of the entity.

C) The shareholders of the individual companies in the group can use the segment information to assess the performance of their company.

D) The segments of the entity will be taxed separately on their earnings.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

38

The guidelines for determining that a segment is reportable in accordance with AASB 8 includes:

A) The segment's equity is equal to or greater than 10 per cent of the total segment equity.

B) The expenses of the segment that relate to external sales are equal to or greater than 10 per cent of total segment expenses.

C) The segment's revenues are 10 per cent or more of the total segment revenues.

D) The expenses of the segment that relate to external sales are equal to or greater than 10 per cent of total segment expenses and the segment's revenues are 10 per cent or more of the total segment revenues.

A) The segment's equity is equal to or greater than 10 per cent of the total segment equity.

B) The expenses of the segment that relate to external sales are equal to or greater than 10 per cent of total segment expenses.

C) The segment's revenues are 10 per cent or more of the total segment revenues.

D) The expenses of the segment that relate to external sales are equal to or greater than 10 per cent of total segment expenses and the segment's revenues are 10 per cent or more of the total segment revenues.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

39

The guidelines to determine that a segment is reportable in accordance with AASB 8 Operating Segments includes:

A) The segment's assets are equal to or greater than 10 per cent of the entity's total assets.

B) The expenses of the segment that relate to external sales are equal to or greater than 10 per cent of total segment expenses.

C) The segment's assets are 10 per cent or more of the combined assets of all operating segments.

D) The expenses of the segment that relate to external and internal sales are equal to or greater than 10 per cent of total segment expenses.

A) The segment's assets are equal to or greater than 10 per cent of the entity's total assets.

B) The expenses of the segment that relate to external sales are equal to or greater than 10 per cent of total segment expenses.

C) The segment's assets are 10 per cent or more of the combined assets of all operating segments.

D) The expenses of the segment that relate to external and internal sales are equal to or greater than 10 per cent of total segment expenses.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

40

An operating segment is defined by AASB 8 as:

A) a component of an entity that is of separable and identifiable interest to a section of stakeholders of the entity.

B) a distinguishable component of an entity and that component is engaged in providing an individual product or service or group of related products or services and is subject to risks and returns that are different from those of other distinguishable components of the entity.

C) an identifiable component of an entity that is engaged in providing an individual product or service to other entities within the group and is subject to special risks and returns as a result of relying on other components of the entity.

D) an identifiable component of an entity based on functional relationships with suppliers or customers or financiers established over a period of time.

A) a component of an entity that is of separable and identifiable interest to a section of stakeholders of the entity.

B) a distinguishable component of an entity and that component is engaged in providing an individual product or service or group of related products or services and is subject to risks and returns that are different from those of other distinguishable components of the entity.

C) an identifiable component of an entity that is engaged in providing an individual product or service to other entities within the group and is subject to special risks and returns as a result of relying on other components of the entity.

D) an identifiable component of an entity based on functional relationships with suppliers or customers or financiers established over a period of time.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

41

In accordance with AASB 8 an operating segment is a component of an entity:

A) that engages in business activities from which it may earn revenues and incur expenses.

B) whose operating results are regularly reviewed by the entity's chief operating decision maker to make decisions about resources to be allocated to the segment and asses its performance.

C) for which discrete financial information is available.

D) All of the given answers are correct.

A) that engages in business activities from which it may earn revenues and incur expenses.

B) whose operating results are regularly reviewed by the entity's chief operating decision maker to make decisions about resources to be allocated to the segment and asses its performance.

C) for which discrete financial information is available.

D) All of the given answers are correct.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

42

Consider the following list of operating segments and segment results for the current reporting period relating to Legolas Ltd,and answer the question below. What is the minimum loss (rounded to the nearest $1000)that the publishing segment could have made for that segment to be considered a reportable segment according to AASB 8?

A) ($39 000)

B) ($114 000)

C) ($103 000)

D) ($142 000)

A) ($39 000)

B) ($114 000)

C) ($103 000)

D) ($142 000)

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

43

The following information relates to All Industrials Ltd and its operating segment (in $'000s): Which operating segments are considered to be reportable under AASB 8 using the segment asset qualitative threshold?

A) all segments

B) retail and agriculture

C) retail, agriculture and brewing

D) retail, agriculture and chemicals

A) all segments

B) retail and agriculture

C) retail, agriculture and brewing

D) retail, agriculture and chemicals

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

44

Segment expenses do not include:

A) joint venturer's expenses relating to the operation of joint venture operations.

B) losses on sales of investments or extinguishment of debt unless the segment's operations are primarily financial in nature.

C) income tax expense.

D) losses on sales of investments or extinguishment of debt unless the segment's operations are primarily financial in nature and before income tax expense.

A) joint venturer's expenses relating to the operation of joint venture operations.

B) losses on sales of investments or extinguishment of debt unless the segment's operations are primarily financial in nature.

C) income tax expense.

D) losses on sales of investments or extinguishment of debt unless the segment's operations are primarily financial in nature and before income tax expense.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

45

AASB 8 is more:

A) rules based.

B) cost based.

C) principles based.

D) profit based.

A) rules based.

B) cost based.

C) principles based.

D) profit based.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

46

The following segment information is presented for Hobbitt Ltd: Which segments are reportable according to the guidelines provided in AASB 8?

A) retailing, light manufacturing, mining, marine transport, general insurance

B) retailing, marine transport

C) light manufacturing, mining, marine transport, general insurance

D) retailing, mining, marine transport

A) retailing, light manufacturing, mining, marine transport, general insurance

B) retailing, marine transport

C) light manufacturing, mining, marine transport, general insurance

D) retailing, mining, marine transport

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

47

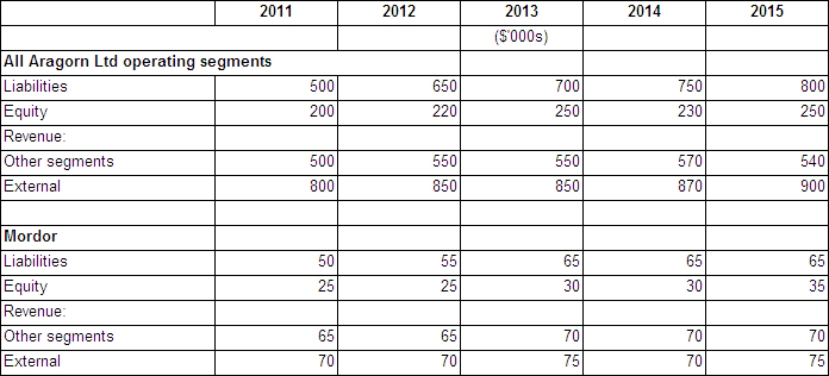

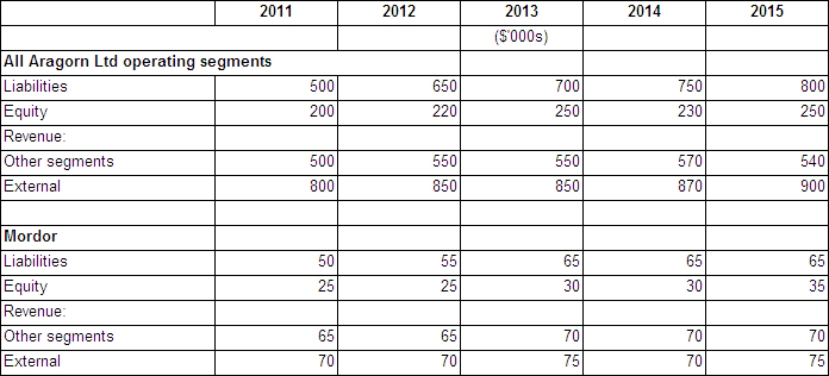

The following information relates to Aragorn Ltd and its Mordor segment:  In which years would the Mordor segment be classified as a reportable segment according to AASB 8?

In which years would the Mordor segment be classified as a reportable segment according to AASB 8?

A) 2011, 2013 and 2015

B) 2011, 2012, 2013 and 2015

C) 2012, 2013, 2014 and 2015

D) 2013 and 2015

In which years would the Mordor segment be classified as a reportable segment according to AASB 8?

In which years would the Mordor segment be classified as a reportable segment according to AASB 8?A) 2011, 2013 and 2015

B) 2011, 2012, 2013 and 2015

C) 2012, 2013, 2014 and 2015

D) 2013 and 2015

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

48

AASB 8 requires:

A) the segments to be identified as business segments or geographical segments.

B) the amount reported for each operating segment item to be the measure reported to the chief operating decision maker.

C) the reporting entity to determine its primary reporting format.

D) the segments to be based on the location of assets or location of customers.

A) the segments to be identified as business segments or geographical segments.

B) the amount reported for each operating segment item to be the measure reported to the chief operating decision maker.

C) the reporting entity to determine its primary reporting format.

D) the segments to be based on the location of assets or location of customers.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

49

AASB 8 requires a number of reconciliations to be presented,including:

A) total reportable segment financial expenses reconciled to total entity financial expenses.

B) total reportable segment revenues reconciled to total entity revenues.

C) total reportable segment assets reconciled to total entity assets.

D) total reportable segment revenues reconciled to total entity revenues and total segment assets reconciled to total entity assets.

A) total reportable segment financial expenses reconciled to total entity financial expenses.

B) total reportable segment revenues reconciled to total entity revenues.

C) total reportable segment assets reconciled to total entity assets.

D) total reportable segment revenues reconciled to total entity revenues and total segment assets reconciled to total entity assets.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

50

The following information relates to All Industrials Ltd and its operating segment (in $'000s): Which operating segments are considered to be reportable under AASB 8 using the absolute amount of its reported profit or loss qualitative threshold?

A) all segments

B) retail and agriculture

C) retail, agriculture and brewing

D) retail, agriculture and chemicals

A) all segments

B) retail and agriculture

C) retail, agriculture and brewing

D) retail, agriculture and chemicals

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

51

According to AASB 8,'where total external revenues attributable to reportable segments constitute less than 75 per cent of the entity's total revenues':

A) additional reportable segments must be identified in accordance with the definition of reportable segments, until at least 75 per cent of the entity's total revenues are included in reportable segments.

B) the entity reports those segments already identified as reportable, even though they constitute less than 75 per cent of the entity's total revenues.

C) additional segments must be identified as reportable segments, even if they do not qualify as reportable segments, until at least 75 per cent of the entity's total revenues are included in reportable segments.

D) the entity considers whether total external revenues attributable to reportable segments constitute greater than 75 per cent of the entity's total external revenues, and if so, report those segments already identified.

A) additional reportable segments must be identified in accordance with the definition of reportable segments, until at least 75 per cent of the entity's total revenues are included in reportable segments.

B) the entity reports those segments already identified as reportable, even though they constitute less than 75 per cent of the entity's total revenues.

C) additional segments must be identified as reportable segments, even if they do not qualify as reportable segments, until at least 75 per cent of the entity's total revenues are included in reportable segments.

D) the entity considers whether total external revenues attributable to reportable segments constitute greater than 75 per cent of the entity's total external revenues, and if so, report those segments already identified.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

52

Information about operating segments that do not meet any of the quantitative thresholds:

A) should be ignored.

B) shall be combined and disclosed in an 'all other segments' category.

C) should be combined with other segments that exhibit similar economic characteristics.

D) All of the given answers are correct.

A) should be ignored.

B) shall be combined and disclosed in an 'all other segments' category.

C) should be combined with other segments that exhibit similar economic characteristics.

D) All of the given answers are correct.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following is not likely to be a 'chief operating decision maker' as referred to in AASB 8 Operating Segments?

A) executive committee of the board

B) chief executive officer

C) chief operating officer

D) chief accountant

A) executive committee of the board

B) chief executive officer

C) chief operating officer

D) chief accountant

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

54

AASB 8 requires reconciliation of reported segments' amounts to the entity's reported amount for which of the following items?

A) dividend income

B) expenses

C) depreciation

D) liabilities

A) dividend income

B) expenses

C) depreciation

D) liabilities

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

55

AASB 8 requires entities to disclose information to enable users of its financial statements to:

A) ensure management is using the resources efficiently.

B) evaluate the nature and financial effects of the business activities the entity is engaged in.

C) better understand the geographical areas.

D) determine the liabilities relating to finance leases.

A) ensure management is using the resources efficiently.

B) evaluate the nature and financial effects of the business activities the entity is engaged in.

C) better understand the geographical areas.

D) determine the liabilities relating to finance leases.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

56

Consider the following list of operating segments and segment assets for the current reporting period relating to Arwen Ltd,and answer the question below. What is the minimum asset amount (rounded to the nearest $1000)that the fast food segment should have for that segment to be considered a reportable segment according to AASB 8?

A) $83 000

B) $106 000

C) $174 000

D) $184 000

A) $83 000

B) $106 000

C) $174 000

D) $184 000

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

57

In accordance with AASB 8 Operating Segments,which of the following statements is incorrect?

A) If the total external revenue reported by operating segments constitutes less than 75 per cent of the entity's revenue, additional operating segments shall be identified as reportable segments until at least 75 per cent of the entity's revenue is included in reportable segments.

B) Operating segments that are not reportable are combined and disclosed as part of 'all other segments'.

C) If management judges that an operating segment identified as a reportable segment in the immediately preceding period is of continuing significance, information about that segment shall continue to be reported separately in the current period even if it no longer meets the criteria for a reportable segment.

D) Identification of operating segments in AASB 8 Operating Segments adopts a 'rules-based' approach, while its predecessor AASB 114 Segment Reporting adopted a 'principles-based' approach.

A) If the total external revenue reported by operating segments constitutes less than 75 per cent of the entity's revenue, additional operating segments shall be identified as reportable segments until at least 75 per cent of the entity's revenue is included in reportable segments.

B) Operating segments that are not reportable are combined and disclosed as part of 'all other segments'.

C) If management judges that an operating segment identified as a reportable segment in the immediately preceding period is of continuing significance, information about that segment shall continue to be reported separately in the current period even if it no longer meets the criteria for a reportable segment.

D) Identification of operating segments in AASB 8 Operating Segments adopts a 'rules-based' approach, while its predecessor AASB 114 Segment Reporting adopted a 'principles-based' approach.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

58

The following information is provided for Gandalf Ltd: Which segments are reportable according to the guidelines provided in AASB 8?

A) retailing, marine transport, general insurance

B) retailing, heavy manufacturing, marine transport, general insurance

C) retailing, light manufacturing, marine transport, general insurance

D) retailing, light manufacturing, mining, marine transport, general insurance

A) retailing, marine transport, general insurance

B) retailing, heavy manufacturing, marine transport, general insurance

C) retailing, light manufacturing, marine transport, general insurance

D) retailing, light manufacturing, mining, marine transport, general insurance

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

59

The following information relates to All Industrials Ltd and its operating segment (in $'000s): Which operating segments are considered to be reportable under AASB 8 using the segment revenue qualitative threshold?

A) all segments

B) retail and agriculture

C) retail, agriculture and brewing

D) retail, agriculture and chemicals

A) all segments

B) retail and agriculture

C) retail, agriculture and brewing

D) retail, agriculture and chemicals

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

60

According to AASB 8 segment assets are:

A) the net value of assets that are directly employed by a segment in its activities.

B) the gross value of assets attributable to the segment plus any share of centrally held assets that contribute to segment activities indirectly.

C) the current assets that constitute the working capital of the segment and are used directly in its activities plus any non-current assets specifically held for the purpose identified as the segment's business or geographical activity.

D) required to be disclosed by way of an explanation of how the assets are measured for each reportable item.

A) the net value of assets that are directly employed by a segment in its activities.

B) the gross value of assets attributable to the segment plus any share of centrally held assets that contribute to segment activities indirectly.

C) the current assets that constitute the working capital of the segment and are used directly in its activities plus any non-current assets specifically held for the purpose identified as the segment's business or geographical activity.

D) required to be disclosed by way of an explanation of how the assets are measured for each reportable item.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

61

In accordance with AASB 8 Operating Segments,which of the following statements is incorrect?

A) The standard requires an entity to report financial and descriptive information about its reportable segments.

B) Reportable segments are operating segments or aggregations of operating segments that meet specified criteria.

C) The standard requires an entity to report a measure of operating segment profit or loss and of segment assets.

D) Reportable segments exclude business activities for which it has yet to earn revenues (e.g. start-up operations).

A) The standard requires an entity to report financial and descriptive information about its reportable segments.

B) Reportable segments are operating segments or aggregations of operating segments that meet specified criteria.

C) The standard requires an entity to report a measure of operating segment profit or loss and of segment assets.

D) Reportable segments exclude business activities for which it has yet to earn revenues (e.g. start-up operations).

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

62

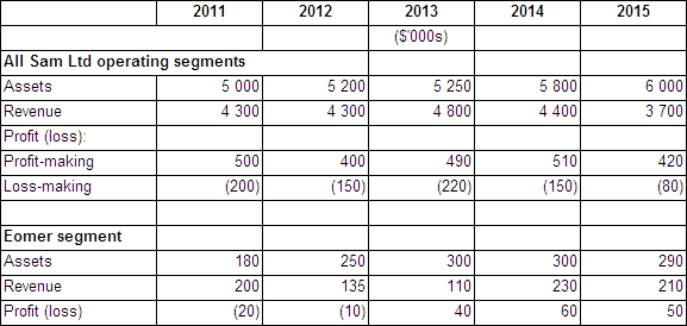

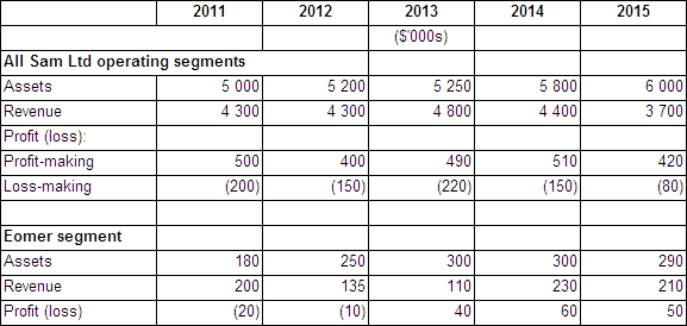

The following information relates to Sam Ltd and its Eomer segment:  In accordance with AASB 8 Operating Segments,in which years is the Eomer segment a reportable segment?

In accordance with AASB 8 Operating Segments,in which years is the Eomer segment a reportable segment?

A) 2011, 2012 and 2013

B) 2011, 2014 and 2015

C) 2011 and 2014

D) 2012 and 2013

In accordance with AASB 8 Operating Segments,in which years is the Eomer segment a reportable segment?

In accordance with AASB 8 Operating Segments,in which years is the Eomer segment a reportable segment?A) 2011, 2012 and 2013

B) 2011, 2014 and 2015

C) 2011 and 2014

D) 2012 and 2013

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

63

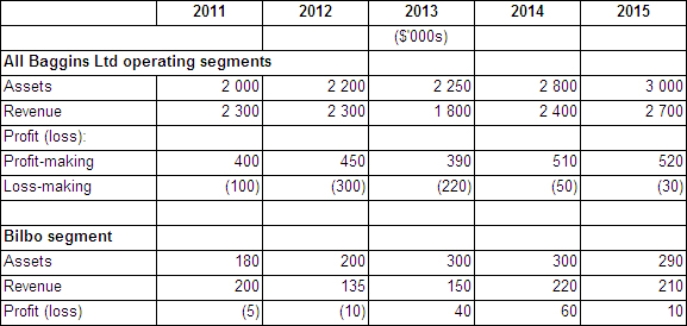

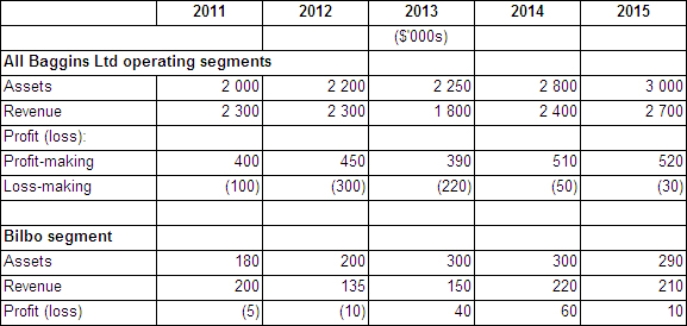

The following information relates to Baggins Ltd and its Bilbo segment:  In accordance with AASB 8 Operating Segments,in which years is the Bilbo segment a reportable?

In accordance with AASB 8 Operating Segments,in which years is the Bilbo segment a reportable?

A) 2011, 2012 and 2013

B) 2012, 2013 and 2014

C) 2011 and 2012

D) 2013 and 2014

In accordance with AASB 8 Operating Segments,in which years is the Bilbo segment a reportable?

In accordance with AASB 8 Operating Segments,in which years is the Bilbo segment a reportable?A) 2011, 2012 and 2013

B) 2012, 2013 and 2014

C) 2011 and 2012

D) 2013 and 2014

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

64

In addition to financial information disclosures,AASB 8 also requires disclosure of non-financial information.Discuss what non-financial disclosures related to segment reporting are required under AASB 8 and the rationale for these disclosures.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

65

Discuss the concerns raised about competitive disadvantage to the reporting entity in providing disclosures on operating segments.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

66

Discuss the advantages and disadvantages to the users and preparers of financial reports of disclosing segment data.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

67

Edwards and Smith (1996)found that one of the main reasons companies resisted segment disclosures is:

A) There are unreasonable costs to prepare disclosures.

B) Investors were not interested in additional information.

C) The financial report had sufficient information for users.

D) It means a competitive disadvantage.

A) There are unreasonable costs to prepare disclosures.

B) Investors were not interested in additional information.

C) The financial report had sufficient information for users.

D) It means a competitive disadvantage.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

68

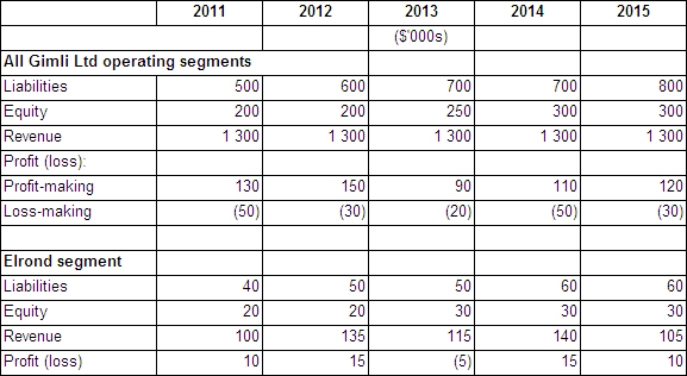

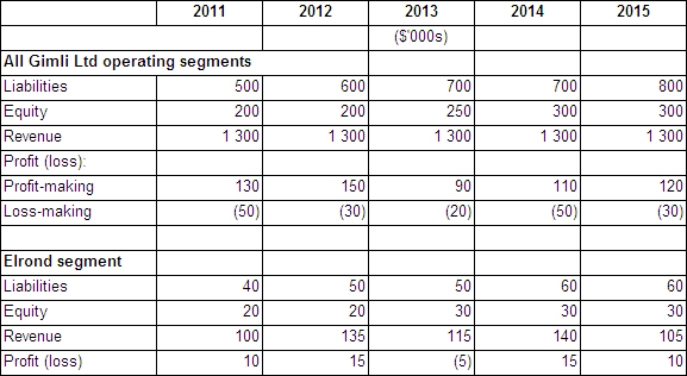

The following information relates to Gimli Ltd and its Elrond segment:  In accordance with AASB 8 Operating Segments,in which years is the Elrond segment a reportable segment?

In accordance with AASB 8 Operating Segments,in which years is the Elrond segment a reportable segment?

A) 2011, 2012 and 2013

B) 2012, 2013 and 2014

C) 2012 and 2014

D) 2011 and 2015

In accordance with AASB 8 Operating Segments,in which years is the Elrond segment a reportable segment?

In accordance with AASB 8 Operating Segments,in which years is the Elrond segment a reportable segment?A) 2011, 2012 and 2013

B) 2012, 2013 and 2014

C) 2012 and 2014

D) 2011 and 2015

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

69

What is the rationale for including a final threshold test where entities are required to include in their reportable segment at least 75 per cent of the entity's total external revenues?

What action must an entity take if this threshold is not achieved?

What action must an entity take if this threshold is not achieved?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

70

Discuss the specific financial information items that must be disclosed in relation to segment reporting.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

71

Explain the reconciliation information AASB 8 requires for segment reporting.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

72

Discuss the entity-wide disclosures in AASB 8 that need to been made about major customers.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

73

Discuss the issues involved in allowing management to determine the basis of measurement for operating segments.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

74

One of the advantages of AASB segment reporting is?

A) all segments are reportable

B) provides full disclosure of the entity's activities

C) highlights the performance of the different entity activities

D) increased rules based reporting

A) all segments are reportable

B) provides full disclosure of the entity's activities

C) highlights the performance of the different entity activities

D) increased rules based reporting

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

75

Discuss the reasons for the release of IFRS 8.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

76

AASB 8 requires which of the following information to be disclosed about major customers?

A) customer identity

B) revenues when greater that 10 per cent of an entity's revenue

C) amount of revenues for each segment

D) revenue history

A) customer identity

B) revenues when greater that 10 per cent of an entity's revenue

C) amount of revenues for each segment

D) revenue history

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

77

AASB 8 requires reconciliation of reported segments' amounts to the entity's reported amount for which of the following items?

A) dividend income

B) expenses

C) depreciation

D) revenues

A) dividend income

B) expenses

C) depreciation

D) revenues

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck