Deck 7: Inventory

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/75

Play

Full screen (f)

Deck 7: Inventory

1

The cost-flow assumption selected for inventory costing purposes should always reflect the physical flow of goods out of inventory.

False

2

In periods where production costs or purchase prices of inventory items do not change,it does not matter which inventory method is adopted as this would generate the same value for cost of goods sold and ending inventory.

True

3

Some biological assets may be covered by AASB 102 Inventories.

True

4

When reversing a previous period inventory write down,this would result in a debit entry to the inventory account.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

5

The first-in,first-out (FIFO)method assumes that items remaining in inventory at the end of the period are those most recently purchased or produced.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

6

AASB 102 applies to all inventories including work in progress under construction contracts.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

7

AASB 102 provides that inventories must be valued at the lower of cost and net realisable value for groups of homogeneous items where it is impracticable to measure them on an item-by-item basis.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

8

A company engaged in buying and selling equity securities should consider this asset as inventory and should be accounted for in accordance with AASB 102.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

9

The definition of inventories includes assets in the form of materials or supplies to be consumed in the production process or in rendering of services.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

10

The only difference between IAS 2 and AASB 102 is that the 'international' standards allow inventory to be valued using LIFO.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

11

The value of inventory reported in the financial statements under AASB 102 may be reported at an amount lower than its original cost.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

12

Reversal of a previous inventory write down is not advocated in AASB 102.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

13

Upward revaluation of inventory is permitted for as long as all assets in same inventory class are revalued.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

14

Standard costs may be used to arrive at the cost of inventory only where standards are set at ideal levels and any costs arising from exceptional wastage are excluded from the cost of inventories.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

15

The cost of sub-contracted work is not included in costs of conversion for the purposes of calculating the cost of inventory.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

16

The measurement of inventories is no different for not-for-profit entities.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

17

FIFO method is an income decreasing inventory cost flow method in periods of rising prices.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

18

Perpetual inventory system is also known as the physical inventory method.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

19

AASB 102 requires that fixed manufacturing costs be excluded from the cost of inventories,as they cannot be allocated accurately.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

20

AASB 102 Inventories applies to biological assets related to agricultural activity.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

21

The cost of inventory is defined by AASB 102 as including:

A) the cost of purchase and conversion.

B) duties and taxes on purchase of goods or services for sale.

C) the cost incurred in the normal course of operations to bring the inventories to their present location and condition.

D) all of the given answers.

A) the cost of purchase and conversion.

B) duties and taxes on purchase of goods or services for sale.

C) the cost incurred in the normal course of operations to bring the inventories to their present location and condition.

D) all of the given answers.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

22

According to AASB 102,one or more of which set of methods should be used to apply the costs of inventories to particular items of inventory?

A) specific identification, LIFO or FIFO

B) absorption costing, weighted average costing or LIFO

C) FIFO, specific identification or weighted average cost

D) weighted average costing, ABC costing or FIFO

A) specific identification, LIFO or FIFO

B) absorption costing, weighted average costing or LIFO

C) FIFO, specific identification or weighted average cost

D) weighted average costing, ABC costing or FIFO

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

23

Under AASB 102 revaluations are permitted:

A) only in the form of a write-down.

B) only when an independent valuation is made by an external party.

C) only if upward revaluations are credited to an inventory revaluation reserve.

D) only if the replacement cost of the asset is higher than the historical cost.

A) only in the form of a write-down.

B) only when an independent valuation is made by an external party.

C) only if upward revaluations are credited to an inventory revaluation reserve.

D) only if the replacement cost of the asset is higher than the historical cost.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

24

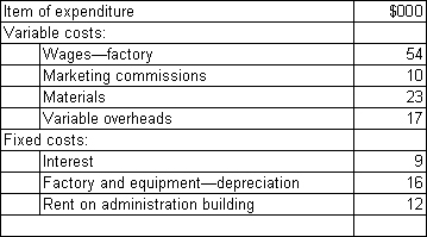

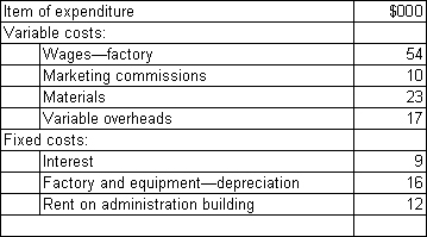

Digitoll Ltd produces a range of computer accessories.One product is a webcam.The following are the summary costs for the web-cam for the period ended 31 December 2012:

The production level this period was normal at 10 000 units.What is the cost per unit (rounded to the nearest cent)in accordance with AASB 102 requirements?

A) $11.00

B) $10.40

C) $14.10

D) $11.90

The production level this period was normal at 10 000 units.What is the cost per unit (rounded to the nearest cent)in accordance with AASB 102 requirements?

A) $11.00

B) $10.40

C) $14.10

D) $11.90

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

25

AASB 102 on inventories does not apply to:

A) trees held for sale as part of forestry operations.

B) work-in-progress under construction contracts.

C) agricultural produce of a biological asset.

D) any of the given answers.

A) trees held for sale as part of forestry operations.

B) work-in-progress under construction contracts.

C) agricultural produce of a biological asset.

D) any of the given answers.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

26

AASB 102 requires that inventory is valued at:

A) the lower of cost and recoverable value, on an item-by-item basis where practicable.

B) cost or fair value for classes of assets and services that are defined as inventories.

C) the lower of cost and net realisable value, on an item-by-item basis where practicable.

D) cost or deprival value, whichever is the lower, for classes of inventories.

A) the lower of cost and recoverable value, on an item-by-item basis where practicable.

B) cost or fair value for classes of assets and services that are defined as inventories.

C) the lower of cost and net realisable value, on an item-by-item basis where practicable.

D) cost or deprival value, whichever is the lower, for classes of inventories.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

27

The following information relates to the total production costs and estimates of realisable value for a line of water pistols produced by Splash Happy Co Ltd.

Packaging and transport costs are necessarily incurred in order to be able to sell the inventory.What is the value of the inventory in accordance with AASB 102?

A) $37 000

B) $21 000

C) $39 000

D) $36 000

Packaging and transport costs are necessarily incurred in order to be able to sell the inventory.What is the value of the inventory in accordance with AASB 102?

A) $37 000

B) $21 000

C) $39 000

D) $36 000

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

28

Handy Ltd produces a line of brooms.The summary cost information for brooms for the year ended 30 June 2012 is:

The level of output for the period was the normal level of production of 290 000 units.What is the cost per broom (rounded to the nearest cent)in accordance with AASB 102 requirements?

A) $4.13

B) $2.00

C) $0.13

D) $2.06

The level of output for the period was the normal level of production of 290 000 units.What is the cost per broom (rounded to the nearest cent)in accordance with AASB 102 requirements?

A) $4.13

B) $2.00

C) $0.13

D) $2.06

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

29

Toey Ltd has provided the following information about the total production cost and estimates of realisable value of three lines of shoes they produce within the same class of inventory

Packaging and freight are necessary in order to be able to sell the shoes.What is the value of the inventory in accordance with AASB 102?

A) $34 000

B) $40 000

C) $32 000

D) $24 000

Packaging and freight are necessary in order to be able to sell the shoes.What is the value of the inventory in accordance with AASB 102?

A) $34 000

B) $40 000

C) $32 000

D) $24 000

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following statements is correct in relation to the costing of inventories?

A) Direct costing treats fixed production costs as an expense of the period and is not permitted as a method for valuing inventories under AASB 102.

B) Absorption costing treats fixed production costs as a product cost, allocating them to the goods produced, and is not permitted as a method for valuing inventories under AASB 102.

C) Absorption costing treats fixed production costs as an expense of the period and is the required method for valuing inventories under AASB 102.

D) Direct costing treats fixed production costs as a product cost, allocating them to the goods produced, and is not permitted as a method of valuing inventory under AASB 102.

A) Direct costing treats fixed production costs as an expense of the period and is not permitted as a method for valuing inventories under AASB 102.

B) Absorption costing treats fixed production costs as a product cost, allocating them to the goods produced, and is not permitted as a method for valuing inventories under AASB 102.

C) Absorption costing treats fixed production costs as an expense of the period and is the required method for valuing inventories under AASB 102.

D) Direct costing treats fixed production costs as a product cost, allocating them to the goods produced, and is not permitted as a method of valuing inventory under AASB 102.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

31

Standard costs are able to be used under AASB 102 where:

A) they have been properly set and maintained.

B) they are realistically attainable and are reviewed regularly.

C) they are assessed to be a sound basis for the purpose of inventory valuation.

D) they are revised in the light of current conditions as necessary.

A) they have been properly set and maintained.

B) they are realistically attainable and are reviewed regularly.

C) they are assessed to be a sound basis for the purpose of inventory valuation.

D) they are revised in the light of current conditions as necessary.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

32

In times of rising prices for inventory,which of the following is true?

A) LIFO adopters would report higher cost of goods sold and lower ending inventory than FIFO adopters.

B) FIFO adopters would report higher profits and lower ending inventory than LIFO adopters.

C) LIFO adopters would report higher profits and higher ending inventory than FIFO adopters.

D) FIFO adopters would report higher cost of goods sold and higher ending inventory than LIFO adopters.

A) LIFO adopters would report higher cost of goods sold and lower ending inventory than FIFO adopters.

B) FIFO adopters would report higher profits and lower ending inventory than LIFO adopters.

C) LIFO adopters would report higher profits and higher ending inventory than FIFO adopters.

D) FIFO adopters would report higher cost of goods sold and higher ending inventory than LIFO adopters.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

33

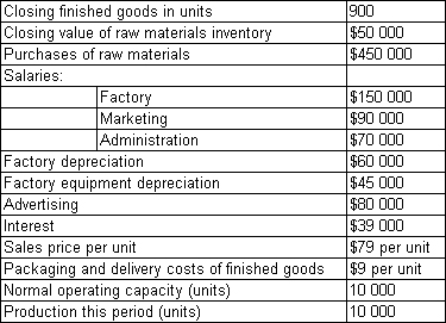

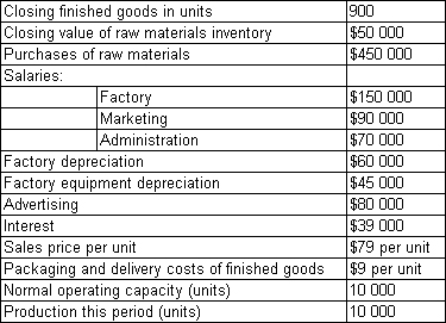

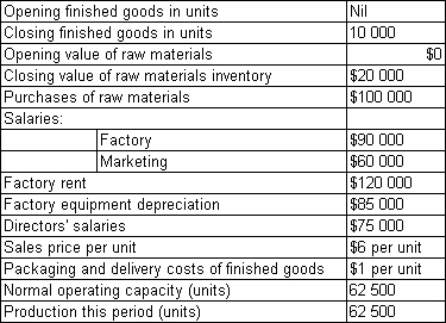

Balmoral Ltd commenced business on 1 July 2011.The company manufactures bookcases.Summary data for Balmoral's first full year of operations are:

Packaging and delivery are essential to be able to sell the product.What total value should be attributed to finished goods inventory in the financial statements in accordance with AASB 102?

A) $58 950

B) $63 000

C) $49 500

D) $69 660

Packaging and delivery are essential to be able to sell the product.What total value should be attributed to finished goods inventory in the financial statements in accordance with AASB 102?

A) $58 950

B) $63 000

C) $49 500

D) $69 660

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

34

AASB 102 provides that not-for-profit entities:

A) must value their assets at the lower of cost or net realisable value to allow reports to be compared.

B) should only report inventories at cost for simplicity.

C) should value their assets at either cost or current replacement cost, whichever is more beneficial.

D) will record the inventories at the lower of cost or current replacement cost.

A) must value their assets at the lower of cost or net realisable value to allow reports to be compared.

B) should only report inventories at cost for simplicity.

C) should value their assets at either cost or current replacement cost, whichever is more beneficial.

D) will record the inventories at the lower of cost or current replacement cost.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is not a definition in AASB 102 on inventories?

A) Assets in the form of materials or supplies to be consumed in the production process.

B) Assets in the process of production for sale.

C) Raw materials to be used in maintaining machines that prepare goods for sale.

D) Assets held for sale in the ordinary course of business.

A) Assets in the form of materials or supplies to be consumed in the production process.

B) Assets in the process of production for sale.

C) Raw materials to be used in maintaining machines that prepare goods for sale.

D) Assets held for sale in the ordinary course of business.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

36

Fixed production costs are those that,within normal operating limits:

A) vary in relation to production volume by a fixed amount.

B) remain a constant per unit amount as volume changes.

C) vary in relation to the levels of input but remain constant at varying levels of output.

D) remain a constant amount at varying production volume levels.

A) vary in relation to production volume by a fixed amount.

B) remain a constant per unit amount as volume changes.

C) vary in relation to the levels of input but remain constant at varying levels of output.

D) remain a constant amount at varying production volume levels.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

37

AASB 102 requires that the specific identification method of assigning cost to items of inventory be applied:

A) wherever possible in order to achieve the most accurate cost figure.

B) to items of inventory that are ordinarily interchangeable or identical and have significant individual dollar value.

C) wherever items are separately identifiable and of significant individual dollar value.

D) to items of inventory that are not ordinarily interchangeable or are produced and segregated for specific projects.

A) wherever possible in order to achieve the most accurate cost figure.

B) to items of inventory that are ordinarily interchangeable or identical and have significant individual dollar value.

C) wherever items are separately identifiable and of significant individual dollar value.

D) to items of inventory that are not ordinarily interchangeable or are produced and segregated for specific projects.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

38

The two main methods for dealing with fixed costs in relation to the production of inventory are:

A) variable costing and incremental costing.

B) absorption costing and direct costing.

C) overhead costing and ABC costing.

D) relevant costing and incremental costing.

A) variable costing and incremental costing.

B) absorption costing and direct costing.

C) overhead costing and ABC costing.

D) relevant costing and incremental costing.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

39

According to AASB 102 inventories include assets:

A) such as service contracts arising under construction contracts.

B) held over the long term for use in the production process.

C) such as financial instruments.

D) held in the process of production, preparation or conversion for sale.

A) such as service contracts arising under construction contracts.

B) held over the long term for use in the production process.

C) such as financial instruments.

D) held in the process of production, preparation or conversion for sale.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

40

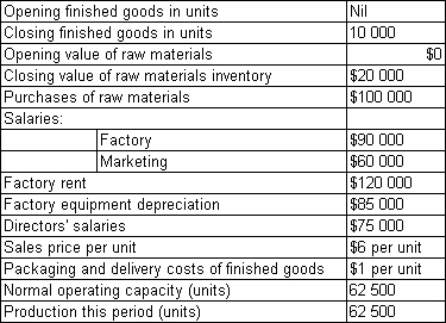

Video Productions Ltd commenced business manufacturing video tapes on 1 July 2011.Summary data for the first full year of production are:

Packaging and delivery are essential to be able to sell the product.What total value should be attributed to finished goods inventory in the financial statements in accordance with AASB 102?

A) $66 400

B) $72 000

C) $46 400

D) $50 000

Packaging and delivery are essential to be able to sell the product.What total value should be attributed to finished goods inventory in the financial statements in accordance with AASB 102?

A) $66 400

B) $72 000

C) $46 400

D) $50 000

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

41

Circle Ltd manufactures polystyrene trays for a variety of purposes.The following information relates to the production of the medium trays used by meat packing companies for the period ended 30 June 2012.

The company uses a perpetual inventory system.The net realisable value per extra large cardboard box is $0.17 at the end of the period.What are the costs of sales and the value of ending inventory for Rectangle Ltd assuming the FIFO cost-flow assumption is used?

A) cost of sales: $633.80; ending inventory: $83

B) cost of sales: $654.55; ending inventory: $62.25

C) cost of sales: $657.19; ending inventory: $59.61

D) cost of sales: $633.80; ending inventory: $70.55

The company uses a perpetual inventory system.The net realisable value per extra large cardboard box is $0.17 at the end of the period.What are the costs of sales and the value of ending inventory for Rectangle Ltd assuming the FIFO cost-flow assumption is used?

A) cost of sales: $633.80; ending inventory: $83

B) cost of sales: $654.55; ending inventory: $62.25

C) cost of sales: $657.19; ending inventory: $59.61

D) cost of sales: $633.80; ending inventory: $70.55

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

42

The periodic inventory system operates by:

A) keeping track of inventory as it comes into the organisation and as it leaves.

B) counting inventory at regular intervals to establish how much of each item is on hand.

C) assuming that the inventory that came in first is the first to be sold.

D) tracking the cost of specific items of inventory to the products sold by grouping items according to cost drivers.

A) keeping track of inventory as it comes into the organisation and as it leaves.

B) counting inventory at regular intervals to establish how much of each item is on hand.

C) assuming that the inventory that came in first is the first to be sold.

D) tracking the cost of specific items of inventory to the products sold by grouping items according to cost drivers.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

43

According to AASB 102 material information relating to which of the following must be disclosed?

A) the carrying amount of closing inventories included in equity accounted profits

B) the carrying amount of inventories classified as non-current assets

C) the aggregate amount of inventory recorded at recoverable amount

D) the carrying amount of inventories revalued upwards as at the end of the period

A) the carrying amount of closing inventories included in equity accounted profits

B) the carrying amount of inventories classified as non-current assets

C) the aggregate amount of inventory recorded at recoverable amount

D) the carrying amount of inventories revalued upwards as at the end of the period

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following statements is correct with respect to positive accounting theory?

A) Managers of firms with bonus-based contracts prefer LIFO method of valuation basis, if permitted.

B) Managers of firms with bonus-based contracts prefer FIFO method of valuation basis.

C) Managers prefer the FIFO method of valuation basis.

D) Managers with debt covenants prefer LIFO method, if permitted.

A) Managers of firms with bonus-based contracts prefer LIFO method of valuation basis, if permitted.

B) Managers of firms with bonus-based contracts prefer FIFO method of valuation basis.

C) Managers prefer the FIFO method of valuation basis.

D) Managers with debt covenants prefer LIFO method, if permitted.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

45

Rectangle Ltd manufactures cardboard boxes for a variety of purposes.The following information relates to the production of the extra large packing boxes used by removalists for the period ended 30 June 2012.

The company uses a perpetual inventory system.The net realisable value per extra large cardboard box is $3.15 at the end of the period.What are the costs of goods sold and the value of ending inventory for Rectangle Ltd assuming the LIFO cost-flow assumption is used?

A) cost of sales: $3460.40; ending inventory: $380.00

B) cost of sales: $3453.90; ending inventory: $393.75

C) cost of sales: $3459.41; ending inventory: $380.99

D) cost of sales: $3453.90; ending inventory: $386.50

The company uses a perpetual inventory system.The net realisable value per extra large cardboard box is $3.15 at the end of the period.What are the costs of goods sold and the value of ending inventory for Rectangle Ltd assuming the LIFO cost-flow assumption is used?

A) cost of sales: $3460.40; ending inventory: $380.00

B) cost of sales: $3453.90; ending inventory: $393.75

C) cost of sales: $3459.41; ending inventory: $380.99

D) cost of sales: $3453.90; ending inventory: $386.50

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

46

The inventory record of Palm Springs Ltd shows 1000 surf boards on stock that cost $50 each.During the last stocktake,the accountant noted 100 old style surf boards with net realisable amount of $15.What journal entry would be required of Palm Springs to comply with AASB 102?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

47

Which accounting policy for manufacturing fixed costs is likely to favour managers whose firms are subject to political scrutiny?

A) direct costing

B) absorption costing

C) LIFO assuming prices are falling

D) FIFO assuming prices are rising

A) direct costing

B) absorption costing

C) LIFO assuming prices are falling

D) FIFO assuming prices are rising

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

48

Randwick Ltd has a year-end of 30 June 2009.During the year the following errors were discovered. - Merchandise inventory at the factory had been understated by $44 000.

- Goods on consignment from a supplier for $13 000 were included in inventory at the shops.

- Physical inventory for one warehouse had a shortage of $58 000.

What is the net effect of above errors in the statement of comprehensive income and statement of financial position (inventory)accounts of Randwick Ltd?

A)

B)

C)

D)

- Goods on consignment from a supplier for $13 000 were included in inventory at the shops.

- Physical inventory for one warehouse had a shortage of $58 000.

What is the net effect of above errors in the statement of comprehensive income and statement of financial position (inventory)accounts of Randwick Ltd?

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

49

Using the periodic system of inventory:

A) gives the same results as a perpetual system when FIFO is applied but without some of the extra detail.

B) is much more cost-effective as a perpetual system requires a computer.

C) does not require a stock take each year and is therefore more accurate.

D) accurately reports all stock movements which assists with decision making.

A) gives the same results as a perpetual system when FIFO is applied but without some of the extra detail.

B) is much more cost-effective as a perpetual system requires a computer.

C) does not require a stock take each year and is therefore more accurate.

D) accurately reports all stock movements which assists with decision making.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

50

Big Games for Big Kids sell a variety of gaming consoles and games.The company has presented you with the following information for the sales of a new product,Angel's Hat 2,for the three months from November to January.They began in November with 50 units on hand valued at $1500.In the lead up to Christmas each unit sold for $90 but in the post-Christmas sales in January this price was reduced to $50.

Big Games for Big Kids use the periodic system to record inventory.A physical stock take reveals 30 units on hand at the end of January.What is the cost of sales and value of ending inventory using the FIFO cost-flow assumption?

A) cost of sales: $14 190; ending inventory: $1290

B) cost of sales: $14 060; ending inventory: $1420

C) cost of sales: $14 060; ending inventory: $1260

D) cost of sales: $24 850; ending inventory: $1420

Big Games for Big Kids use the periodic system to record inventory.A physical stock take reveals 30 units on hand at the end of January.What is the cost of sales and value of ending inventory using the FIFO cost-flow assumption?

A) cost of sales: $14 190; ending inventory: $1290

B) cost of sales: $14 060; ending inventory: $1420

C) cost of sales: $14 060; ending inventory: $1260

D) cost of sales: $24 850; ending inventory: $1420

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

51

In addition to the cost-flow assumption,the system used to record movements in inventory also affects the determination of the cost of inventory.What are the systems commonly in use for recording the movement of inventory?

A) continuous and cyclic

B) ABC costing and overhead allocation

C) positive and periodic

D) periodic and perpetual

A) continuous and cyclic

B) ABC costing and overhead allocation

C) positive and periodic

D) periodic and perpetual

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

52

Kensington Ltd is an importer and retailer of European made glass crystals.For the year ended 30 June 2008,Kensington Ltd still holds 30 units of an item originally purchased for $10 000 each and a net realisable value of $8000.On 1 June 2009 the TV show Home Improvement featured a similar item prompting an increase in demand for this glass crystal.Management believes that the net realisable value of this item is now $15 000.All 30 items remain unsold on 30 June 2009.What is the effect of holding this inventory on the statement of comprehensive income of Kensington Ltd for the years ended 30 June 2008 and 2009?

A) No effect on both years because the inventory items are still unsold.

B) Decrease profit by $60 000 in 2008; increase profit by $210 000 in 2009.

C) Decrease profit by $60 000 in 2008; no effect in 2009.

D) Decrease profit by $60 000 in 2008; increase profit by $60 000 in 2009.

A) No effect on both years because the inventory items are still unsold.

B) Decrease profit by $60 000 in 2008; increase profit by $210 000 in 2009.

C) Decrease profit by $60 000 in 2008; no effect in 2009.

D) Decrease profit by $60 000 in 2008; increase profit by $60 000 in 2009.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

53

David Gordon is an accountant for Bronte Ltd.At the end of the year he realised that ending inventory was overstated but the purchases account was recorded correctly.What is the effect of correcting the above error in the statement of comprehensive income and statement of financial position (inventory)accounts of Bronte Ltd?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

54

Paris Merchandising Ltd sells ladies skirts.The opening stock consisted of 300 skirts with purchase price of $50 each.Subsequent purchases during the period include: 400 at $60 each and another 200 for $70 each.A total of 700 skirts were sold during the period.What is ending inventory using FIFO method?

A) $10 000

B) $11 800

C) $12 000

D) $14 000

A) $10 000

B) $11 800

C) $12 000

D) $14 000

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

55

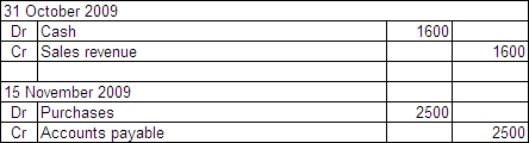

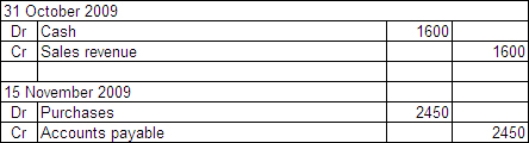

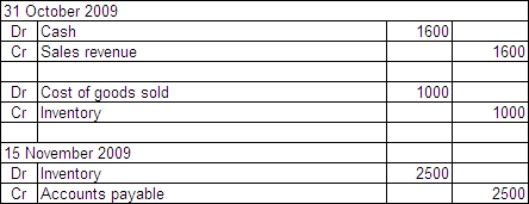

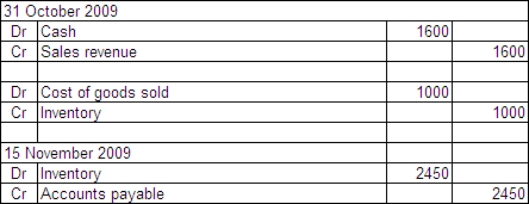

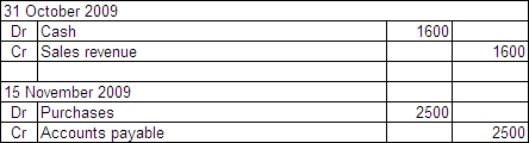

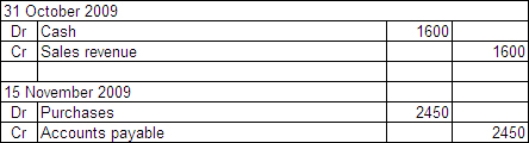

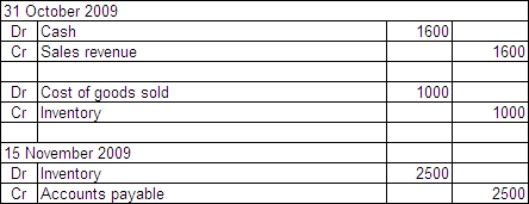

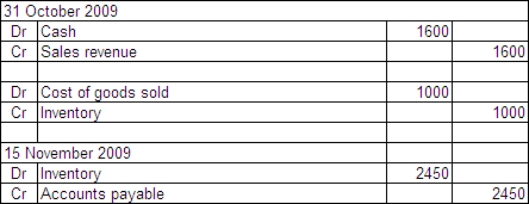

Bondi Ltd is a small sport shop.At the beginning of the period,Bondi Ltd had 30 tennis racquets on hand costing $50 each.On 31 October 2009,the shop sold 20 racquets to a tennis instructor for $80.A delivery of 50 racquets was received on 15 November 2009 at $50 but received 2% discount if the account is paid within 30 days.What are the appropriate journal entries to recognise above transactions using the periodic system?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

56

Use of the LIFO method has been deemed unacceptable under AASB 102 because:

A) It presents too many options to report preparers and may confuse them.

B) This method allows profits to be manipulated by purchasing items at year's end even though they have not been sold.

C) It can result in higher cost of goods sold figures and therefore lower taxes.

D) This method did reflect the actual physical flow of inventories.

A) It presents too many options to report preparers and may confuse them.

B) This method allows profits to be manipulated by purchasing items at year's end even though they have not been sold.

C) It can result in higher cost of goods sold figures and therefore lower taxes.

D) This method did reflect the actual physical flow of inventories.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

57

AASB 102 requires,among others,disclosure of which of the following pieces of information?

A) accounting policy adopted for measuring inventories

B) carrying amount of inventories for each classification of inventory appropriate to the entity

C) amount of any write-down during the period

D) all of the given answers

A) accounting policy adopted for measuring inventories

B) carrying amount of inventories for each classification of inventory appropriate to the entity

C) amount of any write-down during the period

D) all of the given answers

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

58

The valuation of inventories may be on the basis of:

A) the lower of direct cost and recoverable amount.

B) regular revaluations by classes of inventories undertaken at the end of the period.

C) the weighted average of market value and absorption cost over the period.

D) the lower of cost and net realisable value.

A) the lower of direct cost and recoverable amount.

B) regular revaluations by classes of inventories undertaken at the end of the period.

C) the weighted average of market value and absorption cost over the period.

D) the lower of cost and net realisable value.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

59

Oblong Ltd manufactures cardboard boxes for a variety of purposes.The following information relates to the production of the extra large packing boxes used by removalists for the period ended 30 June 2012.

The company uses a perpetual inventory system.The net realisable value per extra large cardboard box is $3.15 at the end of the period.What are the costs of sales and the value of ending inventory for Oblong Ltd assuming the FIFO cost-flow assumption is used?

A) cost of sales: $3460.40; ending inventory: $380.00

B) cost of sales: $3453.90; ending inventory: $386.50

C) cost of sales: $3459.41; ending inventory: $380.99

D) cost of sales: $3453.90 ending inventory: $393.75

The company uses a perpetual inventory system.The net realisable value per extra large cardboard box is $3.15 at the end of the period.What are the costs of sales and the value of ending inventory for Oblong Ltd assuming the FIFO cost-flow assumption is used?

A) cost of sales: $3460.40; ending inventory: $380.00

B) cost of sales: $3453.90; ending inventory: $386.50

C) cost of sales: $3459.41; ending inventory: $380.99

D) cost of sales: $3453.90 ending inventory: $393.75

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

60

Consistent with positive accounting theory,an entity close to breaching their debt covenant will:

A) prefer LIFO method over FIFO method.

B) prefer FIFO method over LIFO method.

C) prefer weighted average method over FIFO method.

D) prefer moving average method over FIFO method.

A) prefer LIFO method over FIFO method.

B) prefer FIFO method over LIFO method.

C) prefer weighted average method over FIFO method.

D) prefer moving average method over FIFO method.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

61

Under the perpetual system,a difference with the stocktake records might indicate:

A) damaged stock.

B) theft of stock.

C) obsolete stock.

D) all of the given answers.

A) damaged stock.

B) theft of stock.

C) obsolete stock.

D) all of the given answers.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

62

What are production overheads?

Explain the criteria to be used when selecting a method to allocate production overheads.

Explain the criteria to be used when selecting a method to allocate production overheads.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

63

Discuss the relative merits of using FIFO and LIFO as basis of cost of inventories during periods of rising prices.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

64

When calculating cost of inventory AASB 102 requires which of the following costs are to be excluded?

A) abnormal amounts of wasted materials

B) selling costs

C) administrative overheads

D) All of the given answers should be excluded.

A) abnormal amounts of wasted materials

B) selling costs

C) administrative overheads

D) All of the given answers should be excluded.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

65

Discuss why LIFO cost-flow method is not permitted in Australia under AASB 102 when it is supported in the US in periods of rising prices.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

66

Las Vegas Ltd sells second hand luxury cars of various makes and models,and uses the FIFO cost flow assumption to ascertain the cost of ending inventory.This would be incorrect because:

A) this is not the practice used by other car dealerships.

B) this method will overstate profit.

C) this method will not capture unique characteristics of items held in inventory.

D) this method requires detailed bookkeeping.

A) this is not the practice used by other car dealerships.

B) this method will overstate profit.

C) this method will not capture unique characteristics of items held in inventory.

D) this method requires detailed bookkeeping.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

67

What are the benefits of using LIFO method in jurisdictions where this inventory cost-flow assumption is permitted?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

68

Phoenix Ltd sells hard disks of similar make and model and reports an opening inventory on 1 July 2012 of 20 units purchased at $60.Its purchases during are as follows:

September 90 units @ $70

November 110 units @ $75

March 70 units @ $80

Phoenix Ltd sold 260 units during the year.

What is the cost of ending inventory using FIFO and weighted average method respectively (rounded to the nearest dollar)?

A) $2100; $2209

B) $2100; $2250

C) $2400; $2209

D) $2400; $2250

September 90 units @ $70

November 110 units @ $75

March 70 units @ $80

Phoenix Ltd sold 260 units during the year.

What is the cost of ending inventory using FIFO and weighted average method respectively (rounded to the nearest dollar)?

A) $2100; $2209

B) $2100; $2250

C) $2400; $2209

D) $2400; $2250

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

69

AASB 102 require that inventories be reinstated to the extent that the new carrying amount does not:

A) exceed the net realisable value in the previous period.

B) exceed the lower of the original cost.

C) exceed the net realisable value in the current period.

D) exceed the lower of the original cost or the net realisable value in the current period.

A) exceed the net realisable value in the previous period.

B) exceed the lower of the original cost.

C) exceed the net realisable value in the current period.

D) exceed the lower of the original cost or the net realisable value in the current period.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

70

Identify and discuss the items included as inventory cost.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

71

Weighted-average cost will generate results that are:

A) higher value that LIFO.

B) higher value than FIFO.

C) in between LIFO and FIFO.

D) higher value that LIFO and FIFO.

A) higher value that LIFO.

B) higher value than FIFO.

C) in between LIFO and FIFO.

D) higher value that LIFO and FIFO.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

72

Discuss when a standard cost may be used to arrive at the cost of inventory.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

73

What is the implication on valuation of work-in-progress inventories when the net realisable value is lower than the carrying amount of the asset?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

74

Generally,AASB 102 requires inventories to be measured at cost or net realisable value.Discuss circumstances when other measurement bases (such as current replacement cost)are permitted.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

75

Explain the circumstances where borrowing costs are permitted to be included in the cost of inventories?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck