Deck 24: Losses and Bad Debts

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

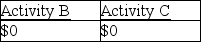

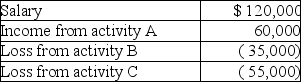

Question

Question

Question

Question

Question

Question

Question

Question

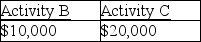

Question

Question

Question

Question

Question

Question

Question

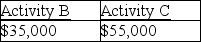

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/125

Play

Full screen (f)

Deck 24: Losses and Bad Debts

1

Lucia owns 100 shares of Cronco Inc.which she purchased on December 1 of last year for $10,000.The stock is not Sec.1244 stock.On July 1 of the current year,Lucia receives notice from the bankruptcy court that Cronco Inc.has been liquidated,and there are no assets remaining for shareholders.As a result,Lucia will have

A)a short-term capital loss of $10,000.

B)a long-term capital loss of $10,000.

C)an ordinary loss of $10,000.

D)no loss allowed.

A)a short-term capital loss of $10,000.

B)a long-term capital loss of $10,000.

C)an ordinary loss of $10,000.

D)no loss allowed.

B

Explanation:B)Worthlessness of securities is deemed to occur at the end of the year so the loss will be treated as long-term capital loss.

Explanation:B)Worthlessness of securities is deemed to occur at the end of the year so the loss will be treated as long-term capital loss.

2

Classification of a loss as a capital loss is based upon the length of time the asset was held.

False

Explanation:Classification of a loss on an asset as capital or ordinary is based upon the type of property involved and the nature of the transaction in which the taxpayer sustains the loss,

Explanation:Classification of a loss on an asset as capital or ordinary is based upon the type of property involved and the nature of the transaction in which the taxpayer sustains the loss,

3

Jamie sells investment real estate for $80,000,resulting in a $15,000 loss.Jamie's loss is

A)an ordinary loss.

B)a capital loss.

C)a Sec.1231 loss.

D)a Sec.1244 loss.

A)an ordinary loss.

B)a capital loss.

C)a Sec.1231 loss.

D)a Sec.1244 loss.

B

Explanation:B)Real estate held for investment is considered a capital asset; therefore the loss on the sale or exchange is a capital loss.

Explanation:B)Real estate held for investment is considered a capital asset; therefore the loss on the sale or exchange is a capital loss.

4

One of the requirements which must be met for stock to be considered Section 1244 stock is that the corporation cannot have more than $10 million of total capital and paid in surplus as of the stock issuance.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

5

In order to be recognized and deducted on a tax return,a loss must first be realized.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

6

The amount of loss realized on the sale of property is computed by subtracting adjusted basis from amount realized.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

7

A loss on business or investment property which is abandoned is deductible as an ordinary loss to the extent of the property's adjusted basis on the date of abandonment.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

8

The destruction of a capital asset due to a casualty will result in recognition of an ordinary loss.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

9

All of the following losses are deductible except

A)decline in value of securities.

B)total worthlessness of securities.

C)abandonment of business property.

D)destruction of personal-use property by fire,storm,or casualty.

A)decline in value of securities.

B)total worthlessness of securities.

C)abandonment of business property.

D)destruction of personal-use property by fire,storm,or casualty.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

10

In 2000,Michael purchased land for $100,000.Over the years,economic conditions deteriorated,and the value of the land declined to $60,000.Michael sells the property in this year,when it is subject to a $30,000 nonrecourse mortgage.The buyer pays Michael $34,000 cash and takes the property subject to the mortgage.Michael incurs $5,000 in real estate commissions.Michael's gain or loss on the sale is

A)$4,000 gain.

B)$1,000 loss.

C)$36,000 loss.

D)$41,000 loss.

A)$4,000 gain.

B)$1,000 loss.

C)$36,000 loss.

D)$41,000 loss.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

11

The total worthlessness of a security generally results in an ordinary loss.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

12

Juan has a casualty loss of $32,500 on investment property after receiving an insurance settlement.This is Juan's only casualty transaction this year.Juan's loss is

A)an ordinary loss.

B)a capital loss.

C)a Sec.1231 loss.

D)a Sec.1244 loss.

A)an ordinary loss.

B)a capital loss.

C)a Sec.1231 loss.

D)a Sec.1244 loss.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

13

Atkon Corporation acquired 90% of the stock of Beta Corporation three years ago.Both corporations are located in the United States.Beta has been an energy drink producer,but unfortunately has suffered substantial losses due to government fines and lawsuits.All of its revenues had been from the sales of the energy drinks.Beta has now filed for bankruptcy and is closing the business with no assets remaining for shareholders.Atkon Corporation will recognize

A)a long-term capital loss.

B)a short-term capital loss.

C)an ordinary loss.

D)no gain or loss.

A)a long-term capital loss.

B)a short-term capital loss.

C)an ordinary loss.

D)no gain or loss.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

14

A loss incurred on the sale or exchange of property is deductible only if the property is used in a trade or business or held for investment.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

15

The amount realized by Matt on the sale of property to Caitlin includes all of the following with the exception of

A)cash received by Matt.

B)mortgage on the property that is assumed by Caitlin.

C)mortgage on the property paid off by Matt prior to the sale.

D)the FMV of any other property received by Matt in the transaction.

A)cash received by Matt.

B)mortgage on the property that is assumed by Caitlin.

C)mortgage on the property paid off by Matt prior to the sale.

D)the FMV of any other property received by Matt in the transaction.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

16

What must an individual taxpayer prove to receive a worthless security deduction?

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

17

The sale of inventory at a loss results in an ordinary loss.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

18

One of the requirements which must be met for stock to be considered Section 1244 stock is that the stock must be owned by an individual or a partnership.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

19

Losses incurred in the sale or exchange of personal-use property are deductible as capital losses.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

20

Businesses can recognize a loss on abandoned property.What types of factors would indicate that property had been abandoned?

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

21

A taxpayer may deduct suspended losses of a passive activity when the taxpayer completely terminates his or her ownership of the activity.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

22

Individuals who actively participate in the management of rental real property may deduct up to $25,000 in losses,subject to AGI limitations.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

23

Erin,a single taxpayer,has 1,000 shares of 1244 stock she purchased directly from AAA Corporation for $120,000 five years ago.The stock has a FMV of $30,000,and Erin is thinking of selling the stock.She has no other capital gains or losses for the year.Discuss the tax consequences and planning opportunities relating to selling the stock.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

24

Why was Section 1244 enacted by Congress? Specifically,consider and discuss some of the individual qualifying requirements of Sec.1244.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

25

Losses from passive activities that cannot be deducted currently are carried over for up to 5 subsequent years.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

26

Amy,a single individual and sole shareholder of Brown Corporation,sold all of the Brown stock for $30,000.Amy's stock basis was $150,000.She had owned the stock for 3 years.Brown Corporation meets the Section 1244 requirements.Amy has

A)a $50,000 ordinary loss and $70,000 LTCL.

B)a $50,000 STCL and a $70,000 LTCL.

C)a $100,000 ordinary loss and a $20,000 LTCL.

D)a $100,000 LTCL and a $20,000 ordinary loss.

A)a $50,000 ordinary loss and $70,000 LTCL.

B)a $50,000 STCL and a $70,000 LTCL.

C)a $100,000 ordinary loss and a $20,000 LTCL.

D)a $100,000 LTCL and a $20,000 ordinary loss.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

27

A passive activity includes any rental activity or any trade or business in which the taxpayer does not materially participate.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

28

All of the following are true of losses from the sale or worthlessness of small business corporation (Section 1244)stock with the exception of

A)the stock must be owned by an individual or a partnership.

B)the stock must have been issued by a domestic corporation.

C)the stock must have been issued for cash or property other than stock or securities.

D)a single taxpayer may deduct,as ordinary losses,up to a maximum of $100,000 per tax year with the remainder treated as capital losses.

A)the stock must be owned by an individual or a partnership.

B)the stock must have been issued by a domestic corporation.

C)the stock must have been issued for cash or property other than stock or securities.

D)a single taxpayer may deduct,as ordinary losses,up to a maximum of $100,000 per tax year with the remainder treated as capital losses.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

29

Stacy,who is married and sole shareholder of ABC Corporation,sold all of her stock in the corporation for $100,000.Stacy had organized the corporation in 2009 by contributing $225,000 and receiving all of the capital stock of the corporation.ABC Corporation is a domestic corporation engaged in the manufacturing of ski boots.The stock in ABC Corporation qualified as Sec.1244 stock.The sale results in a(n)

A)ordinary loss of $125,000.

B)long-term capital loss of $125,000.

C)long-term capital loss of $100,000 and ordinary loss of $25,000.

D)ordinary loss of $100,000 and long-term capital loss of $25,000.

A)ordinary loss of $125,000.

B)long-term capital loss of $125,000.

C)long-term capital loss of $100,000 and ordinary loss of $25,000.

D)ordinary loss of $100,000 and long-term capital loss of $25,000.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

30

Two separate business operations conducted at the same location may be treated as separate activities under the passive activity rules.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

31

If a taxpayer disposes of an interest in a passive activity,unused carryover losses are available to the purchaser of the interest.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

32

When applying the limitations of the passive activity rules,a taxpayer's AGI is classified into active income,portfolio income and passive income.For this purpose,portfolio income includes dividends,interest,annuities,and royalties.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

33

Once an activity has been classified as passive,it is considered passive with regard to that taxpayer until it is sold.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

34

A closely held C corporation's passive losses may offset its portfolio income.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

35

Partnerships and S corporations must classify their business and rental activities by applying the passive activity rules at the partnership or S corporation level and then must report the results of their operations by activity to the partners or shareholders.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

36

Individual taxpayers can offset portfolio income with passive losses.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

37

Material participation by a taxpayer in a passive activity is satisfied if the individual participates in the activity for more than 500 hours during the year.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

38

Before consideration of stock sales,Rex has generated $150,000 of AGI this year due to salary,interest income and dividends.Rex is a single taxpayer.He plans to sell his shares of Trisco Inc. ,a qualifying small business corporation under Sec.1244,realizing a $110,000 loss.Due to the sale of the stock,he will reduce his AGI by

A)$3,000.

B)$110,000.

C)$50,000.

D)$53,000.

A)$3,000.

B)$110,000.

C)$50,000.

D)$53,000.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

39

For purposes of the application of the passive loss limitations,a closely held C corporation is a C corporation in which more than 50 percent of the stock is owned by five or fewer individuals at any time during the last half of the taxable year.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

40

For purposes of applying the passive loss limitations for rental real estate,active participation requires a greater time commitment by the taxpayer than does material participation.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

41

Tom and Shawn own all of the outstanding stock of Brady Corporation (a retail store operated as a C corporation).This year,Brady generates taxable income of $20,000 from active business operations,and also reports investment interest of $22,000 and losses of $28,000 from a passive activity.As a result,Brady Corporation reports

A)net income of $42,000.

B)interest income of $22,000 and a passive loss carryover of $8,000.

C)business income of $20,000 and a passive loss carryover of $6,000.

D)business income of $20,000,interest income of $22,000,and a passive loss carryover of $28,000.

A)net income of $42,000.

B)interest income of $22,000 and a passive loss carryover of $8,000.

C)business income of $20,000 and a passive loss carryover of $6,000.

D)business income of $20,000,interest income of $22,000,and a passive loss carryover of $28,000.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

42

During the year,Mark reports $90,000 of active business income from his law practice.He also owns two passive activities.From Activity A,he earns $20,000 of income,and from Activity B,he incurs a $30,000 loss.As a result,Mark

A)reports AGI of $80,000.

B)reports AGI of $90,000 with a $10,000 passive loss carryover.

C)reports AGI of $90,000 with a $30,000 passive loss carryover.

D)reports AGI of $110,000 with a $30,000 passive loss carryover.

A)reports AGI of $80,000.

B)reports AGI of $90,000 with a $10,000 passive loss carryover.

C)reports AGI of $90,000 with a $30,000 passive loss carryover.

D)reports AGI of $110,000 with a $30,000 passive loss carryover.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

43

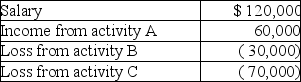

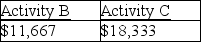

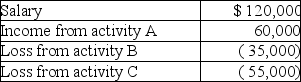

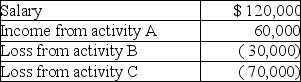

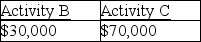

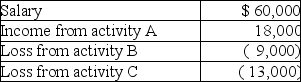

Jana reports the following income and loss:  Activities A,B,and C are all passive activities.

Activities A,B,and C are all passive activities.

Based on this information,Jana will recognize

A)adjusted gross income of $80,000.

B)salary of $120,000 and deductible net losses of $40,000.

C)salary of $120,000,passive income of $60,000,and passive loss carryovers of $100,000.

D)salary of $120,000 and net passive losses of $40,000 that will be carried over.

Activities A,B,and C are all passive activities.

Activities A,B,and C are all passive activities.Based on this information,Jana will recognize

A)adjusted gross income of $80,000.

B)salary of $120,000 and deductible net losses of $40,000.

C)salary of $120,000,passive income of $60,000,and passive loss carryovers of $100,000.

D)salary of $120,000 and net passive losses of $40,000 that will be carried over.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

44

Jen and Saachi are the owners of J&S Legal Services,P.C. ,an incorporated law firm treated as a C corporation for tax purposes.Jen and Saachi work full-time in the firm,performing all of the legal services.This year,J&S generates taxable income of $100,000 from the active business operations,and also reports investment interest income of $22,000 and losses of $28,000 from a passive activity.As a result,J&S Legal Services,P.C.reports taxable income of

A)$122,000.

B)$100,000.

C)$94,000.

D)$97,000.

A)$122,000.

B)$100,000.

C)$94,000.

D)$97,000.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

45

An individual is considered to materially participate in an activity if any of the following tests are met with the exception of

A)the individual participates in the activity for more than 500 hours during the year.

B)the individual participates in the activity for 75 hours during the year,and that participation is more than any other individual's participation for the year.

C)the individual has materially participated in the activity in any five years during the immediate preceding 10 taxable years.

D)the individual's participation in the activity for the year constitutes substantially all of the participation in the activity by all individuals.

A)the individual participates in the activity for more than 500 hours during the year.

B)the individual participates in the activity for 75 hours during the year,and that participation is more than any other individual's participation for the year.

C)the individual has materially participated in the activity in any five years during the immediate preceding 10 taxable years.

D)the individual's participation in the activity for the year constitutes substantially all of the participation in the activity by all individuals.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is not generally classified as a passive activity?

A)an activity in which the taxpayer does not materially participate

B)a limited partnership interest

C)rental real estate

D)a business in which the taxpayer owns an interest and works 1,000 hours a year

A)an activity in which the taxpayer does not materially participate

B)a limited partnership interest

C)rental real estate

D)a business in which the taxpayer owns an interest and works 1,000 hours a year

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

47

Joseph has AGI of $170,000 before considering the $20,000 rental loss for property which he actively manages.How much of the rental loss can he deduct?

A)$0

B)$10,000

C)$20,000

D)$25,000

A)$0

B)$10,000

C)$20,000

D)$25,000

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

48

Lewis died during the current year.Lewis owned passive activity property with a FMV of $61,000 and a basis of $48,000.Suspended losses of $15,000 were attributable to the property.How much of the suspended loss is deductible on Lewis's final income tax return?

A)$0

B)$2,000

C)$13,000

D)$15,000

A)$0

B)$2,000

C)$13,000

D)$15,000

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

49

Myriah earns salary of $80,000 and $20,000 of dividend income from her stock portfolio this year.Myriah owns a passive activity from which she incurs a $10,000 loss.In addition,the passive activity has generated tax credits this year,and Myriah's share is $5,000.What portion of the $5,000 of tax credits can Myriah apply against her tax liability this year?

A)$0

B)$1,000

C)$2,000

D)$5,000

A)$0

B)$1,000

C)$2,000

D)$5,000

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

50

Charlie owns activity B which was considered a passive activity and generated a $17,000 suspended loss.Charlie increases his involvement with activity B so that this year activity B is not considered passive for Charlie.During this year,activity B produces a $9,000 loss.In addition,Charlie acquires an investment in activity X,a passive activity,this year.Charlie's share of activity X's income is $13,000.Charlie's salary this year is $70,000.As a result,this year Charlie must

A)offset B's loss carryover against X's current income and carry over $9,000 loss from activity B to next year.

B)offset B's carryover loss and current loss against X's income first and then offset any remaining loss against salary.

C)offset B's $9,000 loss against X's $13,000 income and offset B's loss carryover against the remaining $4,000 of X's income.

D)offset B's current $9,000 loss against his salary and offset B's loss carryover against X's income and carry over $4,000 of loss to next year.

A)offset B's loss carryover against X's current income and carry over $9,000 loss from activity B to next year.

B)offset B's carryover loss and current loss against X's income first and then offset any remaining loss against salary.

C)offset B's $9,000 loss against X's $13,000 income and offset B's loss carryover against the remaining $4,000 of X's income.

D)offset B's current $9,000 loss against his salary and offset B's loss carryover against X's income and carry over $4,000 of loss to next year.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

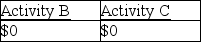

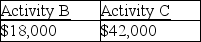

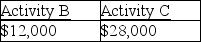

51

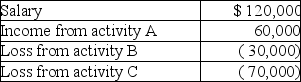

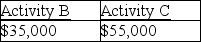

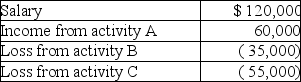

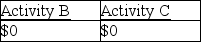

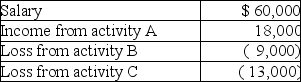

Joy reports the following income and loss:  Activities A,B,and C are all passive activities.

Activities A,B,and C are all passive activities.

Based on this information,Joy has the following suspended losses:

A)

B)

C)

D)

Activities A,B,and C are all passive activities.

Activities A,B,and C are all passive activities.Based on this information,Joy has the following suspended losses:

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

52

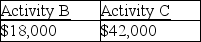

Joy reports the following income and loss:  Activities A,B,and C are all passive activities.

Activities A,B,and C are all passive activities.

Based on this information,Joy has

A)adjusted gross income of $90,000.

B)salary of $120,000 and deductible net losses of $30,000.

C)salary of $120,000 and net passive losses of $30,000 that will be carried over.

D)salary of $120,000,passive income of $60,000,and passive loss carryovers of $90,000.

Activities A,B,and C are all passive activities.

Activities A,B,and C are all passive activities.Based on this information,Joy has

A)adjusted gross income of $90,000.

B)salary of $120,000 and deductible net losses of $30,000.

C)salary of $120,000 and net passive losses of $30,000 that will be carried over.

D)salary of $120,000,passive income of $60,000,and passive loss carryovers of $90,000.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

53

Taxpayers are allowed to recognize net passive losses from all activities up to a ceiling of $25,000.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

54

Jeff owned one passive activity.Jeff sold the activity and realized a $2,000 gain on the sale.Prior to the sale,he realized a current year loss from the activity of $6,000.In addition,he has suspended losses from prior years of $7,000.What is the net impact on Jeff's AGI this year due to the passive activity?

A)increase of $2,000

B)no net change

C)decrease of $4,000

D)decrease of $11,000

A)increase of $2,000

B)no net change

C)decrease of $4,000

D)decrease of $11,000

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

55

Justin has AGI of $110,000 before considering his $30,000 loss from rental property,which he actively manages.How much of the rental loss can Justin deduct this year?

A)$10,000

B)$20,000

C)$25,000

D)$30,000

A)$10,000

B)$20,000

C)$25,000

D)$30,000

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

56

A taxpayer's rental activities will be considered a trade or business,rather than a passive activity,if

A)the taxpayer performs more than 750 hours of work during the year managing the rental properties

B)the taxpayer performs more than 500 hours of work during the year managing the rental properties.

C)more than half of the taxpayer's personal services performed in all business activities during the year are spent managing the rental properties.

D)conditions A and C,but not B,are satisfied.

A)the taxpayer performs more than 750 hours of work during the year managing the rental properties

B)the taxpayer performs more than 500 hours of work during the year managing the rental properties.

C)more than half of the taxpayer's personal services performed in all business activities during the year are spent managing the rental properties.

D)conditions A and C,but not B,are satisfied.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

57

Jorge owns activity X which produced a $20,000 passive loss last year.Jorge's only income last year was wages of $30,000.Jorge is a material participant in activity X this year when it produces a $14,000 loss.This year,Jorge's wages are $40,000.This year,Jorge also has passive activity income from activity Y of $16,000.What is the total passive activity loss carryover to next year?

A)$0

B)$3,000

C)$4,000

D)$18,000

A)$0

B)$3,000

C)$4,000

D)$18,000

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

58

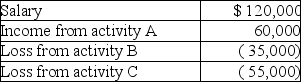

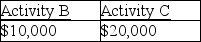

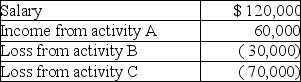

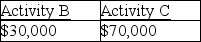

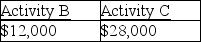

Jana reports the following income and loss:  Activities A,B,and C are all passive activities.

Activities A,B,and C are all passive activities.

Based on this information,Jana has the following suspended losses

A)

B)

C)

D)

Activities A,B,and C are all passive activities.

Activities A,B,and C are all passive activities.Based on this information,Jana has the following suspended losses

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

59

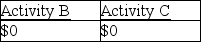

Nancy reports the following income and loss in the current year.  All three activities are passive activities with respect to Nancy.Nancy also has $21,000 of suspended losses attributable to activity C carried over from prior years.During the year,Nancy sells activity C and realizes a $15,000 taxable gain.What is Nancy's AGI as a result of these transactions?

All three activities are passive activities with respect to Nancy.Nancy also has $21,000 of suspended losses attributable to activity C carried over from prior years.During the year,Nancy sells activity C and realizes a $15,000 taxable gain.What is Nancy's AGI as a result of these transactions?

A)$50,000

B)$55,000

C)$64,000

D)$71,000

All three activities are passive activities with respect to Nancy.Nancy also has $21,000 of suspended losses attributable to activity C carried over from prior years.During the year,Nancy sells activity C and realizes a $15,000 taxable gain.What is Nancy's AGI as a result of these transactions?

All three activities are passive activities with respect to Nancy.Nancy also has $21,000 of suspended losses attributable to activity C carried over from prior years.During the year,Nancy sells activity C and realizes a $15,000 taxable gain.What is Nancy's AGI as a result of these transactions?A)$50,000

B)$55,000

C)$64,000

D)$71,000

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

60

Mara owns an activity with suspended passive losses from prior years of $13,000.In the current year,Mara becomes a material participant in the activity.This year the activity generates $6,000 of income.The net effect of this activity on Mara's current year AGI is

A)an increase of $6,000.

B)a decrease of $13,000.

C)0)

D)a decrease of $7,000.

A)an increase of $6,000.

B)a decrease of $13,000.

C)0)

D)a decrease of $7,000.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following is most likely not considered a casualty?

A)fire loss

B)water damage caused by the bursting of a water heater

C)death of a pine tree due to a two-day infestation of pine beetles

D)water damage to the walls and ceiling of a taxpayer's personal residence as the result of gradual deterioration of the roof

A)fire loss

B)water damage caused by the bursting of a water heater

C)death of a pine tree due to a two-day infestation of pine beetles

D)water damage to the walls and ceiling of a taxpayer's personal residence as the result of gradual deterioration of the roof

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

62

When personal-use property is covered by insurance,no deduction is available for a casualty loss of the property unless the taxpayer timely files an insurance claim for the loss.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

63

Shaunda has AGI of $90,000 and owns rental property generating a $27,000 loss.She actively manages the property.Her deductible loss is

A)$0.

B)$13,500.

C)$25,000.

D)$27,000.

A)$0.

B)$13,500.

C)$25,000.

D)$27,000.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

64

Why did Congress enact restrictions and limitations on losses from passive activities?

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

65

When the taxpayer anticipates a full recovery on a casualty loss of personal-use property but receives less than full recovery in a subsequent year,the unrecovered portion may be deducted.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

66

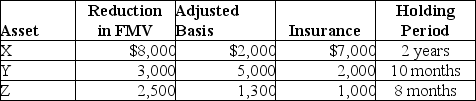

In the current year,Marcus reports the following casualty gains and losses on personal-use property.Assets X and Y are destroyed in the first casualty while Z is destroyed in a second casualty.  As a result of these losses and insurance recoveries,Marcus must report

As a result of these losses and insurance recoveries,Marcus must report

A)a net gain of $3,700.

B)a long-term gain of $4,900 on asset X; a short-term capital loss of $900 on asset Y; and a short-term capital loss of $200 on asset Z.

C)a long-term capital gain of $5,000 on asset X; a short-term capital loss of $900 on asset Y; and a short-term capital loss of $200 on asset Z.

D)a long-term capital gain of $5,000 on asset X; a short-term capital loss of $900 on asset Y; and a short-term capital loss of $300 on asset Z.

As a result of these losses and insurance recoveries,Marcus must report

As a result of these losses and insurance recoveries,Marcus must reportA)a net gain of $3,700.

B)a long-term gain of $4,900 on asset X; a short-term capital loss of $900 on asset Y; and a short-term capital loss of $200 on asset Z.

C)a long-term capital gain of $5,000 on asset X; a short-term capital loss of $900 on asset Y; and a short-term capital loss of $200 on asset Z.

D)a long-term capital gain of $5,000 on asset X; a short-term capital loss of $900 on asset Y; and a short-term capital loss of $300 on asset Z.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

67

Leonard owns a hotel which was damaged by a hurricane.The hotel had an adjusted basis of $1,000,000 before the hurricane.A recent appraisal determined that the hotel's FMV was $1,500,000 before the hurricane and $700,000 afterwards.Leonard received insurance proceeds of $500,000.His AGI is $60,000.What is the amount of his deductible casualty loss?

A)$293,900

B)$300,000

C)$793,900

D)$800,000

A)$293,900

B)$300,000

C)$793,900

D)$800,000

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

68

If a taxpayer suffers a loss attributable to a disaster in an area subsequently declared a disaster area,the casualty loss may be deducted in the year preceding the year in which the loss actually occurs.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

69

A fire totally destroyed office equipment and furniture which Monica uses in her business.The equipment had an adjusted basis of $15,000 and a FMV of $10,000 before the fire.The furniture's adjusted basis was $5,000 and its FMV was $2,000 before the fire.Monica's AGI for the year is $60,000.Monica does not have insurance on the destroyed assets.How much is Monica's deductible casualty loss?

A)$5,900

B)$12,000

C)$13,900

D)$20,000

A)$5,900

B)$12,000

C)$13,900

D)$20,000

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

70

In the case of casualty losses of personal-use property,the losses sustained in each separate casualty are reduced by both $100 and 10 percent of the taxpayer's AGI for the year.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

71

Nicole has a weekend home on Pecan Island that she purchased in 2013 for $250,000.Recently,the home was appraised at $260,000.After the appraisal,a hurricane hit Pecan Island,severely damaging Nicole's home.An appraisal placed the value of the home at $140,000 after the hurricane.Because of its prohibitive cost,Nicole had no hurricane insurance.Before any reductions or limitations,Nicole's casualty loss amount is

A)$0.

B)$10,000.

C)$120,000.

D)$140,000.

A)$0.

B)$10,000.

C)$120,000.

D)$140,000.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

72

A theft loss is deducted in the year in which the theft is discovered.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

73

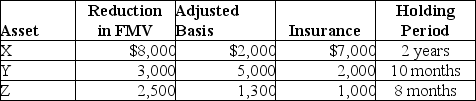

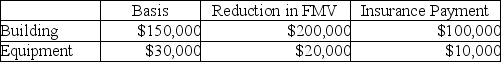

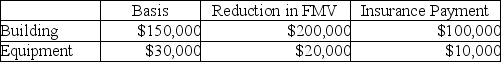

Lena owns a restaurant which was damaged by a tornado.The following assets were partially destroyed:  Lena has AGI of $50,000.What is the amount of Lena's deductible casualty loss?

Lena has AGI of $50,000.What is the amount of Lena's deductible casualty loss?

A)$54,900

B)$60,000

C)$70,000

D)$180,000

Lena has AGI of $50,000.What is the amount of Lena's deductible casualty loss?

Lena has AGI of $50,000.What is the amount of Lena's deductible casualty loss?A)$54,900

B)$60,000

C)$70,000

D)$180,000

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

74

Jarrett owns a mountain chalet that he purchased in 2008 for $175,000.This year,the home appraised at $300,000.Shortly after the appraisal,a blizzard hit the area in spring of the current year,destroying trees and severely damaging several homes,including Jarrett's chalet.Its value was reduced to $135,000.Jarrett does not have insurance.Jarrett's AGI is $200,000.Jarrett's deductible loss after limitations is

A)$135,000.

B)$144,900.

C)$164,900.

D)$165,000.

A)$135,000.

B)$144,900.

C)$164,900.

D)$165,000.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

75

Brandon,a single taxpayer,had a loss of $48,000 from a rental real estate activity in which he actively participated.He also had $27,000 of income from another rental real estate activity in which he actively participated.He acquired both investments in the current year.If Brandon has no other passive income or losses and has adjusted gross income of $84,000 before considering passive activities,how much loss from rental activities can he use to offset his nonpassive income?

A)$21,000

B)$24,000

C)$25,000

D)$45,000

A)$21,000

B)$24,000

C)$25,000

D)$45,000

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

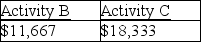

76

Aretha has AGI of less than $100,000 and a 25% marginal tax rate.During the year,she reports a $36,000 loss from Activity A and a $24,000 loss from Activity B.Additionally,Activity A generates $8,000 of tax credits.Both activities A and B are passive real estate rental activities in which Anita actively participates and owns over 10% of each activity.

a.How much loss can be recognized from each activity?

b.What is the amount of Aretha's suspended loss from each activity?

c.How much of the tax credits can be applied this year?

a.How much loss can be recognized from each activity?

b.What is the amount of Aretha's suspended loss from each activity?

c.How much of the tax credits can be applied this year?

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

77

Hope sustained a $3,600 casualty loss due to a severe storm.She also incurred a $800 loss from a theft in the same year.Both the casualty and theft involved personal-use property.Hope's AGI for the year is $25,000 and she does not have insurance coverage.Hope's deductible casualty loss is

A)$1,700.

B)$1,800.

C)$4,200.

D)$4,300.

A)$1,700.

B)$1,800.

C)$4,200.

D)$4,300.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

78

When business property involved in a casualty is totally destroyed,the amount of the loss is limited to the lesser of the taxpayer's adjusted basis in the property or the reduction in FMV.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

79

What is required for an individual to be considered as actively participating in a real estate activity for purposes of utilizing the $25,000 ceiling on rental real estate losses?

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

80

A taxpayer may deduct a loss resulting from the theft of business and investment property but not a theft of personal-use property.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck