Deck 15: Financial Statements and Ratios

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

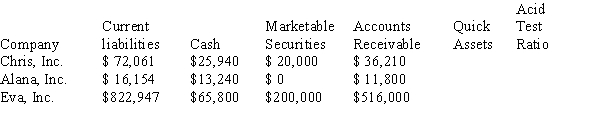

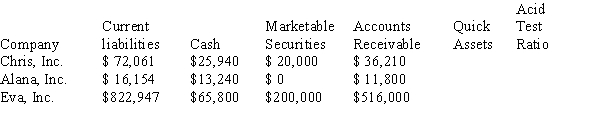

Question

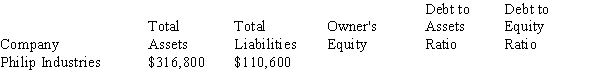

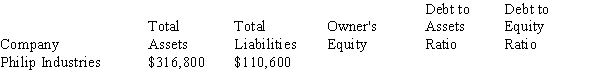

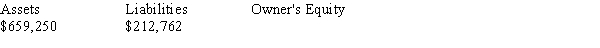

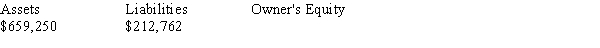

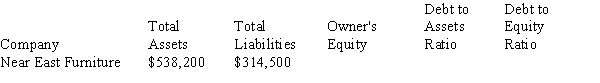

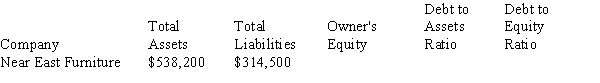

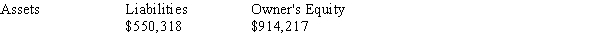

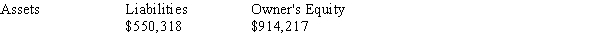

Question

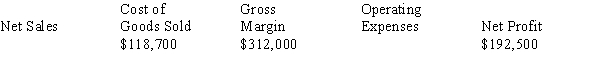

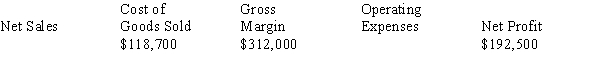

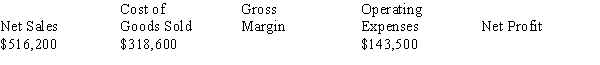

Question

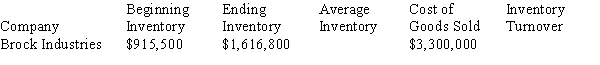

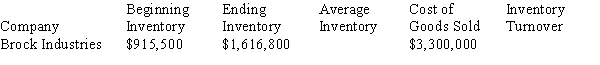

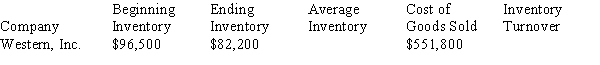

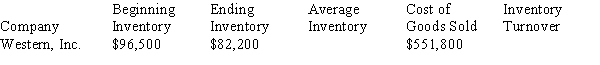

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

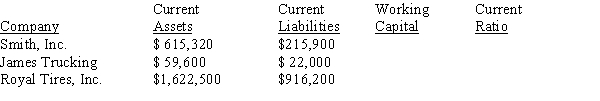

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/122

Play

Full screen (f)

Deck 15: Financial Statements and Ratios

1

You own a business that has assets of $148,000. If your equity is $55,000, what is the amount of your liabilities?

A) $203,000

B) $93,000

C) $122,000

D) $98,000

A) $203,000

B) $93,000

C) $122,000

D) $98,000

$93,000

2

Into what category does the following balance sheet item fall: Land

A) Long-term Liability

B) Stockholder's (or Owner's) Equity

C) Current Assets

D) Fixed Assets (Property, Plant, and Equipment)

A) Long-term Liability

B) Stockholder's (or Owner's) Equity

C) Current Assets

D) Fixed Assets (Property, Plant, and Equipment)

Fixed Assets (Property, Plant, and Equipment)

3

Into what category does the following balance sheet item fall: Goodwill

A) Current asset

B) Fixed asset

C) Intangible asset

D) Current liability

A) Current asset

B) Fixed asset

C) Intangible asset

D) Current liability

Intangible asset

4

____________________ are financial ratios that indicate how effectively a company uses its resources to generate sales.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

5

The rights of the creditors of a business are known as ____________________ and represent debts of the business.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

6

The primary tools of financial analysis are financial ____________________.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

7

The rights of the owners of a business are known as ____________________.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

8

You are considering buying a business that has assets of $148,000. Owner's equity is shown as $45,000. What is the amount of liabilities in that business?

A) $103,000

B) $93,000

C) $112,000

D) $108,000

A) $103,000

B) $93,000

C) $112,000

D) $108,000

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

9

In vertical analysis, each item on the balance sheet is expressed as a percent of the total ____________________.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

10

The difference between current assets and current liabilities at a point in time is known as ____________________.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

11

In ____________________ analysis, each item of the current period is compared in dollars and percent with the corresponding item from a previous period.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

12

A(n) ____________________ balance sheet shows data from the current year side by side with the figures from one or more previous periods.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

13

Into what category does the following balance sheet item fall: Note Receivable (3-month)

A) Current asset

B) Fixed asset

C) Intangible asset

D) Current liability

A) Current asset

B) Fixed asset

C) Intangible asset

D) Current liability

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

14

Into what category does the following balance sheet item fall: Salaries Payable

A) Intangible Liability

B) Intangible Asset

C) Current Asset

D) Current Liability

A) Intangible Liability

B) Intangible Asset

C) Current Asset

D) Current Liability

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

15

Voltron Electrical has assets of $157,000 and liabilities of $71,000. What is the owner's equity?

A) $158,000

B) $86,000

C) $81,000

D) $117,000

A) $158,000

B) $86,000

C) $81,000

D) $117,000

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

16

Your partnership business has liabilities of $38,000. If your equity is $85,000, what is the amount of your assets?

A) $103,000

B) $123,000

C) $122,000

D) $108,000

A) $103,000

B) $123,000

C) $122,000

D) $108,000

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

17

Your small printing shop has assets of $18,000. If your equity is $5,000, what is the amount of your liabilities?

A) $3,000

B) $13,000

C) $2,000

D) $8,000

A) $3,000

B) $13,000

C) $2,000

D) $8,000

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

18

____________________ ratios tell how well a company can pay off its short-term debts and meet unexpected needs for cash.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

19

A(n) ____________________ is a summary of the operations of a business over a period of time.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

20

____________________ provides a dynamic picture of a firm by showing its financial direction over a period of time.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

21

Use the following financial information to find the entry you would make on an income statement for COST OF GOODS SOLD for the year ended December 31, 2011: Gross Sales, $180,000; Sales Returns and Allowances, $9,000; Sales Discounts, $6,300; Merchandise Inventory, January 1, 2011, $60,900; Merchandise Inventory, December 31, 2011, $66,700; Net Purchases, $58,300; Freight In, $600; Salaries, $84,700; Rent, $22,000; Utilities, $1,125; Insurance, $2,025; and Income Tax, $17,750.

A) $45,985

B) $30,800

C) $53,100

D) $65,754

A) $45,985

B) $30,800

C) $53,100

D) $65,754

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

22

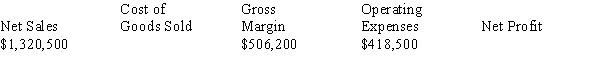

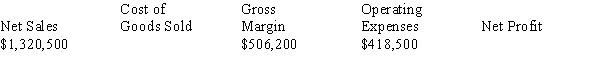

Perform a vertical analysis for the entry "Sales Returns and Allowances" on the portion of an income statement shown below. (Round to the nearest tenth)

A) 2.6%

B) 2.7%

C) 3.9%

D) 3.1%

A) 2.6%

B) 2.7%

C) 3.9%

D) 3.1%

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

23

Perform a horizontal analysis for the balance sheet entry "Accounts Receivable" given below. (Round to the nearest tenth)

A) (2.0%)

B) (19.6%)

C) (3.5%)

D) (8.9%)

A) (2.0%)

B) (19.6%)

C) (3.5%)

D) (8.9%)

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

24

Perform a horizontal analysis for the entry "Sales Returns and Allowances" shown on the income statement portion below. (Round to the nearest tenth)

A) 1.3%

B) 3.7%

C) 12.8%

D) 41.9%

A) 1.3%

B) 3.7%

C) 12.8%

D) 41.9%

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

25

Panhead's Bike Shop had net sales of $382,500 and the cost of goods sold were $172,300. Operating expenses were $107,645 and owner's equity is $437,645. Calculate the net profit margin. (Round to the nearest tenth)

A) 40.4%

B) 34.8%

C) 26.8%

D) 22.8%

A) 40.4%

B) 34.8%

C) 26.8%

D) 22.8%

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

26

Use the following financial information to find the entry you would make on an income statement for GROSS MARGIN for the year ended December 31, 2011: Gross Sales, $231,000; Sales Returns and Allowances, $7,700; Sales Discounts, $6,800; Merchandise Inventory, January 1, 2011, $55,200; Merchandise Inventory, December 31, 2011, $61,300; Net Purchases, $81,900; Freight In, $950; Salaries, $87,000; Rent, $20,600; Utilities, $1,500; Insurance, $2,350; and Income Tax, $17,350.

A) $216,500

B) $139,750

C) $128,800

D) $87,700

A) $216,500

B) $139,750

C) $128,800

D) $87,700

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

27

Perform a vertical analysis for the balance sheet entry "Accounts Receivable" given below. (Round to the nearest tenth)

A) 42.6%

B) 13.8%

C) 37.7%

D) 27.7%

A) 42.6%

B) 13.8%

C) 37.7%

D) 27.7%

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

28

Perform a horizontal analysis for the entry "Gross Sales" shown on the income statement portion below. (Round to the nearest tenth)

A) 33.3%

B) 10.5%

C) 3.3%

D) 23.9%

A) 33.3%

B) 10.5%

C) 3.3%

D) 23.9%

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

29

Use the following financial information to find the entry you would make on an income statement for INCOME BEFORE TAXES for the year ended December 31, 2011: Gross Sales, $223,000; Sales Returns and Allowances, $11,200; Sales Discounts, $1,800; Merchandise Inventory, January 1, 2011, $67,600; Merchandise Inventory, December 31, 2011, $78,300; Net Purchases, $84,000; Freight In, $950; Salaries, $107,200; Rent, $19,500; Utilities, $1,450; Insurance, $2,150; and Income Tax, $14,900.

A) $130,300

B) $135,750

C) ($9,450)

D) $5,450

A) $130,300

B) $135,750

C) ($9,450)

D) $5,450

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

30

Use the following financial information to find the entry you would make on an income statement for NET INCOME (LOSS) for the year ended December 31, 2011: Gross Sales, $123,000; Sales Returns and Allowances, $9,300; Sales Discounts, $8,700; Merchandise Inventory, January 1, 2011, $89,000; Merchandise inventory, December 31, 2011, $109,500; Net Purchases, $74,700; Freight In, $575; Salaries, $107,800; Rent, $20,100; Utilities, $1,425; Insurance, $2,250; and Income Tax, $15,900.

A) $81,350

B) $97,250

C) ($97,250)

D) ($15,900)

A) $81,350

B) $97,250

C) ($97,250)

D) ($15,900)

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

31

Use the following financial information to find the entry you would make on an income statement for NET INCOME (LOSS) for the year ended December 31, 2011: Gross Sales, $223,000; Sales Returns and Allowances, $11,200; Sales Discounts, $1,800; Merchandise Inventory, January 1, 2011, $67,600; Merchandise Inventory, December 31, 2011, $78,300; Net Purchases, $84,000; Freight In, $950; Salaries, $107,200; Rent, $19,500; Utilities, $1,450; Insurance, $2,150; and Income Tax, $14,900.

A) $135,750

B) $210,000

C) $9,450

D) ($9,450)

A) $135,750

B) $210,000

C) $9,450

D) ($9,450)

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

32

Use the following financial information to find the entry you would make on an income statement for NET INCOME (LOSS) for the year ended December 31, 2011: Gross Sales, $110,000; Sales Returns and Allowances, $8,000; Sales Discounts, $2,400; Merchandise Inventory, January 1, 2011, $50,000; Merchandise Inventory, December 31, 2011, $43,100; Net Purchases, $80,500; Freight In, $975; Salaries, $92,900; Rent, $15,500; Utilities, $1,275; Insurance, $2,450; and Income Tax, $15,650.

A) $23,458

B) ($98,544)

C) $65,782

D) ($116,550)

A) $23,458

B) ($98,544)

C) $65,782

D) ($116,550)

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

33

Use the following financial information to find the entry you would make on an income statement for COST OF GOODS SOLD for the year ended December 31, 2011: Gross Sales, $241,000; Sales Returns and Allowances, $5,200; Sales Discounts, $1,000; Merchandise Inventory, January 1, 2011, $62,900; Merchandise Inventory, December 31, 2011, $70,200; net purchases, $95,800; Freight In, $525; Salaries, $93,200; Rent, $17,900; Utilities, $1,125; Insurance, $2,025; and Income Tax, $16,950.

A) $159,225

B) $70,200

C) $89,025

D) $114,250

A) $159,225

B) $70,200

C) $89,025

D) $114,250

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

34

What entry would you make on an income statement for NET SALES for the year ended December 31, 2011? Gross Sales, $200,000; Sales Returns and Allowances, $5,800; Sales Discounts, $5,700; Merchandise Inventory, January 1, 2011, $67,100; Merchandise Inventory, December 31, 2011, $51,900; Net Purchases, $89,200; Freight In, $700; Salaries, $81,800; Rent, $18,600; Utilities, $1,125; Insurance, $2,175; and Income Tax, $14,900.

A) $105,100

B) $118,600

C) $157,000

D) $188,500

A) $105,100

B) $118,600

C) $157,000

D) $188,500

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

35

Find the entry you would make on an income statement for TOTAL OPERATING EXPENSES for the year ended December 31, 2011: Gross Sales, $141,000; Sales Returns and Allowances, $7,600; Sales Discounts, $9,600; Merchandise Inventory, January 1, 2011, $50,300; Merchandise Inventory, December 31, 2011, $42,400; Net Purchases, $62,100; Freight In, $1,000; Salaries, $80,500; Rent, $18,900; Utilities, $1,225; Insurance, $2,250; and Income Tax, $17,400.

A) $71,000

B) $102,875

C) $120,275

D) $123,800

A) $71,000

B) $102,875

C) $120,275

D) $123,800

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

36

Use the following financial information to find the entry you would make on an income statement for GROSS MARGIN for the year ended December 31, 2011: Gross Sales, $241,000; Sales Returns and Allowances, $7,500; Sales Discounts, $7,800; Merchandise Inventory, January 1, 2011, $45,200; Merchandise Inventory, December 31, 2011, $71,300; Net Purchases, $91,900; Freight In, $1950; Salaries, $97,000; Rent, $30,600; Utilities, $2,500; Insurance, $2,450; and Income Tax, $19,350.

A) $206,500

B) $157,950

C) $138,800

D) $107,700

A) $206,500

B) $157,950

C) $138,800

D) $107,700

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

37

Perform a horizontal analysis for the balance sheet entry "Accounts Payable" given below. (Round to the nearest tenth)

A) (2.9%)

B) (3.0%)

C) 3.4%

D) (9.2%)

A) (2.9%)

B) (3.0%)

C) 3.4%

D) (9.2%)

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

38

Perform a vertical analysis for the balance sheet entry "Accounts Payable" given below. (Round to the nearest tenth)

A) 22.0%

B) 17.5%

C) 16.9%

D) 14.8%

A) 22.0%

B) 17.5%

C) 16.9%

D) 14.8%

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

39

Perform a vertical analysis for the entry "Gross Sales" on the portion of an income statement shown below. (Round to the nearest tenth)

A) 105.9%

B) 103.6%

C) 13.1%

D) 3.6%

A) 105.9%

B) 103.6%

C) 13.1%

D) 3.6%

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

40

Perform a vertical analysis for the balance sheet entry "Accounts Receivable" given below. (Round to the nearest tenth)

A) 14.6%

B) 13.8%

C) 17.7%

D) 14.0%

A) 14.6%

B) 13.8%

C) 17.7%

D) 14.0%

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

41

You own a business that has current liabilities of $117,300; cash in the amount $5,600; securities valued at $98,400; and accounts receivable of $85,900. Calculate the acid test ratio. (Round to the nearest hundredth)

A) 1.56:1

B) 1.62:1

C) 1.89:1

D) 2.02:1

A) 1.56:1

B) 1.62:1

C) 1.89:1

D) 2.02:1

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

42

From the following data, find the 2014 Total Assets index number. (Round to nearest tenth percent)

A) 83.9%

B) 58.5%

C) 79.6%

D) 63.2%

A) 83.9%

B) 58.5%

C) 79.6%

D) 63.2%

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

43

Alan's Chairs has current assets of $138,000 and current liabilities of $102,750. Find the current ratio. (Round to the nearest hundredth)

A) 59:1

B) 1.62:1

C) 1.34:1

D) .74:1

A) 59:1

B) 1.62:1

C) 1.34:1

D) .74:1

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

44

Clara's Clothing Store had accounts receivable of $53,261.98 and credit sales of $1,620,052. Calculate the average collection period. (Round to the nearest day)

A) 16 days

B) 12 days

C) 18 days

D) 14 days

A) 16 days

B) 12 days

C) 18 days

D) 14 days

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

45

The Cowboy Shop has current liabilities of $151,200; cash in the amount $13,900; securities valued at $95,250; and accounts receivable of $157,300. Calculate the acid test ratio. (Round to the nearest hundredth)

A) 1.76:1

B) 1.53:1

C) .57:1

D) .93:1

A) 1.76:1

B) 1.53:1

C) .57:1

D) .93:1

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

46

Ward Inc. had a beginning inventory of $26,800 and an ending inventory of $52,650. If the cost of goods sold was $305,000, calculate the inventory turnover. (Round to the nearest tenth)

A) 7.4 times

B) 8.7 times

C) 6.8 times

D) 7.7 times

A) 7.4 times

B) 8.7 times

C) 6.8 times

D) 7.7 times

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

47

Classic Vehicles had a beginning inventory of $156,700 and an ending inventory of $98,500. If the cost of goods sold was $152,100, calculate the inventory turnover. (Round to the nearest tenth)

A) 1.3 times

B) 1.1 times

C) 1.2 times

D) 1.7 times

A) 1.3 times

B) 1.1 times

C) 1.2 times

D) 1.7 times

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

48

Shari's Tennis Club had net sales of $186,400 and the cost of goods sold were $88,760. Operating expenses were $35,100 and owner's equity is $553,400. Calculate the return on investment. (Round to the nearest tenth)

A) 15.0%

B) 11.3%

C) 12.2%

D) 13.6%

A) 15.0%

B) 11.3%

C) 12.2%

D) 13.6%

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

49

Matie's Playground Equipment has current assets of $128,400 and current liabilities of $78,950. Find the current ratio. (Round to the nearest hundredth)

A) .78:1

B) 1.63:1

C) .61:1

D) .75:1

A) .78:1

B) 1.63:1

C) .61:1

D) .75:1

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

50

Hawk's Nest Corp had net sales of $61,300 and total assets of $155,400. Find the asset turnover ratio. (Round to the nearest hundredth)

A) 0.39:1

B) 1.08:1

C) 28.09:1

D) 230.96:1

A) 0.39:1

B) 1.08:1

C) 28.09:1

D) 230.96:1

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

51

You own a business that has assets of $139,300 and liabilities of $74,800. What is your current ratio? (Round to the nearest hundredth)

A) 1.46:1

B) 1.52:1

C) 1.86:1

D) 2.89:1

A) 1.46:1

B) 1.52:1

C) 1.86:1

D) 2.89:1

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

52

Stan's Balloon Rides had net sales of $280,611 and the cost of goods sold were $110,900. Operating expenses were $45,315 and owner's equity is $423,600. Calculate the return on investment. (Round to the nearest tenth)

A) 29.4%

B) 18.8%

C) 24.1%

D) 28.6%

A) 29.4%

B) 18.8%

C) 24.1%

D) 28.6%

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

53

You own a business that has assets of $279,000. If your equity is $87,000, what is the amount of your liabilities?

A) $279,000

B) $87,000

C) $192,000

D) $98,000

A) $279,000

B) $87,000

C) $192,000

D) $98,000

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

54

From the following data, find the 2013 Net Income index number. (Round to nearest tenth percent)

A) 95.0%

B) 86.2%

C) 35.4%

D) 23.9%

A) 95.0%

B) 86.2%

C) 35.4%

D) 23.9%

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

55

Silver Bullet Ranch had net sales of $340,000 and total assets of $208,500. Find the asset turnover ratio. (Round to the nearest hundredth)

A) 1.48:1

B) 0.83:1

C) 112.0:1

D) 1.63:1

A) 1.48:1

B) 0.83:1

C) 112.0:1

D) 1.63:1

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

56

You own a business that has assets of $149,300 and liabilities of $83,800. What is your current ratio? (Round to the nearest hundredth)

A) 1.56:1

B) 1.62:1

C) 1.78:1

D) 2.19:1

A) 1.56:1

B) 1.62:1

C) 1.78:1

D) 2.19:1

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

57

The Earhardt Flight School had accounts receivable of $98,500 and an average collection period of 35 days. What were the total credit sales for Earhardt?

A) $1,876,319.30

B) $588,221.60

C) $1,027,214.29

D) $754,296.48

A) $1,876,319.30

B) $588,221.60

C) $1,027,214.29

D) $754,296.48

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

58

Sports and More Inc. has total assets of $162,500. If total equity is $72,250, find the debt-to-assets ratio. (Round to the nearest hundredth)

A) 1.38:1

B) 1.29:1

C) .56:1

D) .44:1

A) 1.38:1

B) 1.29:1

C) .56:1

D) .44:1

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

59

Lia's Swim Shoppe has current liabilities of $298,100; cash in the amount $52,500; securities valued at $95,400; and accounts receivable of $158,200. Calculate the acid test ratio. (Round to the nearest hundredth)

A) 1.80:1

B) .85:1

C) .97:1

D) 1.03:1

A) 1.80:1

B) .85:1

C) .97:1

D) 1.03:1

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

60

Trina Corp has total assets of $131,000. If total liabilities are $54,300, find the debt-to-equity ratio. (Round to the nearest hundredth)

A) .41:1

B) 1.71:1

C) .71:1

D) 1.41:1

A) .41:1

B) 1.71:1

C) .71:1

D) 1.41:1

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

61

Narrative 15-1

For the balance sheet items, indicate the appropriate category:

a.Current Asset

b.Fixed Asset

c.Current Liability

d.Long-Term Liability

e.Owner's Equity

Refer to Narrative in your text 15-1. Preferred Stock

For the balance sheet items, indicate the appropriate category:

a.Current Asset

b.Fixed Asset

c.Current Liability

d.Long-Term Liability

e.Owner's Equity

Refer to Narrative in your text 15-1. Preferred Stock

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

62

Narrative 15-1

For the balance sheet items, indicate the appropriate category:

a.Current Asset

b.Fixed Asset

c.Current Liability

d.Long-Term Liability

e.Owner's Equity

Refer to Narrative in your text 15-1. Retained Earnings

For the balance sheet items, indicate the appropriate category:

a.Current Asset

b.Fixed Asset

c.Current Liability

d.Long-Term Liability

e.Owner's Equity

Refer to Narrative in your text 15-1. Retained Earnings

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

63

Into what category does the following balance sheet item fall: Cash

A) Long-term Liability

B) Stockholder's (or Owner's) Equity

C) Current Assets

D) Fixed Asset (Property, Plant, and Equipment)

A) Long-term Liability

B) Stockholder's (or Owner's) Equity

C) Current Assets

D) Fixed Asset (Property, Plant, and Equipment)

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

64

Jamie's Natural Foods had net sales of $329,500 and the cost of goods sold were $192,400. Operating expenses were $89,672 and owner's equity is $328,775. Calculate the net profit margin. (Round to the nearest tenth)

A) 20.4%

B) 14.4%

C) 26.8%

D) 22.8%

A) 20.4%

B) 14.4%

C) 26.8%

D) 22.8%

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

65

Calculate the quick assets and acid test ratios.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

66

Calculate the amount of owner's equity and the two leverage ratios:

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

67

Calculate the missing information based on the format of the income statement:

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

68

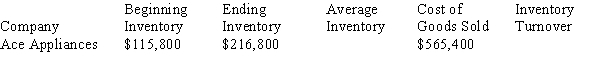

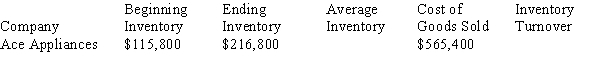

Calculate the average inventory and inventory turnover ratios:

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

69

Perform a vertical analysis for the entry "Gross Sales" on the portion of an income statement shown below. (Round to the nearest tenth)

A) 104.9%

B) 103.6%

C) 95.3%

D) 58.6%

A) 104.9%

B) 103.6%

C) 95.3%

D) 58.6%

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

70

Narrative 15-1

For the balance sheet items, indicate the appropriate category:

a.Current Asset

b.Fixed Asset

c.Current Liability

d.Long-Term Liability

e.Owner's Equity

Refer to Narrative in your text 15-1. R. Smith, Capital

For the balance sheet items, indicate the appropriate category:

a.Current Asset

b.Fixed Asset

c.Current Liability

d.Long-Term Liability

e.Owner's Equity

Refer to Narrative in your text 15-1. R. Smith, Capital

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

71

Calculate the average inventory and inventory turnover ratios:

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

72

Calculate the value according to the accounting equation:

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

73

Calculate the amount of owner's equity and the two leverage ratios:

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

74

Find the entry you would make on an income statement for TOTAL OPERATING EXPENSES for the year ended December 31, 2007: Gross Sales, $161,000; Sales Returns and Allowances, $9,600; Sales Discounts, $11,600; Merchandise Inventory, January 1, 2011, $52,500; Merchandise Inventory, December 31, 2011, $62,500; Net Purchases, $82,300; Freight In, $3,000; Salaries, $94,700; Rent, $29,800; Utilities, $2,245; Insurance, $3,250; and Income Tax, $19,600.

A) $129,995

B) $102,875

C) $127,750

D) $149,595

A) $129,995

B) $102,875

C) $127,750

D) $149,595

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

75

Calculate the missing information based on the format of the income statement:

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

76

Calculate the average inventory and inventory turnover ratios:

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

77

Calculate the value according to the accounting equation:

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

78

Calculate the missing information based on the format of the income statement:

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

79

Calculate the amount of working capital and the current ratio for the following companies:

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

80

Narrative 15-1

For the balance sheet items, indicate the appropriate category:

a.Current Asset

b.Fixed Asset

c.Current Liability

d.Long-Term Liability

e.Owner's Equity

Refer to Narrative in your text 15-1. Common Stock

For the balance sheet items, indicate the appropriate category:

a.Current Asset

b.Fixed Asset

c.Current Liability

d.Long-Term Liability

e.Owner's Equity

Refer to Narrative in your text 15-1. Common Stock

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck