Deck 25: Derivatives and Hedging Risk

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/64

Play

Full screen (f)

Deck 25: Derivatives and Hedging Risk

1

The party most apt to take a long position in agriculture futures is the firm that:

A)harvests lumber.

B)raises corn.

C)harvests cotton.

D)uses cocoa to make candy.

E)supplies pigs to slaughter houses.

A)harvests lumber.

B)raises corn.

C)harvests cotton.

D)uses cocoa to make candy.

E)supplies pigs to slaughter houses.

uses cocoa to make candy.

2

To protect against interest rate risk,the mortgage banker who has committed to lending funds but has yet to raise those funds should:

A)buy futures,as this position will hedge losses if rates rise.

B)sell futures,as this position will hedge losses if rates rise.

C)sell futures,as this position will add to his gains if rates rise.

D)buy futures,as this position will add to his gains if rates rise.

E)avoid the futures market.

A)buy futures,as this position will hedge losses if rates rise.

B)sell futures,as this position will hedge losses if rates rise.

C)sell futures,as this position will add to his gains if rates rise.

D)buy futures,as this position will add to his gains if rates rise.

E)avoid the futures market.

sell futures,as this position will hedge losses if rates rise.

3

Hedging in the futures markets can reduce all risk if:

A)price movements in both the cash and futures markets are perfectly correlated.

B)price movements in both the cash and futures markets have zero correlation.

C)price movements in both the cash and futures markets are less than perfectly correlated.

D)the hedge is a short hedge,but not a long hedge.

E)the hedge is a long hedge,but not a short hedge.

A)price movements in both the cash and futures markets are perfectly correlated.

B)price movements in both the cash and futures markets have zero correlation.

C)price movements in both the cash and futures markets are less than perfectly correlated.

D)the hedge is a short hedge,but not a long hedge.

E)the hedge is a long hedge,but not a short hedge.

price movements in both the cash and futures markets are perfectly correlated.

4

A potential disadvantage of forward contracts versus futures contracts is:

A)the extra liquidity required to cover the potential outflows that can occur prior to delivery.

B)the higher incentive for a particular party to default.

C)that the buyers and sellers don't know each other and never meet.

D)the obligatory requirements rather than the optional opportunities.

E)the increased ability to close out a position prior to expiration.

A)the extra liquidity required to cover the potential outflows that can occur prior to delivery.

B)the higher incentive for a particular party to default.

C)that the buyers and sellers don't know each other and never meet.

D)the obligatory requirements rather than the optional opportunities.

E)the increased ability to close out a position prior to expiration.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

5

The buyer of a forward contract will be:

A)taking delivery of the goods today at today's price.

B)making delivery of the goods at a later date at that date's price.

C)making delivery of the goods today at today's price.

D)taking delivery of the goods at a later date at a pre-specified price.

E)deciding on a future date whether or not to take delivery at a pre-specified price.

A)taking delivery of the goods today at today's price.

B)making delivery of the goods at a later date at that date's price.

C)making delivery of the goods today at today's price.

D)taking delivery of the goods at a later date at a pre-specified price.

E)deciding on a future date whether or not to take delivery at a pre-specified price.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

6

Futures contracts:

A)are traded off-exchange.

B)require delivery on a specific date.

C)are standardized.

D)are individually negotiated.

E)marked to market on a weekly basis.

A)are traded off-exchange.

B)require delivery on a specific date.

C)are standardized.

D)are individually negotiated.

E)marked to market on a weekly basis.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

7

Comparing long-term bonds with short-term bonds,long-term bonds are ________ volatile and therefore experience ________ price change than short-term bonds for the same interest rate shift.

A)less; less

B)less; more

C)more; more

D)more; less

E)more; the same

A)less; less

B)less; more

C)more; more

D)more; less

E)more; the same

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

8

A forward contract is described as agreeing today to either purchase or sell an asset or security:

A)at a later date at a price to be set in the future.

B)today at the current market price.

C)at a later date at a price set today.

D)if it is advantageous to do so in the future.

E)with delivery today and payment in the future.

A)at a later date at a price to be set in the future.

B)today at the current market price.

C)at a later date at a price set today.

D)if it is advantageous to do so in the future.

E)with delivery today and payment in the future.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

9

Which one of the following is not associated with forward contracts?

A)Making delivery

B)Taking delivery

C)Deliverable instrument

D)Cash transaction

E)Delayed delivery

A)Making delivery

B)Taking delivery

C)Deliverable instrument

D)Cash transaction

E)Delayed delivery

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

10

A miller who needs wheat to mill into flour most likely uses the futures market for taking a:

A)long hedge position to lock in production costs.

B)short hedge position to lock in delivery.

C)long hedge position to lock in a sales price for flour.

D)seller's position in wheat.

E)speculator's position in wheat.

A)long hedge position to lock in production costs.

B)short hedge position to lock in delivery.

C)long hedge position to lock in a sales price for flour.

D)seller's position in wheat.

E)speculator's position in wheat.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

11

A 3-month futures contract on gold is priced at $1,200 per troy ounce when the contract is initiated.If the price of gold rises every day over the 3-month period,then when the contract is settled,the buyer will ________ and the seller will ________.

A)lose; gain

B)gain; lose

C)gain; break even

D)gain; gain

E)lose; lose

A)lose; gain

B)gain; lose

C)gain; break even

D)gain; gain

E)lose; lose

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

12

Futures market transactions are commonly used to reduce risk.The most risk reduction can be obtained when the asset at risk and the futures contract:

A)have different maturities.

B)have payoff schedules that differ.

C)have differing volatilities.

D)have uncorrelated price movements.

E)have perfectly correlated price movements.

A)have different maturities.

B)have payoff schedules that differ.

C)have differing volatilities.

D)have uncorrelated price movements.

E)have perfectly correlated price movements.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

13

If the producer of a product has entered into a fixed price sale agreement for that output,the producer generally faces:

A)a nice steady profit because the output price is fixed.

B)an uncertain profit if the input prices are volatile.This risk can be reduced by a short hedge.

C)an uncertain profit if the input prices are volatile.This risk can be reduced by a long hedge.

D)a modest profit if the input prices are stable.This risk can be reduced by a long hedge.

E)a modest profit if the input prices are stable.This risk can be reduced by a short hedge.

A)a nice steady profit because the output price is fixed.

B)an uncertain profit if the input prices are volatile.This risk can be reduced by a short hedge.

C)an uncertain profit if the input prices are volatile.This risk can be reduced by a long hedge.

D)a modest profit if the input prices are stable.This risk can be reduced by a long hedge.

E)a modest profit if the input prices are stable.This risk can be reduced by a short hedge.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

14

A derivative is a financial instrument with a value derived from a:

A)regulatory body such as the FTC.

B)primitive or underlying asset.

C)specified risk.

D)negotiated contract.

E)probability of occurrence.

A)regulatory body such as the FTC.

B)primitive or underlying asset.

C)specified risk.

D)negotiated contract.

E)probability of occurrence.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

15

You hold a futures contract to take delivery of U.S.Treasury bonds in 6 months.If the entire term structure of interest rates shifts down over the 6-month period,the value of the forward contract will have ________ the date of delivery.

A)increased in value by

B)decreased in value by

C)the same value as when obtained on

D)either decreased in value or have a zero value by

E)zero value by

A)increased in value by

B)decreased in value by

C)the same value as when obtained on

D)either decreased in value or have a zero value by

E)zero value by

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

16

Derivatives can be used to either hedge or speculate.These strategies:

A)increase risk in both cases.

B)decrease risk in both cases.

C)spread or minimize risk in both cases.

D)offset risk by hedging and increase risk by speculating.

E)offset risks by speculating and increase risk by hedging.

A)increase risk in both cases.

B)decrease risk in both cases.

C)spread or minimize risk in both cases.

D)offset risk by hedging and increase risk by speculating.

E)offset risks by speculating and increase risk by hedging.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

17

Mortgage bankers earn income principally by:

A)speculating in Treasury futures.

B)collecting interest on long-term mortgages.

C)offsetting long and short hedge positions in Treasury futures.

D)charging origination and servicing fees.

E)hedging all interest rate risk.

A)speculating in Treasury futures.

B)collecting interest on long-term mortgages.

C)offsetting long and short hedge positions in Treasury futures.

D)charging origination and servicing fees.

E)hedging all interest rate risk.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

18

The main difference between a forward contract and a cash transaction is:

A)a forward contract provides an option while a cash transaction is an obligation.

B)a forward contract is fulfilled at a later date while the cash transaction is carried out immediately.

C)the price of a forward contract is decided at a later date while a cash transaction occurs at the current spot rate.

D)a cash transaction can be reversed but a forward contract cannot.

E)the forward contract can be negotiated while a cash transaction cannot.

A)a forward contract provides an option while a cash transaction is an obligation.

B)a forward contract is fulfilled at a later date while the cash transaction is carried out immediately.

C)the price of a forward contract is decided at a later date while a cash transaction occurs at the current spot rate.

D)a cash transaction can be reversed but a forward contract cannot.

E)the forward contract can be negotiated while a cash transaction cannot.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

19

Futures contracts contrast with forward contracts by:

A)providing an option for the buyer rather than an obligation.

B)marking to the market on a weekly basis.

C)allowing the seller to deliver any day during the delivery month.

D)allowing the parties to negotiate the contract size.

E)requiring contract fulfillment by the two originating parties.

A)providing an option for the buyer rather than an obligation.

B)marking to the market on a weekly basis.

C)allowing the seller to deliver any day during the delivery month.

D)allowing the parties to negotiate the contract size.

E)requiring contract fulfillment by the two originating parties.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

20

Which one of these parties would generally have the most reason to take a short hedge position in the agricultural futures market?

A)A local bakery

B)A wheat farmer

C)A major breakfast food company

D)A beverage maker

E)An international investor

A)A local bakery

B)A wheat farmer

C)A major breakfast food company

D)A beverage maker

E)An international investor

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

21

A bond manager who wishes to hold the bonds with the greatest potential price volatility should acquire:

A)short-term,high-coupon bonds.

B)long-term,low-coupon bonds.

C)long-term,zero-coupon bonds.

D)short-term,zero-coupon bonds.

E)short-term,low-coupon bonds.

A)short-term,high-coupon bonds.

B)long-term,low-coupon bonds.

C)long-term,zero-coupon bonds.

D)short-term,zero-coupon bonds.

E)short-term,low-coupon bonds.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

22

LIBOR stands for:

A)London Interest Basis Offered Rate.

B)London International Offered Rate.

C)London Interbank Offered Rate.

D)London Interagency Offered Rate.

E)London International Option Rate.

A)London Interest Basis Offered Rate.

B)London International Offered Rate.

C)London Interbank Offered Rate.

D)London Interagency Offered Rate.

E)London International Option Rate.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

23

Suenette wants to own bonds but also wants their market values to remain as steady as possible.Which type of bonds are best suited to her wishes?

A)High-coupon,short-term

B)Zero-coupon,long-term

C)High-coupon,long-term

D)Low-coupon,short term

E)Zero coupon,short term

A)High-coupon,short-term

B)Zero-coupon,long-term

C)High-coupon,long-term

D)Low-coupon,short term

E)Zero coupon,short term

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

24

In percentage terms,higher coupon bonds experience a ________ price change compared with lower coupon bonds of the same maturity given a stated change in market interest rates.

A)greater

B)smaller

C)similar

D)equal

E)zero

A)greater

B)smaller

C)similar

D)equal

E)zero

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

25

Which one of these bonds has the highest duration?

A)15-year high coupon

B)15-year zero coupon

C)10-year zero coupon

D)10-year high coupon

E)15-year low coupon

A)15-year high coupon

B)15-year zero coupon

C)10-year zero coupon

D)10-year high coupon

E)15-year low coupon

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

26

When interest rates shift,the price of zero coupon bonds are ________ volatile ________

A)more; if they have a short maturity rather than a long maturity.

B)not; because their duration always matches their maturity.

C)equally; regardless of their maturity.

D)less; than coupon bonds of the same maturity.

E)more; than coupon bonds of the same maturity.

A)more; if they have a short maturity rather than a long maturity.

B)not; because their duration always matches their maturity.

C)equally; regardless of their maturity.

D)less; than coupon bonds of the same maturity.

E)more; than coupon bonds of the same maturity.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

27

A financial institution can hedge its interest rate risk by:

A)matching the duration of its assets to the duration of its liabilities.

B)setting the duration of its assets equal to half that of the duration of its liabilities.

C)matching the duration of its assets,weighted by the market value of its assets with the duration of its liabilities,weighted by the market value of its liabilities.

D)setting the duration of its assets,weighted by the market value of its assets to one half that of the duration of the liabilities,weighted by the market value of the liabilities.

E)setting the duration of its assets equal to 1.0.

A)matching the duration of its assets to the duration of its liabilities.

B)setting the duration of its assets equal to half that of the duration of its liabilities.

C)matching the duration of its assets,weighted by the market value of its assets with the duration of its liabilities,weighted by the market value of its liabilities.

D)setting the duration of its assets,weighted by the market value of its assets to one half that of the duration of the liabilities,weighted by the market value of the liabilities.

E)setting the duration of its assets equal to 1.0.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

28

Assume a firm has a floating-rate loan and purchases a 10 percent cap on that loan.As a result,the firm will receive payments equal to:

A).10 × Assets.

B).10 × Annual interest payment.

C)(LIBOR − .10)× Principal loan amount.

D)(LIBOR + .10)× Principal loan amount.

E).10 × Principal loan amount.

A).10 × Assets.

B).10 × Annual interest payment.

C)(LIBOR − .10)× Principal loan amount.

D)(LIBOR + .10)× Principal loan amount.

E).10 × Principal loan amount.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

29

Which one of these bonds will have the lowest percentage price change for a stated shift in interest rates?

A)5-year,zero coupon

B)5-year,high coupon

C)5-year,low coupon

D)10-year,low coupon

E)10-year,high coupon

A)5-year,zero coupon

B)5-year,high coupon

C)5-year,low coupon

D)10-year,low coupon

E)10-year,high coupon

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

30

The duration of a pure discount bond is:

A)equal to its half-life.

B)less than that of a comparable coupon bond.

C)independent of the bond's maturity.

D)is equal to the bond's maturity.

E)always equal to one year.

A)equal to its half-life.

B)less than that of a comparable coupon bond.

C)independent of the bond's maturity.

D)is equal to the bond's maturity.

E)always equal to one year.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

31

Credit default swaps:

A)have no standardized agreement template.

B)are traded on international exchanges.

C)are traded only on national exchanges.

D)are rarely used in actual practice.

E)must follow the structure outlined by the SEC.

A)have no standardized agreement template.

B)are traded on international exchanges.

C)are traded only on national exchanges.

D)are rarely used in actual practice.

E)must follow the structure outlined by the SEC.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

32

Duration is a measure of the:

A)yield to maturity of a bond.

B)coupon yield of a bond.

C)price of a bond.

D)effective maturity of a bond.

E)probability of a bond defaulting.

A)yield to maturity of a bond.

B)coupon yield of a bond.

C)price of a bond.

D)effective maturity of a bond.

E)probability of a bond defaulting.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

33

A swap is an arrangement for two counterparties to:

A)exchange cash flows over time.

B)permit fluctuation in interest rates.

C)help exchange markets clear.

D)temporarily exchange fixed assets.

E)insure natural catastrophes.

A)exchange cash flows over time.

B)permit fluctuation in interest rates.

C)help exchange markets clear.

D)temporarily exchange fixed assets.

E)insure natural catastrophes.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

34

The duration of a coupon bond is:

A)equal to its number of payments.

B)less than that of a zero coupon bond of equal maturity.

C)equal to the zero coupon bond of the same maturity.

D)equal to its maturity.

E)increases as the time to maturity decreases.

A)equal to its number of payments.

B)less than that of a zero coupon bond of equal maturity.

C)equal to the zero coupon bond of the same maturity.

D)equal to its maturity.

E)increases as the time to maturity decreases.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

35

An inverse floater and a super-inverse floater probably become the most valuable to a purchaser when:

A)interest rates remain constant.

B)interest rates fall.

C)interest rates rise.

D)their maturities are shorter rather than longer.

E)capped and floored.

A)interest rates remain constant.

B)interest rates fall.

C)interest rates rise.

D)their maturities are shorter rather than longer.

E)capped and floored.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

36

A financial institution has equity equal to one-tenth of its assets.If its asset duration is currently equal to its liability duration,then to immunize,the firm needs to:

A)decrease the duration of its assets.

B)increase the duration of its assets.

C)decrease the duration of its liabilities.

D)maintain the equal durations.

E)increase either the duration of its assets or of its liabilities.

A)decrease the duration of its assets.

B)increase the duration of its assets.

C)decrease the duration of its liabilities.

D)maintain the equal durations.

E)increase either the duration of its assets or of its liabilities.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

37

If a financial institution has equated the dollar effects of interest rate risk on its assets with the dollar effects on its liabilities,it has engaged in:

A)a long futures hedge.

B)a short futures hedge.

C)a protected swap.

D)hedging by matching.

E)hedging by swapping.

A)a long futures hedge.

B)a short futures hedge.

C)a protected swap.

D)hedging by matching.

E)hedging by swapping.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

38

Interest rate swaps allow one party to exchange a:

A)floating interest rate for a fixed rate.

B)fixed interest rate for a lower fixed rate.

C)floating interest rate for a lower floating rate.

D)floating interest rate for a one-time immediate cash payment.

E)fixed interest rate for a one-time future cash payment.

A)floating interest rate for a fixed rate.

B)fixed interest rate for a lower fixed rate.

C)floating interest rate for a lower floating rate.

D)floating interest rate for a one-time immediate cash payment.

E)fixed interest rate for a one-time future cash payment.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

39

Caps and floors are used in conjunction with derivatives to:

A)limit any impact from interest rate changes.

B)increase the rate of return to the derivative holder.

C)increase the volatility of the at-risk asset.

D)offset the costs associated with establishing the derivative position.

E)lower acquisition costs irrespective of financing costs.

A)limit any impact from interest rate changes.

B)increase the rate of return to the derivative holder.

C)increase the volatility of the at-risk asset.

D)offset the costs associated with establishing the derivative position.

E)lower acquisition costs irrespective of financing costs.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

40

A U.S.firm involved in foreign exports is most apt to highly engage in:

A)inverse floaters.

B)super floaters.

C)Treasury futures.

D)currency swaps.

E)interest rate swaps.

A)inverse floaters.

B)super floaters.

C)Treasury futures.

D)currency swaps.

E)interest rate swaps.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

41

Small Town Bank has total assets with a market value of $14.23 million and a duration of 2.64 years.The bank's liabilities equal $12.87 million and its equity is $1.36 million on a market value basis.To hedge interest rate risk,what duration should the bank seek for its liabilities?

A)2.86 years

B)2.78 years

C)2.39 years

D)2.48 years

E)2.92 years

A)2.86 years

B)2.78 years

C)2.39 years

D)2.48 years

E)2.92 years

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

42

Assume you write a futures contract on corn at $4.05 per bushel.Over the next 5 trading days the contract settled at $4.07,$4.05,$4.04,$4.02,and $4.04.You then decide to reverse your position in the futures market on the fifth day at close.What is the net amount you receive on this contract per bushel?

A)$4.04

B)$4.05

C)$4.07

D)$4.02

E)$4.06

A)$4.04

B)$4.05

C)$4.07

D)$4.02

E)$4.06

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

43

Calculate the duration of a $1,000 zero-coupon bond with a current price of $455.59,a maturity of 6 years,and a yield to maturity of 14 percent.

A)5.29 years

B)5.76 years

C)6.00 years

D)5.47 years

E)5.86 years

A)5.29 years

B)5.76 years

C)6.00 years

D)5.47 years

E)5.86 years

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

44

Calculate the duration of a $1,000 face value bond with annual coupon payments,a coupon rate of 7 percent,a maturity of 4 years,and a yield to maturity of 8.2 percent.

A)3.49 years

B)3.62 years

C)3.69 years

D)3.81 years

E)3.74 years

A)3.49 years

B)3.62 years

C)3.69 years

D)3.81 years

E)3.74 years

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

45

Which one of the following is true about the use of derivatives?

A)Derivatives usually appear explicitly in the financial statements.

B)Academic surveys account for much of our knowledge of corporate derivatives use.

C)Small firms are more likely to use derivatives than large firms.

D)The most frequently used derivatives are commodity and equity futures.

E)Derivatives are primarily used by firms that have easy access to capital markets.

A)Derivatives usually appear explicitly in the financial statements.

B)Academic surveys account for much of our knowledge of corporate derivatives use.

C)Small firms are more likely to use derivatives than large firms.

D)The most frequently used derivatives are commodity and equity futures.

E)Derivatives are primarily used by firms that have easy access to capital markets.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

46

Assume the futures contracts on silver are quoted in dollars per troy ounce with a contract size of 5,000 troy ounces.Contract quotes for the day included an open value of $16.650,a high of $16.660,a low of $16.620,and a settle of $16.645.If you purchased three contracts at the closing price what was the dollar cost of your purchase ignoring all transaction costs?

A)$83,250

B)$82,500

C)$249,675

D)$249,750

E)$83,225

A)$83,250

B)$82,500

C)$249,675

D)$249,750

E)$83,225

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

47

Assume you write a futures contract on corn at $3.74 per bushel.Over the next 5 days the contract settles at $3.68,$3.71,$3.67,$3.64,and $3.61.Before you can reverse your position in the futures market you are notified to complete delivery on Day 5.What will you receive on delivery per bushel and what is the net amount per bushel you receive in total?

A)$3.74; −$.13

B)$3.74; $.13

C)$3.64; $3.74

D)$3.61; $3.61

E)$3.61; $3.74

A)$3.74; −$.13

B)$3.74; $.13

C)$3.64; $3.74

D)$3.61; $3.61

E)$3.61; $3.74

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

48

Last week,you sold a futures contract on 5,000 troy ounces of silver at a settle price of $16.59.Today,you made delivery and the daily settle price was $16.62.What amount will you receive at the time of delivery? Assume yesterday's settle price was $16.66.

A)$82,950

B)−$200

C)$300

D)$83,100

E)$83,300

A)$82,950

B)−$200

C)$300

D)$83,100

E)$83,300

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

49

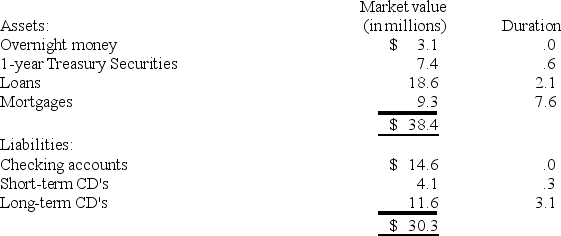

You have gathered the following market value and duration information on the Eastern Bank:  Calculate the duration of the bank's assets and of its liabilities.

Calculate the duration of the bank's assets and of its liabilities.

A)2.86 years; 1.23 years

B)2.97 years; 1.06 years

C)2.86 years; 1.06 years

D)2.48 years; 1.06 years

E)2.97 years; 1.23 years

Calculate the duration of the bank's assets and of its liabilities.

Calculate the duration of the bank's assets and of its liabilities.A)2.86 years; 1.23 years

B)2.97 years; 1.06 years

C)2.86 years; 1.06 years

D)2.48 years; 1.06 years

E)2.97 years; 1.23 years

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

50

Today,you purchased two natural gas futures contracts at the settle price for a May delivery.The contract size is 10,000 MMBtu with quotes in dollars per MMBtu.The day's high was 2.954,the low was 2.939,and the settle was 2.948.What was the total amount you had to pay today?

A)$14,740

B)$14,695

C)$14,770

D)$14,755

E)$0

A)$14,740

B)$14,695

C)$14,770

D)$14,755

E)$0

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

51

Assume a futures contract on gold is based on 100 troy ounces with prices quoted in dollars per troy ounce.Assume one contract called for delivery some time during the month of April.The price of gold opened the month at $1,194.The low quote for April was $1,189,the high was $1,212,and the end of month settle quote was $1,197.By what amount did the value on one contract vary over the month of April?

A)$30

B)$23

C)$3,000

D)$2,300

E)$300

A)$30

B)$23

C)$3,000

D)$2,300

E)$300

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

52

There are always at least ________ counterparties in a credit default swap.

A)0

B)1

C)2

D)3

E)more than three

A)0

B)1

C)2

D)3

E)more than three

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

53

Credit default swaps are most like:

A)inverse floaters.

B)call options on fixed assets.

C)an insurance policy.

D)an interest rate swap.

E)a delinquent loan.

A)inverse floaters.

B)call options on fixed assets.

C)an insurance policy.

D)an interest rate swap.

E)a delinquent loan.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

54

Today,you purchased a futures contract obligating you to purchase 100 troy ounces of gold for $1,218 per ounce any time over the next month.Assume the spot price of gold falls to $1,216 tomorrow.What will be your cash flow tomorrow for this contract?

A)−$400

B)$200

C)$0

D)−$200

E)$400

A)−$400

B)$200

C)$0

D)−$200

E)$400

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

55

Assume a bank has a $25 million mortgage bond risk position which it hedges in the Treasury bond futures market.Approximately how many futures contracts would be needed for this hedge if you assumed mortgage bonds and Treasury bonds were perfectly correlated?

A)5

B)25

C)250

D)500

E)2,500

A)5

B)25

C)250

D)500

E)2,500

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

56

Firm A is paying $300,000 in fixed interest payments a year while Firm B is paying LIBOR plus 30 basis points on $5 million loans.The current LIBOR rate is 5.5 percent.Firm A and B have agreed to swap interest payments.What is the net payment between these firms this year?

A)Firm A pays $10,000 to Firm B

B)Firm B pays $10,000 to Firm A

C)Firm B pays $12,500 to Firm A

D)Firm A pays $15,000 to Firm B

E)Firm B pays $15,000 to Firm A

A)Firm A pays $10,000 to Firm B

B)Firm B pays $10,000 to Firm A

C)Firm B pays $12,500 to Firm A

D)Firm A pays $15,000 to Firm B

E)Firm B pays $15,000 to Firm A

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

57

Assume a bond matures in 2 years,has a coupon rate of 6 percent,pays interest annually,and has a face value of $1,000.What is the duration of this bond if it is priced at par?

A)1.00 year

B)1.94 years

C)1.97 years

D)1.91 years

E)2.03 years

A)1.00 year

B)1.94 years

C)1.97 years

D)1.91 years

E)2.03 years

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

58

A mortgage banker has forward contracts to lend $12 million at 4.5 percent for 15 years.What position in Treasury bond futures does this banker need to hedge the interest rate risk?

A)Short position in 12 contracts

B)Short position in 120 contracts

C)Long position in 12 contracts

D)Long position in 120 contracts

E)Long position in 1,200 contracts

A)Short position in 12 contracts

B)Short position in 120 contracts

C)Long position in 12 contracts

D)Long position in 120 contracts

E)Long position in 1,200 contracts

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

59

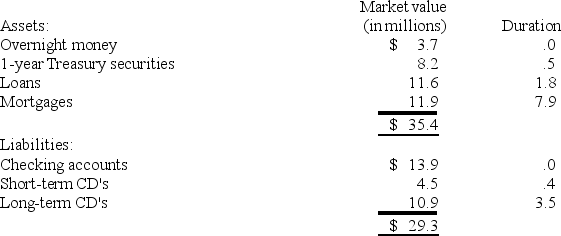

You have gathered the following market value and duration information on Northern Bank:  What new asset duration will immunize the balance sheet?

What new asset duration will immunize the balance sheet?

A)1.22 years

B).99 years

C)1.36 years

D)1.48 years

E)1.13 years

What new asset duration will immunize the balance sheet?

What new asset duration will immunize the balance sheet?A)1.22 years

B).99 years

C)1.36 years

D)1.48 years

E)1.13 years

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

60

You bought a futures contract on corn for $3.55 per bushel and closed the contract five days later at $3.56.The daily closing prices were $3.57,$3.54,$3.53,$3.58,and $3.56.What was the mark-to-market sequence of payments per bushel from (+)and to (−)the clearing house?

A)+$.02,−.03,−.01,+.05,−.02

B)+$.01,−.03,−.01,+.05,−.02

C)+$.02,+.01,−.02,−.06,+.04

D)−$.02,+.03,+.01,−.05,+.02

E)−$.01,+.03,+.01,−.05,+.02

A)+$.02,−.03,−.01,+.05,−.02

B)+$.01,−.03,−.01,+.05,−.02

C)+$.02,+.01,−.02,−.06,+.04

D)−$.02,+.03,+.01,−.05,+.02

E)−$.01,+.03,+.01,−.05,+.02

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

61

Explain why credit default swaps act like an insurance policy.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

62

The futures markets are considered by some to be highly risky and equivalent to gambling.Why is this an inaccurate portrayal of the market's function?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

63

Identify several of the differences between a forward contract and a futures contract.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

64

Duration is defined as the weighted average time to maturity of a financial instrument.List at least four other key things you know about duration.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck