Deck 9: Cash Receipts, Cash Payments, and Banking Procedures

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

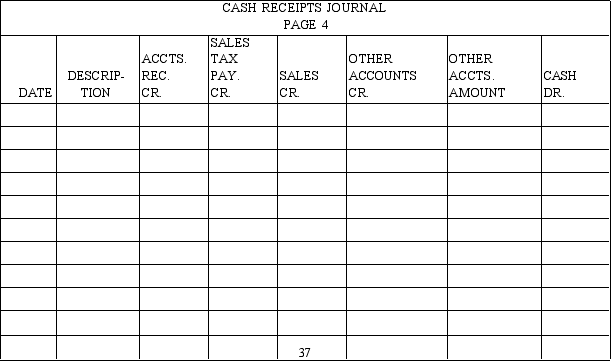

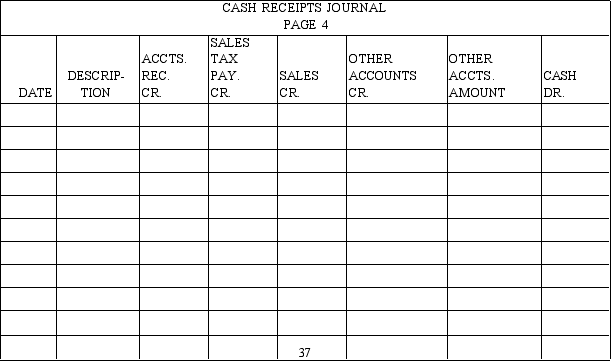

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/92

Play

Full screen (f)

Deck 9: Cash Receipts, Cash Payments, and Banking Procedures

1

The individual amounts in the Accounts Payable Debit column of the cash payments journal are posted to the accounts payable subsidiary ledger.

True

2

In a firm that has a good system of internal control, cash receipts are deposited often.

True

3

Upon collection of the amount due on an interest-bearing promissory note from a customer, the accountant would debit Cash, credit Notes Receivable, and:

A)credit Interest Income.

B)credit Interest Expense.

C)debit Interest Income.

D)debit Interest Expense.

A)credit Interest Income.

B)credit Interest Expense.

C)debit Interest Income.

D)debit Interest Expense.

A

4

The entry to record an additional cash investment by the owner is recorded in:

A)the purchases journal.

B)the cash payments journal.

C)the cash receipts journal.

D)the general journal.

A)the purchases journal.

B)the cash payments journal.

C)the cash receipts journal.

D)the general journal.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following statements is NOT correct regarding the cash receipts journal?

A)The amounts recorded in the Accounts Receivable Credit column are posted daily to individual accounts in the accounts receivable subsidiary ledger.

B)The amounts that appear in the Other Accounts Credit column are posted individually to the general ledger accounts during the month.

C)After posting a column total from the cash receipts journal to a general ledger account, a (--)is entered at the bottom of the journal column.

D)Before any posting to the general ledger takes place, the equality of the debits and credits recorded in the cash receipts journal are proved.

A)The amounts recorded in the Accounts Receivable Credit column are posted daily to individual accounts in the accounts receivable subsidiary ledger.

B)The amounts that appear in the Other Accounts Credit column are posted individually to the general ledger accounts during the month.

C)After posting a column total from the cash receipts journal to a general ledger account, a (--)is entered at the bottom of the journal column.

D)Before any posting to the general ledger takes place, the equality of the debits and credits recorded in the cash receipts journal are proved.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

6

Purchases Discounts is a contra cost of goods sold account.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

7

The monthly bank statement should be received and reconciled by the same employee who deposits cash receipts and writes the checks.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

8

A sale of merchandise for cash would be recorded in:

A)the cash payments journal.

B)the cash receipts journal.

C)the general journal.

D)the sales journal.

A)the cash payments journal.

B)the cash receipts journal.

C)the general journal.

D)the sales journal.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

9

A strong system of internal control requires that all payments be made by check except those made from a carefully controlled cash fund, such as a petty cash fund.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following statements is not correct?

A)The cash register proof is used to enter the cash sales and sales tax in the cash receipts journal.

B)The entry to record the receipt of a promissory note to replace an open account is recorded in the cash receipts journal.

C)In accounting, the term "cash" includes checks, money orders, and funds on deposit in a bank as well as currency and coins.

D)The cash receipts journal has separate columns for debits to Cash, credits to Accounts Receivable, and credits to Sales and Sales Tax Payable.

A)The cash register proof is used to enter the cash sales and sales tax in the cash receipts journal.

B)The entry to record the receipt of a promissory note to replace an open account is recorded in the cash receipts journal.

C)In accounting, the term "cash" includes checks, money orders, and funds on deposit in a bank as well as currency and coins.

D)The cash receipts journal has separate columns for debits to Cash, credits to Accounts Receivable, and credits to Sales and Sales Tax Payable.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

11

To arrive at the accurate balance on a bank reconciliation statement, it is necessary to deduct any NSF checks from the bank statement balance.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

12

The individual amounts in the Sales Credit column of the cash receipts journal are posted to the accounts receivable subsidiary ledger.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

13

Amounts that appear in the Other Accounts Credit section of the cash receipts journal require individual posting to the general ledger.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

14

To record the payment of a purchase invoice when a cash discount is taken, the accountant would:

A)debit Accounts Payable and credit Cash.

B)debit Accounts Payable, credit Purchases Discounts, and credit Cash.

C)debit Purchases, credit Purchases Discounts, and credit Cash.

D)debit Accounts Payable, debit Purchases Discounts, and credit Cash.

A)debit Accounts Payable and credit Cash.

B)debit Accounts Payable, credit Purchases Discounts, and credit Cash.

C)debit Purchases, credit Purchases Discounts, and credit Cash.

D)debit Accounts Payable, debit Purchases Discounts, and credit Cash.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

15

The entry to replenish petty cash includes a debit to the various expense and asset accounts and a credit to Cash.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following statements is correct?

A)Purchase discounts is a contra revenue account.

B)A transaction that is properly recorded in the cash payments journal will always include the recording of an amount in the Cash Debit column.

C)The entry to record the payment of an invoice within the cash discount period would include a debit to the Purchases Discounts account.

D)To record a cash purchase of merchandise, the accountant would debit Purchases and credit Cash.

A)Purchase discounts is a contra revenue account.

B)A transaction that is properly recorded in the cash payments journal will always include the recording of an amount in the Cash Debit column.

C)The entry to record the payment of an invoice within the cash discount period would include a debit to the Purchases Discounts account.

D)To record a cash purchase of merchandise, the accountant would debit Purchases and credit Cash.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

17

No end-of-month posting is required for the total of the Other Accounts Debit column of the cash payments journal.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

18

After a multicolumn special journal such as a cash receipts journal is totaled, it should be proved to be sure that the debits and credits in the journal are equal.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

19

Grouping all transactions involving cash payments together in the cash payments journal strengthens the audit trail.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

20

Cash Short or Over is an expense account when it has a debit balance.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

21

On a bank reconciliation statement, you would find all of the following except:

A)a list of outstanding checks.

B)a list of canceled checks.

C)the bank service charge.

D)a list of NSF checks.

A)a list of outstanding checks.

B)a list of canceled checks.

C)the bank service charge.

D)a list of NSF checks.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

22

The entry to replenish a petty cash fund includes:

A)a debit to Petty Cash Fund and a credit to Cash.

B)debits to various expense and asset accounts and a credit to Cash.

C)debits to various expense and asset accounts and a credit to petty Cash Fund.

D)a debit to Cash and a credit to Petty Cash.

A)a debit to Petty Cash Fund and a credit to Cash.

B)debits to various expense and asset accounts and a credit to Cash.

C)debits to various expense and asset accounts and a credit to petty Cash Fund.

D)a debit to Cash and a credit to Petty Cash.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

23

A check issued for $1,980 to pay a vendor on account was recorded in the firm's records as $1,890; the canceled check was properly listed on the bank statement at $1,980. To arrive at an accurate balance on a bank reconciliation statement, the error should be:

A)deducted from the book balance.

B)added to the bank statement balance.

C)added to the book balance.

D)deducted from the bank statement balance.

A)deducted from the book balance.

B)added to the bank statement balance.

C)added to the book balance.

D)deducted from the bank statement balance.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following would not be shown as an adjustment to the book balance on a bank reconciliation statement?

A)a charge for printing new checks

B)bank service charges

C)NSF checks

D)deposits in transit

A)a charge for printing new checks

B)bank service charges

C)NSF checks

D)deposits in transit

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

25

The entry to create a petty cash fund includes:

A)a debit to petty Cash and a credit to Cash.

B)a debit to Cash and a credit to Petty Cash Fund.

C)a debit to Cash and a credit to Miscellaneous Expense.

D)a debit to Petty Cash Fund and a credit to Cash Over and Short.

A)a debit to petty Cash and a credit to Cash.

B)a debit to Cash and a credit to Petty Cash Fund.

C)a debit to Cash and a credit to Miscellaneous Expense.

D)a debit to Petty Cash Fund and a credit to Cash Over and Short.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

26

To arrive at an accurate balance on a bank reconciliation statement, deposits in transit should be:

A)deducted from the bank statement balance.

B)added to the book balance.

C)added to the bank statement balance.

D)deducted from the book balance.

A)deducted from the bank statement balance.

B)added to the book balance.

C)added to the bank statement balance.

D)deducted from the book balance.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

27

To arrive at an accurate balance on a bank reconciliation statement, outstanding checks should be:

A)added to the book balance.

B)added to the bank statement balance.

C)deducted from the book balance.

D)deducted from the bank statement balance.

A)added to the book balance.

B)added to the bank statement balance.

C)deducted from the book balance.

D)deducted from the bank statement balance.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

28

A firm wrote a check for $78 but entered the amount as payment of $87 in its records. On a bank reconciliation statement this error would be shown as:

A)a deduction of $9 from the book balance.

B)an addition of $9 to the bank statement balance.

C)an addition of $9 to the book balance.

D)a deduction of $9 from the bank statement balance.

A)a deduction of $9 from the book balance.

B)an addition of $9 to the bank statement balance.

C)an addition of $9 to the book balance.

D)a deduction of $9 from the bank statement balance.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

29

To arrive at an accurate balance on a bank reconciliation statement, a service charge should be:

A)added to the bank statement balance.

B)deducted from the bank statement balance.

C)added to the book balance.

D)deducted from the book balance.

A)added to the bank statement balance.

B)deducted from the bank statement balance.

C)added to the book balance.

D)deducted from the book balance.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

30

A check issued for $890 to pay a vendor on account was recorded in the firm's records as $980; the canceled check was properly listed on the bank statement at $890. To arrive at an accurate balance on a bank reconciliation statement, the error should be:

A)added to the bank statement balance.

B)deducted from the book balance.

C)added to the book balance.

D)deducted from the bank statement balance.

A)added to the bank statement balance.

B)deducted from the book balance.

C)added to the book balance.

D)deducted from the bank statement balance.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

31

A firm's bank reconciliation statement shows a book balance of $16,640, a non-interest note collected by the bank of $3,400 an NSF check of $1,650, and a service charge of $60. Its adjusted book balance is:

A)$14,950.

B)$21,750.

C)$18,330.

D)$14,930.

A)$14,950.

B)$21,750.

C)$18,330.

D)$14,930.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

32

To arrive at an accurate balance on a bank reconciliation statement, an error made by the bank in which the bank deducted a check issued by another business from the balance of the company's bank account should be:

A)deducted from the book balance.

B)added to the bank statement balance.

C)deducted from the bank statement balance.

D)added to the book balance.

A)deducted from the book balance.

B)added to the bank statement balance.

C)deducted from the bank statement balance.

D)added to the book balance.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

33

While reconciling the bank statement, it is noted that the bank deducted a check written by another depositor. On a bank reconciliation statement this error would be shown as:

A)a deduction from the book balance.

B)a deduction from the bank statement balance.

C)an addition to the bank statement balance.

D)an addition to the book balance.

A)a deduction from the book balance.

B)a deduction from the bank statement balance.

C)an addition to the bank statement balance.

D)an addition to the book balance.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

34

A firm wrote a check for $282 but the bank deducted $228 from the firm's account for the check. On a bank reconciliation statement this error would be shown as:

A)an addition of $228 to the book balance.

B)a deduction of $54 from the bank statement balance.

C)a deduction of $54 from the book balance.

D)an addition of $282 to the bank statement balance.

A)an addition of $228 to the book balance.

B)a deduction of $54 from the bank statement balance.

C)a deduction of $54 from the book balance.

D)an addition of $282 to the bank statement balance.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

35

To arrive at an accurate balance on a bank reconciliation statement, a credit memorandum from the bank for the collection of a note and interest should be:

A)deducted from the bank statement balance.

B)added to the book balance.

C)deducted from the book balance.

D)added to the bank statement balance.

A)deducted from the bank statement balance.

B)added to the book balance.

C)deducted from the book balance.

D)added to the bank statement balance.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

36

A firm's bank reconciliation statement shows a book balance of $21,640, an NSF check of $800, and a service charge of $50. Its adjusted book balance is:

A)$20,890.

B)$22,390.

C)$20,790.

D)$22,490.

A)$20,890.

B)$22,390.

C)$20,790.

D)$22,490.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

37

Identify the procedure below that is NOT essential for proper control over cash receipts.

A)Have only designated employees receive and handle cash received by the business.

B)Enter cash receipts transactions in the accounting records promptly.

C)Keep cash receipts in a cash register or locked cash drawer or safe.

D)Hold all cash received during a month and make one bank deposit at the end of the month.

A)Have only designated employees receive and handle cash received by the business.

B)Enter cash receipts transactions in the accounting records promptly.

C)Keep cash receipts in a cash register or locked cash drawer or safe.

D)Hold all cash received during a month and make one bank deposit at the end of the month.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

38

Identify the procedure below that is NOT essential for proper control over cash payments.

A)Make all payments out of a petty cash fund or a travel and entertainment fund.

B)Use prenumbered checks.

C)Enter all cash payments promptly in the accounting records.

D)Have only designated personnel approve bills and invoices before they are paid.

A)Make all payments out of a petty cash fund or a travel and entertainment fund.

B)Use prenumbered checks.

C)Enter all cash payments promptly in the accounting records.

D)Have only designated personnel approve bills and invoices before they are paid.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

39

A check for $2,560 to pay a vendor on account was recorded in the firm's records as $2,650; the canceled check was properly listed on the bank statement at $2,560. To arrive at an accurate balance on a bank reconciliation statement:

A)add $2,650 to the bank statement balance.

B)add $90 to the book balance.

C)deducted $2,560 from the book balance.

D)deducted $90 from the bank statement balance.

A)add $2,650 to the bank statement balance.

B)add $90 to the book balance.

C)deducted $2,560 from the book balance.

D)deducted $90 from the bank statement balance.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

40

To arrive at an accurate balance on a bank reconciliation statement, a debit memorandum for a customer check marked NSF should be:

A)deducted from the book balance.

B)added to the book balance.

C)deducted from the bank statement balance.

D)added to the bank statement balance.

A)deducted from the book balance.

B)added to the book balance.

C)deducted from the bank statement balance.

D)added to the bank statement balance.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

41

The entry to record the issuance of a check in settlement of an interest-bearing promissory note of

$4,000 and interest of $100, would be to:

A)debit Notes Payable $4,100 and credit Cash $4,100.

B)debit Accounts Payable $4,000, debit Interest Expense $100 and credit Cash $4,100.

C)debit Interest Expense $100, debit Notes Payable $4,000 and credit Cash $4,100.

D)debit Cash $4,100, credit Notes Payable $4,000 and credit Cash $100.

$4,000 and interest of $100, would be to:

A)debit Notes Payable $4,100 and credit Cash $4,100.

B)debit Accounts Payable $4,000, debit Interest Expense $100 and credit Cash $4,100.

C)debit Interest Expense $100, debit Notes Payable $4,000 and credit Cash $4,100.

D)debit Cash $4,100, credit Notes Payable $4,000 and credit Cash $100.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

42

Hawthorne Inc. uses the perpetual inventory system when recording its cash payments and cash receipts. If the company issues a check to pay for goods purchased and they pay within the discount period, identify the account used to record the discount.

A)merchandise inventory

B)purchases

C)sales discounts

D)purchases discounts

A)merchandise inventory

B)purchases

C)sales discounts

D)purchases discounts

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

43

Valerie's Market uses a perpetual inventory system when recording its cash payments and cash receipts. The business sells $6,000 of goods to a charge account customer with terms of 2/10, n/30. If the customer pays within the discount period, the entry to record the receipt of cash from the customer would include:

A)a debit to Cash for $5,880 and a credit to Accounts Receivable for $5,880

B)a debit to Cash for $5,880; a debit to Purchase Discounts for $120 and a credit to Accounts Receivable for $5,880

C)a debit to Cash for $6,000 and a credit to Accounts Receivable for $6,000

D)a debit to Cash for $5,880; a debit to Sales Discounts for $120 and a credit to Accounts Receivable for $6,000

A)a debit to Cash for $5,880 and a credit to Accounts Receivable for $5,880

B)a debit to Cash for $5,880; a debit to Purchase Discounts for $120 and a credit to Accounts Receivable for $5,880

C)a debit to Cash for $6,000 and a credit to Accounts Receivable for $6,000

D)a debit to Cash for $5,880; a debit to Sales Discounts for $120 and a credit to Accounts Receivable for $6,000

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

44

Included on a firm's bank statement was a credit memorandum, which could indicate:

A)a bank service charge deducted from the firm's account balance.

B)an addition to the firm's account balance because the bank collected the amount due on a promissory note from a customer of the firm.

C)the bank's return of a dishonored (NSF)check that was issued by a credit customer of the firm.

D)a fee for printing new business checks.

A)a bank service charge deducted from the firm's account balance.

B)an addition to the firm's account balance because the bank collected the amount due on a promissory note from a customer of the firm.

C)the bank's return of a dishonored (NSF)check that was issued by a credit customer of the firm.

D)a fee for printing new business checks.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

45

If a check written by a firm is not canceled by the bank, the firm should:

A)consider this check as outstanding when preparing the bank reconciliation.

B)make no adjustment when preparing the bank reconciliation.

C)adjust the balance in the firm's checkbook to reflect the data that appears in the bank's records.

D)immediately notify the bank requesting that it correct its records.

A)consider this check as outstanding when preparing the bank reconciliation.

B)make no adjustment when preparing the bank reconciliation.

C)adjust the balance in the firm's checkbook to reflect the data that appears in the bank's records.

D)immediately notify the bank requesting that it correct its records.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

46

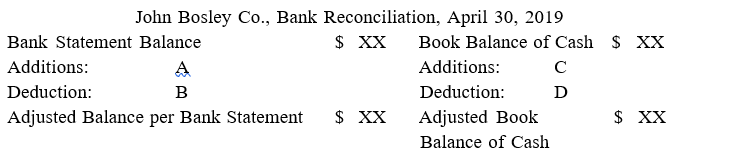

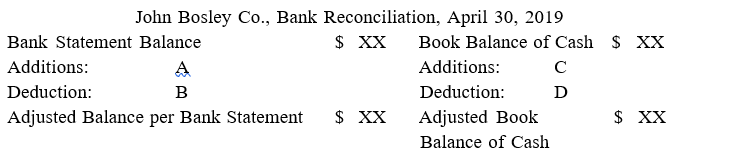

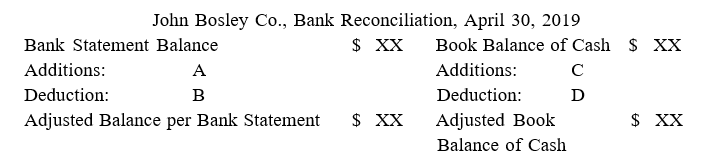

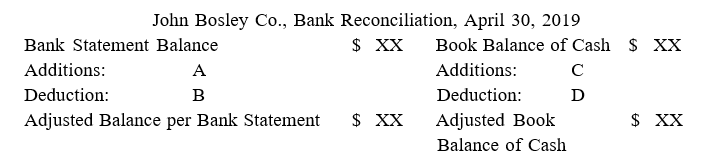

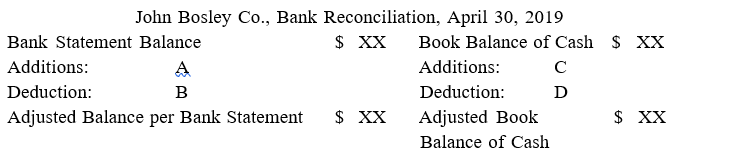

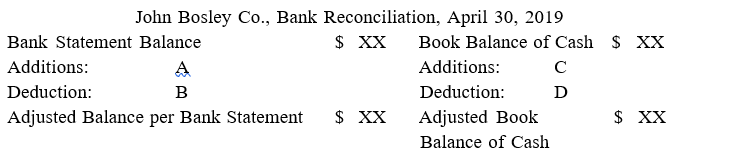

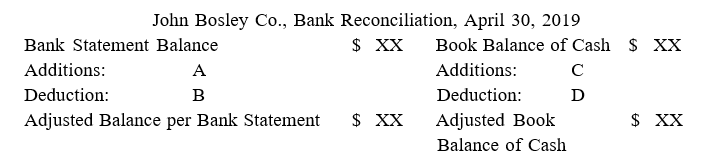

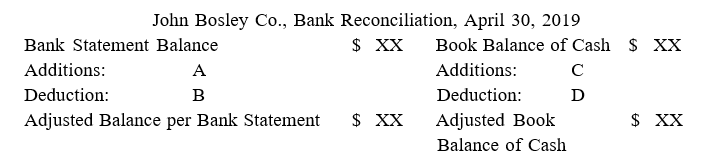

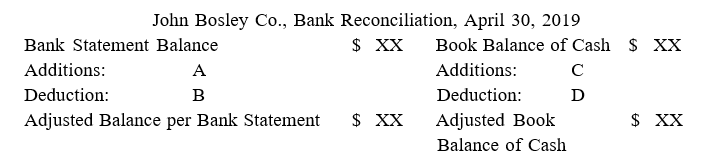

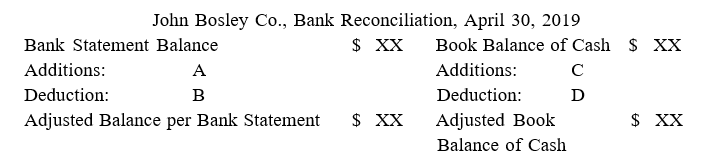

Indicate in which section of the Bank Reconciliation Statement the following reconciling items would appear.

-

An NSF check from a customer.

A)Option A

B)Option B

C)Option C

D)Option D

-

An NSF check from a customer.

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

47

Merchandise is sold for $5,600, terms 1/10, n/30. Prior to payment, the customer returned $360 of the merchandise. If the invoice is paid within the discount period the amount of the sales discount is:

A)$36.00

B)$52.40

C)$59.60

D)$56.00

A)$36.00

B)$52.40

C)$59.60

D)$56.00

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

48

Beckett Co. sold merchandise on account for $12,200, terms 2/10, n/30. Freight charges of $400 were prepaid by the seller and added to the invoice. The customer returned $1,000 of merchandise before making the payment then paid the invoice within the discount period. What is the amount Beckett Co. received?

A)$10,976

B)$11,376

C)$12,356

D)$11,368

A)$10,976

B)$11,376

C)$12,356

D)$11,368

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

49

Indicate in which section of the Bank Reconciliation Statement the following reconciling items would appear.

-

A service charge charged by the bank.

A)Option A

B)Option B

C)Option C

D)Option D

-

A service charge charged by the bank.

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

50

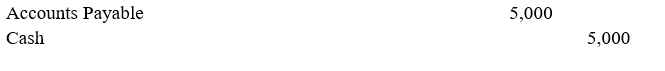

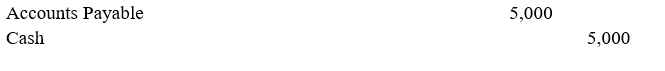

Phones R Us uses a perpetual inventory system when recording its cash payments and cash receipts. In June, the business purchases $5,000 of goods on account with terms of 2/10, n/30. Select the correct entry to record the payment of the goods within the discount period.

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

51

The entry in a firm's accounting records for the monthly service charge by the bank noted on the bank statement would include:

A)a debit to Cash and a credit to Accounts Payable.

B)a debit to Cash and a credit to Fees Income.

C)a debit to Accounts Payable and a credit to Cash.

D)a debit to Bank Fees Expense and a credit to Cash.

A)a debit to Cash and a credit to Accounts Payable.

B)a debit to Cash and a credit to Fees Income.

C)a debit to Accounts Payable and a credit to Cash.

D)a debit to Bank Fees Expense and a credit to Cash.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following statements is NOT correct?

A)Bank Reconciliation Statements are not that important because banks never make errors.

B)Bank Reconciliation Statements should be prepared each month.

C)Not all reconciling items on the Bank Reconciliation Statement are errors.

D)Prior to preparing the Bank Reconciliation Statement, neither the book balance nor the bank statement balance are correct.

A)Bank Reconciliation Statements are not that important because banks never make errors.

B)Bank Reconciliation Statements should be prepared each month.

C)Not all reconciling items on the Bank Reconciliation Statement are errors.

D)Prior to preparing the Bank Reconciliation Statement, neither the book balance nor the bank statement balance are correct.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

53

After a bank reconciliation statement is completed, a firm may have to make an entry in its accounting records for:

A)deposits in transit.

B)NSF checks.

C)the bank statement balance.

D)outstanding checks.

A)deposits in transit.

B)NSF checks.

C)the bank statement balance.

D)outstanding checks.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

54

Indicate in which section of the Bank Reconciliation Statement the following reconciling items would appear.

-

A check written by Bosley Co. for $186 was mistakenly recorded in the company records as $168.

A)Option A

B)Option B

C)Option C

D)Option D

-

A check written by Bosley Co. for $186 was mistakenly recorded in the company records as $168.

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

55

Merchandise costing $5,600 with terms of 1/10, n/30, with transportation costs of $320 included on the invoice (not included in the $5,600)is sold on account. If the bill is paid within ten days, the amount of the purchase discount is:

A)$56.00.

B)$59.20.

C)$3.20.

D)$52.80.

A)$56.00.

B)$59.20.

C)$3.20.

D)$52.80.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

56

Indicate in which section of the Bank Reconciliation Statement the following reconciling items would appear.

-

A deposit in transit.

A)Option A

B)Option B

C)Option C

D)Option D

-

A deposit in transit.

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

57

Of the four categories shown in the form above, which category or categories require journal entries in the firm's records?

A)Bank Statement Balance Additions and Bank Statement Balance Deductions

B)Book Balance Cash Additions and Book Balance Cash Deductions

C)Bank Statement Balance Additions and Book Balance of Cash Additions

D)Bank Statement Balance Deductions and Book Balance of Cash Deductions

A)Bank Statement Balance Additions and Bank Statement Balance Deductions

B)Book Balance Cash Additions and Book Balance Cash Deductions

C)Bank Statement Balance Additions and Book Balance of Cash Additions

D)Bank Statement Balance Deductions and Book Balance of Cash Deductions

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

58

Indicate in which section of the Bank Reconciliation Statement the following reconciling items would appear.

-

A canceled check for $147 erroneously listed on bank statement as $74.

A)Option A

B)Option B

C)Option C

D)Option D

-

A canceled check for $147 erroneously listed on bank statement as $74.

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

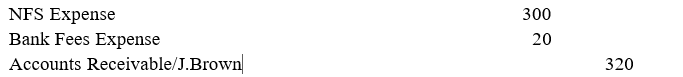

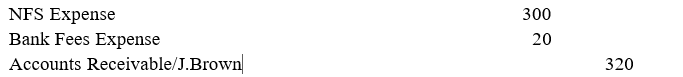

59

The March bank reconciliation statement for Cab World, Inc., showed an NSF check of $300 from

A. Brown as well as a bank service charge of $20 for monthly service fees. Which of the following is the correct journal entry required to record these items.

A)

B)

C)

D)

A. Brown as well as a bank service charge of $20 for monthly service fees. Which of the following is the correct journal entry required to record these items.

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

60

The entry in a firm's accounting records for a credit customer's check that was returned by the bank marked "NSF" would include:

A)a debit to Accounts Receivable and a credit to Accounts Payable.

B)a debit to Cash and a credit to Accounts Receivable.

C)a debit to Accounts Receivable and a credit to Cash.

D)a debit to Miscellaneous Expense and a credit to Cash.

A)a debit to Accounts Receivable and a credit to Accounts Payable.

B)a debit to Cash and a credit to Accounts Receivable.

C)a debit to Accounts Receivable and a credit to Cash.

D)a debit to Miscellaneous Expense and a credit to Cash.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

61

To transfer ownership of a check from one party to another, it is necessary to ________ the check.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

62

Checks issued by a firm and entered in its accounting records that have not been paid by the bank are called ________ checks.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

63

Sepulveda Inc. uses the perpetual inventory system when recording its cash payments and cash receipts. If the company receives a check from a customer for goods sold and it is received within the discount period, identify the account used to record the discount.

A)purchases

B)sales discounts

C)purchases discounts

D)merchandise inventory

A)purchases

B)sales discounts

C)purchases discounts

D)merchandise inventory

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

64

After totaling the receipts in the petty cash box, Kelly Garrett Detective Agency spent $65 on Office Supplies and $145 on Auto Expense. The journal entry to record the reimbursement to the petty cash fund would include:

A)a debit to Petty Cash Fund for $210

B)a credit to Petty Cash Fund for $210

C)a credit to Office Supplies for $65

D)a credit to Cash for $210

A)a debit to Petty Cash Fund for $210

B)a credit to Petty Cash Fund for $210

C)a credit to Office Supplies for $65

D)a credit to Cash for $210

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

65

Record the following transactions for the month of June 2019 on page 23 of a cash receipts journal. Total, prove, and rule the cash receipts journal as of June 30.

June 4 Collected $850 from Tom Whitney, a credit customer on account.

1 Received a cash refund of $60 for damaged supplies.

2 Laurie Bradley, the owner, invested an additional $10,000 cash in the business.

21 Received a check from Scott White to pay his $2,400 promissory note plus interest of $140.

26 Received $1,700 for cash sales of plus sales tax of $119. There was a cash overage of $5.

June 4 Collected $850 from Tom Whitney, a credit customer on account.

1 Received a cash refund of $60 for damaged supplies.

2 Laurie Bradley, the owner, invested an additional $10,000 cash in the business.

21 Received a check from Scott White to pay his $2,400 promissory note plus interest of $140.

26 Received $1,700 for cash sales of plus sales tax of $119. There was a cash overage of $5.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

66

If a firm's bank reconciliation statement shows a bank statement balance of $16,200, total deposits in transit of $1,800, and total outstanding checks of $1,200, the adjusted bank balance is ________.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

67

Checks written by a firm that were paid by the bank are called ________ checks.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

68

To record the payment of sales tax owed, the accountant would debit ________ and credit Cash.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

69

Read each of the following transactions. Determine the accounts to be debited and credited.

A)Sold merchandise for $200 in cash plus sales tax of $14.

B)Collected $3,400 from credit customers on account.

C)Sold merchandise for $1,600 in cash plus sales tax of $112. There was a cash shortage of $6.

A)Sold merchandise for $200 in cash plus sales tax of $14.

B)Collected $3,400 from credit customers on account.

C)Sold merchandise for $1,600 in cash plus sales tax of $112. There was a cash shortage of $6.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

70

Read each of the following transactions. Determine the accounts to be debited and credited.

A)Collected cash in settlement of a $600 promissory note plus interest of $18.

B)Jaime Gomez, the owner, made an additional cash investment of $11,000.

C)Sold merchandise for $3,000 in cash plus sales tax of $210. There was a cash overage of $4.

A)Collected cash in settlement of a $600 promissory note plus interest of $18.

B)Jaime Gomez, the owner, made an additional cash investment of $11,000.

C)Sold merchandise for $3,000 in cash plus sales tax of $210. There was a cash overage of $4.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

71

The process of determining why a difference exists between a firm's records and the bank's records and bringing the two sets of records into balance is known as ________ the bank statement.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

72

Read each of the following transactions. Determine the accounts and amounts to be debited and credited.

A)Issued a check for $2,500 to Jaime Gomez, the owner, as a cash withdrawal for personal use.

B)Issued a check for $75 to establish a petty cash fund.

C)Issued a check for $50 to replenish the petty cash fund. An analysis of the payments from the fund showed the following totals: Supplies, $25; Delivery Expense, $10; Miscellaneous Expense,

$15)

A)Issued a check for $2,500 to Jaime Gomez, the owner, as a cash withdrawal for personal use.

B)Issued a check for $75 to establish a petty cash fund.

C)Issued a check for $50 to replenish the petty cash fund. An analysis of the payments from the fund showed the following totals: Supplies, $25; Delivery Expense, $10; Miscellaneous Expense,

$15)

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

73

A(n)is a form received from the bank showing all transactions recorded in the depositor's account during the month.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

74

The Petty Cash Fund account has a(n)________ balance.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

75

A(n)________ is a written promise to pay a specified amount of money at a specified time.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

76

Read each of the following transactions. Determine the accounts to be debited and credited. The company uses the Periodic Inventory method

A)Purchased merchandise for $950 in cash.

B)Issued a check for $752 to remit sales tax to the state sales tax authority.

C)Issued a check for $1,894 to purchase supplies.

A)Purchased merchandise for $950 in cash.

B)Issued a check for $752 to remit sales tax to the state sales tax authority.

C)Issued a check for $1,894 to purchase supplies.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

77

Read each of the following transactions. Determine the accounts and amounts to be debited and credited. The company uses the Periodic Inventory method.

A)Issued a check for $10,600 to pay a $10,000 note plus interest of $600.

B)Issued a check for $1,500 to pay the monthly rent.

C)Issued a check for $7,840 to a creditor on account for an invoice of $8,000 less a cash discount of $160.

A)Issued a check for $10,600 to pay a $10,000 note plus interest of $600.

B)Issued a check for $1,500 to pay the monthly rent.

C)Issued a check for $7,840 to a creditor on account for an invoice of $8,000 less a cash discount of $160.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

78

If the amount of cash available for deposit is less than the amount listed on the audit tape taken from the cash register, the Cash Short or Over account is________.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

79

When a bank deducts any amount other than a paid check or electronic payment from a depositor's account, it issues a form called a(n)________memorandum.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck

80

Record the following transactions for the month of April, 2019 on page 4 of a cash receipts journal. Total, prove, and rule the cash receipts journal as of April 30.

April 3 Collected $350 from Margo Daub, a credit customer on account.

1 Kevin Sharp, the owner, invested an additional $5,000 cash in the business.

2 Received a cash refund of $30 for damaged supplies.

15 Had cash sales of $5,500 plus sales tax of $385. There was a cash overage of $5.

18 Received $800 from Brian Cobb, a credit customer, in payment of his account.

20 Received a check from Phil Stout to pay his $700 promissory note plus interest of $42.

30 Had cash sales of $3,800 plus sales tax of $266. There was a cash shortage of $5.

April 3 Collected $350 from Margo Daub, a credit customer on account.

1 Kevin Sharp, the owner, invested an additional $5,000 cash in the business.

2 Received a cash refund of $30 for damaged supplies.

15 Had cash sales of $5,500 plus sales tax of $385. There was a cash overage of $5.

18 Received $800 from Brian Cobb, a credit customer, in payment of his account.

20 Received a check from Phil Stout to pay his $700 promissory note plus interest of $42.

30 Had cash sales of $3,800 plus sales tax of $266. There was a cash shortage of $5.

Unlock Deck

Unlock for access to all 92 flashcards in this deck.

Unlock Deck

k this deck