Deck 21: Option Valuation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/40

Play

Full screen (f)

Deck 21: Option Valuation

1

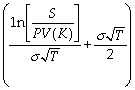

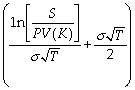

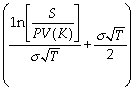

Consider the following equation: C = S × N  - PV(K)× N

- PV(K)× N  In this equation,the term σ represents

In this equation,the term σ represents

A) the number of days to expiration.

B) the number of years to expiration.

C) the expected return on the stock.

D) the annual volatility of the stock.

- PV(K)× N

- PV(K)× N  In this equation,the term σ represents

In this equation,the term σ representsA) the number of days to expiration.

B) the number of years to expiration.

C) the expected return on the stock.

D) the annual volatility of the stock.

the annual volatility of the stock.

2

Which of the following statements is false?

A) If you take the option price quoted in the market as an input and solve for the volatility you will have an estimate of a stock's volatility known as the implied volatility.

B) The Black-Scholes formula can be used to price American or European call options on non-dividend-paying stocks.

C) We need to know the expected return on the stock to calculate the option price in the Black-Scholes Option Pricing Model.

D) We can use the Black-Scholes formula to compute the price of a European put option on a non-dividend-paying stock by using the put-call parity formula.

A) If you take the option price quoted in the market as an input and solve for the volatility you will have an estimate of a stock's volatility known as the implied volatility.

B) The Black-Scholes formula can be used to price American or European call options on non-dividend-paying stocks.

C) We need to know the expected return on the stock to calculate the option price in the Black-Scholes Option Pricing Model.

D) We can use the Black-Scholes formula to compute the price of a European put option on a non-dividend-paying stock by using the put-call parity formula.

We need to know the expected return on the stock to calculate the option price in the Black-Scholes Option Pricing Model.

3

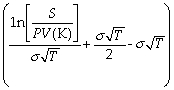

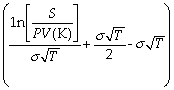

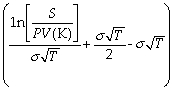

Consider the following equation: C = S × N  - PV(K)× N

- PV(K)× N  In this equation,the term T represents

In this equation,the term T represents

A) the number of years to expiration.

B) the annual volatility of the stock.

C) the expected return on the stock.

D) the number of days to expiration.

- PV(K)× N

- PV(K)× N  In this equation,the term T represents

In this equation,the term T representsA) the number of years to expiration.

B) the annual volatility of the stock.

C) the expected return on the stock.

D) the number of days to expiration.

the number of years to expiration.

4

Use the information for the question(s) below.

The current price of KD Industries' stock is $20. In the next year the stock price will either go up by 20% or go down by 20%. KD pays no dividends. The one year risk-free rate is 5% and will remain constant.

Using the binomial pricing model,the calculated price of a one-year put option on KD stock with a strike price of $20 is closest to:

A) $2.00

B) $1.45

C) $2.40

D) $2..15

The current price of KD Industries' stock is $20. In the next year the stock price will either go up by 20% or go down by 20%. KD pays no dividends. The one year risk-free rate is 5% and will remain constant.

Using the binomial pricing model,the calculated price of a one-year put option on KD stock with a strike price of $20 is closest to:

A) $2.00

B) $1.45

C) $2.40

D) $2..15

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is NOT an input required by the Black-Scholes option pricing model?

A) The expected volatility of the stock

B) The expected return on the stock

C) The risk-free interest rate

D) The current stock price

A) The expected volatility of the stock

B) The expected return on the stock

C) The risk-free interest rate

D) The current stock price

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

6

Use the information for the question(s) below.

The current price of Kinston Corporation stock is $10. In each of the next two years, this stock price can either go up by $3.00 or go down by $2.00. Kinston stock pays no dividends. The one year risk-free interest rate is 5% and will remain constant.

-Using the binomial pricing model,calculate the price of a two-year call option on Kinston stock with a strike price of $9.

The current price of Kinston Corporation stock is $10. In each of the next two years, this stock price can either go up by $3.00 or go down by $2.00. Kinston stock pays no dividends. The one year risk-free interest rate is 5% and will remain constant.

-Using the binomial pricing model,calculate the price of a two-year call option on Kinston stock with a strike price of $9.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements is correct?

A) Prior to the Black-Scholes formula, most economists and practitioners anticipated that mathematical formulas could be derived that could accurately price financial securities such as options.

B) Without the Black-Scholes formula, the job of corporate managers would be very different: many corporations would bear much less risk than they now do.

C) The most important factors contributing to the huge growth in the types of financial securities that are available today are the techniques that everyone uses to discount them.

D) It is not an exaggeration to say that the techniques developed by Black, Scholes, and Merton to value options changed the course of financial economics and gave birth to a new profession: financial engineering.

A) Prior to the Black-Scholes formula, most economists and practitioners anticipated that mathematical formulas could be derived that could accurately price financial securities such as options.

B) Without the Black-Scholes formula, the job of corporate managers would be very different: many corporations would bear much less risk than they now do.

C) The most important factors contributing to the huge growth in the types of financial securities that are available today are the techniques that everyone uses to discount them.

D) It is not an exaggeration to say that the techniques developed by Black, Scholes, and Merton to value options changed the course of financial economics and gave birth to a new profession: financial engineering.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

8

Use the information for the question(s) below.

The current price of KD Industries' stock is $20. In the next year the stock price will either go up by 20% or go down by 20%. KD pays no dividends. The one year risk-free rate is 5% and will remain constant.

Construct a binomial tree detailing the option information and payoffs for a call option on KD stock with a $20 strike price that expires in one year.

The current price of KD Industries' stock is $20. In the next year the stock price will either go up by 20% or go down by 20%. KD pays no dividends. The one year risk-free rate is 5% and will remain constant.

Construct a binomial tree detailing the option information and payoffs for a call option on KD stock with a $20 strike price that expires in one year.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements is false?

A) The option delta, Δ, has a natural interpretation: it is the change in the price of the stock given a $1 change in the price of the option.

B) Because a leveraged position in a stock is riskier than the stock itself, this implies that call options on a positive beta stock are more risky than the underlying stock and therefore have higher returns and higher betas.

C) Only one parameter input for the Black-Scholes formula, the volatility of the stock price, is not observable directly.

D) Because a stock's volatility is much easier to measure (and forecast) than its expected return, the Black-Scholes formula can be very precise.

A) The option delta, Δ, has a natural interpretation: it is the change in the price of the stock given a $1 change in the price of the option.

B) Because a leveraged position in a stock is riskier than the stock itself, this implies that call options on a positive beta stock are more risky than the underlying stock and therefore have higher returns and higher betas.

C) Only one parameter input for the Black-Scholes formula, the volatility of the stock price, is not observable directly.

D) Because a stock's volatility is much easier to measure (and forecast) than its expected return, the Black-Scholes formula can be very precise.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

10

Consider the following equation: =  In this equation,the term represents

In this equation,the term represents

A) the change in the stock price from the low state to the high state.

B) the number of shares of stock to buy for the replicating portfolio.

C) the position in bonds for the replicating portfolio.

D) the change in the stock price from the high state to the low state.

In this equation,the term represents

In this equation,the term representsA) the change in the stock price from the low state to the high state.

B) the number of shares of stock to buy for the replicating portfolio.

C) the position in bonds for the replicating portfolio.

D) the change in the stock price from the high state to the low state.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

11

Use the information for the question(s) below.

The current price of KD Industries' stock is $20. In the next year the stock price will either go up by 20% or go down by 20%. KD pays no dividends. The one year risk-free rate is 5% and will remain constant.

Using the binomial pricing model,the calculated price of a one-year call option on KD stock with a strike price of $20 is closest to:

A) $2.40

B) $2.00

C) $2.15

D) $1.45

The current price of KD Industries' stock is $20. In the next year the stock price will either go up by 20% or go down by 20%. KD pays no dividends. The one year risk-free rate is 5% and will remain constant.

Using the binomial pricing model,the calculated price of a one-year call option on KD stock with a strike price of $20 is closest to:

A) $2.40

B) $2.00

C) $2.15

D) $1.45

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following statements is correct?

A) It was in 2000 that Canadian accounting standards required firms to include stock option grants as part of their compensation expense.

B) Canadian accounting standards did not require firms to include stock option grants as part of their compensation expense until the Asian flu happened in the mid-90s.

C) Canadian accounting standards did not require firms to include stock option grants as part of their compensation expense until Nortel announced bankruptcy protection in 2009.

D) Until 2005, Canadian accounting standards did not require firms to include stock option grants as part of their compensation expense.

A) It was in 2000 that Canadian accounting standards required firms to include stock option grants as part of their compensation expense.

B) Canadian accounting standards did not require firms to include stock option grants as part of their compensation expense until the Asian flu happened in the mid-90s.

C) Canadian accounting standards did not require firms to include stock option grants as part of their compensation expense until Nortel announced bankruptcy protection in 2009.

D) Until 2005, Canadian accounting standards did not require firms to include stock option grants as part of their compensation expense.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following statements is false?

A) The techniques of the binomial option pricing model are specific to European call and put options.

B) We can summarize the payoffs for the Binomial Option Pricing Model in a binomial tree - a timeline with two branches at every date that represent the possible events that could happen at those times.

C) We define the state in which the stock price goes up as the up state and the state in which the stock price goes down as the down state.

D) When using the Binomial Option Pricing Model, by the Law of One Price, the price of the option today must equal the current market value of the replicating portfolio.

A) The techniques of the binomial option pricing model are specific to European call and put options.

B) We can summarize the payoffs for the Binomial Option Pricing Model in a binomial tree - a timeline with two branches at every date that represent the possible events that could happen at those times.

C) We define the state in which the stock price goes up as the up state and the state in which the stock price goes down as the down state.

D) When using the Binomial Option Pricing Model, by the Law of One Price, the price of the option today must equal the current market value of the replicating portfolio.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

14

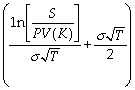

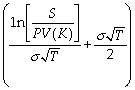

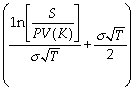

Consider the following equation: C = S × N  - PV(K)× N

- PV(K)× N  In this equation,the term S represents

In this equation,the term S represents

A) the current price of the stock.

B) the stock price at expiration.

C) the annual volatility of the stock.

D) the strike price for the option.

- PV(K)× N

- PV(K)× N  In this equation,the term S represents

In this equation,the term S representsA) the current price of the stock.

B) the stock price at expiration.

C) the annual volatility of the stock.

D) the strike price for the option.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following statements is false?

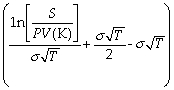

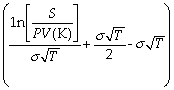

A) N(d) is the cumulative normal distribution - that is, the probability that a normally distributed variable is greater than d.

B) Of the five required inputs in the Black-Scholes formula, four are directly observable.

C) The Black-Scholes formula is derived assuming that the call is a European option.

D) The Black-Scholes Option Pricing Model can be derived from the Binomial Option Pricing Model by making the length of each period, and the movement of the stock price per period, shrink to zero and letting the number of periods grow infinitely large.

A) N(d) is the cumulative normal distribution - that is, the probability that a normally distributed variable is greater than d.

B) Of the five required inputs in the Black-Scholes formula, four are directly observable.

C) The Black-Scholes formula is derived assuming that the call is a European option.

D) The Black-Scholes Option Pricing Model can be derived from the Binomial Option Pricing Model by making the length of each period, and the movement of the stock price per period, shrink to zero and letting the number of periods grow infinitely large.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

16

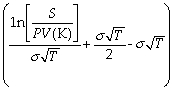

Consider the following equation: B =  In this equation,the term B represents

In this equation,the term B represents

A) the bid price for the option.

B) the position in bonds for the replicating portfolio.

C) the highest price at which it is advantageous to buy the option.

D) the number of shares of stock to buy for the replicating portfolio.

In this equation,the term B represents

In this equation,the term B representsA) the bid price for the option.

B) the position in bonds for the replicating portfolio.

C) the highest price at which it is advantageous to buy the option.

D) the number of shares of stock to buy for the replicating portfolio.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

17

Luther Industries does not pay dividend and is currently trading at $25 per share.The current risk-free rate of interest is 5%.Calculate the price of a call option on Luther Industries with a strike price of $30 that expires in 75 days when N(d1)= .639 and N(d2)= .454.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following statements is false?

A) A replicating portfolio is a portfolio of other securities that has exactly the same value in one period as the option.

B) By using the Law of One Price, we are able to solve for the price of the option as long as we know the probabilities of the states in the binomial tree.

C) The binomial tree contains all the information we currently know: the value of the stock, bond, and call options in each state in one period, as well as the price of the stock and bond today.

D) The idea that you can replicate the option payoff by dynamically trading in a portfolio of the underlying stock and a risk-free bond was one of the most important contributions of the original Black-Scholes paper. Today, this kind of replication strategy is called a dynamic trading strategy.

A) A replicating portfolio is a portfolio of other securities that has exactly the same value in one period as the option.

B) By using the Law of One Price, we are able to solve for the price of the option as long as we know the probabilities of the states in the binomial tree.

C) The binomial tree contains all the information we currently know: the value of the stock, bond, and call options in each state in one period, as well as the price of the stock and bond today.

D) The idea that you can replicate the option payoff by dynamically trading in a portfolio of the underlying stock and a risk-free bond was one of the most important contributions of the original Black-Scholes paper. Today, this kind of replication strategy is called a dynamic trading strategy.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

19

Use the information for the question(s) below.

The current price of Kinston Corporation stock is $10. In each of the next two years, this stock price can either go up by $3.00 or go down by $2.00. Kinston stock pays no dividends. The one year risk-free interest rate is 5% and will remain constant.

-Using the binomial pricing model,calculate the price of a two-year put option on Kinston stock with a strike price of $9.

The current price of Kinston Corporation stock is $10. In each of the next two years, this stock price can either go up by $3.00 or go down by $2.00. Kinston stock pays no dividends. The one year risk-free interest rate is 5% and will remain constant.

-Using the binomial pricing model,calculate the price of a two-year put option on Kinston stock with a strike price of $9.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following statements is correct?

A) Now, under the Canadian Institute of Chartered Accountants (CICA) Handbook, firms are not required to expense executive stock options when calculating their earnings.

B) Now, under the Canadian Institute of Chartered Accountants (CICA) Handbook, firms are required to expense executive stock options when calculating their earnings.

C) Now, under the Generally Accepted Accounting Principles (GAAP), firms are required to expense executive stock options when calculating their earnings.

D) Now, under the International Financial Reporting Standards, firms are not required to expense executive stock options when calculating their earnings.

A) Now, under the Canadian Institute of Chartered Accountants (CICA) Handbook, firms are not required to expense executive stock options when calculating their earnings.

B) Now, under the Canadian Institute of Chartered Accountants (CICA) Handbook, firms are required to expense executive stock options when calculating their earnings.

C) Now, under the Generally Accepted Accounting Principles (GAAP), firms are required to expense executive stock options when calculating their earnings.

D) Now, under the International Financial Reporting Standards, firms are not required to expense executive stock options when calculating their earnings.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

21

Assuming the beta on KD stock is 1.1,the calculated beta for a one-year call option on KD stock with a strike price of $20 is closest to:

A) -1.8

B) 2.4

C) -7.7

D) 4.6

A) -1.8

B) 2.4

C) -7.7

D) 4.6

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

22

Use the information for the question(s) below.

The current price of KD Industries' stock is $20. In the next year the stock price will either go up by 20% or go down by 20%. KD pays no dividends. The one year risk-free rate is 5% and will remain constant.

Using risk-neutral probabilities,the calculated price of a one-year call option on KD stock with a strike price of $20 is closest to:

A) $1.45

B) $2.40

C) $2.00

D) $2.15

The current price of KD Industries' stock is $20. In the next year the stock price will either go up by 20% or go down by 20%. KD pays no dividends. The one year risk-free rate is 5% and will remain constant.

Using risk-neutral probabilities,the calculated price of a one-year call option on KD stock with a strike price of $20 is closest to:

A) $1.45

B) $2.40

C) $2.00

D) $2.15

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

23

________ on a positive beta stock have very large ________ betas,respectively.

A) Calls and puts; negative and positive

B) Calls and puts; positive and negative

C) Puts and calls; positive and negative

D) None of the above

A) Calls and puts; negative and positive

B) Calls and puts; positive and negative

C) Puts and calls; positive and negative

D) None of the above

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

24

Risk-neutral probabilities are also known as all of the following EXCEPT:

A) Contingent probabilities

B) State-contingent prices

C) Martingale prices

D) State prices

A) Contingent probabilities

B) State-contingent prices

C) Martingale prices

D) State prices

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

25

Using the binomial pricing model,the calculated price of a one-year put option on KD stock with a strike price of $20 is closest to:

A) -7.7

B) 2.4

C) 4.6

D) -1.8

A) -7.7

B) 2.4

C) 4.6

D) -1.8

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following statements is false?

A) For a call written on a stock with a positive beta, the beta of the call always exceeds the beta of the stock.

B) The beta of a put option written on a negative beta stock is always negative.

C) As the stock price changes, the beta of an option will change, with its magnitude falling as the option goes in-the-money.

D) A put option is a hedge, so its price goes up when the stock price goes down.

A) For a call written on a stock with a positive beta, the beta of the call always exceeds the beta of the stock.

B) The beta of a put option written on a negative beta stock is always negative.

C) As the stock price changes, the beta of an option will change, with its magnitude falling as the option goes in-the-money.

D) A put option is a hedge, so its price goes up when the stock price goes down.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

27

________ have the highest expected returns and ________ have the lowest expected returns.

A) Out-of-the-money calls; out-of-the-money puts

B) In-the-money puts; out-of-the-money puts

C) Out-of-the-money puts; out-of-the-money calls

D) In-the-money calls; out-of-the-money puts

A) Out-of-the-money calls; out-of-the-money puts

B) In-the-money puts; out-of-the-money puts

C) Out-of-the-money puts; out-of-the-money calls

D) In-the-money calls; out-of-the-money puts

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

28

The models of pricing options give ________ option price no matter what the ________ and expected stock returns are.

A) a different; actual risk preferences

B) the same; expected risk preferences

C) the same; actual risk preferences

D) a different; expected risk preferences

A) a different; actual risk preferences

B) the same; expected risk preferences

C) the same; actual risk preferences

D) a different; expected risk preferences

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

29

Use the information for the question(s) below.

The current price of Kinston Corporation stock is $10. In each of the next two years, this stock price can either go up by $3.00 or go down by $2.00. Kinston stock pays no dividends. The one year risk-free interest rate is 5% and will remain constant.

Using risk-neutral probabilities,calculate the price of a two-year put option on Kinston stock with a strike price of $9.

The current price of Kinston Corporation stock is $10. In each of the next two years, this stock price can either go up by $3.00 or go down by $2.00. Kinston stock pays no dividends. The one year risk-free interest rate is 5% and will remain constant.

Using risk-neutral probabilities,calculate the price of a two-year put option on Kinston stock with a strike price of $9.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

30

Use the information for the question(s) below.

The current price of KD Industries' stock is $20. In the next year the stock price will either go up by 20% or go down by 20%. KD pays no dividends. The one year risk-free rate is 5% and will remain constant.

The risk-neutral probability of an up state for KD industries is closest to:

A) 37.5%

B) 60.0%

C) 40.0%

D) 62.5%

The current price of KD Industries' stock is $20. In the next year the stock price will either go up by 20% or go down by 20%. KD pays no dividends. The one year risk-free rate is 5% and will remain constant.

The risk-neutral probability of an up state for KD industries is closest to:

A) 37.5%

B) 60.0%

C) 40.0%

D) 62.5%

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

31

Consider the following equation: option =  S +

S +  B

B

The term B is

B is

A) always equal to zero since B = 0.

B) always positive since B is always positive.

C) could be positive or negative depending on whether the option in question is a put or a call.

D) always negative since B is always negative.

S +

S +  B

BThe term

B is

B isA) always equal to zero since B = 0.

B) always positive since B is always positive.

C) could be positive or negative depending on whether the option in question is a put or a call.

D) always negative since B is always negative.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following statements is false?

A) Out-of-the-money calls have the highest expected returns and out-of-the-money puts have the lowest expected returns.

B) The expression SΔ/(SΔ +B) is the ratio of the amount of money in the stock position in the replicating portfolio to the value of the replicating portfolio (or the option price); it is known as the leverage ratio.

C) The beta of a portfolio is just the weighted average beta of the constituent securities that make up the portfolio.

D) The magnitude of the leverage ratio for options is usually very small, especially for out-of-the-money options.

A) Out-of-the-money calls have the highest expected returns and out-of-the-money puts have the lowest expected returns.

B) The expression SΔ/(SΔ +B) is the ratio of the amount of money in the stock position in the replicating portfolio to the value of the replicating portfolio (or the option price); it is known as the leverage ratio.

C) The beta of a portfolio is just the weighted average beta of the constituent securities that make up the portfolio.

D) The magnitude of the leverage ratio for options is usually very small, especially for out-of-the-money options.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

33

Use the information for the question(s) below.

The current price of KD Industries' stock is $20. In the next year the stock price will either go up by 20% or go down by 20%. KD pays no dividends. The one year risk-free rate is 5% and will remain constant.

Using risk-neutral probabilities,the calculated price of a one-year put option on KD stock with a strike price of $20 is closest to:

A) $2.00

B) $2.15

C) $1.45

D) $2.40

The current price of KD Industries' stock is $20. In the next year the stock price will either go up by 20% or go down by 20%. KD pays no dividends. The one year risk-free rate is 5% and will remain constant.

Using risk-neutral probabilities,the calculated price of a one-year put option on KD stock with a strike price of $20 is closest to:

A) $2.00

B) $2.15

C) $1.45

D) $2.40

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following statements is false?

A) In both the Binomial and Black-Scholes Pricing Models, we need to know the risk-neutral probability of each possible future stock price to calculate the option price.

B) In the real world, investors are risk averse. Thus, the expected return of a typical stock includes a positive risk premium to compensate investors for risk.

C) Because no assumption on the risk preferences of investors is necessary to calculate the option price using either the Binomial Model or the Black-Scholes formula, the models must work for any set of preferences, including risk-neutral investors.

D) If all market participants were risk-neutral, then all financial assets (including options) would have the same cost of capital - the risk-free rate of interest.

A) In both the Binomial and Black-Scholes Pricing Models, we need to know the risk-neutral probability of each possible future stock price to calculate the option price.

B) In the real world, investors are risk averse. Thus, the expected return of a typical stock includes a positive risk premium to compensate investors for risk.

C) Because no assumption on the risk preferences of investors is necessary to calculate the option price using either the Binomial Model or the Black-Scholes formula, the models must work for any set of preferences, including risk-neutral investors.

D) If all market participants were risk-neutral, then all financial assets (including options) would have the same cost of capital - the risk-free rate of interest.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following statements is false?

A) For companies with high debt-to-equity ratios, the approximation that the beta of debt is zero is unrealistic; such corporations have a positive probability of bankruptcy, and this uncertainty usually has systematic components.

B) When the debt is risky, the firm's equity is always in-the-money; thus Δ = 1.

C) If we let A be the value of the firm's assets, E be the value of equity, and D be the value of debt, then because equity is a call option on the assets of the firm, E = SΔ + B with A = E + D = S.

D) Equity can be viewed as a call option on the firm's assets.

A) For companies with high debt-to-equity ratios, the approximation that the beta of debt is zero is unrealistic; such corporations have a positive probability of bankruptcy, and this uncertainty usually has systematic components.

B) When the debt is risky, the firm's equity is always in-the-money; thus Δ = 1.

C) If we let A be the value of the firm's assets, E be the value of equity, and D be the value of debt, then because equity is a call option on the assets of the firm, E = SΔ + B with A = E + D = S.

D) Equity can be viewed as a call option on the firm's assets.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

36

You would like to know the beta of debt for KT Industries.The value of KT's outstanding equity is $50 million,and you have estimated its beta to be 1.62.You cannot,however,find enough market data to estimate the beta of its debt,so you decide to use the Black-Scholes formula to find an approximate value for the debt.KT has a five year zero coupon bond outstanding with a market value of $80 million.If the estimated from the Black-Scholes model is .60,then the beta for KT's debt is closest to:

A) 1.00

B) 0.59

C) 0.90

D) 2.70

A) 1.00

B) 0.59

C) 0.90

D) 2.70

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

37

Use the information for the question(s) below.

The current price of Kinston Corporation stock is $10. In each of the next two years, this stock price can either go up by $3.00 or go down by $2.00. Kinston stock pays no dividends. The one year risk-free interest rate is 5% and will remain constant.

Using risk-neutral probabilities,calculate the price of a two-year call option on Kinston stock with a strike price of $9.

The current price of Kinston Corporation stock is $10. In each of the next two years, this stock price can either go up by $3.00 or go down by $2.00. Kinston stock pays no dividends. The one year risk-free interest rate is 5% and will remain constant.

Using risk-neutral probabilities,calculate the price of a two-year call option on Kinston stock with a strike price of $9.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

38

Risk-neutral probabilities are known by other names as well: ________.

A) martingale prices

B) state prices

C) state-contingent prices

D) all the above

A) martingale prices

B) state prices

C) state-contingent prices

D) all the above

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

39

Use the information for the question(s) below.

The current price of KD Industries' stock is $20. In the next year the stock price will either go up by 20% or go down by 20%. KD pays no dividends. The one year risk-free rate is 5% and will remain constant.

The risk-neutral probability of a down state for KD industries is closest to:

A) 37.5%

B) 62.5%

C) 40.0%

D) 60.0%

The current price of KD Industries' stock is $20. In the next year the stock price will either go up by 20% or go down by 20%. KD pays no dividends. The one year risk-free rate is 5% and will remain constant.

The risk-neutral probability of a down state for KD industries is closest to:

A) 37.5%

B) 62.5%

C) 40.0%

D) 60.0%

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements is false?

A) After we have constructed the tree and calculated the probabilities in the risk-neutral world, we can use them to price the derivative by simply discounting its expected payoff (using the risk-neutral probabilities) at the risk-free rate.

B) By using the probabilities in the risk-neutral world we can price any derivative security - that is, any security whose payoff depends solely on the prices of other marketed assets.

C) To ensure that all assets in the risk-neutral world have an expected return equal to the risk-free rate, relative to the true probabilities, the risk-neutral probabilities underweigh the bad states and overweigh the good states.

D) In Monte Carlo simulation, the expected payoff of the derivative security is estimated by calculating its average payoff after simulating many random paths for the underlying stock price.

A) After we have constructed the tree and calculated the probabilities in the risk-neutral world, we can use them to price the derivative by simply discounting its expected payoff (using the risk-neutral probabilities) at the risk-free rate.

B) By using the probabilities in the risk-neutral world we can price any derivative security - that is, any security whose payoff depends solely on the prices of other marketed assets.

C) To ensure that all assets in the risk-neutral world have an expected return equal to the risk-free rate, relative to the true probabilities, the risk-neutral probabilities underweigh the bad states and overweigh the good states.

D) In Monte Carlo simulation, the expected payoff of the derivative security is estimated by calculating its average payoff after simulating many random paths for the underlying stock price.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck