Deck 22: Bankruptcy and Financial Distress

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/97

Play

Full screen (f)

Deck 22: Bankruptcy and Financial Distress

1

The alteration of a company's capital structure to reduce high fixed charges is called

A) recapitalization

B) cramdown procedure

C) involuntary reorganization

D) absolute priority rule

A) recapitalization

B) cramdown procedure

C) involuntary reorganization

D) absolute priority rule

recapitalization

2

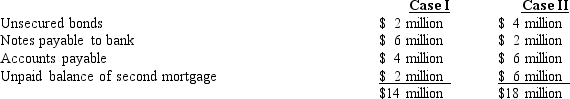

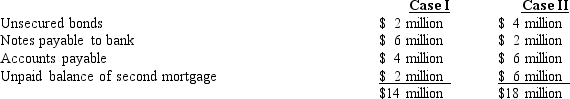

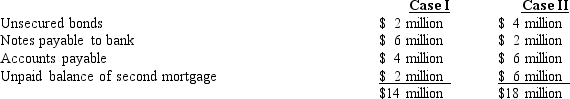

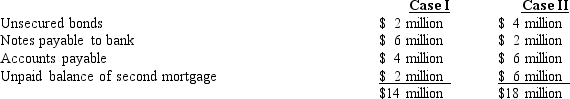

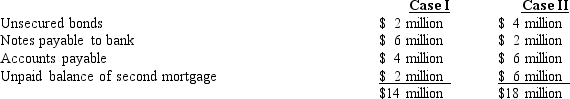

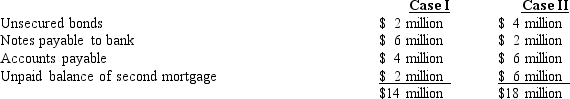

NARRBEGIN: Exhibit 22-1 Liquidation

Exhibit 23-1

If the company has $3,000,000 in funds to distribute to unsecured creditors,what percentage of their claims are going to be satisfied if Case II occurs?

A) 70.59%

B) 53.49%

C) 100%

D) 46.51%

Exhibit 23-1

If the company has $3,000,000 in funds to distribute to unsecured creditors,what percentage of their claims are going to be satisfied if Case II occurs?

A) 70.59%

B) 53.49%

C) 100%

D) 46.51%

46.51%

3

NARRBEGIN: Exhibit 22-1 Liquidation

Exhibit 23-1

If the company has $3,000,000 in funds to distribute to unsecured creditors,what is the settlement that is received by the holders of the subordinated debentures in Case III?

A) $1,250,000

B) $958,250

C) $745,400

D) $1,075,268

Exhibit 23-1

If the company has $3,000,000 in funds to distribute to unsecured creditors,what is the settlement that is received by the holders of the subordinated debentures in Case III?

A) $1,250,000

B) $958,250

C) $745,400

D) $1,075,268

$1,250,000

4

NARRBEGIN: Exhibit 22-1 Liquidation

Exhibit 23-1

If the company has $4,268,000 in funds to distribute to unsecured creditors,what percentage of their claims are going to be satisfied if Case II occurs?

A) 100%

B) 33.83%

C) 66.17%

D) 46.23%

Exhibit 23-1

If the company has $4,268,000 in funds to distribute to unsecured creditors,what percentage of their claims are going to be satisfied if Case II occurs?

A) 100%

B) 33.83%

C) 66.17%

D) 46.23%

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

5

NARRBEGIN: Exhibit 22-1 Liquidation

Exhibit 23-1

If the company has $3,000,000 in funds to distribute to unsecured creditors,how much do the owners of the firm receive in Case III?

A) $675,000

B) $0

C) $525,000

D) $175,000

Exhibit 23-1

If the company has $3,000,000 in funds to distribute to unsecured creditors,how much do the owners of the firm receive in Case III?

A) $675,000

B) $0

C) $525,000

D) $175,000

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

6

NARRBEGIN: Exhibit 22-1 Liquidation

Exhibit 23-1

If the company has $2,456,000 in funds to distribute to unsecured creditors,what is the settlement that is received by the holders of the notes payable in Case I?

A) $1,444,706

B) $2,500,000

C) $1,055,294

D) $1,863,685

Exhibit 23-1

If the company has $2,456,000 in funds to distribute to unsecured creditors,what is the settlement that is received by the holders of the notes payable in Case I?

A) $1,444,706

B) $2,500,000

C) $1,055,294

D) $1,863,685

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

7

A creditor that has a specific asset pledged as collateral are called

A) secured creditors

B) unsecured creditors

C) general creditors

D) shareholders

A) secured creditors

B) unsecured creditors

C) general creditors

D) shareholders

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

8

NARRBEGIN: Exhibit 22-1 Liquidation

Exhibit 23-1

If the company has $2,534,000 in funds to distribute to unsecured creditors,what percentage of their claims are going to be satisfied if Case I occurs?

A) 26.32%

B) 40.38%

C) 100%

D) 59.62%

Exhibit 23-1

If the company has $2,534,000 in funds to distribute to unsecured creditors,what percentage of their claims are going to be satisfied if Case I occurs?

A) 26.32%

B) 40.38%

C) 100%

D) 59.62%

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

9

NARRBEGIN: Exhibit 22-1 Liquidation

Exhibit 23-1

If the company has $3,000,000 in funds to distribute to unsecured creditors,what is the settlement that is received by the holders of the subordinated debentures in Case II?

A) $2,250,000

B) $1,203,525

C) $$1,046512

D) $1,538,957

Exhibit 23-1

If the company has $3,000,000 in funds to distribute to unsecured creditors,what is the settlement that is received by the holders of the subordinated debentures in Case II?

A) $2,250,000

B) $1,203,525

C) $$1,046512

D) $1,538,957

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

10

NARRBEGIN: Exhibit 22-1 Liquidation

Exhibit 23-1

If the company has $3,000,000 in funds to distribute to unsecured creditors,what is the settlement that is received by the holders of the subordinated debentures in Case I?

A) $1,050,534

B) $1,250,000

C) $367,647

D) $882,353

Exhibit 23-1

If the company has $3,000,000 in funds to distribute to unsecured creditors,what is the settlement that is received by the holders of the subordinated debentures in Case I?

A) $1,050,534

B) $1,250,000

C) $367,647

D) $882,353

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

11

NARRBEGIN: Exhibit 22-1 Liquidation

Exhibit 23-1

If the company has $3,000,000 in funds to distribute to unsecured creditors,what is the settlement that is received by the holders of the accounts payables in Case II?

A) $162,791

B) $187,209

C) $350,000

D) $235,310

Exhibit 23-1

If the company has $3,000,000 in funds to distribute to unsecured creditors,what is the settlement that is received by the holders of the accounts payables in Case II?

A) $162,791

B) $187,209

C) $350,000

D) $235,310

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

12

NARRBEGIN: Exhibit 22-1 Liquidation

Exhibit 23-1

If the company has $3,000,000 in funds to distribute to unsecured creditors,how much do the owners of the firm receive in Case I?

A) $125,678

B) $0

C) $357,250

D) $475,000

Exhibit 23-1

If the company has $3,000,000 in funds to distribute to unsecured creditors,how much do the owners of the firm receive in Case I?

A) $125,678

B) $0

C) $357,250

D) $475,000

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

13

A company that does not pay its debts when they come due is called

A) insolvent

B) debtor in possession

C) broke

D) financially distressed

A) insolvent

B) debtor in possession

C) broke

D) financially distressed

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

14

NARRBEGIN: Exhibit 22-1 Liquidation

Exhibit 23-1

If the company has $3,000,000 in funds to distribute to unsecured creditors,what is the settlement that is received by the holders of the notes payable in Case I?

A) $1,764,706

B) $2,500,000

C) $735,250

D) $1,326,690

Exhibit 23-1

If the company has $3,000,000 in funds to distribute to unsecured creditors,what is the settlement that is received by the holders of the notes payable in Case I?

A) $1,764,706

B) $2,500,000

C) $735,250

D) $1,326,690

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

15

NARRBEGIN: Exhibit 22-1 Liquidation

Exhibit 23-1

If the company has $5,245,000 in funds to distribute to unsecured creditors,what is the settlement that is received by the holders of the subordinated debentures in Case II?

A) $420,300

B) $1,829,700

C) $2,250,000

D) $1,256,200

Exhibit 23-1

If the company has $5,245,000 in funds to distribute to unsecured creditors,what is the settlement that is received by the holders of the subordinated debentures in Case II?

A) $420,300

B) $1,829,700

C) $2,250,000

D) $1,256,200

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

16

NARRBEGIN: Exhibit 22-1 Liquidation

Exhibit 23-1

If the company has $578,000 in funds to distribute to unsecured creditors,what percentage of their claims are going to be satisfied if Case III occurs?

A) 24.86%

B) 75.14%

C) 100%

D) 56.35%

Exhibit 23-1

If the company has $578,000 in funds to distribute to unsecured creditors,what percentage of their claims are going to be satisfied if Case III occurs?

A) 24.86%

B) 75.14%

C) 100%

D) 56.35%

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

17

NARRBEGIN: Exhibit 22-1 Liquidation

Exhibit 23-1

If the company has $3,000,000 in funds to distribute to unsecured creditors,what percentage of their claims are going to be satisfied if Case III occurs?

A) 129.03%

B) 100%

C) 82.56%

D) 17.44%

Exhibit 23-1

If the company has $3,000,000 in funds to distribute to unsecured creditors,what percentage of their claims are going to be satisfied if Case III occurs?

A) 129.03%

B) 100%

C) 82.56%

D) 17.44%

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

18

The section of the Bankruptcy Reform Act of 1978 that outlines the procedures for reorganizing a failed or failing firm is

A) chapter 7

B) chapter 11

C) chapter 13

D) none of the above

A) chapter 7

B) chapter 11

C) chapter 13

D) none of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

19

The case of business failure in which a firm's liabilities exceed the fair market value of its assets is called

A) economic failure

B) technical insolvency

C) insolvency bankruptcy

D) business failure

A) economic failure

B) technical insolvency

C) insolvency bankruptcy

D) business failure

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

20

NARRBEGIN: Exhibit 22-1 Liquidation

Exhibit 23-1

If the company has $3,000,000 in funds to distribute to unsecured creditors,what percentage of their claims are going to be satisfied if Case I occurs?

A) 100.00%

B) 70.59%

C) 29.41%

D) 82.57%

Exhibit 23-1

If the company has $3,000,000 in funds to distribute to unsecured creditors,what percentage of their claims are going to be satisfied if Case I occurs?

A) 100.00%

B) 70.59%

C) 29.41%

D) 82.57%

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

21

Smart Products has a working capital to total assets ratio of 0.15,a retained earnings to total assets ratio of 0.2,an EBIT to total assets ratio of 0.4,a market value of equity to book value of equity ratio of 1.3,and a sales to total assets ratio of 0.75.What is Smart Products' Z-score?

A) 2.60

B) 3.31

C) 5.74

D) 2.79

A) 2.60

B) 3.31

C) 5.74

D) 2.79

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

22

Polaroid's bankruptcy filing is an example of a failure due to

A) business cycle downturn

B) corporate maturity

C) poor financial actions

D) illiquidity

A) business cycle downturn

B) corporate maturity

C) poor financial actions

D) illiquidity

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

23

NARRBEGIN: Exhibit 22-1 Liquidation

Exhibit 23-1

If the company has $2,475,000 in funds to distribute to unsecured creditors,how much do the owners of the firm receive in Case III?

A) $75,000

B) $0

C) $150,000

D) $225,000

Exhibit 23-1

If the company has $2,475,000 in funds to distribute to unsecured creditors,how much do the owners of the firm receive in Case III?

A) $75,000

B) $0

C) $150,000

D) $225,000

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

24

NARRBEGIN: Exhibit 22-1 Liquidation

Exhibit 23-1

If the company has $4,152,000 in funds to distribute to unsecured creditors,how much do the owners of the firm receive in Case I?

A) $0

B) $98,000

C) $128,000

D) $253,000

Exhibit 23-1

If the company has $4,152,000 in funds to distribute to unsecured creditors,how much do the owners of the firm receive in Case I?

A) $0

B) $98,000

C) $128,000

D) $253,000

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

25

A firm has outstanding debt of $100 million.Suppose it voluntarily agrees to pay all creditors 40 cents on the dollar.This is

A) an extension.

B) a composition.

C) a combination of the two in (a)and (b).

D) a cram-down.

A) an extension.

B) a composition.

C) a combination of the two in (a)and (b).

D) a cram-down.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

26

If absolute priority rules are enforced in a Chapter 7 bankruptcy,which of the following is most likely to receive payment?

A) local,state,and federal governments owed taxes.

B) owners of common stock

C) owners of bonds

D) banks holding loans secured by collateral

A) local,state,and federal governments owed taxes.

B) owners of common stock

C) owners of bonds

D) banks holding loans secured by collateral

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

27

Bavarian Sausages has a working capital/total assets ratio of 0.8,a retained earnings/total assets ratio of 0.2,an earnings before interest and taxes/total assets ratio of 0.34,a market value of equity/book value of equity ratio of 1.2,and a sales/total assets ratio of 0.75.What is the company's Z score?

A) 3.25

B) 2.78

C) 1.65

D) 3.83

A) 3.25

B) 2.78

C) 1.65

D) 3.83

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

28

Bavarian Sausages has a working capital/total assets ratio of 0.3,a retained earnings/total assets ratio of 0.4,an earnings before interest and taxes/total assets ratio of 0.24,a market value of equity/book value of equity ratio of 0.4,and a sales/total assets ratio of 0.55.What is the company's Z score?

A) 2.50

B) 1.75

C) 3.25

D) 2.85

A) 2.50

B) 1.75

C) 3.25

D) 2.85

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

29

If a company's financial position is characterized by current liabilities greater than current assets,it is

A) bankrupt.

B) illiquid.

C) insolvent.

D) liquidated.

A) bankrupt.

B) illiquid.

C) insolvent.

D) liquidated.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

30

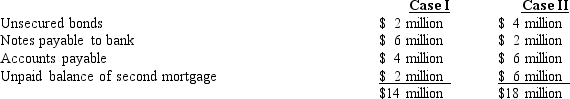

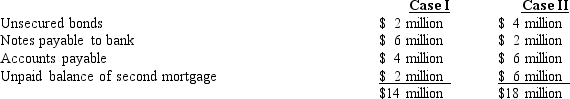

NARRBEGIN: Needsalift APRs

Needsalift,Inc.APRs

Needsalift,Inc.has $10 million in funds to distribute to its unsecured creditors.Two sets of possible claims are presented below.

For Case I,what settlement will the unsecured bondholders receive?

A) Nothing

B) $2 million

C) $1.43 million

D) $1 million

Needsalift,Inc.APRs

Needsalift,Inc.has $10 million in funds to distribute to its unsecured creditors.Two sets of possible claims are presented below.

For Case I,what settlement will the unsecured bondholders receive?

A) Nothing

B) $2 million

C) $1.43 million

D) $1 million

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

31

Bavarian Sausages has a working capital/total assets ratio of 0.1,a retained earnings/total assets ratio of 0.2,an earnings before interest and taxes/total assets ratio of 0.14,a market value of equity/book value of equity ratio of 0.2,and a sales/total assets ratio of 0.35.What is the company's Z score?

A) 0.86

B) 1.96

C) 1.33

D) 2.13

A) 0.86

B) 1.96

C) 1.33

D) 2.13

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

32

A firm has outstanding debt of $100 million.Suppose it voluntarily agrees to pay a group of creditors 40 cents on the dollar immediately and to pay the remaining creditors 60 cents on the dollar in four periodic installments.This is

A) an extension.

B) a composition.

C) a combination of an extension and a composition.

D) a cram-down.

A) an extension.

B) a composition.

C) a combination of an extension and a composition.

D) a cram-down.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

33

Which factor in the Z-score model will most affect the likelihood of bankruptcy predicted?

A) working capital to total assets ratio

B) EBIT to total assets ratio

C) market value of equity to book value of equity ratio

D) retained earnings to total assets ratio

A) working capital to total assets ratio

B) EBIT to total assets ratio

C) market value of equity to book value of equity ratio

D) retained earnings to total assets ratio

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

34

If absolute priority rules are enforced in a Chapter 7 bankruptcy,which of the following is least likely to receive payment?

A) local,state,or federal governments owed taxes

B) owners of common stock

C) owners of bonds

D) banks holding loans secured by collateral

A) local,state,or federal governments owed taxes

B) owners of common stock

C) owners of bonds

D) banks holding loans secured by collateral

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

35

NARRBEGIN: Needsalift APRs

Needsalift,Inc.APRs

Needsalift,Inc.has $10 million in funds to distribute to its unsecured creditors.Two sets of possible claims are presented below.

For Case I,how much will the bank receive for its notes payable claim?

A) $3.75 million

B) $4.29 million

C) $6.00 million

D) nothing.

Needsalift,Inc.APRs

Needsalift,Inc.has $10 million in funds to distribute to its unsecured creditors.Two sets of possible claims are presented below.

For Case I,how much will the bank receive for its notes payable claim?

A) $3.75 million

B) $4.29 million

C) $6.00 million

D) nothing.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

36

A firm that is subject to Chapter 7 of the Bankruptcy Reform Act is one that

A) is in involuntary reorganization.

B) is facing a cram-down procedure.

C) is to be liquidated.

D) is seeking a recapitalization.

A) is in involuntary reorganization.

B) is facing a cram-down procedure.

C) is to be liquidated.

D) is seeking a recapitalization.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

37

NARRBEGIN: Needsalift APRs

Needsalift,Inc.APRs

Needsalift,Inc.has $10 million in funds to distribute to its unsecured creditors.Two sets of possible claims are presented below.

For Case II,what settlement will the unsecured bondholders receive?

A) $4 million

B) $3.25 million

C) $2.22 million

D) Nothing

Needsalift,Inc.APRs

Needsalift,Inc.has $10 million in funds to distribute to its unsecured creditors.Two sets of possible claims are presented below.

For Case II,what settlement will the unsecured bondholders receive?

A) $4 million

B) $3.25 million

C) $2.22 million

D) Nothing

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

38

In order to move forward in a financial crisis without many of the costs of legal bankruptcy,a firm may seek

A) a consent procedure.

B) a cram-down procedure.

C) a chapter 11 reorganization.

D) a voluntary settlement.

A) a consent procedure.

B) a cram-down procedure.

C) a chapter 11 reorganization.

D) a voluntary settlement.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

39

The debtor in possession (DIP)is

A) the lenders who are owed money by the bankrupt firm.

B) the trustee of the bankrupt firm.

C) the bankrupt (filing)firm.

D) none of the above.

A) the lenders who are owed money by the bankrupt firm.

B) the trustee of the bankrupt firm.

C) the bankrupt (filing)firm.

D) none of the above.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

40

NARRBEGIN: Needsalift APRs

Needsalift,Inc.APRs

Needsalift,Inc.has $10 million in funds to distribute to its unsecured creditors.Two sets of possible claims are presented below.

For Case II,what settlement will the accounts payable holders receive?

A) $3 million

B) $3.34 million

C) $4.65 million

D) $6 million

Needsalift,Inc.APRs

Needsalift,Inc.has $10 million in funds to distribute to its unsecured creditors.Two sets of possible claims are presented below.

For Case II,what settlement will the accounts payable holders receive?

A) $3 million

B) $3.34 million

C) $4.65 million

D) $6 million

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

41

In a Chapter 11 setting,a firm

A) must be liquidated.

B) can be reorganized,but only if all creditors unanimously agree to the plan.

C) may have the terms of its debt relaxed.

D) none of the above.

A) must be liquidated.

B) can be reorganized,but only if all creditors unanimously agree to the plan.

C) may have the terms of its debt relaxed.

D) none of the above.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

42

Financial distress

A) always leads to bankruptcy.

B) imposes direct and indirect costs on the firm.

C) has no effect on the firm's customers.

D) all of the above.

A) always leads to bankruptcy.

B) imposes direct and indirect costs on the firm.

C) has no effect on the firm's customers.

D) all of the above.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

43

When a firm's liabilities exceed the fair market value of its assets the firm

A) is insolvency bankrupt.

B) is in default.

C) is in a liquidity crisis.

D) none of the above.

A) is insolvency bankrupt.

B) is in default.

C) is in a liquidity crisis.

D) none of the above.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following is not an example of mismanagement?

A) oil price increases

B) overexpansion

C) ineffective sales force

D) poor financial actions

A) oil price increases

B) overexpansion

C) ineffective sales force

D) poor financial actions

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

45

A reorganization of debts whereby the creditor committee decides that replacing the operating management is the only feasible way to maintain the firm,is called

A) a composition.

B) an extension.

C) creditor control.

D) none of the above.

A) a composition.

B) an extension.

C) creditor control.

D) none of the above.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

46

Winding up a firm's operations,selling off its assets,and distributing the proceeds to creditors is called

A) reorganization.

B) liquidation.

C) dissolution.

D) none of the above.

A) reorganization.

B) liquidation.

C) dissolution.

D) none of the above.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

47

Economic failure occurs when

A) a firm fails to earn a return that is greater than its cost of debt.

B) a firm fails to earn a return that is greater than its cost of equity capital.

C) a firm fails to earn a return that is greater than its cost of capital.

D) both a and c.

A) a firm fails to earn a return that is greater than its cost of debt.

B) a firm fails to earn a return that is greater than its cost of equity capital.

C) a firm fails to earn a return that is greater than its cost of capital.

D) both a and c.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

48

Gizmo Co.has the following financial measures: working capital to total assets ratio of 0.05,retained earnings to total assets ratio of 0.10,EBIT to total assets ratio of 0.3,market value of equity to book value of equity ratio of 1.1,and sales to total assets ratio of 0.4.What is Gizmo's Z-score?

A) 2.40

B) 2.35

C) 2.30

D) 2.25

A) 2.40

B) 2.35

C) 2.30

D) 2.25

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

49

Gizmo Co.has a Z-score based on its most recent financial information of 1.2.Based on this,

A) Gizmo has a high probability of failure.

B) Gizmo has a low probability of failure.

C) Gizmo's probability of failure is uncertain.

D) None of these,since the Z-score does not predict firm failure.

A) Gizmo has a high probability of failure.

B) Gizmo has a low probability of failure.

C) Gizmo's probability of failure is uncertain.

D) None of these,since the Z-score does not predict firm failure.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

50

Gizmo Co.has a Z-score based on its most recent financial information of 2.3.Based on this,

A) Gizmo has a high probability of failure.

B) Gizmo has a low probability of failure.

C) Gizmo's probability of failure is uncertain.

D) None of these,since the Z-score does not predict firm failure.

A) Gizmo has a high probability of failure.

B) Gizmo has a low probability of failure.

C) Gizmo's probability of failure is uncertain.

D) None of these,since the Z-score does not predict firm failure.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

51

A modern day buggy whip maker that went out of business because of low sales really failed because of

A) its corporate maturity.

B) its inability to control the business cycle.

C) an aggressive capital structure.

D) none of the above.

A) its corporate maturity.

B) its inability to control the business cycle.

C) an aggressive capital structure.

D) none of the above.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

52

A firm has outstanding debt of $100 million.Suppose it voluntarily agrees to pay all creditors in full in six periodic installments.This is

A) an extension.

B) a composition.

C) a combination of the two in (a)and (b).

D) a cram-down.

A) an extension.

B) a composition.

C) a combination of the two in (a)and (b).

D) a cram-down.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

53

A voluntary reorganization of debts whereby a firm's debt obligations are still expected to be paid in full but at a later than originally scheduled date,is called

A) a composition.

B) an extension.

C) creditor control.

D) none of the above.

A) a composition.

B) an extension.

C) creditor control.

D) none of the above.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

54

The legal mechanism by which inefficient firms may leave the market is

A) economic darwinism.

B) bankruptcy.

C) liquidation.

D) none of the above.

A) economic darwinism.

B) bankruptcy.

C) liquidation.

D) none of the above.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

55

Gizmo Co.has a Z-score based on its most recent financial information of 3.0.Based on this,

A) Gizmo has a high probability of failure.

B) Gizmo has a low probability of failure.

C) Gizmo's probability of failure is uncertain.

D) None of these,since the Z-score does not predict firm failure.

A) Gizmo has a high probability of failure.

B) Gizmo has a low probability of failure.

C) Gizmo's probability of failure is uncertain.

D) None of these,since the Z-score does not predict firm failure.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

56

Suppose a firm's creditors decide that replacing current management is a requirement in a voluntary reorganization.This is called

A) an extension reorganization.

B) a composition reorganization.

C) a creditor control reorganization.

D) a cram-down reorganization.

A) an extension reorganization.

B) a composition reorganization.

C) a creditor control reorganization.

D) a cram-down reorganization.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

57

If an auto maker were to fail in an economic downturn then it would fail due to

A) economic activity.

B) corporate maturity.

C) an overly conservative capital structure.

D) none of the above.

A) economic activity.

B) corporate maturity.

C) an overly conservative capital structure.

D) none of the above.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

58

If a firm is technically insolvent then the firm may arrange

A) a workout.

B) a voluntary settlement.

C) both (a)and (b)

D) none of the above

A) a workout.

B) a voluntary settlement.

C) both (a)and (b)

D) none of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

59

Suppose a firm has a Z score of 1.6,and the following financial characteristics: working capital to total assets ratio of 0.05,retained earnings to total assets ratio of 0.10,market value of equity to book value of equity ratio of 1.1,and sales to total assets ratio of 0.4.What must be its EBIT to total assets ratio?

A) 0.15

B) 0.10

C) 0.05

D) 0.0

A) 0.15

B) 0.10

C) 0.05

D) 0.0

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

60

A voluntary reorganization of debts whereby a firm's debt obligations are reorganized according to a creditors pro-rata share of the debting firm's total debt,is called

A) a composition.

B) an extension.

C) creditor control.

D) none of the above.

A) a composition.

B) an extension.

C) creditor control.

D) none of the above.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following situations allow for a reorganization type bankruptcy filing?

A) a commercial bank that was caught in a cyclical downturn

B) a firm that sells high end pork bellies but finds little market for its product

C) an auto maker that became over-leveraged before an unexpected economic downturn

D) both a and c

A) a commercial bank that was caught in a cyclical downturn

B) a firm that sells high end pork bellies but finds little market for its product

C) an auto maker that became over-leveraged before an unexpected economic downturn

D) both a and c

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

62

The procedures for liquidating a corporation reside

A) in Chapter 7 of the Bankruptcy Reform Act of 1978.

B) in Chapter 11 of the Bankruptcy Reform Act of 1978.

C) Common Law.

D) none of the above.

A) in Chapter 7 of the Bankruptcy Reform Act of 1978.

B) in Chapter 11 of the Bankruptcy Reform Act of 1978.

C) Common Law.

D) none of the above.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

63

What is the term that describes an arrangement a firm can make with its creditors that enables it to bypass many of the costs involved in legal bankruptcy proceedings if it becomes technically insolvent?

A) voluntary reorganization

B) composition

C) liquidation

D) workout

E) none of the above

A) voluntary reorganization

B) composition

C) liquidation

D) workout

E) none of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

64

Within Altman's Z score model of predicting bankruptcy,working capital is included in the model.If working capital increases what affect does that have on the probability of the firm being in bankruptcy?

A) increases

B) remains the same

C) decreases

D) it is impossible to determine

A) increases

B) remains the same

C) decreases

D) it is impossible to determine

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

65

Liquidation is seen as a means

A) of providing breathing space to viable firms that are in temporary financial distress.

B) of winding up the operations of firms that are not economically viable.

C) of punishing management of firms that have defrauded shareholders.

D) all of the above

A) of providing breathing space to viable firms that are in temporary financial distress.

B) of winding up the operations of firms that are not economically viable.

C) of punishing management of firms that have defrauded shareholders.

D) all of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

66

What is the term that describes an agreement of the creditors by which they pass the power to liquidate the firm's assets to an adjustment bureau,a trade association,or a third party?

A) trustee

B) assignment

C) absolute priority

D) extension

E) composition

A) trustee

B) assignment

C) absolute priority

D) extension

E) composition

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following terms describes when a firm's liabilities exceed the fair market value of its assets?

A) bankruptcy

B) insolvency bankruptcy

C) liquidity crisis

D) economic failure

E) technical insolvency

A) bankruptcy

B) insolvency bankruptcy

C) liquidity crisis

D) economic failure

E) technical insolvency

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following terms describes when a firm is unable to pay its liabilities as they come due because assets cannot be converted into cash within a reasonable period of time?

A) bankruptcy

B) insolvency bankruptcy

C) liquidity crisis

D) economic failure

E) technical insolvency

A) bankruptcy

B) insolvency bankruptcy

C) liquidity crisis

D) economic failure

E) technical insolvency

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

69

The term that describes winding up a firm's operations,selling off its assets,and distributing the proceeds to creditors is

A) voluntary reorganization.

B) composition.

C) liquidation.

D) workout.

E) none of the above

A) voluntary reorganization.

B) composition.

C) liquidation.

D) workout.

E) none of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

70

Bank A has debt that is backed with secured assets of Company B,who is currently liquidating its assets in bankruptcy.If Bank A is owed $10,000,000 and the liquidation of the assets will provide $8,000,000,then what happens to the remaining $2,000,000?

A) the $2,000,000 will be lost in the bankruptcy process

B) the $2,000,000 will have to be repaid through the automatic securitization of other assets

C) the $2,000,000 will become an unsecured or general credit amount in the liquidation process.

D) none of the above.

A) the $2,000,000 will be lost in the bankruptcy process

B) the $2,000,000 will have to be repaid through the automatic securitization of other assets

C) the $2,000,000 will become an unsecured or general credit amount in the liquidation process.

D) none of the above.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

71

Which party is given the responsibility of liquidating a firm if it is necessary to do so?

A) the bankruptcy judge

B) the creditors of the firm

C) the bankruptcy trustee

D) the creditors committee

A) the bankruptcy judge

B) the creditors of the firm

C) the bankruptcy trustee

D) the creditors committee

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

72

A cramdown procedure is used when

A) a reorganization plan fails to meet the standard for approval by all classes under the unanimous consent procedure.

B) the firm is clearly insolvent and the existing equity has no value.

C) either a or b

D) none of the above

A) a reorganization plan fails to meet the standard for approval by all classes under the unanimous consent procedure.

B) the firm is clearly insolvent and the existing equity has no value.

C) either a or b

D) none of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

73

Which party is responsible for filing a reorganization plan to the court in a case of bankruptcy?

A) the shareholders

B) the debtholders

C) the debtor in possession

D) all of the above

A) the shareholders

B) the debtholders

C) the debtor in possession

D) all of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following claims is first to be paid in a Chapter 7 liquidation?

A) secured creditors

B) the federal government for taxes due

C) the expenses incurred by those administering the bankruptcy process

D) none of the above

A) secured creditors

B) the federal government for taxes due

C) the expenses incurred by those administering the bankruptcy process

D) none of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

75

The procedures for reorganizing a failed or failing corporation reside

A) in Chapter 7 of the Bankruptcy Reform Act of 1978.

B) in Chapter 11 of the Bankruptcy Reform Act of 1978.

C) Common Law.

D) none of the above.

A) in Chapter 7 of the Bankruptcy Reform Act of 1978.

B) in Chapter 11 of the Bankruptcy Reform Act of 1978.

C) Common Law.

D) none of the above.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

76

Within the bankruptcy process when debts are exchanged for equity or the maturity of existing debts are extended,this is called

A) a recapitalization.

B) a reprioritization.

C) a refinancing.

D) none of the above

A) a recapitalization.

B) a reprioritization.

C) a refinancing.

D) none of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following is (are)legally mandated subsidies to corporations in bankruptcy?

A) the ability to reject collective bargaining agreements

B) the right to cease the obligation to pay interest to prebankruptcy creditors

C) the right to terminate underfunded pension plans

D) all of the above

A) the ability to reject collective bargaining agreements

B) the right to cease the obligation to pay interest to prebankruptcy creditors

C) the right to terminate underfunded pension plans

D) all of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

78

When a firm files to either reorganize or liquidate in bankruptcy all creditors of the firm

A) are prevented from filing or continuing with lawsuits against the firm.

B) all creditors of the firm are guaranteed to receive less than their original claim.

C) automatically become shareholders of the firm.

D) none of the above.

A) are prevented from filing or continuing with lawsuits against the firm.

B) all creditors of the firm are guaranteed to receive less than their original claim.

C) automatically become shareholders of the firm.

D) none of the above.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

79

If an outside party files a bankruptcy petition on a firm that owes the outside party a debt,then that is called

A) a voluntary reorganization.

B) an involuntary reorganization.

C) a liquidation.

D) none of the above

A) a voluntary reorganization.

B) an involuntary reorganization.

C) a liquidation.

D) none of the above

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

80

Within Altman's Z score model of predicting bankruptcy,the total value of the assets are included in the model.If the total value of the assets decreases what effect does that have on the probability of the firm being in bankruptcy?

A) increases

B) remains the same

C) decreases

D) it is impossible to determine since the value of the assets is only used as a parameter in the model

A) increases

B) remains the same

C) decreases

D) it is impossible to determine since the value of the assets is only used as a parameter in the model

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck