Deck 3: Cost-Volume-Profit Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/107

Play

Full screen (f)

Deck 3: Cost-Volume-Profit Analysis

1

The Kringel Company provides the following information:

-Refer to the figure.What is the contribution margin ratio for Kringel?

A)0.16

B)0.34

C)0.50

D)0.76

-Refer to the figure.What is the contribution margin ratio for Kringel?

A)0.16

B)0.34

C)0.50

D)0.76

0.50

2

The Kringel Company provides the following information:

-Refer to the figure.What is the net income for Kringel?

A)$50,000

B)$200,000

C)$250,000

D)$500,000

-Refer to the figure.What is the net income for Kringel?

A)$50,000

B)$200,000

C)$250,000

D)$500,000

$200,000

3

What is the contribution margin at the break-even point?

A)It equals total fixed costs.

B)It is zero.

C)It is total fixed costs plus total revenues.

D)It is greater than variable costs.

A)It equals total fixed costs.

B)It is zero.

C)It is total fixed costs plus total revenues.

D)It is greater than variable costs.

A

4

Baker Company sells its product for $60.In addition,it has a variable cost ratio of 40 percent and total fixed costs of $9,000.What is the break-even point in units for Baker Company?

A)250 units

B)375 units

C)2,400 units

D)3,600 units

A)250 units

B)375 units

C)2,400 units

D)3,600 units

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

5

The Allen Company had the following income statement for the month of July:

- What is Allen Company's break-even sales volume?

A)7,000 units

B)10,000 units

C)11,211 units

D)20,000 units

- What is Allen Company's break-even sales volume?

A)7,000 units

B)10,000 units

C)11,211 units

D)20,000 units

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

6

The Kringel Company provides the following information:

-Refer to the figure.What is the contribution margin per unit for Kringel?

A)$0.85

B)$1.25

C)$1.65

D)$2.50

-Refer to the figure.What is the contribution margin per unit for Kringel?

A)$0.85

B)$1.25

C)$1.65

D)$2.50

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

7

The Kringel Company provides the following information:

-Refer to the figure.What is the break-even point in units for Kringel?

A)33,334 units

B)40,000 units

C)100,000 units

D)200,000 units

-Refer to the figure.What is the break-even point in units for Kringel?

A)33,334 units

B)40,000 units

C)100,000 units

D)200,000 units

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

8

The income statement for Thomas Manufacturing Company is as follows: What is the contribution margin ratio?

A)30%

B)40%

C)60%

D)100%

A)30%

B)40%

C)60%

D)100%

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

9

Sales * Contribution Margin is a shortcut for what formula?

A)Sales - (Variable Cost Ratio * Sales)

B)Sales - (Fixed Costs + Variable Costs)

C)Sales/Fixed Costs

D)Fixed Costs/Unit Contribution Margin

A)Sales - (Variable Cost Ratio * Sales)

B)Sales - (Fixed Costs + Variable Costs)

C)Sales/Fixed Costs

D)Fixed Costs/Unit Contribution Margin

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

10

Which item is considered in cost-volume-profit analysis?

A)efficiency

B)effectiveness

C)product mix

D)gross profit margin

A)efficiency

B)effectiveness

C)product mix

D)gross profit margin

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

11

The Kringel Company provides the following information:

-Refer to the figure.What is the total contribution margin for Kringel?

A)$50,000

B)$200,000

C)$250,000

D)$500,000

-Refer to the figure.What is the total contribution margin for Kringel?

A)$50,000

B)$200,000

C)$250,000

D)$500,000

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

12

The Kringel Company provides the following information:

-Refer to the figure.What is the variable cost per unit for Kringel?

A)$0.40

B)$0.85

C)$1.25

D)$2.50

-Refer to the figure.What is the variable cost per unit for Kringel?

A)$0.40

B)$0.85

C)$1.25

D)$2.50

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

13

The Kringel Company provides the following information:

-Refer to the figure.What is the variable product cost per unit for Kringel?

A)$0.40

B)$0.85

C)$1.25

D)$2.50

-Refer to the figure.What is the variable product cost per unit for Kringel?

A)$0.40

B)$0.85

C)$1.25

D)$2.50

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

14

What is the formula used to calculate the contribution margin ratio?

A)Sales revenue * Variable cost ratio

B)Contribution margin/Variable costs

C)Fixed costs

D)1 - Variable cost ratio

A)Sales revenue * Variable cost ratio

B)Contribution margin/Variable costs

C)Fixed costs

D)1 - Variable cost ratio

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following equations is used to calculate cost-volume-profit?

A)Sales revenues = Variable expenses - (Fixed expenses + Operating income)

B)Sales revenues - Variable expenses - Fixed expenses = Operating income

C)Sales revenues + Variable expenses + Fixed expenses = Operating income

D)Sales revenues - Fixed expenses = Variable expenses - Operating income

A)Sales revenues = Variable expenses - (Fixed expenses + Operating income)

B)Sales revenues - Variable expenses - Fixed expenses = Operating income

C)Sales revenues + Variable expenses + Fixed expenses = Operating income

D)Sales revenues - Fixed expenses = Variable expenses - Operating income

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

16

The break-even point in units can be calculated using the contribution margin approach in which of the following formulas?

A)Total Costs/Unit Contribution Margin

B)Total Costs/Fixed Costs

C)Fixed Costs/Selling Price per unit

D)Fixed Costs/Unit Contribution Margin

A)Total Costs/Unit Contribution Margin

B)Total Costs/Fixed Costs

C)Fixed Costs/Selling Price per unit

D)Fixed Costs/Unit Contribution Margin

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is a use of CVP (Cost-Volume-Profit)analysis?

A)the ability to conduct sensitivity analysis of cost or price changes

B)the identification of price variances

C)the determination of who is responsible for what

D)the calculation of efficiency variances

A)the ability to conduct sensitivity analysis of cost or price changes

B)the identification of price variances

C)the determination of who is responsible for what

D)the calculation of efficiency variances

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

18

The Allen Company had the following income statement for the month of July:

-What is the sales volume required to earn a profit of $9,000?

A)3,300 units

B)4,300 units

C)7,300 units

D)10,000 units

-What is the sales volume required to earn a profit of $9,000?

A)3,300 units

B)4,300 units

C)7,300 units

D)10,000 units

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

19

How is total contribution margin calculated?

A)by subtracting cost of goods sold from total revenues

B)by subtracting fixed costs from total revenues

C)by subtracting total manufacturing costs from total revenues

D)by subtracting total variable costs from total revenues

A)by subtracting cost of goods sold from total revenues

B)by subtracting fixed costs from total revenues

C)by subtracting total manufacturing costs from total revenues

D)by subtracting total variable costs from total revenues

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

20

What is the break-even point?

A)the volume of activity where all fixed costs are recovered

B)the point where fixed costs equal total variable costs

C)the point where total revenues equal total costs

D)the point where total costs equal total contribution margin

A)the volume of activity where all fixed costs are recovered

B)the point where fixed costs equal total variable costs

C)the point where total revenues equal total costs

D)the point where total costs equal total contribution margin

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

21

Lewis Production Company had the following projected information:

- What is the profit when one unit more than the break-even point is sold?

A)$60

B)$90

C)$150

D)$240

- What is the profit when one unit more than the break-even point is sold?

A)$60

B)$90

C)$150

D)$240

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

22

Dirth Company sells only one product at a regular price of $7.50 per unit.Variable expenses are 60 percent of sales and fixed expenses are $30,000.Management has decided to decrease the selling price to $6.00 in hopes of increasing its volume of sales.

-What is the sales dollars level required to break even at the old price of $7.50?

A)$12,000

B)$18,000

C)$50,000

D)$75,000

-What is the sales dollars level required to break even at the old price of $7.50?

A)$12,000

B)$18,000

C)$50,000

D)$75,000

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

23

Sarah Smith,a sole proprietor,has the following projected figures for next year: What is the contribution margin ratio?

A)0.300

B)0.429

C)1.429

D)3.333

A)0.300

B)0.429

C)1.429

D)3.333

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

24

Halbert Company projected the following information for next year:

How many units must be sold to obtain an after-tax profit of $40,000?

A)3,750 units

B)5,000 units

C)5,167 units

D)5,625 units

How many units must be sold to obtain an after-tax profit of $40,000?

A)3,750 units

B)5,000 units

C)5,167 units

D)5,625 units

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

25

What does the variable cost ratio express?

A)variable costs as a percentage of total costs

B)the proportion between fixed costs and variable costs

C)variable cost in terms of sales dollars

D)the proportion of sales dollars available to cover fixed costs and provide for a profit

A)variable costs as a percentage of total costs

B)the proportion between fixed costs and variable costs

C)variable cost in terms of sales dollars

D)the proportion of sales dollars available to cover fixed costs and provide for a profit

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

26

Sarah Smith,a sole proprietor,has the following projected figures for next year: How many units must be sold to obtain a target before-tax profit of $270,000?

A)6,000 units

B)8,572 units

C)14,000 units

D)20,000 units

A)6,000 units

B)8,572 units

C)14,000 units

D)20,000 units

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

27

Lewis Production Company had the following projected information: What is the contribution margin ratio?

A)0.400

B)0.600

C)1.667

D)2.500

A)0.400

B)0.600

C)1.667

D)2.500

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

28

In 2011,Angel's Bath and Body Shop had variable costs of $27,000,fixed costs of $18,000,and a net loss of $4,500. What is the annual sales volume required for Angel's to have a before-tax income of $18,000?

A)$42,000

B)$73,500

C)$84,000

D)$126,000

A)$42,000

B)$73,500

C)$84,000

D)$126,000

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

29

Baker Company sells its product for $60.In addition,it has a variable cost ratio of 40 percent and total fixed costs of $9,000.How many units must be sold in order to obtain a before-tax profit of $12,000?

A)333 units

B)350 units

C)584 units

D)875 units

A)333 units

B)350 units

C)584 units

D)875 units

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

30

The Kringel Company provides the following information: What is the break-even point in sales dollars for Kringel?

A)$25,000

B)$83,333

C)$100,000

D)$250,000

A)$25,000

B)$83,333

C)$100,000

D)$250,000

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

31

Baker Company sells its product for $60.In addition,it has a variable cost ratio of 40 percent and total fixed costs of $9,000.What is the break-even point in sales dollars for Baker Company?

A)$3,600

B)$5,400

C)$9,000

D)$15,000

A)$3,600

B)$5,400

C)$9,000

D)$15,000

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

32

Malone Printing Company projected the following information for next year:

How many units must be sold to obtain an after-tax profit of $67,500?

A)3,750 units

B)5,167 units

C)5,625 units

D)7,750 units

How many units must be sold to obtain an after-tax profit of $67,500?

A)3,750 units

B)5,167 units

C)5,625 units

D)7,750 units

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

33

Angel's Bath and Body Shop had variable costs of $27,000,fixed costs of $18,000,and a net loss of $4,500.

What was Angel's 2011 break-even sales volume?

A)$36,000

B)$37,500

C)$49,500

D)$54,000

What was Angel's 2011 break-even sales volume?

A)$36,000

B)$37,500

C)$49,500

D)$54,000

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

34

Assume the following information:

What volume of sales dollars is needed to break even?

A)$12,000

B)$48,000

C)$75,000

D)$300,000

What volume of sales dollars is needed to break even?

A)$12,000

B)$48,000

C)$75,000

D)$300,000

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

35

Sarah Smith,a sole proprietor,has the following projected figures for next year:

What is the break-even point in dollars?

A)$189,000

B)$426,000

C)$900,000

D)$2,100,000

What is the break-even point in dollars?

A)$189,000

B)$426,000

C)$900,000

D)$2,100,000

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

36

The income statement for Thomas Manufacturing Company is as follows: What is the contribution margin per unit?

A)$1.20

B)$4.80

C)$7.20

D)$7.80

A)$1.20

B)$4.80

C)$7.20

D)$7.80

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

37

Lewis Production Company had the following projected information:

-What is the break-even point in units?

A)2,000 units

B)3,333 units

C)5,000 units

D)60,000 units

-What is the break-even point in units?

A)2,000 units

B)3,333 units

C)5,000 units

D)60,000 units

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

38

Dirth Company sells only one product at a regular price of $7.50 per unit.Variable expenses are 60 percent of sales and fixed expenses are $30,000.Management has decided to decrease the selling price to $6.00 in hopes of increasing its volume of sales.

- What is the contribution margin ratio when the selling price is reduced to $6 per unit?

A)25%

B)40%

C)60%

D)75%

- What is the contribution margin ratio when the selling price is reduced to $6 per unit?

A)25%

B)40%

C)60%

D)75%

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

39

Assume the following information:

How many units must be sold to generate a before-tax profit of $45,000?

A)2,500 units

B)3,000 units

C)3,750 units

D)4,500 units

How many units must be sold to generate a before-tax profit of $45,000?

A)2,500 units

B)3,000 units

C)3,750 units

D)4,500 units

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

40

Lewis Production Company had the following projected information:

What level of sales dollars is needed to obtain a target before-tax profit of $75,000?

A)$375,000

B)$625,000

C)$750,000

D)$937,500

What level of sales dollars is needed to obtain a target before-tax profit of $75,000?

A)$375,000

B)$625,000

C)$750,000

D)$937,500

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

41

In a cost-volume-profit graph,what does the slope of the total revenue line represent?

A)the selling price per unit

B)the contribution margin per unit

C)the variable cost per unit

D)total contribution margin

A)the selling price per unit

B)the contribution margin per unit

C)the variable cost per unit

D)total contribution margin

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

42

The following data pertain to the three products produced by Alberts Corporation: Fixed costs are $90,000 per month.

Sixty percent of all units sold are Product A,30 percent are Product B,and 10 percent are Product C.

What is the monthly break-even point for total units?

A)36,000 units

B)45,000 units

C)60,000 units

D)180,000 units

Sixty percent of all units sold are Product A,30 percent are Product B,and 10 percent are Product C.

What is the monthly break-even point for total units?

A)36,000 units

B)45,000 units

C)60,000 units

D)180,000 units

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

43

What is represented in a cost-volume-profit graph?

A)The total revenue line crosses the horizontal axis at the break-even point.

B)Beyond the break-even sales volume,profits are maximized at the sales volume where total revenues equal total costs.

C)An increase in unit variable costs would decrease the slope of the total cost line.

D)An increase in the unit selling price would shift the break-even point in units to the left.

A)The total revenue line crosses the horizontal axis at the break-even point.

B)Beyond the break-even sales volume,profits are maximized at the sales volume where total revenues equal total costs.

C)An increase in unit variable costs would decrease the slope of the total cost line.

D)An increase in the unit selling price would shift the break-even point in units to the left.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

44

On a profit-volume graph,where does the profit line intersect the horizontal axis?

A)at the origin

B)at the break-even point

C)at a volume of 1,000 units

D)at the total fixed costs

A)at the origin

B)at the break-even point

C)at a volume of 1,000 units

D)at the total fixed costs

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

45

What are direct fixed costs in multiple-product analysis?

A)fixed costs that are not traceable to the segments and would remain even if one of the segments were eliminated

B)fixed costs that can be traced to each segment and would remain even if one of the segments were eliminated

C)fixed costs that are not traceable to the segments and would be avoided if the segment did not exist

D)fixed costs that can be traced to each segment and would be avoided if the segment did not exist

A)fixed costs that are not traceable to the segments and would remain even if one of the segments were eliminated

B)fixed costs that can be traced to each segment and would remain even if one of the segments were eliminated

C)fixed costs that are not traceable to the segments and would be avoided if the segment did not exist

D)fixed costs that can be traced to each segment and would be avoided if the segment did not exist

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

46

Malone Printing Company projected the following information for next year:

What is the break-even point in dollars?

A)$120,000

B)$200,000

C)$300,000

D)$500,000

What is the break-even point in dollars?

A)$120,000

B)$200,000

C)$300,000

D)$500,000

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

47

Assume the following cost behaviour data for Portrait Company:

-What volume of sales dollars is required to earn an after-tax income of $40,500?

A)$90,000

B)$252,000

C)$360,000

D)$495,000

-What volume of sales dollars is required to earn an after-tax income of $40,500?

A)$90,000

B)$252,000

C)$360,000

D)$495,000

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

48

Information about the Harmon Company's two products includes:

If the sales mix in units is 50 percent Product X and 50 percent Product Y,what is the monthly break-even total sales dollars?

A)$150,000

B)$450,000

C)$510,000

D)$630,000

If the sales mix in units is 50 percent Product X and 50 percent Product Y,what is the monthly break-even total sales dollars?

A)$150,000

B)$450,000

C)$510,000

D)$630,000

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

49

Assume the following cost behaviour data for Portrait Company:

-What volume of sales dollars is required to earn a before-tax income of $27,000?

A)$90,000

B)$180,000

C)$198,000

D)$270,000

-What volume of sales dollars is required to earn a before-tax income of $27,000?

A)$90,000

B)$180,000

C)$198,000

D)$270,000

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

50

How are income taxes treated in cost-volume-profit analysis?

A)They are treated as a fixed cost.

B)They increase the sales volume required to break even.

C)They increase the sales volume required to earn a desired profit.

D)They are treated as a fixed cost.

A)They are treated as a fixed cost.

B)They increase the sales volume required to break even.

C)They increase the sales volume required to earn a desired profit.

D)They are treated as a fixed cost.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

51

Information about the Harmon Company's two products includes:

What is the total monthly sales volume in units required to break even when the sales mix in units is 70 percent Product X and 30 percent Product Y?

A)8,333 units

B)16,667 units

C)50,000 units

D)56,667 units

What is the total monthly sales volume in units required to break even when the sales mix in units is 70 percent Product X and 30 percent Product Y?

A)8,333 units

B)16,667 units

C)50,000 units

D)56,667 units

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

52

Patricia Company produces two products,X and Y,which account for 60 percent and 40 percent,respectively,of total sales dollars.Contribution margin ratios are 50 percent for X and 25 percent for Y.Total fixed costs are $120,000.What is Patricia's break-even point in sales dollars?

A)$300,000

B)$328,767

C)$342,856

D)$375,000

A)$300,000

B)$328,767

C)$342,856

D)$375,000

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

53

In a cost-volume-profit graph,what does the slope of the total revenue line represent?

A)the selling price

B)the contribution margin

C)the variable cost per unit

D)the fixed costs

A)the selling price

B)the contribution margin

C)the variable cost per unit

D)the fixed costs

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

54

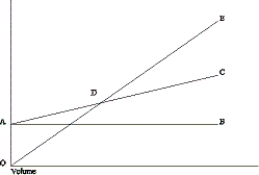

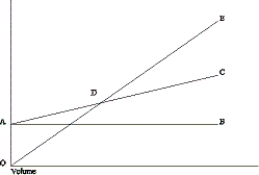

The following diagram is a cost-volume-profit graph for a manufacturing company:

Refer to the figure.Which of the following statements best describes the labelled item on the diagram?

A)Area CDE represents the area of net loss.

B)Line AC graphs the total fixed costs.

C)Point D is where contribution margin increases.

D)Line AC graphs the total costs.

Refer to the figure.Which of the following statements best describes the labelled item on the diagram?

A)Area CDE represents the area of net loss.

B)Line AC graphs the total fixed costs.

C)Point D is where contribution margin increases.

D)Line AC graphs the total costs.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

55

Product 1 has a contribution margin of $6.00 per unit,and Product 2 has a contribution margin of $7.50 per unit.Total fixed costs are $300,000.Sales mix and total volume varies from one period to another.How does this sales mix affect the profit and contribution margin?

A)At a sales volume in excess of 25,000 units of 1 and 25,000 units of 2,operations will be profitable.

B)The ratio of net profit to total sales for 2 will be larger than the ratio of net profit to total sales for 1.

C)The contribution margin per unit of direct materials is lower for 1 than for 2.

D)The ratio of contribution to total sales always will be larger for 1 than for 2.

A)At a sales volume in excess of 25,000 units of 1 and 25,000 units of 2,operations will be profitable.

B)The ratio of net profit to total sales for 2 will be larger than the ratio of net profit to total sales for 1.

C)The contribution margin per unit of direct materials is lower for 1 than for 2.

D)The ratio of contribution to total sales always will be larger for 1 than for 2.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

56

The following diagram is a cost-volume-profit graph for a manufacturing company:

What is the formula to determine the Y-axis value ($)at point D on the graph?

A)Fixed costs + (Variable costs per unit * Number of units)

B) XY - b X

C)Fixed costs/Unit contribution margin

D)Fixed costs/Contribution margin ratio

What is the formula to determine the Y-axis value ($)at point D on the graph?

A)Fixed costs + (Variable costs per unit * Number of units)

B) XY - b X

C)Fixed costs/Unit contribution margin

D)Fixed costs/Contribution margin ratio

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

57

How does sales mix impact profits?

A)Profits may decline with an increase in total dollars of sales if the sales mix shifts to sell more of the high-contribution-margin product.

B)Profits may decline with an increase in total dollars of sales if the sales mix shifts to sell more of the lower-contribution-margin product.

C)Profits will remain constant with an increase in total dollars of sales if the total sales in units remain constant.

D)Profits will remain constant with a decrease in total dollars of sales if the sales mix also remains constant.

A)Profits may decline with an increase in total dollars of sales if the sales mix shifts to sell more of the high-contribution-margin product.

B)Profits may decline with an increase in total dollars of sales if the sales mix shifts to sell more of the lower-contribution-margin product.

C)Profits will remain constant with an increase in total dollars of sales if the total sales in units remain constant.

D)Profits will remain constant with a decrease in total dollars of sales if the sales mix also remains constant.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

58

What is represented in a cost-volume-profit graph ?

A)The slope of the total cost line is dependent on the variable cost per unit.

B)The total cost line normally begins at zero.

C)The total revenue line typically begins above zero.

D)The slope of the total revenue line is the contribution margin per unit.

A)The slope of the total cost line is dependent on the variable cost per unit.

B)The total cost line normally begins at zero.

C)The total revenue line typically begins above zero.

D)The slope of the total revenue line is the contribution margin per unit.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

59

The following diagram is a cost-volume-profit graph for a manufacturing company:

Refer to the figure.What is the difference between line AB and line AC (area BAC)?

A)the contribution ratio

B)the total variable cost

C)the contribution margin per unit

D)the total fixed cost

Refer to the figure.What is the difference between line AB and line AC (area BAC)?

A)the contribution ratio

B)the total variable cost

C)the contribution margin per unit

D)the total fixed cost

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

60

What does the term "sales mix" refer to?

A)the different volume of sales achieved during the year

B)the contribution margins achieved on the different products during the year

C)the relative proportions of different products that constitute total sales

D)the mix of variable and fixed costs

A)the different volume of sales achieved during the year

B)the contribution margins achieved on the different products during the year

C)the relative proportions of different products that constitute total sales

D)the mix of variable and fixed costs

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following assumptions is necessary for cost-volume-profit analysis?

A)Total variable costs are linear.

B)Total revenues increase when total costs increase.

C)Inventories change levels.

D)The product sales mix is change.

A)Total variable costs are linear.

B)Total revenues increase when total costs increase.

C)Inventories change levels.

D)The product sales mix is change.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

62

In a cost-volume-profit graph,what does the slope of the total cost line represent?

A)the selling price per unit

B)the contribution margin per unit

C)the variable cost per unit

D)total contribution margin

A)the selling price per unit

B)the contribution margin per unit

C)the variable cost per unit

D)total contribution margin

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

63

Dirth Company sells only one product at a regular price of $7.50 per unit.Variable expenses are 60 percent of sales and fixed expenses are $30,000.Management has decided to decrease the selling price to $6.00 in hopes of increasing its volume of sales.

-What sales dollar level is needed to obtain a before-tax profit of $60,000 when the selling price is $6.00 per unit?

A)$72,000

B)$90,000

C)$120,000

D)$360,000

-What sales dollar level is needed to obtain a before-tax profit of $60,000 when the selling price is $6.00 per unit?

A)$72,000

B)$90,000

C)$120,000

D)$360,000

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

64

What happens when a company sells more units than the break-even point?

A)The relevant range changes.

B)Profits are positive.

C)There are no new variable costs incurred.

D)Profits are negative.

A)The relevant range changes.

B)Profits are positive.

C)There are no new variable costs incurred.

D)Profits are negative.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

65

Dirth Company sells only one product at a regular price of $7.50 per unit.Variable expenses are 60 percent of sales and fixed expenses are $30,000.Management has decided to decrease the selling price to $6.00 in hopes of increasing its volume of sales.

- What is the new break-even point in units for Dirth Company when the selling price is $6.00?

A)4,000 units

B)6,667 units

C)10,000 units

D)20,000 units

- What is the new break-even point in units for Dirth Company when the selling price is $6.00?

A)4,000 units

B)6,667 units

C)10,000 units

D)20,000 units

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

66

On a profit-volume graph,what does the intersection of the profit line with the vertical axis represent?

A)a profit of $1,000

B)a profit equal to zero

C)a profit equal to fixed costs

D)a loss equal to fixed costs

A)a profit of $1,000

B)a profit equal to zero

C)a profit equal to fixed costs

D)a loss equal to fixed costs

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

67

In a profit-volume graph,what does the slope of the profit line represent?

A)the selling price per unit

B)the contribution margin per unit

C)the variable cost per unit

D)the total contribution margin

A)the selling price per unit

B)the contribution margin per unit

C)the variable cost per unit

D)the total contribution margin

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

68

Assuming all other things are equal,what must have happened to the fixed costs if there was a decrease in the break-even point?

A)It remained the same.

B)It increased first,then decreased.

C)It increased.

D)It decreased.

A)It remained the same.

B)It increased first,then decreased.

C)It increased.

D)It decreased.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following assumption pertains to cost-profit-volume analysis?

A)Sales price per unit changes.

B)The sales mix changes.

C)Inventories in a manufacturing entity may go up or down.

D)Fixed expenses are constant at all volumes of activities within the relevant range.

A)Sales price per unit changes.

B)The sales mix changes.

C)Inventories in a manufacturing entity may go up or down.

D)Fixed expenses are constant at all volumes of activities within the relevant range.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

70

Using cost-volume-profit analysis,what would be the result of a 20 percent reduction in variable costs?

A)It would reduce the break-even sales volume by 20 percent.

B)It would reduce total costs by 20 percent.

C)It would reduce the slope of the total cost line by 20 percent.

D)It would not affect the break-even sales volume if there were an offsetting 20 percent increase in fixed costs.

A)It would reduce the break-even sales volume by 20 percent.

B)It would reduce total costs by 20 percent.

C)It would reduce the slope of the total cost line by 20 percent.

D)It would not affect the break-even sales volume if there were an offsetting 20 percent increase in fixed costs.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

71

What would be the result of a decrease in the sales price in the basic cost-volume-profit model?

A)The decrease would require a recomputation of the gross profit per unit.

B)The decrease would be offset by an increase in unit costs.

C)The decrease would decrease the break-even volume.

D)The decrease would increase the break-even volume.

A)The decrease would require a recomputation of the gross profit per unit.

B)The decrease would be offset by an increase in unit costs.

C)The decrease would decrease the break-even volume.

D)The decrease would increase the break-even volume.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following assumption pertains to cost-volume-profit analysis?

A)The units produced will not equal the units sold.

B)Inventories are variable.

C)All costs are classified as fixed or variable.

D)Sales mix may vary during the related period.

A)The units produced will not equal the units sold.

B)Inventories are variable.

C)All costs are classified as fixed or variable.

D)Sales mix may vary during the related period.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

73

What do cost-volume-profit models assume?

A)The sales mix may vary among multiple products.

B)Unit selling prices are constant.

C)Inventories are dynamic and subject to change.

D)The total cost function is quadratic.

A)The sales mix may vary among multiple products.

B)Unit selling prices are constant.

C)Inventories are dynamic and subject to change.

D)The total cost function is quadratic.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

74

What is represented by a profit-volume graph?

A)It measures profit or loss on the horizontal axis.

B)It illustrates total revenues,total cost,and profits at various sales volumes.

C)It is not subject to the same limiting assumptions as cost-volume-profit graphs.

D)It illustrates the relationship between volume and profits.

A)It measures profit or loss on the horizontal axis.

B)It illustrates total revenues,total cost,and profits at various sales volumes.

C)It is not subject to the same limiting assumptions as cost-volume-profit graphs.

D)It illustrates the relationship between volume and profits.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

75

The income statement for Thomas Manufacturing Company is as follows:

- If sales increase by $60,000,what will happen to profit?

A)It will increase by $6,000.

B)It will increase by $24,000.

C)It will increase by $36,000.

D)It will increase by $60,000.

- If sales increase by $60,000,what will happen to profit?

A)It will increase by $6,000.

B)It will increase by $24,000.

C)It will increase by $36,000.

D)It will increase by $60,000.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

76

Assuming all other things are the same,what must have happened to the variable cost per unit if there was an increase in the break-even point?

A)It remained the same.

B)It increased first,then decreased.

C)It increased.

D)It decreased first,then increased.

A)It remained the same.

B)It increased first,then decreased.

C)It increased.

D)It decreased first,then increased.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

77

The income statement for Thomas Manufacturing Company is as follows:

- If sales increase by 1,000 units,what will happen to profit?

A)It will increase by $1,200.

B)It will increase by $4,800.

C)It will increase by $7,200.

D)It will increase by $12,000.

- If sales increase by 1,000 units,what will happen to profit?

A)It will increase by $1,200.

B)It will increase by $4,800.

C)It will increase by $7,200.

D)It will increase by $12,000.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

78

The Allen Company had the following income statement for the month of July: If the monthly sales volume increases by 450 units,by how much will Allen Company's monthly profits increase?

A)$1,282.50

B)$9,450.00

C)$13,500.00

D)$14,175.00

A)$1,282.50

B)$9,450.00

C)$13,500.00

D)$14,175.00

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

79

Sarah Smith,a sole proprietor,has the following projected figures for next year:

What selling price per unit is needed to obtain a before-tax profit of $270,000 at a volume of 4,000 units?

A)$105.00

B)$150.00

C)$225.00

D)$330.00

What selling price per unit is needed to obtain a before-tax profit of $270,000 at a volume of 4,000 units?

A)$105.00

B)$150.00

C)$225.00

D)$330.00

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

80

Assuming all other things are the same,what must have happened to the selling price per unit if there was a decrease in the break-even point?

A)It remained the same.

B)It increased first,then decreased.

C)It increased.

D)It decreased.

A)It remained the same.

B)It increased first,then decreased.

C)It increased.

D)It decreased.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck