Deck 1: The Corporation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/42

Play

Full screen (f)

Deck 1: The Corporation

1

Canada Revenue Agency,CRA,allows an exemption from double taxation for certain flow through entities where all income produced by the business flows to the investors and virtually no earnings are retained within the business.These entities are called

A) Canadian Federal Crown Corporations.

B) Canadian Controlled Corporations.

C) Income Trust Corporations.

D) Foreign Controlled Corporations.

A) Canadian Federal Crown Corporations.

B) Canadian Controlled Corporations.

C) Income Trust Corporations.

D) Foreign Controlled Corporations.

Income Trust Corporations.

2

Which of the following is/are an advantage(s)of incorporation?

A) Access to capital markets

B) Limited liability

C) Unlimited life

D) All of the above

A) Access to capital markets

B) Limited liability

C) Unlimited life

D) All of the above

All of the above

3

A sole proprietorship is owned by

A) one person.

B) two or more people.

C) shareholders.

D) bankers.

A) one person.

B) two or more people.

C) shareholders.

D) bankers.

one person.

4

In Canada,which of the following organization forms accounts for the greatest number of firms?

A) Limited Liability Partnership

B) Limited Partnership

C) Sole Proprietorship

D) Publicly Traded Corporation

A) Limited Liability Partnership

B) Limited Partnership

C) Sole Proprietorship

D) Publicly Traded Corporation

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

5

You own 100 shares of a Canadian Income Trust Corporation.The corporation earns $5.00 per share before taxes.Once the corporation has paid any corporate taxes that are due,it will distribute the rest of its earnings to its shareholders in the form of a dividend.If the corporate tax rate is 40% and your personal tax rate on (both dividend and non-dividend)income is 30%,then how much money is left for you after all taxes have been paid?

A) $210

B) $300

C) $350

D) $500

A) $210

B) $300

C) $350

D) $500

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following statements is most correct?

A) An advantage to incorporation is that it allows for less regulation of the business.

B) An advantage of a corporation is that it is subject to double taxation.

C) Unlike a partnership, a disadvantage of a corporation is that it has limited liability.

D) Corporations face more regulations when compared to partnerships.

A) An advantage to incorporation is that it allows for less regulation of the business.

B) An advantage of a corporation is that it is subject to double taxation.

C) Unlike a partnership, a disadvantage of a corporation is that it has limited liability.

D) Corporations face more regulations when compared to partnerships.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following organization forms earns the most revenue?

A) Privately Owned Corporation

B) Limited Partnership

C) Publicly Owned Corporation

D) Limited Liability Company

A) Privately Owned Corporation

B) Limited Partnership

C) Publicly Owned Corporation

D) Limited Liability Company

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

8

In Canada,the dividend tax credit gives some relief by

A) effectively giving a lower tax rate on dividend income than on other sources of income.

B) effectively giving a higher tax rate on dividend income than on other sources of income.

C) effectively giving the same tax rate on dividend income as on other sources of income.

D) effectively giving a tax rate of zero on dividend income compared to other sources of income.

A) effectively giving a lower tax rate on dividend income than on other sources of income.

B) effectively giving a higher tax rate on dividend income than on other sources of income.

C) effectively giving the same tax rate on dividend income as on other sources of income.

D) effectively giving a tax rate of zero on dividend income compared to other sources of income.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements regarding limited partnerships is true?

A) There is no limit on a limited partner's liability.

B) A limited partner's liability is limited by the amount of his investment.

C) A limited partner is not liable until all of the assets of the general partners have been exhausted.

D) A general partner's liability is limited by the amount of his investment.

A) There is no limit on a limited partner's liability.

B) A limited partner's liability is limited by the amount of his investment.

C) A limited partner is not liable until all of the assets of the general partners have been exhausted.

D) A general partner's liability is limited by the amount of his investment.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is/are subject to double taxation in Canada?

A) Corporation

B) Partnership

C) Sole proprietorship

D) Both A and B

A) Corporation

B) Partnership

C) Sole proprietorship

D) Both A and B

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

11

In Canada,which of the following business organization forms cannot avoid double taxation?

A) Limited Partnership

B) Publicly Traded Corporation

C) Privately Owned Corporation

D) Limited Liability Company

A) Limited Partnership

B) Publicly Traded Corporation

C) Privately Owned Corporation

D) Limited Liability Company

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

12

In Canada,a limited liability partnership,LLP,is essentially

A) a limited partnership without limited partners.

B) a limited partnership without a general partner.

C) just another name for a limited partnership.

D) just another name for a corporation.

A) a limited partnership without limited partners.

B) a limited partnership without a general partner.

C) just another name for a limited partnership.

D) just another name for a corporation.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is NOT an advantage of a sole proprietorship?

A) Single taxation

B) Ease of setup

C) Limited liability

D) No separation of ownership and control

A) Single taxation

B) Ease of setup

C) Limited liability

D) No separation of ownership and control

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

14

You are a shareholder in a publicly owned corporation.This corporation earns $4 per share before taxes.After it has paid taxes,it will distribute the remainder of its earnings to you as a dividend.The dividend is income to you,so you will then pay taxes on these earnings.The corporate tax rate is 35% and your tax rate on dividend income is 15%.The effective tax rate on your share of the corporations earnings is closest to:

A) 15%

B) 35%

C) 45%

D) 50%

A) 15%

B) 35%

C) 45%

D) 50%

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

15

One of the major characteristics of a limited liability partnership,LLP,in Canada is

A) the limitation on a partner's liability is only in cases related to actions of negligence by other partners or those supervised by other partners.

B) any partner will not be liable for his or her negligence at any time.

C) any partners will be only liable for other partners' negligence.

D) none of the above

A) the limitation on a partner's liability is only in cases related to actions of negligence by other partners or those supervised by other partners.

B) any partner will not be liable for his or her negligence at any time.

C) any partners will be only liable for other partners' negligence.

D) none of the above

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

16

The person charged with running the corporation by instituting the rules and policies set by the board of directors is called

A) the Chief Operating Officer.

B) the Company President.

C) the Chief Executive Officer.

D) the Chief Financial Officer.

A) the Chief Operating Officer.

B) the Company President.

C) the Chief Executive Officer.

D) the Chief Financial Officer.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

17

Explain the benefits of incorporation.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

18

In 2006,the Canadian government effectively neutralized the tax advantages that had existed for most income trusts,relative to firms set up as corporations. The advantages that existed for income trusts prior to these changes were that

A) income trusts avoided double taxation in that the Canada Revenue Agency did not collect corporate taxes but rather collected only personal taxes from income trust unit holders.

B) income trusts effectively afforded unlimited liability to unit holders while corporate shareholders could face unlimited liability.

C) while double taxation existed for both income trusts and corporations, the net tax paid by income trust unit holders was in most cases less than that paid by corporate shareholders.

D) the changes introduced in 2006 eliminated double taxation for corporations, thereby making the taxation of income trusts and corporations substantially equivalent.

A) income trusts avoided double taxation in that the Canada Revenue Agency did not collect corporate taxes but rather collected only personal taxes from income trust unit holders.

B) income trusts effectively afforded unlimited liability to unit holders while corporate shareholders could face unlimited liability.

C) while double taxation existed for both income trusts and corporations, the net tax paid by income trust unit holders was in most cases less than that paid by corporate shareholders.

D) the changes introduced in 2006 eliminated double taxation for corporations, thereby making the taxation of income trusts and corporations substantially equivalent.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

19

In Canada,the distinguishing feature of a corporation is that

A) there is no legal difference between the corporation and its owners.

B) it is a legally defined, artificial being, separate from its owners.

C) it spreads liability for its corporate obligations to all shareholders.

D) it provides limited liability only to small shareholders.

A) there is no legal difference between the corporation and its owners.

B) it is a legally defined, artificial being, separate from its owners.

C) it spreads liability for its corporate obligations to all shareholders.

D) it provides limited liability only to small shareholders.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

20

You own 100 shares of a publicly traded Canadian Corporation.The corporation earns $5.00 per share before taxes.Once the corporation has paid any corporate taxes that are due,it will distribute the rest of its earnings to its shareholders in the form of a dividend.If the corporate tax rate is 40% and your personal tax rate on (both dividend and non-dividend)income is 30%,then how much money is left for you after all taxes have been paid?

A) $210

B) $300

C) $350

D) $500

A) $210

B) $300

C) $350

D) $500

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

21

A ________ is when a rich individual or organization purchases a large fraction of the stock of a poorly performing firm and in doing so gets enough votes to replace the board of directors and the CEO.

A) shareholder proposal

B) leveraged buyout

C) shareholder action

D) hostile takeover

A) shareholder proposal

B) leveraged buyout

C) shareholder action

D) hostile takeover

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

22

In 2011 what position was the Toronto Stock Exchange,TSX,ranked based on the value of trades in U.S.dollars?

A) The 10th position

B) The 8th position

C) The 20th position

D) None of the above

A) The 10th position

B) The 8th position

C) The 20th position

D) None of the above

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

23

In 2011,what position was the Toronto Stock Exchange,TSX,ranked based on domestic market capitalization in U.S.dollars?

A) The 8th position

B) The 14th position

C) The 20th position

D) None of the above

A) The 8th position

B) The 14th position

C) The 20th position

D) None of the above

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

24

One of the major reasons that corporations have a principal-agent problem is that

A) management is less transparent.

B) they have an inefficient and incompetent management team.

C) direct control and ownership are often separate.

D) there is a lack of communication between the owners and the management team.

A) management is less transparent.

B) they have an inefficient and incompetent management team.

C) direct control and ownership are often separate.

D) there is a lack of communication between the owners and the management team.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

25

The Principal-Agent Problem arises

A) because managers have little incentive to work in the interest of shareholders when this means working against their own self-interest.

B) because of the separation of ownership and control in a corporation.

C) Both A and B.

D) None of the above.

A) because managers have little incentive to work in the interest of shareholders when this means working against their own self-interest.

B) because of the separation of ownership and control in a corporation.

C) Both A and B.

D) None of the above.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

26

The ultimate goal of financial management in corporations is

A) to maximize annual profit.

B) to maximize the benefit of the employees.

C) to maximize the interest of the communities.

D) to maximize shareholder wealth.

A) to maximize annual profit.

B) to maximize the benefit of the employees.

C) to maximize the interest of the communities.

D) to maximize shareholder wealth.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

27

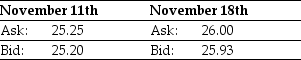

Use the table for the question(s) below.

Consider the following two quotes for XYZ stock:

How much would you have to pay to purchase 100 shares of XYZ stock on November 18th?

A) $2,520

B) $2,525

C) $2,593

D) $2,600

Consider the following two quotes for XYZ stock:

How much would you have to pay to purchase 100 shares of XYZ stock on November 18th?

A) $2,520

B) $2,525

C) $2,593

D) $2,600

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following statements is false?

A) On the NASDAQ, stocks can and do have multiple market makers who compete with each other. Each market maker must post bid and ask prices in the NASDAQ network where they can be viewed by all participants.

B) Bid prices exceed ask prices.

C) Because customers always buy at the ask price and sell at the bid price, the bid-ask spread is a transaction cost investors have to pay in order to trade.

D) On the floor of the NYSE, market makers (known on the NYSE as specialists) match buyers and sellers.

A) On the NASDAQ, stocks can and do have multiple market makers who compete with each other. Each market maker must post bid and ask prices in the NASDAQ network where they can be viewed by all participants.

B) Bid prices exceed ask prices.

C) Because customers always buy at the ask price and sell at the bid price, the bid-ask spread is a transaction cost investors have to pay in order to trade.

D) On the floor of the NYSE, market makers (known on the NYSE as specialists) match buyers and sellers.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

29

In 2011,the largest stock market by value of shares traded in the world was

A) the London Stock Exchange.

B) the New York Stock Exchange.

C) the American Stock Exchange.

D) the NASDAQ.

A) the London Stock Exchange.

B) the New York Stock Exchange.

C) the American Stock Exchange.

D) the NASDAQ.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

30

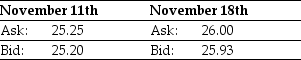

Use the table for the question(s) below.

Consider the following two quotes for XYZ stock:

How much would you receive if you sold 200 shares of XYZ stock on November 11th?

A) $5,050

B) $5,040

C) $5,186

D) $5,200

Consider the following two quotes for XYZ stock:

How much would you receive if you sold 200 shares of XYZ stock on November 11th?

A) $5,050

B) $5,040

C) $5,186

D) $5,200

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

31

The two common measures used to rank stock markets worldwide are

A) the total number of all domestic corporations listed on the exchange and the total value of the volume of shares traded on the exchange at the end of each year.

B) the total value of all domestic corporations listed on the exchange and the total number of shares traded on the exchange at the end of each year.

C) the total value of all domestic corporations listed on the exchange and the total value of the volume of shares traded on the exchange at the end of each year.

D) the total value of all foreign corporations listed on the exchange and the total value of the volume of shares traded on the exchange at the end of each year.

A) the total number of all domestic corporations listed on the exchange and the total value of the volume of shares traded on the exchange at the end of each year.

B) the total value of all domestic corporations listed on the exchange and the total number of shares traded on the exchange at the end of each year.

C) the total value of all domestic corporations listed on the exchange and the total value of the volume of shares traded on the exchange at the end of each year.

D) the total value of all foreign corporations listed on the exchange and the total value of the volume of shares traded on the exchange at the end of each year.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

32

In 2011,the largest stock market by domestic capitalization in the world was

A) the London Stock Exchange.

B) the NASDAQ.

C) the American Stock Exchange.

D) the New York Stock Exchange.

A) the London Stock Exchange.

B) the NASDAQ.

C) the American Stock Exchange.

D) the New York Stock Exchange.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

33

What strategies are available to shareholders to help ensure that managers are motivated to act in the interest of the shareholders rather than their own interest?

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

34

Stocks trading in a large electronic exchange such as the TSX will normally

A) experience a narrow bid-ask range.

B) experience a wide bid-ask range.

C) be thinly traded.

D) incur high transaction costs.

A) experience a narrow bid-ask range.

B) experience a wide bid-ask range.

C) be thinly traded.

D) incur high transaction costs.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

35

In a corporation,the ultimate decisions regarding business matters are made by

A) the Board of Directors.

B) debt holders.

C) shareholders.

D) investors.

A) the Board of Directors.

B) debt holders.

C) shareholders.

D) investors.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

36

What type of company trades on an organized stock exchange?

A) a limited liability company

B) a private company

C) a crown corporation

D) a public company

A) a limited liability company

B) a private company

C) a crown corporation

D) a public company

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

37

If shareholders are unhappy with a CEO's performance,they are most likely to

A) buy more shares in an effort to gain control of the firm.

B) file a shareholder resolution.

C) replace the CEO through a grassroots shareholder uprising.

D) sell their shares.

A) buy more shares in an effort to gain control of the firm.

B) file a shareholder resolution.

C) replace the CEO through a grassroots shareholder uprising.

D) sell their shares.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

38

An investment is said to be liquid if the investment

A) has large day-to-day fluctuations in price.

B) has a large bid-ask spread.

C) can easily be converted into cash.

D) is traded on a stock exchange.

A) has large day-to-day fluctuations in price.

B) has a large bid-ask spread.

C) can easily be converted into cash.

D) is traded on a stock exchange.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following statements is false?

A) In bankruptcy, management is given the opportunity to reorganize the firm and renegotiate with debt holders.

B) Because a corporation is a separate legal entity, when it fails to repay its debts, the people who lent to the firm (the debt holders) are entitled to seize the assets of the corporation in compensation for the default.

C) As long as the corporation can satisfy the claims of the debt holders, ownership remains in the hands of the equity holders.

D) If the corporation fails to satisfy debt holders' claims, equity holders may take control of the firm.

A) In bankruptcy, management is given the opportunity to reorganize the firm and renegotiate with debt holders.

B) Because a corporation is a separate legal entity, when it fails to repay its debts, the people who lent to the firm (the debt holders) are entitled to seize the assets of the corporation in compensation for the default.

C) As long as the corporation can satisfy the claims of the debt holders, ownership remains in the hands of the equity holders.

D) If the corporation fails to satisfy debt holders' claims, equity holders may take control of the firm.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements is correct?

A) The TSX is an electronic exchange and investors can post orders onto the TSX trading system from anywhere in the world.

B) The TSX is an electronic exchange and investors can post orders onto the TSX trading system from anywhere in North America.

C) The TSX is an electronic exchange and investors can post orders onto the TSX trading system from anywhere in Canada.

D) The TSX is an electronic exchange and investors can post orders onto the TSX trading system from anywhere in Toronto.

A) The TSX is an electronic exchange and investors can post orders onto the TSX trading system from anywhere in the world.

B) The TSX is an electronic exchange and investors can post orders onto the TSX trading system from anywhere in North America.

C) The TSX is an electronic exchange and investors can post orders onto the TSX trading system from anywhere in Canada.

D) The TSX is an electronic exchange and investors can post orders onto the TSX trading system from anywhere in Toronto.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

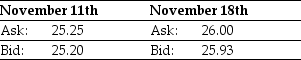

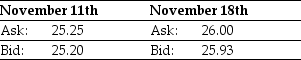

41

What are your net proceeds if you purchased 2,500 shares of XYZ stock on November 11th and then sold them a week later on November 18th?

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

42

Explain the main differences between the NYSE and NASDAQ stock markets.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck