Deck 3: Arbitrage and Financial Decision Making

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

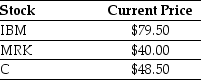

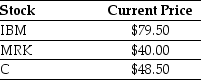

Question

Question

Question

Question

Question

Question

Question

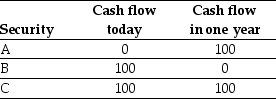

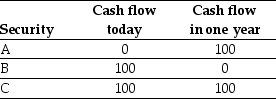

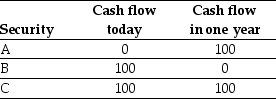

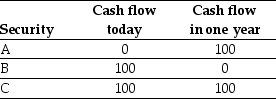

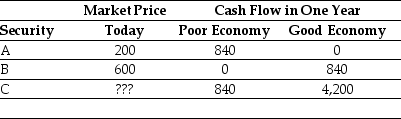

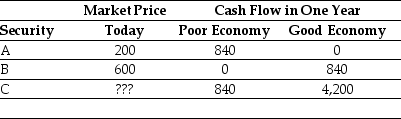

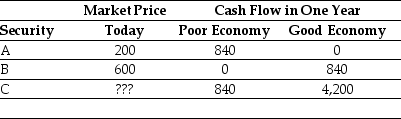

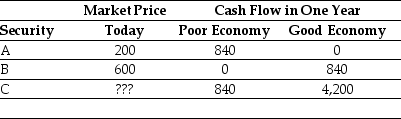

Question

Question

Question

Question

Question

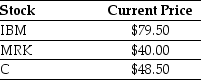

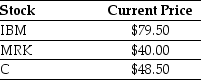

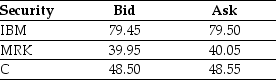

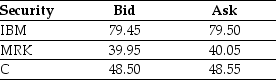

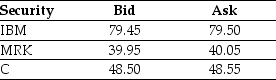

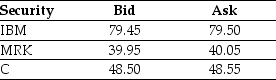

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/79

Play

Full screen (f)

Deck 3: Arbitrage and Financial Decision Making

1

A competitive market is a market in which a good can be bought at ________ it is sold.

A) a lower price than

B) the same price as

C) a higher price than

D) any price

A) a lower price than

B) the same price as

C) a higher price than

D) any price

the same price as

2

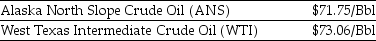

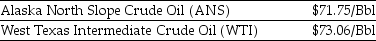

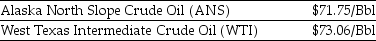

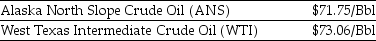

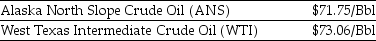

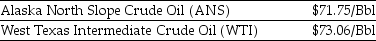

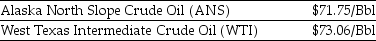

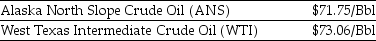

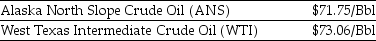

Use the information for the question(s) below.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

Assuming you just purchased 10,000 Bbls of WTI crude at the current market price,the total benefit (cost)to you if you were to refine this crude oil and sell the unleaded gasoline is closest to:

A) $730,600

B) $770,000

C) $771,400

D) $773,908

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.Assuming you just purchased 10,000 Bbls of WTI crude at the current market price,the total benefit (cost)to you if you were to refine this crude oil and sell the unleaded gasoline is closest to:

A) $730,600

B) $770,000

C) $771,400

D) $773,908

$770,000

3

Suppose you will receive $500 in one year and the risk-free interest rate (rf)is 5%.The equivalent value today is closest to:

A) $475

B) $476

C) $500

D) $525

A) $475

B) $476

C) $500

D) $525

$476

4

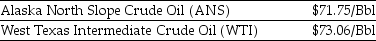

Use the information for the question(s) below.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

Assuming you currently have 10,000 Bbls of WTI crude,the total benefit to you if you were to sell the 10,000 Bbls of WTI crude and use the proceeds to purchase and refine ANS crude is closest to:

A) $730,600

B) $770,000

C) $771,400

D) $773,908

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.Assuming you currently have 10,000 Bbls of WTI crude,the total benefit to you if you were to sell the 10,000 Bbls of WTI crude and use the proceeds to purchase and refine ANS crude is closest to:

A) $730,600

B) $770,000

C) $771,400

D) $773,908

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

5

If the risk-free rate of interest (rf)is 6%,then you should be indifferent between receiving $250 today or

A) $235.85 in one year.

B) $250.00 in one year.

C) $265.00 in one year.

D) none of the above

A) $235.85 in one year.

B) $250.00 in one year.

C) $265.00 in one year.

D) none of the above

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following statements is incorrect?

A) In general, money today is worth more than money in one year.

B) We define the risk-free interest rate, rf, for a given period as the interest rate at which money can be borrowed or lent without risk over that period.

C) We refer to (1 - rf) as the interest rate factor for risk-free cash flows.

D) For most financial decisions, costs and benefits occur at different points in time.

A) In general, money today is worth more than money in one year.

B) We define the risk-free interest rate, rf, for a given period as the interest rate at which money can be borrowed or lent without risk over that period.

C) We refer to (1 - rf) as the interest rate factor for risk-free cash flows.

D) For most financial decisions, costs and benefits occur at different points in time.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

7

The value today of any financial asset equals ________ of all of its future cash flows.

A) the future value

B) the present value

C) the book value

D) the maturity value

A) the future value

B) the present value

C) the book value

D) the maturity value

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

8

Use the information for the question(s) below.

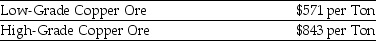

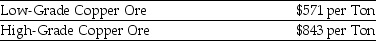

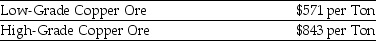

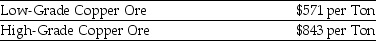

Coloma Cooper Incorporated is able to produce $640 worth of copper from one ton of low-grade copper ore. Because of its higher copper content, Coloma can produce $940 worth of copper from one ton of high-grade copper ore.

Coloma Cooper Incorporated is able to produce $640 worth of copper from one ton of low-grade copper ore. Because of its higher copper content, Coloma can produce $940 worth of copper from one ton of high-grade copper ore.

A company that manufactures copper piping is offering to trade you 5,925 tons of low-grade copper ore for 4,000 tons of high-grade copper ore.Assuming you currently have 4,000 tons of high-grade ore,what are the total benefits and added benefits of taking the trade?

Coloma Cooper Incorporated is able to produce $640 worth of copper from one ton of low-grade copper ore. Because of its higher copper content, Coloma can produce $940 worth of copper from one ton of high-grade copper ore.

Coloma Cooper Incorporated is able to produce $640 worth of copper from one ton of low-grade copper ore. Because of its higher copper content, Coloma can produce $940 worth of copper from one ton of high-grade copper ore.A company that manufactures copper piping is offering to trade you 5,925 tons of low-grade copper ore for 4,000 tons of high-grade copper ore.Assuming you currently have 4,000 tons of high-grade ore,what are the total benefits and added benefits of taking the trade?

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

9

The first step in evaluating a project is to identify its ________.

A) amortization value and depreciation value

B) principal value and maturity value

C) present value and future value

D) costs and benefits

A) amortization value and depreciation value

B) principal value and maturity value

C) present value and future value

D) costs and benefits

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

10

Use the information for the question(s) below.

Coloma Cooper Incorporated is able to produce $640 worth of copper from one ton of low-grade copper ore. Because of its higher copper content, Coloma can produce $940 worth of copper from one ton of high-grade copper ore.

Coloma Cooper Incorporated is able to produce $640 worth of copper from one ton of low-grade copper ore. Because of its higher copper content, Coloma can produce $940 worth of copper from one ton of high-grade copper ore.

A mining company is offering to trade you 7,250 tons of low-grade copper ore for 5,000 tons of high-grade copper ore.Assuming you currently have 5,000 tons of high-grade ore,what should you do?

Coloma Cooper Incorporated is able to produce $640 worth of copper from one ton of low-grade copper ore. Because of its higher copper content, Coloma can produce $940 worth of copper from one ton of high-grade copper ore.

Coloma Cooper Incorporated is able to produce $640 worth of copper from one ton of low-grade copper ore. Because of its higher copper content, Coloma can produce $940 worth of copper from one ton of high-grade copper ore.A mining company is offering to trade you 7,250 tons of low-grade copper ore for 5,000 tons of high-grade copper ore.Assuming you currently have 5,000 tons of high-grade ore,what should you do?

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

11

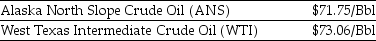

Use the information for the question(s) below.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

Another oil refiner is offering to trade you 10,150 Bbls of Alaska North Slope (ANS)crude oil for 10,000 Bbls of West Texas Intermediate (WTI)crude oil.Assuming you currently have 10,000 Bbls of WTI crude,what should you do?

A) Sell 10,000 Bbls WTI crude on the market and use the proceeds to purchase and refine ANS crude.

B) Do nothing; refine the 10,000 Bbls of WTI crude.

C) Trade the 10,000 Bbls WTI crude with the other refiner and refine the 10,150 Bbls of ANS crude.

D) Trade the 10,000 Bbls WTI crude with the other refiner and then sell the 10,150 Bbls of ANS crude.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.Another oil refiner is offering to trade you 10,150 Bbls of Alaska North Slope (ANS)crude oil for 10,000 Bbls of West Texas Intermediate (WTI)crude oil.Assuming you currently have 10,000 Bbls of WTI crude,what should you do?

A) Sell 10,000 Bbls WTI crude on the market and use the proceeds to purchase and refine ANS crude.

B) Do nothing; refine the 10,000 Bbls of WTI crude.

C) Trade the 10,000 Bbls WTI crude with the other refiner and refine the 10,150 Bbls of ANS crude.

D) Trade the 10,000 Bbls WTI crude with the other refiner and then sell the 10,150 Bbls of ANS crude.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

12

A project you are considering is expected to provide benefits worth $225,000 in one year.If the risk-free rate of interest (rf)is 8%,then the value of the benefits of this project today are closest to:

A) $190,333

B) $208,333

C) $225,000

D) $243,000

A) $190,333

B) $208,333

C) $225,000

D) $243,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

13

If the risk-free rate of interest (rf)is 6%,then you should be indifferent between receiving $250 in one year or

A) $235.85 today.

B) $250.00 today.

C) $265.00 today.

D) none of the above

A) $235.85 today.

B) $250.00 today.

C) $265.00 today.

D) none of the above

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

14

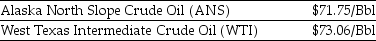

Use the information for the question(s) below.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

Assuming you currently have 10,000 Bbls of WTI crude,the added benefit (cost)to you if you were to sell the 10,000 Bbls of WTI crude and use the proceeds to purchase and refine ANS crude is closest to:

A) ($1,400)

B) $1,400

C) ($3,908)

D) $3,908

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.Assuming you currently have 10,000 Bbls of WTI crude,the added benefit (cost)to you if you were to sell the 10,000 Bbls of WTI crude and use the proceeds to purchase and refine ANS crude is closest to:

A) ($1,400)

B) $1,400

C) ($3,908)

D) $3,908

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following statements regarding the valuing of costs and benefits is NOT correct?

A) The first step in evaluating a project is to identify its costs and benefits.

B) In the absence of competitive markets, we can use one-sided prices to determine exact cash values.

C) Competitive market prices allow us to calculate the value of a decision without worrying about the tastes or opinions of the decision maker.

D) Because competitive markets exist for most commodities and financial assets, we can use them to determine cash values and evaluate decisions in most situations.

A) The first step in evaluating a project is to identify its costs and benefits.

B) In the absence of competitive markets, we can use one-sided prices to determine exact cash values.

C) Competitive market prices allow us to calculate the value of a decision without worrying about the tastes or opinions of the decision maker.

D) Because competitive markets exist for most commodities and financial assets, we can use them to determine cash values and evaluate decisions in most situations.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

16

Use the information for the question(s) below.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

Another oil refiner is offering to trade you 10,150 Bbls of Alaska North Slope (ANS)crude oil for 10,000 Bbls of West Texas Intermediate (WTI)crude oil.Assuming you currently have 10,000 Bbls of WTI crude,the added benefit (cost)to you if you take the trade is closest to:

A) ($1,400)

B) $1,400

C) ($3,908)

D) $3,908

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.Another oil refiner is offering to trade you 10,150 Bbls of Alaska North Slope (ANS)crude oil for 10,000 Bbls of West Texas Intermediate (WTI)crude oil.Assuming you currently have 10,000 Bbls of WTI crude,the added benefit (cost)to you if you take the trade is closest to:

A) ($1,400)

B) $1,400

C) ($3,908)

D) $3,908

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

17

Use the information for the question(s) below.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

Another oil refiner is offering to trade you 10,150 Bbls of Alaska North Slope (ANS)crude oil for 10,000 Bbls of West Texas Intermediate (WTI)crude oil.Assuming you just purchased 10,000 Bbls of WTI crude at the current market price,the total benefit (cost)to you if you take the trade is closest to:

A) $730,600

B) $770,000

C) $771,400

D) $773,908

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.Another oil refiner is offering to trade you 10,150 Bbls of Alaska North Slope (ANS)crude oil for 10,000 Bbls of West Texas Intermediate (WTI)crude oil.Assuming you just purchased 10,000 Bbls of WTI crude at the current market price,the total benefit (cost)to you if you take the trade is closest to:

A) $730,600

B) $770,000

C) $771,400

D) $773,908

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

18

Net Present Value (NPV)is defined as the difference between ________.

A) present value and future value

B) purchasing price and selling price

C) present value of benefits and present value of costs

D) present value of benefit and future value of costs

A) present value and future value

B) purchasing price and selling price

C) present value of benefits and present value of costs

D) present value of benefit and future value of costs

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

19

Suppose you have $500 today and the risk-free interest rate (rf)is 5%.The equivalent value in one year is closest to:

A) $475

B) $476

C) $500

D) $525

A) $475

B) $476

C) $500

D) $525

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

20

The Time Value of Money (TVM)is defined as ________.

A) the difference in value between money today and money in the future

B) the difference in value between accounting book value and marketplace value

C) the difference in value between purchase and sales of any asset values

D) none of the above

A) the difference in value between money today and money in the future

B) the difference in value between accounting book value and marketplace value

C) the difference in value between purchase and sales of any asset values

D) none of the above

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following statements is correct?

A) Regardless of our preferences for cash today versus cash in the future, we should always maximize benefits first. We can then borrow or lend to shift cash flows through time and find our most preferred pattern of cash flows.

B) Regardless of our preferences for cash today versus cash in the future, we should always maximize present value first. We can then borrow or lend to shift cash flows through time and find our most preferred pattern of cash flows.

C) Regardless of our preferences for cash today versus cash in the future, we should always maximize net present value first. We can then borrow or lend to shift cash flows through time and find our most preferred pattern of cash flows.

D) Regardless of our preferences for cash today versus cash in the future, we should always minimize the cost first. We can then borrow or lend to shift cash flows through time and find our most preferred pattern of cash flows.

A) Regardless of our preferences for cash today versus cash in the future, we should always maximize benefits first. We can then borrow or lend to shift cash flows through time and find our most preferred pattern of cash flows.

B) Regardless of our preferences for cash today versus cash in the future, we should always maximize present value first. We can then borrow or lend to shift cash flows through time and find our most preferred pattern of cash flows.

C) Regardless of our preferences for cash today versus cash in the future, we should always maximize net present value first. We can then borrow or lend to shift cash flows through time and find our most preferred pattern of cash flows.

D) Regardless of our preferences for cash today versus cash in the future, we should always minimize the cost first. We can then borrow or lend to shift cash flows through time and find our most preferred pattern of cash flows.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

22

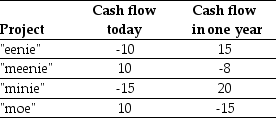

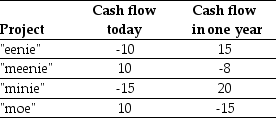

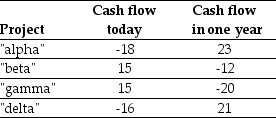

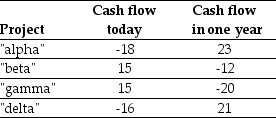

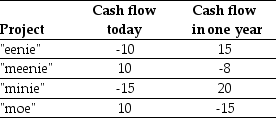

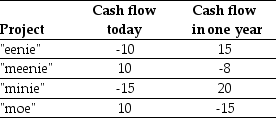

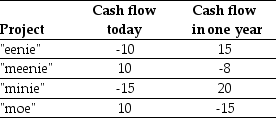

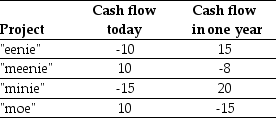

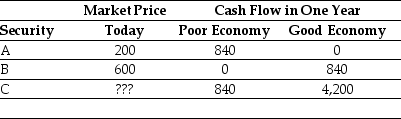

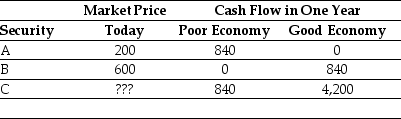

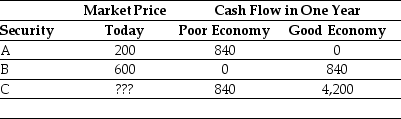

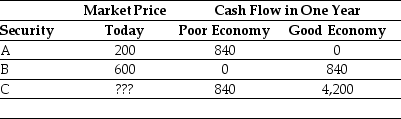

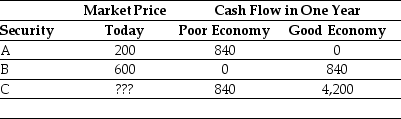

Use the table for the question(s) below.

If the risk-free interest rate is 10%,then the NPV for "moe" is closest to:

A) -3.64

B) 2.73

C) 3.18

D) 3.64

If the risk-free interest rate is 10%,then the NPV for "moe" is closest to:

A) -3.64

B) 2.73

C) 3.18

D) 3.64

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

23

You have an investment opportunity in Germany that requires an investment of $250,000 today and will produce a cash flow of €208,650 in one year with no risk.Suppose the risk-free rate of interest in Germany is 6% and the current competitive exchange rate is €0.78 to $1.00.What is the NPV of this project? Would you take the project?

A) NPV = 0; No

B) NPV = 2,358; No

C) NPV = 2,358; Yes

D) NPV = 13,650; Yes

A) NPV = 0; No

B) NPV = 2,358; No

C) NPV = 2,358; Yes

D) NPV = 13,650; Yes

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following statements regarding arbitrage is not correct?

A) Any situation in which it is possible to make a profit without taking any risk is known as an arbitrage opportunity.

B) Any situation in which it is possible to make a profit without making any investment is known as an arbitrage opportunity.

C) We call a competitive market in which there are no arbitrage opportunities an arbitrage market.

D) The practice of buying and selling equivalent goods in different markets to take advantage of a price difference is known as arbitrage.

A) Any situation in which it is possible to make a profit without taking any risk is known as an arbitrage opportunity.

B) Any situation in which it is possible to make a profit without making any investment is known as an arbitrage opportunity.

C) We call a competitive market in which there are no arbitrage opportunities an arbitrage market.

D) The practice of buying and selling equivalent goods in different markets to take advantage of a price difference is known as arbitrage.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

25

You are offered an investment opportunity in which you will receive $25,000 in one year in exchange for paying $23,750 today.Suppose the risk-free interest rate is 6% per year.Should you take this project,and what is the closest estimate of the NPV?

A) Yes; NPV = $165

B) No; NPV = $165

C) Yes; NPV = -$165

D) No; NPV = -$165

A) Yes; NPV = $165

B) No; NPV = $165

C) Yes; NPV = -$165

D) No; NPV = -$165

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

26

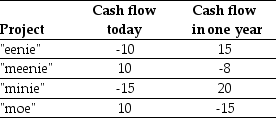

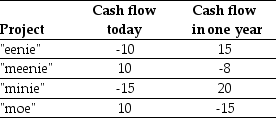

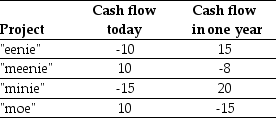

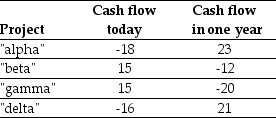

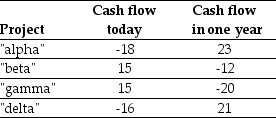

Use the table for the question(s) below.

Assume that the risk-free interest rate is 10%.Rank each of the four projects from most desirable to least desirable based upon NPV.Which project would you invest in first? Are there any projects that you wouldn't invest in?

Assume that the risk-free interest rate is 10%.Rank each of the four projects from most desirable to least desirable based upon NPV.Which project would you invest in first? Are there any projects that you wouldn't invest in?

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

27

You have an investment opportunity in Germany that requires an investment of $250,000 today and will produce a cash flow of €208,650 in one year with no risk.Suppose the risk-free rate of interest in Germany is 7% and the current competitive exchange rate is €0.78 to $1.00.What is the NPV of this project? Would you take the project?

A) NPV = 0; No

B) NPV = 2,358; No

C) NPV = 2,358; Yes

D) NPV = 13,650; Yes

A) NPV = 0; No

B) NPV = 2,358; No

C) NPV = 2,358; Yes

D) NPV = 13,650; Yes

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following statements regarding Net Present Value (NPV)is incorrect?

A) The NPV represents the value of the project in terms of cash today.

B) Good projects will have a positive NPV.

C) The NPV of a project is the difference between the present value of its benefits and the present value of its costs.

D) When faced with a set of alternatives, choose the one with the lowest NPV in order to minimize the present value of costs.

A) The NPV represents the value of the project in terms of cash today.

B) Good projects will have a positive NPV.

C) The NPV of a project is the difference between the present value of its benefits and the present value of its costs.

D) When faced with a set of alternatives, choose the one with the lowest NPV in order to minimize the present value of costs.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

29

Use the table for the question(s) below.

If the risk-free interest rate is 10%,then of the four projects listed,if you could only invest in one project,which one would you select?

A) Eenie

B) Meenie

C) Minie

D) Moe

If the risk-free interest rate is 10%,then of the four projects listed,if you could only invest in one project,which one would you select?

A) Eenie

B) Meenie

C) Minie

D) Moe

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following statements regarding the Law of One Price is incorrect?

A) At any point in time, the price of two equivalent goods trading in different competitive markets will be the same.

B) One useful consequence of the Law of One Price is that when evaluating costs and benefits to compute a net present value, we can use any competitive price to determine a cash value, without checking the price in all possible markets.

C) If equivalent goods or securities trade simultaneously in different competitive markets, then they will trade for the same price in both markets.

D) An important property of the Law of One Price is that it holds even in markets where arbitrage is not possible.

A) At any point in time, the price of two equivalent goods trading in different competitive markets will be the same.

B) One useful consequence of the Law of One Price is that when evaluating costs and benefits to compute a net present value, we can use any competitive price to determine a cash value, without checking the price in all possible markets.

C) If equivalent goods or securities trade simultaneously in different competitive markets, then they will trade for the same price in both markets.

D) An important property of the Law of One Price is that it holds even in markets where arbitrage is not possible.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

31

Use the table for the question(s) below.

If the risk-free interest rate is 10%,then the NPV for "eenie" is closest to:

A) -3.64

B) 2.73

C) 3.18

D) 3.64

If the risk-free interest rate is 10%,then the NPV for "eenie" is closest to:

A) -3.64

B) 2.73

C) 3.18

D) 3.64

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

32

Use the table for the question(s) below.

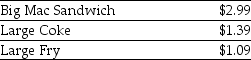

Consider the following prices from a McDonald's Restaurant:

A McDonald's Big Mac value meal consists of a Big Mac Sandwich,Large Coke,and a Large Fry.Assuming that there is a competitive market for McDonald's food items,at what price must a Big Mac value meal sell to insure the absence of an arbitrage opportunity and uphold the law of one price?

A) $4.08

B) $4.38

C) $5.47

D) $5.77

Consider the following prices from a McDonald's Restaurant:

A McDonald's Big Mac value meal consists of a Big Mac Sandwich,Large Coke,and a Large Fry.Assuming that there is a competitive market for McDonald's food items,at what price must a Big Mac value meal sell to insure the absence of an arbitrage opportunity and uphold the law of one price?

A) $4.08

B) $4.38

C) $5.47

D) $5.77

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

33

You are offered an investment opportunity in which you will receive $23,750 today in exchange for paying $25,000 in one year.Suppose the risk-free interest rate is 6% per year.Should you take this project,and what is the closest estimate of the NPV?

A) Yes; NPV = $165

B) No; NPV = $165

C) Yes; NPV = -$165

D) No; NPV = -$165

A) Yes; NPV = $165

B) No; NPV = $165

C) Yes; NPV = -$165

D) No; NPV = -$165

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

34

Use the table for the question(s) below.

If the risk-free interest rate is 10%,then of the four projects listed,if could only invest in two of these projects,which two projects would you select?

A) Minie & Eenie

B) Minie & Meenie

C) Eenie & Moe

D) Eenie & Meenie

If the risk-free interest rate is 10%,then of the four projects listed,if could only invest in two of these projects,which two projects would you select?

A) Minie & Eenie

B) Minie & Meenie

C) Eenie & Moe

D) Eenie & Meenie

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

35

You have an investment opportunity in the United Kingdom that requires an investment of $500,000 today and will produce a cash flow of £320,000 in one year with no risk.Suppose the risk-free rate of interest in the U.K is 6% and the current competitive exchange rate is $1.70/£.What is the NPV of this project? Would you take the project?

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following formulas regarding NPV is incorrect?

A) NPV + PV(benefits) = PV(Cost)

B) NPV + PV(costs) = PV(benefits)

C) NPV = PV(All project cash flows)

D) NPV = PV(benefits) - PV(costs)

A) NPV + PV(benefits) = PV(Cost)

B) NPV + PV(costs) = PV(benefits)

C) NPV = PV(All project cash flows)

D) NPV = PV(benefits) - PV(costs)

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements is correct?

A) When making an investment decision, take the alternative with the positive NPV. Choosing this alternative is equivalent to receiving its NPV in cash today.

B) When making an investment decision, take the alternative with the negative NPV. Choosing this alternative is equivalent to receiving its NPV in cash today.

C) When making an investment decision, take the alternative with the highest NPV. Choosing this alternative is equivalent to receiving its NPV in cash today.

D) When making an investment decision, take the alternative with the lowest NPV. Choosing this alternative is equivalent to receiving its NPV in cash today.

A) When making an investment decision, take the alternative with the positive NPV. Choosing this alternative is equivalent to receiving its NPV in cash today.

B) When making an investment decision, take the alternative with the negative NPV. Choosing this alternative is equivalent to receiving its NPV in cash today.

C) When making an investment decision, take the alternative with the highest NPV. Choosing this alternative is equivalent to receiving its NPV in cash today.

D) When making an investment decision, take the alternative with the lowest NPV. Choosing this alternative is equivalent to receiving its NPV in cash today.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

38

Use the table for the question(s) below.

If the risk-free interest rate is 10%,then of the four projects listed,which project would you never want to invest in?

A) Eenie

B) Meenie

C) Minie

D) Moe

If the risk-free interest rate is 10%,then of the four projects listed,which project would you never want to invest in?

A) Eenie

B) Meenie

C) Minie

D) Moe

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

39

Use the table for the question(s) below.

A competitive market in which there are no arbitrage opportunities is called

A) a normal market.

B) a fair market.

C) an arbitrage market.

D) a free market.

A competitive market in which there are no arbitrage opportunities is called

A) a normal market.

B) a fair market.

C) an arbitrage market.

D) a free market.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements regarding the NPV decision rule is false?

A) Reject projects with an NPV of zero, as accepting them is equivalent to losing the present value of the projects' costs.

B) When faced with a set of alternatives, choose the one with the highest NPV.

C) Accept those projects with a positive NPV, as accepting them is equivalent to receiving their NPV in cash today.

D) Reject those projects with a negative NPV, as not doing them has NPV = 0.

A) Reject projects with an NPV of zero, as accepting them is equivalent to losing the present value of the projects' costs.

B) When faced with a set of alternatives, choose the one with the highest NPV.

C) Accept those projects with a positive NPV, as accepting them is equivalent to receiving their NPV in cash today.

D) Reject those projects with a negative NPV, as not doing them has NPV = 0.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

41

Use the information for the question(s) below.

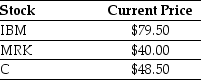

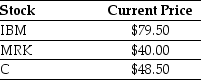

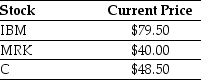

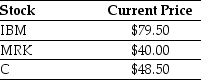

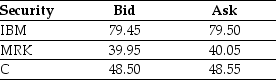

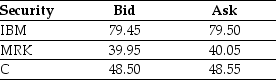

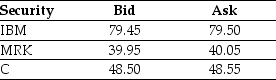

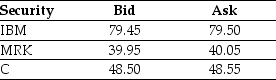

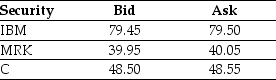

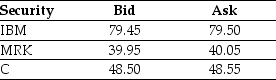

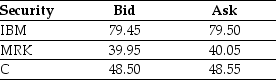

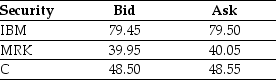

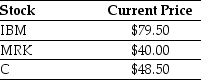

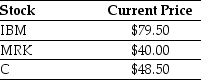

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM), three shares of Merck (MRK), and three shares of Citigroup Inc. (C). Suppose the current market price of each individual stock are shown below:

Suppose a security with a risk-free cash flow of $1,000 in one year trades for $909 today.If there are no arbitrage opportunities,then the current risk-free interest rate is closest to:

A) 8%

B) 10%

C) 11%

D) 12%

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM), three shares of Merck (MRK), and three shares of Citigroup Inc. (C). Suppose the current market price of each individual stock are shown below:

Suppose a security with a risk-free cash flow of $1,000 in one year trades for $909 today.If there are no arbitrage opportunities,then the current risk-free interest rate is closest to:

A) 8%

B) 10%

C) 11%

D) 12%

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

42

Advanced Micro Devices (NYSE: AMD)is currently trading at $20.75 on the NYSE.Advanced Micro Devices is also listed on NASDAQ and assume it is currently trading on NASDAQ at $20.50.Does an arbitrage opportunity exist and if so how would you exploit it and how much would you make on a block trade of 1,000 shares?

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

43

A McDonald's Big Mac value meal consists of a Big Mac Sandwich,Large Coke,and a Large Fry.Assume that there is a competitive market for McDonald's food items and that McDonald's sells the Big Mac value meal for $4.79.Does an arbitrage opportunity exist and,if so,how would you exploit it and how much would you make on one extra value meal?

A) Yes, buy an extra value meal and then sell the Big Mac, Coke, and Fries to make an arbitrage profit of $0.68

B) No, no arbitrage opportunity exists

C) Yes, buy a Big Mac, Coke, and Fries then sell the value meal to make an arbitrage profit of $1.09

D) Yes, buy a Big Mac, Coke, and Fries then sell the value meal to make an arbitrage profit of $0.68

A) Yes, buy an extra value meal and then sell the Big Mac, Coke, and Fries to make an arbitrage profit of $0.68

B) No, no arbitrage opportunity exists

C) Yes, buy a Big Mac, Coke, and Fries then sell the value meal to make an arbitrage profit of $1.09

D) Yes, buy a Big Mac, Coke, and Fries then sell the value meal to make an arbitrage profit of $0.68

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

44

Walgreen Company (NYSE: WAG)is currently trading at $48.75 on the NYSE.Walgreen Company is also listed on NASDAQ and assume it is currently trading on NASDAQ at $48.50.Does an arbitrage opportunity exist and if so how would you exploit it and how much would you make on a block trade of 100 shares?

A) No, no arbitrage opportunity exists

B) Yes, buy on NASDAQ and sell on NYSE, make $25

C) Yes, buy on NYSE and sell on NASDAQ, make $25

D) Yes, buy on NASDAQ and sell on NYSE, make $250

A) No, no arbitrage opportunity exists

B) Yes, buy on NASDAQ and sell on NYSE, make $25

C) Yes, buy on NYSE and sell on NASDAQ, make $25

D) Yes, buy on NASDAQ and sell on NYSE, make $250

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

45

The no-arbitrage price of any financial asset is

A) the future value of all future cash flows received from the assets.

B) the accounting book value of all future cash flows received from the asset.

C) the present value of all future cash flows received from the asset.

D) the market value of all future cash flows received from the asset.

A) the future value of all future cash flows received from the assets.

B) the accounting book value of all future cash flows received from the asset.

C) the present value of all future cash flows received from the asset.

D) the market value of all future cash flows received from the asset.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

46

You are up late watching TV one night and see an ad from Ronco for the Dial-o-matic food slicer.You learn that the Dial-o-matic sells for $29.95.But wait,there's more! Ronco is also including in this deal a set of Ginsu steak knives worth $10.95 and another free gift worth $7.95.Assuming that there is a competitive market for Ronco items,at what price must Ronco be selling this three item Dial-o-matic deal to insure the absence of an arbitrage opportunity and uphold the law of one price?

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

47

Suppose that Bondi Inc.is a Canadian holding company that owns both Pizza Hut and Kentucky Fried Chicken Franchised Restaurants.If the value of Bondi is $130 million,and the Pizza Hut Franchises are worth $70 million,then what is the value of the Kentucky Fried Chicken Franchises?

A) $60 million

B) $70 million

C) $130 million

D) Unable to determine with the information provided.

A) $60 million

B) $70 million

C) $130 million

D) Unable to determine with the information provided.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

48

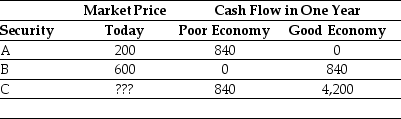

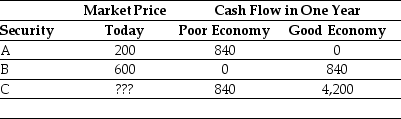

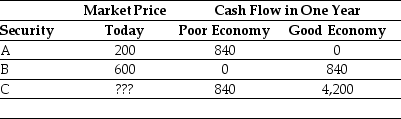

Use the table for the question(s) below.

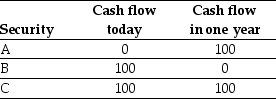

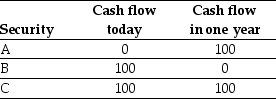

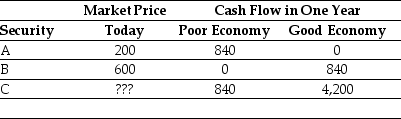

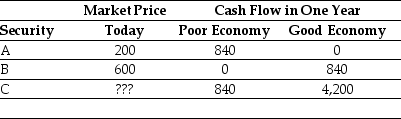

If the value of security "C" is $180,then what must be the value of security "A"?

A) $80

B) $90

C) $100

D) Unable to determine without the risk-free rate.

If the value of security "C" is $180,then what must be the value of security "A"?

A) $80

B) $90

C) $100

D) Unable to determine without the risk-free rate.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

49

Consider two securities,A & B.Suppose a third security,C,has the same cash flows as A and B combined.Given this information about securities A,B,& C,which of the following statements is incorrect?

A) If the total price of A and B is cheaper than the price of C, then we could make a profit selling A and B and buying C.

B) Price(C) = Price(A) + Price(B)

C) Because security C is equivalent to the portfolio of A and B, by the law of one price they must have the same price.

D) The relationship known as value additivity says that the value of a portfolio is equal to the sum of the values of its parts.

A) If the total price of A and B is cheaper than the price of C, then we could make a profit selling A and B and buying C.

B) Price(C) = Price(A) + Price(B)

C) Because security C is equivalent to the portfolio of A and B, by the law of one price they must have the same price.

D) The relationship known as value additivity says that the value of a portfolio is equal to the sum of the values of its parts.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

50

No arbitrage is equivalent to the idea that all risk-free investments should offer investors ________.

A) zero return

B) the same return

C) positive returns

D) negative returns

A) zero return

B) the same return

C) positive returns

D) negative returns

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

51

Use the table for the question(s) below.

If the risk-free rate of interest is 7.5%,then the value of security "B" is closest to:

A) $91.00

B) $92.50

C) $93.00

D) $100.00

If the risk-free rate of interest is 7.5%,then the value of security "B" is closest to:

A) $91.00

B) $92.50

C) $93.00

D) $100.00

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

52

Use the information for the question(s) below.

An independent Canadian film maker is considering producing a new movie. The initial cost for making this movie will be $20 million today. Once the movie is completed, in one year, the movie will be sold to a major studio for $25 million. Rather than paying the $20 million investment entirely using its own cash, the film maker is considering raising additional funds by issuing a security that will pay investors $11 million in one year. Suppose the risk-free rate of interest is 10%.

Without issuing the new security,the NPV for this project is closest to what amount? Should the film maker make the investment?

A) $1.7 million; Yes

B) $1.7 million; No

C) $2.7 million; Yes

D) $2.7 million; No

An independent Canadian film maker is considering producing a new movie. The initial cost for making this movie will be $20 million today. Once the movie is completed, in one year, the movie will be sold to a major studio for $25 million. Rather than paying the $20 million investment entirely using its own cash, the film maker is considering raising additional funds by issuing a security that will pay investors $11 million in one year. Suppose the risk-free rate of interest is 10%.

Without issuing the new security,the NPV for this project is closest to what amount? Should the film maker make the investment?

A) $1.7 million; Yes

B) $1.7 million; No

C) $2.7 million; Yes

D) $2.7 million; No

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

53

Use the information for the question(s) below.

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM), three shares of Merck (MRK), and three shares of Citigroup Inc. (C). Suppose the current market price of each individual stock are shown below:

The price per share of the ETF in a normal market is closest to:

A) $168.00

B) $336.00

C) $424.50

D) $504.00

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM), three shares of Merck (MRK), and three shares of Citigroup Inc. (C). Suppose the current market price of each individual stock are shown below:

The price per share of the ETF in a normal market is closest to:

A) $168.00

B) $336.00

C) $424.50

D) $504.00

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

54

Use the information for the question(s) below.

An independent Canadian film maker is considering producing a new movie. The initial cost for making this movie will be $20 million today. Once the movie is completed, in one year, the movie will be sold to a major studio for $25 million. Rather than paying the $20 million investment entirely using its own cash, the film maker is considering raising additional funds by issuing a security that will pay investors $11 million in one year. Suppose the risk-free rate of interest is 10%.

What is the NPV of this project if the film maker does not issue the new security? What is the NPV if the film maker issues the new security?

A) $1.7 million; $1.7 million

B) $1.7 million; $2.7 million

C) $2.7 million; $1.7 million

D) $2.7 million; $2.7 million

An independent Canadian film maker is considering producing a new movie. The initial cost for making this movie will be $20 million today. Once the movie is completed, in one year, the movie will be sold to a major studio for $25 million. Rather than paying the $20 million investment entirely using its own cash, the film maker is considering raising additional funds by issuing a security that will pay investors $11 million in one year. Suppose the risk-free rate of interest is 10%.

What is the NPV of this project if the film maker does not issue the new security? What is the NPV if the film maker issues the new security?

A) $1.7 million; $1.7 million

B) $1.7 million; $2.7 million

C) $2.7 million; $1.7 million

D) $2.7 million; $2.7 million

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

55

Use the table for the question(s) below.

If the risk-free rate of interest is 7.5%,then the value of security "A" is closest to:

A) $91.00

B) $92.50

C) $93.00

D) $100.00

If the risk-free rate of interest is 7.5%,then the value of security "A" is closest to:

A) $91.00

B) $92.50

C) $93.00

D) $100.00

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

56

Use the information for the question(s) below.

An independent Canadian film maker is considering producing a new movie. The initial cost for making this movie will be $20 million today. Once the movie is completed, in one year, the movie will be sold to a major studio for $25 million. Rather than paying the $20 million investment entirely using its own cash, the film maker is considering raising additional funds by issuing a security that will pay investors $11 million in one year. Suppose the risk-free rate of interest is 10%.

Assuming that the film maker issues the new security,the NPV for this project is closest to what amount? Should the film maker make the investment?

A) $1.7 million; Yes

B) $1.7 million; No

C) $2.7 million; Yes

D) $2.7 million; No

An independent Canadian film maker is considering producing a new movie. The initial cost for making this movie will be $20 million today. Once the movie is completed, in one year, the movie will be sold to a major studio for $25 million. Rather than paying the $20 million investment entirely using its own cash, the film maker is considering raising additional funds by issuing a security that will pay investors $11 million in one year. Suppose the risk-free rate of interest is 10%.

Assuming that the film maker issues the new security,the NPV for this project is closest to what amount? Should the film maker make the investment?

A) $1.7 million; Yes

B) $1.7 million; No

C) $2.7 million; Yes

D) $2.7 million; No

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following statements is false?

A) Financial transactions are not sources of value, but merely serve to adjust the timing and risk of the cash flows to best suit the needs of the firm or its investors.

B) The NPV of trading a security in a normal market is zero.

C) We cannot separate a firm's investment decision from the decision of how to finance the investment.

D) In normal markets, trading securities neither creates nor destroys value.

A) Financial transactions are not sources of value, but merely serve to adjust the timing and risk of the cash flows to best suit the needs of the firm or its investors.

B) The NPV of trading a security in a normal market is zero.

C) We cannot separate a firm's investment decision from the decision of how to finance the investment.

D) In normal markets, trading securities neither creates nor destroys value.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following statements regarding value additivity is false?

A) The value of a portfolio is equal to the sum of the values of its parts.

B) The price or value of the entire firm is equal to the sum of the values of all projects and investments within the firm.

C) To maximize the value of the entire firm, managers should make decisions that maximize NPV.

D) Value additivity does not have important consequences for the value of the entire firm, only for portfolios of firms.

A) The value of a portfolio is equal to the sum of the values of its parts.

B) The price or value of the entire firm is equal to the sum of the values of all projects and investments within the firm.

C) To maximize the value of the entire firm, managers should make decisions that maximize NPV.

D) Value additivity does not have important consequences for the value of the entire firm, only for portfolios of firms.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following statements regarding arbitrage and security prices is incorrect?

A) We call the price of a security in a normal market the no-arbitrage price for the security.

B) In financial markets it is possible to sell a security you do not own by doing a short sale.

C) When a bond is underpriced, the arbitrage strategy involves selling the bond and investing some of the proceeds.

D) The general formula for the no-arbitrage price of a security is Price(security) = PV(All cash flows paid by the security).

A) We call the price of a security in a normal market the no-arbitrage price for the security.

B) In financial markets it is possible to sell a security you do not own by doing a short sale.

C) When a bond is underpriced, the arbitrage strategy involves selling the bond and investing some of the proceeds.

D) The general formula for the no-arbitrage price of a security is Price(security) = PV(All cash flows paid by the security).

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

60

Use the information for the question(s) below.

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM), three shares of Merck (MRK), and three shares of Citigroup Inc. (C). Suppose the current market price of each individual stock are shown below:

Suppose that the ETF is trading for $424.50; you should

A) sell the ETF and buy 2 shares of IBM, 3 shares of MRK, and 3 shares of C.

B) sell the ETF and buy 3 shares of IBM, 2 shares of MRK, and 3 shares of C.

C) buy the ETF and sell 2 shares of IBM, 3 shares of MRK, and 3 shares of C.

D) do nothing, no arbitrage opportunity exists.

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM), three shares of Merck (MRK), and three shares of Citigroup Inc. (C). Suppose the current market price of each individual stock are shown below:

Suppose that the ETF is trading for $424.50; you should

A) sell the ETF and buy 2 shares of IBM, 3 shares of MRK, and 3 shares of C.

B) sell the ETF and buy 3 shares of IBM, 2 shares of MRK, and 3 shares of C.

C) buy the ETF and sell 2 shares of IBM, 3 shares of MRK, and 3 shares of C.

D) do nothing, no arbitrage opportunity exists.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

61

Use the table for the question(s) below.

Which of the following statements is false?

A) No arbitrage opportunities will exist until the underlying prices diverge by more than the amount of the transaction costs.

B) Because you will generally pay a slightly lower price when you buy a security (the ask price) than you receive when you sell (the bid price) you will pay the bid-ask spread.

C) The price of a security should equal to the present value of its cash flows, up to the transaction costs of trading the security and the cash flows.

D) In most markets, you must pay transactions costs to trade securities.

Which of the following statements is false?

A) No arbitrage opportunities will exist until the underlying prices diverge by more than the amount of the transaction costs.

B) Because you will generally pay a slightly lower price when you buy a security (the ask price) than you receive when you sell (the bid price) you will pay the bid-ask spread.

C) The price of a security should equal to the present value of its cash flows, up to the transaction costs of trading the security and the cash flows.

D) In most markets, you must pay transactions costs to trade securities.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

62

Use the table for the question(s) below.

Consider an ETF that is made up of one share each of IBM,MRK,and C. The current quote for this ETF currently is $167.75 (bid)$167.85 (ask).What should you do?

Consider an ETF that is made up of one share each of IBM,MRK,and C. The current quote for this ETF currently is $167.75 (bid)$167.85 (ask).What should you do?

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

63

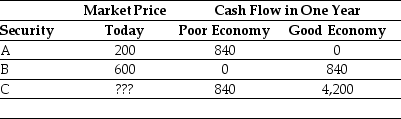

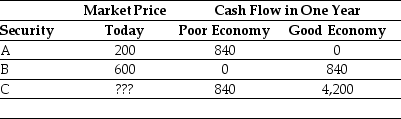

Use the table for the question(s) below.

Suppose that security C had a risk premium of 30%.Describe what arbitrage opportunity exists and how you would exploit it.

Suppose that security C had a risk premium of 30%.Describe what arbitrage opportunity exists and how you would exploit it.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

64

Use the table for the question(s) below.

In a normal market with transactions costs,is it possible for different investors to place different values on an investment opportunity? Are there any limits on the amount that their values can differ?

In a normal market with transactions costs,is it possible for different investors to place different values on an investment opportunity? Are there any limits on the amount that their values can differ?

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

65

Use the table for the question(s) below.

On June 5th 2009,a share of Lululemon stock on Toronto Stock Exchange (TSX)was quoted as Bid: $15.58 and Ask: $15.84.If a competitive price is $15.71,

A) the transaction cost to buy or sell is $0.13.

B) the transaction cost to buy or sell is $0.26.

C) the transaction cost to buy or sell is zero.

D) none of the above

On June 5th 2009,a share of Lululemon stock on Toronto Stock Exchange (TSX)was quoted as Bid: $15.58 and Ask: $15.84.If a competitive price is $15.71,

A) the transaction cost to buy or sell is $0.13.

B) the transaction cost to buy or sell is $0.26.

C) the transaction cost to buy or sell is zero.

D) none of the above

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

66

Use the table for the question(s) below.

Based upon the information provided about securities A,B,and C,the risk-free rate of interest is closest to:

A) 4%

B) 5%

C) 8%

D) 10%

Based upon the information provided about securities A,B,and C,the risk-free rate of interest is closest to:

A) 4%

B) 5%

C) 8%

D) 10%

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

67

Which one of the following statements is false?

A) When we compute the return of a security based on the average payoff we expect to receive, we call it the expected return.

B) The notion that investors prefer to have a safe income rather than a risky one of the same average amount is call risk aversion.

C) Because investors are risk averse, the risk-free interest rate is not the right rate to use when converting risky cash flows across time.

D) The more risk averse investors are, the higher the current price of a risky asset will be compared to a risk-free bond.

A) When we compute the return of a security based on the average payoff we expect to receive, we call it the expected return.

B) The notion that investors prefer to have a safe income rather than a risky one of the same average amount is call risk aversion.

C) Because investors are risk averse, the risk-free interest rate is not the right rate to use when converting risky cash flows across time.

D) The more risk averse investors are, the higher the current price of a risky asset will be compared to a risk-free bond.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

68

Use the information for the question(s) below.

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM), three shares of Merck (MRK), and three shares of Citigroup Inc. (C). Suppose the current market price of each individual stock are shown below:

Assume that the ETF is trading for $426.00.What (if any)arbitrage opportunity exists? What (if any)trades would you make?

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM), three shares of Merck (MRK), and three shares of Citigroup Inc. (C). Suppose the current market price of each individual stock are shown below:

Assume that the ETF is trading for $426.00.What (if any)arbitrage opportunity exists? What (if any)trades would you make?

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

69

Use the table for the question(s) below.

Consider a bond that pays $1,000 in one year.Suppose that the market interest rate for savings is 8%,but the interest rate for borrowing is 10%.The price range that this bond must trade in a normal market if no arbitrage opportunities exist is closest to:

A) $909 to $917

B) $909 to $926

C) $917 to $926

D) $909 to $1000

Consider a bond that pays $1,000 in one year.Suppose that the market interest rate for savings is 8%,but the interest rate for borrowing is 10%.The price range that this bond must trade in a normal market if no arbitrage opportunities exist is closest to:

A) $909 to $917

B) $909 to $926

C) $917 to $926

D) $909 to $1000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

70

A nominal interest rate is normally composed of following elements

A) real interest rate, expected inflation rate and risk premium.

B) real interest rate and risk premium.

C) periodic interest rate, real interest rate and expected inflation rate.

D) periodic interest rate, expected inflation rate and risk premium.

A) real interest rate, expected inflation rate and risk premium.

B) real interest rate and risk premium.

C) periodic interest rate, real interest rate and expected inflation rate.

D) periodic interest rate, expected inflation rate and risk premium.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

71

Use the table for the question(s) below.

Consider an ETF that is made up of one share each of IBM,MRK,and C. The current quote for this ETF currently is $168.15 (bid)$168.20 (ask).What should you do?

Consider an ETF that is made up of one share each of IBM,MRK,and C. The current quote for this ETF currently is $168.15 (bid)$168.20 (ask).What should you do?

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

72

Which is the following statements is correct?

A) The expected return is the return of a security that we compute based on the payoff value that we expect to receive on average.

B) The expected return is the return of a security that we compute based on the future value that we expect to receive on average.

C) The expected return is the return of a security that we compute based on the present value that we expect to receive on average.

D) The expected return is the return of a security that we compute based on the book value that we expect to receive on average.

A) The expected return is the return of a security that we compute based on the payoff value that we expect to receive on average.

B) The expected return is the return of a security that we compute based on the future value that we expect to receive on average.

C) The expected return is the return of a security that we compute based on the present value that we expect to receive on average.

D) The expected return is the return of a security that we compute based on the book value that we expect to receive on average.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

73

Use the table for the question(s) below.

Consider an ETF that is made up of one share each of IBM,MRK,and C.The maximum bid price for this ETF in a normal market is closest to:

A) $167.80

B) $167.90

C) $168.00

D) $168.10

Consider an ETF that is made up of one share each of IBM,MRK,and C.The maximum bid price for this ETF in a normal market is closest to:

A) $167.80

B) $167.90

C) $168.00

D) $168.10

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

74

Use the table for the question(s) below.

What is the no-arbitrage price for security C?

A) $800

B) $1,600

C) $3,200

D) $4,000

What is the no-arbitrage price for security C?

A) $800

B) $1,600

C) $3,200

D) $4,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

75

Use the table for the question(s) below.

Suppose a risky security pays an average cash flow of $100 in one year.The risk-free rate is 5%,and the expected return on the market index is 13%.If the returns on this security are high when the economy is strong and low when the economy is weak,but the returns vary by only half as much as the market index,what risk premium is appropriate for this security?

A) 4%

B) 6.5%

C) 9%

D) 11%

Suppose a risky security pays an average cash flow of $100 in one year.The risk-free rate is 5%,and the expected return on the market index is 13%.If the returns on this security are high when the economy is strong and low when the economy is weak,but the returns vary by only half as much as the market index,what risk premium is appropriate for this security?

A) 4%

B) 6.5%

C) 9%

D) 11%

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

76

Use the table for the question(s) below.

Consider an ETF that is made up of one share each of IBM,MRK,and C.The minimum ask price for this ETF in a normal market is closest to:

A) $167.80

B) $167.90

C) $168.00

D) $168.10

Consider an ETF that is made up of one share each of IBM,MRK,and C.The minimum ask price for this ETF in a normal market is closest to:

A) $167.80

B) $167.90

C) $168.00

D) $168.10

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

77

Use the table for the question(s) below.

Suppose a risky security pays an average cash flow of $100 in one year.The risk-free rate is 5%,and the expected return on the market index is 13%.If the returns on this security are high when the economy is strong and low when the economy is weak,but the returns vary by only half as much as the market index,then the price for this risky security is closest to:

A) $88

B) $92

C) $93

D) $95

Suppose a risky security pays an average cash flow of $100 in one year.The risk-free rate is 5%,and the expected return on the market index is 13%.If the returns on this security are high when the economy is strong and low when the economy is weak,but the returns vary by only half as much as the market index,then the price for this risky security is closest to:

A) $88

B) $92

C) $93

D) $95

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

78

Use the table for the question(s) below.

Consider an ETF that is made up of one share each of IBM,MRK,and C. The current quote for this ETF currently is $167.85 (bid)$167.95 (ask).What should you do?

Consider an ETF that is made up of one share each of IBM,MRK,and C. The current quote for this ETF currently is $167.85 (bid)$167.95 (ask).What should you do?

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

79

Use the information for the question(s) below.

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM), three shares of Merck (MRK), and three shares of Citigroup Inc. (C). Suppose the current market price of each individual stock are shown below:

The price per share of the ETF in a normal market is:

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM), three shares of Merck (MRK), and three shares of Citigroup Inc. (C). Suppose the current market price of each individual stock are shown below:

The price per share of the ETF in a normal market is:

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck