Deck 5: Interest Rates

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/69

Play

Full screen (f)

Deck 5: Interest Rates

1

You are considering purchasing a new automobile that will cost you $28,000.The dealer offers you 4.9% APR financing for 60 months (with payments made at the end of the month).Assuming you finance the entire $28,000 and finance through the dealer,your monthly payments will be closest to:

A) $1,454

B) $527

C) $467

D) $478

A) $1,454

B) $527

C) $467

D) $478

$527

2

Which of the following equations is incorrect?

A) - 1= APR

- 1= APR

B) Equivalent n - Period Discount Rate = (1 + r)n - 1

C) 1 + EAR =

D) Interest Rate per Compounding Period =

A)

- 1= APR

- 1= APRB) Equivalent n - Period Discount Rate = (1 + r)n - 1

C) 1 + EAR =

D) Interest Rate per Compounding Period =

- 1= APR

- 1= APR 3

The effective annual rate (EAR)for a savings account with a stated APR of 4% compounded daily is closest to:

A) 4.00%

B) 4.10%

C) 4.08%

D) 4.06%

A) 4.00%

B) 4.10%

C) 4.08%

D) 4.06%

4.08%

4

In Canada,by regulation,how many times is a mortgage rate allowed to compound in a year if the rate is fixed with a closed term?

A) Monthly

B) Semiannually

C) Annually

D) Quarterly

A) Monthly

B) Semiannually

C) Annually

D) Quarterly

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

5

The effective annual rate (EAR)for a loan with a stated APR of 8% compounded monthly is closest to:

A) 8.30%

B) 8.33%

C) 8.00%

D) 8.24%

A) 8.30%

B) 8.33%

C) 8.00%

D) 8.24%

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

6

Use the information for the question(s) below.

Your firm needs to invest in a new delivery truck. The life expectancy of the delivery truck is five years. You can purchase a new delivery truck for an upfront cost of $200,000, or you can lease a truck from the manufacturer for five years for a monthly lease payment of $4,000 (paid at the end of each month). Your firm can borrow at 6% APR with quarterly compounding.

The effective annual rate on your firm's borrowings is closest to:

A) 6.00%

B) 6.24%

C) 6.17%

D) 6.14%

Your firm needs to invest in a new delivery truck. The life expectancy of the delivery truck is five years. You can purchase a new delivery truck for an upfront cost of $200,000, or you can lease a truck from the manufacturer for five years for a monthly lease payment of $4,000 (paid at the end of each month). Your firm can borrow at 6% APR with quarterly compounding.

The effective annual rate on your firm's borrowings is closest to:

A) 6.00%

B) 6.24%

C) 6.17%

D) 6.14%

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

7

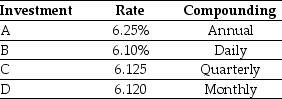

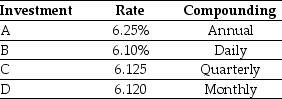

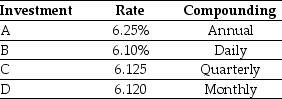

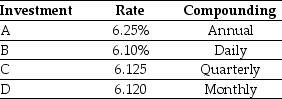

Use the table for the question(s) below.

Consider the following investment alternatives:

Which alternative offers you the highest effective rate of return?

A) Investment A

B) Investment B

C) Investment C

D) Investment D

Consider the following investment alternatives:

Which alternative offers you the highest effective rate of return?

A) Investment A

B) Investment B

C) Investment C

D) Investment D

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

8

Normally,a Canadian mortgage rate is quoted as ________.

A) an effective annual rate with annual compounding

B) a nominal interest rate with monthly compounding

C) a real interest rate with quarterly compounding

D) an annual percentage rate with semiannual compounding

A) an effective annual rate with annual compounding

B) a nominal interest rate with monthly compounding

C) a real interest rate with quarterly compounding

D) an annual percentage rate with semiannual compounding

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

9

An effective annual rate (EAR)is normally compounded

A) monthly.

B) quarterly.

C) semiannually.

D) annually.

A) monthly.

B) quarterly.

C) semiannually.

D) annually.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following statements is false?

A) Because interest rates may be quoted for different time intervals, it is often necessary to adjust the interest rate to a time period that matches that of our cash flows.

B) The effective annual rate indicates the amount of interest that will be earned at the end of one year.

C) The annual percentage rate indicates the amount of simple interest earned in one year.

D) The annual percentage rate indicates the amount of interest including the effect of compounding.

A) Because interest rates may be quoted for different time intervals, it is often necessary to adjust the interest rate to a time period that matches that of our cash flows.

B) The effective annual rate indicates the amount of interest that will be earned at the end of one year.

C) The annual percentage rate indicates the amount of simple interest earned in one year.

D) The annual percentage rate indicates the amount of interest including the effect of compounding.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

11

The lowest effective rate of return you could earn on any of these investments is closest to:

A) 6.250%

B) 6.267%

C) 6.100%

D) 6.300%

A) 6.250%

B) 6.267%

C) 6.100%

D) 6.300%

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

12

In Canada,the reason an APR cannot be used as a discount rate in a mortgage calculation is

A) because it has a different compounding frequency in a year than the payment frequency in a year.

B) because it has the same compounding frequency in a year as the payment frequency in a year.

C) because it has twice the compounding frequency in a year that the payment frequency in a year has.

D) none of the above

A) because it has a different compounding frequency in a year than the payment frequency in a year.

B) because it has the same compounding frequency in a year as the payment frequency in a year.

C) because it has twice the compounding frequency in a year that the payment frequency in a year has.

D) none of the above

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

13

The rate of growth of your purchasing power,after adjusting for inflation,is determined by ________.

A) the nominal rate of interest

B) the risk-free interest rate

C) the periodic interest rate

D) the real interest rate

A) the nominal rate of interest

B) the risk-free interest rate

C) the periodic interest rate

D) the real interest rate

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

14

An annual percentage rate (APR)could be compounded

A) monthly.

B) quarterly.

C) semiannually.

D) all the above.

A) monthly.

B) quarterly.

C) semiannually.

D) all the above.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

15

The effective annual rate (EAR)for a loan with a stated APR of 10% compounded quarterly is closest to:

A) 10.52%

B) 10.25%

C) 10.38%

D) 10.00%

A) 10.52%

B) 10.25%

C) 10.38%

D) 10.00%

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

16

Use the table for the question(s) below.

Consider the following investment alternatives:

Which alternative offers you the lowest effective rate of return?

A) Investment A

B) Investment B

C) Investment C

D) Investment D

Consider the following investment alternatives:

Which alternative offers you the lowest effective rate of return?

A) Investment A

B) Investment B

C) Investment C

D) Investment D

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

17

You are considering purchasing a new truck that will cost you $34,000.The dealer offers you 1.9% APR financing for 48 months (with payments made at the end of the month).Assuming you finance the entire $34,000 and finance through the dealer,your monthly payments will be closest to:

A) $708

B) $594

C) $736

D) $1,086

A) $708

B) $594

C) $736

D) $1,086

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

18

The highest effective rate of return you could earn on any of these investments is closest to:

A) 6.250%

B) 6.267%

C) 6.300%

D) 6.320%

A) 6.250%

B) 6.267%

C) 6.300%

D) 6.320%

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

19

Use the information for the question(s) below.

Your firm needs to invest in a new delivery truck. The life expectancy of the delivery truck is five years. You can purchase a new delivery truck for an upfront cost of $200,000, or you can lease a truck from the manufacturer for five years for a monthly lease payment of $4,000 (paid at the end of each month). Your firm can borrow at 6% APR with quarterly compounding.

The present value of the lease payments for the delivery truck is closest to:

A) $206,900

B) $207,050

C) $207,680

D) $198,420

Your firm needs to invest in a new delivery truck. The life expectancy of the delivery truck is five years. You can purchase a new delivery truck for an upfront cost of $200,000, or you can lease a truck from the manufacturer for five years for a monthly lease payment of $4,000 (paid at the end of each month). Your firm can borrow at 6% APR with quarterly compounding.

The present value of the lease payments for the delivery truck is closest to:

A) $206,900

B) $207,050

C) $207,680

D) $198,420

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

20

Use the information for the question(s) below.

Your firm needs to invest in a new delivery truck. The life expectancy of the delivery truck is five years. You can purchase a new delivery truck for an upfront cost of $200,000, or you can lease a truck from the manufacturer for five years for a monthly lease payment of $4,000 (paid at the end of each month). Your firm can borrow at 6% APR with quarterly compounding.

The monthly discount rate that you should use to evaluate the truck lease is closest to:

A) 0.487%

B) 0.512%

C) 0.498%

D) 0.500%

Your firm needs to invest in a new delivery truck. The life expectancy of the delivery truck is five years. You can purchase a new delivery truck for an upfront cost of $200,000, or you can lease a truck from the manufacturer for five years for a monthly lease payment of $4,000 (paid at the end of each month). Your firm can borrow at 6% APR with quarterly compounding.

The monthly discount rate that you should use to evaluate the truck lease is closest to:

A) 0.487%

B) 0.512%

C) 0.498%

D) 0.500%

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

21

Use the information for the question(s) below.

Two years ago you purchased a new SUV. You financed your SUV for 60 months (with payments made at the end of the month) with a loan at 5.9% APR. Your monthly payments are $617.16 and you have just made your 24th monthly payment on your SUV.

Assuming that you have made all of the first 24 payments on time,how much interest have you paid over the first two years of your loan?

Two years ago you purchased a new SUV. You financed your SUV for 60 months (with payments made at the end of the month) with a loan at 5.9% APR. Your monthly payments are $617.16 and you have just made your 24th monthly payment on your SUV.

Assuming that you have made all of the first 24 payments on time,how much interest have you paid over the first two years of your loan?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

22

Use the information for the question(s) below.

Your firm needs to invest in a new delivery truck. The life expectancy of the delivery truck is five years. You can purchase a new delivery truck for an upfront cost of $200,000, or you can lease a truck from the manufacturer for five years for a monthly lease payment of $4,000 (paid at the end of each month). Your firm can borrow at 6% APR with quarterly compounding.

Should you purchase the delivery truck or lease it? Why?

Your firm needs to invest in a new delivery truck. The life expectancy of the delivery truck is five years. You can purchase a new delivery truck for an upfront cost of $200,000, or you can lease a truck from the manufacturer for five years for a monthly lease payment of $4,000 (paid at the end of each month). Your firm can borrow at 6% APR with quarterly compounding.

Should you purchase the delivery truck or lease it? Why?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

23

Use the information for the question(s) below.

Your firm needs to invest in a new delivery truck. The life expectancy of the delivery truck is five years. You can purchase a new delivery truck for an upfront cost of $200,000, or you can lease a truck from the manufacturer for five years for a monthly lease payment of $4,000 (paid at the end of each month). Your firm can borrow at 6% APR with quarterly compounding.

You are purchasing a new home and need to borrow $325,000 from a mortgage lender.The mortgage lender quotes you a rate of 6.5% APR for a 30-year fixed rate mortgage (with payments made at the end of each month).The mortgage lender also tells you that if you are willing to pay 1 point,they can offer you a lower rate of 6.25% APR for a 30-year fixed rate mortgage.One point is equal to 1% of the loan value.So if you take the lower rate and pay the points you will need to borrow an additional $3250 to cover the point you are paying the lender.Assuming that you do not intend to prepay your mortgage (pay off your mortgage early),are you better off paying the 1 point and borrowing at 6.25% APR or just taking out the loan at 6.5% without any points?

Your firm needs to invest in a new delivery truck. The life expectancy of the delivery truck is five years. You can purchase a new delivery truck for an upfront cost of $200,000, or you can lease a truck from the manufacturer for five years for a monthly lease payment of $4,000 (paid at the end of each month). Your firm can borrow at 6% APR with quarterly compounding.

You are purchasing a new home and need to borrow $325,000 from a mortgage lender.The mortgage lender quotes you a rate of 6.5% APR for a 30-year fixed rate mortgage (with payments made at the end of each month).The mortgage lender also tells you that if you are willing to pay 1 point,they can offer you a lower rate of 6.25% APR for a 30-year fixed rate mortgage.One point is equal to 1% of the loan value.So if you take the lower rate and pay the points you will need to borrow an additional $3250 to cover the point you are paying the lender.Assuming that you do not intend to prepay your mortgage (pay off your mortgage early),are you better off paying the 1 point and borrowing at 6.25% APR or just taking out the loan at 6.5% without any points?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

24

Canadian mortgages are quoted with APRs using ________ compounding even though payments are usually monthly.

A) semiannual

B) monthly

C) quarterly

D) annual

A) semiannual

B) monthly

C) quarterly

D) annual

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

25

If the current inflation rate is 4% and you have an investment opportunity that pays 10%,then the real rate of interest on your investment is closest to:

A) 10.0%

B) 14.0%

C) 6.0%

D) 5.8%

A) 10.0%

B) 14.0%

C) 6.0%

D) 5.8%

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

26

A mortgage is a loan where the borrower offers ________ as security for the lender.

A) principal

B) payments

C) property

D) equity

A) principal

B) payments

C) property

D) equity

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

27

The most common payment schedule calls for monthly payments; thus,before using the quoted APR,you must convert the quoted APR into ________ rate per month.

A) compound

B) nominal

C) mortgage

D) equivalent effective

A) compound

B) nominal

C) mortgage

D) equivalent effective

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

28

Use the information for the question(s) below.

You are in the process of purchasing a new automobile that will cost you $27,500. The dealership is offering you either a $2,500 rebate (applied toward the purchase price) or 1.9% financing for 48 months (with payments made at the end of the month). You have been pre-approved for an auto loan through your local credit union at an interest rate of 6.5% for 48 months.

If you take the $2,500 rebate and finance your new car through your credit union your monthly payments will be closest to:

A) $595

B) $652

C) $593

D) $541

You are in the process of purchasing a new automobile that will cost you $27,500. The dealership is offering you either a $2,500 rebate (applied toward the purchase price) or 1.9% financing for 48 months (with payments made at the end of the month). You have been pre-approved for an auto loan through your local credit union at an interest rate of 6.5% for 48 months.

If you take the $2,500 rebate and finance your new car through your credit union your monthly payments will be closest to:

A) $595

B) $652

C) $593

D) $541

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

29

Use the information for the question(s) below.

You are in the process of purchasing a new automobile that will cost you $27,500. The dealership is offering you either a $2,500 rebate (applied toward the purchase price) or 1.9% financing for 48 months (with payments made at the end of the month). You have been pre-approved for an auto loan through your local credit union at an interest rate of 6.5% for 48 months.

If you forgo the $2,500 rebate and finance your new car through the dealership your monthly payments (with payments made at the end of the month)will be closest to:

A) $593

B) $652

C) $595

D) $541

You are in the process of purchasing a new automobile that will cost you $27,500. The dealership is offering you either a $2,500 rebate (applied toward the purchase price) or 1.9% financing for 48 months (with payments made at the end of the month). You have been pre-approved for an auto loan through your local credit union at an interest rate of 6.5% for 48 months.

If you forgo the $2,500 rebate and finance your new car through the dealership your monthly payments (with payments made at the end of the month)will be closest to:

A) $593

B) $652

C) $595

D) $541

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

30

The Bank of Canada determines very short-term interest rates through its influence on

A) the overnight rate.

B) the nominal interest rate.

C) the real interest rate.

D) the effective annual rate.

A) the overnight rate.

B) the nominal interest rate.

C) the real interest rate.

D) the effective annual rate.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

31

Use the information for the question(s) below.

Two years ago you purchased a new SUV. You financed your SUV for 60 months (with payments made at the end of the month) with a loan at 5.9% APR. Your monthly payments are $617.16 and you have just made your 24th monthly payment on your SUV.

Assuming that you have made all of the first 24 payments on time,then the outstanding principal balance on your SUV loan is closest to:

A) $31,250

B) $20,300

C) $19,200

D) $32,000

Two years ago you purchased a new SUV. You financed your SUV for 60 months (with payments made at the end of the month) with a loan at 5.9% APR. Your monthly payments are $617.16 and you have just made your 24th monthly payment on your SUV.

Assuming that you have made all of the first 24 payments on time,then the outstanding principal balance on your SUV loan is closest to:

A) $31,250

B) $20,300

C) $19,200

D) $32,000

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

32

Use the information for the question(s) below.

You are purchasing a new home and need to borrow $250,000 from a mortgage lender. The mortgage lender quotes you a rate of 6.25% APR for a 30-year fixed rate mortgage. The mortgage lender also tells you that if you are willing to pay 2 points, they can offer you a lower rate of 6.0% APR for a 30-year fixed rate mortgage. One point is equal to 1% of the loan value. So if you take the lower rate and pay the points you will need to borrow an additional $5,000 to cover points you are paying the lender.

Assuming you pay the points and borrow from the mortgage lender at 6.00%,then your monthly mortgage payment (with payments made at the end of the month)will be closest to:

A) $1,540

B) $1,530

C) $1,570

D) $1,500

You are purchasing a new home and need to borrow $250,000 from a mortgage lender. The mortgage lender quotes you a rate of 6.25% APR for a 30-year fixed rate mortgage. The mortgage lender also tells you that if you are willing to pay 2 points, they can offer you a lower rate of 6.0% APR for a 30-year fixed rate mortgage. One point is equal to 1% of the loan value. So if you take the lower rate and pay the points you will need to borrow an additional $5,000 to cover points you are paying the lender.

Assuming you pay the points and borrow from the mortgage lender at 6.00%,then your monthly mortgage payment (with payments made at the end of the month)will be closest to:

A) $1,540

B) $1,530

C) $1,570

D) $1,500

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

33

Use the information for the question(s) below.

Two years ago you purchased a new SUV. You financed your SUV for 60 months (with payments made at the end of the month) with a loan at 5.9% APR. Your monthly payments are $617.16 and you have just made your 24th monthly payment on your SUV.

The amount of your original loan is closest to:

A) $37,000

B) $32,000

C) $20,300

D) $31,250

Two years ago you purchased a new SUV. You financed your SUV for 60 months (with payments made at the end of the month) with a loan at 5.9% APR. Your monthly payments are $617.16 and you have just made your 24th monthly payment on your SUV.

The amount of your original loan is closest to:

A) $37,000

B) $32,000

C) $20,300

D) $31,250

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

34

The target range of annual inflation rates established by the Bank of Canada and the federal government currently extends

A) from 10 to 12 percent.

B) from 5 to 8 percent.

C) from 0 to 1 percent.

D) from 1 to 3 percent.

A) from 10 to 12 percent.

B) from 5 to 8 percent.

C) from 0 to 1 percent.

D) from 1 to 3 percent.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

35

To calculate a loan payment,we first compute ________ from the quoted interest rate of the loan,and then equate the outstanding loan balance with ________ of the loan payments and solve for the loan payment.

A) the compounding rate; the present value

B) the discount rate; the present value

C) the discount rate; the future value

D) the compounding rate; the future value

A) the compounding rate; the present value

B) the discount rate; the present value

C) the discount rate; the future value

D) the compounding rate; the future value

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

36

Use the information for the question(s) below.

You are purchasing a new home and need to borrow $250,000 from a mortgage lender. The mortgage lender quotes you a rate of 6.25% APR for a 30-year fixed rate mortgage. The mortgage lender also tells you that if you are willing to pay 2 points, they can offer you a lower rate of 6.0% APR for a 30-year fixed rate mortgage. One point is equal to 1% of the loan value. So if you take the lower rate and pay the points you will need to borrow an additional $5,000 to cover points you are paying the lender.

Assuming you don't pay the points and borrow from the mortgage lender at 6.25%,then your monthly mortgage payment (with payments made at the end of the month)will be closest to:

A) $1,570

B) $1,530

C) $1,540

D) $1,500

You are purchasing a new home and need to borrow $250,000 from a mortgage lender. The mortgage lender quotes you a rate of 6.25% APR for a 30-year fixed rate mortgage. The mortgage lender also tells you that if you are willing to pay 2 points, they can offer you a lower rate of 6.0% APR for a 30-year fixed rate mortgage. One point is equal to 1% of the loan value. So if you take the lower rate and pay the points you will need to borrow an additional $5,000 to cover points you are paying the lender.

Assuming you don't pay the points and borrow from the mortgage lender at 6.25%,then your monthly mortgage payment (with payments made at the end of the month)will be closest to:

A) $1,570

B) $1,530

C) $1,540

D) $1,500

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

37

Most provinces in Canada have harmonized their cost of credit disclosure requirements so that when the compounding interval for the APR is not stated explicitly,it is equal ________.

A) to the interval between the payments

B) to the number of payment intervals in a year

C) to the effective rate

D) to the nominal rate

A) to the interval between the payments

B) to the number of payment intervals in a year

C) to the effective rate

D) to the nominal rate

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

38

Use the information for the question(s) below.

Two years ago you purchased a new SUV. You financed your SUV for 60 months (with payments made at the end of the month) with a loan at 5.9% APR. Your monthly payments are $617.16 and you have just made your 24th monthly payment on your SUV.

Amortizing loans are the loans that have monthly payments and are quoted in terms of ________ with ________ compounding.

A) an effective rate; annual

B) an equivalent rate; annual

C) an annual percentage rate; monthly

D) a nominal rate; semiannual

Two years ago you purchased a new SUV. You financed your SUV for 60 months (with payments made at the end of the month) with a loan at 5.9% APR. Your monthly payments are $617.16 and you have just made your 24th monthly payment on your SUV.

Amortizing loans are the loans that have monthly payments and are quoted in terms of ________ with ________ compounding.

A) an effective rate; annual

B) an equivalent rate; annual

C) an annual percentage rate; monthly

D) a nominal rate; semiannual

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

39

If the current inflation rate is 5%,then the nominal rate necessary for you to earn an 8% real interest rate on your investment is closest to:

A) 13.0%

B) 13.4%

C) 4.9%

D) 3.0%

A) 13.0%

B) 13.4%

C) 4.9%

D) 3.0%

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

40

Use the information for the question(s) below.

Your firm needs to invest in a new delivery truck. The life expectancy of the delivery truck is five years. You can purchase a new delivery truck for an upfront cost of $200,000, or you can lease a truck from the manufacturer for five years for a monthly lease payment of $4,000 (paid at the end of each month). Your firm can borrow at 6% APR with quarterly compounding.

You are in the process of purchasing a new automobile that will cost you $25,000.The dealership is offering you either a $1,000 rebate (applied toward the purchase price)or 3.9% financing for 60 months (with payments made at the end of the month).You have been pre-approved for an auto loan through your local credit union at an interest rate of 7.5% for 60 months.Should you take the $1,000 rebate and finance through your credit union or forgo the rebate and finance through the dealership at the lower 3.9% APR?

Your firm needs to invest in a new delivery truck. The life expectancy of the delivery truck is five years. You can purchase a new delivery truck for an upfront cost of $200,000, or you can lease a truck from the manufacturer for five years for a monthly lease payment of $4,000 (paid at the end of each month). Your firm can borrow at 6% APR with quarterly compounding.

You are in the process of purchasing a new automobile that will cost you $25,000.The dealership is offering you either a $1,000 rebate (applied toward the purchase price)or 3.9% financing for 60 months (with payments made at the end of the month).You have been pre-approved for an auto loan through your local credit union at an interest rate of 7.5% for 60 months.Should you take the $1,000 rebate and finance through your credit union or forgo the rebate and finance through the dealership at the lower 3.9% APR?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

41

Can the nominal interest rate ever be negative? Can the real interest rate ever be negative? Explain.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

42

The difference between a nominal and a real interest rate is

A) that a nominal interest rate includes the overnight rate.

B) that a nominal interest rate includes prime rate.

C) that a nominal interest rate includes rate of inflation.

D) none of the above.

A) that a nominal interest rate includes the overnight rate.

B) that a nominal interest rate includes prime rate.

C) that a nominal interest rate includes rate of inflation.

D) none of the above.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following statements is false?

A) An inverted yield curve generally signals an expected decline in future interest rates.

B) An inverted yield curve is often interpreted as a positive forecast for economic growth.

C) All the formulas for computing present values of annuities and perpetuities are based upon discounting all of the cash flows at the same rate.

D) The rate of growth of your purchasing power is determined by the real interest rate.

A) An inverted yield curve generally signals an expected decline in future interest rates.

B) An inverted yield curve is often interpreted as a positive forecast for economic growth.

C) All the formulas for computing present values of annuities and perpetuities are based upon discounting all of the cash flows at the same rate.

D) The rate of growth of your purchasing power is determined by the real interest rate.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

44

During the 2007-2009 financial crisis,the U.S.Federal Reserve Bank established "central bank liquidity swaps" with the European Central Bank (ECB)and other major central banks. This involved

A) the Fed exchanging US dollars for foreign currencies on a temporary basis.

B) the Fed exchanging US dollars for foreign currencies on a permanent basis.

C) the Fed providing reserve guarantees to the ECB, denominated in US dollars.

D) the ECB did not utilize the swap line directly but used it indirectly to stabilize their financial markets by indicating to European investors the potential backing of the Fed.

A) the Fed exchanging US dollars for foreign currencies on a temporary basis.

B) the Fed exchanging US dollars for foreign currencies on a permanent basis.

C) the Fed providing reserve guarantees to the ECB, denominated in US dollars.

D) the ECB did not utilize the swap line directly but used it indirectly to stabilize their financial markets by indicating to European investors the potential backing of the Fed.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following statements is false?

A) The plot of the relationship between the investment risk and the interest rate is call the yield curve.

B) Each of the previous recessions in Canada was preceded by a period with an inverted yield curve.

C) The nominal interest rate does not represent the increase in purchasing power that will result from investing.

D) A risk-free cash flow received in two years should be discounted at the two-year interest rate.

A) The plot of the relationship between the investment risk and the interest rate is call the yield curve.

B) Each of the previous recessions in Canada was preceded by a period with an inverted yield curve.

C) The nominal interest rate does not represent the increase in purchasing power that will result from investing.

D) A risk-free cash flow received in two years should be discounted at the two-year interest rate.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

46

The government of Canada pays lower rates of interest than Canadian corporations when each of them borrows from the public because

A) the government of Canada only pays the overnight rate when it borrows.

B) the government of Canada only pays the nominal rate when it borrows.

C) the government of Canada only pays the real rate when it borrows.

D) the government of Canada only pays the risk-free rate when it borrows.

A) the government of Canada only pays the overnight rate when it borrows.

B) the government of Canada only pays the nominal rate when it borrows.

C) the government of Canada only pays the real rate when it borrows.

D) the government of Canada only pays the risk-free rate when it borrows.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

47

Use the table for the question(s) below.

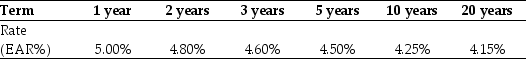

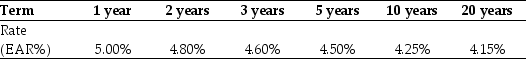

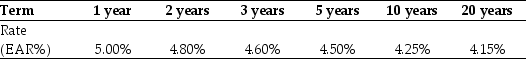

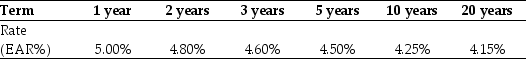

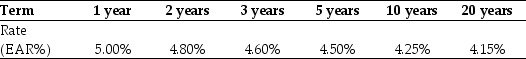

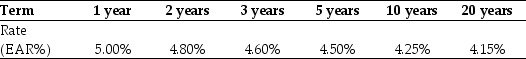

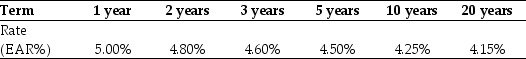

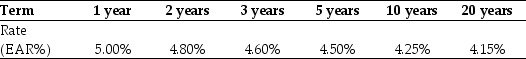

Suppose the term structure of interest rates is shown below:

After examining the yield curve,what predictions do you have about interest rates in the future? About future economic growth and the overall state of the economy?

Suppose the term structure of interest rates is shown below:

After examining the yield curve,what predictions do you have about interest rates in the future? About future economic growth and the overall state of the economy?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

48

Use the table for the question(s) below.

Suppose the term structure of interest rates is shown below:

What is the NPV of an investment that costs $2,500 and pays $1,000 certain at the end of one,three,and five years ?

Suppose the term structure of interest rates is shown below:

What is the NPV of an investment that costs $2,500 and pays $1,000 certain at the end of one,three,and five years ?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

49

The term structure of interest rates predicts that long-term interest rates will exceed short-term interest rates,resulting in an upward sloping yield curve. If Central Banks were to intervene in the financial market to "flatten" the shape of the yield curve,they would attempt this by

A) purchasing long-term bonds.

B) selling long-term bonds.

C) purchasing short-term bonds.

D) selling short-term bonds.

A) purchasing long-term bonds.

B) selling long-term bonds.

C) purchasing short-term bonds.

D) selling short-term bonds.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following statements is false?

A) The actual cash flow that the investor will get to keep will be reduced by the amount of any tax payments.

B) The equivalent after-tax interest rate is r(1 - τ).

C) The right discount rate for a cash flow is the rate of return available in the market on other investments of comparable risk and term.

D) To compensate for the risk that they will receive less if the firm defaults, investors demand a lower interest rate than the rate on Treasury Bills of the Government of Canada.

A) The actual cash flow that the investor will get to keep will be reduced by the amount of any tax payments.

B) The equivalent after-tax interest rate is r(1 - τ).

C) The right discount rate for a cash flow is the rate of return available in the market on other investments of comparable risk and term.

D) To compensate for the risk that they will receive less if the firm defaults, investors demand a lower interest rate than the rate on Treasury Bills of the Government of Canada.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

51

Use the table for the question(s) below.

Suppose the term structure of interest rates is shown below:

The present value of receiving $1,000 per year with certainty at the end of the next three years is closest to:

A) $2,737

B) $2,723

C) $2,733

D) $2,744

Suppose the term structure of interest rates is shown below:

The present value of receiving $1,000 per year with certainty at the end of the next three years is closest to:

A) $2,737

B) $2,723

C) $2,733

D) $2,744

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following statements is false?

A) The yield curve changes over time.

B) The formulas for computing present values of annuities and perpetuities cannot be used in situations in which cash flows need to be discounted at different rates.

C) We can use the term structure to compute the present and future values of a risk-free cash flow over different investment horizons.

D) The yield curve tends to be inverted as the economy comes out of a recession.

A) The yield curve changes over time.

B) The formulas for computing present values of annuities and perpetuities cannot be used in situations in which cash flows need to be discounted at different rates.

C) We can use the term structure to compute the present and future values of a risk-free cash flow over different investment horizons.

D) The yield curve tends to be inverted as the economy comes out of a recession.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following statements is false?

A) The relationship between the investment term and the interest rate is called the term structure of interest rates.

B) Real interest rates indicate the rate at which your money will grow if invested for a certain period.

C) The yield curve is a potential leading indicator of future economic growth.

D) The shape of the yield curve will be strongly influenced by interest rate expectations.

A) The relationship between the investment term and the interest rate is called the term structure of interest rates.

B) Real interest rates indicate the rate at which your money will grow if invested for a certain period.

C) The yield curve is a potential leading indicator of future economic growth.

D) The shape of the yield curve will be strongly influenced by interest rate expectations.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

54

Use the table for the question(s) below.

Suppose the term structure of interest rates is shown below:

What is the shape of the yield curve and what expectations are investors likely to have about future interest rates?

A) Inverted; Higher

B) Normal; Higher

C) Inverted; Lower

D) Normal; Lower

Suppose the term structure of interest rates is shown below:

What is the shape of the yield curve and what expectations are investors likely to have about future interest rates?

A) Inverted; Higher

B) Normal; Higher

C) Inverted; Lower

D) Normal; Lower

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following statements is false?

A) The interest rates that banks offer on investments or charge on loans depends on the horizon of the investment or loan.

B) The Bank of Canada determines very short-term interest rates through its influence on the overnight rate.

C) The interest rates that are quoted by banks and other financial institutions are nominal interest rates.

D) Fundamentally, interest rates are determined by the Bank of Canada.

A) The interest rates that banks offer on investments or charge on loans depends on the horizon of the investment or loan.

B) The Bank of Canada determines very short-term interest rates through its influence on the overnight rate.

C) The interest rates that are quoted by banks and other financial institutions are nominal interest rates.

D) Fundamentally, interest rates are determined by the Bank of Canada.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following formulas is incorrect?

A) i = - 1

- 1

B) 1 + rr =

C) rr ≈ i - r

D) rr =

A) i =

- 1

- 1B) 1 + rr =

C) rr ≈ i - r

D) rr =

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

57

The NPV of an investment that costs $2,700 and pays $1,000 with certainty at the end of one,three,and five years is closest to:

A) 21.47

B) $1,665.62

C) -100.26

D) -71.38

A) 21.47

B) $1,665.62

C) -100.26

D) -71.38

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following statements is false?

A) Canadian T-Bill securities are widely regarded to be risk-free because there is virtually no chance the government will default on these bonds.

B) In general, if the interest rate is r and the tax rate is τ, then for each $1 invested you will earn interest equal to r and owe taxes of τ × r on the interest.

C) Investors may receive less than the stated interest rate if the borrowing company has financial difficulties and is unable to fully repay the loan.

D) Taxes reduce the amount of interest the investor can keep, and we refer to this reduced amount as the tax effective interest rate.

A) Canadian T-Bill securities are widely regarded to be risk-free because there is virtually no chance the government will default on these bonds.

B) In general, if the interest rate is r and the tax rate is τ, then for each $1 invested you will earn interest equal to r and owe taxes of τ × r on the interest.

C) Investors may receive less than the stated interest rate if the borrowing company has financial difficulties and is unable to fully repay the loan.

D) Taxes reduce the amount of interest the investor can keep, and we refer to this reduced amount as the tax effective interest rate.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

59

Consider an investment that pays $1,000 with certainty at the end of each of the next four years.If the investment costs $3,500 and has an NPV of $74.26,then the four year risk-free interest rate is closest to:

A) 4.5%

B) 4.58%

C) 4.55%

D) 4.53%

A) 4.5%

B) 4.58%

C) 4.55%

D) 4.53%

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

60

The term structure of risk-free Canadian interest rates provides the yield curve that can be used to compute

A) present value of a risk-free cash flow over different investment horizons.

B) future value of a risk-free cash flow over different investment horizons.

C) both present and future values of a risk-free cash flow over different investment horizons.

D) none of the above.

A) present value of a risk-free cash flow over different investment horizons.

B) future value of a risk-free cash flow over different investment horizons.

C) both present and future values of a risk-free cash flow over different investment horizons.

D) none of the above.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

61

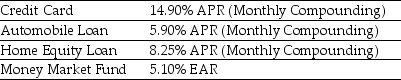

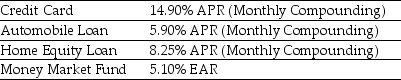

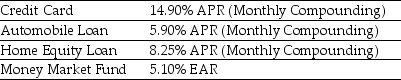

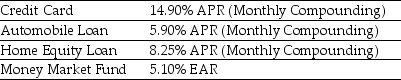

Use the table for the question(s) below.

Suppose you have the following Loans / Investments

If your income tax rate is 30%,then the after-tax return you receive on your money market fund is closest to:

A) 3.7%

B) 5.1%

C) 3.6%

D) 4.2%

Suppose you have the following Loans / Investments

If your income tax rate is 30%,then the after-tax return you receive on your money market fund is closest to:

A) 3.7%

B) 5.1%

C) 3.6%

D) 4.2%

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following statements is false?

A) The actual return kept by an investor will depend on how the interest is taxed.

B) The equivalent after-tax interest rate is r(1 - τ).

C) The highest interest rate for a given horizon is the rate paid on Treasury Bills of the Government of Canada.

D) It is important to use a discount rate that matches both the horizon and the risk of the cash flows.

A) The actual return kept by an investor will depend on how the interest is taxed.

B) The equivalent after-tax interest rate is r(1 - τ).

C) The highest interest rate for a given horizon is the rate paid on Treasury Bills of the Government of Canada.

D) It is important to use a discount rate that matches both the horizon and the risk of the cash flows.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

63

Assume that you presently have a monthly mortgage on a rental property with a stated interest rate of 7% APR.If your income tax rate is 20%,then the after tax EAR for your mortgage on a rental property is closest to:

A) 5.6%

B) 7.2%

C) 5.8%

D) 7.0%

A) 5.6%

B) 7.2%

C) 5.8%

D) 7.0%

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

64

In Canada,one of the reasons that the rates of bonds issued by Telus and by provincial governments are different is because of

A) the prime rate.

B) the real rate of interest.

C) the risk level of investment.

D) the rate of inflation.

A) the prime rate.

B) the real rate of interest.

C) the risk level of investment.

D) the rate of inflation.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following statements is false?

A) The investor's opportunity cost of capital is the best available expected return offered in the market on an investment of comparable risk and term of the cash flows being discounted.

B) Interest rates we observe in the market will vary based on quoting conventions, the term of investment, and risk.

C) The opportunity cost of capital is the return the investor forgoes when the investor takes on a new investment.

D) For a risk-free project, the opportunity cost of capital will typically be greater than the interest rate of Canadian T-bill securities with a similar term.

A) The investor's opportunity cost of capital is the best available expected return offered in the market on an investment of comparable risk and term of the cash flows being discounted.

B) Interest rates we observe in the market will vary based on quoting conventions, the term of investment, and risk.

C) The opportunity cost of capital is the return the investor forgoes when the investor takes on a new investment.

D) For a risk-free project, the opportunity cost of capital will typically be greater than the interest rate of Canadian T-bill securities with a similar term.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

66

What is the effective after-tax rate of each instrument,expressed as an EAR?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following statements is false?

A) The equivalent after-tax interest rate is r - (τ × r).

B) Interest rates vary based on the identity of the borrower.

C) The ability to deduct the interest expense increases the effective after-tax interest rate paid on the loan.

D) For loans to borrowers other than the Government of Canada the stated interest rate is the maximum amount that investors will receive.

A) The equivalent after-tax interest rate is r - (τ × r).

B) Interest rates vary based on the identity of the borrower.

C) The ability to deduct the interest expense increases the effective after-tax interest rate paid on the loan.

D) For loans to borrowers other than the Government of Canada the stated interest rate is the maximum amount that investors will receive.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

68

Use the table for the question(s) below.

Suppose you have the following Loans / Investments

If your income tax rate is 30%,then the after-tax EAR for your home equity loan is closest to:

A) 6.0%

B) 5.9%

C) 8.6%

D) 5.8%

Suppose you have the following Loans / Investments

If your income tax rate is 30%,then the after-tax EAR for your home equity loan is closest to:

A) 6.0%

B) 5.9%

C) 8.6%

D) 5.8%

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following statements is false?

A) When we refer to the "risk-free interest rate," we mean the rate on Treasury Bills of the Government of Canada.

B) Interest rates vary with the investment horizon.

C) All borrowers, besides the Government of Canada, have some risk of default.

D) When interest on a loan is tax deductible, the effective after-tax interest rate is τ × (1 - r).

A) When we refer to the "risk-free interest rate," we mean the rate on Treasury Bills of the Government of Canada.

B) Interest rates vary with the investment horizon.

C) All borrowers, besides the Government of Canada, have some risk of default.

D) When interest on a loan is tax deductible, the effective after-tax interest rate is τ × (1 - r).

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck