Deck 8: Investment Decision Rules

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/83

Play

Full screen (f)

Deck 8: Investment Decision Rules

1

Which of the following statements is correct?

A) From 1977 to 2001, the percentage of firms that used the NPV rule for making investment decisions increased from less than 50% to 74.9%.

B) From 1977 to 2001, the percentage of firms that used the NPV rule for making investment decisions increased from 9.8% to less than 50%.

C) From 1977 to 2001, the percentage of firms that used the NPV rule for making investment decisions increased from 9.8% to 74.9%.

D) From 1977 to 2001, the percentage of firms that used the NPV rule for making investment decisions decreased from 75% to 74.9%.

A) From 1977 to 2001, the percentage of firms that used the NPV rule for making investment decisions increased from less than 50% to 74.9%.

B) From 1977 to 2001, the percentage of firms that used the NPV rule for making investment decisions increased from 9.8% to less than 50%.

C) From 1977 to 2001, the percentage of firms that used the NPV rule for making investment decisions increased from 9.8% to 74.9%.

D) From 1977 to 2001, the percentage of firms that used the NPV rule for making investment decisions decreased from 75% to 74.9%.

From 1977 to 2001, the percentage of firms that used the NPV rule for making investment decisions increased from 9.8% to 74.9%.

2

Unconventional cash flows normally means

A) that you have cash outflows at the beginning of the investment and have cash inflows afterwards.

B) that you have cash inflows at the beginning of the investment and have cash outflows afterwards.

C) that you have major cash outflows at the beginning of the investment and have both cash outflows and cash inflows afterwards.

D) none of the above.

A) that you have cash outflows at the beginning of the investment and have cash inflows afterwards.

B) that you have cash inflows at the beginning of the investment and have cash outflows afterwards.

C) that you have major cash outflows at the beginning of the investment and have both cash outflows and cash inflows afterwards.

D) none of the above.

that you have cash inflows at the beginning of the investment and have cash outflows afterwards.

3

Which of the following statements is false?

A) In general, the IRR rule works for a stand-alone project if all of the project's positive cash flows precede its negative cash flows.

B) There is no easy fix for the IRR rule when there are multiple IRRs.

C) The payback rule is primarily used because of its simplicity.

D) No investment rule that ignores the set of alternative investment alternatives can be optimal.

A) In general, the IRR rule works for a stand-alone project if all of the project's positive cash flows precede its negative cash flows.

B) There is no easy fix for the IRR rule when there are multiple IRRs.

C) The payback rule is primarily used because of its simplicity.

D) No investment rule that ignores the set of alternative investment alternatives can be optimal.

In general, the IRR rule works for a stand-alone project if all of the project's positive cash flows precede its negative cash flows.

4

Which of the following statements is false?

A) The payback investment rule is based on the notion that an opportunity that pays back its initial investments quickly is a good idea.

B) An IRR will always exist for an investment opportunity.

C) An NPV will always exist for an investment opportunity.

D) In general, there can be as many IRRs as the number of times the project's cash flows change sign over time.

A) The payback investment rule is based on the notion that an opportunity that pays back its initial investments quickly is a good idea.

B) An IRR will always exist for an investment opportunity.

C) An NPV will always exist for an investment opportunity.

D) In general, there can be as many IRRs as the number of times the project's cash flows change sign over time.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

5

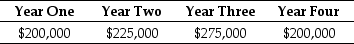

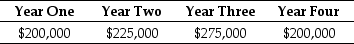

Use the information for the question(s) below.

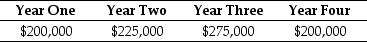

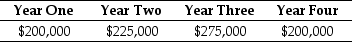

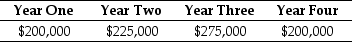

The Sisyphean Company is planning on investing in a new project. This will involve the purchase of some new machinery costing $450,000. The Sisyphean Company expects cash inflows from this project as detailed below:

The appropriate discount rate for this project is 16%.

The appropriate discount rate for this project is 16%.

The NPV for this project is closest to:

A) $176,270

B) $123,420

C) $450,000

D) $179,590

The Sisyphean Company is planning on investing in a new project. This will involve the purchase of some new machinery costing $450,000. The Sisyphean Company expects cash inflows from this project as detailed below:

The appropriate discount rate for this project is 16%.

The appropriate discount rate for this project is 16%.The NPV for this project is closest to:

A) $176,270

B) $123,420

C) $450,000

D) $179,590

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following statements is false?

A) It is possible that an IRR does not exist for an investment opportunity.

B) If the payback period is less than a pre-specified length of time you accept the project.

C) The internal rate of return (IRR) investment rule is based upon the notion that if the return on other alternatives is greater than the return on the investment opportunity you should undertake the investment opportunity.

D) It is possible that there is no discount rate that will set the NPV equal to zero.

A) It is possible that an IRR does not exist for an investment opportunity.

B) If the payback period is less than a pre-specified length of time you accept the project.

C) The internal rate of return (IRR) investment rule is based upon the notion that if the return on other alternatives is greater than the return on the investment opportunity you should undertake the investment opportunity.

D) It is possible that there is no discount rate that will set the NPV equal to zero.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

7

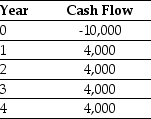

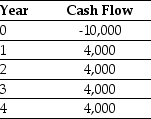

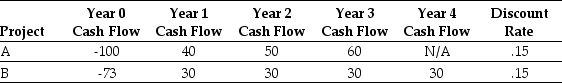

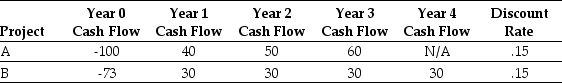

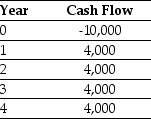

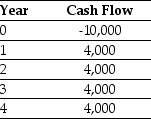

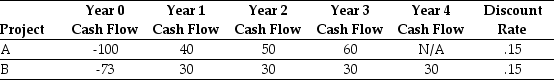

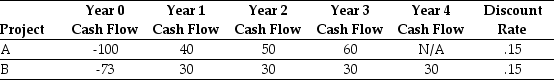

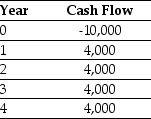

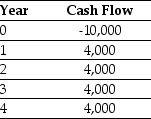

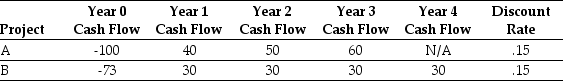

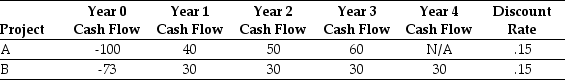

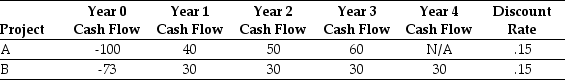

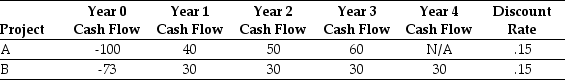

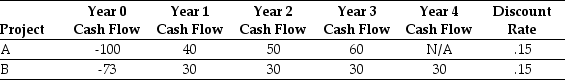

Use the table for the question(s) below.

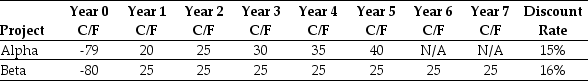

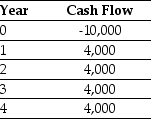

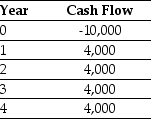

Consider a project with the following cash flows:

If the appropriate discount rate for this project is 15%,then the NPV is closest to:

A) $6,000

B) -$867

C) $1,420

D) $867

Consider a project with the following cash flows:

If the appropriate discount rate for this project is 15%,then the NPV is closest to:

A) $6,000

B) -$867

C) $1,420

D) $867

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following statements is false?

A) In general, the difference between the cost of capital and the IRR is the maximum amount of estimation error in the cost of capital estimate that can exist without altering the original decision.

B) The IRR can provide information on how sensitive your analysis is to errors in the estimate of your cost of capital.

C) If you are unsure of your cost of capital estimate, it is important to determine how sensitive your analysis is to errors in this estimate.

D) If the cost of capital estimate is more than the IRR, the NPV will be positive.

A) In general, the difference between the cost of capital and the IRR is the maximum amount of estimation error in the cost of capital estimate that can exist without altering the original decision.

B) The IRR can provide information on how sensitive your analysis is to errors in the estimate of your cost of capital.

C) If you are unsure of your cost of capital estimate, it is important to determine how sensitive your analysis is to errors in this estimate.

D) If the cost of capital estimate is more than the IRR, the NPV will be positive.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements is correct?

A) Investment decisions should be treated separately from the related capital budgeting decisions.

B) Investment decisions should not be treated separately from the related capital budgeting decisions.

C) Investment decisions should be treated the same as the related capital budgeting decisions.

D) Investment decisions should be treated differently than the related capital budgeting decisions.

A) Investment decisions should be treated separately from the related capital budgeting decisions.

B) Investment decisions should not be treated separately from the related capital budgeting decisions.

C) Investment decisions should be treated the same as the related capital budgeting decisions.

D) Investment decisions should be treated differently than the related capital budgeting decisions.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following statements is correct?

A) When firms make an investment decision, they should treat stand-alone projects the same as exclusive projects.

B) When firms make an investment decision, they should not treat stand-alone projects the same as exclusive projects.

C) There are no differences between stand-alone projects and exclusive projects when an investment decision is made.

D) Both A and B

A) When firms make an investment decision, they should treat stand-alone projects the same as exclusive projects.

B) When firms make an investment decision, they should not treat stand-alone projects the same as exclusive projects.

C) There are no differences between stand-alone projects and exclusive projects when an investment decision is made.

D) Both A and B

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

11

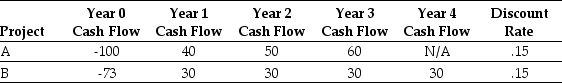

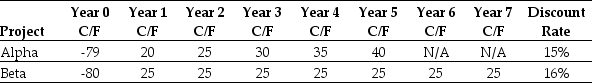

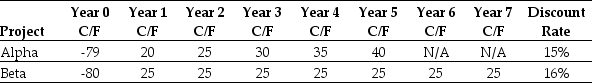

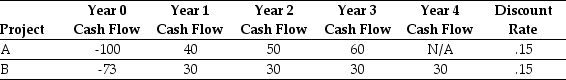

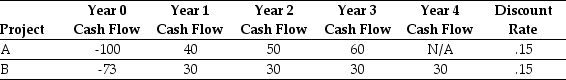

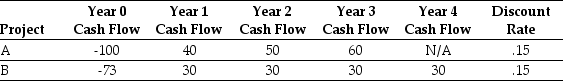

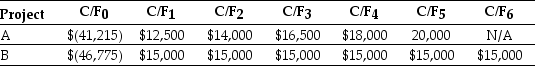

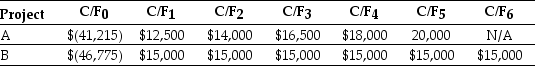

Use the table for the question(s) below.

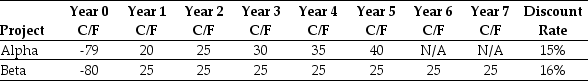

Consider the following two projects:

The NPV of project B is closest to:

A) 12.6

B) 23.3

C) 12.0

D) 15.0

Consider the following two projects:

The NPV of project B is closest to:

A) 12.6

B) 23.3

C) 12.0

D) 15.0

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following statements is false?

A) About 75% of firms surveyed used the NPV rule for making investment decisions.

B) If you are unsure of your cost of capital estimate, it is important to determine how sensitive your analysis is to errors in this estimate.

C) To decide whether to invest using the NPV rule, we need to know the cost of capital.

D) NPV is positive only for discount rates greater than the internal rate of return.

A) About 75% of firms surveyed used the NPV rule for making investment decisions.

B) If you are unsure of your cost of capital estimate, it is important to determine how sensitive your analysis is to errors in this estimate.

C) To decide whether to invest using the NPV rule, we need to know the cost of capital.

D) NPV is positive only for discount rates greater than the internal rate of return.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following statements is correct?

A) According to a 1995 study, less than 80% of Canadian firms used the rule of NPV, but about 50% of firms used some form of discounted cash flow analysis.

B) According to a 1995 study, less than 50% of Canadian firms used the rule of NPV, but about 79% of firms used some form of discounted cash flow analysis.

C) According to a 1995 study, every Canadian firm used the rule of NPV, and about 80% of firms used some form of discounted cash flow analysis.

D) According to a 1995 study, no Canadian firms used the rule of NPV, but about 79% of firms used some form of discounted cash flow analysis.

A) According to a 1995 study, less than 80% of Canadian firms used the rule of NPV, but about 50% of firms used some form of discounted cash flow analysis.

B) According to a 1995 study, less than 50% of Canadian firms used the rule of NPV, but about 79% of firms used some form of discounted cash flow analysis.

C) According to a 1995 study, every Canadian firm used the rule of NPV, and about 80% of firms used some form of discounted cash flow analysis.

D) According to a 1995 study, no Canadian firms used the rule of NPV, but about 79% of firms used some form of discounted cash flow analysis.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

14

Use the information for the question(s) below.

Boulderado has come up with a new composite snowboard. Development will take Boulderado four years and cost $250,000 per year, with the first of the four equal investments payable today upon acceptance of the project. Once in production the snowboard is expected to produce annual cash flows of $200,000 each year for 10 years. Boulderado's discount rate is 10%.

Take any investment opportunity where the IRR ________ the opportunity cost of capital.Turn down any opportunity whose IRR is ________ than the opportunity cost of capital.

A) exceeds; less

B) exceeds; higher

C) less than; less

D) less than; higher

Boulderado has come up with a new composite snowboard. Development will take Boulderado four years and cost $250,000 per year, with the first of the four equal investments payable today upon acceptance of the project. Once in production the snowboard is expected to produce annual cash flows of $200,000 each year for 10 years. Boulderado's discount rate is 10%.

Take any investment opportunity where the IRR ________ the opportunity cost of capital.Turn down any opportunity whose IRR is ________ than the opportunity cost of capital.

A) exceeds; less

B) exceeds; higher

C) less than; less

D) less than; higher

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

15

Use the information for the question(s) below.

Boulderado has come up with a new composite snowboard. Development will take Boulderado four years and cost $250,000 per year, with the first of the four equal investments payable today upon acceptance of the project. Once in production the snowboard is expected to produce annual cash flows of $200,000 each year for 10 years. Boulderado's discount rate is 10%.

The NPV for Boulderado's snowboard project is closest to:

A) $228,900

B) $46,900

C) $51,600

D) $23,800

Boulderado has come up with a new composite snowboard. Development will take Boulderado four years and cost $250,000 per year, with the first of the four equal investments payable today upon acceptance of the project. Once in production the snowboard is expected to produce annual cash flows of $200,000 each year for 10 years. Boulderado's discount rate is 10%.

The NPV for Boulderado's snowboard project is closest to:

A) $228,900

B) $46,900

C) $51,600

D) $23,800

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

16

Use the table for the question(s) below.

Consider the following two projects:

The NPV of project A is closest to:

A) 12.0

B) 12.6

C) 15.0

D) 42.9

Consider the following two projects:

The NPV of project A is closest to:

A) 12.0

B) 12.6

C) 15.0

D) 42.9

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

17

Use the information for the question(s) below.

Larry the Cucumber has been offered $14 million to star in the lead role of the next three Larry Boy adventure movies. If Larry takes this offer, he will have to forgo acting in other Veggie movies that would pay him $5 million at the end of each of the next three years. Assume Larry's personal cost of capital is 10% per year.

The NPV of Larry's three-movie Larry Boy offer is closest to:

A) 3.5 million

B) -1.6 million

C) 1.6 million

D) -1.0 million

Larry the Cucumber has been offered $14 million to star in the lead role of the next three Larry Boy adventure movies. If Larry takes this offer, he will have to forgo acting in other Veggie movies that would pay him $5 million at the end of each of the next three years. Assume Larry's personal cost of capital is 10% per year.

The NPV of Larry's three-movie Larry Boy offer is closest to:

A) 3.5 million

B) -1.6 million

C) 1.6 million

D) -1.0 million

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following statements is false?

A) The IRR investment rule states that you should turn down any investment opportunity where the IRR is less than the opportunity cost of capital.

B) The IRR investment rule states that you should take any investment opportunity where the IRR exceeds the opportunity cost of capital.

C) Since the IRR rule is based upon the rate at which the NPV equals zero, like the NPV decision rule, the IRR decision rule will always identify the correct investment decisions.

D) There are situations in which multiple IRRs exist.

A) The IRR investment rule states that you should turn down any investment opportunity where the IRR is less than the opportunity cost of capital.

B) The IRR investment rule states that you should take any investment opportunity where the IRR exceeds the opportunity cost of capital.

C) Since the IRR rule is based upon the rate at which the NPV equals zero, like the NPV decision rule, the IRR decision rule will always identify the correct investment decisions.

D) There are situations in which multiple IRRs exist.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

19

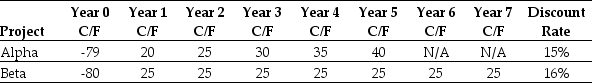

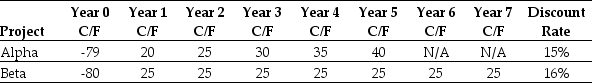

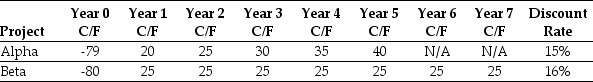

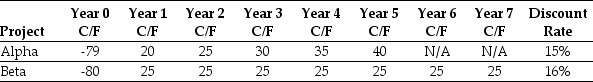

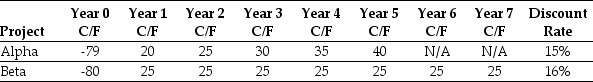

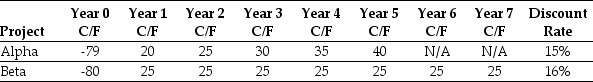

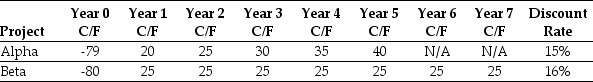

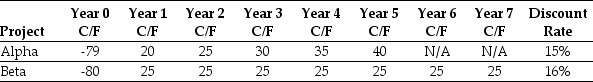

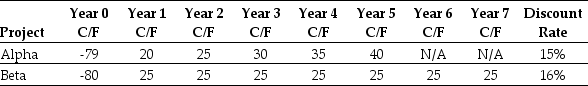

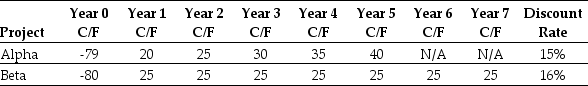

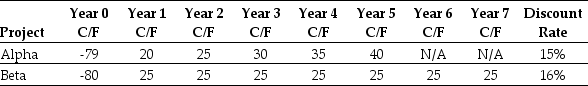

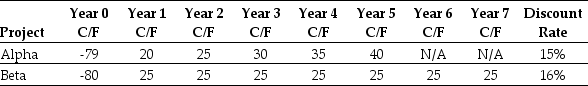

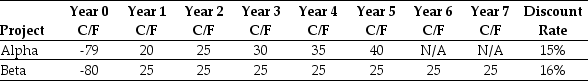

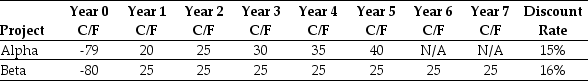

Use the table for the question(s) below.

Consider the following two projects:

The NPV for project Beta is closest to:

A) $24.01

B) $16.92

C) $20.96

D) $14.41

Consider the following two projects:

The NPV for project Beta is closest to:

A) $24.01

B) $16.92

C) $20.96

D) $14.41

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

20

Use the table for the question(s) below.

Consider the following two projects:

The NPV for project Alpha is closest to:

A) $20.96

B) $16.92

C) $24.01

D) $14.41

Consider the following two projects:

The NPV for project Alpha is closest to:

A) $20.96

B) $16.92

C) $24.01

D) $14.41

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

21

Use the information for the question(s) below.

Boulderado has come up with a new composite snowboard. Development will take Boulderado four years and cost $250,000 per year, with the first of the four equal investments payable today upon acceptance of the project. Once in production the snowboard is expected to produce annual cash flows of $200,000 each year for 10 years. Boulderado's discount rate is 10%.

Which of the following statements is correct?

A) The normal IRR rule prevails to give the correct answer in unconventional cases; IRR itself also provides useful information in conjunction with the NPV rule.

B) Because the normal IRR rule fails to give the correct answer in unconventional cases, IRR itself cannot provide useful information in conjunction with the NPV rule.

C) Because the normal IRR rule can be used in conventional cases, it cannot provide useful information in conjunction with the NPV rule.

D) The normal IRR rule fails to give the correct answer in unconventional cases, but IRR itself still provides useful information in conjunction with the NPV rule.

Boulderado has come up with a new composite snowboard. Development will take Boulderado four years and cost $250,000 per year, with the first of the four equal investments payable today upon acceptance of the project. Once in production the snowboard is expected to produce annual cash flows of $200,000 each year for 10 years. Boulderado's discount rate is 10%.

Which of the following statements is correct?

A) The normal IRR rule prevails to give the correct answer in unconventional cases; IRR itself also provides useful information in conjunction with the NPV rule.

B) Because the normal IRR rule fails to give the correct answer in unconventional cases, IRR itself cannot provide useful information in conjunction with the NPV rule.

C) Because the normal IRR rule can be used in conventional cases, it cannot provide useful information in conjunction with the NPV rule.

D) The normal IRR rule fails to give the correct answer in unconventional cases, but IRR itself still provides useful information in conjunction with the NPV rule.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

22

Use the information for the question(s) below.

Larry the Cucumber has been offered $14 million to star in the lead role of the next three Larry Boy adventure movies. If Larry takes this offer, he will have to forgo acting in other Veggie movies that would pay him $5 million at the end of each of the next three years. Assume Larry's personal cost of capital is 10% per year.

Larry should:

A) reject the offer because the NPV < 0

B) accept the offer even though the IRR < 10%, because the NPV > 0

C) reject the offer because the IRR < 10%

D) accept the offer because the IRR > 0%

Larry the Cucumber has been offered $14 million to star in the lead role of the next three Larry Boy adventure movies. If Larry takes this offer, he will have to forgo acting in other Veggie movies that would pay him $5 million at the end of each of the next three years. Assume Larry's personal cost of capital is 10% per year.

Larry should:

A) reject the offer because the NPV < 0

B) accept the offer even though the IRR < 10%, because the NPV > 0

C) reject the offer because the IRR < 10%

D) accept the offer because the IRR > 0%

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following statements is correct?

A) The IRR rule must be reversed for projects with conventional and unconventional cash flows.

B) The IRR rule must be the same for projects with conventional and unconventional cash flows.

C) The IRR rule must be useless for projects with conventional and unconventional cash flows.

D) There is no difference between when the IRR rule is used with conventional and unconventional cash flows.

A) The IRR rule must be reversed for projects with conventional and unconventional cash flows.

B) The IRR rule must be the same for projects with conventional and unconventional cash flows.

C) The IRR rule must be useless for projects with conventional and unconventional cash flows.

D) There is no difference between when the IRR rule is used with conventional and unconventional cash flows.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following statements is correct?

A) You should accept project A since its IRR > 15%.

B) You should reject project B since its NPV > 0.

C) You should accept project A since its NPV < 0.

D) You should accept project B since its IRR < 15%.

A) You should accept project A since its IRR > 15%.

B) You should reject project B since its NPV > 0.

C) You should accept project A since its NPV < 0.

D) You should accept project B since its IRR < 15%.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

25

To apply the payback rule,you calculate the amount of time it takes to pay back ________,called the payback period.

A) the all cash flows

B) all cash inflows

C) the incremental cash flows

D) the initial investment

A) the all cash flows

B) all cash inflows

C) the incremental cash flows

D) the initial investment

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

26

Use the table for the question(s) below.

Consider a project with the following cash flows:

Assume the appropriate discount rate for this project is 15%.The IRR for this project is closest to:

A) 21%

B) 22%

C) 15%

D) 60%

Consider a project with the following cash flows:

Assume the appropriate discount rate for this project is 15%.The IRR for this project is closest to:

A) 21%

B) 22%

C) 15%

D) 60%

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

27

Use the information for the question(s) below.

Larry the Cucumber has been offered $14 million to star in the lead role of the next three Larry Boy adventure movies. If Larry takes this offer, he will have to forgo acting in other Veggie movies that would pay him $5 million at the end of each of the next three years. Assume Larry's personal cost of capital is 10% per year.

Explain why the NPV decision rule might provide Larry with a different decision outcome than the IRR rule when evaluating Larry's three movie deal offer.

Larry the Cucumber has been offered $14 million to star in the lead role of the next three Larry Boy adventure movies. If Larry takes this offer, he will have to forgo acting in other Veggie movies that would pay him $5 million at the end of each of the next three years. Assume Larry's personal cost of capital is 10% per year.

Explain why the NPV decision rule might provide Larry with a different decision outcome than the IRR rule when evaluating Larry's three movie deal offer.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following statements is false?

A) The payback rule is useful in cases where the cost of making an incorrect decision might not be large enough to justify the time required for calculating the NPV.

B) The payback rule is reliable because it considers the time value of money and depends on the cost of capital.

C) For most investment opportunities expenses occur initially and cash is received later.

D) Fifty percent of firms surveyed reported using the payback rule for making decisions.

A) The payback rule is useful in cases where the cost of making an incorrect decision might not be large enough to justify the time required for calculating the NPV.

B) The payback rule is reliable because it considers the time value of money and depends on the cost of capital.

C) For most investment opportunities expenses occur initially and cash is received later.

D) Fifty percent of firms surveyed reported using the payback rule for making decisions.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following statements is false?

A) The IRR investment rule will identify the correct decision in many, but not all, situations.

B) By setting the NPV equal to zero and solving for r, we find the IRR.

C) If you are unsure of your cost of capital estimate, it is important to determine how sensitive your analysis is to errors in this estimate.

D) The simplest investment rule is the NPV investment rule.

A) The IRR investment rule will identify the correct decision in many, but not all, situations.

B) By setting the NPV equal to zero and solving for r, we find the IRR.

C) If you are unsure of your cost of capital estimate, it is important to determine how sensitive your analysis is to errors in this estimate.

D) The simplest investment rule is the NPV investment rule.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

30

Use the table for the question(s) below.

Consider the following two projects:

The internal rate of return (IRR)for project Beta is closest to:

A) 25.0%

B) 22.7%

C) 24.5%

D) 22.2%

Consider the following two projects:

The internal rate of return (IRR)for project Beta is closest to:

A) 25.0%

B) 22.7%

C) 24.5%

D) 22.2%

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

31

Use the table for the question(s) below.

Consider the following two projects:

The internal rate of return (IRR)for project Alpha is closest to:

A) 25.0%

B) 22.2%

C) 24.5%

D) 22.7%

Consider the following two projects:

The internal rate of return (IRR)for project Alpha is closest to:

A) 25.0%

B) 22.2%

C) 24.5%

D) 22.7%

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

32

Use the table for the question(s) below.

Consider the following two projects:

Which of the following statements is correct?

A) You should invest in project Beta since NPVBeta > 0.

B) You should invest in project Alpha since IRRAlpha > IRRBeta.

C) You should invest in project Alpha since NPVAlpha < 0.

D) You should invest in project Beta since IRRBeta > 0.

Consider the following two projects:

Which of the following statements is correct?

A) You should invest in project Beta since NPVBeta > 0.

B) You should invest in project Alpha since IRRAlpha > IRRBeta.

C) You should invest in project Alpha since NPVAlpha < 0.

D) You should invest in project Beta since IRRBeta > 0.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

33

Use the information for the question(s) below.

Boulderado has come up with a new composite snowboard. Development will take Boulderado four years and cost $250,000 per year, with the first of the four equal investments payable today upon acceptance of the project. Once in production the snowboard is expected to produce annual cash flows of $200,000 each year for 10 years. Boulderado's discount rate is 10%.

Calculate the IRR for the snow board project and use it to determine the maximum deviation allowable in the cost of capital estimate that leaves the investment decision unchanged.The maximum deviation allowable is closest to:

A) 11.0%

B) 0.0%

C) 2.5%

D) 1.0%

Boulderado has come up with a new composite snowboard. Development will take Boulderado four years and cost $250,000 per year, with the first of the four equal investments payable today upon acceptance of the project. Once in production the snowboard is expected to produce annual cash flows of $200,000 each year for 10 years. Boulderado's discount rate is 10%.

Calculate the IRR for the snow board project and use it to determine the maximum deviation allowable in the cost of capital estimate that leaves the investment decision unchanged.The maximum deviation allowable is closest to:

A) 11.0%

B) 0.0%

C) 2.5%

D) 1.0%

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

34

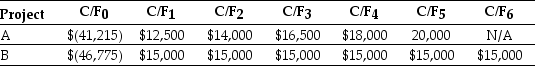

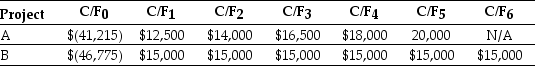

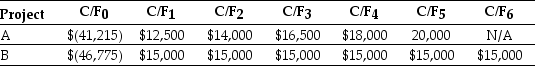

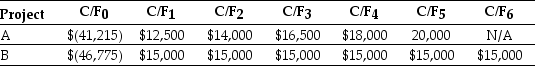

The maximum number of IRRs that could exist for project B is:

A) 3

B) 1

C) 2

D) 0

A) 3

B) 1

C) 2

D) 0

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

35

Use the information for the question(s) below.

Boulderado has come up with a new composite snowboard. Development will take Boulderado four years and cost $250,000 per year, with the first of the four equal investments payable today upon acceptance of the project. Once in production the snowboard is expected to produce annual cash flows of $200,000 each year for 10 years. Boulderado's discount rate is 10%.

The IRR for Boulderado's snowboard project is closest to:

A) 10.4%

B) 10.0%

C) 11.0%

D) 15.1%

Boulderado has come up with a new composite snowboard. Development will take Boulderado four years and cost $250,000 per year, with the first of the four equal investments payable today upon acceptance of the project. Once in production the snowboard is expected to produce annual cash flows of $200,000 each year for 10 years. Boulderado's discount rate is 10%.

The IRR for Boulderado's snowboard project is closest to:

A) 10.4%

B) 10.0%

C) 11.0%

D) 15.1%

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

36

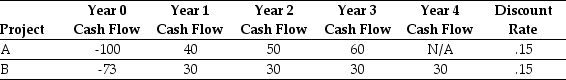

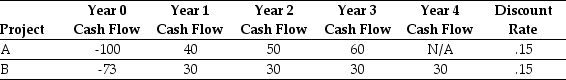

Use the table for the question(s) below.

Consider the following two projects:

The internal rate of return (IRR)for project B is closest to:

A) 21.6%

B) 23.3%

C) 42.9%

D) 7.7%

Consider the following two projects:

The internal rate of return (IRR)for project B is closest to:

A) 21.6%

B) 23.3%

C) 42.9%

D) 7.7%

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

37

Use the table for the question(s) below.

Consider the following two projects:

The internal rate of return (IRR)for project A is closest to:

A) 7.7%

B) 21.6%

C) 23.3%

D) 42.9%

Consider the following two projects:

The internal rate of return (IRR)for project A is closest to:

A) 7.7%

B) 21.6%

C) 23.3%

D) 42.9%

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

38

Use the information for the question(s) below.

Larry the Cucumber has been offered $14 million to star in the lead role of the next three Larry Boy adventure movies. If Larry takes this offer, he will have to forgo acting in other Veggie movies that would pay him $5 million at the end of each of the next three years. Assume Larry's personal cost of capital is 10% per year.

The IRR for Larry's three movie deal offer is closest to:

A) 3.5%

B) 1.6%

C) -3.5%

D) -1.6%

Larry the Cucumber has been offered $14 million to star in the lead role of the next three Larry Boy adventure movies. If Larry takes this offer, he will have to forgo acting in other Veggie movies that would pay him $5 million at the end of each of the next three years. Assume Larry's personal cost of capital is 10% per year.

The IRR for Larry's three movie deal offer is closest to:

A) 3.5%

B) 1.6%

C) -3.5%

D) -1.6%

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

39

In addition to the NPV rule that is used as an investment decision rule,we also use the following rules for single,stand-alone projects within the firm:

A) the payback rule, IRR rule, and EVA rule.

B) the payback rule, discounted payback rule and ROE rule.

C) the payback rule, ROE rule and ROA rule.

D) the payback rule, IRR rule and ROI rule.

A) the payback rule, IRR rule, and EVA rule.

B) the payback rule, discounted payback rule and ROE rule.

C) the payback rule, ROE rule and ROA rule.

D) the payback rule, IRR rule and ROI rule.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

40

Use the information for the question(s) below.

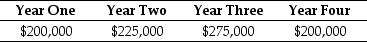

The Sisyphean Company is planning on investing in a new project. This will involve the purchase of some new machinery costing $450,000. The Sisyphean Company expects cash inflows from this project as detailed below:

The appropriate discount rate for this project is 16%.

The appropriate discount rate for this project is 16%.

The IRR for this project is closest to:

A) 18.9%

B) 22.7%

C) 34.1%

D) 39.1%

The Sisyphean Company is planning on investing in a new project. This will involve the purchase of some new machinery costing $450,000. The Sisyphean Company expects cash inflows from this project as detailed below:

The appropriate discount rate for this project is 16%.

The appropriate discount rate for this project is 16%.The IRR for this project is closest to:

A) 18.9%

B) 22.7%

C) 34.1%

D) 39.1%

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

41

Consider two mutually exclusive projects A & B.If you subtract the cash flows of opportunity B from the cash flows of opportunity A,then you should

A) take opportunity A if the regular IRR exceeds the cost of capital.

B) take opportunity A if the incremental IRR exceeds the cost of capital.

C) take opportunity B if the regular IRR exceeds the cost of capital.

D) take opportunity B if the incremental IRR exceeds the cost of capital.

A) take opportunity A if the regular IRR exceeds the cost of capital.

B) take opportunity A if the incremental IRR exceeds the cost of capital.

C) take opportunity B if the regular IRR exceeds the cost of capital.

D) take opportunity B if the incremental IRR exceeds the cost of capital.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following statements is false?

A) The incremental IRR need not exist.

B) If a change in the timing of the cash flows does not affect the NPV, then the change in timing will not impact the IRR.

C) Although the incremental IRR rule can provide a reliable method for choosing among projects, it can be difficult to apply correctly.

D) When projects are mutually exclusive, it is not enough to determine which projects have positive NPVs.

A) The incremental IRR need not exist.

B) If a change in the timing of the cash flows does not affect the NPV, then the change in timing will not impact the IRR.

C) Although the incremental IRR rule can provide a reliable method for choosing among projects, it can be difficult to apply correctly.

D) When projects are mutually exclusive, it is not enough to determine which projects have positive NPVs.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

43

Use the table for the question(s) below.

Consider a project with the following cash flows:

Assume the appropriate discount rate for this project is 15%.The payback period for this project is closest to:

A) 3

B) 2.5

C) 2

D) 4

Consider a project with the following cash flows:

Assume the appropriate discount rate for this project is 15%.The payback period for this project is closest to:

A) 3

B) 2.5

C) 2

D) 4

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following statements is false?

A) When using the incremental IRR rule, you must keep track of which project is the incremental project and ensure that the incremental cash flows are initially positive and then become negative.

B) Picking one project over another simply because it has a larger IRR can lead to mistakes.

C) Problems arise using the IRR method when the mutually exclusive investments have differences in scale.

D) When the risks of two projects are different, only the NPV rule will give a reliable answer.

A) When using the incremental IRR rule, you must keep track of which project is the incremental project and ensure that the incremental cash flows are initially positive and then become negative.

B) Picking one project over another simply because it has a larger IRR can lead to mistakes.

C) Problems arise using the IRR method when the mutually exclusive investments have differences in scale.

D) When the risks of two projects are different, only the NPV rule will give a reliable answer.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

45

Use the table for the question(s) below.

Consider the following two projects:

Assume that projects A and B are mutually exclusive.What is the correct investment decision and the best rationale for that decision?

A) Invest in project A since NPVB < NPVA

B) Invest in project B since IRRB > IRRA

C) Invest in project B since NPVB > NPVA

D) Invest in project A since NPVA > 0

Consider the following two projects:

Assume that projects A and B are mutually exclusive.What is the correct investment decision and the best rationale for that decision?

A) Invest in project A since NPVB < NPVA

B) Invest in project B since IRRB > IRRA

C) Invest in project B since NPVB > NPVA

D) Invest in project A since NPVA > 0

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

46

You are trying to decide between three mutually exclusive investment opportunities.The most appropriate tool for identifying the correct decision is

A) the NPV.

B) the Profitability Index.

C) the IRR.

D) the Incremental IRR.

A) the NPV.

B) the Profitability Index.

C) the IRR.

D) the Incremental IRR.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

47

Use the information for the question(s) below.

The Sisyphean Company is planning on investing in a new project. This will involve the purchase of some new machinery costing $450,000. The Sisyphean Company expects cash inflows from this project as detailed below:

The appropriate discount rate for this project is 16%.

The appropriate discount rate for this project is 16%.

The payback period for this project is closest to:

A) 2.1 years

B) 3.0 years

C) 2 years

D) 2.2 years

The Sisyphean Company is planning on investing in a new project. This will involve the purchase of some new machinery costing $450,000. The Sisyphean Company expects cash inflows from this project as detailed below:

The appropriate discount rate for this project is 16%.

The appropriate discount rate for this project is 16%.The payback period for this project is closest to:

A) 2.1 years

B) 3.0 years

C) 2 years

D) 2.2 years

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

48

Use the table for the question(s) below.

Consider the following two projects:

Assume that projects Alpha and Beta are mutually exclusive.Which of the following statements is true regarding the investment decision tools' suitability for deciding between projects Alpha & Beta?

A) The incremental IRR should not be used since the projects have different lives.

B) The incremental IRR should not be used since the projects have different discount rates.

C) The incremental IRR should not be used since the projects have different cash flow patterns.

D) Both the NPV and incremental IRR approaches are appropriate to solve this problem.

Consider the following two projects:

Assume that projects Alpha and Beta are mutually exclusive.Which of the following statements is true regarding the investment decision tools' suitability for deciding between projects Alpha & Beta?

A) The incremental IRR should not be used since the projects have different lives.

B) The incremental IRR should not be used since the projects have different discount rates.

C) The incremental IRR should not be used since the projects have different cash flow patterns.

D) Both the NPV and incremental IRR approaches are appropriate to solve this problem.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

49

Use the table for the question(s) below.

Consider the following two projects:

The payback period for project Beta is closest to:

A) 2.9 years

B) 3.1 years

C) 2.6 years

D) 3.2 years

Consider the following two projects:

The payback period for project Beta is closest to:

A) 2.9 years

B) 3.1 years

C) 2.6 years

D) 3.2 years

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

50

When an investment decision has to be made for mutually exclusive projects and source constraints

A) the NPV rule prevails.

B) the IRR rule prevails.

C) the Payback rule prevails.

D) the ROA rule prevails.

A) the NPV rule prevails.

B) the IRR rule prevails.

C) the Payback rule prevails.

D) the ROA rule prevails.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

51

When the IRR rule is used for mutually exclusive projects,we should mainly rely on

A) the rule of the Modified Internal Rate of Return (MIRR).

B) the rule of the Incremental Internal Rate of Return (IIRR).

C) the rule of the Net Present Value (NPV).

D) the rule of the normal Internal Rate of Return (IRR).

A) the rule of the Modified Internal Rate of Return (MIRR).

B) the rule of the Incremental Internal Rate of Return (IIRR).

C) the rule of the Net Present Value (NPV).

D) the rule of the normal Internal Rate of Return (IRR).

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

52

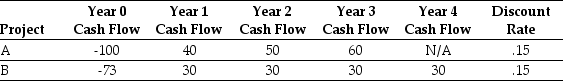

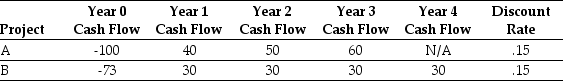

Use the table for the question(s) below.

Consider the following two projects:

The maximum number of incremental IRRs that could exist for project B over project A is?

A) 1

B) 2

C) 0

D) 3

Consider the following two projects:

The maximum number of incremental IRRs that could exist for project B over project A is?

A) 1

B) 2

C) 0

D) 3

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

53

Use the table for the question(s) below.

Consider the following two projects:

The payback period for project Alpha is closest to:

A) 3.2 years

B) 2.9 years

C) 3.1 years

D) 2.6 years

Consider the following two projects:

The payback period for project Alpha is closest to:

A) 3.2 years

B) 2.9 years

C) 3.1 years

D) 2.6 years

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following statements is false?

A) Problems can arise using the IRR method when the mutually exclusive investments have different cash flow patterns.

B) The IRR is affected by the scale of the investment opportunity.

C) Multiple incremental IRRs might exist.

D) The incremental IRR rule assumes that the riskiness of the two projects is the same.

A) Problems can arise using the IRR method when the mutually exclusive investments have different cash flow patterns.

B) The IRR is affected by the scale of the investment opportunity.

C) Multiple incremental IRRs might exist.

D) The incremental IRR rule assumes that the riskiness of the two projects is the same.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

55

Use the table for the question(s) below.

Consider the following two projects:

The payback period for project B is closest to:

A) 2.5 years

B) 2.0 years

C) 2.2 years

D) 2.4 years

Consider the following two projects:

The payback period for project B is closest to:

A) 2.5 years

B) 2.0 years

C) 2.2 years

D) 2.4 years

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

56

Use the table for the question(s) below.

Consider the following two projects:

The payback period for project A is closest to:

A) 2.0 years

B) 2.4 years

C) 2.5 years

D) 2.2 years

Consider the following two projects:

The payback period for project A is closest to:

A) 2.0 years

B) 2.4 years

C) 2.5 years

D) 2.2 years

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following statements is false?

A) The incremental IRR investment rule applies the IRR rule to the difference between the cash flows of the two mutually exclusive alternatives.

B) When a manager must choose among mutually exclusive investments, the NPV rule provides a straightforward answer.

C) The likelihood of multiple IRRs is greater with the regular IRR rule than with the incremental IRR rule.

D) Problems can arise using the IRR method when the mutually exclusive investments have differences in scale.

A) The incremental IRR investment rule applies the IRR rule to the difference between the cash flows of the two mutually exclusive alternatives.

B) When a manager must choose among mutually exclusive investments, the NPV rule provides a straightforward answer.

C) The likelihood of multiple IRRs is greater with the regular IRR rule than with the incremental IRR rule.

D) Problems can arise using the IRR method when the mutually exclusive investments have differences in scale.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

58

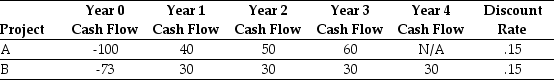

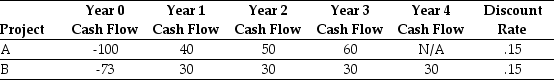

Use the table for the question(s) below.

Consider the following two projects:

Assume that projects Alpha and Beta are mutually exclusive.The correct investment decision and the best rational for that decision is to?

A) Invest in project Beta since NPVBeta > 0

B) Invest in project Alpha since NPVBeta < NPVAlpha

C) Invest in project Beta since IRRB > IRRA

D) Invest in project Beta since NPVBeta > NPVAlpha > 0

Consider the following two projects:

Assume that projects Alpha and Beta are mutually exclusive.The correct investment decision and the best rational for that decision is to?

A) Invest in project Beta since NPVBeta > 0

B) Invest in project Alpha since NPVBeta < NPVAlpha

C) Invest in project Beta since IRRB > IRRA

D) Invest in project Beta since NPVBeta > NPVAlpha > 0

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

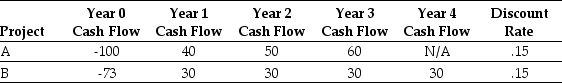

59

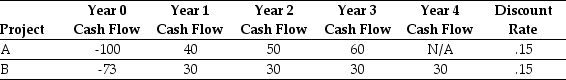

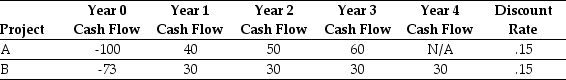

Use the table for the question(s) below.

Consider two mutually exclusive projects with the following cash flows:

You are considering using the incremental IRR approach to decide between the two mutually exclusive projects A & B.How many potential incremental IRRs could there be?

A) 3

B) 0

C) 2

D) 1

Consider two mutually exclusive projects with the following cash flows:

You are considering using the incremental IRR approach to decide between the two mutually exclusive projects A & B.How many potential incremental IRRs could there be?

A) 3

B) 0

C) 2

D) 1

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

60

Use the table for the question(s) below.

Consider the following two projects:

The incremental IRR of Project B over Project A is closest to:

A) 12.6%

B) 23.3%

C) 1.7%

D) 17.3%

Consider the following two projects:

The incremental IRR of Project B over Project A is closest to:

A) 12.6%

B) 23.3%

C) 1.7%

D) 17.3%

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

61

What is the incremental IRR for project B over project A? Would you feel comfortable basing your decision on the incremental IRR?

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

62

You are opening up a brand new retail strip mall.You presently have more potential retail outlets wanting to locate in your mall than you have space available.What is the most appropriate tool to use if you are trying to determine the optimal allocation of your retail space?

A) IRR

B) Payback period

C) NPV

D) Profitability index

A) IRR

B) Payback period

C) NPV

D) Profitability index

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following statements is false?

A) The profitability index measures the value created in terms of NPV per unit of resource consumed.

B) The profitability index is the ratio of value created to resources consumed.

C) The profitability index can be easily adapted for determining the correct investment decisions when multiple resource constraints exist.

D) The profitability index measures the "bang for your buck."

A) The profitability index measures the value created in terms of NPV per unit of resource consumed.

B) The profitability index is the ratio of value created to resources consumed.

C) The profitability index can be easily adapted for determining the correct investment decisions when multiple resource constraints exist.

D) The profitability index measures the "bang for your buck."

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

64

Use the table for the question(s) below.

Consider the following two projects:

The profitability index for project B is closest to:

A) 23.34

B) 12.64

C) 0.17

D) 0.12

Consider the following two projects:

The profitability index for project B is closest to:

A) 23.34

B) 12.64

C) 0.17

D) 0.12

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

65

Use the table for the question(s) below.

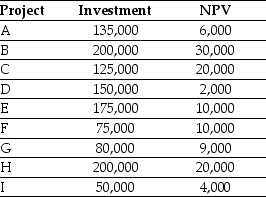

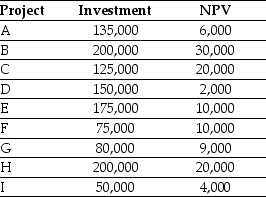

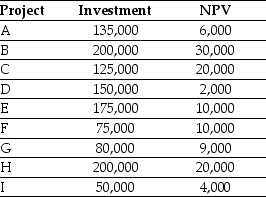

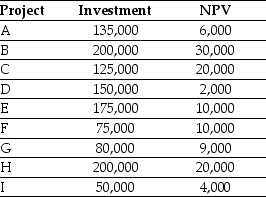

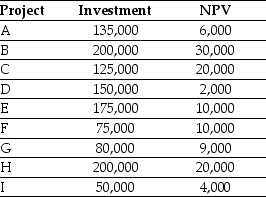

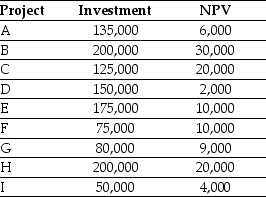

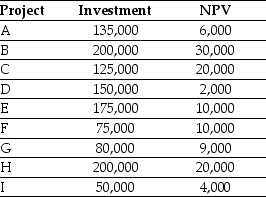

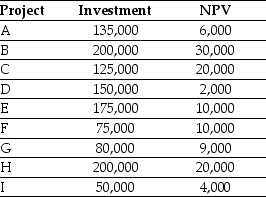

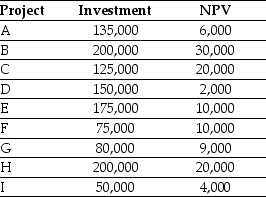

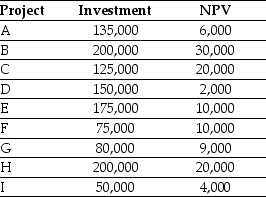

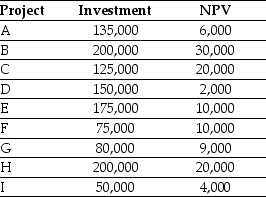

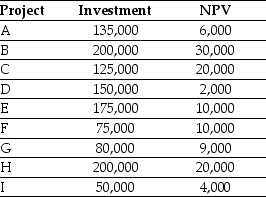

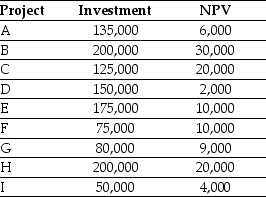

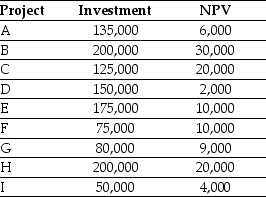

Consider the following list of projects:

Assume that your capital is constrained,so that you only have $500,000 available to invest in projects.If you invest in the optimal combination of projects given your capital constraint,then the total NPV for all the projects you invest in will be closest to:

A) $111,000

B) $69,000

C) $80,000

D) $58,000

Consider the following list of projects:

Assume that your capital is constrained,so that you only have $500,000 available to invest in projects.If you invest in the optimal combination of projects given your capital constraint,then the total NPV for all the projects you invest in will be closest to:

A) $111,000

B) $69,000

C) $80,000

D) $58,000

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

66

Use the information for the question(s) below.

The Sisyphean Company is planning on investing in a new project. This will involve the purchase of some new machinery costing $450,000. The Sisyphean Company expects cash inflows from this project as detailed below:

The appropriate discount rate for this project is 16%.

The appropriate discount rate for this project is 16%.

The profitability index for this project is closest to:

A) .044

B) 0.26

C) 0.39

D) 0.34

The Sisyphean Company is planning on investing in a new project. This will involve the purchase of some new machinery costing $450,000. The Sisyphean Company expects cash inflows from this project as detailed below:

The appropriate discount rate for this project is 16%.

The appropriate discount rate for this project is 16%.The profitability index for this project is closest to:

A) .044

B) 0.26

C) 0.39

D) 0.34

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

67

Assuming that the discount rate for project A is 16% and the discount rate for B is 15%,then given that these are mutually exclusive projects,which project would you take and why?

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

68

Use the table for the question(s) below.

Consider the following list of projects:

Assuming that your capital is constrained,so that you only have $600,000 available to invest in projects,which four projects should you invest in and in what order?

A) CBFH

B) CBGF

C) BCFG

D) CBFG

Consider the following list of projects:

Assuming that your capital is constrained,so that you only have $600,000 available to invest in projects,which four projects should you invest in and in what order?

A) CBFH

B) CBGF

C) BCFG

D) CBFG

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

69

Use the table for the question(s) below.

Consider the following list of projects:

Assume that your capital is constrained,so that you only have $600,000 available to invest in projects.If you invest in the optimal combination of projects given your capital constraint,then the total NPV for all the projects you invest in will be closest to:

A) $65,000

B) $80,000

C) $69,000

D) $111,000

Consider the following list of projects:

Assume that your capital is constrained,so that you only have $600,000 available to invest in projects.If you invest in the optimal combination of projects given your capital constraint,then the total NPV for all the projects you invest in will be closest to:

A) $65,000

B) $80,000

C) $69,000

D) $111,000

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

70

Use the table for the question(s) below.

Consider the following list of projects:

Assuming that your capital is constrained,which project should you invest in last?

A) Project A

B) Project I

C) Project D

D) Project C

Consider the following list of projects:

Assuming that your capital is constrained,which project should you invest in last?

A) Project A

B) Project I

C) Project D

D) Project C

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

71

Use the table for the question(s) below.

Consider the following list of projects:

Assuming that your capital is constrained,which investment tool should you use to determine the correct investment decisions?

A) Profitability Index

B) Incremental IRR

C) NPV

D) IRR

Consider the following list of projects:

Assuming that your capital is constrained,which investment tool should you use to determine the correct investment decisions?

A) Profitability Index

B) Incremental IRR

C) NPV

D) IRR

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

72

Use the table for the question(s) below.

Consider two mutually exclusive projects with the following cash flows:

If the discount rate for project B is 15%,then what is the NPV for project B?

Consider two mutually exclusive projects with the following cash flows:

If the discount rate for project B is 15%,then what is the NPV for project B?

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

73

Use the table for the question(s) below.

Consider a project with the following cash flows:

Assume the appropriate discount rate for this project is 15%.The profitability index for this project is closest to:

A) 0.14

B) 0.22

C) 0.60

D) 0.15

Consider a project with the following cash flows:

Assume the appropriate discount rate for this project is 15%.The profitability index for this project is closest to:

A) 0.14

B) 0.22

C) 0.60

D) 0.15

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

74

Use the table for the question(s) below.

Consider the following list of projects:

Assuming that your capital is constrained,which project should you invest in first?

A) Project C

B) Project G

C) Project B

D) Project F

Consider the following list of projects:

Assuming that your capital is constrained,which project should you invest in first?

A) Project C

B) Project G

C) Project B

D) Project F

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following statements is false?

A) If there is a fixed supply of resources available, you should rank projects by the profitability index, selecting the project with the lowest profitability index first and working your way down the list until the resource is consumed.

B) Practitioners often use the profitability index to identify the optimal combination of projects when there is a fixed supply of resources.

C) If there is a fixed supply of resources available, so that you cannot undertake all possible opportunities, then simply picking the highest NPV opportunity might not lead to the best decision.

D) The profitability index is calculated as the NPV divided by the resources consumed by the project.

A) If there is a fixed supply of resources available, you should rank projects by the profitability index, selecting the project with the lowest profitability index first and working your way down the list until the resource is consumed.

B) Practitioners often use the profitability index to identify the optimal combination of projects when there is a fixed supply of resources.

C) If there is a fixed supply of resources available, so that you cannot undertake all possible opportunities, then simply picking the highest NPV opportunity might not lead to the best decision.

D) The profitability index is calculated as the NPV divided by the resources consumed by the project.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

76

The investment rule with the Internal Rate of Return states:

A) Take any investment opportunity whose IRR is less than the opportunity cost of capital. Turn down any opportunity whose IRR exceeds the opportunity cost of capital.

B) Forego any investment opportunity whose IRR exceeds the opportunity cost of capital. Take any opportunity whose IRR is less than the opportunity cost of capital.

C) Take any investment opportunity whose IRR exceeds the opportunity cost of capital. Turn down any opportunity whose IRR is less than the opportunity cost of capital.

D) None of the above

A) Take any investment opportunity whose IRR is less than the opportunity cost of capital. Turn down any opportunity whose IRR exceeds the opportunity cost of capital.

B) Forego any investment opportunity whose IRR exceeds the opportunity cost of capital. Take any opportunity whose IRR is less than the opportunity cost of capital.

C) Take any investment opportunity whose IRR exceeds the opportunity cost of capital. Turn down any opportunity whose IRR is less than the opportunity cost of capital.

D) None of the above

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

77

If firm's objective is to maximize wealth,

A) the rule of the Profitability Index will always give you the correct answer.

B) the rule of the Net Present Value will always give you the correct answer.

C) the rule of the Payback Period will always give you the correct answer.

D) the rule of the Internal Rate of Return will always give you the correct answer.

A) the rule of the Profitability Index will always give you the correct answer.

B) the rule of the Net Present Value will always give you the correct answer.

C) the rule of the Payback Period will always give you the correct answer.

D) the rule of the Internal Rate of Return will always give you the correct answer.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

78

Use the table for the question(s) below.

Consider the following list of projects:

Assuming that your capital is constrained,what is the fifth project that you should invest in?

A) Project H

B) Project I

C) Project B

D) Project A

Consider the following list of projects:

Assuming that your capital is constrained,what is the fifth project that you should invest in?

A) Project H

B) Project I

C) Project B

D) Project A

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

79

Use the table for the question(s) below.

Consider two mutually exclusive projects with the following cash flows:

If the discount rate for project A is 16%,then what is the NPV for project A?

Consider two mutually exclusive projects with the following cash flows:

If the discount rate for project A is 16%,then what is the NPV for project A?

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

80

Use the table for the question(s) below.

Consider the following two projects:

The profitability index for project A is closest to:

A) 0.12

B) 21.65

C) 0.17

D) 12.04

Consider the following two projects:

The profitability index for project A is closest to:

A) 0.12

B) 21.65

C) 0.17

D) 12.04

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck