Deck 7: Valuing Stocks

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/88

Play

Full screen (f)

Deck 7: Valuing Stocks

1

Which of the following statements is false?

A) There are two potential sources of cash flows from owning a stock.

B) An investor will be willing to pay a price today for a share of stock up to the point that this transaction has a zero NPV.

C) An investor might generate cash by choosing to sell the shares at some future date.

D) Because the cash flows from stock are known with certainty, we can discount them using the risk-free interest rate.

A) There are two potential sources of cash flows from owning a stock.

B) An investor will be willing to pay a price today for a share of stock up to the point that this transaction has a zero NPV.

C) An investor might generate cash by choosing to sell the shares at some future date.

D) Because the cash flows from stock are known with certainty, we can discount them using the risk-free interest rate.

Because the cash flows from stock are known with certainty, we can discount them using the risk-free interest rate.

2

Use the information for the question(s) below.

Von Bora Corporation is expected pay a dividend of $1.40 per share at the end of this year and $1.50 per share at the end of the second year. You expect Von Bora's stock price to be $25.00 at the end of two years. Von Bora's equity cost of capital is 10%.

Suppose you plan on purchasing Von Bora stock in one year,right after the $1.40 dividend is paid.You then plan on selling your stock at the end of year two,right after the $1.50 dividend is paid.The capital gain rate that you will receive on your investment is closest to:

A) 4.00%

B) 3.75%

C) 6.25%

D) 3.50%

Von Bora Corporation is expected pay a dividend of $1.40 per share at the end of this year and $1.50 per share at the end of the second year. You expect Von Bora's stock price to be $25.00 at the end of two years. Von Bora's equity cost of capital is 10%.

Suppose you plan on purchasing Von Bora stock in one year,right after the $1.40 dividend is paid.You then plan on selling your stock at the end of year two,right after the $1.50 dividend is paid.The capital gain rate that you will receive on your investment is closest to:

A) 4.00%

B) 3.75%

C) 6.25%

D) 3.50%

3.75%

3

Use the information for the question(s) below.

Von Bora Corporation is expected pay a dividend of $1.40 per share at the end of this year and $1.50 per share at the end of the second year. You expect Von Bora's stock price to be $25.00 at the end of two years. Von Bora's equity cost of capital is 10%.

Suppose you plan to hold Von Bora stock for only one year.Your dividend yield from holding Von Bora stock for the first year is closest to:

A) 6.0%

B) 4.0%

C) 6.5%

D) 5.5%

Von Bora Corporation is expected pay a dividend of $1.40 per share at the end of this year and $1.50 per share at the end of the second year. You expect Von Bora's stock price to be $25.00 at the end of two years. Von Bora's equity cost of capital is 10%.

Suppose you plan to hold Von Bora stock for only one year.Your dividend yield from holding Von Bora stock for the first year is closest to:

A) 6.0%

B) 4.0%

C) 6.5%

D) 5.5%

6.0%

4

Which of the following statements is false?

A) The equity cost of capital for a stock is the expected return of other investments available in the market with equivalent risk to the firm's shares.

B) The price of a share of stock is equal to the present value of the expected future dividends it will pay.

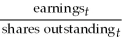

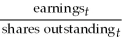

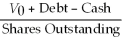

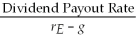

C) If the current stock price were less than P0 = , it would be a negative NPV investment, and we would expect investors to rush in and sell it, driving down the stock's price.

, it would be a negative NPV investment, and we would expect investors to rush in and sell it, driving down the stock's price.

D) The law of one price implies that to value any security, we must determine the expected cash flows an investor will receive from owning it.

A) The equity cost of capital for a stock is the expected return of other investments available in the market with equivalent risk to the firm's shares.

B) The price of a share of stock is equal to the present value of the expected future dividends it will pay.

C) If the current stock price were less than P0 =

, it would be a negative NPV investment, and we would expect investors to rush in and sell it, driving down the stock's price.

, it would be a negative NPV investment, and we would expect investors to rush in and sell it, driving down the stock's price.D) The law of one price implies that to value any security, we must determine the expected cash flows an investor will receive from owning it.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following statements is false?

A) If investors have the same beliefs, their valuation of the stock will depend on their investment horizon.

B) If investors have the same beliefs, their valuation of the stock will depend on their required rate of return.

C) If investors have the same beliefs, their valuation of the stock will not depend on their investment horizon.

D) Although investors may have the same beliefs, their valuation of the stock will still depend on their attitude toward to the risk of the stock.

A) If investors have the same beliefs, their valuation of the stock will depend on their investment horizon.

B) If investors have the same beliefs, their valuation of the stock will depend on their required rate of return.

C) If investors have the same beliefs, their valuation of the stock will not depend on their investment horizon.

D) Although investors may have the same beliefs, their valuation of the stock will still depend on their attitude toward to the risk of the stock.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following statements is false?

A) An investor will be willing to pay up to the point at which the current price of a share of stock equals the present value of the expected future dividends of an expected future sale price.

B) The expected total return of a stock should equal the expected return of other investments available in the market with equivalent risk.

C) The total amount received in dividends and from selling the stock will depend on the investor's investment horizon.

D) If the current stock price were greater than P0 = , it would be a positive NPV investment, and we would expect investors to rush in and buy it, driving up the stock's price.

, it would be a positive NPV investment, and we would expect investors to rush in and buy it, driving up the stock's price.

A) An investor will be willing to pay up to the point at which the current price of a share of stock equals the present value of the expected future dividends of an expected future sale price.

B) The expected total return of a stock should equal the expected return of other investments available in the market with equivalent risk.

C) The total amount received in dividends and from selling the stock will depend on the investor's investment horizon.

D) If the current stock price were greater than P0 =

, it would be a positive NPV investment, and we would expect investors to rush in and buy it, driving up the stock's price.

, it would be a positive NPV investment, and we would expect investors to rush in and buy it, driving up the stock's price.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

7

The total return of a stock is equal to

A) the dividend yield plus the capital gain.

B) the capital gain plus the rate of return.

C) the dividend yield plus the required rate of return.

D) the dividend yield plus the capital gain rate.

A) the dividend yield plus the capital gain.

B) the capital gain plus the rate of return.

C) the dividend yield plus the required rate of return.

D) the dividend yield plus the capital gain rate.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

8

When discounting dividends you should use

A) the weighted average cost of capital.

B) the after-tax weighted average cost of capital.

C) the equity cost of capital.

D) the before tax cost of debt.

A) the weighted average cost of capital.

B) the after-tax weighted average cost of capital.

C) the equity cost of capital.

D) the before tax cost of debt.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following formulas is incorrect?

A) Capital Gain Rate =

B) Dividend Yield =

C) P0 = +

+

D) rE = Capital Gain Rate + Dividend Yield

A) Capital Gain Rate =

B) Dividend Yield =

C) P0 =

+

+

D) rE = Capital Gain Rate + Dividend Yield

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

10

Use the information for the question(s) below.

Von Bora Corporation is expected pay a dividend of $1.40 per share at the end of this year and $1.50 per share at the end of the second year. You expect Von Bora's stock price to be $25.00 at the end of two years. Von Bora's equity cost of capital is 10%.

Suppose you plan to hold Von Bora stock for one year.The price you would expect to be able to sell a share of Von Bora stock at in one year is closest to:

A) $26.50

B) $22.20

C) $23.15

D) $24.10

Von Bora Corporation is expected pay a dividend of $1.40 per share at the end of this year and $1.50 per share at the end of the second year. You expect Von Bora's stock price to be $25.00 at the end of two years. Von Bora's equity cost of capital is 10%.

Suppose you plan to hold Von Bora stock for one year.The price you would expect to be able to sell a share of Von Bora stock at in one year is closest to:

A) $26.50

B) $22.20

C) $23.15

D) $24.10

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

11

Use the information for the question(s) below.

Von Bora Corporation is expected pay a dividend of $1.40 per share at the end of this year and $1.50 per share at the end of the second year. You expect Von Bora's stock price to be $25.00 at the end of two years. Von Bora's equity cost of capital is 10%.

The price you would be willing to pay today for a share of Von Bora stock,if you plan to hold the stock for two years is closest to:

A) $23.15

B) $20.65

C) $21.95

D) $21.30

Von Bora Corporation is expected pay a dividend of $1.40 per share at the end of this year and $1.50 per share at the end of the second year. You expect Von Bora's stock price to be $25.00 at the end of two years. Von Bora's equity cost of capital is 10%.

The price you would be willing to pay today for a share of Von Bora stock,if you plan to hold the stock for two years is closest to:

A) $23.15

B) $20.65

C) $21.95

D) $21.30

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

12

Use the information for the question(s) below.

Von Bora Corporation is expected pay a dividend of $1.40 per share at the end of this year and $1.50 per share at the end of the second year. You expect Von Bora's stock price to be $25.00 at the end of two years. Von Bora's equity cost of capital is 10%.

Suppose you plan on purchasing Von Bora stock in one year,right after the $1.40 dividend is paid.You then plan on selling your stock at the end of year two,right after the $1.50 dividend is paid.The total return that you will receive on your investment is closest to:

A) 9.50%

B) 10.75%

C) 10.25%

D) 10.00%

Von Bora Corporation is expected pay a dividend of $1.40 per share at the end of this year and $1.50 per share at the end of the second year. You expect Von Bora's stock price to be $25.00 at the end of two years. Von Bora's equity cost of capital is 10%.

Suppose you plan on purchasing Von Bora stock in one year,right after the $1.40 dividend is paid.You then plan on selling your stock at the end of year two,right after the $1.50 dividend is paid.The total return that you will receive on your investment is closest to:

A) 9.50%

B) 10.75%

C) 10.25%

D) 10.00%

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

13

Because the cash flows from owning a stock are risky,we can only discount them using

A) the risk-free interest rate.

B) the real interest rate.

C) the effective rate of interest.

D) the equity cost of capital.

A) the risk-free interest rate.

B) the real interest rate.

C) the effective rate of interest.

D) the equity cost of capital.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following statements is correct?

A) There is one potential source of cash flows from owning a stock.

B) There are two potential sources of cash flows from owning a stock.

C) There are three potential sources of cash flows from owning a stock.

D) There are more than three potential sources of cash flows from owning a stock.

A) There is one potential source of cash flows from owning a stock.

B) There are two potential sources of cash flows from owning a stock.

C) There are three potential sources of cash flows from owning a stock.

D) There are more than three potential sources of cash flows from owning a stock.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

15

Use the information for the question(s) below.

Von Bora Corporation is expected pay a dividend of $1.40 per share at the end of this year and $1.50 per share at the end of the second year. You expect Von Bora's stock price to be $25.00 at the end of two years. Von Bora's equity cost of capital is 10%.

Suppose you plan to hold Von Bora stock for only one year.Your capital gain from holding Von Bora stock for the first year is closest to:

A) $0.95

B) $1.40

C) $1.85

D) $1.25

Von Bora Corporation is expected pay a dividend of $1.40 per share at the end of this year and $1.50 per share at the end of the second year. You expect Von Bora's stock price to be $25.00 at the end of two years. Von Bora's equity cost of capital is 10%.

Suppose you plan to hold Von Bora stock for only one year.Your capital gain from holding Von Bora stock for the first year is closest to:

A) $0.95

B) $1.40

C) $1.85

D) $1.25

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following statements is false?

A) Future dividend payments and stock prices are not known with certainty; rather these values are based on the investor's expectations at the time the stock is purchased.

B) The capital gain is the difference between the expected sale price and the purchase price of the stock.

C) The sum of the dividend yield and the capital gain rate is called the total return of the stock.

D) We divide the capital gain by the expected future stock price to calculate the capital gain rate.

A) Future dividend payments and stock prices are not known with certainty; rather these values are based on the investor's expectations at the time the stock is purchased.

B) The capital gain is the difference between the expected sale price and the purchase price of the stock.

C) The sum of the dividend yield and the capital gain rate is called the total return of the stock.

D) We divide the capital gain by the expected future stock price to calculate the capital gain rate.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

17

Use the information for the question(s) below.

Von Bora Corporation is expected pay a dividend of $1.40 per share at the end of this year and $1.50 per share at the end of the second year. You expect Von Bora's stock price to be $25.00 at the end of two years. Von Bora's equity cost of capital is 10%.

Suppose you plan on purchasing Von Bora stock in one year,right after the $1.40 dividend is paid.You then plan on selling your stock at the end of year two,right after the $1.50 dividend is paid.The dividend yield that you will receive on your investment is closest to:

A) 5.75%

B) 6.50%

C) 6.25%

D) 4.00%

Von Bora Corporation is expected pay a dividend of $1.40 per share at the end of this year and $1.50 per share at the end of the second year. You expect Von Bora's stock price to be $25.00 at the end of two years. Von Bora's equity cost of capital is 10%.

Suppose you plan on purchasing Von Bora stock in one year,right after the $1.40 dividend is paid.You then plan on selling your stock at the end of year two,right after the $1.50 dividend is paid.The dividend yield that you will receive on your investment is closest to:

A) 5.75%

B) 6.50%

C) 6.25%

D) 4.00%

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following statements is false?

A) We must discount the cash flows from stock based on the equity cost of capital for the stock.

B) The divided yield is the percentage return the investor expects to earn from the dividend paid by the stock.

C) The firm might pay out cash to its shareholders in the form of a dividend.

D) The dividend yield is the expected annual dividend of a stock, divided by its expected future sale price.

A) We must discount the cash flows from stock based on the equity cost of capital for the stock.

B) The divided yield is the percentage return the investor expects to earn from the dividend paid by the stock.

C) The firm might pay out cash to its shareholders in the form of a dividend.

D) The dividend yield is the expected annual dividend of a stock, divided by its expected future sale price.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

19

Use the information for the question(s) below.

Von Bora Corporation is expected pay a dividend of $1.40 per share at the end of this year and $1.50 per share at the end of the second year. You expect Von Bora's stock price to be $25.00 at the end of two years. Von Bora's equity cost of capital is 10%.

Suppose you plan to hold Von Bora stock for only one year.Your capital gain rate from holding Von Bora stock for the first year is closest to:

A) 3.5%

B) 4.0%

C) 6.0%

D) 4.5%

Von Bora Corporation is expected pay a dividend of $1.40 per share at the end of this year and $1.50 per share at the end of the second year. You expect Von Bora's stock price to be $25.00 at the end of two years. Von Bora's equity cost of capital is 10%.

Suppose you plan to hold Von Bora stock for only one year.Your capital gain rate from holding Von Bora stock for the first year is closest to:

A) 3.5%

B) 4.0%

C) 6.0%

D) 4.5%

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following statements is correct?

A) The expected total return of the stock should equal the expected return of other investments available in the market with higher risk.

B) The expected total return of the stock should equal the expected return of other investments available in the market with lower risk.

C) The expected total return of the stock should equal the expected return of other investments available in the market with equivalent risk.

D) The expected total return of the stock should equal the expected return of other investments available in the market with different risk.

A) The expected total return of the stock should equal the expected return of other investments available in the market with higher risk.

B) The expected total return of the stock should equal the expected return of other investments available in the market with lower risk.

C) The expected total return of the stock should equal the expected return of other investments available in the market with equivalent risk.

D) The expected total return of the stock should equal the expected return of other investments available in the market with different risk.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following statements regarding profitable and unprofitable growth is false?

A) If a firm wants to increase its share price, it must cut its dividend and invest more.

B) If the firm retains more earnings, it will be able to pay out less of those earnings, which means that the firm will have to reduce its dividend.

C) A firm can increase its growth rate by retaining more of its earnings.

D) Cutting the firm's dividend to increase investment will raise the stock price if, and only if, the new investments have a positive NPV.

A) If a firm wants to increase its share price, it must cut its dividend and invest more.

B) If the firm retains more earnings, it will be able to pay out less of those earnings, which means that the firm will have to reduce its dividend.

C) A firm can increase its growth rate by retaining more of its earnings.

D) Cutting the firm's dividend to increase investment will raise the stock price if, and only if, the new investments have a positive NPV.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following formulas is incorrect?

A) g = retention rate × return on new investment

B) Divt = EPSt × Dividend Payout Rate

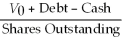

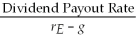

C) P0 =

D) rE = - g

- g

A) g = retention rate × return on new investment

B) Divt = EPSt × Dividend Payout Rate

C) P0 =

D) rE =

- g

- g

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following is NOT a way that a firm can increase its dividend?

A) by increasing its retention rate

B) by decreasing its shares outstanding

C) by increasing its earnings (net income)

D) by increasing its dividend payout rate

A) by increasing its retention rate

B) by decreasing its shares outstanding

C) by increasing its earnings (net income)

D) by increasing its dividend payout rate

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following formulas is incorrect?

A) Divt = × Dividend Payout Rate

× Dividend Payout Rate

B) PN =

C) earnings growth rate = retention rate × return on new investment

D) P0 = +

+

+ ... +

+ ... +

+

+

×

×

A) Divt =

× Dividend Payout Rate

× Dividend Payout RateB) PN =

C) earnings growth rate = retention rate × return on new investment

D) P0 =

+

+ + ... +

+ ... + +

+ ×

×

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

25

Cutting the firm's dividend to increase investment will raise the stock price if,and only if,the new investments have

A) a positive NPV.

B) a positive IRR.

C) a positive payback period.

D) a positive growth rate.

A) a positive NPV.

B) a positive IRR.

C) a positive payback period.

D) a positive growth rate.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following statements is false?

A) Estimating dividends, especially for the distant future, is difficult.

B) A firm can only pay out its earnings to investors or reinvest its earnings.

C) Successful young firms often have high initial earnings growth rates.

D) According to the constant dividend growth model, the value of the firm depends on the current dividend level, divided by the equity cost of capital plus the growth rate.

A) Estimating dividends, especially for the distant future, is difficult.

B) A firm can only pay out its earnings to investors or reinvest its earnings.

C) Successful young firms often have high initial earnings growth rates.

D) According to the constant dividend growth model, the value of the firm depends on the current dividend level, divided by the equity cost of capital plus the growth rate.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

27

You expect that KT Industries (KTI)will have earnings per share of $3 this year and that they will pay out $1.50 of these earnings to shareholders in the form of a dividend.KTI's return on new investments is 15% and their equity cost of capital is 12%.The expected growth rate for KTI's dividends is closest to:

A) 6.0%

B) 7.5%

C) 4.5%

D) 3.0%

A) 6.0%

B) 7.5%

C) 4.5%

D) 3.0%

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

28

Suppose you plan to hold Von Bora stock for only one year.Calculate your total return from holding Von Bora stock for the first year.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

29

Monsters Inc.is a utility company that recently paid a common stock dividend of $2.35 per share.Determine the current price of a share of Monsters' common stock if its divided growth rate is expected to remain at 7 percent per year indefinitely and its equity cost of capital is 12 percent.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

30

NoGrowth Industries presently pays an annual dividend of $1.50 per share and it is expected that these dividend payments will continue indefinitely.If NoGrowth's equity cost of capital is 12%,then the value of a share of NoGrowth's stock is closest to:

A) $10.00

B) $15.00

C) $14.00

D) $12.50

A) $10.00

B) $15.00

C) $14.00

D) $12.50

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

31

You expect that Bean Enterprises will have earnings per share of $2 for the coming year.Bean plans to retain all of its earnings for the next three years.For the subsequent two years,the firm plans on retaining 50% of its earnings.It will then retain only 25% of its earnings from that point forward.Retained earnings will be invested in projects with an expected return of 20% per year.If Bean's equity cost of capital is 12%,then the price of a share of Bean's stock is closest to:

A) $17.00

B) $10.75

C) $27.75

D) $43.50

A) $17.00

B) $10.75

C) $27.75

D) $43.50

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

32

The Sisyphean Company's common stock is currently trading for $25.00 per share.The stock is expected to pay a $2.50 dividend at the end of the year and the Sisyphean Company's equity cost of capital is 14%.If the dividend payout rate is expected to remain constant,then the expected growth rate in the Sisyphean Company's earnings is closest to:

A) 8%

B) 6%

C) 4%

D) 2%

A) 8%

B) 6%

C) 4%

D) 2%

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following statements is false?

A) A common approximation is to assume that in the long run, dividends will grow at a constant rate.

B) The dividend each year is the firm's earnings per share (EPS) multiplied by its dividend payout rate.

C) There is a tremendous amount of uncertainty associated with any forecast of a firm's future dividends.

D) During periods of high growth, it is not unusual for firms to pay out 100% of their earnings to shareholders in the form of dividends.

A) A common approximation is to assume that in the long run, dividends will grow at a constant rate.

B) The dividend each year is the firm's earnings per share (EPS) multiplied by its dividend payout rate.

C) There is a tremendous amount of uncertainty associated with any forecast of a firm's future dividends.

D) During periods of high growth, it is not unusual for firms to pay out 100% of their earnings to shareholders in the form of dividends.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

34

Luther Industries has a dividend yield of 4.5% and a cost of equity capital of 12%.Luther Industries' dividends are expected to grow at a constant rate indefinitely.The grow rate of Luther's dividends are closest to:

A) 7.5%

B) 5.5%

C) 16.5%

D) 12%

A) 7.5%

B) 5.5%

C) 16.5%

D) 12%

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

35

You expect KT industries (KTI)will have earnings per share of $3 this year and expect that they will pay out $1.50 of these earnings to shareholders in the form of a dividend.KTI's return on new investments is 15% and their equity cost of capital is 12%.The value of a share of KTI's stock is closest to:

A) $39.25

B) $20.00

C) $33.35

D) $12.50

A) $39.25

B) $20.00

C) $33.35

D) $12.50

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

36

JRN Enterprises just announced that it plans to cut its dividend from $2.50 to $1.50 per share and use the extra funds to expand its operations.Prior to this announcement,JRN's dividends were expected to grow at 4% per year and JRN's stock was trading at $25.00 per share.With the new expansion,JRN's dividends are expected to grow at 8% per year indefinitely.Assuming that JRN's risk is unchanged by the expansion,the value of a share of JRN after the announcement is closest to:

A) $25.00

B) $15.00

C) $31.25

D) $27.50

A) $25.00

B) $15.00

C) $31.25

D) $27.50

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements is false?

A) As firms mature, their earnings exceed their investment needs and they begin to pay dividends.

B) Total return equals earnings multiplied by the dividend payout rate.

C) Cutting the firm's dividend to increase investment will raise the stock price if, and only if, the new investments have a positive NPV.

D) We cannot use the constant dividend growth model to value the stock of a firm with rapid or changing growth.

A) As firms mature, their earnings exceed their investment needs and they begin to pay dividends.

B) Total return equals earnings multiplied by the dividend payout rate.

C) Cutting the firm's dividend to increase investment will raise the stock price if, and only if, the new investments have a positive NPV.

D) We cannot use the constant dividend growth model to value the stock of a firm with rapid or changing growth.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following statements is false?

A) We cannot use the general dividend discount model to value the stock of a firm with rapid or changing growth.

B) As firms mature, their growth slows to rates more typical of established companies.

C) The dividend discount model values the stock based on a forecast of the future dividends paid to shareholders.

D) The simplest forecast for the firm's future dividends states that they will grow at a constant rate, g, forever.

A) We cannot use the general dividend discount model to value the stock of a firm with rapid or changing growth.

B) As firms mature, their growth slows to rates more typical of established companies.

C) The dividend discount model values the stock based on a forecast of the future dividends paid to shareholders.

D) The simplest forecast for the firm's future dividends states that they will grow at a constant rate, g, forever.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

39

In general,one of the reasons that the constant dividend growth model should not be used for young firms is

A) because young firms have no profits.

B) because young firms have zero growth.

C) because young firms' growth rates are unstable.

D) because young firms grow too fast.

A) because young firms have no profits.

B) because young firms have zero growth.

C) because young firms' growth rates are unstable.

D) because young firms grow too fast.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

40

Von Bora Corporation (VBC)is expected to pay a $2.00 dividend at the end of this year.If you expect VBC's dividend to grow by 5% per year forever and VBC's equity cost of capital is 13%,then the value of a share of VBC stock is closest to:

A) $25.00

B) $40.00

C) $15.40

D) $11.10

A) $25.00

B) $40.00

C) $15.40

D) $11.10

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

41

If you want to value a firm but don't want to explicitly forecast its dividends,share repurchases,or its use of debt,what is the simplest model for you to use?

A) Discounted free cash flow model

B) Dividend discount model

C) Enterprise value model

D) Total payout model

A) Discounted free cash flow model

B) Dividend discount model

C) Enterprise value model

D) Total payout model

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following statements is false?

A) The total payout model allows us to ignore the firm's choice between dividends and share repurchases.

B) By repurchasing shares, the firm increases its share count, which decreases its earnings and dividends on a per-share basis.

C) The total payout model discounts the total payouts that the firm makes to shareholders, which is the total amount spent on both dividends and share repurchases.

D) In the dividend discount model we implicitly assume that any cash paid out to the shareholders takes the form of a dividend.

A) The total payout model allows us to ignore the firm's choice between dividends and share repurchases.

B) By repurchasing shares, the firm increases its share count, which decreases its earnings and dividends on a per-share basis.

C) The total payout model discounts the total payouts that the firm makes to shareholders, which is the total amount spent on both dividends and share repurchases.

D) In the dividend discount model we implicitly assume that any cash paid out to the shareholders takes the form of a dividend.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

43

The firm's weighted average capital cost (WACC)is mainly used in

A) the zero dividend growth model.

B) the constant dividend growth model.

C) the discounted free cash flow model.

D) the total payout model.

A) the zero dividend growth model.

B) the constant dividend growth model.

C) the discounted free cash flow model.

D) the total payout model.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following equations correctly defines Free Cash Flow?

A) EBIT × (1-tax rate) + CCA - Net Investment- Change in Working Capital

B) (Gross Profit - Depreciation) × (1-tax rate) - Net Investment - Change in Working Capital

C) (Gross Profit - Capital Cost Allowance) - Net Investment - Change in Working Capital

D) (Gross Profit - Depreciation) - Net Investment - Change in Working Capital

A) EBIT × (1-tax rate) + CCA - Net Investment- Change in Working Capital

B) (Gross Profit - Depreciation) × (1-tax rate) - Net Investment - Change in Working Capital

C) (Gross Profit - Capital Cost Allowance) - Net Investment - Change in Working Capital

D) (Gross Profit - Depreciation) - Net Investment - Change in Working Capital

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

45

In the discounted free cash flow model,we assume that

A) we are focusing on the present value of all operating cash flows.

B) we are focusing on the present value of all investing cash flows.

C) we are focusing on the present value of all financing cash flows.

D) we are focusing on the present value of all cash flows before any payments to debt or equity holders.

A) we are focusing on the present value of all operating cash flows.

B) we are focusing on the present value of all investing cash flows.

C) we are focusing on the present value of all financing cash flows.

D) we are focusing on the present value of all cash flows before any payments to debt or equity holders.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following statements is false?

A) The more cash the firm uses to repurchase shares, the less it has available to pay dividends.

B) Free cash flow measures the cash generated by the firm after payments to debt or equity holders are considered.

C) We estimate a firm's current enterprise value by computing the present value of the firm's free cash flow.

D) We can interpret the enterprise value as the net cost of acquiring the firm's equity, taking its cash and paying off all debts.

A) The more cash the firm uses to repurchase shares, the less it has available to pay dividends.

B) Free cash flow measures the cash generated by the firm after payments to debt or equity holders are considered.

C) We estimate a firm's current enterprise value by computing the present value of the firm's free cash flow.

D) We can interpret the enterprise value as the net cost of acquiring the firm's equity, taking its cash and paying off all debts.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

47

The Rufus Corporation has 125 million shares outstanding and analysts expect Rufus to have earnings of $500 million this year.Rufus plans to pay out 40% of its earnings in dividends and they expect to use another 20% of their earnings to repurchase shares.If Rufus' equity cost of capital is 15% and Rufus' earnings are expected to grow at a rate of 3% per year,then the value of a share of Rufus' stock is closest to:

A) $13.35

B) $33.50

C) $20.00

D) $16.00

A) $13.35

B) $33.50

C) $20.00

D) $16.00

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following statements is false?

A) To estimate a firm's enterprise value, we compute the present value of the free cash flows (FCF) that the firm has available to pay equity holders.

B) The NPV of any individual project represents its contribution to the firm's enterprise value.

C) When using the total payout model, we discount total dividends and share repurchases, and use the growth rate in earnings when forecasting the growth of the firm's payout.

D) In the total payout model, we first value the firm's equity, rather than just a single share.

A) To estimate a firm's enterprise value, we compute the present value of the free cash flows (FCF) that the firm has available to pay equity holders.

B) The NPV of any individual project represents its contribution to the firm's enterprise value.

C) When using the total payout model, we discount total dividends and share repurchases, and use the growth rate in earnings when forecasting the growth of the firm's payout.

D) In the total payout model, we first value the firm's equity, rather than just a single share.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

49

Use the information for the question(s) below.

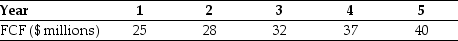

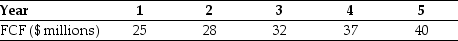

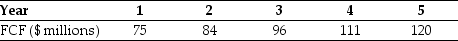

You expect CCM Corporation to generate the following free cash flows over the next five years:

Following year five, you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

Following year five, you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

The enterprise value of CCM corporation is closest to:

A) $396 million

B) $290 million

C) $382 million

D) $350 million

You expect CCM Corporation to generate the following free cash flows over the next five years:

Following year five, you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

Following year five, you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.The enterprise value of CCM corporation is closest to:

A) $396 million

B) $290 million

C) $382 million

D) $350 million

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following statements is false?

A) In a share repurchase, the firm uses excess cash to buy back its own stock.

B) The discounted free cash flow model begins by determining the value of the firm's equity.

C) The discounted free cash flow model focuses on the cash flows to all of the firm's investors, both debt and equity holders, and allows us to avoid estimating the impact of the firm's borrowing decisions on earnings.

D) In recent years an increasing number of firms have replaced dividend payouts with share repurchases.

A) In a share repurchase, the firm uses excess cash to buy back its own stock.

B) The discounted free cash flow model begins by determining the value of the firm's equity.

C) The discounted free cash flow model focuses on the cash flows to all of the firm's investors, both debt and equity holders, and allows us to avoid estimating the impact of the firm's borrowing decisions on earnings.

D) In recent years an increasing number of firms have replaced dividend payouts with share repurchases.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following statements is false?

A) The firm's weighted average cost of capital (WACC) denoted rwacc is the cost of capital that reflects the risk of the overall business, which is the combined risk of the firm's equity and debt.

B) Intuitively, the difference between the discounted free cash flow model and the dividend-discount model is that in the divided-discount model the firm's cash and debt are included indirectly through the effect of interest income and expenses on earnings.

C) We interpret rwacc as the expected return the firm must pay to investors to compensate them for the risk of holding the firm's debt and equity together.

D) When using the discounted free cash flow model we should use the firm's equity cost of capital.

A) The firm's weighted average cost of capital (WACC) denoted rwacc is the cost of capital that reflects the risk of the overall business, which is the combined risk of the firm's equity and debt.

B) Intuitively, the difference between the discounted free cash flow model and the dividend-discount model is that in the divided-discount model the firm's cash and debt are included indirectly through the effect of interest income and expenses on earnings.

C) We interpret rwacc as the expected return the firm must pay to investors to compensate them for the risk of holding the firm's debt and equity together.

D) When using the discounted free cash flow model we should use the firm's equity cost of capital.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

52

MJ LTD is expected to grow at various rates over the next five years.The company just paid a $1.00 dividend.The company expects to grow at 20% for the next two years (affecting D1 and D2),then the company expects to grow at 10% for three additional years (D3,D4,D5)after which the company expects to grow at a constant rate of 5% per year indefinitely.If the required rate of return on MJ's common stock is 12%,then what is a share of MJ's stock worth?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

53

Growing Real Fast Company (GRF)is expected to have a 25 percent growth rate for the next four years (affecting D1,D2,D3,and D4).Beginning in year five,the growth rate is expected to drop to 7 percent per year and last indefinitely.If GRF just paid a $2.00 dividend and the appropriate discount rate is 15 percent,then what is the value of a share of GRF?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

54

The firm's weighted average capital cost is the cost of capital that reflects

A) the combined risk of the firm's equity and debt.

B) the combined risk of the firm's capital assets and current assets.

C) the combined risk of the firm's current assets and current liabilities.

D) the combined risk of the firm's fixed cost and variable cost.

A) the combined risk of the firm's equity and debt.

B) the combined risk of the firm's capital assets and current assets.

C) the combined risk of the firm's current assets and current liabilities.

D) the combined risk of the firm's fixed cost and variable cost.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

55

Use the information for the question(s) below.

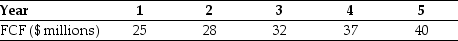

You expect CCM Corporation to generate the following free cash flows over the next five years:

Following year five, you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

Following year five, you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

If CCM has $150 million of debt and 12 million shares of stock outstanding,then the share price for CCM is closest to:

A) $49.50

B) $11.25

C) $20.50

D) $22.75

You expect CCM Corporation to generate the following free cash flows over the next five years:

Following year five, you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

Following year five, you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.If CCM has $150 million of debt and 12 million shares of stock outstanding,then the share price for CCM is closest to:

A) $49.50

B) $11.25

C) $20.50

D) $22.75

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following statements is false?

A) The long-run growth rate gFCF is typically based on the expected long-run growth rate of the firm's revenues.

B) Because the firm's free cash flow is equal to the sum of the free cash flows from the firm's current and future investments, we can interpret the firm's enterprise value as the total NPV that the firm will earn from continuing its existing projects and initiating new ones.

C) If the firm has no debt then rwacc = the risk-free rate of return.

D) When using the discounted free cash flow model, we forecast the firm's free cash flow up to some horizon, together with some terminal (continuation) value of the enterprise.

A) The long-run growth rate gFCF is typically based on the expected long-run growth rate of the firm's revenues.

B) Because the firm's free cash flow is equal to the sum of the free cash flows from the firm's current and future investments, we can interpret the firm's enterprise value as the total NPV that the firm will earn from continuing its existing projects and initiating new ones.

C) If the firm has no debt then rwacc = the risk-free rate of return.

D) When using the discounted free cash flow model, we forecast the firm's free cash flow up to some horizon, together with some terminal (continuation) value of the enterprise.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

57

Use the information for the question(s) below.

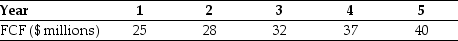

You expect CCM Corporation to generate the following free cash flows over the next five years:

Following year five, you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

Following year five, you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

If CCM has $200 million of debt and 8 million shares of stock outstanding,then the share price for CCM is closest to:

A) $49.50

B) $12.50

C) $19.35

D) $24.50

You expect CCM Corporation to generate the following free cash flows over the next five years:

Following year five, you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

Following year five, you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.If CCM has $200 million of debt and 8 million shares of stock outstanding,then the share price for CCM is closest to:

A) $49.50

B) $12.50

C) $19.35

D) $24.50

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

58

If you want to value a firm that consistently pays out its earnings as dividends,the simplest model for you to use is the

A) enterprise value model.

B) total payout model.

C) dividend discount model.

D) discounted free cash flow model.

A) enterprise value model.

B) total payout model.

C) dividend discount model.

D) discounted free cash flow model.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

59

If you want to value a firm that has consistent earnings growth,but varies how it pays out these earnings to shareholders between dividends and repurchases,the simplest model for you to use is the

A) enterprise value model.

B) dividend discount model.

C) total payout model.

D) discounted free cash flow model.

A) enterprise value model.

B) dividend discount model.

C) total payout model.

D) discounted free cash flow model.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following equations is incorrect?

A) P0 =

B) V0 = +

+

+ ... +

+ ... +

+

+

C) Free Cash Flow = EBIT × (1 - τc) + Depreciation - Capital Expenditures - NWC

D) Enterprise Value = Market Value of Equity + Debt - Cash

A) P0 =

B) V0 =

+

+ + ... +

+ ... + +

+

C) Free Cash Flow = EBIT × (1 - τc) + Depreciation - Capital Expenditures - NWC

D) Enterprise Value = Market Value of Equity + Debt - Cash

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

61

If DM has $500 million of debt and 14 million shares of stock outstanding,then what is the price per share for DM Corporation?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following statements is false?

A) The most common valuation multiple is the price-earnings (P/E) ratio.

B) You should be willing to pay proportionally more for a stock with lower current earnings.

C) A firm's P/E ratio is equal to the share price divided by its earnings per share.

D) The intuition behind the use of the P/E ratio is that when you buy a stock, you are in a sense buying the rights to the firm's future earnings and differences in the scale of firms' earnings are likely to persist.

A) The most common valuation multiple is the price-earnings (P/E) ratio.

B) You should be willing to pay proportionally more for a stock with lower current earnings.

C) A firm's P/E ratio is equal to the share price divided by its earnings per share.

D) The intuition behind the use of the P/E ratio is that when you buy a stock, you are in a sense buying the rights to the firm's future earnings and differences in the scale of firms' earnings are likely to persist.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

63

The trailing price-earning ratio is based on

A) the earnings over the previous 12 months and current share price.

B) the estimated earnings over the next 12 months and current share price.

C) the earnings over the previous 12 months and the average share price of the past 12 months.

D) the estimated earnings over the next 12 months and the average share price of the past 12 months.

A) the earnings over the previous 12 months and current share price.

B) the estimated earnings over the next 12 months and current share price.

C) the earnings over the previous 12 months and the average share price of the past 12 months.

D) the estimated earnings over the next 12 months and the average share price of the past 12 months.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

64

You expect Whirlpool Corporation (WHR)to have earnings per share of $6.10 over the coming year.If Whirlpool stock is currently trading at $87.00 per share,then Whirlpool's P/E ratio is closest to:

A) 17.00

B) 13.50

C) 14.25

D) 7.00

A) 17.00

B) 13.50

C) 14.25

D) 7.00

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following statements is false?

A) The fact that a firm has an exceptional management team, has developed an efficient manufacturing process, or has just secured a patent on a new technology is ignored when we apply a valuation multiple.

B) Valuation multiples have the advantage that they allow us to incorporate specific information about the firm's cost of capital or future growth.

C) For firms with substantial tangible assets, the ratio of price to book value of equity per share is sometimes used.

D) Using multiples will not help us determine if an entire industry is overvalued.

A) The fact that a firm has an exceptional management team, has developed an efficient manufacturing process, or has just secured a patent on a new technology is ignored when we apply a valuation multiple.

B) Valuation multiples have the advantage that they allow us to incorporate specific information about the firm's cost of capital or future growth.

C) For firms with substantial tangible assets, the ratio of price to book value of equity per share is sometimes used.

D) Using multiples will not help us determine if an entire industry is overvalued.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following formulas is incorrect?

A) Forward =

=

B) Forward =

=

C) =

=

D) Forward =

=

A) Forward

=

=

B) Forward

=

=

C)

=

=

D) Forward

=

=

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following statements is false?

A) Two firms in the same industry selling the same types of products, while similar in many respects, are likely to be of different size or scale.

B) In the method of comparables we estimate the value of the firm based on the value of other, comparable firms or investments that we expect will generate very similar cash flows in the future.

C) Consider the case of a new firm that is identical to an existing publicly traded company. If these firms will generate identical cash flows, the Law of One Price implies that we can use the value of the existing company to determine the value of the new firm.

D) A valuation multiple is a ratio of some measure of the firm's scale to the value of the firm.

A) Two firms in the same industry selling the same types of products, while similar in many respects, are likely to be of different size or scale.

B) In the method of comparables we estimate the value of the firm based on the value of other, comparable firms or investments that we expect will generate very similar cash flows in the future.

C) Consider the case of a new firm that is identical to an existing publicly traded company. If these firms will generate identical cash flows, the Law of One Price implies that we can use the value of the existing company to determine the value of the new firm.

D) A valuation multiple is a ratio of some measure of the firm's scale to the value of the firm.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

68

You expect Whirlpool Corporation (WHR)to have earnings per share of $6.10 over the coming year.If the average P/E ratio for the appliance industry sector is 17.0,then the value of a share of Whirlpool stock based upon the comparables approach is closest to:

A) $103.75

B) $27.90

C) $35.90

D) $23.10

A) $103.75

B) $27.90

C) $35.90

D) $23.10

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

69

Use the information for the question(s) below.

Suppose that Texas Trucking (TT) has earnings per share of $3.45 and EBITDA of $45 million. TT also has 5 million shares outstanding and debt of $150 million (net of cash). You believe that Oklahoma Logistics and Transport (OLT) is comparable to TT in terms of its underlying business, but OLT has no debt. OLT has a P/E of 12.5 and an enterprise value to EBITDA multiple of 7.

Based upon the enterprise value to EBITDA ratio,the value of a share of Texas Trucking is closest to:

A) $33.00

B) $82.50

C) $43.10

D) $21.25

Suppose that Texas Trucking (TT) has earnings per share of $3.45 and EBITDA of $45 million. TT also has 5 million shares outstanding and debt of $150 million (net of cash). You believe that Oklahoma Logistics and Transport (OLT) is comparable to TT in terms of its underlying business, but OLT has no debt. OLT has a P/E of 12.5 and an enterprise value to EBITDA multiple of 7.

Based upon the enterprise value to EBITDA ratio,the value of a share of Texas Trucking is closest to:

A) $33.00

B) $82.50

C) $43.10

D) $21.25

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

70

Use the information for the question(s) below.

Defenestration Industries plans to pay a $4.00 dividend this year and you expect that the firm's earnings are on track to grow at 5% per year for the foreseeable future. Defenestration's equity cost of capital is 13%.

Suppose that Defenestration decides to pay a dividend of only $2 per share this year and use the remaining $2 per share to repurchase stock.If Defenestration maintains this dividend and total payout rate,then the rate at which Defenestration's dividends and earnings per share are expected to grow is closest to:

A) 7%

B) 13%

C) 9%

D) 5%

Defenestration Industries plans to pay a $4.00 dividend this year and you expect that the firm's earnings are on track to grow at 5% per year for the foreseeable future. Defenestration's equity cost of capital is 13%.

Suppose that Defenestration decides to pay a dividend of only $2 per share this year and use the remaining $2 per share to repurchase stock.If Defenestration maintains this dividend and total payout rate,then the rate at which Defenestration's dividends and earnings per share are expected to grow is closest to:

A) 7%

B) 13%

C) 9%

D) 5%

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

71

Use the information for the question(s) below.

Defenestration Industries plans to pay a $4.00 dividend this year and you expect that the firm's earnings are on track to grow at 5% per year for the foreseeable future. Defenestration's equity cost of capital is 13%.

Assuming that Defenestration's dividend payout rate and expected growth rate remain constant,and Defenestration does not issue or repurchase shares,then Defenestration's stock price is closest to:

A) $50.00

B) $32.30

C) $22.25

D) $30.75

Defenestration Industries plans to pay a $4.00 dividend this year and you expect that the firm's earnings are on track to grow at 5% per year for the foreseeable future. Defenestration's equity cost of capital is 13%.

Assuming that Defenestration's dividend payout rate and expected growth rate remain constant,and Defenestration does not issue or repurchase shares,then Defenestration's stock price is closest to:

A) $50.00

B) $32.30

C) $22.25

D) $30.75

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following statements is false?

A) Because the enterprise value represents the entire value of the firm before the firm pays its debt, to form an appropriate multiple, we divide it by a measure of earnings or cash flows after interest payments are made.

B) We can compute a firm's P/E ratio by using either trailing earnings or forward earnings with the resulting ratio called the trailing P/E or forward P/E.

C) It is common practice to use valuation multiples based on the firm's enterprise value.

D) Using a valuation multiple based on comparables is best viewed as a "shortcut" to the discounted cash flow method of valuation.

A) Because the enterprise value represents the entire value of the firm before the firm pays its debt, to form an appropriate multiple, we divide it by a measure of earnings or cash flows after interest payments are made.

B) We can compute a firm's P/E ratio by using either trailing earnings or forward earnings with the resulting ratio called the trailing P/E or forward P/E.

C) It is common practice to use valuation multiples based on the firm's enterprise value.

D) Using a valuation multiple based on comparables is best viewed as a "shortcut" to the discounted cash flow method of valuation.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

73

Use the information for the question(s) below.

Defenestration Industries plans to pay a $4.00 dividend this year and you expect that the firm's earnings are on track to grow at 5% per year for the foreseeable future. Defenestration's equity cost of capital is 13%.

Suppose that Defenestration decides to pay a dividend of only $2 per share this year and use the remaining $2 per share to repurchase stock.If Defenestration's payout rate remains constant,then Defenestration's stock price is closest to:

A) $50.00

B) $22.25

C) $32.30

D) $30.75

Defenestration Industries plans to pay a $4.00 dividend this year and you expect that the firm's earnings are on track to grow at 5% per year for the foreseeable future. Defenestration's equity cost of capital is 13%.

Suppose that Defenestration decides to pay a dividend of only $2 per share this year and use the remaining $2 per share to repurchase stock.If Defenestration's payout rate remains constant,then Defenestration's stock price is closest to:

A) $50.00

B) $22.25

C) $32.30

D) $30.75

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

74

Use the information for the question(s) below.

Suppose that Texas Trucking (TT) has earnings per share of $3.45 and EBITDA of $45 million. TT also has 5 million shares outstanding and debt of $150 million (net of cash). You believe that Oklahoma Logistics and Transport (OLT) is comparable to TT in terms of its underlying business, but OLT has no debt. OLT has a P/E of 12.5 and an enterprise value to EBITDA multiple of 7.

Based upon the price earnings multiple,the value of a share of Texas Trucking is closest to:

A) $49.30

B) $43.10

C) $24.15

D) $27.60

Suppose that Texas Trucking (TT) has earnings per share of $3.45 and EBITDA of $45 million. TT also has 5 million shares outstanding and debt of $150 million (net of cash). You believe that Oklahoma Logistics and Transport (OLT) is comparable to TT in terms of its underlying business, but OLT has no debt. OLT has a P/E of 12.5 and an enterprise value to EBITDA multiple of 7.

Based upon the price earnings multiple,the value of a share of Texas Trucking is closest to:

A) $49.30

B) $43.10

C) $24.15

D) $27.60

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following statements is false?

A) Because capital expenditures can vary substantially from period to period, most practitioners rely on enterprise value to free cash flow multiples.

B) Common multiples to consider are enterprise value to EBIT, EBITDA, and free cash flow.

C) If two stocks have the same payout and EPS growth rates as well as equivalent risk, then they should have the same P/E ratio.

D) Looking at enterprise value as a multiple of sales can be useful if it is reasonable to assume that the firms will maintain similar margins in the future.

A) Because capital expenditures can vary substantially from period to period, most practitioners rely on enterprise value to free cash flow multiples.

B) Common multiples to consider are enterprise value to EBIT, EBITDA, and free cash flow.

C) If two stocks have the same payout and EPS growth rates as well as equivalent risk, then they should have the same P/E ratio.

D) Looking at enterprise value as a multiple of sales can be useful if it is reasonable to assume that the firms will maintain similar margins in the future.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

76

The forward price-earning ratio is based on

A) the expected earnings over the coming 12 months and predicted share price in the next 12 months.

B) the earnings in the previous 12 months and predicted share price in the next 12 months.

C) the expected earnings over the coming 12 months and current share price.

D) the previous earnings in the past 12 months and the current share price.

A) the expected earnings over the coming 12 months and predicted share price in the next 12 months.

B) the earnings in the previous 12 months and predicted share price in the next 12 months.

C) the expected earnings over the coming 12 months and current share price.

D) the previous earnings in the past 12 months and the current share price.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

77

What are some common multiples used to value stocks?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

78

What are some implicit assumptions that are made when valuing a firm using multiples based on comparable firms?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

79

Use the information for the question(s) below.

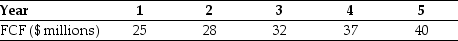

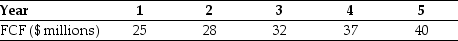

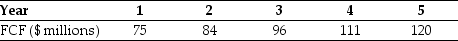

You expect DM Corporation to generate the following free cash flows over the next five years:

Beginning with year six, you estimate that DM's free cash flows will grow at 6% per year and that DM's weighted average cost of capital is 15%.

Beginning with year six, you estimate that DM's free cash flows will grow at 6% per year and that DM's weighted average cost of capital is 15%.

Calculate the enterprise value for DM Corporation.

You expect DM Corporation to generate the following free cash flows over the next five years:

Beginning with year six, you estimate that DM's free cash flows will grow at 6% per year and that DM's weighted average cost of capital is 15%.

Beginning with year six, you estimate that DM's free cash flows will grow at 6% per year and that DM's weighted average cost of capital is 15%.Calculate the enterprise value for DM Corporation.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following statements is false?

A) We can estimate the value of a firm's shares by multiplying its current earnings per share by the average P/E ratio of comparable firms.

B) For valuation purposes, the trailing P/E ratio is generally preferred, since it is based on actual, not expected, earnings.

C) Forward earnings are the expected earnings over the coming 12 months.

D) Trailing earnings are the earnings over the previous 12 months.

A) We can estimate the value of a firm's shares by multiplying its current earnings per share by the average P/E ratio of comparable firms.

B) For valuation purposes, the trailing P/E ratio is generally preferred, since it is based on actual, not expected, earnings.

C) Forward earnings are the expected earnings over the coming 12 months.

D) Trailing earnings are the earnings over the previous 12 months.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck