Deck 16: Real Options

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/57

Play

Full screen (f)

Deck 16: Real Options

1

Which of the following statements is false?

A) If there is a lot of uncertainty, the benefit of waiting is diminished.

B) In the real option context, the dividends correspond to any value from the investment that we give up by waiting.

C) By delaying an investment, we can base our decision on additional information.

D) Given the option to wait, an investment that currently has a negative-NPV can have a positive value.

A) If there is a lot of uncertainty, the benefit of waiting is diminished.

B) In the real option context, the dividends correspond to any value from the investment that we give up by waiting.

C) By delaying an investment, we can base our decision on additional information.

D) Given the option to wait, an investment that currently has a negative-NPV can have a positive value.

If there is a lot of uncertainty, the benefit of waiting is diminished.

2

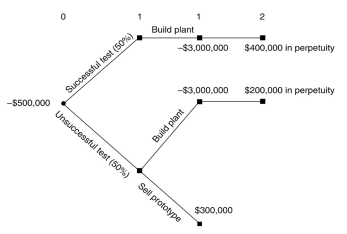

Assuming that Kinston has the ability to sell the prototype in year one for $300,000,draw a decision tree detailing the Kinston Industries Mountain Bike Project.

3

One of the major differences between decision trees and binomial trees is that in binomial trees ________.

A) the certainty is not under the control of the decision maker

B) the uncertainty is under the control of the decision maker

C) the uncertainty is not under the control of the decision maker

D) the certainty is under the control of the decision maker

A) the certainty is not under the control of the decision maker

B) the uncertainty is under the control of the decision maker

C) the uncertainty is not under the control of the decision maker

D) the certainty is under the control of the decision maker

the uncertainty is not under the control of the decision maker

4

Assume that Kinston has the ability to ignore the pilot production and test marketing and to go ahead and build their manufacturing plant immediately.Further assume that the probability of high or low demand is still 50%.Draw a decision tree that details Kinston Industries Mountain Bike Project if Kinston goes ahead and builds the plant immediately.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

5

List three kinds of real options that are most frequently encountered in practice.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

6

Use the information for the question(s) below.

Kinston Industries has come up with a new mountain bike prototype and is ready to go ahead with pilot production and test marketing. The pilot production and test marketing phase will last for one year and will cost $500,000. The management team believes that there is a 50% chance that the test marketing will be successful and that there will be sufficient demand for the new mountain bike. If the test-marketing phase is successful, then Kinston Industries will invest $3 million in year one to build a plant that will generate expected annual after-tax cash flows of $400,000 in perpetuity beginning in year two. If the test marketing is not successful, Kinston can still go ahead and build the new plant, but the expected annual after-tax cash flows would be only $200,000 in perpetuity beginning in year two. Kinston has the option to stop the project at any time and sell the prototype mountain bike to an overseas competitor for $300,000. Kinston's cost of capital is 10%.

Assuming that Kinston has the ability to sell the prototype in year one for $300,000,the NPV of the Kinston Industries Mountain Bike Project is closest to:

A) $90,000

B) $590,000

C) $455,000

D) -$45,000

Kinston Industries has come up with a new mountain bike prototype and is ready to go ahead with pilot production and test marketing. The pilot production and test marketing phase will last for one year and will cost $500,000. The management team believes that there is a 50% chance that the test marketing will be successful and that there will be sufficient demand for the new mountain bike. If the test-marketing phase is successful, then Kinston Industries will invest $3 million in year one to build a plant that will generate expected annual after-tax cash flows of $400,000 in perpetuity beginning in year two. If the test marketing is not successful, Kinston can still go ahead and build the new plant, but the expected annual after-tax cash flows would be only $200,000 in perpetuity beginning in year two. Kinston has the option to stop the project at any time and sell the prototype mountain bike to an overseas competitor for $300,000. Kinston's cost of capital is 10%.

Assuming that Kinston has the ability to sell the prototype in year one for $300,000,the NPV of the Kinston Industries Mountain Bike Project is closest to:

A) $90,000

B) $590,000

C) $455,000

D) -$45,000

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

7

In addition to the value of the current NPV of the investment,what other two factors affect the value of an investment and the decision to wait?

A) Financing sources and capital decision procedures

B) Uncertainty and future cash inflows

C) Financing sources and risks

D) Uncertainty and the capital budgeting process

A) Financing sources and capital decision procedures

B) Uncertainty and future cash inflows

C) Financing sources and risks

D) Uncertainty and the capital budgeting process

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

8

Luther Industries is considering launching a new toy just in time for the Christmas season.They estimate that if Luther launches the new toy this year it will have an NPV of $25 million.Luther has the option to wait one year until the next Christmas season to launch the toy,however,the demand next year will depend upon what new toys Luther's competitors introduce and therefore there is greater uncertainty about next year's demand.Launching the new toy today will involve a total capital expenditure of $100 million.If the risk-free rate is 5%,N(d1)is .62 and N(d2)is .65,then what is the value of the option to wait until next year to launch the new toy?

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

9

Assuming that Kinston does not have the ability to sell the prototype in year one for $300,000,the NPV of the Kinston Industries Mountain Bike Project is closest to:

A) -$45,000

B) $455,000

C) $590,000

D) $90,000

A) -$45,000

B) $455,000

C) $590,000

D) $90,000

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following statements is false?

A) One way to understand why you would sometimes choose not to invest in a positive-NPV project is to think about the decision of when to invest as a choice between two mutually exclusive projects: (1) invest today or (2) wait.

B) You invest today only when the NPV of investing today exceeds the value of the option of waiting, which from option pricing theory we know to be always positive.

C) When you do not have the option to wait, it is optimal to invest in any positive-NPV project.

D) When you have the option of deciding when to invest, it is usually optimal to invest only when the NPV is positive but close to zero.

A) One way to understand why you would sometimes choose not to invest in a positive-NPV project is to think about the decision of when to invest as a choice between two mutually exclusive projects: (1) invest today or (2) wait.

B) You invest today only when the NPV of investing today exceeds the value of the option of waiting, which from option pricing theory we know to be always positive.

C) When you do not have the option to wait, it is optimal to invest in any positive-NPV project.

D) When you have the option of deciding when to invest, it is usually optimal to invest only when the NPV is positive but close to zero.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

11

Assume that Kinston has the ability to ignore the pilot production and test marketing and to go ahead and build their manufacturing plant immediately and that the probability of high or low demand would still be 50%.What is the value of the the option to do pilot production and test marketing?

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

12

One of the major differences between a real option and a financial option is that

A) a real option is not traded in competitive markets.

B) a real option is traded in competitive markets.

C) a real option is less risky than a financial option.

D) a real option has more risk than a financial option.

A) a real option is not traded in competitive markets.

B) a real option is traded in competitive markets.

C) a real option is less risky than a financial option.

D) a real option has more risk than a financial option.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following statements is false?

A) Aside from the current NPV of the investment, other factors affect the value of an investment and the decision to wait.

B) The option to wait is most valuable when there is a great deal of uncertainty regarding what the value of the investment will be in the future.

C) The smaller the cost of waiting, the less attractive the option to delay becomes.

D) It is always better to wait to invest unless there is a cost to doing so.

A) Aside from the current NPV of the investment, other factors affect the value of an investment and the decision to wait.

B) The option to wait is most valuable when there is a great deal of uncertainty regarding what the value of the investment will be in the future.

C) The smaller the cost of waiting, the less attractive the option to delay becomes.

D) It is always better to wait to invest unless there is a cost to doing so.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is NOT a real option?

A) A stock option

B) An abandonment option

C) An investment timing option

D) An expansion option

A) A stock option

B) An abandonment option

C) An investment timing option

D) An expansion option

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

15

Describe the two factors that affect the value of an investment timing option?

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

16

Assume that Kinston has the ability to ignore the pilot production and test marketing and to go ahead and build their manufacturing plant immediately.Assuming that the probability of high or low demand is still 50%,the NPV of the Kinston Industries Mountain Bike Project is closest to:

A) $0

B) $90,000

C) -$45,000

D) $1,000,000

A) $0

B) $90,000

C) -$45,000

D) $1,000,000

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

17

Use the information for the question(s) below.

Kinston Industries has come up with a new mountain bike prototype and is ready to go ahead with pilot production and test marketing. The pilot production and test marketing phase will last for one year and will cost $500,000. The management team believes that there is a 50% chance that the test marketing will be successful and that there will be sufficient demand for the new mountain bike. If the test-marketing phase is successful, then Kinston Industries will invest $3 million in year one to build a plant that will generate expected annual after-tax cash flows of $400,000 in perpetuity beginning in year two. If the test marketing is not successful, Kinston can still go ahead and build the new plant, but the expected annual after-tax cash flows would be only $200,000 in perpetuity beginning in year two. Kinston has the option to stop the project at any time and sell the prototype mountain bike to an overseas competitor for $300,000. Kinston's cost of capital is 10%.

Assuming that Kinston does not have the ability to sell the prototype in year one for $300,000,draw a decision tree detailing the Kinston Industries Mountain Bike Project.

Kinston Industries has come up with a new mountain bike prototype and is ready to go ahead with pilot production and test marketing. The pilot production and test marketing phase will last for one year and will cost $500,000. The management team believes that there is a 50% chance that the test marketing will be successful and that there will be sufficient demand for the new mountain bike. If the test-marketing phase is successful, then Kinston Industries will invest $3 million in year one to build a plant that will generate expected annual after-tax cash flows of $400,000 in perpetuity beginning in year two. If the test marketing is not successful, Kinston can still go ahead and build the new plant, but the expected annual after-tax cash flows would be only $200,000 in perpetuity beginning in year two. Kinston has the option to stop the project at any time and sell the prototype mountain bike to an overseas competitor for $300,000. Kinston's cost of capital is 10%.

Assuming that Kinston does not have the ability to sell the prototype in year one for $300,000,draw a decision tree detailing the Kinston Industries Mountain Bike Project.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following statements is false?

A) Because real options allow a decision maker to choose the most attractive alternative after new information has been learned, the presence of real options adds value to an investment opportunity.

B) To make an investment decision correctly, the value of embedded real options must be included in the decision-making process.

C) A key distinction between a real option and a financial option is that real options, and the underlying assets on which they are based, are often traded in competitive markets.

D) We can compute the value of the real option by comparing the expected profit without the real option to the value with the option.

A) Because real options allow a decision maker to choose the most attractive alternative after new information has been learned, the presence of real options adds value to an investment opportunity.

B) To make an investment decision correctly, the value of embedded real options must be included in the decision-making process.

C) A key distinction between a real option and a financial option is that real options, and the underlying assets on which they are based, are often traded in competitive markets.

D) We can compute the value of the real option by comparing the expected profit without the real option to the value with the option.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following statements is false?

A) Decision nodes are nodes in which uncertainty is involved that is out of the control of the decision maker.

B) Most investment projects allow for the possibility of reevaluating the decision to invest at a later point in time.

C) A decision tree is a graphical representation of future decisions and uncertainty resolution.

D) With binomial trees the uncertainty is not under the control of the decision maker.

A) Decision nodes are nodes in which uncertainty is involved that is out of the control of the decision maker.

B) Most investment projects allow for the possibility of reevaluating the decision to invest at a later point in time.

C) A decision tree is a graphical representation of future decisions and uncertainty resolution.

D) With binomial trees the uncertainty is not under the control of the decision maker.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

20

When you do not have the option to wait,it is optimal to invest in ________ project.When you have the option of deciding when to invest,it is usually optimal to invest only when ________.

A) any negative-NPV; the NPV is substantially greater than zero

B) any positive-NPV; the NPV is substantially smaller than one

C) any positive-NPV; the NPV is substantially greater than zero

D) any zero-NPV; the NPV is substantially greater than zero

A) any negative-NPV; the NPV is substantially greater than zero

B) any positive-NPV; the NPV is substantially smaller than one

C) any positive-NPV; the NPV is substantially greater than zero

D) any zero-NPV; the NPV is substantially greater than zero

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

21

Assume that you are not able to sell the plant,but you are able to shut down the plant at no cost at any time.Draw a decision tree detailing this problem.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

22

Use the information for the question(s) below.

You own a small manufacturing plant that currently generates revenues of $2 million per year. Next year, based upon a decision on a long-term government contract, your revenues will either increase by 20% or decrease by 25%, with equal probability, and stay at that level as long as you operate the plant. Other costs run $1.6 million dollars per year. You can sell the plant at any time to a large conglomerate for $5 million and your cost of capital is 10%.

If you are not awarded the government contract and your sales decrease by 25%,then the value of your plant will be closest to:

A) -$1 million

B) $5 million

C) $8 million

D) $0

You own a small manufacturing plant that currently generates revenues of $2 million per year. Next year, based upon a decision on a long-term government contract, your revenues will either increase by 20% or decrease by 25%, with equal probability, and stay at that level as long as you operate the plant. Other costs run $1.6 million dollars per year. You can sell the plant at any time to a large conglomerate for $5 million and your cost of capital is 10%.

If you are not awarded the government contract and your sales decrease by 25%,then the value of your plant will be closest to:

A) -$1 million

B) $5 million

C) $8 million

D) $0

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

23

Given the embedded option to sell the plant,the value of your plant will be closest to:

A) $5.0 million

B) $4.0 million

C) $6.5 million

D) $8.0 million

A) $5.0 million

B) $4.0 million

C) $6.5 million

D) $8.0 million

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

24

The value today of the investment opportunity is ________ of the expected cash flows discounted at ________.

A) the future value; the risk-free rate

B) the present value; the required rate of return

C) the future value; the nominal interest rate

D) the present value; the risk-free rate

A) the future value; the risk-free rate

B) the present value; the required rate of return

C) the future value; the nominal interest rate

D) the present value; the risk-free rate

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

25

As most homeowners know,in Canada mortgage interest rates are ________ than comparable risk-free rates like the yield on the 5-year ________.

A) higher; Canada Saving bonds

B) higher; Canadian corporate bonds

C) lower; Government of Canada bond

D) higher; Government of Canada bond

A) higher; Canada Saving bonds

B) higher; Canadian corporate bonds

C) lower; Government of Canada bond

D) higher; Government of Canada bond

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

26

Assume that you are not able to sell the plant,but you are able to shut down the plant at no cost at any time.The value of the option to abandon production will be closest to:

A) $1.0 million

B) $0.5 million

C) -$1.0 million

D) $3.0 million

A) $1.0 million

B) $0.5 million

C) -$1.0 million

D) $3.0 million

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

27

An abandonment option is the option to walk away.Abandonment options can ________ a project because a firm can drop a project if it turns out to be unsuccessful.

A) add value to

B) subtract value from

C) keep the value of

D) none of the above

A) add value to

B) subtract value from

C) keep the value of

D) none of the above

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following statements is false?

A) An alternative to using the Black-Scholes formula is to compute the value of growth options using risk-neutral probabilities.

B) Future growth options are not only important to firm value, but can also be important in the value of an individual project.

C) While the Black-Scholes formula values American options, most growth options cannot be exercised at any time.

D) Out-of-the-money calls are riskier than in-the-money calls, and because most growth options are likely to be out-of-the-money, the growth component of firm value is likely to be riskier than the ongoing assets of the firm.

A) An alternative to using the Black-Scholes formula is to compute the value of growth options using risk-neutral probabilities.

B) Future growth options are not only important to firm value, but can also be important in the value of an individual project.

C) While the Black-Scholes formula values American options, most growth options cannot be exercised at any time.

D) Out-of-the-money calls are riskier than in-the-money calls, and because most growth options are likely to be out-of-the-money, the growth component of firm value is likely to be riskier than the ongoing assets of the firm.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

29

Assume that you are not able to sell the plant,but you are able to shut down the plant at no cost at any time.Given the embedded option to abandon production the value of your plant will be closest to:

A) $8.0 million

B) $4.0 million

C) $5.0 million

D) $6.5 million

A) $8.0 million

B) $4.0 million

C) $5.0 million

D) $6.5 million

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

30

In Canada,mortgage lenders are ________ against default by government agencies such as ________.

A) insured; the Canada Mortgage and Housing Corporation

B) not insured; the Canada Mortgage and Housing Corporation

C) insured; the Canada Credit Bureau

D) insured; the Bank of Canada

A) insured; the Canada Mortgage and Housing Corporation

B) not insured; the Canada Mortgage and Housing Corporation

C) insured; the Canada Credit Bureau

D) insured; the Bank of Canada

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

31

Assuming you are able to sell the plant,draw a decision tree detailing this problem.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following statements is false?

A) Abandonment options can add value to a project because a firm can drop a project if it turns out to be unsuccessful.

B) Corporate bonds often contain embedded abandonment options; the issuing firm sometimes has the option to convert the bond - that is, to repay it.

C) An abandonment option is the option to walk away.

D) An important abandonment option that most people encounter at some point in their lives is the option to abandon their mortgage.

A) Abandonment options can add value to a project because a firm can drop a project if it turns out to be unsuccessful.

B) Corporate bonds often contain embedded abandonment options; the issuing firm sometimes has the option to convert the bond - that is, to repay it.

C) An abandonment option is the option to walk away.

D) An important abandonment option that most people encounter at some point in their lives is the option to abandon their mortgage.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

33

Because most growth options are likely to be ________,the growth component of firm value is likely to be ________ than the ongoing assets of the firm.

A) out-of-the-money; riskier

B) in-the-money; riskier

C) out-of-the-money; more certain

D) in-the-money; more certain

A) out-of-the-money; riskier

B) in-the-money; riskier

C) out-of-the-money; more certain

D) in-the-money; more certain

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

34

When a firm has a real option to invest in the future,it is known as a ________.Because these options have value,they contribute to the value of any firm that has ________ investment opportunities.

A) growth option; future possible

B) delayed option; future possible

C) abandonment option; present possible

D) financial option; present possible

A) growth option; future possible

B) delayed option; future possible

C) abandonment option; present possible

D) financial option; present possible

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

35

Assume that it will cost you $1 million to shut down the plant,but you are able to sell the plant for $5 million at any time.The value of the option to sell the plant will be closest to:

A) $3.0 million

B) $6.0 million

C) $5.0 million

D) $0.5 million

A) $3.0 million

B) $6.0 million

C) $5.0 million

D) $0.5 million

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

36

Use the information for the question(s) below.

You own a small manufacturing plant that currently generates revenues of $2 million per year. Next year, based upon a decision on a long-term government contract, your revenues will either increase by 20% or decrease by 25%, with equal probability, and stay at that level as long as you operate the plant. Other costs run $1.6 million dollars per year. You can sell the plant at any time to a large conglomerate for $5 million and your cost of capital is 10%.

If you are awarded the government contract and your sales increase by 20%,then the value of your plant will be closest to:

A) $5 million

B) $8 million

C) $0

D) $4 million

You own a small manufacturing plant that currently generates revenues of $2 million per year. Next year, based upon a decision on a long-term government contract, your revenues will either increase by 20% or decrease by 25%, with equal probability, and stay at that level as long as you operate the plant. Other costs run $1.6 million dollars per year. You can sell the plant at any time to a large conglomerate for $5 million and your cost of capital is 10%.

If you are awarded the government contract and your sales increase by 20%,then the value of your plant will be closest to:

A) $5 million

B) $8 million

C) $0

D) $4 million

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements is false?

A) Traditionally, managers have used the equivalent annual benefit method to choose between projects of different lives.

B) The equivalent annual benefit method ignores the value of any real options because it assumes that the projects will always be replaced at their original terms.

C) If the future costs (or benefits) are certain with mutually exclusive projects, then we must use a real options approach to determine the correct decision.

D) The equivalent annual benefit method accounts for the difference in project lengths by calculating the constant payment over the life of the project that is equivalent to receiving the NPV today and then selecting the project with the higher equivalent annual benefit.

A) Traditionally, managers have used the equivalent annual benefit method to choose between projects of different lives.

B) The equivalent annual benefit method ignores the value of any real options because it assumes that the projects will always be replaced at their original terms.

C) If the future costs (or benefits) are certain with mutually exclusive projects, then we must use a real options approach to determine the correct decision.

D) The equivalent annual benefit method accounts for the difference in project lengths by calculating the constant payment over the life of the project that is equivalent to receiving the NPV today and then selecting the project with the higher equivalent annual benefit.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following statements is false?

A) It is tempting to use the Black-Scholes formula to value future growth options, but often there are good reasons why this formula might not price these options correctly.

B) When a firm has a real option to invest in the future it is known as a growth option.

C) Because growth options have value, they contribute to the value of any firm that has future possible investment opportunities.

D) Future growth opportunities can be thought of as a collection of real put options on potential projects.

A) It is tempting to use the Black-Scholes formula to value future growth options, but often there are good reasons why this formula might not price these options correctly.

B) When a firm has a real option to invest in the future it is known as a growth option.

C) Because growth options have value, they contribute to the value of any firm that has future possible investment opportunities.

D) Future growth opportunities can be thought of as a collection of real put options on potential projects.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

39

Mortgage interest rates ________ Government of Canada bond rates because mortgages have ________ that the bonds do not have.

A) are lower than; an abandonment option

B) are higher than; a growth option

C) are lower than; a growth option

D) are higher than; an abandonment option

A) are lower than; an abandonment option

B) are higher than; a growth option

C) are lower than; a growth option

D) are higher than; an abandonment option

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements is false?

A) Often, the decision to abandon a project entails costs, which may be either positive or negative.

B) Mortgage interest rates are higher than Treasury rates because mortgages have an abandonment option that Treasuries do not have; you can prepay your mortgage at any time, while the Canadian government can repay its debt only according to the schedule outlined in the bond contract.

C) A popular option gives holders of the bond the option to convert the bond into equity. These kinds of bonds are termed callable bonds.

D) More often than not, there is an opportunity cost of abandoning a project: if you shut down the project and later decide to start it up again, you have to pay the costs of restarting the project.

A) Often, the decision to abandon a project entails costs, which may be either positive or negative.

B) Mortgage interest rates are higher than Treasury rates because mortgages have an abandonment option that Treasuries do not have; you can prepay your mortgage at any time, while the Canadian government can repay its debt only according to the schedule outlined in the bond contract.

C) A popular option gives holders of the bond the option to convert the bond into equity. These kinds of bonds are termed callable bonds.

D) More often than not, there is an opportunity cost of abandoning a project: if you shut down the project and later decide to start it up again, you have to pay the costs of restarting the project.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

41

Using the equivalent annual benefit method,which project would you select and why?

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following statements is false?

A) The hurdle rate rule for projects with the option to delay uses a lower discount rate than the cost of capital to compute the NPV, but then applies the regular NPV rule: invest whenever the NPV calculated using this lower discount rate is positive.

B) While using a hurdle rate rule for deciding when to invest might be a cost-effective way to make investment decisions, it is important to remember that this rule does not provide an accurate measure of value.

C) When the cash flows are constant and perpetual, and the reason to wait derives solely from interest rate uncertainty, the hurdle rate rule of thumb is always exact. However, when these conditions are not satisfied, the rule of thumb merely approximates the correct decision.

D) When a firm faces the same uncertainty for most of its investment decisions, using a single profitability index criterion for all projects can provide a useful rule of thumb to account for cash flow uncertainty.

A) The hurdle rate rule for projects with the option to delay uses a lower discount rate than the cost of capital to compute the NPV, but then applies the regular NPV rule: invest whenever the NPV calculated using this lower discount rate is positive.

B) While using a hurdle rate rule for deciding when to invest might be a cost-effective way to make investment decisions, it is important to remember that this rule does not provide an accurate measure of value.

C) When the cash flows are constant and perpetual, and the reason to wait derives solely from interest rate uncertainty, the hurdle rate rule of thumb is always exact. However, when these conditions are not satisfied, the rule of thumb merely approximates the correct decision.

D) When a firm faces the same uncertainty for most of its investment decisions, using a single profitability index criterion for all projects can provide a useful rule of thumb to account for cash flow uncertainty.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

43

If there is ________ to waiting,investing ________ never makes sense.

A) cost; late

B) cost; early

C) no cost; early

D) no cost; late

A) cost; late

B) cost; early

C) no cost; early

D) no cost; late

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following statements is false?

A) The profitability index rule of thumb raises the bar on the NPV to take into account the option to wait.

B) In practice, correctly modeling the sources of uncertainty and the appropriate dynamic decisions usually requires an extensive amount of time and financial expertise.

C) Some firms use the following rule of thumb: invest whenever the profitability index is below a specified level.

D) Instead of raising the bar on the NPV, the hurdle rate rule raises the discount rate.

A) The profitability index rule of thumb raises the bar on the NPV to take into account the option to wait.

B) In practice, correctly modeling the sources of uncertainty and the appropriate dynamic decisions usually requires an extensive amount of time and financial expertise.

C) Some firms use the following rule of thumb: invest whenever the profitability index is below a specified level.

D) Instead of raising the bar on the NPV, the hurdle rate rule raises the discount rate.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

45

The profitability index rule of thumb raises the bar on the NPV to take into account the option to ________.

A) wait

B) delay

C) abandon

D) take immediate action

A) wait

B) delay

C) abandon

D) take immediate action

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

46

The hurdle rate rule uses ________ than ________ to compute the NPV,but then applies the regular NPV rule.

A) a lower discount rate; the cost of capital

B) a higher discount rate; the required rate of return

C) a lower discount rate; the required rate of return

D) a higher discount rate, the cost of capital

A) a lower discount rate; the cost of capital

B) a higher discount rate; the required rate of return

C) a lower discount rate; the required rate of return

D) a higher discount rate, the cost of capital

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

47

________ need not be exercised immediately.

A) Out-of-the money real options

B) At-the-money real options

C) Real options

D) In-the-money real options

A) Out-of-the money real options

B) At-the-money real options

C) Real options

D) In-the-money real options

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

48

When there is an option to delay,a good rule of thumb is to invest only when ________.

A) the internal rate of return is at least 1

B) the net present value is at least 1

C) the payback period is at least 1

D) the profitability index is at least 1

A) the internal rate of return is at least 1

B) the net present value is at least 1

C) the payback period is at least 1

D) the profitability index is at least 1

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following statements is false?

A) When the investment cannot be delayed, the optimal rule is to invest whenever the profitability index is greater than zero.

B) It is often better to wait too long (use a profitability index criterion that is too high) than to invest too soon (use a profitability index criterion that is too low).

C) When the source of uncertainty that creates a motive to wait is interest rate uncertainty, the hurdle rate is relatively easy to calculate.

D) When there is an option to delay, a good rule of thumb is to invest only when the profitability index is at least 1.

A) When the investment cannot be delayed, the optimal rule is to invest whenever the profitability index is greater than zero.

B) It is often better to wait too long (use a profitability index criterion that is too high) than to invest too soon (use a profitability index criterion that is too low).

C) When the source of uncertainty that creates a motive to wait is interest rate uncertainty, the hurdle rate is relatively easy to calculate.

D) When there is an option to delay, a good rule of thumb is to invest only when the profitability index is at least 1.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

50

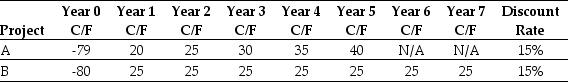

Use the table for the question(s) below.

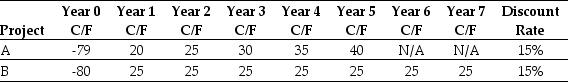

Consider the following mutually exclusive projects:

The NPV of project B is closest to:

A) $18.10

B) $21.70

C) $24.00

D) $16.90

Consider the following mutually exclusive projects:

The NPV of project B is closest to:

A) $18.10

B) $21.70

C) $24.00

D) $16.90

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

51

In the example of Canada Motors on p.571 of the text,it presents that if the future costs (benefits)are uncertain,we must use ________ approach to determine the correct decision.

A) a real options

B) an abandonment option

C) a financial option

D) a growth option

A) a real options

B) an abandonment option

C) a financial option

D) a growth option

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

52

When the investment cannot be delayed,the optimal rule is to invest whenever ________ is greater than zero.

A) the profitability index

B) the payback period

C) the internal rate of return

D) the discounted payback period

A) the profitability index

B) the payback period

C) the internal rate of return

D) the discounted payback period

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

53

Even if an investment opportunity currently has ________ NPV,it does not imply that the opportunity is ________.

A) negative; worthless

B) positive; worthless

C) negative; worth more

D) positive; worth more

A) negative; worthless

B) positive; worthless

C) negative; worth more

D) positive; worth more

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

54

Value can be created by ________ to resolve.

A) waiting for certainty

B) waiting for uncertainty

C) act on certainty

D) act on uncertainty

A) waiting for certainty

B) waiting for uncertainty

C) act on certainty

D) act on uncertainty

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

55

Use the table for the question(s) below.

Consider the following mutually exclusive projects:

The NPV of project A is closest to:

A) $21.70

B) $24.00

C) $18.10

D) $16.90

Consider the following mutually exclusive projects:

The NPV of project A is closest to:

A) $21.70

B) $24.00

C) $18.10

D) $16.90

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

56

The equivalent annual benefit of project B is closest to:

A) $5.05

B) $5.75

C) 3.45

D) $3.40

A) $5.05

B) $5.75

C) 3.45

D) $3.40

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

57

The equivalent annual benefit of project A is closest to:

A) $21.70

B) $5.05

C) $24.00

D) $3.40

A) $21.70

B) $5.05

C) $24.00

D) $3.40

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck