Deck 26: Working Capital Management

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/45

Play

Full screen (f)

Deck 26: Working Capital Management

1

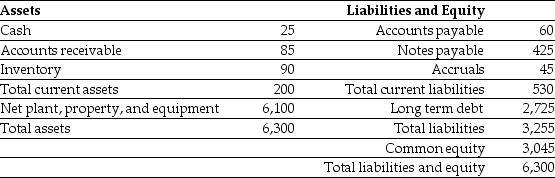

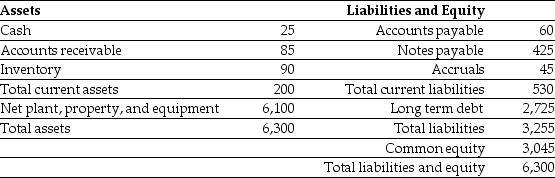

Use the table for the question(s) below.

Luther Industries had sales of $980 million and a cost of goods sold of $560 million in 2006. A simplified balance sheet for the firm appears below:

Luther Industries

Balance Sheet

As of December 31, 2006

(millions of dollars)

Luther's Accounts Receivable days is closest to:

A) 42 days

B) 39 days

C) 32 days

D) 59 days

Luther Industries had sales of $980 million and a cost of goods sold of $560 million in 2006. A simplified balance sheet for the firm appears below:

Luther Industries

Balance Sheet

As of December 31, 2006

(millions of dollars)

Luther's Accounts Receivable days is closest to:

A) 42 days

B) 39 days

C) 32 days

D) 59 days

32 days

2

Which of the following statements is false?

A) In reality, product markets are rarely perfectly competitive, so firms can maximize their value by using their trade credit options effectively.

B) Trade credit is, in essence, a loan from the selling firm to its customer.

C) The accounts receivable balance represents the amount that a firm owes its suppliers for goods that it has received but for which it has not yet paid.

D) Providing financing at below-market rates is an indirect way to lower prices for only certain customers.

A) In reality, product markets are rarely perfectly competitive, so firms can maximize their value by using their trade credit options effectively.

B) Trade credit is, in essence, a loan from the selling firm to its customer.

C) The accounts receivable balance represents the amount that a firm owes its suppliers for goods that it has received but for which it has not yet paid.

D) Providing financing at below-market rates is an indirect way to lower prices for only certain customers.

The accounts receivable balance represents the amount that a firm owes its suppliers for goods that it has received but for which it has not yet paid.

3

The difference between a firm's operating cycle and its cash cycle is

A) its account receivable days.

B) its accounts payable days.

C) its inventory days.

D) there is no difference between the cash and operating cycles.

A) its account receivable days.

B) its accounts payable days.

C) its inventory days.

D) there is no difference between the cash and operating cycles.

its accounts payable days.

4

Working capital alters a firm's value by affecting its ________.

A) operating cash flow

B) financing cash flow

C) investment cash flow

D) free cash flow

A) operating cash flow

B) financing cash flow

C) investment cash flow

D) free cash flow

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

5

Calculate the number of days in Luther's Operating Cycle.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

6

The cash conversion cycle (CCC)is defined as

A) Inventory Days + Accounts Receivable Days - Accounts Payable Days.

B) Inventory Days - Accounts Receivable Days - Accounts Payable Days.

C) Inventory Days + Accounts Receivable Days + Accounts Payable Days.

D) Inventory Days + Accounts Payable Days - Accounts Receivable Days.

A) Inventory Days + Accounts Receivable Days - Accounts Payable Days.

B) Inventory Days - Accounts Receivable Days - Accounts Payable Days.

C) Inventory Days + Accounts Receivable Days + Accounts Payable Days.

D) Inventory Days + Accounts Payable Days - Accounts Receivable Days.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements is false?

A) The main components of net working capital are cash, inventory, receivables, and payables.

B) The firm's cash cycle is the average length of time between when a firm originally purchases its inventory and when it receives the cash back from selling its product.

C) Working capital includes the cash that is needed to run the firm on a day-to-day basis. It does not include excess cash, which is cash that is not required to run the business and can be invested at a market rate.

D) If the firm pays cash for its inventory, the firm's operating cycle is identical to the firm's cash cycle.

A) The main components of net working capital are cash, inventory, receivables, and payables.

B) The firm's cash cycle is the average length of time between when a firm originally purchases its inventory and when it receives the cash back from selling its product.

C) Working capital includes the cash that is needed to run the firm on a day-to-day basis. It does not include excess cash, which is cash that is not required to run the business and can be invested at a market rate.

D) If the firm pays cash for its inventory, the firm's operating cycle is identical to the firm's cash cycle.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

8

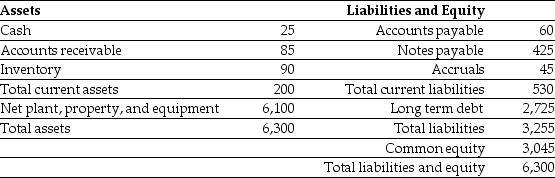

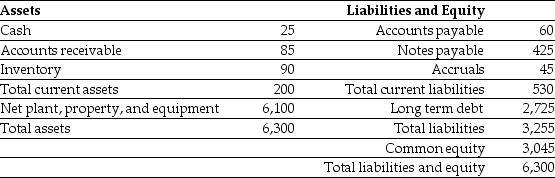

Use the table for the question(s) below.

Luther Industries had sales of $980 million and a cost of goods sold of $560 million in 2006. A simplified balance sheet for the firm appears below:

Luther Industries

Balance Sheet

As of December 31, 2006

(millions of dollars)

Luther's inventory days is closest to:

A) 32 days

B) 59 days

C) 39 days

D) 42 days

Luther Industries had sales of $980 million and a cost of goods sold of $560 million in 2006. A simplified balance sheet for the firm appears below:

Luther Industries

Balance Sheet

As of December 31, 2006

(millions of dollars)

Luther's inventory days is closest to:

A) 32 days

B) 59 days

C) 39 days

D) 42 days

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements is false?

A) Under the Modigliani-Miller assumptions of perfect capital markets, the amounts of payables and receivables are irrelevant.

B) If the firm can obtain a bank loan at a lower interest rate, it would be better off borrowing at the lower rate and using the cash proceeds of the loan to take advantage of the discount offered by the supplier.

C) Collection float is the amount of time it takes before payments to suppliers actually result in a cash outflow for the firm.

D) The credit that the firm is extending to its customers is known as trade credit.

A) Under the Modigliani-Miller assumptions of perfect capital markets, the amounts of payables and receivables are irrelevant.

B) If the firm can obtain a bank loan at a lower interest rate, it would be better off borrowing at the lower rate and using the cash proceeds of the loan to take advantage of the discount offered by the supplier.

C) Collection float is the amount of time it takes before payments to suppliers actually result in a cash outflow for the firm.

D) The credit that the firm is extending to its customers is known as trade credit.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

10

Any ________ in working capital requirements generates a ________ free cash flow that the firm can distribute immediately to shareholders.

A) reduction; negative

B) increase; positive

C) reduction; positive

D) increase; negative

A) reduction; negative

B) increase; positive

C) reduction; positive

D) increase; negative

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

11

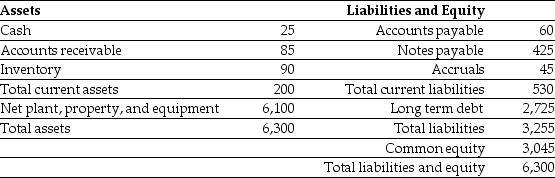

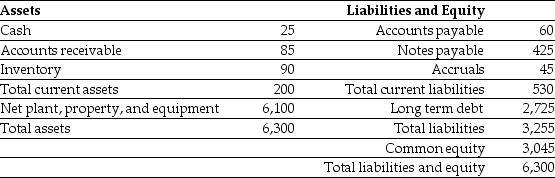

Use the table for the question(s) below.

Luther Industries had sales of $980 million and a cost of goods sold of $560 million in 2006. A simplified balance sheet for the firm appears below:

Luther Industries

Balance Sheet

As of December 31, 2006

(millions of dollars)

Luther's cash conversion cycle is closest to:

A) 51 days

B) 66 days

C) 71 days

D) 129 days

Luther Industries had sales of $980 million and a cost of goods sold of $560 million in 2006. A simplified balance sheet for the firm appears below:

Luther Industries

Balance Sheet

As of December 31, 2006

(millions of dollars)

Luther's cash conversion cycle is closest to:

A) 51 days

B) 66 days

C) 71 days

D) 129 days

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

12

The cash cycle is the ________ between when a firm pays for its inventory and when it receives cash from the sale of its product.

A) average time

B) minimum time

C) maximum time

D) delayed time

A) average time

B) minimum time

C) maximum time

D) delayed time

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

13

Collection float is made up of all of the following EXCEPT

A) disbursement float.

B) processing float.

C) mail float.

D) availability float.

A) disbursement float.

B) processing float.

C) mail float.

D) availability float.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

14

Your firm purchases goods from its supplier on terms of 2/10,net 45.Calculate the effective annual cost to your firm if it chooses not to take advantage of the trade discount offered.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

15

Your firm purchases goods from its supplier on terms of 1/10,net 30.The effective annual cost to your firm if it chooses not to take advantage of the trade discount offered is closest to:

A) 16.8%

B) 44.6%

C) 20.1%

D) 13.0%

A) 16.8%

B) 44.6%

C) 20.1%

D) 13.0%

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

16

If the firm can obtain a bank loan ________ interest rate,it would be ________ borrowing at that rate and using the cash proceeds of the loan to take advantage of the discount offered by the supplier.

A) at a higher; better off

B) at a required rate of return; worse off

C) at a lower; better off

D) at a required rate of return; better off

A) at a higher; better off

B) at a required rate of return; worse off

C) at a lower; better off

D) at a required rate of return; better off

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following statements is false?

A) A firm's cash cycle is the length of time between when the firm pays cash to purchase its initial inventory and when it receives cash from the sale of the output produced from that inventory.

B) The longer a firm's cash cycle, the more working capital it has, and the more cash it needs to carry to conduct its daily operations.

C) Most firms buy their inventory on credit, which increases the amount of time between the cash investment and the receipt of cash from that investment.

D) Any reduction in working capital requirements generates a positive free cash flow that the firm can distribute immediately to shareholders.

A) A firm's cash cycle is the length of time between when the firm pays cash to purchase its initial inventory and when it receives cash from the sale of the output produced from that inventory.

B) The longer a firm's cash cycle, the more working capital it has, and the more cash it needs to carry to conduct its daily operations.

C) Most firms buy their inventory on credit, which increases the amount of time between the cash investment and the receipt of cash from that investment.

D) Any reduction in working capital requirements generates a positive free cash flow that the firm can distribute immediately to shareholders.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

18

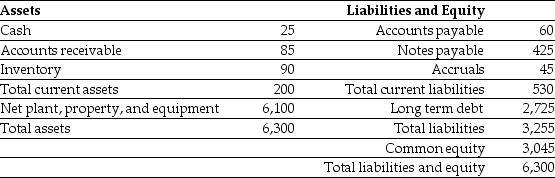

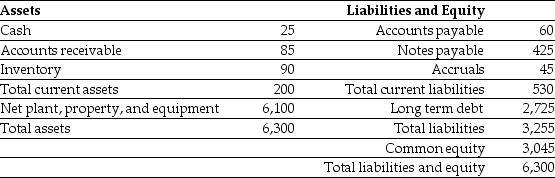

Use the table for the question(s) below.

Luther Industries had sales of $980 million and a cost of goods sold of $560 million in 2006. A simplified balance sheet for the firm appears below:

Luther Industries

Balance Sheet

As of December 31, 2006

(millions of dollars)

Luther's Accounts Payable days is closest to:

A) 39 days

B) 32 days

C) 59 days

D) 42 days

Luther Industries had sales of $980 million and a cost of goods sold of $560 million in 2006. A simplified balance sheet for the firm appears below:

Luther Industries

Balance Sheet

As of December 31, 2006

(millions of dollars)

Luther's Accounts Payable days is closest to:

A) 39 days

B) 32 days

C) 59 days

D) 42 days

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

19

What does the term 2/10 net 30 mean?

A) If the invoice is paid within 10 days a 2% discount can be taken. If the invoice is paid between 11 and 29 days a 1% discount can be taken. After 30 days the full invoice is due.

B) If the invoice is paid within 2 days a 10% discount can be taken, otherwise the full invoice is due in 30 days.

C) If the invoice is paid within 2 days a 10% discount can be taken, otherwise a 2% discount can be taken if the invoice is paid in 30 days.

D) If the invoice is paid within 10 days a 2% discount can be taken, otherwise the full invoice is due in 30 days.

A) If the invoice is paid within 10 days a 2% discount can be taken. If the invoice is paid between 11 and 29 days a 1% discount can be taken. After 30 days the full invoice is due.

B) If the invoice is paid within 2 days a 10% discount can be taken, otherwise the full invoice is due in 30 days.

C) If the invoice is paid within 2 days a 10% discount can be taken, otherwise a 2% discount can be taken if the invoice is paid in 30 days.

D) If the invoice is paid within 10 days a 2% discount can be taken, otherwise the full invoice is due in 30 days.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

20

KT Enterprises would like to construct and operate a new ice skating rink.In addition to the capital expenditures on the rink,management estimates that the project will require an investment today of $220,000 in net working capital.The firm will recover the investment in net working capital fifteen years from today,when management anticipates closing the rink.The discount rate for this type of cash flow is 8% per year.Calculate the present value of the cost of working capital for the ice skating rink.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following statements is false?

A) The aging schedule is also sometimes augmented by analysis of the payments pattern, which provides information on the percentage of monthly sales that the firm collects in each month after the sale.

B) Because accounts receivable days can be calculated from the firm's financial statement, outside investors commonly use this measure to evaluate a firm's credit management policy.

C) If the aging schedule gets "top-heavy" - that is, if the percentages in the upper half of the schedule begin to increase - the firm will likely need to revisit its credit policy.

D) Seasonal sales patterns may cause the number calculated for the accounts receivable days to change depending on when the calculation takes place.

A) The aging schedule is also sometimes augmented by analysis of the payments pattern, which provides information on the percentage of monthly sales that the firm collects in each month after the sale.

B) Because accounts receivable days can be calculated from the firm's financial statement, outside investors commonly use this measure to evaluate a firm's credit management policy.

C) If the aging schedule gets "top-heavy" - that is, if the percentages in the upper half of the schedule begin to increase - the firm will likely need to revisit its credit policy.

D) Seasonal sales patterns may cause the number calculated for the accounts receivable days to change depending on when the calculation takes place.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following money market investments is short-term debt issued by a bank with a minimum denomination of $100,000?

A) Treasury Bill

B) Banker's Acceptance

C) Repurchase Agreement

D) Commercial Paper

E) Certificates of Deposit (CD)

A) Treasury Bill

B) Banker's Acceptance

C) Repurchase Agreement

D) Commercial Paper

E) Certificates of Deposit (CD)

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

23

Kinston Industries has an average accounts payable balance of $220,000.Its annual cost of goods sold is $5,475,000,and it receives terms of 2/10,net 30 from its suppliers.Kinston chooses to forgo this discount.Is Kinston managing its accounts payable well?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following statements is false?

A) Under the Modigliani-Miller assumptions of perfect capital markets, the amount of inventory is irrelevant.

B) Unlike trade credit, inventory represents one of the required factors of production.

C) It is the firm's financial manager who must arrange for the financing necessary to support the firm's inventory policy and who is responsible for ensuring the firm's overall profitability.

D) Inventory management receives extensive coverage in courses on operations management.

A) Under the Modigliani-Miller assumptions of perfect capital markets, the amount of inventory is irrelevant.

B) Unlike trade credit, inventory represents one of the required factors of production.

C) It is the firm's financial manager who must arrange for the financing necessary to support the firm's inventory policy and who is responsible for ensuring the firm's overall profitability.

D) Inventory management receives extensive coverage in courses on operations management.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

25

Your firm purchases goods from its supplier on terms of 1/10,net 30.The effective annual cost to your firm if it chooses not to take advantage of the trade discount offered and stretches the accounts payable to 45 days is closest to:

A) 13.0%

B) 11.1%

C) 15.9%

D) 20.1%

A) 13.0%

B) 11.1%

C) 15.9%

D) 20.1%

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following statements is false?

A) Firms may hold inventory because factors such as seasonality in demand mean that customer purchases do not perfectly match the most efficient production cycle.

B) Inventory helps minimize the risk that the firm will not be able to obtain an input it needs for production.

C) If a firm holds too much inventory, stock-outs, the situation when a firm runs out of product, may occur, leading to lost sales.

D) Because excessive inventory uses cash, efficient management of inventory increases firm value.

A) Firms may hold inventory because factors such as seasonality in demand mean that customer purchases do not perfectly match the most efficient production cycle.

B) Inventory helps minimize the risk that the firm will not be able to obtain an input it needs for production.

C) If a firm holds too much inventory, stock-outs, the situation when a firm runs out of product, may occur, leading to lost sales.

D) Because excessive inventory uses cash, efficient management of inventory increases firm value.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following money market investments is essentially a loan arrangement wherein a securities dealer is the "borrower" and the investor is the "lender?" The investor buys securities from the securities dealer,with an agreement to sell the securities back to the dealer at a later date for a specified higher price.

A) Certificates of Deposit (CD)

B) Commercial Paper

C) Banker's Acceptance

D) Repurchase Agreement

E) Treasury Bill

A) Certificates of Deposit (CD)

B) Commercial Paper

C) Banker's Acceptance

D) Repurchase Agreement

E) Treasury Bill

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

28

Stretching the accounts payable means to ________.

A) reduce the trade credit period

B) raise the amount of accounts payable

C) decrease the discount percentage offered

D) increase the trade credit period

A) reduce the trade credit period

B) raise the amount of accounts payable

C) decrease the discount percentage offered

D) increase the trade credit period

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following money market investments is a short-term debt obligation of the Canadian government?

A) Treasury Bill

B) Repurchase Agreement

C) Commercial Paper

D) Certificates of Deposit (CD)

E) Banker's Acceptance

A) Treasury Bill

B) Repurchase Agreement

C) Commercial Paper

D) Certificates of Deposit (CD)

E) Banker's Acceptance

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following statements is false?

A) Similar to the situation with its accounts receivable, a firm should monitor its accounts payable to ensure that it is making its payments at an optimal time.

B) Some firms ignore the payment due period and pay later, in a practice referred to as pushing the accounts payable.

C) Suppliers may react to a firm whose payments are always late by imposing terms of cash on delivery (COD) or cash before delivery (CBD).

D) If the accounts payable outstanding is 40 days and the terms are 2/10, net 30, the firm can conclude that it generally pays late and may be risking supplier difficulties.

A) Similar to the situation with its accounts receivable, a firm should monitor its accounts payable to ensure that it is making its payments at an optimal time.

B) Some firms ignore the payment due period and pay later, in a practice referred to as pushing the accounts payable.

C) Suppliers may react to a firm whose payments are always late by imposing terms of cash on delivery (COD) or cash before delivery (CBD).

D) If the accounts payable outstanding is 40 days and the terms are 2/10, net 30, the firm can conclude that it generally pays late and may be risking supplier difficulties.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

31

Goldsboro Industries has an average accounts payable balance of $680,000.Its annual cost of goods sold is $4,500,000,and it receives terms of 1/10,net 40 from its suppliers.Goldsboro chooses to forgo this discount.Is Goldsboro managing its accounts payable well?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is NOT a direct cost associated with inventory?

A) Acquisition costs

B) Order costs

C) Carrying costs

D) Stock-out costs

A) Acquisition costs

B) Order costs

C) Carrying costs

D) Stock-out costs

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following statements is false?

A) The lower the discount percentage offered, the greater the cost of forgoing the discount and using trade credit.

B) A firm should choose to borrow using accounts payable only if trade credit is the cheapest source of funding.

C) A firm should always pay on the latest day allowed.

D) A firm should strive to keep its money working for it as long as possible without developing a bad relationship with its suppliers or engaging in unethical practices.

A) The lower the discount percentage offered, the greater the cost of forgoing the discount and using trade credit.

B) A firm should choose to borrow using accounts payable only if trade credit is the cheapest source of funding.

C) A firm should always pay on the latest day allowed.

D) A firm should strive to keep its money working for it as long as possible without developing a bad relationship with its suppliers or engaging in unethical practices.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

34

The ________ the discount percentage offered,the ________ the cost of forgoing the discount.

A) lower; greater

B) higher; smaller

C) higher; greater

D) lower; the more expensive

A) lower; greater

B) higher; smaller

C) higher; greater

D) lower; the more expensive

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

35

Your firm purchases goods from its supplier on terms of 2/10,net 40.The effective annual cost to your firm if it chooses not to take advantage of the trade discount offered and stretches the accounts payable to 60 days is closest to:

A) 20.1%

B) 15.9%

C) 13.0%

D) 11.1%

A) 20.1%

B) 15.9%

C) 13.0%

D) 11.1%

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

36

Luther Industries bills its accounts on terms of 2/10,net 30.The firm's accounts receivable include $250,000 that has been outstanding for 10 or fewer days,$375,000 outstanding for 11 to 30 days,$70,000 outstanding for 31 to 40 days,$35,000 outstanding for 41 to 50 days,$20,000 outstanding for 51 to 60 days,and $8,000 outstanding for more than 60 days.Prepare an aging schedule for Luther Industries.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

37

Describe "just-in-time" inventory management.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

38

In Canada,large firms assess credit risk in-house with their own credit departments.Small firms purchase credit reports from credit rating systems such as ________.

A) the System for Electronic Document Analysis and Retrieval (SEDAR)

B) the Profit Impact of Market Strategy (PIMS)

C) the Business Information Center of Industry Canada

D) Dun and Bradstreet Business Information (DnB)

A) the System for Electronic Document Analysis and Retrieval (SEDAR)

B) the Profit Impact of Market Strategy (PIMS)

C) the Business Information Center of Industry Canada

D) Dun and Bradstreet Business Information (DnB)

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

39

Which one of the following is NOT one of the three steps involved in establishing a credit policy?

A) Establishing credit payment patterns

B) Establishing credit standards

C) Establishing a collection policy

D) Establishing credit terms

A) Establishing credit payment patterns

B) Establishing credit standards

C) Establishing a collection policy

D) Establishing credit terms

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements is false?

A) After a firm decides on its credit standards, it must next establish its credit terms.

B) The decision of how much credit risk to assume plays a large role in determining how much money a firm ties up in its payables.

C) Knowledge of the payments pattern is also useful for forecasting the firm's working capital requirements.

D) An aging schedule categorizes accounts by the number of days they have been on the firm's books.

A) After a firm decides on its credit standards, it must next establish its credit terms.

B) The decision of how much credit risk to assume plays a large role in determining how much money a firm ties up in its payables.

C) Knowledge of the payments pattern is also useful for forecasting the firm's working capital requirements.

D) An aging schedule categorizes accounts by the number of days they have been on the firm's books.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following money market investments is a short-term,unsecured debt obligation issued by a large corporation? The minimum denomination is $25,000,but most have a face value of $100,000 or more.

A) Banker's Acceptance

B) Commercial Paper

C) Repurchase Agreement

D) Certificates of Deposit (CD)

E) Treasury Bill

A) Banker's Acceptance

B) Commercial Paper

C) Repurchase Agreement

D) Certificates of Deposit (CD)

E) Treasury Bill

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

42

The amount of cash a firm holds to counter the uncertainty surrounding its future cash needs is known as a(n)

A) speculative balance.

B) compensating balance.

C) operating balance.

D) precautionary balance.

A) speculative balance.

B) compensating balance.

C) operating balance.

D) precautionary balance.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

43

What is a compensating balance?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following money market investments is a draft written by the borrower and guaranteed by the bank on which the draft is drawn? It is typically used in international trade transactions.The borrower is an importer who writes the draft in payment for goods.

A) Treasury Bill

B) Repurchase Agreement

C) Certificates of Deposit (CD)

D) Banker's Acceptance

E) Commercial Paper

A) Treasury Bill

B) Repurchase Agreement

C) Certificates of Deposit (CD)

D) Banker's Acceptance

E) Commercial Paper

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

45

The amount of cash a firm needs to be able to pay its bills is sometimes referred to as a(n)

A) operating balance.

B) compensating balance.

C) transactions balance.

D) precautionary balance.

A) operating balance.

B) compensating balance.

C) transactions balance.

D) precautionary balance.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck