Deck 17: Advanced Issues in Options

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/40

Play

Full screen (f)

Deck 17: Advanced Issues in Options

1

For LEPOs,a fall in the premium results in __________ the margin writer's account and __________ the option taker's account.

D

Explanation: Low exercise price options (LEPOs)are physical delivery-based European-type options with an exercise price typically of one cent.LEPOs are traded on the ASX via the derivatives trading facility in the same way that standard options are traded.Similar to standard options written on shares,LEPOs generally require delivery of 1000 shares on expiry of the contract but,unlike standard options on shares,only one option is issued for each expiry,as there is only one exercise price for each expiry date.An important feature of these options is the requirement for deposit and margining of the premium on a daily basis.Thus a premium is not paid on taking the option position.Rather,the option writer and taker are liable for margin adjustments as the option premium changes over time.If the premium rises (falls),then the option writer's (taker's)margin account is reduced (increased)by the amount of the rise (fall),and the option taker's (writer's)account is increased (decreased)by the same amount.

Explanation: Low exercise price options (LEPOs)are physical delivery-based European-type options with an exercise price typically of one cent.LEPOs are traded on the ASX via the derivatives trading facility in the same way that standard options are traded.Similar to standard options written on shares,LEPOs generally require delivery of 1000 shares on expiry of the contract but,unlike standard options on shares,only one option is issued for each expiry,as there is only one exercise price for each expiry date.An important feature of these options is the requirement for deposit and margining of the premium on a daily basis.Thus a premium is not paid on taking the option position.Rather,the option writer and taker are liable for margin adjustments as the option premium changes over time.If the premium rises (falls),then the option writer's (taker's)margin account is reduced (increased)by the amount of the rise (fall),and the option taker's (writer's)account is increased (decreased)by the same amount.

2

Warrants are not typically priced using the futures cost-of-carry model.

True

Explanation: An important feature of company-issued options is that new shares are issued upon exercise.Standard warrants are written over existing shares and hence,on exercise,there is a transfer of existing shares.In contrast,company-issued options involve the issue of new shares at exercise.The implication of the new issue is to create a dilution effect.Originally it was argued that the option value should be adjusted for dilution,but Handley (2002)shows that this is not required,and that arbitrage will ensure the underlying share price reflects the dilution as from the announcement of the issue,so there is no need for a dilution adjustment.Thus,options are valued as if they are ordinary options written on the firm's share once the share market is aware of the option issue.Consistent with Handley's argument,empirical evidence has shown that the Black-Scholes model without adjustment provides a reasonable approximation of company-issued option prices,except perhaps for deep out-of-the-money options (Schulz and Trautmann 1994),though this may simply reflect well-documented biases in the Black-Scholes option pricing model.

Explanation: An important feature of company-issued options is that new shares are issued upon exercise.Standard warrants are written over existing shares and hence,on exercise,there is a transfer of existing shares.In contrast,company-issued options involve the issue of new shares at exercise.The implication of the new issue is to create a dilution effect.Originally it was argued that the option value should be adjusted for dilution,but Handley (2002)shows that this is not required,and that arbitrage will ensure the underlying share price reflects the dilution as from the announcement of the issue,so there is no need for a dilution adjustment.Thus,options are valued as if they are ordinary options written on the firm's share once the share market is aware of the option issue.Consistent with Handley's argument,empirical evidence has shown that the Black-Scholes model without adjustment provides a reasonable approximation of company-issued option prices,except perhaps for deep out-of-the-money options (Schulz and Trautmann 1994),though this may simply reflect well-documented biases in the Black-Scholes option pricing model.

3

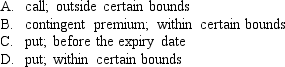

Low exercise price options (LEPOs)are physical delivery-based __________ options with __________.

C

Explanation: Low exercise price options (LEPOs)are physical delivery-based European-type options with an exercise price typically of one cent.LEPOs are traded on the ASX via the derivatives trading facility in the same way that standard options are traded.Similar to standard options written on shares,LEPOs generally require delivery of 1000 shares on expiry of the contract but,unlike standard options on shares,only one option is issued for each expiry,as there is only one exercise price for each expiry date.An important feature of these options is the requirement for deposit and margining of the premium on a daily basis.Thus a premium is not paid on taking the option position.Rather,the option writer and taker are liable for margin adjustments as the option premium changes over time.If the premium rises (falls),then the option writer's (taker's)margin account is reduced (increased)by the amount of the rise (fall),and the option taker's (writer's)account is increased (decreased)by the same amount.

Explanation: Low exercise price options (LEPOs)are physical delivery-based European-type options with an exercise price typically of one cent.LEPOs are traded on the ASX via the derivatives trading facility in the same way that standard options are traded.Similar to standard options written on shares,LEPOs generally require delivery of 1000 shares on expiry of the contract but,unlike standard options on shares,only one option is issued for each expiry,as there is only one exercise price for each expiry date.An important feature of these options is the requirement for deposit and margining of the premium on a daily basis.Thus a premium is not paid on taking the option position.Rather,the option writer and taker are liable for margin adjustments as the option premium changes over time.If the premium rises (falls),then the option writer's (taker's)margin account is reduced (increased)by the amount of the rise (fall),and the option taker's (writer's)account is increased (decreased)by the same amount.

4

Credit default swaps (CDS)transfer credit risk from the protection seller to the protection buyer.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

5

One way in which LEPOs are identical to standard options is that there is only one option for each exercise price.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

6

Convertible notes typically have a window for conversion that is unlimited.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

7

The premium on a LEPO tends to move similarly to that of a futures contract.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

8

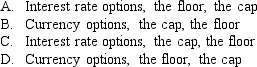

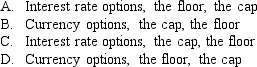

options can be used to control interest rate risk. allows borrowers to set a maximum interest rate,while . allows investors to set a minimum interest rate earned on their investment

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

9

The term to maturity of company-issued warrants tends to be greater than that of standard exchange-traded options.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

10

Given a LEPO price of $0.01,a share price of $5,time to expiry of six months,a risk-free rate of 5% p.a.and a dividend present value of $0.25,what is the value the LEPO?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

11

Index warrant holders are generally not protected against changes in the composition of the underlying index.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

12

An equity-linked deposit is a zero coupon instrument that offers to pay the face value at maturity.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

13

A convertible note is a security that is initially issued as equity,but can later be converted into a debt security.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

14

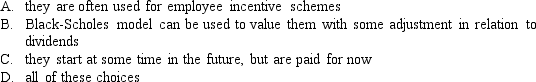

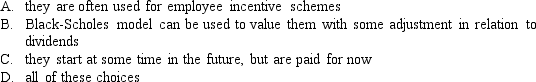

With forward start options the following applies:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

15

Suppose the LEPO has an exercise price of one cent,the share price of the underlying share is currently $13.25,the time to expiry is two months,the risk-free rate is 5.0% p.a.and the present value of the dividend is $0.84.What would be the price of this LEPO?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following are limitations to the range of derivative contracts offered in over-the-counter markets?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following provides insurance to a portfolio manager against declines in value without limiting the increase in portfolio value?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

18

In Australia,options that are heavily traded on the ASX 24 futures contracts include:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

19

The key difference between a call option written on the USD cost of the AUD and a put option written on the AUD cost of the USD is the standard deviation estimate.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following are features of LEPOs?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

21

Company-issued options tend to arise because of:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

22

Unsecured notes issued by companies where the holder receives periodic coupon payments and an option to change the note into ordinary shares at a ratio which is pre-specified and remains constant over the life of the note are known as:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

23

If the futures contract is the SPI 200 futures contract and the premium is quoted as 12.5,what is the premium?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

24

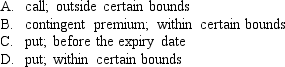

A ___________ option could be used to pay back the initial premium where the price falls ____________________,in which case the option is sometimes called a money back option.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

25

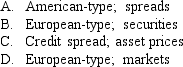

______________ option pay-off is a function either of specified credit spreads or credit sensitive _______________.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

26

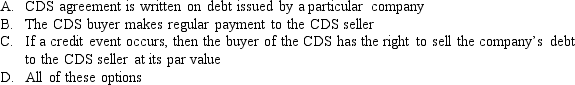

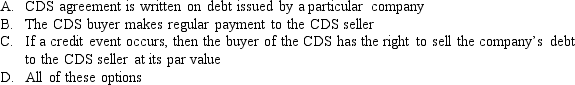

Which of the following about CDS is correct?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

27

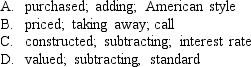

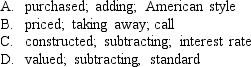

Following figure 17.1,we can see that portfolio insurance on a large share portfolio is most typically performed using a strategy involving buying index put options.

A barrier option may be _________ by _____________ a complementary barrier option from a/an____________ option.

A barrier option may be _________ by _____________ a complementary barrier option from a/an____________ option.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

28

Currency options are generally __________-traded __________ options.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

29

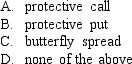

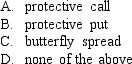

Portfolio insurance on a large share portfolio is most typically performed using a strategy involving:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

30

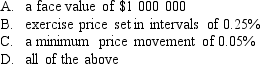

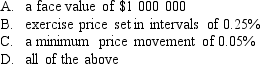

Options written on the 90-day bank bill contract have:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

31

If the futures contract is the SPI 200 futures contract and the premium is quoted as 25,what is the premium?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

32

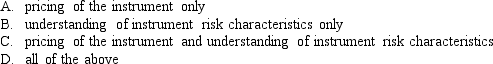

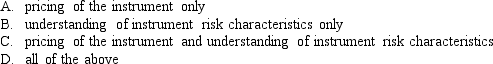

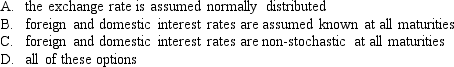

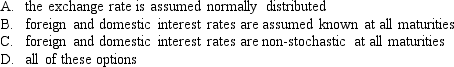

The Garman Kohlhagen (1983)model may be used to price an European-type option where:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

33

You have $1250 000 invested in a property index,which has a current value of 9000.0.If a put option is available with an exercise price of 11500,standard deviation of returns is 40%,time to maturity is 9 months and risk-free rate is 8% p.a. ,how many contracts are required for an exact hedge of this index? Assume an index point value of $10.00.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

34

You have $500 000 invested in a property index,which has a current value of 4000.00.If a put option is available with an exercise price of 3800,standard deviation of returns is 20%,time to maturity is 6 months and risk free rate is 8% p.a. ,how many contracts are required for an exact hedge of this index? Assume an index point value of $10.00.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

35

In an issue of third-party warrants,the issuer is usually:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

36

The contingent premium in the contingent premium option may be contingent on the:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

37

The exercise value of a __________ option is determined by the maximum or minimum price of the underlying asset reached during the life of an option and the expiry price of the asset.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

38

An option that starts at some time in the future but which is paid for now is called a:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

39

An Asian call option gives its holder the right to ____________.

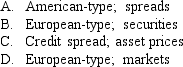

A)buy the underlying asset at the exercise price on or before the expiration date

B)buy the underlying asset at a price determined by the average stock price during some specified portion of the option's life

C)sell the underlying asset at the exercise price on or before the expiration date

D)sell the underlying asset at a price determined by the average stock price during some specified portion of the option's life

A)buy the underlying asset at the exercise price on or before the expiration date

B)buy the underlying asset at a price determined by the average stock price during some specified portion of the option's life

C)sell the underlying asset at the exercise price on or before the expiration date

D)sell the underlying asset at a price determined by the average stock price during some specified portion of the option's life

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

40

Barrier options exist within certain:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck