Deck 9: Alternative Risky Asset Pricing Models

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/40

Play

Full screen (f)

Deck 9: Alternative Risky Asset Pricing Models

1

In a study of the Australian equity market,Faff (1988)identifies up to three priced factors.

True

Explanation: Priced factors are observed in the USA and around five factors seem necessary for pricing.Faff (1988,1992)also identifies a small number of factors in Australian equity returns.Using data from the period 1974-85,Faff (1988)identifies up to three priced factors.In a later paper,the sample period is increased to include observations up to September 1987,and improved econometric techniques are applied.In this test,Faff (1992)observes that a five-factor APT model outperforms a 10-factor APT model and the CAPM.

Explanation: Priced factors are observed in the USA and around five factors seem necessary for pricing.Faff (1988,1992)also identifies a small number of factors in Australian equity returns.Using data from the period 1974-85,Faff (1988)identifies up to three priced factors.In a later paper,the sample period is increased to include observations up to September 1987,and improved econometric techniques are applied.In this test,Faff (1992)observes that a five-factor APT model outperforms a 10-factor APT model and the CAPM.

2

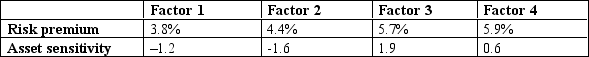

Given the factors pricing assets above and a risk-free rate of return of 6%,what is the expected return of the asset using the APT?

D

Explanation: Utilising equation 9.3,we can calculate the asset's expected return as follows,0.06 + (0.038 ´ -1.2)+ (0.044 ´ -1.6)+ (0.057 ´ 1.9)+ (0.059 ´ 0.6)= 0.0877 or 8.77%.

Explanation: Utilising equation 9.3,we can calculate the asset's expected return as follows,0.06 + (0.038 ´ -1.2)+ (0.044 ´ -1.6)+ (0.057 ´ 1.9)+ (0.059 ´ 0.6)= 0.0877 or 8.77%.

3

The international CAPM avoids the critique regarding the identification of the market portfolio,as raised by Roll (1977).

False

Explanation: In a globally integrated market,it is international market forces that are systematic.However,this model suffers from similar criticisms as the CAPM,in that the global market portfolio can never be identified.

Explanation: In a globally integrated market,it is international market forces that are systematic.However,this model suffers from similar criticisms as the CAPM,in that the global market portfolio can never be identified.

4

The arbitrage pricing theory was developed by _________.

A)Henry Markowitz

B)Stephen Ross

C)William Sharpe

D)Eugene Fama

A)Henry Markowitz

B)Stephen Ross

C)William Sharpe

D)Eugene Fama

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

5

According to the Faff studies in 1992,which of the following models dominates in describing equity returns in the Australian market?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

6

An asset in the Australian market has a consumption beta of 3.0.If the variance of the asset is 20% and the variance of the growth rate in consumption is 12.5%,what is the asset's covariance with the growth rate in consumption?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

7

The findings of Jegadeesh and Titman (1993)when looking at stocks in the USA in relation to findings about very strong prior positive or negative performance confer that a profitable momentum strategy appears viable and can be assessed by assuming a long position in the winner portfolio and a short position in the loser portfolio.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

8

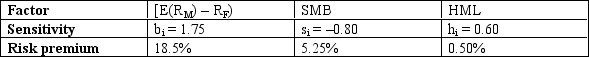

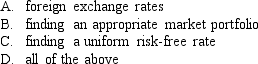

One of the main problems with the arbitrage pricing theory is __________.

A)its use of several factors instead of a single market index to explain the risk-return relationship

B)the introduction of nonsystematic risk as a key factor in the risk-return relationship

C)that the APT requires an even larger number of unrealistic assumptions than does the CAPM

D)the model fails to identify the key macroeconomic variables in the risk-return relationship

A)its use of several factors instead of a single market index to explain the risk-return relationship

B)the introduction of nonsystematic risk as a key factor in the risk-return relationship

C)that the APT requires an even larger number of unrealistic assumptions than does the CAPM

D)the model fails to identify the key macroeconomic variables in the risk-return relationship

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

9

The CCAPM assumes that a functioning capital market exists that allows investors to achieve their desired level of personal consumption.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

10

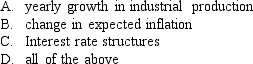

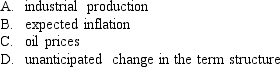

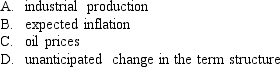

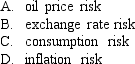

Which of the following factors did Chen,Roll and Ross (1986)include in their APT model?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

11

Chen,Roll and Ross (1986)note the difficulty with identifying factors,and select observable variables that are expected to drive prices.Their research focuses on the ability of macroeconomic variables to explain changes in share prices.Chen,Roll and Ross test for a variety of variables - a set of which is provided in table 9.2,This table includes monthly growth in industrial production,change in expected inflation,unexpected inflation,return on a value-weighted portfolio of New York Stock Exchange and a risk premium.

The three factors that appear to be most relevant when testing the APT relate to:

The three factors that appear to be most relevant when testing the APT relate to:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

12

According to the CCAPM,if the expected return on the market return is 6% and the risk-free rate is 4.5%,the consumption beta of a portfolio with 6% is 3.0.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

13

The dividend discount model is often used for the purpose of identifying factors in the international CAPM.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

14

Calculate the consumption beta for an asset with a variance of 10%,where the variance of consumption growth is 15% and the covariance between the growth rate in consumption and the asset is 20%.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

15

The most significant conceptual difference between the arbitrage pricing theory (APT)and the capital asset pricing model (CAPM)is that the CAPM _____________.

A)places less emphasis on market risk

B)recognizes multiple unsystematic risk factors

C)recognizes only one systematic risk factor

D)recognizes multiple systematic risk factors

A)places less emphasis on market risk

B)recognizes multiple unsystematic risk factors

C)recognizes only one systematic risk factor

D)recognizes multiple systematic risk factors

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

16

According to the CCAPM,if the expected return on the market return is 7% and the risk-free rate is 5%,the expected return on a portfolio with a consumption beta of 1.5 is 3.1%.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

17

The possibility of arbitrage arises when there is no consensus among investors regarding the future direction of the market,and thus trades are made arbitrarily.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

18

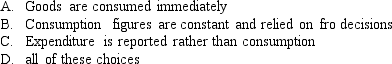

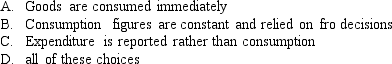

Which of the following is an issue associated with the calculation of consumption for practical application in the CCAPM?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

19

The APT of Ross requires the assumption of quadratic utility.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

20

The cross-sectional regression technique of Fama and Macbeth (1973)is used in the Asset Pricing field to estimate risk premiums.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

21

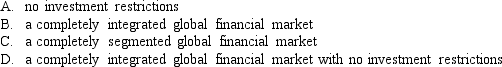

The international capital asset pricing model (ICAPM)assumes:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

22

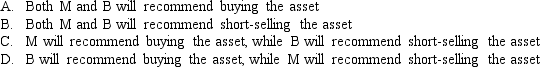

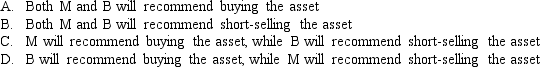

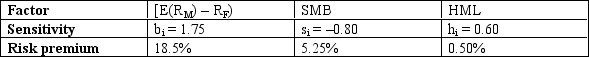

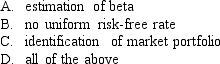

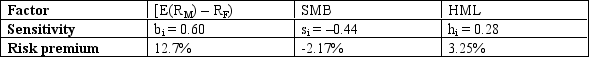

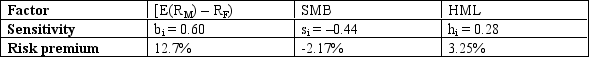

Marion and Birkan (i.e.M and B)are aspiring young investment students.During the lecture on asset pricing,both were inspired by the beauty of the models presented.M found the CAPM model overly simplistic and favoured the Fama-French model,while B disagreed,and instead believed that the CAPM,being more theoretical,was the better model.As part of a class assignment,they were each given the tabled information regarding an asset and asked to recommend a trading strategy based upon their preferred asset pricing model.If the asset is observed in the market trading with an expected return of 28%,and the risk-free rate is 8%,what are the relative trading strategy recommendations of each investor?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

23

If the All-Ordinaries has a beta with respect to the world market of 1.2,and the world market return and risk-free rate are 12% and 6% respectively,then the expected return predicted by the ICAPM for Australia is:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

24

Using Solnik's (1974)ICAPM,what is the expected return on an Australian security with a world market beta of 0.78 if the Australian risk-free rate is 5.37%,the world risk-free rate is 1.7% and the expected return on the world market portfolio is 13.19%?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

25

Chen,Roll and Ross (1986)note the difficulty with identifying factors,and select observable variables that are expected to drive prices.Their research focuses on the ability of macroeconomic variables to explain changes in share prices.Chen,Roll and Ross test for a variety of variables - a set of which is provided in table 9.2,This table includes monthly growth in industrial production,change in expected inflation,unexpected inflation,return on a value-weighted portfolio of New York Stock Exchange and a risk premium.

Which of the following is NOT a factor used by Chen,Roll and Ross (1986)in their empirical test of the APT?

Which of the following is NOT a factor used by Chen,Roll and Ross (1986)in their empirical test of the APT?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

26

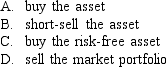

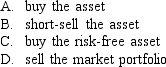

Suppose the above asset is observed in the market trading with an expected return of 18%.What strategy would you suggest to profit from this situation,assuming the CAPM was the correct pricing model and the risk-free rate was 8%?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

27

Consider the single factor APT.Portfolio A has a beta of 0.2 and an expected return of 13%.Portfolio B has a beta of 0.4 and an expected return of 15%.The risk-free rate of return is 10%.If you wanted to take advantage of an arbitrage opportunity,you should take a short position in portfolio __________ and a long position in portfolio _________.

A.A;A

B.A;B

C.B;A

D.B;B

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

28

An arbitrage portfolio exists,including an asset A with a total market value of $60 000 and 100 other assets with a combined market value of $850 000.Assume that asset A is mispriced,with a pricing error of 17%,while the remainder of the assets are priced correctly according to the factor structure.What is the arbitrage portfolio pricing error?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

29

The ICAPM has been extended to a two-factor version by Adler and Dumas (1983)that incorporates what additional type of risk?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

30

If the ICAPM beta is 0.8,and the world market return and risk-free rate are 12% and 5% respectively,then the expected return predicted by the ICAPM is:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

31

Calculate the consumption beta for an asset with a standard deviation of 10%,where the variance of consumption growth is 10% and the covariance between the growth rate in consumption and the asset is 0.015.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

32

A major difference between the application of the ICAPM compared with the domestic CAPM is:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

33

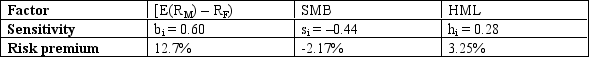

Assume the Fama-French model is the correct model to price assets.If an asset has the above sensitivities and the risk-free rate is 5%,what is the asset's expected return?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

34

An asset in the Australian market has a consumption beta of 0.5.If the variance of the asset is 0.024 and the variance of the growth rate in consumption is 0.035,what is the asset's covariance with the growth rate in consumption?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

35

Consider the multifactor APT with two factors.Portfolio A has a beta of .5 on factor 1 and a beta of 1.25 on factor 2.The risk premiums on the factor 1 and 2 portfolios are 1% and 7%,respectively.The risk-free rate of return is 7%.The expected return on portfolio A is __________ if no arbitrage opportunities exist.

A)13.5%

B)15%

C)16.25%

D)23%

A)13.5%

B)15%

C)16.25%

D)23%

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

36

Suppose the above asset is observed in the market trading with an expected return of 28%.What strategy would you suggest to profit from this situation,assuming the Fama-French model was the correct pricing model and the risk-free rate was 8%?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

37

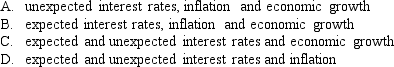

Chen,Roll and Ross (1986)note the difficulty with identifying factors and select observable variables that are expected to drive prices.Their research focuses on the ability of macroeconomic variables to explain changes in share prices.Chen,Roll and Ross test for a variety of variables-a set of which is provided in table 9.2,page 291.This table includes monthly growth in industrial production,change in expected inflation,unexpected inflation,return on a value-weighted portfolio of New York Stock Exchange,unanticipated changes in the term structure and a risk premium.

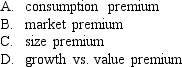

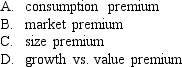

Which of the following is NOT a risk premium incorporated in the Fama and French (1992)three-factor model of expected returns?

Which of the following is NOT a risk premium incorporated in the Fama and French (1992)three-factor model of expected returns?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

38

Using Solnik's (1974)ICAPM,what is the expected return on an Australian security with a world market beta of 1.2 if the Australian risk-free rate is 7%,the world risk-free rate is 3.5% and the expected return on the world market portfolio is 22%?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

39

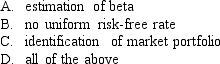

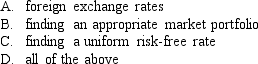

Considering the CAPM in an international context leads to further complications on top of those associated with the local CAPM.These include:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

40

An asset has the above sensitivity to the market portfolio and the risk-free rate is 6%.If an investor uses the CAPM model,but the Fama-French model is the correct model,by how much is the asset's expected return differ?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck