Deck 10: Concepts and Applications of Market Efficiency

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/40

Play

Full screen (f)

Deck 10: Concepts and Applications of Market Efficiency

1

According to Black (1986),informed traders are most unlikely to trade on 'noise'.

True

Explanation: As uninformed traders do not trade on specific pieces of information,they can drive prices away from fundamental values.Black (1986)terms such price movements as noise.The presence of noise allows informed traders to enter the market and make profits from trading on information that is not reflected in the noise in prices.

Explanation: As uninformed traders do not trade on specific pieces of information,they can drive prices away from fundamental values.Black (1986)terms such price movements as noise.The presence of noise allows informed traders to enter the market and make profits from trading on information that is not reflected in the noise in prices.

2

One misconception about market efficiency is that:

C

Explanation: There are several widely held misconceptions in relation to market efficiency.First,efficiency does not imply predictability of prices.Indeed,it is inefficiency that implies predictability.Prices in an efficient market reflect available information.Prices change as new information arrives.Second,efficiency does not imply that prices are set in a random fashion.In an efficient market,prices are set relative to the current information set.Third,frequent price movements of varying magnitude can be consistent with an efficient market.If the rate of new information arrival is high and this information implies variations in prices,then it is expected that price changes would be frequent and of varying magnitude.Indeed,if such price variations were not observed,then market efficiency would be questioned.Fourth,expected return does not imply actual return.Fifth,investors will not all perform equally.In a large sample,a degree of variation is expected.Some investors will win and some investors will lose.Finally,the financial press often refers to a market correction,a realignment or a downgrade due to price levels having reached a peak.That is,what goes up must come down.This is another fallacy.The efficient markets hypothesis simply claims that prices fully reflect available information.

Explanation: There are several widely held misconceptions in relation to market efficiency.First,efficiency does not imply predictability of prices.Indeed,it is inefficiency that implies predictability.Prices in an efficient market reflect available information.Prices change as new information arrives.Second,efficiency does not imply that prices are set in a random fashion.In an efficient market,prices are set relative to the current information set.Third,frequent price movements of varying magnitude can be consistent with an efficient market.If the rate of new information arrival is high and this information implies variations in prices,then it is expected that price changes would be frequent and of varying magnitude.Indeed,if such price variations were not observed,then market efficiency would be questioned.Fourth,expected return does not imply actual return.Fifth,investors will not all perform equally.In a large sample,a degree of variation is expected.Some investors will win and some investors will lose.Finally,the financial press often refers to a market correction,a realignment or a downgrade due to price levels having reached a peak.That is,what goes up must come down.This is another fallacy.The efficient markets hypothesis simply claims that prices fully reflect available information.

3

Which of the following is a misconception of market efficiency?

A

Explanation: There are several widely held misconceptions in relation to market efficiency.First,efficiency does not imply predictability of prices.Indeed,it is inefficiency that implies predictability.Prices in an efficient market reflect available information.Prices change as new information arrives.Second,efficiency does not imply that prices are set in a random fashion.In an efficient market,prices are set relative to the current information set.Third,frequent price movements of varying magnitude can be consistent with an efficient market.If the rate of new information arrival is high and this information implies variations in prices,then it is expected that price changes would be frequent and of varying magnitude.Indeed,if such price variations were not observed,then market efficiency would be questioned.Fourth,expected return does not imply actual return.Fifth,investors will not all perform equally.In a large sample,a degree of variation is expected.Some investors will win and some investors will lose.Finally,the financial press often refers to a market correction,a realignment or a downgrade due to price levels having reached a peak.That is,what goes up must come down.This is another fallacy.The efficient markets hypothesis simply claims that prices fully reflect available information.

Explanation: There are several widely held misconceptions in relation to market efficiency.First,efficiency does not imply predictability of prices.Indeed,it is inefficiency that implies predictability.Prices in an efficient market reflect available information.Prices change as new information arrives.Second,efficiency does not imply that prices are set in a random fashion.In an efficient market,prices are set relative to the current information set.Third,frequent price movements of varying magnitude can be consistent with an efficient market.If the rate of new information arrival is high and this information implies variations in prices,then it is expected that price changes would be frequent and of varying magnitude.Indeed,if such price variations were not observed,then market efficiency would be questioned.Fourth,expected return does not imply actual return.Fifth,investors will not all perform equally.In a large sample,a degree of variation is expected.Some investors will win and some investors will lose.Finally,the financial press often refers to a market correction,a realignment or a downgrade due to price levels having reached a peak.That is,what goes up must come down.This is another fallacy.The efficient markets hypothesis simply claims that prices fully reflect available information.

4

Figure 10.6,page 334,shows Beedles,Dodd and Officer's (1988)study.The authors find that Australian small firms have risk-adjusted returns of around 8% p.a.

Joe bought a stock at $57 per share.The price promptly fell to $55.Joe held on to the stock until it again reached $57,and then he sold it once he had eliminated his loss.If other investors do the same to establish a trading pattern,this would contradict _______.

A)the strong form

B)the weak form

C)technical analysis

D)the semi-strong form

Joe bought a stock at $57 per share.The price promptly fell to $55.Joe held on to the stock until it again reached $57,and then he sold it once he had eliminated his loss.If other investors do the same to establish a trading pattern,this would contradict _______.

A)the strong form

B)the weak form

C)technical analysis

D)the semi-strong form

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

5

The group of investors who trade because of a surplus or need for cash are called:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

6

Economy wide announcements such as those about money supply tend to create a large amount of market reaction.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

7

In Australia,share returns are at their highest in both January and July and their lowest in June (Brown,Keim,Kleidon and Marsh 1983,Brailsford and Easton 1991).In New Zealand,share returns exhibit a large positive spike in January and April (Brailsford 1993).The abnormally high January return is also present in the Asian markets such as Singapore (Gultekin and Gultekin 1983).Figure 10.2,page 323,plots the average monthly return in Australia.The peaks in January and July are quite clear.Also note the large positive return in December.

In Australia,which day of the week has equity returns that are on average 'low?

In Australia,which day of the week has equity returns that are on average 'low?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

8

Returns in the Australian market are on average positive in which of the following months?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

9

Efficiency predicts that when markets reach a peak there will often be a 'realignment' or 'market correction'.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

10

It is impossible for markets to incorporate all information into prices.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

11

The study by Brailsford and Faff (1993)shows that the All-Ordinaries Index exhibits autocorrelation in the order of:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

12

Figure 10.6,page 334,shows Beedles,Dodd and Officer's (1988)study.The authors find that Australian small firms have risk-adjusted returns of around 8% p.a.

Which of the following beliefs would not preclude charting as a method of portfolio management?

A)The market is strong form efficient.

B)The market is semi-strong form efficient.

C)The market is weak form efficient.

D)Stock prices follow recurring patterns.

Which of the following beliefs would not preclude charting as a method of portfolio management?

A)The market is strong form efficient.

B)The market is semi-strong form efficient.

C)The market is weak form efficient.

D)Stock prices follow recurring patterns.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

13

The Australian study by Easton in 1990 found an insignificant jump in stock returns around extraordinary item announcements.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

14

Random price movements indicate ________.

A)irrational markets

B)that prices cannot equal fundamental values

C)that technical analysis to uncover trends can be quite useful

D)that markets are functioning efficiently

A)irrational markets

B)that prices cannot equal fundamental values

C)that technical analysis to uncover trends can be quite useful

D)that markets are functioning efficiently

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

15

Beedles,Dodd and Officer (1988)find that Australian small firms have risk-adjusted returns of around 8% p.a.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

16

Haugen and Lakonishok (1988)seek to replicate the trading strategy in the USA by:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

17

Positive autocorrelation implies that negative price changes are followed by positive price changes.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

18

The presence of autocorrelation in stock returns is consistent with market efficiency.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

19

The weak form efficiency states that all past information,including security price and volume data,must be reflected in the current stock price.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

20

The large positive returns observed for firms in the Australian market in July and January are primarily caused by market overreaction.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

21

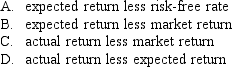

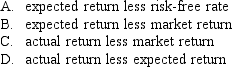

An abnormal return is calculated as:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

22

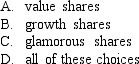

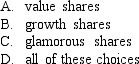

Lakonishok,Shleifer and Vishny (1994)provide arguments why fund managers will avoid:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

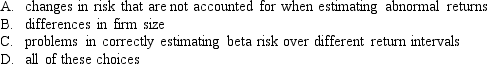

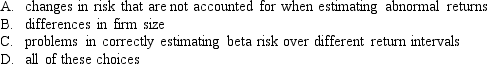

23

Loyalists believe that the long-term patterns in returns are induced by institutional and/or research method problems such that the patterns are artificial and therefore not exploitable.Examples are:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

24

An unbiased reaction is one where there is ___ to the arrival of new information.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

25

Trading on the NYSE is halted for one hour if the Dow Jones Index falls by:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

26

Event study tests generally focus on the price reaction to

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

27

The hypothesis that argues that there is a downward price pressure at the end of the tax year on shares that have experienced recent price declines as investors attempt to sell in order to realise capital losses is the:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

28

The production of _____ is more likely to be greater during trading periods.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

29

Growth shares are those firms that are expected to grow at a faster rate than:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

30

The presence of negative correlation over long horizons is consistent with:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following strategies will be profitable if the market overreacts?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

32

Loyalists believe that the long-term patterns in returns are induced by:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

33

According to the semi-strong form efficient: ____________.

A)stock prices do not rapidly adjust to new information

B)future changes in stock prices cannot be predicted from any information that is publicly available

C)corporate insiders should have no better investment performance than other investors even if allowed to trade freely

D)arbitrage between futures and cash markets should not produce extraordinary profits

A)stock prices do not rapidly adjust to new information

B)future changes in stock prices cannot be predicted from any information that is publicly available

C)corporate insiders should have no better investment performance than other investors even if allowed to trade freely

D)arbitrage between futures and cash markets should not produce extraordinary profits

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

34

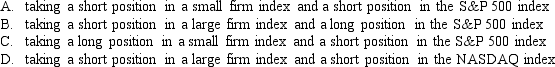

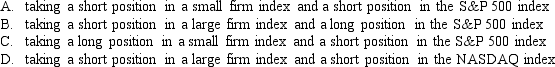

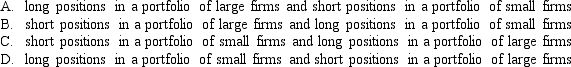

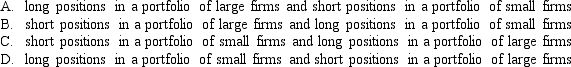

Banz (1981)has evidenced a trading strategy in the USA that can earn risk-adjusted profits of around 20% by taking:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

35

Transaction costs of taking a short position exceed those of a long position by:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

36

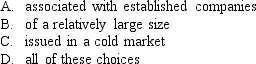

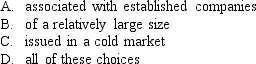

The more profitable IPO investments seem to be those:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

37

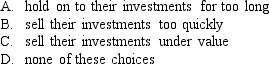

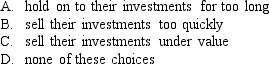

Prospect theory provides an explanation for why individuals tend to

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

38

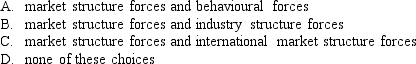

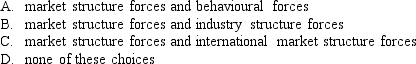

Bowman and Buchanan (1995)argue that there are two sets of forces at work that operate as impediments to the acceptance of efficient markets.These are:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

39

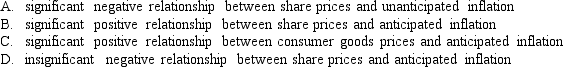

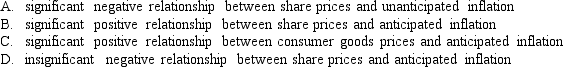

By using the Consumer Price Index (CPI)as an economic indicator,it can be argued that it has a:

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

40

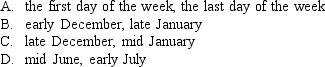

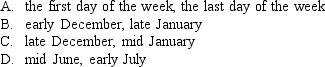

Short-term profits are expected to be greatest by forming a position on/in _________ and closing it in ____________.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck