Deck 13: Accounting for Employee Benefits

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/67

Play

Full screen (f)

Deck 13: Accounting for Employee Benefits

1

When determining accounting entries to be made in relation to the defined benefit liability of an entity,AASB 119 "Employee Benefits" requires actuarial gains and losses to be recognised as part of the income or expense of the period.

True

2

Until the release of the first accounting standards on employee entitlements,it was common for entities to fail to accrue employee entitlements such as long service leave:

True

3

In a long service leave liability to an employee,a conditional period refers to the period where no legal entitlement to any cash payment or leave exists.

False

4

In relation to required disclosures,AASB 119 requires an entity to disclose the amount recognised as an expense for defined contribution plans:

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

5

There are no accounting requirements relating to how superannuation plans should account for the plan's assets,liabilities,expenses and revenues:

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

6

Long service leave must be accrued and a liability recorded from the first day of employment:

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

7

When employees finish their time with their employer,it is normal practice to pay them for any annual leave earned but not taken:

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

8

Defined benefit plans are fairly simplistic and AASB 119 devotes only a small section to them:

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

9

In a defined contribution plan,the employer effectively bears the risks associated with the movements in the value of the superannuation plan set up for its employees.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

10

Employee benefits include:

A) Wages and salaries, sick leave, payroll tax, annual leave.

B) Superannuation, wages and salaries, sick leave and annual leave.

C) Sick leave, annual leave, unemployment benefits, salaries and wages.

D) Annual leave, wages and salaries, post-employment benefits, payroll tax.

E) None of the given answers.

A) Wages and salaries, sick leave, payroll tax, annual leave.

B) Superannuation, wages and salaries, sick leave and annual leave.

C) Sick leave, annual leave, unemployment benefits, salaries and wages.

D) Annual leave, wages and salaries, post-employment benefits, payroll tax.

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

11

AASB 119 "Employee Benefits" prescribes that all obligations relating to wages and salaries,annual leave and sick-leave entitlements,regardless of whether they were expected to be settled within 12 months of the reporting date be measured at nominal (undiscounted)amounts.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

12

The creation of cash reserves through accounting provisions ensures employees can be paid their entitlements as they fall due:

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

13

The general philosophy behind offering shares to employees is that it makes them wealthier:

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

14

Non-vesting sick leave that has accumulated will be paid to employees when their employment ceases:

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

15

In a long service leave liability,conditional period is period during which an employee gains legal entitlement to pro rata payment.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

16

Any employee benefits that have been earned but not paid as at the reporting date are assets of the employer:

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

17

AASB 119 defines employees as 'natural persons (including a director)appointed or engaged under a contract for services who is subject to the directions of an employer in respect of the manner of execution of those services,whether on a full-time,part-time,permanent,casual or temporary basis':

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

18

If there is no deep market for high quality corporate bonds,AASB 119 "Employee Benefits" permits the use of market yields on government bonds as a discount rate to determine the present value of a defined benefit obligation.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

19

Employees generally receive superannuation entitlements as part of their employment agreements.Thus usually involves the employer transferring funds to an independent superannuation fund that is administered by an independent trustee:

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

20

Any employee benefit that is incurred by the employer during the period and that contributes to the generation of items expected to provide future economic benefits for the employer may be capitalised as an asset:

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

21

A defined contribution scheme:

A) Moves any actuarial and investment risk from the employer to the employee.

B) Requires the contribution made by an employer to be recognised as an expense.

C) Will only create a liability for the employer to the extent that any agreed contribution remains unpaid at the end of the financial year.

D) Requires employers to measure their obligations on an undiscounted basis, unless they are not wholly due within the 12 months after the period in which the employee rendered their services.

E) All of the given answers.

A) Moves any actuarial and investment risk from the employer to the employee.

B) Requires the contribution made by an employer to be recognised as an expense.

C) Will only create a liability for the employer to the extent that any agreed contribution remains unpaid at the end of the financial year.

D) Requires employers to measure their obligations on an undiscounted basis, unless they are not wholly due within the 12 months after the period in which the employee rendered their services.

E) All of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

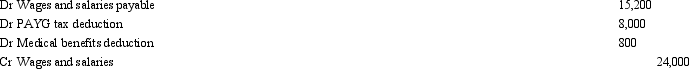

22

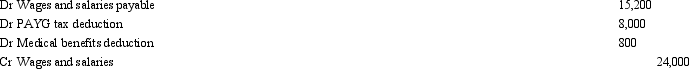

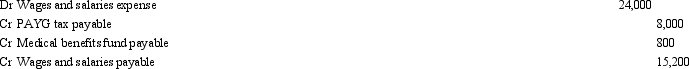

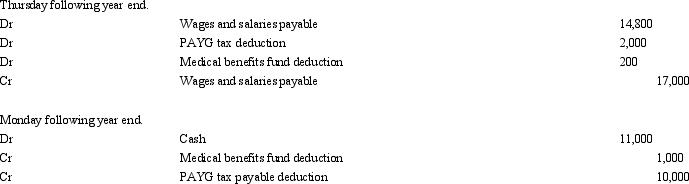

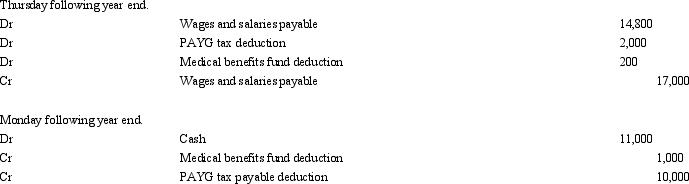

Major Ltd has a weekly payroll of $30,000.Its employees work a 5-day week (Monday to Friday)and are paid on Thursdays in arrears (i.e.,for the five days up to,and including,the Thursday).Pay-as-you-go tax on the weekly payroll is $10,000 and this is paid to the Australian Tax Office on the following Monday.Deductions of $1,000 are also made on behalf of employees to pay into a medical benefits fund.The year ended 30 June 2004 falls on a Wednesday.What is the accounting entry to record accrued salaries and wages for this period?

A)

B)

C)

D)

E) None of the given answers.

A)

B)

C)

D)

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

23

An employee whose contract for service includes an entitlement to 2 weeks' non-cumulative,vesting sick leave tenders his/her resignation to take effect exactly halfway through their fifth year of employment.What is the employee's sick leave entitlement,in weeks,that will be paid out on his/her departure assuming that no sick leave has been used?

A) Nine weeks.

B) Zero.

C) Ten weeks.

D) One week.

E) None of the given answers.

A) Nine weeks.

B) Zero.

C) Ten weeks.

D) One week.

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

24

Sick leave may be classified as:

A) Cumulative vesting.

B) Non-cumulative non-vesting.

C) Cumulative non-vesting.

D) Non-cumulative vesting.

E) All of the given answers.

A) Cumulative vesting.

B) Non-cumulative non-vesting.

C) Cumulative non-vesting.

D) Non-cumulative vesting.

E) All of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

25

An employee whose contract for service includes an entitlement to 1 week's cumulative sick leave per annum will be entitled to how many weeks' sick leave after 3 years' employment if no sick leave has been taken?

A) One week.

B) Between 1 and 3 weeks depending on annual leave entitlements.

C) Three weeks.

D) Either 1 or 3 weeks depending on long service leave entitlements.

E) None of the given answers.

A) One week.

B) Between 1 and 3 weeks depending on annual leave entitlements.

C) Three weeks.

D) Either 1 or 3 weeks depending on long service leave entitlements.

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

26

What discount rate does AASB 119 require to be used to discount estimated future cash outflows associated with the relevant employee entitlements?

A) Risk-adjusted, organisation-specific discount rate.

B) Market-determined, organisation-specific discount rate.

C) Inflation adjusted, real rate of return required on equity financing.

D) The interest rate on high quality corporate bonds with terms to maturity that match the terms of the related liabilities.

E) None of the given answers.

A) Risk-adjusted, organisation-specific discount rate.

B) Market-determined, organisation-specific discount rate.

C) Inflation adjusted, real rate of return required on equity financing.

D) The interest rate on high quality corporate bonds with terms to maturity that match the terms of the related liabilities.

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

27

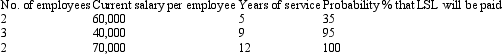

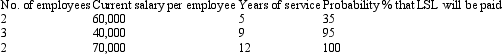

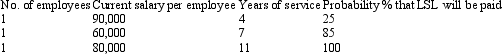

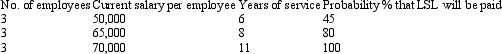

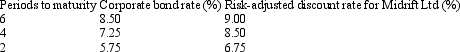

Manuka Ltd has seven employees who are entitled to long service leave (LSL).The LSL can be taken after 15 years of service,at which time the employee is entitled to 13 weeks' leave.After 10 years the employee is entitled to a pro rata cash payment on leaving the company.Information about the employees is set out below:  Other information collected.

Other information collected.

The inflation rate for the foreseeable future is 2 per cent.The future salaries of the employees are expected to keep pace with inflation but not increase as a result of promotion.Based on the information provided,what should the balance of the long service leave provision account be (rounded to the nearest dollar)?

The inflation rate for the foreseeable future is 2 per cent.The future salaries of the employees are expected to keep pace with inflation but not increase as a result of promotion.Based on the information provided,what should the balance of the long service leave provision account be (rounded to the nearest dollar)?

A) $47,163

B) $47,146

C) $47,545

D) $20,991

E) None of the given answers.

Other information collected.

Other information collected. The inflation rate for the foreseeable future is 2 per cent.The future salaries of the employees are expected to keep pace with inflation but not increase as a result of promotion.Based on the information provided,what should the balance of the long service leave provision account be (rounded to the nearest dollar)?

The inflation rate for the foreseeable future is 2 per cent.The future salaries of the employees are expected to keep pace with inflation but not increase as a result of promotion.Based on the information provided,what should the balance of the long service leave provision account be (rounded to the nearest dollar)?A) $47,163

B) $47,146

C) $47,545

D) $20,991

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

28

The appropriate accounting treatment for accumulating non-vesting sick leave is to:

A) Recognise as a liability that part of the entitlement that has accumulated through past service and is expected to be taken if it can be reliably measured.

B) Expense payments as they are made to a 'wages and salaries' account because the entitlement does not vest with the employee.

C) Recognise as a liability the accumulated entitlement as at reporting date.

D) Expense the entitlement as it accumulates over the reporting period as an on-cost.

E) None of the given answers.

A) Recognise as a liability that part of the entitlement that has accumulated through past service and is expected to be taken if it can be reliably measured.

B) Expense payments as they are made to a 'wages and salaries' account because the entitlement does not vest with the employee.

C) Recognise as a liability the accumulated entitlement as at reporting date.

D) Expense the entitlement as it accumulates over the reporting period as an on-cost.

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

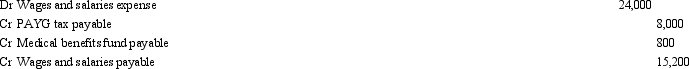

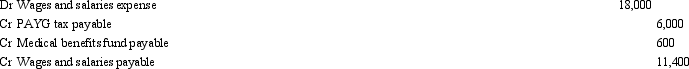

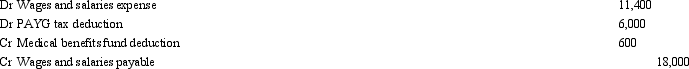

29

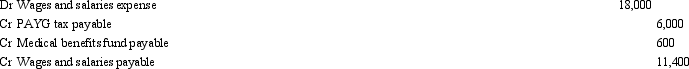

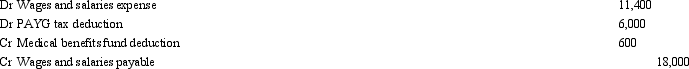

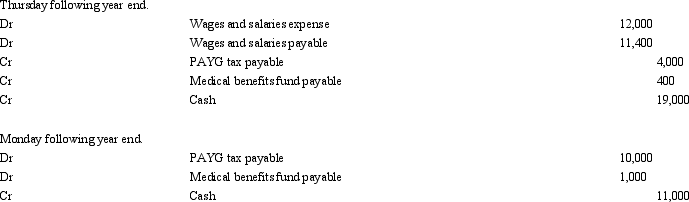

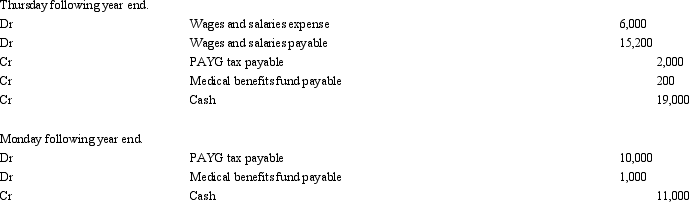

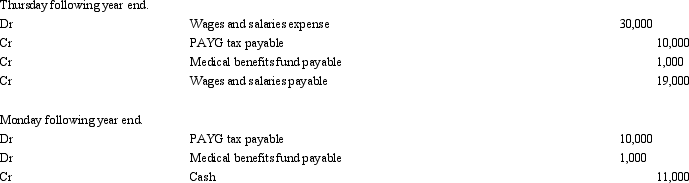

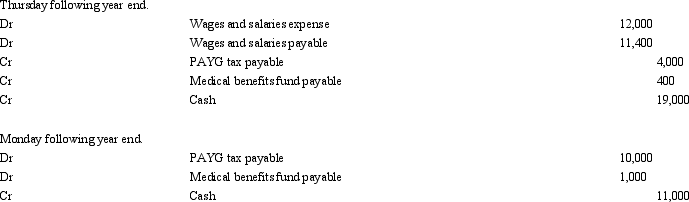

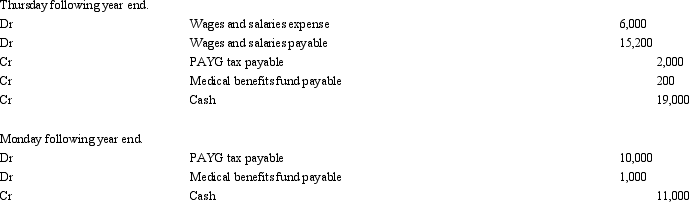

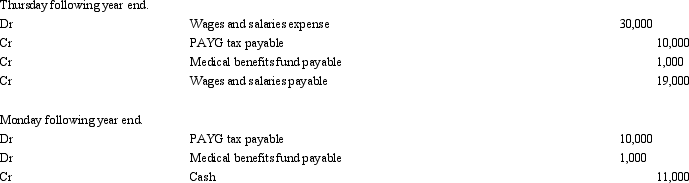

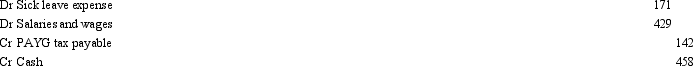

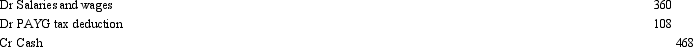

Minor Ltd has a weekly payroll of $30,000.Its employees work a 5-day week (Monday to Friday)and are paid on Thursdays in arrears (i.e.,for the five days up to,and including,the Thursday).Pay-as-you-go tax on the weekly payroll is $10,000 and this is paid to the Australian Tax Office on the following Monday.Deductions of $1,000 are also made on behalf of employees to pay into a medical benefits fund,which is also paid on the following Monday each week.The year ended 30 June 2004 falls on a Wednesday.Assuming that no reversing entry has been made since the year end,what is the entry to record the payment of the wages and salaries and the tax and medical benefits on the appropriate days immediately after the year end?

A)

B)

C)

D)

E) None of the given answers.

A)

B)

C)

D)

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

30

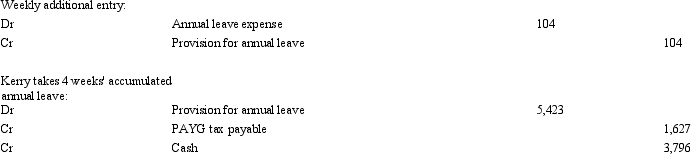

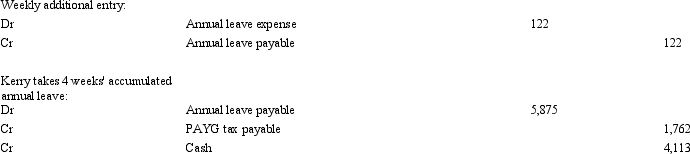

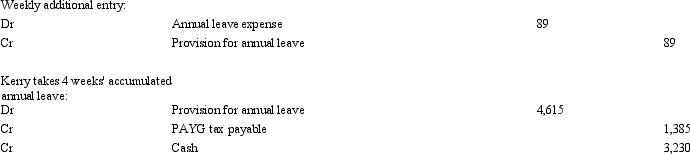

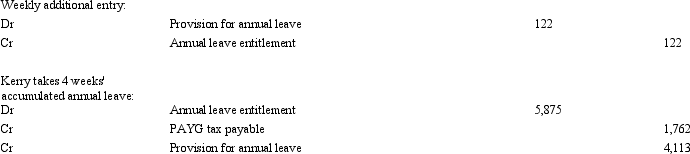

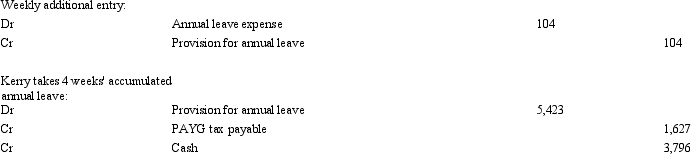

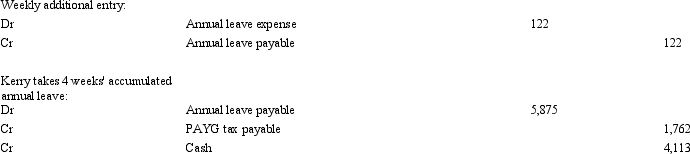

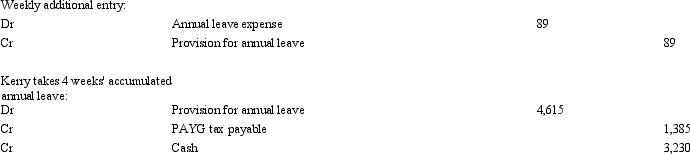

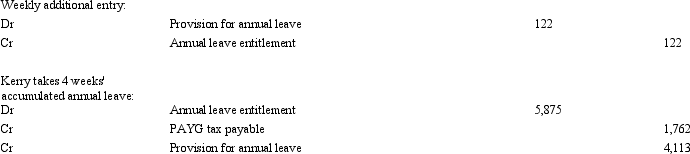

Kerry Gill works for Kentucky Enterprises for an annual salary of $60,000.Kerry is entitled to 4 weeks' annual leave per year with a leave loading of 17.5 per cent.What entry each week,additional to the one recording wages expense and PAYG tax deduction,would be required to accrue Kerry's entitlement to annual leave? When Kerry takes his 4 weeks' annual leave,what entry would be made to record this (only)? The tax is calculated at 30 per cent.(Assume that there are 52 weeks in a year and round to the nearest dollar.)

A)

B)

C)

D)

E) None of the given answers.

A)

B)

C)

D)

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

31

Short-term employee benefits are defined in AASB 119 as:

A) Benefits that are paid to employees while they are employed by the company making the payment.

B) All payments made to an employee within 12 months of the date the employee rendered the service.

C) The undiscounted value of wages, salaries and social security contributions to which the employer is presently obliged.

D) Benefits that are paid to employees while they are employed by the company making the payment and the undiscounted value of wages, salaries and social security contributions to which the employer is presently obliged.

E) Employee benefits that are wholly due within 12 months after the end of the period in which the employee rendered the related service.

A) Benefits that are paid to employees while they are employed by the company making the payment.

B) All payments made to an employee within 12 months of the date the employee rendered the service.

C) The undiscounted value of wages, salaries and social security contributions to which the employer is presently obliged.

D) Benefits that are paid to employees while they are employed by the company making the payment and the undiscounted value of wages, salaries and social security contributions to which the employer is presently obliged.

E) Employee benefits that are wholly due within 12 months after the end of the period in which the employee rendered the related service.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

32

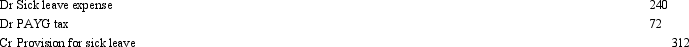

Dervish Ltd has an average weekly payroll of $700 000.The employees are entitled to 2 weeks',non-vesting sick leave per annum.Past experience suggests that 66 per cent of employees will take the full 2 weeks' sick leave and 15 per cent will take 1 week's leave each year.The rest of the employees take no sick leave.What weekly entry would Dervish make in relation to sick leave?

A)

B) None.

C)

D)

E) None of the given answers.

A)

B) None.

C)

D)

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

33

According to the former Australian guidance section of AASB 119 what are the categories of long service leave entitlements and how should they be accounted for?

A) Categories: Vesting and non-vesting accounting treatment: Vesting entitlements should be treated as a liability and expense of the period in which they are accumulated, while non-vesting entitlements should not be recognised until they vest.

B) Categories - Unconditional, conditional and pre-conditional accounting treatment: Unconditional entitlements should be recognised as an expense and a liability as there is a commitment to a future cash outflow, whereas conditional and pre-conditional entitlements do not meet the AASB Framework requirements for recognition.

C) Categories - Defined benefit and defined contribution accounting treatment: Defined benefit entitlements should be treated as a liability and expense of the period in which they are accumulated, while defined contribution entitlements should not be recognised until they are actually taken by the employee.

D) Categories - Pre-conditional, conditional and unconditional accounting treatment: To the extent that entitlements accumulated in a period in any of the three categories are expected to result in future cash outflows for the reporting entity, they should be treated as expenses.

E) None of the given answers.

A) Categories: Vesting and non-vesting accounting treatment: Vesting entitlements should be treated as a liability and expense of the period in which they are accumulated, while non-vesting entitlements should not be recognised until they vest.

B) Categories - Unconditional, conditional and pre-conditional accounting treatment: Unconditional entitlements should be recognised as an expense and a liability as there is a commitment to a future cash outflow, whereas conditional and pre-conditional entitlements do not meet the AASB Framework requirements for recognition.

C) Categories - Defined benefit and defined contribution accounting treatment: Defined benefit entitlements should be treated as a liability and expense of the period in which they are accumulated, while defined contribution entitlements should not be recognised until they are actually taken by the employee.

D) Categories - Pre-conditional, conditional and unconditional accounting treatment: To the extent that entitlements accumulated in a period in any of the three categories are expected to result in future cash outflows for the reporting entity, they should be treated as expenses.

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

34

'On-costs' can be described as:

A) The additional monies owed to an employee for working overtime or on public holidays.

B) The costs incurred by the employer that will be received by the employee once they move on.

C) The extra costs incurred by the employer not directly received by the employee such as providing ergonomic equipment or an up to date computer.

D) Additional costs borne by the employer such as payroll tax and workers compensation insurance.

E) None of the given answers.

A) The additional monies owed to an employee for working overtime or on public holidays.

B) The costs incurred by the employer that will be received by the employee once they move on.

C) The extra costs incurred by the employer not directly received by the employee such as providing ergonomic equipment or an up to date computer.

D) Additional costs borne by the employer such as payroll tax and workers compensation insurance.

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

35

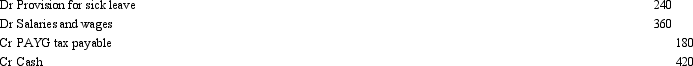

Danish Ltd has an average weekly payroll of $200,000.The employees are entitled to 2 weeks',non-vesting sick leave per annum.Past experience suggests that 56 per cent of employees will take the full 2 weeks' sick leave and 22 per cent will take 1 week's leave each year.The rest of the employees take no sick leave.In the current week an employee with a weekly salary of $600 has been off sick for the first time this year.The employee took 2 days off out of her normal 5-day working week.Assuming that a weekly entry has been made to record the accumulated liability for sick leave and that PAYG tax is deducted at 30 per cent,what would the entry be to record the employee's weekly salary (round amounts to the nearest dollar)?

A)

B)

C)

D)

E) None of the given answers.

A)

B)

C)

D)

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

36

A defined contribution superannuation plan is one in which:

A) The contributions to the plan only are paid out to members on retirement.

B) The benefits paid out by the plan are based on the average salary of an employee over a period of years as a reflection of the employee's contribution to the employer.

C) The contributions are defined by the amount needed to pay out benefits to the members at a specified level on retirement.

D) The benefits paid out by the plan depend on the contributions made to the plan and the earnings of that plan.

E) None of the given answers.

A) The contributions to the plan only are paid out to members on retirement.

B) The benefits paid out by the plan are based on the average salary of an employee over a period of years as a reflection of the employee's contribution to the employer.

C) The contributions are defined by the amount needed to pay out benefits to the members at a specified level on retirement.

D) The benefits paid out by the plan depend on the contributions made to the plan and the earnings of that plan.

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is not a step in accounting for contributions to a defined benefit superannuation plan?

A) Determine the fair value of any plan.

B) Discount any benefit employees have earned.

C) Estimate the amount of benefits the employees have earned in return for their service in the current and prior periods.

D) Establish the numbers of years until retirement for each employee to accurately calculate their likely benefit.

E) Determine the total amount of actuarial gains and losses.

A) Determine the fair value of any plan.

B) Discount any benefit employees have earned.

C) Estimate the amount of benefits the employees have earned in return for their service in the current and prior periods.

D) Establish the numbers of years until retirement for each employee to accurately calculate their likely benefit.

E) Determine the total amount of actuarial gains and losses.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

38

Because of the uncertainties involved in making future predictions,AASB 119 requires:

A) That the long service leave estimate be based on the level of salary paid to employees at the time the entitlement was earned.

B) That there is no consideration given to future inflation rates or promotion prospects of employees.

C) That the discount rate used be based on the rates offered by high quality corporate bonds.

D) That market-adjusted expected cash flows be discounted at the risk-adjusted rate.

E) None of the given answers.

A) That the long service leave estimate be based on the level of salary paid to employees at the time the entitlement was earned.

B) That there is no consideration given to future inflation rates or promotion prospects of employees.

C) That the discount rate used be based on the rates offered by high quality corporate bonds.

D) That market-adjusted expected cash flows be discounted at the risk-adjusted rate.

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

39

AASB 119 requires which items to be recorded at their discounted amounts?

A) Annual leave and sick leave if they are expected to be settled after 12 months have elapsed from reporting date.

B) Cumulative sick leave that has accrued for longer than 12 months.

C) Wages and salaries.

D) Annual leave that has accrued for longer than 12 months.

E) None of the given answers.

A) Annual leave and sick leave if they are expected to be settled after 12 months have elapsed from reporting date.

B) Cumulative sick leave that has accrued for longer than 12 months.

C) Wages and salaries.

D) Annual leave that has accrued for longer than 12 months.

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

40

The amount represented as a current liability,'Provision for Long-Service Leave' generally represents:

A) The amount to be expensed as long-service leave expense in the next 12 months.

B) The amount of long-service that has been provided for, for all employees of the entity.

C) The amount of long-service leave remaining to be taken by staff.

D) The amount of long-service leave that is expected to be taken in the 12 months following balance date.

E) None of the given answers.

A) The amount to be expensed as long-service leave expense in the next 12 months.

B) The amount of long-service that has been provided for, for all employees of the entity.

C) The amount of long-service leave remaining to be taken by staff.

D) The amount of long-service leave that is expected to be taken in the 12 months following balance date.

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

41

AASB 119 has resulted in many more companies recognising liabilities for employee entitlements.There is evidence that this requirement has the effect of:

A) Creating cash reserves from which employee entitlements can be paid in the case of company insolvency.

B) Increasing the probability of companies becoming insolvent.

C) Reducing the level of employment in Australia.

D) Increasing the probability that employees will be paid their full entitlements in the case of the entity becoming insolvent.

E) None of the given answers.

A) Creating cash reserves from which employee entitlements can be paid in the case of company insolvency.

B) Increasing the probability of companies becoming insolvent.

C) Reducing the level of employment in Australia.

D) Increasing the probability that employees will be paid their full entitlements in the case of the entity becoming insolvent.

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

42

Performance bonuses:

A) Are capitalised as part of the cost of an asset 'Bonus Payments'.

B) Form part of salaries and wages and are treated in the same manner.

C) Are charged directly against 'Opening Retained Earnings'.

D) Form part of the leave entitlements of employees.

E) Are not covered by AASB 119.

A) Are capitalised as part of the cost of an asset 'Bonus Payments'.

B) Form part of salaries and wages and are treated in the same manner.

C) Are charged directly against 'Opening Retained Earnings'.

D) Form part of the leave entitlements of employees.

E) Are not covered by AASB 119.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

43

Suggested approaches to improving the financial security of employees in the case of the collapse of their employer include:

A) Promoting compulsory, private self-insurance schemes for individuals so that they will be covered in the case of company failure.

B) Providing stronger government funding for unions so they can act as a financial support for members made unemployed by corporate failure.

C) Creating a sub-committee of Cabinet to oversee the raising of funds and investment of these funds to provide a special needs fund for employees severely financially affected by the collapse of their employer.

D) The establishment of central funds, either in the form of government-backed compulsory insurance or a trust to which it is compulsory for employers to contribute, from which employee entitlements could be paid in the case of corporate collapse.

E) None of the given answers.

A) Promoting compulsory, private self-insurance schemes for individuals so that they will be covered in the case of company failure.

B) Providing stronger government funding for unions so they can act as a financial support for members made unemployed by corporate failure.

C) Creating a sub-committee of Cabinet to oversee the raising of funds and investment of these funds to provide a special needs fund for employees severely financially affected by the collapse of their employer.

D) The establishment of central funds, either in the form of government-backed compulsory insurance or a trust to which it is compulsory for employers to contribute, from which employee entitlements could be paid in the case of corporate collapse.

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

44

AASB 119 divides employee benefits into a number of categories,including:

A) Terminations benefits.

B) Payroll tax.

C) PAYG tax.

D) Performance increments.

E) Contingent payments.

A) Terminations benefits.

B) Payroll tax.

C) PAYG tax.

D) Performance increments.

E) Contingent payments.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

45

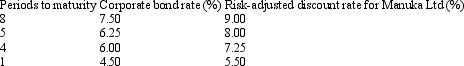

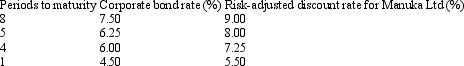

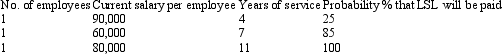

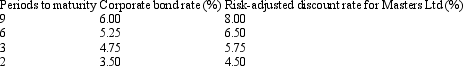

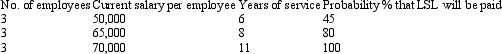

Masters Ltd has three employees who are entitled to long service leave (LSL).The LSL can be taken after 15 years of service,at which time the employee is entitled to 13 weeks' leave.After 10 years the employee is entitled to a pro rata cash payment on leaving the company.Information about the employees is set out below:  Other information collected.

Other information collected.

The inflation rate for the foreseeable future is 3.5 per cent.The future salaries of the employees are expected to keep pace with inflation but not increase as a result of promotion.If the opening balance of the LSL provision is $20,561,what is the LSL expense for the current period (round amounts to the nearest dollar)?

The inflation rate for the foreseeable future is 3.5 per cent.The future salaries of the employees are expected to keep pace with inflation but not increase as a result of promotion.If the opening balance of the LSL provision is $20,561,what is the LSL expense for the current period (round amounts to the nearest dollar)?

A) $1202

B) $948

C) $1064

D) $21 763

E) None of the given answers.

Other information collected.

Other information collected. The inflation rate for the foreseeable future is 3.5 per cent.The future salaries of the employees are expected to keep pace with inflation but not increase as a result of promotion.If the opening balance of the LSL provision is $20,561,what is the LSL expense for the current period (round amounts to the nearest dollar)?

The inflation rate for the foreseeable future is 3.5 per cent.The future salaries of the employees are expected to keep pace with inflation but not increase as a result of promotion.If the opening balance of the LSL provision is $20,561,what is the LSL expense for the current period (round amounts to the nearest dollar)?A) $1202

B) $948

C) $1064

D) $21 763

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

46

Dennis Carter works for Midrift Ltd and has taken his long service leave this period.He was paid $2,450 as his entitlement.What account(s)is/are debited in the entry to record this event?

A) Provision for long service leave and PAYG tax deduction.

B) Provision for long service leave.

C) Long service leave expense.

D) Long service leave expense and PAYG tax deduction.

E) None of the given answers.

A) Provision for long service leave and PAYG tax deduction.

B) Provision for long service leave.

C) Long service leave expense.

D) Long service leave expense and PAYG tax deduction.

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

47

The causes of actuarial gains and losses when accounting for defined benefit superannuation plans includes:

A) The effect of changes in the CPI.

B) The effect of changes of future employee turnover.

C) The effect of changes to strategic direction for the entity.

D) The effect of differences between the actual return on plan assets and the actual payments on plan liabilities.

E) The effect of the change of Government.

A) The effect of changes in the CPI.

B) The effect of changes of future employee turnover.

C) The effect of changes to strategic direction for the entity.

D) The effect of differences between the actual return on plan assets and the actual payments on plan liabilities.

E) The effect of the change of Government.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

48

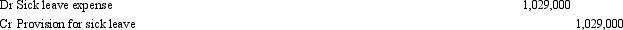

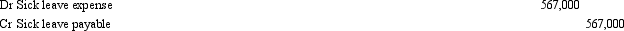

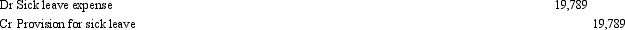

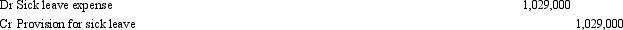

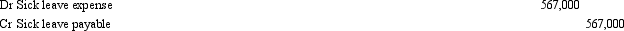

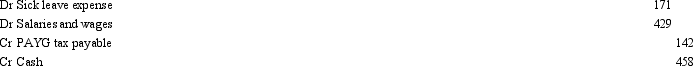

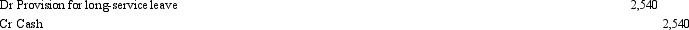

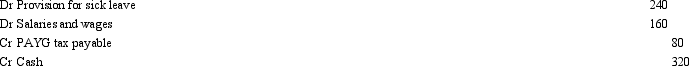

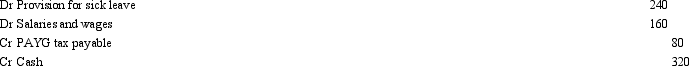

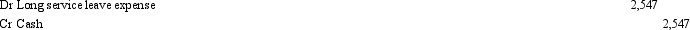

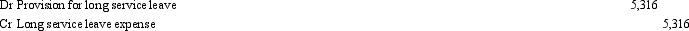

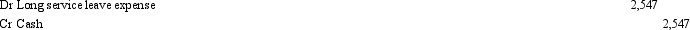

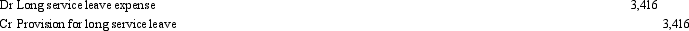

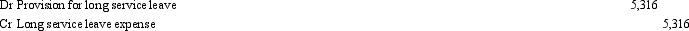

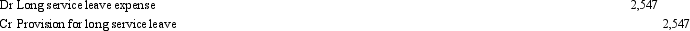

The following journal entry shows:

A) An (some) employee(s) may have taken long-service leave.

B) An (some) employee(s) may have been paid out their long-service leave entitlement upon resignation.

C) An employer is building up a provision account for long-service to enable it to account for leave taken in the future.

D) An (some) employee(s) may have taken long-service leave and an (some) employee(s) may have been paid out their long-service leave entitlement upon resignation

E) An (some) employee(s) may have taken long-service leave and an employer is building up a provision account for long-service to enable it to account for leave taken in the future.

A) An (some) employee(s) may have taken long-service leave.

B) An (some) employee(s) may have been paid out their long-service leave entitlement upon resignation.

C) An employer is building up a provision account for long-service to enable it to account for leave taken in the future.

D) An (some) employee(s) may have taken long-service leave and an (some) employee(s) may have been paid out their long-service leave entitlement upon resignation

E) An (some) employee(s) may have taken long-service leave and an employer is building up a provision account for long-service to enable it to account for leave taken in the future.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

49

Post-employment benefits include:

A) Cash payments.

B) Pensions payable through a superannuation fund.

C) Insurance costs.

D) All of the given answers.

E) None of the given answers.

A) Cash payments.

B) Pensions payable through a superannuation fund.

C) Insurance costs.

D) All of the given answers.

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

50

A non-contributory superannuation fund means:

A) No contributions are made to the fund by either the employer or employee.

B) Only the employer makes contributions to the fund.

C) Only the employee makes contributions to the fund.

D) It is a solely Government-funded scheme.

E) The fund is not taxed.

A) No contributions are made to the fund by either the employer or employee.

B) Only the employer makes contributions to the fund.

C) Only the employee makes contributions to the fund.

D) It is a solely Government-funded scheme.

E) The fund is not taxed.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

51

In Australia,employee entitlements are protected in the case of company insolvency because:

A) Employees are given first priority for payment after the taxation department and the company administrators.

B) Employees are given some preferential access to payment, but after secured creditors.

C) ASIC monitors companies' annual reports to ensure that their assets are greater than the total secured debt and employee entitlements.

D) Employees are encouraged to withdraw their labour in the case of a company beginning to fail in order to minimise their loss of employee entitlements.

E) None of the given answers.

A) Employees are given first priority for payment after the taxation department and the company administrators.

B) Employees are given some preferential access to payment, but after secured creditors.

C) ASIC monitors companies' annual reports to ensure that their assets are greater than the total secured debt and employee entitlements.

D) Employees are encouraged to withdraw their labour in the case of a company beginning to fail in order to minimise their loss of employee entitlements.

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

52

Entity A contributes to a defined benefit superannuation plan for its employees.It calculates the following: Present value of the obligation 12,286

Fair value of plan assets 11,500

786

The $786 represents:

A) The expense to be recognised in the income statement.

B) The asset to be recognised in the balance sheet.

C) The liability to be recognised in the balance sheet.

D) The revenue to be recognised in the income statement.

E) The cash flow pertaining to the contributions made for the period.

Fair value of plan assets 11,500

786

The $786 represents:

A) The expense to be recognised in the income statement.

B) The asset to be recognised in the balance sheet.

C) The liability to be recognised in the balance sheet.

D) The revenue to be recognised in the income statement.

E) The cash flow pertaining to the contributions made for the period.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

53

Junior Ltd employs three workers to develop and test games.The employees are currently earning $30,000 each and are expected to cease their employment in 20 years.At the end of their employment each employee is entitled to a lump sum payment equal to 10 per cent of their final salary.Actuarial analysis suggests salaries will increase evenly at a rate of 5 per cent per year over the 20 years.In 5 years' time,what total benefit will the three employees have accrued (rounded to the nearest dollar):

A) $114,865.

B) $23,899.

C) $165,000.

D) $119,399.

E) None of the given answers.

A) $114,865.

B) $23,899.

C) $165,000.

D) $119,399.

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

54

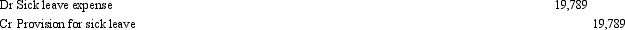

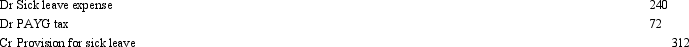

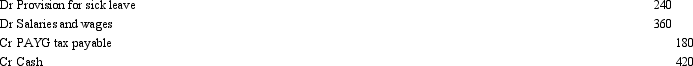

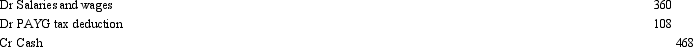

The following journal entry accounts for one week's (five days)salaries and wages for an employee:  Which of the following statements is(are)correct?

Which of the following statements is(are)correct?

A) That the employee's gross salary is $400 per week.

B) That the employee was absent from work for 3 days during the week and was paid for his/her absence.

C) That the employee's bank account is credited with an amount of $320 for his/her week's work.

D) That the PAYG tax rate for this employee is 20 per cent.

E) All of the given answers.

Which of the following statements is(are)correct?

Which of the following statements is(are)correct?A) That the employee's gross salary is $400 per week.

B) That the employee was absent from work for 3 days during the week and was paid for his/her absence.

C) That the employee's bank account is credited with an amount of $320 for his/her week's work.

D) That the PAYG tax rate for this employee is 20 per cent.

E) All of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

55

The expense recognised by an employer for a defined benefit superannuation plan:

A) Will always equal the amount of the contribution for the period.

B) Is not necessarily the amount of the contribution for the period.

C) Will never equal the amount of the contribution for the period.

D) Is always greater than the amount of the contribution for the period.

E) Is always less than the amount of the contribution for the period.

A) Will always equal the amount of the contribution for the period.

B) Is not necessarily the amount of the contribution for the period.

C) Will never equal the amount of the contribution for the period.

D) Is always greater than the amount of the contribution for the period.

E) Is always less than the amount of the contribution for the period.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

56

Junior Ltd employs three workers to develop and test games.The employees are currently earning $30,000 each and are expected to cease their employment in 20 years.At the end of their employment each employee is entitled to a lump sum payment equal to 10 per cent of their final salary.Actuarial analysis suggests salaries will increase evenly at a rate of 5 per cent per year over the 20 years.At the end of the 20 years Junior's undiscounted obligation is $477,593.Assuming an interest rate of 8 per cent,calculate the obligation that would be recorded at the end of year 1 (rounded to the nearest dollar):

A) $5,123.

B) $23,898.

C) $21,986.

D) $102,466.

E) None of the given answers.

A) $5,123.

B) $23,898.

C) $21,986.

D) $102,466.

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

57

AASB 119 defines 'employee benefits' as:

A) Salaries and wages, and associated on-costs.

B) All cash payments made to employees.

C) All cash payments made to employees in their roles as employees.

D) All forms of consideration given up by an entity in exchange for service rendered by employees.

E) Salaries, wages, payments for leave and share options.

A) Salaries and wages, and associated on-costs.

B) All cash payments made to employees.

C) All cash payments made to employees in their roles as employees.

D) All forms of consideration given up by an entity in exchange for service rendered by employees.

E) Salaries, wages, payments for leave and share options.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

58

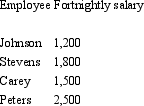

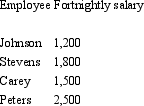

Trailers of the World has a small group of four employees.Trailers take part in a defined contribution plan and pay the required government contribution of 9 per cent plus an additional 4 per cent to reward its employees.Based on the employee earnings below,what is Trailers' superannuation obligation for the year?

A) $10,920.

B) $23,660.

C) $47,320.

D) $16,380.

E) None of the given answers.

A) $10,920.

B) $23,660.

C) $47,320.

D) $16,380.

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

59

When salaries and wages are capitalised as part of the costs of an asset,such as inventory:

A) An expense will never be recognised for the salaries and wages.

B) An expense will only be recognised when the employee takes leave.

C) An expense is recognised as part of the cost of the inventory.

D) An expense is recognised immediately.

E) An expense is finally recognised in the form of 'Cost of Goods Sold'.

A) An expense will never be recognised for the salaries and wages.

B) An expense will only be recognised when the employee takes leave.

C) An expense is recognised as part of the cost of the inventory.

D) An expense is recognised immediately.

E) An expense is finally recognised in the form of 'Cost of Goods Sold'.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

60

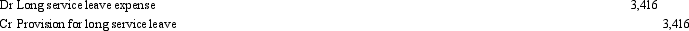

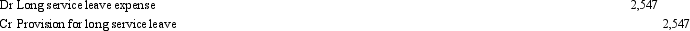

Midrift Ltd has nine employees who are entitled to long service leave (LSL).The LSL can be taken after 12 years of service,at which time the employee is entitled to 15 weeks' leave.After 10 years the employee is entitled to a pro rata cash payment on leaving the company.Information about the employees is set out below:  Other information collected.

Other information collected.

The inflation rate for the foreseeable future is 1.5 per cent.The future salaries of the employees are expected to keep pace with inflation but not increase as a result of promotion.If the opening balance of the LSL provision is $87,560,what is the entry to record LSL expense for the current period (round amounts to the nearest dollar)?

The inflation rate for the foreseeable future is 1.5 per cent.The future salaries of the employees are expected to keep pace with inflation but not increase as a result of promotion.If the opening balance of the LSL provision is $87,560,what is the entry to record LSL expense for the current period (round amounts to the nearest dollar)?

A)

B)

C)

D)

E) None of the given answers.

Other information collected.

Other information collected. The inflation rate for the foreseeable future is 1.5 per cent.The future salaries of the employees are expected to keep pace with inflation but not increase as a result of promotion.If the opening balance of the LSL provision is $87,560,what is the entry to record LSL expense for the current period (round amounts to the nearest dollar)?

The inflation rate for the foreseeable future is 1.5 per cent.The future salaries of the employees are expected to keep pace with inflation but not increase as a result of promotion.If the opening balance of the LSL provision is $87,560,what is the entry to record LSL expense for the current period (round amounts to the nearest dollar)?A)

B)

C)

D)

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

61

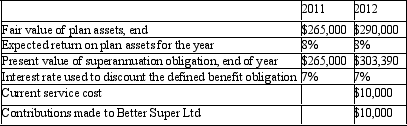

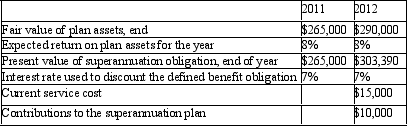

Great Keppel Ltd provides defined superannuation benefits to two (2)of its employees which represents an entitlement of three times their final salary on retirement.The company's superannuation plan is managed by Better Super Funds. The following details are relevant to the superannuation obligation of the company for the years ended 30 June 2011 and 2012:

Which of the following course of actions should Great Keppel Ltd take to comply with the accounting treatment on superannuation prescribed in AASB 119 "Employee Benefits" in preparation of the financial statements for the year ending 30 June 2012?

Which of the following course of actions should Great Keppel Ltd take to comply with the accounting treatment on superannuation prescribed in AASB 119 "Employee Benefits" in preparation of the financial statements for the year ending 30 June 2012?

A) No action necessary as the contribution of $10,000 was remitted to better Super Ltd.

B) No action necessary as the assets and liabilities of the superannuation for its employees are managed by Better Super Ltd.

C) Recognise a superannuation obligation of $13,390 being the difference between ending balance of plan assets and the present value of superannuation obligation as at 30 June 2012.

D) Recognise a superannuation expense of $38,390 for the year 2012 being the difference between beginning and ending balance of the present value of superannuation obligation.

E) None of the given answers.

Which of the following course of actions should Great Keppel Ltd take to comply with the accounting treatment on superannuation prescribed in AASB 119 "Employee Benefits" in preparation of the financial statements for the year ending 30 June 2012?

Which of the following course of actions should Great Keppel Ltd take to comply with the accounting treatment on superannuation prescribed in AASB 119 "Employee Benefits" in preparation of the financial statements for the year ending 30 June 2012?A) No action necessary as the contribution of $10,000 was remitted to better Super Ltd.

B) No action necessary as the assets and liabilities of the superannuation for its employees are managed by Better Super Ltd.

C) Recognise a superannuation obligation of $13,390 being the difference between ending balance of plan assets and the present value of superannuation obligation as at 30 June 2012.

D) Recognise a superannuation expense of $38,390 for the year 2012 being the difference between beginning and ending balance of the present value of superannuation obligation.

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

62

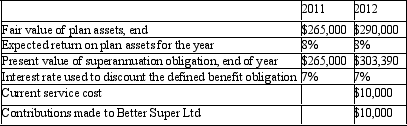

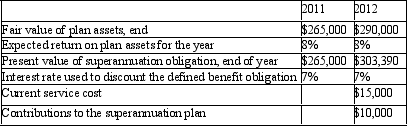

Mackay Ltd provides defined superannuation benefits to two (2)of its employees which represents an entitlement of three times their final salary on retirement.The following details are relevant to the current superannuation obligation of the company for the two employees for the years ended 30 June 2011 and 2012:  In accordance with AASB 119 "Employee Benefits",what is the interest cost and actuarial gain (loss)for the defined benefit obligation for the year ending 2012?

In accordance with AASB 119 "Employee Benefits",what is the interest cost and actuarial gain (loss)for the defined benefit obligation for the year ending 2012?

A) $13 250; $10 140

B) $13 250; ($10 140)

C) $18 550; $4 840

D) $18 550; ($4 840)

E) None of the given answers.

In accordance with AASB 119 "Employee Benefits",what is the interest cost and actuarial gain (loss)for the defined benefit obligation for the year ending 2012?

In accordance with AASB 119 "Employee Benefits",what is the interest cost and actuarial gain (loss)for the defined benefit obligation for the year ending 2012?A) $13 250; $10 140

B) $13 250; ($10 140)

C) $18 550; $4 840

D) $18 550; ($4 840)

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

63

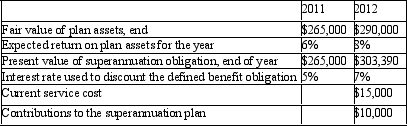

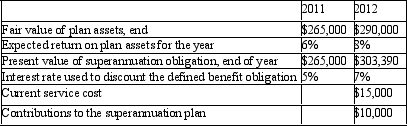

Whitsunday Ltd provides defined superannuation benefits to two (2)of its employees which represents an entitlement of three times their final salary on retirement.The following details are relevant to the current superannuation obligation of the company for the two employees for the years ended 30 June 2011 and 2012:  In accordance with AASB 119 "Employee Benefits",what is the expected return and actuarial gain (loss)for the plan assets for the year ending 2012,respectively?

In accordance with AASB 119 "Employee Benefits",what is the expected return and actuarial gain (loss)for the plan assets for the year ending 2012,respectively?

A) $21 200; $6 200

B) $21 200; ($6 200)

C) $23 200; $8 200

D) $23 200; ($8 200)

E) None of the given answers

In accordance with AASB 119 "Employee Benefits",what is the expected return and actuarial gain (loss)for the plan assets for the year ending 2012,respectively?

In accordance with AASB 119 "Employee Benefits",what is the expected return and actuarial gain (loss)for the plan assets for the year ending 2012,respectively?A) $21 200; $6 200

B) $21 200; ($6 200)

C) $23 200; $8 200

D) $23 200; ($8 200)

E) None of the given answers

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

64

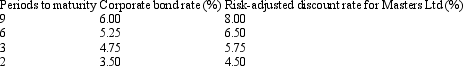

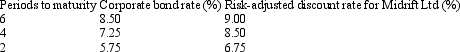

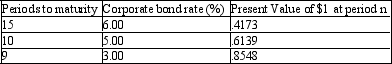

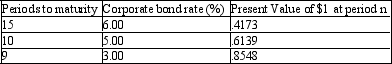

Annette French joined Paris Ltd on 1 July 2011 as a bookkeeper.She is the only permanent employee of Paris Ltd.On 30 June 2012 her salary was $35,000.Annette French's salary is expected to increase with inflation at a rate of 3%.Paris Ltd provides long service leave entitlement of 13 weeks after 15 years of service.A pro rata payment is made after 10 years of service.The probability of Annette French staying in the job until the obligation vests is 35%. Other information:

What is the long service leave liability (to the nearest $)of Paris Ltd as at 30 June 2012?

What is the long service leave liability (to the nearest $)of Paris Ltd as at 30 June 2012?

A) $133

B) $228

C) $253

D) $976

E) None of the given answers.

What is the long service leave liability (to the nearest $)of Paris Ltd as at 30 June 2012?

What is the long service leave liability (to the nearest $)of Paris Ltd as at 30 June 2012?A) $133

B) $228

C) $253

D) $976

E) None of the given answers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following is ?not considered compensated absences under AASB 119 "Employee Benefits"?

A) Sick leave

B) Annual leave

C) Long service leave

D) Sabbatical leave

E) None of the given answers

A) Sick leave

B) Annual leave

C) Long service leave

D) Sabbatical leave

E) None of the given answers

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

66

Entity A contributes to a defined benefit superannuation plan for its employees.It calculates the following: Current service cost 12,785

Interest cost 983

Expected return on plan assets (1,150)

Net actuarial gain recognised in period (1,835)

10,783

The 'Expected return on plan assets (1,150)' represents:

A) The expected return at the start of the period, measured as a proportion of the current service cost.

B) The expected return at the start of the period, measured as a proportion of the opening fair value of the plan obligation.

C) The adjusted return for the period, measured as a proportion of the closing fair value of the plan assets.

D) The adjusted return for the period, measured as a proportion of the opening fair value of the plan assets.

E) The expected return at the start of the period, measured as a proportion of the opening fair value of the plan assets.

Interest cost 983

Expected return on plan assets (1,150)

Net actuarial gain recognised in period (1,835)

10,783

The 'Expected return on plan assets (1,150)' represents:

A) The expected return at the start of the period, measured as a proportion of the current service cost.

B) The expected return at the start of the period, measured as a proportion of the opening fair value of the plan obligation.

C) The adjusted return for the period, measured as a proportion of the closing fair value of the plan assets.

D) The adjusted return for the period, measured as a proportion of the opening fair value of the plan assets.

E) The expected return at the start of the period, measured as a proportion of the opening fair value of the plan assets.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

67

Entity A contributes to a defined benefit superannuation plan for its employees.It calculates the following: Current service cost 12,785

Interest cost 983

Expected return on plan assets (1,150)

Net actuarial gain recognised in period (1,835)

10,783

The $10,783 represents:

A) The expense to be recognised in the income statement.

B) The asset to be recognised in the balance sheet.

C) The liability to be recognised in the balance sheet.

D) The revenue to be recognised in the income statement.

E) The cash flow pertaining to the contributions made for the period.

Interest cost 983

Expected return on plan assets (1,150)

Net actuarial gain recognised in period (1,835)

10,783

The $10,783 represents:

A) The expense to be recognised in the income statement.

B) The asset to be recognised in the balance sheet.

C) The liability to be recognised in the balance sheet.

D) The revenue to be recognised in the income statement.

E) The cash flow pertaining to the contributions made for the period.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck