Deck 6: The Trade-Off Between Risk and Return

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/91

Play

Full screen (f)

Deck 6: The Trade-Off Between Risk and Return

1

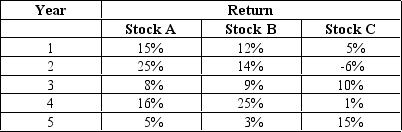

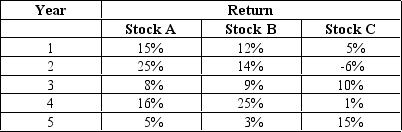

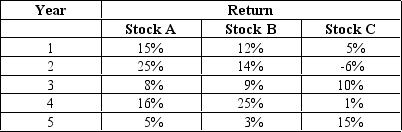

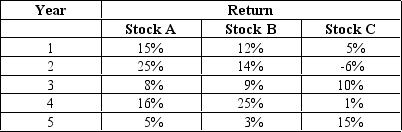

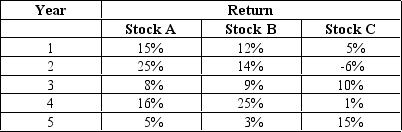

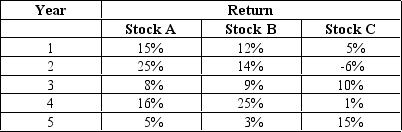

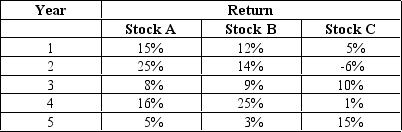

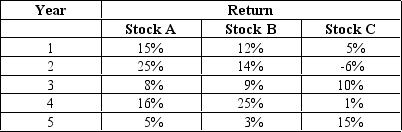

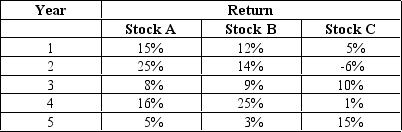

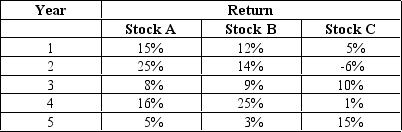

What is the average return of a portfolio that has 30% invested in stock A,30% invested in stock B and 40% invested in stock C?

A) 9.92%

B) 12.6%

C) 7.59%

D) 13.8%

9.92%

2

What do you call the portion of your total return on a stock investment that is caused by an increase in the value of the stock.

A) Dividend yield.

B) Risk-free return.

C) Capital gain.

D) None of the above.

A) Dividend yield.

B) Risk-free return.

C) Capital gain.

D) None of the above.

Capital gain.

3

What is the standard deviation of returns for stock C?

A) 7.79%

B) 8.52%

C) 8.09%

D) 6.38%

8.09%

4

What is the variance of returns for stock B?

A) .00653

B) .00607

C) .00528

D) .00721

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

5

What is the average return of a portfolio that has 10% invested in stock A,40% invested in stock B and 50% invested in stock C?

A) 9.92%

B) 15.32%

C) 13.80%

D) 8.92%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is an example of unsystematic risk?

A) IBM posts lower than expected earnings.

B) The Fed raises interest rates unexpectedly.

C) The rate of inflation is higher than expected.

D) None of the above.

A) IBM posts lower than expected earnings.

B) The Fed raises interest rates unexpectedly.

C) The rate of inflation is higher than expected.

D) None of the above.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

7

Bavarian Sausage 2

You bought a share of Bavarian Sausage stock for $46.50 at the beginning of the year. During the year the stock paid a $2.75 dividend and at the end of the year it trades at $44.75.

Refer to Bavarian Sausage 2.What is the total return on your investment?

A) 2.15%

B) -3.76%

C) 8.06%

D) 5.91%

You bought a share of Bavarian Sausage stock for $46.50 at the beginning of the year. During the year the stock paid a $2.75 dividend and at the end of the year it trades at $44.75.

Refer to Bavarian Sausage 2.What is the total return on your investment?

A) 2.15%

B) -3.76%

C) 8.06%

D) 5.91%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

8

What is the variance of returns for stock A?

A) .00607

B) .00653

C) .00655

D) .00506

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

9

Bavarian Sausage

You bought a share of Bavarian Sausage stock for $46.50 at the beginning of the year. During the year the stock paid a $2.75 dividend and at the end of the year it trades at $52.75.

Refer to Bavarian Sausage.What is the total dollar return on your investment?

A) $9.00

B) $2.75

C) $6.25

D) $52.75

You bought a share of Bavarian Sausage stock for $46.50 at the beginning of the year. During the year the stock paid a $2.75 dividend and at the end of the year it trades at $52.75.

Refer to Bavarian Sausage.What is the total dollar return on your investment?

A) $9.00

B) $2.75

C) $6.25

D) $52.75

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

10

What is the average return of stock B?

A) 13.8%

B) 12.6%

C) 5.00%

D) 8.52%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

11

What is the standard deviation of returns for stock A?

A) 8.09%

B) 8.08%

C) 7.79%

D) 6.53%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

12

Bavarian Sausage

You bought a share of Bavarian Sausage stock for $46.50 at the beginning of the year. During the year the stock paid a $2.75 dividend and at the end of the year it trades at $52.75.

Refer to Bavarian Sausage.What is the capital gain/loss on your stock investment?

A) 5.91%

B) 13.44%

C) 19.35%

D) 28.24%

You bought a share of Bavarian Sausage stock for $46.50 at the beginning of the year. During the year the stock paid a $2.75 dividend and at the end of the year it trades at $52.75.

Refer to Bavarian Sausage.What is the capital gain/loss on your stock investment?

A) 5.91%

B) 13.44%

C) 19.35%

D) 28.24%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

13

What is the purpose of diversification?

A) Maximize possible returns.

B) Increase the risk of your portfolio.

C) Lower the overall risk of your portfolio.

D) None of the above.

A) Maximize possible returns.

B) Increase the risk of your portfolio.

C) Lower the overall risk of your portfolio.

D) None of the above.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is an example of systematic risk?

A) IBM posts lower than expected earnings.

B) Intel announces record earnings.

C) The national trade deficit is higher than expected.

D) None of the above.

A) IBM posts lower than expected earnings.

B) Intel announces record earnings.

C) The national trade deficit is higher than expected.

D) None of the above.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

15

What is the average return of stock C?

A) 13.8%

B) 12.6%

C) 5.00%

D) 8.52%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

16

Bavarian Sausage 2

You bought a share of Bavarian Sausage stock for $46.50 at the beginning of the year. During the year the stock paid a $2.75 dividend and at the end of the year it trades at $44.75.

If the return on your common stock investment is on average 18% and the return on Treasury bills was 5% over the same period of time,what is the risk premium that you earned.

A) 23%

B) 13%

C) 18%

D) 5%

You bought a share of Bavarian Sausage stock for $46.50 at the beginning of the year. During the year the stock paid a $2.75 dividend and at the end of the year it trades at $44.75.

If the return on your common stock investment is on average 18% and the return on Treasury bills was 5% over the same period of time,what is the risk premium that you earned.

A) 23%

B) 13%

C) 18%

D) 5%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

17

Bavarian Sausage 2

You bought a share of Bavarian Sausage stock for $46.50 at the beginning of the year. During the year the stock paid a $2.75 dividend and at the end of the year it trades at $44.75.

Refer to Bavarian Sausage 2.What is the capital gain's yield of your investment?

A) 2.15%

B) -3.76%

C) 8.06%

D) 5.91%

You bought a share of Bavarian Sausage stock for $46.50 at the beginning of the year. During the year the stock paid a $2.75 dividend and at the end of the year it trades at $44.75.

Refer to Bavarian Sausage 2.What is the capital gain's yield of your investment?

A) 2.15%

B) -3.76%

C) 8.06%

D) 5.91%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

18

What is one of the most important lessons from capital market history?

A) Risk does not matter.

B) There is a positive relationship between risk and return.

C) You are always better off investing in stock.

D) T-bills are the highest yielding investment.

A) Risk does not matter.

B) There is a positive relationship between risk and return.

C) You are always better off investing in stock.

D) T-bills are the highest yielding investment.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

19

What is the average return for stock A?

A) 12.6%

B) 13.8%

C) 5.00%

D) 8.26%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

20

Bavarian Sausage

You bought a share of Bavarian Sausage stock for $46.50 at the beginning of the year. During the year the stock paid a $2.75 dividend and at the end of the year it trades at $52.75.

Refer to Bavarian Sausage.What is the total return of your stock investment?

A) 5.91%

B) 13.44%

C) 26.69%

D) 19.35%

You bought a share of Bavarian Sausage stock for $46.50 at the beginning of the year. During the year the stock paid a $2.75 dividend and at the end of the year it trades at $52.75.

Refer to Bavarian Sausage.What is the total return of your stock investment?

A) 5.91%

B) 13.44%

C) 26.69%

D) 19.35%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

21

The total return of an asset captures

A) income paid by an asset over time.

B) the capital gain or loss on the asset over time.

C) the book value of the asset over time.

D) a and b are both correct.

A) income paid by an asset over time.

B) the capital gain or loss on the asset over time.

C) the book value of the asset over time.

D) a and b are both correct.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

22

You are introduced to an investment that has an expected return of 20% equal to the standard deviation of the distribution of returns.What is the probability that the investment will lose some of your initial investment in the first year?

A) 50%

B) 34%

C) 16%

D) unable to determine from the information given

A) 50%

B) 34%

C) 16%

D) unable to determine from the information given

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

23

You purchased WPC common shares for $50 one year ago.You have received total dividends equal to $8 during the year.If your total return during the period is 12%,then what was the price of WPC when you sold the stock today?

A) $52.00

B) $48.00

C) $98.00

D) none of the above

A) $52.00

B) $48.00

C) $98.00

D) none of the above

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

24

You are analyzing the performance of different asset classes for a foreign economy.You find that over the last 60 years the average annual return for equities was 12% while that of corporate bonds was 10% and the rate of inflation was about 3%.If inflation were projected to be around 1% for the foreseeable future,then what would you project the return of equities to be during that same foreseeable period?

A) 12%

B) 11%

C) 10%

D) 9%

A) 12%

B) 11%

C) 10%

D) 9%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

25

You purchased stock of Blue McBrushes Corp one year ago for $85 and generated a total return of 20% during that time.If you just sold the stock for $89.50,then what were the total dividends that you received during the year?

A) $12.50

B) $12.73

C) $13.18

D) none of the above

A) $12.50

B) $12.73

C) $13.18

D) none of the above

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

26

Over the last 3 years you have earned 5%,7%,and 9% on your portfolio.What is the standard deviation of the returns of that portfolio?

A) .07

B) .02

C) .0004

D) none of the above

A) .07

B) .02

C) .0004

D) none of the above

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

27

The statistical term,variance is defined as

A) the expected value of deviations from the mean.

B) the expected value of squared deviations from the mean.

C) the sum of squared deviations from the mean.

D) the sum of squared deviations from the mean divided by the number of observations available.

A) the expected value of deviations from the mean.

B) the expected value of squared deviations from the mean.

C) the sum of squared deviations from the mean.

D) the sum of squared deviations from the mean divided by the number of observations available.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

28

You have it on good account that the probability of good returns on energy investments is equal to that of poor returns.If we define good returns as 100% while that of poor returns is 50%,then what is the probability of getting an exact return of 75% in the next year?

A) 50%

B) 25%

C) 0%

D) there is not enough information to solve the problem.

A) 50%

B) 25%

C) 0%

D) there is not enough information to solve the problem.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

29

Bavarian Sausage stock has an average historical return of 16.3% and a standard deviation of 5.3%.In which range do you expect the returns of Bavarian Sausage 68% of the time.

A) 5.7%:26.9%

B) 5.3%:16.3%

C) 11.0%:21.6%

D) 6.2%:18.5%

A) 5.7%:26.9%

B) 5.3%:16.3%

C) 11.0%:21.6%

D) 6.2%:18.5%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

30

The additional return offered by a more risky investment relative to a safer one is called

A) the risk-free rate.

B) the risky return.

C) the risk premium.

D) the insurance premium.

A) the risk-free rate.

B) the risky return.

C) the risk premium.

D) the insurance premium.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

31

Bavarian Sausage stock has an average historical return of 16.3% and a standard deviation of 5.3%.In which range do you expect the returns of Bavarian Sausage 95% of the time.

A) 5.7%:26.9%

B) 5.3%:16.3%

C) 11.00%:21.6%

D) 6.2%:18.5%

A) 5.7%:26.9%

B) 5.3%:16.3%

C) 11.00%:21.6%

D) 6.2%:18.5%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is not part of the procedure for valuing a risky asset?

A) determining the asset's expected cash flows

B) choosing a discount rate that reflects the asset's risk

C) calculating the present value

D) determining whether the project is mutually exclusive or not

A) determining the asset's expected cash flows

B) choosing a discount rate that reflects the asset's risk

C) calculating the present value

D) determining whether the project is mutually exclusive or not

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

33

Bavarian Sausage stock has an average historical return of 16.3% and a standard deviation of 5.3%.What is the probability that the return on Bavarian Sausage will be higher than 26.9 %?

A) 5%

B) 2.5%

C) 16%

D) 95%

A) 5%

B) 2.5%

C) 16%

D) 95%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

34

If you were to plot the return of asset classes on a graph with the standard deviation of returns on the horizontal axis and expected returns on the vertical axis,then which security class is most likely to be in the farthest upper right hand corner of the graph?

A) Treasury Bills

B) Treasury Bonds

C) Corporate Bonds

D) Stocks

A) Treasury Bills

B) Treasury Bonds

C) Corporate Bonds

D) Stocks

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

35

Your family has invested in a security over the last 100 years.The expected return during that period has been .15 and the variance of the returns has been .048.Your investment advisor told you that the security had a 95th percentile performance (with respect to its historical performance)this period.What was the actual return during the period?

A) 15.0%

B) 19.8%

C) 37.0%

D) 58.8%

A) 15.0%

B) 19.8%

C) 37.0%

D) 58.8%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

36

If you were to purchase an asset for $100 today and receive a dividend of $5 at the end of the year in addition to selling the asset for $110,then what would the capital gain on the asset be?

A) 15%

B) 10%

C) 5%

D) none of the above

A) 15%

B) 10%

C) 5%

D) none of the above

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

37

You purchased a 10-year,6% coupon bond (the bond makes semi-annual payments)last year based upon a discount rate of 6%.One year later the discount rate has fallen to 5.5%.What is your total return on the bond?

A) 6.000%

B) 3.512%

C) 9.512%

D) none of the above

A) 6.000%

B) 3.512%

C) 9.512%

D) none of the above

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

38

What is the average return of a portfolio that has 45% invested in stock A,35% invested in stock B and the rest invested in stock C?

A) 9.92%

B) 11.62%

C) 10.62%

D) 12.48%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

39

Bavarian Sausage stock has an average historical return of 16.3% and a standard deviation of 5.3%.What is the probability that the return on Bavarian Sausage will be less than 11%?

A) 84%

B) 50%

C) 16%

D) 32%

A) 84%

B) 50%

C) 16%

D) 32%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

40

You are introduced to an investment that has an expected return of 20% equal to the standard deviation of the distribution of returns.What is the probability that the investment will have a return less than 20% in the first year? Assume a normal distribution.

A) 0%

B) 50%

C) 68%

D) not enough information to determine

A) 0%

B) 50%

C) 68%

D) not enough information to determine

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following asset classes would give you the greatest probability of achieving a return that is closest to its expected return?

A) Treasury Bills

B) Treasury Bonds

C) Corporate Bonds

D) Stocks

A) Treasury Bills

B) Treasury Bonds

C) Corporate Bonds

D) Stocks

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

42

Exhibit 6-1

Suppose that an investor bought a bond last year for $980. The bond pays a 7% annual coupon and has a face value of $1,000. Today, the same bond is selling for $960.

Refer to Exhibit 6-1.If the investor sells the bond this morning,what is the total dollar return of the investment?

A) -$40

B) $30

C) $50

D) $70

Suppose that an investor bought a bond last year for $980. The bond pays a 7% annual coupon and has a face value of $1,000. Today, the same bond is selling for $960.

Refer to Exhibit 6-1.If the investor sells the bond this morning,what is the total dollar return of the investment?

A) -$40

B) $30

C) $50

D) $70

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

43

Big Diesel Incorporated

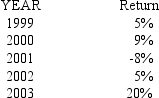

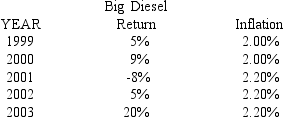

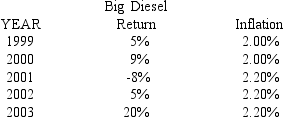

Consider the following historical returns for Big Diesel Incorporated:

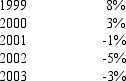

Refer to Big Diesel Incorporated.What is the average return over the five year time period?

A) 6.00%

B) 6.20%

C) 6.40%

D) 6.60%

Consider the following historical returns for Big Diesel Incorporated:

Refer to Big Diesel Incorporated.What is the average return over the five year time period?

A) 6.00%

B) 6.20%

C) 6.40%

D) 6.60%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

44

Hillary Investments

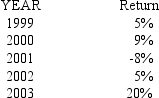

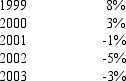

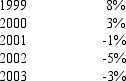

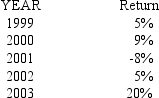

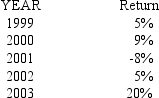

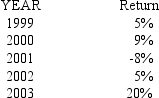

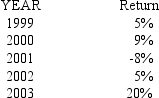

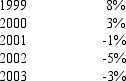

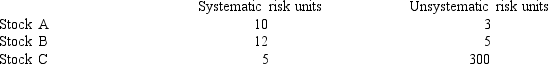

Between 1999 and 2003, Hillary Investments has produced returns as follows:

What is the variance of the return of Hillary Investments?

A) .01072

B) .00268

C) .00214

D) none of the above

Between 1999 and 2003, Hillary Investments has produced returns as follows:

What is the variance of the return of Hillary Investments?

A) .01072

B) .00268

C) .00214

D) none of the above

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

45

If we are able to eliminate all of the unsystematic risk in a portfolio then,what is the result?

A) a risk-free portfolio

B) a portfolio that contains only systematic risk

C) a portfolio that has an expected return of zero

D) such a portfolio cannot be constructed since there will always be unsystematic risk in any portfolio

A) a risk-free portfolio

B) a portfolio that contains only systematic risk

C) a portfolio that has an expected return of zero

D) such a portfolio cannot be constructed since there will always be unsystematic risk in any portfolio

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

46

If the standard deviation of a diversified portfolio is 20% and if the stocks in that portfolio are positively correlated,then what would we expect the average standard deviation of stocks in that portfolio to be?

A) less than 20%

B) 20%

C) greater than 20%

D) you would need to know the percentage of each stock invested in that portfolio to determine the answer

A) less than 20%

B) 20%

C) greater than 20%

D) you would need to know the percentage of each stock invested in that portfolio to determine the answer

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

47

Terry Corporation

One year ago, Jason purchased 50 shares of Terry Corporation stock at $20 per share. Today, one year later, the stock pays a $2 per share dividend and the price is now $22 per share.

What is the risk premium?

A) It is the risk associated with investing in Treasury bonds.

B) It is the difference in annual returns between common stocks and Treasury bills.

C) It is the annual return associated with investing in Treasury bonds.

D) It is the variance in stock market returns over the last fifty years.

One year ago, Jason purchased 50 shares of Terry Corporation stock at $20 per share. Today, one year later, the stock pays a $2 per share dividend and the price is now $22 per share.

What is the risk premium?

A) It is the risk associated with investing in Treasury bonds.

B) It is the difference in annual returns between common stocks and Treasury bills.

C) It is the annual return associated with investing in Treasury bonds.

D) It is the variance in stock market returns over the last fifty years.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

48

Consider the following historical returns for Big Diesel Incorporated and inflation for the United States economy:

What is the average real return for Big Diesel over the five-year time period?

A) 2.92%

B) 3.40%

C) 4.00%

D) 4.12%

What is the average real return for Big Diesel over the five-year time period?

A) 2.92%

B) 3.40%

C) 4.00%

D) 4.12%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

49

You have the choice of introducing either Stock X or Stock Y into your fully diversified portfolio.Both stocks have 5 units of systematic risk while Stock X has 6 units of unsystematic risk and Stock Y has 8 units of unsystematic risk.Which stock offers the greatest opportunity from diversification?

A) Stock X

B) Stock Y

C) both stock offer the same opportunity

D) there is not enough information to determine the answer

A) Stock X

B) Stock Y

C) both stock offer the same opportunity

D) there is not enough information to determine the answer

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

50

Terry Corporation

One year ago, Jason purchased 50 shares of Terry Corporation stock at $20 per share. Today, one year later, the stock pays a $2 per share dividend and the price is now $22 per share.

Refer to Terry Corporation.What is the total percentage return on the investment for the one year?

A) 9.09%

B) 10.00%

C) 18.18%

D) 20.00%

One year ago, Jason purchased 50 shares of Terry Corporation stock at $20 per share. Today, one year later, the stock pays a $2 per share dividend and the price is now $22 per share.

Refer to Terry Corporation.What is the total percentage return on the investment for the one year?

A) 9.09%

B) 10.00%

C) 18.18%

D) 20.00%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

51

You are presented with 4 distinct investment opportunities involving a Treasury Bill,a Treasury Bond,a Corporate Bond,and a Stock.You are told that each of these investments are expected to produce (after the cash is paid out then no other cash flows are anticipated)$100 one year from now.Which asset should be the least expensive today,in terms of dollars that you will have to pay for the asset?

A) Treasury Bills

B) Treasury Bonds

C) Corporate Bonds

D) Stocks

A) Treasury Bills

B) Treasury Bonds

C) Corporate Bonds

D) Stocks

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

52

Terry Corporation

One year ago, Jason purchased 50 shares of Terry Corporation stock at $20 per share. Today, one year later, the stock pays a $2 per share dividend and the price is now $22 per share.

Refer to Terry Corporation.What is the total dollar return on the investment for the one year?

A) $4

B) $50

C) $75

D) $200

One year ago, Jason purchased 50 shares of Terry Corporation stock at $20 per share. Today, one year later, the stock pays a $2 per share dividend and the price is now $22 per share.

Refer to Terry Corporation.What is the total dollar return on the investment for the one year?

A) $4

B) $50

C) $75

D) $200

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

53

Exhibit 6-1

Suppose that an investor bought a bond last year for $980. The bond pays a 7% annual coupon and has a face value of $1,000. Today, the same bond is selling for $960.

Refer to Exhibit 6-1.If the investor sells the bond this morning,what is the total percentage return of the investment?

A) 5.10%

B) 5.21%

C) 7.00%

D) 9.18%

Suppose that an investor bought a bond last year for $980. The bond pays a 7% annual coupon and has a face value of $1,000. Today, the same bond is selling for $960.

Refer to Exhibit 6-1.If the investor sells the bond this morning,what is the total percentage return of the investment?

A) 5.10%

B) 5.21%

C) 7.00%

D) 9.18%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

54

Inflation,recession,and higher interest rates are economic events that are characterized as:

A) Company-specific risk that can be diversified away.

B) Market risk.

C) Systematic risk that can be diversified away.

D) Diversifiable risk

A) Company-specific risk that can be diversified away.

B) Market risk.

C) Systematic risk that can be diversified away.

D) Diversifiable risk

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

55

Big Diesel Incorporated

Consider the following historical returns for Big Diesel Incorporated:

Refer to Big Diesel Incorporated.What is the standard deviation of the returns over the five year time period?

A) 8.97%

B) 9.25%

C) 9.74%

D) 10.03%

Consider the following historical returns for Big Diesel Incorporated:

Refer to Big Diesel Incorporated.What is the standard deviation of the returns over the five year time period?

A) 8.97%

B) 9.25%

C) 9.74%

D) 10.03%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

56

Big Diesel Incorporated

Consider the following historical returns for Big Diesel Incorporated:

Refer to Big Diesel Incorporated.If we assume that these returns represent the full sample of Big Diesel returns,what is the 95% confidence interval for Big Diesel returns next year?

A) Between -13.86% and 26.26%

B) Between -11.74% and 42.08%

C) Between 6.20% and 20.06%

D) Between -3.83% and 17.94%

Consider the following historical returns for Big Diesel Incorporated:

Refer to Big Diesel Incorporated.If we assume that these returns represent the full sample of Big Diesel returns,what is the 95% confidence interval for Big Diesel returns next year?

A) Between -13.86% and 26.26%

B) Between -11.74% and 42.08%

C) Between 6.20% and 20.06%

D) Between -3.83% and 17.94%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

57

Terry Corporation

One year ago, Jason purchased 50 shares of Terry Corporation stock at $20 per share. Today, one year later, the stock pays a $2 per share dividend and the price is now $22 per share.

Refer to Terry Corporation.What is the capital gains yield on the investment for the one year?

A) 9.09%

B) 10.00%

C) 18.18%

D) 20.00%

One year ago, Jason purchased 50 shares of Terry Corporation stock at $20 per share. Today, one year later, the stock pays a $2 per share dividend and the price is now $22 per share.

Refer to Terry Corporation.What is the capital gains yield on the investment for the one year?

A) 9.09%

B) 10.00%

C) 18.18%

D) 20.00%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

58

Stock X has 3 units of systematic risk and 2 units of unsystematic risk while Stock Y has 3 units of systematic risk and 4 units of unsystematic risk.If Stock X is priced to generate an 8% return for investors then what do we know about the return that Stock Y should be priced to return?

A) Stock Y should be priced to return greater than 8%

B) Stock Y should be priced to return 8%

C) Stock Y should be priced to return less than 8%

D) there is not enough information to solve this problem

A) Stock Y should be priced to return greater than 8%

B) Stock Y should be priced to return 8%

C) Stock Y should be priced to return less than 8%

D) there is not enough information to solve this problem

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

59

Hillary Investments

Between 1999 and 2003, Hillary Investments has produced returns as follows:

Calculate the expected return for Hillary Investments.

A) .003

B) .004

C) .005

D) .006

Between 1999 and 2003, Hillary Investments has produced returns as follows:

Calculate the expected return for Hillary Investments.

A) .003

B) .004

C) .005

D) .006

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

60

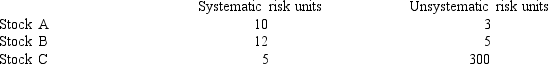

Based upon the following levels of risk,which stock should have the highest price if each stock is expected to produce the same level of cash over the future life of each asset?

A) Stock A

B) Stock B

C) Stock C

D) there is not enough information to decide

A) Stock A

B) Stock B

C) Stock C

D) there is not enough information to decide

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

61

Which statement is FALSE regarding risk and return?

A) For broad asset classes, the relationship between risk and return is nearly linear.

B) Adding multiple stocks to a portfolio can reduce non-systematic risk.

C) There is a nearly linear relationship between risk and return for individual stocks.

D) Because investors can easily eliminate risk through diversification, investors should only be rewarded for non-diversifiable risk.

A) For broad asset classes, the relationship between risk and return is nearly linear.

B) Adding multiple stocks to a portfolio can reduce non-systematic risk.

C) There is a nearly linear relationship between risk and return for individual stocks.

D) Because investors can easily eliminate risk through diversification, investors should only be rewarded for non-diversifiable risk.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

62

Why are Treasury bills among the safest investments in the world?

A) They are short-term investments and therefore extremely sensitive to interest rate changes.

B) They are long-term investments and therefore extremely insensitive to interest rate changes.

C) They are short-term investments and therefore fairly insensitive to interest rate changes.

D) They are backed by the full faith and credit of the U.S. government.

E) Both (c) and (d).

A) They are short-term investments and therefore extremely sensitive to interest rate changes.

B) They are long-term investments and therefore extremely insensitive to interest rate changes.

C) They are short-term investments and therefore fairly insensitive to interest rate changes.

D) They are backed by the full faith and credit of the U.S. government.

E) Both (c) and (d).

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

63

An investor seeks a 4% real return on his investment in a stock fund.If there is 3% inflation in the economy,what nominal return must this stock fund provide to meet his objective?

A) 1%

B) 4%

C) 7.12%

D) 9.71%

A) 1%

B) 4%

C) 7.12%

D) 9.71%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following statements is true?

A) While finance teaches that investments with higher risk should have higher returns there is no historical evidence in the capital markets to suggest this relationship exists.

B) Finance teaches that investments with higher risk should have higher returns and historical evidence in the capital markets suggests this relationship exists.

C) When individuals decide how to invest their money they must weigh the expected benefits (returns) against the costs of additional risk.

D) Both (a) and (c) are true.

E) Both (b) and (c) are true.

A) While finance teaches that investments with higher risk should have higher returns there is no historical evidence in the capital markets to suggest this relationship exists.

B) Finance teaches that investments with higher risk should have higher returns and historical evidence in the capital markets suggests this relationship exists.

C) When individuals decide how to invest their money they must weigh the expected benefits (returns) against the costs of additional risk.

D) Both (a) and (c) are true.

E) Both (b) and (c) are true.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

65

Exhibit 6-2

You purchased a bond last year that pays an 8% annual coupon with a face value of $1,000. At the time of purchase, the bond had a yield to maturity of 10% and had 10 years until maturity. Today, the bond trades at a yield to maturity of 9%.

Refer to Exhibit 6-2.What was the percentage return of this investment over the last year?

A) 8.00%

B) 9.00%

C) 15.21%

D) 16.30%

You purchased a bond last year that pays an 8% annual coupon with a face value of $1,000. At the time of purchase, the bond had a yield to maturity of 10% and had 10 years until maturity. Today, the bond trades at a yield to maturity of 9%.

Refer to Exhibit 6-2.What was the percentage return of this investment over the last year?

A) 8.00%

B) 9.00%

C) 15.21%

D) 16.30%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

66

Based upon a histogram of nominal returns on equities for the last 100 years,we can conjecture that stock returns follow a ____ distribution.

A) normal

B) skewed

C) uniform

D) binomial

E) None of the above

A) normal

B) skewed

C) uniform

D) binomial

E) None of the above

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

67

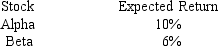

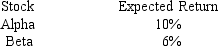

Suppose you are interested in the following two stocks:

What is your expected portfolio return if you put 40% of you investment in Alpha,and 60% of your investment in Beta?

A) 7.20%

B) 7.60%

C) 8.00%

D) 8.40%

What is your expected portfolio return if you put 40% of you investment in Alpha,and 60% of your investment in Beta?

A) 7.20%

B) 7.60%

C) 8.00%

D) 8.40%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

68

Exhibit 6-3

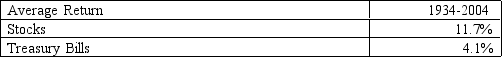

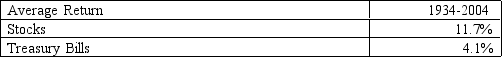

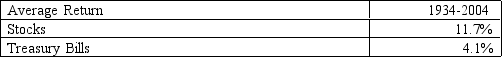

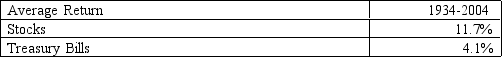

Consider the following information concerning stock returns and bond returns over the last 75 years:

Refer to Exhibit 6-3.Currently,investors want a 12% return on stocks as a whole.Based on this information,what is a good estimate for the current return on Treasury Bills?

A) 4.10%

B) 4.40%

C) 7.20%

D) 7.60%

Consider the following information concerning stock returns and bond returns over the last 75 years:

Refer to Exhibit 6-3.Currently,investors want a 12% return on stocks as a whole.Based on this information,what is a good estimate for the current return on Treasury Bills?

A) 4.10%

B) 4.40%

C) 7.20%

D) 7.60%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

69

A financial publication states that Stone Cold stock had a return of 15% last year.If the price of Stone Cold went from $20 to $20.75 over the last year,what was the dividend yield over the last year?

A) 10.25%

B) 11.25%

C) 13.25%

D) 14.25%

A) 10.25%

B) 11.25%

C) 13.25%

D) 14.25%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

70

Which statement is TRUE regarding diversification?

A) The greater the systematic risk, the greater the return required by the investor.

B) The greater the diversifiable risk, the greater the return required by the investor.

C) We are able to remove all systematic risk if enough stocks are added to a portfolio.

D) Systematic risk is diversifiable.

A) The greater the systematic risk, the greater the return required by the investor.

B) The greater the diversifiable risk, the greater the return required by the investor.

C) We are able to remove all systematic risk if enough stocks are added to a portfolio.

D) Systematic risk is diversifiable.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

71

Exhibit 6-2

You purchased a bond last year that pays an 8% annual coupon with a face value of $1,000. At the time of purchase, the bond had a yield to maturity of 10% and had 10 years until maturity. Today, the bond trades at a yield to maturity of 9%.

Refer to Exhibit 6-2.What was the dollar return of this investment over the last year?

A) $80

B) $93

C) $143

D) $160

You purchased a bond last year that pays an 8% annual coupon with a face value of $1,000. At the time of purchase, the bond had a yield to maturity of 10% and had 10 years until maturity. Today, the bond trades at a yield to maturity of 9%.

Refer to Exhibit 6-2.What was the dollar return of this investment over the last year?

A) $80

B) $93

C) $143

D) $160

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following statements is true?

A) While asset classes with higher standard deviations tend to have higher returns, this relationship seems to break down for specific securities.

B) Asset classes with higher standard deviations tend to have higher returns, and this relationship tends to hold true when examining specific securities as well.

C) Asset classes with higher standard deviations tend to have higher returns, but when we examine specific assets within those classes we find that high standard deviation securities tend to have lower returns.

D) None of the above

A) While asset classes with higher standard deviations tend to have higher returns, this relationship seems to break down for specific securities.

B) Asset classes with higher standard deviations tend to have higher returns, and this relationship tends to hold true when examining specific securities as well.

C) Asset classes with higher standard deviations tend to have higher returns, but when we examine specific assets within those classes we find that high standard deviation securities tend to have lower returns.

D) None of the above

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

73

A normal distribution is ____.

A) skewed

B) symmetrical

C) uniform

D) all of the above

E) none of the above

A) skewed

B) symmetrical

C) uniform

D) all of the above

E) none of the above

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

74

Exhibit 6-3

Consider the following information concerning stock returns and bond returns over the last 75 years:

Refer to Exhibit 6-3.Currently,Treasury bills yield 2.50% on the secondary market.What is a good estimate for the return on the stock market in the next year given this information?

A) 6.60%

B) 7.60%

C) 10.10%

D) 11.70%

Consider the following information concerning stock returns and bond returns over the last 75 years:

Refer to Exhibit 6-3.Currently,Treasury bills yield 2.50% on the secondary market.What is a good estimate for the return on the stock market in the next year given this information?

A) 6.60%

B) 7.60%

C) 10.10%

D) 11.70%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

75

According to historical data,in the last 106 years returns on stocks in the U.S.have been negative about ____ of the time.

A) 50%

B) 20%

C) 26%

D) 42%

E) 33%

A) 50%

B) 20%

C) 26%

D) 42%

E) 33%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

76

A brochure for an investment company reports average nominal returns of 9% per year.If the economy has averaged 3% inflation over these years,what is the average real return for this investment company?

A) 3.00%

B) 5.83%

C) 6.00%

D) 9.00%

A) 3.00%

B) 5.83%

C) 6.00%

D) 9.00%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

77

A financial publication states that Stone Cold stock had a return of 15% last year.If the price of Stone Cold went from $20 to $20.75 over the last year,what dividend was paid?

A) $2.00

B) $2.15

C) $2.25

D) $2.36

A) $2.00

B) $2.15

C) $2.25

D) $2.36

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

78

A bond was purchased last year for $900.The bond pays a 10% annual coupon and has a face value of $1,000.Today,the bond has a coupon yield of 8%.What is the total return for this bond over the last year?

A) 8%

B) 10%

C) 39%

D) 50%

A) 8%

B) 10%

C) 39%

D) 50%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

79

A stock was purchased two years ago for $20.The stock does not pay dividends and sells today for $26.00.If sold today,what was the annual realized return on your investment?

A) 9%

B) 12%

C) 14%

D) 15%

A) 9%

B) 12%

C) 14%

D) 15%

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

80

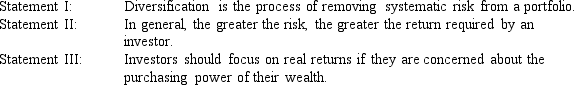

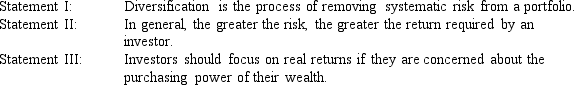

Which statements are TRUE regarding risk and return?

A) Statement I only

B) Statements I and III only

C) Statements II and III only

D) Statements I and II only

A) Statement I only

B) Statements I and III only

C) Statements II and III only

D) Statements I and II only

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck