Deck 5: Corporations: Earnings and Profits and Dividend Distributions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/82

Play

Full screen (f)

Deck 5: Corporations: Earnings and Profits and Dividend Distributions

1

Any loss in current E & P always is treated as occurring ratably during the year.

False

This is usually the case.However,if an identifiable event causes the loss (e.g.a capital loss from the sale of a particular stock),the loss is fixed as of that time.

This is usually the case.However,if an identifiable event causes the loss (e.g.a capital loss from the sale of a particular stock),the loss is fixed as of that time.

2

Regardless of any deficit in accumulated E & P,distributions during the year are treated as dividends to the extent of current E & P.

True

3

Cash distributions received from a corporation with a positive balance in accumulated E & P at the beginning of the year will always be taxed as dividend income.

False

A positive balance in accumulated E & P at the beginning of the year does not guarantee dividend treatment for distributions.If there is a deficit in current E & P during the year,it may completely offset the positive accumulated E & P balance.If it does,the distributions will not receive dividend treatment.

A positive balance in accumulated E & P at the beginning of the year does not guarantee dividend treatment for distributions.If there is a deficit in current E & P during the year,it may completely offset the positive accumulated E & P balance.If it does,the distributions will not receive dividend treatment.

4

A distribution from a corporation will be taxable to the recipient shareholders only to the extent of the corporation's E & P and any excess over the basis in the stock investment.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

5

All dividends received by individual shareholders are subject to either a 15% or a 0% tax rate.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

6

Any distribution in excess of E & P is treated as a tax-free recovery of capital by shareholders.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

7

Federal income tax paid in the current year must be subtracted from taxable income to determine E & P.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

8

Dividends taxed at a 15% rate are not considered investment income for purposes of the investment interest expense limitation.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

9

Distributions by a corporation to its shareholders are presumed to be dividends unless the parties can prove otherwise.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

10

When computing E & P,no adjustment to taxable income is necessary for the domestic production activities deduction.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

11

When computing current E & P,taxable income is not adjusted for the deferred gain in a § 1033 involuntary conversion.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

12

In the current year,Pink Corporation has a § 179 expense of $80,000.As a result,next year,taxable income must be decreased by $16,000 to determine current E & P.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

13

The amount of dividend income recognized by a shareholder from a property distribution is always reduced by the amount of liabilities assumed by the shareholder.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

14

Of the § 179 expense deducted in the current year,80% must be added to this year's taxable income to determine current E & P.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

15

A realized gain from a like-kind exchange under § 1031 that is not recognized for income tax purposes has no effect on E & P.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

16

When a corporation makes an installment sale,for E & P purposes the realized gain is recognized as payments are received.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

17

Nondeductible meal and entertainment expenses must be subtracted from taxable income to determine current E & P.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

18

Differences between MACRS and ADS cost recovery require an E & P adjustment.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

19

During the year,Aqua Corporation distributes land to its sole shareholder.If the fair market value of the land is more than its adjusted basis,Aqua will recognize gain on the distribution.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

20

A corporation borrows money to purchase State of Wisconsin bonds.The interest on the loan has no effect on either taxable income or current E & P.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

21

A corporation that distributes a property dividend must reduce its E & P by the fair market value of the property less any liability on the property.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

22

A constructive dividend must satisfy the legal requirements of a dividend as set forth by applicable state law.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

23

On January 2,2008,Green Corporation purchased equipment with an ADS recovery period of 10 years and a MACRS useful life of 7 years.The cost of the equipment was $150,000.Section 179 was not elected.MACRS depreciation properly claimed on the asset,including depreciation in the year of sale,totaled $39,802.50.The assets were sold on July 1,2009,for $145,000.To arrive at current E & P in 2009,how should taxable income be adjusted for the sale?

A)No adjustment to taxable income is necessary.

B)Decrease taxable income by $24,802.50.

C)Increase taxable income by $24,802.50.

D)Decrease taxable income by $39,802.50.

E)None of the above.

A)No adjustment to taxable income is necessary.

B)Decrease taxable income by $24,802.50.

C)Increase taxable income by $24,802.50.

D)Decrease taxable income by $39,802.50.

E)None of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

24

A pro rata distribution of nonconvertible preferred stock to common shareholders is not generally taxable.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

25

If a distribution of stock rights is taxable and their fair market value is less than 15 percent of the value of the old stock,then either a zero basis or a portion of the old stock basis may be assigned to the rights,at the shareholder's option.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

26

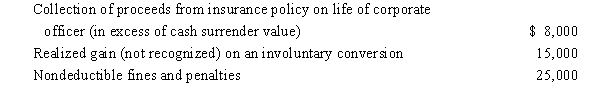

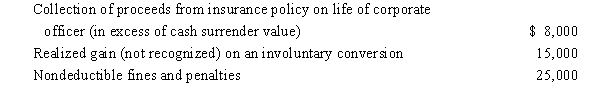

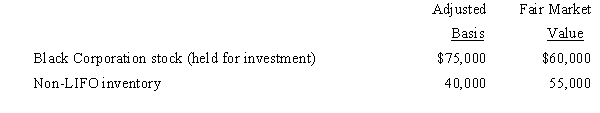

Tangerine Corporation,a calendar year taxpayer,has taxable income of $400,000.Among its transactions for the year are the following:

Disregarding any provision for Federal income taxes,the effect of these transactions on Tangerine Corporation's current E & P is:

A)$448,000.

B)$383,000.

C)$398,000.

D)$352,000.

E)None of the above.

Disregarding any provision for Federal income taxes,the effect of these transactions on Tangerine Corporation's current E & P is:

A)$448,000.

B)$383,000.

C)$398,000.

D)$352,000.

E)None of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

27

If a stock dividend is taxable,the shareholder's basis of the newly received shares is determined by reallocating the basis of the previously owned stock.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

28

The tax treatment of corporate distributions at the shareholder level does not depend on:

A)The basis of stock in the hands of the shareholder.

B)The earnings and profits of the corporation.

C)The character of the property being distributed.

D)Whether the distributed property is subject to a liability.

E)None of the above.

A)The basis of stock in the hands of the shareholder.

B)The earnings and profits of the corporation.

C)The character of the property being distributed.

D)Whether the distributed property is subject to a liability.

E)None of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

29

Constructive dividends have no effect on a distributing corporation's E & P.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

30

Pink,Corporation,a calendar year taxpayer,made quarterly estimated tax payments of $300 each quarter in 2008,for a total of $1,200.Pink filed its 2008 tax return in 2009 and the return showed a tax liability for 2008 of $1,600.At the time of filing,March 15,2009,Pink paid an additional $400 in Federal income taxes.How does the additional payment of $400 impact Pink's E & P?

A)Pink's 2008 E & P is increased by $400.

B)Pink's 2009 E & P is increased by $400.

C)Pink's 2008 E & P is decreased by $400.

D)Pink's 2009 E & P is decreased by $400.

E)None of the above.

A)Pink's 2008 E & P is increased by $400.

B)Pink's 2009 E & P is increased by $400.

C)Pink's 2008 E & P is decreased by $400.

D)Pink's 2009 E & P is decreased by $400.

E)None of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

31

The rules used to determine the taxability of stock dividends also apply to distributions of stock rights.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

32

A corporate shareholder that receives a constructive dividend cannot apply a dividends received deduction to the distribution.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

33

During the current year,Blue Corporation sold equipment for $220,000.The equipment had an adjusted basis of $150,000 at the sale date and was purchased a few years ago for $250,000.MACRS deductions claimed on the equipment was $100,000 while ADS depreciation was $60,000.As a result of the sale,what adjustment to taxable income is needed to determine E & P?

A)No adjustment is required.

B)Add $40,000 to taxable income.

C)Subtract $40,000 from taxable income.

D)Add $30,000 to taxable income.

E)None of the above.

A)No adjustment is required.

B)Add $40,000 to taxable income.

C)Subtract $40,000 from taxable income.

D)Add $30,000 to taxable income.

E)None of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

34

Tern Corporation,a cash basis taxpayer,has taxable income of $500,000 for the current year.Tern elected $100,000 of § 179 expense.It also had a related party loss of $20,000 and a realized (not recognized)gain from an involuntary conversion of $75,000.It paid Federal income tax of $150,000 and paid a nondeductible fine of $10,000.Tern's current E & P is:

A)$400,000.

B)$410,000.

C)$320,000.

D)$475,000.

E)None of the above.

A)$400,000.

B)$410,000.

C)$320,000.

D)$475,000.

E)None of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

35

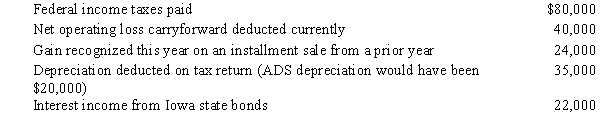

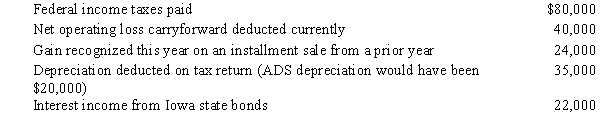

Emu Corporation (a calendar year taxpayer)has taxable income of $250,000,and its financial records reflect the following for the year.

Emu Corporation's current E & P is:

A)$149,000.

B)$193,000.

C)$223,000.

D)$271,000.

E)None of the above.

Emu Corporation's current E & P is:

A)$149,000.

B)$193,000.

C)$223,000.

D)$271,000.

E)None of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

36

Under no circumstances can a distribution generate (or add to)a deficit in E & P.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

37

If stock rights are taxable,the recipient has income to the extent of the fair market value of the rights.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

38

Jen,the sole shareholder of Mahogany Corporation,sold her stock to Jason on July 1 for $90,000.Jen's stock basis at the beginning of the year was $60,000.Mahogany made a $30,000 cash distribution to Jen immediately before the sale,while Jason received a $60,000 cash distribution from Mahogany on November 1.As of the beginning of the current year,Mahogany had $16,000 in accumulated E & P,while current E & P (before distributions)was $30,000.Which of the following statements is correct?

A)Jen recognizes a $30,000 gain on the sale of the stock.

B)Jen recognizes a $34,000 gain on the sale of the stock.

C)Jason recognizes dividend income of $60,000.

D)Jen recognizes dividend income of $30,000.

E)None of the above.

A)Jen recognizes a $30,000 gain on the sale of the stock.

B)Jen recognizes a $34,000 gain on the sale of the stock.

C)Jason recognizes dividend income of $60,000.

D)Jen recognizes dividend income of $30,000.

E)None of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

39

Property distributed by a corporation as a dividend is subject to a liability in excess of its basis.For purposes of determining gain on the distribution,the basis of the property is treated as being not less than the amount of liability.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

40

Scarlet Corporation has a deficit in accumulated E & P of $500,000.It has current E & P of $350,000.On July 1,Scarlet distributes $400,000 to its sole shareholder,Lupita.Lupita has a basis of $95,000 in her stock in Scarlet Corporation.As a result of the distribution,Lupita has:

A)Dividend income of $400,000.

B)Dividend income of $95,000 and reduces her stock basis to zero.

C)Dividend income of $350,000 and reduces her stock basis to $45,000.

D)No dividend income, reduces her stock basis to zero, and has a capital gain of $400,000.

E)None of the above.

A)Dividend income of $400,000.

B)Dividend income of $95,000 and reduces her stock basis to zero.

C)Dividend income of $350,000 and reduces her stock basis to $45,000.

D)No dividend income, reduces her stock basis to zero, and has a capital gain of $400,000.

E)None of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

41

At the beginning of the current year,Paul and Yong each own 50% of Sparrow Corporation.In July,Paul sold his stock to Sarah for $110,000.At the beginning of the year,Sparrow Corporation had accumulated E & P of $200,000 and its current E & P is $240,000 (prior to any distributions).Sparrow distributed $260,000 on March 10 ($130,000 to Paul and $130,000 to Yong)and distributed another $260,000 on October 1 ($130,000 to Sarah and $130,000 to Yong).Sarah has dividend income of:

A)$60,000.

B)$90,000.

C)$110,000.

D)$130,000.

E)None of the above.

A)$60,000.

B)$90,000.

C)$110,000.

D)$130,000.

E)None of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

42

Using the legend provided, classify each statement accordingly. In all cases, assume that taxable income is being adjusted to arrive at current E & P for 2008.

a.Increase

b.Decrease

c.No effect

Gain on installment sale in 2008 deferred until 2009.

a.Increase

b.Decrease

c.No effect

Gain on installment sale in 2008 deferred until 2009.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

43

Mulberry Corporation has an August 31 year-end.Mulberry had $50,000 in accumulated E & P at the beginning of its 2009 fiscal year (September 1,2008)and during the year,it incurred a $75,000 operating loss.It also distributed $65,000 to its sole shareholder,Charles,on November 30,2008.If Charles is a calendar year taxpayer,how should he treat the distribution when he files his 2008 income tax return (assuming the return is filed by April 15,2009)?

A)The distribution has no effect on Charles in the current year.

B)$50,000 of dividend income and $15,000 recovery of capital.

C)$60,000 of dividend income and $5,000 recovery of capital.

D)$65,000 of dividend income.

E)None of the above.

A)The distribution has no effect on Charles in the current year.

B)$50,000 of dividend income and $15,000 recovery of capital.

C)$60,000 of dividend income and $5,000 recovery of capital.

D)$65,000 of dividend income.

E)None of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

44

Blue Corporation distributes property to its sole shareholder,Zeke.The property has a fair market value of $450,000,an adjusted basis of $305,000,and is subject to a liability of $250,000.Current E & P is $550,000.With respect to the distribution,Blue has a gain of:

A)$200,000 and Zeke has dividend income of $450,000.

B)$145,000 and Zeke's basis is the distributed property is $305,000.

C)$200,000 and Zeke's basis in the distributed property is $450,000.

D)$145,000 and Zeke has dividend income of $200,000.

E)None of the above.

A)$200,000 and Zeke has dividend income of $450,000.

B)$145,000 and Zeke's basis is the distributed property is $305,000.

C)$200,000 and Zeke's basis in the distributed property is $450,000.

D)$145,000 and Zeke has dividend income of $200,000.

E)None of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

45

Coral Corporation declares a nontaxable dividend payable in rights to subscribe to common stock.Each right entitles the holder to purchase one share of stock for $25.One right is issued for every two shares of stock owned.John owns 100 shares of stock in Coral,which he purchased three years ago for $3,000.At the time of the distribution,the value of the stock is $45 per share and the value of the rights is $2 per share.John receives 50 rights.He exercises 25 rights and sells the remaining 25 rights three months later for $2.50 per right.

A)John must allocate a part of the basis of his original stock in Coral to the rights.

B)If John does not allocate a part of the basis of his original stock to the rights, his basis in the new stock is zero.

C)Sale of the rights produces ordinary income to John of $62.50.

D)If John does not allocate a part of the basis of his original stock to the rights, his basis in the new stock is $625.

E)None of the above.

A)John must allocate a part of the basis of his original stock in Coral to the rights.

B)If John does not allocate a part of the basis of his original stock to the rights, his basis in the new stock is zero.

C)Sale of the rights produces ordinary income to John of $62.50.

D)If John does not allocate a part of the basis of his original stock to the rights, his basis in the new stock is $625.

E)None of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

46

As of January 1,Cassowary Corporation has a deficit in accumulated E & P of $100,000.For the tax year,current E & P (accrued ratably)is $240,000 (prior to any distributions).On July 1,Cassowary Corporation distributes $275,000 to its sole shareholder.The amount of the distribution that is a dividend is:

A)$20,000.

B)$140,000.

C)$240,000.

D)$275,000.

E)None of the above.

A)$20,000.

B)$140,000.

C)$240,000.

D)$275,000.

E)None of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

47

Using the legend provided, classify each statement accordingly. In all cases, assume that taxable income is being adjusted to arrive at current E & P for 2008.

a.Increase

b.Decrease

c.No effect

Meal and entertainment expenses not deducted in 2008 because of the 50% limitation.

a.Increase

b.Decrease

c.No effect

Meal and entertainment expenses not deducted in 2008 because of the 50% limitation.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

48

Using the legend provided, classify each statement accordingly. In all cases, assume that taxable income is being adjusted to arrive at current E & P for 2008.

a.Increase

b.Decrease

c.No effect

Cash dividends distributed to shareholders in 2008.

a.Increase

b.Decrease

c.No effect

Cash dividends distributed to shareholders in 2008.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

49

Tern Corporation distributes equipment (basis of $70,000 and fair market value of $90,000)as a property dividend to its shareholders.The equipment is subject to a liability of $100,000.Tern Corporation recognizes gain of:

A)$0.

B)$20,000.

C)$30,000.

D)$100,000.

E)None of the above.

A)$0.

B)$20,000.

C)$30,000.

D)$100,000.

E)None of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

50

Using the legend provided, classify each statement accordingly. In all cases, assume that taxable income is being adjusted to arrive at current E & P for 2008.

a.Increase

b.Decrease

c.No effect

Interest on municipal bonds received in 2008.

a.Increase

b.Decrease

c.No effect

Interest on municipal bonds received in 2008.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

51

Using the legend provided, classify each statement accordingly. In all cases, assume that taxable income is being adjusted to arrive at current E & P for 2008.

a.Increase

b.Decrease

c.No effect

Nondeductible fines and penalties incurred in 2008.

a.Increase

b.Decrease

c.No effect

Nondeductible fines and penalties incurred in 2008.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

52

Ten years ago,Connie purchased 4,000 shares in Platinum Corporation for $40,000.In the current year,Connie receives a nontaxable stock dividend of 40 shares of Platinum preferred.Values at the time of the dividend are: $8,000 for the preferred stock and $72,000 for the common.Based on this information,Connie's basis is:

A)$40,000 in the common and $16,000 in the preferred.

B)$4,000 in the common and $136,000 in the preferred.

C)$36,000 in the common and $4,000 in the preferred.

D)$39,600 in the common and $400 in the preferred.

E)None of the above.

A)$40,000 in the common and $16,000 in the preferred.

B)$4,000 in the common and $136,000 in the preferred.

C)$36,000 in the common and $4,000 in the preferred.

D)$39,600 in the common and $400 in the preferred.

E)None of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

53

Using the legend provided, classify each statement accordingly. In all cases, assume that taxable income is being adjusted to arrive at current E & P for 2008.

a.Increase

b.Decrease

c.No effect

Loss on sale between related parties in 2008.

a.Increase

b.Decrease

c.No effect

Loss on sale between related parties in 2008.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

54

In August,Sunglow Corporation declares a $4 dividend out of E & P on each share of common stock to shareholders of record on October 1.Elaine and Tom each purchase 100 shares of Sunglow stock on September 1.On September 15,Elaine also purchases a short position in Sunglow.Tom sells 50 of his shares on October 15 and continues to hold the remaining 50 shares through the end of the year.Elaine closes her short position in Sunglow on December 15.With respect to the dividends,which of the following is correct?

A)Tom will have $200 of qualifying dividends subject to reduced tax rates and $200 of ordinary income.

B)Elaine will have $400 of qualifying dividends subject to reduced tax rates and $400 of ordinary income (from dividends paid on the short position of Sunglow stock).

C)All $800 of Elaine's dividends will qualify for reduced tax rates.

D)All $400 of Tom's dividends will qualify for reduced tax rates.

E)None of the above.

A)Tom will have $200 of qualifying dividends subject to reduced tax rates and $200 of ordinary income.

B)Elaine will have $400 of qualifying dividends subject to reduced tax rates and $400 of ordinary income (from dividends paid on the short position of Sunglow stock).

C)All $800 of Elaine's dividends will qualify for reduced tax rates.

D)All $400 of Tom's dividends will qualify for reduced tax rates.

E)None of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

55

Puffin Corporation has E & P of $240,000.It distributes land with a fair market value of $70,000 (adjusted basis of $25,000)to its sole shareholder,Bonnie.The land is subject to a liability of $55,000 that Bonnie assumes.Bonnie has:

A)A taxable dividend of $15,000.

B)A taxable dividend of $25,000.

C)A taxable dividend of $45,000.

D)A taxable dividend of $70,000.

E)A basis in the machinery of $55,000.

A)A taxable dividend of $15,000.

B)A taxable dividend of $25,000.

C)A taxable dividend of $45,000.

D)A taxable dividend of $70,000.

E)A basis in the machinery of $55,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

56

Green Corporation has accumulated E & P of $50,000 on January 1,2008.In 2008,Green has current E & P of $65,000 (before any distribution).On December 31,2008,the corporation distributes $125,000 to its sole shareholder,Maxwell (an individual).Green Corporation's E & P as of January 1,2009 is:

A)$0.

B)($10,000).

C)$50,000.

D)$65,000.

E)None of the above.

A)$0.

B)($10,000).

C)$50,000.

D)$65,000.

E)None of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

57

Rust Corporation has accumulated E & P of $30,000 on January 1,2008.In 2008,Rust Corporation had an operating loss of $40,000.It distributed cash of $20,000 to Andre,its sole shareholder,on December 31,2008.Rust Corporation's balance in its E & P account as of January 1,2009,is:

A)$30,000 deficit.

B)$10,000 deficit.

C)$0.

D)$30,000.

E)None of the above.

A)$30,000 deficit.

B)$10,000 deficit.

C)$0.

D)$30,000.

E)None of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

58

Jose receives a nontaxable distribution of stock rights during the year from Gold Corporation on January 30.Each right entitles the holder to purchase one share of stock for $50.One right is issued for every share of stock owned.Jose owns 100 shares of stock purchased two years ago for $5,000.At the date of distribution,the rights are worth $1,000 (100 rights at $10 per right)and Jose's stock in Gold is worth $6,000 (or $60 per share).On December 1,Jose sells all stock rights for $13 per right.How much gain does Jose recognize on the sale?

A)$1,300.

B)$586.

C)$500.

D)$0.

E)None of the above.

A)$1,300.

B)$586.

C)$500.

D)$0.

E)None of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

59

On January 1,Tanager Corporation (a calendar year taxpayer)has accumulated E & P of $190,000.During the year,Tanager incurs a net loss of $240,000 from operations that accrues ratably.On June 30,Tanager distributes $100,000 to Sharisa,its sole shareholder,who has a basis in her stock of $40,000.How much of the $100,000 is a dividend to Sharisa?

A)$0.

B)$70,000.

C)$60,000.

D)$50,000.

E)None of the above.

A)$0.

B)$70,000.

C)$60,000.

D)$50,000.

E)None of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

60

In the current year,Verdigris Corporation (with E & P of $250,000)made the following property distributions to its shareholders (all corporations):

Verdigris Corporation is not a member of a controlled group.As a result of the distribution:

A)The shareholders have dividend income of $100,000.

B)The shareholders have dividend income of $130,000.

C)Verdigris has a gain of $15,000 and a loss of $15,000, both of which it must recognize.

D)Verdigris has no recognized gain or loss.

E)None of the above.

Verdigris Corporation is not a member of a controlled group.As a result of the distribution:

A)The shareholders have dividend income of $100,000.

B)The shareholders have dividend income of $130,000.

C)Verdigris has a gain of $15,000 and a loss of $15,000, both of which it must recognize.

D)Verdigris has no recognized gain or loss.

E)None of the above.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

61

Rosie,the sole shareholder of Eagle Corporation,has a stock basis of $100,000 at the beginning of the year.On July 1,she sells all of her stock to Manuel for $500,000.On January 1,Eagle has accumulated E & P of $45,000 and during the year,current E & P of $80,000.Eagle makes the following cash distributions: $90,000 to Rosie on March 31 and $90,000 to Manuel on November 1.How are the distributions taxed to Rosie and Manuel? What is Rosie's recognized gain on the sale to Manuel?

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

62

Using the legend provided, classify each statement accordingly. In all cases, assume that taxable income is being adjusted to determine current E & P for 2008.

a.Increase

b.Decrease

c.No effect

Federal income tax paid.

a.Increase

b.Decrease

c.No effect

Federal income tax paid.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

63

Using the legend provided, classify each statement accordingly. In all cases, assume that taxable income is being adjusted to determine current E & P for 2008.

a.Increase

b.Decrease

c.No effect

Dividends received deduction.

a.Increase

b.Decrease

c.No effect

Dividends received deduction.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

64

Using the legend provided, classify each statement accordingly. In all cases, assume that taxable income is being adjusted to determine current E & P for 2008.

a.Increase

b.Decrease

c.No effect

Intangible drilling costs deducted currently.

a.Increase

b.Decrease

c.No effect

Intangible drilling costs deducted currently.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

65

Using the legend provided, classify each statement accordingly. In all cases, assume that taxable income is being adjusted to determine current E & P for 2008.

a.Increase

b.Decrease

c.No effect

Nontaxable stock dividend distributed to shareholders.

a.Increase

b.Decrease

c.No effect

Nontaxable stock dividend distributed to shareholders.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

66

Using the legend provided, classify each statement accordingly. In all cases, assume that taxable income is being adjusted to arrive at current E & P for 2008.

a.Increase

b.Decrease

c.No effect

State income taxes paid in 2008.

a.Increase

b.Decrease

c.No effect

State income taxes paid in 2008.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

67

Using the legend provided, classify each statement accordingly. In all cases, assume that taxable income is being adjusted to determine current E & P for 2008.

a.Increase

b.Decrease

c.No effect

Proceeds of life insurance received upon the death of a key employee (policy had no cash surrender value).

a.Increase

b.Decrease

c.No effect

Proceeds of life insurance received upon the death of a key employee (policy had no cash surrender value).

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

68

Sophie is the sole shareholder and president of Green Corporation. She feels that she can justify at least a $200,000 bonus this year because of her performance. However,rather than a bonus in the form of a salary,she plans to have Green pay her a $200,000 dividend. She believes this is preferable because it will be taxed at only 15% (her marginal rate is 39.6%). Her CPA suggests a $300,000 bonus in lieu of the $200,000 (Green Corporation is in a 34% tax bracket).Should Sophie take the $200,000 dividend or the $300,000 bonus? Support your answer by computing the after-tax cost of the two alternatives to Green and to Sophie.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

69

Lark Corporation is the sole shareholder of Plover Corporation,which it hopes to sell within the next three years.The Plover stock (basis of $27 million)is currently worth $30 million,but Lark believes that it would be easier to find a buyer if it was worth less.To lower the value of its stock,Plover distributes $2 million cash to Lark (sufficient E & P exists to cover the distribution).At a later date,Lark sells Plover for $28 million.

a.What are the tax consequences to Lark on the sale?

b.What would be the tax consequences if Plover had not first distributed the $2 million in cash and Lark sold the Plover stock for $30 million?

a.What are the tax consequences to Lark on the sale?

b.What would be the tax consequences if Plover had not first distributed the $2 million in cash and Lark sold the Plover stock for $30 million?

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

70

Thistle Corporation declares a nontaxable dividend payable in rights to subscribe to common stock.One right and $25 entitle the holder to subscribe to one share of stock.One right is issued for each share of stock held.Annette,a shareholder,owns 200 shares of stock that she purchased five years ago for $3,000.At the date of distribution of the rights,the market values were $50 per share for the stock and $25 for a right.Annette received 200 rights.She exercises 160 rights and purchases 160 additional shares of stock.She sells the remaining 40 rights for $1,080.What are the tax consequences to Annette?

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

71

On January 1,Cotton Candy Corporation (a calendar year taxpayer)has accumulated E & P of $400,000.Its current E & P for the year is $120,000 (before considering dividend distributions).During the year,Cotton Candy distributes $800,000 ($400,000 each)to its equal shareholders,Mary and Larry.Mary has a basis in her stock of $95,000,while Larry's basis is $160,000.What is the effect of the distribution by Cotton Candy Corporation on Mary and Larry?

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

72

Using the legend provided, classify each statement accordingly. In all cases, assume that taxable income is being adjusted to determine current E & P for 2008.

a.Increase

b.Decrease

c.No effect

Section 179 expenses in year of election.

a.Increase

b.Decrease

c.No effect

Section 179 expenses in year of election.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

73

Silver Corporation has accumulated E & P of $1,000,000 as of January 1 of the current year.During the year,it expects to have earnings from operations of $840,000 and to make a cash distribution of $450,000.Silver Corporation also expects to sell an asset for a loss of $1,000,000.Thus,it anticipates incurring a deficit of $160,000 for the year.What can Silver do to minimize the amount of dividend income to its shareholders?

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

74

Using the legend provided, classify each statement accordingly. In all cases, assume that taxable income is being adjusted to arrive at current E & P for 2008.

a.Increase

b.Decrease

c.No effect

Domestic production activities deduction claimed in 2008.

a.Increase

b.Decrease

c.No effect

Domestic production activities deduction claimed in 2008.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

75

Using the legend provided, classify each statement accordingly. In all cases, assume that taxable income is being adjusted to determine current E & P for 2008.

a.Increase

b.Decrease

c.No effect

Gain realized (but not recognized)on a like-kind exchange.

a.Increase

b.Decrease

c.No effect

Gain realized (but not recognized)on a like-kind exchange.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

76

Using the legend provided, classify each statement accordingly. In all cases, assume that taxable income is being adjusted to arrive at current E & P for 2008.

a.Increase

b.Decrease

c.No effect

Premiums paid on key employee life insurance policy (assume no increase in cash surrender value of policy)in 2008.

a.Increase

b.Decrease

c.No effect

Premiums paid on key employee life insurance policy (assume no increase in cash surrender value of policy)in 2008.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

77

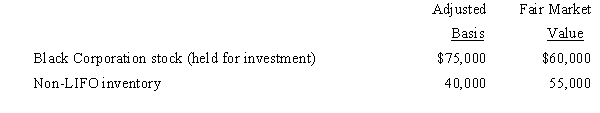

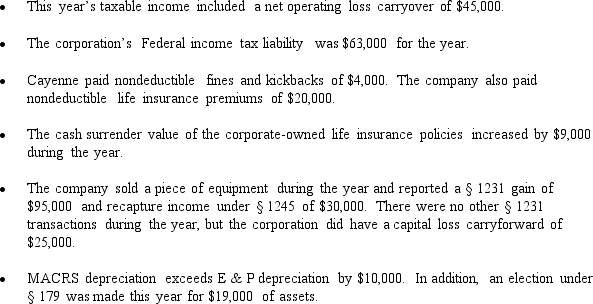

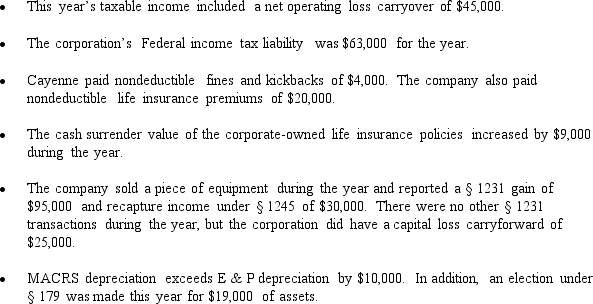

Cayenne Corporation,an accrual basis taxpayer,has struggled to survive since its formation,six years ago.As a result,it has a deficit in accumulated E & P at the beginning of the year of $310,000.This year,however,the tide was turned and Cayenne earned a significant profit; taxable income was $210,000.To celebrate,Cayenne made two cash distributions to Marty,its sole shareholder.The first distribution,$130,000,was made on July 1.The second distribution,$180,000,was paid on December 31.Cayenne's accountant has provided you with the following information that she thinks might be relevant to determining the tax treatment of the distributions.

a.Compute Cayenne's E & P for the year using the above information.

b.What are the tax consequences of the two distributions made during the year to Marty? Assume Marty's stock basis is $65,000.

a.Compute Cayenne's E & P for the year using the above information.

b.What are the tax consequences of the two distributions made during the year to Marty? Assume Marty's stock basis is $65,000.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

78

Using the legend provided, classify each statement accordingly. In all cases, assume that taxable income is being adjusted to determine current E & P for 2008.

a.Increase

b.Decrease

c.No effect

Penalties paid to state government for failure to comply with state law.

a.Increase

b.Decrease

c.No effect

Penalties paid to state government for failure to comply with state law.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

79

Using the legend provided, classify each statement accordingly. In all cases, assume that taxable income is being adjusted to determine current E & P for 2008.

a.Increase

b.Decrease

c.No effect

Excess capital loss in year incurred.

a.Increase

b.Decrease

c.No effect

Excess capital loss in year incurred.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

80

Using the legend provided, classify each statement accordingly. In all cases, assume that taxable income is being adjusted to arrive at current E & P for 2008.

a.Increase

b.Decrease

c.No effect

Gain realized,but not recognized,on involuntary conversion in 2008.

a.Increase

b.Decrease

c.No effect

Gain realized,but not recognized,on involuntary conversion in 2008.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck