Deck 10: Partnerships: Formation, operation, and Basis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/71

Play

Full screen (f)

Deck 10: Partnerships: Formation, operation, and Basis

1

Rachel and Barry formed the equal RB Partnership during the current year,with Rachel contributing $100,000 in cash and Barry contributing land (basis of $60,000,fair market value of $80,000)and equipment (basis of $0,fair market value of $20,000).Barry recognizes a $40,000 gain on the contribution and his basis in his partnership interest is $100,000.

False

Under § 721,neither the partnership nor a partner will generally recognize gain or loss on contribution of property to a partnership.Barry's substituted basis in his partnership interest is his $60,000 basis in the assets contributed ($60,000 basis in land plus $0 basis in equipment).

Under § 721,neither the partnership nor a partner will generally recognize gain or loss on contribution of property to a partnership.Barry's substituted basis in his partnership interest is his $60,000 basis in the assets contributed ($60,000 basis in land plus $0 basis in equipment).

2

Section 721 provides that no gain or loss is recognized on contribution of property to a partnership in exchange for an interest in the partnership.An exception might apply if the taxpayer receives a cash distribution from the partnership soon after the property contribution.

True

A contribution of property to a partnership followed by a distribution soon thereafter may be recharacterized as a disguised sale of the property by the partner to the partnership.A disguised sale does not receive tax-deferred treatment under § 721.

A contribution of property to a partnership followed by a distribution soon thereafter may be recharacterized as a disguised sale of the property by the partner to the partnership.A disguised sale does not receive tax-deferred treatment under § 721.

3

Mark and Jodi formed an equal partnership on August 1 of the current year.Mark contributed $25,000 cash and land with a basis of $5,000 and a fair market value of $10,000.Jodi contributed equipment with a basis of $23,000 and a value of $35,000.Jodi's tax basis in her interest is $23,000; Mark's tax basis is $30,000.

True

Mark's basis includes the $5,000 substituted basis for the contributed land plus $25,000 cash,for a total of $30,000.Jodi's basis is $23,000,a substituted basis from the contributed equipment.

Mark's basis includes the $5,000 substituted basis for the contributed land plus $25,000 cash,for a total of $30,000.Jodi's basis is $23,000,a substituted basis from the contributed equipment.

4

Hardy's basis in his partnership interest was $5,000 at the beginning of the tax year.For the year,his share of the partnership's loss was $6,000,and he also received a distribution of $3,000.Hardy can deduct a $2,000 loss,and the remaining $4,000 loss is suspended until a year in which he has adequate basis.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

5

Meagan purchased her partnership interest from Lisa on the first day of the current year for $30,000 cash.She received a $15,000 cash distribution from the partnership during the year,and her share of partnership income is $12,000.If her share of partnership liabilities on the last day of the partnership year is $10,000,her outside basis for her partnership interest at the end of the year is $27,000.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

6

Maria owns a 60% interest in the KLM Partnership.Four years ago her father gave her a parcel of land.The gift basis of the land to Maria is $60,000.In the current year,Maria had still not figured out how to use the land for her own personal or business use; consequently,she sold the land to the partnership for $75,000.The partnership immediately started using the land as a parking lot for its employees.Maria recognizes a capital gain of $15,000 on the sale.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

7

Nina and Sue form an equal partnership during the current year.Nina contributes cash of $100,000,and Sue contributes property (adjusted basis of $40,000,fair market value of $250,000)subject to a nonrecourse liability of $150,000.As a result of these transactions,Sue has a recognized gain of $35,000 and a basis in her partnership interest of $75,000.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

8

Monroe,a 1/3 partner with a basis in the interest of $60,000 at the beginning of the year,received a guaranteed payment in the current year of $40,000.Partnership income before consideration of the guaranteed payment was $25,000.Monroe must report a $5,000 ordinary loss from partnership operations,and the $40,000 guaranteed payment as ordinary income.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

9

On January 1 of the current year,Sarah and Bart form an equal partnership.Sarah makes a cash contribution of $60,000 and a property contribution (adjusted basis of $160,000; fair market value of $140,000)in exchange for her interest in the partnership.Bart contributes property (adjusted basis of $120,000; fair market value of $200,000)in exchange for his partnership interest.Which of the following statements is true concerning the income tax results of this partnership formation?

A)Sarah has a $200,000 tax basis for her partnership interest.

B)The partnership has a $140,000 adjusted basis in the property contributed by Sarah.

C)Bart recognizes an $80,000 gain on his property transfer.

D)Bart has a $120,000 tax basis for his partnership interest.

E)None of the statements is true.

A)Sarah has a $200,000 tax basis for her partnership interest.

B)The partnership has a $140,000 adjusted basis in the property contributed by Sarah.

C)Bart recognizes an $80,000 gain on his property transfer.

D)Bart has a $120,000 tax basis for his partnership interest.

E)None of the statements is true.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

10

During the current year,John and Ashley form the JA Partnership and agree to share profits and losses equally.John contributes cash of $50,000 and Ashley contributes land with a fair market value of $80,000 (subject to a $30,000 nonrecourse mortgage).On the contribution date,Ashley's adjusted basis in the land is $40,000.Immediately after formation,John's partnership outside basis is $65,000,Ashley's partnership outside basis is $25,000,and JA's basis in the land is $40,000.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

11

Michael contributes land with a value of $120,000 and a basis of $80,000 to the MNO Partnership in exchange for a 1/4 interest.Soon thereafter,the partnership sells the land for $140,000.Of the gain on the land sale,$15,000 is allocated to Michael.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

12

During the current year,ALF Partnership reported the following items of receipts and expenditures: $200,000 sales,$10,000 utilities,$12,000 rent,$50,000 salaries to employees,$30,000 guaranteed payment to partner Lloyd,investment interest income of $3,000,a charitable contribution of $5,000,and a distribution of $10,000 to partner Frank.Arnold,a 40% partner,will receive a K-1 that reflects a $39,200 share of partnership ordinary income,a $1,200 share of partnership interest income,and a $2,000 charitable contribution.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

13

Roxanne contributes land to the RB Partnership in exchange for a 40% interest.The land has an adjusted basis and fair market value of $75,000 and is subject to a liability of $25,000,which the partnership assumes.None of this liability is repaid at year-end.At the end of the year,the partnership has trade accounts payable of $30,000.Assume all liabilities are allocated proportionately to the partners.Total partnership income for the year is $100,000.Roxanne's basis in her partnership interest at the end of the year is $112,000.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

14

The MNO Partnership,a calendar year taxpayer,was formed on July 1 of the current year and started business on October 1.MNO incurred $3,000 of legal fees on formation and $30,000 in start-up costs.MNO may deduct $5,000 and amortize the remaining $28,000 over 180 months starting in July,for $933 in the current year.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

15

A partnership will take a carryover basis in an asset it acquires when:

A)The partnership acquires the asset through a § 1031 like-kind exchange.

B)A partner owning 25% of partnership capital and profits sells the asset to the partnership.

C)The partnership acquires the asset from a partner as a contribution to partnership capital under § 721(a).

D)The partnership leases the asset from a partner on a one-year lease.

E)None of the above.

A)The partnership acquires the asset through a § 1031 like-kind exchange.

B)A partner owning 25% of partnership capital and profits sells the asset to the partnership.

C)The partnership acquires the asset from a partner as a contribution to partnership capital under § 721(a).

D)The partnership leases the asset from a partner on a one-year lease.

E)None of the above.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

16

On the first day of the current tax year,Melanie's basis in her partnership interest was $85,000.Her Schedule K-1 from the partnership reflected the following items for the current year: share of partnership ordinary loss,$95,000; interest income from money market accounts,$6,000.On her personal tax return,Melanie will report a loss from the partnership of $91,000,and interest income of $6,000.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

17

PaulCo,DavidCo,and Ralph form a partnership with cash contributions of $80,000,$50,000 and $30,000,respectively,and agree to share profits and losses in the ratio of their original cash contributions.PaulCo uses a January 31 fiscal year-end,while DavidCo and Ralph use a November 30 and December 31 fiscal year-end,respectively.Since PaulCo is a majority partner,this partnership will use a January 31 year-end.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

18

Julie is a real estate developer and owns property that is treated as inventory (not a capital asset)in her business.She contributed a parcel of this land (basis $60,000; fair market value $58,000)to a partnership,which will also hold it as inventory.After three years,the partnership sells the land for $56,000.The partnership will recognize a $4,000 ordinary loss on sale of the property.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

19

John and Ken formed the equal JK Partnership during the current year,with John contributing $50,000 in cash and Ken contributing land (basis of $30,000,fair market value of $20,000)and equipment (basis of $0,fair market value of $30,000).Ken recognizes no gain or loss on the contribution and his basis in his partnership interest is $30,000.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

20

Formation of a partnership is generally a tax-deferred transaction,provided the contributing partners receive partnership interests representing "control" of the entity (more than 80% of the voting power of the partnership interests).

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

21

Kevin,Chuck,and Greg contributed assets to form the equal KCG Partnership.Kevin contributed cash of $50,000 and land with a basis of $80,000 (fair market value of $50,000).Chuck contributed cash of $30,000 and land with a basis of $40,000 (fair market value of $70,000).Greg contributed cash of $60,000 and a fully depreciated property ($0 basis)valued at $40,000.Which of the following tax treatments is not correct?

A)Kevin's basis in his partnership interest is $130,000.

B)Chuck's basis in his partnership interest is $100,000.

C)Greg's basis in his partnership interest is $60,000.

D)KCG has a basis of $80,000, $40,000, and $0 in the land and property (excluding cash) contributed by Kevin, Chuck, and Greg, respectively.

E)All of these statement are correct.

A)Kevin's basis in his partnership interest is $130,000.

B)Chuck's basis in his partnership interest is $100,000.

C)Greg's basis in his partnership interest is $60,000.

D)KCG has a basis of $80,000, $40,000, and $0 in the land and property (excluding cash) contributed by Kevin, Chuck, and Greg, respectively.

E)All of these statement are correct.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

22

Jamie contributed fully depreciated ($0 basis)property valued at $30,000 to the JKLM Partnership in exchange for a 40% interest in partnership capital and profits.During the first year of partnership operations,JKLM had net taxable income of $80,000 and tax-exempt income of $10,000.The partnership distributed $20,000 cash to Jamie.Her share of partnership recourse liabilities on the last day of the partnership year was $13,000.Jamie's adjusted basis (outside basis)for her partnership interest at year-end is:

A)$16,000.

B)$29,000.

C)$59,000.

D)$79,000.

E)None of the above.

A)$16,000.

B)$29,000.

C)$59,000.

D)$79,000.

E)None of the above.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

23

Match each of the following statements with the terms below that provide the best definition.

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."

k.Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

l.Allows many unincorporated entities to select their Federal tax status.

m.No correct match provided.

Check the box regulations

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."

k.Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

l.Allows many unincorporated entities to select their Federal tax status.

m.No correct match provided.

Check the box regulations

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

24

Cheryl and Nina formed a partnership.Cheryl received a 40% interest in partnership capital and profits in exchange for contributing land with a basis of $60,000 and a fair market value of $80,000.Nina received a 60% interest in partnership capital and profits in exchange for contributing $120,000 of cash.Three years after the contribution date,the land contributed by Cheryl is sold by the partnership to a third party for $90,000.How much taxable gain will Cheryl recognize from the sale?

A)$4,000.

B)$12,000.

C)$24,000.

D)$30,000.

E)None of the above.

A)$4,000.

B)$12,000.

C)$24,000.

D)$30,000.

E)None of the above.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

25

Tina and Randy formed the TR Partnership four years ago.Because they decided the company needed some expertise in multimedia presentations,they offered Susan a 1/3 interest in partnership capital and profits if she would come to work for the partnership.On July 1 of the current year,the unrestricted partnership interest (fair market value of $25,000)was transferred to Susan.How should Susan treat the receipt of the partnership interest in the current year?

A)Nontaxable.

B)$25,000 short-term capital gain.

C)$25,000 long-term capital gain.

D)$25,000 ordinary income.

E)None of the above.

A)Nontaxable.

B)$25,000 short-term capital gain.

C)$25,000 long-term capital gain.

D)$25,000 ordinary income.

E)None of the above.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

26

Alicia and Barry form the AB Partnership at the start of the current year with a land contribution by Barry and a cash contribution by Alicia.Barry's contributed property is subject to a recourse mortgage assumed by the partnership.Immediately after formation,Barry has an 80% interest in AB's profits and losses.The land has been held by Barry for the past 6 years as an investment.It will be used by AB as an operating asset in its parking lot business.Which of the following statements is correct?

A)Immediately after formation, Alicia's basis in the partnership equals the cash contributed by Alicia.

B)Immediately after formation, Alicia's basis in the partnership equals the cash she contributed plus her share of the recourse debt contributed by Barry.

C)Since the debt is recourse, the constructive liquidation scenario is not applicable for determining the allocation of debt to the partners.

D)AB's basis in the land contributed by Barry equals Barry's basis in the land immediately before the contribution date, less the amount of the recourse debt assumed by the partnership.

E)None of the above.

A)Immediately after formation, Alicia's basis in the partnership equals the cash contributed by Alicia.

B)Immediately after formation, Alicia's basis in the partnership equals the cash she contributed plus her share of the recourse debt contributed by Barry.

C)Since the debt is recourse, the constructive liquidation scenario is not applicable for determining the allocation of debt to the partners.

D)AB's basis in the land contributed by Barry equals Barry's basis in the land immediately before the contribution date, less the amount of the recourse debt assumed by the partnership.

E)None of the above.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

27

Jim and Marta created the JM Partnership by contributing $60,000 each.The $120,000 cash was used by the partnership to acquire a depreciable asset.The partnership agreement provides that the partners' capital accounts will be maintained in accordance with Reg.§ 1.704-1(b)(the "economic effect" Regulations)and that any partner with a deficit capital account will be required to restore that capital account when the partner's interest is liquidated.The partnership agreement provides that MACRS will be allocated 10% to Jim and 90% to Marta.All other items of partnership income,gain,loss,deduction,and credit will be allocated equally between the partners.If the first year MACRS is $20,000 and no other operating transactions occur,which of the following statements satisfies the economic effect test of the Regulations?

A)If the property is sold at the end of the year for $100,000 and the partnership is liquidated immediately thereafter, cash will be distributed $58,000 to Jim and $42,000 to Marta.

B)Because each partner's profit and loss sharing ratio is 50%, a sale of the property for $108,000 at the end of the year, followed by an immediate liquidation of the partnership, will result in both partners receiving $54,000 cash.

C)MACRS cannot be allocated to the partners in a 90/10 ratio since Regulations require that the allocation of MACRS must follow the relative capital contributions of the partners. Therefore, MACRS must be allocated equally between Jim and Marta.

D)If the property is sold at the end of the first year for $120,000 and the partnership liquidated immediately thereafter, $60,000 cash would be distributed each to Jim and to Marta.

E)None of the above.

A)If the property is sold at the end of the year for $100,000 and the partnership is liquidated immediately thereafter, cash will be distributed $58,000 to Jim and $42,000 to Marta.

B)Because each partner's profit and loss sharing ratio is 50%, a sale of the property for $108,000 at the end of the year, followed by an immediate liquidation of the partnership, will result in both partners receiving $54,000 cash.

C)MACRS cannot be allocated to the partners in a 90/10 ratio since Regulations require that the allocation of MACRS must follow the relative capital contributions of the partners. Therefore, MACRS must be allocated equally between Jim and Marta.

D)If the property is sold at the end of the first year for $120,000 and the partnership liquidated immediately thereafter, $60,000 cash would be distributed each to Jim and to Marta.

E)None of the above.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

28

Fern,Inc.,Ivy Inc.,and Jason formed a general partnership,each contributing equally.Fern,Inc.files its tax return on a July 1 - June 30 fiscal year; Ivy Inc.files on a September 1 - August 31 fiscal year; and Jason is a calendar year taxpayer.Which of the following statements is true regarding the taxable year the partnership can choose?

A)The partnership must choose the calendar year since it has no principal partners.

B)The partnership can choose the taxable year of any of its "principal partners" without obtaining IRS permission.

C)The partnership can choose a January 31 fiscal year without obtaining IRS permission, if the partnership can prove that the January 31 fiscal year will reduce the cost of preparing the partnership tax return.

D)The partnership can choose the taxable year that provides for the "least aggregate deferral" without obtaining IRS permission.

E)None of the above

A)The partnership must choose the calendar year since it has no principal partners.

B)The partnership can choose the taxable year of any of its "principal partners" without obtaining IRS permission.

C)The partnership can choose a January 31 fiscal year without obtaining IRS permission, if the partnership can prove that the January 31 fiscal year will reduce the cost of preparing the partnership tax return.

D)The partnership can choose the taxable year that provides for the "least aggregate deferral" without obtaining IRS permission.

E)None of the above

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

29

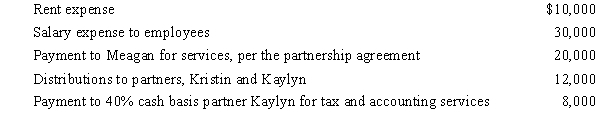

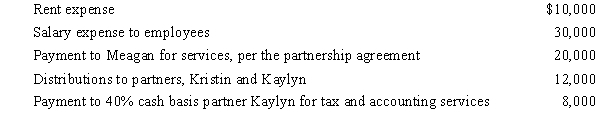

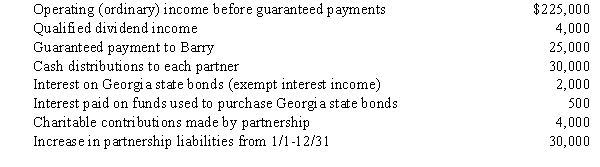

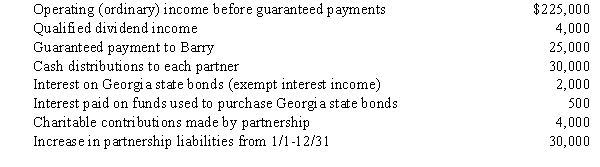

Meagan is a 40% general partner in the calendar year,cash basis MKK Partnership.The partnership received $100,000 income from services and paid the following other amounts:

How much is Meagan's adjusted gross income increased as a result of the above items?

A)$8,000.

B)$12,800.

C)$32,000.

D)$32,800.

E)$40,800.

How much is Meagan's adjusted gross income increased as a result of the above items?

A)$8,000.

B)$12,800.

C)$32,000.

D)$32,800.

E)$40,800.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

30

Richard made a contribution of property to the newly formed QRST Partnership.The property had a $30,000 adjusted basis to Richard and a $100,000 fair market value on the contribution date.The property was also encumbered by a $50,000 nonrecourse debt,which was transferred to the partnership on that date.Another partner,Sylvia,shares 1/3 of the partnership income,gain,loss,deduction,and credit.Under IRS regulations,Sylvia's share of the nonrecourse debt for basis purposes is:

A)$10,000.

B)$30,000.

C)$36,667.

D)$40,000.

E)$50,000.

A)$10,000.

B)$30,000.

C)$36,667.

D)$40,000.

E)$50,000.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

31

At the beginning of the tax year,Wick's basis for his partnership interest and his amount at risk in the partnership was $30,000. His share of partnership items for the year consisted of tax-exempt interest income of $2,000 and an ordinary loss of $44,000. He also received a distribution from the partnership of $20,000 cash during the year. For the tax year,Wick will report:

A)A nontaxable distribution of $20,000, an ordinary loss of $10,000, and a suspended loss carryforward of $34,000.

B)An ordinary loss of $32,000, a suspended loss carryforward of $12,000, and a taxable distribution of $20,000.

C)A nontaxable distribution of $20,000, an ordinary loss of $12,000, and a suspended loss carryforward of $32,000.

D)An ordinary loss of $44,000 and a nontaxable distribution of $20,000.

A)A nontaxable distribution of $20,000, an ordinary loss of $10,000, and a suspended loss carryforward of $34,000.

B)An ordinary loss of $32,000, a suspended loss carryforward of $12,000, and a taxable distribution of $20,000.

C)A nontaxable distribution of $20,000, an ordinary loss of $12,000, and a suspended loss carryforward of $32,000.

D)An ordinary loss of $44,000 and a nontaxable distribution of $20,000.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

32

Partner Tom transferred property (basis of $20,000; fair market value of $50,000)to the TUV Partnership in exchange for a partnership interest.At a later date,when Tom's outside basis for his partnership interest was $70,000,Tom received a $50,000 cash distribution from the partnership.Which one of the following statements is not true?

A)If the cash distribution occurred two months after the property contribution, the IRS may treat the transaction as a disguised sale.

B)If the transaction is treated as a disguised sale, Tom's basis in the partnership interest will be $20,000.

C)If Tom would have made the property contribution anyway, even if he knew that the partnership would probably not have any cash to distribute to him, the IRS would not likely contend the transaction was a disguised sale.

D)If the IRS treated the transaction as a disguised sale, the partnership's basis in the property would be $50,000.

A)If the cash distribution occurred two months after the property contribution, the IRS may treat the transaction as a disguised sale.

B)If the transaction is treated as a disguised sale, Tom's basis in the partnership interest will be $20,000.

C)If Tom would have made the property contribution anyway, even if he knew that the partnership would probably not have any cash to distribute to him, the IRS would not likely contend the transaction was a disguised sale.

D)If the IRS treated the transaction as a disguised sale, the partnership's basis in the property would be $50,000.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

33

Sharon and Sara are equal partners in the S&S Partnership.On January 1 of the current year,each partner's adjusted basis in S&S was $50,000 (including each partner's $15,000 share of the partnership's $30,000 of liabilities).During the current year,S&S repaid the beginning liabilities and borrowed $20,000 for which Sharon and Sara are equally liable.In the current year ended December 31,S&S also sustained a net operating loss of $25,000 and earned $5,000 of interest and qualified dividend income from investments.If liabilities are shared equally by the partners,on January 1 of the next year each partner's basis in her interest in S&S is:

A)$35,000.

B)$40,000.

C)$45,000.

D)$47,500.

E)$50,000.

A)$35,000.

B)$40,000.

C)$45,000.

D)$47,500.

E)$50,000.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

34

In the current year,the DOE Partnership received revenues of $100,000 and paid the following amounts: $20,000 in rent and utilities,a $30,000 guaranteed payment to 50% partner Don,$6,000 to partner Eugene for consulting services,and $10,000 as a distribution to partner Olivia.In addition,the partnership earned $4,000 of qualifying dividend income during the year.Don's basis in his partnership interest was $35,000 at the beginning of the year,and includes a $10,000 share of partnership liabilities.At the end of the year,his share of partnership liabilities was $20,000.How much income must Don report for the tax year,and what is his basis in his partnership interest at the end of the year?

A)$25,000 ordinary income; $2,000 of qualifying dividends; $62,000 basis.

B)$24,000 ordinary income; $30,000 guaranteed payment; $89,000 basis.

C)$22,000 ordinary income; $2,000 of qualifying dividends; $30,000 guaranteed payment; $69,000 basis.

D)$17,000 ordinary income; $2,000 of qualifying dividends; $30,000 guaranteed payment; $84,000 basis.

E)None of the above.

A)$25,000 ordinary income; $2,000 of qualifying dividends; $62,000 basis.

B)$24,000 ordinary income; $30,000 guaranteed payment; $89,000 basis.

C)$22,000 ordinary income; $2,000 of qualifying dividends; $30,000 guaranteed payment; $69,000 basis.

D)$17,000 ordinary income; $2,000 of qualifying dividends; $30,000 guaranteed payment; $84,000 basis.

E)None of the above.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

35

René is a partner in the RST Partnership,which is not publicly traded.Her allocable share of RST's passive ordinary losses from a nonrealty activity for the current year is ($60,000).René has a $40,000 adjusted basis (outside basis)for her interest in RST (before deduction of any of the passive losses).Her amount "at risk" under § 465 is $30,000 (before deduction of any of the passive losses).She also has $25,000 of passive income from other sources.How much of her ($60,000)allocable loss can René deduct on her current year's tax return?

A)$25,000.

B)$30,000.

C)$40,000.

D)$60,000.

E)None of the above.

A)$25,000.

B)$30,000.

C)$40,000.

D)$60,000.

E)None of the above.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

36

In the current year,Greg formed an equal partnership with Melvin.Greg contributed land with an adjusted basis of $90,000 and a fair market value of $150,000.Greg also contributed $75,000 cash to the partnership.Melvin contributed land with an adjusted basis of $100,000 and a fair market value of $200,000.The land contributed by Greg was encumbered by a $50,000 nonrecourse debt.The land contributed by Melvin was encumbered by $25,000 of nonrecourse debt.Assume the partners share debt equally.Immediately after the formation,the basis of Melvin's partnership interest is:

A)$0.

B)$77,500.

C)$112,500.

D)$125,000.

E)$137,000.

A)$0.

B)$77,500.

C)$112,500.

D)$125,000.

E)$137,000.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

37

Match each of the following statements with the terms below that provide the best definition.

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."

k.Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

l.Allows many unincorporated entities to select their Federal tax status.

m.No correct match provided.

Limited partnership

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."

k.Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

l.Allows many unincorporated entities to select their Federal tax status.

m.No correct match provided.

Limited partnership

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

38

When property is contributed to a partnership for a capital and profits interest,the holding period of the contributing partner's interest:

A)May include the holding period of the contributed property.

B)Always starts the day after the contribution date.

C)Always starts the day the property was contributed.

D)Never includes the holding period of the contributed property.

E)None of the above.

A)May include the holding period of the contributed property.

B)Always starts the day after the contribution date.

C)Always starts the day the property was contributed.

D)Never includes the holding period of the contributed property.

E)None of the above.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

39

In computing the ordinary income of a partnership,a deduction is generally allowed for:

A)Guaranteed payments to partners.

B)A standard deduction.

C)Partners' personal exemptions.

D)The net operating loss deduction.

E)All of the above can be deducted.

A)Guaranteed payments to partners.

B)A standard deduction.

C)Partners' personal exemptions.

D)The net operating loss deduction.

E)All of the above can be deducted.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

40

Rachel uses a June 30 fiscal year.She owns a 50% profit and loss interest in a calendar year partnership.For the 2008 calendar year,the partnership's taxable income (after guaranteed payments)was $40,000,and for the 2009 calendar year it was $50,000.During the 2008 calendar year,the partnership paid Rachel a guaranteed payment of $100 per month.During the 2009 calendar year,it paid Rachel a guaranteed payment of $200 per month.Rachel must report the following total amount of income from the partnership for her June 30,2009,tax year.

A)$26,800.

B)$26,200.

C)$21,800.

D)$21,200.

E)None of the above.

A)$26,800.

B)$26,200.

C)$21,800.

D)$21,200.

E)None of the above.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

41

Match each of the following statements with the terms below that provide the best definition.

a.Operating expenses incurred after entity is formed but before it begins doing business.

b.Each partner's basis in the partnership.

c.Tax accounting election made by partnership.

d.Tax accounting calculation made by partner

e.Tax accounting election made by partner.

f.Designed to prevent excessive deferral of taxation of partnership income.

g.Amount that may be received by partner for performance of services for the partnership.

h.Adjusted basis of each partnership asset.

i.Computation that determines the way recourse debt is shared.

j.Will eventually be allocated to partner making tax-free property contribution to partnership.

k.Must be satisfied if a loss item is to be specially allocated to a partner.

l.Justification for a tax year other than the required taxable year.

m.No correct match is provided.

Inside basis

a.Operating expenses incurred after entity is formed but before it begins doing business.

b.Each partner's basis in the partnership.

c.Tax accounting election made by partnership.

d.Tax accounting calculation made by partner

e.Tax accounting election made by partner.

f.Designed to prevent excessive deferral of taxation of partnership income.

g.Amount that may be received by partner for performance of services for the partnership.

h.Adjusted basis of each partnership asset.

i.Computation that determines the way recourse debt is shared.

j.Will eventually be allocated to partner making tax-free property contribution to partnership.

k.Must be satisfied if a loss item is to be specially allocated to a partner.

l.Justification for a tax year other than the required taxable year.

m.No correct match is provided.

Inside basis

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

42

Match each of the following statements with the terms below that provide the best definition.

a.Operating expenses incurred after entity is formed but before it begins doing business.

b.Each partner's basis in the partnership.

c.Tax accounting election made by partnership.

d.Tax accounting calculation made by partner

e.Tax accounting election made by partner.

f.Designed to prevent excessive deferral of taxation of partnership income.

g.Amount that may be received by partner for performance of services for the partnership.

h.Adjusted basis of each partnership asset.

i.Computation that determines the way recourse debt is shared.

j.Will eventually be allocated to partner making tax-free property contribution to partnership.

k.Must be satisfied if a loss item is to be specially allocated to a partner.

l.Justification for a tax year other than the required taxable year.

m.No correct match is provided.

Start-up costs

a.Operating expenses incurred after entity is formed but before it begins doing business.

b.Each partner's basis in the partnership.

c.Tax accounting election made by partnership.

d.Tax accounting calculation made by partner

e.Tax accounting election made by partner.

f.Designed to prevent excessive deferral of taxation of partnership income.

g.Amount that may be received by partner for performance of services for the partnership.

h.Adjusted basis of each partnership asset.

i.Computation that determines the way recourse debt is shared.

j.Will eventually be allocated to partner making tax-free property contribution to partnership.

k.Must be satisfied if a loss item is to be specially allocated to a partner.

l.Justification for a tax year other than the required taxable year.

m.No correct match is provided.

Start-up costs

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

43

Match each of the following statements with the terms below that provide the best definition.

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."

k.Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

l.Allows many unincorporated entities to select their Federal tax status.

m.No correct match provided.

Entity concept

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."

k.Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

l.Allows many unincorporated entities to select their Federal tax status.

m.No correct match provided.

Entity concept

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

44

Match each of the following statements with the terms below that provide the best definition.

a.Operating expenses incurred after entity is formed but before it begins doing business.

b.Each partner's basis in the partnership.

c.Tax accounting election made by partnership.

d.Tax accounting calculation made by partner

e.Tax accounting election made by partner.

f.Designed to prevent excessive deferral of taxation of partnership income.

g.Amount that may be received by partner for performance of services for the partnership.

h.Adjusted basis of each partnership asset.

i.Computation that determines the way recourse debt is shared.

j.Will eventually be allocated to partner making tax-free property contribution to partnership.

k.Must be satisfied if a loss item is to be specially allocated to a partner.

l.Justification for a tax year other than the required taxable year.

m.No correct match is provided.

§ 179 deduction

a.Operating expenses incurred after entity is formed but before it begins doing business.

b.Each partner's basis in the partnership.

c.Tax accounting election made by partnership.

d.Tax accounting calculation made by partner

e.Tax accounting election made by partner.

f.Designed to prevent excessive deferral of taxation of partnership income.

g.Amount that may be received by partner for performance of services for the partnership.

h.Adjusted basis of each partnership asset.

i.Computation that determines the way recourse debt is shared.

j.Will eventually be allocated to partner making tax-free property contribution to partnership.

k.Must be satisfied if a loss item is to be specially allocated to a partner.

l.Justification for a tax year other than the required taxable year.

m.No correct match is provided.

§ 179 deduction

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

45

Match each of the following statements with the terms below that provide the best definition.

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."

k.Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

l.Allows many unincorporated entities to select their Federal tax status.

m.No correct match provided.

Syndication costs

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."

k.Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

l.Allows many unincorporated entities to select their Federal tax status.

m.No correct match provided.

Syndication costs

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

46

Match each of the following statements with the terms below that provide the best definition.

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."

k.Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

l.Allows many unincorporated entities to select their Federal tax status.

m.No correct match provided.

Separately stated item

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."

k.Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

l.Allows many unincorporated entities to select their Federal tax status.

m.No correct match provided.

Separately stated item

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

47

Match each of the following statements with the terms below that provide the best definition.

a.Operating expenses incurred after entity is formed but before it begins doing business.

b.Each partner's basis in the partnership.

c.Tax accounting election made by partnership.

d.Tax accounting calculation made by partner

e.Tax accounting election made by partner.

f.Designed to prevent excessive deferral of taxation of partnership income.

g.Amount that may be received by partner for performance of services for the partnership.

h.Adjusted basis of each partnership asset.

i.Computation that determines the way recourse debt is shared.

j.Will eventually be allocated to partner making tax-free property contribution to partnership.

k.Must be satisfied if a loss item is to be specially allocated to a partner.

l.Justification for a tax year other than the required taxable year.

m.No correct match is provided.

Organization costs

a.Operating expenses incurred after entity is formed but before it begins doing business.

b.Each partner's basis in the partnership.

c.Tax accounting election made by partnership.

d.Tax accounting calculation made by partner

e.Tax accounting election made by partner.

f.Designed to prevent excessive deferral of taxation of partnership income.

g.Amount that may be received by partner for performance of services for the partnership.

h.Adjusted basis of each partnership asset.

i.Computation that determines the way recourse debt is shared.

j.Will eventually be allocated to partner making tax-free property contribution to partnership.

k.Must be satisfied if a loss item is to be specially allocated to a partner.

l.Justification for a tax year other than the required taxable year.

m.No correct match is provided.

Organization costs

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

48

Match each of the following statements with the terms below that provide the best definition.

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."

k.Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

l.Allows many unincorporated entities to select their Federal tax status.

m.No correct match provided.

Profits interest

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."

k.Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

l.Allows many unincorporated entities to select their Federal tax status.

m.No correct match provided.

Profits interest

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

49

Match each of the following statements with the terms below that provide the best definition.

a.Operating expenses incurred after entity is formed but before it begins doing business.

b.Each partner's basis in the partnership.

c.Tax accounting election made by partnership.

d.Tax accounting calculation made by partner

e.Tax accounting election made by partner.

f.Designed to prevent excessive deferral of taxation of partnership income.

g.Amount that may be received by partner for performance of services for the partnership.

h.Adjusted basis of each partnership asset.

i.Computation that determines the way recourse debt is shared.

j.Will eventually be allocated to partner making tax-free property contribution to partnership.

k.Must be satisfied if a loss item is to be specially allocated to a partner.

l.Justification for a tax year other than the required taxable year.

m.No correct match is provided.

Economic effect test

a.Operating expenses incurred after entity is formed but before it begins doing business.

b.Each partner's basis in the partnership.

c.Tax accounting election made by partnership.

d.Tax accounting calculation made by partner

e.Tax accounting election made by partner.

f.Designed to prevent excessive deferral of taxation of partnership income.

g.Amount that may be received by partner for performance of services for the partnership.

h.Adjusted basis of each partnership asset.

i.Computation that determines the way recourse debt is shared.

j.Will eventually be allocated to partner making tax-free property contribution to partnership.

k.Must be satisfied if a loss item is to be specially allocated to a partner.

l.Justification for a tax year other than the required taxable year.

m.No correct match is provided.

Economic effect test

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

50

Match each of the following statements with the terms below that provide the best definition.

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."

k.Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

l.Allows many unincorporated entities to select their Federal tax status.

m.No correct match provided.

Limited liability company

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."

k.Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

l.Allows many unincorporated entities to select their Federal tax status.

m.No correct match provided.

Limited liability company

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

51

Match each of the following statements with the terms below that provide the best definition.

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."

k.Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

l.Allows many unincorporated entities to select their Federal tax status.

m.No correct match provided.

Aggregate concept

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."

k.Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

l.Allows many unincorporated entities to select their Federal tax status.

m.No correct match provided.

Aggregate concept

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

52

Match each of the following statements with the terms below that provide the best definition.

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."

k.Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

l.Allows many unincorporated entities to select their Federal tax status.

m.No correct match provided.

Substituted

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."

k.Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

l.Allows many unincorporated entities to select their Federal tax status.

m.No correct match provided.

Substituted

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

53

Match each of the following statements with the terms below that provide the best definition.

a.Operating expenses incurred after entity is formed but before it begins doing business.

b.Each partner's basis in the partnership.

c.Tax accounting election made by partnership.

d.Tax accounting calculation made by partner

e.Tax accounting election made by partner.

f.Designed to prevent excessive deferral of taxation of partnership income.

g.Amount that may be received by partner for performance of services for the partnership.

h.Adjusted basis of each partnership asset.

i.Computation that determines the way recourse debt is shared.

j.Will eventually be allocated to partner making tax-free property contribution to partnership.

k.Must be satisfied if a loss item is to be specially allocated to a partner.

l.Justification for a tax year other than the required taxable year.

m.No correct match is provided.

Required taxable year

a.Operating expenses incurred after entity is formed but before it begins doing business.

b.Each partner's basis in the partnership.

c.Tax accounting election made by partnership.

d.Tax accounting calculation made by partner

e.Tax accounting election made by partner.

f.Designed to prevent excessive deferral of taxation of partnership income.

g.Amount that may be received by partner for performance of services for the partnership.

h.Adjusted basis of each partnership asset.

i.Computation that determines the way recourse debt is shared.

j.Will eventually be allocated to partner making tax-free property contribution to partnership.

k.Must be satisfied if a loss item is to be specially allocated to a partner.

l.Justification for a tax year other than the required taxable year.

m.No correct match is provided.

Required taxable year

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

54

Match each of the following statements with the terms below that provide the best definition.

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."

k.Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

l.Allows many unincorporated entities to select their Federal tax status.

m.No correct match provided.

Qualified nonrecourse debt

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."

k.Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

l.Allows many unincorporated entities to select their Federal tax status.

m.No correct match provided.

Qualified nonrecourse debt

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

55

Match each of the following statements with the terms below that provide the best definition.

a.Operating expenses incurred after entity is formed but before it begins doing business.

b.Each partner's basis in the partnership.

c.Tax accounting election made by partnership.

d.Tax accounting calculation made by partner

e.Tax accounting election made by partner.

f.Designed to prevent excessive deferral of taxation of partnership income.

g.Amount that may be received by partner for performance of services for the partnership.

h.Adjusted basis of each partnership asset.

i.Computation that determines the way recourse debt is shared.

j.Will eventually be allocated to partner making tax-free property contribution to partnership.

k.Must be satisfied if a loss item is to be specially allocated to a partner.

l.Justification for a tax year other than the required taxable year.

m.No correct match is provided.

Precontribution gain

a.Operating expenses incurred after entity is formed but before it begins doing business.

b.Each partner's basis in the partnership.

c.Tax accounting election made by partnership.

d.Tax accounting calculation made by partner

e.Tax accounting election made by partner.

f.Designed to prevent excessive deferral of taxation of partnership income.

g.Amount that may be received by partner for performance of services for the partnership.

h.Adjusted basis of each partnership asset.

i.Computation that determines the way recourse debt is shared.

j.Will eventually be allocated to partner making tax-free property contribution to partnership.

k.Must be satisfied if a loss item is to be specially allocated to a partner.

l.Justification for a tax year other than the required taxable year.

m.No correct match is provided.

Precontribution gain

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

56

Match each of the following statements with the terms below that provide the best definition.

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."

k.Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

l.Allows many unincorporated entities to select their Federal tax status.

m.No correct match provided.

Carryover

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."

k.Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

l.Allows many unincorporated entities to select their Federal tax status.

m.No correct match provided.

Carryover

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

57

Match each of the following statements with the terms below that provide the best definition.

a.Operating expenses incurred after entity is formed but before it begins doing business.

b.Each partner's basis in the partnership.

c.Tax accounting election made by partnership.

d.Tax accounting calculation made by partner

e.Tax accounting election made by partner.

f.Designed to prevent excessive deferral of taxation of partnership income.

g.Amount that may be received by partner for performance of services for the partnership.

h.Adjusted basis of each partnership asset.

i.Computation that determines the way recourse debt is shared.

j.Will eventually be allocated to partner making tax-free property contribution to partnership.

k.Must be satisfied if a loss item is to be specially allocated to a partner.

l.Justification for a tax year other than the required taxable year.

m.No correct match is provided.

Business purpose

a.Operating expenses incurred after entity is formed but before it begins doing business.

b.Each partner's basis in the partnership.

c.Tax accounting election made by partnership.

d.Tax accounting calculation made by partner

e.Tax accounting election made by partner.

f.Designed to prevent excessive deferral of taxation of partnership income.

g.Amount that may be received by partner for performance of services for the partnership.

h.Adjusted basis of each partnership asset.

i.Computation that determines the way recourse debt is shared.

j.Will eventually be allocated to partner making tax-free property contribution to partnership.

k.Must be satisfied if a loss item is to be specially allocated to a partner.

l.Justification for a tax year other than the required taxable year.

m.No correct match is provided.

Business purpose

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

58

Match each of the following statements with the terms below that provide the best definition.

a.Operating expenses incurred after entity is formed but before it begins doing business.

b.Each partner's basis in the partnership.

c.Tax accounting election made by partnership.

d.Tax accounting calculation made by partner

e.Tax accounting election made by partner.

f.Designed to prevent excessive deferral of taxation of partnership income.

g.Amount that may be received by partner for performance of services for the partnership.

h.Adjusted basis of each partnership asset.

i.Computation that determines the way recourse debt is shared.

j.Will eventually be allocated to partner making tax-free property contribution to partnership.

k.Must be satisfied if a loss item is to be specially allocated to a partner.

l.Justification for a tax year other than the required taxable year.

m.No correct match is provided.

Cost versus percentage depletion decision

a.Operating expenses incurred after entity is formed but before it begins doing business.

b.Each partner's basis in the partnership.

c.Tax accounting election made by partnership.

d.Tax accounting calculation made by partner

e.Tax accounting election made by partner.

f.Designed to prevent excessive deferral of taxation of partnership income.

g.Amount that may be received by partner for performance of services for the partnership.

h.Adjusted basis of each partnership asset.

i.Computation that determines the way recourse debt is shared.

j.Will eventually be allocated to partner making tax-free property contribution to partnership.

k.Must be satisfied if a loss item is to be specially allocated to a partner.

l.Justification for a tax year other than the required taxable year.

m.No correct match is provided.

Cost versus percentage depletion decision

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

59

Match each of the following statements with the terms below that provide the best definition.

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."

k.Theory treating the partnership as a collection of taxpayers joined in an agency relationship.

l.Allows many unincorporated entities to select their Federal tax status.

m.No correct match provided.

Limited liability partnership

a.Organizational choice of many large accounting firms.

b.Partner's percentage allocation of current operating results.

c.Might affect any two partners' tax liabilities in different ways.

d.Brokerage and registration fees incurred for promoting and marketing partnership interests.

e.Transfer of asset to partnership followed by immediate distribution of cash to partner.

f.Must have at least one general partner.

g.Theory treating the partner and partnership as separate economic units.

h.Partner's basis in partnership interest after tax-free contribution of asset to partnership.

i.Partnership's basis in asset after tax-free contribution of asset to partnership.

j.Owners are "members."