Deck 16: Tax Practice and Ethics

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/147

Play

Full screen (f)

Deck 16: Tax Practice and Ethics

1

The IRS is a Federal agency,equal in rank to the Department of the Treasury.

False

The IRS is a subsidiary of the Treasury Department.

The IRS is a subsidiary of the Treasury Department.

2

The tax professional can render valuable services to the client in consultation over the strategy and tactics of dealing with a Federal tax audit.

True

3

Babs filed an amended return in 2008,claiming a refund relative to her 2006 tax computation.When the IRS approves the amended return,it will pay Babs interest with respect to the overpayment.

True

4

A negligence penalty is 20% of the underpayment attributable to negligence.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

5

Recently,the overall Federal income tax audit rate for individual returns has been about 0.3%.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

6

A letter ruling is issued by the IRS at no charge.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

7

One of the four operating divisions of the IRS deals exclusively with the largest corporations and partnerships.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

8

When the IRS issues a notice of tax due,the taxpayer has 30 days to either pay the tax or file a petition with the Tax Court.This is conveyed in the "thirty-day letter."

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

9

A letter ruling can be used to establish the level of reasonable employee compensation.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

10

IRS letter rulings seldom are revised or revoked.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

11

After a tax audit,the taxpayer receives the Revenue Agent's Report and a "30-day letter."

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

12

The head of IRS operations is the Chief Counsel.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

13

When a tax issue is taken to court,the burden of proof is on the taxpayer to show that the items reported on the return are substantiated.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

14

An "office audit" takes place at the headquarters of the corporate taxpayer.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

15

The IRS targets high-income individuals for a higher audit rate than that of the general populace.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

16

During any month in which both the failure-to-file and failure-to-pay penalties apply,both penalties must be paid in full.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

17

The IRS responds to a taxpayer request concerning the tax treatment of a proposed transaction in a Tax Interpretation.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

18

Only the government can appeal a decision of the Tax Court Small Cases Division.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

19

The IRS uses document matching programs to keep the audit rate low.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

20

Several months prior to the due date of the return,Maria provides her accountant with all of the information necessary for the filing of the return.This was an extraordinarily busy tax season,and the accountant files the return late.Maria should not be subject to any penalties,because of the reasonable cause exception.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

21

No overvaluation penalty is incurred by a C corporation until the misstatement would cause a tax underpayment of at least $10,000.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

22

Debbie,a calendar year taxpayer,did not file a tax return for 2003 because she honestly believed that no additional tax was due.In 2008,Debbie is audited by the IRS and the agent assesses a deficiency of $7,000 for tax year 2003.Debbie need not pay this deficiency,since the statute of limitations expired on April 15,2007.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

23

As a result of undervaluing property transferred by gift,Dan owes additional gift taxes of $3,000.The penalty for undervaluation does not apply in this situation,because the tax understatement was too small.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

24

Circular 230 prohibits a tax preparer from charging a contingent fee for any professional tax services.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

25

If someone prepares the tax return of another and accepts a fee for that service,the preparer must sign the tax return,or the preparer will lose the "tax return preparer" status of Circular 230.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

26

In preparing a tax return,a CPA should verify "to the penny" every item of information submitted by a client.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

27

In the case of bad debts and worthless securities,the statute of limitations on claims for refund is seven years.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

28

The AICPA's Statements on Standards for Tax Services are advisory,not mandatory,on its members.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

29

The Statements on Standards for Tax Services apply to attorneys,as well as to CPAs.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

30

Circular 230 prohibits a tax preparer from charging an unconscionable fee for his/her services.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

31

Faye,a CPA,is preparing Judith's tax return.One item on the return requires a Yes or No answer.Faye can avoid checking either box if the effect is to increase Judith's tax liability.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

32

In the context of civil fraud,the burden of proof is on the IRS to show by a "preponderance of the evidence" that the taxpayer had a specific intent to evade a tax.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

33

If a taxpayer understates her cash sales by 30% of the adjusted gross income on the return,the statute of limitations on assessments is increased to six years.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

34

A penalty is assessed if the tax preparer fails to give the client a copy of the completed return.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

35

Jenny prepared Steve's income tax returns for no compensation for 2005 and 2006.Jenny is Steve's daughter.In 2008,the IRS notifies Steve that it will audit his returns for 2004-2006.If Steve so desires,Jenny may represent him during the audit of all three returns.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

36

In a criminal fraud case,the burden is on the taxpayer to show that he or she was innocent "beyond the shadow of any reasonable doubt."

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

37

Circular 230 applies to all tax practitioners other than attorneys,CPAs,and enrolled agents,who are exempt because this group have their own codes of conduct..

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

38

A tax preparer cannot disclose to a mortgage banker the client's income level,or other information acquired by preparing the return,without the client's permission.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

39

A CPA cannot take a tax return position for a client that is contrary to current IRS interpretations of the law.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

40

A tax preparer and his/her client hold a privilege of confidentiality from the IRS,as to their discussions about completing a tax return.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following statements,if any,do not reflect the rules governing the accuracy-related penalty for negligence?

A)The penalty rate is 20%.

B)The penalty is imposed only on the part of the deficiency attributable to negligence.

C)The penalty applies to all Federal taxes, except when fraud is involved.

D)The penalty is waived if the taxpayer uses Form 8275 to disclose a return position that is reasonable though contrary to the IRS position.

E)None of the above is incorrect.

A)The penalty rate is 20%.

B)The penalty is imposed only on the part of the deficiency attributable to negligence.

C)The penalty applies to all Federal taxes, except when fraud is involved.

D)The penalty is waived if the taxpayer uses Form 8275 to disclose a return position that is reasonable though contrary to the IRS position.

E)None of the above is incorrect.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

42

George,a calendar year taxpayer subject to a 40% marginal gift tax rate,made a gift of a sculpture to Redd,valuing the property at $100,000.The IRS later valued the gift at $140,000.The applicable undervaluation penalty is:

A)$0.

B)$1,000 (minimum penalty).

C)$4,000.

D)$20,000.

A)$0.

B)$1,000 (minimum penalty).

C)$4,000.

D)$20,000.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following statements correctly reflects the rules governing interest on an individual's Federal tax deficiency and a claim for refund?

A)The IRS has full discretion in determining the rate that will apply.

B)The simple interest method for calculating interest is used.

C)For noncorporate taxpayers, the rate of interest for assessments is the same as the rate of interest for refunds.

D)The IRS must adjust the rate of interest semiannually.

E)None of the above is correct.

A)The IRS has full discretion in determining the rate that will apply.

B)The simple interest method for calculating interest is used.

C)For noncorporate taxpayers, the rate of interest for assessments is the same as the rate of interest for refunds.

D)The IRS must adjust the rate of interest semiannually.

E)None of the above is correct.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

44

Gloria,a calendar year taxpayer subject to a 35% marginal tax rate,claimed a charitable contribution deduction of $800,000 for a sculpture that the IRS later valued at $100,000.The applicable overvaluation penalty is:

A)$245,000.

B)$98,000.

C)$49,000.

D)$10,000 (maximum penalty).

E)$0.

A)$245,000.

B)$98,000.

C)$49,000.

D)$10,000 (maximum penalty).

E)$0.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

45

Which statement appearing below does not correctly describe the IRS letter ruling process?

A)In certain situations, the IRS will not issue a ruling.

B)Some letter rulings are of such importance and general interest that they are later published (in anonymous form) as Revenue Rulings.

C)Letter rulings benefit both taxpayers and the IRS.

D)Letter rulings are private and are not open to public inspection.

E)None of the above is false.

A)In certain situations, the IRS will not issue a ruling.

B)Some letter rulings are of such importance and general interest that they are later published (in anonymous form) as Revenue Rulings.

C)Letter rulings benefit both taxpayers and the IRS.

D)Letter rulings are private and are not open to public inspection.

E)None of the above is false.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

46

Ron,a calendar year taxpayer subject to a 35% marginal tax rate,claimed a charitable contribution deduction of $500,000 for a sculpture that the IRS later valued at $150,000.The applicable overvaluation penalty is:

A)$0.

B)$5,000 (maximum penalty).

C)$24,500.

D)$49,000.

A)$0.

B)$5,000 (maximum penalty).

C)$24,500.

D)$49,000.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

47

The Commissioner of the IRS is appointed by the:

A)Secretary of the Treasury Department.

B)U. S. Senate.

C)U. S. House of Representatives.

D)U. S. President.

E)American Bar Association President.

A)Secretary of the Treasury Department.

B)U. S. Senate.

C)U. S. House of Representatives.

D)U. S. President.

E)American Bar Association President.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

48

With respect to the audit process which,if any,of the following statements is incorrect?

A)Upon advance request, a taxpayer must be allowed to make an audio recording during the audit conference.

B)Only the Appeals Division of the IRS has the authority to settle tax disputes based on the hazards of litigation.

C)The issuance of a Revenue Agents Report (RAR) is usually not necessary when mathematical errors on a tax return understate a taxpayer's tax liability.

D)The IRS publishes the factors it uses for audit selection purposes annually in the Commissioner's Report.

E)None of the above is incorrect.

A)Upon advance request, a taxpayer must be allowed to make an audio recording during the audit conference.

B)Only the Appeals Division of the IRS has the authority to settle tax disputes based on the hazards of litigation.

C)The issuance of a Revenue Agents Report (RAR) is usually not necessary when mathematical errors on a tax return understate a taxpayer's tax liability.

D)The IRS publishes the factors it uses for audit selection purposes annually in the Commissioner's Report.

E)None of the above is incorrect.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

49

Last year,Ned's property tax deduction on his residence was $12,500.Although he lives in the same house,he tells his CPA that this year's taxes will be only $7,500.The CPA can use this estimate in computing Ned's itemized deductions,under the Statements of Standards for Tax Services.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

50

Harold,a calendar year taxpayer subject to a 35% marginal tax rate,claimed a charitable contribution deduction of $18,000 for a sculpture that the IRS later valued at $10,000.The applicable overvaluation penalty is:

A)$560.

B)$2,800.

C)$3,500.

D)$5,000.

A)$560.

B)$2,800.

C)$3,500.

D)$5,000.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

51

Max (a calendar year taxpayer)donates a painting to a local art museum (a qualified charity).The painting cost Max $12,000 ten years ago and,according to one of Max's friends (an amateur artist),is worth $50,000.On his income tax return,Max deducts $50,000 as a charitable contribution.Upon later audit by the IRS,it is determined that the true value of the painting was $20,000.Assuming that Max is subject to a 35% marginal income tax rate,his penalty for overvaluation is:

A)$0.

B)$2,100.

C)$4,200.

D)$12,000.

E)None of the above.

A)$0.

B)$2,100.

C)$4,200.

D)$12,000.

E)None of the above.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

52

Leroy,who is subject to a 40% marginal gift tax rate,made a gift of a sculpture to Marvin,valuing the property at $150,000.The IRS later valued the gift at $400,000.The applicable undervaluation penalty is:

A)$0.

B)$5,000 (maximum penalty).

C)$20,000.

D)$40,000.

A)$0.

B)$5,000 (maximum penalty).

C)$20,000.

D)$40,000.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

53

When a practitioner discovers an error in a client's prior return,AICPA tax ethics rules require that an amended return immediately be filed.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

54

The penalty for substantial understatement of tax liability does not apply if:

A)The taxpayer has substantial authority for the treatment taken on the tax return.

B)The relevant facts affecting the treatment are adequately disclosed in the return or on Form 8275.

C)The IRS failed to meet its burden of proof in showing the taxpayer's error.

D)All of the above statements are correct.

E)None of the above statements are correct.

A)The taxpayer has substantial authority for the treatment taken on the tax return.

B)The relevant facts affecting the treatment are adequately disclosed in the return or on Form 8275.

C)The IRS failed to meet its burden of proof in showing the taxpayer's error.

D)All of the above statements are correct.

E)None of the above statements are correct.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

55

Maureen,a calendar year taxpayer subject to a 35% marginal tax rate,claimed a charitable contribution deduction of $250,000 for a sculpture that the IRS later valued at $200,000.The applicable overvaluation penalty is:

A)$17,500.

B)$14,000.

C)$3,500.

D)$0.

A)$17,500.

B)$14,000.

C)$3,500.

D)$0.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

56

Most practitioners encourage their clients to attend an IRS office audit.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

57

A taxpayer should conduct a cost-benefit analysis before taking a tax dispute to court.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

58

With respect to the audit process,which statement is correct?

A)Office audits are conducted at the office of the taxpayer.

B)The filing of a claim for refund always results in an audit of the taxpayer filing the claim.

C)The most common type of Federal income tax audit is the correspondence audit.

D)For a disputed factual issue, the taxpayer should plan to ask the Appeals officer to adopt a more favorable interpretation of the situation.

A)Office audits are conducted at the office of the taxpayer.

B)The filing of a claim for refund always results in an audit of the taxpayer filing the claim.

C)The most common type of Federal income tax audit is the correspondence audit.

D)For a disputed factual issue, the taxpayer should plan to ask the Appeals officer to adopt a more favorable interpretation of the situation.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

59

With respect to the Small Cases Division of the Tax Court,

A)The taxpayer (but not the IRS) can appeal a contrary judgment.

B)The IRS (but not the taxpayer) can appeal a contrary judgment.

C)Either the IRS or the taxpayer can appeal a contrary judgment.

D)Neither the IRS nor the taxpayer can appeal a contrary judgment.

A)The taxpayer (but not the IRS) can appeal a contrary judgment.

B)The IRS (but not the taxpayer) can appeal a contrary judgment.

C)Either the IRS or the taxpayer can appeal a contrary judgment.

D)Neither the IRS nor the taxpayer can appeal a contrary judgment.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

60

Henrietta has hired Gracie,a CPA,to complete this year's Form 1040.Henrietta uses software to keep the books for her business.She tells Gracie that a $5,000 amount for business supplies is "close enough" to constitute the deduction.Gracie can use this estimate in completing the Form 1040.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

61

The usual three-year statute of limitations on additional tax assessments applies in the following situation(s).

A)No return at all is filed.

B)An investment in a marketable security is worthless.

C)Taxpayer discovers an inadvertent overstatement of deductions equal to 5% of gross income.

D)Taxpayer inadvertently omits an amount of gross income in excess of 25% of the gross income stated on the return.

A)No return at all is filed.

B)An investment in a marketable security is worthless.

C)Taxpayer discovers an inadvertent overstatement of deductions equal to 5% of gross income.

D)Taxpayer inadvertently omits an amount of gross income in excess of 25% of the gross income stated on the return.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

62

Match each of the following penalties with the rate for that penalty as specified by the Code.

a.$1,000 per violation

b.$500 per violation

c.$50 per violation

d.1/2% per month

e.5% per month

f.15% per month

g.5% of tax due

h.15% of tax due

i.20% of tax due

j.75% of tax due

Misstatement of withholding allowances

a.$1,000 per violation

b.$500 per violation

c.$50 per violation

d.1/2% per month

e.5% per month

f.15% per month

g.5% of tax due

h.15% of tax due

i.20% of tax due

j.75% of tax due

Misstatement of withholding allowances

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

63

The rules of Circular 230 need not be followed by:

A)An attorney.

B)A CPA.

C)A Wal-Mart cashier who e-files 15 tax returns for her paying clients per filing season.

D)An enrolled agent.

E)All of the above are subject to the Circular 230 rules.

A)An attorney.

B)A CPA.

C)A Wal-Mart cashier who e-files 15 tax returns for her paying clients per filing season.

D)An enrolled agent.

E)All of the above are subject to the Circular 230 rules.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

64

Match each of the following penalties with the rate for that penalty as specified by the Code.

a.$1,000 per violation

b.$500 per violation

c.$50 per violation

d.1/2% per month

e.5% per month

f.15% per month

g.5% of tax due

h.15% of tax due

i.20% of tax due

j.75% of tax due

Failure by a tax preparer to sign the return

a.$1,000 per violation

b.$500 per violation

c.$50 per violation

d.1/2% per month

e.5% per month

f.15% per month

g.5% of tax due

h.15% of tax due

i.20% of tax due

j.75% of tax due

Failure by a tax preparer to sign the return

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

65

Match each of the following penalties with the rate for that penalty as specified by the Code.

a.$1,000 per violation

b.$500 per violation

c.$50 per violation

d.1/2% per month

e.5% per month

f.15% per month

g.5% of tax due

h.15% of tax due

i.20% of tax due

j.75% of tax due

Civil tax fraud

a.$1,000 per violation

b.$500 per violation

c.$50 per violation

d.1/2% per month

e.5% per month

f.15% per month

g.5% of tax due

h.15% of tax due

i.20% of tax due

j.75% of tax due

Civil tax fraud

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

66

Match each of the following penalties with the rate for that penalty as specified by the Code.

a.$1,000 per violation

b.$500 per violation

c.$50 per violation

d.1/2% per month

e.5% per month

f.15% per month

g.5% of tax due

h.15% of tax due

i.20% of tax due

j.75% of tax due

Failure to file a tax return

a.$1,000 per violation

b.$500 per violation

c.$50 per violation

d.1/2% per month

e.5% per month

f.15% per month

g.5% of tax due

h.15% of tax due

i.20% of tax due

j.75% of tax due

Failure to file a tax return

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

67

Match each of the following penalties with the rate for that penalty as specified by the Code.

a.$1,000 per violation

b.$500 per violation

c.$50 per violation

d.1/2% per month

e.5% per month

f.15% per month

g.5% of tax due

h.15% of tax due

i.20% of tax due

j.75% of tax due

Fraudulent failure to file

a.$1,000 per violation

b.$500 per violation

c.$50 per violation

d.1/2% per month

e.5% per month

f.15% per month

g.5% of tax due

h.15% of tax due

i.20% of tax due

j.75% of tax due

Fraudulent failure to file

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

68

The Statements on Standards for Tax Services are issued by the:

A)IRS.

B)Sarbanes-Oxley Commission.

C)AICPA.

D)SEC.

A)IRS.

B)Sarbanes-Oxley Commission.

C)AICPA.

D)SEC.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

69

Match each of the following penalties with the rate for that penalty as specified by the Code.

a.$1,000 per violation

b.$500 per violation

c.$50 per violation

d.1/2% per month

e.5% per month

f.15% per month

g.5% of tax due

h.15% of tax due

i.20% of tax due

j.75% of tax due

Helping another party to understate a tax

a.$1,000 per violation

b.$500 per violation

c.$50 per violation

d.1/2% per month

e.5% per month

f.15% per month

g.5% of tax due

h.15% of tax due

i.20% of tax due

j.75% of tax due

Helping another party to understate a tax

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

70

Juanita,who is subject to a 40% marginal gift tax rate,made a gift of a sculpture to Bianca,valuing the property at $150,000.The IRS later valued the gift at $300,000.The applicable undervaluation penalty is:

A)$0.

B)$10,000 (maximum penalty).

C)$12,000.

D)$24,000.

A)$0.

B)$10,000 (maximum penalty).

C)$12,000.

D)$24,000.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

71

The privilege of confidentiality applies to a CPA tax preparer concerning the client's information relative to:

A)Financial accounting tax accrual workpapers.

B)A tax research memo used to determine an amount reported on the tax return.

C)Building a defense against a penalty assessed for the use of a tax shelter.

D)Building a defense against a charge brought by the SEC.

A)Financial accounting tax accrual workpapers.

B)A tax research memo used to determine an amount reported on the tax return.

C)Building a defense against a penalty assessed for the use of a tax shelter.

D)Building a defense against a charge brought by the SEC.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

72

Circular 230 allows a tax preparer to:

A)Take a position on a tax return that is contrary to a decision of the U.S. Supreme Court.

B)Charge a $5,000 fee to prepare a Form 1040EZ.

C)Purposely delay the tax audit process.

D)Advertise tax preparation services on the Internet.

E)All of the above are allowed by Circular 230.

A)Take a position on a tax return that is contrary to a decision of the U.S. Supreme Court.

B)Charge a $5,000 fee to prepare a Form 1040EZ.

C)Purposely delay the tax audit process.

D)Advertise tax preparation services on the Internet.

E)All of the above are allowed by Circular 230.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

73

Match each of the following penalties with the rate for that penalty as specified by the Code.

a.$1,000 per violation

b.$500 per violation

c.$50 per violation

d.1/2% per month

e.5% per month

f.15% per month

g.5% of tax due

h.15% of tax due

i.20% of tax due

j.75% of tax due

Negligence

a.$1,000 per violation

b.$500 per violation

c.$50 per violation

d.1/2% per month

e.5% per month

f.15% per month

g.5% of tax due

h.15% of tax due

i.20% of tax due

j.75% of tax due

Negligence

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

74

Mickey,a calendar year taxpayer,filed a return correctly showing no income tax liability for 2007.During 2008,his AGI is $120,000 and his income tax liability was $20,000.To avoid a penalty for 2008,Mickey must make aggregate estimated tax payments of at least:

A)$0.

B)$1,000 (minimum estimate).

C)$18,000.

D)$20,000.

A)$0.

B)$1,000 (minimum estimate).

C)$18,000.

D)$20,000.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

75

Anthony,an individual calendar year taxpayer,incurred the following transactions.

Assuming that any error in timely reporting these amounts was inadvertent,how much omission from gross income would be required before the six-year statute of limitations would apply?

A)More than $245,000.

B)More than $225,000.

C)More than $149,250.

D)The six-year rule cannot apply here.

Assuming that any error in timely reporting these amounts was inadvertent,how much omission from gross income would be required before the six-year statute of limitations would apply?

A)More than $245,000.

B)More than $225,000.

C)More than $149,250.

D)The six-year rule cannot apply here.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

76

A tax preparer is in violation of Circular 230 if he or she:

A)Discusses the content of a client's tax return with a friend.

B)Does not sign the tax return that is prepared as a favor for a relative.

C)Files a tax return that includes a math error.

D)Fails to inform the IRS of an error on the client's prior-year return.

E)All of the above are circular 230 violations.

A)Discusses the content of a client's tax return with a friend.

B)Does not sign the tax return that is prepared as a favor for a relative.

C)Files a tax return that includes a math error.

D)Fails to inform the IRS of an error on the client's prior-year return.

E)All of the above are circular 230 violations.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

77

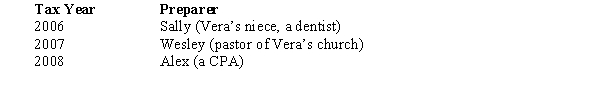

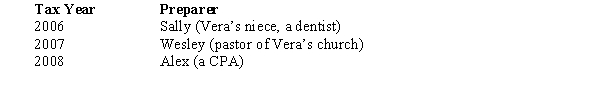

Vera is audited by the IRS for tax years 2006,2007,and 2008.Her returns were prepared by the following parties.

Which of the following statements is correct?

A)Sally may represent Vera for tax year 2006. Such representation may extend through the Appeals Division of the IRS.

B)Wesley may represent Vera for all tax years under audit.

C)Alex can only represent Vera for tax year 2008.

D)Vera may represent herself for all tax years involved.

Which of the following statements is correct?

A)Sally may represent Vera for tax year 2006. Such representation may extend through the Appeals Division of the IRS.

B)Wesley may represent Vera for all tax years under audit.

C)Alex can only represent Vera for tax year 2008.

D)Vera may represent herself for all tax years involved.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

78

Match each of the following penalties with the rate for that penalty as specified by the Code.

a.$1,000 per violation

b.$500 per violation

c.$50 per violation

d.1/2% per month

e.5% per month

f.15% per month

g.5% of tax due

h.15% of tax due

i.20% of tax due

j.75% of tax due

Failure to pay a tax

a.$1,000 per violation

b.$500 per violation

c.$50 per violation

d.1/2% per month

e.5% per month

f.15% per month

g.5% of tax due

h.15% of tax due

i.20% of tax due

j.75% of tax due

Failure to pay a tax

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

79

Match each of the following penalties with the rate for that penalty as specified by the Code.

a.$1,000 per violation

b.$500 per violation

c.$50 per violation

d.1/2% per month

e.5% per month

f.15% per month

g.5% of tax due

h.15% of tax due

i.20% of tax due

j.75% of tax due

Improper refund claim

a.$1,000 per violation

b.$500 per violation

c.$50 per violation

d.1/2% per month

e.5% per month

f.15% per month

g.5% of tax due

h.15% of tax due

i.20% of tax due

j.75% of tax due

Improper refund claim

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

80

Match each of the following penalties with the rate for that penalty as specified by the Code.

a.$1,000 per violation

b.$500 per violation

c.$50 per violation

d.1/2% per month

e.5% per month

f.15% per month

g.5% of tax due

h.15% of tax due

i.20% of tax due

j.75% of tax due

Failure to pay over withheld tax

a.$1,000 per violation

b.$500 per violation

c.$50 per violation

d.1/2% per month

e.5% per month

f.15% per month

g.5% of tax due

h.15% of tax due

i.20% of tax due

j.75% of tax due

Failure to pay over withheld tax

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck