Deck 15: The Human Resources Management and Payroll Cycle

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/58

Play

Full screen (f)

Deck 15: The Human Resources Management and Payroll Cycle

1

Regarding the use of incentives,commissions and bonuses in payroll,which of the following statements is false?

A) Using incentives, commissions, and bonuses requires linking the payroll system and the information systems of sales and other cycles in order to collect the data used to calculate bonuses.

B) Bonus/incentive schemes must be properly designed with realistic, attainable goals that can be objectively measured.

C) Incentive schemes can result in undesirable behavior.

D) All of the above are true.

A) Using incentives, commissions, and bonuses requires linking the payroll system and the information systems of sales and other cycles in order to collect the data used to calculate bonuses.

B) Bonus/incentive schemes must be properly designed with realistic, attainable goals that can be objectively measured.

C) Incentive schemes can result in undesirable behavior.

D) All of the above are true.

D

2

Which type of payroll report lists the voluntary deductions for each employee?

A) payroll register

B) deduction register

C) earnings statement

D) federal W-4 form

A) payroll register

B) deduction register

C) earnings statement

D) federal W-4 form

B

3

Companies that specialize in processing payroll are known as

A) paycheck distribution companies.

B) payroll service bureaus.

C) professional employer organizations.

D) semi-governmental organizations.

A) paycheck distribution companies.

B) payroll service bureaus.

C) professional employer organizations.

D) semi-governmental organizations.

B

4

What step can be taken to reduce the distribution of fraudulent paychecks?

A) have internal audit investigate unclaimed paychecks

B) allow department managers to investigate unclaimed paychecks

C) immediately mark "void" across all unclaimed paychecks

D) match up all paychecks with time cards

A) have internal audit investigate unclaimed paychecks

B) allow department managers to investigate unclaimed paychecks

C) immediately mark "void" across all unclaimed paychecks

D) match up all paychecks with time cards

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

5

Why is a separate payroll account used to clear payroll checks?

A) for internal control purposes to help limit any exposure to loss by the company

B) to make bank reconciliation easier

C) banks don't like to commingle payroll and expense checks

D) All of the above are correct.

A) for internal control purposes to help limit any exposure to loss by the company

B) to make bank reconciliation easier

C) banks don't like to commingle payroll and expense checks

D) All of the above are correct.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

6

Which type of payroll report includes the details of the current paycheck and deductions as well as year-to-date totals?

A) payroll register

B) deduction register

C) earnings statement

D) federal W-4 form

A) payroll register

B) deduction register

C) earnings statement

D) federal W-4 form

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

7

One good way to eliminate paper paychecks is to

A) pay in cash only.

B) pay with money orders.

C) use direct deposit.

D) use Electronic Funds Transfer.

A) pay in cash only.

B) pay with money orders.

C) use direct deposit.

D) use Electronic Funds Transfer.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

8

Which activity below is not performed by the HRM?

A) compensation

B) training

C) discharge

D) recruitment and hiring

A) compensation

B) training

C) discharge

D) recruitment and hiring

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

9

What is not a desired result of an employee bonus/incentive system?

A) Employees may recommend unnecessary services to customers in order to exceed set sales quotas and earn a bonus.

B) Employees may look for ways to improve service.

C) Employees may analyze their work environment and find ways to cut costs.

D) Employees may work harder and may be more motivated to exceed target goals to earn a bonus.

A) Employees may recommend unnecessary services to customers in order to exceed set sales quotas and earn a bonus.

B) Employees may look for ways to improve service.

C) Employees may analyze their work environment and find ways to cut costs.

D) Employees may work harder and may be more motivated to exceed target goals to earn a bonus.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

10

The sales department administrative assistant has been assigning phone order sales to her brother-in-law,a company sales person.Company policy is to pay commissions only on orders directly received by sales people,not on orders received over the phone.The resulting fraudulent commission payments might best have been prevented by requiring that

A) sales commission statements be supported by sales order forms signed by the customer and approved by the sales manager.

B) sales order forms be prenumbered and accounted for by the sales department manager.

C) sales orders and commission statements be approved by the accounting department.

D) disbursement vouchers for commission payments be reviewed by the internal audit department and compared to sales commission statements and sales orders.

A) sales commission statements be supported by sales order forms signed by the customer and approved by the sales manager.

B) sales order forms be prenumbered and accounted for by the sales department manager.

C) sales orders and commission statements be approved by the accounting department.

D) disbursement vouchers for commission payments be reviewed by the internal audit department and compared to sales commission statements and sales orders.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

11

Which type of payroll report contains information such as the employees' gross pay,payroll deductions,and net pay in a multicolumn format?

A) payroll register

B) deduction register

C) employee earnings statement

D) federal W-4 form

A) payroll register

B) deduction register

C) employee earnings statement

D) federal W-4 form

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

12

Which department should have the sole ability to provide information to the AIS about hiring,terminations,and pay rate changes?

A) payroll

B) timekeeping

C) production

D) HRM

A) payroll

B) timekeeping

C) production

D) HRM

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is not one of the major sources of input to the payroll system?

A) payroll rate changes

B) time and attendance data

C) checks to insurance and benefits providers

D) withholdings and deduction requests from employees

A) payroll rate changes

B) time and attendance data

C) checks to insurance and benefits providers

D) withholdings and deduction requests from employees

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

14

This organization provides payroll processing as well as other HRM services,such as employee benefit design and administration.

A) Cashier

B) Payroll service bureau

C) Professional employer organization

D) Paycheck distribution companies

A) Cashier

B) Payroll service bureau

C) Professional employer organization

D) Paycheck distribution companies

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

15

These are used to transmit time and attendance data directly to the payroll processing system.

A) Badge readers

B) Electronic time clocks

C) Magnetic cards

D) none of the above

A) Badge readers

B) Electronic time clocks

C) Magnetic cards

D) none of the above

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

16

For recording time spent on specific work projects,manufacturing companies usually use a

A) job time ticket.

B) time card.

C) time clock.

D) labor time card.

A) job time ticket.

B) time card.

C) time clock.

D) labor time card.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

17

In the payroll system,checks are issued to

A) employees and to banks participating in direct deposit.

B) a company payroll bank account.

C) government agencies.

D) All of the above are correct.

A) employees and to banks participating in direct deposit.

B) a company payroll bank account.

C) government agencies.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

18

Experts estimate that on average the costs associated with replacing an employee are about ________ that of the employee's annual salary.

A) one-quarter

B) one-half

C) one and one-half

D) twice

A) one-quarter

B) one-half

C) one and one-half

D) twice

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following deductions is not classified as a voluntary deduction?

A) pension plan contributions

B) social security withholdings

C) insurance premiums

D) deductions for a charity organization

A) pension plan contributions

B) social security withholdings

C) insurance premiums

D) deductions for a charity organization

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

20

Payroll deductions fall into the broad categories of ________ and ________.

A) payroll tax withholdings; voluntary deductions

B) unemployment; social security taxes

C) unemployment taxes; income taxes

D) voluntary deductions; income taxes

A) payroll tax withholdings; voluntary deductions

B) unemployment; social security taxes

C) unemployment taxes; income taxes

D) voluntary deductions; income taxes

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

21

What is the purpose of a general ledger payroll clearing account?

A) to check the accuracy and completeness of payroll recording and its allocation to cost centers

B) to make the bank reconciliation easier

C) to make sure that all employees are paid correctly each week

D) to prevent the cashier from having complete control of the payroll cycle

A) to check the accuracy and completeness of payroll recording and its allocation to cost centers

B) to make the bank reconciliation easier

C) to make sure that all employees are paid correctly each week

D) to prevent the cashier from having complete control of the payroll cycle

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

22

When using electronic documents,________ increase the accuracy of data entry.

A) access controls

B) separation of duties

C) general controls

D) application controls

A) access controls

B) separation of duties

C) general controls

D) application controls

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

23

What is a potential threat to the specific activity of payroll processing?

A) hiring unqualified employees

B) poor system performance

C) violations of employment laws

D) unauthorized changes to the payroll master file

A) hiring unqualified employees

B) poor system performance

C) violations of employment laws

D) unauthorized changes to the payroll master file

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

24

What is the best control to reduce the risk of losing payroll data?

A) passwords

B) physical security controls

C) backup and disaster recovery procedures

D) encryption

A) passwords

B) physical security controls

C) backup and disaster recovery procedures

D) encryption

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

25

The document that lists each employee's gross pay,payroll deductions,and net pay in a multicolumn format is called

A) an employee earnings statement.

B) the payroll register.

C) a deduction register.

D) an employee time sheet summary.

A) an employee earnings statement.

B) the payroll register.

C) a deduction register.

D) an employee time sheet summary.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

26

A "zero balance check" refers to which of the following control procedures?

A) a type of batch total

B) cross-footing the payroll register

C) the payroll clearing account shows a zero balance once all entries are posted

D) trial balance showing that debits equal credits

A) a type of batch total

B) cross-footing the payroll register

C) the payroll clearing account shows a zero balance once all entries are posted

D) trial balance showing that debits equal credits

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is not a potential effect of inaccurate data on employee time cards?

A) increased labor expenses

B) erroneous labor expense reports

C) damaged employee morale

D) inaccurate calculation of overhead costs

A) increased labor expenses

B) erroneous labor expense reports

C) damaged employee morale

D) inaccurate calculation of overhead costs

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

28

The results of an internal audit finds that there is a problem with inaccurate time data being entered into the payroll system.What is an applicable control that can help prevent this event from occurring in the future?

A) proper segregation of duties

B) automation of data collection

C) sound hiring procedures

D) review of appropriate performance metrics

A) proper segregation of duties

B) automation of data collection

C) sound hiring procedures

D) review of appropriate performance metrics

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

29

Direct deposit of employee paychecks is one way an organization can improve efficiency and reduce payroll-processing costs.Which statement regarding direct deposit is false?

A) The cashier does not authorize the transfer of funds from the organization's checking account to a payroll checking account.

B) The cashier does not have to sign employee paychecks.

C) Employees who are part of a direct deposit program receive a copy of their paycheck indicating the amount deposited.

D) Employees who are part of a direct deposit program receive an earnings statement on payday rather than a paper check.

A) The cashier does not authorize the transfer of funds from the organization's checking account to a payroll checking account.

B) The cashier does not have to sign employee paychecks.

C) Employees who are part of a direct deposit program receive a copy of their paycheck indicating the amount deposited.

D) Employees who are part of a direct deposit program receive an earnings statement on payday rather than a paper check.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

30

As the payroll system processes each payroll transaction,the system should also perform which activity listed below?

A) allocate labor costs to appropriate general ledger accounts

B) use cumulative totals generated from a payroll to create a summary journal entry to be posted to the general ledger

C) both A and B above

D) The HRM system should not perform either activity A or B.

A) allocate labor costs to appropriate general ledger accounts

B) use cumulative totals generated from a payroll to create a summary journal entry to be posted to the general ledger

C) both A and B above

D) The HRM system should not perform either activity A or B.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

31

The payroll transaction file would contain

A) entries to add new hires.

B) time card data.

C) changes in tax rates.

D) All of the above are correct.

A) entries to add new hires.

B) time card data.

C) changes in tax rates.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

32

The key to preventing unauthorized changes to the payroll master file is

A) hiring totally honest people to access and make changes to this file.

B) segregation of duties between the preparation of paychecks and their distribution.

C) segregation of duties between the authorization of changes and the physical handling of paychecks.

D) having the controller closely review and then approve any changes to the master file.

A) hiring totally honest people to access and make changes to this file.

B) segregation of duties between the preparation of paychecks and their distribution.

C) segregation of duties between the authorization of changes and the physical handling of paychecks.

D) having the controller closely review and then approve any changes to the master file.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

33

All of the following are controls that should be implemented in a payroll process,except

A) supervisors distribute paychecks since they should know all employees in their department.

B) someone independent of the payroll process should reconcile the payroll bank account.

C) sequential numbering of paychecks and accounting for the numbers.

D) restrict access to blank payroll checks and documents.

A) supervisors distribute paychecks since they should know all employees in their department.

B) someone independent of the payroll process should reconcile the payroll bank account.

C) sequential numbering of paychecks and accounting for the numbers.

D) restrict access to blank payroll checks and documents.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

34

Which control would be most appropriate to address the problem of inaccurate payroll processing?

A) encryption

B) direct deposit

C) cross-footing of the payroll register

D) an imprest payroll checking account

A) encryption

B) direct deposit

C) cross-footing of the payroll register

D) an imprest payroll checking account

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

35

The employer pays a portion of some payroll taxes and employee benefits.Both the employee and employer pay which benefit or tax listed below?

A) social security taxes

B) federal income taxes

C) state income taxes

D) none of the above

A) social security taxes

B) federal income taxes

C) state income taxes

D) none of the above

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following is a control that can be implemented to help prevent paychecks being issued to a "phantom" or "ghost" employee?

A) The cashier should sign all payroll checks.

B) Sequentially prenumber all payroll checks.

C) Use an imprest account to clear payroll checks.

D) Paychecks should be physically distributed by someone who does not authorize time data or record payroll.

A) The cashier should sign all payroll checks.

B) Sequentially prenumber all payroll checks.

C) Use an imprest account to clear payroll checks.

D) Paychecks should be physically distributed by someone who does not authorize time data or record payroll.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is not a benefit of using a payroll service bureau or a professional employer organization?

A) Freeing up of computer resources

B) Increased internal control

C) Reduced costs

D) Wider range of benefits

A) Freeing up of computer resources

B) Increased internal control

C) Reduced costs

D) Wider range of benefits

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

38

Pay rate information is stored in

A) employees' personnel files.

B) employee subsidiary ledgers.

C) the payroll master file.

D) electronic time cards.

A) employees' personnel files.

B) employee subsidiary ledgers.

C) the payroll master file.

D) electronic time cards.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

39

The threat of violation of employment laws relates directly to which activity?

A) payroll processing

B) collecting employee time data

C) hiring and recruiting

D) all of the above

A) payroll processing

B) collecting employee time data

C) hiring and recruiting

D) all of the above

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

40

Many companies offer their employees a "cafeteria" approach to voluntary benefits in which employees can pick and choose the benefits they want.This plan is normally called a(n)

A) elective plan.

B) menu options benefit plan.

C) flexible benefit plan.

D) buffet plan.

A) elective plan.

B) menu options benefit plan.

C) flexible benefit plan.

D) buffet plan.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

41

Explain benefits to companies and to employees of using electronic direct deposit for payroll.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

42

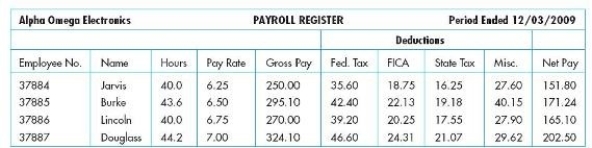

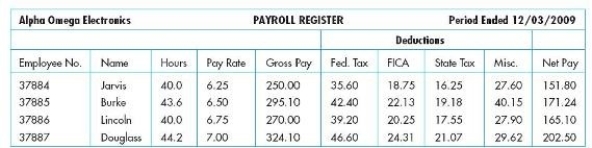

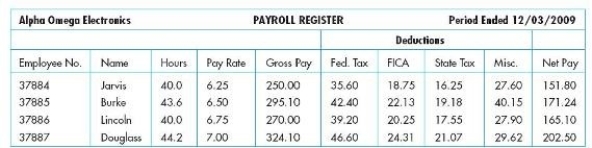

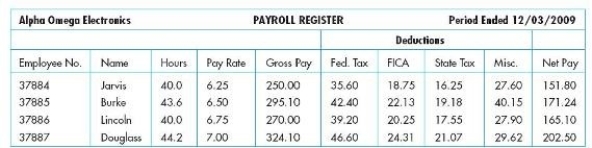

For the payroll register below,all the following processing controls would be useful except

A) Concurrent update control

B) Cross-footing balance test

C) Mathematical accuracy test

D) Hash total on Employee No.

A) Concurrent update control

B) Cross-footing balance test

C) Mathematical accuracy test

D) Hash total on Employee No.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

43

For the payroll register below,all the following data entry controls would be useful except

A) Validity check on Fed. Tax

B) Sequence check on Employee No.

C) Limit check on Hours

D) Field check on Pay Rate

A) Validity check on Fed. Tax

B) Sequence check on Employee No.

C) Limit check on Hours

D) Field check on Pay Rate

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following is a control that addresses the threat of unauthorized changes to the payroll master file?

A) Field checks

B) Batch totals

C) Segregation of duties

D) Sound hiring procedures

A) Field checks

B) Batch totals

C) Segregation of duties

D) Sound hiring procedures

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

45

What is the difference between a payroll service bureau and a professional employer organization?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

46

Why are accurate cumulative earnings records important?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

47

Discuss the threat of unauthorized changes to the payroll master file and its consequences.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

48

Explain the functions of the payroll register,deduction register,and earnings statement.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following documents would be likely to yield the greatest cost saving by converting from paper to electronic?

A) Payroll register

B) Earnings statement

C) Deduction register

D) Time card

A) Payroll register

B) Earnings statement

C) Deduction register

D) Time card

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

50

What controls are available to address the threat of payroll errors?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

51

Discuss the various types and sources of input into the HRM/payroll cycle.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

52

Describe the basic activities in an HRM/payroll cycle.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

53

Describe benefits and threats of incentive and bonus programs.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following will contribute to the efficiency of a payroll system?

A) Segregation of check distribution from payroll duties

B) Prompt redeposit of unclaimed paychecks

C) A separate payroll bank account

D) Direct deposit of checks

A) Segregation of check distribution from payroll duties

B) Prompt redeposit of unclaimed paychecks

C) A separate payroll bank account

D) Direct deposit of checks

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

55

What factors should be considered in outsourcing payroll to a payroll service bureau? Discuss the advantages and disadvantages of using a payroll service bureau to process a payroll.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following will limit a firm's potential loss exposure from paycheck forgery?

A) Segregation of check distribution from payroll duties

B) Prompt redeposit of unclaimed paychecks

C) A separate payroll bank account

D) Direct deposit of checks

A) Segregation of check distribution from payroll duties

B) Prompt redeposit of unclaimed paychecks

C) A separate payroll bank account

D) Direct deposit of checks

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

57

The average annual middle-management salary at Folding Squid Technologies is $60,000.If the average turnover rate for middle management is ten employees per year,what is the approximate average annual cost of turnover?

A) $300,000

B) $600,000

C) $900,000

D) $1,200,000

A) $300,000

B) $600,000

C) $900,000

D) $1,200,000

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

58

Identify the two types of payroll deductions and give two examples of each type.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck