Deck 10: Capital Budgeting - Cash Flows

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/84

Play

Full screen (f)

Deck 10: Capital Budgeting - Cash Flows

1

Operating cash flow (OCF)is calculated by adding back depreciation to the net operating profit after taxes.

True

2

Projects should be evaluated on the basis of accounting profits,as these profits actually cover the company's obligations.

True

3

An outlay for installation costs is not considered part of the depreciable basis of the asset to be purchased.

False

4

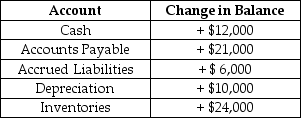

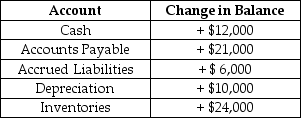

Using the following data,what is the change in net working capital?

A) -$4,000

B) -$1,000

C) +$9,000

D) +$19.000

A) -$4,000

B) -$1,000

C) +$9,000

D) +$19.000

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

5

The book value of an asset is equal to the

A) purchase price minus accumulated depreciation.

B) purchase price minus recaptured depreciation.

C) purchase price minus depreciation expense.

D) fair market value.

A) purchase price minus accumulated depreciation.

B) purchase price minus recaptured depreciation.

C) purchase price minus depreciation expense.

D) fair market value.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

6

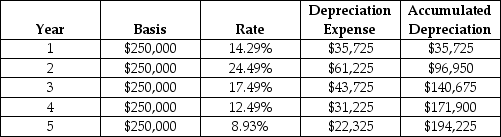

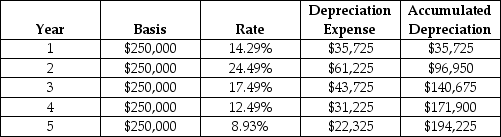

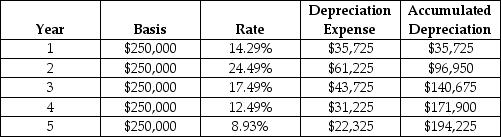

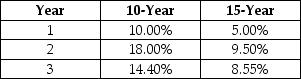

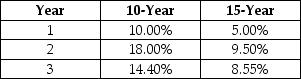

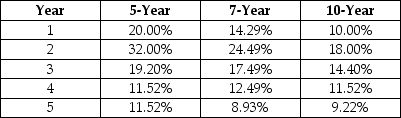

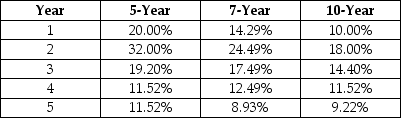

Bill Sharpe,owner of Sharper Knives Inc.,is closing his business at the end of the current fiscal year.His sole asset,the knife-sharpening machine,is four years old.A depreciation table for the asset is shown below.Bill has agreed to sell the machine at the end of the year for $100,000.What is the impact on taxes from the sale of the machine? (Assume that Sharper Knives claimed a regular depreciation expense in the calculation of income taxes.)The tax rate is 35%.Round your answers to the nearest dollar.

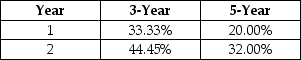

Depreciation Table for Knife Sharpener

A) $7,665 additional taxes owing to IRS

B) $7,665 tax refund from IRS

C) $25,165 additional taxes owing to IRS

D) $25,165 tax refund from IRS

E) $27,335 additional taxes owing to IRS

Depreciation Table for Knife Sharpener

A) $7,665 additional taxes owing to IRS

B) $7,665 tax refund from IRS

C) $25,165 additional taxes owing to IRS

D) $25,165 tax refund from IRS

E) $27,335 additional taxes owing to IRS

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

7

Jones Crusher Company is evaluating the proposed acquisition of a new machine.The machine will cost $190,000,and it will cost another $33,000 to modify it for special use by the firm.The machine falls into the MACRS 3-year class,and it will be sold after 3 years of use for $110,000.The machine will require an increase in net working capital of $9,000 and will have no effect on revenues,but is expected to save the firm $90,000 per year in before-tax operating costs,mainly labour.The company's marginal tax rate is 40%.What is the initial cash flow for the project?

A) -$42,000

B) -$190,000

C) -$199,000

D) -$223,000

E) -$232,000

A) -$42,000

B) -$190,000

C) -$199,000

D) -$223,000

E) -$232,000

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

8

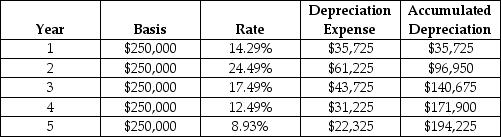

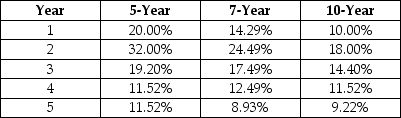

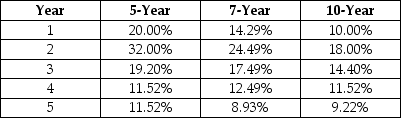

Bill Sharpe,owner of Sharper Knives Inc.,is closing his business at the end of the current fiscal year.His sole asset,the knife-sharpening machine,is three years old.A depreciation table for the asset is shown below.Bill has agreed to sell the machine at the end of the year for $100,000.What is the impact on taxes from the sale of the machine? (Assume that Sharper Knives claimed a regular depreciation expense in the calculation of income taxes.)The tax rate is 35%.Round your answers to the nearest dollar.

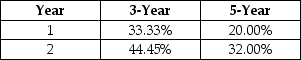

Depreciation Table for Knife Sharpener

A) $3,264 tax refund from IRS

B) $3,264 additional taxes owing to IRS

C) $14,236 tax refund from IRS

D) $14,236 additional taxes owing to IRS

E) $38,264 tax refund from IRS

Depreciation Table for Knife Sharpener

A) $3,264 tax refund from IRS

B) $3,264 additional taxes owing to IRS

C) $14,236 tax refund from IRS

D) $14,236 additional taxes owing to IRS

E) $38,264 tax refund from IRS

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

9

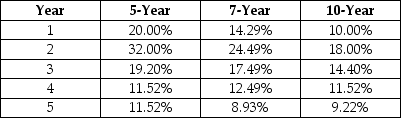

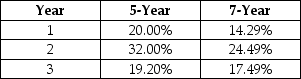

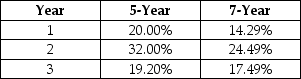

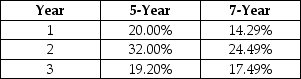

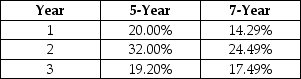

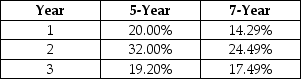

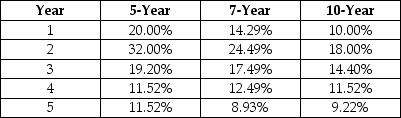

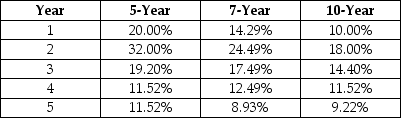

Droids-R-Us Inc.(DRU),is considering the installation of a new production line to make service mechanoids.The cost of the new manufacturing equipment is $2.2 million.The machines are classified as 7-year properties.(MACRS rates are provided in the table,below.)The machines will be purchased at the beginning of 2014.(DRU uses a mid-year placed-in-service convention.)DRU's engineers estimate that the new assembly line could be ready for operations in early 2014.Annual EBITDA is forecasted to be $1.3M for 2014 and all subsequent years of the project.DRU's marginal tax rate is 35%.What is the value of the depreciation tax shield in 2015? (Do NOT assume that the equipment is salvaged in 2015.)Round your answers to the nearest dollar.

A) $110,033

B) $188,573

C) $134,673

D) $314,380

E) $538,780

A) $110,033

B) $188,573

C) $134,673

D) $314,380

E) $538,780

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

10

A project having the conventional pattern of cash flows exhibits all of the following EXCEPT

A) a terminal cash flow.

B) initial investment.

C) operating cash outflows.

D) operating cash inflows.

A) a terminal cash flow.

B) initial investment.

C) operating cash outflows.

D) operating cash inflows.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

11

The book value of an asset is equal to the asset's after-tax proceeds,provided after the asset has been sold.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

12

The sale of an ordinary asset for its book value results in

A) no tax benefit.

B) recaptured depreciation.

C) a capital gain.

D) an ordinary tax benefit.

A) no tax benefit.

B) recaptured depreciation.

C) a capital gain.

D) an ordinary tax benefit.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

13

The relevant cash flows for a proposed project are the incremental after-tax cash outflows and the resulting cash inflows.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

14

Net working capital is the amount by which a firm's current assets exceed its current liabilities.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

15

Projects will usually have an initial investment,cash inflows,and a terminal cash flow.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

16

The initial purchase price of a new stamp press is $6,000.The firm will spend $5,000 on shipping and installation.Training of new employees will cost $2,000.As a result of the purchase,inventory must increase $1,300.What is the net initial cash flow? Round your answer to the nearest dollar.Sign your cash flows negative for outflows and positive for inflows.

A) $13,000

B) -$13,000

C) $14,300

D) -$14,300

E) $11,000

A) $13,000

B) -$13,000

C) $14,300

D) -$14,300

E) $11,000

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

17

When the sale of an asset is equal to its book value,a firm will have to pay taxes on recaptured depreciation.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

18

When calculating the cash flows for a project,you should include interest payments.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

19

A corporation has decided to replace an existing machine with a newer model.The old machine had an initial purchase price of $35,000,and has $20,000 in accumulated depreciation.If the 40% tax rate applies to the corporation and the old asset can be sold for $10,000,what will be the tax effect of the replacement?

A) No effect

B) Loss of $2,000

C) Refund of $2,000

D) Loss of $4,000

A) No effect

B) Loss of $2,000

C) Refund of $2,000

D) Loss of $4,000

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

20

The initial outlays and operating costs of large projects can be forecast with great accuracy,but revenues are more uncertain and large errors are not uncommon.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

21

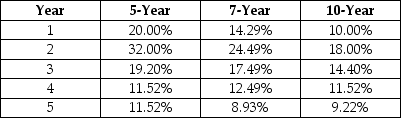

Goodweek Tire,Inc.,has recently developed a new tire,the SuperTread,and must decide whether to make the investment.The research and development costs so far total $10 million.Market research (costing $5 million)shows that there is significant demand for a SuperTread type tire.

The SuperTread will be produced and sold for the next two years.Goodweek Tire must initially invest $120 million in production equipment.This equipment can be sold for $51,428,571 at the end of two years.The equipment is classified as 15-year property for depreciation purposes.

The SuperTread is expected to sell for $45 per tire.The variable cost for each SuperTread is $15.Analysts expect automobile manufacturers to build five million new cars this year and for production to grow 2.5% in the following year.Each new car needs four tires.Goodweek Tire expects the SuperTread to capture 10 percent of the market.Assume that revenues and expenses occur at the end of each of the two years of production.

Working capital is equal to 15% of sales.Investments in working capital are made at the beginning of each year.At the end of the terminal year,the working capital is liquidated.What is the initial cash flow for the project?

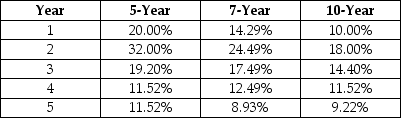

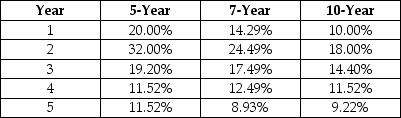

MACRS Depreciation Rates

A) -$15,000,000

B) -$120,000,000

C) -$133,500,000

D) -$138,500,000

E) -$148,500,000

The SuperTread will be produced and sold for the next two years.Goodweek Tire must initially invest $120 million in production equipment.This equipment can be sold for $51,428,571 at the end of two years.The equipment is classified as 15-year property for depreciation purposes.

The SuperTread is expected to sell for $45 per tire.The variable cost for each SuperTread is $15.Analysts expect automobile manufacturers to build five million new cars this year and for production to grow 2.5% in the following year.Each new car needs four tires.Goodweek Tire expects the SuperTread to capture 10 percent of the market.Assume that revenues and expenses occur at the end of each of the two years of production.

Working capital is equal to 15% of sales.Investments in working capital are made at the beginning of each year.At the end of the terminal year,the working capital is liquidated.What is the initial cash flow for the project?

MACRS Depreciation Rates

A) -$15,000,000

B) -$120,000,000

C) -$133,500,000

D) -$138,500,000

E) -$148,500,000

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

22

Dr.Magneto is evaluating whether to open a private MRI clinic in leased office space in a local strip mall.The clinic will run for two years and then close.Before the clinic opens,the offices require $200,000 of renovations.Dr.Magneto will buy $20,000 of computer equipment and one MRI machine.The MRI machine (GE 3.0T Signa Excite HD)costs $2.4M.Assume that the renovations,computer equipment and MRI are paid for at the beginning of the first year (t=0)and that all three are classified as 15-year property.

Assume that the MRI machine will be sold for $500,000 at the end of the second year of business.The computer equipment will be worthless at that time.

The clinic can perform 72 scans per week for 49 operational weeks per year.The clinic will charge $600 per scan.

The clinic will need two technicians,two receptionists and one office manager.Wages,salaries and other payroll costs (i.e.,health insurance premiums)will total $275,000 per year.Maintenance,supplies,marketing and operating costs for the machine are expected to be $200,000 per year.Annual rent is $60,000 payable at the end of each year.Assume that all revenues (and expenses)occur at the end of the year.The tax rate is 40% and Dr.Magneto's cost of capital is 10%.What is the initial cash flow for the project?

MACRS Depreciation Rates

A) -$2,400,000

B) -$2,420,000

C) -$2,620,000

D) -$2,655,000

E) -$2,835,000

Assume that the MRI machine will be sold for $500,000 at the end of the second year of business.The computer equipment will be worthless at that time.

The clinic can perform 72 scans per week for 49 operational weeks per year.The clinic will charge $600 per scan.

The clinic will need two technicians,two receptionists and one office manager.Wages,salaries and other payroll costs (i.e.,health insurance premiums)will total $275,000 per year.Maintenance,supplies,marketing and operating costs for the machine are expected to be $200,000 per year.Annual rent is $60,000 payable at the end of each year.Assume that all revenues (and expenses)occur at the end of the year.The tax rate is 40% and Dr.Magneto's cost of capital is 10%.What is the initial cash flow for the project?

MACRS Depreciation Rates

A) -$2,400,000

B) -$2,420,000

C) -$2,620,000

D) -$2,655,000

E) -$2,835,000

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

23

Dr.Magneto is evaluating whether to open a private MRI clinic in leased office space in a local strip mall.The clinic will run for two years and then close.Before the clinic opens,the offices require $200,000 of renovations.Dr.Magneto will buy $20,000 of computer equipment and one MRI machine.The MRI machine (GE 3.0T Signa Excite HD)costs $2.4M.Assume that the renovations,computer equipment and MRI are paid for at the beginning of the first year (t=0)and that all three are classified as 15-year property.

Assume that the MRI machine will be sold for $500,000 at the end of the second year of business.The computer equipment will be worthless at that time.

The clinic can perform 72 scans per week for 49 operational weeks per year.The clinic will charge $600 per scan.

The clinic will need two technicians,two receptionists and one office manager.Wages,salaries and other payroll costs (i.e.,health insurance premiums)will total $275,000 per year.Maintenance,supplies,marketing and operating costs for the machine are expected to be $200,000 per year.Annual rent is $60,000 payable at the end of each year.Assume that all revenues (and expenses)occur at the end of the year.The tax rate is 40% and Dr.Magneto's cost of capital is 10%.What are the operating cash flows at the end of Year 1?

MACRS Depreciation Rates

A) $997,080

B) $1,001,480

C) $1,037,480

D) $1,048,640

E) $1,053,880

Assume that the MRI machine will be sold for $500,000 at the end of the second year of business.The computer equipment will be worthless at that time.

The clinic can perform 72 scans per week for 49 operational weeks per year.The clinic will charge $600 per scan.

The clinic will need two technicians,two receptionists and one office manager.Wages,salaries and other payroll costs (i.e.,health insurance premiums)will total $275,000 per year.Maintenance,supplies,marketing and operating costs for the machine are expected to be $200,000 per year.Annual rent is $60,000 payable at the end of each year.Assume that all revenues (and expenses)occur at the end of the year.The tax rate is 40% and Dr.Magneto's cost of capital is 10%.What are the operating cash flows at the end of Year 1?

MACRS Depreciation Rates

A) $997,080

B) $1,001,480

C) $1,037,480

D) $1,048,640

E) $1,053,880

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

24

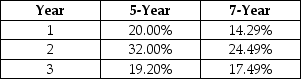

Jones Crusher Company is evaluating the proposed acquisition of a new machine.The machine will cost $190,000,and it will cost another $33,000 to modify it for special use by the firm.The machine falls into the MACRS 3-year class,and it will be sold after 3 years of use for $110,000.The machine will require an increase in net working capital of $9,000 and will have no effect on revenues,but is expected to save the firm $90,000 per year in before-tax operating costs,mainly labour.The company's marginal tax rate is 40%.What are the terminal year cash flows?

MACRS Depreciation Rates

A) $93,649

B) $102,649

C) $148,820

D) $179,470

E) $188,740

MACRS Depreciation Rates

A) $93,649

B) $102,649

C) $148,820

D) $179,470

E) $188,740

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

25

The Munsell Colour Company is considering the purchase of a new batch polymer-bonding machine for producing its number one line of crayons.Although the machine being considered will not produce any increase in sales revenues,it will result in the before-tax reduction of labour costs by $200,000 per year.The machine has a purchase price of $250,000,and it would cost an additional $10,000 to install the machine.In addition,to operate this machine,inventory must be increased by $15,000.The machine is categorized as 10-year property.After 2 years,it can be sold for $150,000.The tax rate is 34% and the cost of capital is 15%.What is the initial cash flow for the project?

MACRS Depreciation Rates

A) -$250,000

B) -$260,000

C) -$265,000

D) -$275,000

E) -$285,000

MACRS Depreciation Rates

A) -$250,000

B) -$260,000

C) -$265,000

D) -$275,000

E) -$285,000

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

26

The Munsell Colour Company is considering the purchase of a new batch polymer-bonding machine for producing its number one line of crayons.Although the machine being considered will not produce any increase in sales revenues,it will result in the before-tax reduction of labour costs by $200,000 per year.The machine has a purchase price of $250,000,and it would cost an additional $10,000 to install the machine.In addition,to operate this machine,inventory must be increased by $15,000.The machine is categorized as 10-year property.After 2 years,it can be sold for $150,000.The tax rate is 34% and the cost of capital is 15%.What are the operating cash flows at the end of Year 1?

MACRS Depreciation Rates

A) $132,000

B) $136,420

C) $140,840

D) $165,780

E) $175,240

MACRS Depreciation Rates

A) $132,000

B) $136,420

C) $140,840

D) $165,780

E) $175,240

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

27

Goodweek Tire,Inc.,has recently developed a new tire,the SuperTread,and must decide whether to make the investment.The research and development costs so far total $10 million.Market research (costing $5 million)shows that there is significant demand for a SuperTread type tire.

The SuperTread will be produced and sold for the next two years.Goodweek Tire must initially invest $120 million in production equipment.This equipment can be sold for $51,428,571 at the end of two years.The equipment is classified as 15-year property for depreciation purposes.

The SuperTread is expected to sell for $45 per tire.The variable cost for each SuperTread is $15.Analysts expect automobile manufacturers to build five million new cars this year and for production to grow 2.5% in the following year.Each new car needs four tires.Goodweek Tire expects the SuperTread to capture 10 percent of the market.Assume that revenues and expenses occur at the end of each of the two years of production.

Working capital is equal to 15% of sales.Investments in working capital are made at the beginning of each year.At the end of the terminal year,the working capital is liquidated.Assume a tax rate of 40%.What are the operating cash flows at the end of Year 1?

MACRS Depreciation Rates

A) 11.6625M

B) 25.4625M

C) 30.2625M

D) 38.0625M

E) 38.4000M

The SuperTread will be produced and sold for the next two years.Goodweek Tire must initially invest $120 million in production equipment.This equipment can be sold for $51,428,571 at the end of two years.The equipment is classified as 15-year property for depreciation purposes.

The SuperTread is expected to sell for $45 per tire.The variable cost for each SuperTread is $15.Analysts expect automobile manufacturers to build five million new cars this year and for production to grow 2.5% in the following year.Each new car needs four tires.Goodweek Tire expects the SuperTread to capture 10 percent of the market.Assume that revenues and expenses occur at the end of each of the two years of production.

Working capital is equal to 15% of sales.Investments in working capital are made at the beginning of each year.At the end of the terminal year,the working capital is liquidated.Assume a tax rate of 40%.What are the operating cash flows at the end of Year 1?

MACRS Depreciation Rates

A) 11.6625M

B) 25.4625M

C) 30.2625M

D) 38.0625M

E) 38.4000M

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

28

Tom Morrison Inc.,a leading manufacturer of golf equipment,is currently evaluating a new golf ball called the 'Feathery'.The secret to the Feathery is that its core is made from goose down.The advantage of down is that the ball flies higher and longer.You have been asked to analyze The Feathery project and present your findings to the company's executive committee.

The production line would be set up in an unused section of Morrison's main plant.The machinery is estimated at $480,000.Further,Morrison's inventories would have to be increased by $50,000 to handle the new line.The machinery is depreciated using MACRS with a 7-year recovery period.The machinery will be used for two years and have an expected salvage value of $200,000 at the end of that time.Morrison's tax rate is 30% and its weighted average cost of capital is 10%.

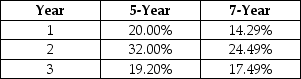

Operating earnings (EBITDA)are expected to be $330,000 per year for each of the two years.Assume that the purchase of the machine and increase in inventory occur at the beginning of the first year of operations.Assume that operating cash flows occur at the end of each of the two years of operations.What are the operating cash flows at the end of Year 1?

MACRS Depreciation Rates

A) $182,986

B) $211,738

C) $225,437

D) $251,578

E) $261,408

The production line would be set up in an unused section of Morrison's main plant.The machinery is estimated at $480,000.Further,Morrison's inventories would have to be increased by $50,000 to handle the new line.The machinery is depreciated using MACRS with a 7-year recovery period.The machinery will be used for two years and have an expected salvage value of $200,000 at the end of that time.Morrison's tax rate is 30% and its weighted average cost of capital is 10%.

Operating earnings (EBITDA)are expected to be $330,000 per year for each of the two years.Assume that the purchase of the machine and increase in inventory occur at the beginning of the first year of operations.Assume that operating cash flows occur at the end of each of the two years of operations.What are the operating cash flows at the end of Year 1?

MACRS Depreciation Rates

A) $182,986

B) $211,738

C) $225,437

D) $251,578

E) $261,408

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

29

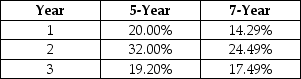

Jones Crusher Company is evaluating the proposed acquisition of a new machine.The machine will cost $190,000,and it will cost another $33,000 to modify it for special use by the firm.The machine falls into the MACRS 3-year class,and it will be sold after 3 years of use for $110,000.The machine will require an increase in net working capital of $9,000 and will have no effect on revenues,but is expected to save the firm $90,000 per year in before-tax operating costs,mainly labour.The company's marginal tax rate is 40%.What is the cash flow from the project for year 1?

MACRS Depreciation Rates

A) $90,000

B) $83,730

C) $79,331

D) $71,840

E) $9,404

MACRS Depreciation Rates

A) $90,000

B) $83,730

C) $79,331

D) $71,840

E) $9,404

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

30

The Boeing Corp.is considering building a new aircraft,the 787--larger than the 747 and larger than the Airbus A380.The company's Renton WA Facility,where 747s are currently manufactured,would have to be expanded.Expansion costs are forecast to be $2.5B,incurred at t = 0.Also at time t = 0,before production begins,inventory will be increased by $1.855B.Assume that this inventory is sold at the end of the project at t = 2.The first sales from operation of the new plant will occur at the end of year 1 (t = 1).Boeing forecasts sales of 220 planes in each of the two years.The plane will be sold for $130M each.The cost of manufacturing a plane is $115M.Annual overhead expenses are $775M.The construction facilities are classified as 15 year property.When the plant is closed it will be sold for $1B.The company is in the 34% marginal tax bracket.Boeing's cost of capital is 12%.What is the initial cash flow for the project?

MACRS Depreciation Rates

A) -$645M

B) -$1,885M

C) -$2,500M

D) -$4,355M

E) -$5,000M

MACRS Depreciation Rates

A) -$645M

B) -$1,885M

C) -$2,500M

D) -$4,355M

E) -$5,000M

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

31

Orange Inc.,the Cupertino-based computer manufacturer,has developed a new all-in-one device: phone,music-player,camera,GPS,and computer.The device is called the iPip.The following data have been collected regarding the iPip project.The company has identified a prime piece of real estate and must purchase it immediately for $100,000.In addition,R&D expenditures of $175,000 must be made immediately.During the first year the manufacturing plant will be constructed.The plant will be ready for operation at the end of Year 1.The construction costs are $500,000 and will be paid upon completion.At the end of the Year 1,an inventory of raw materials will be purchased costing $50,000.Production and sales will occur during years 2 and 3.(Assume that all revenues and operating expenses are received (paid)at the end of each year.)Annual revenues are expected to be $850,000.Fixed operating expenses are $100,000 per year and variable operating expenses are 25% of sales.The construction facilities are classified as 10-year property for tax-depreciation purposes.When the plant is closed it will be sold for $200,000.(Note: Assume the investment in plant is depreciated during years 2 and 3.)The land will be sold for $225,000 at the end of year 3.The tax rate on all types of income is 34%.The cost of capital is 12%.What are the operating cash flows at the end of Year 2?

MACRS Depreciation Rates

A) $304,750

B) $318,775

C) $321,750

D) $368,775

E) $371,750

MACRS Depreciation Rates

A) $304,750

B) $318,775

C) $321,750

D) $368,775

E) $371,750

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

32

The Boeing Corp.is considering building a new aircraft,the 787--larger than the 747 and larger than the Airbus A380.The company's Renton WA Facility,where 747s are currently manufactured,would have to be expanded.Expansion costs are forecast to be $2.5B,incurred at t = 0.Also at time t = 0,before production begins,inventory will be increased by $1.855B.Assume that this inventory is sold at the end of the project at t = 2.The first sales from operation of the new plant will occur at the end of year 1 (t = 1).Boeing forecasts sales of 220 planes in each of the two years.The plane will be sold for $130M each.The cost of manufacturing a plane is $115M.Annual overhead expenses are $775M.The construction facilities are classified as 15 year property.When the plant is closed it will be sold for $1B.The company is in the 34% marginal tax bracket.Boeing's cost of capital is 12%.What are the operating cash flows at the end of Year 1 (t = 1)?

MACRS Depreciation Rates

A) $1,584M

B) $1,709M

C) $1,945M

D) $2,400M

E) $2,525M

MACRS Depreciation Rates

A) $1,584M

B) $1,709M

C) $1,945M

D) $2,400M

E) $2,525M

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

33

John Kay Inc.is considering the installation of a new production line to make automated flying shuttles for weaving machines.The capital cost of the equipment is $2.2 million.The machines on the new line are classified as 15-year property.Kay plans to operate the line for two years,at which time the project will end and the assets will be disposed of for $1,000,000.The new line requires an increase in net working capital of $20,000,which would be liquidated at the end of the project.The investment outlays would occur immediately.

Sales are expected to be constant at $2,000,000,and operating expenses at $800,000.Assume that all revenues and operating expenses are received (paid)at the end of each of the two years of operations.Kay's marginal tax rate is 35 percent.Kay's cost of capital is 11%.What is initial cash flow for the flying shuttle project?

MACRS Depreciation Rates

A) $2,220,000

B) $2,200,000

C) $0

D) -$2,200,000

E) -$2,220,000

Sales are expected to be constant at $2,000,000,and operating expenses at $800,000.Assume that all revenues and operating expenses are received (paid)at the end of each of the two years of operations.Kay's marginal tax rate is 35 percent.Kay's cost of capital is 11%.What is initial cash flow for the flying shuttle project?

MACRS Depreciation Rates

A) $2,220,000

B) $2,200,000

C) $0

D) -$2,200,000

E) -$2,220,000

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

34

After a trip to Bordeaux France you are considering opening a restaurant based on Restaurant L'Entrecote.You will offer a fixed menu of salad,steak and French fries.Your innovation is that you will use a bordelaise (red wine)sauce instead of a tarragon butter sauce.You plan to run the restaurant for two years and then retire.Start-up costs,to be incurred immediately,are $500,000.Start-up costs include kitchen equipment,kitchen supplies,renovations,furniture,fixtures,and the point-of-sales system.

Assume that all of those assets are classified as 5-year property.The assets can be sold for $150,000 after two years.

You expect 100 diners per night.The restaurant will be open for 300 nights per year.The average diner orders food with a menu price of $35 and beverages with a menu price of $15.Food costs are 34% of the menu price and beverage costs are 50% of the menu price.

The nightly wages are $2,160 (for the chef,5 kitchen staff,a bartender,the Maitre d' and 10 wait staff).Municipal tax,rent,and utilities,are $41,400 per annum.

Assume that all revenues and operating expenses are received (paid)at the end of each year.

The small business tax rate is 20%.The cost of capital is 10%.

When the restaurant opens you will have to invest in an inventory of wine,beer and liquor costing $50,000.What are the operating cash flows at the end of Year 1?

MACRS Depreciation Rates

A) $100,000

B) $128,600

C) $102,880

D) $202,880

E) $1,271,400

Assume that all of those assets are classified as 5-year property.The assets can be sold for $150,000 after two years.

You expect 100 diners per night.The restaurant will be open for 300 nights per year.The average diner orders food with a menu price of $35 and beverages with a menu price of $15.Food costs are 34% of the menu price and beverage costs are 50% of the menu price.

The nightly wages are $2,160 (for the chef,5 kitchen staff,a bartender,the Maitre d' and 10 wait staff).Municipal tax,rent,and utilities,are $41,400 per annum.

Assume that all revenues and operating expenses are received (paid)at the end of each year.

The small business tax rate is 20%.The cost of capital is 10%.

When the restaurant opens you will have to invest in an inventory of wine,beer and liquor costing $50,000.What are the operating cash flows at the end of Year 1?

MACRS Depreciation Rates

A) $100,000

B) $128,600

C) $102,880

D) $202,880

E) $1,271,400

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

35

After a trip to Bordeaux France you are considering opening a restaurant based on Restaurant L'Entrecote.You will offer a fixed menu of salad,steak and French fries.Your innovation is that you will use a bordelaise (red wine)sauce instead of a tarragon butter sauce.You plan to run the restaurant for two years and then retire.Start-up costs,to be incurred immediately,are $500,000.Start-up costs include kitchen equipment,kitchen supplies,renovations,furniture,fixtures,and the point-of-sales system.

Assume that all of those assets are classified as 5-year property.The assets can be sold for $150,000 after two years.

You expect 100 diners per night.The restaurant will be open for 300 nights per year.The average diner orders food with a menu price of $35 and beverages with a menu price of $15.Food costs are 34% of the menu price and beverage costs are 50% of the menu price.

The nightly wages are $2,160 (for the chef,5 kitchen staff,a bartender,the Maitre d' and 10 wait staff).Municipal tax,rent,and utilities,are $41,400 per annum.

Assume that all revenues and operating expenses are received (paid)at the end of each year.

The small business tax rate is 20%.The cost of capital is 10%.

When the restaurant opens you will have to invest in an inventory of wine,beer and liquor costing $50,000.What is initial cash flow for the L'Entrecote project?

MACRS Depreciation Rates

A) -$50,000

B) -$175,000

C) -$275,000

D) -$500,000

E) -$550,000

Assume that all of those assets are classified as 5-year property.The assets can be sold for $150,000 after two years.

You expect 100 diners per night.The restaurant will be open for 300 nights per year.The average diner orders food with a menu price of $35 and beverages with a menu price of $15.Food costs are 34% of the menu price and beverage costs are 50% of the menu price.

The nightly wages are $2,160 (for the chef,5 kitchen staff,a bartender,the Maitre d' and 10 wait staff).Municipal tax,rent,and utilities,are $41,400 per annum.

Assume that all revenues and operating expenses are received (paid)at the end of each year.

The small business tax rate is 20%.The cost of capital is 10%.

When the restaurant opens you will have to invest in an inventory of wine,beer and liquor costing $50,000.What is initial cash flow for the L'Entrecote project?

MACRS Depreciation Rates

A) -$50,000

B) -$175,000

C) -$275,000

D) -$500,000

E) -$550,000

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

36

Orange Inc.,the Cupertino-based computer manufacturer,has developed a new all-in-one device: phone,music-player,camera,GPS,and computer.The device is called the iPip.The following data have been collected regarding the iPip project.The company has identified a prime piece of real estate and must purchase it immediately for $100,000.In addition,R&D expenditures of $175,000 must be made immediately.During the first year the manufacturing plant will be constructed.The plant will be ready for operation at the end of Year 1.The construction costs are $500,000 and will be paid upon completion.At the end of the Year 1,an inventory of raw materials will be purchased costing $50,000.Production and sales will occur during years 2 and 3.(Assume that all revenues and operating expenses are received (paid)at the end of each year.)Annual revenues are expected to be $850,000.Fixed operating expenses are $100,000 per year and variable operating expenses are 25% of sales.The construction facilities are classified as 10-year property for tax-depreciation purposes.When the plant is closed it will be sold for $200,000.(Note: Assume the investment in plant is depreciated during years 2 and 3.)The land will be sold for $225,000 at the end of year 3.The tax rate on all types of income is 34%.The cost of capital is 12%.What is the undiscounted sum of the initial cash flows incurred at Year 0 and Year 1 for the iPip project?

MACRS Depreciation Rates

A) -$100,000

B) -$175,000

C) -$275,000

D) -$550,000

E) -$825,000

MACRS Depreciation Rates

A) -$100,000

B) -$175,000

C) -$275,000

D) -$550,000

E) -$825,000

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

37

You estimate that if a new 4D computer graphic display product is launched by your firm,revenues will increase by $3,053 in the first year and 10% each year for the next 3 years.Expenses will be 50% of revenues.Depreciation is computed using MACRS for an asset with a 3-year life and a basis of $7,236.The tax rate is 40%.Compute the second years' annual cash flows.

MACRS Depreciation Rates

A) $1,542

B) $1,881

C) $2,294

D) $2,386

E) $2,974

MACRS Depreciation Rates

A) $1,542

B) $1,881

C) $2,294

D) $2,386

E) $2,974

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

38

The relevant cash flows for capital budgeting analysis are

A) incremental cash flows.

B) ordinary cash flows.

C) necessary cash flows.

D) consistent cash flows.

A) incremental cash flows.

B) ordinary cash flows.

C) necessary cash flows.

D) consistent cash flows.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

39

John Kay Inc.is considering the installation of a new production line to make automated flying shuttles for weaving machines.The capital cost of the equipment is $2.2 million.The machines on the new line are classified as 15-year property.Kay plans to operate the line for 2 years,at which time the project will end and the assets will be disposed of for $1,000,000.The new line requires an increase in net working capital of $20,000,which would be liquidated at the end of the project.The investment outlays would occur immediately.

Sales are expected to be constant at $2,000,000,and operating expenses at $800,000.Assume that all revenues and operating expenses are received (paid)at the end of each of the two years of operations.Kay's marginal tax rate is 35 percent.Kay's cost of capital is 11%.What are the operating cash flows at the end of Year 1?

MACRS Depreciation Rates

A) $708,500

B) $764,000

C) $793,000

D) $818,500

E) $818,850

Sales are expected to be constant at $2,000,000,and operating expenses at $800,000.Assume that all revenues and operating expenses are received (paid)at the end of each of the two years of operations.Kay's marginal tax rate is 35 percent.Kay's cost of capital is 11%.What are the operating cash flows at the end of Year 1?

MACRS Depreciation Rates

A) $708,500

B) $764,000

C) $793,000

D) $818,500

E) $818,850

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

40

Tom Morrison Inc.,a leading manufacturer of golf equipment,is currently evaluating a new golf ball called the 'Feathery'.The secret to the Feathery is that its core is made from goose down.The advantage of down is that the ball flies higher and longer.You have been asked to analyze The Feathery project and present your findings to the company's executive committee.

The production line would be set up in an unused section of Morrison's main plant.The machinery is estimated at $480,000.Further,Morrison's inventories would have to be increased by $50,000 to handle the new line.The machinery is depreciated using MACRS with a 7-year recovery period.The machinery will be used for 2 years and have an expected salvage value of $200,000 at the end of that time.Morrison's tax rate is 30% and its weighted average cost of capital is 10%.

Operating earnings (EBITDA)are expected to be $330,000 per year for each of the two years.Assume that the purchase of the machine and increase in inventory occur at the beginning of the first year of operations.Assume that operating cash flows occur at the end of each of the two years of operations.What is initial cash flow for the Feathery project?

MACRS Depreciation Rates

A) -$530,000

B) -$480,000

C) -$430,000

D) -$50,000

E) $0

The production line would be set up in an unused section of Morrison's main plant.The machinery is estimated at $480,000.Further,Morrison's inventories would have to be increased by $50,000 to handle the new line.The machinery is depreciated using MACRS with a 7-year recovery period.The machinery will be used for 2 years and have an expected salvage value of $200,000 at the end of that time.Morrison's tax rate is 30% and its weighted average cost of capital is 10%.

Operating earnings (EBITDA)are expected to be $330,000 per year for each of the two years.Assume that the purchase of the machine and increase in inventory occur at the beginning of the first year of operations.Assume that operating cash flows occur at the end of each of the two years of operations.What is initial cash flow for the Feathery project?

MACRS Depreciation Rates

A) -$530,000

B) -$480,000

C) -$430,000

D) -$50,000

E) $0

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

41

The Boeing Corp.is considering building a new aircraft,the 787--larger than the 747 and larger than the Airbus A380.The company's Renton WA Facility,where 747s are currently manufactured,would have to be expanded.Expansion costs are forecast to be $2.5B,incurred at t = 0.Also at time t = 0,before production begins,inventory will be increased by $1.855B.Assume that this inventory is sold at the end of the project at t = 2.The first sales from operation of the new plant will occur at the end of year 1 (t = 1).Boeing forecasts sales of 220 planes in each of the two years.The plane will be sold for $130M each.The cost of manufacturing a plane is $115M.Annual overhead expenses are $775M.The construction facilities are classified as 15 year property.When the plant is closed it will be sold for $1B.The company is in the 34% marginal tax bracket.Boeing's cost of capital is 12%.What is the IRR for the proposed acquisition?

MACRS Depreciation Rates

A) 22.4%

B) 24.4%

C) 26.4%

D) 28.4%

E) 30.4%

MACRS Depreciation Rates

A) 22.4%

B) 24.4%

C) 26.4%

D) 28.4%

E) 30.4%

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

42

Jones Crusher Company is evaluating the proposed acquisition of a new machine.The machine will cost $190,000,and it will cost another $33,000 to modify it for special use by the firm.The machine falls into the MACRS 3-year class,and it will be sold after 3 years of use for $110,000.The machine will require an increase in net working capital of $9,000 and will have no effect on revenues,but is expected to save the firm $90,000 per year in before-tax operating costs,mainly labour.The company's marginal tax rate is 40%.What is the NPV for the proposed acquisition if the cost of capital is 14%?

A) $13,957

B) $14,619

C) $15,322

D) $18,579

E) $20,456

A) $13,957

B) $14,619

C) $15,322

D) $18,579

E) $20,456

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

43

The Munsell Colour Company is considering the purchase of a new batch polymer-bonding machine for producing its number one line of crayons.Although the machine being considered will not produce any increase in sales revenues,it will result in the before-tax reduction of labour costs by $200,000 per year.The machine has a purchase price of $250,000,and it would cost an additional $10,000 to install the machine.In addition,to operate this machine,inventory must be increased by $15,000.Operating expenses are expected to grow at 2.5%.The machine is categorized as 10-year property.After 2 years,it can be sold for $150,000.The tax rate is 34% and the cost of capital is 15%.What is the IRR for the proposed acquisition?

MACRS Depreciation Rates

A) 38%

B) 39%

C) 40%

D) 41%

E) 42%

MACRS Depreciation Rates

A) 38%

B) 39%

C) 40%

D) 41%

E) 42%

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

44

The Boeing Corp.is considering building a new aircraft,the 787-larger than the 747 and larger than the Airbus A380.The company's Renton WA Facility,where 747s are currently manufactured,would have to be expanded.Expansion costs are forecast to be $2.5B,incurred at t = 0.Also at time t = 0,before production begins,inventory will be increased by $1.855B.Assume that this inventory is sold at the end of the project at t = 2.The first sales from operation of the new plant will occur at the end of year 1 (t = 1).Boeing forecasts sales of 220 planes in each of the two years.The plane will be sold for $130M each.The cost of manufacturing a plane is $115M.Annual overhead expenses are $775M.The construction facilities are classified as 15 year property.When the plant is closed it will be sold for $1B.The company is in the 34% marginal tax bracket.Boeing's cost of capital is 12%.What are the terminal year cash flows?

MACRS Depreciation Rates

A) $1,747M

B) $3,134M

C) $3,242M

D) $4,989M

E) $5,089M

MACRS Depreciation Rates

A) $1,747M

B) $3,134M

C) $3,242M

D) $4,989M

E) $5,089M

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

45

Dr.Magneto is evaluating whether to open a private MRI clinic in leased office space in a local strip mall.The clinic will run for two years and then close.Before the clinic opens,the offices require $200,000 of renovations.Dr.Magneto will buy $20,000 of computer equipment and one MRI machine.The MRI machine (GE 3.0T Signa Excite HD)costs $2.4M.Assume that the renovations,computer equipment and MRI are paid for at the beginning of the first year (t=0)and that all three are classified as 15-year property.

Assume that the MRI machine will be sold for $500,000 at the end of the second year of business.The computer equipment will be worthless at that time.

The clinic can perform 72 scans per week for 49 operational weeks per year.The clinic will charge $600 per scan.

The clinic will need two technicians,two receptionists and one office manager.Wages,salaries and other payroll costs (i.e.,health insurance premiums)will total $275,000 per year.Maintenance,supplies,marketing and operating costs for the machine are expected to be $200,000 per year.Annual rent is $60,000 payable at the end of each year.Assume that all revenues (and expenses)occur at the end of the year.Revenues and operating expenses are expected to grow at a rate of 2.5%.The tax rate is 40% and Dr.Magneto's cost of capital is 10%.What are the terminal year cash flows?

MACRS Depreciation Rates

A) $1,336,630

B) $2,167,927

C) $2,268,407

D) $2,429,287

E) $2,603,527

Assume that the MRI machine will be sold for $500,000 at the end of the second year of business.The computer equipment will be worthless at that time.

The clinic can perform 72 scans per week for 49 operational weeks per year.The clinic will charge $600 per scan.

The clinic will need two technicians,two receptionists and one office manager.Wages,salaries and other payroll costs (i.e.,health insurance premiums)will total $275,000 per year.Maintenance,supplies,marketing and operating costs for the machine are expected to be $200,000 per year.Annual rent is $60,000 payable at the end of each year.Assume that all revenues (and expenses)occur at the end of the year.Revenues and operating expenses are expected to grow at a rate of 2.5%.The tax rate is 40% and Dr.Magneto's cost of capital is 10%.What are the terminal year cash flows?

MACRS Depreciation Rates

A) $1,336,630

B) $2,167,927

C) $2,268,407

D) $2,429,287

E) $2,603,527

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

46

Dr.Magneto is evaluating whether to open a private MRI clinic in leased office space in a local strip mall.The clinic will run for two years and then close.Before the clinic opens,the offices require $200,000 of renovations.Dr.Magneto will buy $20,000 of computer equipment and one MRI machine.The MRI machine (GE 3.0T Signa Excite HD)costs $2.4M.Assume that the renovations,computer equipment and MRI are paid for at the beginning of the first year (t=0)and that all three are classified as 15-year property.

Assume that the MRI machine will be sold for $500,000 at the end of the second year of business.The computer equipment will be worthless at that time.

The clinic can perform 72 scans per week for 49 operational weeks per year.The clinic will charge $600 per scan.

The clinic will need two technicians,two receptionists and one office manager.Wages,salaries and other payroll costs (i.e.,health insurance premiums)will total $275,000 per year.Maintenance,supplies,marketing and operating costs for the machine are expected to be $200,000 per year.Annual rent is $60,000 payable at the end of each year.Assume that all revenues (and expenses)occur at the end of the year and that they grow at a rate of 2.5%.The tax rate is 40% and Dr.Magneto's cost of capital is 10%.What is the NPV for the proposed acquisition if the cost of capital is 10%?

MACRS Depreciation Rates

A) -$410,087

B) $55,807

C) $165,153

D) $169,483

E) $312,062

Assume that the MRI machine will be sold for $500,000 at the end of the second year of business.The computer equipment will be worthless at that time.

The clinic can perform 72 scans per week for 49 operational weeks per year.The clinic will charge $600 per scan.

The clinic will need two technicians,two receptionists and one office manager.Wages,salaries and other payroll costs (i.e.,health insurance premiums)will total $275,000 per year.Maintenance,supplies,marketing and operating costs for the machine are expected to be $200,000 per year.Annual rent is $60,000 payable at the end of each year.Assume that all revenues (and expenses)occur at the end of the year and that they grow at a rate of 2.5%.The tax rate is 40% and Dr.Magneto's cost of capital is 10%.What is the NPV for the proposed acquisition if the cost of capital is 10%?

MACRS Depreciation Rates

A) -$410,087

B) $55,807

C) $165,153

D) $169,483

E) $312,062

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

47

After a trip to Bordeaux France you are considering opening a restaurant based on Restaurant L'Entrecote.You will offer a fixed menu of salad,steak and French fries.Your innovation is that you will use a bordelaise (red wine)sauce instead of a tarragon butter sauce.You plan to run the restaurant for two years and then retire.Start-up costs,to be incurred immediately,are $500,000.Start-up costs include kitchen equipment,kitchen supplies,renovations,furniture,fixtures,and the point-of-sales system.Assume that all of those assets are classified as 5-year property.The assets can be sold for $150,000 after two years.

You expect 100 diners per night.The restaurant will be open for 300 nights per year.The average diner orders food with a menu price of $35 and beverages with a menu price of $15.Food costs are 34% of the menu price and beverage costs are 50% of the menu price.The nightly wages are $2,160 (for the chef,5 kitchen staff,a bartender,the Maitre d' and 10 wait staff).Municipal tax,rent,and utilities,are $41,400 per annum.Assume that all revenues and operating expenses are received (paid)at the end of each year.The small business tax rate is 20%.The cost of capital is 10%.When the restaurant opens you will have to invest in an inventory of wine,beer and liquor costing $50,000.What are the terminal year cash flows?

MACRS Depreciation Rates

A) $357,752

B) $68,600

C) $50,000

D) $214,880

E) $432,880

You expect 100 diners per night.The restaurant will be open for 300 nights per year.The average diner orders food with a menu price of $35 and beverages with a menu price of $15.Food costs are 34% of the menu price and beverage costs are 50% of the menu price.The nightly wages are $2,160 (for the chef,5 kitchen staff,a bartender,the Maitre d' and 10 wait staff).Municipal tax,rent,and utilities,are $41,400 per annum.Assume that all revenues and operating expenses are received (paid)at the end of each year.The small business tax rate is 20%.The cost of capital is 10%.When the restaurant opens you will have to invest in an inventory of wine,beer and liquor costing $50,000.What are the terminal year cash flows?

MACRS Depreciation Rates

A) $357,752

B) $68,600

C) $50,000

D) $214,880

E) $432,880

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

48

Goodweek Tire,Inc.,has recently developed a new tire,the SuperTread,and must decide whether to make the investment.The research and development costs so far total $10 million.Market research (costing $5 million)shows that there is significant demand for a SuperTread type tire.

The SuperTread will be produced and sold for the next two years.Goodweek Tire must initially invest $120 million in production equipment.This equipment can be sold for $51,428,571 at the end of two years.The equipment is classified as 15-year property for depreciation purposes.

The SuperTread is expected to sell for $45 per tire.The variable cost for each SuperTread is $15.Analysts expect automobile manufacturers to build five million new cars this year and for production to grow 2.5% in the following year.Each new car needs four tires.Goodweek Tire expects the SuperTread to capture 10 percent of the market.Assume that revenues and expenses occur at the end of each of the two years of production.

Working capital is equal to 15% of sales.Investments in working capital are made at the beginning of each year.Assume a tax rate of 40%.At the end of the terminal year,the working capital is liquidated.What is the NPV for the proposed acquisition if the cost of capital is 7.64%?

MACRS Depreciation Rates

A) $11.6M

B) $11.8M

C) $12.0M

D) $12.2M

E) $12.4M

The SuperTread will be produced and sold for the next two years.Goodweek Tire must initially invest $120 million in production equipment.This equipment can be sold for $51,428,571 at the end of two years.The equipment is classified as 15-year property for depreciation purposes.

The SuperTread is expected to sell for $45 per tire.The variable cost for each SuperTread is $15.Analysts expect automobile manufacturers to build five million new cars this year and for production to grow 2.5% in the following year.Each new car needs four tires.Goodweek Tire expects the SuperTread to capture 10 percent of the market.Assume that revenues and expenses occur at the end of each of the two years of production.

Working capital is equal to 15% of sales.Investments in working capital are made at the beginning of each year.Assume a tax rate of 40%.At the end of the terminal year,the working capital is liquidated.What is the NPV for the proposed acquisition if the cost of capital is 7.64%?

MACRS Depreciation Rates

A) $11.6M

B) $11.8M

C) $12.0M

D) $12.2M

E) $12.4M

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

49

Orange Inc.,the Cupertino-based computer manufacturer,has developed a new all-in-one device: phone,music-player,camera,GPS,and computer.The device is called the iPip.The following data have been collected regarding the iPip project.The company has identified a prime piece of real estate and must purchase it immediately for $100,000.In addition,R&D expenditures of $175,000 must be made immediately.During the first year the manufacturing plant will be constructed.The plant will be ready for operation at the end of Year 1.The construction costs are $500,000 and will be paid upon completion.At the end of the Year 1,an inventory of raw materials will be purchased costing $50,000.Production and sales will occur during years 2 and 3.(Assume that all revenues and operating expenses are received (paid)at the end of each year.)Annual revenues are expected to be $850,000.Fixed operating expenses are $100,000 per year and variable operating expenses are 25% of sales.The construction facilities are classified as 10-year property for tax-depreciation purposes.When the plant is closed it will be sold for $200,000.(Note: Assume the investment in plant is depreciated during years 2 and 3.)The land will be sold for $225,000 at the end of year 3.The tax rate on all types of income is 34%.The cost of capital is 12%.What are the terminal year (Year 3)cash flows?

MACRS Depreciation Rates

A) $846,810

B) $868,850

C) $872,250

D) $896,810

E) $922,400

MACRS Depreciation Rates

A) $846,810

B) $868,850

C) $872,250

D) $896,810

E) $922,400

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

50

John Kay Inc.is considering the installation of a new production line to make automated flying shuttles for weaving machines.The capital cost of the equipment is $2.2 million.The machines on the new line are classified as 15-year property.Kay plans to operate the line for 2 years,at which time the project will end and the assets will be disposed of for $1,000,000.The new line requires an increase in net working capital of $20,000,which would be liquidated at the end of the project.The investment outlays would occur immediately.

Sales are expected to be constant at $2,000,000,and operating expenses at $800,000.Assume that all revenues and operating expenses are received (paid)at the end of each of the two years of operations.Kay's marginal tax rate is 35 percent.Kay's cost of capital is 11%.What is the NPV for the proposed acquisition if the cost of capital is 11%?

MACRS Depreciation Rates

A) $287,942

B) $291,709

C) $326,983

D) $341,505

E) $430,816

Sales are expected to be constant at $2,000,000,and operating expenses at $800,000.Assume that all revenues and operating expenses are received (paid)at the end of each of the two years of operations.Kay's marginal tax rate is 35 percent.Kay's cost of capital is 11%.What is the NPV for the proposed acquisition if the cost of capital is 11%?

MACRS Depreciation Rates

A) $287,942

B) $291,709

C) $326,983

D) $341,505

E) $430,816

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

51

The Munsell Colour Company is considering the purchase of a new batch polymer-bonding machine for producing its number one line of crayons.Although the machine being considered will not produce any increase in sales revenues,it will result in the before-tax reduction of labour costs by $200,000 per year.The machine has a purchase price of $250,000,and it would cost an additional $10,000 to install the machine.In addition,to operate this machine,inventory must be increased by $15,000.Operating expenses are expected to grow at 2.5%.The machine is categorized as 10-year property.After 2 years,it can be sold for $150,000.The tax rate is 34% and the cost of capital is 15%.What is the NPV for the proposed acquisition if the cost of capital is 15%?

MACRS Depreciation Rates

A) $74,392

B) $81,567

C) $89,541

D) $96,135

E) $99,792

MACRS Depreciation Rates

A) $74,392

B) $81,567

C) $89,541

D) $96,135

E) $99,792

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

52

The cash flows in an expansion project are different from those in a replacement project.In an expansion project,the cash flows from the old asset

A) will always be zero.

B) will be evaluated on an after-tax basis.

C) will always be negative.

D) will always equal the terminal cash flow.

A) will always be zero.

B) will be evaluated on an after-tax basis.

C) will always be negative.

D) will always equal the terminal cash flow.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

53

The Munsell Colour Company is considering the purchase of a new batch polymer-bonding machine for producing its number one line of crayons.Although the machine being considered will not produce any increase in sales revenues,it will result in the before-tax reduction of labour costs by $200,000 per year.The machine has a purchase price of $250,000,and it would cost an additional $10,000 to install the machine.In addition,to operate this machine,inventory must be increased by $15,000.The machine is categorized as 10-year property.After 2 years,it can be sold for $150,000.The tax rate is 34% and the cost of capital is 15%.Operating expenses are expected to increase by 2.5%.What are the terminal year cash flows?

MACRS Depreciation Rates

A) $147,912

B) $155,139

C) $170,139

D) $320,139

E) $328,860

MACRS Depreciation Rates

A) $147,912

B) $155,139

C) $170,139

D) $320,139

E) $328,860

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

54

Tom Morrison Inc.,a leading manufacturer of golf equipment,is currently evaluating a new golf ball called the 'Feathery'.The secret to the Feathery is that its core is made from goose down.The advantage of down is that the ball flies higher and longer.You have been asked to analyze The Feathery project and present your findings to the company's executive committee.

The production line would be set up in an unused section of Morrison's main plant.The machinery is estimated at $480,000.Further,Morrison's inventories would have to be increased by $50,000 to handle the new line.The machinery is depreciated using MACRS with a 7-year recovery period.The machinery will be used for 2 years and have an expected salvage value of $200,000 at the end of that time.Morrison's tax rate is 30% and its weighted average cost of capital is 10%.

Operating earnings (EBITDA)are expected to be $330,000 per year for each of the two 2 years.Assume that the purchase of the machine and increase in inventory occur at the beginning of the first year of operations.Assume that operating cash flows occur at the end of each of the two years of operations.What is the NPV for the proposed acquisition if the cost of capital is 10%?

MACRS Depreciation Rates

A) $107,320

B) $119,894

C) $125,373

D) $148,643

E) $157,320

The production line would be set up in an unused section of Morrison's main plant.The machinery is estimated at $480,000.Further,Morrison's inventories would have to be increased by $50,000 to handle the new line.The machinery is depreciated using MACRS with a 7-year recovery period.The machinery will be used for 2 years and have an expected salvage value of $200,000 at the end of that time.Morrison's tax rate is 30% and its weighted average cost of capital is 10%.

Operating earnings (EBITDA)are expected to be $330,000 per year for each of the two 2 years.Assume that the purchase of the machine and increase in inventory occur at the beginning of the first year of operations.Assume that operating cash flows occur at the end of each of the two years of operations.What is the NPV for the proposed acquisition if the cost of capital is 10%?

MACRS Depreciation Rates

A) $107,320

B) $119,894

C) $125,373

D) $148,643

E) $157,320

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

55

Goodweek Tire,Inc.,has recently developed a new tire,the SuperTread,and must decide whether to make the investment.The research and development costs so far total $10 million.Market research (costing $5 million)shows that there is significant demand for a SuperTread type tire.

The SuperTread will be produced and sold for the next two years.Goodweek Tire must initially invest $120 million in production equipment.This equipment can be sold for $51,428,571 at the end of two years.The equipment is classified as 15-year property for depreciation purposes.

The SuperTread is expected to sell for $45 per tire.The variable cost for each SuperTread is $15.Analysts expect automobile manufacturers to build five million new cars this year and for production to grow 2.5% in the following year.Each new car needs four tires.Goodweek Tire expects the SuperTread to capture 10 percent of the market.Assume that revenues and expenses occur at the end of each of the two years of production.

Working capital is equal to 15% of sales.Investments in working capital are made at the beginning of each year.Assume a tax rate of 40%.At the end of the terminal year,the working capital is liquidated.What are the terminal year cash flows?

MACRS Depreciation Rates

A) $30,540,000

B) $44,377,500

C) $95,806,071

D) $105,928,048

E) $127,195,000

The SuperTread will be produced and sold for the next two years.Goodweek Tire must initially invest $120 million in production equipment.This equipment can be sold for $51,428,571 at the end of two years.The equipment is classified as 15-year property for depreciation purposes.

The SuperTread is expected to sell for $45 per tire.The variable cost for each SuperTread is $15.Analysts expect automobile manufacturers to build five million new cars this year and for production to grow 2.5% in the following year.Each new car needs four tires.Goodweek Tire expects the SuperTread to capture 10 percent of the market.Assume that revenues and expenses occur at the end of each of the two years of production.

Working capital is equal to 15% of sales.Investments in working capital are made at the beginning of each year.Assume a tax rate of 40%.At the end of the terminal year,the working capital is liquidated.What are the terminal year cash flows?

MACRS Depreciation Rates

A) $30,540,000

B) $44,377,500

C) $95,806,071

D) $105,928,048

E) $127,195,000

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

56

Tom Morrison Inc.,a leading manufacturer of golf equipment,is currently evaluating a new golf ball called the 'Feathery'.The secret to the Feathery is that its core is made from goose down.The advantage of down is that the ball flies higher and longer.You have been asked to analyze The Feathery project and present your findings to the company's executive committee.

The production line would be set up in an unused section of Morrison's main plant.The machinery is estimated at $480,000.Further,Morrison's inventories would have to be increased by $50,000 to handle the new line.The machinery is depreciated using MACRS with a 7-year recovery period.The machinery will be used for two years and have an expected salvage value of $200,000 at the end of that time.Morrison's tax rate is 30% and its weighted average cost of capital is 10%.

Operating earnings (EBITDA)are expected to be $330,000 per year for each of the two years.Assume that the purchase of the machine and increase in inventory occur at the beginning of the first year of operations.Assume that operating cash flows occur at the end of each of the two years of operations.What are the terminal year cash flows?

MACRS Depreciation Rates

A) $455,211

B) $494,422

C) $507,279

D) $516,266

E) $544,422

The production line would be set up in an unused section of Morrison's main plant.The machinery is estimated at $480,000.Further,Morrison's inventories would have to be increased by $50,000 to handle the new line.The machinery is depreciated using MACRS with a 7-year recovery period.The machinery will be used for two years and have an expected salvage value of $200,000 at the end of that time.Morrison's tax rate is 30% and its weighted average cost of capital is 10%.

Operating earnings (EBITDA)are expected to be $330,000 per year for each of the two years.Assume that the purchase of the machine and increase in inventory occur at the beginning of the first year of operations.Assume that operating cash flows occur at the end of each of the two years of operations.What are the terminal year cash flows?

MACRS Depreciation Rates

A) $455,211

B) $494,422

C) $507,279

D) $516,266

E) $544,422

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

57

After a trip to Bordeaux France you are considering opening a restaurant based on Restaurant L'Entrecote.You will offer a fixed menu of salad,steak and French fries.Your innovation is that you will use a bordelaise (red wine)sauce instead of a tarragon butter sauce.You plan to run the restaurant for two years and then retire.Start-up costs,to be incurred immediately,are $500,000.Start-up costs include kitchen equipment,kitchen supplies,renovations,furniture,fixtures,and the point-of-sales system.Assume that all of those assets are classified as 5-year property.The assets can be sold for $150,000 after two years.

You expect 100 diners per night.The restaurant will be open for 300 nights per year.The average diner orders food with a menu price of $35 and beverages with a menu price of $15.Food costs are 34% of the menu price and beverage costs are 50% of the menu price.

The nightly wages are $2,160 (for the chef,5 kitchen staff,a bartender,the Maitre d' and 10 wait staff).Municipal tax,rent,and utilities,are $41,400 per annum.

Assume that all revenues and operating expenses are received (paid)at the end of each year.

The small business tax rate is 20%.The cost of capital is 10%.

When the restaurant opens you will have to invest in an inventory of wine,beer and liquor costing $50,000.What is the NPV for the proposed acquisition if the cost of capital is 12%?

MACRS Depreciation Rates

A) $102,880

B) $(9,586)

C) $(7,812)

D) $432,880

E) $128,600

You expect 100 diners per night.The restaurant will be open for 300 nights per year.The average diner orders food with a menu price of $35 and beverages with a menu price of $15.Food costs are 34% of the menu price and beverage costs are 50% of the menu price.

The nightly wages are $2,160 (for the chef,5 kitchen staff,a bartender,the Maitre d' and 10 wait staff).Municipal tax,rent,and utilities,are $41,400 per annum.

Assume that all revenues and operating expenses are received (paid)at the end of each year.

The small business tax rate is 20%.The cost of capital is 10%.

When the restaurant opens you will have to invest in an inventory of wine,beer and liquor costing $50,000.What is the NPV for the proposed acquisition if the cost of capital is 12%?

MACRS Depreciation Rates

A) $102,880

B) $(9,586)

C) $(7,812)

D) $432,880

E) $128,600

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

58

Orange Inc.,the Cupertino-based computer manufacturer,has developed a new all-in-one device: phone,music-player,camera,GPS,and computer.The device is called the iPip.The following data have been collected regarding the iPip project.The company has identified a prime piece of real estate and must purchase it immediately for $100,000.In addition,R&D expenditures of $175,000 must be made immediately.During the first year the manufacturing plant will be constructed.The plant will be ready for operation at the end of Year 1.The construction costs are $500,000 and will be paid upon completion.At the end of the Year 1,an inventory of raw materials will be purchased costing $50,000.Production and sales will occur during years 2 and 3.(Assume that all revenues and operating expenses are received (paid)at the end of each year.)Annual revenues are expected to be $850,000.Fixed operating expenses are $100,000 per year and variable operating expenses are 25% of sales.The construction facilities are classified as 10-year property for tax-depreciation purposes.When the plant is closed it will be sold for $200,000.(Note: Assume the investment in plant is depreciated during years 2 and 3.)The land will be sold for $225,000 at the end of year 3.The tax rate on all types of income is 34%.The cost of capital is 12%.What is the NPV for the proposed acquisition if the cost of capital is 12%?

MACRS Depreciation Rates

A) $95,833

B) $134,419

C) $151,136

D) $162,140

E) $223,750

MACRS Depreciation Rates

A) $95,833

B) $134,419

C) $151,136

D) $162,140

E) $223,750

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

59

The Boeing Corp.is considering building a new aircraft,the 787--larger than the 747 and larger than the Airbus A380.The company's Renton WA Facility,where 747s are currently manufactured,would have to be expanded.Expansion costs are forecast to be $2.5B,incurred at t = 0.Also at time t = 0,before production begins,inventory will be increased by $1.855B.Assume that this inventory is sold at the end of the project at t = 2.The first sales from operation of the new plant will occur at the end of year 1 (t = 1).Boeing forecasts sales of 220 planes in each of the two years.The plane will be sold for $130M each.The cost of manufacturing a plane is $115M.Annual overhead expenses are $775M.The construction facilities are classified as 15 year property.When the plant is closed it will be sold for $1B.The company is in the 34% marginal tax bracket.Boeing's cost of capital is 12%.What is the NPV for the proposed acquisition if the cost of capital is 12%?

MACRS Depreciation Rates

A) $1,025M

B) $1,148M

C) $2,343M

D) $3,242M

E) $3,602M

MACRS Depreciation Rates

A) $1,025M

B) $1,148M

C) $2,343M

D) $3,242M

E) $3,602M

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

60