Deck 13: Investor Behavior and Capital Market Efficiency

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

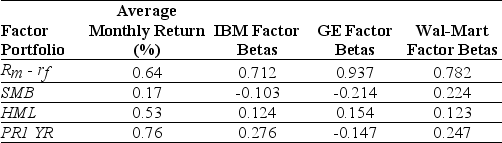

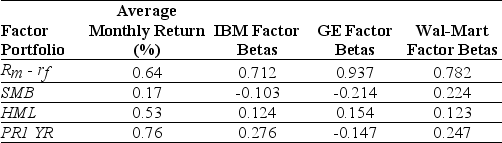

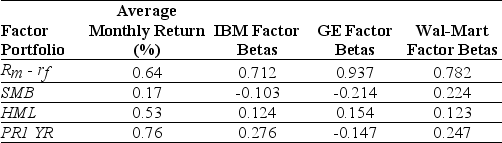

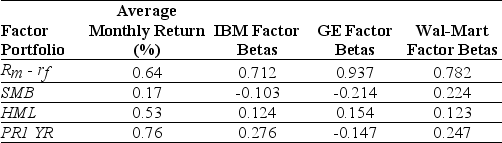

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/75

Play

Full screen (f)

Deck 13: Investor Behavior and Capital Market Efficiency

1

The CAPM does not require investors have homogeneous expectations, but rather that they have:

A)rational biases.

B)no biases.

C)heterogenous expectations.

D)rational expectations.

A)rational biases.

B)no biases.

C)heterogenous expectations.

D)rational expectations.

rational expectations.

2

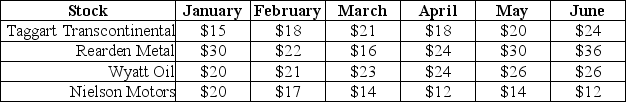

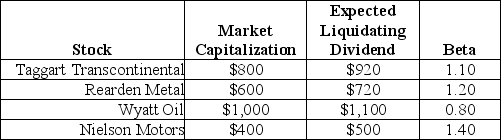

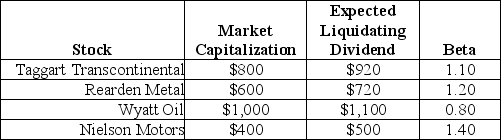

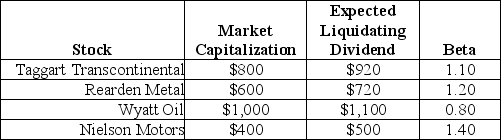

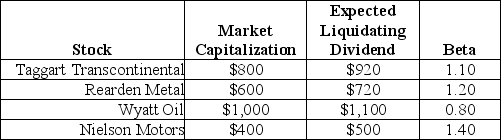

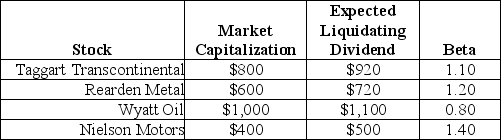

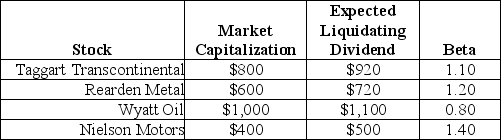

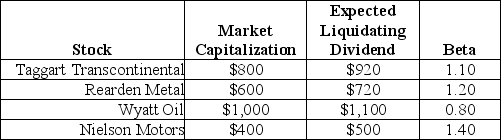

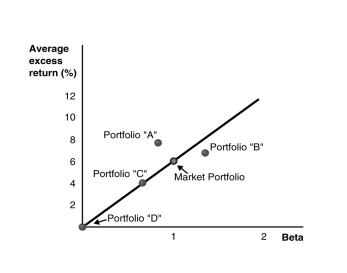

Use the following information to answer the question(s)below.

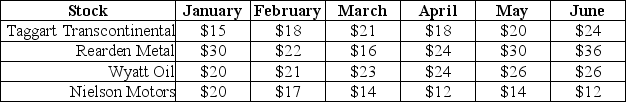

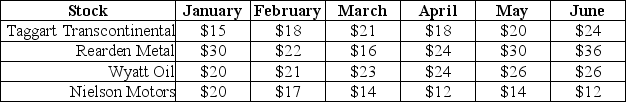

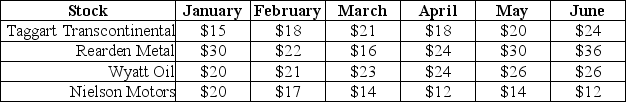

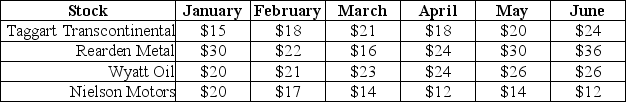

Consider the price paths of the following stocks over a six-month period:

None of these stocks pay dividends.

None of these stocks pay dividends.

Assume that you are an investor with the disposition effect and you bought each of these stocks in January. Suppose that it is currently the end of March, which stocks are you most inclined to hold? 1. Taggart Transcontinental

2. Rearden Metal

3. Wyatt Oil

4. Nielson Motors

A)1 only

B)1 and 3 only

C)2 only

D)2 and 4 only

Consider the price paths of the following stocks over a six-month period:

None of these stocks pay dividends.

None of these stocks pay dividends.Assume that you are an investor with the disposition effect and you bought each of these stocks in January. Suppose that it is currently the end of March, which stocks are you most inclined to hold? 1. Taggart Transcontinental

2. Rearden Metal

3. Wyatt Oil

4. Nielson Motors

A)1 only

B)1 and 3 only

C)2 only

D)2 and 4 only

2 and 4 only

3

Use the following information to answer the question(s)below.

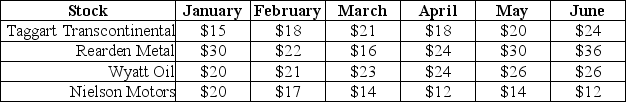

Consider the price paths of the following stocks over a six-month period:

None of these stocks pay dividends.

None of these stocks pay dividends.

Assume that you are an investor with the disposition effect and you bought each of these stocks in January. Suppose that it is currently the end of March, which stocks are you most inclined to sell? 1. Taggart Transcontinental

2. Rearden Metal

3. Wyatt Oil

4. Nielson Motors

A)1 only

B)1 and 3 only

C)2 only

D)2 and 4 only

Consider the price paths of the following stocks over a six-month period:

None of these stocks pay dividends.

None of these stocks pay dividends.Assume that you are an investor with the disposition effect and you bought each of these stocks in January. Suppose that it is currently the end of March, which stocks are you most inclined to sell? 1. Taggart Transcontinental

2. Rearden Metal

3. Wyatt Oil

4. Nielson Motors

A)1 only

B)1 and 3 only

C)2 only

D)2 and 4 only

1 and 3 only

4

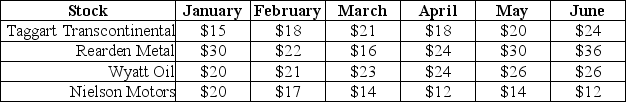

Which of the following stocks represent buying opportunities? 1. Taggart Transcontinental

2. Rearden Metal

3. Wyatt Oil

4. Nielson Motors

A)1 only

B)1 and 2 only

C)2 and 3 only

D)2 and 4 only

2. Rearden Metal

3. Wyatt Oil

4. Nielson Motors

A)1 only

B)1 and 2 only

C)2 and 3 only

D)2 and 4 only

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

5

If investors believe that others have superior information which they can take advantage of by copying their trades, this can lead to:

A)an informational cascade effect.

B)a disposition effect.

C)a sensation seeking effect.

D)an overconfidence bias.

A)an informational cascade effect.

B)a disposition effect.

C)a sensation seeking effect.

D)an overconfidence bias.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

6

The tendency to hang on to losers and sell winners is known as the:

A)cascade effect.

B)disposition effect.

C)overconfidence bias.

D)systematic behavior bias.

A)cascade effect.

B)disposition effect.

C)overconfidence bias.

D)systematic behavior bias.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

7

Use the following information to answer the question(s)below.

Assume that the economy has three types of people. 20% are fad followers, 75% are passive investors, and 5% are informed traders. The portfolio consisting of all informed traders has a beta of 1.4 and an expected return of 16%. The market has an expected return of 10% and the risk-free rate is 4%.

The alpha for the informed investors is closest to:

A)-2.4%

B)-0.9%

C)0.0%

D)3.6%

Assume that the economy has three types of people. 20% are fad followers, 75% are passive investors, and 5% are informed traders. The portfolio consisting of all informed traders has a beta of 1.4 and an expected return of 16%. The market has an expected return of 10% and the risk-free rate is 4%.

The alpha for the informed investors is closest to:

A)-2.4%

B)-0.9%

C)0.0%

D)3.6%

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following stocks represent selling opportunities? 1. Taggart Transcontinental

2. Rearden Metal

3. Wyatt Oil

4. Nielson Motors

A)1 only

B)1 and 2 only

C)2 and 3 only

D)2 and 4 only

2. Rearden Metal

3. Wyatt Oil

4. Nielson Motors

A)1 only

B)1 and 2 only

C)2 and 3 only

D)2 and 4 only

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

9

The tendency of uninformed individuals to overestimate the precision of their knowledge is known as:

A)overconfidence bias.

B)herd behavior.

C)familiarity bias.

D)disposition bias.

A)overconfidence bias.

B)herd behavior.

C)familiarity bias.

D)disposition bias.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

10

Investors that suffer from a familiarity bias:

A)prefer not to invest in companies they are familiar with.

B)favor investments in companies they are familiar with.

C)invest in the same stocks that their friends or family recommend.

D)tend to overestimate the precision of their knowledge.

A)prefer not to invest in companies they are familiar with.

B)favor investments in companies they are familiar with.

C)invest in the same stocks that their friends or family recommend.

D)tend to overestimate the precision of their knowledge.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

11

Use the following information to answer the question(s)below.

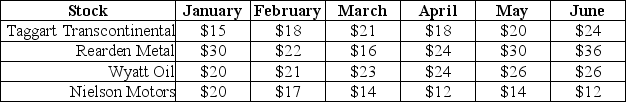

Consider the price paths of the following stocks over a six-month period:

None of these stocks pay dividends.

None of these stocks pay dividends.

Assume that you are an investor with the disposition effect and you bought each of these stocks in January. Suppose that it is currently the end of June, which stocks are you most inclined to sell? 1. Taggart Transcontinental

2. Rearden Metal

3. Wyatt Oil

4. Nielson Motors

A)1 only

B)1 and 3 only

C)2 only

D)1, 2, and 3 only

Consider the price paths of the following stocks over a six-month period:

None of these stocks pay dividends.

None of these stocks pay dividends.Assume that you are an investor with the disposition effect and you bought each of these stocks in January. Suppose that it is currently the end of June, which stocks are you most inclined to sell? 1. Taggart Transcontinental

2. Rearden Metal

3. Wyatt Oil

4. Nielson Motors

A)1 only

B)1 and 3 only

C)2 only

D)1, 2, and 3 only

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

12

If investors have relative wealth concerns, they care most about:

A)the return on their portfolio relative to their overall current wealth.

B)the performance of their portfolio relative to that of their peers.

C)their current portfolio performance relative to their past portfolio performance.

D)the performance of their current wealth relative to their past wealth.

A)the return on their portfolio relative to their overall current wealth.

B)the performance of their portfolio relative to that of their peers.

C)their current portfolio performance relative to their past portfolio performance.

D)the performance of their current wealth relative to their past wealth.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

13

An individual's desire for intense risk-taking experiences is known as:

A)phenomenon seeking.

B)herd seeking.

C)sensation seeking.

D)rational expectations seeking.

A)phenomenon seeking.

B)herd seeking.

C)sensation seeking.

D)rational expectations seeking.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

14

Use the following information to answer the question(s)below.

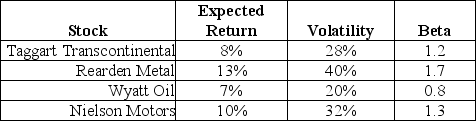

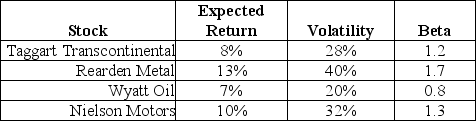

Assume that the CAPM is a good description of stock price returns. The market expected return is 8% with 12% volatility and the risk-free rate is 3%. New news arrives that does not change any of these numbers, but it does change the expected returns of the following stocks:

The expected alpha for Taggart Transcontinental is closest to:

A)-3.00%

B)-1.00%

C)1.00%

D)3.00%

Assume that the CAPM is a good description of stock price returns. The market expected return is 8% with 12% volatility and the risk-free rate is 3%. New news arrives that does not change any of these numbers, but it does change the expected returns of the following stocks:

The expected alpha for Taggart Transcontinental is closest to:

A)-3.00%

B)-1.00%

C)1.00%

D)3.00%

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

15

The expected alpha for Wyatt Oil is closest to:

A)-3.00%

B)-1.00%

C)0.00%

D)3.00%

A)-3.00%

B)-1.00%

C)0.00%

D)3.00%

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

16

When investors imitate each other's actions, this is known as ________ behavior.

A)pack

B)flock

C)herd

D)shepherd

A)pack

B)flock

C)herd

D)shepherd

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

17

A stock's alpha is defined as the stock's:

A)expected return minus its required return.

B)expected return minus its actual return.

C)nominal return minus its required return.

D)required return minus its actual return.

A)expected return minus its required return.

B)expected return minus its actual return.

C)nominal return minus its required return.

D)required return minus its actual return.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

18

When all investors correctly interpret and use their own information, as well as information that can be inferred from market prices or the trades of others, they are said to have:

A)sensation seeking expectations.

B)positive expectations.

C)rational expectations.

D)confident expectations.

A)sensation seeking expectations.

B)positive expectations.

C)rational expectations.

D)confident expectations.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is NOT true regarding individual investor behavior?

A)Individual investors fail to diversify their portfolios adequately.

B)A vast majority of individual investors hold fewer than 10 stocks in their portfolio.

C)Employees tend to overinvest in their company's own stock.

D)Individual investors' portfolios consistently outperform the market averages.

A)Individual investors fail to diversify their portfolios adequately.

B)A vast majority of individual investors hold fewer than 10 stocks in their portfolio.

C)Employees tend to overinvest in their company's own stock.

D)Individual investors' portfolios consistently outperform the market averages.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

20

Use the following information to answer the question(s)below.

Consider the price paths of the following stocks over a six-month period:

None of these stocks pay dividends.

None of these stocks pay dividends.

Assume that you are an investor with the disposition effect and you bought each of these stocks in January. Suppose that it is currently the end of June, which stocks are you most inclined to hold? 1. Taggart Transcontinental

2. Rearden Metal

3. Wyatt Oil

4. Nielson Motors

A)1 only

B)4 only

C)1 and 3 only

D)2 and 4 only

Consider the price paths of the following stocks over a six-month period:

None of these stocks pay dividends.

None of these stocks pay dividends.Assume that you are an investor with the disposition effect and you bought each of these stocks in January. Suppose that it is currently the end of June, which stocks are you most inclined to hold? 1. Taggart Transcontinental

2. Rearden Metal

3. Wyatt Oil

4. Nielson Motors

A)1 only

B)4 only

C)1 and 3 only

D)2 and 4 only

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

21

Use the following information to answer the question(s)below.

John Galt is a mutual fund manager at Atlas Asset Management. He can generate an alpha of 2% a year up to $500 million of invested capital. After that amount his skills are spread too thin, so he cannot add value and his alpha is zero for all investments over $500 million. Atlas Asset Management charges a fee of 0.80% on the total amount of money under management. Assume that there are always investors looking for positive alpha investments and no investor would invest in a fund with a negative alpha. Assume that the fund is in equilibrium, meaning that no investor either takes out money or wishes to invest new money into the fund.

The amount of fee income that Galt's fund will generate is closest to:

A)$3.75 million

B)$8.00 million

C)$10.00 million

D)$25.00 million

John Galt is a mutual fund manager at Atlas Asset Management. He can generate an alpha of 2% a year up to $500 million of invested capital. After that amount his skills are spread too thin, so he cannot add value and his alpha is zero for all investments over $500 million. Atlas Asset Management charges a fee of 0.80% on the total amount of money under management. Assume that there are always investors looking for positive alpha investments and no investor would invest in a fund with a negative alpha. Assume that the fund is in equilibrium, meaning that no investor either takes out money or wishes to invest new money into the fund.

The amount of fee income that Galt's fund will generate is closest to:

A)$3.75 million

B)$8.00 million

C)$10.00 million

D)$25.00 million

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

22

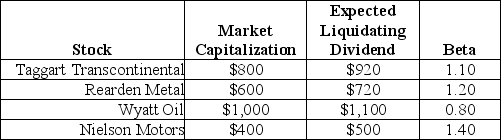

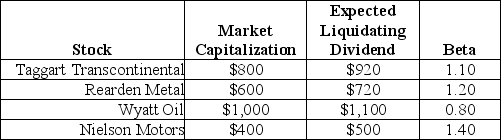

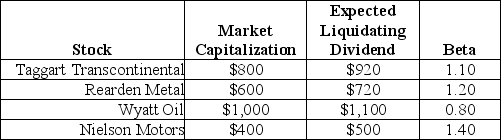

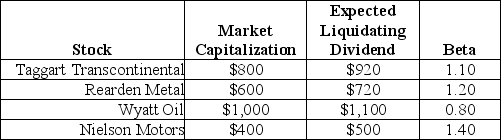

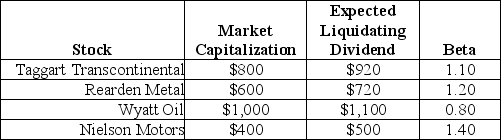

Use the following information to answer the question(s)below.

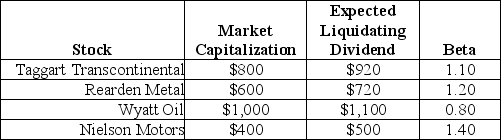

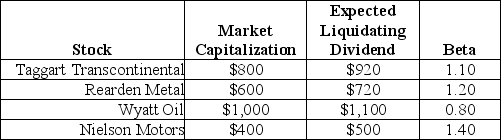

All amounts are in millions.

All amounts are in millions.

The correlation between the expected return and the market capitalization of these stocks is

A)negative.

B)positive.

C)zero.

D)Unable to determine with the information given

All amounts are in millions.

All amounts are in millions.The correlation between the expected return and the market capitalization of these stocks is

A)negative.

B)positive.

C)zero.

D)Unable to determine with the information given

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

23

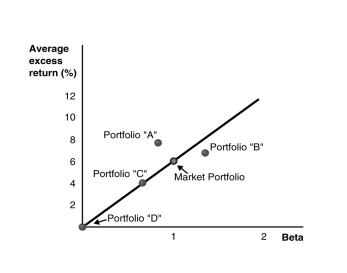

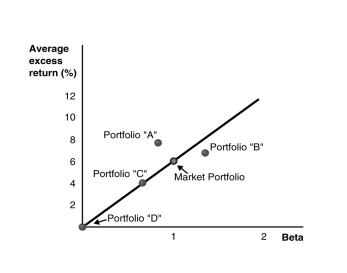

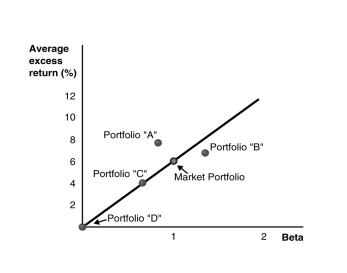

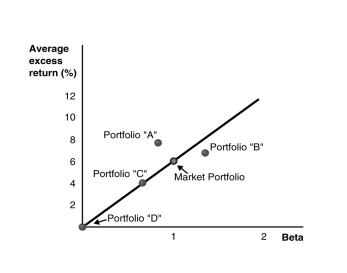

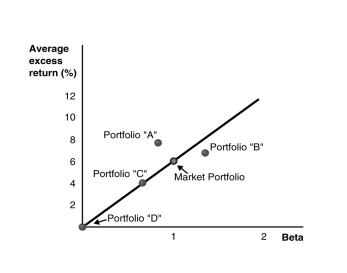

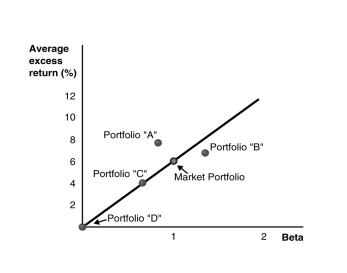

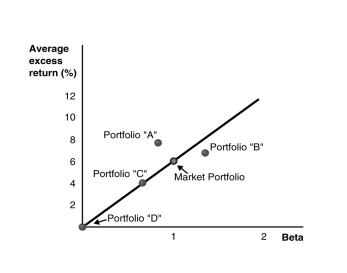

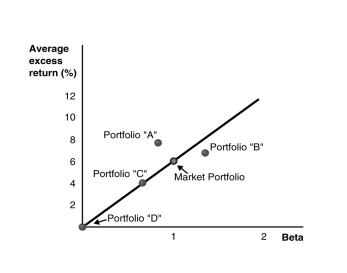

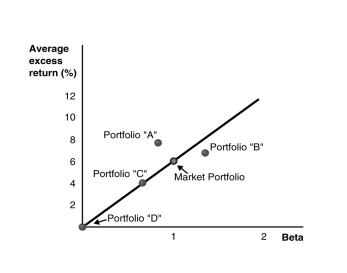

Use the figure for the question(s)below.

Consider the following graph of the security market line:

Portfolio "B":

A)is less risky than the market portfolio.

B)is overpriced.

C)has a positive alpha.

D)falls above the SML.

Consider the following graph of the security market line:

Portfolio "B":

A)is less risky than the market portfolio.

B)is overpriced.

C)has a positive alpha.

D)falls above the SML.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

24

Use the following information to answer the question(s)below.

All amounts are in millions.

All amounts are in millions.

Which of the following statements is FALSE?

A)If the market portfolio is efficient, then all securities and portfolios must plot on the SML, not just individual stocks.

B)For most stocks the standard errors of the alpha estimates are large, so it is impossible to conclude that the alphas are statistically different from zero.

C)It is not difficult to find individual stocks that, in the past have not plotted on the SML.

D)Small stocks (those with lower market capitalization)have lower average returns.

All amounts are in millions.

All amounts are in millions.Which of the following statements is FALSE?

A)If the market portfolio is efficient, then all securities and portfolios must plot on the SML, not just individual stocks.

B)For most stocks the standard errors of the alpha estimates are large, so it is impossible to conclude that the alphas are statistically different from zero.

C)It is not difficult to find individual stocks that, in the past have not plotted on the SML.

D)Small stocks (those with lower market capitalization)have lower average returns.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

25

Use the following information to answer the question(s)below.

Assume that the economy has three types of people. 20% are fad followers, 75% are passive investors, and 5% are informed traders. The portfolio consisting of all informed traders has a beta of 1.4 and an expected return of 16%. The market has an expected return of 10% and the risk-free rate is 4%.

The expected return for the fad follower's portfolio is closest to:

A)11.5%

B)12.4%

C)13.6%

D)16.0%

Assume that the economy has three types of people. 20% are fad followers, 75% are passive investors, and 5% are informed traders. The portfolio consisting of all informed traders has a beta of 1.4 and an expected return of 16%. The market has an expected return of 10% and the risk-free rate is 4%.

The expected return for the fad follower's portfolio is closest to:

A)11.5%

B)12.4%

C)13.6%

D)16.0%

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

26

Use the following information to answer the question(s)below.

John Galt is a mutual fund manager at Atlas Asset Management. He can generate an alpha of 2% a year up to $500 million of invested capital. After that amount his skills are spread too thin, so he cannot add value and his alpha is zero for all investments over $500 million. Atlas Asset Management charges a fee of 0.80% on the total amount of money under management. Assume that there are always investors looking for positive alpha investments and no investor would invest in a fund with a negative alpha. Assume that the fund is in equilibrium, meaning that no investor either takes out money or wishes to invest new money into the fund.

The alpha that investors in Galt's fund expect to receive is closest to:

A)-.80%

B)0.0%

C)0.80%

D)1.8%

John Galt is a mutual fund manager at Atlas Asset Management. He can generate an alpha of 2% a year up to $500 million of invested capital. After that amount his skills are spread too thin, so he cannot add value and his alpha is zero for all investments over $500 million. Atlas Asset Management charges a fee of 0.80% on the total amount of money under management. Assume that there are always investors looking for positive alpha investments and no investor would invest in a fund with a negative alpha. Assume that the fund is in equilibrium, meaning that no investor either takes out money or wishes to invest new money into the fund.

The alpha that investors in Galt's fund expect to receive is closest to:

A)-.80%

B)0.0%

C)0.80%

D)1.8%

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

27

Use the following information to answer the question(s)below.

All amounts are in millions.

All amounts are in millions.

Which of the following statements is FALSE?

A)A momentum strategy is one where you buy stocks that have had low past returns and (short)sell stocks that have had high past returns.

B)Over the years since the discovery of the CAPM, it has become increasing clear to researchers and practitioners alike that forming portfolios based on market capitalization, book-to-market ratios, and past returns, one can construct trading strategies that have a positive alpha.

C)Portfolios containing firms with the highest realized returns over the previous six months have positive alphas over the next six months.

D)If the market portfolio is not efficient, then a portfolio of small stocks will likely have positive alphas.

All amounts are in millions.

All amounts are in millions.Which of the following statements is FALSE?

A)A momentum strategy is one where you buy stocks that have had low past returns and (short)sell stocks that have had high past returns.

B)Over the years since the discovery of the CAPM, it has become increasing clear to researchers and practitioners alike that forming portfolios based on market capitalization, book-to-market ratios, and past returns, one can construct trading strategies that have a positive alpha.

C)Portfolios containing firms with the highest realized returns over the previous six months have positive alphas over the next six months.

D)If the market portfolio is not efficient, then a portfolio of small stocks will likely have positive alphas.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

28

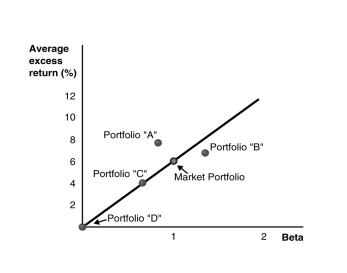

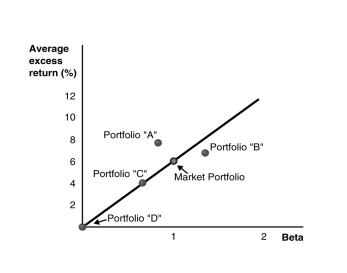

Use the figure for the question(s)below.

Consider the following graph of the security market line:

Portfolio "A":

A)has a relatively lower expected return than predicted.

B)has a positive alpha.

C)falls below the SML.

D)is overpriced.

Consider the following graph of the security market line:

Portfolio "A":

A)has a relatively lower expected return than predicted.

B)has a positive alpha.

C)falls below the SML.

D)is overpriced.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

29

Use the figure for the question(s)below.

Consider the following graph of the security market line:

Which of the following statements regarding portfolio "A" is/are correct? 1. Portfolio "A" has a positive alpha.

2. Portfolio "A" is overpriced.

3. Portfolio "A" is less risky than the market portfolio.

4. Portfolio "A" should not exist if the market portfolio is efficient.

A)1 and 2

B)1, 3, and 4

C)1 and 3

D)1, 2, 3, and 4

Consider the following graph of the security market line:

Which of the following statements regarding portfolio "A" is/are correct? 1. Portfolio "A" has a positive alpha.

2. Portfolio "A" is overpriced.

3. Portfolio "A" is less risky than the market portfolio.

4. Portfolio "A" should not exist if the market portfolio is efficient.

A)1 and 2

B)1, 3, and 4

C)1 and 3

D)1, 2, 3, and 4

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

30

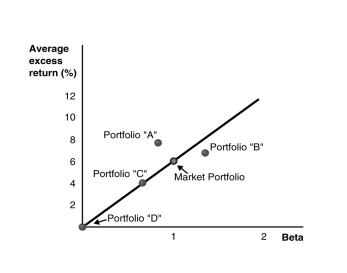

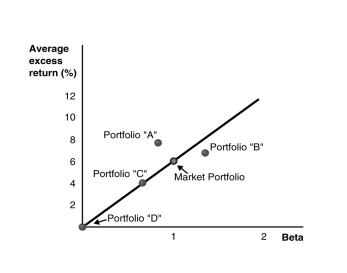

Use the figure for the question(s)below.

Consider the following graph of the security market line:

Portfolio "C":

A)is less risky than the market portfolio.

B)has a relatively lower expected return than predicted.

C)is underpriced.

D)has a negative alpha.

Consider the following graph of the security market line:

Portfolio "C":

A)is less risky than the market portfolio.

B)has a relatively lower expected return than predicted.

C)is underpriced.

D)has a negative alpha.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

31

Use the following information to answer the question(s)below.

All amounts are in millions.

All amounts are in millions.

If the risk-free rate is 3% and the market risk premium is 5%, then the CAPM's predicted expected return for Wyatt Oil is closest to:

A)7.0%

B)8.5%

C)9.0%

D)9.5%

All amounts are in millions.

All amounts are in millions.If the risk-free rate is 3% and the market risk premium is 5%, then the CAPM's predicted expected return for Wyatt Oil is closest to:

A)7.0%

B)8.5%

C)9.0%

D)9.5%

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

32

Use the figure for the question(s)below.

Consider the following graph of the security market line:

The market portfolio:

A)is underpriced.

B)has a positive alpha.

C)is overpriced.

D)falls on the SML.

Consider the following graph of the security market line:

The market portfolio:

A)is underpriced.

B)has a positive alpha.

C)is overpriced.

D)falls on the SML.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

33

Use the following information to answer the question(s)below.

All amounts are in millions.

All amounts are in millions.

If the risk-free rate is 3% and the market risk premium is 5%, then the CAPM's predicted expected return for Nielson Motors is closest to:

A)8.5%

B)9.0%

C)9.5%

D)10.0%

All amounts are in millions.

All amounts are in millions.If the risk-free rate is 3% and the market risk premium is 5%, then the CAPM's predicted expected return for Nielson Motors is closest to:

A)8.5%

B)9.0%

C)9.5%

D)10.0%

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

34

Use the following information to answer the question(s)below.

John Galt is a mutual fund manager at Atlas Asset Management. He can generate an alpha of 2% a year up to $500 million of invested capital. After that amount his skills are spread too thin, so he cannot add value and his alpha is zero for all investments over $500 million. Atlas Asset Management charges a fee of 0.80% on the total amount of money under management. Assume that there are always investors looking for positive alpha investments and no investor would invest in a fund with a negative alpha. Assume that the fund is in equilibrium, meaning that no investor either takes out money or wishes to invest new money into the fund.

A stock's ________ measures the stock's return relative to that predicted based on its beta, at the time of some event.

A)excessive abnormal return

B)cumulative average return

C)excessive predicted return

D)cumulative abnormal return

John Galt is a mutual fund manager at Atlas Asset Management. He can generate an alpha of 2% a year up to $500 million of invested capital. After that amount his skills are spread too thin, so he cannot add value and his alpha is zero for all investments over $500 million. Atlas Asset Management charges a fee of 0.80% on the total amount of money under management. Assume that there are always investors looking for positive alpha investments and no investor would invest in a fund with a negative alpha. Assume that the fund is in equilibrium, meaning that no investor either takes out money or wishes to invest new money into the fund.

A stock's ________ measures the stock's return relative to that predicted based on its beta, at the time of some event.

A)excessive abnormal return

B)cumulative average return

C)excessive predicted return

D)cumulative abnormal return

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

35

Use the following information to answer the question(s)below.

Assume that the economy has three types of people. 20% are fad followers, 75% are passive investors, and 5% are informed traders. The portfolio consisting of all informed traders has a beta of 1.4 and an expected return of 16%. The market has an expected return of 10% and the risk-free rate is 4%.

The alpha for the fad follower's portfolio is closest to:

A)-0.9%

B)0.0%

C)3.6%

D)6.0%

Assume that the economy has three types of people. 20% are fad followers, 75% are passive investors, and 5% are informed traders. The portfolio consisting of all informed traders has a beta of 1.4 and an expected return of 16%. The market has an expected return of 10% and the risk-free rate is 4%.

The alpha for the fad follower's portfolio is closest to:

A)-0.9%

B)0.0%

C)3.6%

D)6.0%

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

36

Use the following information to answer the question(s)below.

All amounts are in millions.

All amounts are in millions.

Which of the following statements is FALSE?

A)The size effect is the observation that small stocks have positive alphas.

B)When considering portfolios formed based on the book-to-market ratio, most of the portfolios plot below the security market line.

C)The largest alphas occur in the smallest size deciles.

D)When considering portfolios formed based on size, although the portfolios with the higher betas yield higher returns, most size portfolios plot above the security market line.

All amounts are in millions.

All amounts are in millions.Which of the following statements is FALSE?

A)The size effect is the observation that small stocks have positive alphas.

B)When considering portfolios formed based on the book-to-market ratio, most of the portfolios plot below the security market line.

C)The largest alphas occur in the smallest size deciles.

D)When considering portfolios formed based on size, although the portfolios with the higher betas yield higher returns, most size portfolios plot above the security market line.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

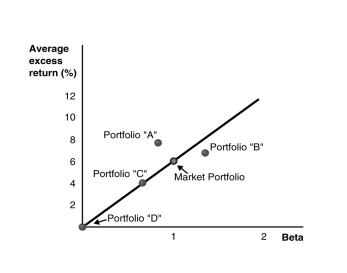

37

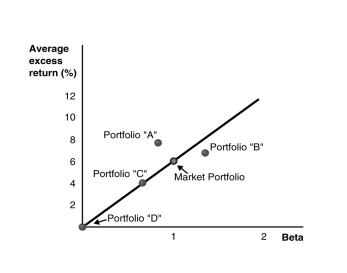

Use the figure for the question(s)below.

Consider the following graph of the security market line:

Portfolio "D":

A)falls below the SML.

B)has a negative alpha.

C)is overpriced.

D)offers an expected return equal to the risk-free rate.

Consider the following graph of the security market line:

Portfolio "D":

A)falls below the SML.

B)has a negative alpha.

C)is overpriced.

D)offers an expected return equal to the risk-free rate.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

38

Use the following information to answer the question(s)below.

John Galt is a mutual fund manager at Atlas Asset Management. He can generate an alpha of 2% a year up to $500 million of invested capital. After that amount his skills are spread too thin, so he cannot add value and his alpha is zero for all investments over $500 million. Atlas Asset Management charges a fee of 0.80% on the total amount of money under management. Assume that there are always investors looking for positive alpha investments and no investor would invest in a fund with a negative alpha. Assume that the fund is in equilibrium, meaning that no investor either takes out money or wishes to invest new money into the fund.

The amount of money that Galt's fund will have under management is closest to:

A)$500 million

B)$600 million

C)$1,000 million

D)$1,250 million

John Galt is a mutual fund manager at Atlas Asset Management. He can generate an alpha of 2% a year up to $500 million of invested capital. After that amount his skills are spread too thin, so he cannot add value and his alpha is zero for all investments over $500 million. Atlas Asset Management charges a fee of 0.80% on the total amount of money under management. Assume that there are always investors looking for positive alpha investments and no investor would invest in a fund with a negative alpha. Assume that the fund is in equilibrium, meaning that no investor either takes out money or wishes to invest new money into the fund.

The amount of money that Galt's fund will have under management is closest to:

A)$500 million

B)$600 million

C)$1,000 million

D)$1,250 million

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

39

Use the following information to answer the question(s)below.

All amounts are in millions.

All amounts are in millions.

Which of the following statements is FALSE?

A)Portfolios with high market capitalizations must have positive alphas if the market portfolio is not efficient.

B)The book-to-market is the observation that firms with high book-to-market ratios have positive alphas.

C)If the market portfolio is not efficient, then a portfolio of high book-to-market stocks will likely have positive alphas.

D)Portfolios with low book-to-market ratios must have zero alphas if the market portfolio is efficient.

All amounts are in millions.

All amounts are in millions.Which of the following statements is FALSE?

A)Portfolios with high market capitalizations must have positive alphas if the market portfolio is not efficient.

B)The book-to-market is the observation that firms with high book-to-market ratios have positive alphas.

C)If the market portfolio is not efficient, then a portfolio of high book-to-market stocks will likely have positive alphas.

D)Portfolios with low book-to-market ratios must have zero alphas if the market portfolio is efficient.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

40

Use the following information to answer the question(s)below.

Assume that the economy has three types of people. 20% are fad followers, 75% are passive investors, and 5% are informed traders. The portfolio consisting of all informed traders has a beta of 1.4 and an expected return of 16%. The market has an expected return of 10% and the risk-free rate is 4%.

The alpha for the passive investors is closest to:

A)-2.4%

B)-0.9%

C)0.0%

D)3.6%

Assume that the economy has three types of people. 20% are fad followers, 75% are passive investors, and 5% are informed traders. The portfolio consisting of all informed traders has a beta of 1.4 and an expected return of 16%. The market has an expected return of 10% and the risk-free rate is 4%.

The alpha for the passive investors is closest to:

A)-2.4%

B)-0.9%

C)0.0%

D)3.6%

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

41

Use the information for the question(s)below.

Consider two firms, Chihuahua Corporation and Bernard Industries that are each expected to pay the same $1.5 million dollar dividend every year in perpetuity. Chihuahua Corporation is riskier and has an equity cost of capital of 15%. Bernard Industries is not as shaky as Chihuahua, so Bernard has an equity cost of capital of only 10%. Assume that the market portfolio is not efficient. Both stocks have the same beta and the CAPM would assign them both an expected return of 12% to both.

The market value for Bernard is closest to:

A)$12.0 million

B)$10 million

C)$15.0 million

D)$12.5 million

Consider two firms, Chihuahua Corporation and Bernard Industries that are each expected to pay the same $1.5 million dollar dividend every year in perpetuity. Chihuahua Corporation is riskier and has an equity cost of capital of 15%. Bernard Industries is not as shaky as Chihuahua, so Bernard has an equity cost of capital of only 10%. Assume that the market portfolio is not efficient. Both stocks have the same beta and the CAPM would assign them both an expected return of 12% to both.

The market value for Bernard is closest to:

A)$12.0 million

B)$10 million

C)$15.0 million

D)$12.5 million

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

42

Use the information for the question(s)below.

Consider two firms, Chihuahua Corporation and Bernard Industries that are each expected to pay the same $1.5 million dollar dividend every year in perpetuity. Chihuahua Corporation is riskier and has an equity cost of capital of 15%. Bernard Industries is not as shaky as Chihuahua, so Bernard has an equity cost of capital of only 10%. Assume that the market portfolio is not efficient. Both stocks have the same beta and the CAPM would assign them both an expected return of 12% to both.

The alpha for Bernard is closest to:

A)+5%

B)-2%

C)-3%

D)+2%

Consider two firms, Chihuahua Corporation and Bernard Industries that are each expected to pay the same $1.5 million dollar dividend every year in perpetuity. Chihuahua Corporation is riskier and has an equity cost of capital of 15%. Bernard Industries is not as shaky as Chihuahua, so Bernard has an equity cost of capital of only 10%. Assume that the market portfolio is not efficient. Both stocks have the same beta and the CAPM would assign them both an expected return of 12% to both.

The alpha for Bernard is closest to:

A)+5%

B)-2%

C)-3%

D)+2%

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

43

What does the existence of a positive alpha investment strategy imply?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

44

The term  is a(n):

is a(n):

A)measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the second factor portfolio.

B)constant term.

C)error term that has an expectation of zero and is uncorrelated with either factor.

D)measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the first factor portfolio.

is a(n):

is a(n):A)measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the second factor portfolio.

B)constant term.

C)error term that has an expectation of zero and is uncorrelated with either factor.

D)measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the first factor portfolio.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following statements is FALSE?

A)If the CAPM correctly computes the risk premium, investors would stop investing only when they expected the alpha of an investment strategy to be negative.

B)If the CAPM correctly computes the risk premium, an investment opportunity with a positive alpha is a positive NPV investment opportunity.

C)If the CAPM correctly computes the risk premium, investors should flock to invest in positive alpha stocks.

D)Anyone can implement a momentum trading strategy and therefore generate a positive investment opportunity.

A)If the CAPM correctly computes the risk premium, investors would stop investing only when they expected the alpha of an investment strategy to be negative.

B)If the CAPM correctly computes the risk premium, an investment opportunity with a positive alpha is a positive NPV investment opportunity.

C)If the CAPM correctly computes the risk premium, investors should flock to invest in positive alpha stocks.

D)Anyone can implement a momentum trading strategy and therefore generate a positive investment opportunity.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

46

Various trading strategies appear to offer non-zero alphas when we examine real world data. If indeed these alphas are positive, it could be explained by any of the following EXCEPT:

A)Investors are systematically ignoring positive-NPV investment opportunities.

B)The market portfolio is inefficient, but the market portfolio proxy used to calculate the alphas is efficient.

C)A stock's beta with the market portfolio does not adequately measure a stock's systematic risk.

D)The positive alpha trading strategies contain risk that investors are unwilling to bear but the CAPM does not capture.

A)Investors are systematically ignoring positive-NPV investment opportunities.

B)The market portfolio is inefficient, but the market portfolio proxy used to calculate the alphas is efficient.

C)A stock's beta with the market portfolio does not adequately measure a stock's systematic risk.

D)The positive alpha trading strategies contain risk that investors are unwilling to bear but the CAPM does not capture.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following statements is FALSE?

A)The existence of the momentum trading strategy has been widely known for at least ten years.

B)The information required to implement a momentum strategy is not readily available to investors.

C)If the market portfolio is not efficient, then a stock's beta with the market is not an adequate measure of its systematic risk.

D)If the market portfolio is not efficient, then the so-called profits from a positive alpha trading strategy are really returns for bearing risk that investors are averse to and the CAPM doesn't capture.

A)The existence of the momentum trading strategy has been widely known for at least ten years.

B)The information required to implement a momentum strategy is not readily available to investors.

C)If the market portfolio is not efficient, then a stock's beta with the market is not an adequate measure of its systematic risk.

D)If the market portfolio is not efficient, then the so-called profits from a positive alpha trading strategy are really returns for bearing risk that investors are averse to and the CAPM doesn't capture.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

48

Use the information for the question(s)below.

Consider two firms, Chihuahua Corporation and Bernard Industries that are each expected to pay the same $1.5 million dollar dividend every year in perpetuity. Chihuahua Corporation is riskier and has an equity cost of capital of 15%. Bernard Industries is not as shaky as Chihuahua, so Bernard has an equity cost of capital of only 10%. Assume that the market portfolio is not efficient. Both stocks have the same beta and the CAPM would assign them both an expected return of 12% to both.

The market value for Chihuahua is closest to:

A)$10.0 million

B)$12.5 million

C)$12.0 million

D)$15 million

Consider two firms, Chihuahua Corporation and Bernard Industries that are each expected to pay the same $1.5 million dollar dividend every year in perpetuity. Chihuahua Corporation is riskier and has an equity cost of capital of 15%. Bernard Industries is not as shaky as Chihuahua, so Bernard has an equity cost of capital of only 10%. Assume that the market portfolio is not efficient. Both stocks have the same beta and the CAPM would assign them both an expected return of 12% to both.

The market value for Chihuahua is closest to:

A)$10.0 million

B)$12.5 million

C)$12.0 million

D)$15 million

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following statements is FALSE?

A)Nonzero alphas may merely indicate that the wrong market proxy is beings used; they do not necessarily indicate forgone positive NPV investment opportunities.

B)The true market portfolio contains much more than just stocks, it includes bonds, real estate, art, precious metals, and any other investment vehicles available.

C)If the true market portfolio is efficient, but the proxy portfolio is not highly correlated with the true market portfolio, then the true market portfolio will not be efficient and stocks will have nonzero alphas.

D)Much of the investment wealth cannot be included in the proxy for the market portfolio since it does not trade in competitive markets.

A)Nonzero alphas may merely indicate that the wrong market proxy is beings used; they do not necessarily indicate forgone positive NPV investment opportunities.

B)The true market portfolio contains much more than just stocks, it includes bonds, real estate, art, precious metals, and any other investment vehicles available.

C)If the true market portfolio is efficient, but the proxy portfolio is not highly correlated with the true market portfolio, then the true market portfolio will not be efficient and stocks will have nonzero alphas.

D)Much of the investment wealth cannot be included in the proxy for the market portfolio since it does not trade in competitive markets.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

50

Explain why the market portfolio proxy may not be efficient.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

51

The term  is a(n):

is a(n):

A)measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the second factor portfolio.

B)error term that has an expectation of zero and is uncorrelated with either factor.

C)constant term.

D)measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the first factor portfolio.

is a(n):

is a(n):A)measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the second factor portfolio.

B)error term that has an expectation of zero and is uncorrelated with either factor.

C)constant term.

D)measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the first factor portfolio.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

52

A group of portfolios from which we can form an efficient portfolio are called:

A)factor portfolios.

B)semi-efficient portfolios.

C)partially efficient portfolios.

D)characteristic portfolios.

A)factor portfolios.

B)semi-efficient portfolios.

C)partially efficient portfolios.

D)characteristic portfolios.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

53

The term as is a(n):

A)error term that has an expectation of zero and is uncorrelated with either factor.

B)measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the first factor portfolio.

C)measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the second factor portfolio.

D) constant term.

A)error term that has an expectation of zero and is uncorrelated with either factor.

B)measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the first factor portfolio.

C)measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the second factor portfolio.

D) constant term.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

54

Use the figure for the question(s)below.

Consider the following graph of the security market line:

Which of the following statements regarding portfolio "C" is/are correct? 1. Portfolio "C" has a negative alpha.

2. Portfolio "C" is overpriced.

3. Portfolio "C" is less risky than the market portfolio.

4. Portfolio "C" should not exist if the market portfolio is efficient.

A)1 and 3

B)2 and 4

C)1, 3, and 4

D)3 only

Consider the following graph of the security market line:

Which of the following statements regarding portfolio "C" is/are correct? 1. Portfolio "C" has a negative alpha.

2. Portfolio "C" is overpriced.

3. Portfolio "C" is less risky than the market portfolio.

4. Portfolio "C" should not exist if the market portfolio is efficient.

A)1 and 3

B)2 and 4

C)1, 3, and 4

D)3 only

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following is NOT an investment likely to be found in any proxy for the market portfolio?

A)Human capital

B)Stocks

C)Bonds

D)Precious metals

A)Human capital

B)Stocks

C)Bonds

D)Precious metals

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following statements is FALSE?

A)The most important example of non-tradeable wealth is human capital.

B)If investors have a significant amount of non-tradeable wealth, this wealth will be an important part of their portfolios, but will not be part of the market portfolio of tradeable securities.

C)If the entire portfolio of investments is efficient, then just the tradeable part of the portfolio should be efficient also.

D)Researchers have found evidence that the presence of human capital can explain at least part of the reason for the inefficiency of the most commonly used market proxies.

A)The most important example of non-tradeable wealth is human capital.

B)If investors have a significant amount of non-tradeable wealth, this wealth will be an important part of their portfolios, but will not be part of the market portfolio of tradeable securities.

C)If the entire portfolio of investments is efficient, then just the tradeable part of the portfolio should be efficient also.

D)Researchers have found evidence that the presence of human capital can explain at least part of the reason for the inefficiency of the most commonly used market proxies.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following statements is FALSE?

A)If indeed alphas are positive, it is possible that the positive alpha trading strategies contain risk that investors are unwilling to bear but the CAPM does not capture.

B)If indeed alphas are positive, it is possible that the costs of implementing investment strategies are larger than the NPVs of undertaking them.

C)If indeed alphas are positive, then investors have to be systematically ignoring negative-NPV investments opportunities.

D)The only way a positive NPV investment opportunity can exist in a market is if some barrier to entry restricts competition.

A)If indeed alphas are positive, it is possible that the positive alpha trading strategies contain risk that investors are unwilling to bear but the CAPM does not capture.

B)If indeed alphas are positive, it is possible that the costs of implementing investment strategies are larger than the NPVs of undertaking them.

C)If indeed alphas are positive, then investors have to be systematically ignoring negative-NPV investments opportunities.

D)The only way a positive NPV investment opportunity can exist in a market is if some barrier to entry restricts competition.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

58

Use the figure for the question(s)below.

Consider the following graph of the security market line:

Which of the following statements regarding portfolio "B" is/are correct? 1. Portfolio "B" has a positive alpha.

2. Portfolio "B" is overpriced.

3. Portfolio "B" is less risky than the market portfolio.

4. Portfolio "B" should not exist if the market portfolio is efficient.

A)2 and 4

B)4 only

C)1, 3, and 4

D)1 and 4

Consider the following graph of the security market line:

Which of the following statements regarding portfolio "B" is/are correct? 1. Portfolio "B" has a positive alpha.

2. Portfolio "B" is overpriced.

3. Portfolio "B" is less risky than the market portfolio.

4. Portfolio "B" should not exist if the market portfolio is efficient.

A)2 and 4

B)4 only

C)1, 3, and 4

D)1 and 4

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

59

Use the information for the question(s)below.

Consider two firms, Chihuahua Corporation and Bernard Industries that are each expected to pay the same $1.5 million dollar dividend every year in perpetuity. Chihuahua Corporation is riskier and has an equity cost of capital of 15%. Bernard Industries is not as shaky as Chihuahua, so Bernard has an equity cost of capital of only 10%. Assume that the market portfolio is not efficient. Both stocks have the same beta and the CAPM would assign them both an expected return of 12% to both.

The alpha for Chihuahua is closest to:

A)+2%

B)-5%

C)-3%

D)+3%

Consider two firms, Chihuahua Corporation and Bernard Industries that are each expected to pay the same $1.5 million dollar dividend every year in perpetuity. Chihuahua Corporation is riskier and has an equity cost of capital of 15%. Bernard Industries is not as shaky as Chihuahua, so Bernard has an equity cost of capital of only 10%. Assume that the market portfolio is not efficient. Both stocks have the same beta and the CAPM would assign them both an expected return of 12% to both.

The alpha for Chihuahua is closest to:

A)+2%

B)-5%

C)-3%

D)+3%

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following statements is FALSE?

A)A significant fraction of investors might care about aspects of their portfolios other than expected return and volatility, and so would be unwilling to hold inefficient investment portfolios.

B)Although the true market portfolio of all invested wealth might be efficient, the proxy portfolio might not track the actual market very well.

C)We might be using the wrong proxy portfolio when we calculate alphas.

D)The true market portfolio consists of all traded investment wealth in the economy.

A)A significant fraction of investors might care about aspects of their portfolios other than expected return and volatility, and so would be unwilling to hold inefficient investment portfolios.

B)Although the true market portfolio of all invested wealth might be efficient, the proxy portfolio might not track the actual market very well.

C)We might be using the wrong proxy portfolio when we calculate alphas.

D)The true market portfolio consists of all traded investment wealth in the economy.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

61

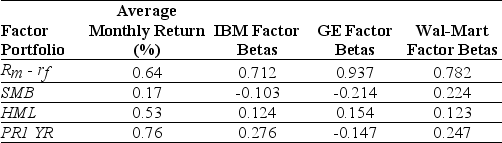

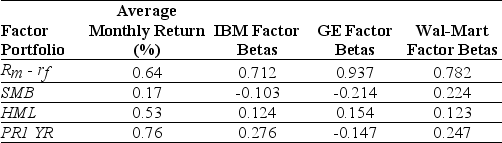

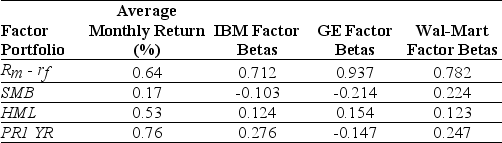

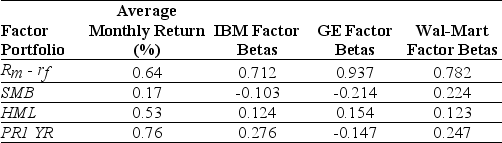

Use the table for the question(s)below.

Consider the following information regarding the Fama French Carhart four factor model:

According to a survey of 392 CFOs conducted by John Graham and Campbell Harvey, the most common method used in corporate America to estimate the cost of capital is

A)the CAPM.

B)multifactor models.

C)characteristic models.

D)the dividend discount model.

Consider the following information regarding the Fama French Carhart four factor model:

According to a survey of 392 CFOs conducted by John Graham and Campbell Harvey, the most common method used in corporate America to estimate the cost of capital is

A)the CAPM.

B)multifactor models.

C)characteristic models.

D)the dividend discount model.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following statements is FALSE?

A)It is not actually necessary to identify the efficient portfolio itself. All that is required is to identify a collection of portfolios from which the efficient portfolio can be constructed.

B)Although we might not be able to identify the efficient portfolio itself, we know some characteristics of the efficient portfolio.

C)An efficient portfolio can be constructed from other diversified portfolios.

D)An efficient portfolio need not be well diversified.

A)It is not actually necessary to identify the efficient portfolio itself. All that is required is to identify a collection of portfolios from which the efficient portfolio can be constructed.

B)Although we might not be able to identify the efficient portfolio itself, we know some characteristics of the efficient portfolio.

C)An efficient portfolio can be constructed from other diversified portfolios.

D)An efficient portfolio need not be well diversified.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

63

The term  measures the sensitivity of the securities returns to:

measures the sensitivity of the securities returns to:

A)the overall market.

B)book to market.

C)size.

D)momentum.

measures the sensitivity of the securities returns to:

measures the sensitivity of the securities returns to:A)the overall market.

B)book to market.

C)size.

D)momentum.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

64

Use the table for the question(s)below.

Consider the following information regarding the Fama French Carhart four factor model:

Using the FFC four factor model and the historical average monthly returns, the expected monthly return for Wal-Mart is closest to:

A)0.71%

B)0.53%

C)1.38%

D)0.79%

Consider the following information regarding the Fama French Carhart four factor model:

Using the FFC four factor model and the historical average monthly returns, the expected monthly return for Wal-Mart is closest to:

A)0.71%

B)0.53%

C)1.38%

D)0.79%

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

65

Use the table for the question(s)below.

Consider the following information regarding the Fama French Carhart four factor model:

Using the FFC four factor model and the historical average monthly returns, the expected monthly return for GE is closest to:

A)0.53%

B)0.73%

C)0.79%

D)0.71%

Consider the following information regarding the Fama French Carhart four factor model:

Using the FFC four factor model and the historical average monthly returns, the expected monthly return for GE is closest to:

A)0.53%

B)0.73%

C)0.79%

D)0.71%

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following statements is FALSE?

A)A portfolio costs nothing to construct is called a self-financing portfolio.

B)The most obvious portfolio to use in a multifactor model is the market portfolio itself.

C)In general, a self-financing portfolio is any portfolio with portfolio weights that sum to one rather than zero.

D)We can construct a self-financing portfolio by going long some stocks, and going short other stocks with equal market value.

A)A portfolio costs nothing to construct is called a self-financing portfolio.

B)The most obvious portfolio to use in a multifactor model is the market portfolio itself.

C)In general, a self-financing portfolio is any portfolio with portfolio weights that sum to one rather than zero.

D)We can construct a self-financing portfolio by going long some stocks, and going short other stocks with equal market value.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following statements is FALSE?

A)Rather than relying on the efficiency of a single portfolio (such as the market), multifactor models rely on the weaker condition that an efficient portfolio can be constructed from a collection of well-diversified portfolios or factors.

B)A positive alpha in a single factor model means that the portfolios that implement the trading strategy capture risk that is not captured by the market portfolio.

C)Multifactor models have a distinct advantage over single-factor models in that it is much easier to identify a collection of portfolios that captures systematic risk than just a single portfolio.

D)Trading strategies based on market capitalization, book-to-market ratios, and momentum have been developed that appear to have zero alphas.

A)Rather than relying on the efficiency of a single portfolio (such as the market), multifactor models rely on the weaker condition that an efficient portfolio can be constructed from a collection of well-diversified portfolios or factors.

B)A positive alpha in a single factor model means that the portfolios that implement the trading strategy capture risk that is not captured by the market portfolio.

C)Multifactor models have a distinct advantage over single-factor models in that it is much easier to identify a collection of portfolios that captures systematic risk than just a single portfolio.

D)Trading strategies based on market capitalization, book-to-market ratios, and momentum have been developed that appear to have zero alphas.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following statements is FALSE?

A)As a practical matter, it is extremely difficult to identify portfolios that are efficient because we cannot measure the expected return and the standard deviation of a portfolio with great accuracy.

B)The portfolios in a multifactor model can be thought of as either risk factors themselves or portfolios of stocks correlated with unobservable risk factors.

C)Each factor beta is the expected percent change in the excess return of a security for a 1% change in the excess return of the factor portfolio.

D)Even if the market portfolio is not efficient, it still must capture all components of systematic risk.

A)As a practical matter, it is extremely difficult to identify portfolios that are efficient because we cannot measure the expected return and the standard deviation of a portfolio with great accuracy.

B)The portfolios in a multifactor model can be thought of as either risk factors themselves or portfolios of stocks correlated with unobservable risk factors.

C)Each factor beta is the expected percent change in the excess return of a security for a 1% change in the excess return of the factor portfolio.

D)Even if the market portfolio is not efficient, it still must capture all components of systematic risk.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

69

The term  measures the sensitivity of the securities returns to:

measures the sensitivity of the securities returns to:

A)size.

B)book to market.

C)momentum.

D)the overall market.

measures the sensitivity of the securities returns to:

measures the sensitivity of the securities returns to:A)size.

B)book to market.

C)momentum.

D)the overall market.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

70

The term ε is a(n):

A)measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the first factor portfolio.

B)error term that has an expectation of zero and is uncorrelated with either factor.

C)measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the second factor portfolio.

D)constant term.

A)measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the first factor portfolio.

B)error term that has an expectation of zero and is uncorrelated with either factor.

C)measure of the expected percent change in the excess return of a security for a 1% change in the excess return of the second factor portfolio.

D)constant term.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

71

Use the table for the question(s)below.

Consider the following information regarding the Fama French Carhart four factor model:

Using the FFC four factor model and the historical average monthly returns, the expected monthly return for IBM is closest to:

A)0.79%

B)0.53%

C)0.71%

D)1.01%

Consider the following information regarding the Fama French Carhart four factor model:

Using the FFC four factor model and the historical average monthly returns, the expected monthly return for IBM is closest to:

A)0.79%

B)0.53%

C)0.71%

D)1.01%

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

72

The term  measures the sensitivity of the securities returns to:

measures the sensitivity of the securities returns to:

A)momentum.

B)the overall market.

C)book to market.

D)size.

measures the sensitivity of the securities returns to:

measures the sensitivity of the securities returns to:A)momentum.

B)the overall market.

C)book to market.

D)size.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following statements is FALSE?

A)The risk premium of any marketable security can be written as the sum of the risk premium of each factor multiplied by the sensitivity of the stock with that factor.

B)The factor betas measure the sensitivity of the stock to a particular factor.

C)If we use more than one portfolio as factors, then together these factors will capture systematic risk, but each factor captures different components of the systematic risk.

D)When we use more than one portfolio to capture risk, the model is known as a single factor model.

A)The risk premium of any marketable security can be written as the sum of the risk premium of each factor multiplied by the sensitivity of the stock with that factor.

B)The factor betas measure the sensitivity of the stock to a particular factor.

C)If we use more than one portfolio as factors, then together these factors will capture systematic risk, but each factor captures different components of the systematic risk.

D)When we use more than one portfolio to capture risk, the model is known as a single factor model.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following statements is FALSE?

A)Because expected returns are not easy to estimate, each portfolio that is added to a multifactor model increases the difficulty of implementing the model.

B)The self-financing portfolio made from high minus low book-to-market stocks is called the high-minus-low (HML)portfolio.

C)The FFC factor specification was identified a little more than ten years ago. Although it is widely used in academic literature to measure risk, much debate persists about whether it really is a significant improvement over the CAPM.

D)A trading strategy that each year short sells portfolio S (small stocks)and uses this position to buy portfolio B (big stocks)has produced positive risk adjusted returns historically. This self-financing portfolio is widely known as the small minus big (SMB)portfolio.

A)Because expected returns are not easy to estimate, each portfolio that is added to a multifactor model increases the difficulty of implementing the model.

B)The self-financing portfolio made from high minus low book-to-market stocks is called the high-minus-low (HML)portfolio.

C)The FFC factor specification was identified a little more than ten years ago. Although it is widely used in academic literature to measure risk, much debate persists about whether it really is a significant improvement over the CAPM.

D)A trading strategy that each year short sells portfolio S (small stocks)and uses this position to buy portfolio B (big stocks)has produced positive risk adjusted returns historically. This self-financing portfolio is widely known as the small minus big (SMB)portfolio.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

75

The term  measures the sensitivity of the securities returns to:

measures the sensitivity of the securities returns to:

A)book to market.

B)momentum.

C)size.

D)the overall market.

measures the sensitivity of the securities returns to:

measures the sensitivity of the securities returns to:A)book to market.

B)momentum.

C)size.

D)the overall market.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck