Deck 14: Financial Statement Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/84

Play

Full screen (f)

Deck 14: Financial Statement Analysis

1

If the interest rate on debt is higher than the ROA,then a firm's ROE will _________.

A) decrease

B) increase

C) not change

D) change but in an indeterminable manner

A) decrease

B) increase

C) not change

D) change but in an indeterminable manner

A

2

Firm A acquires Firm B when Firm B has a book value of assets of $155 million and a book value of liabilities of $35 million.Firm A actually pays $175 million for Firm

A) $175 million

B) $155 million

B) This purchase would result in goodwill for Firm A equal to

C) $120 million

D) $55 million Book Value of B = $155 - $35 = $120; Firm A pays $175, goodwill = $175 - $120 = $55

A) $175 million

B) $155 million

B) This purchase would result in goodwill for Firm A equal to

C) $120 million

D) $55 million Book Value of B = $155 - $35 = $120; Firm A pays $175, goodwill = $175 - $120 = $55

D

3

Common size balance sheets are prepared by dividing all quantities by ____________.

A) total assets

B) total liabilities

C) shareholder's equity

D) fixed assets

A) total assets

B) total liabilities

C) shareholder's equity

D) fixed assets

A

4

By 2008,over 100 countries have adopted financial reporting standards which are in conformance with ________.

A) GAAP

B) IFRS

C) FASB

D) GASB

A) GAAP

B) IFRS

C) FASB

D) GASB

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

5

The process of decomposing ROE into a series of component ratios is called ______________.

A) DuPont analysis

B) technical analysis

C) comparative analysis

D) liquidity analysis

A) DuPont analysis

B) technical analysis

C) comparative analysis

D) liquidity analysis

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

6

Many observers believe that firms "manage" their income statements to _______.

A) minimize taxes over time

B) maximize expenditures

C) smooth their earnings over time

D) generate level sales

A) minimize taxes over time

B) maximize expenditures

C) smooth their earnings over time

D) generate level sales

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

7

The highest possible value for the interest burden ratio is ______ and this occurs when the firm _________.

A) 0; uses as much debt as possible

B) 1; uses debt to the point where ROA = interest cost of debt

C) 1; uses no interest bearing debt

D) -1; pays down its existing debts

A) 0; uses as much debt as possible

B) 1; uses debt to the point where ROA = interest cost of debt

C) 1; uses no interest bearing debt

D) -1; pays down its existing debts

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

8

Cost of goods sold refers to ___________.

A) direct costs attributable to producing the product sold by the firm

B) salaries, advertising and selling expenses

C) payments to the firm's creditors

D) payments to federal and local governments

A) direct costs attributable to producing the product sold by the firm

B) salaries, advertising and selling expenses

C) payments to the firm's creditors

D) payments to federal and local governments

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is not one of the three key financial statements available to investors in publicly traded firms?

A) Income statement

B) Balance sheet

C) Statement of operating earnings

D) Statement of cash flows

A) Income statement

B) Balance sheet

C) Statement of operating earnings

D) Statement of cash flows

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

10

In 2006 Hewlett Packard repurchased shares of common stock worth $5,241 million and made dividend payments of $894 million.Other financing activities raised $196 million and Hewlett-Packard's total cash flow from financing was -$6,077 million.How much did the long term debt accounts of Hewlett Packard change?

A) Increased $138 million

B) Decreased $138 million

C) Increased $836 million

D) Decreased $836 million

A) Increased $138 million

B) Decreased $138 million

C) Increased $836 million

D) Decreased $836 million

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

11

Which one of the following ratios is used to calculate the times interest earned ratio?

A) Net profit/Interest expense

B) Pretax profit/EBIT

C) EBIT/Sales

D) EBIT/Interest expense

A) Net profit/Interest expense

B) Pretax profit/EBIT

C) EBIT/Sales

D) EBIT/Interest expense

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

12

Operating ROA is calculated as __________ while ROE is calculated as _________.

A) EBIT/Total Assets; Net Profit/Total Assets

B) Net Profit/Total Assets; EBIT/Total Assets

C) EBIT/Total Assets; Net Profit/Equity

D) Net Profit/EBIT; Sales/Total Assets

A) EBIT/Total Assets; Net Profit/Total Assets

B) Net Profit/Total Assets; EBIT/Total Assets

C) EBIT/Total Assets; Net Profit/Equity

D) Net Profit/EBIT; Sales/Total Assets

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

13

Based on the cash flow data in the table for Interceptors Inc.,which of the following statements is/are correct?

I)This firm appears to be a good investment because of its steady growth in cash.

II)This firm has only been able to generate growing cash flows by borrowing or selling equity to offset declining operating cash flows.

III)Financing activities have been increasingly important for this firm's operations,at least in the short run.

A) I only

B) II and III only

C) II only

D) I and II only

I)This firm appears to be a good investment because of its steady growth in cash.

II)This firm has only been able to generate growing cash flows by borrowing or selling equity to offset declining operating cash flows.

III)Financing activities have been increasingly important for this firm's operations,at least in the short run.

A) I only

B) II and III only

C) II only

D) I and II only

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

14

One of the biggest impediments to a global capital market is _________.

A) volatile exchange rates

B) the lack of common accounting standards

C) lower disclosure standards in the U.S. than abroad

D) the lack of transparent reporting standards across the EU

A) volatile exchange rates

B) the lack of common accounting standards

C) lower disclosure standards in the U.S. than abroad

D) the lack of transparent reporting standards across the EU

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

15

Benjamin Graham thought that the benefits from detailed analysis of a firm's financial statements had _________ over his long professional life.

A) increased greatly

B) increased slightly

C) remained constant

D) decreased

A) increased greatly

B) increased slightly

C) remained constant

D) decreased

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

16

A firm increases its financial leverage when its ROA is greater than the cost of debt.Everything else equal this change will probably increase the firm's _______.

I)beta

II)earnings variability over the business cycle

III)ROE

IV)stock price

A) I and II only

B) III and IV only

C) I, III and IV only

D) I, II and III only

I)beta

II)earnings variability over the business cycle

III)ROE

IV)stock price

A) I and II only

B) III and IV only

C) I, III and IV only

D) I, II and III only

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following assets is most liquid?

A) Cash equivalents

B) Receivables

C) Inventories

D) Plant and equipment

A) Cash equivalents

B) Receivables

C) Inventories

D) Plant and equipment

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

18

What must cash flow from financing have been in 2008 for Interceptors,Inc.?

A) $5

B) $28

C) $30

D) $33

A) $5

B) $28

C) $30

D) $33

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is not a ratio used in the DuPont analysis?

A) Interest burden

B) Profit margin

C) Asset turnover

D) Earnings yield ratio

A) Interest burden

B) Profit margin

C) Asset turnover

D) Earnings yield ratio

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

20

Depreciation expense is in what broad category of expenditures?

A) Cost of goods sold

B) General and administrative expenses

C) Debt interest expense

D) Tax expenditures

A) Cost of goods sold

B) General and administrative expenses

C) Debt interest expense

D) Tax expenditures

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

21

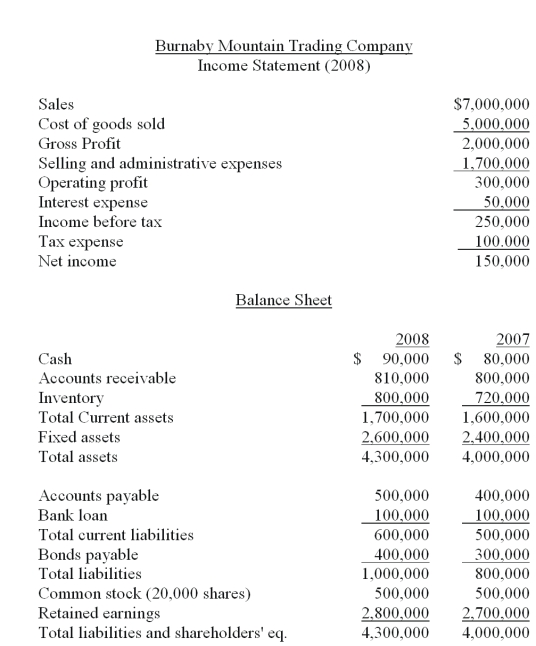

The financial statements of Flathead Lake Manufacturing Company are given below:  Note: The common shares are trading in the stock market for $15 per share

Note: The common shares are trading in the stock market for $15 per share

Refer to the financial statements of Flathead Lake Manufacturing Company.In 2007 Flathead generated ______ of EBIT for every dollar of sales.

A) $0.075

B) $0.086

C) $0.092

D) $0.099

Note: The common shares are trading in the stock market for $15 per share

Note: The common shares are trading in the stock market for $15 per shareRefer to the financial statements of Flathead Lake Manufacturing Company.In 2007 Flathead generated ______ of EBIT for every dollar of sales.

A) $0.075

B) $0.086

C) $0.092

D) $0.099

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

22

The financial statements of Flathead Lake Manufacturing Company are given below:  Note: The common shares are trading in the stock market for $15 per share

Note: The common shares are trading in the stock market for $15 per share

Refer to the financial statements of Flathead Lake Manufacturing Company.The firm's cash flow from operating activities for 2007 was _______.

A) $810,000

B) $775,000

C) $755,000

D) $735,000

Note: The common shares are trading in the stock market for $15 per share

Note: The common shares are trading in the stock market for $15 per shareRefer to the financial statements of Flathead Lake Manufacturing Company.The firm's cash flow from operating activities for 2007 was _______.

A) $810,000

B) $775,000

C) $755,000

D) $735,000

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

23

A firm has an ROA of 8%,a debt/equity ratio of 0.5,its ROE is _________.

A) 4%

B) 6%

C) 8%

D) 12%

A) 4%

B) 6%

C) 8%

D) 12%

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

24

Economic Value Added (EVA)is:

A) The difference between the return on assets and the opportunity cost of capital times the capital base

B) ROA x ROE

C) A measure of the firm's abnormal return

D) Largest for high growth firms

A) The difference between the return on assets and the opportunity cost of capital times the capital base

B) ROA x ROE

C) A measure of the firm's abnormal return

D) Largest for high growth firms

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

25

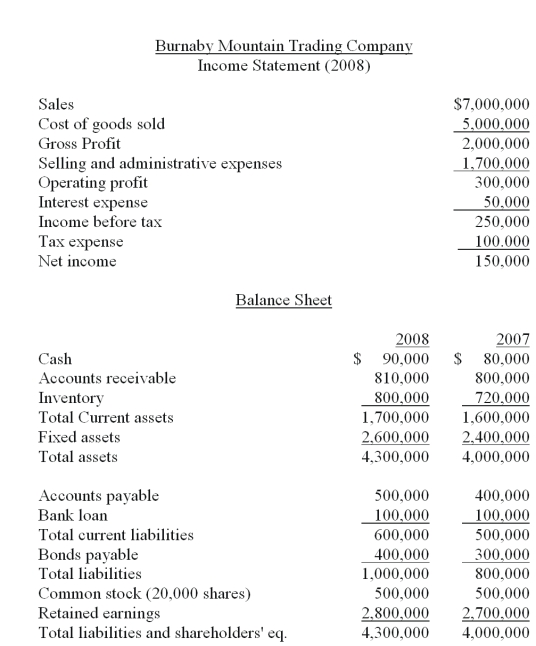

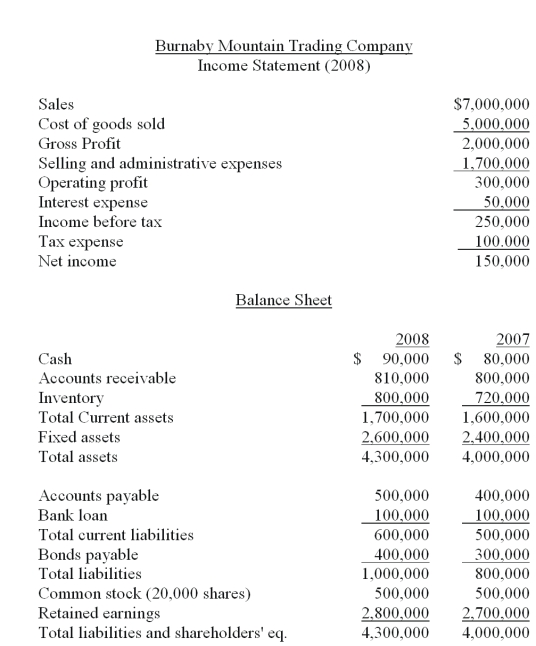

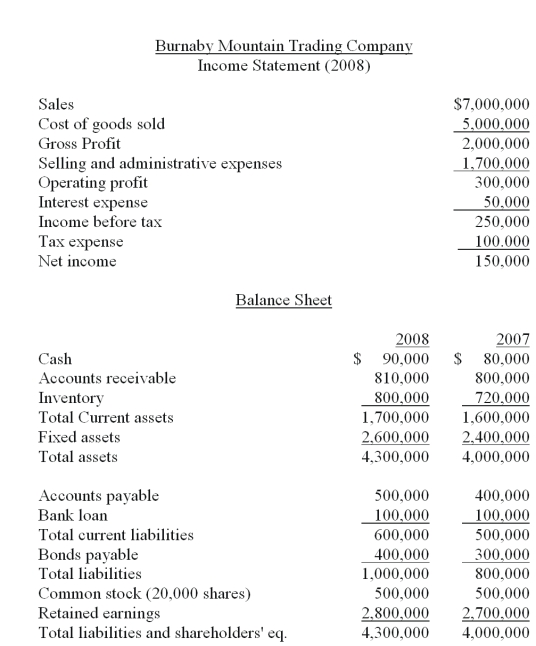

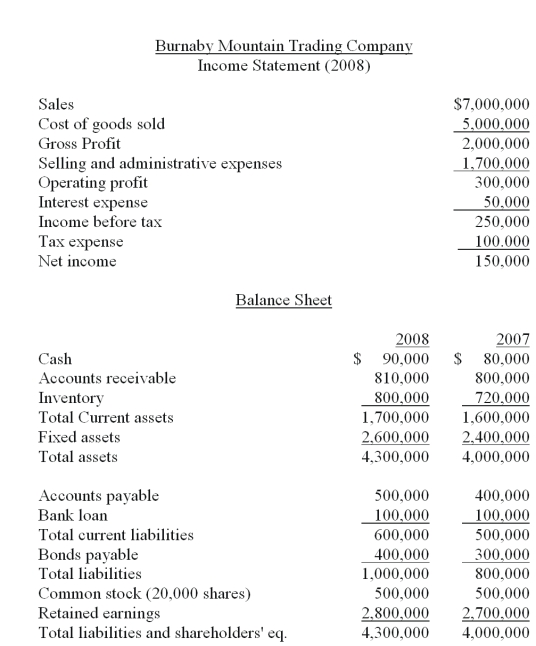

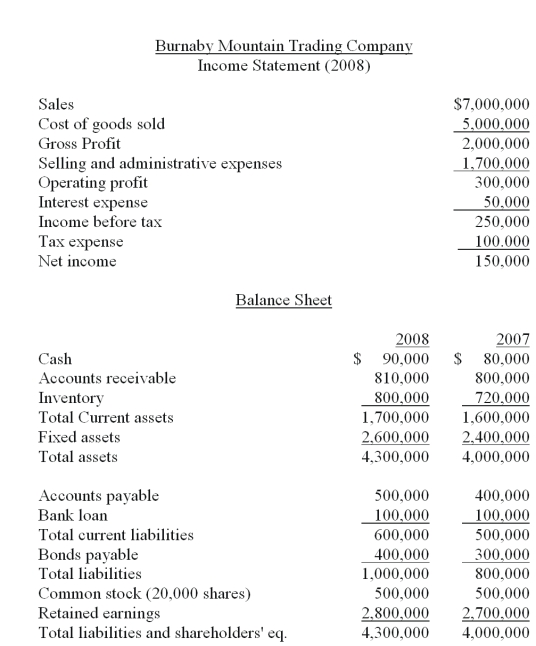

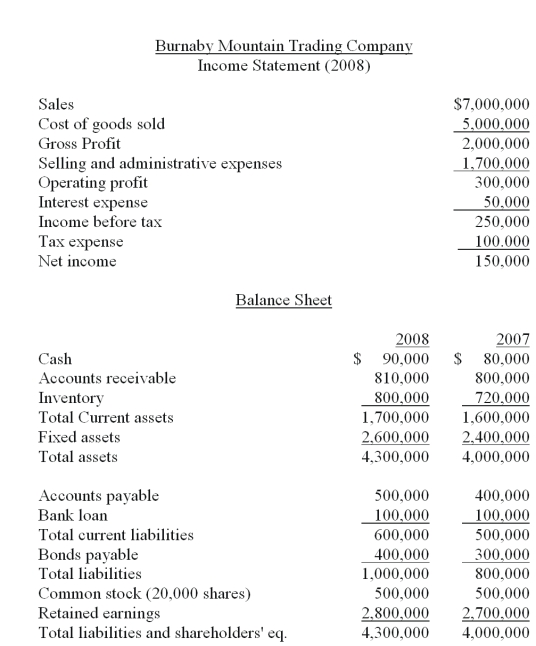

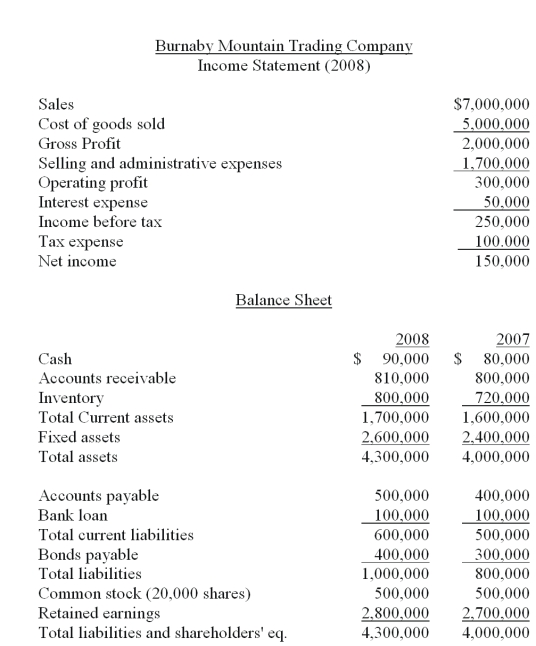

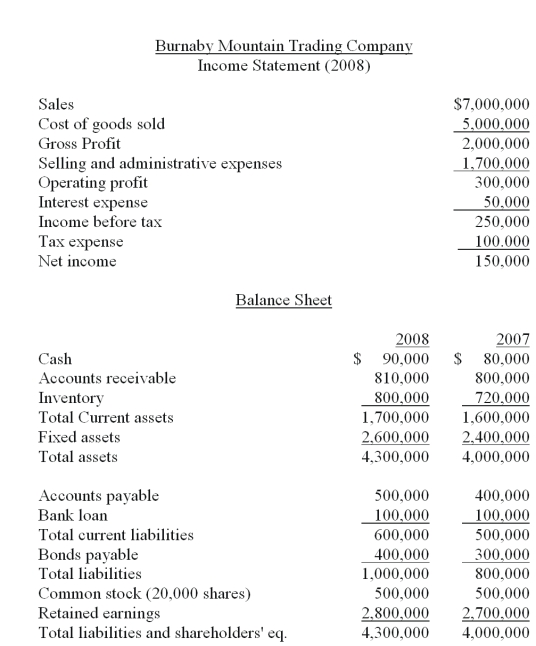

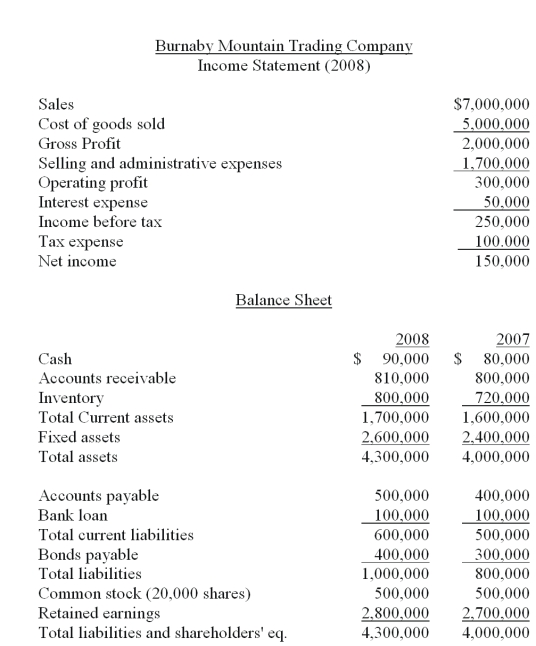

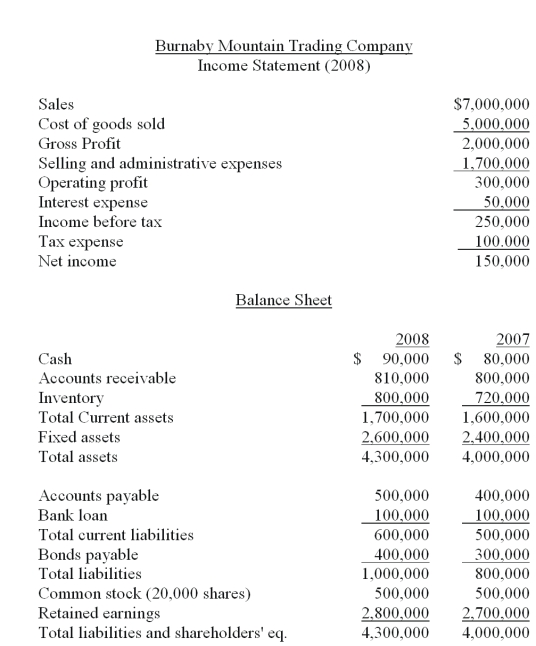

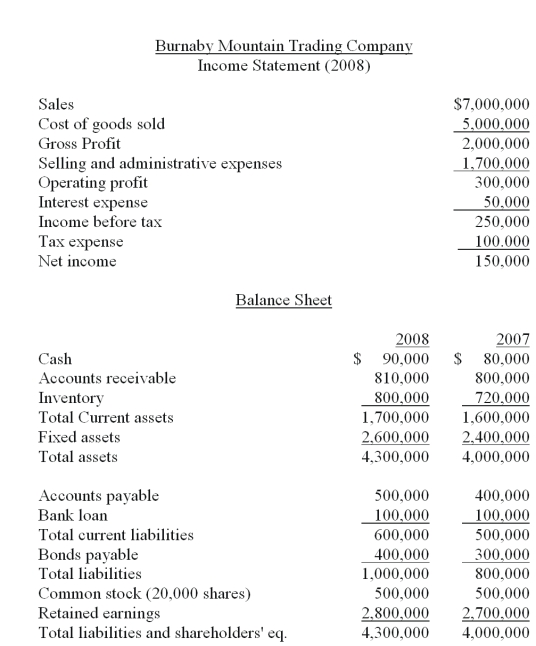

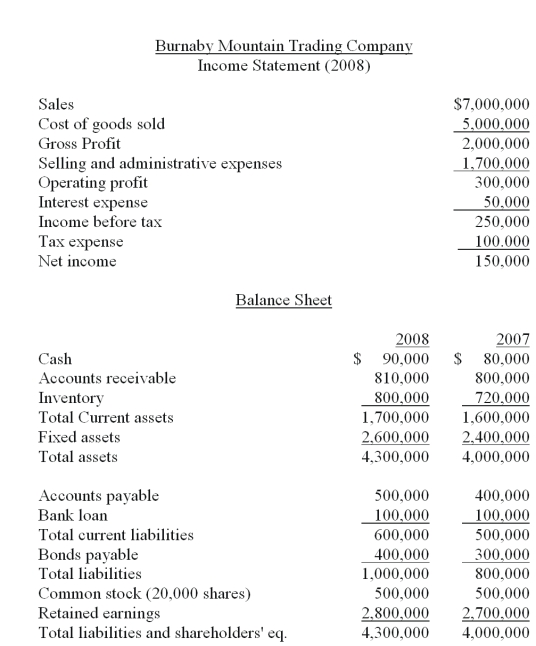

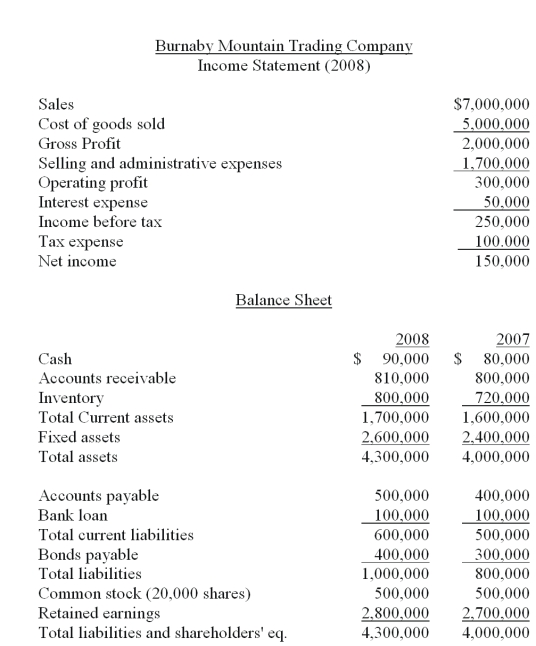

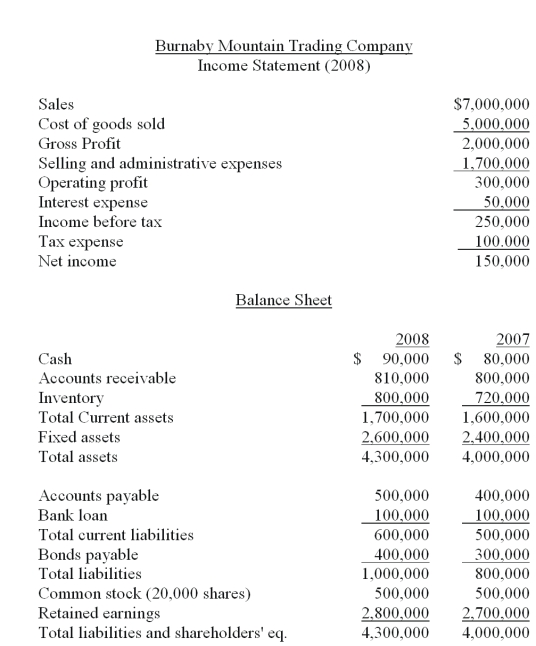

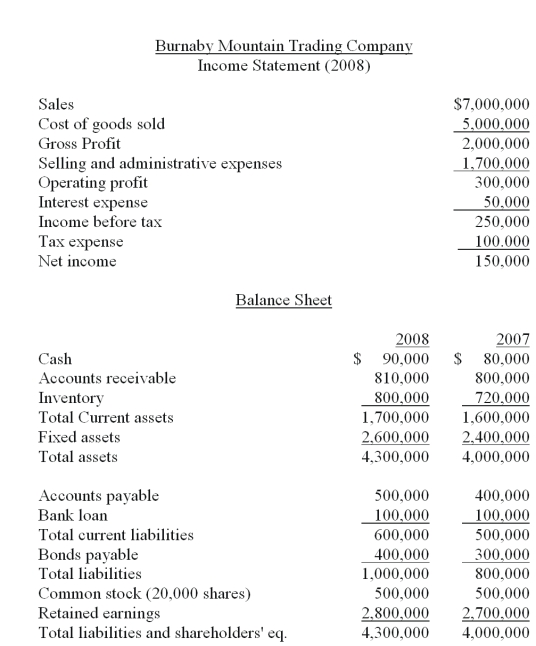

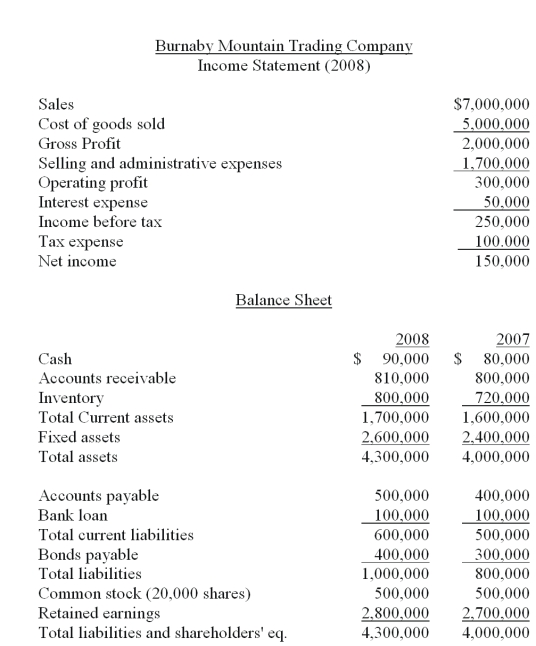

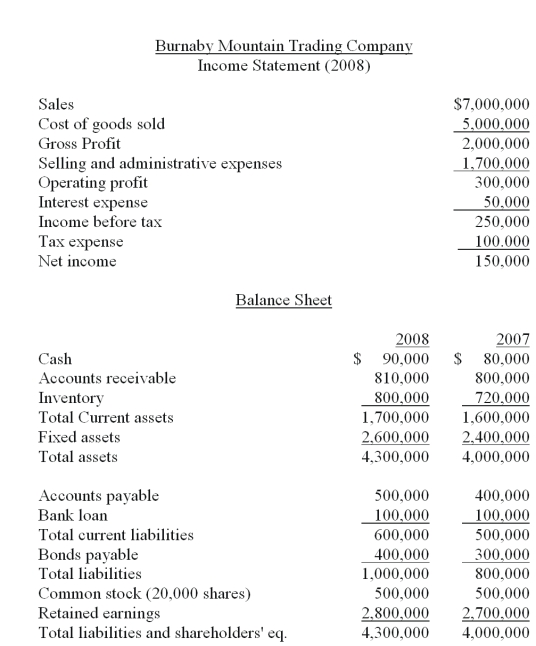

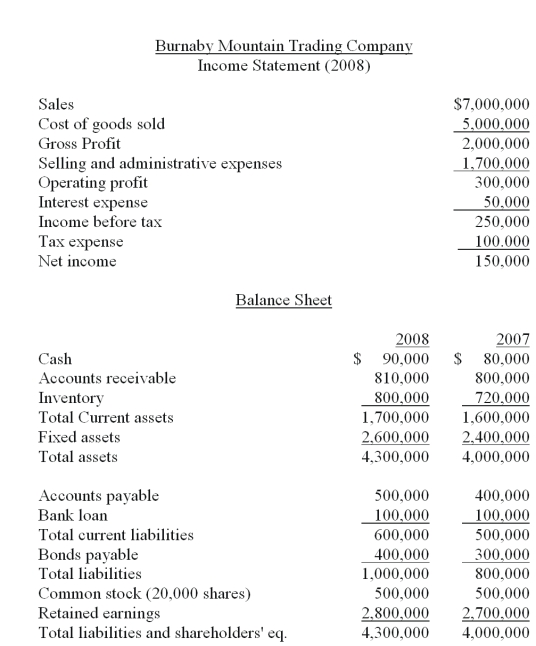

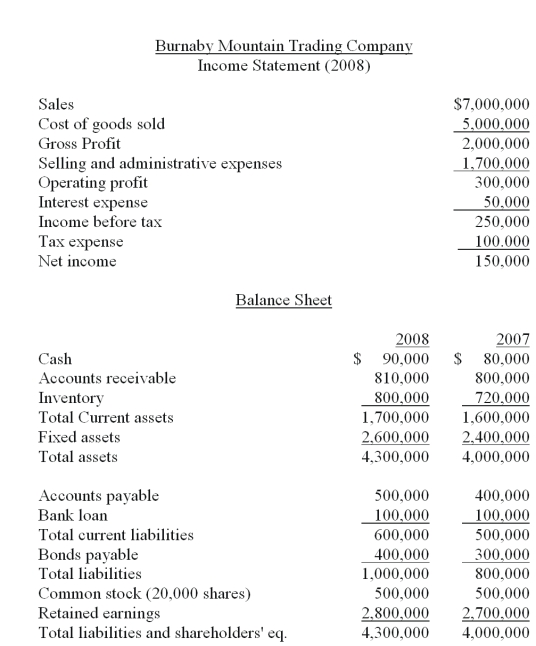

The financial statements of Burnaby Mountain Trading Company are given below.  Note: The common shares are trading in the stock market for $27 each.

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company.The firm's current ratio for 2008 is _________.

A) 1.30

B) 1.50

C) 1.69

D) 2.83

Note: The common shares are trading in the stock market for $27 each.

Note: The common shares are trading in the stock market for $27 each.Refer to the financial statements of Burnaby Mountain Trading Company.The firm's current ratio for 2008 is _________.

A) 1.30

B) 1.50

C) 1.69

D) 2.83

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

26

Operating ROA can be found as the product of ______.

A) return on sales x ATO

B) tax burden x Interest burden

C) interest burden x Leverage ratio

D) ROE x Dividend payout ratio

A) return on sales x ATO

B) tax burden x Interest burden

C) interest burden x Leverage ratio

D) ROE x Dividend payout ratio

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

27

The financial statements of Flathead Lake Manufacturing Company are given below:  Note: The common shares are trading in the stock market for $15 per share

Note: The common shares are trading in the stock market for $15 per share

Refer to the financial statements of Flathead Lake Manufacturing Company.The firm's debt to equity ratio for 2007 is _________.

A) 2.13

B) 2.44

C) 2.56

D) 2.89

Note: The common shares are trading in the stock market for $15 per share

Note: The common shares are trading in the stock market for $15 per shareRefer to the financial statements of Flathead Lake Manufacturing Company.The firm's debt to equity ratio for 2007 is _________.

A) 2.13

B) 2.44

C) 2.56

D) 2.89

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

28

The financial statements of Flathead Lake Manufacturing Company are given below:  Note: The common shares are trading in the stock market for $15 per share

Note: The common shares are trading in the stock market for $15 per share

Refer to the financial statements of Flathead Lake Manufacturing Company.The firm's P/E ratio for 2007 is _________.

A) 3.39

B) 3.60

C) 13.33

D) 10.67

Note: The common shares are trading in the stock market for $15 per share

Note: The common shares are trading in the stock market for $15 per shareRefer to the financial statements of Flathead Lake Manufacturing Company.The firm's P/E ratio for 2007 is _________.

A) 3.39

B) 3.60

C) 13.33

D) 10.67

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

29

The financial statements of Flathead Lake Manufacturing Company are given below:  Note: The common shares are trading in the stock market for $15 per share

Note: The common shares are trading in the stock market for $15 per share

Refer to the financial statements of Flathead Lake Manufacturing Company.The firm's return on equity ratio for 2005 is _________.Please keep in mind that when a ratio involves both income statement and balance sheet numbers,the balance sheet numbers for the beginning and end of the year must be averaged.

A) 6.5%

B) 26.5%

C) 33.4%

D) 38.0%

Note: The common shares are trading in the stock market for $15 per share

Note: The common shares are trading in the stock market for $15 per shareRefer to the financial statements of Flathead Lake Manufacturing Company.The firm's return on equity ratio for 2005 is _________.Please keep in mind that when a ratio involves both income statement and balance sheet numbers,the balance sheet numbers for the beginning and end of the year must be averaged.

A) 6.5%

B) 26.5%

C) 33.4%

D) 38.0%

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

30

The financial statements of Flathead Lake Manufacturing Company are given below:  Note: The common shares are trading in the stock market for $15 per share

Note: The common shares are trading in the stock market for $15 per share

Refer to the financial statements of Flathead Lake Manufacturing Company.The firm's inventory turnover ratio is _________.Please keep in mind that when a ratio involves both income statement and balance sheet numbers,the balance sheet numbers for the beginning and end of the year must be averaged.

A) 11.6

B) 10.2

C) 9.5

D) 7.7

Note: The common shares are trading in the stock market for $15 per share

Note: The common shares are trading in the stock market for $15 per shareRefer to the financial statements of Flathead Lake Manufacturing Company.The firm's inventory turnover ratio is _________.Please keep in mind that when a ratio involves both income statement and balance sheet numbers,the balance sheet numbers for the beginning and end of the year must be averaged.

A) 11.6

B) 10.2

C) 9.5

D) 7.7

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

31

If a firm has a positive tax rate,a positive operating ROA,and the interest rate on debt is the same as the operating ROA,then operating ROA will be _________.

A) greater than zero but it is impossible to determine how operating ROA will compare to ROE

B) equal to ROE

C) greater than ROE

D) less than ROE

A) greater than zero but it is impossible to determine how operating ROA will compare to ROE

B) equal to ROE

C) greater than ROE

D) less than ROE

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

32

A firm has a ROE of 20% and a market-to-book ratio of 2.38.Its P/E ratio is _________.

A) 8.40

B) 11.90

C) 17.62

D) 47.60

A) 8.40

B) 11.90

C) 17.62

D) 47.60

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following statements is true concerning Economic Value Added?

A) A growing number of firms tie managers' compensation to EVA.

B) A profitable firm will always have a positive EVA.

C) EVA recognizes that the cost of capital is not a real cost.

D) If a firm has positive present value of growth opportunities it will have positive EVA.

A) A growing number of firms tie managers' compensation to EVA.

B) A profitable firm will always have a positive EVA.

C) EVA recognizes that the cost of capital is not a real cost.

D) If a firm has positive present value of growth opportunities it will have positive EVA.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

34

The financial statements of Flathead Lake Manufacturing Company are given below:  Note: The common shares are trading in the stock market for $15 per share

Note: The common shares are trading in the stock market for $15 per share

Refer to the financial statements of Flathead Lake Manufacturing Company.The firm's ATO for 2007 is _________.Please keep in mind that when a ratio involves both income statement and balance sheet numbers,the balance sheet numbers for the beginning and end of the year must be averaged.

A) 3.56

B) 3.26

C) 3.14

D) 3.02

Note: The common shares are trading in the stock market for $15 per share

Note: The common shares are trading in the stock market for $15 per shareRefer to the financial statements of Flathead Lake Manufacturing Company.The firm's ATO for 2007 is _________.Please keep in mind that when a ratio involves both income statement and balance sheet numbers,the balance sheet numbers for the beginning and end of the year must be averaged.

A) 3.56

B) 3.26

C) 3.14

D) 3.02

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

35

The financial statements of Flathead Lake Manufacturing Company are given below:  Note: The common shares are trading in the stock market for $15 per share

Note: The common shares are trading in the stock market for $15 per share

Refer to the financial statements of Flathead Lake Manufacturing Company.The firm's compound leverage ratio is __________.Please keep in mind that when a ratio involves both income statement and balance sheet numbers,the balance sheet numbers for the beginning and end of the year must be averaged.

A) 1.5

B) 2.0

C) 2.5

D) 3.0

Note: The common shares are trading in the stock market for $15 per share

Note: The common shares are trading in the stock market for $15 per shareRefer to the financial statements of Flathead Lake Manufacturing Company.The firm's compound leverage ratio is __________.Please keep in mind that when a ratio involves both income statement and balance sheet numbers,the balance sheet numbers for the beginning and end of the year must be averaged.

A) 1.5

B) 2.0

C) 2.5

D) 3.0

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

36

A firm has a tax burden of 0.7,a leverage ratio of 1.3,an interest burden of 0.8,and a return on sales ratio of 10%.The firm generates $2.28 in sales per dollar of assets.What is the firm's ROE?

A) 12.4%

B) 14.5%

C) 16.6%

D) 17.8%

A) 12.4%

B) 14.5%

C) 16.6%

D) 17.8%

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

37

The financial statements of Flathead Lake Manufacturing Company are given below:  Note: The common shares are trading in the stock market for $15 per share

Note: The common shares are trading in the stock market for $15 per share

Refer to the financial statements of Flathead Lake Manufacturing Company.The firm's current ratio for 2007 indicates that Flathead's liquidity has ________ since 2006.

A) risen

B) fallen

C) stayed the same

D) can't tell from the information given

Note: The common shares are trading in the stock market for $15 per share

Note: The common shares are trading in the stock market for $15 per shareRefer to the financial statements of Flathead Lake Manufacturing Company.The firm's current ratio for 2007 indicates that Flathead's liquidity has ________ since 2006.

A) risen

B) fallen

C) stayed the same

D) can't tell from the information given

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

38

A firm has a P/E ratio of 24 and a ROE of 12%.Its market-to-book-value ratio is _________.

A) 2.88

B) 2.00

C) 1.75

D) 0.69

A) 2.88

B) 2.00

C) 1.75

D) 0.69

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

39

The financial statements of Flathead Lake Manufacturing Company are given below:  Note: The common shares are trading in the stock market for $15 per share

Note: The common shares are trading in the stock market for $15 per share

Refer to the financial statements of Flathead Lake Manufacturing Company.The industry average ACP is 32 days.How is Flathead doing in its collections relative to the industry? (Please keep in mind that when a ratio involves both income statement and balance sheet numbers,the balance sheet numbers for the beginning and end of the year must be averaged.)

A) Flathead's receivables are outstanding about 9 fewer days than the industry average.

B) Flathead's receivables are outstanding about 15 fewer days than the industry average.

C) Flathead's receivables are outstanding about 12 more days than the industry average.

D) Flathead's receivables are outstanding about 6 more days than the industry average.

Note: The common shares are trading in the stock market for $15 per share

Note: The common shares are trading in the stock market for $15 per shareRefer to the financial statements of Flathead Lake Manufacturing Company.The industry average ACP is 32 days.How is Flathead doing in its collections relative to the industry? (Please keep in mind that when a ratio involves both income statement and balance sheet numbers,the balance sheet numbers for the beginning and end of the year must be averaged.)

A) Flathead's receivables are outstanding about 9 fewer days than the industry average.

B) Flathead's receivables are outstanding about 15 fewer days than the industry average.

C) Flathead's receivables are outstanding about 12 more days than the industry average.

D) Flathead's receivables are outstanding about 6 more days than the industry average.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

40

You find that a firm that uses debt has a compound leverage factor less than 1.This tells you that ________.

A) the firm's use of financial leverage is positively contributing to ROE

B) the firm's use of financial leverage is negatively contributing to ROE

C) the firm's use of operating leverage is positively contributing to ROE

D) the firm's use of operating leverage is negatively contributing to ROE

A) the firm's use of financial leverage is positively contributing to ROE

B) the firm's use of financial leverage is negatively contributing to ROE

C) the firm's use of operating leverage is positively contributing to ROE

D) the firm's use of operating leverage is negatively contributing to ROE

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

41

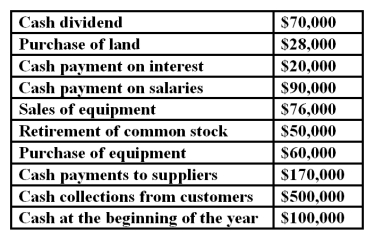

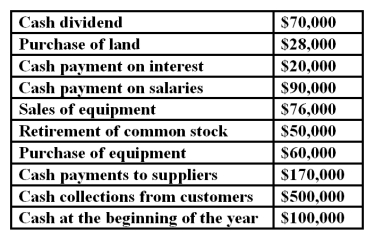

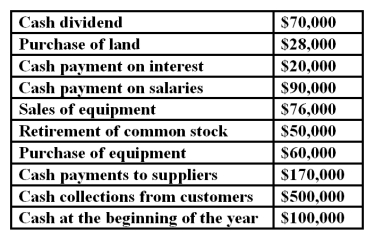

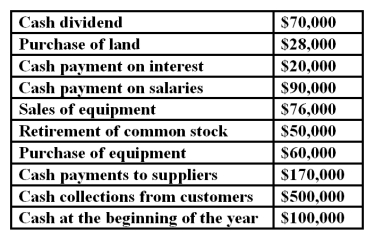

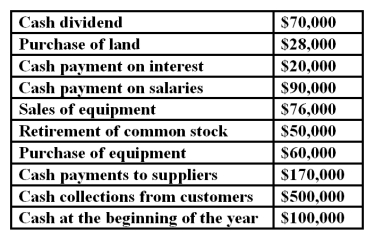

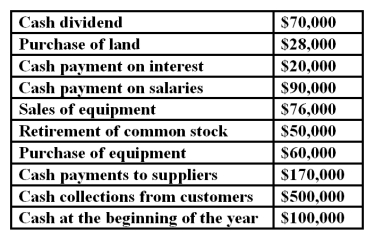

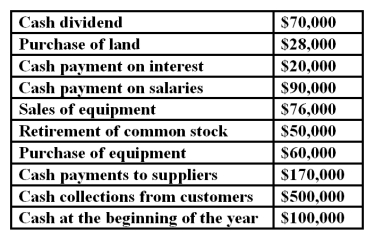

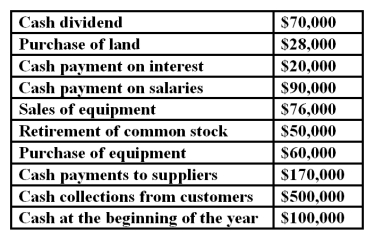

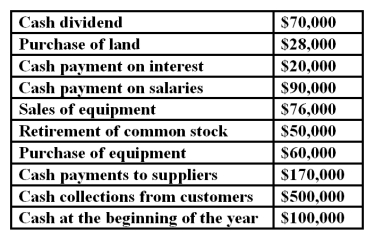

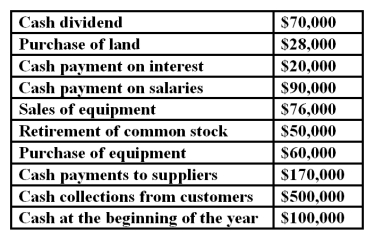

Use the following cash flow data of Haven Hardware for the year ended December 31, 2008.

What is the net increase or decrease in cash for Haven Hardware for 2008?

A) ($94,000)

B) ($88,000)

C) $88,000

D) $188,000

What is the net increase or decrease in cash for Haven Hardware for 2008?

A) ($94,000)

B) ($88,000)

C) $88,000

D) $188,000

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

42

The financial statements of Burnaby Mountain Trading Company are given below.  Note: The common shares are trading in the stock market for $27 each.

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company.The firm's market-to-book-value for 2008 is _________.

A) 0.1708

B) 0.1529

C) 0.1462

D) 0.1636

Note: The common shares are trading in the stock market for $27 each.

Note: The common shares are trading in the stock market for $27 each.Refer to the financial statements of Burnaby Mountain Trading Company.The firm's market-to-book-value for 2008 is _________.

A) 0.1708

B) 0.1529

C) 0.1462

D) 0.1636

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

43

A firm has a ROE equal to the industry average but its price to book ratio is below the industry average.You know that the firm's _________.

A) earnings yield is above the industry average

B) P/E ratio is above the industry average

C) dividend payout ratio is too high

D) interest burden must be below the industry average

A) earnings yield is above the industry average

B) P/E ratio is above the industry average

C) dividend payout ratio is too high

D) interest burden must be below the industry average

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

44

The financial statements of Burnaby Mountain Trading Company are given below.  Note: The common shares are trading in the stock market for $27 each.

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company.The firm's return on sales ratio for 2008 is _________.

A) 0.0409

B) 0.0429

C) 0.0475

D) 0.0753

Note: The common shares are trading in the stock market for $27 each.

Note: The common shares are trading in the stock market for $27 each.Refer to the financial statements of Burnaby Mountain Trading Company.The firm's return on sales ratio for 2008 is _________.

A) 0.0409

B) 0.0429

C) 0.0475

D) 0.0753

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

45

The financial statements of Burnaby Mountain Trading Company are given below.  Note: The common shares are trading in the stock market for $27 each.

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company.The firm's leverage ratio for 2008 is _________.

A) 1.30

B) 1.50

C) 1.69

D) 2.83

Note: The common shares are trading in the stock market for $27 each.

Note: The common shares are trading in the stock market for $27 each.Refer to the financial statements of Burnaby Mountain Trading Company.The firm's leverage ratio for 2008 is _________.

A) 1.30

B) 1.50

C) 1.69

D) 2.83

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

46

The financial statements of Burnaby Mountain Trading Company are given below.  Note: The common shares are trading in the stock market for $27 each.

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company.The firm's fixed asset turnover ratio for 2008 is _________.Please keep in mind that when a ratio involves both income statement and balance sheet numbers,the balance sheet numbers for the beginning and end of the year must be averaged.

A) 2.80

B) 6.00

C) 9.00

D) 11.11

Note: The common shares are trading in the stock market for $27 each.

Note: The common shares are trading in the stock market for $27 each.Refer to the financial statements of Burnaby Mountain Trading Company.The firm's fixed asset turnover ratio for 2008 is _________.Please keep in mind that when a ratio involves both income statement and balance sheet numbers,the balance sheet numbers for the beginning and end of the year must be averaged.

A) 2.80

B) 6.00

C) 9.00

D) 11.11

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

47

The financial statements of Burnaby Mountain Trading Company are given below.  Note: The common shares are trading in the stock market for $27 each.

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company.The firm's return on equity ratio for 2008 is _________.Please keep in mind that when a ratio involves both income statement and balance sheet numbers,the balance sheet numbers for the beginning and end of the year must be averaged.

A) 0.0409

B) 0.0429

C) 0.0462

D) 0.0923

Note: The common shares are trading in the stock market for $27 each.

Note: The common shares are trading in the stock market for $27 each.Refer to the financial statements of Burnaby Mountain Trading Company.The firm's return on equity ratio for 2008 is _________.Please keep in mind that when a ratio involves both income statement and balance sheet numbers,the balance sheet numbers for the beginning and end of the year must be averaged.

A) 0.0409

B) 0.0429

C) 0.0462

D) 0.0923

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

48

The financial statements of Burnaby Mountain Trading Company are given below.  Note: The common shares are trading in the stock market for $27 each.

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company.The firm's quick ratio for 2008 is _________.

A) 1.30

B) 1.50

C) 1.69

D) 2.83

Note: The common shares are trading in the stock market for $27 each.

Note: The common shares are trading in the stock market for $27 each.Refer to the financial statements of Burnaby Mountain Trading Company.The firm's quick ratio for 2008 is _________.

A) 1.30

B) 1.50

C) 1.69

D) 2.83

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

49

A firm has an ROA of 19%,a debt/equity ratio of 1.8,a tax rate of 30%,and the interest rate on its debt is 7%.Its ROE is _________.

A) 15.12%

B) 28.42%

C) 37.24%

D) 40.60%

A) 15.12%

B) 28.42%

C) 37.24%

D) 40.60%

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

50

Use the following cash flow data of Haven Hardware for the year ended December 31, 2008.

What is the net cash provided by or used in financing activities of Haven Hardware?

A) ($10,000)

B) ($120,000)

C) $10,000

D) $120,000

What is the net cash provided by or used in financing activities of Haven Hardware?

A) ($10,000)

B) ($120,000)

C) $10,000

D) $120,000

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

51

A firm has lower inventory turnover,a longer ACP,and a lower fixed-asset turnover than the industry averages.You should not be surprised to find that this firm has _____________.

I)lower ATO than the industry average

II)lower ROA than the industry average

III)lower ROE than the industry average

A) I only

B) I and II only

C) II and III only

D) I, II and III

I)lower ATO than the industry average

II)lower ROA than the industry average

III)lower ROE than the industry average

A) I only

B) I and II only

C) II and III only

D) I, II and III

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

52

The financial statements of Burnaby Mountain Trading Company are given below.  Note: The common shares are trading in the stock market for $27 each.

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company.The firm's times interest earned ratio for 2008 is _________.

A) 2.80

B) 6.00

C) 9.00

D) 11.11

Note: The common shares are trading in the stock market for $27 each.

Note: The common shares are trading in the stock market for $27 each.Refer to the financial statements of Burnaby Mountain Trading Company.The firm's times interest earned ratio for 2008 is _________.

A) 2.80

B) 6.00

C) 9.00

D) 11.11

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

53

A firm has a (net profit/pretax profit)ratio of 0.6,a leverage ratio of 1.5,a (pretax profit/EBIT)of 0.7,an asset turnover ratio of 4,a current ratio of 2,and a return on sales ratio of 6%.Its ROE is _________.

A) 7.56%

B) 15.12%

C) 20.16%

D) 30.24%

A) 7.56%

B) 15.12%

C) 20.16%

D) 30.24%

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

54

The financial statements of Burnaby Mountain Trading Company are given below.  Note: The common shares are trading in the stock market for $27 each.

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company.The firm's P/E ratio for 2008 is _________.

A) 2.80

B) 3.60

C) 6.00

D) 11.11

Note: The common shares are trading in the stock market for $27 each.

Note: The common shares are trading in the stock market for $27 each.Refer to the financial statements of Burnaby Mountain Trading Company.The firm's P/E ratio for 2008 is _________.

A) 2.80

B) 3.60

C) 6.00

D) 11.11

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

55

A high price to book ratio may indicate which one of the following?

A) The firm expanded its plant and equipment in the past few years.

B) The firm is doing a better job controlling its inventory expense than other related firms.

C) Investors may believe that this firm has opportunities of earnings a rate of return excess of the market capitalization rate.

D) The firm's P/E ratio is too high.

A) The firm expanded its plant and equipment in the past few years.

B) The firm is doing a better job controlling its inventory expense than other related firms.

C) Investors may believe that this firm has opportunities of earnings a rate of return excess of the market capitalization rate.

D) The firm's P/E ratio is too high.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

56

Use the following cash flow data of Haven Hardware for the year ended December 31, 2008.

What is the net cash provided by or used in investing activities of Haven Hardware?

A) ($12,000)

B) ($62,000)

C) $12,000

D) $164,000

What is the net cash provided by or used in investing activities of Haven Hardware?

A) ($12,000)

B) ($62,000)

C) $12,000

D) $164,000

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

57

Use the following cash flow data of Haven Hardware for the year ended December 31, 2008.

What is the net cash provided by operating activities of Haven Hardware?

A) ($30,000)

B) $220,000

C) $320,000

D) $780,000

What is the net cash provided by operating activities of Haven Hardware?

A) ($30,000)

B) $220,000

C) $320,000

D) $780,000

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

58

The level of real income of a firm can be distorted by the reporting of depreciation and interest expense.During periods of low inflation,the level of reported depreciation tends to __________ income,and the level of interest expense reported tends to __________ income.

A) understate; overstate

B) understate; understate

C) overstate; understate

D) overstate; overstate

A) understate; overstate

B) understate; understate

C) overstate; understate

D) overstate; overstate

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

59

The financial statements of Burnaby Mountain Trading Company are given below.  Note: The common shares are trading in the stock market for $27 each.

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company.The firm's asset turnover ratio for 2008 is _________.Please keep in mind that when a ratio involves both income statement and balance sheet numbers,the balance sheet numbers for the beginning and end of the year must be averaged.

A) 1.30

B) 1.50

C) 1.69

D) 2.83

Note: The common shares are trading in the stock market for $27 each.

Note: The common shares are trading in the stock market for $27 each.Refer to the financial statements of Burnaby Mountain Trading Company.The firm's asset turnover ratio for 2008 is _________.Please keep in mind that when a ratio involves both income statement and balance sheet numbers,the balance sheet numbers for the beginning and end of the year must be averaged.

A) 1.30

B) 1.50

C) 1.69

D) 2.83

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

60

If a firm's ratio of (stockholders' equity/total assets)is lower than the industry average and its ratio of (long-term debt/stockholders' equity)is also lower than the industry average,this would suggest that the firm _________.

A) has more current liabilities than the industry average

B) has more leased assets than the industry average

C) will be less profitable than the industry average

D) has more current assets than the industry average

A) has more current liabilities than the industry average

B) has more leased assets than the industry average

C) will be less profitable than the industry average

D) has more current assets than the industry average

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following transactions will result in a decrease in cash flow from operations?

A) Increase in accounts receivable

B) Decrease in inventories

C) Decrease in taxes payable

D) Decrease in bonds outstanding

A) Increase in accounts receivable

B) Decrease in inventories

C) Decrease in taxes payable

D) Decrease in bonds outstanding

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

62

Use the following cash flow data of Haven Hardware for the year ended December 31, 2008.

What is the cash at the end of 2008 for Haven Hardware?

A) $6,000

B) $94,000

C) $736,000

D) $188,000

What is the cash at the end of 2008 for Haven Hardware?

A) $6,000

B) $94,000

C) $736,000

D) $188,000

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

63

Another term for EVA is ______.

A) net income

B) operating income

C) residual income

D) market based income

A) net income

B) operating income

C) residual income

D) market based income

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

64

The net income of the company is $120.Accounts payable increase by $20,depreciation is $15,and equipment is purchased for $40.If the firm issued $110 in new bonds,what is the total change in cash for the firm for all activities?

A) Increase of $225

B) Increase of $130

C) Decrease of $195

D) Decrease of $110

A) Increase of $225

B) Increase of $130

C) Decrease of $195

D) Decrease of $110

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

65

The term quality of earnings refers to ________.

A) how well reported earnings conform to GAAP

B) the realism and sustainability of reported earnings

C) whether actual earnings matched expected earnings

D) how well reported earnings fit a trend line of earnings growth

A) how well reported earnings conform to GAAP

B) the realism and sustainability of reported earnings

C) whether actual earnings matched expected earnings

D) how well reported earnings fit a trend line of earnings growth

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

66

A firm purchases goods on credit worth $150.The same firm pays off $100 in old credit purchases.An investment is made via the purchase of a new facility and equity is issued in the amount of $300 to pay for the purchase.What is the change in net cash provided by operations?

A) $50 increase

B) $100 increase

C) $150 increase

D) $250 increase

A) $50 increase

B) $100 increase

C) $150 increase

D) $250 increase

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

67

A firm purchases goods on credit worth $100.The same firm pays off $80 in old credit purchases.An investment is made via the purchase of a new facility and equity is issued in the amount of $200 to pay for the purchase.What is the change in net cash provided by financing?

A) $20 increase

B) $80 increase

C) $100 increase

D) $200 increase

A) $20 increase

B) $80 increase

C) $100 increase

D) $200 increase

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

68

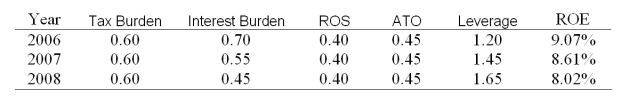

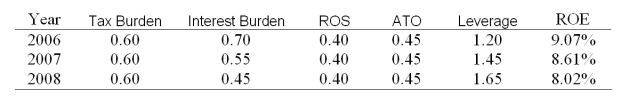

Look at the following table of data for Key Biscuit Company:  What must have caused the firm's ROE to drop?

What must have caused the firm's ROE to drop?

A) Because the firm began using more debt as a percentage of financing

B) Because the firm began using less debt as a percentage of financing

C) Because the compound leverage ratio was less than 1

D) Because the operating ROA was declining

What must have caused the firm's ROE to drop?

What must have caused the firm's ROE to drop?A) Because the firm began using more debt as a percentage of financing

B) Because the firm began using less debt as a percentage of financing

C) Because the compound leverage ratio was less than 1

D) Because the operating ROA was declining

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

69

The tax burden of the firm is 0.5,the interest burden is 0.55,the profit margin is 0.25,the asset turnover is 1.5,and the leverage ratio is 1.65.What is the ROE of the firm?

A) 1.88%

B) 6.68%

C) 12.15%

D) 17.02%

A) 1.88%

B) 6.68%

C) 12.15%

D) 17.02%

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

70

The practice of 'selling' large quantities of goods to customers in order to get quarterly sales up while allowing these customers to return the goods next quarter is termed _____________.

A) channel stuffing

B) clogging the network

C) spamming the johns

D) artificial sales

A) channel stuffing

B) clogging the network

C) spamming the johns

D) artificial sales

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

71

The tax burden of the firm is .4,the interest burden is 0.65,the return on sales is 0.05,the asset turnover is 0.90,and the leverage ratio is 1.35.What is the ROE of the firm?

A) 1.58%

B) 5.68%

C) 12.20%

D) 13.33%

A) 1.58%

B) 5.68%

C) 12.20%

D) 13.33%

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

72

The ABS company has a capital base of $100 million,an opportunity cost of capital (k)of 15%,a return on assets (ROA)of 9% and a return on equity (ROE)of 18%.What is the economic value added (EVA)for ABS?

A) $8 million

B) -$6 million

C) $3 million

D) -$4 million

A) $8 million

B) -$6 million

C) $3 million

D) -$4 million

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

73

When assessing sustainability of a firm's cash flows,analysts will prefer to see cash growth generated from which of the following sources?

A) Cash flow from investment activities

B) Cash flow from operating activities

C) Cash flow from financing

D) Cash flow from extraordinary events

A) Cash flow from investment activities

B) Cash flow from operating activities

C) Cash flow from financing

D) Cash flow from extraordinary events

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

74

A firm purchases goods on credit worth $90.The same firm pays off $100 in old credit purchases.An investment is made via the purchase of a new facility and equity is issued in the amount of $180 to pay for the purchase.What is the change in net cash provided by investments?

A) $10 decrease

B) $90 decrease

C) $180 decrease

D) $190 decrease

A) $10 decrease

B) $90 decrease

C) $180 decrease

D) $190 decrease

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following results in an increase in cash to the firm?

A) Dividends paid

B) A delay in collecting on accounts receivable

C) Net new investments

D) Increase in accounts payable

A) Dividends paid

B) A delay in collecting on accounts receivable

C) Net new investments

D) Increase in accounts payable

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

76

What ratio will definitely increase when a firm increases its annual sales with no corresponding increase in assets?

A) Asset turnover

B) Current ratio

C) Liquidity ratio

D) Quick ratio

A) Asset turnover

B) Current ratio

C) Liquidity ratio

D) Quick ratio

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following transactions will result in a decrease in cash flow from investments?

A) Acquisition of another business

B) Capital gain from sale of a subsidiary

C) Decrease in net investments

D) Sale of equipment

A) Acquisition of another business

B) Capital gain from sale of a subsidiary

C) Decrease in net investments

D) Sale of equipment

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

78

The firms leverage ratio is 1.2,interest burden ratio is .81,profit margin is .25,and its asset turnover is 1.10.What is the firm's compound leverage factor?

A) .243

B) .267

C) .826

D) .972

A) .243

B) .267

C) .826

D) .972

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following would result in a cash inflow under the heading cash flow from investing in the statement of cash flows?

A) Purchase of capital equipment

B) Payments to suppliers for inventory

C) Collections on receivables

D) Sale of production machinery

A) Purchase of capital equipment

B) Payments to suppliers for inventory

C) Collections on receivables

D) Sale of production machinery

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

80

All of the following ratios are related to efficiency except for _______.

A) total asset turnover

B) fixed asset turnover

C) average collection period

D) cash ratio

A) total asset turnover

B) fixed asset turnover

C) average collection period

D) cash ratio

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck