Deck 8: Risk, return, and Portfolio Theory

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/104

Play

Full screen (f)

Deck 8: Risk, return, and Portfolio Theory

1

Use the following two statements to answer this question:

I)Risk is the possibility of incurring harm.

I)Ex post returns are expected returns while ex ante returns are future returns.

A) I and II are correct.

B) I and II are incorrect.

C) I is correct, II is incorrect.

D) I is incorrect, II is correct.

I)Risk is the possibility of incurring harm.

I)Ex post returns are expected returns while ex ante returns are future returns.

A) I and II are correct.

B) I and II are incorrect.

C) I is correct, II is incorrect.

D) I is incorrect, II is correct.

C

2

Which of the following is NOT a true statement?

A) The capital gain yield measures the appreciation in the price of the asset from some starting price.

B) Common shares should lose from inflation over the long run as their prices and cash flows are not fixed.

C) The capital loss yield measures the depreciation in the price of the asset from the purchase price.

D) The addition of the capital gain (or loss) yield explains why the yield gap between equities and bonds has varied so much over time.

A) The capital gain yield measures the appreciation in the price of the asset from some starting price.

B) Common shares should lose from inflation over the long run as their prices and cash flows are not fixed.

C) The capital loss yield measures the depreciation in the price of the asset from the purchase price.

D) The addition of the capital gain (or loss) yield explains why the yield gap between equities and bonds has varied so much over time.

B

3

You made an investment in your RRSP account of $3,000 in an ETF that pays quarterly dividends.The price of each unit the day of the investment is $60.The following year you invested another $2,000 in your RRSP account at a price of $ 70 a unit.How much would you have in your account two years after your initial investment if you know that the income yield of the ETF is 5% and an ETF unit is trading at $75 today?

A) $6500.00

B) $6292.86

C) $5992.86

D) $6042.86

A) $6500.00

B) $6292.86

C) $5992.86

D) $6042.86

B,

4

Steve bought a share of Toronto Skates Inc.three years ago for $45.00.He was paid two annual dividends of $4.50 in the past two years.If the stock price today is $ 48.50,calculate the three year's income yield,capital gain,and total return.

a) IY=7.78%, CGY=20.00%, TR=27.78%

b) IY=20.00%, CGY=9.26%, TR=29.26%

c) IY=20.00%, CGY=7.78%, TR=27.78%

d) IY=7.78%, CGY=9.26%, TR=17.04%

a) IY=7.78%, CGY=20.00%, TR=27.78%

b) IY=20.00%, CGY=9.26%, TR=29.26%

c) IY=20.00%, CGY=7.78%, TR=27.78%

d) IY=7.78%, CGY=9.26%, TR=17.04%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

5

Suppose you have a total return of 8 percent on the 500 shares of XYZ Company that you bought for $9,590 last year.XYZ paid four equal quarterly dividends during the year.What would be the quarterly dividend if the current stock price is $18.64 per share?

a) $0.50

b) $0.52

c) $0.54

d) $0.56

a) $0.50

b) $0.52

c) $0.54

d) $0.56

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

6

A share of Oedipus Construction Company was selling for $32.16 one year ago.The stock paid an annual dividend of $0.25 during the year.What is the capital gain yield if the current stock price is $34.02?

a) 9.45%

b) 5.78%

c) 7.77%

d) 5.46%

a) 9.45%

b) 5.78%

c) 7.77%

d) 5.46%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

7

Steve bought a share of Toronto Skates Inc.three years ago for $45.00.He was paid two annual dividends of $4.50 in the past two years.If the stock price today is $ 48.50,what is the annual holding period return of the stock?

a) 7.78%

b) 15.56%

c) 27.78%

d) 9.26%

a) 7.78%

b) 15.56%

c) 27.78%

d) 9.26%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

8

The capital gain yield of an equity security is 9.27 percent.The security paid a quarterly dividend of $0.55 per share during the year.What is the current price of the security if the total return is 13.76 percent?

a) $12.25

b) $13.38

c) $49.00

d) $53.54

a) $12.25

b) $13.38

c) $49.00

d) $53.54

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is NOT a correct statement about income yield?

A) It is one of the two components of the total return on an investment.

B) It is the return earned in the form of a periodic cash flow received by the investors.

C) These periodic cash flows are interest payments from bonds and dividends from equities.

D) It measures the periodic cash receipts by dividing it by the selling price of the security.

A) It is one of the two components of the total return on an investment.

B) It is the return earned in the form of a periodic cash flow received by the investors.

C) These periodic cash flows are interest payments from bonds and dividends from equities.

D) It measures the periodic cash receipts by dividing it by the selling price of the security.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

10

Connie bought 400 shares of ABC Company for $9,288 one year ago.ABC paid a quarterly dividend of $0.40 per share throughout the year,and is currently trading at $24.85 per share.What are the income yield,capital gain yield,and total return for Connie's investment?

a) Income yield = 6.44%; capital gain yield = 6.56%; total return = 13.00%

b) Income yield = 6.56%; capital gain yield = 6.44%; total return = 13.00%

c) Income yield = 6.89%; capital gain yield = 7.02%; total return = 13.91%

d) Income yield = 7.02%; capital gain yield = 6.89%; total return = 13.91%

a) Income yield = 6.44%; capital gain yield = 6.56%; total return = 13.00%

b) Income yield = 6.56%; capital gain yield = 6.44%; total return = 13.00%

c) Income yield = 6.89%; capital gain yield = 7.02%; total return = 13.91%

d) Income yield = 7.02%; capital gain yield = 6.89%; total return = 13.91%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is a FALSE statement?

A) Paper losses are capital losses that people accept as losses before they actually sell and realize them.

B) A day trader is someone who buys and sells based on intraday price movements.

C) Mark to market refers to carrying securities at the current market value regardless of whether they are sold or not.

D) The total return including the paper gains and losses over the relevant investment horizon reflects the economic value of past investment decisions.

A) Paper losses are capital losses that people accept as losses before they actually sell and realize them.

B) A day trader is someone who buys and sells based on intraday price movements.

C) Mark to market refers to carrying securities at the current market value regardless of whether they are sold or not.

D) The total return including the paper gains and losses over the relevant investment horizon reflects the economic value of past investment decisions.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

12

A stock selling for $12.00 today and expected to pay a $1.50 dividend and have a capital gain of 5% in one year will increase in price to sell at:

a) $ 13.50

b) $ 14.10

c) $ 12.60

d) $ 15.18

a) $ 13.50

b) $ 14.10

c) $ 12.60

d) $ 15.18

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

13

Laura purchased a share of MVP Company for $26.43 one year ago.The stock paid a quarterly dividend of $0.50 during the year.What is the capital gain yield if the current stock price is $28.26?

a) 6.48%

b) 6.92%

c) 7.57%

d) 14.49%

a) 6.48%

b) 6.92%

c) 7.57%

d) 14.49%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

14

In question 18 above,what is the income yield (dividend yield)for the stock of Oedipus Construction Company?

a) 0.945%

b) 0.578%

c) 0.777%

d) 0.546%

a) 0.945%

b) 0.578%

c) 0.777%

d) 0.546%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

15

The income yield and capital gain yield of a stock are 4.90 percent and 7.37 percent,respectively.The stock paid a quarterly dividend of $0.65 per share during the year.What should the stock sell for today?

a) $35.28

b) $37.01

c) $53.06

d) $56.97

a) $35.28

b) $37.01

c) $53.06

d) $56.97

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

16

A stock selling for $20.00 today and expected to have an income (dividend)yield of 3% and a capital gain yield of 5% in one year will increase in price to sell at:

a) $21.60

b) $20.60

c) $21.00

d) $20.40

a) $21.60

b) $20.60

c) $21.00

d) $20.40

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

17

A year ago,you bought some shares of CIA Company,which pays equal quarterly dividends.The income yield and the capital gain yield are 4.38 percent and 9.5 percent,respectively.The current price of CIA is $18.What was the quarterly dividend that CIA paid during the year?

a) $0.18

b) $0.41

c) $0.72

d) $1.64

a) $0.18

b) $0.41

c) $0.72

d) $1.64

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

18

Melanie bought a share of MPT Company for $53.98 one year ago.The stock paid a quarterly dividend of $0.52 throughout the year.What is the income yield if the stock is selling for $57.10 today?

a) 0.91%

b) 0.96%

c) 3.85%

d) 3.64%

a) 0.91%

b) 0.96%

c) 3.85%

d) 3.64%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

19

Sandy paid $47.38 for one share of EMH Company one year ago.The stock paid four quarterly dividends of $1.00 each during the year,and is selling for $49.50 now.What are the income yield and capital gain yield for EMH over the past year?

a) Income yield = 4.28%; capital gain yield = 8.08%

b) Income yield = 8.08%; capital gain yield = 4.28%

c) Income yield = 4.47%; capital gain yield = 8.44%

d) Income yield = 8.44%; capital gain yield = 4.47%

a) Income yield = 4.28%; capital gain yield = 8.08%

b) Income yield = 8.08%; capital gain yield = 4.28%

c) Income yield = 4.47%; capital gain yield = 8.44%

d) Income yield = 8.44%; capital gain yield = 4.47%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following statements is TRUE?

A) The geometric mean measures the average annual rates of return while the arithmetic mean measures the compound growth rate over multiple time periods.

B) The more the returns vary, the bigger the difference between the arithmetic and geometric mean will be. The difference is dependent on the relevant investment horizon.

C) The geometric mean is appropriate when we are trying to estimate the typical return for a given period.

D) The arithmetic mean is a better average return estimate when we are interested in the rate of return performance of an investment over time.

A) The geometric mean measures the average annual rates of return while the arithmetic mean measures the compound growth rate over multiple time periods.

B) The more the returns vary, the bigger the difference between the arithmetic and geometric mean will be. The difference is dependent on the relevant investment horizon.

C) The geometric mean is appropriate when we are trying to estimate the typical return for a given period.

D) The arithmetic mean is a better average return estimate when we are interested in the rate of return performance of an investment over time.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

21

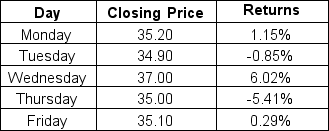

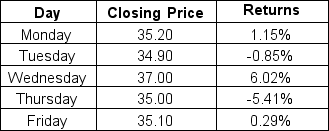

The following table shows the closing prices and daily returns of Toronto Skates Inc.over a week:

Calculate the weekly geometric and arithmetic returns of Toronto Skates Inc.(your answer should be four decimals,margin of error is +/- 0.0050%)

a) GM=0.2400% and AM=0.1728%

b) GM=-0.2841% and AM=0.1728%

c) GM=0.1728% and AM=-0.2841%

d) GM=0.1728% and AM=0.2400%

Calculate the weekly geometric and arithmetic returns of Toronto Skates Inc.(your answer should be four decimals,margin of error is +/- 0.0050%)

a) GM=0.2400% and AM=0.1728%

b) GM=-0.2841% and AM=0.1728%

c) GM=0.1728% and AM=-0.2841%

d) GM=0.1728% and AM=0.2400%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

22

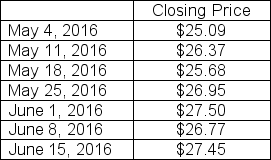

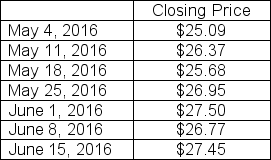

You have observed the following for Montreal Smoked Meat Corporation:

What are the arithmetic and geometric average weekly returns over the 6-week period ended June 15,2016?

a) Arithmetic mean = 3.317%; geometric mean = 3.309%

b) Arithmetic mean = 3.309%; geometric mean = 3.317%

c) Arithmetic mean = 1.559%; geometric mean = 1.509%

d) Arithmetic mean = 1.510%; geometric mean = 1.559%

What are the arithmetic and geometric average weekly returns over the 6-week period ended June 15,2016?

a) Arithmetic mean = 3.317%; geometric mean = 3.309%

b) Arithmetic mean = 3.309%; geometric mean = 3.317%

c) Arithmetic mean = 1.559%; geometric mean = 1.509%

d) Arithmetic mean = 1.510%; geometric mean = 1.559%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

23

The geometric average quarterly return of ROM Company was 5 percent for the previous year.What was the return for the third quarter if the returns for the first,second,and fourth quarters were 10 percent,-9.05 percent,and 8 percent,respectively?

a) -6.18%

b) -7.05%

c) 11.05%

d) 12.50%

a) -6.18%

b) -7.05%

c) 11.05%

d) 12.50%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

24

If the closing price of Stock Y was $38.63 on Friday,which was after it had earned daily returns of 8 percent,23 percent,-30 percent,20 percent,and -5 percent during the week (Monday to Friday),what was the opening price of Stock Y on Monday?

a) $17.47

b) $17.75

c) $33.00

d) $36.44

a) $17.47

b) $17.75

c) $33.00

d) $36.44

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

25

The arithmetic average daily return for Dopey Inc.was 2 percent for this past week.Dopey's stock was traded at $23.70 when the market closed on Friday.The daily returns for Monday,Tuesday,Thursday,and Friday are 4.8%,5.6%,-4.0%,and 12.2%,respectively.What was Dopey's opening price on Monday?

a) $21.47

b) $21.55

c) $21.75

d) $22.80

a) $21.47

b) $21.55

c) $21.75

d) $22.80

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

26

What is the standard deviation of returns on a stock priced today at $10 that has a 25 percent probability of increasing to $13,a 50 percent probability of increasing to $12,a 15 percent probability of increasing by 5 percent,and a 10 percent probability of decreasing to $ 7?

a) 0.0094

b) 0.0286

c) 0.0968

d) 0.1692

a) 0.0094

b) 0.0286

c) 0.0968

d) 0.1692

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following statements is FALSE?

A) Risk measures the volatility of the returns of the asset.

B) Risk measures are concerned only with the negative performance of the asset.

C) The standard deviation is not the only measure of risk.

D) Risk and return are inversely related.

A) Risk measures the volatility of the returns of the asset.

B) Risk measures are concerned only with the negative performance of the asset.

C) The standard deviation is not the only measure of risk.

D) Risk and return are inversely related.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

28

The geometric average daily return for Grumpy Inc.was 3 percent for this past week.Grumpy's stock was traded at $18.82 when the market closed on Friday.The daily returns for Monday through Thursday are 5 percent,2 percent,-10 percent,and 8 percent,respectively.What is the opening price of Grumpy on Friday?

a) $16.68

b) $16.90

c) $16.94

d) $17.11

a) $16.68

b) $16.90

c) $16.94

d) $17.11

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

29

On January 1,you forecasted that there is a 45 percent chance that the stock price of Edward Bear Inc.will be $95 in one year while there is a 55 percent chance that the stock price will be $35.Six months later,you revised the estimated probability to 25 percent chance of the high state (stock price of $95).If the market agrees with your revised forecasts,what is the expected change in stock price from January 1 to July 1? Assume the discount rate is zero.

a) Price goes up by 19.35%

b) Price goes down by 19.35%

c) Price goes up by 24%

d) Price goes down by 24%

a) Price goes up by 19.35%

b) Price goes down by 19.35%

c) Price goes up by 24%

d) Price goes down by 24%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

30

What is the expected return on a stock that has a 15 percent probability of a 35 percent return,a 20 percent probability of a 25 percent return,a 50 percent probability of a 15 percent,and a probability of 15 percent of -20 percent?

a) 18.75%

b) 14.75%

c) 13.75%

d) 20.75%

a) 18.75%

b) 14.75%

c) 13.75%

d) 20.75%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

31

La Maudite Corporation's annual returns for the past five years were: 11.5%,18%,-12%,-16.5%,and 28%.What are the arithmetic and geometric average annual returns for La Maudite over the five-year period?

a) Arithmetic mean = 5.80%; geometric mean = 4.35%

b) Arithmetic mean = 4.35%; geometric mean = 5.80%

c) Arithmetic mean = 17.20%; geometric mean = 17.05%

d) Arithmetic mean = 17.05%; geometric mean = 17.20%

a) Arithmetic mean = 5.80%; geometric mean = 4.35%

b) Arithmetic mean = 4.35%; geometric mean = 5.80%

c) Arithmetic mean = 17.20%; geometric mean = 17.05%

d) Arithmetic mean = 17.05%; geometric mean = 17.20%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

32

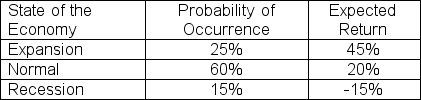

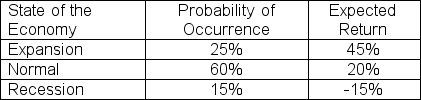

Given the following forecasts,what is the standard deviation of returns?

a) 18.4120%

b) 11.3908%

c) 3.3900%

d) 1.2975%

a) 18.4120%

b) 11.3908%

c) 3.3900%

d) 1.2975%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following statements is TRUE?

A) The more stable the possible returns, the greater the risk.

B) Risk means the probability that the actual return from an investment is less than the expected return.

C) The range is a more accurate measure of risk than the standard deviation, because the range uses the maximum and minimum values, whereas the standard deviation uses all the observations.

D) Securities offering lower expected rates of return tend to be riskier.

A) The more stable the possible returns, the greater the risk.

B) Risk means the probability that the actual return from an investment is less than the expected return.

C) The range is a more accurate measure of risk than the standard deviation, because the range uses the maximum and minimum values, whereas the standard deviation uses all the observations.

D) Securities offering lower expected rates of return tend to be riskier.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

34

What is the expected return from an investment that has an equally likely probability to lose half of the investment or double the investment?

A) 50%

B) 125%

C) -50%

D) 200%

A) 50%

B) 125%

C) -50%

D) 200%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

35

AMC Corp had a geometric weekly return of 5% for this past week.The daily returns for Monday through Thursday are 4 percent,3 percent,-7 percent,and 9 percent,respectively.If AMC's stock traded at $16.22 when the market closed on Friday,what is the opening price of the stock on Friday?

a) $13.47

b) $13.38

c) $13.94

d) $14.11

a) $13.47

b) $13.38

c) $13.94

d) $14.11

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

36

You have done a thorough study of the economy and of Stock X and concluded the following probabilities: having a boom next year is 20 percent,having a stable economy is 55 percent,and having a recession is 25 percent.You have also found the price of Stock X will be: $45 if there is a boom,$25 if the economy is stable,and $15 if there is a recession.What is the ex ante expected return on Stock X if it is currently selling for $24?

a) -9.43%

b) 10.42%

c) 18.06%

d) 26.50%

a) -9.43%

b) 10.42%

c) 18.06%

d) 26.50%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

37

Baxter Inc.'s annual returns for the past four years were: 2.75%,-1.8%,7.2%,and 6.5%.What are the arithmetic and geometric average annual returns for Baxter over the four-year period?

a) Arithmetic mean = 6.80%; geometric mean = 3.35%

b) Arithmetic mean = 3.66%; geometric mean = 3.60%

c) Arithmetic mean = 14.65%; geometric mean = 10.05%

d) Arithmetic mean = 18.03%; geometric mean = 21.20%

a) Arithmetic mean = 6.80%; geometric mean = 3.35%

b) Arithmetic mean = 3.66%; geometric mean = 3.60%

c) Arithmetic mean = 14.65%; geometric mean = 10.05%

d) Arithmetic mean = 18.03%; geometric mean = 21.20%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

38

You have observed the following annual returns for Motherboard Inc.: 25%,15%,-20%,30%,and -15%.What are the variance and standard deviation of returns?

a) Variance = 0.00425; standard deviation = 0.06519

b) Variance = 0.06519; standard deviation = 0.00425

c) Variance = 0.05325; standard deviation = 0.23076

d) Variance = 0.23076; standard deviation = 0.05325

a) Variance = 0.00425; standard deviation = 0.06519

b) Variance = 0.06519; standard deviation = 0.00425

c) Variance = 0.05325; standard deviation = 0.23076

d) Variance = 0.23076; standard deviation = 0.05325

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

39

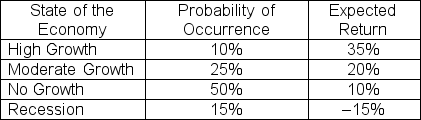

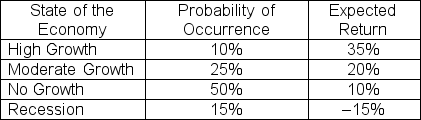

Given the information in the following table,what is the expected return of the security?

a) 11.25%

b) 12.50%

c) 15.75%

d) 25.00%

a) 11.25%

b) 12.50%

c) 15.75%

d) 25.00%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

40

The closing prices for Stock B from December to June are: $42.90,$44.20,$51.50,$49.60,$45.50,$46.30,and $42.50.What is the standard deviation of returns over the six-month period?

a) 0.295%

b) 0.868%

c) 5.436%

d) 9.318%

a) 0.295%

b) 0.868%

c) 5.436%

d) 9.318%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

41

What is the expected return for a portfolio that has $1,000 invested in Stock X,$1,500 invested in Stock Y,and $2,500 invested in Stock Z,if the expected returns on Stock X,Stock Y,and Stock Z are 10%,12%,and 15%,respectively?

a) 11.90%

b) 12.00%

c) 12.50%

d) 13.10%

a) 11.90%

b) 12.00%

c) 12.50%

d) 13.10%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

42

What is the expected return for a portfolio that has $800 invested in Stock A and $1,200 invested in Stock B,if the expected returns on Stock A and Stock B are 10% and 18%,respectively?

a) 14.00%

b) 14.80%

c) 13.20%

d) 12.60%

a) 14.00%

b) 14.80%

c) 13.20%

d) 12.60%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

43

Suppose you own 100 shares of CyberChase Corporation and 200 shares of NetSurfer Corporation.At the time of purchase,the stocks of CyberChase and NetSurfer were trading at $25 and $15 per share,respectively.What is the expected value of the portfolio if CyberChase has an expected return of 8 percent and NetSurfer has an expected return of 13 percent?

a) $6,065

b) $6,090

c) $7,095

d) $7,270

a) $6,065

b) $6,090

c) $7,095

d) $7,270

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

44

No benefits of diversification with two stocks occur when  is:

is:

A) 0

B) 1

C) -1

D) 0.52

is:

is:A) 0

B) 1

C) -1

D) 0.52

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

45

Use the following three statements to answer this question:

I)There will be benefits from diversification as long as

)

II)As long as

,an equally weighted portfolio would be risk-free.

III)Diversification can never eliminate the total risk of the portfolio.

A) I is correct, II is incorrect, III is correct.

B) I is incorrect, II is correct, III is correct.

C) I and II are correct, III is incorrect.

D) I, II and II are incorrect.

I)There will be benefits from diversification as long as

)

II)As long as

,an equally weighted portfolio would be risk-free.

III)Diversification can never eliminate the total risk of the portfolio.

A) I is correct, II is incorrect, III is correct.

B) I is incorrect, II is correct, III is correct.

C) I and II are correct, III is incorrect.

D) I, II and II are incorrect.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

46

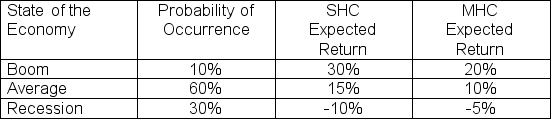

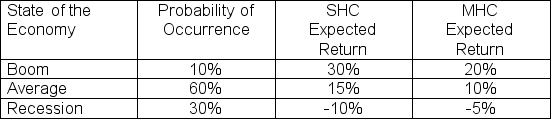

Suppose you own a portfolio that has 500 shares of SHC Company and 1,000 shares of MHC Company.The stock prices of SHC and MHC at the time of purchase were $40 and $25 per share,respectively.Given the following forecasts,what is the expected return for the portfolio?

a) 7.61%

b) 7.89%

c) 11.94%

d) 12.56%

a) 7.61%

b) 7.89%

c) 11.94%

d) 12.56%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

47

Given the following forecasts,what is the expected return for a portfolio that has $2,200 invested in Stock X,$3,600 in Stock Y,and $4,200 invested in Stock Z?

a) 10.62%

b) 14.82%

c) 30.50%

d) 33.25%

a) 10.62%

b) 14.82%

c) 30.50%

d) 33.25%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following is a FALSE statement of the correlation coefficient?

A) It measures how security returns move in relation to one another.

B) Positive correlation coefficients imply that the returns on Security A tend to move in the same direction as those on security B.

C) Negative correlation coefficients imply that the returns on Security A tend to move in the opposite direction to those on security B.

D) The closer the absolute value of the correlation coefficient is to one, the weaker the relationship between the returns on the two securities.

A) It measures how security returns move in relation to one another.

B) Positive correlation coefficients imply that the returns on Security A tend to move in the same direction as those on security B.

C) Negative correlation coefficients imply that the returns on Security A tend to move in the opposite direction to those on security B.

D) The closer the absolute value of the correlation coefficient is to one, the weaker the relationship between the returns on the two securities.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

49

Use the following three statements to answer this question:

I)When

And we know the return on Security A,we can predict the return on Security B with certainty.

II)Generally,security returns display positive correlations with one another but they are less than one,because all securities tend not to follow the movements of the overall market.

III)Any value of correlation less than +1 provides a possibility of diversification.

A) I is incorrect, II is correct, III is correct.

B) I is correct, II is incorrect, III is correct.

C) I and II are incorrect, III is incorrect.

D) I and II are correct, III is incorrect.

I)When

And we know the return on Security A,we can predict the return on Security B with certainty.

II)Generally,security returns display positive correlations with one another but they are less than one,because all securities tend not to follow the movements of the overall market.

III)Any value of correlation less than +1 provides a possibility of diversification.

A) I is incorrect, II is correct, III is correct.

B) I is correct, II is incorrect, III is correct.

C) I and II are incorrect, III is incorrect.

D) I and II are correct, III is incorrect.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

50

Stocks A and B have a correlation of +1.If stock A went from $10 to $12 over the past month,what is the price of stock B,if its price one month ago was $5?

A) $5

B) $4

C) $6

D) Cannot be determined

A) $5

B) $4

C) $6

D) Cannot be determined

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is a TRUE statement of modern portfolio theory?

A) It states that securities should be managed within a portfolio, rather than individually, to lower risk-reduction gains.

B) It stipulates that investors should diversify their investments so as to be unnecessarily exposed to a single negative event.

C) It shows how to form portfolios with the highest possible expected rate of return for any given level of risk.

D) It demonstrates that by combining securities into portfolios, we can increase risk.

A) It states that securities should be managed within a portfolio, rather than individually, to lower risk-reduction gains.

B) It stipulates that investors should diversify their investments so as to be unnecessarily exposed to a single negative event.

C) It shows how to form portfolios with the highest possible expected rate of return for any given level of risk.

D) It demonstrates that by combining securities into portfolios, we can increase risk.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

52

A portfolio consists of two securities: Nervy and Goofy.The expected return of Nervy is 12 percent with a standard deviation of 15 percent.The expected return of Goofy is 9 percent with a standard deviation of 10 percent.What is the portfolio standard deviation if 35 percent of the portfolio is in Nervy and the two securities have a correlation of 0.6?

a) 9.02%

b) 10.52%

c) 11.75%

d) 12.18%

a) 9.02%

b) 10.52%

c) 11.75%

d) 12.18%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

53

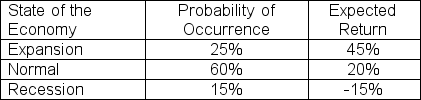

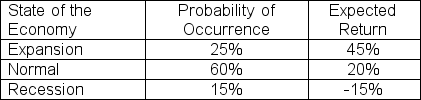

Given the following forecasts,what is the variance of returns?

a) 18.4120% squared

b) 11.3908% squared

c) 3.3900% squared

d) 1.2975% squared

a) 18.4120% squared

b) 11.3908% squared

c) 3.3900% squared

d) 1.2975% squared

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following is TRUE about diversification?

A) By diversifying, portfolio risk can be reduced to zero.

B) There is no benefit from diversification if the correlation coefficient is 1.

C) The variance is the weighted average of the individual securities' variances when the correlation is equal to -1.

D) If the covariance between two securities is negative, then the portfolio's standard deviation can be reduced to zero.

A) By diversifying, portfolio risk can be reduced to zero.

B) There is no benefit from diversification if the correlation coefficient is 1.

C) The variance is the weighted average of the individual securities' variances when the correlation is equal to -1.

D) If the covariance between two securities is negative, then the portfolio's standard deviation can be reduced to zero.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

55

You are contemplating investing in two stocks ABC and XYZ that have an expected return of 12 percent and 9 percent,respectively.If your target expected return is 10 percent,what would be the weight in ABC?

a) 50%

b) 33%

c) 67%

d) 100%

a) 50%

b) 33%

c) 67%

d) 100%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following is NOT a correct statement?

A) Risk-averse investors like expected returns and dislike risk, and therefore require compensation to assume additional risk.

B) Efficient portfolios are those portfolios that offer the highest expected return for a given level of risk, or offer the lowest risk for a given expected return.

C) The minimum variance portfolio is a portfolio that lies on the efficient frontier and has the minimum amount of portfolio risk available from any possible combination of available securities.

D) Portfolios on the lower segment of the minimum variance frontier dominate portfolios that lie above the minimum variance portfolio on the upper segment.

A) Risk-averse investors like expected returns and dislike risk, and therefore require compensation to assume additional risk.

B) Efficient portfolios are those portfolios that offer the highest expected return for a given level of risk, or offer the lowest risk for a given expected return.

C) The minimum variance portfolio is a portfolio that lies on the efficient frontier and has the minimum amount of portfolio risk available from any possible combination of available securities.

D) Portfolios on the lower segment of the minimum variance frontier dominate portfolios that lie above the minimum variance portfolio on the upper segment.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

57

Given the following forecasts,what is the expected return for a portfolio that has $1,500 invested in Stock A and $4,500 invested in Stock B?

a) 12.0%

b) 12.5%

c) 14.0%

d) 14.2%

a) 12.0%

b) 12.5%

c) 14.0%

d) 14.2%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

58

Use the following two statements to answer this question:

I)The expected return on a portfolio is the equally weighted average of the expected returns on the individual securities in the portfolio.

II)The standard deviation of a portfolio reflects the weighted impact of the individual securities' standard deviations and the relationship among the co-movements of the returns on those individual securities.

A) I is incorrect, II is correct.

B) I is correct, II is incorrect.

C) I and II are incorrect.

D) I and II are correct.

I)The expected return on a portfolio is the equally weighted average of the expected returns on the individual securities in the portfolio.

II)The standard deviation of a portfolio reflects the weighted impact of the individual securities' standard deviations and the relationship among the co-movements of the returns on those individual securities.

A) I is incorrect, II is correct.

B) I is correct, II is incorrect.

C) I and II are incorrect.

D) I and II are correct.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

59

Calculate the correlation between the two stocks.

a) -0.99

b) 0

c) 0.99

d) -1.00

a) -0.99

b) 0

c) 0.99

d) -1.00

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following statements is FALSE?

A) The standard deviation is one measure of risk.

B) Risk measures focus only on the negative performance of the asset.

C) The volatility of the returns of the asset is a measure of risk.

D) Risk increases as return decreases.

A) The standard deviation is one measure of risk.

B) Risk measures focus only on the negative performance of the asset.

C) The volatility of the returns of the asset is a measure of risk.

D) Risk increases as return decreases.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

61

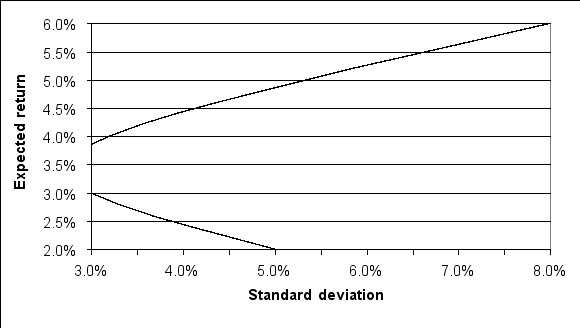

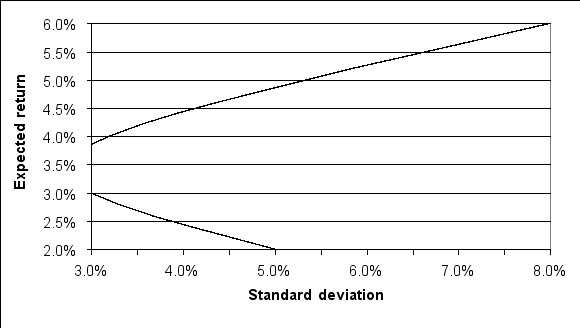

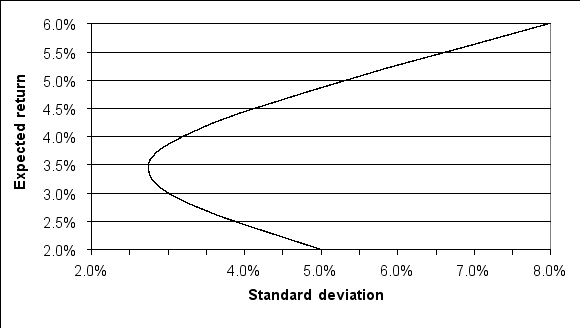

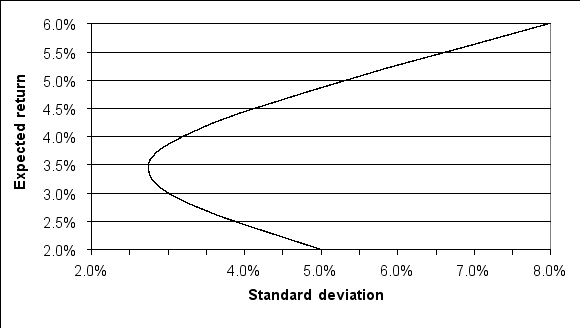

For the following efficient frontier,the standard deviation of the minimum variance portfolio is:

A) <2.5%

B) Between 2.5% and 3.5%

C) Between 3.5% and 4.5%

D) 5.0%

A) <2.5%

B) Between 2.5% and 3.5%

C) Between 3.5% and 4.5%

D) 5.0%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

62

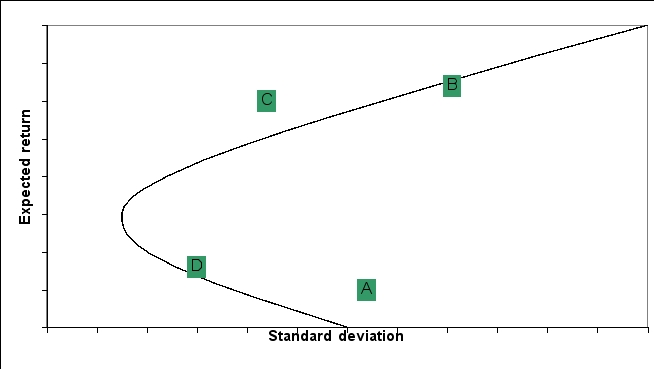

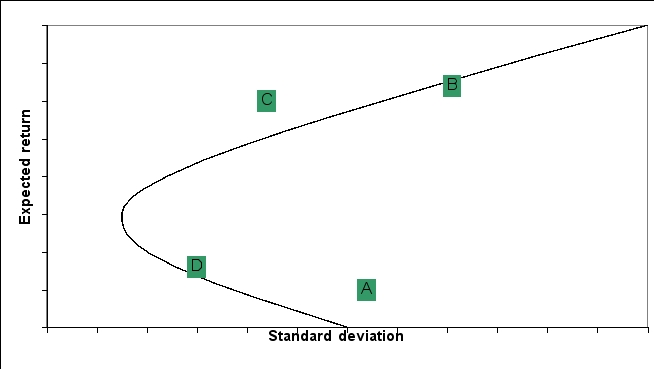

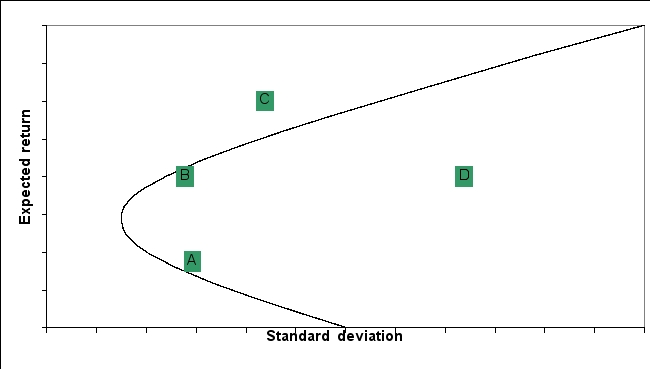

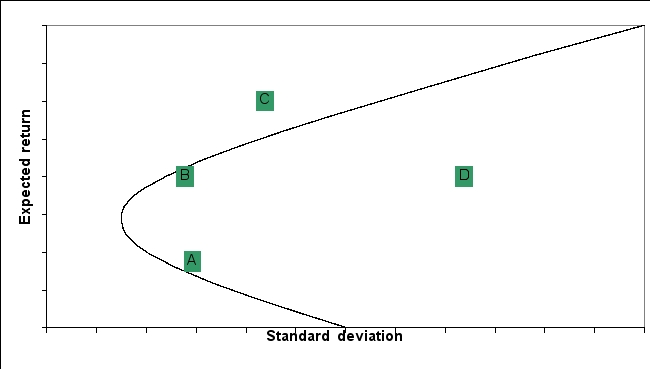

The standard deviation and expected returns for 4 portfolios (A,B,C,and D)are graphed on the following efficient frontier:  Which of the following portfolios are efficient?

Which of the following portfolios are efficient?

A) A and C only

B) B and D only

C) B only

D) All are efficient

Which of the following portfolios are efficient?

Which of the following portfolios are efficient?A) A and C only

B) B and D only

C) B only

D) All are efficient

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

63

A portfolio consists of three securities: Treachery (T),Sleazy (S),and Felony (F).The expected returns for Treachery,Sleazy,and Felony are 10 percent,8 percent,and 16 percent,respectively.The standard deviation is 15 percent for Treachery,20 percent for Sleazy,and 25 percent for Felony.The covariance of the returns on the three securities is: COVTS = 0.0144,COVTF = 0.0084,and COVSF = 0.03.What is the portfolio standard deviation if 20 percent of the portfolio is in Treachery and 35 percent is in Sleazy?

a) 17.73%

b) 13.91%

c) 3.14%

d) 1.93%

a) 17.73%

b) 13.91%

c) 3.14%

d) 1.93%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

64

Suppose you own a two-security portfolio.You have 35 percent of your money invested in Security X and the remainder in Security Y.The standard deviations of Securities X and Y are 10 percent and 15 percent,respectively.What is the correlation between the two securities if the portfolio variance is 0.013225?

a) 0.0055

b) 0.0137

c) 0.3654

d) 0.9148

a) 0.0055

b) 0.0137

c) 0.3654

d) 0.9148

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

65

Suppose you own a two-security portfolio.You have 25 percent of your funds invested in Security A and the balance of your funds invested in Security B.Security A has a standard deviation of 8 percent and Security B has a standard deviation of 12 percent.What is the covariance of the returns on Securities A and B if the portfolio standard deviation is 10 percent?

a) 0.0040

b) 0.0093

c) 0.0147

d) 0.0258

a) 0.0040

b) 0.0093

c) 0.0147

d) 0.0258

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

66

The expected returns for ABC Company and XYZ Company are 12 percent and 9 percent,respectively.The standard deviation is 20 percent for ABC and 15 percent for XYZ.What is the portfolio standard deviation if one-third of the portfolio is in ABC and the two securities have perfect positive correlation?

a) 16.67%

b) 10.00%

c) 2.78%

d) 1.00%

a) 16.67%

b) 10.00%

c) 2.78%

d) 1.00%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

67

The standard deviation and expected returns for 4 portfolios (A,B,C,and D)are graphed on the following efficient frontier:  Which of the following portfolios are attainable?

Which of the following portfolios are attainable?

A) A and B only

B) B and D only

C) B, A, and D only

D) All are attainable

Which of the following portfolios are attainable?

Which of the following portfolios are attainable?A) A and B only

B) B and D only

C) B, A, and D only

D) All are attainable

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

68

The expected returns for Bumpy Inc.and Bouncy Inc.are 20 percent and 8 percent,respectively.The standard deviation is 35 percent for Bumpy and 16 percent for Bouncy.What is the portfolio standard deviation if 45 percent of the portfolio is in Bumpy and the two securities have perfect negative correlation?

a) 4.60%

b) 6.95%

c) 0.21%

d) 0.48%

a) 4.60%

b) 6.95%

c) 0.21%

d) 0.48%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

69

A portfolio is composed of 100 shares (priced at $22/share)of Mensa Corporation and 200 shares of Einstein Corporation (priced at $15/share).What is the expected value of the portfolio if Mensa has an expected return of 14 percent and Einstein has an expected return of 8 percent?

a) $5,530

b) $5,748

c) $5,796

d) $6,272

a) $5,530

b) $5,748

c) $5,796

d) $6,272

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

70

Which portfolio represents the minimum variance portfolio?

A) B

B) C

C) A

D) D

A) B

B) C

C) A

D) D

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

71

The expected returns for Hickory Inc.and Dickory Inc.are 8 percent and 13 percent,respectively.The standard deviation is 12 percent for Hickory and 18 percent for Dickory.What is the portfolio standard deviation if 40 percent of the portfolio is in Hickory and there is no relationship between the returns on the two securities?

a) 0.7108%

b) 1.3968%

c) 8.4309%

d) 11.8186%

a) 0.7108%

b) 1.3968%

c) 8.4309%

d) 11.8186%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

72

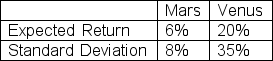

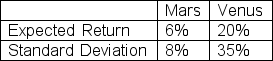

Suppose you observed the following data on two securities: Mars and Venus:

You short sold 200 shares of Mars at $20 per share and purchased 400 shares of Venus at $25 per share to increase the possible return on the portfolio.The correlation between the securities is 0.30.What is the standard deviation of the portfolio?

a) 7.06%

b) 26.56%

c) 32.45%

d) 56.96%

You short sold 200 shares of Mars at $20 per share and purchased 400 shares of Venus at $25 per share to increase the possible return on the portfolio.The correlation between the securities is 0.30.What is the standard deviation of the portfolio?

a) 7.06%

b) 26.56%

c) 32.45%

d) 56.96%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

73

Indiana Jones intends to form a portfolio with two securities: Virtual and Real.Virtual has an expected return of 25 percent with a standard deviation of 5 percent.Real has an expected return of 12 percent with a standard deviation of 16 percent.The correlation between the two securities is 0.2.What is the portfolio standard deviation if the portfolio has an expected return of 20 percent?

a) 0.55%

b) 1.08%

c) 7.41%

d) 10.40%

a) 0.55%

b) 1.08%

c) 7.41%

d) 10.40%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

74

The expected return on Alpha Inc.is 8 percent and the expected return on Beta Inc.is 24 percent.What is the trade-off between investing in Alpha and Beta if the portfolio weight in Alpha is increased by 1%?

a) -0.08%

b) -0.16%

c) -0.24%

d) -0.32%

a) -0.08%

b) -0.16%

c) -0.24%

d) -0.32%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

75

Your portfolio that has $500 invested in Stock A and $1,500 invested in Stock B.If the expected returns on Stock A and Stock B are 7% and 23%,respectively,what is the portfolio return?

a) 19.00%

b) 17.80%

c) 16.10%

d) 12.00%

a) 19.00%

b) 17.80%

c) 16.10%

d) 12.00%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

76

Suppose you plan to create a portfolio with two securities: Rolie and Polie.Rolie has an expected return of 6 percent with a standard deviation of 5 percent.Polie has an expected return of 18 percent with a standard deviation of 15 percent.The correlation between the returns of these two securities is perfectly negative.What percentage of your investment should be in Polie to make the portfolio risk free? What would be the expected return on the portfolio?

a) Portfolio weight in Polie = 25%; expected return on the portfolio = 9.00%

b) Portfolio weight in Polie = 40%; expected return on the portfolio = 10.80%

c) Portfolio weight in Polie = 60%; expected return on the portfolio = 13.20%

d) Portfolio weight in Polie = 75%; expected return on the portfolio = 15.00%

a) Portfolio weight in Polie = 25%; expected return on the portfolio = 9.00%

b) Portfolio weight in Polie = 40%; expected return on the portfolio = 10.80%

c) Portfolio weight in Polie = 60%; expected return on the portfolio = 13.20%

d) Portfolio weight in Polie = 75%; expected return on the portfolio = 15.00%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

77

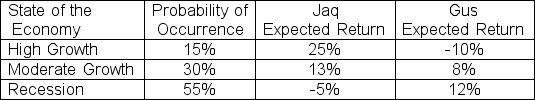

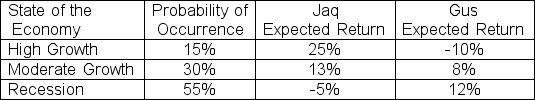

Cinderella plans to form a portfolio with two securities: Jaq and Gus.The correlation between the two securities is -1.Given the following forecasts,what are the weights in Jaq and Gus that will set the standard deviation of the portfolio equal to zero?

a) Portfolio weights in Jaq and Gus are 74.37% and 25.63%, respectively

b) Portfolio weights in Jaq and Gus are 25.63% and 74.37%, respectively

c) Portfolio weights in Jaq and Gus are 60.51% and 39.49%, respectively

d) Portfolio weights in Jaq and Gus are 39.49% and 60.51% respectively

a) Portfolio weights in Jaq and Gus are 74.37% and 25.63%, respectively

b) Portfolio weights in Jaq and Gus are 25.63% and 74.37%, respectively

c) Portfolio weights in Jaq and Gus are 60.51% and 39.49%, respectively

d) Portfolio weights in Jaq and Gus are 39.49% and 60.51% respectively

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

78

Suppose you plan to create a portfolio with three securities: Dizzy (D),Lazy (L),and Crazy (C).The expected returns for Dizzy,Lazy and Crazy are 6 percent,8 percent,and 10 percent,respectively.The standard deviation is 9 percent for Dizzy,15 percent for Lazy,and 12 percent for Crazy.The correlation coefficients among the returns for the three securities are: CORRDL= 0.6,CORRDC = -0.3,and CORRLC = 0.4.What is the portfolio standard deviation if 30 percent of the portfolio is in Dizzy and 40 percent is in Lazy?

a) 0.34%

b) 0.87%

c) 5.82%

d) 9.33%

a) 0.34%

b) 0.87%

c) 5.82%

d) 9.33%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

79

The efficient frontier is constructed by:

A) Maximizing expected portfolio return while holding portfolio variance constant.

B) Minimizing portfolio variance while holding expected portfolio return constant.

C) Either A or B

D) None of the above will generate an efficient frontier.

A) Maximizing expected portfolio return while holding portfolio variance constant.

B) Minimizing portfolio variance while holding expected portfolio return constant.

C) Either A or B

D) None of the above will generate an efficient frontier.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

80

For the following efficient frontier,the expected return of the minimum variance portfolio is:

A) <3.0%

B) Between 3.0% and 4.0%

C) Between 4.0% and 5.0%

D) >5.0%

A) <3.0%

B) Between 3.0% and 4.0%

C) Between 4.0% and 5.0%

D) >5.0%

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck