Deck 20: The Secondary Mortgage Market: Cmos and Derivative Securities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/41

Play

Full screen (f)

Deck 20: The Secondary Mortgage Market: Cmos and Derivative Securities

1

CMO investors only pay taxes on interest income.

True

2

If a premium is paid on a CMO issue (at the time of issue),yields will increase as prepayment rates accelerate.

False

3

A floater is a CMO tranche that has a variable interest rate.

True

4

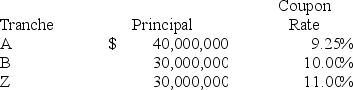

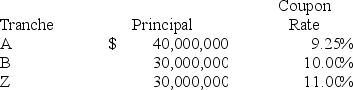

A mortgage company is issuing a CMO with three tranches,with the principal and coupon rate given in the table below.When issued,the weighted average coupon on the CMO will be:

A)9.25%

B)10.00%

C)10.08%

D)11.00%

A)9.25%

B)10.00%

C)10.08%

D)11.00%

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

5

Subprime mortgage-backed securities generally include FHA-insured or VA-guaranteed mortgages,along with conventional mortgages.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

6

The CMO is a considered a marketing innovation as well as a financial innovation,because it is the first security in the secondary mortgage market to have run a prime-time television ad.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

7

A derivative security derives its value from another security,index,or financial claim.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

8

The CMO investor assumes the prepayment risk of the underlying mortgages,although the CMO modifies how the risk is allocated.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

9

A CMO does not completely eliminate prepayment risk.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

10

Investors retain prepayment risk on MBBs,but issuers incur this risk with MPTBs.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

11

The issuer of a mortgage pass-through bond bears all of the prepayment risk of the underlying mortgages.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

12

CDO managers raises capital through the issuance of rated CDO debt and equity to purchase an undiversified pool of credit instruments.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

13

What is the primary distinction between mortgage-related securities backed by residential mortgages and those backed by commercial mortgages?

A)Default is the key risk with residential mortgages; prepayment is the key risk with commercial mortgages

B)Interest rate risk is the key risk with residential mortgages; prepayment is the key risk with commercial mortgages

C)Prepayment is the key risk with residential mortgages; default is the key risk with commercial mortgages

D)Prepayment is the key risk with residential mortgages; interest rate risk is the key risk with commercial mortgages

A)Default is the key risk with residential mortgages; prepayment is the key risk with commercial mortgages

B)Interest rate risk is the key risk with residential mortgages; prepayment is the key risk with commercial mortgages

C)Prepayment is the key risk with residential mortgages; default is the key risk with commercial mortgages

D)Prepayment is the key risk with residential mortgages; interest rate risk is the key risk with commercial mortgages

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

14

In comparison to mortgage pass-though securities,CMOs attract a broader class of investors because,by prioritizing cash flows,they can offer more specific maturities.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

15

From the issuer's perspective,the use of MBBs and MPTBs should be viewed as a method of debt financing.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

16

Cash flows remaining after all CMO tranches have been paid off are referred to as REMICs.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

17

In CMO terminology,planned amortization classes (PACs)are also known as companion tranches.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

18

CDOs often include "B" notes,mezzanine debt and preferred equity as investments.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

19

In CDOs both equity and debt holders prefer riskier,higher-yielding collateral to collect excess spreads.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

20

One way in which a mortgage pay-through bond (MPTB)is similar to a mortgage-backed bond (MBB)is that the pay-through bond is a debt obligation of the issuer.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

21

In comparison to other mortgage-backed securities,the unique characteristic of CMOs is that:

A)CMO issuers do not retain ownership of the underlying mortgage pool

B)CMOs are issued in multiple security classes

C)The CMO mortgage pool is not overcollateralized

D)CMOs are a pay-through in which all amortization and prepayments flow through to investors

A)CMO issuers do not retain ownership of the underlying mortgage pool

B)CMOs are issued in multiple security classes

C)The CMO mortgage pool is not overcollateralized

D)CMOs are a pay-through in which all amortization and prepayments flow through to investors

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

22

The residual position in the CMO offering is considered which kind of position?

A)Primary

B)Equity

C)Interest

D)Debt

A)Primary

B)Equity

C)Interest

D)Debt

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following is NOT characteristic of commercial-backed mortgage securities?

A)The underlying mortgage pool represents a variety of different property types (retail,multifamily,etc.)and a specific geographical area

B)The underlying mortgages have usually been outstanding for several years

C)One of the primary issuers of such securities are insurance companies

D)In general,the underlying mortgage pool for such securities contain fewer mortgages than are included in residential-backed mortgage pools

A)The underlying mortgage pool represents a variety of different property types (retail,multifamily,etc.)and a specific geographical area

B)The underlying mortgages have usually been outstanding for several years

C)One of the primary issuers of such securities are insurance companies

D)In general,the underlying mortgage pool for such securities contain fewer mortgages than are included in residential-backed mortgage pools

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following statements regarding subprime mortgages is TRUE?

A)Subprime mortgages are not Ginnie Mae guaranteed,so CMO investors are exposed to default risk

B)Subprime mortgages are not Ginnie Mae guaranteed,so securities backed by subprime mortgages cannot be issued

C)CMOs backed by subprime mortgages cannot be used as collateral for CDOs

D)Due to diversification,securities backed by subprime loans are of no more risk than those back by prime loans

A)Subprime mortgages are not Ginnie Mae guaranteed,so CMO investors are exposed to default risk

B)Subprime mortgages are not Ginnie Mae guaranteed,so securities backed by subprime mortgages cannot be issued

C)CMOs backed by subprime mortgages cannot be used as collateral for CDOs

D)Due to diversification,securities backed by subprime loans are of no more risk than those back by prime loans

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

25

These items are hybrid securities that contain elements of mortgage-backed bonds and mortgage pass-throughs:

A)MPTBs

B)CDOs

C)CMOs

D)Tranches

A)MPTBs

B)CDOs

C)CMOs

D)Tranches

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following investments in NOT a debt obligation of the issuer?

A)CMOs

B)MBBs

C)MPTs

D)MPTBs

A)CMOs

B)MBBs

C)MPTs

D)MPTBs

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following does NOT increase the noncredit risks of CDOs?

A)Collateral management risk

B)Certainty in average life of CDO tranches

C)Higher correlation and liquidity

D)None of the above

A)Collateral management risk

B)Certainty in average life of CDO tranches

C)Higher correlation and liquidity

D)None of the above

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

28

Duration is defined as:

A)A measure of the extent to which different investments expose an investor to interest rate risk

B)A measure of the weighted-average time required before all principal and interest is received on an investment

C)A measure that takes into account both the size of cash flows and the timing of their receipt

D)All of the above

A)A measure of the extent to which different investments expose an investor to interest rate risk

B)A measure of the weighted-average time required before all principal and interest is received on an investment

C)A measure that takes into account both the size of cash flows and the timing of their receipt

D)All of the above

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

29

For which of the following investments does the issuer bear all of the prepayment risk?

A)CMOs

B)MBBs

C)MPTs

D)MPTBs

A)CMOs

B)MBBs

C)MPTs

D)MPTBs

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

30

REMICs were created in order to avoid taxes:

A)Entirely

B)At the investor level

C)At the entity level

D)No taxes can be avoided.

A)Entirely

B)At the investor level

C)At the entity level

D)No taxes can be avoided.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is FALSE regarding a planned amortization class (PAC)tranche?

A)It has the greatest degree of cash flow certainty

B)Variable payments are received

C)Payments are received over predetermined period of time

D)Payments are received under a range of prepayment scenarios

A)It has the greatest degree of cash flow certainty

B)Variable payments are received

C)Payments are received over predetermined period of time

D)Payments are received under a range of prepayment scenarios

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

32

The main purpose of the Term Asset-Backed Securities Loan Facility (TALF)is to:

A)Buy mortgage backed securities owned by Freddie Mac,Fannie Mae,and Ginnie Mae

B)Issue CDOs and use the proceeds to fund infrastructure projects to stimulate the economy

C)Regulate hedge funds to reduce investments in risky assets

D)Use residential loans as collateral to purchase U.S.Treasuries as a way to reduce interest rates

A)Buy mortgage backed securities owned by Freddie Mac,Fannie Mae,and Ginnie Mae

B)Issue CDOs and use the proceeds to fund infrastructure projects to stimulate the economy

C)Regulate hedge funds to reduce investments in risky assets

D)Use residential loans as collateral to purchase U.S.Treasuries as a way to reduce interest rates

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

33

A calamity call,which allows the issuer to recall all securities for a specified time,can be used in each of the following situations EXCEPT when:

A)Investors want to cash out their positions

B)Interest rates decline sharply

C)Prepayments decline sharply

D)Reinvestment rates are below what was promised to investors

A)Investors want to cash out their positions

B)Interest rates decline sharply

C)Prepayments decline sharply

D)Reinvestment rates are below what was promised to investors

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

34

Convexity is a gauge for which of the following?

A)Profitability

B)Return

C)Sensitivity

D)Duration

A)Profitability

B)Return

C)Sensitivity

D)Duration

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

35

Class A investors are sometimes repaid with an accelerated pattern of cash flows and are sometimes referred to as:

A)Accelerated tranches

B)Quick pay tranches

C)Tranche residuals

D)Fast pay tranches

A)Accelerated tranches

B)Quick pay tranches

C)Tranche residuals

D)Fast pay tranches

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

36

The credit rating of an MPTB depends largely on the:

A)Amount of overcollateralization

B)Degree to which government-related securities constitute the excess collateral

C)Riskiness of the mortgage in the underlying pools

D)All of the above

A)Amount of overcollateralization

B)Degree to which government-related securities constitute the excess collateral

C)Riskiness of the mortgage in the underlying pools

D)All of the above

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

37

The total interest collected from the pool will be ________ if prepayment accelerates; therefore,the dollar spread between interest inflow and outflow becomes ________.

A)Lower,smaller

B)Lower,wider

C)Higher,smaller

D)Higher,wider

A)Lower,smaller

B)Lower,wider

C)Higher,smaller

D)Higher,wider

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following statements regarding mortgage pass-through bonds (MPTBs)is FALSE?

A)MPTBs can be viewed as mortgage-backed bonds with the pass-through of principal and prepayment features of a mortgage pass-through security

B)Most MPTBs are based on residential mortgage pools and are generally overcollateralized

C)MPTBs represent an undivided equity ownership interest in a mortgage pool

D)All of the above are false.

A)MPTBs can be viewed as mortgage-backed bonds with the pass-through of principal and prepayment features of a mortgage pass-through security

B)Most MPTBs are based on residential mortgage pools and are generally overcollateralized

C)MPTBs represent an undivided equity ownership interest in a mortgage pool

D)All of the above are false.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

39

For which of the following investments is the exact date of maturity known?

A)CMOs

B)MBBs

C)MPTs

D)MPTBs

A)CMOs

B)MBBs

C)MPTs

D)MPTBs

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is NOT a CMO security type?

A)A repeat floater

B)A Z tranche

C)An inverse floater

D)An IO tranche

A)A repeat floater

B)A Z tranche

C)An inverse floater

D)An IO tranche

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

41

A tranche that has a coupon interest rate that adjusts in the opposite direction to its index is referred to as:

A)Reverse floater tranche

B)Inverse floater tranche

C)Upside-down floater tranche

D)Backwards floater tranche

A)Reverse floater tranche

B)Inverse floater tranche

C)Upside-down floater tranche

D)Backwards floater tranche

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck