Deck 6: Merchandise Inventory

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

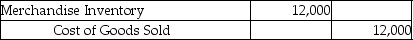

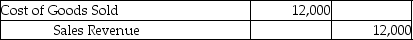

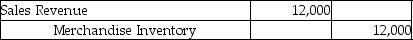

Question

Question

Question

Question

Question

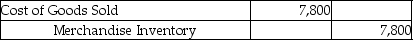

Question

Question

Question

Question

Question

Question

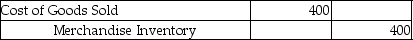

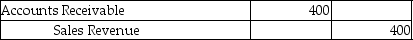

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/155

Play

Full screen (f)

Deck 6: Merchandise Inventory

1

A company is uncertain whether a complex transaction should be recorded as gain or loss. Under the conservatism principle, they should choose to treat it a loss.

True

2

A company decides to ignore a very small error in their inventory balance. This is an example of application of the:

A)accounting conservatism.

B)materiality concept.

C)disclosure principle.

D)consistency principle.

A)accounting conservatism.

B)materiality concept.

C)disclosure principle.

D)consistency principle.

B

3

Which of the following is an application of the conservatism concept?

A)reporting inventory at the lower of cost or market

B)reporting only material amounts in the financial statements

C)reporting all relevant information in the financial statements

D)using the same depreciation method from period to period

A)reporting inventory at the lower of cost or market

B)reporting only material amounts in the financial statements

C)reporting all relevant information in the financial statements

D)using the same depreciation method from period to period

A

4

Which of the following requires that financial statements should report the least favorable figures?

A)conservatism

B)materiality concept

C)disclosure principle

D)consistency principle

A)conservatism

B)materiality concept

C)disclosure principle

D)consistency principle

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

5

A company is uncertain whether a complex transaction should result in an asset being recorded at $100,000 or at $150,000. Under the conservatism principle, they should choose to show it at $100,000.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

6

A company discovers that its cost of goods sold is understated by an insignificant amount. They do not need to correct the error because of the conservatism principle.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

7

A company reports in its financial statements that it uses the FIFO method of inventory costing. This is an example of the disclosure principle.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following states that the business should use the same accounting methods from period to period?

A)materiality concept

B)consistency principle

C)conservatism

D)disclosure principle

A)materiality concept

B)consistency principle

C)conservatism

D)disclosure principle

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

9

The consistency principle states that businesses should report the same amount of ending merchandise inventory from period to period.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following principles states that a business should never anticipate gains?

A)conservatism

B)materiality concept

C)disclosure principle

D)consistency principle

A)conservatism

B)materiality concept

C)disclosure principle

D)consistency principle

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

11

The disclosure concept states that a company should report enough information for outsiders to make knowledgeable decisions about the company.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following states that a company must perform strictly proper accounting only for items that are significant to the business's financial statements?

A)accounting conservatism

B)materiality concept

C)disclosure principle

D)consistency principle

A)accounting conservatism

B)materiality concept

C)disclosure principle

D)consistency principle

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

13

The consistency principle states that a business should use the same accounting methods from period to period.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

14

A company changes its inventory costing method each period in order to maximize net income. This is a violation of the consistency principle.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following principles states that a business's financial statements must report enough information for outsiders to make knowledgeable decisions about the company?

A)accounting conservatism

B)materiality concept

C)disclosure principle

D)consistency principle

A)accounting conservatism

B)materiality concept

C)disclosure principle

D)consistency principle

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

16

A company should not change the inventory costing method each period in order to maximize net income. This is an example of the disclosure principle.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

17

The lower-of-cost-or-market rule demonstrates accounting conservatism in action.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

18

A company is uncertain whether a complex transaction should be recorded as an asset or an expense. Under the conservatism principle, they should choose to treat it as an asset.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

19

Changing from the LIFO (Last-In, First-Out)to the specific identification method of valuing inventory ignores the principle of:

A)conservatism.

B)consistency.

C)disclosure.

D)materiality.

A)conservatism.

B)consistency.

C)disclosure.

D)materiality.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

20

A company discovers that its cost of goods sold is understated by an insignificant amount. They do not need to correct the error because of the materiality concept.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

21

When a company uses the first-in, first-out (FIFO)method the cost of goods sold correlates to the most recently purchased goods and the value of ending inventory correlates to the oldest goods in stock.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

22

When a company uses the last-in, first-out (LIFO)method, the cost of goods sold correlates to the most recently purchased goods, and the ending inventory correlates to the oldest goods in stock.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following inventory costing methods uses the costs of the oldest purchases to calculate the value of the ending inventory?

A)Specific identification

B)Weighted-average

C)Last-in, first-out

D)First-in, first-out

A)Specific identification

B)Weighted-average

C)Last-in, first-out

D)First-in, first-out

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

24

The disclosure principle states that a company should disclose all major accounting methods and procedures in the:

A)balance sheet.

B)income statement.

C)footnotes to the financial statements.

D)adjusted trial balance.

A)balance sheet.

B)income statement.

C)footnotes to the financial statements.

D)adjusted trial balance.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following inventory costing methods is based on the actual cost of each particular unit of inventory?

A)Specific identification

B)Weighted-average

C)Last-in, first-out

D)First-in, first-out

A)Specific identification

B)Weighted-average

C)Last-in, first-out

D)First-in, first-out

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

26

A company purchased 100 units for $30 each on January 31. It purchased 150 units for $25 on February 28. It sold a total of 150 units for $50 each from March 1 through December 31. If the company uses the weighted-average inventory costing method, calculate the amount of ending inventory on December 31. (Assume that the company uses a perpetual inventory system.)

A)$6,750

B)$2,700

C)$4,350

D)$2,900

A)$6,750

B)$2,700

C)$4,350

D)$2,900

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

27

A company purchased 100 units for $30 each on January 31. It purchased 150 units for $25 on February 28. It sold 150 units for $50 each from March 1 through December 31. If the company uses the first-in, first-out inventory costing method, what is the amount of Cost of Goods Sold on the income statement for the year ending December 31? (Assume that the company uses a perpetual inventory system.)

A)$3,000

B)$4,000

C)$4,250

D)$6,750

A)$3,000

B)$4,000

C)$4,250

D)$6,750

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

28

Ending inventory equals the cost of goods available for sale less beginning inventory.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

29

The materiality concept states that a company must:

A)report only such information that enhances the financial position of the company.

B)perform strictly proper accounting only for significant items.

C)report enough information for outsiders to make knowledgeable decisions about the company.

D)use the same accounting methods and procedures from period to period.

A)report only such information that enhances the financial position of the company.

B)perform strictly proper accounting only for significant items.

C)report enough information for outsiders to make knowledgeable decisions about the company.

D)use the same accounting methods and procedures from period to period.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

30

A company purchased 100 units for $20 each on January 31. It purchased 100 units for $30 on February 28. It sold a total of 150 units for $45 each from March 1 through December 31. If the company uses the last-in, first-out inventory costing method, calculate the amount of ending inventory on December 31. (Assume that the company uses a perpetual inventory system.)

A)$1,500

B)$1,250

C)$1,000

D)$2,250

A)$1,500

B)$1,250

C)$1,000

D)$2,250

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

31

The tracking of inventory shrinkage due to theft, damage, or errors is done with the help of ________ of inventory.

A)authorization

B)sale

C)physical count

D)delivery

A)authorization

B)sale

C)physical count

D)delivery

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

32

Under the last-in, first-out (LIFO)method, the cost of goods sold is based on the oldest purchases.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

33

A company purchased 100 units for $20 each on January 31. It purchased 100 units for $30 on February 28. It sold a total of 150 units for $45 each from March 1 through December 31. What is the amount of ending inventory on December 31, if the company uses the first-in, first-out (FIFO)inventory costing method? (Assume that the company uses a perpetual inventory system.)

A)$1,500

B)$1,250

C)$1,000

D)$2,250

A)$1,500

B)$1,250

C)$1,000

D)$2,250

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following statements is true of a good merchandise inventory control system?

A)It minimizes the authorization of purchase of merchandise.

B)It ensures that a physical count of inventory is not required.

C)It often prevents the company from a stockout.

D)It minimizes the authorization of sale of merchandise.

A)It minimizes the authorization of purchase of merchandise.

B)It ensures that a physical count of inventory is not required.

C)It often prevents the company from a stockout.

D)It minimizes the authorization of sale of merchandise.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

35

Ending inventory is calculated by multiplying the number of units on hand with the unit cost.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

36

The total cost spent on inventory that was available to be sold during a period is called cost of goods sold.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following methods of inventory valuation requires the calculation of a new average cost after each purchase?

A)Specific identification

B)Weighted-average

C)Last-in, first-out

D)First-in, first-out

A)Specific identification

B)Weighted-average

C)Last-in, first-out

D)First-in, first-out

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following inventory costing methods uses the cost of the oldest purchases to calculate the cost of goods sold?

A)Specific identification

B)Weighted-average

C)Last-in, first-out

D)First-in, first-out

A)Specific identification

B)Weighted-average

C)Last-in, first-out

D)First-in, first-out

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

39

The specific identification method of inventory costing is recommended when a business deals in unique and high-priced inventory items.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

40

Under which of the following inventory costing methods is the ending inventory valued on the cost of the most recent purchases?

A)Specific identification

B)Weighted-average

C)Last-in, first-out

D)First-in, first-out

A)Specific identification

B)Weighted-average

C)Last-in, first-out

D)First-in, first-out

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

41

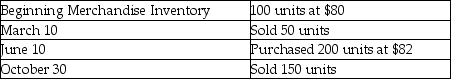

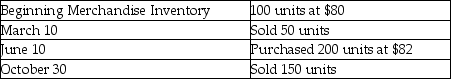

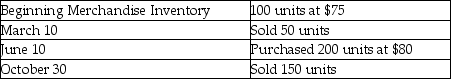

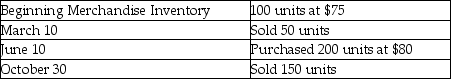

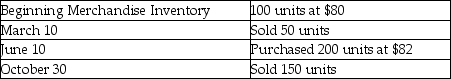

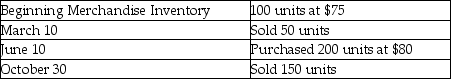

Rodriguez Company had the following balances and transactions during 2014, from January 1 to December 31:  What would the Ending Merchandise Inventory amount be as reported on the balance sheet at December 31, 2014 if the perpetual weighted-average costing method is used? (Round your intermediate calculations to two decimal places)

What would the Ending Merchandise Inventory amount be as reported on the balance sheet at December 31, 2014 if the perpetual weighted-average costing method is used? (Round your intermediate calculations to two decimal places)

A)$8,160

B)$4,000

C)$8,000

D)$12,000

What would the Ending Merchandise Inventory amount be as reported on the balance sheet at December 31, 2014 if the perpetual weighted-average costing method is used? (Round your intermediate calculations to two decimal places)

What would the Ending Merchandise Inventory amount be as reported on the balance sheet at December 31, 2014 if the perpetual weighted-average costing method is used? (Round your intermediate calculations to two decimal places)A)$8,160

B)$4,000

C)$8,000

D)$12,000

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

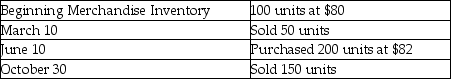

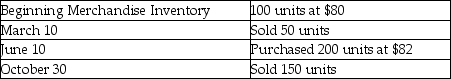

42

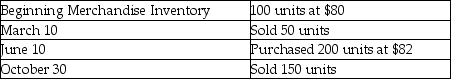

Lewis Company had the following balances and transactions during 2014:  What would the Cost of Goods Sold be as reported on the income statement for the year ending December 31, 2014 if the perpetual weighted-average costing method is used? (Round your intermediate calculations to two decimal places)

What would the Cost of Goods Sold be as reported on the income statement for the year ending December 31, 2014 if the perpetual weighted-average costing method is used? (Round your intermediate calculations to two decimal places)

A)$8,160

B)$20,400

C)$16,240

D)$12,000

What would the Cost of Goods Sold be as reported on the income statement for the year ending December 31, 2014 if the perpetual weighted-average costing method is used? (Round your intermediate calculations to two decimal places)

What would the Cost of Goods Sold be as reported on the income statement for the year ending December 31, 2014 if the perpetual weighted-average costing method is used? (Round your intermediate calculations to two decimal places)A)$8,160

B)$20,400

C)$16,240

D)$12,000

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

43

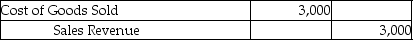

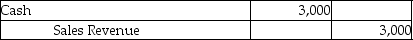

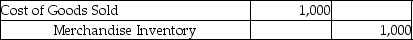

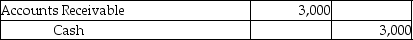

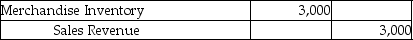

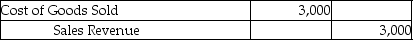

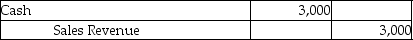

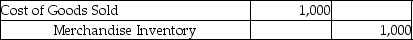

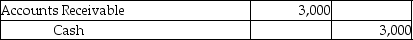

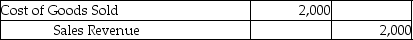

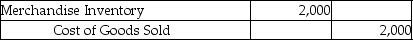

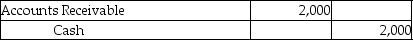

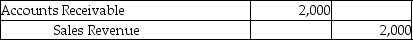

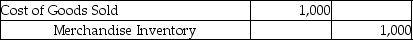

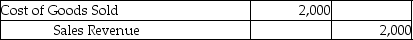

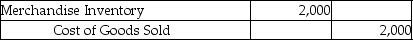

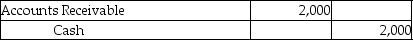

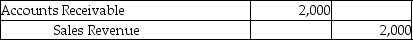

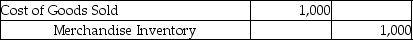

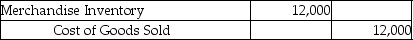

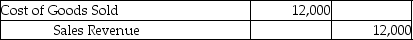

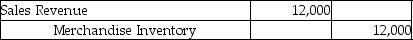

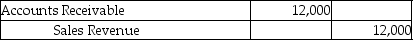

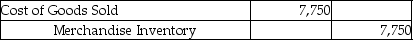

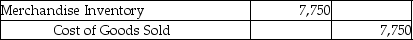

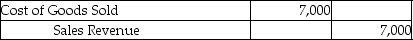

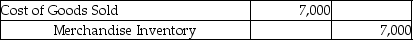

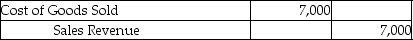

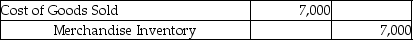

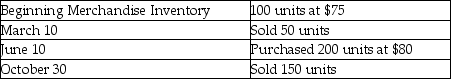

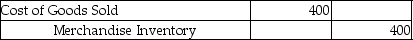

A company that uses the perpetual inventory system sold goods to a customer for cash for $3,000. The cost of the goods sold was $1,000. Which of the following journal entries correctly records this transaction?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

44

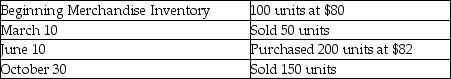

Rodriguez Company had the following balances and transactions during 2015:  What would the Ending Merchandise Inventory amount be as reported on the balance sheet at December 31, 2015 if the perpetual first-in, first-out costing method is used?

What would the Ending Merchandise Inventory amount be as reported on the balance sheet at December 31, 2015 if the perpetual first-in, first-out costing method is used?

A)$4,000

B)$16,400

C)$8,200

D)$8,000

What would the Ending Merchandise Inventory amount be as reported on the balance sheet at December 31, 2015 if the perpetual first-in, first-out costing method is used?

What would the Ending Merchandise Inventory amount be as reported on the balance sheet at December 31, 2015 if the perpetual first-in, first-out costing method is used?A)$4,000

B)$16,400

C)$8,200

D)$8,000

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

45

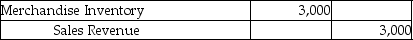

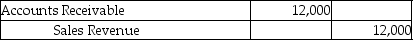

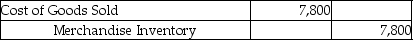

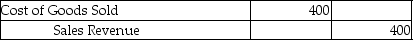

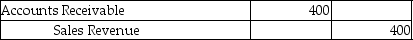

A company that uses the perpetual inventory system sold goods to a customer on account for $2,000. The cost of the goods sold was $1,000. Which of the following journal entries correctly records this transaction?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

46

Perez Company purchased 500 units of inventory at $25 per unit by payment of cash. Provide the journal entry to record the purchase of inventory. (Assume a perpetual inventory system)

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

47

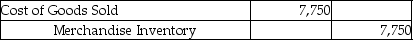

A company that uses the perpetual inventory system purchased 500 pallets of industrial soap for $7,000 and paid $800 for the freight-in. The company sold the whole lot to a supermarket chain for $12,000 on account. Which of the following entries correctly records the sale?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

48

Henderson Sales purchased $6,000 of inventory on account. Provide the journal entry. (Assume a perpetual inventory system)

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

49

Perez Company purchased inventory on account for $6,500. Provide the journal entry to record the purchase of inventory on account. (Assume a perpetual inventory system)

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

50

A company purchased 100 units for $30 each on January 31. It purchased 150 units for $25 on February 28. It sold 150 units for $50 each from March 1 through December 31. If the company uses the weighted-average inventory costing method, calculate the amount of Cost of Goods Sold on the income statement for the year ending December 31. (Assume the company uses the perpetual inventory system.)

A)$6,750

B)$4,050

C)$3,000

D)$3,750

A)$6,750

B)$4,050

C)$3,000

D)$3,750

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

51

Metro Computer Company had the following balances and transactions during 2014:  What would the company's ending merchandise inventory amount be on December 31, 2014 if the perpetual last-in, first-out costing method is used?

What would the company's ending merchandise inventory amount be on December 31, 2014 if the perpetual last-in, first-out costing method is used?

A)$7,500

B)$23,500

C)$7,750

D)$16,000

What would the company's ending merchandise inventory amount be on December 31, 2014 if the perpetual last-in, first-out costing method is used?

What would the company's ending merchandise inventory amount be on December 31, 2014 if the perpetual last-in, first-out costing method is used?A)$7,500

B)$23,500

C)$7,750

D)$16,000

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

52

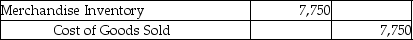

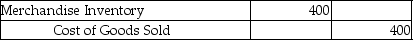

A company that uses the perpetual inventory system purchased 500 pallets of industrial soap for $7,000 and paid $750 for the freight-in. The company sold the whole lot to a supermarket chain for $13,000 on account. The company uses the specific-identification method of inventory costing. Which of the following entries correctly records the cost of goods sold?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

53

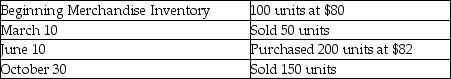

Harris Company had the following balances and transactions during 2015:  What would the Cost of Goods Sold be as reported on the income statement for the year ending December 31, 2015 if the perpetual first-in, first-out costing method is used?

What would the Cost of Goods Sold be as reported on the income statement for the year ending December 31, 2015 if the perpetual first-in, first-out costing method is used?

A)$8,000

B)$12,200

C)$24,400

D)$16,200

What would the Cost of Goods Sold be as reported on the income statement for the year ending December 31, 2015 if the perpetual first-in, first-out costing method is used?

What would the Cost of Goods Sold be as reported on the income statement for the year ending December 31, 2015 if the perpetual first-in, first-out costing method is used?A)$8,000

B)$12,200

C)$24,400

D)$16,200

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

54

A company purchased 100 units for $20 each on January 31. It purchased 100 units for $30 on February 28. It sold 150 units for $45 each from March 1 through December If the company uses the last-in, first-out inventory costing method, what is the amount of cost of goods sold on the income statement for the year ending December 31? (Assume that the company uses a perpetual inventory system.)

A)$4,000

B)$3,000

C)$2,000

D)$5,000

A)$4,000

B)$3,000

C)$2,000

D)$5,000

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following is the correct formula to calculate weighted-average unit cost?

A)Weighted-average unit cost = Cost of goods available for sale + Number of units available

B)Weighted-average unit cost = Cost of goods available for sale × Number of units available

C)Weighted-average unit cost = Cost of goods available for sale - Number of units available

D)Weighted-average unit cost = Cost of goods available for sale ÷ Number of units available

A)Weighted-average unit cost = Cost of goods available for sale + Number of units available

B)Weighted-average unit cost = Cost of goods available for sale × Number of units available

C)Weighted-average unit cost = Cost of goods available for sale - Number of units available

D)Weighted-average unit cost = Cost of goods available for sale ÷ Number of units available

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

56

Harris Company had the following balances and transactions during 2014:  What would the Cost of Goods Sold be as reported on the income statement for the year ending December 31, 2014 if the perpetual, last-in, first-out costing method is used? Round your answer to two decimal places.

What would the Cost of Goods Sold be as reported on the income statement for the year ending December 31, 2014 if the perpetual, last-in, first-out costing method is used? Round your answer to two decimal places.

A)$15,750

B)$12,000

C)$3,750

D)$15,000

What would the Cost of Goods Sold be as reported on the income statement for the year ending December 31, 2014 if the perpetual, last-in, first-out costing method is used? Round your answer to two decimal places.

What would the Cost of Goods Sold be as reported on the income statement for the year ending December 31, 2014 if the perpetual, last-in, first-out costing method is used? Round your answer to two decimal places.A)$15,750

B)$12,000

C)$3,750

D)$15,000

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

57

Under the weighted-average method, the cost per unit is determined by:

A)dividing the cost of goods available for sale by the number of units available.

B)dividing the cost of goods available for sale by the number of units in beginning inventory.

C)multiplying the number of units purchased with the weighted-average cost.

D)multiplying the cost of goods available for sale by the ending weighted-average price of previous accounting period.

A)dividing the cost of goods available for sale by the number of units available.

B)dividing the cost of goods available for sale by the number of units in beginning inventory.

C)multiplying the number of units purchased with the weighted-average cost.

D)multiplying the cost of goods available for sale by the ending weighted-average price of previous accounting period.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

58

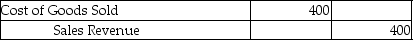

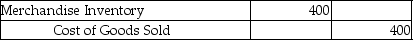

A company that uses the perpetual inventory system sold goods for $1,000 to a customer on account. The company had purchased the inventory for $400. Which of the following journal entries correctly records the cost of goods sold?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

59

Clark Sales sold 450 units of product to a customer on account. The company uses the perpetual inventory system. The selling price was $28 per unit, and the cost, according to the company's inventory records, was $12 per unit. Provide the journal entry to record the sales revenue.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

60

Henderson Sales sold 400 units of product to a customer on account. The selling price was $28 per unit, and the cost, according to the company's inventory records, was $14 per unit. Provide the journal entry to record cost of goods sold. (Assume a perpetual inventory system)

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

61

In a period of rising costs, the last-in, first-out (LIFO)method results in higher cost of goods sold and lower net income than the first-in, first-out (FIFO)method.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following values remains the same irrespective of the inventory valuation method used by a company? Assume the cost of inventory is rising.

A)Purchases

B)Cost of goods sold

C)Ending merchandise inventory

D)Net income

A)Purchases

B)Cost of goods sold

C)Ending merchandise inventory

D)Net income

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following inventory valuation methods minimizes income tax payment during a period of rising inventory costs?

A)First-in, first-out

B)Last-in, first-out

C)Weighted-average

D)Specific identification

A)First-in, first-out

B)Last-in, first-out

C)Weighted-average

D)Specific identification

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following inventory valuation methods should be used for unique or high dollar items?

A)First-in, first-out

B)Last-in, first-out

C)Weighted-average

D)Specific identification

A)First-in, first-out

B)Last-in, first-out

C)Weighted-average

D)Specific identification

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

65

Given the same purchase and sales data, the three major costing methods for inventory will result in three different amounts for sales revenue. Assume the cost of inventory is rising.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

66

Given the same purchase and sales data, the three major costing methods for inventory will result in three different amounts for cost of goods sold. Assume the cost of inventory is rising.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

67

In a period of rising costs, the first-in, first-out (FIFO)method results in higher cost of goods sold and lower gross profit than the last-in, first-out (LIFO)method.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

68

In a period of rising costs, the first-in, first-out (FIFO)method results in lower cost of goods sold and higher gross profit than the last-in, first-out (LIFO)method.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following inventory costing methods yields the lowest cost of goods sold during a period of rising inventory costs?

A)Specific identification

B)Weighted-average

C)Last-in, first-out

D)First-in, first-out

A)Specific identification

B)Weighted-average

C)Last-in, first-out

D)First-in, first-out

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

70

Perez Company sold 500 units of inventory at $25 per unit on account. The company uses the perpetual inventory system. The cost of the units sold was $10 per unit. Provide the journal entries to record the sale on account.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

71

The sum of the cost of goods sold and the ending inventory equals the cost of goods available for sale.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following inventory costing methods yields the highest net income during a period of rising inventory costs?

A)Specific identification

B)Weighted-average

C)Last-in, first-out

D)First-in, first-out

A)Specific identification

B)Weighted-average

C)Last-in, first-out

D)First-in, first-out

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following inventory costing methods results in the highest value of ending inventory during a period of rising inventory costs?

A)Specific identification

B)Weighted-average

C)Last-in, first-out

D)First-in, first-out

A)Specific identification

B)Weighted-average

C)Last-in, first-out

D)First-in, first-out

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

74

In a period of rising costs, the last-in, first-out (LIFO)method results in lower cost of goods sold and higher net income than the first-in, first-out (FIFO)method.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

75

Perez Company sold 500 units of inventory at $25 per unit for cash. The company uses the perpetual inventory system. The cost of the units sold was $10 per unit. Provide the journal entries to record the sale.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

76

The cost of goods available for sale is equal to the:

A)cost of goods sold minus the ending inventory.

B)sales revenue minus the cost of goods sold.

C)cost of goods sold plus the ending inventory.

D)ending inventory plus the sales revenues.

A)cost of goods sold minus the ending inventory.

B)sales revenue minus the cost of goods sold.

C)cost of goods sold plus the ending inventory.

D)ending inventory plus the sales revenues.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following inventory costing methods results in the lowest value of ending inventory during a period of rising inventory costs?

A)Specific identification

B)Weighted-average

C)Last-in, first-out

D)First-in, first-out

A)Specific identification

B)Weighted-average

C)Last-in, first-out

D)First-in, first-out

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

78

Given the same purchase and sales data, the three major costing methods for inventory will result in three different amounts for net income. Assume the cost of inventory is rising.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following inventory costing methods yields the lowest net income during a period of rising inventory costs?

A)Specific identification

B)Weighted-average

C)Last-in, first-out

D)First-in, first-out

A)Specific identification

B)Weighted-average

C)Last-in, first-out

D)First-in, first-out

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following inventory costing methods yields the highest cost of goods sold during a period of rising inventory costs?

A)Specific identification

B)Weighted-average

C)Last-in, first-out

D)First-in, first-out

A)Specific identification

B)Weighted-average

C)Last-in, first-out

D)First-in, first-out

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck