Deck 12: Systematic Risk and the Equity Risk Premium

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/103

Play

Full screen (f)

Deck 12: Systematic Risk and the Equity Risk Premium

1

The price of BHP is $35 per share and that of RIO is $60 per share. The price of BHP increases to $37 per share after one year and to $40 after two years. Also, shares of RIO increase to $65 after one year and to $70 after two years. If your portfolio comprises 100 shares of each security, what is your portfolio return in year 1 and year 2? Assume no dividends are paid.

A)7.37%, 7.84%

B)9.62%, 11.34%

C)11.21%, 8.81%

D)9.01%, 13.62%

A)7.37%, 7.84%

B)9.62%, 11.34%

C)11.21%, 8.81%

D)9.01%, 13.62%

7.37%, 7.84%

2

A portfolio has shares in three firms-300 shares of Commonwealth Bank (CBA), 300 shares of Woolworths (WOW), and 100 shares of Rio Tinto (RIO). If the price of CBA is $20, the price of WOW is $30, and the price of RIO is $150, calculate the portfolio weight of CBA and WOW.

A)15%, 25%

B)20%, 30%

C)20%, 40%

D)10%, 20%

A)15%, 25%

B)20%, 30%

C)20%, 40%

D)10%, 20%

20%, 30%

3

Use the information for the question(s)below.

Suppose you invest $20 000 by purchasing 400 shares of BHP Billiton (BHP)at $13 per share, 500 shares of ANZ Bank (ANZ)at $20 per share, and 200 shares of Flight Centre (FLT)at $24 per share.

The weight of BHP in your portfolio is:

A)26%.

B)24%.

C)50%.

D)42%.

Suppose you invest $20 000 by purchasing 400 shares of BHP Billiton (BHP)at $13 per share, 500 shares of ANZ Bank (ANZ)at $20 per share, and 200 shares of Flight Centre (FLT)at $24 per share.

The weight of BHP in your portfolio is:

A)26%.

B)24%.

C)50%.

D)42%.

26%.

4

Use the information for the question(s)below.

Suppose you invest $20 000 by purchasing 400 shares of BHP Billiton (BHP)at $13 per share, 500 shares of ANZ Bank (ANZ)at $20 per share, and 200 shares of Flight Centre (FLT)at $24 per share.

The weight of ANZ in your portfolio is:

A)40%.

B)30%.

C)50%.

D)20%.

Suppose you invest $20 000 by purchasing 400 shares of BHP Billiton (BHP)at $13 per share, 500 shares of ANZ Bank (ANZ)at $20 per share, and 200 shares of Flight Centre (FLT)at $24 per share.

The weight of ANZ in your portfolio is:

A)40%.

B)30%.

C)50%.

D)20%.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following equations is INCORRECT?

A)Rp = Σi xiRi

B)E[Rp} = E[Σi xiRi]

C)xi =![<strong>Which of the following equations is INCORRECT?</strong> A)R<sub>p</sub> = Σ<sub>i</sub> x<sub>i</sub>R<sub>i</sub> B)E[R<sub>p</sub>} = E[Σ<sub>i</sub> x<sub>i</sub>R<sub>i</sub>] C)x<sub>i</sub> = D)R<sub>p</sub> = x<sub>1</sub>R<sub>1</sub> + x<sub>2</sub>R<sub>2</sub> + ... + x<sub>n</sub>R<sub>n</sub>](https://d2lvgg3v3hfg70.cloudfront.net/TB3082/11ea825d_bf6e_081c_bbd8_5bb68f15ae30_TB3082_00.jpg)

D)Rp = x1R1 + x2R2 + ... + xnRn

A)Rp = Σi xiRi

B)E[Rp} = E[Σi xiRi]

C)xi =

![<strong>Which of the following equations is INCORRECT?</strong> A)R<sub>p</sub> = Σ<sub>i</sub> x<sub>i</sub>R<sub>i</sub> B)E[R<sub>p</sub>} = E[Σ<sub>i</sub> x<sub>i</sub>R<sub>i</sub>] C)x<sub>i</sub> = D)R<sub>p</sub> = x<sub>1</sub>R<sub>1</sub> + x<sub>2</sub>R<sub>2</sub> + ... + x<sub>n</sub>R<sub>n</sub>](https://d2lvgg3v3hfg70.cloudfront.net/TB3082/11ea825d_bf6e_081c_bbd8_5bb68f15ae30_TB3082_00.jpg)

D)Rp = x1R1 + x2R2 + ... + xnRn

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

6

A portfolio comprises two firms, A and B, with equal amounts of money invested in each. If firm A's share price increases and that of firm B decreases, the weight of firm A in the portfolio will increase.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements is FALSE?

A)Portfolio weights add up to one so that they represent the way we have divided our money between the different individual investments in the portfolio.

B)The expected return of a portfolio is simply the weighted average of the expected returns of the investments within the portfolio.

C)Without trading, the portfolio weights will decrease for the shares in the portfolio whose returns are above the overall portfolio return.

D)A portfolio weight is the fraction of the total investment in the portfolio held in an individual investment in the portfolio.

A)Portfolio weights add up to one so that they represent the way we have divided our money between the different individual investments in the portfolio.

B)The expected return of a portfolio is simply the weighted average of the expected returns of the investments within the portfolio.

C)Without trading, the portfolio weights will decrease for the shares in the portfolio whose returns are above the overall portfolio return.

D)A portfolio weight is the fraction of the total investment in the portfolio held in an individual investment in the portfolio.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

8

Suppose you invest in 200 shares of CBA at $70 per share and 200 shares of WOW at $20 per share. If the price of CBA increases to $80 and the price of WOW decreases to $18 per share, what is the return on your portfolio?

A)8.89%

B)12.21%

C)9.76%

D)11.21%

A)8.89%

B)12.21%

C)9.76%

D)11.21%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

9

Suppose you invest in 100 shares of BHP at $40 per share and 200 shares of ANZ at $25 per share. If the price of BHP increases to $50 and the price of ANZ decreases to $20 per share, what is the return on your portfolio?

A)-5%

B)0%

C)12%

D)-10%

A)-5%

B)0%

C)12%

D)-10%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

10

Suppose you invest in 100 shares of NAB at $40 per share and 100 shares of WES at $25 per share. If the price of NAB increases to $45 and the price of WES decreases to $22 per share, what is the return on your portfolio?

A)4.12%

B)5.39%

C)3.08%

D)9.45%

A)4.12%

B)5.39%

C)3.08%

D)9.45%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

11

A portfolio has shares in three firms-200 shares of Commonwealth Bank (CBA), 100 shares of Woolworths (WOW), and 50 shares of Rio Tinto (RIO). If the price of CBA is $30, the price of WOW is $30, and the price of RIO is $130, calculate the portfolio weight of CBA and WOW.

A)21.3%, 35.2%

B)38.7%, 19.4%

C)36.2%, 21.6%

D)11.7%, 12.7%

A)21.3%, 35.2%

B)38.7%, 19.4%

C)36.2%, 21.6%

D)11.7%, 12.7%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

12

A portfolio has shares in three firms-100 shares of Commonwealth Bank (CBA), 200 shares of Woolworths (WOW), and 50 shares of Rio Tinto (RIO). If the price of CBA is $20, the price of WOW is $20, and the price of RIO is $130, calculate the portfolio weight of CBA and WOW.

A)15%, 29%

B)12%, 17%

C)16%, 32%

D)11%, 31%

A)15%, 29%

B)12%, 17%

C)16%, 32%

D)11%, 31%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

13

The price of BHP is $30 per share and that of RIO is $50 per share. The price of BHP increases to $35 per share after one year and to $40 after two years. Also, shares of RIO increase to $60 after one year and to $70 after two years. If your portfolio comprises 100 shares of each security, what is your portfolio return in year 1 and year 2? Assume no dividends are paid.

A)18.01%, 14.52%

B)18.62%, 17.75%

C)18.75%, 15.79%

D)19.97%, 17.85%

A)18.01%, 14.52%

B)18.62%, 17.75%

C)18.75%, 15.79%

D)19.97%, 17.85%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

14

For large portfolios, investors should expect a higher return for higher volatility, but this does not hold true for individual shares.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

15

Shares have both diversifiable risk and undiversifiable risk, but only undiversifiable risk is rewarded with higher expected returns.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

16

Your superannuation fund comprises 200 units of the Diversified Large Industrials fund (DLI)and 100 shares of Cochlear (COH). The price of DLI is $130 and that of COH is $105. If you expect the return on DLI to be 9% in the next year and the return on COH to be 7%, what is the expected return for your retirement portfolio?

A)9.64%

B)8.42%

C)7.81%

D)8.94%

A)9.64%

B)8.42%

C)7.81%

D)8.94%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

17

Your superannuation fund comprises 100 units of the Diversified Large Industrials fund (DLI)and 100 shares of Cochlear (COH). The price of DLI is $120 and that of COH is $98. If you expect the return on DLI to be 10% in the next year and the return on COH to be 5%, what is the expected return for your retirement portfolio?

A)7.75%

B)6.65%

C)7.01%

D)8.82%

A)7.75%

B)6.65%

C)7.01%

D)8.82%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

18

Use the information for the question(s)below.

Suppose you invest $20 000 by purchasing 400 shares of BHP Billiton (BHP)at $13 per share, 500 shares of ANZ Bank (ANZ)at $20 per share, and 200 shares of Flight Centre (FLT)at $24 per share.

The weight of FLT in your portfolio is:

A)30%.

B)24%.

C)42%.

D)26%.

Suppose you invest $20 000 by purchasing 400 shares of BHP Billiton (BHP)at $13 per share, 500 shares of ANZ Bank (ANZ)at $20 per share, and 200 shares of Flight Centre (FLT)at $24 per share.

The weight of FLT in your portfolio is:

A)30%.

B)24%.

C)42%.

D)26%.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

19

The price of BHP is $40 per share and that of RIO is $45 per share. The price of BHP increases to $45 per share after one year and to $50 after two years. Also, shares of RIO increase to $50 after one year and to $60 after two years. If your portfolio comprises 100 shares of each security, what is your portfolio return in year 1 and year 2? Assume no dividends are paid.

A)11.76%, 15.79%

B)9.91%, 17.96%

C)11.21%, 14.53%

D)10.05%, 18.76%

A)11.76%, 15.79%

B)9.91%, 17.96%

C)11.21%, 14.53%

D)10.05%, 18.76%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

20

Your superannuation fund comprises 300 units of the Diversified Large Industrials fund (DLI)and 100 shares of Cochlear (COH). The price of DLI is $140 and that of COH is $95. If you expect the return on DLI to be 15% in the next year and the return on COH to be 8%, what is the expected return for your retirement portfolio?

A)13.71%

B)12.52%

C)11.67%

D)12.25%

A)13.71%

B)12.52%

C)11.67%

D)12.25%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

21

The portfolio weight of the better performing asset decreases in a two-asset portfolio.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

22

A portfolio has 25% of its value in ASX shares and the rest in Woodside Petroleum (WPL). The volatilities of ASX and WPL are 40% and 20%, respectively, and the correlation between ASX and WPL is -0.5. What is the standard deviation of the portfolio?

A)13.65%

B)14.95%

C)12.17%

D)13.23%

A)13.65%

B)14.95%

C)12.17%

D)13.23%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

23

Diversification reduces the risk of a portfolio because share prices do not move identically and some of the risks are averaged out of the portfolio.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

24

'Correlation' is the degree to which the returns share common risks.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

25

When we form an equally weighted portfolio of shares and keep increasing the number of shares in the portfolio, the volatility of the portfolio also increases.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

26

Share prices tend to move together if they are affected by:

A)common economic events.

B)events unrelated to the economy.

C)company specific events.

D)idiosyncratic shocks.

A)common economic events.

B)events unrelated to the economy.

C)company specific events.

D)idiosyncratic shocks.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

27

Use the information for the question(s)below.

Suppose you invest $20 000 by purchasing 400 shares of BHP Billiton (BHP)at $13 per share, 500 shares of ANZ Bank (ANZ)at $20 per share, and 200 shares of Flight Centre (FLT)at $24 per share.

Suppose over the next year BHP has a return of 12.5%, ANZ has a return of 20%, and FLT has a return of -10%. The value of your portfolio over the year is:

A)$21 500.

B)$20 000.

C)$22 170.

D)$21 000.

Suppose you invest $20 000 by purchasing 400 shares of BHP Billiton (BHP)at $13 per share, 500 shares of ANZ Bank (ANZ)at $20 per share, and 200 shares of Flight Centre (FLT)at $24 per share.

Suppose over the next year BHP has a return of 12.5%, ANZ has a return of 20%, and FLT has a return of -10%. The value of your portfolio over the year is:

A)$21 500.

B)$20 000.

C)$22 170.

D)$21 000.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

28

The volatility of Woolworth's share price is 25% and that of Reckon's shares is 25%. The correlation between Woolworth and Reckon shares is 0.15. When I hold both shares in my portfolio, the overall volatility of the portfolio is:

A)26%.

B)30%.

C)28%.

D)More information needed.

A)26%.

B)30%.

C)28%.

D)More information needed.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

29

A portfolio has 50% of its value in ASX shares and the rest in Woodside Petroleum (WPL). The volatilities of ASX and WPL are 20% and 20%, respectively, and the correlation between ASX and WPL is 0. What is the standard deviation of the portfolio?

A)12.17%

B)14.14%

C)19.52%

D)11.51%

A)12.17%

B)14.14%

C)19.52%

D)11.51%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

30

The standard deviation of the two assets does not play any role in computation of the expected return of the two-asset portfolio.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

31

If you build a large enough portfolio, you can diversify away all the risks of a portfolio.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

32

The correlation of the two assets does not play any role in computation of the expected return of the two-asset portfolio.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

33

The volatility of Woolworth's share price is 30% and that of Reckon's shares is 30%. When I hold both shares in my portfolio and the returns have a correlation of 1, the overall volatility of returns of the portfolio is:

A)less than 30%.

B)unchanged at 30%.

C)more than 30%.

D)Cannot say for sure.

A)less than 30%.

B)unchanged at 30%.

C)more than 30%.

D)Cannot say for sure.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

34

When we combine shares in a portfolio, the amount of risk that is eliminated depends on the degree to which the shares face common risks and move together.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

35

The volatility of Woolworth's share price is 15% and that of Reckon's shares is 15%. When I hold both shares in my portfolio and the returns have zero correlation, the overall volatility of returns of the portfolio is:

A)more than 15%.

B)unchanged at 15%.

C)less than 15%.

D)Cannot say for sure.

A)more than 15%.

B)unchanged at 15%.

C)less than 15%.

D)Cannot say for sure.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

36

A portfolio has 10% of its value in ASX shares and the rest in Woodside Petroleum (WPL). The volatilities of ASX and WPL are 40% and 20%, respectively, and the correlation between ASX and WPL is 0.5. What is the standard deviation of the portfolio?

A)21.67%

B)20.23%

C)20.30%

D)21.35%

A)21.67%

B)20.23%

C)20.30%

D)21.35%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

37

The volatility of Woolworth's share price is 30% and that of Reckon's shares is 30%. When I hold both shares in my portfolio with an equal amount in each, and the returns have a correlation of minus 1, the overall volatility of returns of the portfolio is

A)zero.

B)unchanged at 30%.

C)more than 30%.

D)Cannot say for sure.

A)zero.

B)unchanged at 30%.

C)more than 30%.

D)Cannot say for sure.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

38

Use the information for the question(s)below.

Suppose you invest $20 000 by purchasing 400 shares of BHP Billiton (BHP)at $13 per share, 500 shares of ANZ Bank (ANZ)at $20 per share, and 200 shares of Flight Centre (FLT)at $24 per share.

Suppose over the next year BHP has a return of 12.5%, ANZ has a return of 20%, and FLT has a return of -10%. The return on your portfolio over the year is:

A)0%.

B)7.52%.

C)15.51%.

D)10.85%.

Suppose you invest $20 000 by purchasing 400 shares of BHP Billiton (BHP)at $13 per share, 500 shares of ANZ Bank (ANZ)at $20 per share, and 200 shares of Flight Centre (FLT)at $24 per share.

Suppose over the next year BHP has a return of 12.5%, ANZ has a return of 20%, and FLT has a return of -10%. The return on your portfolio over the year is:

A)0%.

B)7.52%.

C)15.51%.

D)10.85%.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

39

If two shares are perfectly negatively correlated, a portfolio with equal weighting in each share will always have a volatility (standard deviation)of 0.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

40

Use the information for the question(s)below.

Suppose you invest $20 000 by purchasing 400 shares of BHP Billiton (BHP)at $13 per share, 500 shares of ANZ Bank (ANZ)at $20 per share, and 200 shares of Flight Centre (FLT)at $24 per share.

The expected return of a portfolio that is equally invested in Data#3 and Metcash is closest to:

A)44%.

B)14%.

C)15%.

D)29%.

Suppose you invest $20 000 by purchasing 400 shares of BHP Billiton (BHP)at $13 per share, 500 shares of ANZ Bank (ANZ)at $20 per share, and 200 shares of Flight Centre (FLT)at $24 per share.

The expected return of a portfolio that is equally invested in Data#3 and Metcash is closest to:

A)44%.

B)14%.

C)15%.

D)29%.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

41

Use the table for the question(s)below.

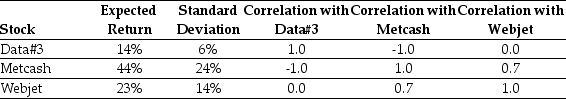

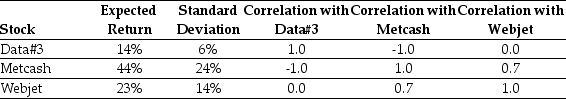

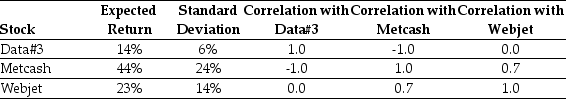

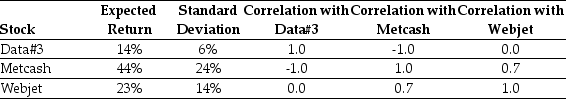

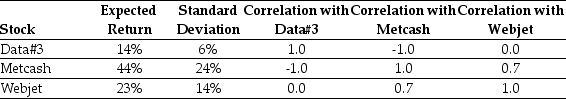

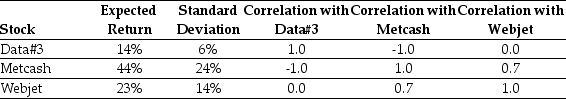

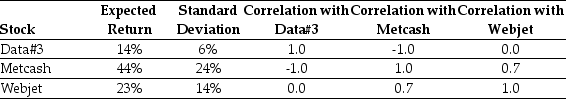

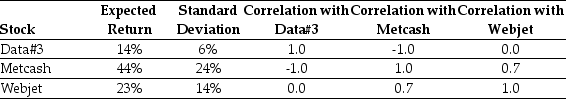

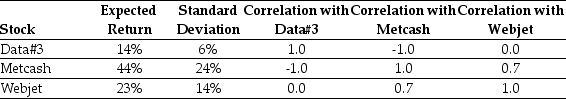

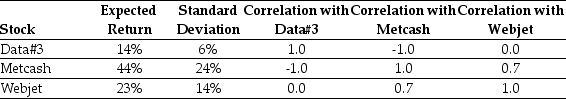

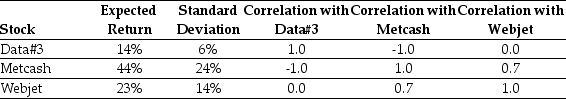

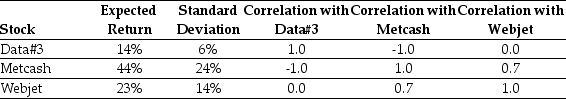

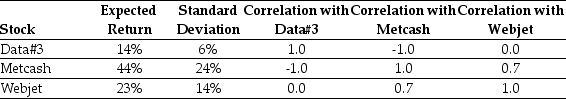

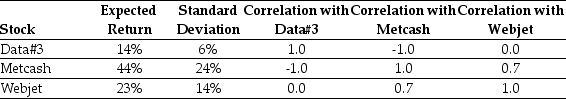

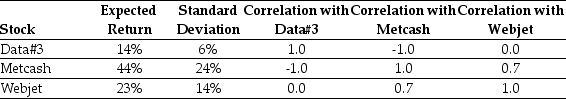

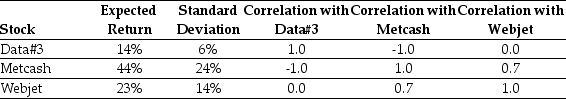

Consider the following expected returns, volatilities and correlations:

A share market comprises 5 000 shares of company A and 2 000 shares of company B. Assume the share prices for companies A and B are $20 and $35, respectively. What is the capitalisation of the market portfolio?

A)$165 000

B)$170 000

C)$150 000

D)$185 000

Consider the following expected returns, volatilities and correlations:

A share market comprises 5 000 shares of company A and 2 000 shares of company B. Assume the share prices for companies A and B are $20 and $35, respectively. What is the capitalisation of the market portfolio?

A)$165 000

B)$170 000

C)$150 000

D)$185 000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

42

Use the table for the question(s)below.

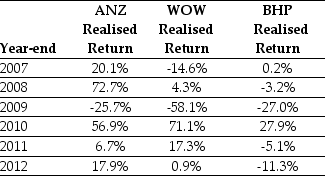

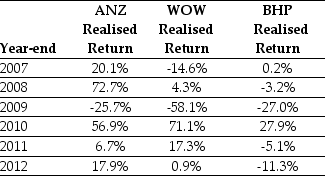

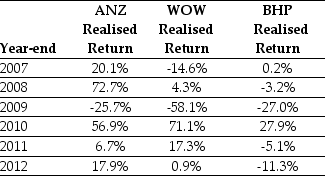

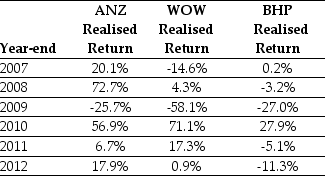

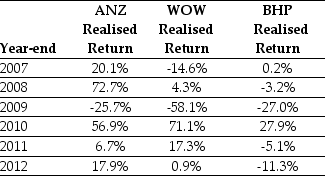

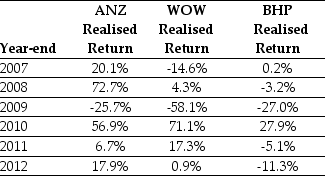

Consider the following returns:

The covariance between ANZ and WOW's returns is closest to:

A)0.12.

B)0.29.

C)0.10.

D)0.69.

Consider the following returns:

The covariance between ANZ and WOW's returns is closest to:

A)0.12.

B)0.29.

C)0.10.

D)0.69.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

43

Use the table for the question(s)below.

Consider the following expected returns, volatilities and correlations:

The volatility of a portfolio that is equally invested in Webjet and Data#3 is closest to:

A)7.6%.

B)0.6%.

C)22.4%.

D)5.0%.

Consider the following expected returns, volatilities and correlations:

The volatility of a portfolio that is equally invested in Webjet and Data#3 is closest to:

A)7.6%.

B)0.6%.

C)22.4%.

D)5.0%.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

44

Use the table for the question(s)below.

Consider the following expected returns, volatilities and correlations:

A share market comprises 1 000 shares of company A and 3 000 shares of company B. The share prices for companies A and B are $25 and $30, respectively. What is the capitalisation of the market portfolio?

A)$125 000

B)$115 000

C)$100 000

D)$98 000

Consider the following expected returns, volatilities and correlations:

A share market comprises 1 000 shares of company A and 3 000 shares of company B. The share prices for companies A and B are $25 and $30, respectively. What is the capitalisation of the market portfolio?

A)$125 000

B)$115 000

C)$100 000

D)$98 000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

45

Use the table for the question(s)below.

Consider the following expected returns, volatilities and correlations:

The volatility of a portfolio that is equally invested in Data#3 and Metcash is closest to:

A)11%.

B)8%.

C)6%.

D)9%.

Consider the following expected returns, volatilities and correlations:

The volatility of a portfolio that is equally invested in Data#3 and Metcash is closest to:

A)11%.

B)8%.

C)6%.

D)9%.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following equations is INCORRECT?

A)Cov(Ri,Rj)= E[(Ri - E[Ri])(Rj - E[Rj])]

B)Corr(Ri,Rj)=![<strong>Which of the following equations is INCORRECT?</strong> A)Cov(R<sub>i</sub>,R<sub>j</sub>)= E[(R<sub>i</sub> - E[R<sub>i</sub>])(R<sub>j</sub> - E[R<sub>j</sub>])] B)Corr(R<sub>i</sub>,R<sub>j</sub>)= C)Cov(R<sub>i</sub>,R<sub>j</sub>)= Σ(R<sub>i</sub> - R<sub>i</sub>)(R<sub>j</sub> - R<sub>j</sub>) D)Var(R<sub>p</sub>)= x<sub>1</sub><sup>2</sup><sup>Var</sup>(R<sub>1</sub>)+ x<sub>2</sub><sup>2</sup><sup>Var</sup>(R<sub>2</sub>)+ 2X<sub>1</sub>X<sub>2</sub>Cov(R<sub>1</sub>,R<sub>2</sub>)](https://d2lvgg3v3hfg70.cloudfront.net/TB3082/11ea825d_bf70_03ed_bbd8_01ea9924f985_TB3082_11.jpg)

C)Cov(Ri,Rj)=![<strong>Which of the following equations is INCORRECT?</strong> A)Cov(R<sub>i</sub>,R<sub>j</sub>)= E[(R<sub>i</sub> - E[R<sub>i</sub>])(R<sub>j</sub> - E[R<sub>j</sub>])] B)Corr(R<sub>i</sub>,R<sub>j</sub>)= C)Cov(R<sub>i</sub>,R<sub>j</sub>)= Σ(R<sub>i</sub> - R<sub>i</sub>)(R<sub>j</sub> - R<sub>j</sub>) D)Var(R<sub>p</sub>)= x<sub>1</sub><sup>2</sup><sup>Var</sup>(R<sub>1</sub>)+ x<sub>2</sub><sup>2</sup><sup>Var</sup>(R<sub>2</sub>)+ 2X<sub>1</sub>X<sub>2</sub>Cov(R<sub>1</sub>,R<sub>2</sub>)](https://d2lvgg3v3hfg70.cloudfront.net/TB3082/11ea825d_bf70_2afe_bbd8_35ebbfe54186_TB3082_11.jpg) Σ(Ri - Ri)(Rj - Rj)

Σ(Ri - Ri)(Rj - Rj)

D)Var(Rp)= x12Var(R1)+ x22Var(R2)+ 2X1X2Cov(R1,R2)

A)Cov(Ri,Rj)= E[(Ri - E[Ri])(Rj - E[Rj])]

B)Corr(Ri,Rj)=

![<strong>Which of the following equations is INCORRECT?</strong> A)Cov(R<sub>i</sub>,R<sub>j</sub>)= E[(R<sub>i</sub> - E[R<sub>i</sub>])(R<sub>j</sub> - E[R<sub>j</sub>])] B)Corr(R<sub>i</sub>,R<sub>j</sub>)= C)Cov(R<sub>i</sub>,R<sub>j</sub>)= Σ(R<sub>i</sub> - R<sub>i</sub>)(R<sub>j</sub> - R<sub>j</sub>) D)Var(R<sub>p</sub>)= x<sub>1</sub><sup>2</sup><sup>Var</sup>(R<sub>1</sub>)+ x<sub>2</sub><sup>2</sup><sup>Var</sup>(R<sub>2</sub>)+ 2X<sub>1</sub>X<sub>2</sub>Cov(R<sub>1</sub>,R<sub>2</sub>)](https://d2lvgg3v3hfg70.cloudfront.net/TB3082/11ea825d_bf70_03ed_bbd8_01ea9924f985_TB3082_11.jpg)

C)Cov(Ri,Rj)=

![<strong>Which of the following equations is INCORRECT?</strong> A)Cov(R<sub>i</sub>,R<sub>j</sub>)= E[(R<sub>i</sub> - E[R<sub>i</sub>])(R<sub>j</sub> - E[R<sub>j</sub>])] B)Corr(R<sub>i</sub>,R<sub>j</sub>)= C)Cov(R<sub>i</sub>,R<sub>j</sub>)= Σ(R<sub>i</sub> - R<sub>i</sub>)(R<sub>j</sub> - R<sub>j</sub>) D)Var(R<sub>p</sub>)= x<sub>1</sub><sup>2</sup><sup>Var</sup>(R<sub>1</sub>)+ x<sub>2</sub><sup>2</sup><sup>Var</sup>(R<sub>2</sub>)+ 2X<sub>1</sub>X<sub>2</sub>Cov(R<sub>1</sub>,R<sub>2</sub>)](https://d2lvgg3v3hfg70.cloudfront.net/TB3082/11ea825d_bf70_2afe_bbd8_35ebbfe54186_TB3082_11.jpg) Σ(Ri - Ri)(Rj - Rj)

Σ(Ri - Ri)(Rj - Rj)D)Var(Rp)= x12Var(R1)+ x22Var(R2)+ 2X1X2Cov(R1,R2)

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

47

Use the table for the question(s)below.

Consider the following expected returns, volatilities and correlations:

A share market comprises 5 000 shares of company A and 2 000 shares of company B. Assume the share prices for companies A and B are $20 and $35, respectively. What proportion of the market portfolio is comprised of company A?

A)58.8%

B)$100 000

C)$70 000

D)41.2%

Consider the following expected returns, volatilities and correlations:

A share market comprises 5 000 shares of company A and 2 000 shares of company B. Assume the share prices for companies A and B are $20 and $35, respectively. What proportion of the market portfolio is comprised of company A?

A)58.8%

B)$100 000

C)$70 000

D)41.2%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following statements is FALSE?

A)Shares' returns will tend to move together if they are affected similarly by economic events.

B)Almost all of the correlations between shares are negative, illustrating the general tendency of shares to move together.

C)With a positive amount invested in each share, the more the shares move together and the higher their covariance or correlation, the more variable the portfolio will be.

D)Shares in the same industry tend to have more highly correlated returns than shares in different industries.

A)Shares' returns will tend to move together if they are affected similarly by economic events.

B)Almost all of the correlations between shares are negative, illustrating the general tendency of shares to move together.

C)With a positive amount invested in each share, the more the shares move together and the higher their covariance or correlation, the more variable the portfolio will be.

D)Shares in the same industry tend to have more highly correlated returns than shares in different industries.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following statements is FALSE?

A)The closer the correlation is to -1, the more the returns tend to move in opposite directions.

B)A share's return is perfectly positively correlated with itself.

C)The variance of a portfolio depends only on the variance of the individual shares.

D)When the covariance equals 0, the shares have no tendency to move either together or in opposition of one another.

A)The closer the correlation is to -1, the more the returns tend to move in opposite directions.

B)A share's return is perfectly positively correlated with itself.

C)The variance of a portfolio depends only on the variance of the individual shares.

D)When the covariance equals 0, the shares have no tendency to move either together or in opposition of one another.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

50

Use the table for the question(s)below.

Consider the following expected returns, volatilities and correlations:

A share market comprises 2 000 shares of company A and 2 000 shares of company B. The share prices for companies A and B are $20 and $10, respectively. What is the capitalisation of the market portfolio?

A)$70 000

B)$65 000

C)$55 000

D)$60 000

Consider the following expected returns, volatilities and correlations:

A share market comprises 2 000 shares of company A and 2 000 shares of company B. The share prices for companies A and B are $20 and $10, respectively. What is the capitalisation of the market portfolio?

A)$70 000

B)$65 000

C)$55 000

D)$60 000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following statements is FALSE?

A)The covariance of a share with itself is simply its variance.

B)If two shares move in opposite directions, one will tend to be above average when the other is below average, and the covariance will be negative.

C)The covariance allows us to gauge the strength of the relationship between shares.

D)The correlation between two shares has the same sign as their covariance, so it has a similar interpretation.

A)The covariance of a share with itself is simply its variance.

B)If two shares move in opposite directions, one will tend to be above average when the other is below average, and the covariance will be negative.

C)The covariance allows us to gauge the strength of the relationship between shares.

D)The correlation between two shares has the same sign as their covariance, so it has a similar interpretation.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

52

Use the table for the question(s)below.

Consider the following returns:

The volatility on WOW returns is closest to:

A)18%.

B)31%.

C)35%.

D)42%.

Consider the following returns:

The volatility on WOW returns is closest to:

A)18%.

B)31%.

C)35%.

D)42%.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

53

Use the table for the question(s)below.

Consider the following returns:

The volatility on ANZ returns is closest to:

A)13%.

B)10%.

C)42%.

D)35%.

Consider the following returns:

The volatility on ANZ returns is closest to:

A)13%.

B)10%.

C)42%.

D)35%.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following statements is FALSE?

A)Because the prices of shares do not move identically, some of the risk is averaged out in a portfolio.

B)The covariance and correlation allow us to measure the co-movement of returns.

C)The amount of risk that is eliminated in a portfolio depends on the degree to which the shares face common risks and their prices move together.

D)Correlation is the expected product of the deviations of two returns.

A)Because the prices of shares do not move identically, some of the risk is averaged out in a portfolio.

B)The covariance and correlation allow us to measure the co-movement of returns.

C)The amount of risk that is eliminated in a portfolio depends on the degree to which the shares face common risks and their prices move together.

D)Correlation is the expected product of the deviations of two returns.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

55

Use the table for the question(s)below.

Consider the following expected returns, volatilities and correlations:

A share market comprises 2 000 shares of company A and 2 000 shares of company B. The share prices for companies A and B are $20 and $10, respectively. What proportion of the market portfolio is comprised of each company?

A)Company A is 200% and company B is 100%.

B)Company A is 33.3% and company B is 66.7%.

C)Company A is 66.7% and company B is 33.3%.

D)Company A is $40 000 and company B is $20 000.

Consider the following expected returns, volatilities and correlations:

A share market comprises 2 000 shares of company A and 2 000 shares of company B. The share prices for companies A and B are $20 and $10, respectively. What proportion of the market portfolio is comprised of each company?

A)Company A is 200% and company B is 100%.

B)Company A is 33.3% and company B is 66.7%.

C)Company A is 66.7% and company B is 33.3%.

D)Company A is $40 000 and company B is $20 000.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

56

As we add more uncorrelated shares to a portfolio where the shares are held in equal weights, the benefit of diversification is most dramatic:

A)after 20 shares have been added.

B)when there are more than 500 shares.

C)at the outset.

D)when there are more than 1 000 shares.

A)after 20 shares have been added.

B)when there are more than 500 shares.

C)at the outset.

D)when there are more than 1 000 shares.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

57

Use the table for the question(s)below.

Consider the following expected returns, volatilities and correlations:

Which of the following combinations of two stocks would give you the biggest reduction in risk?

A)Metcash and Data#3

B)Data#3 and Webjet

C)Webjet and Metcash

D)No combination will reduce risk.

Consider the following expected returns, volatilities and correlations:

Which of the following combinations of two stocks would give you the biggest reduction in risk?

A)Metcash and Data#3

B)Data#3 and Webjet

C)Webjet and Metcash

D)No combination will reduce risk.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

58

We can reduce volatility by investing in less than perfectly correlated assets through diversification because the expected return of a portfolio is the weighted average of the expected returns of its shares, but the volatility of a portfolio:

A)is independent of weights in the shares.

B)depends on the expected return.

C)is less than the weighted average volatility.

D)is higher than the weighted average volatility.

A)is independent of weights in the shares.

B)depends on the expected return.

C)is less than the weighted average volatility.

D)is higher than the weighted average volatility.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

59

You expect Wesfarmers (WES)to have a beta of 1.3 over the next year and the beta of Qantas (QAN)to be 0.9 over the next year. Also, you expect the volatility of WES to be 40% and that of QAN to be 30% over the next year. Which company has more systematic risk? Which company has more total risk?

A)WES, WES

B)QAN, QAN

C)QAN, WES

D)WES, QAN

A)WES, WES

B)QAN, QAN

C)QAN, WES

D)WES, QAN

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following statements is FALSE?

A)To find the risk of a portfolio, we need to know more than the risk and return of the component shares; we need to know the degree to which the shares' returns move together.

B)While the sign of the correlation is easy to interpret, its magnitude is not.

C)When the covariance equals 0, the returns are uncorrelated.

D)Independent risks are uncorrelated.

A)To find the risk of a portfolio, we need to know more than the risk and return of the component shares; we need to know the degree to which the shares' returns move together.

B)While the sign of the correlation is easy to interpret, its magnitude is not.

C)When the covariance equals 0, the returns are uncorrelated.

D)Independent risks are uncorrelated.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

61

The amount of a share's risk that is diversified away:

A)depends on market risk premium.

B)depends on risk-free rate of interest.

C)is independent of the portfolio that you add it to.

D)depends on the portfolio that you add it to.

A)depends on market risk premium.

B)depends on risk-free rate of interest.

C)is independent of the portfolio that you add it to.

D)depends on the portfolio that you add it to.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

62

The beta of the market portfolio is: 0.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

63

The market or equity risk premium can be estimated by computing the historical average excess return of the market portfolio.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

64

A linear regression to estimate the relation between Domino's Pizza share returns and the market's return gives the best fitting line that represents the relation between the share and the market. The slope of this line is our estimate of:

A)risk-free rate.

B)alpha.

C)volatility.

D)beta.

A)risk-free rate.

B)alpha.

C)volatility.

D)beta.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

65

What is the lowest risk possible by selecting two shares that are perfectly negatively correlated?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

66

For each 1% change in the market portfolio's excess return, the investment's excess return is expected to change by ________ percent due to risks that it has in common with the market.

A)alpha

B)beta

C)zero

D)Cannot say for sure.

A)alpha

B)beta

C)zero

D)Cannot say for sure.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

67

You expect Wesfarmers (WES)to have a beta of 1 over the next year and the beta of Qantas (QAN)to be 1.2 over the next year. Also, you expect the volatility of WES to be 30% and that of QAN to be 40% over the next year. Which company has more systematic risk? Which company has more total risk?

A)WES, QAN

B)QAN, WES

C)WES, WES

D)QAN, QAN

A)WES, QAN

B)QAN, WES

C)WES, WES

D)QAN, QAN

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following statements is FALSE?

A)We can rule out inefficient portfolios because they represent inferior investment choices.

B)Correlation has no effect on the expected return on a portfolio.

C)The volatility of the portfolio will differ, depending on the correlation between the securities in the portfolio.

D)We say a portfolio is an efficient portfolio whenever it is possible to find another portfolio that is better

In terms of both expected return and volatility.

A)We can rule out inefficient portfolios because they represent inferior investment choices.

B)Correlation has no effect on the expected return on a portfolio.

C)The volatility of the portfolio will differ, depending on the correlation between the securities in the portfolio.

D)We say a portfolio is an efficient portfolio whenever it is possible to find another portfolio that is better

In terms of both expected return and volatility.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

69

What diversification, if any, is achieved if two shares in a portfolio are perfectly positively correlated?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

70

Companies that sell household products and food have very little relation to the state of the economy because such basic needs do not go away. These stocks tend to have ________ betas.

A)low

B)negative

C)high

D)Cannot say for sure.

A)low

B)negative

C)high

D)Cannot say for sure.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

71

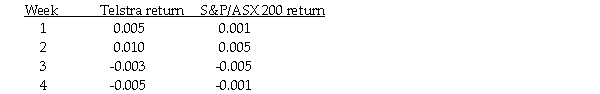

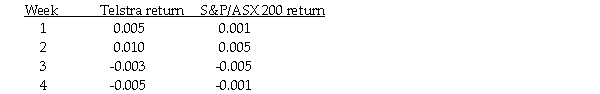

You observe that Telstra shares and the S&P/ASX 200 index have the following weekly returns:  If this pattern of returns is typical of Telstra shares, and you calculated a beta against the S&P/ASX 200, which of the following is true?

If this pattern of returns is typical of Telstra shares, and you calculated a beta against the S&P/ASX 200, which of the following is true?

A)Telstra's beta is zero.

B)Telstra's beta is positive.

C)Telstra's beta is negative.

D)Cannot be determined from information given.

If this pattern of returns is typical of Telstra shares, and you calculated a beta against the S&P/ASX 200, which of the following is true?

If this pattern of returns is typical of Telstra shares, and you calculated a beta against the S&P/ASX 200, which of the following is true?A)Telstra's beta is zero.

B)Telstra's beta is positive.

C)Telstra's beta is negative.

D)Cannot be determined from information given.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

72

The market portfolio is the portfolio of all risky investments held:

A)in descending weights.

B)in ascending weights.

C)based on previous year performance.

D)in proportion to their value.

A)in descending weights.

B)in ascending weights.

C)based on previous year performance.

D)in proportion to their value.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

73

The S&P 500 index traditionally is a(n)________ portfolio of the 500 largest US stocks.

A)value weighted

B)chain weighted

C)price weighted

D)equally weighted

A)value weighted

B)chain weighted

C)price weighted

D)equally weighted

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

74

If you build a large enough portfolio, you can diversify away all ________ risk, but you will be left with ________ risk.

A)diversifiable, diversifiable

B)diversifiable, unsystematic

C)unsystematic, systematic

D)systematic, undiversifiable

A)diversifiable, diversifiable

B)diversifiable, unsystematic

C)unsystematic, systematic

D)systematic, undiversifiable

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

75

A linear regression was done to estimate the relation between Santos' share returns and the market's return. The intercept of the line was found to be 0.23 and the slope was 1.47. Which of the following statements is true regarding Santos shares?

A)The standard deviation of Santos' excess returns is 23%.

B)The risk-free rate is 1.47%.

C)Santos' beta is 1.47.

D)Santos' beta is 0.23.

A)The standard deviation of Santos' excess returns is 23%.

B)The risk-free rate is 1.47%.

C)Santos' beta is 1.47.

D)Santos' beta is 0.23.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

76

The security market line is a graph of the expected return of a security as a function of systematic risk (beta).

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

77

You expect Wesfarmers (WES)to have a beta of 1.5 over the next year and the beta of Qantas (QAN)to be 1.9 over the next year. Also, you expect the volatility of WES to be 50% and that of QAN to be 35% over the next year. Which company has more systematic risk? Which company has more total risk?

A)QAN, WES

B)QAN, QAN

C)WES, QAN

D)WES, WES

A)QAN, WES

B)QAN, QAN

C)WES, QAN

D)WES, WES

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following statements is FALSE?

A)When the correlation between securities is less than 1, the volatility of the portfolio is reduced due to diversification.

B)An investor seeking high returns and low volatility should only invest in an efficient portfolio.

C)Efficient portfolios can be easily ranked, because investors will choose from among them those with the highest expected returns.

D)When shares are perfectly positively correlated, the set of portfolios is identified graphically by a straight line between them.

A)When the correlation between securities is less than 1, the volatility of the portfolio is reduced due to diversification.

B)An investor seeking high returns and low volatility should only invest in an efficient portfolio.

C)Efficient portfolios can be easily ranked, because investors will choose from among them those with the highest expected returns.

D)When shares are perfectly positively correlated, the set of portfolios is identified graphically by a straight line between them.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

79

A portfolio comprises Cochlear (beta of 1.5)and Westpac (beta of 0.75). The amount invested in Cochlear is $25 000 and in Westpac is $35 000. What is the beta of the portfolio?

A)0.99

B)0.96

C)1.15

A)0.99

B)0.96

C)1.15

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

80

The Capital Asset Pricing Model (CAPM)says that the excess return on an investment is equal to its beta times the market risk premium.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck