Deck 30: Mergers and Acquisitions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/53

Play

Full screen (f)

Deck 30: Mergers and Acquisitions

1

Suppose that Verizon and Sprint were to merge. Ignoring potential antitrust problems, this merger would be classified as a:

A) horizontal merger.

B) vertical merger.

C) conglomerate merger.

D) monopolistic merger.

A) horizontal merger.

B) vertical merger.

C) conglomerate merger.

D) monopolistic merger.

horizontal merger.

2

If the acquiring firm and acquired firm are not related to each other, then the acquisition is known as

A) consolidation

B) aggregation

C) Takeovers

D) Conglomerate acquisition

A) consolidation

B) aggregation

C) Takeovers

D) Conglomerate acquisition

Conglomerate acquisition

3

Firm A and Firm B merge to form firm AB. This is an example of:

A) a tender offer.

B) an acquisition of assets.

C) an acquisition of stock.

D) a consolidation.

A) a tender offer.

B) an acquisition of assets.

C) an acquisition of stock.

D) a consolidation.

a consolidation.

4

If the All-Star Fuel Filling Company, a chain of gasoline stations acquire the Mid-States Refining Company, a refiner of oil products, this would be an example of a:

A) conglomerate acquisition.

B) white knight.

C) vertical acquisition.

D) going-private transaction.

E) horizontal acquisition.

A) conglomerate acquisition.

B) white knight.

C) vertical acquisition.

D) going-private transaction.

E) horizontal acquisition.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

5

The complete absorption of one firm by another is called a:

A) merger.

B) consolidation.

C) takeover.

D) spin-off.

A) merger.

B) consolidation.

C) takeover.

D) spin-off.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

6

The synergy of an acquisition between Firm A and Firm B can be determined by:

A) subtracting the change in cost from the change in revenue.

B) subtracting the change in taxes form the change in revenue.

C) subtracting the change in capital requirements from the change in revenues.

D) discounting the change in the cash flows of the combined firm by the risk adjusted discount rate.

E) discounting the change in the revenues of the combined firm by the risk adjusted discount rate.

A) subtracting the change in cost from the change in revenue.

B) subtracting the change in taxes form the change in revenue.

C) subtracting the change in capital requirements from the change in revenues.

D) discounting the change in the cash flows of the combined firm by the risk adjusted discount rate.

E) discounting the change in the revenues of the combined firm by the risk adjusted discount rate.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is not true of an acquisition of stock or tender offers?

A) No stockholder meetings need to be held.

B) No vote is required.

C) The bidding firm deals directly with the stockholders of the target firm.

D) In most cases, 100% of the stock of the target firm is tendered.

A) No stockholder meetings need to be held.

B) No vote is required.

C) The bidding firm deals directly with the stockholders of the target firm.

D) In most cases, 100% of the stock of the target firm is tendered.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

8

If Microsoft were to acquire Air Canada, the acquisition would be classified as a _____ acquisition.

A) horizontal

B) longitudinal

C) conglomerate

D) vertical

A) horizontal

B) longitudinal

C) conglomerate

D) vertical

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

9

Synergy occurs when the:

A) added value is positive from the combination.

B) sum of the parts is grater than the whole.

C) premium paid to the acquired shareholders equals the NPV

D) standstill agreement is effected.

A) added value is positive from the combination.

B) sum of the parts is grater than the whole.

C) premium paid to the acquired shareholders equals the NPV

D) standstill agreement is effected.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

10

In a merger or acquisition, a firm should be acquired if:

A) it generates a positive net present value to the shareholders of an acquiring firm.

B) it is a firm in the same line of business, in which the acquirer has expertise.

C) it is a firm in a totally different line of business which will diversity the firm.

D) it pays a large dividend which will provide cash pass through to the acquirer.

A) it generates a positive net present value to the shareholders of an acquiring firm.

B) it is a firm in the same line of business, in which the acquirer has expertise.

C) it is a firm in a totally different line of business which will diversity the firm.

D) it pays a large dividend which will provide cash pass through to the acquirer.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

11

One company wishes to acquire another. Which of the following forms of acquisition does not require a formal vote by the shareholders of the acquired firm?

A) Merger.

B) Acquisition of stock.

C) Acquisition of assets.

D) Consolidation.

A) Merger.

B) Acquisition of stock.

C) Acquisition of assets.

D) Consolidation.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

12

Dissatisfied shareholders of the acquired firm in a merger can:

A) decide not to tender their shares.

B) exercise their appraisal rights and demand their shares be purchased at fair value.

C) decide not to vote for the current management by proxy.

D) do nothing and are stuck with the outcome.

A) decide not to tender their shares.

B) exercise their appraisal rights and demand their shares be purchased at fair value.

C) decide not to vote for the current management by proxy.

D) do nothing and are stuck with the outcome.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

13

Suppose that General Motors has made an offer to acquire General Mills. Ignoring potential antitrust problems, this merger would be classified as a:

A) monopolistic merger.

B) horizontal merger.

C) vertical merger.

D) conglomerate merger.

A) monopolistic merger.

B) horizontal merger.

C) vertical merger.

D) conglomerate merger.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is not true of mergers?

A) Mergers are legally simple.

B) Mergers must be approved by a vote of the stockholders of each firm.

C) In a merger, the acquiring firm retains its name and identity.

D) Mergers represent a public offer to buy shares directly from the stockholders of another firm.

A) Mergers are legally simple.

B) Mergers must be approved by a vote of the stockholders of each firm.

C) In a merger, the acquiring firm retains its name and identity.

D) Mergers represent a public offer to buy shares directly from the stockholders of another firm.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

15

An important reason for acquisitions is that the combined firm may generate greater revenue that the two separate firms could. Examples of revenue enhancement would not include:

A) an elimination of a previously ineffective media effort.

B) an elimination of a previously ineffective advertising effort.

C) an elimination of a weak existing distribution effort.

D) economies of scale.

A) an elimination of a previously ineffective media effort.

B) an elimination of a previously ineffective advertising effort.

C) an elimination of a weak existing distribution effort.

D) economies of scale.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

16

Following an acquisition, the acquiring firm's balance sheet shows an asset labeled "goodwill." What form of merger accounting is being used?

A) consolidation

B) aggregation

C) purchase

D) pooling

A) consolidation

B) aggregation

C) purchase

D) pooling

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

17

An acquisition may take place because of a real or perceived strategic advantage. An example of a strategic advantage would be:

A) an aircraft manufacturer buying a laser guidance company for possible advanced flight control without pilots.

B) a manufacturer integrating their supply by acquiring downline.

C) a corporation completing a spin-off.

D) a corporation out-sourcing to achieve cost economies.

A) an aircraft manufacturer buying a laser guidance company for possible advanced flight control without pilots.

B) a manufacturer integrating their supply by acquiring downline.

C) a corporation completing a spin-off.

D) a corporation out-sourcing to achieve cost economies.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

18

Suppose that Exxon-Mobil acquired Schlumberger, an exploration/drilling company. Ignoring potential antitrust problems, this merger would be classified as a:

A) monopolistic merger.

B) vertical merger.

C) conglomerate merger.

D) horizontal merger.

A) monopolistic merger.

B) vertical merger.

C) conglomerate merger.

D) horizontal merger.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

19

The value of synergy is estimated by the equation:

A) VA+ VB- ΔRevenue.

B) VAB- VA- VB.

C) VAB- VB- Taxes.

D) VA- VB- ΔCosts.

A) VA+ VB- ΔRevenue.

B) VAB- VA- VB.

C) VAB- VB- Taxes.

D) VA- VB- ΔCosts.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

20

The positive incremental net gain associated with the combination of two firms through a merger or acquisition is called:

A) goodwill.

B) the merger cost.

C) the consolidation effect.

D) synergy.

A) goodwill.

B) the merger cost.

C) the consolidation effect.

D) synergy.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

21

The Albatross Co. has accumulated net operating losses of $70 million and is likely to enter bankruptcy. The Zephyr Co. has earnings of $200 million and is in the 36% marginal tax bracket. Zephyr is considering buying Albatross and liquidating the company and retaining a few of the assets. What is the minimum value of Albatross to Zephyr?

A) $25.2 million.

B) $72.0 million.

C) $70.0 million.

D) not enough information to calculate.

A) $25.2 million.

B) $72.0 million.

C) $70.0 million.

D) not enough information to calculate.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

22

A merger should not take place simply for the purpose of:

A) diversification if shareholders can accomplish the same result on there own portfolios.

B) increasing the debt capacity for the tax shield gain.

C) acquiring free cash flow to be put to use by the acquirer.

D) reducing the cost of production.

A) diversification if shareholders can accomplish the same result on there own portfolios.

B) increasing the debt capacity for the tax shield gain.

C) acquiring free cash flow to be put to use by the acquirer.

D) reducing the cost of production.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

23

The market for corporate control is a phrase that would not describe:

A) a shift in management motivated to increase the value of the firm.

B) top management restructuring of the company.

C) an elimination of managerial inefficiency.

D) the system where corporate insiders trade personal stock holdings.

E) alternative management teams competing for the rights to management

A) a shift in management motivated to increase the value of the firm.

B) top management restructuring of the company.

C) an elimination of managerial inefficiency.

D) the system where corporate insiders trade personal stock holdings.

E) alternative management teams competing for the rights to management

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

24

A modification to the corporate charter that requires 80% shareholder approval for a takeover is called a(n):

A) repurchase standstill provision.

B) exclusionary self-tender.

C) super majority amendment.

D) tender offer.

A) repurchase standstill provision.

B) exclusionary self-tender.

C) super majority amendment.

D) tender offer.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

25

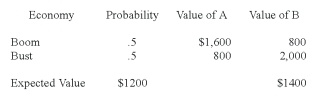

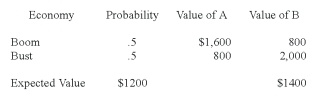

Firm A does well in a boom economy. Firm B does well in a bust economy. The probability of a boom is 50%. The end of period values of the two firms depend on the economy as shown below:  Both firms have debt outstanding with a face value of $1,000. In order to diversify, the two firms have proposed a merger. The NPV of the merger is zero. Which of the following statements is correct?

Both firms have debt outstanding with a face value of $1,000. In order to diversify, the two firms have proposed a merger. The NPV of the merger is zero. Which of the following statements is correct?

A) The stockholders are indifferent to merger since the NPV is zero.

B) The bondholders are indifferent to merger since the NPV is zero.

C) The bondholders stand to gain because the risk of the combined firm is less.

D) The stockholders stand to gain because the probability of bankruptcy becomes zero after the merger.

Both firms have debt outstanding with a face value of $1,000. In order to diversify, the two firms have proposed a merger. The NPV of the merger is zero. Which of the following statements is correct?

Both firms have debt outstanding with a face value of $1,000. In order to diversify, the two firms have proposed a merger. The NPV of the merger is zero. Which of the following statements is correct?A) The stockholders are indifferent to merger since the NPV is zero.

B) The bondholders are indifferent to merger since the NPV is zero.

C) The bondholders stand to gain because the risk of the combined firm is less.

D) The stockholders stand to gain because the probability of bankruptcy becomes zero after the merger.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

26

When the management and/or a small group of investors takeover a firm and the shares of the firm are delisted and no longer publicly available, this action is known as:

A) a consolidation.

B) a vertical acquisition.

C) a proxy contest.

D) a going-private transaction.

A) a consolidation.

B) a vertical acquisition.

C) a proxy contest.

D) a going-private transaction.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

27

When two firms merge and there is no synergy gain but the only change is a reduction in risk:

A) there is no effect on the bondholders or stockholders.

B) both the bondholders and stockholders are made better off.

C) the bondholders gain in value while the stockholders lose value.

D) the stockholders gain in value while the bondholders lose value.

A) there is no effect on the bondholders or stockholders.

B) both the bondholders and stockholders are made better off.

C) the bondholders gain in value while the stockholders lose value.

D) the stockholders gain in value while the bondholders lose value.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

28

Cowboy Curtiss' Cowboy Hat Company recently completed a merger. When valuing the combined firm after the merger, which of the following is an example of the type of common mistake that can occur?

A) The use of market values in valuing either the new firm.

B) The inclusion of cash flows that are incremental to the decision.

C) The use of Curtiss' discount rate when valuing the cash flows of the entire company.

D) The inclusion of all relevant transactions cost associated with the acquisition.

A) The use of market values in valuing either the new firm.

B) The inclusion of cash flows that are incremental to the decision.

C) The use of Curtiss' discount rate when valuing the cash flows of the entire company.

D) The inclusion of all relevant transactions cost associated with the acquisition.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

29

If two leveraged firms merge, the cost of debt for the new firm will generally be lower than it was for the two firms as separate entities. One reason for this is:

A) strategic fits.

B) net operating losses.

C) surplus funds.

D) co-insurance.

A) strategic fits.

B) net operating losses.

C) surplus funds.

D) co-insurance.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is not true regarding monopoly power as it relates to acquisitions that reduce competition?

A) The U.S. Justice Department may challenge a merger if it is not determined to benefit society.

B) Empirical evidence suggests that increased monopoly power is a significant reason for firms to consider merging.

C) If monopoly power is measured through an acquisition, all firms in an industry should benefit as the industry's price is increased.

D) Empirical evidence finds no consistent tendency for share prices of rival firms to rise.

A) The U.S. Justice Department may challenge a merger if it is not determined to benefit society.

B) Empirical evidence suggests that increased monopoly power is a significant reason for firms to consider merging.

C) If monopoly power is measured through an acquisition, all firms in an industry should benefit as the industry's price is increased.

D) Empirical evidence finds no consistent tendency for share prices of rival firms to rise.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

31

A merger that improves the use of one company's design team and the other company's testing group is evidence of:

A) replacement of inefficient management.

B) one company exercising monopoly power.

C) complementary resources.

D) minimizing the net operating losses.

A) replacement of inefficient management.

B) one company exercising monopoly power.

C) complementary resources.

D) minimizing the net operating losses.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

32

What is the cost of acquiring A if the V and A merge. V is worth $450 and has 100 shares outstanding. A has a market value of $375 and has 40 shares outstanding. V to acquire A will swap 80 shares of V for the 40 shares of A. V believes the combination of VA was worth $925.

A) $325.

B) $100.

C) $36.

D) $0.

A) $325.

B) $100.

C) $36.

D) $0.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following defensive tactics completely eliminates the possibility of a takeover via tender offer?

A) Leveraged buyout (LBO).

B) Exclusionary self-tender.

C) Targeted repurchase.

D) Super majority amendment.

A) Leveraged buyout (LBO).

B) Exclusionary self-tender.

C) Targeted repurchase.

D) Super majority amendment.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

34

What is the market value exchange ratio of V acquiring A in a merger. V is worth $450 and has 100 shares outstanding. A has a market value of $375 and has 40 shares outstanding. V to acquire A will swap 80 shares of V for the 40 shares of AC. V believes the combination of VA was worth $925.

A) 1:1.

B) 1.20:1.

C) 1.37:1.

D) 1.10:1.

A) 1:1.

B) 1.20:1.

C) 1.37:1.

D) 1.10:1.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is the opposite of a targeted repurchase?

A) Repurchase standstill provision.

B) Exclusionary self-tender.

C) Super majority amendment.

D) Tender offer.

A) Repurchase standstill provision.

B) Exclusionary self-tender.

C) Super majority amendment.

D) Tender offer.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

36

In a merger with an exchange of stock, when the premerger prices are used to calculate the exchange ratio the true cost of the merger:

A) is less than the number of shares received times the original market price.

B) is equal to the number of shares received times the original market price.

C) is greater than the number of shares received times the original market price.

D) Unchanged from the premerger value.

A) is less than the number of shares received times the original market price.

B) is equal to the number of shares received times the original market price.

C) is greater than the number of shares received times the original market price.

D) Unchanged from the premerger value.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

37

What is the NPV from the merger of V and A. V was worth $450 and A had a market value of $375. V acquired A for $425 because they thought the combination of VA was worth $925.

A) $0.

B) $50.

C) $450.

D) $425.

A) $0.

B) $50.

C) $450.

D) $425.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

38

Firm A is going to acquire Firm B by selling bonds and using the proceeds to purchase (for cash) the stock of Firm

A) Firm A's cost of debt.

B) Firm A's weighted average cost of capital.

C) Firm A's cost of equity.

D) Firm B's weighted average cost of capital.

E) none of the above.

A) Firm A's cost of debt.

B) Firm A's weighted average cost of capital.

C) Firm A's cost of equity.

D) Firm B's weighted average cost of capital.

E) none of the above.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

39

What is the synergy from the merger of V and A. V was worth $450 and A had a market value of $375. V acquired A for $425 because they thought the combination of VA was worth $925.

A) $50.

B) $100.

C) $500.

D) $475.

A) $50.

B) $100.

C) $500.

D) $475.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

40

Compensation paid to top management in the event of a takeover is called a:

A) poison pill.

B) golden parachute.

C) self-tender.

D) buyout.

A) poison pill.

B) golden parachute.

C) self-tender.

D) buyout.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

41

Dexter Department Stores has a market value of $400 million and 20 million shares outstanding. Walnut Stores has a market value of $134 million and 13.4 million shares outstanding. Dexter is deciding to acquire Walnut Stores. The top management of Dexter's have determined that due to the synergies between the firms the combination will worth $667 million. Dexter expect to pay a $67 million premium for Walnut Stores. If Dexter were to make an offer of $201 million in stock for Walnut what would the exchange ratio be?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

42

As a defensive maneuver, a firm issues deep-discount bonds that are redeemable at par in the event of an unfriendly takeover. These bonds are an example of:

A) greenmail.

B) a "scorched earth" policy.

C) a poison pill.

D) crown jewels.

A) greenmail.

B) a "scorched earth" policy.

C) a poison pill.

D) crown jewels.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

43

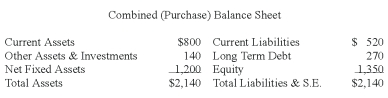

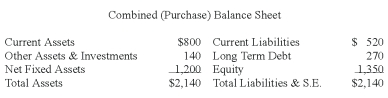

The Turf-Top Lawn Mower Company has acquired the Quick Clean Power Snow Shovel Company. Turf-Top has agreed to pay $400 in stock through a tender offer. All liabilities will be assumed. The balance sheets of both companies are at market values which are also the book values before the combination. Construct the new balance sheet for this tax-free acquisition. How has the position of TTLM shareholders changed?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

44

The Turf-Top Lawn Mower Company has acquired the Quick Clean Power Snow Shovel Company. Turf-Top has agreed to pay $600 in cash, the money was raised through a new debt issue. All liabilities will be paid off. The balance sheets of both companies are at market values which are also the book values before the combination. Construct the new balance sheet for this purchase. How has the position of TTLM shareholders changed?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

45

The empirical evidence strongly indicates that the stockholders of the target firm realize large wealth gains as a result of a takeover bid but the stockholders in the acquiring firm gain little, if anything. Although there exists no definitive answer as to why this is the case, several possible explanations have been proposed. List and explain three of these possible explanations for the minimal returns to the acquiring firm's stockholders.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

46

Dexter Department Stores has a market value of $400 million and 20 million shares outstanding. Walnut Stores has a market value of $134 million and 13.4 million shares outstanding. Dexter is deciding to acquire Walnut Stores. The top management of Dexter's have determined that due to the synergies between the firms the combination will worth $667 million. Dexter expect to pay a $67 million premium for Walnut Stores. If Dexter offers 10 million shares in exchange for the 13.4 million shares of Walnut, what will the after acquisition stock price of Dexter be?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

47

Describe the three basic legal procedures that one firm can use to acquire another and briefly discuss the advantages and disadvantages of each.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

48

Bondholders can be made better off in a merger, this is known as the co-insurance effect. Explain how this can happen using an example.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

49

Firms A and B, both of which are 100% equity, are going to merge. Before the merger, Firm A (100 shares outstanding) is worth $15,000. Firm B (50 shares outstanding) is worth $10,000. The combined firm is worth $30,000. Firm A will pay $11,500 in cash for Firm B. What is the NPV of the merger to Firm A?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

50

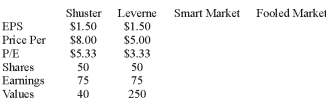

Shuster merges with Leverne. Shuster agrees to exchange 25 of its shares for every 50 of Leverne's old shares, so that Shuster will have 75 shares available after the merger. There is no synergy. Calculate the EPS along with other information below for the combined firm in two cases; one where the market is smart, and another when the market is fooled.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

51

Chucky Chester Inc. takes over Billy Bob Burgers from Billy himself for $1 million in cold cash. Billy started the company years ago on an investment of $50,000 in plant and equipment which has long been paid off. The machinery has no accounting value today. Consider the takeover price as fair market value for the equipment. Calculate the tax consequences of the merger, assuming that Chucky Chester decides not to write-up the machinery. Both Billy and Chucky are in the 28% tax bracket.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

52

Firm A does well in a boom economy. Firm B does well in a bust economy. The probability of a boom is 50%. The end of period values of the two firms depend on the economy as shown below:

A)The stockholders are indifferent to merger since the NPV is zero.

B)The bondholders are indifferent to merger since the NPV is zero.

C)The bondholders stand to gain because the risk of the combined firm is less.

D)The stockholders stand to gain because the probability of bankruptcy becomes zero after the merger.

A)The stockholders are indifferent to merger since the NPV is zero.

B)The bondholders are indifferent to merger since the NPV is zero.

C)The bondholders stand to gain because the risk of the combined firm is less.

D)The stockholders stand to gain because the probability of bankruptcy becomes zero after the merger.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

53

Dexter Department Stores has a market value of $400 million and 20 million shares outstanding. Walnut Stores has a market value of $134 million and 13.4 million shares outstanding. Dexter is deciding to acquire Walnut Stores. The top management of Dexter's have determined that due to the synergies between the firms the combination will worth $667 million. Dexter expect to pay a $67 million premium for Walnut Stores. If Dexter offers 10 million shares in exchange for the 13.4 million shares of Walnut, what will the exchange ratio and the equivalent cash value?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck