Deck 2: Companies and Corporate Regulation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/40

Play

Full screen (f)

Deck 2: Companies and Corporate Regulation

1

The first system of easily registerable companies with limited liability share units tradable on a public stock exchange developed:

A)in ancient Assyria around 400 BC

B)in the Italian city states at the end of the fifteenth century

C)in Great Britain in the 1840s and 1850s

D)in the United States of America in the 1890s.

A)in ancient Assyria around 400 BC

B)in the Italian city states at the end of the fifteenth century

C)in Great Britain in the 1840s and 1850s

D)in the United States of America in the 1890s.

C

2

Which of the following is NOT a characteristic of the proprietary company?

A)There need only be one director

B)There is no obligation to hold an annual general meeting

C)There must be no more than 50 non-employee shareholders

D)Unlike small proprietary companies the proprietary company can advertise in newspapers to obtain loans

A)There need only be one director

B)There is no obligation to hold an annual general meeting

C)There must be no more than 50 non-employee shareholders

D)Unlike small proprietary companies the proprietary company can advertise in newspapers to obtain loans

D

3

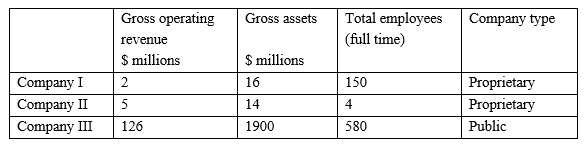

-What type of entity is company II?

Small proprietary Large proprietary Disclosing entity

A)Yes No Yes

B)Yes No Maybe

C)No Yes No

D)No Yes Maybe

Yes No Maybe

4

Under the Scheme based on the Uniform Companies Acts 1961-2 the court system in New South Wales would have had jurisdiction over a company registered in which of the following locations?

A)New Zealand, Great Britain or Tasmania

B)Khazakstan, Sierra Leone or Queensland

C)South Australia

D)None of the above

A)New Zealand, Great Britain or Tasmania

B)Khazakstan, Sierra Leone or Queensland

C)South Australia

D)None of the above

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

5

Under the current structure for accounting standard setting in Australia, accounting standards for public sector entities are made by the:

A)FRC

B)PSASB

C)AARF and the PSASB with guidance from the AASB

D)AASB

A)FRC

B)PSASB

C)AARF and the PSASB with guidance from the AASB

D)AASB

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

6

ICompanies with enhanced disclosure securities on offer

IIPublic companies

IIIWholly Australian-owned large proprietary companies

IVWholly Australian-owned small proprietary companies

As a general rule, under the Corporations Act, which of the following types of companies must have their financial report audited for a financial year?

A)I only

B)I, II and III only

C)II and III only

D)II, III and IV only

IIPublic companies

IIIWholly Australian-owned large proprietary companies

IVWholly Australian-owned small proprietary companies

As a general rule, under the Corporations Act, which of the following types of companies must have their financial report audited for a financial year?

A)I only

B)I, II and III only

C)II and III only

D)II, III and IV only

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

7

With which of the following sources of authority must Snout Ltd always comply?

ASX Listing Rules | Corporations Act | AASB standards

A)No | Yes | Yes

B)No | No | Yes

C)Yes | Yes | No

D)Yes | No | No

ASX Listing Rules | Corporations Act | AASB standards

A)No | Yes | Yes

B)No | No | Yes

C)Yes | Yes | No

D)Yes | No | No

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

8

The directors of Corp Ltd agree that to apply all the AASB standards would not provide a true and fair view of Corp Ltd's financial position.They advise their auditors that the financial report will not comply with all AASB standards.Which is correct?

A)The auditors must state in the audit report that the financial report does not comply with those AASB standards

B)The directors are in accordance with the Corporations Act provided that they provide their reason(s) in the financial report

C)The directors are in accordance with the Corporations Act provided that they list the standards that have not been complied with

D)The auditors should audit the financial statements as they have been prepared and need disclose no information about the non-application of the AASB standards

A)The auditors must state in the audit report that the financial report does not comply with those AASB standards

B)The directors are in accordance with the Corporations Act provided that they provide their reason(s) in the financial report

C)The directors are in accordance with the Corporations Act provided that they list the standards that have not been complied with

D)The auditors should audit the financial statements as they have been prepared and need disclose no information about the non-application of the AASB standards

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements is untrue?

A)AAS standards no longer cover all accounting topics

B)AAS standards may contain requirements not found in IFRS

C)AAS standards may apply to superannuation schemes

D)None of the above

A)AAS standards no longer cover all accounting topics

B)AAS standards may contain requirements not found in IFRS

C)AAS standards may apply to superannuation schemes

D)None of the above

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

10

Complete the following sentence:

The ______________ is responsible for prosecuting companies for breaches of AASB standards.

A)ASIC

B)AARF

C)AASB

D)ASX

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

11

Meteor Pty Ltd owns 100% of the share capital of Satellite Pty Ltd and Meteor Pty Ltd controls Satellite Pty Ltd.The following information is available:

-For the 20X8 year would Satellite Pty Ltd have to:

Prepare a financial report?

Lodge the financial report with ASIC?

Distribute the financial report to members?

A)Yes

Yes

Yes

B) No

Yes

No

C) No

No

No

D)Yes

No

No

-For the 20X8 year would Satellite Pty Ltd have to:

Prepare a financial report?

Lodge the financial report with ASIC?

Distribute the financial report to members?

A)Yes

Yes

Yes

B) No

Yes

No

C) No

No

No

D)Yes

No

No

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is NOT a characteristic of the public company?

A)Company can raise loans from general public

B)Company has no upper limit on the number of shareholders

C)Company must have financial reports audited

D)Company has a lower limit of five shareholders

A)Company can raise loans from general public

B)Company has no upper limit on the number of shareholders

C)Company must have financial reports audited

D)Company has a lower limit of five shareholders

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

13

Meteor Pty Ltd owns 100% of the share capital of Satellite Pty Ltd and Meteor Pty Ltd controls Satellite Pty Ltd.The following information is available:

-For the 20X7 year, Meteor Pty Ltd would have to:

Have an audit

Lodge an audit report with the ASIC

Distribute the audit report to members

A) Yes

Yes

Yes

B) No

Yes

No

C) No

No

No

D) Yes

No

No

-For the 20X7 year, Meteor Pty Ltd would have to:

Have an audit

Lodge an audit report with the ASIC

Distribute the audit report to members

A) Yes

Yes

Yes

B) No

Yes

No

C) No

No

No

D) Yes

No

No

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following requirements is not found in the Corporations Act?

A)types of ledger accounts that must be used in particular circumstances

B)restrictions on the use of amounts in some ledger accounts

C)that accounting records must be kept for seven years

D)the headings that must be used in the balance sheet

A)types of ledger accounts that must be used in particular circumstances

B)restrictions on the use of amounts in some ledger accounts

C)that accounting records must be kept for seven years

D)the headings that must be used in the balance sheet

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

15

ICompanies with enhanced disclosure securities on offer

IIPublic companies

IIIWholly Australian-owned large proprietary companies

IVWholly Australian-owned small proprietary companies

As a general rule, under the Corporations Act, which of the following types of companies must prepare a financial report for a financial year?

A)I only

B)I, II and III only

C)II and III only

D)II, III and IV only

IIPublic companies

IIIWholly Australian-owned large proprietary companies

IVWholly Australian-owned small proprietary companies

As a general rule, under the Corporations Act, which of the following types of companies must prepare a financial report for a financial year?

A)I only

B)I, II and III only

C)II and III only

D)II, III and IV only

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following statements is untrue?

A)A public company can be a guarantee company with limited liability

B)A small proprietary company can have share capital and no liability

C)A public company can have share capital and unlimited liability

D)A no liability company can not be a guarantee company.

A)A public company can be a guarantee company with limited liability

B)A small proprietary company can have share capital and no liability

C)A public company can have share capital and unlimited liability

D)A no liability company can not be a guarantee company.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

17

-What type of entity is company III?

Disclosing entity Reporting entity

A)No Likely

B)No Unlikely

C)Maybe Likely

D)Maybe Unlikely

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following statements is untrue?

A)A public company can be a guarantee company with unlimited liability

B)A small proprietary company can have share capital and unlimited liability

C)A public company can have share capital and unlimited liability

D)A no liability company can not be a guarantee company

A)A public company can be a guarantee company with unlimited liability

B)A small proprietary company can have share capital and unlimited liability

C)A public company can have share capital and unlimited liability

D)A no liability company can not be a guarantee company

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

19

-What type of entity is company I?

Small proprietary Large proprietary Disclosing entity

A)Yes No Yes

B)Yes No Maybe

C)No Yes Yes

D)No Yes Maybe

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

20

Winston owns shares in Beaver Mining NL and his friend Neville owns shares in Otter Pty Ltd.In the event of liquidation of both of these companies who would potentially have to pay the most per share?

A)Neville, because his liability is up to the amount unpaid on his shares and Winston has no such liability

B)Neville, because his shares are in an unlisted company and Winston's are in a listed company

C)Winston, because his shares are in a mining company that is listed

D)Not able to be answered decisively from the information

A)Neville, because his liability is up to the amount unpaid on his shares and Winston has no such liability

B)Neville, because his shares are in an unlisted company and Winston's are in a listed company

C)Winston, because his shares are in a mining company that is listed

D)Not able to be answered decisively from the information

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

21

CPA Australia was a founding member of the IASB's forerunner organisation, the IASC.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

22

Complete the following sentence:

The ______________ is responsible for appointing AASB board members.

A)ASIC

B)AARF

C)ASX

D)FRC

The ______________ is responsible for appointing AASB board members.

A)ASIC

B)AARF

C)ASX

D)FRC

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

23

In a limited liability share company, once the price of the share is fully paid the shareholder has no further liability.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

24

The adoption of IFRS in Australia was preceded by a lengthy public consultation process.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

25

Which answer best describes the following corporate governance system in Australia: 'legislation based in the states, with state-based legal jurisdiction, separate state-based regulators and a body of laws originally designed to be similar across the states, but in practical effect they were not always exactly the same.'

A)Scheme based on Uniform Companies Acts 1961-2

B)National Co-operative Scheme 1981-89

C)Scheme based on Corporations Act 1989

D)Scheme commonly known as the 'Corporations Law' that commenced in 1991

A)Scheme based on Uniform Companies Acts 1961-2

B)National Co-operative Scheme 1981-89

C)Scheme based on Corporations Act 1989

D)Scheme commonly known as the 'Corporations Law' that commenced in 1991

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

26

Complete the following sentence:

The ______________ is primarily responsible for the broad direction of policy (for example, the adoption of IFRS) concerning Australian accounting standards.

A)ASIC

B)AARF

C)AASB

D)FRC

The ______________ is primarily responsible for the broad direction of policy (for example, the adoption of IFRS) concerning Australian accounting standards.

A)ASIC

B)AARF

C)AASB

D)FRC

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

27

Domestic companies in the USA are required to use IFRS.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

28

EU countries like France have had traditionally a greater emphasis on flexibility and presentation of financial statements at fair value than have Anglo countries like Great Britain and the USA.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

29

IFRS standards adopted for use in Australia cover all Australian accounting standard topics.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

30

The Urgent Issues Group was:

A)A sub committee of CPA Australia

B)A sub committee of the AASB

C)A joint committee of CPA Australia and the Institute of Chartered Accountants in Australia

D)A committee that reports directly to the Auditor-General of Australia

A)A sub committee of CPA Australia

B)A sub committee of the AASB

C)A joint committee of CPA Australia and the Institute of Chartered Accountants in Australia

D)A committee that reports directly to the Auditor-General of Australia

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

31

No-liability companies are confined to the mining sector and must not have a share capital.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

32

AASB standards apply by force of law to managed investment schemes and to unit trusts regulated under the Corporations Act.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

33

Which statement is incorrect? AASB standards apply by force of law to:

A)all entities regulated by the Corporations Act

B)entities required to comply with AASB accounting standards by other legislation

C)entities required to comply with AASB accounting standards by ministerial directive

D)all of the above

A)all entities regulated by the Corporations Act

B)entities required to comply with AASB accounting standards by other legislation

C)entities required to comply with AASB accounting standards by ministerial directive

D)all of the above

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

34

Which body has the power to make accounting standards under the Corporations Act?

A)ASIC

B)AASB

C)ICAA

D)AARF

A)ASIC

B)AASB

C)ICAA

D)AARF

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

35

The International Accounting Standards Board (IASB) is:

A)a profit making body registered in Panama

B)a committee of the US Securities and Exchange Commission

C)an independent not for profit body headquartered in London

D)a body of the United Nations

A)a profit making body registered in Panama

B)a committee of the US Securities and Exchange Commission

C)an independent not for profit body headquartered in London

D)a body of the United Nations

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following is not one of the functions of the Financial Reporting Council (FRC)?

A)Appoint members of the AASB

B)Adjust errors in the drafting of accounting standards

C)Organise funding for the AASB

D)Make decisions about adoption of IFRS's by Australia

A)Appoint members of the AASB

B)Adjust errors in the drafting of accounting standards

C)Organise funding for the AASB

D)Make decisions about adoption of IFRS's by Australia

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

37

Governments including the Australian government have direct control over the determination of IFRS content.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

38

Which statement is incorrect:

A)The EU has adopted IFRS for limited purposes from 1 January 2005

B)A nineteen person panel of trustees appoints the IASB members

C)IASB members are appointed jointly by the US and UK governments

D)The IASB's predecessor the IASC commenced operations in 1973

A)The EU has adopted IFRS for limited purposes from 1 January 2005

B)A nineteen person panel of trustees appoints the IASB members

C)IASB members are appointed jointly by the US and UK governments

D)The IASB's predecessor the IASC commenced operations in 1973

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

39

The role of the Urgent Issues Group was:

A)to provide timely guidance on urgent financial reporting issues

B)to report breaches of the Corporations Act to the Auditor-General

C)to report breaches of the Corporations Act to ASIC

D)to investigate attempts at company take-over on the Australian Securities Exchange (ASX)

A)to provide timely guidance on urgent financial reporting issues

B)to report breaches of the Corporations Act to the Auditor-General

C)to report breaches of the Corporations Act to ASIC

D)to investigate attempts at company take-over on the Australian Securities Exchange (ASX)

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

40

Members of the Financial Reporting Council (FRC) are jointly appointed by the Business Council of Australia and the Australian Shareholders' Association.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck