Deck 2: Conceptual Frameworks for Financial Reporting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/60

Play

Full screen (f)

Deck 2: Conceptual Frameworks for Financial Reporting

1

Which statement best explains the concept of "representational faithfulness"?

A)Transactions should be recorded in accordance with their substance rather than their legal form.

B)Transactions should be recorded in accordance with their legal form rather than their substance.

C)Transactions should be recorded accurately and completely to be useful to financial statement users.

D)Transactions should be recorded using the rules and guidelines provided in the accounting standards.

A)Transactions should be recorded in accordance with their substance rather than their legal form.

B)Transactions should be recorded in accordance with their legal form rather than their substance.

C)Transactions should be recorded accurately and completely to be useful to financial statement users.

D)Transactions should be recorded using the rules and guidelines provided in the accounting standards.

A

2

Which of the following is not a purpose of a conceptual framework of accounting concepts and financial reporting objectives?

A)To increase the user's ability to understand financial statements.

B)To increase financial statement users' confidence in financial reporting.

C)To provide a foundation for detailed accounting and reporting rules.

D)To enhance comparability among companies' financial statements.

A)To increase the user's ability to understand financial statements.

B)To increase financial statement users' confidence in financial reporting.

C)To provide a foundation for detailed accounting and reporting rules.

D)To enhance comparability among companies' financial statements.

C

3

Which is a purpose of the conceptual framework in accounting?

A)To support principles-based accounting standards, principles and practices.

B)To provide rules from which decision-useful financial information can be developed.

C)To promote global consistency, acceptance and adoption of IFRS around the globe.

D)To develop different accounting practices between countries around the globe.

A)To support principles-based accounting standards, principles and practices.

B)To provide rules from which decision-useful financial information can be developed.

C)To promote global consistency, acceptance and adoption of IFRS around the globe.

D)To develop different accounting practices between countries around the globe.

A

4

Which statement best explains the qualitative characteristic of "relevance"?

A)Financial reports should be understandable to the users of the information.

B)Omitting information would influence a user's economic decision.

C)Information should influence a user's economic decisions.

D)Financial reports should be accurate and complete.

A)Financial reports should be understandable to the users of the information.

B)Omitting information would influence a user's economic decision.

C)Information should influence a user's economic decisions.

D)Financial reports should be accurate and complete.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

5

When actual financial statements routinely report results that overstate or understate a company's financial position, which qualitative characteristic is violated?

A)Relevance.

B)Neutrality.

C)Conservatism.

D)Reliability.

A)Relevance.

B)Neutrality.

C)Conservatism.

D)Reliability.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

6

What is not an information need of users of financial information under the IFRS Conceptual Framework?

A)Information on the amount of cash flows.

B)Information about the timing of future cash flows.

C)Information on the uncertainty of cash flows.

D)Information about the amount of past cash flows.

A)Information on the amount of cash flows.

B)Information about the timing of future cash flows.

C)Information on the uncertainty of cash flows.

D)Information about the amount of past cash flows.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is part of the IFRS Conceptual Framework?

A)Statement of financial position.

B)Elements of financial statements.

C)Information Asymmetry.

D)Financial statement notes.

A)Statement of financial position.

B)Elements of financial statements.

C)Information Asymmetry.

D)Financial statement notes.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

8

What information does the balance sheet provide to users of financial information under the IFRS Conceptual Framework?

A)Information about changes in liabilities over a period of time.

B)Information about changes in resources over a period of time.

C)Information about the performance of a company over a period of time.

D)Information about the state of a company at a point in time.

A)Information about changes in liabilities over a period of time.

B)Information about changes in resources over a period of time.

C)Information about the performance of a company over a period of time.

D)Information about the state of a company at a point in time.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

9

The underlying or fundamental objective of the accounting conceptual framework is

A)decision usefulness.

B)comparability.

C)representational faithfulness.

D)understandability.

A)decision usefulness.

B)comparability.

C)representational faithfulness.

D)understandability.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

10

What decision would users of financial information need to make under the IFRS Conceptual Framework?

A)Determining whether to lend to the company.

B)Determining if a company is an ethical company.

C)Determining if the liquidation values are accurate.

D)Determine if the company is socially responsible.

A)Determining whether to lend to the company.

B)Determining if a company is an ethical company.

C)Determining if the liquidation values are accurate.

D)Determine if the company is socially responsible.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is not correct about the conceptual framework in accounting?

A)It is the basis for standard-setting for accounting standard setting bodies.

B)It is based on fundamental accounting truths derived from the laws of nature.

C)It can be used to solve emerging or complex accounting problems.

D)It can be used to develop consistent and comparable accounting principles.

A)It is the basis for standard-setting for accounting standard setting bodies.

B)It is based on fundamental accounting truths derived from the laws of nature.

C)It can be used to solve emerging or complex accounting problems.

D)It can be used to develop consistent and comparable accounting principles.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

12

Who are not users of financial information under the IFRS Conceptual Framework?

A)Present investors.

B)Potential investors.

C)Creditors.

D)Management.

A)Present investors.

B)Potential investors.

C)Creditors.

D)Management.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

13

Provide three reasons for the importance of the conceptual framework for financial reporting.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

14

Which financial statement is not needed under the IFRS Conceptual Framework?

A)Balance sheet.

B)Statement of retained earnings.

C)Income statement.

D)Statement of cash flows.

A)Balance sheet.

B)Statement of retained earnings.

C)Income statement.

D)Statement of cash flows.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

15

Financial statements under the IFRS Conceptual Framework do not help users with what kind of objective(s)?

A)Alleviating moral hazard.

B)Forecasting future product growth.

C)Prediction of future earnings.

D)Evaluating the riskiness of an investment.

A)Alleviating moral hazard.

B)Forecasting future product growth.

C)Prediction of future earnings.

D)Evaluating the riskiness of an investment.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

16

What decision would users of financial information not need to make under the IFRS Conceptual Framework?

A)Decide whether to invest in an entity.

B)Information on an entity's economic performance.

C)Amount of money to borrow from an entity.

D)Assessment of the riskiness of cash flows.

A)Decide whether to invest in an entity.

B)Information on an entity's economic performance.

C)Amount of money to borrow from an entity.

D)Assessment of the riskiness of cash flows.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

17

Which is not an element of financial information in the IFRS Conceptual Framework?

A)Other comprehensive income.

B)Assets.

C)Income.

D)Liabilities.

A)Other comprehensive income.

B)Assets.

C)Income.

D)Liabilities.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

18

Which is an assumption of financial information in the IFRS Conceptual Framework?

A)Accrual basis of accounting.

B)Historical cost.

C)Timeliness.

D)Financial capital maintenance.

A)Accrual basis of accounting.

B)Historical cost.

C)Timeliness.

D)Financial capital maintenance.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

19

Which is not a qualitative characteristic of financial information in the IFRS Conceptual Framework?

A)Understandability.

B)Historical cost.

C)Representational faithfulness.

D)Comparability.

A)Understandability.

B)Historical cost.

C)Representational faithfulness.

D)Comparability.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

20

Which is not a criteria for recognition of financial information in the IFRS Conceptual Framework?

A)The amount is reasonably measurable.

B)The expenses should be matched with revenues.

C)The amount must be measured at historical cost.

D)Inflow or outflow of cash flows are probable.

A)The amount is reasonably measurable.

B)The expenses should be matched with revenues.

C)The amount must be measured at historical cost.

D)Inflow or outflow of cash flows are probable.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

21

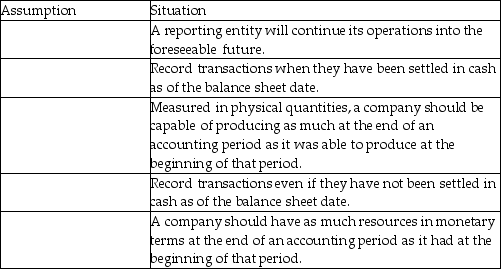

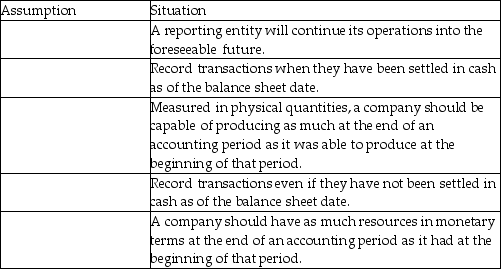

Which concept of financial reporting is being described?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following accurately describes the objective of financial reporting under the IFRS Conceptual Framework?

A)The Conceptual Framework focuses on a narrow set of users such as investors and lenders.

B)Special purpose financial statements are required under the Conceptual Framework.

C)In the Conceptual Framework, users include a broad range such as employees and customers.

D)Under the Conceptual Framework, general purpose financial statements increase moral hazard.

A)The Conceptual Framework focuses on a narrow set of users such as investors and lenders.

B)Special purpose financial statements are required under the Conceptual Framework.

C)In the Conceptual Framework, users include a broad range such as employees and customers.

D)Under the Conceptual Framework, general purpose financial statements increase moral hazard.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following is an attribute of "representational faithfulness"?

A)Historical cost.

B)Confirmatory value.

C)Neutrality.

D)Understandability.

A)Historical cost.

B)Confirmatory value.

C)Neutrality.

D)Understandability.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is/are constraints in the financial reporting process?

A)Classifying an item as a revenue versus an expense in the income statement.

B)Using the historical cost versus the fair value method to measure transactions.

C)Recognizing an item as an asset versus a liability in the balance sheet.

D)Benefits of information versus the costs of producing that information.

A)Classifying an item as a revenue versus an expense in the income statement.

B)Using the historical cost versus the fair value method to measure transactions.

C)Recognizing an item as an asset versus a liability in the balance sheet.

D)Benefits of information versus the costs of producing that information.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

25

Which statement best explains the meaning of "comparability" in financial reporting?

A)Financial information that is available quickly to financial statement users.

B)Financial information that can be objectively confirmed by another person.

C)Financial reports that are comprehendible to the users of such reports.

D)Financial statement preparers using consistent accounting policies year over year.

A)Financial information that is available quickly to financial statement users.

B)Financial information that can be objectively confirmed by another person.

C)Financial reports that are comprehendible to the users of such reports.

D)Financial statement preparers using consistent accounting policies year over year.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following characteristic of financial information alleviates "information asymmetry"?

A)Completeness.

B)Verifiability.

C)Confirmatory value.

D)Materiality.

A)Completeness.

B)Verifiability.

C)Confirmatory value.

D)Materiality.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

27

Which statement best explains the meaning of "measurement" in financial reporting?

A)Determining where items should be presented in the body of the financial statements.

B)Presenting an item in the financial statements but not in the notes.

C)Quantifying items so that they can be presented in the body of the financial statements.

D)Presenting expenses in the same accounting period as the related revenues.

A)Determining where items should be presented in the body of the financial statements.

B)Presenting an item in the financial statements but not in the notes.

C)Quantifying items so that they can be presented in the body of the financial statements.

D)Presenting expenses in the same accounting period as the related revenues.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

28

In which of the following transactions would it not be appropriate to recognize an asset in the financial statements?

A)SGG receives a firm commitment from another company to purchase goods from SGG.

B)SGG pays $10,000 to a lawyer for services to be provided next year.

C)SGG provides services to another company, but will not be paid until after year end.

D)A customer of SGG makes a deposit of $1,500 for goods to be custom-made.

A)SGG receives a firm commitment from another company to purchase goods from SGG.

B)SGG pays $10,000 to a lawyer for services to be provided next year.

C)SGG provides services to another company, but will not be paid until after year end.

D)A customer of SGG makes a deposit of $1,500 for goods to be custom-made.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

29

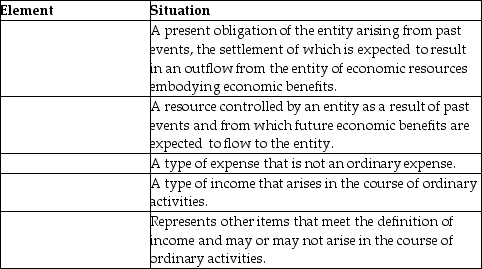

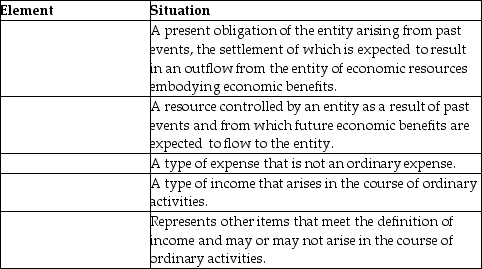

Which financial statement element is being described?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

30

Which statement best explains the meaning of "recognition" in financial reporting?

A)Determining where items should be presented in the body of the financial statements.

B)Presenting an item in the financial statements, rather than simply disclosing in the notes.

C)Quantifying items so that they can be presented in the body of the financial statements.

D)Presenting expenses in the same accounting period as the related revenues.

A)Determining where items should be presented in the body of the financial statements.

B)Presenting an item in the financial statements, rather than simply disclosing in the notes.

C)Quantifying items so that they can be presented in the body of the financial statements.

D)Presenting expenses in the same accounting period as the related revenues.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

31

What is the most commonly used measurement basis?

A)Current cost.

B)Realizable value.

C)Historical cost.

D)Present value.

A)Current cost.

B)Realizable value.

C)Historical cost.

D)Present value.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

32

Which qualitative characteristic of financial information alleviates "moral hazard"?

A)Neutrality.

B)Predictive value.

C)Timeliness.

D)Comparability.

A)Neutrality.

B)Predictive value.

C)Timeliness.

D)Comparability.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

33

Which statement best explains the qualitative characteristic of "completeness"?

A)Financial statements should represent the underlying transactions, assets and liabilities.

B)Omission of financial information that would influence a user's economic decision.

C)Financial information should not contain errors or bias.

D)Financial statements should not omit material items or transactions.

A)Financial statements should represent the underlying transactions, assets and liabilities.

B)Omission of financial information that would influence a user's economic decision.

C)Financial information should not contain errors or bias.

D)Financial statements should not omit material items or transactions.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

34

When are financial items recognized in the financial statements?

A)Items are recognized if the fair value amounts can be determined.

B)Items are recognized if the inflows or outflows of resources are probable.

C)Items are recognized if the future gains will result from disposal of the item.

D)Items are recognized if there are no measurement uncertainties.

A)Items are recognized if the fair value amounts can be determined.

B)Items are recognized if the inflows or outflows of resources are probable.

C)Items are recognized if the future gains will result from disposal of the item.

D)Items are recognized if there are no measurement uncertainties.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

35

Identify the eight major components of the conceptual framework for accounting. Explain how these components interact with the demand for and supply of financial information.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

36

Which statement best explains the meaning of "presentation" in financial reporting?

A)Determining where items should be presented in the body of the financial statements.

B)Presenting an item in the body of the financial statements and in the notes.

C)Quantifying items so that they can be presented in the body of the financial statements.

D)Presenting expenses in the same accounting period as the related revenues.

A)Determining where items should be presented in the body of the financial statements.

B)Presenting an item in the body of the financial statements and in the notes.

C)Quantifying items so that they can be presented in the body of the financial statements.

D)Presenting expenses in the same accounting period as the related revenues.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

37

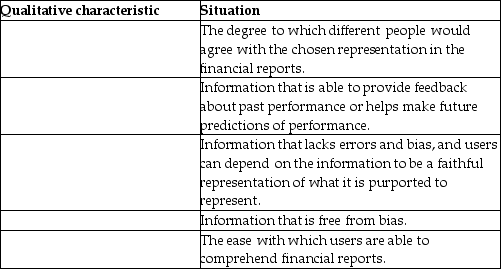

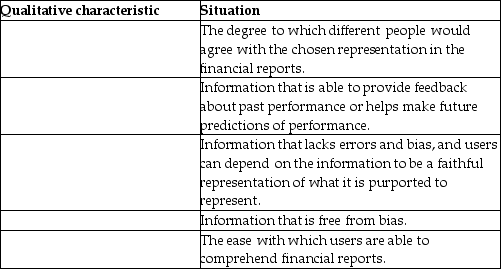

Indicate the qualitative characteristic being described in each situation below:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

38

What information does the income statement provide to users of financial information under the IFRS Conceptual Framework?

A)Information about changes in liabilities over a period of time.

B)Information about changes in resources over a period of time.

C)Information about the performance over a period of time.

D)Information about the state of a company at a point in time.

A)Information about changes in liabilities over a period of time.

B)Information about changes in resources over a period of time.

C)Information about the performance over a period of time.

D)Information about the state of a company at a point in time.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following is an attribute of "relevance"?

A)Verifiability.

B)Predictive value.

C)Free from error.

D)Comparability.

A)Verifiability.

B)Predictive value.

C)Free from error.

D)Comparability.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

40

Explain why assets and liabilities are generally not offset against one another. Use an example to illustrate your rationale.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

41

Which organization oversees accounting standards in Canada?

A)Financial Accounting Standards Board.

B)Chartered Professional Accountants of each province.

C)Chartered Professional Accountants of Canada.

D)International Accounting Standards Board.

A)Financial Accounting Standards Board.

B)Chartered Professional Accountants of each province.

C)Chartered Professional Accountants of Canada.

D)International Accounting Standards Board.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

42

JP Corporation had net income of $1,000,000 for 2020. After issuing its financial statements, the company realized that it had failed to include inventory from one of its small warehouses for several years. Specifically, it forgot to include $20,000 on December 31, 2019 and $30,000 on December 31, 2020. Which of the following is TRUE regarding JP's 2020 net income?

A)Net income was understated by $10,000.

B)Net income was overstated by $10,000.

C)Net income was understated by $30,000.

D)Net income was overstated by $30,000.

A)Net income was understated by $10,000.

B)Net income was overstated by $10,000.

C)Net income was understated by $30,000.

D)Net income was overstated by $30,000.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

43

Discuss some of the conceptual framework concepts involved in determining whether to capitalize or expense an expenditure.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following is part of the ASPE Conceptual Framework?

A)To provide information for investors, lenders and creditors only.

B)Completeness is an attribute of representational faithfulness.

C)To provide information useful for investment decisions.

D)To provide information useful for assessing management stewardship.

A)To provide information for investors, lenders and creditors only.

B)Completeness is an attribute of representational faithfulness.

C)To provide information useful for investment decisions.

D)To provide information useful for assessing management stewardship.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

45

Computer Inc. sells equipment with a 3-year warranty. Prior experience indicates that costs for warranty repairs average 3% in the first year, 2% in the second year and 1% in the third year. In 2020, Computer Inc. had sales of $800,000. It paid $20,000 for materials and labour to make warranty-related repairs in 2020. What amount will be recorded as warranty expense in 2020?

A)$20,000

B)$24,000

C)$28,000

D)$48,000

A)$20,000

B)$24,000

C)$28,000

D)$48,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

46

What standards are not contained in the CPA Canada Handbook?

A)Accounting standards for publicly accountable enterprises.

B)Accounting standards for not-for-profit organizations.

C)Accounting standards for private enterprises.

D)MD&A standards for publicly accountable enterprises.

A)Accounting standards for publicly accountable enterprises.

B)Accounting standards for not-for-profit organizations.

C)Accounting standards for private enterprises.

D)MD&A standards for publicly accountable enterprises.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

47

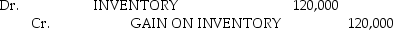

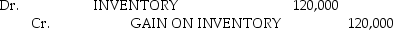

Accelerated Earnings Inc. (Company)has an operating line of credit with the local bank that is secured by accounts receivable and inventory.

The Company purchased inventory whenever the price was low during the year and has a substantial amount on hand at year end. The inventory price has increased substantially at year end. The Controller recorded the following journal at year end:

Required:

Required:

a)Who are the users of the Company's financial statements and what is their informational need?

b)What part of the IFRS Conceptual Framework is violated by this journal entry?

c)What is the impact of this journal entry on the Company's users?

d)What correction is required?

The Company purchased inventory whenever the price was low during the year and has a substantial amount on hand at year end. The inventory price has increased substantially at year end. The Controller recorded the following journal at year end:

Required:

Required:a)Who are the users of the Company's financial statements and what is their informational need?

b)What part of the IFRS Conceptual Framework is violated by this journal entry?

c)What is the impact of this journal entry on the Company's users?

d)What correction is required?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

48

Which statement best describes a private enterprise?

A)Any entity that is not a publicly accountable enterprise.

B)Any for-profit organization that is not a publicly accountable enterprise.

C)An entity that holds assets in a legal capacity for a broad group of outsiders as one of its primary businesses.

D)Any entity, excluding a not-for-profit organization.

A)Any entity that is not a publicly accountable enterprise.

B)Any for-profit organization that is not a publicly accountable enterprise.

C)An entity that holds assets in a legal capacity for a broad group of outsiders as one of its primary businesses.

D)Any entity, excluding a not-for-profit organization.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

49

Maybel Company has a March 31, 2019 year end. Which of the following should not be recorded as a current liability?

A)A deposit received from a customer for the February 2020 rent on a 1-year lease entered into on March 1, 2019.

B)Unpaid payroll taxes.

C)Dividends in arrears on preferred dividends.

D)Property taxes estimated and unpaid based on the prior year's municipal tax bill.

A)A deposit received from a customer for the February 2020 rent on a 1-year lease entered into on March 1, 2019.

B)Unpaid payroll taxes.

C)Dividends in arrears on preferred dividends.

D)Property taxes estimated and unpaid based on the prior year's municipal tax bill.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

50

Which statement best describes a publicly accountable enterprise?

A)An entity that has not issued debt instruments that are outstanding and traded in a public market.

B)An entity that holds assets in a fiduciary capacity for a broad group of outsiders as one of its primary businesses.

C)An entity that has not issued equity instruments that are outstanding and traded in a public market.

D)An entity that holds assets in a legal capacity for a broad group of outsiders as one of its primary businesses.

A)An entity that has not issued debt instruments that are outstanding and traded in a public market.

B)An entity that holds assets in a fiduciary capacity for a broad group of outsiders as one of its primary businesses.

C)An entity that has not issued equity instruments that are outstanding and traded in a public market.

D)An entity that holds assets in a legal capacity for a broad group of outsiders as one of its primary businesses.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

51

Lean Ltd. had a balance of $52,300 in the office supplies account at the start of the year. During the year, purchases of $141,700 were made and debited to the office supplies account. At the end of the year, a physical count of the office supplies indicated $41,800 on hand. What was the office supplies expense for the year?

A)$141,700

B)$152,200

C)$183,500

D)$194,000

A)$141,700

B)$152,200

C)$183,500

D)$194,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

52

Which is not an example of trade-offs made in the IFRS Conceptual Framework?

A)Relevance versus representational faithfulness.

B)Comparability versus consistency.

C)Physical capital versus financial capital.

D)Timeliness versus verifiability.

A)Relevance versus representational faithfulness.

B)Comparability versus consistency.

C)Physical capital versus financial capital.

D)Timeliness versus verifiability.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

53

Explain how accounting standards are set in Canada. Your answer should list the different groups responsible for setting standards and which types of businesses use each standard.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

54

ABC Manufacturing paid $250,000 to defend itself against a patent infringement lawsuit from CCB Limited. CCB has won, but ABC is planning to appeal the decision and continue pursuing its case. ABC is permitted to use its patent during the appeal process.

Provide two arguments to support ABC capitalizing the $250,000 expenses associated with a lawsuit. Provide two arguments against ABC capitalizing the $250,000 expenses associated with a lawsuit. Which option would you recommend and why?

Provide two arguments to support ABC capitalizing the $250,000 expenses associated with a lawsuit. Provide two arguments against ABC capitalizing the $250,000 expenses associated with a lawsuit. Which option would you recommend and why?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

55

Fail-Safe Computer Inc. sells equipment with a 2-year warranty. Prior experience indicates that costs for warranty repairs average 3% in the first year, and 2% in the second year. Sales were $300,000 and $400,000 in fiscal 2019 and 2020 respectively. It paid $5,000 for materials and labour to make warranty-related repairs in 2019. What amount will be recorded as warranty expense in 2019?

A)$5,000

B)$12,000

C)$15,000

D)$18,000

A)$5,000

B)$12,000

C)$15,000

D)$18,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

56

Which statement is correct?

A)Private enterprises may follow IFRS.

B)Not-for-profit organizations must follow ASPE.

C)Publicly accountable enterprises may follow ASPE.

D)Private enterprises must follow ASPE.

A)Private enterprises may follow IFRS.

B)Not-for-profit organizations must follow ASPE.

C)Publicly accountable enterprises may follow ASPE.

D)Private enterprises must follow ASPE.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

57

During the past year, Easy Supplies Ltd.'s assets decreased $33,000, its liabilities decreased $41,000, its share capital increased $5,000, and Easy recorded net profit of $12,000. What was the amount of dividends declared?

A)$ 1,000

B)$ 9,000

C)$12,000

D)$19,000

A)$ 1,000

B)$ 9,000

C)$12,000

D)$19,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following accurately describes the standard setting process in Canada?

A)The Accounting Standards Oversight Council approves the IFRS.

B)The Accounting Standards Board has no authority to alter IFRS.

C)The IFRS are jointly set by the Accounting Standards Board and the IASB.

D)The Public Sector Accounting Board oversees standards for private enterprises.

A)The Accounting Standards Oversight Council approves the IFRS.

B)The Accounting Standards Board has no authority to alter IFRS.

C)The IFRS are jointly set by the Accounting Standards Board and the IASB.

D)The Public Sector Accounting Board oversees standards for private enterprises.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

59

Which statement is not correct?

A)Private enterprises may follow IFRS.

B)Private enterprises may follow ASPE.

C)Not-for-profit organizations may follow IFRS.

D)Government organizations must follow IFRS.

A)Private enterprises may follow IFRS.

B)Private enterprises may follow ASPE.

C)Not-for-profit organizations may follow IFRS.

D)Government organizations must follow IFRS.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

60

Which statement is correct?

A)Private enterprises must follow IFRS.

B)Publicly accountable enterprises must follow IFRS.

C)Not-for-profit organizations must follow ASPE.

D)Private enterprises must follow ASPE.

A)Private enterprises must follow IFRS.

B)Publicly accountable enterprises must follow IFRS.

C)Not-for-profit organizations must follow ASPE.

D)Private enterprises must follow ASPE.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck