Deck 8: Receivables

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/138

Play

Full screen (f)

Deck 8: Receivables

1

The two major types of receivables are interest receivable and taxes receivable.

False

2

Sales through credit cards or debit cards transfer the risk of collection of receivables from the seller to the card issuer.

True

3

Which of the following statements is true?

A)Accounts receivable are more liquid than cash.

B)Notes receivable are always due in 30 days.

C)Notes receivable are longer in term than accounts receivable.

D)Accounts receivable are liabilities.

A)Accounts receivable are more liquid than cash.

B)Notes receivable are always due in 30 days.

C)Notes receivable are longer in term than accounts receivable.

D)Accounts receivable are liabilities.

C

4

A debtor is the party to a credit transaction who will receive the cash for the transaction at a later date.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

5

The collection period of accounts receivable is usually long therefore it is classified as a long-term asset in the balance sheet.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

6

Individual customer accounts of accounts receivable are known as subsidiary accounts.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

7

Businesses must maintain a single account receivable account for all customers.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

8

When a business accepts payment through credit cards or debit cards,it has to pay a fee to the credit card or debit card processor.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

9

When a business pledges its accounts receivable,it transfers the right to collect cash from customers to the bank.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

10

Dividends receivable,interest receivable,and taxes receivable are commonly categorized as other receivables.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

11

Sales through credit cards and debit cards are journalized in the same way as credit sales are journalized.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

12

Notes receivable represents an undertaking by a debtor to pay a fixed amount along with interest at a certain future date.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

13

The credit department must have access to cash in order to exercise effective internal control over receivables.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

14

Factoring is one of the options available to a business to reduce the risk of uncollectible accounts receivable.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

15

A receivable can be described as a monetary claim against a business or an individual.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

16

The receivables of an organization can be categorized into accounts receivable,notes receivable,and other receivables.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

17

Accounts receivable are also known as trade receivables.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

18

A company will have receivables whenever it sells goods or services on credit.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is included in the category of other receivables?

A)interest receivable

B)accounts receivable

C)notes receivable

D)investments

A)interest receivable

B)accounts receivable

C)notes receivable

D)investments

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

20

The terms of payment for a note receivable are longer than that of an account receivable.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

21

Under the direct write-off method,which of the following is included in the entry to write off an uncollectible account?

A)a credit to the Allowance for Bad Debts

B)a credit to the customer's Account Receivable

C)a debit to Allowance for Uncollectible Accounts

D)No entry is made to write off uncollectible accounts.

A)a credit to the Allowance for Bad Debts

B)a credit to the customer's Account Receivable

C)a debit to Allowance for Uncollectible Accounts

D)No entry is made to write off uncollectible accounts.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

22

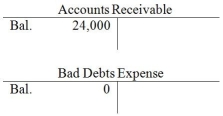

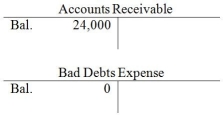

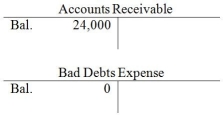

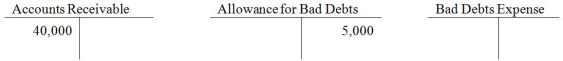

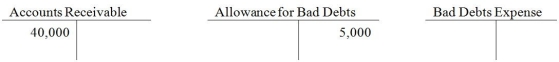

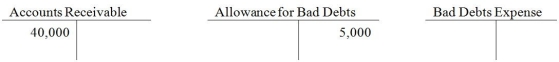

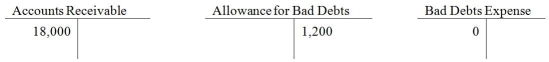

On January 1,Davidson Services has the following balances:  Davidson has the following transactions during January: Credit sales of $100,000,collections of credit sales of $85,000,and write-offs of $15,000.Davidson uses the direct write-off method.

Davidson has the following transactions during January: Credit sales of $100,000,collections of credit sales of $85,000,and write-offs of $15,000.Davidson uses the direct write-off method.

-At the end of January,the balance in Bad Debts Expense is ________.

A)$16,000

B)$17,000

C)$12,000

D)$15,000

Davidson has the following transactions during January: Credit sales of $100,000,collections of credit sales of $85,000,and write-offs of $15,000.Davidson uses the direct write-off method.

Davidson has the following transactions during January: Credit sales of $100,000,collections of credit sales of $85,000,and write-offs of $15,000.Davidson uses the direct write-off method.-At the end of January,the balance in Bad Debts Expense is ________.

A)$16,000

B)$17,000

C)$12,000

D)$15,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

23

Companies that follow GAAP are required to use the direct write-off method for uncollectible accounts receivable.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is an example of exercising internal control over receivables?

A)separating cash collection and credit allowance duties

B)extending credit only to customers who are most likely to pay

C)pursuing collection from customers to maximize cash flow

D)ensuring quick recovery of accounts receivable

A)separating cash collection and credit allowance duties

B)extending credit only to customers who are most likely to pay

C)pursuing collection from customers to maximize cash flow

D)ensuring quick recovery of accounts receivable

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

25

The expense associated with the cost of uncollectible accounts receivable is known as bad debts expense.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

26

The direct write-off method of accounting for uncollectible receivables is primarily used by small,non-public companies.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

27

When a company is using the direct write-off method,and an account is written off,the journal entry consists of a ________.

A)debit to Accounts Receivable and a credit to Cash

B)credit to Accounts Receivable and a debit to Bad Debts Expense

C)debit to the Allowance for Bad Debts and a credit to Accounts Receivable

D)credit Accounts Receivable and a debit to Interest Expense

A)debit to Accounts Receivable and a credit to Cash

B)credit to Accounts Receivable and a debit to Bad Debts Expense

C)debit to the Allowance for Bad Debts and a credit to Accounts Receivable

D)credit Accounts Receivable and a debit to Interest Expense

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

28

A company with significant amounts of accounts receivable,experiences uncollectible accounts from time to time.If the company uses the direct write-off method,the effect of writing off an uncollectible receivable will be ________.

A)a reduction in net income

B)nil on net income

C)an increase in total assets

D)a generation of positive cash flow

A)a reduction in net income

B)nil on net income

C)an increase in total assets

D)a generation of positive cash flow

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

29

For a company with significant uncollectible receivables,the direct write-off method is unsuitable because ________.

A)it overstates liabilities on the balance sheet

B)it violates the matching principle

C)it uses estimates for determining the bad debt expenses.

D)it is not allowed for tax reasons

A)it overstates liabilities on the balance sheet

B)it violates the matching principle

C)it uses estimates for determining the bad debt expenses.

D)it is not allowed for tax reasons

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

30

Under the direct write-off method,the entry to write off an uncollectible account will include ________.

A)a debit to Bad Debts Expense account

B)a debit to the customer's Account Receivable

C)a credit to the Allowance for Bad Debts

D)No entry is made to write off uncollectible accounts

A)a debit to Bad Debts Expense account

B)a debit to the customer's Account Receivable

C)a credit to the Allowance for Bad Debts

D)No entry is made to write off uncollectible accounts

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

31

Give the journal entry to record an uncollectible account receivable using the direct write-off method.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

32

The direct write-off method is only acceptable for companies that have very few uncollectible receivables.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following statements is true of the direct write-off method?

A)GAAP requires public companies to follow the direct write-off method.

B)It provides better matching of revenues with expenses.

C)It results in more accurate net income than any other method.

D)It is only suitable for small companies that have very few uncollectible receivables.

A)GAAP requires public companies to follow the direct write-off method.

B)It provides better matching of revenues with expenses.

C)It results in more accurate net income than any other method.

D)It is only suitable for small companies that have very few uncollectible receivables.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

34

Clothesall Inc.,a readymade garment seller,accepts payment through credit cards.During the month of August,the card sales amounted to $12,000.The processor charges a 3% fee.Assume that the processor nets the deposits.Provide the journal entry for card sales revenue.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

35

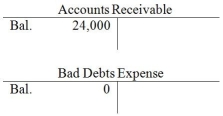

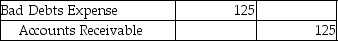

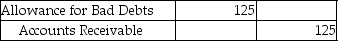

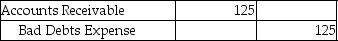

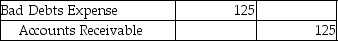

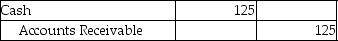

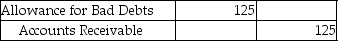

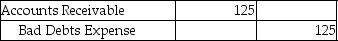

Charms Inc.,a merchandising company,has an account receivable for $125 which it has now deemed uncollectible.The company uses the direct write-off method.Which of the following entries is required to record the write-off?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

36

Clothesall Inc.,a readymade garment seller,accepts payment through credit cards.During the month of August,the card sales amounted to $12,000.The processor charges a 3% fee.Assuming that the credit card processor uses the gross method,provide the journal entries for the receipt of funds and the collection of fees at the end of the period.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

37

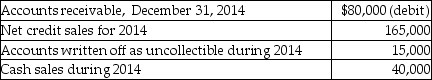

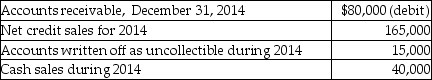

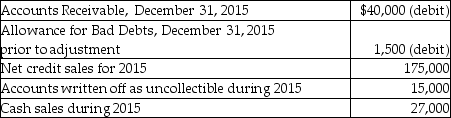

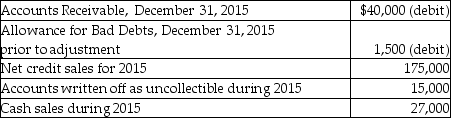

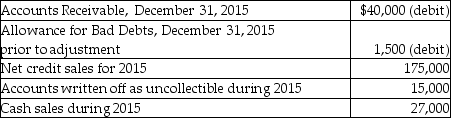

The following information is from the records of Armadillo Camera Shop:  The company uses the direct write-off method for bad debts.What is the amount of bad debts expense?

The company uses the direct write-off method for bad debts.What is the amount of bad debts expense?

A)$80,000

B)$40,000

C)$16,800

D)$15,000

The company uses the direct write-off method for bad debts.What is the amount of bad debts expense?

The company uses the direct write-off method for bad debts.What is the amount of bad debts expense?A)$80,000

B)$40,000

C)$16,800

D)$15,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

38

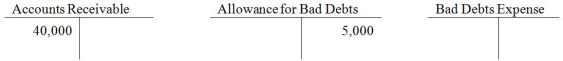

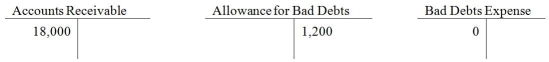

On January 1,Davidson Services has the following balances:  Davidson has the following transactions during January: Credit sales of $100,000,collections of credit sales of $85,000,and write-offs of $15,000.Davidson uses the direct write-off method.

Davidson has the following transactions during January: Credit sales of $100,000,collections of credit sales of $85,000,and write-offs of $15,000.Davidson uses the direct write-off method.

-At the end of January,the balance in Accounts Receivable is ________.

A)$16,000

B)$24,000

C)$68,000

D)$28,000

Davidson has the following transactions during January: Credit sales of $100,000,collections of credit sales of $85,000,and write-offs of $15,000.Davidson uses the direct write-off method.

Davidson has the following transactions during January: Credit sales of $100,000,collections of credit sales of $85,000,and write-offs of $15,000.Davidson uses the direct write-off method.-At the end of January,the balance in Accounts Receivable is ________.

A)$16,000

B)$24,000

C)$68,000

D)$28,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

39

The direct write-off method for uncollectible accounts violates the matching principle.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is a disadvantage of accepting credit cards or debit cards for a business?

A)It will have to bear the responsibility of collecting money from the customer.

B)It will have to bear the risk of nonpayment.

C)It will have to pay a certain amount as processing fee.

D)It will have to check the credit ratings of customers.

A)It will have to bear the responsibility of collecting money from the customer.

B)It will have to bear the risk of nonpayment.

C)It will have to pay a certain amount as processing fee.

D)It will have to check the credit ratings of customers.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

41

The Allowance for Bad Debts account has a credit balance of $2,000.The company's management estimates that 2% of net credit sales will be uncollectible for the year 2015.Net credit sales for the year amounted to $250,000.What will be the amount of Bad Debts Expense reported on the income statement for 2015?

A)$5,000

B)$3,075

C)$2,875

D)$2,675

A)$5,000

B)$3,075

C)$2,875

D)$2,675

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

42

The two methods of estimating uncollectible receivables are ________.

A)allowance method and amortization method

B)aging-of-accounts-receivable method and percent-of-sales method

C)gross-up method and direct write-off method

D)direct write-off method and percent-of-completion method

A)allowance method and amortization method

B)aging-of-accounts-receivable method and percent-of-sales method

C)gross-up method and direct write-off method

D)direct write-off method and percent-of-completion method

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

43

Sunrays Inc.had completely written off the account of one of its old customers,Brad,in 2014 for $500.On January 21,2015,Brad unexpectedly repaid his debt in full.The company uses the direct write-off method to account for uncollectible receivables.Journalize the entries required for Sunrays Inc.on January 21,2015.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

44

The net realizable value of Accounts Receivable is calculated by subtracting Bad Debts Expense from Accounts Receivable.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

45

The Allowance for Bad Debts account has a debit balance of $9,000 before the adjusting entry for bad debt expense.After analyzing the accounts in the accounts receivable subsidiary ledger using the aging method,the company's management estimates that uncollectible accounts will be $15,000.What will be the amount of Bad debts expense reported on the income statement?

A)$4,000

B)$24,000

C)$6,000

D)$15,000

A)$4,000

B)$24,000

C)$6,000

D)$15,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

46

The Allowance for Bad Debts can be calculated as a specific percentage of credit sales and is a contra account to Accounts Receivable.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

47

The Allowance for Bad Debts account has a credit balance of $2,000 before the adjusting entry for bad debt expense.The company's management estimates that 2% of net credit sales will be uncollectible for the year 2015.Net credit sales for the year amounted to $250,000.What will be the balance of the Allowance for Bad Debts reported on the balance sheet at December 31,2015?

A)$7,275

B)$3,075

C)$7,000

D)$5,285

A)$7,275

B)$3,075

C)$7,000

D)$5,285

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

48

Under both the allowance method and the direct-write off method of accounting for uncollectible accounts,the amount of bad debts expense is to be estimated at the end of each accounting period.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

49

The Allowance for Bad Debts has a credit balance of $9,000 before the adjusting entry for bad debt expense.After analyzing the accounts in the accounts receivable subsidiary ledger using the aging method,the company's management estimates that uncollectible accounts will be $15,000.What will be the amount of bad debts expense reported on the income statement?

A)$24,000

B)$6,000

C)$15,000

D)$9,000

A)$24,000

B)$6,000

C)$15,000

D)$9,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

50

The percent-of-sales method computes bad debts expense as a percentage of net cash sales.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

51

A method of accounting for uncollectible receivables in which the company estimates bad debts expense instead of waiting to see which customers the company will not collect from is known as the allowance method.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

52

The allowance method violates the matching principle.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

53

GAAP requires most companies to use the ________.

A)direct write-off method to estimate bad debts

B)allowance method to estimate bad debts

C)amortization method to estimate bad debts

D)360-day method to estimate bad debts

A)direct write-off method to estimate bad debts

B)allowance method to estimate bad debts

C)amortization method to estimate bad debts

D)360-day method to estimate bad debts

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

54

The two methods of accounting for uncollectible receivables are ________.

A)direct write-off method and liability method

B)asset method and sales method

C)allowance method and liability method

D)allowance method and direct write-off method

A)direct write-off method and liability method

B)asset method and sales method

C)allowance method and liability method

D)allowance method and direct write-off method

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

55

An entry to write off an account receivable under the allowance method will ________.

A)reduce net income

B)have no effect on net income

C)increase total assets

D)increase net income

A)reduce net income

B)have no effect on net income

C)increase total assets

D)increase net income

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

56

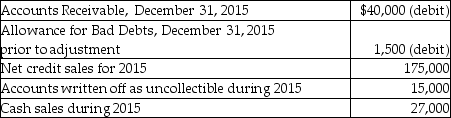

The following information is from the records of Armadillo Camera Shop:  Bad debts expense is estimated by the aging-of-accounts-receivables method.Management estimates that $2,850 of accounts receivable will be uncollectible.Calculate the amount of net accounts receivable after the adjustment for bad debts.

Bad debts expense is estimated by the aging-of-accounts-receivables method.Management estimates that $2,850 of accounts receivable will be uncollectible.Calculate the amount of net accounts receivable after the adjustment for bad debts.

A)$17,750

B)$17,150

C)$16,550

D)$13,000

Bad debts expense is estimated by the aging-of-accounts-receivables method.Management estimates that $2,850 of accounts receivable will be uncollectible.Calculate the amount of net accounts receivable after the adjustment for bad debts.

Bad debts expense is estimated by the aging-of-accounts-receivables method.Management estimates that $2,850 of accounts receivable will be uncollectible.Calculate the amount of net accounts receivable after the adjustment for bad debts.A)$17,750

B)$17,150

C)$16,550

D)$13,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

57

The Allowance for Bad Debts account has a credit balance of $9,000 before the adjusting entry for bad debt expense.After analyzing the accounts in the accounts receivable subsidiary ledger using the aging method,the company's management estimates that uncollectible accounts will be $15,000.What will be the balance of the Allowance for Bad Debts reported on the balance sheet?

A)$15,000

B)$14,900

C)$15,900

D)$14,100

A)$15,000

B)$14,900

C)$15,900

D)$14,100

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

58

The aging-of-receivables method is a balance sheet approach of estimating uncollectible accounts.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

59

The percent-of-sales method to compute uncollectible accounts is also known as the balance sheet approach.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

60

The percent-of-sales method to estimate bad debts computes bad debts expense as a percentage of net credit sales.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

61

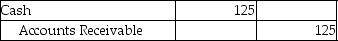

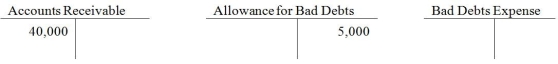

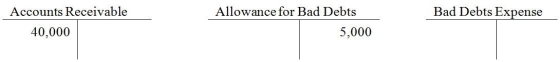

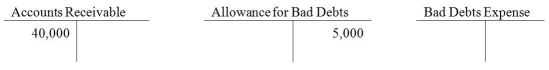

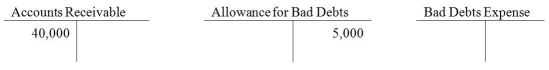

At the beginning of 2015,Elixir Inc.has the following ledger balances:  During the year,credit sales amounted to $800,000.Cash collected on credit sales amounted to $760,000 and $18,000 has been written off.At the end of the year,company adjusted for bad debts expense using the aging method.The amount estimated as uncollectible was $25,000.

During the year,credit sales amounted to $800,000.Cash collected on credit sales amounted to $760,000 and $18,000 has been written off.At the end of the year,company adjusted for bad debts expense using the aging method.The amount estimated as uncollectible was $25,000.

-The ending balance in Bad Debts Expense would be ________.

A)$38,000

B)$25,000

C)$13,000

D)$7,000

During the year,credit sales amounted to $800,000.Cash collected on credit sales amounted to $760,000 and $18,000 has been written off.At the end of the year,company adjusted for bad debts expense using the aging method.The amount estimated as uncollectible was $25,000.

During the year,credit sales amounted to $800,000.Cash collected on credit sales amounted to $760,000 and $18,000 has been written off.At the end of the year,company adjusted for bad debts expense using the aging method.The amount estimated as uncollectible was $25,000.-The ending balance in Bad Debts Expense would be ________.

A)$38,000

B)$25,000

C)$13,000

D)$7,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

62

At the beginning of 2015,Elixir Inc.has the following ledger balances:  During the year,credit sales amounted to $800,000.Cash collected on credit sales amounted to $760,000 and $18,000 has been written off.At the end of the year,company adjusted for bad debts expense using the percent-of-sales method and applied a rate,based on past history,of 2.5%.

During the year,credit sales amounted to $800,000.Cash collected on credit sales amounted to $760,000 and $18,000 has been written off.At the end of the year,company adjusted for bad debts expense using the percent-of-sales method and applied a rate,based on past history,of 2.5%.

-The ending balance in the Allowance for Bad Debts would be ________.

A)$5,000

B)$6,500

C)$6,400

D)$7,000

During the year,credit sales amounted to $800,000.Cash collected on credit sales amounted to $760,000 and $18,000 has been written off.At the end of the year,company adjusted for bad debts expense using the percent-of-sales method and applied a rate,based on past history,of 2.5%.

During the year,credit sales amounted to $800,000.Cash collected on credit sales amounted to $760,000 and $18,000 has been written off.At the end of the year,company adjusted for bad debts expense using the percent-of-sales method and applied a rate,based on past history,of 2.5%.-The ending balance in the Allowance for Bad Debts would be ________.

A)$5,000

B)$6,500

C)$6,400

D)$7,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

63

Smart Art is a new establishment.During the first year,there were credit sales of $40,000 and collections of credit sales of $36,000.One account for $650 was written off.The company decided to use the percent-of-sales method to account for bad debts expense,and decided to use a factor of 2% for their year-end adjustment of bad debts expense.

-The ending balance in Allowance for Bad Debts account would be ________.

A)$150

B)$800

C)$250

D)$1,450

-The ending balance in Allowance for Bad Debts account would be ________.

A)$150

B)$800

C)$250

D)$1,450

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

64

At the beginning of 2015,Elixir Inc.has the following ledger balances:  During the year,credit sales amounted to $800,000.Cash collected on credit sales amounted to $760,000 and $18,000 has been written off.At the end of the year,company adjusted for bad debts expense using the percent-of-sales method and applied a rate,based on past history,of 2.5%.

During the year,credit sales amounted to $800,000.Cash collected on credit sales amounted to $760,000 and $18,000 has been written off.At the end of the year,company adjusted for bad debts expense using the percent-of-sales method and applied a rate,based on past history,of 2.5%.

-The ending balance in Bad Debts Expense would be ________.

A)$20,000

B)$40,000

C)$28,000

D)$27,000

During the year,credit sales amounted to $800,000.Cash collected on credit sales amounted to $760,000 and $18,000 has been written off.At the end of the year,company adjusted for bad debts expense using the percent-of-sales method and applied a rate,based on past history,of 2.5%.

During the year,credit sales amounted to $800,000.Cash collected on credit sales amounted to $760,000 and $18,000 has been written off.At the end of the year,company adjusted for bad debts expense using the percent-of-sales method and applied a rate,based on past history,of 2.5%.-The ending balance in Bad Debts Expense would be ________.

A)$20,000

B)$40,000

C)$28,000

D)$27,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

65

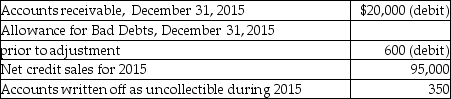

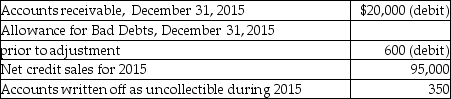

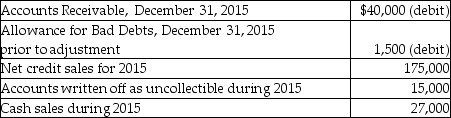

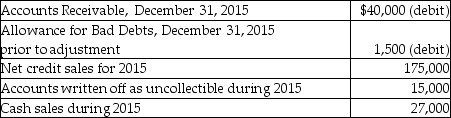

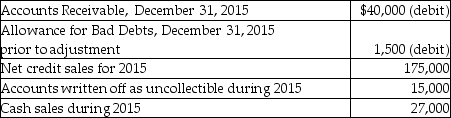

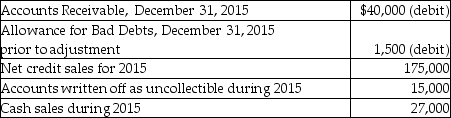

The following information is from the 2015 records of Armand Camera Shop:

- Bad debts expense is estimated by the aging-of-receivables method.Management estimates that $5,000 of accounts receivable will be uncollectible.Calculate the Allowance for Bad Debts after the adjustment for bad debt expense at December 31,2015.

A)$5,250

B)$6,500

C)$7,000

D)$5,000

- Bad debts expense is estimated by the aging-of-receivables method.Management estimates that $5,000 of accounts receivable will be uncollectible.Calculate the Allowance for Bad Debts after the adjustment for bad debt expense at December 31,2015.

A)$5,250

B)$6,500

C)$7,000

D)$5,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

66

Smart Art is a new establishment.During the first year,there were credit sales of $40,000 and collections of credit sales of $36,000.One account for $650 was written off.The company decided to use the aging-of-receivables method to account for bad debts expense,and estimated $500 as uncollectible at year end.Therefore,the ending balance in the Allowance for Bad Debts would be ________.

A)$150

B)$800

C)$200

D)$500

A)$150

B)$800

C)$200

D)$500

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

67

The Allowance for Bad Debts account has a debit balance of $6,000 before the adjusting entry for bad debt expense.After analyzing the accounts in the accounts receivable subsidiary ledger,the company's management estimates that uncollectible accounts will be $10,000.What will be the amount of the adjustment in the Allowance for Bad Debts account?

A)$15,250

B)$10,000

C)$14,900

D)$16,000

A)$15,250

B)$10,000

C)$14,900

D)$16,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

68

On January 1st,2015,Everlight Corp.has the following balances:  During the year,Everlight has $150,000 of credit sales,collections of credit sales of $140,000,and write-offs of $3,000.It records bad debts expense at the end of the year using the aging-of-receivables method.At the end of the year,aging analysis produces a figure of $1,900,being the estimate of uncollectible accounts.Before the year-end entry to adjust the bad debts expense is made,the balance in the Allowance for Bad Debts expense would show ________.

During the year,Everlight has $150,000 of credit sales,collections of credit sales of $140,000,and write-offs of $3,000.It records bad debts expense at the end of the year using the aging-of-receivables method.At the end of the year,aging analysis produces a figure of $1,900,being the estimate of uncollectible accounts.Before the year-end entry to adjust the bad debts expense is made,the balance in the Allowance for Bad Debts expense would show ________.

A)a debit of $1,800

B)a credit of $4,200

C)a zero balance

D)a debit of $3,000

During the year,Everlight has $150,000 of credit sales,collections of credit sales of $140,000,and write-offs of $3,000.It records bad debts expense at the end of the year using the aging-of-receivables method.At the end of the year,aging analysis produces a figure of $1,900,being the estimate of uncollectible accounts.Before the year-end entry to adjust the bad debts expense is made,the balance in the Allowance for Bad Debts expense would show ________.

During the year,Everlight has $150,000 of credit sales,collections of credit sales of $140,000,and write-offs of $3,000.It records bad debts expense at the end of the year using the aging-of-receivables method.At the end of the year,aging analysis produces a figure of $1,900,being the estimate of uncollectible accounts.Before the year-end entry to adjust the bad debts expense is made,the balance in the Allowance for Bad Debts expense would show ________.A)a debit of $1,800

B)a credit of $4,200

C)a zero balance

D)a debit of $3,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

69

Accounts receivable has a balance of $5,000 and the Allowance for Bad Debts has a credit balance of $440.The allowance method is used.What is the net realizable value of Accounts Receivable after a $160 account receivable is written off?

A)$4,400

B)$4,720

C)$4,560

D)$5,000

A)$4,400

B)$4,720

C)$4,560

D)$5,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

70

A newly created design business called Smart Art is just finishing up its first year of operations.During the year,there were credit sales of $40,000 and collections of credit sales of $36,000.One account for $650 was written off.Smart Art uses the aging method to account for uncollectible account expense.It has estimated $200 as uncollectible at year-end.At the end of the year,what is the ending balance in the Bad Debts Expense account?

A)$1,150

B)$800

C)$200

D)$850

A)$1,150

B)$800

C)$200

D)$850

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

71

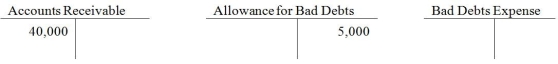

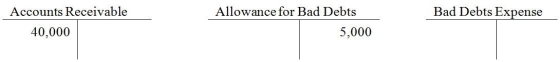

At the beginning of 2015,Elixir Inc.has the following ledger balances:  During the year,credit sales amounted to $800,000.Cash collected on credit sales amounted to $760,000 and $18,000 has been written off.At the end of the year,company adjusted for bad debts expense using the aging method.The amount estimated as uncollectible was $25,000.

During the year,credit sales amounted to $800,000.Cash collected on credit sales amounted to $760,000 and $18,000 has been written off.At the end of the year,company adjusted for bad debts expense using the aging method.The amount estimated as uncollectible was $25,000.

-The ending balance in the Allowance for Bad Debts would be ________.

A)$38.000

B)$18,000

C)$25,000

D)$30,000

During the year,credit sales amounted to $800,000.Cash collected on credit sales amounted to $760,000 and $18,000 has been written off.At the end of the year,company adjusted for bad debts expense using the aging method.The amount estimated as uncollectible was $25,000.

During the year,credit sales amounted to $800,000.Cash collected on credit sales amounted to $760,000 and $18,000 has been written off.At the end of the year,company adjusted for bad debts expense using the aging method.The amount estimated as uncollectible was $25,000.-The ending balance in the Allowance for Bad Debts would be ________.

A)$38.000

B)$18,000

C)$25,000

D)$30,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

72

The following information is from the 2015 records of Armand Camera Shop:

- Bad debts expense is estimated by the aging-of-receivables method.Management estimates that $5,000 of accounts receivable will be uncollectible.Calculate the amount of bad debts expense for 2015.

A)$7,000

B)$6,500

C)$6,450

D)$5,250

- Bad debts expense is estimated by the aging-of-receivables method.Management estimates that $5,000 of accounts receivable will be uncollectible.Calculate the amount of bad debts expense for 2015.

A)$7,000

B)$6,500

C)$6,450

D)$5,250

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

73

Smart Art is a new establishment.During the first year,there were credit sales of $40,000 and collections of credit sales of $36,000.One account for $650 was written off.The company decided to use the percent-of-sales method to account for bad debts expense,and decided to use a factor of 2% for its year-end adjustment of bad debts expense.

-What is the ending balance in Accounts Receivable at the end of the year?

A)$4,000

B)$3,600

C)$3,350

D)$3,200

-What is the ending balance in Accounts Receivable at the end of the year?

A)$4,000

B)$3,600

C)$3,350

D)$3,200

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

74

Accounts receivable has a balance of $30,000 and the Allowance for Bad Debts has a credit balance of $3,000.The allowance method is used.What is the net realizable value of Accounts Receivable before and after a $2,000 Account Receivable is written off?

A)$27,000; $27,000

B)$14,300; $14,300

C)$16,000; $15,940

D)$16,000; $16,000

A)$27,000; $27,000

B)$14,300; $14,300

C)$16,000; $15,940

D)$16,000; $16,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

75

The following information is from the 2015 records of Armand Camera Shop:

- Bad debts expense is estimated by the percent-of-sales method.Management estimates that 3% of net credit sales will be uncollectible.The balance of the Allowance for Bad Debts account after adjustment will be ________.

A)$7,000

B)$3,450

C)$2,850

D)$3,750

- Bad debts expense is estimated by the percent-of-sales method.Management estimates that 3% of net credit sales will be uncollectible.The balance of the Allowance for Bad Debts account after adjustment will be ________.

A)$7,000

B)$3,450

C)$2,850

D)$3,750

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

76

A company reports net accounts receivable of $150,000 on its December 31,2015 balance sheet.The Allowance for Bad Debts has a credit balance of $15,000.What is the balance in Accounts Receivable?

A)$155,000

B)$150,000

C)$165,000

D)$135,000

A)$155,000

B)$150,000

C)$165,000

D)$135,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

77

The following information is from the 2015 records of Armand Camera Shop:

- Bad debts expense is estimated by the percent-of-sales method.The management estimates that 3% of net credit sales will be uncollectible.Calculate the amount of bad debts expense for 2015.

A)$5,250

B)$3,450

C)$2,250

D)$2,850

- Bad debts expense is estimated by the percent-of-sales method.The management estimates that 3% of net credit sales will be uncollectible.Calculate the amount of bad debts expense for 2015.

A)$5,250

B)$3,450

C)$2,250

D)$2,850

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

78

On January 16,Whole Circle Inc.sold goods worth $5,000 to Smith on account.It could not collect cash from the customer,and finally decided to write off the account.Give journal entry to record the write-off assuming that the company uses the allowance method.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

79

Smart Art is a new establishment.During the first year,there were credit sales of $40,000 and collections of credit sales of $36,000.One account for $650 was written off.The company decided to use the percent-of-sales method to account for bad debts expense,and decided to use a factor of 2% for their year-end adjustment of bad debts expense.

-At the end of the year,the balance of bad debts expense would be ________.

A)$150

B)$800

C)$250

D)$1,450

-At the end of the year,the balance of bad debts expense would be ________.

A)$150

B)$800

C)$250

D)$1,450

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

80

At the beginning of 2015,Elixir Inc.has the following ledger balances:  During the year,credit sales amounted to $800,000.Cash collected on credit sales amounted to $760,000,and $18,000 has been written off.At the end of the year,the company adjusted for bad debts expense using the percent-of-sales method and applied a rate,based on past history,of 2.5%.

During the year,credit sales amounted to $800,000.Cash collected on credit sales amounted to $760,000,and $18,000 has been written off.At the end of the year,the company adjusted for bad debts expense using the percent-of-sales method and applied a rate,based on past history,of 2.5%.

-The ending balance of Accounts Receivable would be ________.

A)$40,000

B)$62,000

C)$80,000

D)$18,000

During the year,credit sales amounted to $800,000.Cash collected on credit sales amounted to $760,000,and $18,000 has been written off.At the end of the year,the company adjusted for bad debts expense using the percent-of-sales method and applied a rate,based on past history,of 2.5%.

During the year,credit sales amounted to $800,000.Cash collected on credit sales amounted to $760,000,and $18,000 has been written off.At the end of the year,the company adjusted for bad debts expense using the percent-of-sales method and applied a rate,based on past history,of 2.5%.-The ending balance of Accounts Receivable would be ________.

A)$40,000

B)$62,000

C)$80,000

D)$18,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck