Deck 9: Plant Assets, natural Resources, and Intangibles

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/151

Play

Full screen (f)

Deck 9: Plant Assets, natural Resources, and Intangibles

1

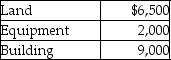

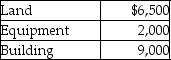

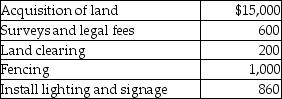

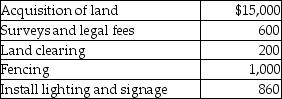

Hastings Corporation has purchased a group of assets for $15,000.The assets and their relative market values are listed below.  Which of the following amounts would be debited to the Land account?

Which of the following amounts would be debited to the Land account?

A)$1,962

B)$5,571

C)$1,714

D)$7,714

Which of the following amounts would be debited to the Land account?

Which of the following amounts would be debited to the Land account?A)$1,962

B)$5,571

C)$1,714

D)$7,714

B

2

Plant assets are long-lived,tangible assets used in the operation of a business.

True

3

Repair work that generates a capital expenditure because it extends the plant asset's useful life past the normal expected life is known as an extraordinary repair.

True

4

Fred Inc.owns a delivery truck.Which of the following costs,associated with the truck,will be treated as a revenue expenditure?

A)oil change and lubrication

B)major engine overhaul

C)modification for new use

D)addition to storage capacity

A)oil change and lubrication

B)major engine overhaul

C)modification for new use

D)addition to storage capacity

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is a characteristic of a plant asset,such as a building?

A)It is used in the operation of a business.

B)It is available for sale to customers in the ordinary course of business.

C)It has a short useful life.

D)It will have a negligible value at the end of its useful life.

A)It is used in the operation of a business.

B)It is available for sale to customers in the ordinary course of business.

C)It has a short useful life.

D)It will have a negligible value at the end of its useful life.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

6

A lump-sum purchase or basket purchase involves paying a single price for several assets as a group.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

7

The cost principle requires a business to record the assets acquired or services received at their actual cost.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

8

The lump-sum amount paid for a group of assets is divided among the assets acquired based on their relative market values.This method is known as the relative-market-value method.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

9

Capitalizing the cost of an asset involves crediting the asset account.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

10

The process of allocating the cost of a plant asset over its useful life is known as cost reduction.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

11

Land and land improvements are one and the same and therefore must be recorded in single account.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

12

The cost of a building depends on whether the company is constructing the building by itself or is acquiring an existing one.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

13

An expenditure which increases the capacity or efficiency of a plant asset or which extends the asset's life is known as a revenue expenditure.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is included in the cost of a plant asset?

A)amounts paid to make the asset ready for its intended use

B)regular repair and maintenance cost

C)replacement of damaged parts of the asset

D)wages of workers who work with the asset

A)amounts paid to make the asset ready for its intended use

B)regular repair and maintenance cost

C)replacement of damaged parts of the asset

D)wages of workers who work with the asset

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

15

Fred Inc.owns a delivery truck.Which of the following costs,associated with the truck,will be capitalized and depreciated?

A)modification for new use

B)change of oil filters

C)replacement of tires

D)normal repair of engine

A)modification for new use

B)change of oil filters

C)replacement of tires

D)normal repair of engine

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

16

A company's accountant capitalized a payment that should be recorded as a revenue expenditure.How will this error affect the financial statements of the company?

A)net income will be understated

B)expenses will be overstated

C)assets will be overstated

D)liabilities will be overstated

A)net income will be understated

B)expenses will be overstated

C)assets will be overstated

D)liabilities will be overstated

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is included in the cost of land?

A)cost of fencing

B)cost of paving

C)brokerage commission

D)cost of outdoor lighting

A)cost of fencing

B)cost of paving

C)brokerage commission

D)cost of outdoor lighting

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

18

The cost of land does not include the cost of fencing and paving the land.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following asset categories would include the cost of clearing land and removing unwanted buildings?

A)land

B)buildings

C)land improvements

D)machinery and equipment

A)land

B)buildings

C)land improvements

D)machinery and equipment

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

20

Ordinary repairs to plant assets are referred to as revenue expenditures.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following costs related to a corporation car would be capitalized?

A)the cost to install an engine with higher horsepower

B)the cost to change the car's oil

C)the cost to replace a broken windshield

D)the cost of new tires

A)the cost to install an engine with higher horsepower

B)the cost to change the car's oil

C)the cost to replace a broken windshield

D)the cost of new tires

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

22

Use of MACRS is acceptable for financial reporting under GAAP.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

23

Nobells Corporation has acquired a property that included both land and a building for $500,000.The corporation hired an appraiser who has determined that the market value of the land to be $300,000 and that of the building is $400,000.At what amount should the corporation record the cost of building?

A)$147,368

B)$285,714

C)$269,125

D)$214,286

A)$147,368

B)$285,714

C)$269,125

D)$214,286

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

24

When a corporation uses the straight-line method of depreciation,the amount of depreciation charged to expense will be reduced from year to year.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

25

Roberts Construction Group paid $5,000 for a plant asset that had a market value of $7,500.At which of the following amounts should the plant asset be recorded?

A)$7,500

B)$2,500

C)$5,000

D)$10,000

A)$7,500

B)$2,500

C)$5,000

D)$10,000

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

26

An asset is said to be obsolete when a newer asset can perform the job more efficiently.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

27

Residual value is also known as depreciable cost.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

28

A company's accountant capitalized a payment that should be recorded as a revenue expenditure.How will this error affect the financial statements of the corporation?

A)net income will be overstated

B)revenues will be understated

C)assets will be understated

D)liabilities will be understated

A)net income will be overstated

B)revenues will be understated

C)assets will be understated

D)liabilities will be understated

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

29

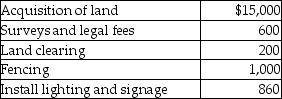

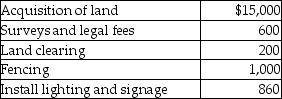

Acer Inc.plans to develop a shopping center.In the first quarter,they spent the following amounts:

- What amount should be recorded as the cost of land in the books of the corporation?

A)$16,800

B)$15,800

C)$16,660

D)$16,200

- What amount should be recorded as the cost of land in the books of the corporation?

A)$16,800

B)$15,800

C)$16,660

D)$16,200

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

30

Give journal entry to record the acquisition of a plant asset for cash.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following should be included in the cost of land?

A)cost to build sidewalks on the land

B)cost to clear the land of old buildings

C)cost of installing signage

D)cost of installing fences

A)cost to build sidewalks on the land

B)cost to clear the land of old buildings

C)cost of installing signage

D)cost of installing fences

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

32

The units-of-production method allocates varying amounts of depreciation each year based on an asset's usage.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

33

Nobells Corporation has acquired a property that included both land and a building for $500,000.The corporation paid cash.The corporation hired an appraiser who has determined that the market value of the land is $300,000 and that of the building is $400,000.Journalize the lump-sum purchase.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

34

The double-declining-balance method is an accelerated method of depreciation.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

35

Depreciation is the allocation of a plant asset's cost to expense over the useful life of the asset.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

36

Nobells Corp.has acquired land and paid an amount of $500 as brokerage to acquire the land.However,the company's accountant has recorded the $500 as a revenue expenditure.What is the effect of this error?

A)net income is understated by $500

B)liabilities are overstated by $500

C)revenue is overstated by $500

D)assets are overstated by $500

A)net income is understated by $500

B)liabilities are overstated by $500

C)revenue is overstated by $500

D)assets are overstated by $500

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

37

Acer Inc.plans to develop a shopping center.In the first quarter,they spent the following amounts:

-What amount should be recorded as the land improvements cost?

A)$1,200

B)$1,800

C)$1,860

D)$800

-What amount should be recorded as the land improvements cost?

A)$1,200

B)$1,800

C)$1,860

D)$800

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

38

Useful life of a plant asset refers to the period for which it can be used for the purposes of the business.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

39

Danube Corp.purchased a used machine for $10,000.The machine required installation costs of $1,000 and insurance while in transit of $500.At which of the following amounts would the machine be recorded?

A)$10,000

B)$11,000

C)$10,500

D)$11,500

A)$10,000

B)$11,000

C)$10,500

D)$11,500

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

40

Nobells Corporation has acquired a property that included both land and a building for $500,000.The corporation hired an appraiser who has determined that the market value of the land is $300,000 and that of the building is $400,000.At what amount should the corporation record the cost of land?

A)$147,368

B)$52,632

C)$250,000

D)$214,286

A)$147,368

B)$52,632

C)$250,000

D)$214,286

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

41

When an asset is fully depreciated,the residual value must be written off.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following depreciation methods allocates a varying amount of depreciation each year based on an asset's usage?

A)the straight-line method

B)the annuity method

C)the units-of-production method

D)the double-declining-balance method

A)the straight-line method

B)the annuity method

C)the units-of-production method

D)the double-declining-balance method

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

43

A company purchased a computer on July 1,2015 for $50,000.Estimated useful life of the computer was 5 years and it has no residual value.Which of the following methods should be used to best match its expense against the revenue it produces?

A)the units-of-production method

B)the straight-line method

C)the double-declining-balance method

D)the first-in,first-out method

A)the units-of-production method

B)the straight-line method

C)the double-declining-balance method

D)the first-in,first-out method

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

44

Iverycoast Inc.purchased a van on January 1,2015,for $800,000.Estimated life of the van was 5 years,and its estimated residual value was $90,000.Iverycoast uses the straight-line method of depreciation.At the beginning of 2017,the corporation revised the total estimated life of the asset from 5 years to 6 years.The estimated residual value remained the same as estimated earlier.Calculate the depreciation expense for the year 2017.

A)$142,000

B)$145,000

C)$106,500

D)$110,000

A)$142,000

B)$145,000

C)$106,500

D)$110,000

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

45

When an asset is fully depreciated,no further depreciation expense is recorded.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following depreciation methods writes off a higher amount of depreciation in earlier years than in later years?

A)the units-of-production method

B)the straight-line method

C)the double-declining-balance method

D)the first-in,first-out method

A)the units-of-production method

B)the straight-line method

C)the double-declining-balance method

D)the first-in,first-out method

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

47

The cost of an asset is $1,000,000 and its residual value is $100,000.Estimated useful life of the asset is four years.Calculate depreciation for the first year using the double-declining-balance method of depreciation.

A)$450,000

B)$500,000

C)$250,000

D)$225,000

A)$450,000

B)$500,000

C)$250,000

D)$225,000

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

48

Companies are required to use Modified Accelerated Cost Recovery System (MACRS)for tax purposes.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following accounting principles requires businesses to record depreciation?

A)the revenue recognition principle

B)the matching principle

C)the cost principle

D)the going concern principle

A)the revenue recognition principle

B)the matching principle

C)the cost principle

D)the going concern principle

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is true when the estimate of an asset's useful life is changed?

A)The new estimate is ignored until the last year of the asset's life.

B)The depreciation expense in the prior year is restated.

C)Prior years' financial statements must be restated.

D)The asset's remaining depreciable book value will be spread over the asset's remaining life.

A)The new estimate is ignored until the last year of the asset's life.

B)The depreciation expense in the prior year is restated.

C)Prior years' financial statements must be restated.

D)The asset's remaining depreciable book value will be spread over the asset's remaining life.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following categories of assets should be depreciated?

A)tangible property,plant and equipment,other than land

B)intangible property

C)land

D)natural resources

A)tangible property,plant and equipment,other than land

B)intangible property

C)land

D)natural resources

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

52

On January 1,2015,Zade Manufacturing Corporation purchased a machine for $40,000,000.The corporation expects to use the machine for 24,000 hours over the next 6 years.The estimated residual value of the machine at the end of the sixth year is $40,000.The corporation used the machine for 3,600 hours in 2015 and 5,000 hours in 2016. Calculate the book value of the machine at the end of 2016 if the company uses the units-of-production method of depreciation.

A)$25,681,000

B)$17,777,778

C)$28,532,688

D)$24,352,951

A)$25,681,000

B)$17,777,778

C)$28,532,688

D)$24,352,951

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

53

Iverycoast Inc.purchased a van on January 1,2015,for $800,000.Estimated life of the van was 5 years,and its estimated residual value was $90,000.Iverycoast uses the straight-line method of depreciation.Calculate the book value of the van at the end of 2015.

A)$650,000,

B)$750,000

C)$710,000

D)$658,000

A)$650,000,

B)$750,000

C)$710,000

D)$658,000

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

54

On January 1,2015,Zade Manufacturing Corporation purchased a machine for $40,000,000.The corporation expects to use the machine for 24,000 hours over the next 6 years.The estimated residual value of the machine at the end of the sixth year is $40,000.The corporation used the machine for 3,600 hours in 2015 and 5,000 hours in 2016.What is the depreciation expense for the year 2015 if the corporation uses the units-of-production method of depreciation?

A)$5,994,000,

B)$13,333,333

C)$6,666,660

D)$12,222,000

A)$5,994,000,

B)$13,333,333

C)$6,666,660

D)$12,222,000

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

55

The cost of an asset is $1,000,000 and its residual value is $100,000.Estimated useful life of the asset is four years.Calculate depreciation for the second year using the double-declining-balance method of depreciation.

A)$250,000

B)$225,000

C)$450,000

D)$240,000

A)$250,000

B)$225,000

C)$450,000

D)$240,000

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

56

On January 1,2015,Anodel Inc.acquired a machine for $1,000,000.The estimated useful life of the asset is 5 years.The residual value at the end of 5 years is estimated to be $50,000.What is the book value of the machine at the end of 2016,if the company uses the straight-line method of depreciation?

A)$600,000

B)$620,000

C)$570,000

D)$550,000

A)$600,000

B)$620,000

C)$570,000

D)$550,000

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

57

Caterpillars Inc.,a manufacturing company,acquired equipment on January 1,2012 for $500,000.Estimated useful life of the equipment was 7 years and the estimated residual value was $10,000.On January 1,2015,after using the equipment for 3 years,the total estimated useful life has been revised to 9 years.Residual value remains unchanged.The company uses the straight-line method of depreciation.Calculate depreciation expense for the year 2015.

A)$48,333

B)$46,667

C)$26,666

D)$33,333

A)$48,333

B)$46,667

C)$26,666

D)$33,333

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

58

On January 1,2015,Anodel Inc.acquired a machine for $1,000,000.The estimated useful life of the asset is 5 years.Residual value at the end of 5 years is estimated to be $50,000.Calculate the depreciation expense per year using the straight-line method.

A)$200,000

B)$190,000

C)$240,000

D)$250,000

A)$200,000

B)$190,000

C)$240,000

D)$250,000

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

59

The expected cash value of an asset at the end of its useful life is known as ________.

A)book value

B)residual value

C)carrying value

D)market value

A)book value

B)residual value

C)carrying value

D)market value

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

60

The double-declining-balance method ignores the residual value while calculating the amount of depreciation.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

61

The cost of an asset is $10,000,000 and its residual value is $100,000.Estimated useful life of the asset is four years.Prepare the schedule of depreciation using the double-declining-balance method of accounting.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

62

Iverycoast Inc.had purchased a van on January 1,2015,for $800,000.Estimated life of the van was 5 years,and its estimated residual value was $90,000.Iverycoast uses the straight-line method of depreciation.Prepare the depreciation schedule.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

63

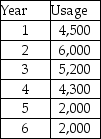

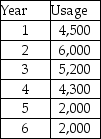

On January 1,2015,Zade Manufacturing Corporation purchased a machine for $40,000,000.The corporation expects to use the machine for 24,000 hours over the next 6 years.The estimated residual value of the machine at the end of the sixth year is $40,000.The schedule of usage of the machine is as below.

Prepare the depreciation schedule using the units-of-production method of depreciation.

Prepare the depreciation schedule using the units-of-production method of depreciation.

Prepare the depreciation schedule using the units-of-production method of depreciation.

Prepare the depreciation schedule using the units-of-production method of depreciation.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

64

Whenever a plant asset is sold or otherwise disposed of,the first step is to bring the depreciation up to date.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

65

On January 1,2015,a corporation acquired a truck for $600,000.Residual value was estimated to be $20,000.The truck can be driven for 50,000 miles over the next 3 years.Actual usage of the truck was recorded as 8,640 miles for the first year.Give journal entry to record depreciation for the first year calculated as per the units-of-production method.(Do not round your intermediate calculations.)

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

66

Discarding of plant assets involves disposing of the asset for no cash.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

67

On July 31,2015,Colora Printers purchased a printer for $50,000.It expects the printer to last for four years and has a residual value of $2,000.Compute the depreciation expense on the printer for the year ended December 31,2015,using the straight-line method.

A)$50,000

B)$5,000

C)$12,500

D)$25,000

A)$50,000

B)$5,000

C)$12,500

D)$25,000

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

68

If the sale price of a plant asset is higher than its book value,there will be a loss.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

69

Iverycoast Inc.purchased a van on January 1,2015,for $800,000.Estimated life of the van was 5 years,and its estimated residual value was $90,000.Iverycoast uses the straight-line method of depreciation.At the beginning of 2017,the company revised the total estimated life of the asset from 5 years to 4 years.The estimated residual value remained the same as estimated earlier.Calculate the depreciation expense for the year 2017.

A)$220,000

B)$213,000

C)$145,000

D)$250,000

A)$220,000

B)$213,000

C)$145,000

D)$250,000

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

70

When a business sells a plant asset for book value,a gain or loss should be recorded.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

71

Iverycoast Inc.purchased a van on January 1,2015,for $800,000.Estimated life of the van was 5 years,and its estimated residual value was $90,000.Iverycoast uses the straight-line method of depreciation.Give journal entry to record the depreciation expense for 2015 on the van.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

72

On January 1,2015,a corporation acquired a truck for $600,000.The residual value was estimated to be $20,000.The truck can be driven for 50,000 miles over the next 3 years.The actual usage of the truck was 8,640 miles for the first year.Calculate the rate of depreciation to be applied,and depreciation for the first year using the units-of-production method.(Do not round your intermediate calculations).

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

73

On January 1,2015,Zade Manufacturing Corporation purchased a machine for $40,000,000.The corporation expects to use the machine for 24,000 hours over the next 6 years.The estimated residual value of the machine at the end of the sixth year is $40,000.The corporation used the machine for 3,600 hours in 2015 and 5,000 hours in 2016.What is the depreciation expense for 2015 and 2016 if the corporation uses the double-declining-balance method of depreciation? (Do not round your intermediate calculations.)

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

74

When a plant asset is sold for a price lower than its book value,there will be a gain.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

75

On January 1,2015,Zade Manufacturing Corporation purchased a machine for $40,000,000.The corporation expects to use the machine for 24,000 hours over the next 6 years.The estimated residual value of the machine at the end of the sixth year is $40,000.The corporation used the machine for 3,600 hours in 2015 and 5,000 hours in 2016.Calculate depreciation expense for the year 2016 if the company uses the units-of-production method of depreciation.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

76

An asset was purchased for $24,000.The asset's estimated useful life was 5 years,and its residual value was $4,000.The straight-line method of depreciation was used.Calculate the gain or loss on sale if the asset is sold for $18,000 at the end of the first year.

A)$1,000 gain

B)$2,000 loss

C)no gain or no loss

D)$2,000 gain

A)$1,000 gain

B)$2,000 loss

C)no gain or no loss

D)$2,000 gain

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

77

A fully depreciated asset that is still in service must not be reported as an asset on the balance sheet.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

78

Iverycoast Inc.purchased a van on January 1,2015,for $800,000.Estimated life of the van was 5 years,and its estimated residual value was $90,000.Iverycoast uses the straight-line method of depreciation.Give journal entry to record the purchase of van for cash.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

79

On January 1,2015,Zade Manufacturing Corporation purchased a machine for $40,000,000.The corporation expects to use the machine for 24,000 hours over the next 6 years.The estimated residual value of the machine at the end of the sixth year is $40,000.The corporation used the machine for 3,600 hours in 2015 and 5,000 hours in 2016.What is the book value of the machine at the end of year 2016 if the corporation uses double-declining-balance method of depreciation? (Do not round your intermediate calculations.)

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

80

When a plant asset,fully depreciated and has no residual value,is discarded,the company will remove the Plant Asset Account and the Accumulated Depreciation Account from their books.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck