Deck 12: Long-Term Liabilities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/151

Play

Full screen (f)

Deck 12: Long-Term Liabilities

1

Trek Holidays Company signed a 9%,10-year note for $150,000.The company paid $1,900 as the installment for the first month.What portion of the first monthly payment is interest expense?

A)$4,800

B)$16,000

C)$14,400

D)$1,125

A)$4,800

B)$16,000

C)$14,400

D)$1,125

D

2

On November 1,2015,EZ Products borrowed $48,000 on a 5%,10-year note with annual installment payments of $4,800 plus interest due on November 1 of each succeeding year.On November 1,2016,what will the balance be in the Long-Term Notes Payable account?

A)$38,400

B)$48,000

C)$43,200

D)$4,800

A)$38,400

B)$48,000

C)$43,200

D)$4,800

A

3

A note payable can either be classified as a long-term liability or a short-term liability depending on the discretion of the accountant.

False

4

The amount of interest paid each period on long-term liabilities remains the same,as well as the principal payments and the total payments

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

5

The current portion of notes payable must be reported on the balance sheet under current liabilities and the long-term portion under long-term liabilities.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

6

On March 1,2015,Vantage Services issued a 5% long-term notes payable for $20,000.It is payable over a 10-year term in $2,000 principal installments on March 1 of each year,beginning March 1,2016.Each yearly installment will include both principal repayment of $2,000 and interest payment for the preceding one-year period.The journal entry to pay the first installment will include a debit to the Interest Expense account for $1,000.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

7

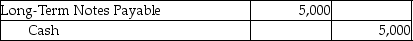

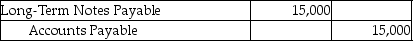

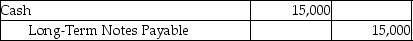

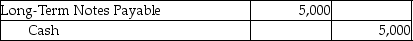

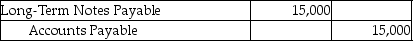

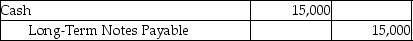

On March 1,2015,Vantage Services issued a 5% long-term notes payable for $15,000.It is payable over a 3-year term in $5,000 principal installments on March 1 of each year,beginning March 1,2016.Which of the following entries needs to be made at March 1,2015?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

8

Issuance of a note by the issuer is recorded by crediting the Cash account and debiting the Note Receivable account.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

9

An amortization schedule details each loan payment's allocation between principal and interest and also the beginning and ending balances of the loan.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

10

A mortgage payable is a long-term debt that is backed with a security interest in specific property.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

11

The current portion of notes payable is the principal amount that will be paid within two years of the balance sheet date and the remaining portion is long term.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

12

Installment payments for mortgages typically contain both an amount for principal repayment and an amount for interest.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

13

Trek Holidays Company signed a 9%,10-year note for $150,000.The company paid $1,900 as the installment for the first month.After the first payment,what is the updated principal balance?

A)$147,625

B)$159,430

C)$149,225

D)$159,100

A)$147,625

B)$159,430

C)$149,225

D)$159,100

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

14

On December 1,2015,Fine Products borrowed $80,000 on a 4%,8-year note with annual installment payments of $10,000 plus interest due on December 1 of each succeeding year.Which of the following describes the first installment payment made on December 1,2016?

A)$10,000 principal plus $3,200 interest

B)$10,000 principal plus $400 interest

C)$10,000 principal plus $10,000 interest

D)$3,200 interest only

A)$10,000 principal plus $3,200 interest

B)$10,000 principal plus $400 interest

C)$10,000 principal plus $10,000 interest

D)$3,200 interest only

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

15

On March 1,2015,Vantage Services issued a 5% long-term notes payable for $15,000.It is payable over a 3-year term in $5,000 annual principal payments on March 1 of each year plus interest,beginning March 1,2016.

-Each yearly installment will include both principal repayment of $5,000 and interest payment for the preceding one-year period.On March 1,2016,________.

A)Vantage must accrue $5,000 of Interest Expense

B)Vantage must accrue for the coming $5,000 as current portion of principal payment

C)Vantage must pay out $750 of Interest Expense to the note holder

D)Vantage will receive $5,000 as an installment payment

-Each yearly installment will include both principal repayment of $5,000 and interest payment for the preceding one-year period.On March 1,2016,________.

A)Vantage must accrue $5,000 of Interest Expense

B)Vantage must accrue for the coming $5,000 as current portion of principal payment

C)Vantage must pay out $750 of Interest Expense to the note holder

D)Vantage will receive $5,000 as an installment payment

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

16

On March 1,2015,Vantage Services issued a 5% long-term notes payable for $15,000.It is payable over a 3-year term in $5,000 annual principal payments on March 1 of each year plus interest,beginning March 1,2016

-How will this information be shown on the balance sheet dated December 31,2015?

A)$15,000 shown as current liability only

B)$5,000 shown as current liability and $15,000 shown as long-term liability

C)$5,000 shown as current liability and $10,000 shown as long-term liability

D)the entire $15,000 shown as long-term liability

-How will this information be shown on the balance sheet dated December 31,2015?

A)$15,000 shown as current liability only

B)$5,000 shown as current liability and $15,000 shown as long-term liability

C)$5,000 shown as current liability and $10,000 shown as long-term liability

D)the entire $15,000 shown as long-term liability

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

17

On December 1,2013,Fine Dining Products borrowed $80,000 on a 4%,8-year note with annual installment payments of $10,000 plus interest due on December 1 of each succeeding year.On December 1,the principal amount was initially recorded as a long-term note payable.What amount of the note payable will be shown as current portion of Long-Term Note Payable on the balance sheet as of December 31,2013?

A)$10,000

B)$13,200

C)$3,200

D)$20,000

A)$10,000

B)$13,200

C)$3,200

D)$20,000

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

18

Trek Holidays Company signed a 9%,10-year note for $150,000.The company paid $1,900 as the installment for the first month.What portion of the first monthly payment is principal?

A)$775

B)$2,375

C)$1,800

D)$14,400

A)$775

B)$2,375

C)$1,800

D)$14,400

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

19

The difference between mortgages payable and notes payable is that notes payable are always secured by specific assets.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

20

On March 1,2015,Vantage Services issued a 5% long-term notes payable for $15,000.It is payable over a 3-year term in $5,000 principal installments on March 1 of each year,beginning March 1,2016.

-Each yearly installment will include both principal repayment of $5,000 and interest payment for the preceding one-year period.What is the amount of total cash payment that Vantage will make on March 1,2016?

A)$5,000

B)$5,750

C)$15,000

D)$5,375

-Each yearly installment will include both principal repayment of $5,000 and interest payment for the preceding one-year period.What is the amount of total cash payment that Vantage will make on March 1,2016?

A)$5,000

B)$5,750

C)$15,000

D)$5,375

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

21

On April 1,2015,Ardos Gardening Products borrowed $100,000 on a 15%,10-year note with annual installment payments of $10,000 plus interest due on April 1 of each succeeding year.Provide the first journal entry for the issuance of the note.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

22

On January 1,2015,Bratios Company purchases equipment and signs a 6-year mortgage note for $80,000 at 15%.The note will be paid in equal annual installments of $21,139,beginning January 1,2016.Calculate the portion of principal amount paid on the third installment.

A)$12,086

B)$12,000

C)$21,139

D)$9,503

A)$12,086

B)$12,000

C)$21,139

D)$9,503

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

23

In order to expand business,the management of Vereos Inc.decided to issue long-term notes payable for $50,000.The instrument carries interest at the rate of 12% with 10 equal yearly installments,beginning in one year.What will be the journal entry at the inception?

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

24

On April 1,2015,Ardos Gardening Products borrowed $100,000 on a 15%,10-year note with annual installment payments of $10,000 plus interest due on April 1 of each succeeding year.Provide the journal entry for the first installment payment made on April 1,2016.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

25

Bonds are short-term debt issued to multiple lenders called bondholders,usually in increments of $1,000.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

26

On January 1,2015,Paramount Inc.issued long-term notes payable for $50,000.The note will be paid over ten years with payments of $5,000 plus 12% interest due each January 1,beginning January 1,2016.Prepare the amortization schedule for the first three payments.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

27

On May 1,2015,Vantage Services issued a long-term note payable for $35,000.It is payable over a 5-year term in $7,000 annual principal payments plus interest,on May 1 of each year beginning on May 1,2016.Provide the initial journal entry for the issuance of the note.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

28

On January 1,2015,Bratios Company purchases equipment and signs a 6-year mortgage note for $80,000 at 15%.The note will be paid in equal annual installments of $21,139,beginning January 1,2016.Calculate the balance of the Mortgage Payable account after the payment of the first installment.

A)$12,000

B)$58,861

C)$70,861

D)$60,351

A)$12,000

B)$58,861

C)$70,861

D)$60,351

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

29

On January 1,2015,Bratios Company purchases equipment and signs a 6-year mortgage note for $80,000 at 15%.The note will be paid in equal annual installments of $21,139,beginning January 1,2016.Calculate the portion of interest expense paid on the third installment.(Round your answer to nearest whole number.)

A)$21,139

B)$9,053

C)$12,000

D)$70,861

A)$21,139

B)$9,053

C)$12,000

D)$70,861

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

30

On January 1,2015,Anderson Tools Company purchases property of $300,000 by paying $50,000 in cash and signing a 10-year mortgage note at 13% for the balance.Anderson will make yearly payments of $46,072.Prepare the amortization schedule for the first five payments.(Round your answers to the nearest dollar.)

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

31

If a bond is issued at a premium,it will sell for more than face value.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

32

On January 1,2015,Anderson Tools Company purchases property of $300,000 by paying $50,000 in cash and signing a 10-year mortgage note at 13% for the balance.The amortization schedule shows that the company will pay $46,072 per year.Journalize the first yearly payment on January 1,2016.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

33

On January 1,2013,Anderson Tools Company purchases machinery with a fair value of $300,000 by paying $50,000 in cash and signing a 10-year mortgage note at 13% for the balance.On January 1,2013,what will be the journal entry?

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

34

Hernandez Carpets Company buys a building on a plot of land for $115,000,paying $30,000 cash and signing a 30-year mortgage note for $85,000 at 11%.The payment will be made in equal monthly installments of $809.Provide the journal entry for the first monthly payment.(Round your answers to nearest whole dollar number.)

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

35

If a bond is issued at a discount,it will sell for more than face value.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

36

On the maturity date,the bondholder is paid the face amount of the bond plus the last interest payment.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

37

In order to expand business,the management of Vereos Inc.decided to issue long-term notes payable for $50,000.The note will be paid over ten years with payments of $5,000 plus 12% interest.Provide the journal entry needed after one year for the first installment payment.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

38

On January 1,2015,Bratios Company purchased equipment and signed a 6-year mortgage note for $80,000 at 15%.The note will be paid in equal annual installments of $21,139,beginning January 1,2016.On January 1,2016,the journal entry to record the first installment payment will include a ________.

A)debit to Mortgage Payable for $21,139

B)debit to Interest Expense for $12,000

C)credit to Cash for $9,139

D)credit to Mortgage Payable for $80,000

A)debit to Mortgage Payable for $21,139

B)debit to Interest Expense for $12,000

C)credit to Cash for $9,139

D)credit to Mortgage Payable for $80,000

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

39

Hernandez Carpets Company buys a building on a plot of land for $115,000,paying $30,000 cash and signing a 30-year mortgage note for $85,000 at 11%.Provide the journal entry for the purchase.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

40

On April 1,2015,Nurix Manufacturers purchases equipment for $100,000,paying $30,000 in cash and signing a 10-year mortgage for $70,000 taken out at 8%.Prepare the journal entry to record the acquisition of the equipment.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following describes a serial bond?

A)a bond that repays principal in installments

B)a bond that gives the bondholder a claim for specific assets

C)a bond that matures at one specified time

D)a bond that is not backed by specific assets

A)a bond that repays principal in installments

B)a bond that gives the bondholder a claim for specific assets

C)a bond that matures at one specified time

D)a bond that is not backed by specific assets

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

42

When a bond is sold,the selling price is generally equivalent to the present value of the bond payments.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

43

The date on which the principal amount is repaid to the bondholder is known as ________.

A)issuing date

B)interest date

C)maturity date

D)installment date

A)issuing date

B)interest date

C)maturity date

D)installment date

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

44

The issue price of a bond-whether it is sold at par,premium,or discount-has a considerable effect on the required principal repayment at maturity.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

45

If bonds with a face value of $200,000 are sold at 98,the amount of cash proceeds is ________.

A)$202,000

B)$200,000

C)$196,000

D)$192,157

A)$202,000

B)$200,000

C)$196,000

D)$192,157

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following describes a secured bond?

A)a bond that repays principal in installments

B)a bond that is backed by issuer's specific assets

C)a bond that matures at one specified time

D)a bond that is not backed by specific assets

A)a bond that repays principal in installments

B)a bond that is backed by issuer's specific assets

C)a bond that matures at one specified time

D)a bond that is not backed by specific assets

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

47

The market rate is the rate used to calculate the actual cash payments made to bondholders.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

48

An instrument that matures at one specified time is known as a ________.

A)preferred share

B)common share

C)bond

D)letter of credit

A)preferred share

B)common share

C)bond

D)letter of credit

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following statements is true of a bond that is issued at a discount?

A)It will be sold at par

B)Its stated interest rate is higher than the prevailing market rate

C)It will repay a lesser amount than the face value at maturity

D)It will be sold for less than the face value

A)It will be sold at par

B)Its stated interest rate is higher than the prevailing market rate

C)It will repay a lesser amount than the face value at maturity

D)It will be sold for less than the face value

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

50

A bond once sold to a bondholder,can be resold to another investor on the bond market.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

51

The interest rate that determines the amount of cash interest the borrower pays and the investor receives each year is called ________.

A)amortization rate

B)market interest rate

C)stated interest rate

D)discounting rate

A)amortization rate

B)market interest rate

C)stated interest rate

D)discounting rate

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

52

A bond is issued at discount ________.

A)when a bond's stated interest rate is equal to the market interest rate

B)when a bond's stated interest rate is more than the effective interest rate

C)when a bond's stated interest rate is less than the market interest rate

D)when a bond's stated interest rate is higher than the market interest rate

A)when a bond's stated interest rate is equal to the market interest rate

B)when a bond's stated interest rate is more than the effective interest rate

C)when a bond's stated interest rate is less than the market interest rate

D)when a bond's stated interest rate is higher than the market interest rate

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

53

If bonds with a face value of $200,000 are sold at 105,the amount of cash proceeds is ________.

A)$209,523

B)$200,000

C)$190,476

D)$210,000

A)$209,523

B)$200,000

C)$190,476

D)$210,000

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following is the amount the borrower must pay back to the bondholders on maturity?

A)market value

B)present value

C)stated interest value

D)principal amount

A)market value

B)present value

C)stated interest value

D)principal amount

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following describes a debenture?

A)a bond that repays principal in installments

B)a bond that gives the bondholder a claim for specific assets

C)a bond that matures at one specified time

D)a bond that is not backed by specific assets

A)a bond that repays principal in installments

B)a bond that gives the bondholder a claim for specific assets

C)a bond that matures at one specified time

D)a bond that is not backed by specific assets

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following statements is true of a bond that is issued at a premium?

A)It will be sold above par

B)Its stated interest rate is lower than the prevailing market rate

C)It will repay a greater amount than the face value at maturity

D)It will be sold at par

A)It will be sold above par

B)Its stated interest rate is lower than the prevailing market rate

C)It will repay a greater amount than the face value at maturity

D)It will be sold at par

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

57

If bonds with a face value of $200,000 are sold at par,the amount of cash proceeds is ________.

A)$202,000

B)$200,000

C)$196,000

D)$192,157

A)$202,000

B)$200,000

C)$196,000

D)$192,157

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

58

The interest rate on which cash payments to bondholders are based is the ________.

A)market rate

B)discount rate

C)stated rate

D)amortization rate

A)market rate

B)discount rate

C)stated rate

D)amortization rate

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

59

A bond is issued at premium ________.

A)when a bond's stated interest rate is equal to the market interest rate

B)when a bond's stated interest rate is less than the effective interest rate

C)when a bond's stated interest rate is less than the market interest rate

D)when a bond's stated interest rate is higher than the market interest rate

A)when a bond's stated interest rate is equal to the market interest rate

B)when a bond's stated interest rate is less than the effective interest rate

C)when a bond's stated interest rate is less than the market interest rate

D)when a bond's stated interest rate is higher than the market interest rate

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

60

The reason investors buy bonds is to ________.

A)earn interest

B)own controlling interest in the company

C)exercise voting rights in a company

D)receive dividend payments

A)earn interest

B)own controlling interest in the company

C)exercise voting rights in a company

D)receive dividend payments

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following statements is true if a bond is sold for an amount higher than face value?

A)The bond's stated rate is lower than the prevailing market rate at time of sale.

B)The bond's stated rate is the same as the prevailing market rate at time of sale.

C)The bond's stated rate is higher than the prevailing market rate at time of sale.

D)The bond is not secured by specific assets of the issuer.

A)The bond's stated rate is lower than the prevailing market rate at time of sale.

B)The bond's stated rate is the same as the prevailing market rate at time of sale.

C)The bond's stated rate is higher than the prevailing market rate at time of sale.

D)The bond is not secured by specific assets of the issuer.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

62

The balance in the Bonds Payable is a credit of $16,500.The balance in the Premium on Bonds Payable is a credit of $800.The balance sheet will report the bond balance as $15,700.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

63

The face value of a bond payable minus the current balance of the discount account or plus the current balance of the premium account is the bond's carrying amount.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

64

The balance in the Bonds Payable account is a credit of $89,000.The balance in the Premium on Bonds Payable account is a credit of $990.The bond's carrying amount is $89,990.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following concepts represents time value of money?

A)the concept that money becomes obsolete over time

B)the concept that money earns income over time

C)the concept that money loses its purchasing power over time

D)the concept that money can be converted into other currencies over time

A)the concept that money becomes obsolete over time

B)the concept that money earns income over time

C)the concept that money loses its purchasing power over time

D)the concept that money can be converted into other currencies over time

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

66

If a bond's stated interest rate is lower than the market rate which of the following is true?

A)The bond will be issued at a premium.

B)The bond will be issued at par.

C)The bond will be issued at a discount.

D)The bond will be issued for an amount higher than the maturity value.

A)The bond will be issued at a premium.

B)The bond will be issued at par.

C)The bond will be issued at a discount.

D)The bond will be issued for an amount higher than the maturity value.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

67

The interest rate that investors demand in order to loan their money is known as the ________.

A)yield to maturity

B)coupon rate

C)differential rate

D)market interest rate

A)yield to maturity

B)coupon rate

C)differential rate

D)market interest rate

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following statements is true if a bond is sold at an amount less than its face value?

A)The bond's stated rate is lower than the prevailing market rate at the time of sale.

B)The bond's stated rate is the same as the prevailing market rate at the time of sale.

C)The bond's stated rate is higher than the prevailing market rate at the time of sale.

D)The bond is not secured by specific assets of the issuer.

A)The bond's stated rate is lower than the prevailing market rate at the time of sale.

B)The bond's stated rate is the same as the prevailing market rate at the time of sale.

C)The bond's stated rate is higher than the prevailing market rate at the time of sale.

D)The bond is not secured by specific assets of the issuer.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

69

Earning more income on borrowed money than the related interest expense is called ________.

A)premium

B)leverage

C)annuity

D)amortization

A)premium

B)leverage

C)annuity

D)amortization

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following statements is true if a bond's stated interest rate is higher than the market rate?

A)The bond will be issued at a premium.

B)The bond will be issued at par.

C)The bond will be issued at a discount.

D)The bond will be issued for an amount lower than the maturity value.

A)The bond will be issued at a premium.

B)The bond will be issued at par.

C)The bond will be issued at a discount.

D)The bond will be issued for an amount lower than the maturity value.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

71

The amortization of bond premium increases interest expense over the life of the bonds.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

72

Premium on Bonds Payable is considered to be an additional Interest Expense of the company that issues the bond.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following statements is true if a bond's stated interest rate is the same as the market rate?

A)The bond will be issued at a premium.

B)The bond will be issued at par.

C)The bond will be issued at a discount.

D)The bond will be issued for an amount lower than the maturity value.

A)The bond will be issued at a premium.

B)The bond will be issued at par.

C)The bond will be issued at a discount.

D)The bond will be issued for an amount lower than the maturity value.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

74

The balance in the Bonds Payable account is a credit of $72,000.The balance in the Discount on Bonds Payable is a debit of $3,500.The balance sheet will report the bond balance as $75,500.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

75

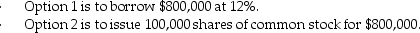

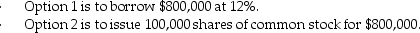

Campbell Inc.has net income of $500,000 and 200,000 shares of common stock.The company is considering a project which requires $800,000 and is considering two options:

Considering all relevant facts and figures,Campbell's management is of the opinion that the funds raised can be used to increase income before interest and taxes by $300,000 each year.The company estimates income tax expense to be 40%.Analyze the Campbell situation to determine which plan will result in higher earnings per share.

Considering all relevant facts and figures,Campbell's management is of the opinion that the funds raised can be used to increase income before interest and taxes by $300,000 each year.The company estimates income tax expense to be 40%.Analyze the Campbell situation to determine which plan will result in higher earnings per share.

(Round your answers to two decimal points.)

Considering all relevant facts and figures,Campbell's management is of the opinion that the funds raised can be used to increase income before interest and taxes by $300,000 each year.The company estimates income tax expense to be 40%.Analyze the Campbell situation to determine which plan will result in higher earnings per share.

Considering all relevant facts and figures,Campbell's management is of the opinion that the funds raised can be used to increase income before interest and taxes by $300,000 each year.The company estimates income tax expense to be 40%.Analyze the Campbell situation to determine which plan will result in higher earnings per share.(Round your answers to two decimal points.)

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

76

Why would a corporation issue bonds payable instead of issuing stock?

A)Debt is a less expensive source of capital than stock.

B)Borrowing by issuing bonds payable carries no risk to the company.

C)Debts affect the percentage of ownership of the corporation by the stockholders.

D)Debts don't carry any cost.

A)Debt is a less expensive source of capital than stock.

B)Borrowing by issuing bonds payable carries no risk to the company.

C)Debts affect the percentage of ownership of the corporation by the stockholders.

D)Debts don't carry any cost.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

77

When a bond is sold at a price higher than the face value,the difference is known as a ________.

A)premium

B)discount

C)maturity value

D)face value

A)premium

B)discount

C)maturity value

D)face value

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

78

Discount on Bonds Payable is considered to be an additional Interest Expense of the company that issues the bond.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

79

The balance in the Bonds Payable account is a credit of $65,000.The balance in the Discount on Bonds Payable account is a debit of $2,250.The bond's carrying amount is $62,750.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following statements is true if a bond is sold for an amount equal to its face value?

A)The bond's stated rate is lower than the prevailing market rate at time of sale.

B)The bond's stated rate is the same as the prevailing market rate at time of sale.

C)The bond's stated rate is higher than the prevailing market rate at time of sale.

D)The bond is not secured by specific assets of the issuer.

A)The bond's stated rate is lower than the prevailing market rate at time of sale.

B)The bond's stated rate is the same as the prevailing market rate at time of sale.

C)The bond's stated rate is higher than the prevailing market rate at time of sale.

D)The bond is not secured by specific assets of the issuer.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck