Deck 13: Stockholders Equity

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

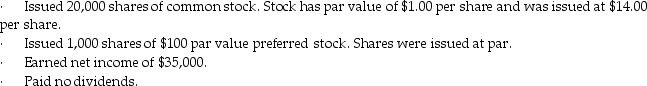

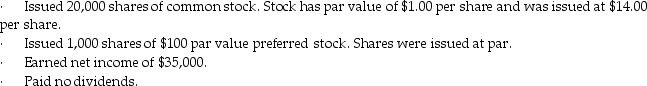

Question

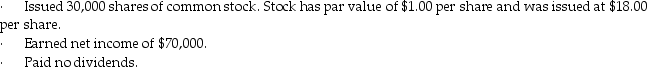

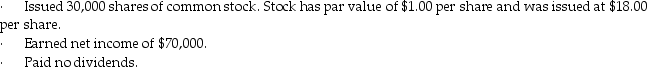

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/158

Play

Full screen (f)

Deck 13: Stockholders Equity

1

Stockholders of a corporation are not personally liable for the corporation's debt.

True

2

The par value of stock is ________.

A)the current selling price of stock

B)the highest price for which a share can sell

C)the price paid if the corporation purchases its own stock back

D)the amount assigned by a company to a share of its stock

A)the current selling price of stock

B)the highest price for which a share can sell

C)the price paid if the corporation purchases its own stock back

D)the amount assigned by a company to a share of its stock

D

3

Outstanding stock refers to the ________.

A)shares of stock that are held by the stockholders

B)shares of stock that are sold for the highest price

C)total amount of stock that has been authorized by state law

D)total amount of stock that has not been sold yet

A)shares of stock that are held by the stockholders

B)shares of stock that are sold for the highest price

C)total amount of stock that has been authorized by state law

D)total amount of stock that has not been sold yet

A

4

Which of the following characteristics is an advantage of the corporate form of business?

A)less degree of government regulation

B)limited liability of stockholders

C)separation of ownership and management

D)low start-up costs

A)less degree of government regulation

B)limited liability of stockholders

C)separation of ownership and management

D)low start-up costs

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is true of stockholders?

A)Stockholders have a right to access confidential information about the business before the information is disseminated to the public.

B)Stockholders can claim a portion of the corporate assets after the corporation pays it debts in the event the company is liquidated.

C)Stockholders may authorize a business contract on behalf of the corporation.

D)Stockholders may determine at what price the company issues stock.

A)Stockholders have a right to access confidential information about the business before the information is disseminated to the public.

B)Stockholders can claim a portion of the corporate assets after the corporation pays it debts in the event the company is liquidated.

C)Stockholders may authorize a business contract on behalf of the corporation.

D)Stockholders may determine at what price the company issues stock.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

6

Stated value stock is no-par stock that has been assigned an amount similar to par value.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

7

The two basic sources of stockholders' equity are ________.

A)common stock and bonds

B)common stock and preferred stock

C)paid-in capital and retained earnings

D)loans from banks and gifts from donors

A)common stock and bonds

B)common stock and preferred stock

C)paid-in capital and retained earnings

D)loans from banks and gifts from donors

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following statements is true of a corporation?

A)The liabilities of a corporation can be paid by the personal assets of the shareholders.

B)Corporate shares of stock cannot be readily bought and sold by investors on the open market.

C)Shareholders are authorized to sign contracts or make business commitments on behalf of the corporation.

D)Corporations pay income tax on corporate earnings,and shareholders pay personal income tax on corporate dividends and gains from sale of stock.

A)The liabilities of a corporation can be paid by the personal assets of the shareholders.

B)Corporate shares of stock cannot be readily bought and sold by investors on the open market.

C)Shareholders are authorized to sign contracts or make business commitments on behalf of the corporation.

D)Corporations pay income tax on corporate earnings,and shareholders pay personal income tax on corporate dividends and gains from sale of stock.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

9

Retained earnings represent amounts received from stockholders of a corporation in exchange for stock.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

10

All classes and types of a corporation's stock carry the same degrees of risk for the stockholder.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

11

A corporation is a separate legal entity and is organized independently of its owners.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is true of a corporation?

A)A corporation can be organized publicly,but it cannot be organized privately.

B)A corporation has to pay income taxes on its business earnings.

C)A corporation has a limited life.

D)The stockholders of a corporation have unlimited liabilities for the corporation's debts.

A)A corporation can be organized publicly,but it cannot be organized privately.

B)A corporation has to pay income taxes on its business earnings.

C)A corporation has a limited life.

D)The stockholders of a corporation have unlimited liabilities for the corporation's debts.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following corporate characteristics is a disadvantage of a corporation?

A)Stockholders of a corporation have limited liability.

B)A corporation has a continuous life.

C)There is no mutual agency among the stockholders and the corporation.

D)Earnings of a corporation are taxed twice.

A)Stockholders of a corporation have limited liability.

B)A corporation has a continuous life.

C)There is no mutual agency among the stockholders and the corporation.

D)Earnings of a corporation are taxed twice.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following represents one of the basic rights of stockholders?

A)Stockholders may sell their stock back to the company if they wish.

B)Stockholders may authorize a business contract on behalf of the corporation.

C)Stockholders may receive dividends from corporate earnings.

D)Stockholders may determine at what price the company issues stock.

A)Stockholders may sell their stock back to the company if they wish.

B)Stockholders may authorize a business contract on behalf of the corporation.

C)Stockholders may receive dividends from corporate earnings.

D)Stockholders may determine at what price the company issues stock.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

15

Paid-in capital consists of ________.

A)amounts paid by customers

B)capital raised by issuing bonds or preferred stocks

C)earnings generated by the corporation

D)amounts received from stockholders in exchange for stock

A)amounts paid by customers

B)capital raised by issuing bonds or preferred stocks

C)earnings generated by the corporation

D)amounts received from stockholders in exchange for stock

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

16

Paid-in capital is externally generated capital and results from transactions with outsiders.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

17

Preferred stockholders receive a dividend preference over common stockholders.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

18

Preferred stock is a stock ________.

A)that sells for a very high price

B)that is distributed to employees of the company as a performance incentive

C)that is distributed by corporations to avoid liquidation

D)that gives its owners certain benefits over common stock

A)that sells for a very high price

B)that is distributed to employees of the company as a performance incentive

C)that is distributed by corporations to avoid liquidation

D)that gives its owners certain benefits over common stock

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

19

The retained earnings of a corporation is the ________.

A)internally generated capital that is raised from profitable operations

B)externally generated capital that is contributed by shareholders

C)externally generated capital that is raised from banks and other creditors

D)internally generated capital that from the direct investment of employees

A)internally generated capital that is raised from profitable operations

B)externally generated capital that is contributed by shareholders

C)externally generated capital that is raised from banks and other creditors

D)internally generated capital that from the direct investment of employees

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following explains the term "lack of mutual agency" of a corporation?

A)The liabilities of the corporation cannot be extended to the personal assets of the stockholder.

B)Shares of stock can be readily bought and sold by investors on the open market.

C)Stockholders are not authorized to sign contracts or make business commitments on behalf of the corporation.

D)Corporations pay income tax on corporate earnings,and shareholders pay personal income tax on corporate dividends and gains from sale of stock.

A)The liabilities of the corporation cannot be extended to the personal assets of the stockholder.

B)Shares of stock can be readily bought and sold by investors on the open market.

C)Stockholders are not authorized to sign contracts or make business commitments on behalf of the corporation.

D)Corporations pay income tax on corporate earnings,and shareholders pay personal income tax on corporate dividends and gains from sale of stock.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

21

Bradley Corporation issued 10,000 shares of common stock on January 1,2015.The stock has a par value of $0.01 per share and was sold for cash at par.Which of the following is the correct journal entry to record this transaction?

A)Cash debited for $100 and Common Stock-$0.01 Par Value credited for $100

B)Cash credited for $10,000 and Common Stock-$0.01 Par Value debited for $10,000

C)Paid-In Capital in Excess of Par-Common debited for $9,900 and Common Stock-$0.01 Par Value credited for $9,900

D)Cash debited for $10,000,Common Stock-$0.01 Par Value credited for $100,and Paid-In Capital in Excess of Par-Common credited for $9,900

A)Cash debited for $100 and Common Stock-$0.01 Par Value credited for $100

B)Cash credited for $10,000 and Common Stock-$0.01 Par Value debited for $10,000

C)Paid-In Capital in Excess of Par-Common debited for $9,900 and Common Stock-$0.01 Par Value credited for $9,900

D)Cash debited for $10,000,Common Stock-$0.01 Par Value credited for $100,and Paid-In Capital in Excess of Par-Common credited for $9,900

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following would be included in the entry to record the issuance of 5,000 shares of $10 par value common stock at $13 per share cash?

A)Cash would be debited for $65,000

B)Common Stock would be debited for $50,000

C)Common Stock would be credited for $65,000

D)Paid-In Capital in Excess of Par-Common would be debited for $15,000

A)Cash would be debited for $65,000

B)Common Stock would be debited for $50,000

C)Common Stock would be credited for $65,000

D)Paid-In Capital in Excess of Par-Common would be debited for $15,000

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following types of stock is considered least risky for investors?

A)common stock

B)par value stock

C)no-par stock

D)preferred stock

A)common stock

B)par value stock

C)no-par stock

D)preferred stock

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

24

A company cannot report a gain or loss when buying or selling its own stock.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

25

When a corporation sells 10,000 shares of $10 par value common stock for $120,000,the Common Stock account is credited for $100,000.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

26

Dallkin Corporation issued 5,000 shares of common stock on January 1,2015.The stock has no par value and was sold at $18 per share.The journal entry for this transaction would include a ________.

A)debit to Cash for $90,000 and a credit to Common Stock-No-Par Value for $90,000

B)debit to Cash for $90,000 and a credit to Paid-In Capital in Excess of Par-Common for $600,000

C)credit to Cash for $90,000 and a debit to Common Stock-No-Par Value for $90,000

D)credit to Cash for $90,000,a debit to Paid-In Capital in Excess of Par-Common for $5,000,and a debit to Common Stock-No-Par Value for $85,000

A)debit to Cash for $90,000 and a credit to Common Stock-No-Par Value for $90,000

B)debit to Cash for $90,000 and a credit to Paid-In Capital in Excess of Par-Common for $600,000

C)credit to Cash for $90,000 and a debit to Common Stock-No-Par Value for $90,000

D)credit to Cash for $90,000,a debit to Paid-In Capital in Excess of Par-Common for $5,000,and a debit to Common Stock-No-Par Value for $85,000

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

27

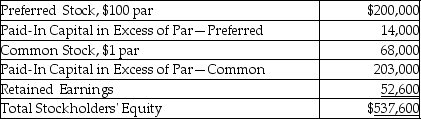

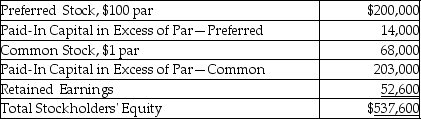

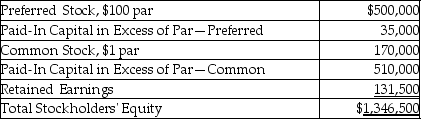

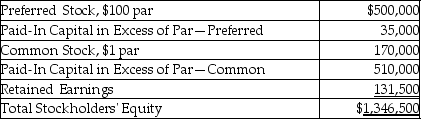

The following information is from the balance sheet of Jackson Corporation as of December 31,2015.

What is the average issue price of the preferred stock shares?

What is the average issue price of the preferred stock shares?

A)$107

B)$100

C)$176

D)$105

What is the average issue price of the preferred stock shares?

What is the average issue price of the preferred stock shares? A)$107

B)$100

C)$176

D)$105

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following is true of preferred stock?

A)Preferred stockholders generally receive a fixed amount of dividends before common stockholders do.

B)Preferred stockholders are guaranteed that they will not take a loss on their investment.

C)Preferred stockholders have higher voting rights than common stockholders.

D)Preferred stockholders may sell their shares for a price higher than that of common stock.

A)Preferred stockholders generally receive a fixed amount of dividends before common stockholders do.

B)Preferred stockholders are guaranteed that they will not take a loss on their investment.

C)Preferred stockholders have higher voting rights than common stockholders.

D)Preferred stockholders may sell their shares for a price higher than that of common stock.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

29

On December 2,2015,Ewell Inc.purchases a piece of land from the original owner.In payment for the land,Ewell Inc.issues 8,000 shares of common stock with $1.00 par value.The land has been appraised at a market value of $400,000.Which of the following is included in the journal entry to record this transaction?

A)debit Common Stock-$1 Par Value for $8,000 and debit Paid-In Capital in Excess of Par-Common $392,000

B)credit Common Stock-$1 Par Value for $8,000 and credit Paid-In Capital in Excess of Par-Common $392,000

C)credit Common Stock-$1 Par Value for $400,000

D)debit Cash $400,000

A)debit Common Stock-$1 Par Value for $8,000 and debit Paid-In Capital in Excess of Par-Common $392,000

B)credit Common Stock-$1 Par Value for $8,000 and credit Paid-In Capital in Excess of Par-Common $392,000

C)credit Common Stock-$1 Par Value for $400,000

D)debit Cash $400,000

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

30

When a company sells stock for less than the par value,it will record a gain on sale for the amount in excess of par.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

31

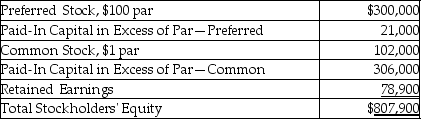

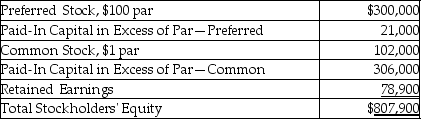

The following information is from the balance sheet of Tudor Corporation as of December 31,2015.  What was the total paid-in capital as of December 31,2015?

What was the total paid-in capital as of December 31,2015?

A)$606,000

B)$807,900

C)$729,000

D)$708,000

What was the total paid-in capital as of December 31,2015?

What was the total paid-in capital as of December 31,2015?A)$606,000

B)$807,900

C)$729,000

D)$708,000

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

32

The price that the corporation receives from issuing stock is called the issue price.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following occurs when a stockholder invests cash in a corporation in exchange for stock?

A)both liabilities and stockholders' equity are increased

B)both assets and stockholders' equity are increased

C)one asset is increased and another asset is decreased

D)both assets and liabilities are increased

A)both liabilities and stockholders' equity are increased

B)both assets and stockholders' equity are increased

C)one asset is increased and another asset is decreased

D)both assets and liabilities are increased

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

34

The following information is from the balance sheet of Lawson Corporation as of December 31,2015.  What was the average issue price of the common stock shares?

What was the average issue price of the common stock shares?

A)$1.90

B)$1.00

C)$3.00

D)$4.00

What was the average issue price of the common stock shares?

What was the average issue price of the common stock shares?A)$1.90

B)$1.00

C)$3.00

D)$4.00

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

35

Stock sold for amounts in excess of par value results in a gain reported on the income statement.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

36

Most corporations set par value low and issue common stock for a price above par called a premium.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

37

Osbourne Inc.issued 50,000 shares of common stock in exchange for manufacturing equipment.The equipment has a fair value of $1,000,000.The stock has par value of $0.01 per share.Which of the following is included in the journal entry to record this transaction?

A)debit Cash $5,000

B)credit Gain on Sale of Common Stock $1,050,000

C)credit Paid-In Capital in Excess of Par-Common $999,500

D)credit Common Stock-$0.01 Par Value $1,000,000

A)debit Cash $5,000

B)credit Gain on Sale of Common Stock $1,050,000

C)credit Paid-In Capital in Excess of Par-Common $999,500

D)credit Common Stock-$0.01 Par Value $1,000,000

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

38

Preferred stockholders ________.

A)are guaranteed that they will not take a loss on their investment

B)have higher voting rights than common stockholders

C)are sold for a price lower than that of common stock

D)have the first claim on dividend funds

A)are guaranteed that they will not take a loss on their investment

B)have higher voting rights than common stockholders

C)are sold for a price lower than that of common stock

D)have the first claim on dividend funds

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

39

Peterson Inc.issued 4,000 shares of preferred stock for $240,000.The stock has a par value of $60 per share.The journal entry to record this transaction would ________.

A)credit Cash $240,000,debit Preferred Stock-$60 Par Value $4,000,and debit Paid-In Capital in Excess of Par-Preferred $236,000

B)debit Cash $240,000,credit Preferred Stock-$60 Par Value $4,000,and credit Paid-In Capital in Excess of Par-Preferred $236,000

C)credit Cash $240,000 and debit Preferred Stock-$60 Par Value $240,000

D)debit Cash $240,000 and credit Preferred Stock-$60 Par Value $240,000

A)credit Cash $240,000,debit Preferred Stock-$60 Par Value $4,000,and debit Paid-In Capital in Excess of Par-Preferred $236,000

B)debit Cash $240,000,credit Preferred Stock-$60 Par Value $4,000,and credit Paid-In Capital in Excess of Par-Preferred $236,000

C)credit Cash $240,000 and debit Preferred Stock-$60 Par Value $240,000

D)debit Cash $240,000 and credit Preferred Stock-$60 Par Value $240,000

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

40

In the event of liquidation,preferred stockholders ________.

A)are guaranteed to get their investment back in full

B)have first claim on remaining corporate assets after debts are paid

C)may sell their shares for higher amounts than common stock

D)may retain their proportionate share of voting rights

A)are guaranteed to get their investment back in full

B)have first claim on remaining corporate assets after debts are paid

C)may sell their shares for higher amounts than common stock

D)may retain their proportionate share of voting rights

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

41

Peterson Inc.issued 4,000 shares of preferred stock for $240,000.The stock has a par value of $60 per share.Provide the journal entry for this transaction.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

42

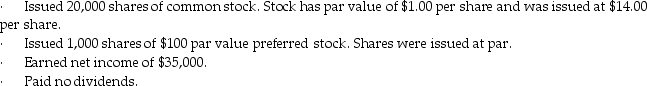

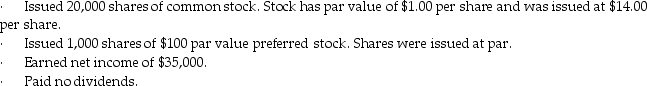

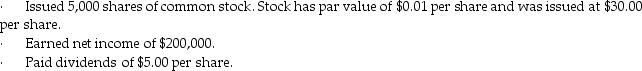

Lerner Inc.had the following transactions in 2015,its first year of operations.

- At the end of 2015,what is the total amount of paid-in capital?

A)$415,000

B)$120,000

C)$280,000

D)$380,000

- At the end of 2015,what is the total amount of paid-in capital?

A)$415,000

B)$120,000

C)$280,000

D)$380,000

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

43

Moretown Inc.had the following transactions in 2015,its first year of operations.

- At the end of 2015,what is the total amount of stockholders' equity?

A)$30,000

B)$610,000

C)$540,000

D)$70,000

- At the end of 2015,what is the total amount of stockholders' equity?

A)$30,000

B)$610,000

C)$540,000

D)$70,000

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

44

Stock dividends have no impact on the total amount of stockholders' equity.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

45

Moretown Inc.had the following transactions in 2015,its first year of operations.

-At the end of 2015,what is the total amount of paid-in capital?

A)$30,000

B)$610,000

C)$540,000

D)$70,000

-At the end of 2015,what is the total amount of paid-in capital?

A)$30,000

B)$610,000

C)$540,000

D)$70,000

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

46

No journal entry is made on the dividend declaration date.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

47

Legal capital refers to the portion of stockholders' equity that cannot be used for dividends.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

48

When a company has issued both preferred and common stock,the common stockholders are allocated their dividends first.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

49

On December 2,2014,Ewell Inc.purchases a piece of land from the original owner.In exchange for the land,Ewell Inc.issues 8,000 shares of common stock with $1.00 par value.The land has been appraised at a market value of $400,000.Provide the journal entry for this transaction.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

50

Stock dividends are distributed to stockholders in proportion to the number of shares each stockholder already owns.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

51

Declaring and paying dividends causes an increase in both assets and stockholders' equity for the corporation.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

52

A stock split decreases par value per share,whereas stock dividends do not affect par value per share.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

53

The declaration of a cash dividend does not create an obligation (liability)for the corporation.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

54

The declaration and payment of cash dividends cause a decrease in both assets (Cash)and stockholders' equity (Retained Earnings)for the corporation.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

55

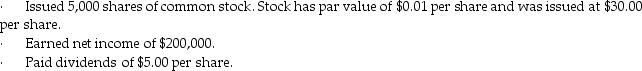

Lerner Inc.had the following transactions in 2015,its first year of operations.

-At the end of 2015,what is the total amount of stockholders' equity?

A)$415,000

B)$120,000

C)$260,000

D)$380,000

-At the end of 2015,what is the total amount of stockholders' equity?

A)$415,000

B)$120,000

C)$260,000

D)$380,000

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

56

The declaration of a stock dividend creates a liability for the corporation.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

57

A stock split,like any other stock issuance,cannot involve issuing more shares of stock than authorized in the corporate charter.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

58

Overton Inc.had the following transactions in 2012,its first year of operations.  At the end of 2012,how much is the total stockholders' equity?

At the end of 2012,how much is the total stockholders' equity?

A)$150,000

B)$325,000

C)$175,000

D)$350,000

At the end of 2012,how much is the total stockholders' equity?

At the end of 2012,how much is the total stockholders' equity?A)$150,000

B)$325,000

C)$175,000

D)$350,000

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

59

A dividend's declaration date is the date the corporation records which stockholders get dividend checks.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

60

If preferred stock is noncumulative,then the company needs to pay dividends that were passed in previous years.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

61

On the ________,cash dividends become a liability of a corporation.

A)declaration date

B)date of record

C)end of the fiscal year

D)payment date

A)declaration date

B)date of record

C)end of the fiscal year

D)payment date

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

62

On November 1,2015,Oster Inc.declared a dividend of $3.00 per share.Oster Inc.has 20,000 shares of common stock outstanding and no preferred stock.The date of record is November 15,and the payment date is November 30,2015.Which of the following is the journal entry needed on November 30?

A)debit Retained Earnings $60,000 and credit Dividends Payable-Common $60,000

B)debit Dividends Payable-Common $60,000 and credit Cash $60,000

C)debit Cash $60,000 and credit Dividends Payable-Common $60,000

D)debit Retained Earnings $60,000 and credit Cash $60,000

A)debit Retained Earnings $60,000 and credit Dividends Payable-Common $60,000

B)debit Dividends Payable-Common $60,000 and credit Cash $60,000

C)debit Cash $60,000 and credit Dividends Payable-Common $60,000

D)debit Retained Earnings $60,000 and credit Cash $60,000

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

63

On the date of record of dividends,the company ________.

A)issues new shares of stock on that date

B)disburses dividend payments to stockholders on that date

C)records the dividend payable amount on that date

D)determines who owns the shares of stock on that date

A)issues new shares of stock on that date

B)disburses dividend payments to stockholders on that date

C)records the dividend payable amount on that date

D)determines who owns the shares of stock on that date

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

64

A corporation has 10,000 shares of 10%,$100 par noncumulative preferred stock outstanding and 20,000 shares of no-par common stock outstanding.At the end of the current year,the corporation declares a dividend of $120,000.What is the dividend per share for preferred stock and for common stock?

A)The dividend per share is $10.00 to preferred stock and $1.00 to common stock.

B)The dividend per share is $6.67 to preferred stock and $1.00 to common stock.

C)The dividend per share is $10.00 to preferred stock and $10 to common stock.

D)The dividend per share is $50.00 to preferred stock and $1.00 to common stock.

A)The dividend per share is $10.00 to preferred stock and $1.00 to common stock.

B)The dividend per share is $6.67 to preferred stock and $1.00 to common stock.

C)The dividend per share is $10.00 to preferred stock and $10 to common stock.

D)The dividend per share is $50.00 to preferred stock and $1.00 to common stock.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

65

A 3-for-1 stock split of a $3 par value share will result in three shares of $1 par value.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

66

On November 1,2015,Oster Inc.declared a dividend of $3.00 per share.Oster Inc.has 10,000 shares of common stock outstanding and 20,000 preferred stock.The date of record is November 15,and the payment date is November 30,2014.Which of the following statements is true of the date of record?

A)No journal entry is made on the date of record.

B)The liability must be recorded on the date of record.

C)Cash is disbursed to shareholders on the date of record.

D)The company transfers cash to a brokerage firm on the date of record.

A)No journal entry is made on the date of record.

B)The liability must be recorded on the date of record.

C)Cash is disbursed to shareholders on the date of record.

D)The company transfers cash to a brokerage firm on the date of record.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

67

Occidental Produce Inc.has 40,000 shares of common stock outstanding and 2,000 shares of preferred stock outstanding.The common stock is $0.01 par value; the preferred stock is 4% noncumulative,with $100 par value.On October 15,2015,the company declares a total dividend payment of $40,000.What is the amount of dividend that will be paid for each share of common stock?

A)$0.80

B)$400.00

C)$4.00

D)$1.00

A)$0.80

B)$400.00

C)$4.00

D)$1.00

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

68

A corporation declares a dividend of $0.50 per share on 10,000 shares of common stock.Which of the following would be included in the entry to record the declaration?

A)Retained Earnings would be debited for $5,000

B)Paid-In Capital in Excess of Par-Common would be credited for $5,000

C)Retained Earnings would be credited for $5,000

D)Dividends Payable-Common would be debited for $5,000

A)Retained Earnings would be debited for $5,000

B)Paid-In Capital in Excess of Par-Common would be credited for $5,000

C)Retained Earnings would be credited for $5,000

D)Dividends Payable-Common would be debited for $5,000

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

69

Occidental Produce Inc.has 40,000 shares of common stock outstanding and 2,000 shares of preferred stock outstanding.The common stock is $0.01 par value; the preferred stock is 4% noncumulative,with $100 par value.On October 15,2015,the company declares a total dividend payment of $40,000.How much dividend will be paid to the preferred stockholders?

A)$40,000

B)$2,000

C)$8,000

D)$4,500

A)$40,000

B)$2,000

C)$8,000

D)$4,500

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

70

Occidental Produce Inc.has 40,000 shares of common stock outstanding and 2,000 shares of preferred stock outstanding.The common stock is $0.01 par value; the preferred stock is 4% noncumulative,with $100 par value.On October 15,2015,the company declares a total dividend payment of $40,000.What is the total amount of dividends that will be paid to the common stockholders?

A)$40,000

B)$32,000

C)$400

D)$4,500

A)$40,000

B)$32,000

C)$400

D)$4,500

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

71

Memorandum entry is an entry in the journal that notes a significant event,but has no debit or credit amount.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

72

On November 1,2015,Oster Inc.declared a dividend of $3.00 per share.Oster Inc.has 20,000 shares of common stock outstanding and no preferred stock.Which of the following is the journal entry needed to record the declaration of dividends?

A)debit Dividends Payable-Common $60,000 and credit Retained Earnings $60,000

B)debit Retained Earnings $60,000 and credit Cash $60,000

C)debit Retained Earnings $60,000 and credit Dividends Payable-Common $60,000

D)debit Cash $60,000 and credit Dividends Payable-Common $60,000

A)debit Dividends Payable-Common $60,000 and credit Retained Earnings $60,000

B)debit Retained Earnings $60,000 and credit Cash $60,000

C)debit Retained Earnings $60,000 and credit Dividends Payable-Common $60,000

D)debit Cash $60,000 and credit Dividends Payable-Common $60,000

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following is true of dividends?

A)Dividends are a distribution of cash,stock,or other assets to the stockholders.

B)Dividends increase assets and decrease total stockholders' equity of a corporation.

C)Dividend payments decrease paid-in capital.

D)Dividend payments increase stockholders' equity.

A)Dividends are a distribution of cash,stock,or other assets to the stockholders.

B)Dividends increase assets and decrease total stockholders' equity of a corporation.

C)Dividend payments decrease paid-in capital.

D)Dividend payments increase stockholders' equity.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

74

Pearland Inc.has 5,000 shares of preferred stock outstanding.The preferred stock has a $90 par value,a 5% dividend rate,and is noncumulative.If Pearland has sufficient funds to pay dividends,what is the total amount of dividends that will be paid out to preferred stockholders?

A)$10,800

B)$22,500

C)$9,000

D)$4,500

A)$10,800

B)$22,500

C)$9,000

D)$4,500

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following is the correct description of dividends in arrears,as it applies to cumulative preferred stock?

A)the cumulative amount of dividends that were not paid in previous years

B)the cumulative amount of dividends that were paid in previous years

C)the amount of dividends that were paid late

D)the amount of dividends that will be paid in the coming year

A)the cumulative amount of dividends that were not paid in previous years

B)the cumulative amount of dividends that were paid in previous years

C)the amount of dividends that were paid late

D)the amount of dividends that will be paid in the coming year

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

76

Saturn Corporation has 10,000 shares of 10%,$75 par noncumulative preferred stock outstanding and 20,000 shares of no-par common stock outstanding.At the end of the current year,the corporation declares a dividend of $180,000.How is the dividend allocated between preferred and common stockholders?

A)The dividend is allocated $5,000 to preferred stockholders and $115,000 to common stockholders.

B)The dividend is allocated $75,000 to preferred stockholders and $105,000 to common stockholders.

C)The dividend is allocated $60,000 to preferred stockholders and $120,000 to common stockholders.

D)The dividend is allocated $72,000 to preferred stockholders and $108,000 to common stockholders.

A)The dividend is allocated $5,000 to preferred stockholders and $115,000 to common stockholders.

B)The dividend is allocated $75,000 to preferred stockholders and $105,000 to common stockholders.

C)The dividend is allocated $60,000 to preferred stockholders and $120,000 to common stockholders.

D)The dividend is allocated $72,000 to preferred stockholders and $108,000 to common stockholders.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following occurs when a cash dividend is declared?

A)liabilities remain unchanged

B)stockholders' equity decreases

C)liabilities decrease

D)assets increase

A)liabilities remain unchanged

B)stockholders' equity decreases

C)liabilities decrease

D)assets increase

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following would be included in the entry to record the payment of a previously declared dividend of $0.25 per share on 12,500 shares of common stock?

A)Retained Earnings would be debited for $3,125.

B)Cash would be debited for $3,125.

C)Retained Earnings would be credited for $3,125.

D)Dividends Payable would be debited for $3,125.

A)Retained Earnings would be debited for $3,125.

B)Cash would be debited for $3,125.

C)Retained Earnings would be credited for $3,125.

D)Dividends Payable would be debited for $3,125.

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following occurs when a previously declared dividend is paid?

A)assets increase

B)stockholders' equity increases

C)liabilities decrease

D)assets remain unchanged

A)assets increase

B)stockholders' equity increases

C)liabilities decrease

D)assets remain unchanged

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck

80

Dividends in arrears are ________.

A)a liability on the balance sheet

B)passed dividends on noncumulative preferred stock

C)passed dividends on cumulative preferred stock

D)passed dividends on common stock

A)a liability on the balance sheet

B)passed dividends on noncumulative preferred stock

C)passed dividends on cumulative preferred stock

D)passed dividends on common stock

Unlock Deck

Unlock for access to all 158 flashcards in this deck.

Unlock Deck

k this deck