Deck 15: Financial Statement Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

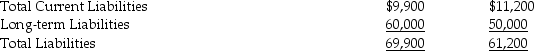

Question

Question

Question

Question

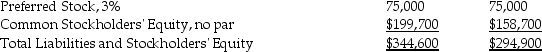

Question

Question

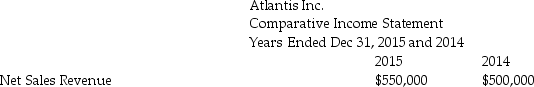

Question

Question

Question

Question

Question

Question

Question

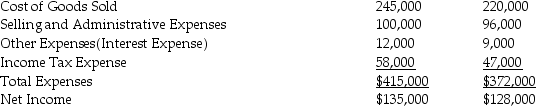

Question

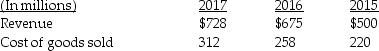

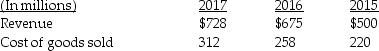

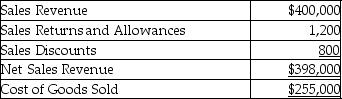

Question

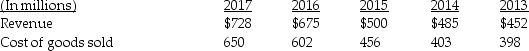

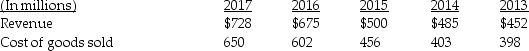

Question

Question

Question

Question

Question

Question

Question

Question

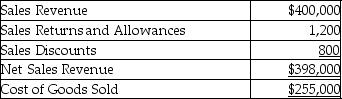

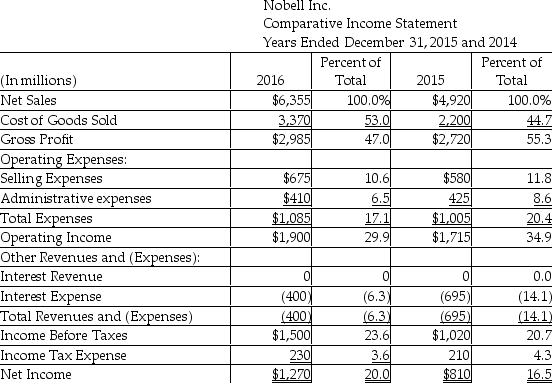

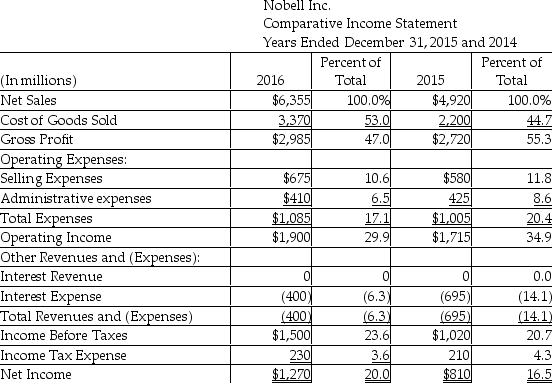

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/113

Play

Full screen (f)

Deck 15: Financial Statement Analysis

1

Which of the following best describes horizontal analysis?

A)comparing figures from year to year for the same company

B)expressing each figure as a percentage of a budgeted figure

C)comparing a company's financial statements with other companies

D)calculating key ratios to evaluate performance

A)comparing figures from year to year for the same company

B)expressing each figure as a percentage of a budgeted figure

C)comparing a company's financial statements with other companies

D)calculating key ratios to evaluate performance

A

2

An annual report provides information about a company's financial condition.

True

3

The study of percentage changes in comparative financial statements is called horizontal analysis.

True

4

Management's discussion and analysis section of the annual report is the company's attempt to explain its financial statements and discuss its performance.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

5

A quarterly report filed with the Securities and Exchange Commission is called a Form 10-K.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

6

A summary of significant accounting policies and explanations of specific items on the financial statements will be given in ________.

A)the balance sheet

B)the income statement

C)the notes to financial statements

D)the report of independent registered public accounting firm

A)the balance sheet

B)the income statement

C)the notes to financial statements

D)the report of independent registered public accounting firm

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

7

The income statement is also known as the ________.

A)statement of operations

B)statement of cash flows

C)statement of stockholders' equity

D)statement of financial position

A)statement of operations

B)statement of cash flows

C)statement of stockholders' equity

D)statement of financial position

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following types of financial statement analysis would be used to see how the sales revenue of a company has changed from one year to the next?

A)vertical analysis of balance sheet

B)horizontal analysis of income statement

C)horizontal analysis of balance sheet

D)vertical analysis of income statement

A)vertical analysis of balance sheet

B)horizontal analysis of income statement

C)horizontal analysis of balance sheet

D)vertical analysis of income statement

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

9

Horizontal analysis compares each item in the income statement to the net sales amount.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

10

The audit report attests to the fairness of the presentation of the financial statements.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

11

An unqualified opinion in an audit report states that the financial statements are presented fairly,in all material respects.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

12

The audit report is prepared by an internal auditor of a company.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

13

If an analyst wants to see how gross profit of a company has changed from one year to the next,vertical analysis would be used.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

14

Trend analysis is a form of horizontal analysis.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

15

An external auditor is responsible for assessing the effectiveness of a company's internal controls.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following best describes trend analysis?

A)calculating key ratios to evaluate performance

B)expressing each figure as a percentage of a budgeted figure

C)comparing a company's financial statements with that of other companies

D)expressing each year's figures as a percentage of the base year figures

A)calculating key ratios to evaluate performance

B)expressing each figure as a percentage of a budgeted figure

C)comparing a company's financial statements with that of other companies

D)expressing each year's figures as a percentage of the base year figures

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

17

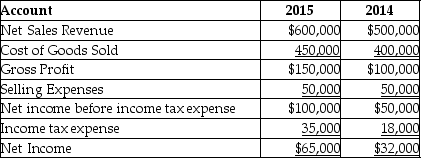

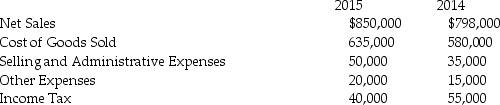

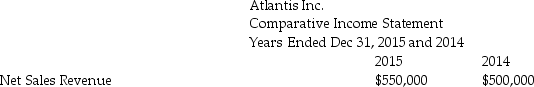

The following is summary of information presented on the financial statements of a company on December 31,2015.  What would a horizontal analysis report show with respect to net income?

What would a horizontal analysis report show with respect to net income?

A)net income is 45.45% of net sales revenue

B)a $25,000 increase in net income

C)a 45.45% increase in net income

D)a 103.125% increase in net income

What would a horizontal analysis report show with respect to net income?

What would a horizontal analysis report show with respect to net income?A)net income is 45.45% of net sales revenue

B)a $25,000 increase in net income

C)a 45.45% increase in net income

D)a 103.125% increase in net income

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

18

An adverse opinion is issued if the auditor finds that the financial statements are not presented fairly.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

19

If an analyst wants to see how the assets of a company have changed from one year to the next,horizontal analysis must be used.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

20

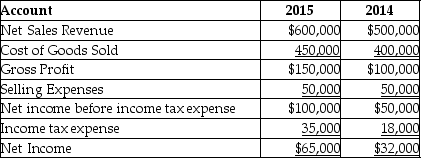

The following is summary of information presented on the financial statements of a company on December 31,2015.  What would a horizontal analysis report show with respect to current liabilities?

What would a horizontal analysis report show with respect to current liabilities?

A)current liabilities are 38.46% of total capital

B)a 50.00% increase in current liabilities

C)a current ratio of .87

D)a 33.33% increase in current liabilities

What would a horizontal analysis report show with respect to current liabilities?

What would a horizontal analysis report show with respect to current liabilities?A)current liabilities are 38.46% of total capital

B)a 50.00% increase in current liabilities

C)a current ratio of .87

D)a 33.33% increase in current liabilities

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

21

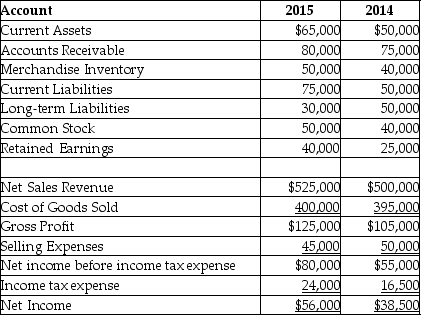

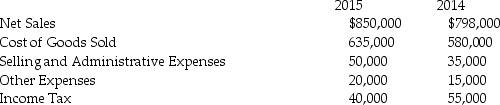

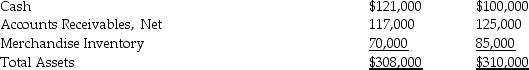

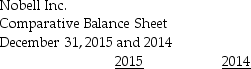

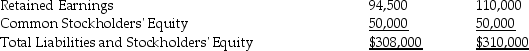

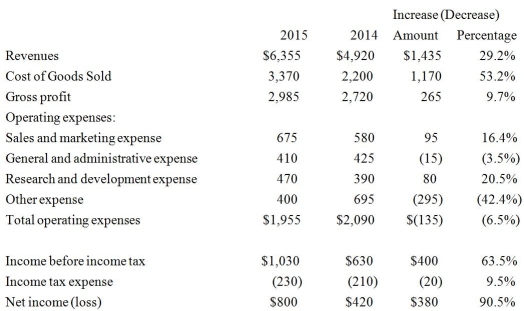

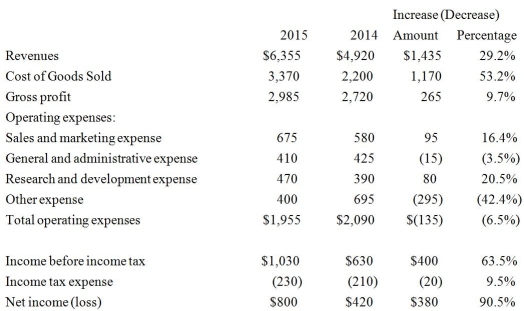

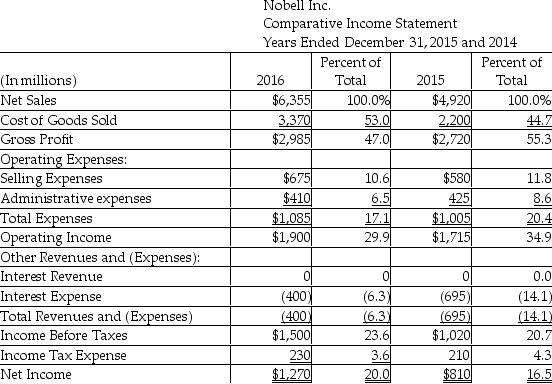

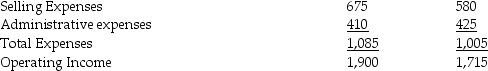

Data for Nobell Inc.is as follows:

Prepare a horizontal analysis of the comparative income statement of Nobell Inc.(Round percentage changes to one decimal place.)Use a multi-step income statement.

Prepare a horizontal analysis of the comparative income statement of Nobell Inc.(Round percentage changes to one decimal place.)Use a multi-step income statement.

Prepare a horizontal analysis of the comparative income statement of Nobell Inc.(Round percentage changes to one decimal place.)Use a multi-step income statement.

Prepare a horizontal analysis of the comparative income statement of Nobell Inc.(Round percentage changes to one decimal place.)Use a multi-step income statement.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

22

The following is summary of information presented on the financial statements of a company on December 31,2015.

What would a horizontal analysis report show with respect to net sales revenue?

What would a horizontal analysis report show with respect to net sales revenue?

A)a 20% increase in net sales revenue

B)a 120% decrease in net sales revenue

C)a decrease of $50,000 in net sales revenue

D)a $50,000 increase in net sales revenue

What would a horizontal analysis report show with respect to net sales revenue?

What would a horizontal analysis report show with respect to net sales revenue? A)a 20% increase in net sales revenue

B)a 120% decrease in net sales revenue

C)a decrease of $50,000 in net sales revenue

D)a $50,000 increase in net sales revenue

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

23

Benchmarking is often done by comparing a company against either a key competitor or against the industry average.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

24

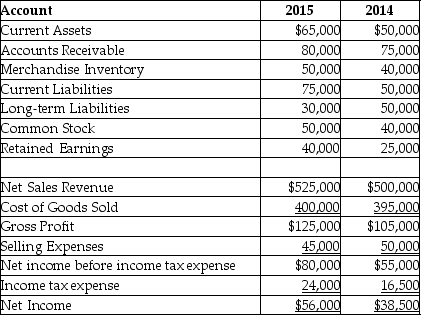

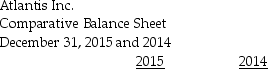

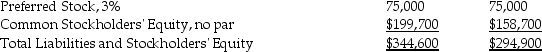

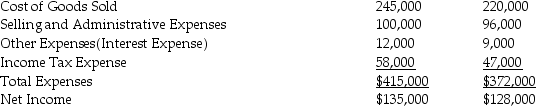

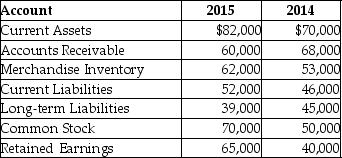

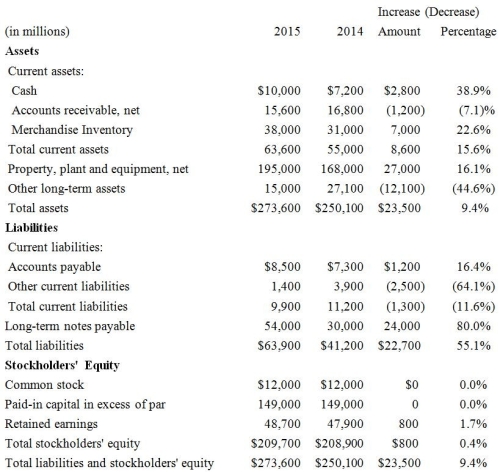

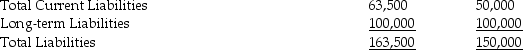

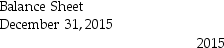

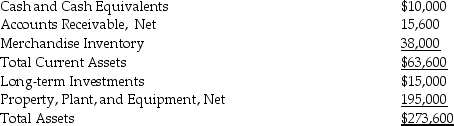

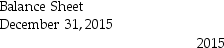

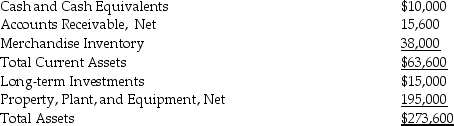

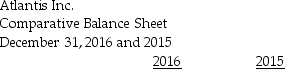

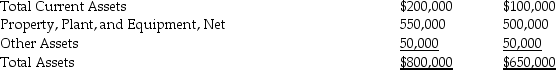

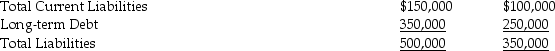

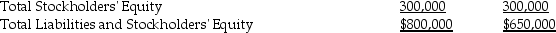

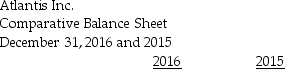

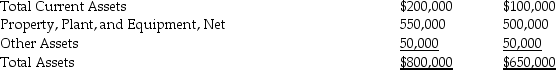

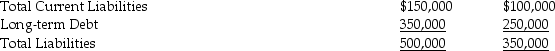

Data for Atlantis Inc.is given below:

Assets

Assets

Current Assets:

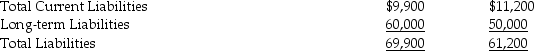

Liabilities

Liabilities

Stockholders' Equity

Stockholders' Equity

Prepare a horizontal analysis of the comparative balance sheet of Atlantis Inc.Round percentage changes to one decimal place.

Prepare a horizontal analysis of the comparative balance sheet of Atlantis Inc.Round percentage changes to one decimal place.

Assets

AssetsCurrent Assets:

Liabilities

Liabilities Stockholders' Equity

Stockholders' Equity Prepare a horizontal analysis of the comparative balance sheet of Atlantis Inc.Round percentage changes to one decimal place.

Prepare a horizontal analysis of the comparative balance sheet of Atlantis Inc.Round percentage changes to one decimal place.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

25

Vertical analysis involves comparing each figure in the financial statements with a corresponding figure of the previous year.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

26

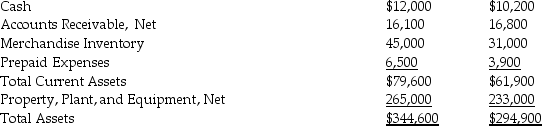

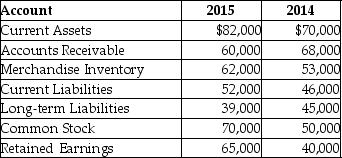

Data for Atlantis Inc.follow:

Expenses:

Expenses:

Prepare a horizontal analysis of the comparative income statement of Atlantis Inc.(Round percentage changes to one decimal place.)Use a multi-step format for the income statement.

Prepare a horizontal analysis of the comparative income statement of Atlantis Inc.(Round percentage changes to one decimal place.)Use a multi-step format for the income statement.

Expenses:

Expenses: Prepare a horizontal analysis of the comparative income statement of Atlantis Inc.(Round percentage changes to one decimal place.)Use a multi-step format for the income statement.

Prepare a horizontal analysis of the comparative income statement of Atlantis Inc.(Round percentage changes to one decimal place.)Use a multi-step format for the income statement.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

27

Benchmarking is the practice of comparing a company with other leading companies.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

28

The following is summary of information presented on the financial statements of a company on December 31,2015.  What would a horizontal analysis report show with respect to long-term liabilities?

What would a horizontal analysis report show with respect to long-term liabilities?

A)long-term liabilities decreased by $30,000

B)long-term liabilities decreased by 40%

C)long-term liabilities decreased by 13.33%

D)long-term liabilities decreased by $10,000

What would a horizontal analysis report show with respect to long-term liabilities?

What would a horizontal analysis report show with respect to long-term liabilities?A)long-term liabilities decreased by $30,000

B)long-term liabilities decreased by 40%

C)long-term liabilities decreased by 13.33%

D)long-term liabilities decreased by $10,000

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

29

Benchmarking is the comparison of a company's current year results with an earlier year's performance.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

30

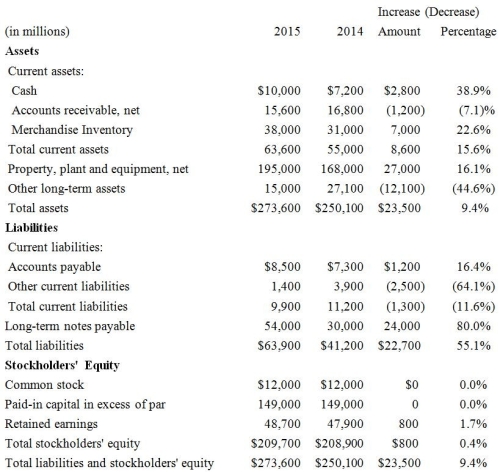

Atlantis Inc.reported the following data:  The horizontal report shows that the amount of total liabilities has ________.

The horizontal report shows that the amount of total liabilities has ________.

A)increased by $22,700

B)increased by $2,500

C)decreased by $2,500

D)increased by $24,000

The horizontal report shows that the amount of total liabilities has ________.

The horizontal report shows that the amount of total liabilities has ________.A)increased by $22,700

B)increased by $2,500

C)decreased by $2,500

D)increased by $24,000

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

31

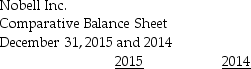

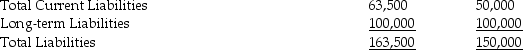

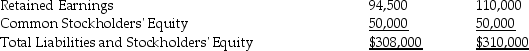

Data for Nobell Inc.is as follows:

Assets

Assets

Current Assets:

Liabilities

Liabilities

Stockholders' Equity

Stockholders' Equity

Prepare a horizontal analysis of the comparative balance sheet of Nobell Inc.Round percentage changes to one decimal place.

Prepare a horizontal analysis of the comparative balance sheet of Nobell Inc.Round percentage changes to one decimal place.

Assets

AssetsCurrent Assets:

Liabilities

Liabilities Stockholders' Equity

Stockholders' Equity Prepare a horizontal analysis of the comparative balance sheet of Nobell Inc.Round percentage changes to one decimal place.

Prepare a horizontal analysis of the comparative balance sheet of Nobell Inc.Round percentage changes to one decimal place.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

32

In a vertical analysis of the balance sheet,each line item is shown as a percentage of shareholders' equity.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

33

Atlantis Inc.reported the following data:  The horizontal analysis report shows that the cost of goods sold has ________.

The horizontal analysis report shows that the cost of goods sold has ________.

A)increased by 29.2%

B)decreased by 29.2%

C)increased by 53.2%

D)decreased by 53.2%

The horizontal analysis report shows that the cost of goods sold has ________.

The horizontal analysis report shows that the cost of goods sold has ________.A)increased by 29.2%

B)decreased by 29.2%

C)increased by 53.2%

D)decreased by 53.2%

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

34

Donald Corp.reported the following on its comparative income statement:

Prepare a horizontal analysis of revenues and cost of goods sold,both in dollar amounts and in percentages,for 2016 and 2017.(Round your percentage answers to two decimal places.)

Prepare a horizontal analysis of revenues and cost of goods sold,both in dollar amounts and in percentages,for 2016 and 2017.(Round your percentage answers to two decimal places.)

Prepare a horizontal analysis of revenues and cost of goods sold,both in dollar amounts and in percentages,for 2016 and 2017.(Round your percentage answers to two decimal places.)

Prepare a horizontal analysis of revenues and cost of goods sold,both in dollar amounts and in percentages,for 2016 and 2017.(Round your percentage answers to two decimal places.)

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

35

Donald Corp.reported the following revenues and net income amounts.

Calculate Donald's trend analysis for revenues and cost of goods sold.Use 2013 as the base year,and round to the nearest percent.

Calculate Donald's trend analysis for revenues and cost of goods sold.Use 2013 as the base year,and round to the nearest percent.

Calculate Donald's trend analysis for revenues and cost of goods sold.Use 2013 as the base year,and round to the nearest percent.

Calculate Donald's trend analysis for revenues and cost of goods sold.Use 2013 as the base year,and round to the nearest percent.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

36

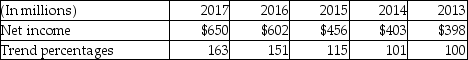

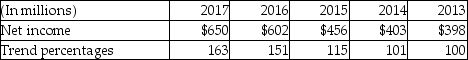

The trend analysis report of Doppler Inc.is given below:

-Which of the following is a correct conclusion from the above analysis?

A)Net income for the year 2015 has increased by 115% over that for the year 2013

B)Net income for the year 2015 has decreased by 15% over that for the year 2013.

C)Net income for the year 2015 has decreased by 115% over that for the year 2013

D)Net income for the year 2015 has increased by 15% over that for the year 2013.

-Which of the following is a correct conclusion from the above analysis?

A)Net income for the year 2015 has increased by 115% over that for the year 2013

B)Net income for the year 2015 has decreased by 15% over that for the year 2013.

C)Net income for the year 2015 has decreased by 115% over that for the year 2013

D)Net income for the year 2015 has increased by 15% over that for the year 2013.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

37

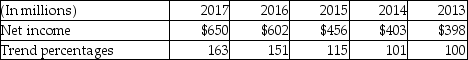

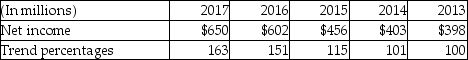

The trend analysis report of Doppler Inc.is given below:

-Which of the following is a correct conclusion from the above analysis?

A)Net income for the year 2016 is 151% of that for the year 2013.

B)Net income for the year 2016 is 151% of previous year.

C)Net income for the year 2016 decreased by 151% from 2015.

D)Net income for the year 2017 increased by 163% from 2016.

-Which of the following is a correct conclusion from the above analysis?

A)Net income for the year 2016 is 151% of that for the year 2013.

B)Net income for the year 2016 is 151% of previous year.

C)Net income for the year 2016 decreased by 151% from 2015.

D)Net income for the year 2017 increased by 163% from 2016.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

38

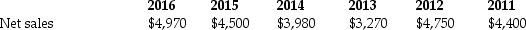

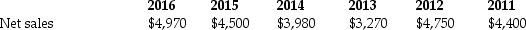

Atlantis Inc.provides the following historical data:

Prepare the trend analysis report Use 2011 as the base year,and round answers to the nearest percent.

Prepare the trend analysis report Use 2011 as the base year,and round answers to the nearest percent.

Prepare the trend analysis report Use 2011 as the base year,and round answers to the nearest percent.

Prepare the trend analysis report Use 2011 as the base year,and round answers to the nearest percent.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

39

In a vertical analysis of the income statement,each line item is shown as a percentage of net sales.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

40

An analysis of a financial statement that reveals the relationship of each statement item to its base amount,which is the 100% figure,is known as vertical analysis.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

41

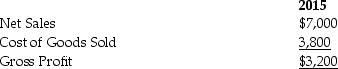

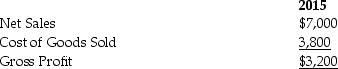

Olivera Inc.provides the following data for the year 2015:  On vertical analysis report,the gross profit as a percentage of net sales will be ________.

On vertical analysis report,the gross profit as a percentage of net sales will be ________.

A)35.9%

B)41.67%

C)56.1%

D)44.1%

On vertical analysis report,the gross profit as a percentage of net sales will be ________.

On vertical analysis report,the gross profit as a percentage of net sales will be ________.A)35.9%

B)41.67%

C)56.1%

D)44.1%

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

42

Working capital measures the ability to meet long-term obligations with current assets.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

43

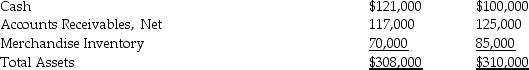

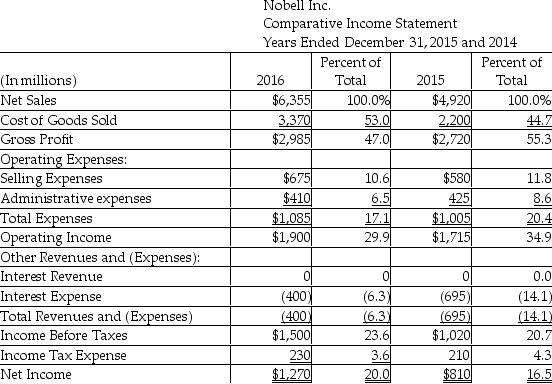

The vertical analysis statement of Nobell Inc.is as shown below:

-Thee figure 16.5% shown for net income in 2015 signifies that ________.

A)net income is 16.5% of net sales revenues

B)net income is increased by 16.5% over the previous year

C)net income is 16.5% of gross profit

D)net income is equal to 16.5 times of the income before income tax

-Thee figure 16.5% shown for net income in 2015 signifies that ________.

A)net income is 16.5% of net sales revenues

B)net income is increased by 16.5% over the previous year

C)net income is 16.5% of gross profit

D)net income is equal to 16.5 times of the income before income tax

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

44

A common-size statement reports only percentages that appear in a ________.

A)horizontal analysis report

B)financial statement

C)vertical analysis report

D)cost statement

A)horizontal analysis report

B)financial statement

C)vertical analysis report

D)cost statement

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

45

The current ratio is calculated as the total current assets divided by the total current liabilities.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

46

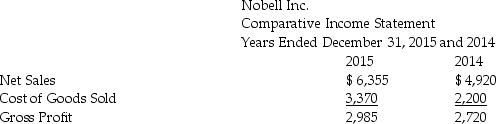

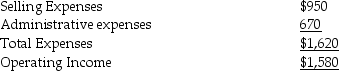

Prepare a comparative common-size income statement for Nobell Inc.using the 2015 and 2014 data.(Round off the percentages to one decimal place.)

Operating Expenses:

Operating Expenses:

Other Revenues and (Expenses):

Other Revenues and (Expenses):

Operating Expenses:

Operating Expenses: Other Revenues and (Expenses):

Other Revenues and (Expenses):

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

47

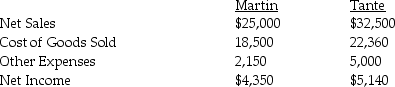

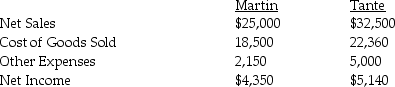

Data for Martin Corp.and Tante Inc.as follows:

Prepare a comparative common-size income statement for Martin Corp and Tante Inc.for the year ending December 31,2016.Round off the percentages to two decimal places.Use a multi-step format for the income statement.

Prepare a comparative common-size income statement for Martin Corp and Tante Inc.for the year ending December 31,2016.Round off the percentages to two decimal places.Use a multi-step format for the income statement.

Prepare a comparative common-size income statement for Martin Corp and Tante Inc.for the year ending December 31,2016.Round off the percentages to two decimal places.Use a multi-step format for the income statement.

Prepare a comparative common-size income statement for Martin Corp and Tante Inc.for the year ending December 31,2016.Round off the percentages to two decimal places.Use a multi-step format for the income statement.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

48

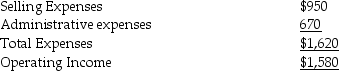

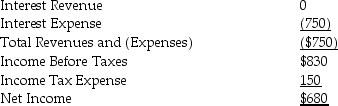

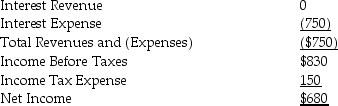

Prepare a vertical analysis report of the income statement shown below.(Round off the percentages to two decimal places.)

Operating Expenses:

Operating Expenses:

Other Revenues and (Expenses):

Other Revenues and (Expenses):

Operating Expenses:

Operating Expenses: Other Revenues and (Expenses):

Other Revenues and (Expenses):

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

49

The cash ratio helps to determine a company's ability to meet its short-term obligations using cash and cash equivalents.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is the base amount when performing vertical analysis of a balance sheet?

A)total assets

B)total cash and cash equivalents

C)net income

D)gross profit

A)total assets

B)total cash and cash equivalents

C)net income

D)gross profit

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

51

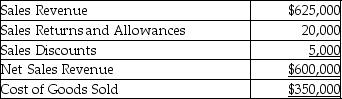

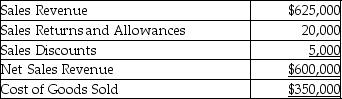

Shelcal Inc.provides the following data for the year 2015:  On vertical analysis report,the cost of goods sold as a percentage of net sales revenue will amount to ________.

On vertical analysis report,the cost of goods sold as a percentage of net sales revenue will amount to ________.

A)59.42%

B)61.15%

C)63.48%

D)64.07%

On vertical analysis report,the cost of goods sold as a percentage of net sales revenue will amount to ________.

On vertical analysis report,the cost of goods sold as a percentage of net sales revenue will amount to ________.A)59.42%

B)61.15%

C)63.48%

D)64.07%

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

52

The vertical analysis statement of Nobell Inc.is as shown below:

- The figure 47.0% shown for gross profit in 2016 signifies that the ________.

A)gross profit is equal to 47.0% of net income

B)gross profit is increased by 47.0% over the previous year

C)gross profit is 47.0% of net sales revenue

D)gross profit is 47.0% of cost of goods sold

- The figure 47.0% shown for gross profit in 2016 signifies that the ________.

A)gross profit is equal to 47.0% of net income

B)gross profit is increased by 47.0% over the previous year

C)gross profit is 47.0% of net sales revenue

D)gross profit is 47.0% of cost of goods sold

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

53

The merchandise inventory turnover ratio measures how profitably a company sells its average level of merchandise inventory during a year.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

54

To calculate the acid-test ratio,merchandise inventory and prepaid expenses are ignored.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following is the base amount when performing vertical analysis of an income statement?

A)total expenses

B)net sales

C)sales revenue

D)gross profit

A)total expenses

B)net sales

C)sales revenue

D)gross profit

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

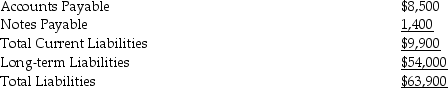

56

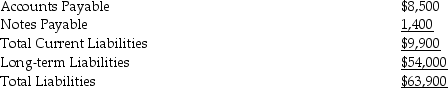

Prepare the vertical analysis report of the balance sheet data given below.(Round off the percentages to two decimal places.)

Assets

Assets

Current Assets:

Liabilities

Liabilities

Current Liabilities:

Stockholders' Equity

Stockholders' Equity

Assets

AssetsCurrent Assets:

Liabilities

LiabilitiesCurrent Liabilities:

Stockholders' Equity

Stockholders' Equity

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

57

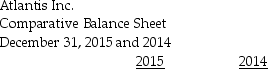

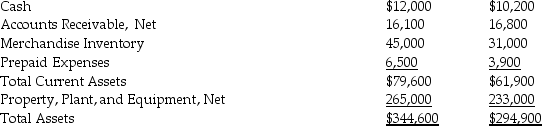

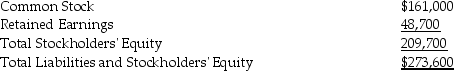

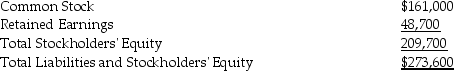

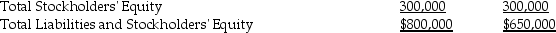

Atlantis Inc.has the following data:

Assets

Assets

Liabilities

Liabilities

Stockholders' Equity

Stockholders' Equity

Perform a vertical analysis of Atlantis's balance sheet for each year.(Round your percentage answers to one decimal place.)

Perform a vertical analysis of Atlantis's balance sheet for each year.(Round your percentage answers to one decimal place.)

Assets

Assets Liabilities

Liabilities Stockholders' Equity

Stockholders' Equity Perform a vertical analysis of Atlantis's balance sheet for each year.(Round your percentage answers to one decimal place.)

Perform a vertical analysis of Atlantis's balance sheet for each year.(Round your percentage answers to one decimal place.)

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

58

Acid-test ratio helps to measure a company's ability to pay all its current liabilities if they came due immediately.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

59

A high current ratio indicates that current liabilities are more than current assets.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following types of financial statement analysis would be used to see how a company's operating expenses as a percentage of net sales have changed from one year to the next?

A)vertical analysis

B)horizontal analysis

C)ratio analysis

D)analysis of internal control system

A)vertical analysis

B)horizontal analysis

C)ratio analysis

D)analysis of internal control system

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

61

The gross profit percentage is an indicator of how well a company is positioned to pay off its short-term liabilities.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

62

The net income of a company for the year ended was $500,000.The company has no preferred stock.Common stockholders' equity was $1,000,000 at the beginning of the year and $2,000,000 at the end of the year.Calculate the return on common stockholders' equity.

A)18.75%.

B)20.00%.

C)21.43%.

D)33.33%.

A)18.75%.

B)20.00%.

C)21.43%.

D)33.33%.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

63

The rate of return on common stockholders' equity shows how much income is earned for each $1 invested by the common shareholders.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

64

The times-interest-earned ratio is also known as interest-coverage ratio.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

65

Days' sales in inventory is a ratio that measures how quickly a company can collect its receivables.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

66

As per FASB guidelines,earnings per share should appear on the face of the income statement.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

67

A corporation has 2,000 shares,10% preferred stock of $50 par,and 6,000 shares of common stock outstanding.The net income for the year is $250,000.Calculate earnings per share.

A)$50

B)$40

C)$42

D)$125

A)$50

B)$40

C)$42

D)$125

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

68

The price/earnings ratio indicates the ________.

A)dividend yield of the company

B)market price of $1 of earnings

C)proportion of total assets financed by debt

D)ease of selling merchandise inventory

A)dividend yield of the company

B)market price of $1 of earnings

C)proportion of total assets financed by debt

D)ease of selling merchandise inventory

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

69

The current ratio is a key indicator of a company's ability to pay current liabilities.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

70

The asset turnover rate is a way to evaluate how well a company can pay its short-term liabilities.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

71

Days' sales in receivables measures the return on average receivables using credit sales.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

72

The debt to equity ratio shows the proportion of total liabilities relative to total equity.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

73

The debt ratio is the ratio of total debt divided by total equity.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

74

The dividend payout ratio indicates the amount of the dividend as a proportion of a share's market price.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following items is a measure of a company's ability to collect receivables?

A)inventory turnover ratio

B)current ratio

C)days' sales in receivables

D)account receivable balance

A)inventory turnover ratio

B)current ratio

C)days' sales in receivables

D)account receivable balance

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

76

The ratio of the market price of a share of stock to the dividends paid per share is called the earnings per share.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

77

The accounts receivable turnover is an indicator of the ability of a company to collect cash from its credit customers.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

78

The times-interest-earned ratio measures the number of times earnings before interest and taxes can cover interest expense..

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

79

The price/earnings ratio shows the market price of $1 of earnings.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck

80

The rate of return on total assets measures a company's success in using its assets to earn income.

Unlock Deck

Unlock for access to all 113 flashcards in this deck.

Unlock Deck

k this deck