Deck 7: Intercompany Profit Transactions - Bonds

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/50

Play

Full screen (f)

Deck 7: Intercompany Profit Transactions - Bonds

1

Use the following information to answer the question(s) below.

Pascalian Company owns a 90% interest in Sapp Company. On January 1, 2013, Pascalian had $300,000, 6% bonds outstanding with an unamortized premium of $9,000. The bonds mature on December 31, 2017. Sapp acquired one-third of Pascalian's bonds in the open market for $97,000 on January 1, 2013. Both companies use straight-line amortization of bond discounts/premiums. Interest is paid on December 31. On December 31, 2013, the books of the two affiliates held the following balances:

-Bond Interest Receivable for 2013 of Pfadt's bonds on Senat's books was

A)$5,400.

B)$6,000.

C)$10,800.

D)$12,000.

Pascalian Company owns a 90% interest in Sapp Company. On January 1, 2013, Pascalian had $300,000, 6% bonds outstanding with an unamortized premium of $9,000. The bonds mature on December 31, 2017. Sapp acquired one-third of Pascalian's bonds in the open market for $97,000 on January 1, 2013. Both companies use straight-line amortization of bond discounts/premiums. Interest is paid on December 31. On December 31, 2013, the books of the two affiliates held the following balances:

-Bond Interest Receivable for 2013 of Pfadt's bonds on Senat's books was

A)$5,400.

B)$6,000.

C)$10,800.

D)$12,000.

$6,000.

2

Use the following information to answer the question(s) below.

Plenty Corporation issued six thousand, $1,000 par, 6% bonds on January 1, 2012, at par. Interest is paid on January 1 and July 1 of each year; the bonds mature on January 1, 2017. On January 2, 2014, Scrawn Corporation, a 75%-owned subsidiary of Plenty, purchased 3,000 of the bonds on the open market at 102.50. Plenty's separate net income for 2014 included the annual interest expense for all 3,000 bonds. Scrawn's separate net income for 2014 was $400,000, which included the bond interest received on July 1 as well as the accrual of bond interest revenue earned on December 31. Both companies use straight-line amortization of bond discounts/premiums.

-Using the original information,the balances for the Bonds Payable and Bond Interest Payable accounts,respectively,on the consolidated balance sheet for December 31,2015 were

A)$3,000,000 and $ 90,000.

B)$3,000,000 and $180,000.

C)$6,000,000 and $ 90,000.

D)$6,000,000 and $180,000.

Plenty Corporation issued six thousand, $1,000 par, 6% bonds on January 1, 2012, at par. Interest is paid on January 1 and July 1 of each year; the bonds mature on January 1, 2017. On January 2, 2014, Scrawn Corporation, a 75%-owned subsidiary of Plenty, purchased 3,000 of the bonds on the open market at 102.50. Plenty's separate net income for 2014 included the annual interest expense for all 3,000 bonds. Scrawn's separate net income for 2014 was $400,000, which included the bond interest received on July 1 as well as the accrual of bond interest revenue earned on December 31. Both companies use straight-line amortization of bond discounts/premiums.

-Using the original information,the balances for the Bonds Payable and Bond Interest Payable accounts,respectively,on the consolidated balance sheet for December 31,2015 were

A)$3,000,000 and $ 90,000.

B)$3,000,000 and $180,000.

C)$6,000,000 and $ 90,000.

D)$6,000,000 and $180,000.

$3,000,000 and $ 90,000.

3

Use the following information to answer the question(s) below.

Plenty Corporation issued six thousand, $1,000 par, 6% bonds on January 1, 2012, at par. Interest is paid on January 1 and July 1 of each year; the bonds mature on January 1, 2017. On January 2, 2014, Scrawn Corporation, a 75%-owned subsidiary of Plenty, purchased 3,000 of the bonds on the open market at 102.50. Plenty's separate net income for 2014 included the annual interest expense for all 3,000 bonds. Scrawn's separate net income for 2014 was $400,000, which included the bond interest received on July 1 as well as the accrual of bond interest revenue earned on December 31. Both companies use straight-line amortization of bond discounts/premiums.

-If the bonds were originally issued at 103,and 70% of them were purchased on January 2,2016 at 104,the constructive gain or (loss)on the purchase was

A)$(142,800).

B)$( 42,000).

C)$ 42,000.

D)$ 142,800.

Plenty Corporation issued six thousand, $1,000 par, 6% bonds on January 1, 2012, at par. Interest is paid on January 1 and July 1 of each year; the bonds mature on January 1, 2017. On January 2, 2014, Scrawn Corporation, a 75%-owned subsidiary of Plenty, purchased 3,000 of the bonds on the open market at 102.50. Plenty's separate net income for 2014 included the annual interest expense for all 3,000 bonds. Scrawn's separate net income for 2014 was $400,000, which included the bond interest received on July 1 as well as the accrual of bond interest revenue earned on December 31. Both companies use straight-line amortization of bond discounts/premiums.

-If the bonds were originally issued at 103,and 70% of them were purchased on January 2,2016 at 104,the constructive gain or (loss)on the purchase was

A)$(142,800).

B)$( 42,000).

C)$ 42,000.

D)$ 142,800.

$( 42,000).

4

There are several theories for allocating constructive gains or losses between purchasing and issuing affiliates.The Agency Theory

A)does so based on the par value of the bonds purchased.

B)assigns the entire constructive gain or loss to the parent based on their control of the decision to purchase the bonds.

C)assigns the entire constructive gain or loss to the subsidiary based on the need to have the noncontrolling interest share in the retirement of the debt.

D)assigns the entire constructive gain or loss to whichever company issued the bonds.

A)does so based on the par value of the bonds purchased.

B)assigns the entire constructive gain or loss to the parent based on their control of the decision to purchase the bonds.

C)assigns the entire constructive gain or loss to the subsidiary based on the need to have the noncontrolling interest share in the retirement of the debt.

D)assigns the entire constructive gain or loss to whichever company issued the bonds.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

5

Use the following information to answer the question(s) below.

Plenty Corporation issued six thousand, $1,000 par, 6% bonds on January 1, 2012, at par. Interest is paid on January 1 and July 1 of each year; the bonds mature on January 1, 2017. On January 2, 2014, Scrawn Corporation, a 75%-owned subsidiary of Plenty, purchased 3,000 of the bonds on the open market at 102.50. Plenty's separate net income for 2014 included the annual interest expense for all 3,000 bonds. Scrawn's separate net income for 2014 was $400,000, which included the bond interest received on July 1 as well as the accrual of bond interest revenue earned on December 31. Both companies use straight-line amortization of bond discounts/premiums.

-Using the original information,the elimination entries on the consolidation working papers prepared on December 31,2014 included at least

A)debit to Bond Interest Expense for $360,000.

B)credit to Bond Interest Expense for $180,000 and a debit to Bond Interest Payable for $90,000.

C)credit to Bond Interest Receivable for $180,000.

D)debit to Bond Interest Revenue for $360,000.

Plenty Corporation issued six thousand, $1,000 par, 6% bonds on January 1, 2012, at par. Interest is paid on January 1 and July 1 of each year; the bonds mature on January 1, 2017. On January 2, 2014, Scrawn Corporation, a 75%-owned subsidiary of Plenty, purchased 3,000 of the bonds on the open market at 102.50. Plenty's separate net income for 2014 included the annual interest expense for all 3,000 bonds. Scrawn's separate net income for 2014 was $400,000, which included the bond interest received on July 1 as well as the accrual of bond interest revenue earned on December 31. Both companies use straight-line amortization of bond discounts/premiums.

-Using the original information,the elimination entries on the consolidation working papers prepared on December 31,2014 included at least

A)debit to Bond Interest Expense for $360,000.

B)credit to Bond Interest Expense for $180,000 and a debit to Bond Interest Payable for $90,000.

C)credit to Bond Interest Receivable for $180,000.

D)debit to Bond Interest Revenue for $360,000.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

6

No constructive gain or loss arises from the purchase of an affiliate's bonds if the

A)affiliate is a 100%-owned subsidiary.

B)bonds are purchased at book value.

C)bonds are purchased with arm's-length bargaining from outside entities.

D)gain or loss cannot be reasonably estimated.

A)affiliate is a 100%-owned subsidiary.

B)bonds are purchased at book value.

C)bonds are purchased with arm's-length bargaining from outside entities.

D)gain or loss cannot be reasonably estimated.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

7

Use the following information to answer the question(s) below.

Pascalian Company owns a 90% interest in Sapp Company. On January 1, 2013, Pascalian had $300,000, 6% bonds outstanding with an unamortized premium of $9,000. The bonds mature on December 31, 2017. Sapp acquired one-third of Pascalian's bonds in the open market for $97,000 on January 1, 2013. Both companies use straight-line amortization of bond discounts/premiums. Interest is paid on December 31. On December 31, 2013, the books of the two affiliates held the following balances:

-With respect to the bond purchase,the consolidated income statement of Pfadt Corporation and Subsidiary for 2013 showed a gain or loss of

A)$ 4,500.

B)$ 5,000.

C)$10,800.

D)$12,000.

Pascalian Company owns a 90% interest in Sapp Company. On January 1, 2013, Pascalian had $300,000, 6% bonds outstanding with an unamortized premium of $9,000. The bonds mature on December 31, 2017. Sapp acquired one-third of Pascalian's bonds in the open market for $97,000 on January 1, 2013. Both companies use straight-line amortization of bond discounts/premiums. Interest is paid on December 31. On December 31, 2013, the books of the two affiliates held the following balances:

-With respect to the bond purchase,the consolidated income statement of Pfadt Corporation and Subsidiary for 2013 showed a gain or loss of

A)$ 4,500.

B)$ 5,000.

C)$10,800.

D)$12,000.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

8

If the price paid by a parent company to acquire the debt of a subsidiary is greater than the book value of the liability,a ________ occurs.

A)realized loss on the retirement of debt from the viewpoint of the subsidiary

B)realized gain on the retirement of debt from the viewpoint of the subsidiary

C)constructive loss on the retirement of debt from the viewpoint of the consolidated entity

D)constructive gain on the retirement of debt from the viewpoint of the consolidated entity

A)realized loss on the retirement of debt from the viewpoint of the subsidiary

B)realized gain on the retirement of debt from the viewpoint of the subsidiary

C)constructive loss on the retirement of debt from the viewpoint of the consolidated entity

D)constructive gain on the retirement of debt from the viewpoint of the consolidated entity

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

9

Use the following information to answer the question(s) below.

Pascalian Company owns a 90% interest in Sapp Company. On January 1, 2013, Pascalian had $300,000, 6% bonds outstanding with an unamortized premium of $9,000. The bonds mature on December 31, 2017. Sapp acquired one-third of Pascalian's bonds in the open market for $97,000 on January 1, 2013. Both companies use straight-line amortization of bond discounts/premiums. Interest is paid on December 31. On December 31, 2013, the books of the two affiliates held the following balances:

-The gain from the bond purchase that appeared on the December 31,2013 consolidated income statement was

A)$4,320.

B)$4,800.

C)$5,400.

D)$6,000.

Pascalian Company owns a 90% interest in Sapp Company. On January 1, 2013, Pascalian had $300,000, 6% bonds outstanding with an unamortized premium of $9,000. The bonds mature on December 31, 2017. Sapp acquired one-third of Pascalian's bonds in the open market for $97,000 on January 1, 2013. Both companies use straight-line amortization of bond discounts/premiums. Interest is paid on December 31. On December 31, 2013, the books of the two affiliates held the following balances:

-The gain from the bond purchase that appeared on the December 31,2013 consolidated income statement was

A)$4,320.

B)$4,800.

C)$5,400.

D)$6,000.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

10

Use the following information to answer the question(s) below.

Poe Corporation owns an 80% interest in Seri Company acquired at book value several years ago. On January 2, 2013, Seri purchased $100,000 par of Poe's outstanding 10% bonds for $103,000. The bonds were issued at par and mature on January 1, 2016. Straight-line amortization is used. Separate incomes of Poe and Seri for 2013 are $350,000 and $120,000, respectively. Poe uses the equity method to account for the investment in Seri.

-Controlling interest share of consolidated net income for 2013 was

A)$443,600.

B)$444,000.

C)$444,400.

D)$448,000.

Poe Corporation owns an 80% interest in Seri Company acquired at book value several years ago. On January 2, 2013, Seri purchased $100,000 par of Poe's outstanding 10% bonds for $103,000. The bonds were issued at par and mature on January 1, 2016. Straight-line amortization is used. Separate incomes of Poe and Seri for 2013 are $350,000 and $120,000, respectively. Poe uses the equity method to account for the investment in Seri.

-Controlling interest share of consolidated net income for 2013 was

A)$443,600.

B)$444,000.

C)$444,400.

D)$448,000.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

11

Use the following information to answer the question(s) below.

Plenty Corporation issued six thousand, $1,000 par, 6% bonds on January 1, 2012, at par. Interest is paid on January 1 and July 1 of each year; the bonds mature on January 1, 2017. On January 2, 2014, Scrawn Corporation, a 75%-owned subsidiary of Plenty, purchased 3,000 of the bonds on the open market at 102.50. Plenty's separate net income for 2014 included the annual interest expense for all 3,000 bonds. Scrawn's separate net income for 2014 was $400,000, which included the bond interest received on July 1 as well as the accrual of bond interest revenue earned on December 31. Both companies use straight-line amortization of bond discounts/premiums.

-Using the original information,the amount of consolidated Interest Expense for 2014 was

A)$ 135,000.

B)$ 180,000.

C)$ 270,000.

D)$ 360,000.

Plenty Corporation issued six thousand, $1,000 par, 6% bonds on January 1, 2012, at par. Interest is paid on January 1 and July 1 of each year; the bonds mature on January 1, 2017. On January 2, 2014, Scrawn Corporation, a 75%-owned subsidiary of Plenty, purchased 3,000 of the bonds on the open market at 102.50. Plenty's separate net income for 2014 included the annual interest expense for all 3,000 bonds. Scrawn's separate net income for 2014 was $400,000, which included the bond interest received on July 1 as well as the accrual of bond interest revenue earned on December 31. Both companies use straight-line amortization of bond discounts/premiums.

-Using the original information,the amount of consolidated Interest Expense for 2014 was

A)$ 135,000.

B)$ 180,000.

C)$ 270,000.

D)$ 360,000.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

12

Use the following information to answer the question(s) below.

Pascalian Company owns a 90% interest in Sapp Company. On January 1, 2013, Pascalian had $300,000, 6% bonds outstanding with an unamortized premium of $9,000. The bonds mature on December 31, 2017. Sapp acquired one-third of Pascalian's bonds in the open market for $97,000 on January 1, 2013. Both companies use straight-line amortization of bond discounts/premiums. Interest is paid on December 31. On December 31, 2013, the books of the two affiliates held the following balances:

-Prussia Corporation owns 80% of the voting stock of Stad Corporation.On January 1,2013,Prussia paid $391,000 cash for $400,000 par of Stad's 10% $1,000,000 par value outstanding bonds,due on April 1,2018.Stad's bonds had a book value of $1,045,000 on January 1,2013.Straight-line amortization is used.The gain or loss on the constructive retirement of $400,000 of Stad bonds on January 1,2013 was reported in the 2013 consolidated income statement in the amount of

A)$14,000.

B)$27,000.

C)$23,000.

D)$21,600.

Pascalian Company owns a 90% interest in Sapp Company. On January 1, 2013, Pascalian had $300,000, 6% bonds outstanding with an unamortized premium of $9,000. The bonds mature on December 31, 2017. Sapp acquired one-third of Pascalian's bonds in the open market for $97,000 on January 1, 2013. Both companies use straight-line amortization of bond discounts/premiums. Interest is paid on December 31. On December 31, 2013, the books of the two affiliates held the following balances:

-Prussia Corporation owns 80% of the voting stock of Stad Corporation.On January 1,2013,Prussia paid $391,000 cash for $400,000 par of Stad's 10% $1,000,000 par value outstanding bonds,due on April 1,2018.Stad's bonds had a book value of $1,045,000 on January 1,2013.Straight-line amortization is used.The gain or loss on the constructive retirement of $400,000 of Stad bonds on January 1,2013 was reported in the 2013 consolidated income statement in the amount of

A)$14,000.

B)$27,000.

C)$23,000.

D)$21,600.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

13

Use the following information to answer the question(s) below.

Pascalian Company owns a 90% interest in Sapp Company. On January 1, 2013, Pascalian had $300,000, 6% bonds outstanding with an unamortized premium of $9,000. The bonds mature on December 31, 2017. Sapp acquired one-third of Pascalian's bonds in the open market for $97,000 on January 1, 2013. Both companies use straight-line amortization of bond discounts/premiums. Interest is paid on December 31. On December 31, 2013, the books of the two affiliates held the following balances:

-Bonds Payable appeared in the December 31,2013 consolidated balance sheet of Pfadt Corporation and Subsidiary in the amount of

A)$398,925.

B)$443,500.

C)$441,000.

D)$450,000.

Pascalian Company owns a 90% interest in Sapp Company. On January 1, 2013, Pascalian had $300,000, 6% bonds outstanding with an unamortized premium of $9,000. The bonds mature on December 31, 2017. Sapp acquired one-third of Pascalian's bonds in the open market for $97,000 on January 1, 2013. Both companies use straight-line amortization of bond discounts/premiums. Interest is paid on December 31. On December 31, 2013, the books of the two affiliates held the following balances:

-Bonds Payable appeared in the December 31,2013 consolidated balance sheet of Pfadt Corporation and Subsidiary in the amount of

A)$398,925.

B)$443,500.

C)$441,000.

D)$450,000.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

14

If an affiliate purchases bonds in the open market,the book value of the intercompany bond liability at the time of purchase is

A)always assigned to the parent company because it has control.

B)the par value of the bonds less the unamortized discount or plus the unamortized premium.

C)par value.

D)the par value of the bonds plus the unamortized discount or less the unamortized premium.

A)always assigned to the parent company because it has control.

B)the par value of the bonds less the unamortized discount or plus the unamortized premium.

C)par value.

D)the par value of the bonds plus the unamortized discount or less the unamortized premium.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

15

Pickle Incorporated acquired a $10,000 bond originally issued by its 80%-owned subsidiary on January 2,2013.The bond was issued in a prior year for $11,250,matures January 1,2018,and pays 9% interest at December 31.The bond's book value at January 2,2013 is $10,625,and Pickle paid $9,500 to purchase it.Straight-line amortization is used by both companies.How much interest income should be eliminated in 2013?

A)$720

B)$800

C)$900

D)$1,000

A)$720

B)$800

C)$900

D)$1,000

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

16

Use the following information to answer the question(s) below.

Plenty Corporation issued six thousand, $1,000 par, 6% bonds on January 1, 2012, at par. Interest is paid on January 1 and July 1 of each year; the bonds mature on January 1, 2017. On January 2, 2014, Scrawn Corporation, a 75%-owned subsidiary of Plenty, purchased 3,000 of the bonds on the open market at 102.50. Plenty's separate net income for 2014 included the annual interest expense for all 3,000 bonds. Scrawn's separate net income for 2014 was $400,000, which included the bond interest received on July 1 as well as the accrual of bond interest revenue earned on December 31. Both companies use straight-line amortization of bond discounts/premiums.

-If the bonds were originally issued at 106,and 80% of them were purchased by Scrawn on January 2,2015 at 98,the gain or (loss)from the intercompany purchase was

A)$(384,000).

B)$(211,200).

C)$ 211,200.

D)$ 384,000.

Plenty Corporation issued six thousand, $1,000 par, 6% bonds on January 1, 2012, at par. Interest is paid on January 1 and July 1 of each year; the bonds mature on January 1, 2017. On January 2, 2014, Scrawn Corporation, a 75%-owned subsidiary of Plenty, purchased 3,000 of the bonds on the open market at 102.50. Plenty's separate net income for 2014 included the annual interest expense for all 3,000 bonds. Scrawn's separate net income for 2014 was $400,000, which included the bond interest received on July 1 as well as the accrual of bond interest revenue earned on December 31. Both companies use straight-line amortization of bond discounts/premiums.

-If the bonds were originally issued at 106,and 80% of them were purchased by Scrawn on January 2,2015 at 98,the gain or (loss)from the intercompany purchase was

A)$(384,000).

B)$(211,200).

C)$ 211,200.

D)$ 384,000.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

17

Use the following information to answer the question(s) below.

Plenty Corporation issued six thousand, $1,000 par, 6% bonds on January 1, 2012, at par. Interest is paid on January 1 and July 1 of each year; the bonds mature on January 1, 2017. On January 2, 2014, Scrawn Corporation, a 75%-owned subsidiary of Plenty, purchased 3,000 of the bonds on the open market at 102.50. Plenty's separate net income for 2014 included the annual interest expense for all 3,000 bonds. Scrawn's separate net income for 2014 was $400,000, which included the bond interest received on July 1 as well as the accrual of bond interest revenue earned on December 31. Both companies use straight-line amortization of bond discounts/premiums.

-What was the amount of gain or (loss)from the intercompany purchase of Plenty's bonds on January 2,2014?

A)$(56,250)

B)$(75,000)

C)$ 75,000

D)$ 56,250

Plenty Corporation issued six thousand, $1,000 par, 6% bonds on January 1, 2012, at par. Interest is paid on January 1 and July 1 of each year; the bonds mature on January 1, 2017. On January 2, 2014, Scrawn Corporation, a 75%-owned subsidiary of Plenty, purchased 3,000 of the bonds on the open market at 102.50. Plenty's separate net income for 2014 included the annual interest expense for all 3,000 bonds. Scrawn's separate net income for 2014 was $400,000, which included the bond interest received on July 1 as well as the accrual of bond interest revenue earned on December 31. Both companies use straight-line amortization of bond discounts/premiums.

-What was the amount of gain or (loss)from the intercompany purchase of Plenty's bonds on January 2,2014?

A)$(56,250)

B)$(75,000)

C)$ 75,000

D)$ 56,250

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

18

Bonds issued by a company remain on their books as a liability,but are considered constructively retired when

A)the company borrows money from unaffiliated entities to re-purchase its own bonds at a gain.

B)the company borrows money from an affiliate to re-purchase its own bonds at a gain.

C)the company's parent or subsidiary purchases the bonds from outside entities.

D)the company borrows money from an affiliate to repurchase its own bonds at a gain or at a loss.

A)the company borrows money from unaffiliated entities to re-purchase its own bonds at a gain.

B)the company borrows money from an affiliate to re-purchase its own bonds at a gain.

C)the company's parent or subsidiary purchases the bonds from outside entities.

D)the company borrows money from an affiliate to repurchase its own bonds at a gain or at a loss.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

19

Use the following information to answer the question(s) below.

Pascalian Company owns a 90% interest in Sapp Company. On January 1, 2013, Pascalian had $300,000, 6% bonds outstanding with an unamortized premium of $9,000. The bonds mature on December 31, 2017. Sapp acquired one-third of Pascalian's bonds in the open market for $97,000 on January 1, 2013. Both companies use straight-line amortization of bond discounts/premiums. Interest is paid on December 31. On December 31, 2013, the books of the two affiliates held the following balances:

-Consolidated Interest Expense and consolidated Interest Income,respectively,that appeared on the consolidated income statement for the year ended December 31,2013 was

A)$10,800 and $0.

B)$10,800 and $6,600.

C)$0 and $0.

D)$16,200 and $6,600.

Pascalian Company owns a 90% interest in Sapp Company. On January 1, 2013, Pascalian had $300,000, 6% bonds outstanding with an unamortized premium of $9,000. The bonds mature on December 31, 2017. Sapp acquired one-third of Pascalian's bonds in the open market for $97,000 on January 1, 2013. Both companies use straight-line amortization of bond discounts/premiums. Interest is paid on December 31. On December 31, 2013, the books of the two affiliates held the following balances:

-Consolidated Interest Expense and consolidated Interest Income,respectively,that appeared on the consolidated income statement for the year ended December 31,2013 was

A)$10,800 and $0.

B)$10,800 and $6,600.

C)$0 and $0.

D)$16,200 and $6,600.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

20

Use the following information to answer the question(s) below.

Poe Corporation owns an 80% interest in Seri Company acquired at book value several years ago. On January 2, 2013, Seri purchased $100,000 par of Poe's outstanding 10% bonds for $103,000. The bonds were issued at par and mature on January 1, 2016. Straight-line amortization is used. Separate incomes of Poe and Seri for 2013 are $350,000 and $120,000, respectively. Poe uses the equity method to account for the investment in Seri.

-Noncontrolling interest share for 2013 was

A)$23,000.

B)$23,600.

C)$24,000.

D)$24,400.

Poe Corporation owns an 80% interest in Seri Company acquired at book value several years ago. On January 2, 2013, Seri purchased $100,000 par of Poe's outstanding 10% bonds for $103,000. The bonds were issued at par and mature on January 1, 2016. Straight-line amortization is used. Separate incomes of Poe and Seri for 2013 are $350,000 and $120,000, respectively. Poe uses the equity method to account for the investment in Seri.

-Noncontrolling interest share for 2013 was

A)$23,000.

B)$23,600.

C)$24,000.

D)$24,400.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

21

Platts Incorporated purchased 80% of Scarab Company several years ago when the fair value equaled the book value.On January 1,2013,Scarab has $100,000 of 8% bonds that were issued at face value and have five years to maturity.Interest is paid annually on December 31.Both Platts and Scarab would use the straight-line method to amortize any premium or discount incurred in the issuance or purchase of bonds.On January 1,2014,Platts purchased all of Scarab's bonds for $96,000.

Required:

1.Prepare the journal entries in 2014 that would be recorded by Platts and Scarab on their separate financial records.

2.Prepare the consolidating working paper entries required for the year ending December 31,2014.

Required:

1.Prepare the journal entries in 2014 that would be recorded by Platts and Scarab on their separate financial records.

2.Prepare the consolidating working paper entries required for the year ending December 31,2014.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

22

Separate company and consolidated income statements for Pitta and Sojourn Corporations for the year ended December 31,2013 are summarized as follows:

Separate net income and

Control.interest share in

The interest income and expense eliminations relate to a $100,000,9% bond issue that was issued at par value and matures on January 1,2018.On January 2,2013,a portion of the bonds was purchased and constructively retired.

The interest income and expense eliminations relate to a $100,000,9% bond issue that was issued at par value and matures on January 1,2018.On January 2,2013,a portion of the bonds was purchased and constructively retired.

Required: Answer the following questions.

1.Which company is the issuing affiliate of the bonds payable?

2.What is the gain or loss from the constructive retirement of the bonds payable that is reported on the consolidated income statement for 2013?

3.What portion of the bonds payable is held by nonaffiliates at December 31,2013?

4.Is Sojourn a wholly-owned subsidiary? If not,what percentage does Pitta own?

5.Does the purchasing affiliate use straight-line or effective interest amortization?

6.Explain the calculation of Pitta's $19,900 income from Sojourn.

Separate net income and

Control.interest share in

The interest income and expense eliminations relate to a $100,000,9% bond issue that was issued at par value and matures on January 1,2018.On January 2,2013,a portion of the bonds was purchased and constructively retired.

The interest income and expense eliminations relate to a $100,000,9% bond issue that was issued at par value and matures on January 1,2018.On January 2,2013,a portion of the bonds was purchased and constructively retired.Required: Answer the following questions.

1.Which company is the issuing affiliate of the bonds payable?

2.What is the gain or loss from the constructive retirement of the bonds payable that is reported on the consolidated income statement for 2013?

3.What portion of the bonds payable is held by nonaffiliates at December 31,2013?

4.Is Sojourn a wholly-owned subsidiary? If not,what percentage does Pitta own?

5.Does the purchasing affiliate use straight-line or effective interest amortization?

6.Explain the calculation of Pitta's $19,900 income from Sojourn.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

23

Paleo Corporation holds 80% of the capital stock of Sockrite Company.On January 1,2013,Sockrite purchased $50,000 par value,10% bonds on the open market that had been issued by Paleo on January 1,2011.Sockrite paid $58,000 for these bonds which had originally been issued by Paleo for $53,000,with a 10-year maturity from the date of issue.Interest is paid annually on December 31.Straight-line amortization is used by both companies.

Required:

1.Calculate the interest income reported by Sockrite related to these bonds in 2013.

2.Calculate the interest expense reported by Paleo related to these bonds in 2013.

3.Calculate the gain or loss on retirement of bonds payable to be reported on consolidated financial statements in 2013.

Required:

1.Calculate the interest income reported by Sockrite related to these bonds in 2013.

2.Calculate the interest expense reported by Paleo related to these bonds in 2013.

3.Calculate the gain or loss on retirement of bonds payable to be reported on consolidated financial statements in 2013.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

24

Pachelor Corporation owns 70% of the outstanding stock of Stabb Company.On January 1,2013,Stabb issued $1,000,000 in 7% bonds that matured on January 1,2018.At the time of issuance,the bonds were sold at a discount of $125,000.At January 2,2015,Pachelor purchased the bonds for $1,400,000,and constructively retired the debt.Interest is paid annually on January 1.Straight-line amortization is used by both companies.

Required:

1.Calculate the gain or loss that the consolidated entity incurred to retire the debt.

2.Prepare eliminating/adjusting entries for the consolidating work papers for the year ended

December 31,2015.

Required:

1.Calculate the gain or loss that the consolidated entity incurred to retire the debt.

2.Prepare eliminating/adjusting entries for the consolidating work papers for the year ended

December 31,2015.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

25

Phlora purchased its 100% ownership in Speshal many years ago at a time when book values of assets and liabilities equaled market values.

On January 2,2014,Phlora purchased $200,000 of Speshal Corporation's 6% bonds for $182,000.At that time,this was all of the bonds that had been issued by Speshal,and unamortized premium on Speshal's books was $3,500.The bonds pay interest on July 1 and January 1 and mature on January 1,2019.Both Phlora and Speshal use straight-line amortization.Phlora uses the equity method of accounting for its investment in Speshal.

Required:

Required:

Prepare elimination/adjusting entries on the consolidating work papers for the year ended December 31,2014.

On January 2,2014,Phlora purchased $200,000 of Speshal Corporation's 6% bonds for $182,000.At that time,this was all of the bonds that had been issued by Speshal,and unamortized premium on Speshal's books was $3,500.The bonds pay interest on July 1 and January 1 and mature on January 1,2019.Both Phlora and Speshal use straight-line amortization.Phlora uses the equity method of accounting for its investment in Speshal.

Required:

Required:Prepare elimination/adjusting entries on the consolidating work papers for the year ended December 31,2014.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

26

Phauna paid $120,000 for its 80% interest in Schrub on January 1,2011 when Schrub had $150,000 of total stockholders' equity.

On January 1,2014,Phauna purchased $50,000 of Schrub Corporation's 8% bonds for $48,000.At that time,$100,000 of bonds had been issued by Schrub,and unamortized premium was $2,000.The bonds pay interest on June 30 and December 31 and mature on December 31,2018.Both Phauna and Schrub use straight-line amortization.Phauna uses the equity method of accounting for its investment in Schrub.

Required:

Prepare eliminating/adjusting entries for the bonds on the consolidating work papers for the year ended December 31,2014.

On January 1,2014,Phauna purchased $50,000 of Schrub Corporation's 8% bonds for $48,000.At that time,$100,000 of bonds had been issued by Schrub,and unamortized premium was $2,000.The bonds pay interest on June 30 and December 31 and mature on December 31,2018.Both Phauna and Schrub use straight-line amortization.Phauna uses the equity method of accounting for its investment in Schrub.

Required:

Prepare eliminating/adjusting entries for the bonds on the consolidating work papers for the year ended December 31,2014.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

27

Popcorn Corporation owns 90% of the outstanding voting common stock of Salty Corporation.On January 1,2009,Salty issued $1,000,000 face amount of 12%,$1,000 bonds payable at 119.20.The bonds pay interest on January 1 and July 1 of each year and mature on January 1,2017.On July 2,2014,Popcorn purchased all of the outstanding bonds at a price of $107.50.Both companies use straight-line amortization.

Required:

1.Prepare the journal entries for July 1,2014 through December 31,2014 for Popcorn Corporation.

2.Prepare the journal entries for July 1,2014 through December 31,2014 for Salty Corporation.

3.Prepare the elimination entries necessary on the consolidating working papers for the year ended December 31,2014.

Required:

1.Prepare the journal entries for July 1,2014 through December 31,2014 for Popcorn Corporation.

2.Prepare the journal entries for July 1,2014 through December 31,2014 for Salty Corporation.

3.Prepare the elimination entries necessary on the consolidating working papers for the year ended December 31,2014.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

28

Pelami Corporation owns a 90% interest in Sunbird Corporation.At December 31,2012,Sunbird had $3,000,000 of par value 6% bonds outstanding with an unamortized premium of $30,000.The bonds have interest payment dates of January 1 and July 1 and mature on January 1,2017.

On January 2,2013,Pelami purchased $1,200,000 par value of Sunbird's outstanding bonds for $1,210,000.Assume straight-line amortization.

Required:

Prepare the necessary consolidation working paper entries with respect to the intercompany bonds for the year ending December 31,2013.

On January 2,2013,Pelami purchased $1,200,000 par value of Sunbird's outstanding bonds for $1,210,000.Assume straight-line amortization.

Required:

Prepare the necessary consolidation working paper entries with respect to the intercompany bonds for the year ending December 31,2013.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

29

Peter Corporation owns a 70% interest in Sundown Corporation acquired several years ago at a price equal to book value and fair value.On December 31,2013,Sundown had $300,000 par of 6% bonds outstanding with an unamortized premium of $30,000.The bonds mature in five years and pay interest on January 1 and July 1.On January 2,2014,Peter acquired one-third of Sundown's bonds for $117,000.Peter and Sundown use straight-line amortization.Sundown reports net income of $250,000 for 2014.Peter uses the equity method to account for the investment.

Required:

1.Calculate Peter's income from Sundown for 2014.

2.Calculate the noncontrolling interest share for 2014.

Required:

1.Calculate Peter's income from Sundown for 2014.

2.Calculate the noncontrolling interest share for 2014.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

30

Snackle Inc.is a 90%-owned subsidiary of Pasha Corp.On January 1,2013,Snackle issued $400,000 of $1,000 face amount 8% bonds at $964 per bond.Interest is paid on January 1 and July 1 of each year and covers the preceding six months.On July 2,2014,Pasha purchased all 400 bonds on the open market for $1,030 per bond.The bonds mature on December 31,2015.Both companies use straight-line amortization.

Required: With respect to the bonds,use General Journal format to:

1.Record the 2014 journal entries from July 1 to December 31 on Pasha's books.

2.Record the 2014 journal entries from July 1 to December 31 on Snackle's books.

3.Record the elimination entries for the consolidation working papers for the year ending December 31,2014.

Required: With respect to the bonds,use General Journal format to:

1.Record the 2014 journal entries from July 1 to December 31 on Pasha's books.

2.Record the 2014 journal entries from July 1 to December 31 on Snackle's books.

3.Record the elimination entries for the consolidation working papers for the year ending December 31,2014.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

31

Sabu is a 65%-owned subsidiary of Peerless.On January 1,2012,Sabu issued $1,000,000 of $1,000 face amount 8% bonds at $980 per bond.The bonds have interest payments on December 31 of each year and mature on January 1,2017.On January 1,2013,Peerless purchased all 1,000 bonds on the open market for $1,010 per bond.Straight-line amortization is used by both companies.

Required: With respect to the bonds,use General Journal format to:

1.Record the journal entries on Sabu's books made from 2012 to 2017.

2.Record the journal entries on Peerless' books made from 2012 to 2017.

3.Record the elimination entries for the consolidation working papers for 2012 through 2017.

Required: With respect to the bonds,use General Journal format to:

1.Record the journal entries on Sabu's books made from 2012 to 2017.

2.Record the journal entries on Peerless' books made from 2012 to 2017.

3.Record the elimination entries for the consolidation working papers for 2012 through 2017.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

32

Pongo Company has $2,000,000 of 6% bonds outstanding on December 31,2013 with unamortized premium of $60,000.These bonds pay interest semiannually on January 1 and July 1 and mature on January 1,2019.Straight-line amortization is used.

Syring Inc.,90%-owned subsidiary of Pongo,buys $1,000,000 par value of Pongo's outstanding bonds in the market for $980,000 on January 2,2014.There is only one issue of outstanding bonds of the affiliated companies and they have consolidated financial statements.

For the year 2014,Pongo has income from its separate operations (excluding investment income)of $3,000,000 and Syring reports net income of $200,000.Pongo uses the equity method to account for the investment.

Required:

Determine the following:

1.Noncontrolling interest share for 2014.

2.Controlling share of consolidated net income for Pongo Company and subsidiary for 2014.

Syring Inc.,90%-owned subsidiary of Pongo,buys $1,000,000 par value of Pongo's outstanding bonds in the market for $980,000 on January 2,2014.There is only one issue of outstanding bonds of the affiliated companies and they have consolidated financial statements.

For the year 2014,Pongo has income from its separate operations (excluding investment income)of $3,000,000 and Syring reports net income of $200,000.Pongo uses the equity method to account for the investment.

Required:

Determine the following:

1.Noncontrolling interest share for 2014.

2.Controlling share of consolidated net income for Pongo Company and subsidiary for 2014.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

33

Pass Corporation owns 80% of Sindy Company,purchased at the underlying book value on January 1,2013.On January 1,2013,Pass also purchased $200,000 par value 6% bonds that had been issued by Sindy on January 1,2010 with a ten-year maturity(due January 1,2020).Annual interest is paid on December 31.Straight-line amortization is used by both companies.

At year-end 2013,the following entry was made on the consolidating worksheet.

Required:

Required:

1.How much did Pass pay for the bonds?

2.What is the book value of the bonds on the date of purchase?

3.What amount of interest income and interest expense must be eliminated in the entry above designated as (a)and (b)?

At year-end 2013,the following entry was made on the consolidating worksheet.

Required:

Required:1.How much did Pass pay for the bonds?

2.What is the book value of the bonds on the date of purchase?

3.What amount of interest income and interest expense must be eliminated in the entry above designated as (a)and (b)?

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

34

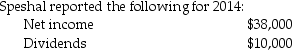

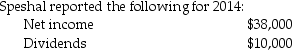

Pheasant Corporation owns 80% of Sal Corporation's outstanding common stock that was purchased at book value equal to fair value on January 1,2007.

Additional information:

1.Pheasant sold inventory items that cost $3,000 to Sal during 2014 for $6,000.One-half of this merchandise was inventoried by Sal at year-end.At December 31,2014,Sal owed Pheasant $2,000 on account from the inventory sales.No other intercompany sales of inventory have occurred since Pheasant acquired its interest in Sal.

2.Pheasant sold equipment with a book value of $5,000 and a 5-year useful life to Sal for $10,000 on December 31,2012.The equipment remains in use by Sal and is depreciated by the straight-line method.The equipment has no salvage value.

3.On January 2,2014,Sal paid $10,800 for $10,000 par value of Pheasant's 10-year,10% bonds.These bonds were originally sold at par value,and have interest payment dates of January 1 and July 1,and mature on January 1,2018.Straight-line amortization has been applied by Sal to the Pheasant bond investment.

4.Pheasant uses the equity method in accounting for its investment in Sal.

Required:

Complete the working papers to consolidate the financial statements of Pheasant Corporation and Sal for the year ended December 31,2014.

Additional information:

1.Pheasant sold inventory items that cost $3,000 to Sal during 2014 for $6,000.One-half of this merchandise was inventoried by Sal at year-end.At December 31,2014,Sal owed Pheasant $2,000 on account from the inventory sales.No other intercompany sales of inventory have occurred since Pheasant acquired its interest in Sal.

2.Pheasant sold equipment with a book value of $5,000 and a 5-year useful life to Sal for $10,000 on December 31,2012.The equipment remains in use by Sal and is depreciated by the straight-line method.The equipment has no salvage value.

3.On January 2,2014,Sal paid $10,800 for $10,000 par value of Pheasant's 10-year,10% bonds.These bonds were originally sold at par value,and have interest payment dates of January 1 and July 1,and mature on January 1,2018.Straight-line amortization has been applied by Sal to the Pheasant bond investment.

4.Pheasant uses the equity method in accounting for its investment in Sal.

Required:

Complete the working papers to consolidate the financial statements of Pheasant Corporation and Sal for the year ended December 31,2014.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

35

Parkview Holdings owns 70% of Skyline Corporation.On January 1,2013,Skyline acquires half of the $2,000,000 of bonds originally issued by Parkview on January 1,2008.The bonds were issued at a stated rate of 5% for 10 years,for $1,920,000.Skyline purchased them for $950,000.Assume that both Parkview and Skyline will use the straight-line method for any bond-related amortization.Annual interest is paid on December 31.

Required: Prepare the entries required for the consolidating worksheet for the years ended December 31,2008 through December 31,2018.

Required: Prepare the entries required for the consolidating worksheet for the years ended December 31,2008 through December 31,2018.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

36

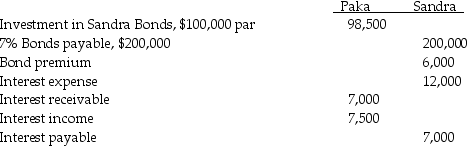

Paka Corporation owns an 80% interest in Sandra Company.Paka acquired Sandra's bonds on January 2,2014.The following information is from the adjusted trial balances at December 31,2014,at which time the bonds have three years to maturity.The bonds have interest payment dates of January 1 and July 1.Straight-line amortization is used by both companies.

Required:

Required:

Prepare the necessary consolidation working paper entries on December 31,2014 with respect to the intercompany bonds.

Required:

Required:Prepare the necessary consolidation working paper entries on December 31,2014 with respect to the intercompany bonds.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

37

Pare Corporation owns 65% of the outstanding voting stock of Summer Corporation.On January 1,2013,Pare purchased $4,000,000 of bonds that were originally issued by Summer several years earlier.The ten-year bonds have a 5% interest rate,and pay interest each December 31.

The bonds were originally issued at a discount of $206,080,but at January 1,2013,they have a book value of $3,896,960.Pare paid $4,067,935 for the bonds and will amortize the premium over the next five years when the bonds mature.Both companies use the straight-method of amortization.

Required:

1.Calculate the interest expense for 2013 that will be recorded by Summer.

2.Calculate the interest income for 2013 that will be recorded by Pare.

3.Calculate the Gain/Loss on retirement of bonds payable that will be reported on the consolidated financial statements for the year ending December 31,2013.

The bonds were originally issued at a discount of $206,080,but at January 1,2013,they have a book value of $3,896,960.Pare paid $4,067,935 for the bonds and will amortize the premium over the next five years when the bonds mature.Both companies use the straight-method of amortization.

Required:

1.Calculate the interest expense for 2013 that will be recorded by Summer.

2.Calculate the interest income for 2013 that will be recorded by Pare.

3.Calculate the Gain/Loss on retirement of bonds payable that will be reported on the consolidated financial statements for the year ending December 31,2013.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

38

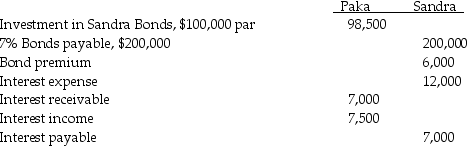

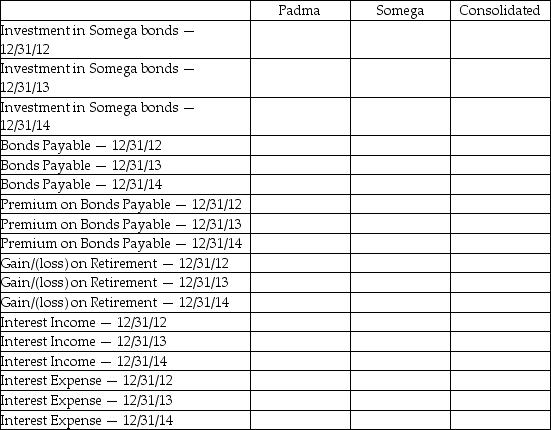

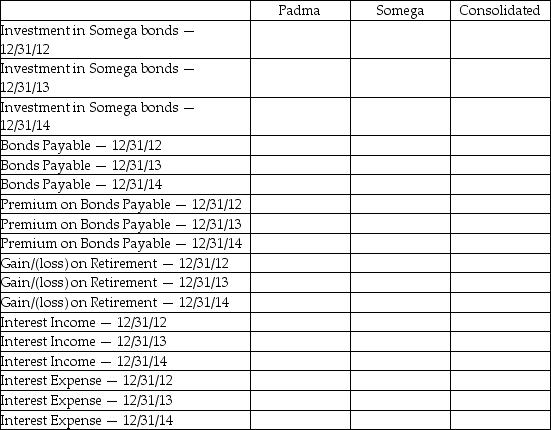

Padma Corporation owns 70% of the outstanding stock of Somega Company.On January 1,2012,Somega issued $2,000,000 in 6% bonds that matured on January 1,2022.At the time of issuance,the bonds were sold at a premium of $250,000.At January 1,2013,Padma purchased half of the bonds for $910,000,and constructively retired the debt.Annual interest is paid on December 31.Straight-line amortization is used by both companies.

Required:

Complete the table below with respect to the account balances that Padma,Somega and the consolidated entity would report on their respective financial statements.

Required:

Complete the table below with respect to the account balances that Padma,Somega and the consolidated entity would report on their respective financial statements.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

39

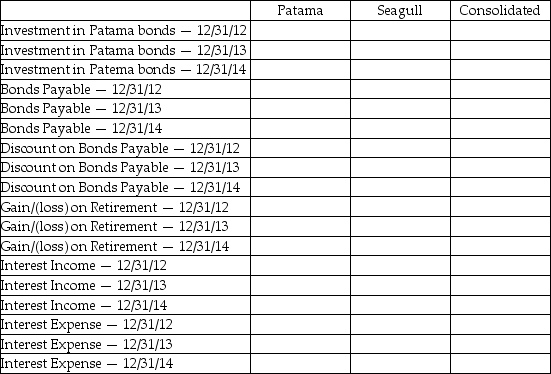

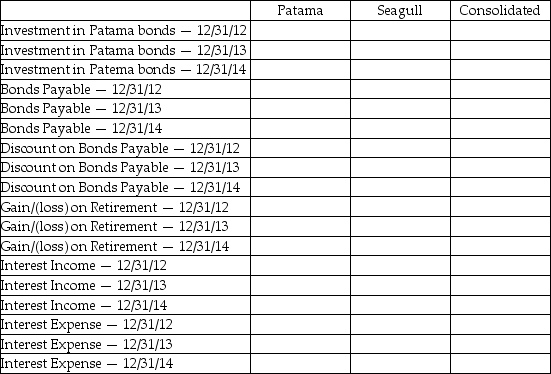

Patama Holdings owns 70% of Seagull Corporation.On January 1,2013,Seagull acquires $1,000,000 of bonds originally issued by Patama on January 1,2008.The bonds were issued at a stated rate of 5% for 10 years,for $960,000.Seagull purchased them for $990,000.Assume that both Patama and Seagull will use the straight-line method for any bond-related amortization.Annual interest is paid on December 31.

Required:

Complete the table below with respect to the account balances that Patama,Seagull and the consolidated entity would report on their respective financial statements.

Required:

Complete the table below with respect to the account balances that Patama,Seagull and the consolidated entity would report on their respective financial statements.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

40

Spott is a 75%-owned subsidiary of Penthal.On January 1,2013,Spott issued $900,000 of $1,000 face amount 8% bonds at par.The bonds have interest payments on January 1 and July 1 of each year and mature on January 1,2017.On July 2,2014,Penthal purchased all 900 bonds on the open market for $1,020 per bond.Both companies use straight-line amortization.

Required: With respect to the bonds,use General Journal format to:

1.Record the 2014 journal entries from July 1 to December 31 on Spott's books.

2.Record the 2014 journal entries from July 1 to December 31 on Penthal's books.

3.Record the elimination entries for the consolidation working papers for the year ending December 31,2014.

Required: With respect to the bonds,use General Journal format to:

1.Record the 2014 journal entries from July 1 to December 31 on Spott's books.

2.Record the 2014 journal entries from July 1 to December 31 on Penthal's books.

3.Record the elimination entries for the consolidation working papers for the year ending December 31,2014.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

41

If the market rate of interest on bonds that are recorded increases,the market value of the liability increases.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

42

The loss on the retirement of bonds only appears in the consolidated income statement in the year in which we constructively retire the bonds.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

43

If the price paid by an affiliate to acquire the debt of another is less than the book value of the debt,a constructive loss on retirement of debt occurs.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

44

The parent,which controls all debt retirement for the consolidated entity can use its available resources to purchase and retire its own bonds if they choose not to use the fair value option.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

45

When a company issues bonds,the bond liability will reflect the current market rate of interest.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

46

The fair value option for liabilities permits recognition of gains and losses due to changes in the market values.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

47

A constructive retirement of parent bonds occurs when an affiliate purchases outstanding bonds of the parent.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

48

Constructive retirement means that bonds are retired for consolidated statement purposes because the bond investment and payable items of the parent and the subsidiary are reciprocals that must be eliminated in consolidation.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

49

The GAAP requires the effective interest method of amoritization on transactions between parent and subsidiary companies.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

50

The difference between the book value of a bond liability and the purchase price of the bond investment is a gain or loss for consolidated statement purposes.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck